Effect of the Emissions Trading Scheme on CO2 Abatement in China

Abstract

:1. Introduction

2. Literature Review

3. CO2 Emissions and Intensities in China

3.1. Method for Calculating CO2 Emissions and Intensities

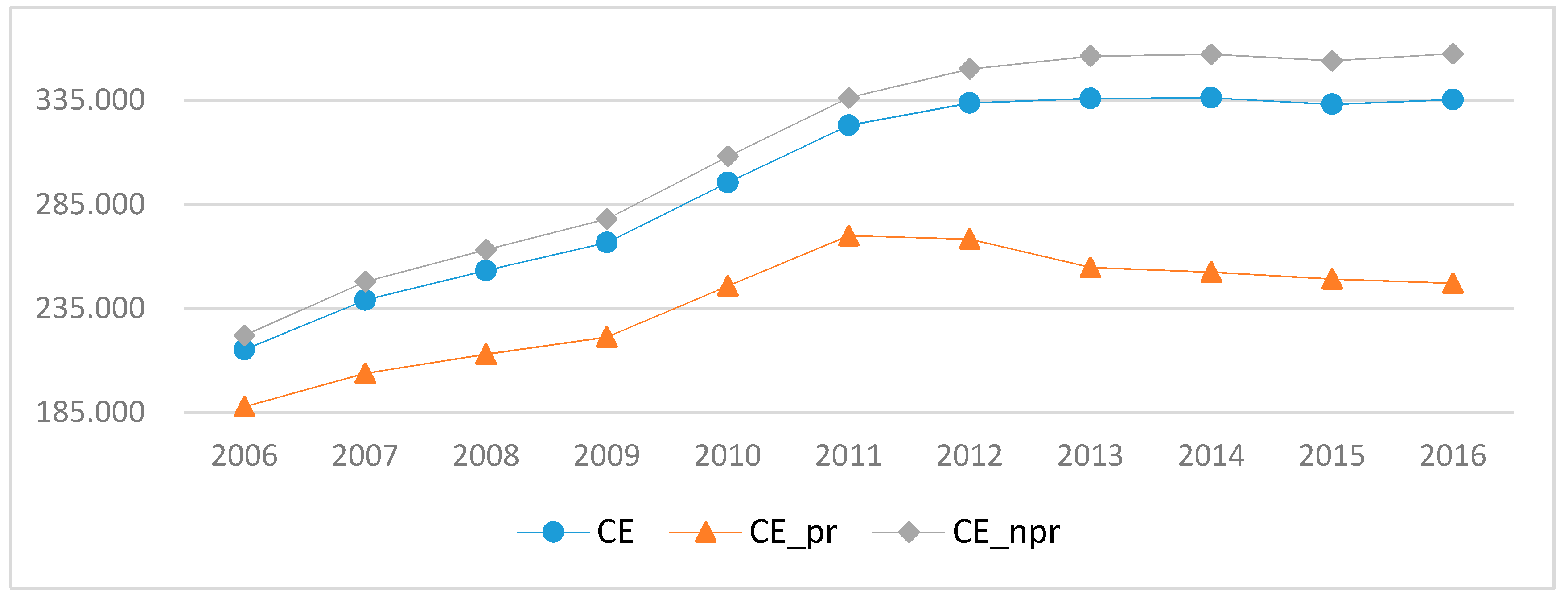

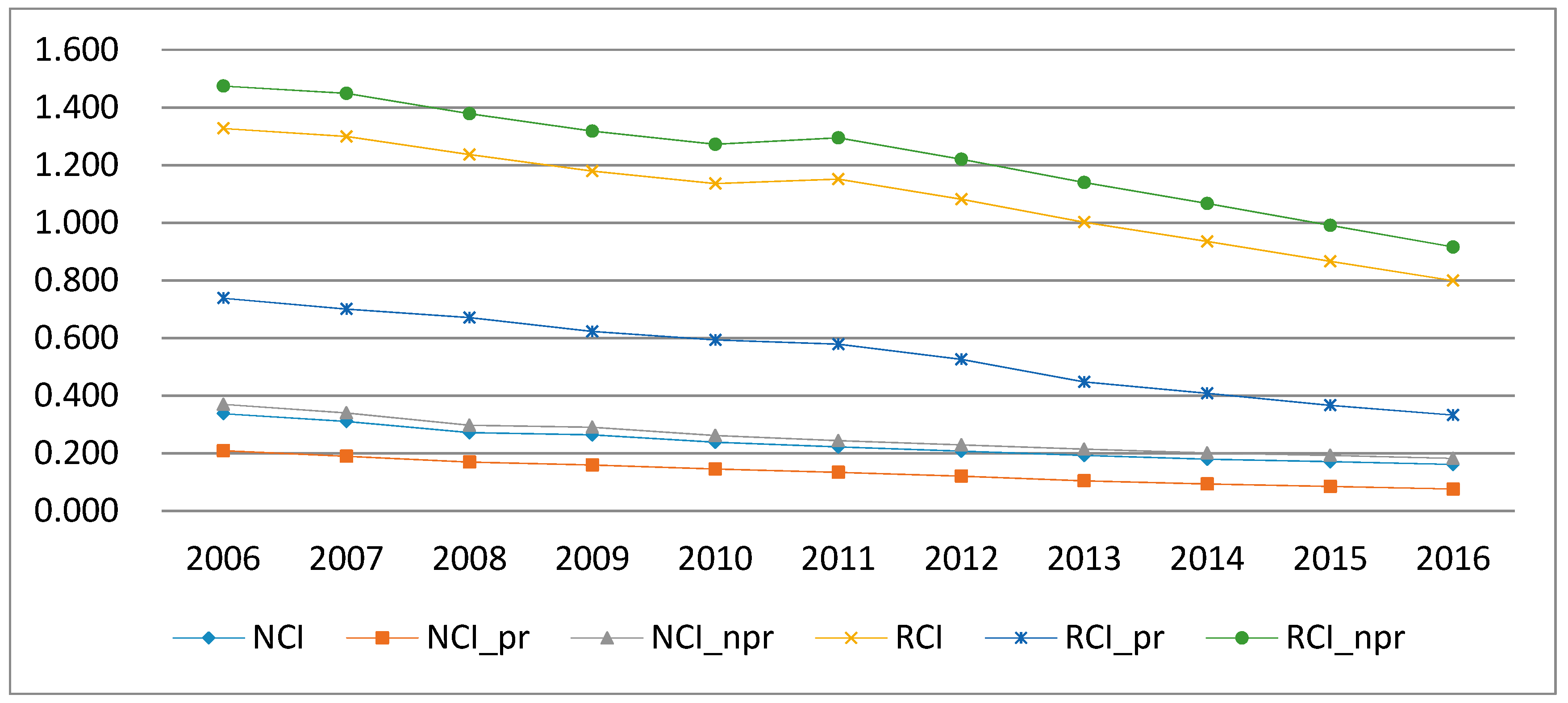

3.2. Trends and Comparisons of China’s CO2 Emissions and Intensities

4. Empirical Analysis and Discussion

4.1. The Estimation Model

4.2. Control Variables and Data

4.3. Estimation Results of ETS on Emissions Abatement

4.4. Estimation Results of ETS on Energy Consumption Structure

5. Conclusions and Future Research

Author Contributions

Funding

Conflicts of Interest

References

- Ellerman, D.; Buchner, B. The European Union Emissions Trading Scheme: Origins, Allocation, and Early Results. Rev. Environ. Econ. Policy 2007, 1, 66–87. [Google Scholar] [CrossRef]

- Ellerman, D.; Buchner, B. Over-allocation or abatement? A preliminary analysis of the EU ETS based on the 2005–06 emissions data. Environ. Resour. Econ. 2008, 41, 267–287. [Google Scholar] [CrossRef]

