Research on Alternative Relationship between Chinese Renewable Energy and Imported Coal for China

Abstract

:1. Introduction

2. Literature Review

3. Research Method

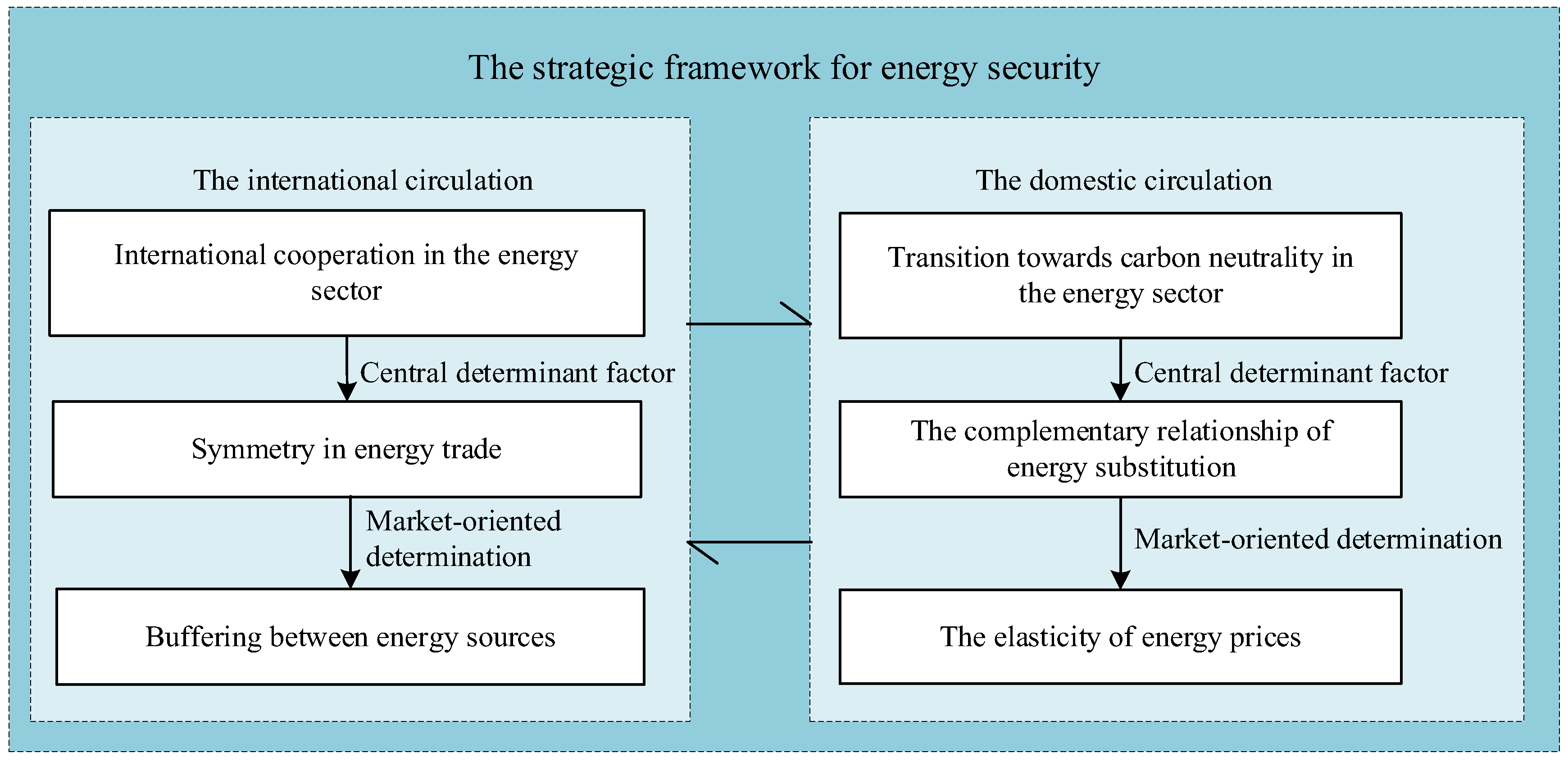

3.1. Theoretical Framework

3.2. Model Construction

3.2.1. The Trade Gravity Model within the International Circulation Framework

3.2.2. The Chinese Circular Price Elasticity Model

4. Analysis of Energy Substitution in International Circulation

4.1. Data Statistics

4.2. Results Analysis

- (1)

- The regulations governing the value of the imported coal trade in recipient countries.

- (2)

- The regulatory framework governing the trade volume of imported coal.

- (3)

- The norms governing coal trade per unit of GDP in importing countries.

5. Analysis of Chinese Circulation Energy Substitution

5.1. Data Processing

- (1)

- The data on energy shares () are obtained from the China coal import volume provided by the United Nations Commodity Trade Statistics Database (2022). The data on wind power generation and photovoltaic power generation are sourced from the “China Electric Power Yearbook (2022)”, the China Electricity Council, and publicly available information from the National Bureau of Statistics. These three sets of data are converted into tons of coal equivalent (tce) for measurement purposes and then aggregated. Each energy source’s proportion is calculated as follows: , , and .

