Corporate Sustainability and Shareholder Wealth—Evidence from British Companies and Lessons from the Crisis

Abstract

:1. Introduction

2. Corporate Social Performance and Financial Performance: the Existing Evidence

3. Theoretical Framework and Development of Hypotheses

4. Method

4.1. Measuring Social Aspects of Corporate Sustainability

- (1)

- Integration of social activities into business strategy and decision-making processes. Here, the robustness of the information provided has been taken into account. The recognized relationship between internal (companies) and external (stakeholders) values combine and focus the business-oriented view and stakeholder perspective on social performance [95].

- (2)

- Publishing of profound CSR reports documenting a wide range of activities related to ongoing social responsibility (in the area of community involvement, social contribution, human resources, customer relations, corporate governance, and diversity). These reports need to be characterized by good “quality,” which means they must contain both numerical and narrative information [96]. Apart from the above, they not only need to contain main objectives (in this case social objectives), but also activities and strategies to achieve them [97].

- (3)

- Active engagement of independent third party actors in the preparation and verification of CSR reports. This criterion meets the requirement of verifiable information [98], as well as linkage of the organization’s activities to key social issues with active stakeholder engagement, which ensure a high quality of voluntary disclosures.

- (4)

- Gaining at least three social responsibility awards given by external institutions and organizations based on objective and publicly available criteria. Verification and appreciation of voluntary actions increase its usefulness and its importance for the decision-making process [99].

4.2. Measuring Environmental Aspects of Corporate Sustainability

- (1)

- In the area of reporting: regularly issued own-designed environmental reports or reports meeting the requirements of Global Reporting Initiative (GRI) guidelines. An appropriate, reliable and standardized system of environmental control, along with a modern cost-accounting system, is essential to calculate the quantitative effects of implementing various environmental business activities [39].

- (2)

- In the area of procurement, manufacturing, distribution, research and development, and service: an environmental management system (EMS) designed at the whim of the organization’s management or developed in line with the established voluntary guidelines of the International Organization for Standardization (ISO) 14001 standard. EMS implementation shows that environmental issues are an important part of day-to-day business, and operations are conducted in a way that reduces their potentially negative environmental impact [103].

- (3)

- In the area of infrastructure: Leadership in Energy and Environmental Design (LEED) certification of any kind of at least one of its buildings. Green building demonstrates a company’s commitment to more efficient use of resources and the provision of a conductive indoor environmental quality for its occupants [104].

- (4)

- In the area of public relations and marketing: attaining at least three environmental awards granted by third parties and based on specified and publicly accessible criteria that instruct the destination managers which environmental obligations must be fulfilled. Verifiable information not only improves the quality of environmental voluntary disclosures [98], but also ensures a higher level of precision, relevance, and usefulness for decision makers [99].

