Innovative Carbon Allowance Allocation Policy for the Shenzhen Emission Trading Scheme in China

Abstract

:1. Introduction

2. Dilemma in the Carbon Allowance Allocation Policy Making of China

2.1. Overview of the Existing Carbon Allowance Allocation Policies

2.2. Dilemma in the Carbon Allowance Allocation Policy Making of China

2.3. Literature Review on Resource Allocation under Incomplete and Asymmetric Information

3. Shenzhen’s Exploration to Formulate Carbon Allowance Allocation Policy

3.1. Case Study

3.2. Shenzhen’s Exploration to Formulate Carbon Allowance Allocation Policy

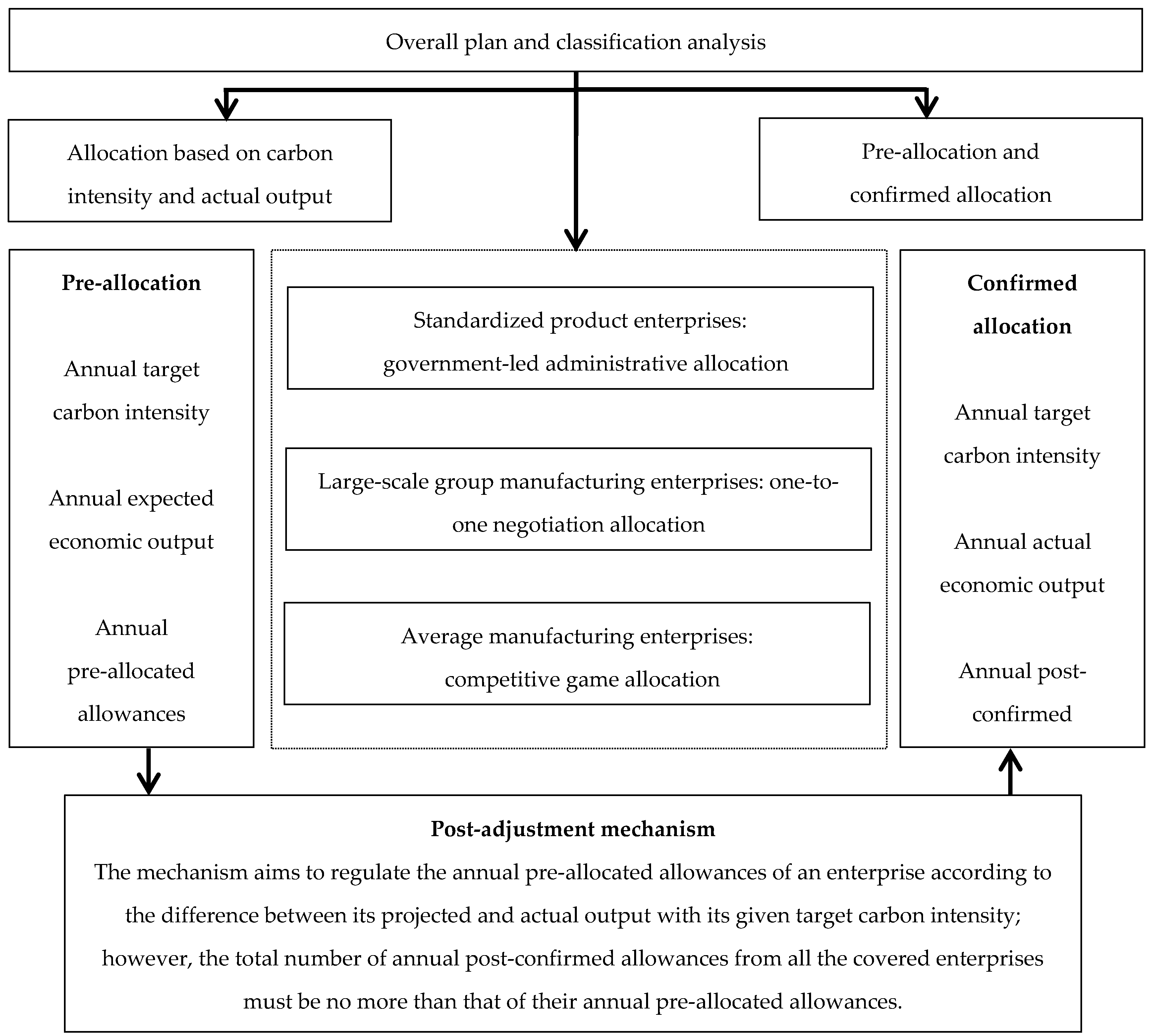

4. Carbon Allowance Allocation Method for SZ ETS

4.1. Standardized Product Enterprises

4.2. Large-Scale Group Manufacturing Enterprises

4.3. Average Manufacturing Enterprises

4.3.1. Design of Game Rules

4.3.2. Information Transmission and Sharing

4.3.3. Game Agent and Equilibrium

| HPE (A) | |||

|---|---|---|---|

| MOB strategy of A1 (x) | MAB strategy of A2 (1 − x) | ||

| LPE (B) | MOB strategy of B1 (y) | a, e | c, g |

| MAB strategy of B2 (1 − y) | b, f | d, h | |

4.3.4. Experimental Framework Design of the Competitive Game Allocation

5. Results and Discussions of Shenzhen’s Carbon Allowance Allocation

5.1. Carbon Allowance Pre-Allocation

| Sector | Number of Entities | Average Annual Baseline Emission 2009–2011 | Average Annual BAU Emission 2013–2015 | Average Annual Pre-Allocated Allowance 2013–2015 | Rate of Change Compared to Baseline Emission | Rate of Change Compared to BAU Emission |

|---|---|---|---|---|---|---|

| ea | 104 t CO2 | 104 t CO2 | 104 t CO2 | % | % | |

| Sector 1 | 8 | 1675 | 1573 | 1498 | −10.6% | −4.8% |

| Sector 2 | 1 | 9 | 9 | 9 | 0.3% | −4.7% |

| Sector 3 | 4 | 25 | 27 | 26 | 4.0% | −4.7% |

| Sector 4 | 1 | 26 | 41 | 38 | 46.2% | −8.3% |

| Sector 5 | 196 | 762 | 1180 | 1026 | 34.6% | −13.0% |

| Sector 6 | 160 | 289 | 385 | 335 | 16.2% | −13.0% |

