1. Introduction

Climate change is currently an issue of wide concerned around the world. In order to deal with climate change and to reduce carbon emissions, political and economic efforts have been made both in developed and developing countries. With regard to economic methods, there is a consensus that it is necessary to put price on carbon emissions, which aims to lead energy-using enterprises toward low carbon behaviors through introducing market mechanisms. Currently, emissions trading schemes and carbon taxes are the two main approaches to carbon pricing [

1].

In 1997, the Kyoto Protocol was signed, which was the first legally-binding agreement obligating major developed countries (Annex I parties) to reduce greenhouse gas (GHG) emissions in order to tackle global warming in history [

2]. Under the Protocol, the countries must take national measures to reduce GHG emissions to an average of 5.2% against 1990 levels over the 2008–2012 commitment period. To help the countries to meet their targets, the Protocol also provided three market-based mechanisms, including international emissions trading (IET), clean development mechanism (CDM) and joint implementation (JI) [

3]. The latter two are project-based mechanisms, while IET is allowance-based under a cap-and-trade scheme [

4]. Thus, as the principal greenhouse gas, carbon dioxide can be traded between developed countries, in the form of a market by creating artificial scarcity of this carbon resource. The countries that cannot meet their obligations can purchase allowances from the countries with a surplus.

After the Kyoto Protocol entered into force in 2005, global emissions trading markets went through a period of dramatic growth. In 2006, nearly 1101 million tons of allowances were transacted, representing a three-fold increase over the previous year [

5]. Furthermore, the overall allowances market continued to grow rapidly in 2007 and 2008. Total transacted allowances in 2007 and 2008 were 2108 megatons of carbon dioxide equivalent (MtCO

2e) and 3276 MtCO

2e, respectively [

6]. In the last five years (from 2009 to 2013), although there was a slight decline in the total volume of the allowances market in 2010 from 2009 levels and it showed no obvious growth compared to 2005–2008, the annual growth rate stayed at around 13%.

As a non-Annex I country under the Kyoto Protocol, China did not have binding limitations for GHG emissions. In fact, China participated in the global carbon market under the project-based mechanism (

i.e., CDM), rather than allowance-based mechanism. However, according to data on CO

2 emissions from the World Bank, China has become the world’s largest emitter of carbon dioxide [

7]. Therefore, both domestic and international pressure has grown for China to take significant action to save energy and reduce carbon emissions, and learn from existing market-based emission abatement measures such as carbon trading.

Thus, at the UN Climate Change Conference held in Copenhagen in 2009, China set a domestically binding goal to cut CO

2 per unit of GDP by 40%–45% below 2005 levels by 2020 [

8]. In order to meet this commitment and promote domestic energy saving and emission reduction, in late 2011, the National Development and Reform Commission (NDRC) published the Notice on Launching Pilots for Emissions Trading System (ETS), in which seven provinces and cities-Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong and Shenzhen were approved as ETS pilots. The policymakers required each pilot to make comprehensive and detailed regulations and rules for ETS as soon as possible, and planned to establish a unified national carbon market by 2017 [

9].

Since the launch of the Shenzhen carbon market pilot in 2013, China has made further concrete progress in developing and implementing polices aimed at reducing greenhouse gas emissions. For China, reducing GHG emissions is both a domestic requirement for the transition to a low-carbon economy and a commitment to the international community in order to mitigate climate change. However, unlike developed countries, China has not yet reached peak carbon emissions, which means the need for energy and technology for China’s economic development should be taken into consideration when designing the national ETS. Therefore, this paper investigates the current carbon markets in China and overseas, and then proposes policy recommendations to establish an appropriate national scheme consistent with China’s economic situation.

The rest of this paper is organized as follows.

Section 2 describes the current situation of China’s seven ETS pilots, especially that of the first compliance period.

Section 3 summaries the common practice across several international schemes, and analyses the similarities and differences between those schemes and China’s.

Section 4 envisages and provides recommendations for the coming national emissions trading scheme, in line with China’s circumstances and international experiences.

Section 5 concludes the main findings of this paper.

2. Current Situation of China’s ETS Pilots

On 18 June 2013, the southern city of Shenzhen was the first to launch its carbon market, and this was subsequently followed by the other pilots. By June 2015, all the seven pilots had completed their first compliance period. In general, China’s carbon market works under the cap-and-trade mechanism. In designing the mechanism, each pilot remains independent, and has local characteristics corresponding with their respective economic development as well as energy-saving and emission reduction technologies, thus resulting in different market performance.

2.1. Thresholds of Coverage and Reporting

During the first compliance period, what all the seven pilots have in common is that CO

2 from both direct and indirect sources is the only regulated greenhouse gas. High-emitting enterprises beyond a certain threshold have to surrender allowances or report their CO

2 emissions. The threshold and regulated sectors are determined by the economic structure, priorities of economic development and data availability. As shown in

Table 1, the threshold varies between pilots, and is mainly measured in tons of carbon dioxide equivalent (tCO

2e). Most pilots require that industrial enterprises that emit more than 10,000 or 20,000 tCO

2e per year should surrender allowances, while Shenzhen sets the threshold at 3000 tCO

2e, which is the lowest among the pilots. As high-emitting sources such as iron and steel, chemical production and power generation contribute less to carbon emissions in Shenzhen than the energy use of buildings, commercial buildings with area of over 20,000 m

2 and government buildings of over 10,000 m

2 are subjected to the ETS [

10]. Uniquely, Hubei is the only pilot that uses energy consumption as the criterion, setting the covered and reporting thresholds as 60,000 tons of standard coal equivalent (tce) (158,400 tCO

2e (According to the Provisional Regulations for the Energy-saving and Low-carbon Technologies published on 6 January 2014 by the NDRC, the emission factor of standard coal is 2.64 tCO

2e/tce.)) and 8000 tce (21,120 tCO

2e) respectively due to its solid industrial foundation and data availability [

11].

