Exploration and Exploitation as Antecedents of Environmental Performance: The Moderating Effect of Technological Dynamism and Firm Size

Abstract

:1. Introduction

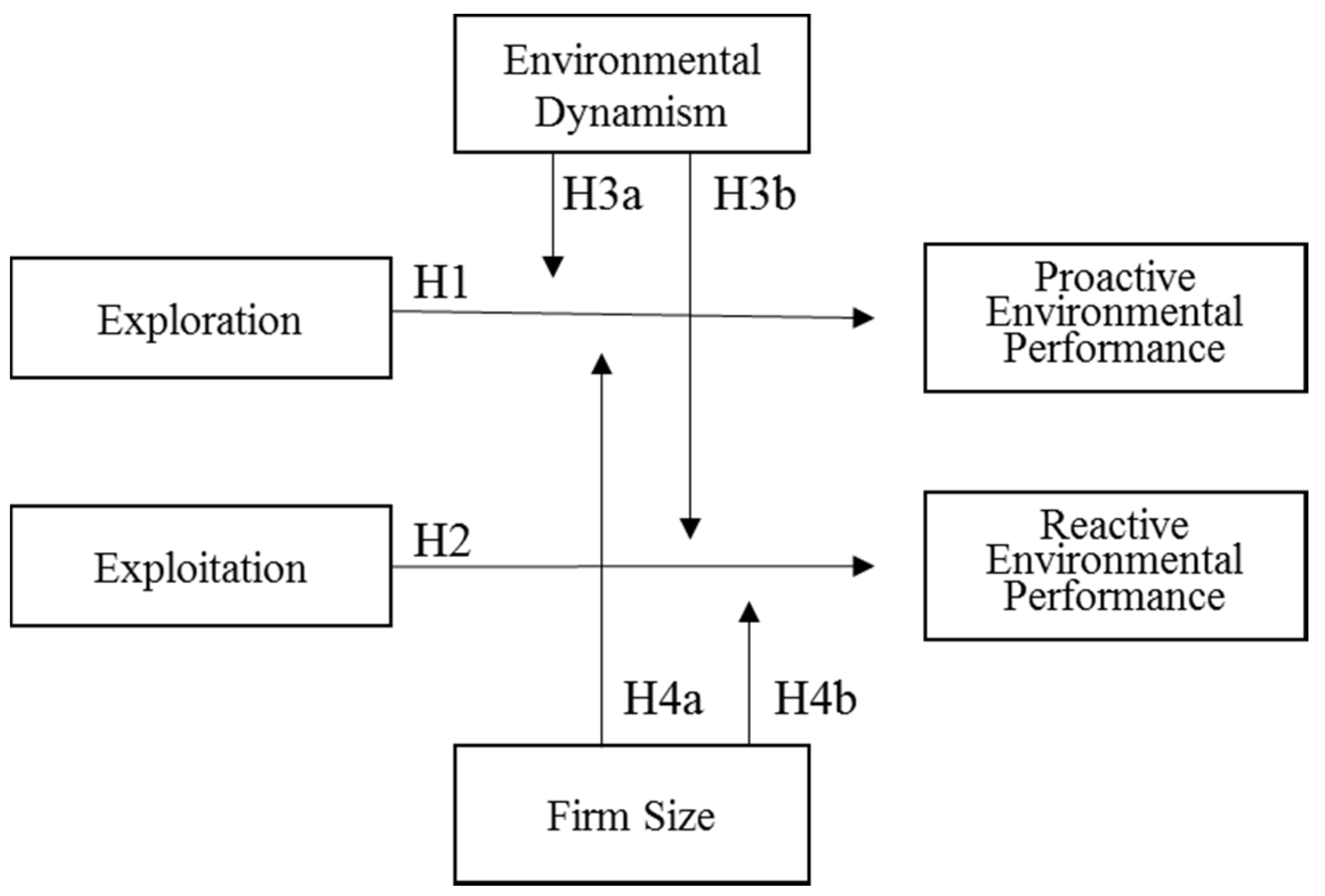

2. Background and Hypotheses

2.1. Exploration and Exploitation as an Antecedent of Environmental Performance

2.2. Moderating the Effects of a Firm’s External and Internal Characteristics

3. Methods

3.1. Data and Summary Statistics

3.2. Research Design

| Environmental strengthsit | = β0 + β1 Explorationit + β2 Exploitationit + β3 Technological dynamismit |

