From Life Cycle Costing to Economic Life Cycle Assessment—Introducing an Economic Impact Pathway

Abstract

:1. Introduction

2. The Economic Pillar of Life Cycle Sustainability Assessment

2.1. Life Cycle Costing

2.2. Economic Aspects within the Life Cycle Sustainability Assessment Framework

3. Introducing Economic Life Cycle Assessment

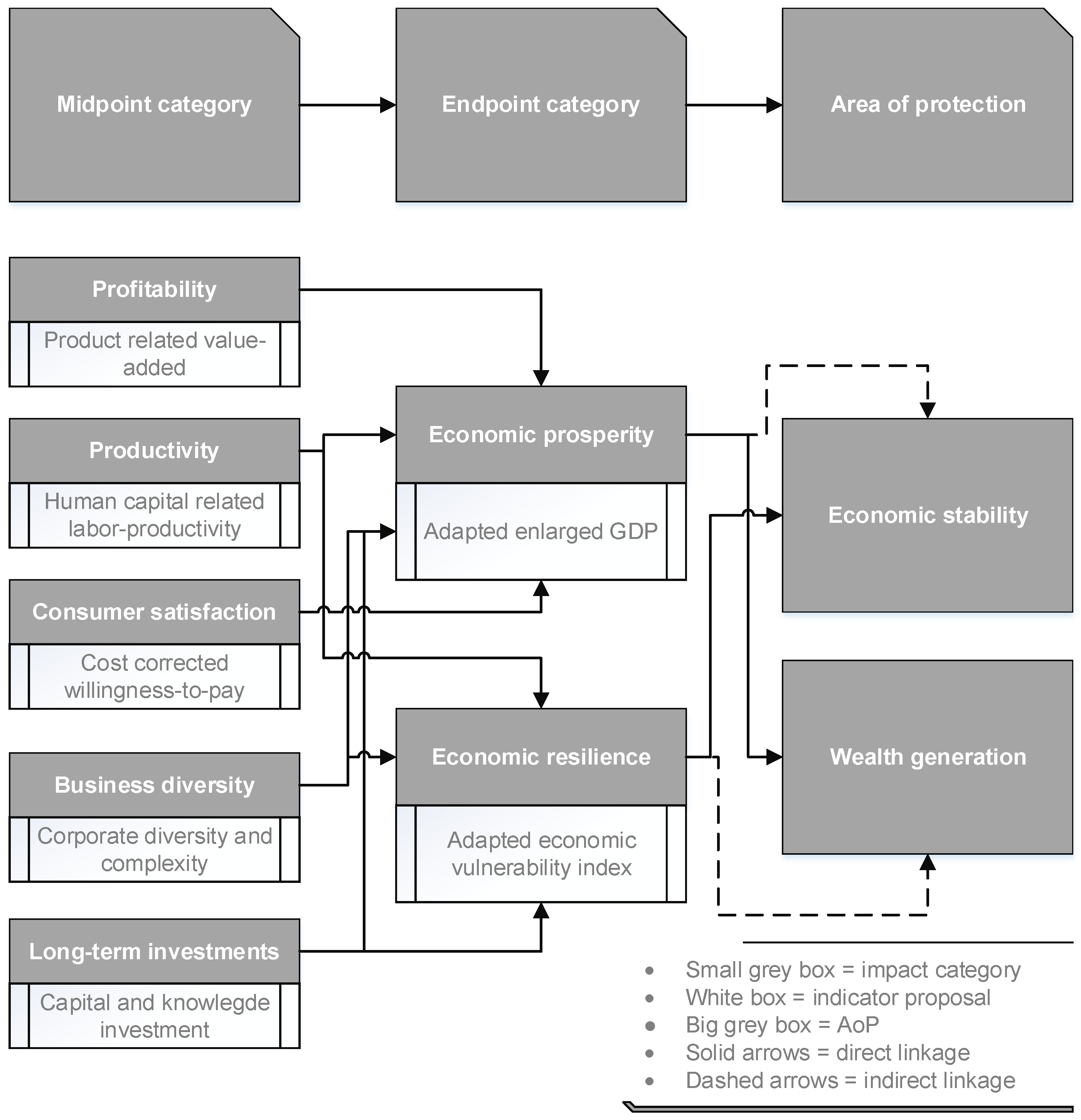

3.1. Impact Pathway Definition

3.2. Areas of Protection within EcLCA

3.2.1. Economic Stability

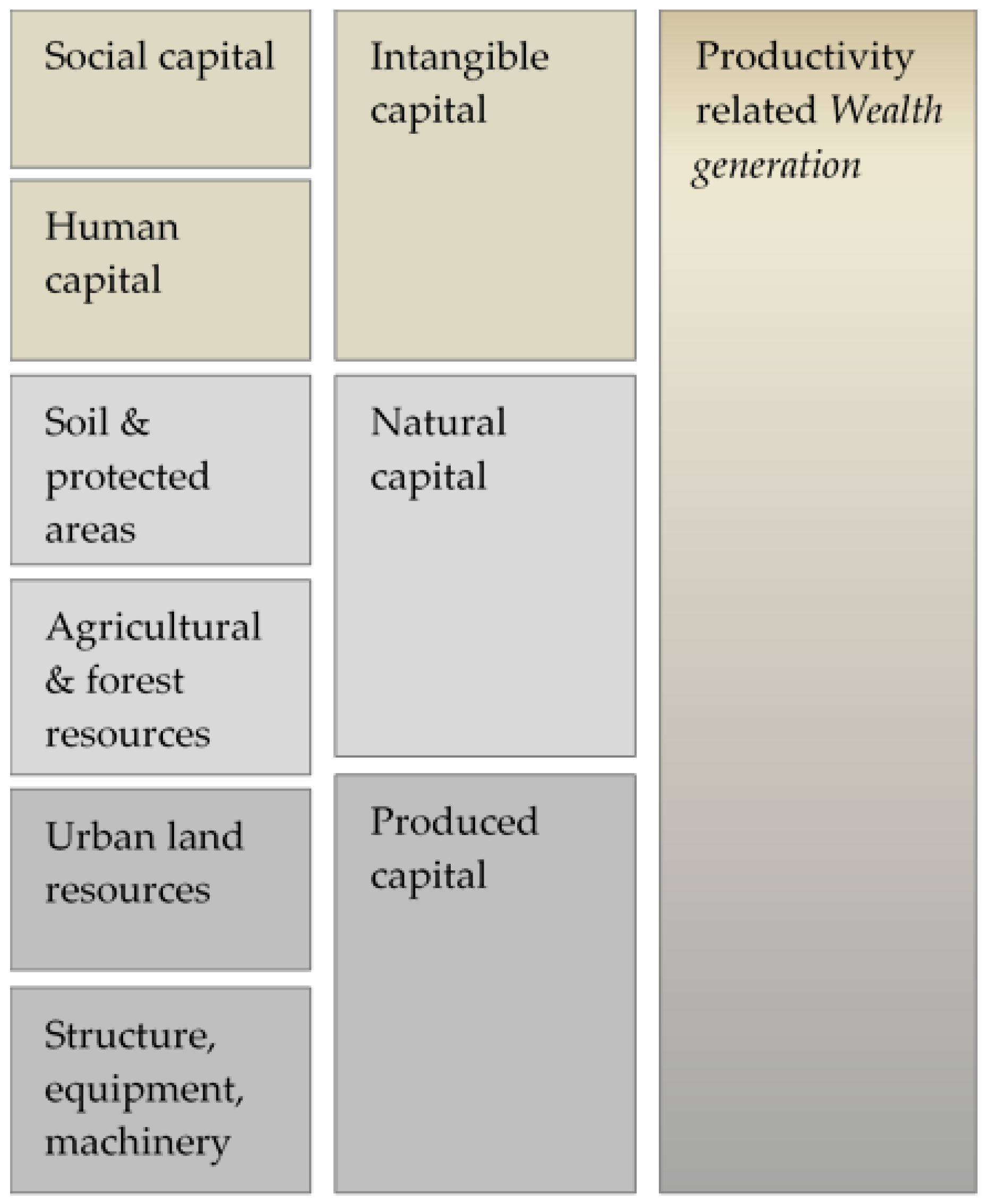

3.2.2. Wealth Generation

3.3. Definition of Endpoint Categories in EcLCA

3.3.1. Economic Prosperity

3.3.2. Economic Resilience

3.4. Definition of Midpoint Categories in EcLCA

3.4.1. Profitability

3.4.2. Productivity

3.4.3. Consumer Satisfaction

3.4.4. Business Diversity

3.4.5. Long-Term Investment

4. Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviation

| AoP | Area of protection |

| CBA | cost–benefit analysis |

| EcLCA | Economic life cycle assessment |

| GDP | Gross domestic product |

| GNP | Gross national product |

| GPI | Genuine Progress Indicator |

| HCRR | Human capital related rate of return |

| ICAEW | Institute of Chartered Accountants in England and Wales |

| IMF | International Monetary Fund |

| ISEW | Index of Sustainable Economic Welfare |

| ISO | International Organization for Standardization |

| LCA | Life cycle assessment |

| LCC | Life cycle costing |

| LCSA | Life cycle sustainability assessment |

| OECD | Organization for Economic Co-operation and Development |

| SD | Sustainable development |

| SLCA | Social life cycle assessment |

| VA | Value added |

| WTP | Willingness-to-pay |

References