The power and industrial sectors (e.g., iron and steel, chemicals, petrochemicals and cement) were first included in the pilot schemes. In addition, the Shanghai pilot covered aviation and Hubei covered automobile manufacturing. To a certain extent, the thresholds of coverage and reporting influence the quantity of enterprises that are included in the ETS, and reflect the resolution and mandatory measures of local governments to control GHG emissions, thereby affecting the effectiveness of the ETS.

2.2. Allowances

The initial allocation of allowances in the primary market is complicated and critically important. Meanwhile, whether allowances can be banked or borrowed is an issue that should be taken seriously.

2.2.1. Allowance Allocation Methods

Free allocation via either grandfathering or benchmarking, as well as auctioning are the three allocation methods generally used currently [

12]. To reduce the compliance costs of the enterprises and protect their competitiveness against the non-covered enterprises, the vast majority of allowances are allocated for free. As shown in

Table 2, with regard to free allocation, Shenzhen only uses benchmarking and Chongqing uses grandfathering. For most covered sectors, grandfathering based on historical emissions using a baseline year(s) is widely used. Moreover, Shanghai considers the enterprise’s previous efforts to reduce emissions, which optimizes grandfathering and provides support for the enterprise’s early abatement actions. However, allocation for the power sector varies across pilots. Shenzhen, Shanghai, Guangdong and Tianjin use benchmarks on the basis of production, among which Guangdong and Tianjin adjust the allowances by adding a sector-level reduction factor and prosperity index, while Beijing allocates the allowances by grandfathering based on historical intensities.

During the first compliance period (2013), Guangdong was the only pilot adopting auctioning during the initial allocation, while in other pilots the initial allowances were all allocated for free. Guangdong requires that only if the enterprises purchase 3% of their initial allowances can they receive the other 97% for free. In the second compliance period (2014), the auctioning proportion for the power sector rose to 5%. Other pilots, such as Shenzhen and Hubei, reserve some allowances to be auctioned for market control and price discovery, which is quite different from Guangdong and will be elaborated in

Section 2.4.4.

2.2.2. Banking and Borrowing

Enhancing temporal flexibility in the use of allowances can reduce compliance costs of covered enterprises, and additionally minimize negative effects on the carbon market due to price fluctuations. All the pilots except Hubei allow that surplus allowances can be traded or banked to the next compliance period. Given the uncertainty on total GHG emissions associated with future economic growth, Hubei requires that surplus allowances which are not used for trading in the current compliance period must be cancelled. However, unlike banking, borrowing next year’s allowances for compliance or sale is forbidden in all the pilots.

2.3. Monitoring, Reporting and Verification (MRV)

To promote orderly development of a national, local and enterprise-level MRV system, the NDRC has released regulations on monitoring and reporting for ten sectors (i.e., generation, power grid, iron and steel, chemical, electrolytic aluminum, magnesium smelting, glass, cement, ceramics, and aviation). On this basis, the pilots issued monitoring and reporting guidelines, and there is little variation. Each pilot requires the establishment of a data monitoring and quality management system, emphasizes that the enterprise should work out a monitoring plan and perform an internal audit. While appointing a responsible department for monitoring and reporting means a new challenge and expenditure for the enterprise, however, technical and funding support are not specified in the guidelines.

After the third-party verification agency submits the verification report of the enterprise’s carbon emissions, combined with the enterprise’s own report, the local Development and Reform Commission will audit annual carbon emissions and re-verify any discrepancy in the two reports. In Shenzhen and Beijing, if the enterprise has a disagreement with the verification report, it can apply to the authorities for re-verification. However, in the other five pilots, the authorities take the initiative in re-verification, with each having varying requirements. For example, in Guangdong, Shanghai and Tianjin, it is provided that if the difference in annual carbon emissions between the reports is greater than 10%, or 100 thousand tons, the authorities will re-verify the carbon emissions. While in Chongqing, the threshold is 10% and 10 thousand tons, in which the requirement is the lowest among the five pilots. In addition, Shanghai and Tianjin pilots also provide that the authorities will re-verify the covered enterprise if the difference in carbon emissions between the current year and the previous year is more than 20%.

2.4. Transactions

Market performance seems to be the most obvious element to validate the design of the ETS. Therefore, to ensure the carbon markets function effectively, who will be eligible to participate in the carbon markets and how the transactions will be conducted and regulated should be carefully examined.

2.4.1. Transaction Entities

Covered enterprises and other voluntary legal entities that are in accordance with local regulations can participate in the carbon market. However, whether or not individuals are involved in carbon trading varies according to each pilot.

During the first compliance period, individuals are not accepted into the carbon market in Shanghai and Beijing, while the other five pilots accept individual applications. The Tianjin pilot sets a high threshold for individuals who want to participate in carbon trading. Specifically, voluntary individuals must have full capacity for civil conduct, with rich investment experience and related theoretical knowledge, aged between 18 and 60. What is more, they must possess a certain level of anti-risk capacity, and his financial assets should be no less than 300 thousand CNY. In contrast, other pilots set no such rigid limitations yet [

13].