4.3. Measuring Financial Aspects of Corporate Sustainability

5. Data and Sample Selection

6. Empirical Results

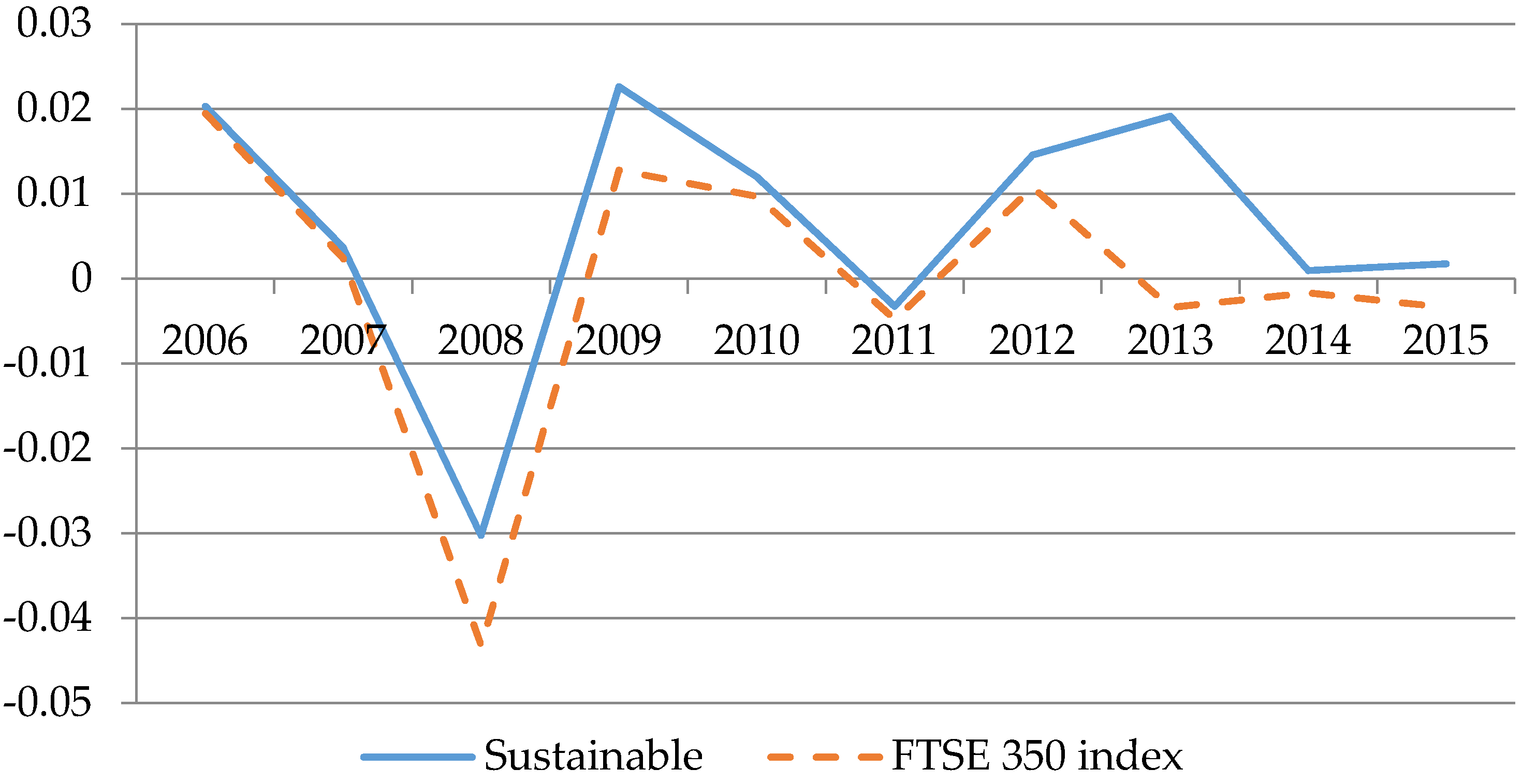

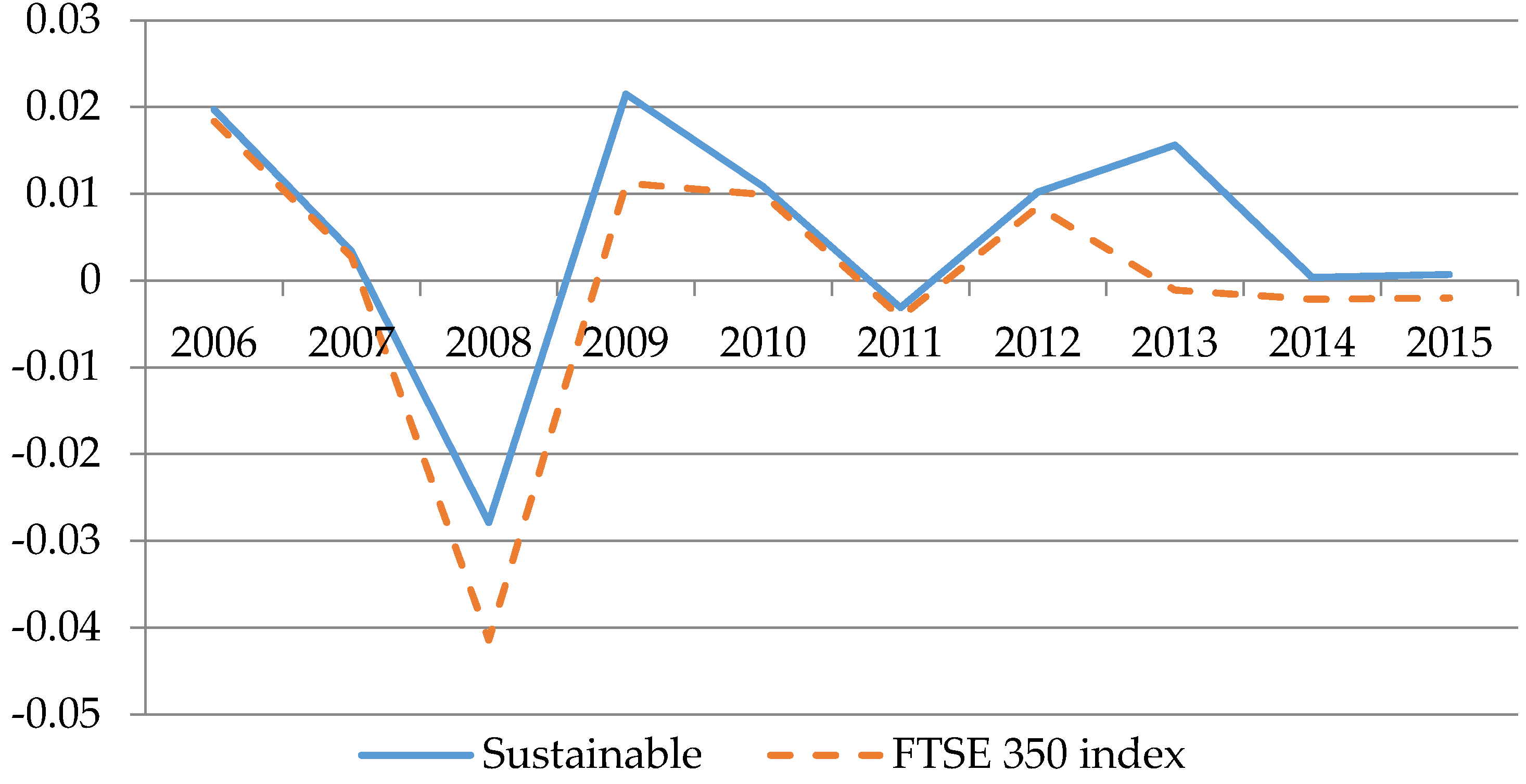

6.1. Corporate Sustainability and Returns

6.2. Corporate Sustainability and Stock Return Volatility

6.3. Corporate Sustainability and Stock Market Crash Resistance

7. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Lacy, P.; Cooper, T.; Hayward, R.; Neuberger, L. A New Era of Sustainability-UN Global Compact-Accenture CEO Study 2010. Available online: http://www.uncsd2012.org/content/documents/Accenture_A_New_Era_of_Sustainability_CEO_Study.pdf (accessed on 20 January 2016).

