A Systemic and Systematic Approach to the Development of a Policy Mix for Material Resource Efficiency

Abstract

:1. Introduction

- The full range of policy instruments;

- Costs of policies (implementation costs, transaction costs, compliance costs);

- Potentially negative side-effects of policy on target groups (e.g., issues of competitiveness of policy addressees from industry, or regressive effects on lower-income households);

- Options to combine instruments to mitigate such side-effects; and

- Political processes during design and implementation.

2. Materials and Methods

2.1. Heuristic Framework for Designing Policy Mixes

- (1)

- Defining longer-term objectives and setting short- to medium-term, more concrete, targets for the respective policy areas;

- (2)

- Elaborating a theoretical causal model for problem solving in the policy areas (What is the problem situation? What are contributing drivers? What does impede changes?);

- (3)

- Selecting, based on heuristics and expert guessing, promising instruments from known potentially relevant policy instruments contributing to problem solving to form an initial policy mix;

- (4)

- Undertaking ex-ante assessments (literature based qualitative assessments, participatory scenario building, and quantitative computer model simulations) of the initial policy mix as to its potential effectiveness and impacts. This usually entails comprehensive scientific analyzes, which then enable substantiated decision-making as to whether or not to include the instrument analyzed into the mix;

- (5)

- Adding, if the initial mix was found sub-optimal against the set objectives and targets, further instruments to the mix or revising existing instruments and re-running the assessment (repetition of Stages (4) and (5)) to finalize the policy mix; and

- (6)

- Preparing the final policy mix for implementation, enforcement, and monitoring.

- A forward-looking roadmap, i.e., relating different policy instruments to each other in a time sequence that helps optimizing synergetic effects and minimizing unintended negative side-effects; and

- Consideration of political processes in multi-actor networks and polycentric governance systems in order to be able to monitor processes and adapt the mix in feedback loops over time.

2.2. The Process to Designing the Metals and Materials Policy Mix

- (1)

- Identifying 20 to 40 of the most important variables (GDP, resource use, environmental pollution, etc.) in the policy field;

- (2)

- Finding consensus on qualitative estimates of the interlinkages and causal relations between these variables;

- (3)

- Analyzing the systemic role of each variable to identify the most sensitive (i.e., strongly affected by policy instruments or other variables), active (i.e., affect other variables strongly), or critical (i.e., strongly affected by and strongly affect other variables); and

- (4)

- Creating a so-called Effect System to illustrate the interdependencies among parameters.

3. Results

3.1. Objectives and Targets for the Policy Mix

- Consumption of virgin metals: to be reduced by 80%, measured as RMC, compared to 2010 levels in the EU. This target represents the scarcity of metals and environmental impacts caused by extraction, refinement, processing, and disposal of metals;

- GHG emissions: to be limited to two tons of CO2 equivalent per capita per year. This is to be measured as a footprint to reflect both emissions generated within the EU and those embedded in imported products. This target represents climate change impacts of greenhouse gas emissions through energy use, as well as agricultural and industrial processes;

- Consumption of arable land: to reach zero net demand of non-EU arable land. This target represents, as a rough approximation, the impacts of biomass production on soil quality, water quality, and biodiversity;

- Nutrients input: reducing nitrogen and phosphorus surpluses in the EU to levels that can be achieved by the best available techniques. This target represents the impacts of agricultural production on marine and freshwater quality, as well as soil quality; and

- Freshwater use: no region should experience water stress.

- Increase material efficiency for metals and all competing materials;

- Increase the global recycling rate of these materials; and

- Substitute metals with other materials, where this is beneficial for the environment and well-being.

3.2. A Causal Theory for Problem Solving

3.2.1. Drivers for Metal Use

3.2.2. Barriers to a More Efficient Use of Materials

3.3. Promising Policy Instruments

- (1)