- (2)

- Energy prices () play a pivotal role in this context. By referencing BP Energy Statistical Data (2021) and incorporating historical exchange rate adjustments, the price of imported coal can be determined. Subsequently, leveraging data from the annual China Electricity Yearbook over the years and information released by the National Bureau of Statistics website and the China Electricity Council (2022), the nationwide average on-grid prices of renewable energy can be compiled and calculated. Specifically, the prices for wind power generation () and solar power generation () are obtained, and conversions are made according to “tce/CNY 10,000”.

- (3)

- Energy costs () are computed based on data pertaining to energy prices and energy production, with the results standardized to the unit of “ten thousand CNY”.

5.2. Analysis of Results

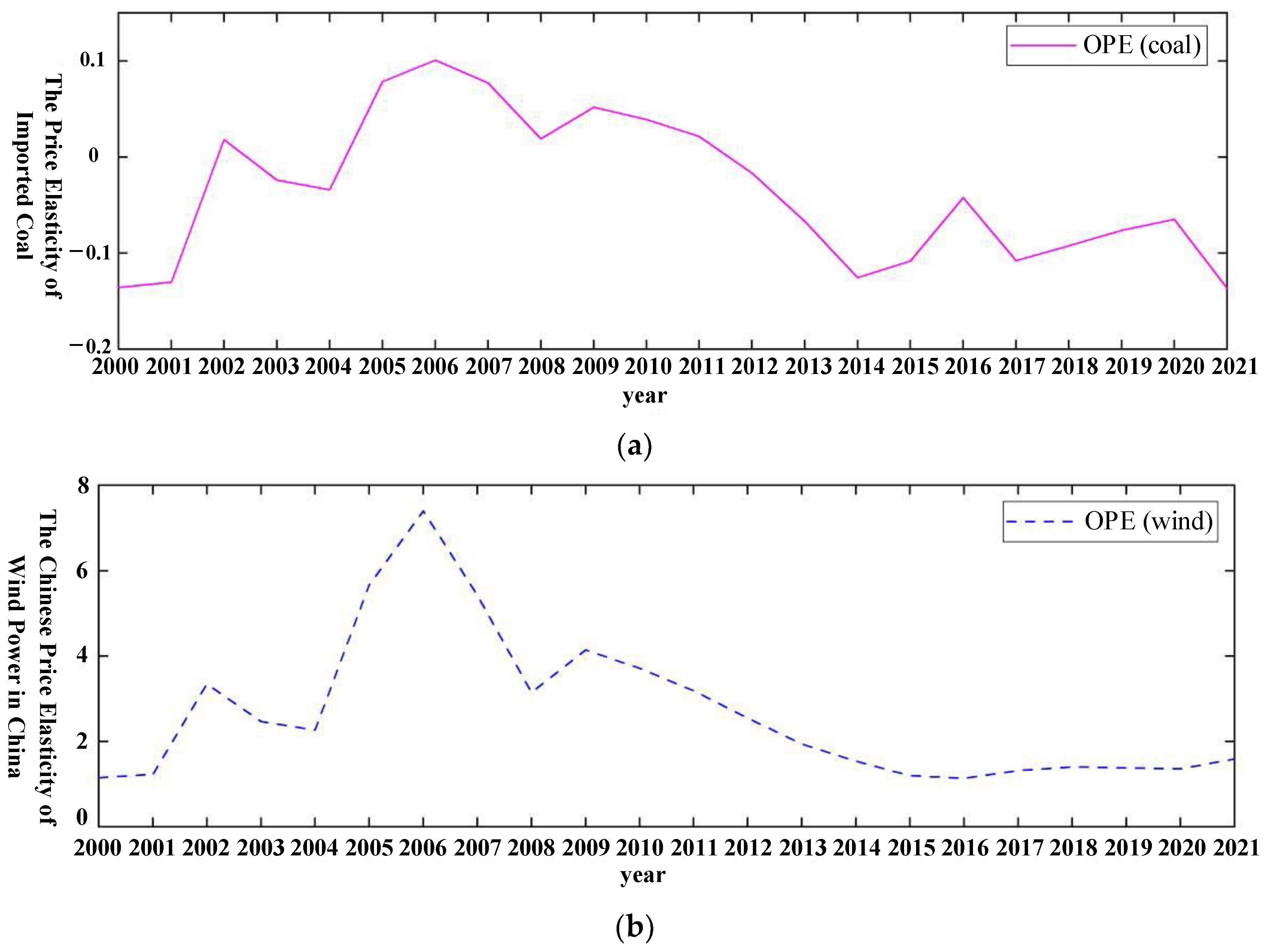

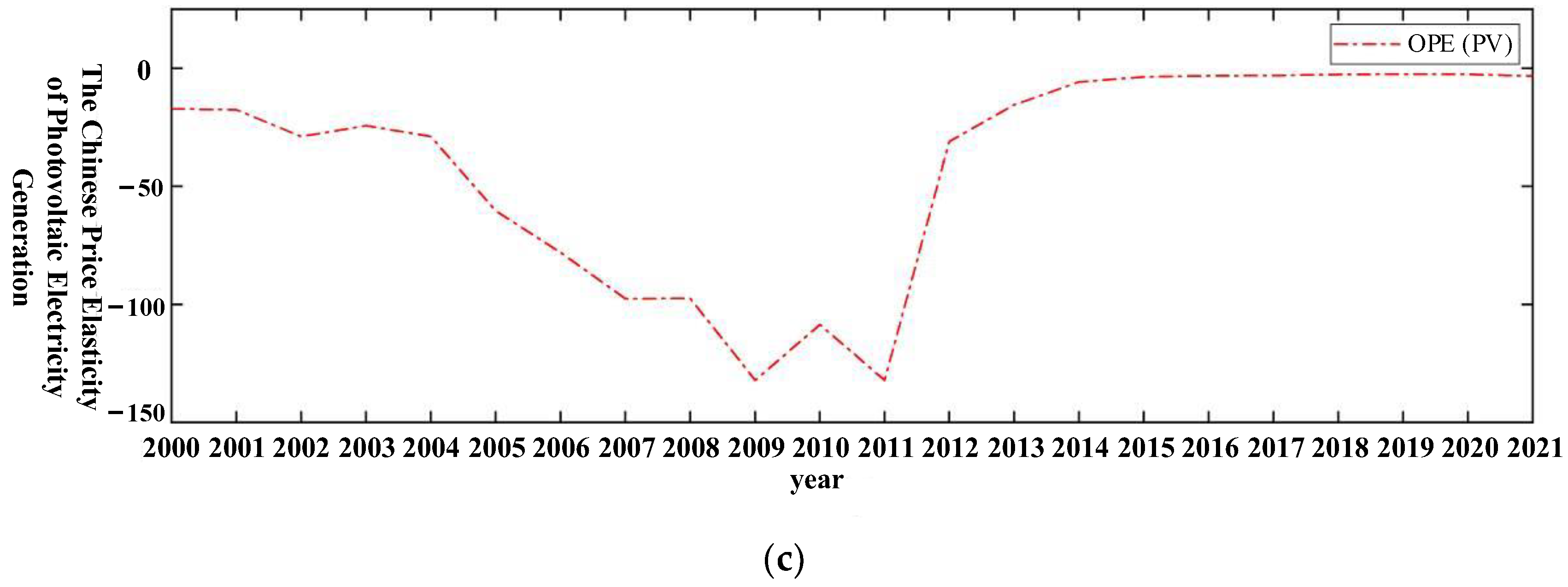

- (1)

- The Price Elasticity of Energy Supply

- (2)

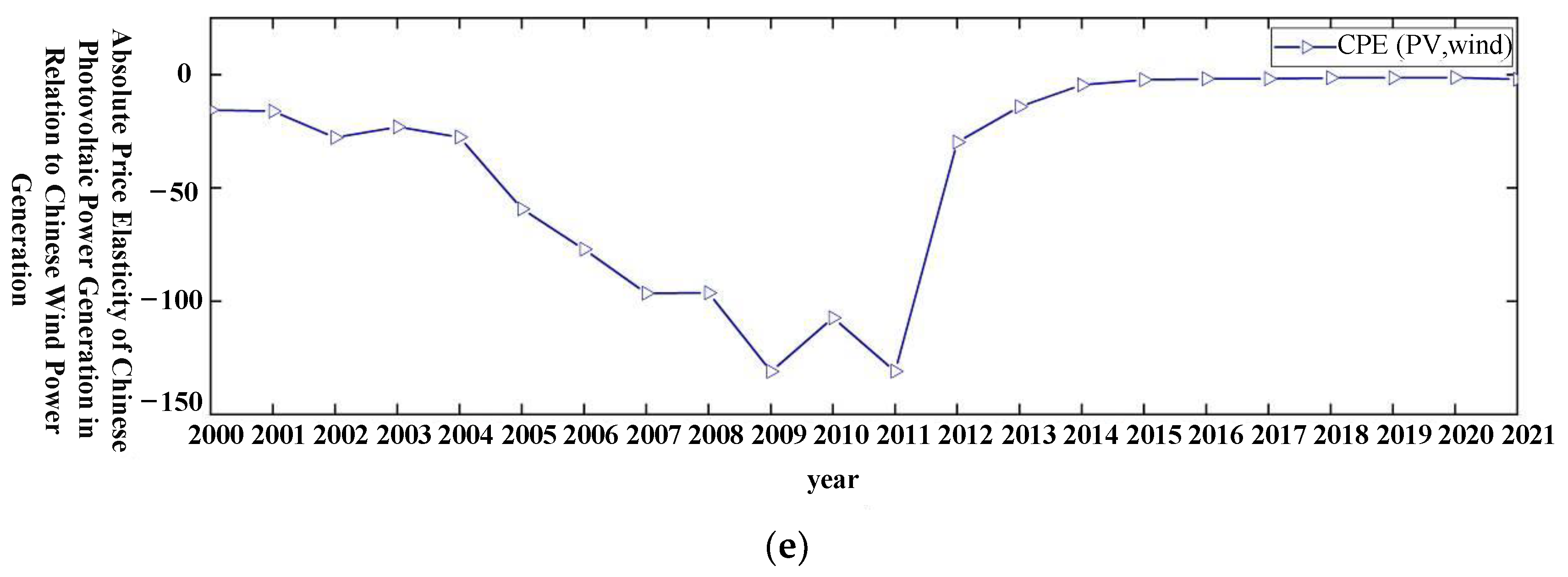

- Absolute Price Elasticity of Energy

- (3)