Some individuals voluntarily take part in carbon trading for investment purposes. In short, to make a profit. Theoretically, individual involvement in the carbon market can help increase public awareness of carbon trading, activate the carbon market and help establish a stable carbon price, and ultimately to meet the reduction commitment. Therefore, in the long term, individuals will be necessarily involved in the carbon market.

2.4.2. Transaction Format

In the secondary market, the enterprises can buy and sell allowances through public bidding and transfer agreement except that there is temporarily no public bidding in Chongqing. In particular, Shenzhen, Shanghai and Hubei, use the limit order format. The enterprise requests to buy or sell a specific number of allowances at a set price, and it will be executed when the record price of the trading system reaches the set price or even better. Besides this, Beijing and Guangdong pilots allow unilateral bidding. In Shenzhen and Tianjin, an electronic bidding format is used, in which the bidder can submit multiple bids for a specific number of allowances at different prices within the given time.

However, although in practice the transaction format in each pilot differs slightly, in general all the allowances are currently transacted in spot markets, and carbon futures have not yet been introduced. Almost certainly, during the three-year transition period, carbon futures will not be introduced in China. However, the futures market will welcome carbon allowances, and whether and when it will become a reality is still controversial, requiring in-depth exploration.

2.4.3. Transaction Costs

In a broad sense, carbon transaction costs include costs for emission reduction activities of the enterprise (e.g., costs of the equipment, technology and management), costs of monitoring, reporting and verification, costs during the trading, as well as opportunity cost resulting from searching for suitable dealers and other cases [

14]. In a more narrow sense, transaction costs simply refer to costs during the trading. To alleviate the compliance burden on the enterprises, each pilot regulates that local governments should arrange the verification and special funds to cover the verification costs. The enterprises should only bear the costs during trading, such as the entrance fee and the commission charge.

Throughout all the seven pilots, during the pilot period, covered enterprises are exempted from an annual membership fee in Shanghai, Beijing and Guangdong [

15,

16,

17]. Besides covered enterprises, Tianjin waives the entrance fee for individuals and other legal entities. With regard to the commission charge, each pilot implements the two-way charging scheme, and the charge ranges from 5‰ to 7.5‰ of the total value of a transaction, except that Shanghai only charges 0.8‰ of that.

2.4.4. Risk Management

To ensure fair trading and avoid price fluctuations resulting from excessive speculation or emergencies in the carbon markets, each exchange has issued detailed rules for the implementation of carbon trading. In addition to necessary rules on registration of the subject matter, information disclosure and treatment of disputes, all the pilots set the price limit based on the previous session’s closing price or the settlement price, ranging from 10% to 30%.

Maximum holdings of allowances and the major reporting system have also been specified and established in most pilots. For example, in the Shanghai pilot, the covered enterprises are divided into three levels depending on their initial allowances: 100,000 tCO2e or below, 100,000 to 1,000,000 tCO2e, and 1,000,000 tCO2e or above. In addition, the covered enterprises are prohibited from holding allowances 1 MtCO2e, 3 MtCO2e and 5 MtCO2e more than their initial allowances, correspondingly. Moreover, the enterprises should report to the exchange if their holdings reach 80% of the maximum limit.

The Shenzhen pilot established a price stability reserve, consisting of the government reserve, the new entrants’ reserve and the buy-back reserve. The reserve will be auctioned at a fixed price, only used for compliance by the covered enterprises instead of being traded in the secondary market. If the carbon price is too high or too low, the price stability reserve will balance the supply and demand of the allowances, thus leading to a relatively stable price.

2.5. Punishment Mechanism

To encourage the covered entities to perform their obligations on schedule and ensure the sound and orderly development of the ETS, each pilot has established a punishment mechanism of various degrees.

For enterprises that falsify materials, withhold information or refuse to deliver the emissions report, in Shenzhen, the local Development and Reform Commission will impose a fine of up to three times the average market clearing price of six consecutive months before the illegal act happens multiplied by the amount of excessive emissions. While in Shanghai and Guangdong, the fine will vary from 10 to 30 thousand CNY, and in the Beijing pilot it will be no more than 50 thousand CNY. In Hubei, however, enterprises that fail to perform the reporting obligation will only be warned without any fine.

For covered enterprises that fail to hand in enough allowances or CCERs (Chinese Certified Emission Reductions) before the deadline, most pilots will firstly order the non-compliant enterprises to complete their obligation within the allotted time. If the enterprises still fail to meet the commitment, the Shenzhen pilot will deduct the non-compliant allowances forcedly from the enterprise’s initial allowances of the following year, meanwhile imposing a fine equivalent to three times (Beijing pilot could be five times) the average market clearing price multiplied by the excessive emissions. The Guangdong and Hubei pilots will deduct double the corresponding amount from the enterprise’s next year’s initial allowances, and the fine will be 50 thousand CNY in Guangdong and no more than 150 thousand CNY in Hubei respectively. In addition, non-compliant enterprises will be fined ranging from 50 to 100 thousand CNY in Shanghai.