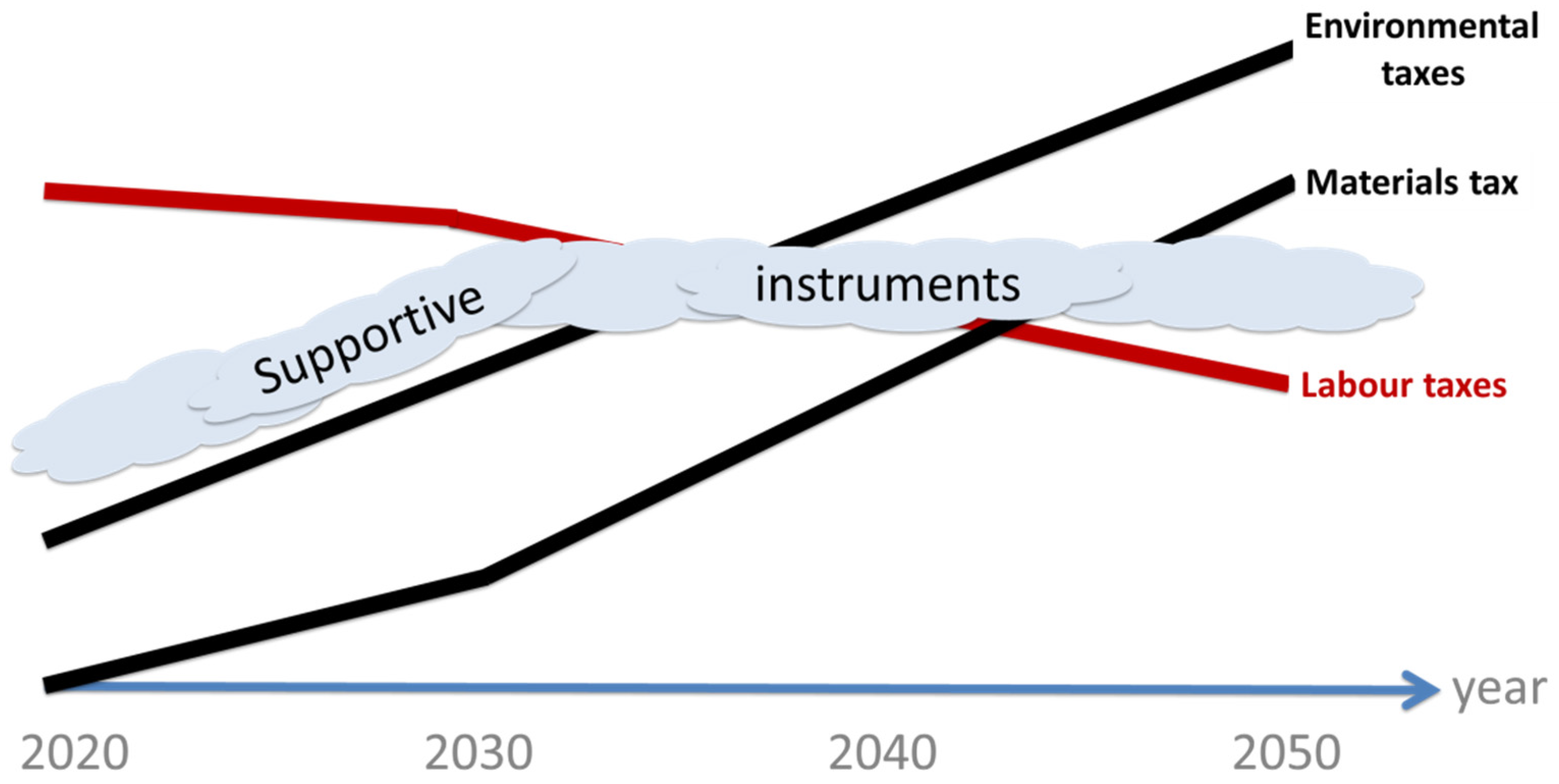

- A tax on all metals and competing materials used in the EU to increase material efficiency. The tax is introduced at a very low level in 2020 and gradually increased to a level that is high enough to make the construction and manufacturing industry significantly more material-efficient. The materials tax is presented and discussed in Section 3.3.1.

- (2)

- Extended producer responsibility schemes are expanded in 2020 to new product groups and countries, with the primary aim to increase recycling, but also contributing to material efficiency (Section 3.3.2).

- (3)

- Technical requirements that specify the type and quantity of materials that can be used in specific products are introduced in 2030, with the aim to substitute metals where appropriate, and to increase material efficiency (Section 3.3.3).

- (4)

- External costs are internalized through gradually expanded and increased environmental taxes from the year 2020, with the aim to improve recycling material efficiency and substitution when these are beneficial for the environment (Section 3.3.4).

