1. Introduction

The current transport sector is regarded to be unsustainable when considering its large and increasing contribution to global air pollution, greenhouse gas (GHGs) emissions and depletion of resources [

1]. Much of the unsustainability comes from the widespread diffusion of internal combustion engine vehicles (ICEVs). Electric vehicles (EVs) are therefore increasingly favored by many governments [

2,

3].

China, one of the fastest growing developing countries, is also facing great challenges from the transport sector [

4]. By 2013, private car ownership in China reached 105 million, increasing by 367 times compared to that of 1985 [

5]. This soar makes the transportation become the most rapidly increasing energy consuming sector [

6]. During the “Eleventh Five-Year Planning (2006–2010)” period, total new additional refining capacity was 100 million tons. This increase was almost entirely consumed by new cars. [

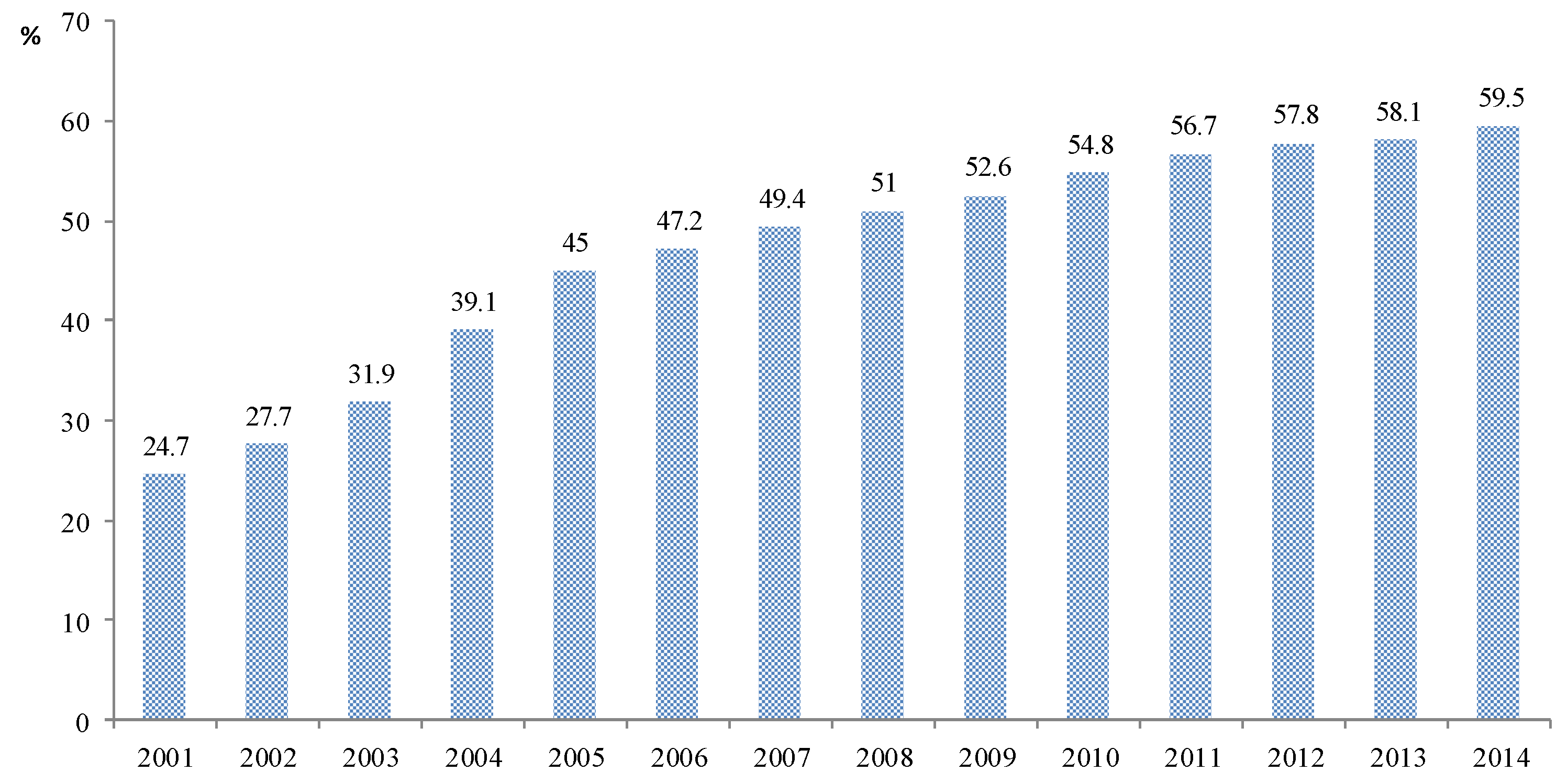

7]. To fuel the growing vehicles, China has had to continue to increase petroleum import in recent years. The petroleum foreign degree of dependency thus increased and reached 59.5% in 2014 (

Figure 1). Such a rapid increase in turn results in huge GHG emissions, which runs counter to the Chinese government’s promise of reducing CO

2 emissions per unit of GDP by between 40% and 45% by 2020 on the basis of 2005 values.

Figure 1.

Petroleum foreign degree of dependency (Data source: [

8,

9,

10]).

Figure 1.

Petroleum foreign degree of dependency (Data source: [

8,

9,

10]).

In this context, the Chinese government tries to introduce EVs to achieve a sustainable transport sector [

11,

12]. In 2001, the Ministry of Science and Technology (MOST), the Ministry of Industry and Information Technology (MIIT), the National Development and Reform Commission (NDRC) and the Ministry of Finance (MOF) launched two-round demonstration programs (DPs) to support the societal introduction of EVs. The first-round DP (FRDP) was from 2009 to 2012 and the second-round DP (SRDP) is from 2013 to 2015. The DP marks the beginning of official protection to support the transition of EV technology from R & D in laboratory to mass deployment [

13].

Despite the great benefit for social sustainability and strong support from governments, EVs have not achieved greater market penetration. Thus, many studies tried to explore how to promote the development of EVs. Among these studies, sustainability transition has received increased attention recently [

14]. These studies argue the transport sector is a socio-technical system which consists of heterogeneous elements including “

technology, policy, markets, consumer practices, infrastructure, cultural meaning and scientific knowledge” [