However, compared to the other ETS pilots, penalties in Tianjin and Chongqing are relatively low. According to the documents issued by the Development and Reform Commission of Tianjin and Chongqing Municipalities, unlike other pilots where there is a rigid systems of fines, the only penalty is that non-compliant enterprises cannot enjoy financial subsidies and other government support concerning financing, energy conservation and environmental protection within three years. In short, there exists no direct economic punishment on non-compliant enterprises in Tianjin and Chongqing currently.

Besides the above regulations on covered enterprises, each pilot has clearly defined the responsibilities of third-party verification agencies, local carbon exchanges and related authorities. For example, third-party verification agencies are integrated into the enterprise credit management system in Shenzhen and Beijing. The Hubei pilot plans to establish a blacklist system of carbon trading; Tianjin promises an open process of public supervision through telephone and emails. In Shenzhen and Hubei, it is stipulated that the SASAC (State-owned Assets Supervision and Administration Commission) should incorporate the implementation of Regulation on Emissions Trading Scheme into the performance appraisal system of state-owned enterprises. Furthermore, local governments have set up special funds to support emission-reducing projects, construction of the carbon trading platform, as well as training and management of carbon trading. Equally, if the third-party verification agencies, transaction entities or related authorities fail to fulfil their respective duties, or even break the law, they will be subjected to fines, or more seriously, to judicial punishment.

2.6. Market Performance

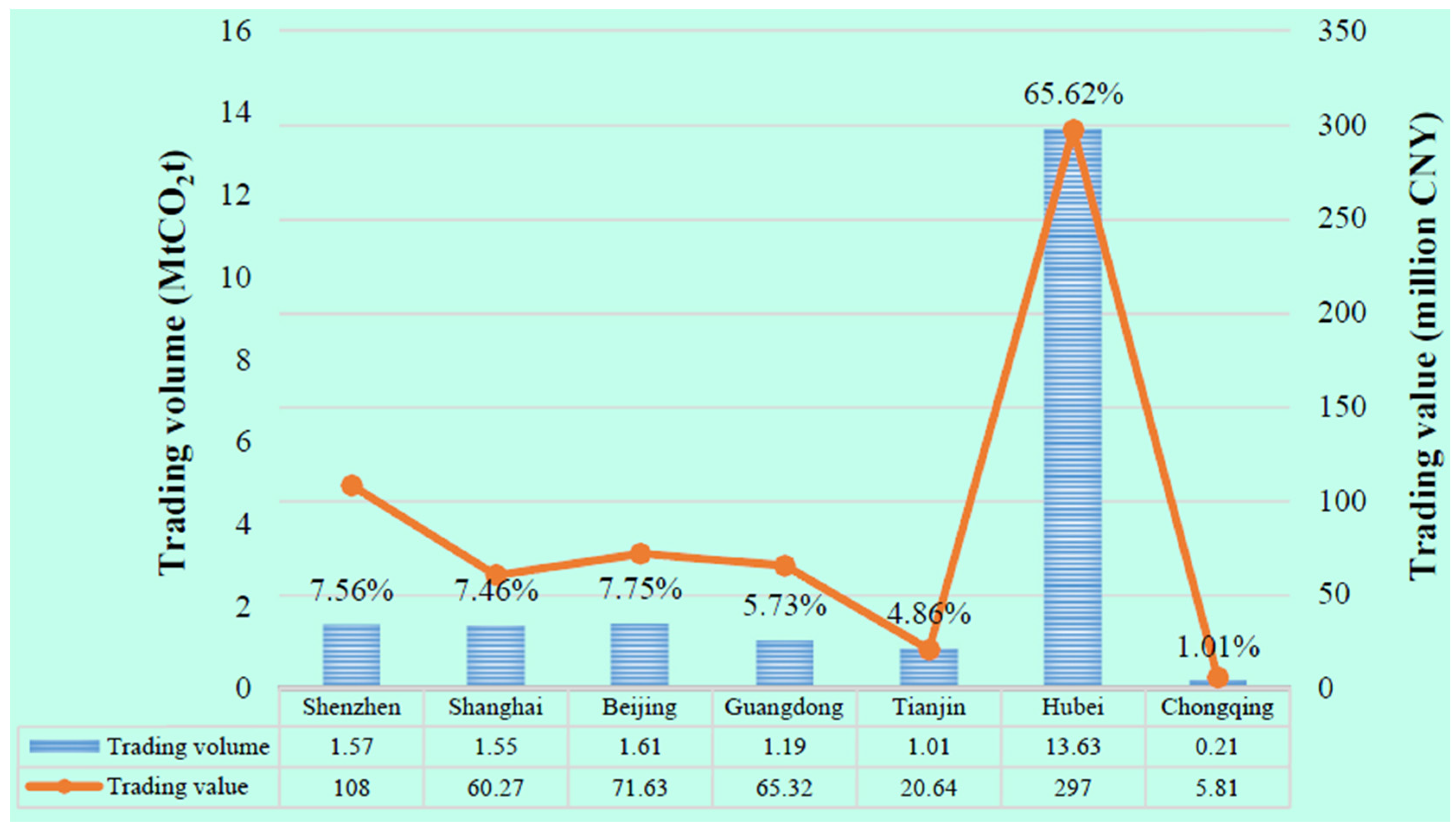

By May 2015, a cumulative 20.27 MtCO

2e have been transacted in the secondary market around China’s seven pilots for a value of 720 million CNY [

18]. As shown in

Table 3, in the first compliance period of each pilot, although some covered enterprises fail to comply with the scheme, the compliance rate still reached around 98%. In other words, about 98% of the covered enterprises surrendered enough allowances before the deadline. Despite differences in the valid trading days, the Hubei pilot proved to be the most active carbon market, accounting for 65.62% of the combined trading volume (including the primary market) of China’s carbon market, with 13.63 MtCO

2e traded at a value of 297 million CNY (see

Figure 1). In contrast, in the Chongqing pilot, transactions took place on only 8 days of its 367 valid trading days, and became highly concentrated with the deadline approaching.