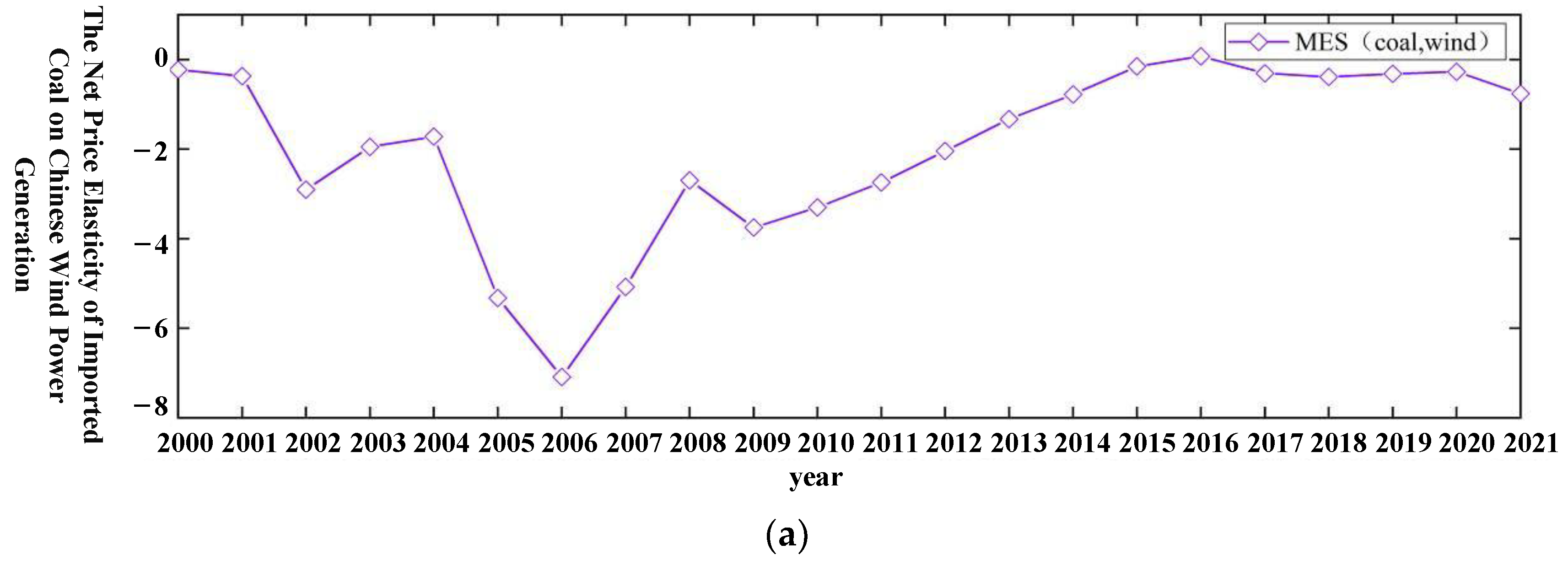

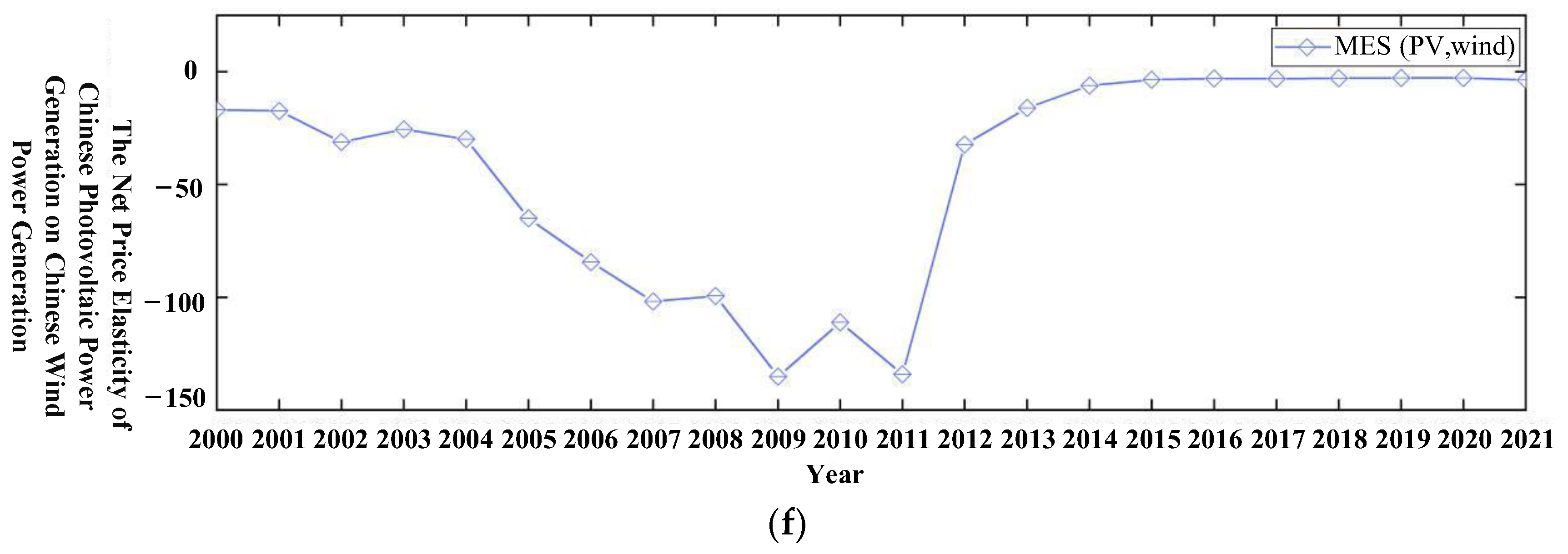

- Net Substitution Elasticity of Energy Resources

6. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Shi, X.L.; Wei, X.X.; Yang, C.H.; Mah, L.; Liy, P. Problems and countermeasures for construction of China’s salt cavern type strategic oil storage. Bull. Chin. Acad. Sci. 2023, 38, 99–111. (In Chinese) [Google Scholar]

- Gao, Y.; Wang, B.; Hu, Y.D.; Gao, Y.J.; Hu, A.L. Development of China’s natural gas: Review 2023 and outlook 2024. Nat. Gas Ind. 2024, 44, 166–177. (In Chinese) [Google Scholar]

- National Energy Administration. The Total Installed Capacity of Renewable Energy Generation in China Has Exceeded 1.4 Billion Kilowatts, Accounting for Nearly 50%[EB/OL]. Available online: https://www.nea.gov.cn/2023-11/30/c_1310753052.htm (accessed on 30 November 2023).

- Berndt, E.R.; Wood, D.O. Technology, Prices, and the Derived Demand for Energy. Rev. Econ. Stat. 1975, 57, 259–268. [Google Scholar] [CrossRef]

- Fuss, M.A. The demand for energy in Canadian manufacturing: An example of the estimation of production structures with many inputs. J. Econom. 1977, 5, 89–116. [Google Scholar] [CrossRef]

- Pindyck, R.S. Interfuel substitution and the industrial demand for energy: An international comparison. Rev. Econ. Stat. 1979, 61, 169–179. [Google Scholar] [CrossRef]

- Magnus, J.R. Substitution between energy and non-energy inputs in The Netherlands 1950–1976. Int. Econ. Rev. 1979, 20, 465–484. [Google Scholar] [CrossRef]