3.3.1. Materials Tax

- It can be argued that implementing a tax on virgin materials would only stimulate recycling in addition to material efficiency, because it would make recycled materials relatively cheaper to use in the EU. However, as discussed in Section 3.2.2, a policy that focus on increasing the use of recycled metals in the EU is not likely to be very effective in increasing the global recycling rates, at least not for metals and paper.

3.3.2. Extended Producer Responsibility

3.3.3. Technical Requirements

- Improve the modularity to increase reparability and reuse of components, taking into account impacts on energy efficiency;

- Reduce the unnecessary use of material; and

- Substitute metals with other materials when appropriate; for example, shifting from copper water-piping to polymer piping.

3.3.4. Environmental Taxes

- Raw materials: these include metal ores, but also the raw materials used to produce materials that clearly compete with metals (concrete, wood, etc.);

- Energy resources: a significant share of the energy resources are used to produce commodities for metals production (coal used to produce coke for crude-iron production, fuel used to produce electricity for primary aluminum production, etc. [66]). Oil and natural gas are used for producing polymers that compete with metals in certain applications. Energy resources used for other purposes are also relevant to include, because shifting from metals to other materials might affect the demand for energy resources in the manufacturing, use, and waste management of the products. Including all energy resources in the instrument safeguards against simply shifting from metals products to products and services with a higher energy demand in these parts of the product life cycles;

- Water: water use could be affected when shifting from steel products to wood or other materials based on biomass. A shift from metals products to other solutions might also affect the water used in the manufacturing and use phase of the products. These effects might not be significant, and the external costs associated with the use of water are probably the least clearly connected to metals. However, the external costs of water use are still included in the instrument, partly to form a coherent whole and to safeguard against unknown risks of burden shifting; and

- Emissions: metals production and metals processing are important point sources for emissions of, for example, CO2, and heavy metals. The production of competing materials, such as concrete and polymers, is also associated with significant emissions. Shifting from metals to other materials will affect the emissions from manufacturing, use, and/or waste management of the products. Including all emissions in the instrument safeguards against simply shifting from metals products to products and services with a higher environmental impact in the life cycle as a whole.

3.3.5. Border-Tax Adjustments

3.3.6. Labor Tax Reductions

3.3.7. Research and Development

- Design for recycling;

- Efficient and consumer-adapted systems for collection, and identification of the role for the public sector in ensuring their provision;

- Technology for dismantling and separation of components and material; and

- Technology for recycling.

- Improved processes and products;

- New business models; and

- Non-material alternatives for safe investments.

3.3.8. Removal of Harmful Subsidies

3.3.9. Support to Sharing Systems

- (1)

- Local authorities set up a scheme for sharing of cars, bicycles, tools, and equipment;

- (2)

- Local authorities support the setting up of private sharing systems through funding of part of the investment cost; and

- (3)

- National authorities support the private sharing systems

- Through deductions in income tax to consumers for the renting costs, or

- Through a differentiation in VAT between goods and services.

3.3.10. Advanced Recycling Centers

- Facilities for collection of recyclable fractions;

- Second-hand shops of building components, clothes, furniture, etc.;

- Repair shops for furniture, bicycles, tools, etc.; and

- Shops for redesign of waste products into art or new useful products.

3.3.11. Education Programs

3.3.12. Fora for Communication

- Giving producers and recyclers the opportunity to discuss what quality of the recycled materials can be obtained and what quality of the material is required for different applications. This can serve to establish or strengthen the markets for recycled material and increase recycling levels; and

- Creating critical mass between purchasers and suppliers in value chains, that allow sufficient purchasers and suppliers to innovate, in the knowledge that their innovation will have a market (suppliers) or will be able to benefit from innovative components (purchasers).

3.3.13. Strategy for Dematerialization

3.3.14. Information Campaigns

- Counteracting commercials by pointing at alternative routes to well-being that do not involve increased consumption; and

- Encourage people to buy jewelry produced from materials with lower environmental impacts than gold.

4. Discussion

4.1. Usefulness of the Sensitivity Model

4.2. The Materials Policy Mix

4.2.1. Pointers for Revising the Taxes

4.2.2. Pointers for Revising the EU Strategy for Dematerialization

4.2.3. Using Mitigating and Synergetic Instrument Combinations

4.3. Concept of Policy Mixing

- Required a deeper and as much as possible systemic understanding of a given problem situation, its system boundaries, and key drivers;

- Demanded clarifying objectives and concrete targets that policy shall achieve in relation to the problem situation;

- Asked for creating an overview (inventory) of policy instruments promising to help achieving the targets, but during the instrument selection urges to consider positive and negative interactions between the instruments to choose a consistent setup; and

- Necessitated to consider political processes that are supportive to or impeding the design and implementation of the policy mix.