| + β4 Firm sizeit + β5 Leverageit + β6 Sales growthit + β7 R & Dit | |

| + ΣIND + ΣYEAR + αit + εit. |

| Environmental concernsit | = β0 + β1 Explorationit + β2 Exploitationit + β3 Technological dynamismit |

| + β4 Firm sizeit + β5 Leverageit + β6 Sales growthit + β7 R & Dit | |

| + ΣIND + ΣYEAR + αit + εit. |

| Environmental strengthsit | = β0 + β1 Explorationit + β2 Exploitationit + β3 Technological dynamismit |

| + β4 Firm sizeit + β5 Explorationit × Technological dynamismit | |

| + β6 Exploitationit × Technological dynamismit + β7 Leverageit | |

| + β8 Sales growthit + β9 R & Dit + ΣIND + ΣYEAR + αit + εit. |

| Environmental concernsit | = β0 + β1 Explorationit + β2 Exploitationit + β3 Technological dynamismit |

| + β4 Firm sizeit + β5 Explorationit × Technological dynamismit | |

| + β6 Exploitationit × Technological dynamismit + β7 Leverageit | |

| + β8 Sales growthit + β9 R & Dit + ΣIND + ΣYEAR + αit + εit. |

| Environmental strengthsit | = β0 + β1 Explorationit + β2 Exploitationit + β3 Technological dynamismit |

| + β4 Firm sizeit + β5 Explorationit × Firm sizeit | |

| + β6 Exploitationit × Firm sizeit + β7 Leverageit + β8 Sales growthit | |

| + β9 R & Dit + ΣIND + ΣYEAR + αit + εit. |

| Environmental concernsit | = β0 + β1 Explorationit + β2 Exploitationit + β3 Technological dynamismit |

| + β4 Firm sizeit + β5 Explorationit × Firm sizeit | |

| + β6 Exploitationit × Firm sizeit + β7 Leverageit + β8 Sales growthit | |

| + β9 R & Dit + ΣIND + ΣYEAR + αit + εit. |

4. Results of the Multivariate Analysis

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix

| No | Variable | Measurement |

|---|---|---|

| 1 | Environmental strengths | Sum of the values of four items: 1 if firm activity has the following strengths: beneficial products and service, pollution prevention, recycling, clean energy. Otherwise, 0. |

| 2 | Environmental concerns | Sum of the values of six items: 1 if firm activity addresses the following concerns: hazardous waste, regulation problem, Ozone depleting chemicals, substantial emissions, agriculture chemicals, climate change. Otherwise, 0. |

| 3 | Exploration | The count of prior citations outside the accumulated focal firm domains in patent applications. |

| 4 | Exploitation | The count of prior citations within the accumulated focal firm domain. |

| 5 | Technological dynamism | The logarithm of industry total R & D expenditures divided by industry total sales. |

| 6 | Firm size | The logarithm of total assets (in millions of dollars). |

| 7 | Leverage | The ratio of long-term debt to total assets. |

| 8 | Sales growth | (Sale t − Salet−1)/Salet−1 |

| 9 | R & D | R & D expenditures (in millions of dollars). |

References

- Buysse, K.; Verbeke, A. Proactive environmental strategies: A stakeholder management perspective. Strateg. Manag. J. 2003, 24, 453–470. [Google Scholar] [CrossRef]

- Kassinis, G.; Vafeas, N. Stakeholder pressures and environmental performance. Acad. Manag. J. 2006, 49, 145–159. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar]

- Berrone, P.; Gomez-Mejia, L.R. Environmental performance and executive compensation: An integrated agency-institutional perspective. Acad. Manag. J. 2009, 52, 103–126. [Google Scholar] [CrossRef]

- Carrión-Flores, C.E.; Innes, R. Environmental innovation and environmental performance. J. Environ. Econ. Manag. 2010, 59, 27–42. [Google Scholar] [CrossRef]

- Dean, T.J.; Brown, R.L. Pollution regulation as a barrier to new firm entry: Initial evidence and implications for future-research. Acad. Manag. J. 1995, 38, 288–303. [Google Scholar] [CrossRef]

- Weng, H.-H.; Chen, J.-S.; Chen, P.-C. Effects of green innovation on environmental and corporate performance: A stakeholder perspective. Sustainability 2015, 7, 4997–5026. [Google Scholar] [CrossRef]