| Sector 7 | 163 | 271 | 371 | 317 | 16.9% | −14.5% |

| Sector 8 | 31 | 38 | 43 | 39 | 3.4% | −9.3% |

| Sector 9 | 9 | 14 | 15 | 14 | −0.8% | −9.1% |

| Sector 10 | 24 | 34 | 34 | 31 | −8.5% | −9.1% |

| Sector 11 | 24 | 49 | 58 | 50 | 1.5% | −13.1% |

| Sector 12 | 14 | 15 | 26 | 22 | 43.8% | −13.6% |

| Total | 635 | 3206 | 3762 | 3404 | 6.2% | −9.5% |

5.2. Historical and Target Carbon Emission Intensity

| Sector | Average Annual Baseline Carbon Intensity (2009–2011) | Average Annual Target Carbon Intensity (2013–2015) | Rate of Change |

|---|---|---|---|

| t CO2/per unit output | t CO2/ per unit output | % | |

| Sector 1 | 6.9 | 6.4 | −7.3% |

| Sector 2 | 167.0 | 156.9 | −6.0% |

| Sector 3 | 2.0 | 1.8 | −10.0% |

| Sector 4 | 0.8 | 0.7 | −12.2% |

| Sector 5 | 0.5 | 0.4 | −22.1% |

| Sector 6 | 1.0 | 0.7 | −28.5% |

| Sector 7 | 2.1 | 1.4 | −33.3% |

| Sector 8 | 1.0 | 0.7 | −24.3% |

| Sector 9 | 0.4 | 0.3 | −29.1% |

| Sector 10 | 1.7 | 1.0 | −37.9% |

| Sector 11 | 1.7 | 1.2 | −30.9% |

5.3. Pre-Allocation and Confirm-Allocation of Carbon Allowances

| Sector | Pre-Allocated Allowances | Confirm-Allocated Allowances | Rate of Change |

|---|---|---|---|

| 104 t CO2 | 104 t CO2 | % | |

| Sector 1 | 1498 | 1385 | −7.5% |

| Sector 2 | 9 | 9 | −3.1% |

| Sector 3 | 26 | 26 | −0.1% |

| Sector 4 | 33 | 24 | −26.7% |

| Sector 5 | 981 | 855 | −12.9% |

| Sector 6 | 325 | 327 | 0.5% |

| Sector 7 | 306 | 313 | 2.2% |

| Sector 8 | 38 | 40 | 4.9% |

| Sector 9 | 13 | 15 | 11.5% |

| Sector 10 | 30 | 35 | 16.7% |

| Sector 11 | 49 | 46 | −6.2% |

| Sector 12 | 21 | 23 | 10.9% |

| Total | 3330 | 3097 | −7.0% |

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References and Notes

- Gregg, J.; Andres, R.; Marland, G. China: Emissions pattern of the world leader in CO2 emissions from fossil fuel consumption and cement production. Geophys. Res. Lett. 2008, 35. [Google Scholar] [CrossRef]