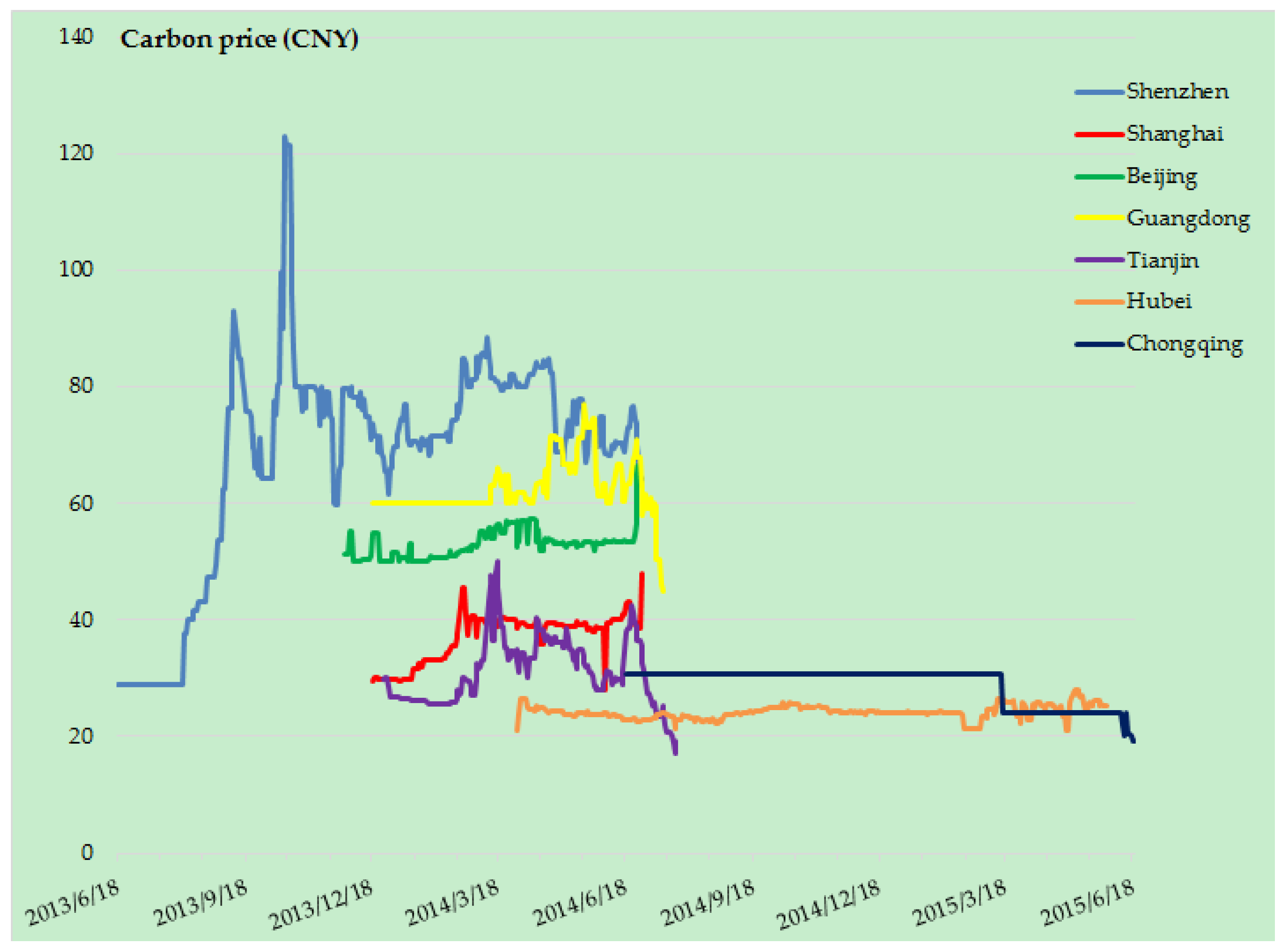

In terms of the carbon price, as illustrated in

Figure 2, Shenzhen and Guangdong maintained the highest prices, ranging from 60 CNY to 80 CNY, while Hubei and Chongqing only stayed from 20 CNY to 30 CNY. The carbon price in the Hubei market fluctuated within a narrow range, while in other pilots such as Shenzhen and Tianjin, the price swung relatively more widely, especially when the deadline approached, with significant enlargement of the trading volume.

In summary, China’s current carbon market presents an apparent trend of temporal variation. Over a whole compliance period, the transactions fluctuate more widely at the beginning and near the deadline compared with in the middle period. The transaction behavior of the entities is determined by their understanding of the policies and certainty of the information they have gathered, rather than their real demand. Thus, firstly improving the scheme design and other relevant policies would be an effective way to stimulate the carbon market in China.