- Intergovernmental Panel on Climate Change (IPCC). IPCC: Climate Change 2013—The Physical Science Basis. Summary for Policymakers; Stocker, T.F., Qin, D., Plattner, G.-K., Tignor, M.M.B., Allen, S.K., Boschung, J., Nauels, A., Xia, Y., Bex, V., Midgley, P.M., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2013. [Google Scholar]

- Boons, F.; Montalvo, C.; Quist, J.; Wagner, M. Sustainable innovation, business models and economic performance: an overview. J. Clean. Prod. 2013, 45, 1–8. [Google Scholar] [CrossRef]

- Ehrenfeld, J.R. The Roots of Sustainability. Sloan Manage. Rev. 2005, 46, 23–25. [Google Scholar]

- United Nations. Report of the World Commission on Environment and Development—Our Common Future; Oxford University Press: New York, NY, USA; Toronto, ON, Canada, 1987. [Google Scholar]

- UNCED. A Summary of the Proceedings of the United Nations Conference on Environment and Development 3–14 June 1992. Available online: http://www.iisd.ca/download/pdf/enb0213e.pdf (accessed on 28 April 2016).

- Finkbeiner, M.; Schau, E.M.; Lehmann, A.; Traverso, M. Towards Life Cycle Sustainability Assessment. Sustainability 2010, 2, 3309–3322. [Google Scholar] [CrossRef]

- Hacking, T.; Guthrie, P. A framework for clarifying the meaning of Triple Bottom-Line, Integrated, and Sustainability Assessment. Environ. Impact Assess. Rev. 2008, 28, 73–89. [Google Scholar] [CrossRef]

- Heijungs, R.; Huppes, G.; Guinée, J.B. Life cycle assessment and sustainability analysis of products, materials and technologies. Toward a scientific framework for sustainability life cycle analysis. Polym. Degrad. Stab. 2010, 95, 422–428. [Google Scholar] [CrossRef]