- Liu, Z.; Guan, D.B.; Crawford-Brown, D.; Zhang, Q.; He, K.; Liu, J. A low-carbon road map for China. Nature 2013, 500, 143–145. [Google Scholar] [CrossRef] [PubMed]

- The State Council of the People’s Republic of China. 2009. Available online: http://www.china.com.cn/policy/txt/2009–11/26/content_18962547.htm (accessed on 15 December 2015).

- The National Development and Reform Commission of China (NDRC). The Notice on Implementing Pilot Cap-and-Trade Schemes; NDRC: Beijing, China, 2011.

- Ahman, M.; Burtraw, D.; Kruger, J.; Zetterberg, L. A ten-year rule to guide the allocation of EU emission allowances. Energy Policy 2007, 35, 1718–1730. [Google Scholar] [CrossRef]

- Jiang, J.J.; Ye, B.; Ma, X.M. The construction of Shenzhen’s carbon emission trading scheme. Energy Policy 2014. [Google Scholar] [CrossRef]

- Shenzhen Development and Reform Commission. 2014. Available online: http://sztqb.sznews.com/html/2014-07/03/content_2929089.htm (accessed on 15 December 2015).

- Coase, R.H. The nature of the firm. Economica 1937, 4, 386–405. [Google Scholar] [CrossRef]

- Coase, R.H. The problem of social cost. J. Law Econ. 1960, 3, 1–44. [Google Scholar] [CrossRef]

- Arrow, K.J. The Organization of Economic Activity: Issues Pertinent to the Choice of Market Versus Non-Market Allocation. 1969. Available online: http://www.uvm.edu/-jdericks/EE/Arrow2.pdf (accessed on 15 December 2015).

- Guzzini, E.; Palestrini, A. The empty core in the Coase theorem: A critical assessment. Econ. Bull. 2009, 29, 3095–3103. [Google Scholar]

- Burtraw, D.; Palmer, K.; Bharvirkar, R.; Paul, A. The Effect of Allowance Allocation on the Cost of Carbon Emissions Trading; Resource for the Future: Washington, DC, USA, 2001; pp. 1–30. [Google Scholar]

- Burtraw, D.; Palmer, K.; Bharvirkar, R.; Paul, A. The effect on asset values of the allocation of carbon dioxide emissions allowance. Electr. J. 2002, 15, 51–62. [Google Scholar] [CrossRef]

- Sijm, J. EU ETS allocation: evaluation of present system and options beyond 2012. Energy 2006, 30, 285–292. [Google Scholar]

- Sterner, T.; Muller, A. Output and abatement effects of allocation readjustment in permit trade. Clim. Chang. 2008, 86, 33–49. [Google Scholar] [CrossRef] [Green Version]

- Pan, X.; Teng, F.; Wang, G.H. A Comparison of Carbon Allocation Schemes: On the Equity-Efficiency Tradeoff. Available online: http://dx.doi.org/10.1016/j.energy.2014.05.109 (accessed on 15 December 2015).

- EC. Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003 Establishing a Scheme for Greenhouse Gas Emission Allowance Trading within the Community and Amending Council Directive 96/61/EC (Text with EEA relevance). Official Journal L275, 25/10/2003P. 0032–0046. 2003. [Google Scholar]

- EC. Directive 2008/101/EC of the European Parliament and of the Council of 19 November 2008 Amending Directive 2003/87/EC so as to Include Aviation Activities in the Scheme for Greenhouse Gas Emission Allowance Trading within the Community, Official Journal of the European Union L 8/3. 2008. [Google Scholar]

- EC. Directive 2009/29/EC of the European Parliament and of the Council of 23 April 2009 Amending Directive 2003/87/EC so as to Improve and Extend the Greenhouse Gas Emission Allowance Trading Scheme of the Community. Official Journal of the European Union L140/63. 2009. [Google Scholar]

- Lecourt, S.; Pallière, C.; Sartor, O.J. The Impact of Emissions-Performance Benchmarking on Free Allocations in EU ETS Phase 3. 2013. Available online: http://cadmus.eui.eu/bitstream/handle/1814/26334/RSCAS_2013_17.pdf?sequence=1&isAllowed=y (accessed on 15 December 2015).