- (1)

- The inherent difficulty of assessing cumulative effectiveness of the mix vs. that of the individual instruments given potential synergetic and/or mitigating effects; and

- (2)

- The logical gap between a scientific ex-ante assessment of a policy mix’ potential effects on the one hand, and the actual implementation of the policy mix in the real-world of politics, multiple interests, and polycentric actor constellations, which will inevitably change the nature or design and, hence, the impacts of the mix through the political processes

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| DYNAMIX | DYNAmic policy MIXes for absolute decoupling of environmental impacts of EU resource use from economic growth (an EU FP7 research project) |

| EPR | Extended producer responsibility |

| EU | European Union |

| FP7 | 7th Framework Programme |

| GHG | Greenhouse gas |

| Gt | Gigatons |

| R and D | Research and development |

| RMC | Raw Material Consumption |

| VAT | Value-added tax |

| WTO | World Trade Organization |

References

- Krausmann, F.; Gingrich, S.; Eisenmenger, N.; Erb, K.H.; Haberl, H.; Fischer-Kowalski, M. Growth in global materials use, GDP and population during the 20th century. Ecol. Econ. 2009, 68, 2696–2705. [Google Scholar] [CrossRef]

- Steffen, W.; Persson, A.; Deutsch, L.; Zalasiewicz, J.; Williams, M.; Richardson, K.; Crumley, C.; Crutzen, P.; Folke, C.; Gordon, L.; et al. The Anthropocene: From Global Change to Planetary Stewardship. Ambio 2011, 40, 739–761. [Google Scholar] [CrossRef] [PubMed]

- Schaffartzik, A.; Mayer, A.; Gingrich, S.; Eisenmenger, N.; Loy, C.; Krausmann, F. The global metabolic transition: Regional patterns and trends of global material flows, 1950–2010. Glob. Environ. Chang. 2014, 26, 87–97. [Google Scholar] [CrossRef] [PubMed]

- Wiedmann, T.O.; Schandl, H.; Lenzen, M.; Moran, D.; Suh, S.; West, J.; Kanemoto, K. The material footprint of nations. Proc. Natl. Acad. Sci. USA 2015, 112, 6271–6276. [Google Scholar] [CrossRef] [PubMed]

- International Energy Agency (IEA). Energy Technology Perspectives 2008: Scenarios & Strategies to 2050; IEA: Paris, France, 2008. [Google Scholar]

- Brown, T.; Gambhir, A.; Florin, N.; Fennell, P. Reducing CO2 Emissions from Heavy Industry: A Review of Technologies and Considerations for Policy Makers; Briefing Paper No 7; Grantham Institute for Climate Change: London, UK, 2012. [Google Scholar]

- Millennium Ecosystem Assessment. Ecosystems and Human Well-Being: Synthesis; Island Press: Washington, DC, USA, 2005. [Google Scholar]

- Montzka, S.A.; Dlugokencky, E.J.; Butler, J.H. Non-CO2 greenhouse gases and climate change. Nature 2011, 476, 43–50. [Google Scholar] [CrossRef] [PubMed]

- Galli, A.; Kitzes, J.; Niccolucci, V.; Wackernagel, M.; Wada, Y.; Marchettini, N. Assessing the global environmental consequences of economic growth through the Ecological Footprint: A focus on China and India. Ecol. Indic. 2012, 17, 99–107. [Google Scholar] [CrossRef]

- Fischer-Kowalski, M.; Swilling, M.; von Weizsäcker, E.U.; Ren, Y.; Sadovy, Y.; Crane, W.; Krausmann, F.; Eisenmenger, N.; Giljum, S.; Hennicke, P.; et al. Decoupling Natural Resource Use and Environmental Impacts from Economic Growth; Report of the Working Group on Decoupling to the International Resource Panel; United Nations Environment Programme: Paris, France, 2011. [Google Scholar]