- Klöpffer, W. Life Cycle Sustainability Assessment of Products. Int. J. Life Cycle Assess. 2008, 13, 89–95. [Google Scholar] [CrossRef]

- Neugebauer, S.; Martinez-Blanco, J.; Scheumann, R.; Finkbeiner, M. Enhancing the practical implementation of life cycle sustainability assessment—Proposal of a Tiered approach. J. Clean. Prod. 2015, 102, 165–176. [Google Scholar] [CrossRef]

- Hunkeler, D.; Rebitzer, G.; Lichtenvort, K. Environmental Life Cycle Costing; CRC Press: Boca Raton, FL, USA, 2008. [Google Scholar]

- Klöpffer, W.; Ciroth, A. Is LCC relevant in a sustainability assessment? Int. J. Life Cycle Assess. 2011, 16, 99–101. [Google Scholar] [CrossRef]

- Swarr, T.E.; Hunkeler, D.; Klöpffer, W.; Pesonen, H.-L.; Ciroth, A.; Brent, A.C.; Pagan, R. Environmental life-cycle costing: A code of practice. Int. J. Life Cycle Assess. 2011, 16, 389–391. [Google Scholar] [CrossRef]

- Gluch, P.; Baumann, H. The life cycle costing (LCC) approach: A conceptual discussion of its usefulness for environmental decision-making. Build. Environ. 2004, 39, 571–580. [Google Scholar] [CrossRef]

- Hall, M.R. A transdisciplinary review of the role of economics in life cycle sustainability assessment. Int. J. Life Cycle Assess. 2015, 20, 1625–1639. [Google Scholar] [CrossRef]

- Singh, R.K.; Murty, H.R.; Gupta, S.K.; Dikshit, A.K. An overview of sustainability assessment methodologies. Ecol. Indic. 2012, 15, 281–299. [Google Scholar] [CrossRef]

- Sneddon, C.; Howarth, R.B.; Norgaard, R.B. Sustainable development in a post-Brundtland world. Ecol. Econ. 2006, 57, 253–268. [Google Scholar] [CrossRef]

- European Commission. Economic Stability and Growth. Available online: http://ec.europa.eu/economy_finance/euro/why/stability_growth/index_en.htm (accessed on 26 April 2016).