- Uri, N.D. Energy demand and interfuel substitution in India. Eur. Econ. Rev. 1979, 12, 181–190. [Google Scholar] [CrossRef]

- Ma, H.; Oxley, L.; Gibson, J.; Kim, B. China’s energy economy: Technical change, factor demand and interfactor/interfuel substitution. Energy Econ. 2008, 30, 2167–2183. [Google Scholar] [CrossRef]

- Smyth, R.; Narayan, P.K.; Shi, H. Inter-fuel substitution in the Chinese iron and steel sector. Int. J. Prod. Econ. 2012, 139, 525–532. [Google Scholar] [CrossRef]

- Zha, D.; Ding, N. Elasticities of substitution between energy and non-energy inputs in China power sector. Econ. Model. 2014, 38, 564–571. [Google Scholar] [CrossRef]

- Xie, C.; Hawkes, A.D. Estimation of inter-fuel substitution possibilities in China’s transport industry using ridge regression. Energy 2015, 88, 260–267. [Google Scholar] [CrossRef]

- Stern, D.I. Interfuel substitution a meta-analysis. J. Econ. Surv. 2012, 26, 307–331. [Google Scholar] [CrossRef]

- Hal, V.B. Major OECD. country industrial sector interfuel substitution estimates: 1960–79. Energy Econ. 1986, 8, 74–89. [Google Scholar] [CrossRef]

- Taheri, A.A. Oil shocks and the dynamics of substitution adjustments of industrial fuels in the US. Appl. Econ. 1994, 26, 751–756. [Google Scholar] [CrossRef]

- Bello, M.O.; Solarin, S.A.; Yen, Y.Y. Hydropower and potential for interfuel substitution: The case of electricity sector in Malaysia. Energy 2018, 151, 966–983. [Google Scholar] [CrossRef]

- Jones, C.T. The role of biomass in US industrial interfuel substitution. Energy Policy 2014, 69, 122–126. [Google Scholar] [CrossRef]