- KPMG. International Survey of Corporate Responsibility Reporting 2011. Available online: https://www.kpmg.com/PT/pt/IssuesAndInsights/Documents/corporate-responsibility2011.pdf (accessed on 9 March 2016).

- United Nations Environmental Program (UNEP). Principles for Responsible Investments. Available online: http://www.unpri.org/ (accessed on 1 November 2013).

- Global Sustainable Investment Alliance (GSIA). 2012 Global Sustainable Investment Review. Available online: http://gsiareview2012.gsi-alliance.org/ (accessed on 9 March 2016).

- European Social Investment Forum (Eurosif). European SRI Study 2012. Available online: http://www.eurosif.org/publication/view/european-sri-study-2012/ (accessed on 9 March 2013).

- US Social Investment Forum (US SIF). 2012 Report on Sustainable and Responsible Investing Trends in the United States (PDF). Available online: http://www.ussif.org/store_product.asp?prodid=4 (accessed on 9 March 2016).

- Przychodzen, J.; Przychodzen, W. Corporate Sustainability and Shareholder Wealth. J. Environ. Plann. Man. 2013, 56, 474–493. [Google Scholar] [CrossRef]

- Weber, M. The Business Case for Corporate Social Responsibility: A Company-Level Measurement Approach for CSR. Eur. Manag. J. 2008, 26, 247–261. [Google Scholar] [CrossRef]

- Wempe, J.; Kaptein, M. The Balanced Company: A Theory of Corporate Integrity; Oxford University Press: Oxford, UK, 2002. [Google Scholar]

- Porter, M.E.; van der Linde, C. Green and Competitive: Ending the Stalemate. Harvard. Bus. Rev. 1995, 73, 120–134. [Google Scholar]

- Hart, S.L. A Natural-Resource-Based View of the Firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar]

- Hart, S.L.; Dowell, G. A Natural-Resource-Based View of the Firm: Fifteen Years After. J. Manag. 2011, 37, 1464–1479. [Google Scholar]

- Fuller, D.A.; Ottman, J.A. Moderating Unintended Pollution: the Role of Sustainable Product Design. J. Bus. Res. 2004, 57, 1231–1238. [Google Scholar] [CrossRef]

- Reinhardt, F.L. Environmental Product Differentiation: Implications for Corporate Strategy. Calif. Manag. Rev. 1994, 40, 43–73. [Google Scholar] [CrossRef]

- Orsato, R. Competitive Environmental Strategies: When does It Pay to be Green? Calif. Manag. Rev. 2006, 48, 127–143. [Google Scholar] [CrossRef]

- Elfenbein, D.; McManus, B. A Greater Price for a Greater Good? Evidence that Consumers Pay More for Charity-Linked Products. Am. Econ. J. Econ. Pol. 2010, 2, 28–60. [Google Scholar] [CrossRef]

- Konar, S.; Cohen, M. Does the Market Value Environmental Performance. Rev Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Rowley, T.; Berman, S. A Brand New Brand of Corporate Social Performance. Bus. Soc. 2000, 39, 397–418. [Google Scholar] [CrossRef]

- Edmans, A. Does the Stock Market Fully Value Intangibles? Employee Satisfaction and Equity Prices. J. Financ. Econ. 2011, 101, 621–640. [Google Scholar] [CrossRef]

- Hillman, A.J.; Keim, G.D. Shareholder Value, Stakeholder Management, and Social Issues: What’s the Bottom Line? Strategic. Manag. J. 2001, 22, 125–139. [Google Scholar] [CrossRef]

- Gardberg, N.A.; Fombrun, C. Corporate Citizenship: Creating Intangible Assets Across Institutional Environments. Acad. Manag. Rev. 2006, 31, 329–346. [Google Scholar] [CrossRef]

- Scholtens, B.; Zhou, Y. Stakeholder Relations and Financial Performance. Sustain. Dev. 2008, 16, 213–232. [Google Scholar] [CrossRef]

- Harrison, J.S.; Bosse, D.A.; Phillips, R.A. Managing for Stakeholders, Stakeholder Utility Functions, and Competitive Advantage. Strategic Manag. J. 2010, 31, 58–74. [Google Scholar] [CrossRef]

- Artiach, T.; Lee, D.; Nelson, D.; Alker, J. The Determinants of Corporate Sustainability Performance. Account. Financ. 2010, 50, 31–51. [Google Scholar] [CrossRef]

- Margolis, J.; Elfenbien, H. Do Well by Doing Good: Don’t Count on It. Harvard Bus Rev. 2008, 86, 19–20. [Google Scholar]