1] and the achievement of sustainability requires fundamental changes—a “transition”—in the current system [

2,

15]. However, the current transport system is characterized by lock-in and path-dependence, which poses great challenges to the transition [

15]. The immaturity of EV technologies further aggravates the transition challenges. In this context, strategic niche management (SNM), one key analysis framework in the sustainability transition, advocates that real-world demonstration projects should be initiated to create niches—protective spaces—for radical innovations [

16]. Indeed, the transition to a sustainable transport is a complicated process, and the policies may fail if the government does not understand the process [

17]. How to manage the transition process from dominant unsustainable technologies to new technologies is just what SNM explores [

18].

In China, EVs also diffuse very slowly. This paper, therefore, takes the EV DPs in China as the analysis object with the aim to explore the problems which may hinder the development of EVs and provide the Chinese government with some insights into how to cultivate the transition to sustainability. To achieve this aim, we address two research questions regarding the EV DPs: (a) What niche protection has been provided at the national and local level, respectively, and why are the diffusion results are different in the pilot cities? We also address (b) What problems are exposed during the EV DPs?

Through focusing on these questions, this paper tries to contribute the sustainability transition in two aspects. First, many of the existing sustainability transition studies focus on developed countries such as the UK [

15,

16], Sweden [

2] and Germany [

19]. Studies about developing countries are scarce by far. For example, Nykvist and Whitmarsh defined three areas of niche innovation for sustainable mobility in UK and Sweden, and the processes of co-evolution, divergence and tension within and between niches were explored [

2]. Steinhilber

et al. tried to find out the social-technical barriers to EV development in the UK and Germany [

19]. Mazur combined the concept of transition with system dynamics to assess the effectiveness of EV policies with regard to transition pathways [

15]. However, the suggestions proposed in these studies are based on the empirical evidence of developed studies and cannot be easily applied in developing countries. Indeed, many developing countries are increasingly suffering from unsustainability problems, and the sustainability of developing countries is essential for the worldwide sustainability [

20]. This paper contributes to this by analyzing the EV DPs in China, in which EVs get strong push from the government.