- Steffen, W.; Richardson, K.; Rockström, J.; Cornell, S.E.; Fetzer, I.; Bennett, E.M.; Biggs, R.; Carpenter, S.R.; de Vries, W.; de Wit, C.A.; et al. Planetary Boundaries: Guiding human development on a changing planet. Science 2015, 347, 1259855:1–1259855:10. [Google Scholar] [CrossRef] [PubMed]

- Moore, D.; Galli, A.; Cranston, G.R.; Reed, A. Projecting future human demand on the Earth’s regenerative capacity. Ecol. Indic. 2012, 16, 3–10. [Google Scholar] [CrossRef]

- Van den Berg, M.; Bakkes, J.; Bouwman, L.; Jeuken, M.; Kram, T.; Neumann, K.; van Vuuren, D.P.; Wilting, H. EU Resource Efficiency Perspectives in a Global Context; PBL Netherlands Environmental Assessment Agency: The Hague, The Nederlands, 2011. [Google Scholar]

- Allwood, J.M.; Ashby, M.F.; Gutowski, T.G.; Worrell, E. Material efficiency: A white paper. Resour. Conserv. Recycl. 2011, 55, 362–381. [Google Scholar] [CrossRef]

- Ekvall, T.; Malmheden, S. (Eds.) Towards Sustainable Waste Management—Popular Summary Report from a Swedish EPA Research Programme; Report C69′; IVL Swedish Environmental Research Institute: Stockholm, Sweden, 2014; Available online: http://www.sustainablewaste.info/download/18.343dc99d14e8bb0f58b602/1439884437777/C69%2BTOSUWAMA%2Breport%2B.pdf (accessed on 15 March 2016).

- Binswanger, M. Technological progress and sustainable development: What about the rebound effect? Ecol. Econ. 2001, 36, 119–132. [Google Scholar] [CrossRef]

- Lindhqvist, T. Extended Producer Responsibility in Cleaner Production—Policy Principle to Promote Environmental Improvements in Product Systems. Ph.D. Dissertation. 2000. Available online: http://lup.lub.lu.se/luur/download?func=downloadFile&recordOId=19692&fileOId=1002025 (accessed on 15 March 2016).

- Söderholm, P. Taxing virgin natural resources: Lessons from aggregates taxation in Europe. Resour. Conserv. Recycl. 2011, 55, 911–922. [Google Scholar] [CrossRef]

- Nicolli, F.; Mazzanti, M. Landfill diversion in a decentralized setting: A dynamic assessment of landfill taxes. Resour. Conserv. Recycl. 2013, 81, 17–23. [Google Scholar] [CrossRef]

- Sahlin, J.; Ekvall, T.; Bisaillon, M.; Sundberg, J. Introduction of a waste incineration tax: Effects on the Swedish waste flows. Resour. Conserv. Recycl. 2007, 51, 827–846. [Google Scholar] [CrossRef]

- Söderholm, P.; Tilton, J.E. Material efficiency: An economic perspective. Resour. Conserv. Recycl. 2012, 61, 75–82. [Google Scholar] [CrossRef]

- Finnveden, G.; Ekvall, T.; Arushanyan, Y.; Bisaillon, M.; Henriksson, G.; Gunnarsson Östling, U.; Ljunggren Söderman, M.; Sahlin, J.; Stenmarck, Å.; Sundberg, J.; et al. Policy instruments towards a sustainable waste management. Sustainability 2013, 5, 841–881. [Google Scholar] [CrossRef]

- OECD. Instrument Mixes for Environmental Policy; OECD Publishing: Paris, France, 2007. [Google Scholar]

- Arnason, R. Iceland’s ITQ system creates new wealth. Electron. J. Sustain. Dev. 2008, 1, 35–41. [Google Scholar]

- Haraldsson, G.; Carey, D. Ensuring a Sustainable and Efficient Fishery in Iceland; OECD Economic Department Working Paper No. 89; OECD: Paris, France, 2011; Available online: http://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=ECO/WKP%282011%2960 (accessed on 23 March 2016).

- Ecorys. The Role of Market-Based Instruments in Achieving a Resource Efficient Economy. Available online: http://blogs.ec.europa.eu/orep/the-role-of-market-based-instruments-in-achieving-a-resource-efficient-economy/ (accessed on 23 March 2016).