- Stavins, R.N. What can we learn from the grand policy experiment? Lessons from SO2 allowance trading. J. Econ. Perspect. 1998, 12, 69–88. [Google Scholar] [CrossRef]

- Jaekyun, A. Assessment of initial emission allowance allocation methods in the Korean electricity market. Energy Econ. 2014, 43, 244–255. [Google Scholar]

- Sijm, J.; Neuhoff, K.; Chen, Y. CO2 cost pass-through and windfall profits in the power sector. Clim. Policy 2006, 6, 49–72. [Google Scholar] [CrossRef]

- Fischer, C.; Fox, A.K. On the Scope for Output-Based Rebating in Climate Policy; Resources for the Future: Washington, DC, USA, 2010. [Google Scholar]

- Tietenberg, T. Emissions Trading-Principles and Practice; Resources for the Future: Washington, DC, USA, 2006. [Google Scholar]

- Goulder, L.H.; Marc, A.C.; Dworsky, H.M. Impacts of alternative emissions allowance allocation methods under a federal cap-and-trade program. J. Environ. Econ. Manag. 2010, 60, 161–181. [Google Scholar] [CrossRef]

- Edwards, T.H.; Hutton, J.P. Allocation of carbon permits within a country: A general equilibrium analysis of the United Kingdom. Energy Econ. 2001, 23, 371–386. [Google Scholar] [CrossRef]

- Takeda, S.; Arimura, T.H.; Tamechika, H.; Fischer, C.; Fox, A. Output-Based Allocation of Emissions Permits for Mitigating the Leakage and Competitiveness Issues for the Japanese Economy; Resources for the Future: Washington, DC, USA, 2011. [Google Scholar]

- RGGI. Regional Greenhouse Gas Initiative: An Initiative of the Northeast and Mid-Atlantic States of the US. 2010. Available online: http://www.rggi.orgS (accessed on 15 December 2015).

- Perdan, S.; Azapagic, A. Carbon trading: current schemes and future developments. Energy Policy 2011, 39, 6040–6054. [Google Scholar] [CrossRef]

- California Air Resources Board (CARB). Assembly Bill 32: Global Warming Solutions Act. 2012. Available online: http://www.arb.ca.gov/cc/ab32/ab32.htm (accessed on 21 December 2015). [Google Scholar]

- Bushnell, J.; Chen, Y. Allocation and leakage in regional cap-and-trade markets for CO2. Resour. Energy Econ. 2012, 34, 647–668. [Google Scholar] [CrossRef]

- New Zealand Government (NZG). The New Zealand Emissions Trading Scheme. 2010. Available online: http://www.climatechange.govt.nz/emissions-trading-scheme/about/S (accessed on 15 December 2015). [Google Scholar]

- New Zealand Ministry for the Environment (NZ ME). Industrial Allocation under the New Zealand Emissions Trading Scheme: Fact Sheet. 2009. Available online: http://www.mfe.govt.nz/publications/climate/industrial-allocation-under-nz-ets/index.htmlS (accessed on 15 December 2015). [Google Scholar]

- New Zealand Ministry for the Environment (NE ME). Industrial Allocation Update. Emissions Trading Bulletin No.12. 2009. Available online: http://www.mfe.govt.nz/publications/climate/emissions-trading-bulletin-12/emissions-tradingbulletin-12.pdf (accessed on 15 December 2015). [Google Scholar]

- Tokyo Metropolitan Government. Tokyo Cap-and-Trade Program: Japan’s First Mandatory Emissions Trading Scheme. Emission Cap and Trade Section, Urban and Global Environment Division; Bureau of Environment, Tokyo Metropolitan Government: Tokyo, Japan, 2010. Available online: http://www.kankyo.metro.tokyo.jp/kouhou/english/index.htmlS (accessed on 15 December 2015).