The second aspect focused on is the spatial dimension, considered to be an important aspect of niche development [

21]. However, its importance in forming protective spaces has been ignored by previous literature [

22]. Although some attention is being paid to this dimension [

23], the study about how place-specific characteristics influence the formation of niche protection and in turn influence the niche development is still being researched [

22]. This paper tries to contribute to this by examining the niche protection of EVs in China from the national and local level and exploring how the specific local conditions influence the formation of local niche protection and diffusion results of EVs.

The structure of the rest of the paper is as follows. We first outline the SNM approach and review the relevant literature in

Section 2.

Section 3 elaborates on the research methods. Then, we adopt the SNM approach to analyze China’s EV DPs from the perspective of niche protection and the niche processes in

Section 4. The results are then discussed in

Section 5.

2. Analytical Approach: The Strategic Niche Management

The SNM was firstly introduced by Schot

et al. [

24] and elaborated on by Kemp

et al. [

18] and Hoogma

et al. [

25]. It assumes that many sustainable innovations fail in the market competition primarily because the established technologies have always been embedded in the existing sector [

18,

24]. Deep-structural rules and practices often lead incumbent actors to be blind to radical new technologies [

1]. Moreover, most new technology is relatively crude. In these cases, the SNM approach advocates “the creation, development and controlled break-down of test-beds (experiments, demonstration projects) for promising new technologies and concepts with the aim of learning about the desirability (for example in terms of sustainable development) and enhancing the rate of diffusion of the new technology” [

26]. In other words, SNM posits that successful sustainable innovations originate from real-world experiments or demonstrations, and protected spaces,

i.e., niches, should be created [

27]. To ensure experiments can achieve desired objects,

i.e., nurturing innovations, three internal processes are critical: voicing and shaping of expectations, building of social networks, and learning process [

18].

Expectations are promises of new technologies [

18]. They can be “problem oriented and deal with the specifications for the technology”, or “function oriented and more qualitative”, or “scenario oriented, general and broad” [

28,

29]. In terms of the uncertain outcomes of radical innovations, expectations play a vital role in attracting actors. Moreover, expectations can provide guidance and cognitive rules for actors’ activities [

30]. Generally, expectations are considered to be powerful when they are (a) accepted and shared by more actors (robust); (b) clear and specific; and (c) supported by experiment results (high quality) [

30,

31].

The development of a new technology requires supporting social networks. Different actors normally have specific perceptions, and they participate in the network for diverse reasons. Actor networks thus aim at creating co-ordination and convergence of diverging expectations [

28]. Social networks are considered to be effective when more diverse actors participate and alignment between actors increases [

32].

Learning aims at discovering opportunities or barriers so that innovations could develop properly [

28]. Typically, a learning process is considered to be adequate when it entails both first-order and second-order learning [

30]. First-order learning aims at accumulation of facts and data about different aspects such as technology, infrastructure, policy and user practice [

30]. Second-order learning is a reflexive learning method which focuses on questioning the given norms and rules to reformulate expectations, redesign the technology and reconstruct the network [

28].

The three internal niche processes are relevant to “understanding failure and success of sustainable technologies” [

32]. Several scholars have used them to analyze the experiments of clean technology. For example, Raven used them to compare the biomass experiments in the Netherlands and Denmark. The study pointed out that the failure of manure digestion in the Netherlands resulted from three factors: single development trajectory, discontinuity of experiments and instability. [

31]. Laak

et al. applied them to explain the success or failure of biofuel experiments in the Netherlands. Based on the analysis, they developed some policy guidelines such as building a broad network and stimulating diversity [

32]. Alan combined the concepts of SNM and social marketing to analyze how the experiments can stimulate the take-up of EVs in the UK. In this paper, we will use the three processes to analyze the EV DPs in China so as to identify the problems exposed in the EV DPs.