3. Comparison of Several International Mandatory Emissions Trading Schemes

So far, national or state-based mandatory emissions trading schemes already in operation around the globe include: The European Union Emissions Trading Scheme (EU ETS), the Regional Greenhouse Gas Initiative (RGGI), New Zealand Emissions Trading Scheme (NZ ETS), Kazakhstan Emissions Trading Scheme (KZA ETS) and the Korea Emissions Trading Scheme. The former three schemes have gone through a relatively long time from pilot to mature market, and accumulated abundant experience in cap setting, allowance allocation, transaction format, price controls and punishment mechanism, some of which have been applied in China’s pilots. On the other hand, the KZA ETS, which started in 2013, has met barriers and challenges that brought great uncertainty to the continuity of the scheme. Therefore, in order to establish an emissions trading scheme consistent with China’s economic and social development, and then to integrate it with the world carbon market, it is necessary to analyze the similarities and differences of the former three schemes. This will help policymakers combine international experience with China’s national economic conditions to develop a suitable national carbon trading scheme. Additionally, given that the Korean scheme has been running for just half a year, and its efficiency and effectiveness still needs to be tested by the market, Korea’s ETS is not analyzed below.

As presented in

Table 4, combined with the previous description of China’s ETS pilots, the similarities and differences between international common practice and China’s practice can be analyzed as follows.

3.1. Undergoing a Transition Period of “Learning by Doing”

Designing a suitable emissions trading scheme is a gradual process. Thus, a transitional period for a newly established scheme, involving exploring and gathering experience, is essential. This can help identify and estimate the major risks in terms of policy and legislation, carbon price fluctuation and its linkage to energy consumption, carbon leakage,

etc. for the follow-up compliance period, and meanwhile cultivates a profound understanding of the association between enterprise-level development and the climate change issue. Most notably, the absence of reliable emissions data highlights the role played by the transition period in monitoring and measuring the emissions, and hence providing references for cap setting and allocation. For instance, during Phase I (2005–2007) of the EU ETS, the total allocation of the allowances was determined on the basis of best guesses. Consequently, the carbon price fell to zero in 2007 because of excess supply of allowances. However, considerable verified data and information had been gathered, supporting preparation for Phase II [

26].

In the main, each mandatory ETS above has undergone a transition period of approximately three years. No exception, China is going through a three-year pilot period. Each pilot is exploring suitable approaches for local emissions abatement. Further, the seven pilots will provide valuable guidance for the national ETS commencing in 2017.

3.2. Energy-Intensive Industry Firstly Incorporated into Coverage

Obviously, energy and industrial sectors are firstly regulated into coverage under the ETS. With the development of the ETS, other sectors have been incorporated pursuant to the emissions trends and regulation requirements. New Zealand gave priority to carbon sequestration in forests during the transition period. In 2015, the agriculture sector had to surrender allowances because it contributed the largest proportion of total emissions from 1990 to 2012, and as much as 46.1% in 2012 [

27]. However, carbon emissions are not necessarily the major factor influencing the determination to set the coverage for all sectors. After the European Commission Directive 2008/101/EC required flights into and out of Europe to be covered under the EU ETS in 2012, it brought criticism of the European Union and negotiations with the United States and China [

28]. This suggests that both domestic and international interests should also be taken into consideration.

3.3. Auctioning to Become the Primary Allocation Method

With regard to allocation method, free allocation and auctioning are both adopted by schemes internationally, except that the RGGI implemented full auctioning from the very beginning. During the transition period, for the EU and NZ, above 90% of the allowances were allocated free of charge. As the carbon market is becoming more active and mature, the covered enterprises show growing enthusiasm for carbon trading, giving way to auctioning of allowances becoming the primary allocation method, with the intention for it replace free allocation completely in the future. However, it varies according to industry. For example, the EU ETS requires that the power sector should purchase all allowances in Phase III, while New Zealand sets a requirement that sectors which can put compliance costs onto customers (e.g., the energy, liquid fossil fuels, synthetic gases and waste sectors) will not receive any allowance for free. Similarly, China follows international common practice. During the pilot period, the covered enterprises receive the allowances without paying in most pilots. However, following Guangdong, Shenzhen and Hubei have reserved some allowances to be auctioned, in order to test the effectiveness of auctioning and the enterprises’ acceptance of purchasing allowances. That is, auctioning is planned to become the main method in China.

3.4. Banking Allowed While Borrowing Not

Largely, most mandatory carbon markets allow that if the covered enterprises acquire more allowances than their actual emissions, they can bank the surplus allowances. However, borrowing allowances is not allowed currently. In particular, within the three-year Phase I of the EU ETS, banking and borrowing was allowed, but surplus allowances could not be banked to the next phase, neither could they be borrowed from the next phase [

29,

30]. However, we might note that adjustment had been made in Phase II. The financial crisis impacted Europe heavily, triggering a full-blown recession. Correspondingly, GHG emissions dramatically declined and so did the demand for allowances as a result. Thus, inter-period banking was allowed in 2012, namely, surplus allowances could be banked to Phase III, which aimed to prevent the price from dropping to zero again [

31].

As mentioned in

Section 2.2.2, there exists no common approach to the process of banking in China. One common concern lies in the fact that inter-period use of the allowances may have a negative impact on current compliance. It seems that throughout the international mandatory schemes, there is more likely to be oversupply of allowances than a scarcity of them, making the demand for banking more urgent than borrowing. Whichever approach is taken, with banking and/or borrowing allowed or not, each scheme has its own concerns.