- Lindhjem, H.; Magne Skjelvik, J.; Eriksson, A.; Fitch, T. The Use of Economic Instruments in Nordic Environmental Policy 2006–2009; Nordic Council of Ministers: Copenhagen, Denmark, 2009. [Google Scholar]

- Howlett, M.; Rayner, J. Design Principles for Policy Mixes: Cohesion and Coherence in “New Governance Arrangements”. Policy Soc. 2007, 26, 1–18. [Google Scholar] [CrossRef]

- Pearce, D. The Role of Carbon Taxes in Adjusting to Global Warming. Econ. J. 1991, 101, 938–948. [Google Scholar] [CrossRef]

- Zárate-Marco, A.; Vallés-Giménez, A. Environmental tax and productivity in a decentralized context: New findings on the Porter hypothesis. Eur. J. Law Econ. 2015, 40, 313–339. [Google Scholar] [CrossRef]

- De Miguel, C.; Manzano, B. Gradual green tax reforms. Energy Econ. 2011, 33 (Suppl. 1), S50–S58. [Google Scholar] [CrossRef]

- Gunningham, N.; Young, M.D. Toward Optimal Environmental Policy: The Case of Biodiversity Conservation. Ecol. Law Q. 1997, 24, 243–298. [Google Scholar]

- Gunningham, N.; Grabosky, P.; Sinclair, D. Smart Regulation: Designing Environmental Policy; Clarendon Press: Oxford, UK, 1998. [Google Scholar]

- Howlett, M. Beyond Good and Evil in Policy Implementation: Instrument Mixes, Implementation Styles and Second Generation Theories of Policy Instrument Choice. Policy Soc. 2004, 23, 1–17. [Google Scholar] [CrossRef]

- Minogue, M. Governance-Based Analysis of Regulation. Ann. Public Coop. Econ. 2002, 73, 649–666. [Google Scholar] [CrossRef]

- Del Rio, P.; Howlett, M. Beyond the “Tinbergen Rule” in Policy Design: Matching Tools and Goals in Policy Portfolios. Annu. Rev. Policy Des. 2013, 1, 1–6. [Google Scholar] [CrossRef]

- DYNAMIX. Decoupling growth from resource use and its environmental impacts. Available online: www.dynamix-project.eu (accessed on 12 April 2016).

- Givoni, M.; Macmillen, J.; Banister, D.; Feitelson, E. From Policy Measures to Policy Packages. Trans. Rev. 2013, 33, 1–20. [Google Scholar] [CrossRef]

- Rogge, K.S.; Reichardt, K. Towards a More Comprehensive Policy Mix Conceptualization for Environmental Technological Change: A Literature Synthesis; Working Paper “Sustainability and Innovation” No. S 3/2013; Fraunhofer ISI: Karlsruhe, Germany, 2013. [Google Scholar]

- Umpfenbach, K. How Will We Know If Absolute Decoupling Has Been Achieved and Will It be Enough?—Common Approach for DYNAMIX; DYNAMIX Project Deliverable D 1.3; Ecologic Institute: Berlin, Germany, 2013; Available online: http://dynamix-project.eu/how-will-we-know-if-absolute-decoupling-has-been-achieved-and-will-it-be-enough-common-approach (accessed on 14 March 2016).

- Vester, F. The Art of Interconnected Thinking. In Tools and Concepts for a New Approach to Tackling Complexity, 1st ed.; MCB Publishing House: Munich, Germany, 2007. [Google Scholar]

- Ekvall, T.; Elander, M.; Umpfenbach, K.; Hirschnitz-Garbers, M.; Hudson, C.; Wunder, S.; Nesbit, M.; Keenleyside, C.; Mazza, L.; Russi, D.; et al. Development of DYNAMIX Policy Mixes; DYNAMIX Project Deliverable D 4.2; IVL Swedish Environmental Research Institute: Stockholm, Sweden; Gothenburg, Sweden, 2015; Available online: http://dynamix-project.eu/development-dynamix-policy-mixes (accessed on 14 March 2016).

- Ekvall, T.; Martin, M.; Palm, D.; Danielsson, L.; Fråne, A.; Laurenti, R.; Oliveira, F. Physical and Environmental Assessment; DYNAMIX Deliverable D6.1; IVL: Gothenburg, Sweden, 2016; Available online: http://dynamix-project.eu/results (accessed on 15 March 2016).