- Boyle, E.J.; Higgins, M.M.; Rhee, S.G. Stock Market Reaction to Ethical Initiatives of Defense Contractors: Theory and Evidence. Critic. Perspect. Account. 1997, 8, 541–561. [Google Scholar] [CrossRef]

- Kahn, N.R.; Lekander, C.; Leimkuhler, T. Just Say No? The Investment Implications of Tobacco Divestiture. J. Invest. 1997, 6, 62–70. [Google Scholar] [CrossRef]

- Brammer, S.; Brooks, C.; Pavelin, S. Corporate Social Performance and Stock Returns: UK Evidence from Disaggregate Measures. Financ. Manag. 2006, 35, 97–116. [Google Scholar] [CrossRef]

- Roman, R.M.; Hayibor, S.; Agle, B.R. The Relationship between Social and Financial Performance: Repainting a Portrait. Bus. Soc. 1999, 38, 109–125. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Aragon-Correa, A.J.; Hurtado-Torres, N.; Sharma, S.; Garcıa-Morales, V.J. Environmental Strategy and Performance in Small Firms: A Resource-Based Perspective. J. Environ. Manag. 2008, 86, 88–103. [Google Scholar] [CrossRef] [PubMed]

- Derwall, J.; Guenster, N.; Bauer, R.; Koedijk, K. The Eco-Efficiency Premium Puzzle. Financ. Anal. J. 2005, 61, 51–63. [Google Scholar] [CrossRef]

- Graham, J.R.; Harvey, C.R.; Rajgopal, S. The Economic Implications of Corporate Financial Reporting. J. Account. Econ. 2005, 40, 3–73. [Google Scholar] [CrossRef]

- Clarkson, P.; Overell, M.; Chapple, L. Environmental Reporting and Its Relation to Corporate Environmental Performance. J. Account. Financ. Bus. Stud. 2011, 47, 27–60. [Google Scholar] [CrossRef]

- Klassen, R.; McLaughlin, C. The Impact of Environmental Management on Firm Performance. Manag. Sci. 1996, 42, 1199–1214. [Google Scholar] [CrossRef]

- Jones, S.; Frost, G.; Loftus, J.; van Der Laan, S. An Empirical Investigation of the Market Returns and Financial Performance of Entities Engaged in Sustainability Reporting. Aust. Account. Rev. 2007, 17, 78–87. [Google Scholar] [CrossRef]

- Zaho, J. The Effect of the ISO 14001 Environmental Management System on Corporate Financial Performance. Int. J. Bus. Excell. 2008, 1, 210–230. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Thorburn, K. Voluntary Corporate Environmental Initiatives and Shareholder Wealth. J. Environ. Econ. Manag. 2011, 62, 430–445. [Google Scholar] [CrossRef]

- Schaltegger, S.; Figge, F. Environmental Shareholder Value: Economic Success with Corporate Environmental Management. Eco-Manage Aud. 2000, 7, 29–42. [Google Scholar] [CrossRef]

- Jacobs, B.; Singhal, V.R.; Subramanian, R. An Empirical Investigation of Environmental Performance and the Market Value of the Firm. J. Oper. Manag. 2010, 28, 430–441. [Google Scholar] [CrossRef]

- Ioppolo, G.; Cucurachi, S.; Salomone, R.; Saija, G.; Shi, L. Sustainable Local Development and Environmental Governance: A Strategic Planning Experience. Sustainability 2016, 8, 180. [Google Scholar] [CrossRef]

- Williams, G. Some Determinants of the Socially Responsible Investment Decision: A Cross-Country Study. J. Behav. Financ. 2007, 8, 43–57. [Google Scholar] [CrossRef]

- Barnea, A.; Rubin, A. Corporate Social Responsibility as a Conflict between Shareholders. J. Bus. Ethics. 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Soppe, A. Sustainable Corporate Finance. J. Bus. Ethics. 2004, 53, 213–224. [Google Scholar] [CrossRef]

- Soppe, A. Sustainable Finance as a Connection between Corporate Social Responsibility and Social Responsible Investing. Indian Manag. Res. J. 2011, 1, 13–23. [Google Scholar]

- Johnsen, B. Socially Responsible Investing: A Critical Appraisal. J. Bus. Ethics. 2003, 43, 219–222. [Google Scholar] [CrossRef]

- Peylo, B. A Synthesis of Modern Portfolio Theory and Sustainable Investment. J. Invest. 2012, 21, 33–46. [Google Scholar]

- Margolis, J.; Walsh, J. Misery Loves Companies: Rethinking Social Initiatives by Business. Admin. Sci. Quart. 2003, 48, 268–305. [Google Scholar] [CrossRef]

- Renneboog, L.; Ter Horst, J.; Zhang, C. Socially Responsible Investments: Institutional Aspects, Performance, and Investor Behavior. J. Bank Financ. 2008, 32, 1723–1742. [Google Scholar] [CrossRef]

- Lo, S.; Sheu, H. Is Corporate Sustainability a Value-Increasing Strategy for Business? Corp. Gov. Int. Rev. 2007, 15, 345–358. [Google Scholar] [CrossRef]