3.5. Flexible Transaction Formats

Official information about the transaction formats in the NZ ETS remains unspecified. Apart from that, in the spot market, auctions are usually held in the format of single-round, sealed bid and uniform-price in the EU ETS and RGGI. In addition, futures markets also exist, accounting for over 80% of the total carbon market. Particularly, as the world’s first major carbon market, the EU ETS introduced carbon futures almost immediately after the scheme launched in 2005. Such financial derivatives as futures, forwards, and options contracts have been traded in the Intercontinental Exchange, and the allowances can be traded across states without restriction. In this regard, China has not established a carbon futures market yet. However, feasibility research on emissions futures has been made by several exchanges, which see the obvious benefits of introducing futures products to promote the carbon market.

3.6. Adopting Price Controls

As can be seen in

Table 4, various price control measures can be classified into two categories: direct control and indirect control. The former, which means setting a concrete limitation on the price, is typical of the RGGI and NZ ETS. The RGGI limited the minimum acceptable price in each quarterly auction as $2 in 2014. As for New Zealand, the primary emissions trading unit issued by the Crown, the NZU is sold by the government at a fixed price of NZ $25.

Indirect control is more complex and is conducted by adjusting supply of the allowances to balance with demand. Strictly speaking, inter-period use of allowances should also be regarded as an indirect way to control the price, which is not covered by this section. Other measures include, for example, the RGGI Cost Containment Reserve (CCR) that allows for limited additional allowances to be available for sale when the auction price rises above the CCR trigger price—$4 in 2014, $6 in 2015, $8 in 2016, $10 in 2020, rising annually by 2.5% thereafter. Similarly, the European Commission has put forward a legislative proposal to establish a market stability reserve in 2021. This proposal, which was approved in late March 2015, is designed to deduct or release a certain amount of allowances to address current imbalance of supply and demand.

The above two methods have been adopted in China’s pilots more or less. Moreover, through such creative measures as the postponing the auctioning of allowances (“back-loading” of auctions) and linking to overseas carbon markets, have only been taken by international schemes so far, they may be applied to China if necessary someday.

3.7. Establishing a Punishment Mechanism

As far as the punishment mechanism is concerned, it is common to impose fines for non-compliance. Further, flexibility in punishment has been enhanced in some schemes. In the RGGI, in addition to a uniform penalty, non-compliant power plants that fail to surrender required allowances may be subjected to state-specific penalties. Under the NZ ETS, it is provided that the penalty may be cancelled by 100 percent, if the non-compliant enterprise reports voluntarily about its failure to meet the obligations before the authorities send the penalty notice or visit the enterprise. At present in China’s pilots, the punishment mechanism has operated at different levels, thereby leading to different market performance. In fact, throughout the entire global carbon market, the inexorable trend toward increasingly rigid punishment of non-compliance is making it an indispensable and significant tool. With the assurance of a valid sanction mechanism, the stakeholders (regulators, covered enterprises, investors, etc.) are organized and encouraged to participate in the market, promising a healthy and long-term future of the emissions trading scheme.

4. Recommendations on Establishing a National Carbon Market in China

In China, the NDRC is leading the establishment of a national emissions trading scheme by 2017. In order to launch the national carbon market as scheduled, extensive studies have been made on cap setting, allocation method, transaction rules, and the regulation system

etc. By the end of 2014, reporting and verification guidelines for ten sectors, as well as a fundamental framework for the national ETS were released. However, related specific rules have not been issued yet. Fortunately, as a result the EU ETS, emissions trading schemes have been in force for more than ten years. In addition to mandatory national schemes, experiences from sub-national schemes, which are not analyzed in

Section 3, are also well worth investigation. Combining Chinese and international experience, recommendations on building a suitable and efficient national scheme are proposed as follows.

4.1. Making Long-Term Effective Targets and Policies

As a major developing country, China is faced with the double pressure to ensure economic growth and energy saving. Since China has not yet reached peak carbon, conflict between increasing energy consumption and carbon trading or GHG emissions abatement has become a paramount consideration in international negotiation and policymaking. Nevertheless, establishing a national emissions trading scheme has been put on the agenda, and should be recognized as an important part of the strategy of economic transformation, rather than an independent system. Therefore, a definite top-down roadmap for developing the national carbon trading scheme needs to be drawn up by the NDRC. The roadmap should elaborate medium- and long-term targets, possible risks and feasible measures, which should be mandatory for local governments to follow, and should facilitate the enterprises to make strategies for energy saving and emissions reduction by sending a clear signal. Besides, the roadmap should also be consistent with existing policies involved in energy reform, upgrading of the industrial structure, climate change and prevention of air pollution, as well as such potential policies as energy trading and carbon tax.

Regarding the carbon trading scheme as a whole, the cap ought to be set via a top-down approach, leaving local governments less autonomy, to avoid a loose target due to local protectionism. Further, regional carbon markets and linking with overseas should be encouraged on a basis of homogenous emissions unit. This needs an appropriate plan in the design stage of the scheme.