- International Monetary Fund (IMF). How the IMF Promotes Global Economic Stability; IMF: Washington, DC, USA, 2015. [Google Scholar]

- Jackson, T. Prosperity without Growth; World Tour Forum Lucerne: Luzern, Switzerland, 2011. [Google Scholar]

- Settanni, E.; Newnes, L.B.; Thenent, N.E.; Parry, G.; Goh, Y.M. A through-life costing methodology for use in product–service-systems. Int. J. Prod. Econ. 2014, 153, 161–177. [Google Scholar] [CrossRef] [Green Version]

- ISO. ISO 15686-5:2008. Buildings and Constructed Assets—Service-Life Planning—Life-Cycle Costing; ISO: Geneva, Switzerland, 2008. [Google Scholar]

- Grießhammer, R.; Buchert, M.; Gensch, C.-O.; Hochfeld, C.; Manhart, A.; Rüdenauer, I. PROSA–Product Sustainability Assessment; Institute for Applied Ecology: Freiburg, Germany, 2007; Volume 49. [Google Scholar]

- Rebitzer, G.; Hunkeler, D. Life cycle costing in LCM: Ambitions, opportunities, and limitations. Int. J. Life Cycle Assess. 2003, 8, 253–256. [Google Scholar] [CrossRef]

- May, J.R.; Brennan, D.J. Sustainability Assessment of Australian Electricity Generation. Process Saf. Environ. Prot. 2006, 84, 131–142. [Google Scholar] [CrossRef]

- Kruse, S.A.; Flysjö, A.; Kasperczyk, N.; Scholz, A.J. Socioeconomic indicators as a complement to life cycle assessment—An application to salmon production systems. Int. J. Life Cycle Assess. 2009, 14, 8–18. [Google Scholar] [CrossRef]

- Thomassen, M.A.; Dolman, M.A.; van Calker, K.J.; de Boer, I.J.M. Relating life cycle assessment indicators to gross value added for Dutch dairy farms. Ecol. Econ. 2009, 68, 2278–2284. [Google Scholar] [CrossRef]

- Heijungs, R.; Settanni, E.; Guinée, J. Toward a computational structure for life cycle sustainability analysis: Unifying LCA and LCC. Int. J. Life Cycle Assess. 2012, 18, 1722–1733. [Google Scholar] [CrossRef] [Green Version]

- Jeswani, H.K.; Azapagic, A.; Schepelmann, P.; Ritthoff, M. Options for broadening and deepening the LCA approaches. J. Clean. Prod. 2010, 18, 120–127. [Google Scholar] [CrossRef]

- Wood, R.; Hertwich, E.G. Economic modelling and indicators in life cycle sustainability assessment. Int. J. Life Cycle Assess. 2012, 18, 1710–1721. [Google Scholar] [CrossRef]

- ISO. ISO 14044:2006. Environmental Management—Life Cycle Assessment—Requirements and Guidelines; Deutsches Institut für Normung e.V.: Berlin, Germany, 2006. [Google Scholar]

- Curran, R.; Raghunathan, S.; Price, M. Review of aerospace engineering cost modelling: The genetic causal approach. Prog. Aerosp. Sci. 2004, 40, 487–534. [Google Scholar] [CrossRef]

- Hochschorner, E.; Noring, M. Practitioners’ use of life cycle costing with environmental costs—A Swedish study. Int. J. Life Cycle Assess. 2011, 16, 897–902. [Google Scholar] [CrossRef]

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Jørgensen, A.; Herrmann, I.T.; Bjørn, A. Analysis of the link between a definition of sustainability and the life cycle methodologies. Int. J. Life Cycle Assess. 2013, 18, 1440–1449. [Google Scholar] [CrossRef]

- Reap, J.; Roman, F.; Duncan, S.; Bras, B. A survey of unresolved problems in life cycle assessment. Int. J. Life Cycle Assess. 2008, 13, 374–388. [Google Scholar] [CrossRef]