The previous literature mainly focuses on the niche-internal dynamics and one important dimension—space—was ignored. This made sustainability transition under criticism from geographers [

31]. Without considering the spatial dimension, one cannot fully explain many questions such as “Why do transitions occur in one place and not in another? How do transitions unfold across different geographical contexts?” [

22]. In this context, many scholars tried to introduce spatial dimension into niche development [

33]. For example, Mans compared the transition of renewable energy in Casablanca and Cape Town and illustrated how the difference between cities resulted in the different development results [

34]. Fontes

et al. drew on the socio-cognitive perspective to analyze the formation of technological niche of wave energy in Portugal and introduced the spatial dimension to extend it [

23]. Sengers and Raven developed the local-global niche model by focusing on the spatiality of the production and transfer of knowledge, the geographies of the actor networks involved and the dynamics of embeddedness [

21].

Within these studies, scholars use different approaches to expand the geography of sustainability transition. This can provide innovative insights but can also result in fuzzy conceptualization [

35]. Therefore, it is important to conceptualize space before we proceed to analyze the niche development. Based on the empirical evidence of EV DPs in China, this paper emphasizes economic geography, which focuses on explaining the dissimilar geographical landscape of niche development. The uneven geographical landscape not only includes natural and geographical dimensions, but also “social, institutional and to some extent cultural dimensions” [

22].

3. Methodology

The data collection in this paper consisted of four steps. First, we conducted a literature review on previous studies about China’s EV development [

4,

6,

11,

12,

13]. Second, we conducted field surveys in some pilot cities including Shenzhen and Shanghai, and conducted in-depth expert interviews with relevant actors. Shenzhen is one of the most influential pilot cities in the FRDP. Its electrification degree of public transport was the highest, and it was the first city to achieve commercial operation of electric taxis. Shanghai is one of the most influential pilot cities in the SRDP. It has deployed the most EVs among pilot cities, and 70% of EVs were purchased by private users [

36].

Table 1 lists the main interviewees. These interviewees covered a wide range and they were all experts in the EV field, including Deputy Director and Assistant Director of Shenzhen Municipal Development and Reform Commission who are directly responsible for EV DPs in Shenzhen; Manager of Futian Charging Station, which was constructed and is operated by China Southern Power Grid Company, General Manager of Pengcheng Electric Vehicle Taxi Vehicle Company which is the only specialized and commercialized electric taxi company in Shenzhen; three professors at Automotive School of Tongji University, which is one of the most important EV research institutions in China; General Manager of Shanghai Zhida Technology Development Company, which is a new actor out of the ICEV industry and the market share of which, as a private charging service provider, is the largest in China by far; Chief Engineer of Power Systems Technology Center of Shanghai Automotive Industry Corp. (SAIC) which is the top-tier ICEV and EV manufacturer in China; Manager of the EV Test Drive Center of Shanghai International Automobile City Company Shanghai, which is the only company responsible for the daily operation of international demonstrations of Shanghai. The EV Test Drive Center provides free EV driving tests to the public to learn about the actual demands of consumers.

The interviews in Shenzhen were two-rounds. (a) We firstly organized an expert panel workshop in which all of the interviewees introduced the EV DPs in Shenzhen including their business models, policy measures and problems. The workshops lasted for about three hours and notes were taken; (b) then, we conducted semi-structured expert interviews with the actors from the taxi company and charging station. The interviews mainly dealt with the actors’ activities regarding electric mobility, their motivations to do so and the problems encountered. In Shanghai, we conducted semi-structured expert interviews with the actors, respectively. Each interview lasted about thirty minutes. The interviews mainly dealt with the EV DPs in Shanghai and the obstacles that many hinder the further development of EVs in China.

Table 1.

List of some interviewees.

Table 1.

List of some interviewees.

| City | Agency/Organization | Title/Division | Actor Group |

|---|

| Shenzhen | Municipal Development and Reform Commission New Energy Vehicles Promotion Office | Deputy Director | Government officer |

| Assistant Director | Government officer |

| China Southern Power Grid Company | Manager of Futian Charging Station | Energy sector representative |

| Pengcheng Electric Taxi Company | General Manager | New actor representative |

| Shanghai | Tongji University | Professors in Automotive School | Research experts |

| Shanghai Zhida Technology Development Company | General Manager | New actor representative |

| SAIC | Chief Engineer of Power Systems Technology Center | Manufacturer |

| Shanghai International Automobile City Company | Manager of EV Test Drive Center | New actor representative |

Thirdly, the data was further supplemented through published documents by the governments and internet search. To ensure the reliability of internet data, we mainly chose data released by the authorities or public statement of representatives from government or associations.