- Lopez, M.; Garcia, A.; Rodriguez, L. Sustainable Development and Corporate Performance: A Study Based on the Dow Jones Sustainability Index. J. Bus. Ethics. 2007, 75, 285–300. [Google Scholar] [CrossRef]

- Christofi, A.; Christofi, P.; Sisaye, S. Corporate Sustainability: Historical Development and Reporting Practices. Manag. Res. Rev. 2012, 35, 157–172. [Google Scholar] [CrossRef]

- Deegan, C. Environmental Disclosures and Share Prices—A Discussion about Efforts to Study this Relationship. Account. Forum. 2004, 28, 87–97. [Google Scholar] [CrossRef]

- Murray, A.; Sinclair, D.; Power, D.; Gray, R. Do Financial Markets Care about Social and Environmental Disclosure? Further Evidence and Exploration from the UK. Account. Aud. Account. J. 2006, 19, 228–255. [Google Scholar] [CrossRef]

- Jones, G.; Jones, B.; Little, P. Reputation as Reservoir: Buffering against Loss in Times of Economic Crisis. Corp. Reput. Rev. 2000, 3, 21–29. [Google Scholar] [CrossRef]

- Schnietz, K.; Epstein, M. Exploring the Financial Value of a Reputation for Corporate Social Responsibility during a Crisis. Corp. Reput. Rev. 2005, 7, 327–345. [Google Scholar] [CrossRef]

- Godfrey, P.C.; Merrill, C.B.; Hansen, J.M. The Relationship between Corporate Social Responsibility and Shareholder Value: An Empirical Test of the Risk Management Hypothesis. Strateg. Manag. J. 2009, 30, 425–445. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A. Does it Pay to be Different? An Analysis of the Relationship between Corporate Social and Financial Performance. Strateg. Manag. J. 2008, 29, 1325–1343. [Google Scholar] [CrossRef]

- Etzion, D. Research on Organizations and the Natural Environment. 1992–Present: A Review. J. Manag. 2007, 33, 637–664. [Google Scholar] [CrossRef]

- Funk, K. Sustainability and Performance. MIT Sloan Manag. Rev. 2003, 44, 65–70. [Google Scholar]

- Berns, M.; Towned, A.; Khayat, Z.; Balagopal, B.; Reeves, M.; Hopkins, M.; Kruschwitz, N. Sustainability and Competitive Advantage. MIT Sloan Manag. Rev. 2009, 51, 18–26. [Google Scholar]

- Carroll, A.B.; Shabana, K.M. The Business Case for Corporate Social Responsibility: A Review of Concepts, Research and Practice. Int. J. Manag. Rev. 2010, 12, 85–105. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M. The Cost of Capital, Corporation Finance, and the Theory of Investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Fama, E.F.; French, K.R. Disagreement, Tastes and Asset Prices. J. Financ. Econ. 2007, 83, 667–689. [Google Scholar] [CrossRef]

- Heinkel, R.; Kraus, A.; Zechner, J. The Effect of Green Investment on Corporate Behavior. J. Financ. Quant. Anal. 2001, 36, 431–449. [Google Scholar] [CrossRef]

- Mackey, A.; Mackey, T.B.; Barney, J.B. Corporate Social Responsibility and Firm Performance: Investor Preferences and Corporate Strategies. Acad. Manag. Rev. 2007, 32, 817–835. [Google Scholar] [CrossRef]

- Bouslah, K.; Kryzanowski, L.; M’Zali, B. The Impact of the Dimensions of Social Performance on Firm Risk. J. Bank. Financ. 2013, 37, 1258–1273. [Google Scholar] [CrossRef]

- Merton, R.C. A Simple Model of Capital Market Equilibrium with Incomplete Information. J. Financ. 1987, 42, 483–510. [Google Scholar] [CrossRef]

- Lee, D.D.; Faff, R.W. Corporate Sustainability Performance and Idiosyncratic Risk: A Global Perspective. Financ. Rev. 2009, 44, 213–237. [Google Scholar] [CrossRef]

- Mao, J.C.T. Security Pricing in an Imperfect Capital Market. J. Financ. Quant. Anal. 1971, 6, 1105–1116. [Google Scholar] [CrossRef]

- Klapper, L.F.; Love, I. Corporate Governance, Investor Protection, and Performance in Emerging Markets. J. Corp. Financ. 2004, 10, 703–728. [Google Scholar] [CrossRef]

- Bolton, G.; Ockenfels, A.; Stauf, J. Social Responsibility Promotes Conservative Risk Behavior. Eur. Econ. Rev. 2015, 74, 109–127. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The Corporate Social Performance–Financial Performance Link. Strat. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Fernando, C.; Sharfman, M.; Uysal, V. Does Greenness Matter? The Effect of Corporate Environmental Performance on Ownership Structure, Analyst Coverage and Firm Value. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.619.1951&rep=rep1&type=pdf (accessed on 11 March 2016).