- Lavie, D.; Stettner, U.; Tushman, M.L. Exploration and exploitation within and across organizations. Acad. Manag. Ann. 2010, 4, 109–155. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar] [CrossRef]

- Sharfman, M.P.; Shaft, T.M.; Tihanyi, L. A model of the global and institutional antecedents of high-level corporate environmental performance. Bus. Soc. 2004, 43, 6–36. [Google Scholar] [CrossRef]

- Shrivastava, P. Ecocentric management for a risk society. Acad. Manag. Rev. 1995, 20, 118–137. [Google Scholar]

- Bos-Brouwers, H.E.J. Corporate sustainability and innovation in smes: Evidence of themes and activities in practice. Bus. Strateg. Environ. 2010, 19, 417–435. [Google Scholar] [CrossRef]

- Montabon, F.; Sroufe, R.; Narasimhan, R. An examination of corporate reporting, environmental management practices and firm performance. J. Oper. Manag. 2007, 25, 998–1014. [Google Scholar] [CrossRef]

- Berchicci, L.; Bodewes, W. Bridging environmental issues with new product development. Bus. Strateg. Environ. 2005, 14, 272–285. [Google Scholar] [CrossRef]

- Krishnan, V.; Ulrich, K.T. Product development decisions: A review of the literature. Manag. Sci. 2001, 47, 1–21. [Google Scholar] [CrossRef]

- Loew, T.; Clausen, J.; Hall, M.; Loft, L.; Braun, S. Case Studies on CSR and Innovation: Company Cases from Germany and the USA; Institute 4 Sustainability: Berlin, Germany, 2009. [Google Scholar]

- Chatterji, A.K.; Levine, D.I.; Toffel, M.W. How well do social ratings actually measure corporate social responsibility? J. Econ. Manag. Strateg. 2009, 18, 125–169. [Google Scholar] [CrossRef]

- Mattingly, J.E.; Berman, S.L. Measurement of corporate social action. Bus. Soc. 2006, 45, 20–46. [Google Scholar] [CrossRef]

- Strike, V.M.; Gao, J.J.; Bansal, P. Being good while being bad: Social responsibility and the international diversification of us firms. J. Int. Bus. Stud. 2006, 37, 850–862. [Google Scholar] [CrossRef]

- Walls, J.L.; Phan, P.H.; Berrone, P. Measuring environmental strategy: Construct development, reliability, and validity. Bus. Soc. 2011, 50, 71–115. [Google Scholar] [CrossRef]

- Florida, R.; Davison, D. Gaining from green management: Environmental management systems inside and outside the factory. Calif. Manag. Rev. 2001, 43, 64–84. [Google Scholar] [CrossRef]

- Mazzanti, M.; Zoboli, R. Economic instruments and induced innovation: The european policies on end-of-life vehicles. Ecol. Econ. 2006, 58, 318–337. [Google Scholar] [CrossRef]

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Innovation and learning: The two faces of R & D. Econ. J. 1989, 569–596. [Google Scholar]

- Nelson, R.R.; Winter, S.G. The schumpeterian tradeoff revisited. Am. Econ. Rev. 1982, 114–132. [Google Scholar]

- Rosenkopf, L.; Nerkar, A. Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strateg. Manag. J. 2001, 22, 287–306. [Google Scholar] [CrossRef]

- Stuart, T.E.; Podolny, J.M. Local search and the evolution of technological capabilities. Strateg. Manag. J. 1996, 17, 21–38. [Google Scholar] [CrossRef]

- Atuahene-Gima, K. Resolving the capability-rigidity paradox in new product innovation. J. Mark. 2005, 69, 61–83. [Google Scholar] [CrossRef]

- Benner, M.J.; Tushman, M.L. Exploitation, exploration, and process management: The productivity dilemma revisited. Acad. Manag. Rev. 2003, 28, 238–256. [Google Scholar]

- Danneels, E. The dynamics of product innovation and firm competences. Strateg. Manag. J. 2002, 23, 1095–1121. [Google Scholar] [CrossRef]

- Holmqvist, M. Experiential learning processes of exploitation and exploration within and between organizations: An empirical study of product development. Organ. Sci. 2004, 15, 70–81. [Google Scholar] [CrossRef]

- Brown, S.L.; Eisenhardt, K.M. Product development—Past research, present findings, and future-directions. Acad. Manag. Rev. 1995, 20, 343–378. [Google Scholar]