- Bosello, F.; Antosiewicz, M.; Bukowski, M.; Eboli, F.; Gąska, J.; Śniegocki, A.; Witajewski-Baltvilks, J.; Zotti, J. Report on Economic Quantitative Ex-Ante Assessment of DYNAMIX Policy Mixes; DYNAMIX Deliverable D6.2; FEEM: Milano, Italy, 2016; Available online: http://dynamix-project.eu/results (accessed on 15 March 2016).

- Nesbit, M.; Watkins, E.; Harris, S. Environmental Assessment of DYNAMIX Policy Mixes; DYNAMIX Project Deliverable D5.1; Institute for European Environmental Policy: London, UK, 2015; Available online: http://dynamix-project.eu/assessment-environmental-impacts-dynamix-policy-mixes (accessed on 14 March 2016).

- Bigano, A.; Zotti, J.; Bukowski, M.; Śniegocki, A. Qualitative Assessment of Economic Impacts; DYNAMIX Project Deliverable D 5.2; FEEM: Milan, Italy; Venice, Italy, 2015; Available online: http://dynamix-project.eu/economic-assessment-dynamix-policy-mixes (accessed on 14 March 2016).

- Bukowski, M.; Śniegocki, A.; Gąska, J.; Trzeciakowski, R.; Pongiglione, F. Report on Qualitative Assessment of Social Impacts; DYNAMIX Project Deliverable D 5.3; WISE Institute: Warsaw, Poland, 2015; Available online: http://dynamix-project.eu/social-assessment-dynamix-policy-mixes (accessed on 14 March 2016).

- Lucha, C.; Roberts, E. Legal Assessment of DYNAMIX Policy Mixes; DYNAMIX Project Deliverable D 5.4.1; Ecologic Institute: Berlin, Germany, 2015; Available online: http://dynamix-project.eu/legal-assessment-dynamix-policy-mixes (accessed on 14 March 2016).

- Vanner, R.; Bicket, M.; Elliott, B.; Harvey, C. Public Acceptability of DYNAMIX Policy Mixes; DYNAMIX Project Deliverable D 5.4.2; PSI: London, UK, 2015; Available online: http://dynamix-project.eu/assessment-public-acceptability-dynamix-policy-mixes (accessed on 14 March 2016).

- Bringezu, S. Visions of a sustainable resource use. In Sustainable Resource Management: Global Trends, Visions and Policies; Bringezu, S., Bleischwitz, R., Eds.; Greenleaf Publishing: Sheffield, UK, 2009; pp. 155–215. [Google Scholar]

- Mara, V.; Haghani, R.; Sagemo, A.; Storck, L.; Nilsson, D. Comparative study of different bridge concepts based on life-cycle cost analyses and life-cycle assessment. In Proceedings of the 2013 Asia-Pacific Conference on FRP in Structures (APFIS 2013), Melbourne, Australia, 11–13 December 2013; Al-Mahaidi, R., Smith, S.T., Bai, Y., Zhao, X.L., Eds.; International Institute for FRP in Construction (IIFC): Melbourne, Australia. Available online: http://publications.lib.chalmers.se/records/fulltext/193796/local_193796.pdf (accessed on 21 March 2016).

- Guggemos, A.; Horvath, A. Decision support tool for environmental analysis of commercial building structures. In Proceedings of the Construction Research Congress, San Diego, CA, USA, 5–7 April 2005; pp. 1–11.

- Hirschnitz-Garbers, M.; Tan, A.; Gradmann, A.; Srebotnjak, T. Key drivers for unsustainable resource use—Categories, effects and policy pointers. J. Clean. Prod. 2015. [Google Scholar] [CrossRef]

- Eurostat. Raw Material Equivalents. Available online: http://epp.eurostat.ec.europa.eu/portal/page/Portal/environmental_accounts/documents/RME_project_Introduction.pdf (accessed on December 2013).

- Allwood, J.; Cullen, J.M. Sustainable Materials—With Both Eyes Open; UIT Cambridge LTD: Cambridge, UK, 2011. [Google Scholar]

- Eurofer (The European Steel Association). Sector Shares in Total EU Steel Consumption in 2010. Available online: http://www.eurofer.org/About%20Steel/Growing%20with%20Steel.fhtml (accessed on 14 March 2016).