- Benoit, C.; Mazijn, B. Guidelines for Social Life Cycle Assessment of Products; UNEP/SETAC Life Cycle Initiative: Paris, France, 2009. [Google Scholar]

- Vanclay, F. Conceptualising social impacts. Environ. Impact Assess. Rev. 2002, 22, 183–211. [Google Scholar] [CrossRef]

- Jolliet, O.; Müller-Wenk, R.; Bare, J.; Brent, A.; Goedkoop, M.; Heijungs, R.; Itsubo, N.; Peña, C.; Pennington, D.; Potting, J.; et al. The LCIA Midpoint-damage Framework of the UNEP/SETAC Life Cycle Initiative. Int. J. Life Cycle Assess. 2004, 9, 394–404. [Google Scholar] [CrossRef]

- Jørgensen, A.; Lai, L.C.H.; Hauschild, M.Z. Assessing the validity of impact pathways for child labour and well-being in social life cycle assessment. Int. J. Life Cycle Assess. 2010, 15, 5–16. [Google Scholar] [CrossRef]

- Zamagni, A.; Pesonen, H.-L.; Swarr, T. From LCA to Life Cycle Sustainability Assessment: Concept, Practice and Future Directions. Int. J. Life Cycle Assess. 2013, 18, 1637–1641. [Google Scholar] [CrossRef]

- Hill, E.; Wial, H.; Wolman, H. Exploring Regional Economic Resilience; Institute of Urban and Regional Development: Berkley, CA, USA, 2008. [Google Scholar]

- Ștefănescu-Mihăilă, R. Social Investment, Economic Growth and Labor Market Performance: Case Study—Romania. Sustainability 2015, 7, 2961–2979. [Google Scholar] [CrossRef]

- Bleaney, M.F. Macroeconomic stability, investment and growth in developing countries. J. Dev. Econ. 1996, 48, 461–477. [Google Scholar] [CrossRef]

- Briguglio, L.; Cordina, G.; Farrugia, N.; Vella, S. Economic Vulnerability and Resilience: Concepts and Measurements. Oxf. Dev. Stud. 2009, 37, 229–247. [Google Scholar] [CrossRef]

- Organisation for Economic Co-operation and Development (OECD). Measuring Productivity; OECD: Paris, France, 2001. [Google Scholar]

- Malizia, E.E.; Ke, S. The Influence of Economic Diversity on Unemployment and Stability. J. Reg. Sci. 1993, 33, 221–235. [Google Scholar] [CrossRef]

- Oxenburgh, M.; Marlow, P.S.P.; Oxenburgh, A. Increasing Productivity and Profit through Health and Safety: The Financial Returns from a Safe Working Environment; CRC Press: Boca Raton, FL, USA, 2004. [Google Scholar]

- Simmie, J.; Martin, R. The economic resilience of regions: Towards an evolutionary approach. Cambridge J. Reg. Econ. Soc. 2010, 3, 27–43. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Service-dominant logic: Continuing the evolution. J. Acad. Mark. Sci. 2008, 36, 1–10. [Google Scholar] [CrossRef]

- Anand, S.; Sen, A. Human development and economic sustainability. World Dev. 2000, 28, 2029–2049. [Google Scholar] [CrossRef]

- Felipe, J.; Hidalgo, C. Economic diversification implications for Kazakhstan. In Development and Modern Industrial Policy in Practice: Issues and Country Experiences; Felipe, J., Ed.; Edward Elgar Pub: Cheltenham, UK; Northampton, MA, USA; Asian Development Bank: Manila, Philippines, 2015; pp. 160–196. [Google Scholar]

- Offer, A. A Vision of Prosperity; SDC Commission Workshop: London, UK, 2007; pp. 1–11. [Google Scholar]

- Blok, K.; Huijbregts, M.; Roes, L.; van Haaster, B.; Patel, M.K.; Hertwich, E.; Hauschild, M.; Sellke, P.; Antunes, P.; Hellweg, S.; et al. A Novel Methodology for the Sustainability Impact Assessment of New Technologies; EC 7th framework project PROSUITE: Utrecht, The Netherlands, 2013. [Google Scholar]

- Daly, H.E. For the Common Good: Redirecting the Economy Toward Community, the Environment, and a Sustainable Future; Beacon Press: Boston, MA, USA, 1994. [Google Scholar]