- Lo, A.Y. Challenges to the development of carbon markets in China. Clim. Policy 2016, 16, 109–124. [Google Scholar] [CrossRef]

- Wang, X.; Xue, M.; Xing, L. Analysis of Carbon Emission Reduction in a Dual-Channel Supply Chain with Cap-And-Trade Regulation and Low-Carbon Preference. Sustainability 2018, 10, 580. [Google Scholar] [CrossRef]

- Zhao, X.; Zhang, Y.; Liang, J.; Li, Y.; Jia, R.; Wang, L. The Sustainable Development of the Economic-Energy-Environment (3E) System under the Carbon Trading (CT) Mechanism: A Chinese Case. Sustainability 2018, 10, 98. [Google Scholar] [CrossRef]

- Petrick, S.; Wagner, U.J. The Impact of Carbon Trading on Industry: Evidence from German Manufacturing Firms. Kiel Work Paper. 2014. Available online: https://ssrn.com/abstract=2389800 (accessed on 4 February 2019).

- Martin, R.; Muûls, M.; Wagner, U.J. The Impact of the European Union Emissions Trading Scheme on regulated firms: What is the evidence after ten years? Rev. Environ. Econ. Policy 2016, 10, 129–148. [Google Scholar] [CrossRef]

- Jaraite, J.; Di Maria, C. Did the EU ETS Make a Difference? An Empirical Assessment Using Lithuanian Firm-Level Data. CERE Working Papers 2. 2014. Available online: http://dx.10.5547/01956574.37.2.jjar (accessed on 4 February 2019).

- Mezosi, A.; Pato, Z.; Szabo, L. Assessment of the EU 10% interconnection target in the context of CO2 mitigation. Clim. Policy 2016, 16, 658–672. [Google Scholar] [CrossRef]

- Laing, T.; Sato, M.; Grubb, M.; Comberti, C. The effects and side-effects of the EU emissions trading scheme. Wiley Interdiscip. Rev. Clim. Chang. 2014, 5, 509–519. [Google Scholar]

- Lofgren, A.; Wrake, M.; Hagberg, T. Why the EU ETS needs reforming: An empirical analysis of the impact on company investments. Clim. Policy 2014, 14, 537–558. [Google Scholar] [CrossRef]

- Teng, F.; Wang, X.; Lv, Z. Introducing the emissions trading system to China’s electricity sector: Challenges and opportunities. Energy Policy 2014, 75, 39–45. [Google Scholar] [CrossRef]

- Zhao, X.; Jiang, G.; Nie, D.; Chen, H. How to improve the market efficiency of carbon trading: A perspective of China.Renew. and Sustain. Energy Rev. 2016, 59, 1229–1245. [Google Scholar]

- Lo, A.Y. Carbon trading in a socialist market economy: Can China make a difference? Ecol. Econ. 2013, 87, 72–74. [Google Scholar] [CrossRef]

- Zhou, P.; Zhang, L.; Zhou, D.Q.; Xia, W.J. Modeling economic performance of interprovincial CO2 emission reduction quota trading in China. Appl. Energy 2013, 112, 1518–1528. [Google Scholar] [CrossRef]

- Cui, L.B.; Fan, Y.; Zhu, L.; Bi, Q.H. How will the emissions trading scheme save cost for achieving China’s 2020 carbon intensity reduction target? Appl. Energy 2014, 136, 1043–1052. [Google Scholar] [CrossRef]

- Wang, P.; Dai, H.; Ren, S.; Zhao, D.; Masui, T. Achieving Copenhagen target through carbon emission trading: Economic impacts assessment in Guangdong Province of China. Energy 2015, 79, 212–227. [Google Scholar] [CrossRef]