- Solarin, S.A.; Bello, M.O. Interfuel substitution, biomass consumption, economic growth, and sustainable development: Evidence from Brazil. J. Clean. Prod. 2019, 211, 1357–1366. [Google Scholar] [CrossRef]

- Smyth, R.; Narayan, P.K.; Shi, H.L. Substitution between energy and classical factor inputs in the Chinese steel sector. Appl. Energy 2011, 88, 361–367. [Google Scholar] [CrossRef]

- Huang, X.G.; Lin, B.Q. Research on Substitution of Capital Energy in Chinese Industrial Sectors: A Meta-Analytic Perspective. Financ. Res. 2011, 6, 86–96. (In Chinese) [Google Scholar]

- Lin, B.Q.; Wesseh, P.K., Jr. Estimates of inter-fuel substitution possibilities in Chinese chemical industry. Energy Econ. 2013, 40, 560–568. [Google Scholar] [CrossRef]

- Zha, D.L.; Zhou, D.Q. The elasticity of substitution and the way of nesting CES production function with emphasis on energy input. Appl. Energy 2014, 130, 793–798. [Google Scholar] [CrossRef]

- Guo, Y.; Li, J.Y. Research on the Substitution Effect of New Energy for Fossil Energy in China. Renew. Energy 2018, 36, 762–770. (In Chinese) [Google Scholar]

- Cisternas, L.A.; Ordóñez, J.I.; Jeldres, R.I.; Serna-Guerrero, R. Toward the Implementation of Circular Economy Strategies: An Overview of the Current Situation in Mineral Processing. Miner. Process. Extr. Metall. Rev. 2022, 43, 775–797. [Google Scholar] [CrossRef]

- Mitko, K.; Turek, M.; Jaroszek, H.; Bernacka, E.; Sambor, M.; Skóra, P.; Dydo, P. Pilot studies on circular economy solution for the coal mining sector. Water Resour. Ind. 2021, 26, 100161. [Google Scholar] [CrossRef]

- Markevych, K.; Maistro, S.; Koval, V.; Paliukh, V. Mining sustainability and circular economy in the context of economic security in Ukraine. Min. Miner. Depos. 2022, 16, 101–113. [Google Scholar] [CrossRef]

- Feng, F. Analysis of Driving Factors of Energy Consumption in China and Insights into Promoting the Development of ‘Dual Circulation’. Chin. Energy 2021, 43, 21–27+43. (In Chinese) [Google Scholar]

- An, H.Y. Research on the Current Status and Issues of China’s Renewable Energy Substituting Fossil Fuels. North. Econ. 2019, 4, 52–54. (In Chinese) [Google Scholar]

- Zhang, H.M. Energy Security and Coal Industry Development Under the New Pattern of ‘Dual Circulation’. Coal Econ. Res. 2020, 40, 1. (In Chinese) [Google Scholar]

- Freeman, R.; Lewis, J. Gravity model estimates of the spatial determinants of trade, migration, and trade-and-migration policies. Econ. Lett. 2021, 204, 109873. [Google Scholar] [CrossRef]

- Liu, P.K.; Wang, M.B.; Chen, B. Orderliness of China’s Power Generation Industry Development: An Empirical Study Based on Inter-provincial Layout and Industrial Organization. Syst. Eng. Theory Pract. 2018, 38, 1445–1464. (In Chinese) [Google Scholar]

- Fuchs, S.S. A further remark on Shephard’s Lemma. Econ. Lett. 1997, 56, 359–365. [Google Scholar] [CrossRef]

- Mukoyama, T. In defense of the Kaldor-Hicks criterion. Econ. Lett. 2023, 224, 111031. [Google Scholar] [CrossRef]

- Cai, H.X.; Cheng, X.L. Evaluation of Regional Energy Efficiency in China from the Perspective of Renewable Energy: Based on the Indivisible Mixed DEA Model. Soft Sci. 2022, 36, 7. (In Chinese) [Google Scholar]

- Liu, P.K.; Chu, P.H. Renewables finance & investment: How to improve industry with private capital in China. J. Mod. Power Syst. Clean Energy 2019, 7, 1385–1398. [Google Scholar]

- Han, L.Q. The New Situation of International Energy Security Under the Changes of the Century. Contemporary International Relations 2022, 9, 1–9+33. (In Chinese) [Google Scholar]

- Valck, J.D.; Williams, G.; Kuik, S. Does coal mining benefit local communities in the long run? A sustainability perspective on regional Queensland, Australia. Resour. Policy 2021, 71, 102009. [Google Scholar] [CrossRef]

- Guo, Y.Z. Research on the Impact of Sanction Policies on Australian Coal Prices. Price Mon. 2022, 3, 1–8. (In Chinese) [Google Scholar] [CrossRef]

- Lei, Q. Research on the Relationship between International Coal Prices and China’s Coal Imports and Exports. Price Mon. 2013, 11, 31–36. (In Chinese) [Google Scholar]

- Ma, Z.; Zhang, T.G. Research on the Impact of International Coal Price Fluctuations on the Domestic Coal Market. Chin. Foreign Energy 2022, 27, 10–16. (In Chinese) [Google Scholar]