- Pearlman, J.G. Diverse information and rational expectations models. J. Econ. Dyn. Control 1986, 10, 333–338. [Google Scholar] [CrossRef]

- Aumann, R. Rationality and bounded rationality. Games Econ. Behav. 1997, 21, 2–14. [Google Scholar]

- Hörne, J. Signalling and Screening. In The New Palgrave Dictionary of Economics, 2nd ed.; Palgrave Macmillan: Basingstoke, UK, 2008. [Google Scholar]

- Marín, J.M.; Rahi, R. Information revelation and market incompleteness. Rev. Econ. Stud. 2000, 67, 563–579. [Google Scholar] [CrossRef]

- Morris, S.; Shin, H.S. The social value of public information. Am. Econ. Rev. 2002, 92, 1521–1534. [Google Scholar] [CrossRef]

- Granados, N.F.; Gupta, A.; Kauffman, R.J. The impact of IT on market information and transparency: A unified theoretical framework. J. Assoc. Inf. Syst. 2006, 7, 148–178. [Google Scholar]

- Carboni, G.; Ellison, M. Inflation and output volatility under asymmetric incomplete information. J. Econ. Dyn. Control 2011, 35, 40–51. [Google Scholar] [CrossRef]

- Aspremont, C.D.; Gerard-Varet, L.A. Incentives and incomplete information. J. Public Econ. 1979, 11, 25–45. [Google Scholar] [CrossRef]

- Simon, H.A. Administrative Behavior—A Study of Decision Making Processes in Administrative Organization; Macmillan Publishing Co. Inc.: New York, NY, USA, 1971. [Google Scholar]

- Kreps, D.M.; Wilson, R. Reputation and imperfect information. J. Econ. Theory 1982, 27, 253–279. [Google Scholar] [CrossRef]

- Roberts, M.R. The role of dynamic renegotiation and asymmetric information in financial contracting. J. Financ. Econ. 2015, 116, 61–81. [Google Scholar] [CrossRef]

- Parry, I.W.H.; Williams, I.R.C.; Goulder, L.H. When can carbon abatement policies increase welfare? The fundamental role of distorted factor markets. J. Environ. Econ. Manag. 1999, 37, 52–84. [Google Scholar] [CrossRef]

- Jensen, J.; Rasmussen, T.N. Allocation of CO2 emissions permits: A general equilibrium analysis of policy instruments. J. Environ. Econ. Manag. 2000, 40, 111–136. [Google Scholar] [CrossRef]

- Dormady, N.C. Market power in cap-and-trade auctions: A Monte Carlo approach. Energy Policy 2013, 62, 788–797. [Google Scholar] [CrossRef]

- Chatterjee, K.; Samuelson, W. Bargain under incomplete information. Oper. Res. 1983, 31, 835–851. [Google Scholar] [CrossRef]

- Williamson, O.E. The Economic Institutions of Capitalism; The Free Press: New York, NY, USA, 1985. [Google Scholar]

- Fudenberg, D.; Levine, K.D. The Theory of Learning in Games; The MIT Press: Cambridge, MA, USA, 1998. [Google Scholar]

- Lipman, B.L. Information processing and bounded rationality: A survey. Can. J. Econ. 1985, 28, 67–75. [Google Scholar] [CrossRef]

- Lucas, R.E. Adaptive behavior and economic theory. J. Bus. 1986, 1, 234–249. [Google Scholar]

- Binmore, K.; Samuelson, L. Evolutionary stability in repeated games played by finite automata. J. Econ. Theory 1992, 57, 278–305. [Google Scholar] [CrossRef]

- Rader, R. The organization of decentralized information processing. Econometrica 1993, 61, 189–197. [Google Scholar]

- Azzoni, R.V.; Isai, Y.J. Estimating the costs of environmental protection in Brazil. Ecol. Econ. 1994, 11, 127–133. [Google Scholar] [CrossRef]

- Norio, H. Hyperganme analysis of the lake Biwa conflict. Water Resour. Res. 1985, 2l, 917–926. [Google Scholar]

- Lord, B.W.; Wallance, G.M.; Shillito, M.R. Linked models for Indian water rights disputes, managing water-related conflicts: the engineer’s role. Am. Soc. Civil Eng. 1990, 16, 325–332. [Google Scholar]

- Frisvold, B.G.; Caswell, F.M. Transboundary water management game-theoretic lessons for projects on the US-Mexico border. Agric. Econ. 2000, 24, 101–111. [Google Scholar]