- Wang, K.; Wie, Y.M.; Huang, Z. Potential gains from CO2 emissions trading in China: A DEA based estimation on abatement cost savings. Omega 2016, 63, 48–59. [Google Scholar] [CrossRef]

- Huang, Y.; Liu, L.; Ma, X.; Pan, X. Abatement technology investment and emissions trading system: A case of coal-fired power industry of Shenzhen, China. Clean Technol. Environ. Policy 2015, 17, 811–817. [Google Scholar] [CrossRef]

- Liu, Y.; Tan, X.; Yu, Y.; Qi, S. Assessment of impacts of Hubei Pilot emission trading schemes in China—A CGE-analysis using Term CO2 model. Appl. Energy 2017, 189, 762–769. [Google Scholar] [CrossRef]

- IPCC. Greenhouse Gas Inventory: IPCC Guidelines for National Greenhouse Gas Inventories; United Kingdom Meteorological Office: Bracknell, England, 2006.

- Imbens, G.W.; Wooldridge, J.M. Recent developments in the econometrics of program evaluation. J. Econ. Lit. 2009, 47, 5–86. [Google Scholar] [CrossRef]

- Clo, S. The effectiveness of the EU Emissions Trading Scheme. Clim. Policy 2009, 9, 227–241. [Google Scholar] [CrossRef]

- Chan, H.S.; Li, S.; Zhang, F. Firm Competitiveness and the European Union Emissions Trading Scheme. Energy Policy 2013, 63, 1056–1064. [Google Scholar] [CrossRef]

- Fowlie, M.; Stephen, P.H.; Erin, M. What do emissions markets deliver and to whom? evidence from southern california’s NOx trading program. Am. Econ. Rev. 2012, 102, 965–993. [Google Scholar] [CrossRef]

- Rosenbaum, P.; Rubin, D. The central role of the propensity score in observational studies for casual effects. Biometrika 1983, 701, 41–55. [Google Scholar] [CrossRef]

- Bel, G.; Joseph, S. Emission abatement: Untangling the impacts of the EU ETS and the economic crisis. Energy Econ. 2015, 49, 531–539. [Google Scholar] [CrossRef]

- Burnett, J.W.; Bergstrom, J.C.; Wetzstein, M.E. Carbon dioxide emissions and economic growth in the US. J. Policy Model. 2013, 35, 1014–1028. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Vladimir, S. Empirical study of the Environmental Kuznets curve and Environmental Sustainability curve hypothesis for Australia, China, Ghana and USA. J. Clean. Prod. 2018, 201, 98–110. [Google Scholar] [CrossRef]

- Pala, D.; Subrata, K.M. The environmental Kuznets curve for carbon dioxide in India and China: Growth and pollution at cross road. J. Policy Model. 2017, 39, 371–385. [Google Scholar] [CrossRef]

- Yang, Y.; Yannan, Z.; Jessie, P.; Ze, H. China’s carbon dioxide emission and driving factors: A spatial analysis. Clim. Policy J. Clean. Prod. 2019, 211, 640–651. [Google Scholar] [CrossRef]

- Hanif, I.; Syed, M.F.R.; Pilar, G.S.; Qaiser, A. Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: Some empirical evidence. Energy 2019, 171, 493–501. [Google Scholar] [CrossRef]

- Zarsky, L. Havens, halos and spaghetti: Untangling the evidence about foreign direct investment and the environment. For. Dir. Invest. Environ. 1999, 13, 47–74. [Google Scholar]

- Shahzad, S.J.H.; Kumar, R.R.; Zakaria, M. Carbon emission, energy consumption, trade openness and financial development in Pakistan: A revisit. Renew. Sustain. Energy Rev. 2017, 70, 185–192. [Google Scholar] [CrossRef]

- Liddle, B. Consumption-Based Accounting and the Trade-Carbon Emissions Nexus in Asia: A Heterogeneous, Common Factor Panel Analysis. Sustainability 2018, 10, 3627. [Google Scholar] [CrossRef]