- Bansal, P.; Clelland, I. Talking Trash: Legitimacy, Impression Management, and Unsystematic Risk in the Context of the Natural Environment. Acad. Manag. J. 2004, 47, 93–103. [Google Scholar] [CrossRef]

- Christmann, P. Effects of Best Practices of Environmental Management on Cost Advantage: The Role of Complementary Assets. Acad. Manag. J. 2000, 43, 663–680. [Google Scholar] [CrossRef]

- Campbell, D.J. Intra- and Intersectoral Effects in Environmental Disclosures: Evidence for Legitimacy Theory? Bus. Strat. Environ. 2003, 12, 357–371. [Google Scholar] [CrossRef]

- Rosenberg, J.V.; Engle, R.F. Empirical Pricing Kernels. J. Financ. Econ. 2002, 64, 341–372. [Google Scholar] [CrossRef]

- Giambona, E.; Golec, J. Mutual Fund Volatility Timing and Management Fees. J. Bank. Financ. 2009, 33, 589–599. [Google Scholar] [CrossRef]

- Oikonomou, I.; Brooks, C.; Pavelin, S. The Impact of Corporate Social Performance on Financial Risk and Utility: A Longitudinal Analysis. Financ. Manag. 2012, 41, 483–515. [Google Scholar] [CrossRef]

- Gray, R.; Javad, M.; Power, D.M.; Sinclair, C.D. Social and Environmental Disclosure and Corporate Characteristics: A Research Note and Extension. J. Bus. Financ. Account. 2001, 28, 327–356. [Google Scholar] [CrossRef]

- Patten, D.M.; Crampton, W. Legitimacy and the Internet: An Examination of Corporate Webpage Environmental Disclosure. Adv. Environ. Account. Manag. 2004, 2, 31–57. [Google Scholar]

- Unerman, J. Reflections on Quantification in Corporate Social Reporting Content Analysis. Account. Audit. Accountanility J. 2000, 13, 667–681. [Google Scholar] [CrossRef]

- Ness, K.E.; Mirza, A.M. Corporate Social Disclosure: A Note on a Test of Agency Theory. Br. Account. Rev. 1991, 23, 211–218. [Google Scholar] [CrossRef]

- Patten, D.M. Exposure, Legitimacy, and Social Disclosure. J. Account. Publ. Pol. 1991, 10, 297–308. [Google Scholar] [CrossRef]

- Aerts, W. Picking up the Pieces: Impression Management in the Retrospective Attributional Framing of Accounting Outcomes. Account. Organiz. Soc. 2005, 30, 493–517. [Google Scholar] [CrossRef]

- Tregidga, H.; Milne, M.J. From Sustainable Management to Sustainable Development: A Longitudinal Analysis of Leading New Zealand Environmental Reporters. Bus. Strat. Environ. 2006, 15, 219–241. [Google Scholar] [CrossRef]

- Bowen, H. Social Responsibility of the Businessman; Harper and Row: New York, NY, USA, 1953. [Google Scholar]

- Quinn, J.; Mintzberg, H.; James, R. The Strategy Process; Prentice-Hall: Englewood Cliffs, NJ, USA, 1987. [Google Scholar]

- Davis, K. The Case For and Against Business Assumption of Social Responsibilities. Acad. Manag. J. 1973, 16, 312–322. [Google Scholar] [CrossRef]

- Carroll, A.B. The Pyramid of Corporate Social Responsibility: Toward the Moral Management of Organizational Stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Husted, B.W. Governance Choices for Corporate Social Responsibility: To Contribute, Collaborate or Internalize? Long Range Plann. 2003, 36, 481–498. [Google Scholar] [CrossRef]

- Hediger, W. Welfare and Capital-Theoretic Foundations of Corporate Social Responsibility and Corporate Sustainability. J. Socio-Econ. 2010, 39, 518–526. [Google Scholar] [CrossRef]

- Lee, K.H.; Saen, R.F. Measuring Corporate Sustainability Management: A Data Envelopment Analysis Approach. Int. J. Prod. Econ. 2012, 140, 219–226. [Google Scholar] [CrossRef]

- Burrit, R.L.; Schaltegger, R. Sustainability Accounting and Reporting: Fad or Trend? Account. Aud. Account. J. 2010, 23, 829–846. [Google Scholar] [CrossRef]

- Lang, M.; Lundholm, R. Cross-Sectional Determinants of Analysts Ratings of Corporate Disclosures. J. Account. Res. 1993, 31, 246–271. [Google Scholar] [CrossRef]

- Loew, T.; Ankele, K.; Braun, S.; Clausen, J. Bedeutung der Internationalen CSR-Diskussion für Nachhaltigkeits und Die Sich Daraus Ergebenden Anforderungen an Unternehmen mit Fokus Berichterstattung; Future e.V.: Münster, Germany; Institut Für Ökologische Wirtschaftsforschung (IÖW): Berlin, Germany, 2004. (In Germany) [Google Scholar]

- Toms, J.S. Firm Resources, Quality Signals and the Determinants of Corporate Environmental Reputation: Some UK Evidence. British Account. Rev. 2002, 34, 257–282. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M.; van Velthoven, B. Environmental Disclosure Quality in Large German Companies: Economic Incentives, Public Pressure or Institutional Conditions? Eur. Account. Rev. 2005, 14, 3–39. [Google Scholar] [CrossRef]

- Delmas, M. Stakeholders and Competitive Advantage: The Case of ISO 14001. Prod. Oper. Manag. 2001, 10, 343–358. [Google Scholar] [CrossRef]