- Zhang, Z.F.; Yang, Q.L.; Wang, Y.J.; Liu, P. The Position and Strategy of China in Establishing Pricing Power in the International Coal Market: Based on the Analysis of the ‘Core-Periphery’ Structure of the Trade Network. Learn. Pract. 2015, 7, 39–46. (In Chinese) [Google Scholar] [CrossRef]

- Wu, Y.; Bian, Y.M. Research on China’s Wind Power Grid-Connected Electricity Price Subsidy Policy from the Perspective of the World Trade Organization (WTO). Macroecon. Res. 2013, 10, 40–46. (In Chinese) [Google Scholar] [CrossRef]

| Data Analysis | Unit | Mean | Max | Min | Std. Dev. | Obs. |

|---|---|---|---|---|---|---|

| USD | 1,460,000,000 | 10,500,000,000 | 790 | 2,300,000,000 | 162 | |

| kg | 15,800,000,000 | 94,400,000,000 | 736 | 22,100,000,000 | 162 | |

| 1 | 0.000159 | 0.001057 | 0.000000000352 | 0.000222 | 162 | |

| kg/USD | 0.001871 | 0.009215 | 0.00000000016 | 0.002241 | 162 | |

| USD | 2,800,000,000,000 | 23,300,000,000,000 | 1,300,000,000 | 5,260,000,000,000 | 168 | |

| USD | 7,780,000,000,000 | 17,800,000,000,000 | 1,340,000,000,000 | 5,120,000,000,000 | 168 | |

| km | 7042.052 | 11,237 | 1166.22 | 3745.48 | 168 | |

| USD/kg | 0.201272 | 7.705163 | 0.005995 | 0.734188 | 162 | |

| 1 | 15.34433 | 28.33 | 11.34 | 5.041868 | 168 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| −6.754562 *** (0.758609) | −7.065504 *** (1.703664) | −8.120987 *** (1.601464) | ||

| 0.154062 (0.630821) | −0.653341 (0.630485) | 0.090594 (0.606572) | ||

| 1.882937 *** (0.436563) | 0.291369 (0.565250) | 0.109630 (0.527821) | ||

| -- | -- | -- | -- | |

| −1.285320 *** (0.262183) | ||||

| 162 | 162 | 162 | 162 | |

| 0.549309 | 0.507452 | 0.569188 | 0.614358 |

| Model 5 | Model 6 | Model 7 | Model 8 | |

|---|---|---|---|---|

| −5.342596 *** (0.869670) | −6.244320 *** (1.941334) | −8.120987 *** (1.601464) | ||

| −0.518571 (0.704027) | −1.232135 * (0.796029) | 0.090594 (0.606572) | ||

| 1.839354 *** (0.487225) | 0.432765 (0.644105) | 0.109630 (0.527821) | ||

| -- | -- | -- | -- | |

| −2.285320 *** (0.262183) | ||||

| 162 | 162 | 162 | 162 | |

| 0.471904 | 0.446524 | 0.482014 | 0.656169 |

| Model 9 | Model 10 | Model 11 | Model 12 | |

|---|---|---|---|---|

| −4.053227 *** (0.765923) | −7.065504 *** (1.703664) | −8.120987 *** (1.601464) | ||

| 0.154062 (0.630821) | −0.653341 (0.630485) | 0.090594 (0.606572) | ||

| 0.882937 *** (0.436563) | −0.708631 (0.565250) | −0.890370 * (0.527821) | ||

| -- | -- | -- | -- | |

| −1.285320 *** (0.262183) | ||||

| 162 | 162 | 162 | 162 | |

| 0.462899 | 0.417339 | 0.476921 | 0.549156 |

| Model 13 | Model 14 | Model 15 | Model 16 | |

|---|---|---|---|---|

| −2.641261 *** (0.876672) | −6.244320 *** (1.941334) | −8.120987 *** (1.601464) | ||

| −0.518571 (0.704027) | −1.232135 * (0.718441) | 0.090594 (0.606572) | ||

| 0.839354 * (0.487225) | −0.567235 (0.644105) | −0.890370 * (0.527821) | ||

| -- | -- | -- | -- | |

| −2.285320 *** (0.262183) | ||||

| 162 | 162 | 162 | 162 | |

| 0.407830 | 0.389245 | 0.428408 | 0.620586 |

| Year | ||||||

|---|---|---|---|---|---|---|

| 2000 (the reference year) | 45.41% | 51.62% | 2.97% | 8.689429 | 9.409605 | 5.428563 |