- Yu, H. The influential factors of China’s regional energy intensity and its spatial linkages: 1988–2007. Energy Policy 2012, 45, 583–593. [Google Scholar] [CrossRef]

- Jiang, X.; Duan, Y.; Green, C. Regional disparity in energy intensity of China and the role of industrial and export structure. Res. Conserv. Recycl. 2017, 120, 209–218. [Google Scholar] [CrossRef]

| Symbol | Variable Explanation | Calculation Method | |

|---|---|---|---|

| Control variable | c | nominal GDP Per capita | nominal GDP/population |

| RGDPP | real GDP Per capita | real GDP/population | |

| IS | industrial structure I | added value of the tertiary industry/nominal GDP | |

| ISS | industrial structure II | added value of the secondary industry/nominal GDP | |

| EI | energy intensity (inverse of energy efficiency) | energy consumption/real GDP | |

| EX | export level | gross export/nominal GDP | |

| FDI | foreign direct investment level | foreign direct investment/nominal GDP |

| lnCE | lnNCI | lnRCI | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Constant | 9.180 *** | 9.527 *** | 0.923 *** | −0.101 | 2.424 *** | 0.655 ** |

| (7.60) | (9.59) | (10.12) | (−0.23) | (22.97) | (2.24) | |

| ETS | −0.167 | −0.14 | −0.190 *** | −0.121 ** | −0.189 *** | −0.076 * |

| (−1.28) | (−1.19) | (−2.90) | (−2.11) | (−3.97) | (−2.03) | |

| lnNGDPP | 0.362 | −0.208 ** | ||||

| (1.45) | (−2.28) | |||||

| lnRGDPP | 0.465 (1.58) | 0.022 (0.21) | ||||

| lnIS | −1.883 ** | −1.854 ** | −0.452 | −0.389 ** | ||

| (−2.45) | (−2.50) | (−1.24) | (−2.08) | |||

| lnEI | −0.035 | 0.065 | 0.825 *** | 1.045 *** | ||

| (−0.11) | (0.18) | (8.85) | (9.47) | |||

| lnEX | 0.487 *** | 0.437 ** | 0.222 *** | 0.111 * | ||

| (2.90) | (2.41) | (3.60) | (1.75) | |||

| lnFDI | −0.291 ** | −0.264 ** | −0.164 *** | −0.104 ** | ||

| (−2.70) | (−2.31) | (−3.34) | (−2.41) | |||

| Observations | 330 | 330 | 330 | 330 | 330 | 330 |

| R2 | 0.421 | 0.430 | 0.271 | 0.828 | 0.248 | 0.924 |

| Controls | Y | Y | N | Y | N | Y |

| lnCE | lnNCI | lnRCI | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Constant | 12.511 *** | 12.608 *** | 0.714 ** | 1.214 ** |

| (13.91) | (15.59) | (2.17) | (4.97) | |

| ETS | −0.132 | −0.127 | −0.112 ** | −0.074 ** |

| (−1.02) | (−2.07) | (−2.13) | ||

| lnNGDPP | 0.125 (0.57) | −0.266 *** (−2.77) | ||

| lnRGDPP | (-0.97) | −0.029 | ||

| 0.155 | (−0.29) | |||

| lnISS | 1.759 ** | 1.733 ** | 0.439 * | 0.264 * |

| (2.67) | (2.58) | (1.70) | (1.80) | |

| lnEI | −0.201 | −0.167 | 0.783 *** | 1.011 *** |

| (−0.74) | (−0.52) | (7.89) | (8.88) | |

| lnEX | 0.390 ** | 0.376 ** | 0.199 *** | 0.098 |

| (2.41) | (2.11) | (3.20) | (1.50) | |

| lnFDI | −0.288 ** | −0.280 ** | −0.164 *** | −0.105 ** |

| (−2.53) | (−2.28) | (−3.44) | (−2.40) | |

| Observations | 330 | 330 | 330 | 330 |

| R2 | 0.487 | 0.487 | 0.836 | 0.922 |

| Controls | Y | Y | Y | Y |

| lnCE | lnNCI | lnRCI | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Region | −0.294 ** | −0.327 ** | −0.081 | −0.167 *** |