- Ramus, C.A.; Steger, U. The Roles of Supervisory Support Behaviors and Environmental Policy in Employee “Ecoinitiative” at Leading-Edge European Companies. Acad. Manag. J. 2000, 43, 605–626. [Google Scholar] [CrossRef]

- Darnall, N.; Henriques, I.; Sadorsky, P. Adopting Proactive Environmental Strategy: The Influence of Stakeholders and Firm Size. J. Manag. Stud. 2010, 47, 1072–1093. [Google Scholar] [CrossRef]

- Wagner, M.; Schaltegger, S. The Effect of Corporate Environmental Strategy Choice and Environmental Performance on Competitiveness and Economic Performance: An Empirical Study of EU Manufacturing. Eur. Manag. J. 2004, 22, 557–572. [Google Scholar] [CrossRef]

- Ravindu, S.; Rameezdeen, R.; Zuo, J.; Zhou, Z.; Chandratilake, R. Indoor Environmental Quality of Green Buildings: Case Study of an LEED Platinum Certified Factory in Warm Humid Tropical Climate. Build Environ. 2015, 84, 105–113. [Google Scholar] [CrossRef]

- Lang, L.; Ofek, E.; Stulz, R.M. Leverage, Investment, and Firm Growth. J. Financ. Econ. 1996, 40, 3–29. [Google Scholar] [CrossRef]

- Wu, X. Corporate Governance and Audit Fees: Evidence from Companies Listed on the Shanghai Stock Exchange. China J. Account. Res. 2012, 5, 321–342. [Google Scholar] [CrossRef]

- Cui, X.G.; Wang, L.Y.; Xu, H. High-Speed Growth, Financial Crisis and Risk Forecasting. Account. Res. 2007, 12, 55–62. [Google Scholar]

- Higgins, R. How Much Growth can a Firm Afford? Financ. Manag. 1997, 6, 7–16. [Google Scholar] [CrossRef]

- Tagesson, T.; Blank, V.; Broberg, P.; Collin, S.O. What Explains the Extent and Content of Social and Environmental Disclosures on Corporate Websites: A Study of Social and Environmental Reporting in Swedish Listed Corporations. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 352–364. [Google Scholar] [CrossRef]

- Ho, F.N.; Wang, H.-M.D.; Vitell, S.J. A Global Analysis of Corporate Social Performance: The Effects of Cultural and Geographic Environments. J. Bus. Ethics. 2012, 107, 423–443. [Google Scholar] [CrossRef]

- Ernult, J; Ashta, A. How to Measure Global Sustainability Performance in a Service Enterprise? A Case Study of the Credibility of Vigeo’s Raiting of Caisse D’Epargne. J. Serv. Res. 2008, 8, 101–123. [Google Scholar]

- Cellier, A.; Chollet, P. The Effects of Social Ratings on Firm Value. Res. Int. Bus. Financ. 2016, 36, 656–683. [Google Scholar] [CrossRef]

- Fombrun, C.J. Indices of Corporate Reputation: An Analysis of Media Rankings and Social Monitors’ Ratings. Corp. Reput. Rev. 1998, 1, 327–334. [Google Scholar] [CrossRef]

- Graves, S.B.; Waddock, S.A. Institutional Owners and Corporate Social Performance. Acad. Manag. J. 1994, 37, 1034–1046. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate Social Performance Measurement: A Comment on Methods for Evaluating an Elusive Construct. In Research in Corporate Social Performance and Policy: A Research Annual; Post, J.E., Collins, D., Eds.; Elsevier Science Limited: Amsterdam, Dutch, 1991; Volume 12, pp. 385–401. [Google Scholar]

- Carhart, M. On Persistence in Mutual Fund Performance. J. Financ. 1997, 52, 57–82. [Google Scholar] [CrossRef]

- Gómez-Bezares, F.; Gómez-Bezares, F.R. Classic Performance Indexes Revisited: Axiomatic and Applications. Appl. Econ. Lett. 2012, 19, 467–470. [Google Scholar] [CrossRef]

| GICS Sector | FTSE 350 Companies | Percentage of All FTSE 350 Companies | 65 Sampled Companies | Percentage of Sample |

|---|---|---|---|---|

| Consumer Discretionary | 68 | 19.40% | 10 | 15.40% |

| Consumer Staples | 26 | 7.40% | 7 | 10.80% |

| Energy | 15 | 4.30% | 5 | 7.70% |

| Financials | 111 | 31.70% | 11 | 16.90% |

| Health Care | 9 | 2.60% | 0 | 0.00% |

| Industrials | 53 | 15.10% | 17 | 26.20% |

| Information Technology | 24 | 6.90% | 6 | 9.20% |

| Materials | 25 | 7.10% | 3 | 4.60% |

| Telecommunications Services | 7 | 2.00% | 2 | 3.10% |

| Utilities | 12 | 3.40% | 4 | 6.20% |

| Category | Full sample (N = 350) | A: Sustainable Companies (N = 65) | B: Unsustainable Companies (N = 285) | Test of Difference (A-B) | ||||

|---|---|---|---|---|---|---|---|---|

| Mean | Median | Mean | Median | Mean | Median | Mean | Median | |

| Total asset (thousands of GBP) | 30,944,286 | 1,391,000 | 74,285,653 | 3,000,800 | 20,591,025 | 1,177,396 | 53,694,628 *** | 1,823,405 *** |