- Meadows, D.H.; Meadows, D.L.; Randers, J.; Behrens, W.W. The Limits to Growth; Universe Books: New York, NY, USA, 1972. [Google Scholar]

- Meadows, D.; Meadows, D.; Randers, J. Limits to Growth: The 30-Year Update; Chelsea Green Publishing: White River Junction, VT, USA, 2004. [Google Scholar]

- Blundell, R.; Dearden, L.; Meghir, C.; Sianesi, B. Human Capital Investment: The Returns from Education and Training to the Individual, the Firm and the Economy. Financ. Stud. 1999, 20, 1–23. [Google Scholar] [CrossRef]

- Jonkman, S.N.; van Gelder, P.H.; Vrijling, J.K. An overview of quantitative risk measures for loss of life and economic damage. J. Hazard. Mater. 2003, 99, 1–30. [Google Scholar] [CrossRef]

- World Bank. The Changing Wealth of Nations; World Bank: Washington, DC, USA, 2011. [Google Scholar]

- Oxfam International. Oxfam Poverty Footprint—Understanding Business Contribution to Development; Oxfam International: Oxford, UK, 2009. [Google Scholar]

- Haes, H.; Jolliet, O.; Norris, G.; Saur, K. UNEP/SETAC life cycle initiative: Background, aims and scope. Int. J. Life Cycle Assess. 2002, 7, 192–195. [Google Scholar] [CrossRef]

- Jørgensen, A.; Le Bocq, A.; Nazarkina, L.; Hauschild, M. Methodologies for Social Life Cycle Assessment. Int. J. Life Cycle Assess. 2008, 13, 96–103. [Google Scholar] [CrossRef]

- Giddings, B.; Hopwood, B.; O’Brien, G. Environment, economy and society: Fitting them together into sustainable development. Sustain. Dev. 2002, 10, 187–196. [Google Scholar] [CrossRef]

- European Commission Joint Research Centre. ILCD Handbook: Analysis of Existing Environmental Impact Assessment Methodologies for Use in Life Cycle Assessment; European Commission Joint Research Centre: Ispra, Italy, 2010. [Google Scholar]

- Kollmorgen, R.; Merkel, W.; Wagener, H. Transformation und Transformationsforschung: Zur Einfuhrung; Springer Fachmedien: Wiesbaden, Germany, 2015. (In German) [Google Scholar]

- Attaran, M. Industrial diversity and economic performance in U.S. areas. Ann. Reg. Sci. 1986, 20, 44–54. [Google Scholar] [CrossRef]

- Hamilton, K.; Ruta, G.; Bolt, K.; Markandya, A.; Pedroso-Galinato, S.; Silva, P.; Ordoubadi, M.S.; Lange, G.-M.; Tajibaeva, L. Where is the Wealth of Nations? World Bank: Washington, DC, USA, 2006. [Google Scholar]

- Costanza, R.; d’Arge, R.; de Groot, R.; Farber, S.; Grasso, M.; Hannon, B.; Limburg, K.; Naeem, S.; O’Neill, R.V.; Paruelo, J.; et al. The value of the world’s ecosystem services and natural capital. Nature 1997, 387, 253–260. [Google Scholar] [CrossRef]

- Easterlin, R. Does economic growth improve the human lot? In Nations and Households in Economic Growth: Essays in Honor of Moses Abramovitz; David, P., Reder, M., Eds.; Academic Press: New York, NY, USA, 1974; pp. 89–125. [Google Scholar]

- Clark, D.A. The Capability Approach: Its Development, Critiques and Recent Advances; Global Poverty Research Group: Oxford, UK, 2005. [Google Scholar]

- Diener, E.; Seligman, M.E.P. Beyond Money—Toward an Economy of Well-Being. Psychol. Sci. Public Interest 2004, 5, 1–31. [Google Scholar] [CrossRef] [PubMed]

- Layard, R.; Mayraz, G.; Nickell, S. The marginal utility of income. J. Public Econ. 2008, 92, 1846–1857. [Google Scholar] [CrossRef]

- Spash, C.L. New foundations for ecological economics. Ecol. Econ. 2012, 77, 36–47. [Google Scholar] [CrossRef] [Green Version]

- Sen, A. The Ends and Means of Sustainability. J. Hum. Dev. Capab. 2013, 14, 6–20. [Google Scholar] [CrossRef]