| (−2.20) | (−2.08) | (−1.26) | (−2.87) | |

| ETS | −0.057 | −0.203 | −0.259 ** | −0.195 * |

| (−0.24) | (−0.95) | (−2.38) | (−1.68) | |

| Controls | Y | Y | Y | Y |

| lnCE | nNCI | lnRCI | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Pilot (1) | Non-Pilot (2) | Pilot (3) | Non-Pilot (4) | Pilot (5) | Non-Pilot (6) | Pilot (7) | Non-Pilot (8) | ||

| Time | −0.285 | −0.005 | −0.203 | −0.052 | −0.971 * | −0.003 | −0.277 * | −0.071 | |

| (−0.51) | (−0.04) | (−1.38) | (−0.45) | (−1.69) | (−0.02) | (−1.97) | (−0.65) | ||

| lnNGDPP | 0.861 *** | 0.768 *** | −0.145 * | −0.272 *** | |||||

| (10.06) | (22.40) | (−1.66) | (−8.09) | ||||||

| lnRGDPP | 1.183 *** | 1.139 *** | 0.194 ** | 0.089 * | |||||

| (12.66) | (23.61) | (2.17) | (1.93) | ||||||

| Observations | 66 | 264 | 66 | 264 | 66 | 264 | 66 | 264 | |

| R2 | 0.903 | 0.875 | 0.934 | 0.882 | 0.982 | 0.928 | 0.983 | 0.882 | |

| Controls | Y | Y | Y | Y | Y | Y | Y | Y | |

| Controlstime | Y | Y | Y | Y | Y | Y | Y | Y | |

| lnCOA | lnPET | lnNAG | |

|---|---|---|---|

| Constant | −0.756 * | −2.852 *** | −6.150 *** |

| (−1.71) | (−6.52) | (−5.82) | |

| ETS | −0.284 ** | 0.045 | 0.093 |

| (−2.32) | (0.53) | (0.68) | |

| lnRGDPP | −0.120 | 0.201 | 0.931 *** |

| (−0.89) | (1.54) | (3.03) | |

| lnIS | −0.953 ** | 0.834 * | 1.101 |

| (−2.32) | (2.02) | (1.02) | |

| lnEX | 0.102 | 0.057 | −0.594 *** |

| (0.91) | (0.49) | (−3.15) | |

| lnFDI | −0.154 * | 0.075 | 0.357 ** |

| (‒1.92) | (0.83) | (2.72) | |

| Observations | 330 | 330 | 330 |

| R2 | 0.429 | 0.349 | 0.266 |

| Controls | Y | Y | Y |

| lnCOA | lnPET | lnNAG | |

|---|---|---|---|

| Pilot | −0.169*** | 0.184 | 0.409* |

| (−3.99) | (1.46) | (1.65) | |

| ETS | −0.174** | −0.085 | −0.295 |

| (−2.22) | (−0.53) | (−0.75) | |

| Controls | Y | Y | Y |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Q.; Gao, C.; Dai, S. Effect of the Emissions Trading Scheme on CO2 Abatement in China. Sustainability 2019, 11, 1055. https://doi.org/10.3390/su11041055

Wang Q, Gao C, Dai S. Effect of the Emissions Trading Scheme on CO2 Abatement in China. Sustainability. 2019; 11(4):1055. https://doi.org/10.3390/su11041055

Chicago/Turabian StyleWang, Qian, Cuiyun Gao, and Shuanping Dai. 2019. "Effect of the Emissions Trading Scheme on CO2 Abatement in China" Sustainability 11, no. 4: 1055. https://doi.org/10.3390/su11041055