- Bao, H.J.; Zhuang, H.M. Logic and controls of developers’ land hoarding. Mod. Urban Res. 2012, 11, 61–66. [Google Scholar]

- Zhu, Q.H.; Dou, Y. Evolutionary game model between governments and core enterprises in greening supply chains. Syst. Eng. Theory Pract. 2007, 27, 85–89. [Google Scholar] [CrossRef]

- Tian, Y.H.; Govindan, K.; Zhu, Q.H. A system dynamics model based on evolutionary game theory for green supply chain management diffusion among Chinese manufacturers. J. Clean. Prod. 2014, 80, 96–105. [Google Scholar] [CrossRef]

- Stanford Encyclopedia of Philosophy. 2010. Available online: http://plato.stanford.edu/entries/game-evolutionary/ (accessed on 6 December 2010).

- Wang, J.H.; Zhou, Z.; Botterud, A. An evolutionary game approach to analyzing bidding strategies in electricity markets with elastic demand. Energy 2011, 16, 3459–3467. [Google Scholar] [CrossRef]

- Kemfert, C.; Lise, W.; Tol, R.S.J. Games of climate change with international trade. Environ. Resour. Econ. 2004, 28, 209–232. [Google Scholar] [CrossRef]

- Breton, M.; Zaccour, G.; Zahaf, M. A game-theoretic formulation of Joint Implementation of environmental projects. Eur. J. Oper. Res. 2006, 168, 221–239. [Google Scholar] [CrossRef]

- Bernard, A.; Haurie, A.; Vielle, M.; Viguier, L. A two-level dynamic game of carbon emission trading between Russia, China, and Annex B countries. J. Econ. Dyn. Control 2007, 9, 1–27. [Google Scholar] [CrossRef]

- Zhang, H.B. Environment and International Relationship-the Rational Thought of Global Environmental Problems; Shanghai People’s Press House: Shanghai, China, 2008; p. 31. [Google Scholar]

- Dale, G. Climate War—The Coming Third World War; Feng, B., Translator; CITIC Publishing House: Beijing, China, 2010. [Google Scholar]

- Yu, S.W.; Wei, Y.M.; Wang, K. Provincial allocation of carbon emission reduction targets in China: An approach based on improved fuzzy cluster and Shapley value decomposition. Energy Policy 2014, 66, 630–644. [Google Scholar] [CrossRef]

- Shenzhen Urban Development Research Center (SZUDRC). The GHG Emission Inventory of Shenzhen: 2005–2010; Shenzhen Municipal People’s Government (SZ MPG): Shenzhen, China, 2012.

- Jiang, J.J.; Ye, B.; Ma, X.M.; Miao, L.X. Controlling GHG emissions from the transportation sector through an ETS: Institutional arrangements in Shenzhen, China. Clim. Policy 2014. [Google Scholar] [CrossRef]

- Ye, B.; Jiang, J.J.; Miao, L.X. Sustainable energy options for a low carbon demonstration city project in Shenzhen, China. J. Renew. Sustain. Energy 2015. [Google Scholar] [CrossRef]

- Shenzhen Municipal People's Government (SZ MPG). Interim Measures of Shenzhen’s Carbon Emission Trading Management; Shenzhen Municipal People’s Government (SZ MPG): Shenzhen, China, 2014.

- Sun, Q.W.; Lu, L.; Yan, C.L.; Che, H.A. Asymptotic stability of evolutionary equilibrium under imperfect knowledge. Theory Pract. Syst. Eng. 2003, 7, 11–16. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ye, B.; Jiang, J.; Miao, L.; Li, J.; Peng, Y. Innovative Carbon Allowance Allocation Policy for the Shenzhen Emission Trading Scheme in China. Sustainability 2016, 8, 3. https://doi.org/10.3390/su8010003

Ye B, Jiang J, Miao L, Li J, Peng Y. Innovative Carbon Allowance Allocation Policy for the Shenzhen Emission Trading Scheme in China. Sustainability. 2016; 8(1):3. https://doi.org/10.3390/su8010003

Chicago/Turabian StyleYe, Bin, Jingjing Jiang, Lixin Miao, Ji Li, and Yang Peng. 2016. "Innovative Carbon Allowance Allocation Policy for the Shenzhen Emission Trading Scheme in China" Sustainability 8, no. 1: 3. https://doi.org/10.3390/su8010003