4.2. Expanding the Coverage in a Steady and Orderly Way

The ultimate purpose of establishing a national scheme is not to reflexively impose regulation on to enterprises, but rather to propel high-emitting enterprises to save energy at least cost. In fact, many high-emitting enterprises need more support and guidance than rigid standards, due to their relatively low profitability. Thus, policymakers can reduce the reporting threshold instead of expanding the coverage in the early years. More enterprises will have to report their emissions and make a clean production plan ahead of compliance, which will give lead-time for them to meet the obligations. Moreover, it is important to balance territorial jurisdiction and sector supervision. For example, in China, the power sector is highly supervised by the National Energy Administration (NEA), the Ministry of Environmental Protection (MEP) and local government. If the local government is offered too much discretion, it may tend to protect local power enterprises, which may interfere with fair competition and allowances liquidity across regions. On the other hand, if emphasis is given to sector supervision, emissions will also be monitored and calculated by the sector authorities, which may to a certain extent separate the power sector from the carbon trading scheme as a whole. Another example is the aviation sector. As mentioned before, regional and international coordination will be emphasized if the aviation sector is covered. To sum up, it is suggested to rely mainly on territorial jurisdiction while taking account of sector supervision, and make policies in accordance with the development requirements and existing standards of the sector.

4.3. Improving Monitoring, Reporting and Verification

No doubt, a well working scheme depends on a foundation of solid data. Although carbon trading is still new in China, policymakers can absorb domestic experience from energy statistics and pilot guidelines to develop the methodologies of estimating emissions. More significantly, regular training should be highlighted. The enterprise, whether covered or not, should organize a professional team or perhaps an independent department with an educational background in energy, environment, economics or management. This team can study national policies, methodologies as well as other trading-related knowledge, to help the enterprise establish a carbon management system, including making the monitoring plan, implementing internal energy audits and investing promising CCER (Chinese Certified Emission Reduction) projects. The government should lead and provide financial support for the training, and promote communication across regions and enterprises. What is more, independent and reliable third-party verification agencies with expertise and discipline are required. Independence, guaranteeing fairness and impartiality, will be achieved by a strict selection procedure and punishment management.

4.4. Introducing Carbon Futures in Due Course

Carbon futures are a financial derivative of the spot market. Its healthy functioning is based on a reliable carbon spot market. In spite of there being seven carbon spot markets in China, each of them operates independently, which obstructs allowances trading between pilots. Thus, moving from pilots to the national scheme, it is not recommended to introduce carbon futures simultaneously when launching the national spot market next year. Firstly, for a national ETS, uniform standards for the carbon spot market should be established, including for the emissions units, transaction rules and offsets mechanism. Secondly, though futures is a powerful instrument to hedge against risks, and covered enterprises may earn a profit through carbon trading, the government should place greater emphasis on the obligations than the profitability. It is not until the national carbon spot market steps into a stage of relatively stable development will the carbon futures be introduced into the scheme. Meanwhile, during the preparatory phase, policymakers should develop various futures products according to the spot market, especially investigating possible connection between the emissions price and the energy market, and design corresponding regulations.

4.5. Establishing a Rigorous and Comprehensive Punishment Mechanism

In fact, the punishment mechanism involves more than just merely penalties that non-compliant enterprises and other agents can face. Therefore, the best way to reduce punishment costs is to foster constant and sufficient communication between the authorities and the trading agents. The government should establish a feedback mechanism and enhance communication of information through multiple platforms, affirm the national commitment to tackle climate change, and stress the severity of non-compliance, to help the enterprises gradually improve their consciousness of emissions reduction and profitability in carbon trading. In this sense, the authorities ought to strengthen legislation and law enforcement on climate change, particularly define responsibilities of each regulator, which is usually ignored. In particular, much of the large-scale state-owned enterprises and public utilities are inevitably regulated under the trading scheme. However, such entities tend to take a conservative attitude towards carbon trading and refuse to disclose related data because of confidentiality concerns. Sometimes they may hardly comply with their obligations, and even seek release from the regulator. Thus, the regulator should pay more attention to their compliance, and strictly execute the punishment mechanism if they fail to meet their obligations. Last but not least, the implementation of the emissions trading scheme should be subject to public scrutiny. Like the Committee on Climate Change (CCC) in the UK, independent agencies also need to be empowered to offer suggestions and raise inquiries to the government in China, which will balance the government power and further turn the emissions trading scheme into an action of public participation.

5. Conclusions

As a major developing country, faced with the conflict between economic growth and emissions reduction, China has been gradually increasing its action to mitigate climate change. After almost three years of experience with carbon market pilots, China has accumulated abundant experience for the establishment of a national emissions trading scheme. In respect to coverage and setting of reporting thresholds, allowance allocation, transactions and punishment mechanisms, each pilot has its own priorities and rules, thus leading to different market performance. This is reflected by the compliance rate, carbon price, and trading volume, etc. However, as with the national or state-based mandatory emissions trading schemes around the world, there exists no one-size-fits-all scheme. Therefore, it is of great importance to understand the logic behind the scheme design, i.e., to gain a comprehensive and profound knowledge of existing economic conditions and problems for the development of ETS. For China, the absence of legislation and low executive capacity are two main factors that may hamper sustainable development of the carbon market. Policymakers should strengthen legislation and make long-term effective policies on climate change. Under the guidance of a uniform framework and other relevant regulations, the regulators should improve their executive capacity and enforce the rules for reward and punishment. Moreover, the government has always emphasized on learning from international experiences, but only if attention is paid to China’s own economic realities and experiences, such as the macroeconomic environment, the operation of both spot and futures markets, will China establish a suitable and efficient national emissions trading scheme.