- Probst, G.; Raisch, S. Organizational crisis: The logic of failure. Acad. Manag. Executive 2005, 19, 90–105. [Google Scholar] [CrossRef]

- Volberda, H.W. Toward the flexible form: How to remain vital in hypercompetitive environments. Organ. Sci. 1996, 7, 359–374. [Google Scholar] [CrossRef]

- Ambec, S.; Lanoie, P. Does it pay to be green? A systematic overview. Acad. Manag. Perspect. 2008, 22, 45–62. [Google Scholar]

- Banerjee, S.B.; Iyer, E.S.; Kashyap, R.K. Corporate environmentalism: Antecedents and influence of industry type. J. Mark. 2003, 67, 106–122. [Google Scholar] [CrossRef]

- Gupta, A.K.; Smith, K.G.; Shalley, C.E. The interplay between exploration and exploitation. Acad. Manag. J. 2006, 49, 693–706. [Google Scholar] [CrossRef]

- He, Z.L.; Wong, P.K. Exploration vs. Exploitation: An empirical test of the ambidexterity hypothesis. Organ. Sci. 2004, 15, 481–494. [Google Scholar] [CrossRef]

- Dess, G.G.; Beard, D.W. Dimensions of organizational task environments. Adm. Sci. Q. 1984, 29, 52–73. [Google Scholar] [CrossRef]

- Baysinger, B.; Hoskisson, R.E. Diversification strategy and R & D intensity in multiproduct firms. Acad. Manag. J. 1989, 32, 310–332. [Google Scholar]

- Nohria, N.; Gulati, R. Is slack good or bad for innovation? Acad. Manag. J. 1996, 39, 1245–1264. [Google Scholar] [CrossRef]

- Cyert, R.M.; March, J.G. A Behavioral Theory of the Firm; Elsevier B.V.: Englewood Cliffs, NJ, USA, 1963. [Google Scholar]

- Bourgeois, L.J., III. On the measurement of organizational slack. Acad. Manag. Rev. 1981, 6, 29–39. [Google Scholar]

- Thompson, J.D. Organizations in Action; McGraw-Hill: New York, NY, USA, 1967. [Google Scholar]

- Vassalou, M.; Xing, Y. Default risk in equity returns. J. Financ. 2004, 59, 831–868. [Google Scholar] [CrossRef]

- Child, J. Organizational structure, environment and performance: The role of strategic choice. Sociology 1972, 6, 1–22. [Google Scholar] [CrossRef]

- Weber, M. Economy and Society: An Outline of Interpretive Sociology; University of California Press: Oakland, CA, USA, 1978. [Google Scholar]

- Baker, D.D.; Cullen, J.B. Administrative reorganization and configurational context: The contingent effects of age, size, and change in size. Acad. Manag. J. 1993, 36, 1251–1277. [Google Scholar] [CrossRef]

- Hannan, M.T.; Freeman, J. The population ecology of organizations. Am. J. Sociol. 1977, 82, 929–964. [Google Scholar] [CrossRef]

- Hannan, M.T.; Freeman, J. Structural inertia and organizational change. Am. Sociol. Rev. 1984, 49, 149–164. [Google Scholar] [CrossRef]

- Harrison, J.S.; Freeman, R.E. Stakeholders, social responsibility, and performance: Empirical evidence and theoretical perspectives. Acad. Manag. J. 1999, 42, 479–485. [Google Scholar] [CrossRef]

- Agle, B.R.; Mitchell, R.K.; Sonnenfeld, J.A. Who matters to ceos? An investigation of stakeholder attributes and salience, corporate performance, and ceo values. Acad. Manag. J. 1999, 42, 507–525. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, D.M. The role of environmental disclosures as tools of legitimacy: A research note. Account. Organ.Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- Mahoney, L.; Roberts, R.W. Corporate social performance, financial performance and institutional ownership in canadian firms. Account. Forum 2007, 31, 233–253. [Google Scholar] [CrossRef]

- Cameron, A.C.; Trivedi, P.K. Regression Analysis of Count Data; Cambridge University Press: New York, NY, USA, 1998. [Google Scholar]

- Jaffe, A.B.; Trajtenberg, M.; Henderson, R. Geographic localization of knowledge spillovers as evidenced by patent citations. Q. J. Econ. 1993, 108, 577–598. [Google Scholar] [CrossRef]