| 2001 | 48.90% | 48.22% | 2.88% | 8.661649 | 9.361814 | 5.572318 |

| 2002 | 77.90% | 20.38% | 1.71% | 8.647465 | 9.333443 | 5.615729 |

| 2003 | 71.61% | 26.34% | 2.05% | 8.633076 | 9.304244 | 5.571058 |

| 2004 | 70.00% | 28.28% | 1.72% | 8.603662 | 9.274167 | 5.869204 |

| 2005 | 86.27% | 12.92% | 0.81% | 8.573357 | 9.243156 | 6.030458 |

| 2006 | 89.20% | 10.18% | 0.62% | 8.557852 | 9.235251 | 6.035519 |

| 2007 | 86.08% | 13.42% | 0.50% | 8.542104 | 9.211154 | 6.114359 |

| 2008 | 78.04% | 21.46% | 0.50% | 8.509843 | 9.178093 | 6.577923 |

| 2009 | 82.66% | 16.98% | 0.36% | 8.424321 | 9.143901 | 6.394137 |

| 2010 | 80.90% | 18.66% | 0.45% | 8.424321 | 9.099450 | 6.591605 |

| 2011 | 78.40% | 21.23% | 0.36% | 8.424321 | 9.052930 | 6.734894 |

| 2012 | 72.77% | 25.63% | 1.60% | 8.424321 | 9.004140 | 6.550098 |

| 2013 | 64.41% | 32.28% | 3.32% | 8.424321 | 8.952846 | 6.361647 |

| 2014 | 50.78% | 39.38% | 9.83% | 8.424321 | 8.952846 | 6.232303 |

| 2015 | 33.38% | 49.44% | 17.18% | 8.397170 | 8.887606 | 6.082834 |

| 2016 | 27.11% | 52.34% | 20.55% | 8.364533 | 8.716457 | 6.200567 |

| 2017 | 33.31% | 45.26% | 21.43% | 8.364533 | 8.573357 | 6.439509 |

| 2018 | 31.33% | 42.71% | 25.96% | 8.264948 | 8.493314 | 6.532625 |

| 2019 | 29.73% | 43.42% | 26.85% | 8.136639 | 8.249117 | 6.381686 |

| 2020 | 28.75% | 43.98% | 27.27% | 8.009887 | 8.112541 | 6.311650 |

| 2021 | 41.99% | 38.30% | 19.72% | 7.982488 | 8.009887 | 6.898339 |

| Variables | Differential Order | ADF Value | 5% Critical Value | Conclusion |

|---|---|---|---|---|

| 1 | −3.322 | 0.027 | passed the test at the 5% significance level after conducting a differencing operation. | |

| 1 | −3.912 | 0.008 | passed the test at the 5% significance level after conducting a differencing operation. | |

| 2 | −3.343 | 0.027 | passed the test at the 5% significance level after conducting a second-order difference. | |

| 1 | −3.739 | 0.011 | passed the test at the 5% significance level after conducting a differencing operation. | |

| 1 | −2.475 | 0.135 | passed the test at the 5% significance level after conducting a differencing operation. | |

| 2 | −6.145 | 0.000 | passed the test at the 5% significance level after conducting a second-order difference. |

| Variables | Conclusion | ||||

|---|---|---|---|---|---|

| Trace Statistic | 0.05 | Max-Eigen Statistic | 0.05 | ||

| Critical Value | Critical Value | ||||

| 113.1628 | 47.85613 | 68.80224 | 27.58434 | Existence of cointegration relationship | |

| 116.4289 | 47.85613 | 59.51362 | 27.58434 | Existence of cointegration relationship | |

| 94.3868 | 47.85613 | 56.47869 | 27.58434 | Existence of cointegration relationship | |

| Statistical Analysis | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| OLS Coefficient | 0.192 | −1.343 | 1.107 | −0.141 | 0.867 | −0.637 | −0.052 | 0.476 | −0.469 |

| (0.098) | (0.093) | (0.003) | (0.145) | (0.189) | (0.027) | (0.108) | (0.036) | (0.000) | |

| R-squared | 0.738245 | 0.524194 | 0.905023 | ||||||

| Adjusted | 0.694619 | 0.444893 | 0.889193 | ||||||

| Energy | Imported Coal | Chinese Wind Power Generation | Chinese Photovoltaic Power Generation |

|---|---|---|---|

| Imported Coal | −0.034400 | 0.689958 | 0.456417 |

| Chinese Wind Power Generation | 3.937886 | 2.662200 | 3.428661 |

| Chinese Photovoltaic Power Generation | −39.173589 | −39.483631 | −40.717000 |

| Energy | Imported Coal | Chinese Wind Power Generation | Chinese Photovoltaic Power Generation |

|---|---|---|---|

| Imported Coal | -- | −1.972244 | 41.173589 |

| Chinese Wind Power Generation | 3.972244 | -- | 44.145833 |

| Chinese Photovoltaic Power Generation | −39.173589 | −42.145833 | -- |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, P.; Guo, K.; Wu, J. Research on Alternative Relationship between Chinese Renewable Energy and Imported Coal for China. Sustainability 2024, 16, 3446. https://doi.org/10.3390/su16083446

Liu P, Guo K, Wu J. Research on Alternative Relationship between Chinese Renewable Energy and Imported Coal for China. Sustainability. 2024; 16(8):3446. https://doi.org/10.3390/su16083446

Chicago/Turabian StyleLiu, Pingkuo, Kailing Guo, and Jiahao Wu. 2024. "Research on Alternative Relationship between Chinese Renewable Energy and Imported Coal for China" Sustainability 16, no. 8: 3446. https://doi.org/10.3390/su16083446