- Bare, J.C.; Hofstetter, P.; Pennington, D.W.; de Haes, H.A.U. Midpoints versus Endpoints: The Sacrifices and Benefits. Int. J. Life Cycle Assess. 2000, 5, 319–326. [Google Scholar] [CrossRef]

- Pennington, D.W.; Potting, J.; Finnveden, G.; Lindeijer, E.; Jolliet, O.; Rydberg, T.; Rebitzer, G. Life cycle assessment part 2: Current impact assessment practice. Environ. Int. 2004, 30, 721–739. [Google Scholar] [CrossRef] [PubMed]

- Neugebauer, S.; Traverso, M.; Scheumann, R.; Chang, Y.-J.; Wolf, K.; Finkbeiner, M. Impact Pathways to Address Social Well-Being and Social Justice in SLCA—Fair Wage and Level of Education. Sustainability 2014, 6, 4839–4857. [Google Scholar] [CrossRef]

- Zadek, S.; Tuppen, C. Adding Values—The Economics of Sustainable Business; Britisch Telecom: London, UK, 2000. [Google Scholar]

- Cinelli, M.; Coles, S.R.; Jørgensen, A.; Zamagni, A.; Fernando, C.; Kirwan, K. Workshop on life cycle sustainability assessment: The state of the art and research needs—November 26, 2012, Copenhagen, Denmark. Int. J. Life Cycle Assess. 2013, 18, 1421–1424. [Google Scholar] [CrossRef]

- Weidema, B. The Integration of Economic and Social Aspects in Life Cycle Impact Assessment. Int. J. Life Cycle Assess. 2006, 1, 89–96. [Google Scholar] [CrossRef]

- Bleys, B. The Regional Index of Sustainable Economic Welfare for Flanders, Belgium. Sustainability 2013, 5, 496–523. [Google Scholar] [CrossRef] [Green Version]

- Talberth, J.; Cobb, C.; Slattery, N. The Genuine Progress Indicator; Redefining progress: Oakland, CA, USA, 2007. [Google Scholar]

- Zieschank, R.; Diefenbacher, H. The National Welfare Index as a Contribution to the Debate on a More Sustainable Economy; Forschungszentrum für Umweltpolitik: Berlin, Germany, 2012. [Google Scholar]

- European Commission. Enlarged GDP. Available online: http://ec.europa.eu/environment/beyond_gdp/indicators_egdp_en.html (accessed on 26 October 2015).

- Oxford Metrica. The 2015 FM Global Resilience Index Annul Report; Oxford Metrica: Oxford, UK, 2015. [Google Scholar]

- Guillaumont, P. An Economic Vulnerability Index: Its Design and Use for International Development Policy. Available online: https://www.econstor.eu/dspace/bitstream/10419/45132/1/589771515.pdf (accessed on 28 April 2016).

- Global Reporting Initiative. G4—Sustainability Reporting Guideline; Global Reporting Initiative: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Aspromourgos, T. On the Origins of Classical Economics: Distribution and Value from William Petty to Adam Smith; Routledge: Abingdon-on-Thames, UK, 2013. [Google Scholar]

- Lindgreen, A.; Hingley, M.K.; Grant, D.B.; Morgan, R.E. Value in business and industrial marketing: Past, present, and future. Ind. Mark. Manag. 2012, 41, 207–214. [Google Scholar] [CrossRef]

- Azapagic, A.; Perdan, S. Indicators of Sustainable Development for Industry: A General Framework. Process Saf. Environ. Prot. 2000, 78, 243–261. [Google Scholar] [CrossRef]

- Nehru, V.; Swanson, E.; Dubey, A. A new database on human capital stock in developing and industrial countries: Sources, methodology, and results. J. Dev. Econ. 1995, 46, 379–401. [Google Scholar] [CrossRef]

- Jamal, W.; Saif, I. Impact of Human Capital Management on Organizational Performance. Eur. J. Econ., Financ. Admin. Sci. 2011, 34, 55–69. [Google Scholar]

- Baxter, R.; Matear, S. Measuring intangible value in business-to-business buyer-seller relationships: An intellectual capital perspective. Ind. Mark. Manag. 2004, 33, 491–500. [Google Scholar] [CrossRef]

- Wößmann, L. Specifying Human Capital: A Review, Some Extensions, and Development Effects; Working Paper No. 1007; Kiel Institute of World Economics: Kiel, Germany, 2000. [Google Scholar]