Fourthly, the interview transcripts and documents were coded using a coding scheme that is based on the three niche internal processes introduced in

Section 2. Then, we organized a remote video workshop with the native English speakers in Cambridge University and the author—Xingkun Liang—played an important role in dual communication.

6. Conclusions

In this paper, we have tried to explore how the transition process of EVs develops in one developing country—China. To explain this, we studied China’s EV DPs and introduced the niche development in the DPs. Spatial dimension was introduced in order to better understand how the different diffusion results of EVs appear in pilot cities, and the dynamics of three internal niche processes were adopted to find out the obstacles hampering the niche development.

The analysis shows that financial subsidies are the most important protective measures on the national level. It aims to reduce the purchase costs of EVs and construction costs of charging infrastructure so as to stimulate the niche development. However, on the local level, the protective measure differs due to the uneven geographical landscape, which in turn influences the niche development. The industry base, consumer demands and the openness degree of local governments play great roles in the uneven geographical landscape. The natural resource endowment, however, has little impact on the niche development.

For the obstacles exposed in the EV DPs, the following issues need to be addressed. (a) Actors still have inconsistent expectations. Governments, therefore, should give sufficient attention to the different and possibly conflicting expectations. It does not mean depressing different voicing, but trying to find out the reasons for conflict, learning about the feasibility of different expectations and translating it into a shared expectation; (b) The failure of expectation about EV deployment may discourage the confidence of actors. The central government therefore should strengthen the evaluation component of the DPs. Our study shows that pilot cities will not be punished if they did not fulfill their promises, and there is also lack of exit mechanism. This may lead to inertia. The data from MIIT shows that 33 pilot cities in the SRDP have not introduced any local protection measures by the end of May 2015. Thus, a well-designed monitoring mechanism is necessary for DPs. For local governments, there are two important things that should be paid more attention in order to fulfill the deployment promises. On one hand, local governments should formulate attainable expectations based on their own industry conditions and economic development level. Communicating and meeting with other actors would be necessary for governments before they shape expectations. On the other hand, breaking local protectionism and keeping an open mind is necessary to attract resources and meet the real needs of consumers; (c) New actors in the EV networks are still relatively few. The SNM approach argues that dominant incumbent actors have much competence and resources, but are lack of radical innovation force. Therefore, involving more new industrial actors is important because they have the potential to bring in new ideas and business models [

54]. Governments should further lower the market access threshold to give new actors more opportunities to participate; (d) Local governments should specify the responsibilities of PMCs in old residential districts and strengthen the monitoring mechanism. Our analysis revealed that charging infrastructure is a critical component during BM innovation. However, the alignment between PMCs and charging pile operators is poor. Although some pilot cities such as Shanghai and Beijing have explicitly specified the installation percentage of charging piles in new residential districts, responsibilities of PMCs in old residential districts still need to be emphasized and supervised; (e) The poor alignment within the network actors requires that governments should pay more attention and make dedicated efforts to coordinate different interests and maintain the emerging networks. Industry alliances should hold regular meetings to promote the technological cooperation within the network. Regular discussions should be organized between pilot cities and industrial actors to share the successful experiences so that good experiences can be applied in many pilot cities and the DPs could scale up.

We would like to argue that this paper adds to the literature on the development of EVs in China from the perspective of SNM. We introduce the spatial dimension into niche protection and contribute to the on-going debate on the role of space in niche development. Further, we discuss the dynamics of internal niche processes. By doing so, one can learn more about the sustainability transition in developing countries and see the differences of obstacles that may hinder the development of niche innovation in developed and developing countries.

The geography of sustainability transition involves different concepts and approaches [

22]. Our study only focuses on the concept of economic geography, and it needs to be further explored on the basis of “overall niche space”, which spatializes the role of abstract socio-cognitive processes at both local and global levels [

23]. This would provide more multiple insights into EV development in China.