| Rate of growth of revenue | 0.194 | 0.077 | 0.087 | 0.066 | 0.229 | 0.083 | −0.142 *** | −0.017 *** |

| Sustainable rate of growth of revenue | 0.133 | 0.100 | 0.087 | 0.089 | 0.145 | 0.100 | −0.057 * | −0.011 |

| Retention ratio | 0.747 | 0.736 | 0.618 | 0.595 | 0.779 | 0.797 | −0.161 *** | −0.202 *** |

| Free cash flow (thousands of GBP) | 145,943,238 | 37,522,500 | 182,068,288 | 57,800,000 | 135,867,900 | 33,250,000 | 46,200,388 * | 24,550,000 * |

| R&D to sales ratio | 0.016 | 0.010 | 0.008 | 0.008 | 0.018 | 0.015 | −0.011 *** | −0.006 *** |

| Levered beta | 1.009 | 0.960 | 1.000 | 0.939 | 1.019 | 0.981 | −0.019 | −0.042 |

| Tobin’s q | 1.557 | 1.269 | 1.582 | 1.315 | 1.447 | 1.250 | 0.135 *** | 0.065 *** |

| Concentration of shareholdings (fraction owned by the five largest shareholders) | 0.272 | 0.099 | 0.118 | 0.069 | 0.306 | 0.117 | −0.189 *** | −0.047 *** |

| Panel A: Excess Returns Over Market Portfolio | ||||

| α | RMRF | SMB | HML | UMD |

| 0.0035 * | −0.3082 *** | 0.2240 *** | 0.0073 | 0.0014 |

| (0.0027) | (0.0818) | (0.0728) | (0.0446) | (0.0638) |

| Adjusted R2 = 0.610535 | ||||

| Panel B: Excess return over industry | ||||

| α | RMRF | SMB | HML | UMD |

| 0.0028 *** | −0.1873 *** | 0.2189 *** | 0.0186 *** | 0.0009 |

| (0.0012) | (0.0634) | (0.0813) | (0.0031) | (0.0526) |

| Adjusted R2 = 0.634672 | ||||

| Panel A: Excess Returns Over Market Portfolio | ||||

| α | RMRF | SMB | HML | UMD |

| 0.0029 *** | −0.7285 *** | 0.8674 *** | −0.2811 ** | 0.1035 |

| (0.0004) | (0.0929) | (0.1337) | (0.1393) | (0.0787) |

| Adjusted R2 = 0.571642 | ||||

| Panel B: Excess return over industry | ||||

| α | RMRF | SMB | HML | UMD |

| 0.0025 *** | −0.2423 *** | 0.7798 *** | 0.0116 *** | 0.1214 * |

| (0.0010) | (0.0714) | (0.1603) | (0.0038) | (0.066) |

| Adjusted R2 = 0.583457 | ||||

| Portfolio | Mean | Median | SD | Min | Max | Kurtosis | Skewness |

|---|---|---|---|---|---|---|---|

| Panel A: Equally weighted portfolios | |||||||

| Sustainable companies | 0.075 | 0.068 | 0.025 | 0.042 | 0.162 | 2.458 | 1.540 |

| Market portfolio | 0.090 | 0.080 | 0.033 | 0.055 | 0.250 | 5.932 | 2.126 |

| Panel B: Value weighted portfolios | |||||||

| Sustainable companies | 0.029 | 0.024 | 0.015 | 0.019 | 0.083 | 1.602 | 1.234 |

| Market portfolio | 0.082 | 0.074 | 0.043 | 0.030 | 0.287 | 5.458 | 1.836 |

| Panel A: Equally Weighted Portfolio | ||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Average |

| 0.0215 | 0.0391 | 0.0402 | 0.0399 | 0.0695 | 0.0648 | 0.0546 | 0.0301 | 0.0227 | 0.0116 | 0.0394 |

| Panel B: Value Weighted Portfolio | ||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Average |

| 0.0206 | 0.0308 | 0.0344 | 0.0366 | 0.0482 | 0.054 | 0.0498 | 0.0264 | 0.0209 | 0.0101 | 0.0332 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gómez-Bezares, F.; Przychodzen, W.; Przychodzen, J. Corporate Sustainability and Shareholder Wealth—Evidence from British Companies and Lessons from the Crisis. Sustainability 2016, 8, 276. https://doi.org/10.3390/su8030276

Gómez-Bezares F, Przychodzen W, Przychodzen J. Corporate Sustainability and Shareholder Wealth—Evidence from British Companies and Lessons from the Crisis. Sustainability. 2016; 8(3):276. https://doi.org/10.3390/su8030276

Chicago/Turabian StyleGómez-Bezares, Fernando, Wojciech Przychodzen, and Justyna Przychodzen. 2016. "Corporate Sustainability and Shareholder Wealth—Evidence from British Companies and Lessons from the Crisis" Sustainability 8, no. 3: 276. https://doi.org/10.3390/su8030276

APA StyleGómez-Bezares, F., Przychodzen, W., & Przychodzen, J. (2016). Corporate Sustainability and Shareholder Wealth—Evidence from British Companies and Lessons from the Crisis. Sustainability, 8(3), 276. https://doi.org/10.3390/su8030276