- Berman, S.L.; Wicks, A.C.; Kotha, S.; Jones, T.M. Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Acad. Manag. J. 1999, 42, 488–506. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The corporate social performance-financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Ahuja, G.; Katila, R. Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strateg. Manag. J. 2001, 22, 197–220. [Google Scholar] [CrossRef]

- Quintana-García, C.; Benavides-Velasco, C.A. Innovative competence, exploration and exploitation: The influence of technological diversification. Res. Policy 2008, 37, 492–507. [Google Scholar] [CrossRef]

- Wang, H.; Li, J. Untangling the effects of overexploration and overexploitation on organizational performance: The moderating role of environmental dynamism. J. Manag. 2008, 34, 925–951. [Google Scholar]

- Audretsch, D.B.; Feldman, M.P. R & D spillovers and the geography of innovation and production. Am. Econ. Rev. 1996, 630–640. [Google Scholar]

- Ito, K.; Pucik, V. R & D spending, domestic competition, and export performance of Japanese manufacturing firms. Strateg. Manag. J. 1993, 14, 61–75. [Google Scholar]

- McWilliams, A.; Siegel, D. Corporate social responsibility and financial performance: Correlation or misspecification? Strateg. Manag. J. 2000, 21, 603–609. [Google Scholar] [CrossRef]

- King, A.; Lenox, M. Exploring the locus of profitable pollution reduction. Manag. Sci. 2002, 48, 289–299. [Google Scholar] [CrossRef]

- Cheng, S. R & D expenditures and ceo compensation. Account. Rev. 2004, 79, 305–328. [Google Scholar]

- Padgett, R.; Galan, J. The effect of R & D intensity on corporate social responsibility. J. Bus. Ethics 2010, 93, 407–418. [Google Scholar]

- Yu, G.; Rhee, S.-Y. Effect of R & D collaboration with research organizations on innovation: The mediation effect of environmental performance. Sustainability 2015, 7, 11998–12016. [Google Scholar]

- Gittelman, M. A note on the value of patents as indicators of innovation: Implications for management research. Acad. Manag. Perspect. 2008, 22, 21–27. [Google Scholar] [CrossRef]

| No. | Variable | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Proactive environmental performance | 0.28 | 0.50 | 1 | ||||||||

| 2 | Reactive environmental performance | 0.27 | 0.55 | 0.37 * | 1 | |||||||

| 3 | Exploration | 3.53 | 1.55 | 0.14 * | 0.12 * | 1 | ||||||

| 4 | Exploitation | 4.51 | 2.11 | 0.09 * | 0.05 * | 0.78 * | 1 | |||||

| 5 | Technological dynamism | 0.06 | 0.03 | −0.17 * | −0.3 * | 0.12 * | 0.2 * | 1 | ||||

| 6 | Firm size | 7.85 | 1.56 | 0.36 * | 0.48 * | 0.28 * | 0.26 * | −0.3 * | 1 | |||

| 7 | Leverage | 0.24 | 0.11 | 0.11 * | 0.11 * | 0.08 * | 0.03 * | −0.12 * | 0.17 * | 1 | ||

| 8 | Sales growth | 0.12 | 0.24 | −0.08 * | −0.08 * | −0.08 * | −0.11 * | 0.03 | −0.09 * | −0.09 * | 1 | |

| 9 | R & D | 4.83 | 1.50 | 0.31 * | 0.36 * | 0.47 * | 0.5 * | 0.14 * | 0.8 * | 0.2 * | −0.11 * | 1 |

| Variable | Category | N | Rate (%) |

|---|---|---|---|

| Industry | Agriculture, Forestry, and Fishing | 5 | 0.2% |

| Mining | 43 | 2.1% | |

| Manufacturing | 1714 | 82.7% | |

| Transportation, Communications, Electric, Gas and Sanitary services | 9 | 0.4% | |

| Wholesale Trade | 7 | 0.3% | |

| Retail Trade | 9 | 0.4% | |

| Finance, Insurance, and Real Estate | 4 | 0.2% | |

| Services | 278 | 13.4% | |

| Non-classifiable | 4 | 0.2% | |

| Firm size (the logarithm of total assets in million dollars) | Less than 4.7 | 24 | 1.2% |