- Allwood, J.M.; Ashby, M.F.; Gutowski, T.G.; Worrell, E. Material efficiency: Providing material services with less material production. Philos. Trans. R. Soc. A 2013, 371, 20120496:1–20120496:15. [Google Scholar] [CrossRef] [PubMed]

- European Copper Institute. Available online: http://www.copperalliance.eu/ (accessed on 13 January 2016).

- World Gold Council. Gold Demand Trends; First Quarter 2014; World Gold Council: London, UK, 2014. [Google Scholar]

- ECSIP Consortium. Treating Waste as a Resource for the EU Industry: Analysis of Various Waste Streams and the Competitiveness of Their Client Industries; ECSIP Consortium: Rotterdam, The Netherlands, 2013. [Google Scholar]

- Graedel, T.E.; Allwood, J.; Birat, J.-P.; Reck, B.K.; Sibley, S.F.; Sonnemann, G.; Buchert, M.; Hagelüken, C. Recycling Rates of Metals—A Status Report; A Report of the Working Group on the Global Metal Flows to the International Resource Panel; United Nations Environment Programme: Paris, France, 2011. [Google Scholar]

- Blomberg, J.; Söderholm, P. The economics of secondary aluminium supply: An econometric analysis based on European Data. Resour. Conserv. Recycl. 2009, 53, 455–463. [Google Scholar] [CrossRef]

- Wyss, F. Modeling the Environmental Impacts of an Increased Market Demand for Products Manufactured from Recycled Materials. Master’s Thesis, ETH Zürich, Zürich, Switzerland, August 2009. [Google Scholar]

- Thollander, P.; Ottosson, M. An energy efficient Swedish pulp and paper industry—Exploring barriers to and driving forces for cost-effective energy efficiency investments. Energy Effic. 2008, 1, 21–34. [Google Scholar] [CrossRef]

- Khan, M.R. Polluter-pays principle: The cardinal instrument for addressing climate Change. Laws 2015, 4, 638–653. [Google Scholar] [CrossRef]

- IEA (International Energy Agency). Sankey Diagram: World—Final Consumption. 2013. Available online: http://www.iea.org/Sankey/index.html#?c=World&s=Final.consumption (accessed on 14 March 2016).

- Copenhagen Economics. Company Car Taxation; Taxation Papers; Working Paper No. 22; European Commission, DG Taxation and Customs Union: Brussel, Belgium, 2010. [Google Scholar]

- Ljunggren Söderman, M.; Palm, D.; Rydberg, T. Reducing Waste through Recycling Parks: Analysis of the Environmental Impact; Report B1958; IVL Swedish Environmental Research Institute: Gothenburg, Sweden, 2011. [Google Scholar]

- JRC-IET. Strategic Energy Technology (SET) Plan Roadmap on Education and Training; Availability and Mobilisation of Appropriately Skilled Human Resources; Science and Policy Report by the Joint Research Centre of the European Commission; Publications Office of the European Union: Luxembourg, Luxembourg, 2014. [Google Scholar]

- EEB (European Environmental Bureau). Smoke and Mirrors as Commission Issues Circular Economy Package with Weaker Waste Targets. Available online: http://www.eeb.org/index.cfm/news-events/news/smoke-and-mirrors-as-commission-issues-circular-economy-package-with-weaker-waste-targets/ (accessed on 14 March 2016).

- Geels, F.W.; McMeekin, A.; Mylan, J.; Southerton, D. A critical appraisal of Sustainable Consumption and Production research: The reformist, revolutionary and reconfiguration positions. Glob. Environ. Chang. 2015, 34, 1–12. [Google Scholar] [CrossRef]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ekvall, T.; Hirschnitz-Garbers, M.; Eboli, F.; Śniegocki, A. A Systemic and Systematic Approach to the Development of a Policy Mix for Material Resource Efficiency. Sustainability 2016, 8, 373. https://doi.org/10.3390/su8040373

Ekvall T, Hirschnitz-Garbers M, Eboli F, Śniegocki A. A Systemic and Systematic Approach to the Development of a Policy Mix for Material Resource Efficiency. Sustainability. 2016; 8(4):373. https://doi.org/10.3390/su8040373

Chicago/Turabian StyleEkvall, Tomas, Martin Hirschnitz-Garbers, Fabio Eboli, and Aleksander Śniegocki. 2016. "A Systemic and Systematic Approach to the Development of a Policy Mix for Material Resource Efficiency" Sustainability 8, no. 4: 373. https://doi.org/10.3390/su8040373