- Mulligan, C.B.; Sala-i-Martin, X. A labor income-based measure of the value of human capital: An application to the states of the United States. Jpn. World Econ. 1997, 9, 159–191. [Google Scholar] [CrossRef]

- Psacharopoulos, G. Returns to investment in education: A further update. Educ. Econ. 1994, 12, 111–134. [Google Scholar] [CrossRef]

- Montenegro, C.; Patrinos, H.A. Comparable Estimates of Returns to Schooling around the World; World Bank, Education Global Practice Group: Washington, DC, USA, 2014. [Google Scholar]

- Pesonen, H.L.; Horn, S. Evaluating the Sustainability SWOT as a streamlined tool for life cycle sustainability assessment. Int. J. Life Cycle Assess. 2012, 18, 1780–1792. [Google Scholar] [CrossRef]

- Payne, A.; Storbacka, K.; Frow, P. Managing the co-creation of value. J. Acad. Mark. Sci. 2008, 36, 83–96. [Google Scholar] [CrossRef]

- Bovea, M.; Vidal, R. Increasing product value by integrating environmental impact, costs and customer valuation. Resour. Conserv. Recycl. 2004, 41, 133–145. [Google Scholar] [CrossRef]

- Cronin, J.; Brady, M.; Hult, G.; Tomas, M. Assessing the effects of quality, value, and customer satisfaction on consumer behavioral intentions in service environments. J. Retail. 2000, 76, 193–218. [Google Scholar] [CrossRef]

- Institute of Chartered Accountants in England and Wales (ICAEW). Measurement in Financial Reporting Information for Better Markets Initiative; ICAEW: London, UK, 2006. [Google Scholar]

- Smals, R.G.M.; Smits, A.A.J. Value for value-The dynamics of supplier value in collaborative new product development. Ind. Mark. Manag. 2012, 41, 156–165. [Google Scholar] [CrossRef]

- Felipe, J.; Kumar, U.; Abdon, A.; Bacate, M. Product complexity and economic development. Struct. Chang. Econ. Dyn. 2012, 23, 36–68. [Google Scholar] [CrossRef]

- Hausmann, R.; Hidalgo, C.A.; Bustos, S.; Coscia, M.; Simoes, A.; Yildirim, M.A. The Atlas of Economic Complexity; MIT Press: Cambridge, UK, 2013. [Google Scholar]

- Bowen, H.P.; Wiersema, M.F. Foreign-based competition and corporate diversification strategy. Strateg. Manag. J. 2005, 26, 1153–1171. [Google Scholar] [CrossRef]

- Kotschi, J. Bodenlos - Negative Auswirkungen von Mineraldüngern in der Tropischen Landwirtschaft; Heinrich Böll Stiftung & WWF Deutschland: Berlin, Germany, 2013. (In German) [Google Scholar]

- Casson, A. Oil Palm, Soy Beans & Critical Habitat Loss. A Review Prepared for the WWF Forest Conservation Initiative; WWF Forest Conversion Initiative: Zurich, Switzerland, 2003. [Google Scholar]

- Jolliet, O.; Frischknecht, R.; Bare, J.; Boulay, A.-M.; Bulle, C.; Fantke, P.; Gheewala, S.; Hauschild, M.; Itsubo, N.; Margni, M.; et al. Global guidance on environmental life cycle impact assessment indicators: findings of the scoping phase. Int. J. Life Cycle Assess. 2014, 19, 962–967. [Google Scholar] [CrossRef]

- Hutchins, M.J.; Sutherland, J.W. An exploration of measures of social sustainability and their application to supply chain decisions. J. Clean. Prod. 2008, 16, 1688–1698. [Google Scholar] [CrossRef]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Neugebauer, S.; Forin, S.; Finkbeiner, M. From Life Cycle Costing to Economic Life Cycle Assessment—Introducing an Economic Impact Pathway. Sustainability 2016, 8, 428. https://doi.org/10.3390/su8050428

Neugebauer S, Forin S, Finkbeiner M. From Life Cycle Costing to Economic Life Cycle Assessment—Introducing an Economic Impact Pathway. Sustainability. 2016; 8(5):428. https://doi.org/10.3390/su8050428

Chicago/Turabian StyleNeugebauer, Sabrina, Silvia Forin, and Matthias Finkbeiner. 2016. "From Life Cycle Costing to Economic Life Cycle Assessment—Introducing an Economic Impact Pathway" Sustainability 8, no. 5: 428. https://doi.org/10.3390/su8050428