| 4.7 to 6.3 | 321 | 15.5% | |

| 6.3 to 7.9 | 726 | 35.0% | |

| 7.9 to 9.4 | 633 | 30.5% | |

| 9.4 to 11.0 | 333 | 16.1% | |

| Over 11.0 | 36 | 1.7% | |

| Proactive environmental performance (environmental concerns) | 0 | 1564 | 75.45% |

| 1 | 383 | 18.48% | |

| 2 | 93 | 4.5% | |

| 3 | 29 | 1.4% | |

| 4 | 4 | 0.2% | |

| Reactive environmental performance (environmental Strengths) | 0 | 1636 | 78.92% |

| 1 | 220 | 10.61% | |

| 2 | 136 | 6.56% | |

| 3 | 49 | 2.36% | |

| 4 | 18 | 0.87% | |

| 5 | 12 | 0.58% | |

| 6 | 2 | 0.1% |

| DV | Environmental Strengths | Environmental Concerns | ||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| Exploration | 0.020 * | 0.034 | −0.001 | 0.009 | −0.000 | −0.000 | ||

| (0.01) | (0.02) | (0.02) | (0.01) | (0.02) | (0.01) | |||

| Exploitation | −0.021 * | −0.022 | −0.018 | −0.017 * | 0.043 * | −0.015 | ||

| (0.01) | (0.02) | (0.01) | (0.01) | (0.02) | (0.01) | |||

| Exploration × Technological dynamism | −0.226 | 0.153 | ||||||

| (0.31) | (0.28) | |||||||

| Exploitation × Technological dynamism | 0.032 | −0.956 *** | ||||||

| (0.27) | (0.25) | |||||||

| Exploration × Firm size | 0.012 † | 0.004 | ||||||

| (0.01) | (0.01) | |||||||

| Exploitation × Firm size | –0.002 | −0.001 | ||||||

| (0.00) | (0.00) | |||||||

| Technological dynamism | −2.723 *** | −2.670 *** | −2.068 * | −2.493 *** | −3.075 *** | −3.035 *** | −0.119 | −2.981 *** |

| (0.58) | (0.59) | (0.96) | (0.59) | (0.61) | (0.61) | (0.94) | (0.62) | |

| Firm size | 0.062 *** | 0.059 *** | 0.059 *** | 0.030 | 0.158 *** | 0.157 *** | 0.156 *** | 0.150 *** |

| (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | |

| Leverage | −0.082 | −0.096 | −0.098 | −0.164 | 0.093 | 0.090 | 0.096 | 0.081 |

| (0.10) | (0.10) | (0.10) | (0.10) | (0.10) | (0.10) | (0.10) | (0.10) | |

| Sales growth | −0.057 † | −0.063 † | −0.063 † | −0.063 † | −0.014 | −0.020 | −0.021 | −0.020 |

| (0.03) | (0.03) | (0.03) | (0.03) | (0.03) | (0.03) | (0.03) | (0.03) | |

| R & D | 0.050 ** | 0.055 ** | 0.055 ** | 0.057 ** | −0.010 | −0.004 | −0.001 | −0.005 |

| (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | |

| Constant | −0.364 *** | −0.334 ** | −0.374 ** | −0.115 | −0.736 *** | −0.709 *** | −0.895 *** | −0.651 *** |

| (0.11) | (0.11) | (0.12) | (0.14) | (0.11) | (0.11) | (0.12) | (0.14) | |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| chi2 | 309.339 | 315.940 | 316.453 | 325.597 | 437.711 | 444.124 | 472.510 | 448.971 |

| N | 2060 | 2060 | 2060 | 2060 | 2060 | 2060 | 2060 | 2060 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, G.J.; Kwon, K.-M.; Lee, J.; Jung, H. Exploration and Exploitation as Antecedents of Environmental Performance: The Moderating Effect of Technological Dynamism and Firm Size. Sustainability 2016, 8, 200. https://doi.org/10.3390/su8030200

Yu GJ, Kwon K-M, Lee J, Jung H. Exploration and Exploitation as Antecedents of Environmental Performance: The Moderating Effect of Technological Dynamism and Firm Size. Sustainability. 2016; 8(3):200. https://doi.org/10.3390/su8030200

Chicago/Turabian StyleYu, Gun Jea, Kyoung-Min Kwon, Joonkyum Lee, and Hojin Jung. 2016. "Exploration and Exploitation as Antecedents of Environmental Performance: The Moderating Effect of Technological Dynamism and Firm Size" Sustainability 8, no. 3: 200. https://doi.org/10.3390/su8030200