Sustainability of Service Intermediary Platform Ecosystems: Analysis and Simulation of Japanese Hotel Booking Platform-Based Markets

Abstract

:1. Introduction

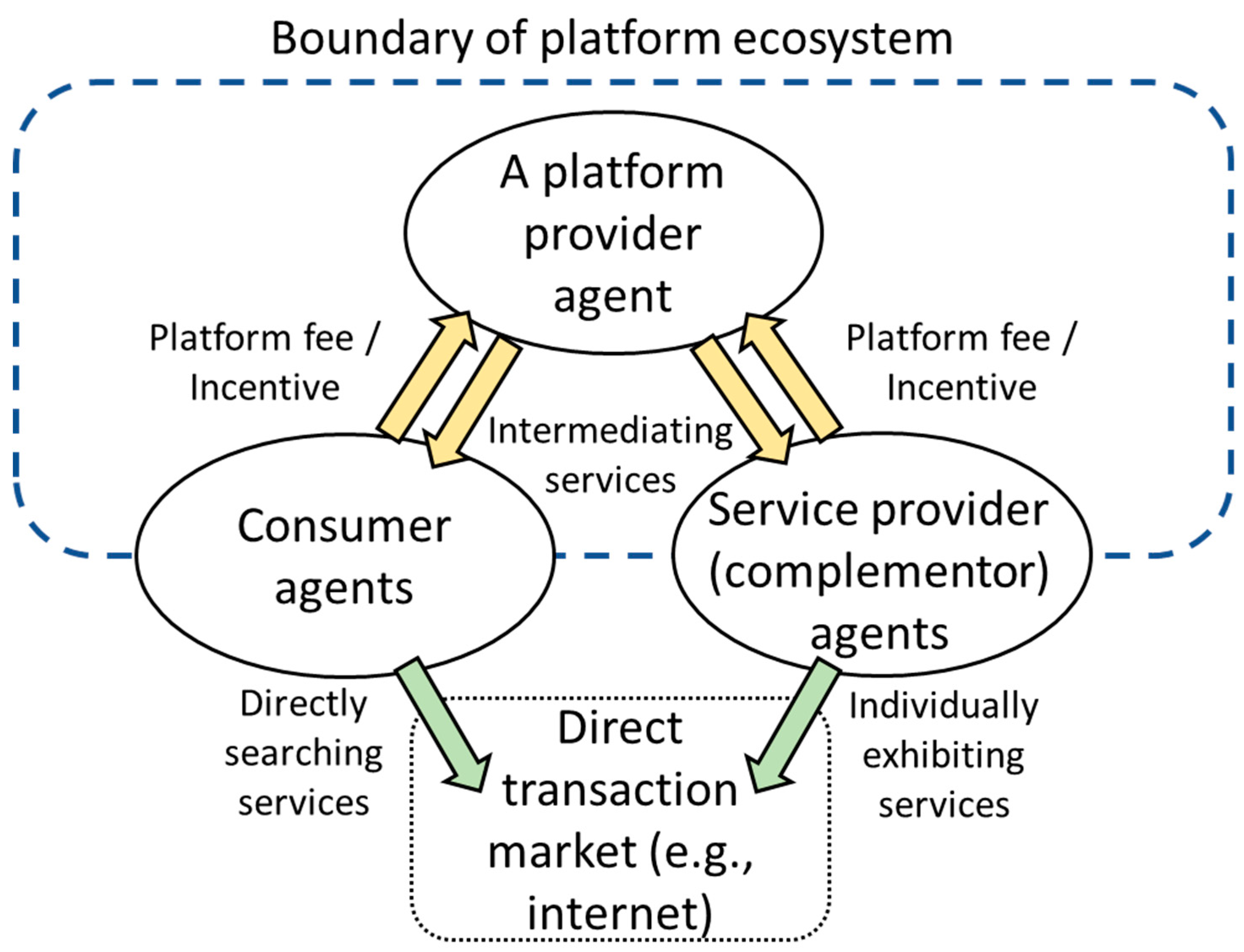

2. Materials and Methods

2.1. Current Situation of Hotel Booking Platform-Based Markets in Japan

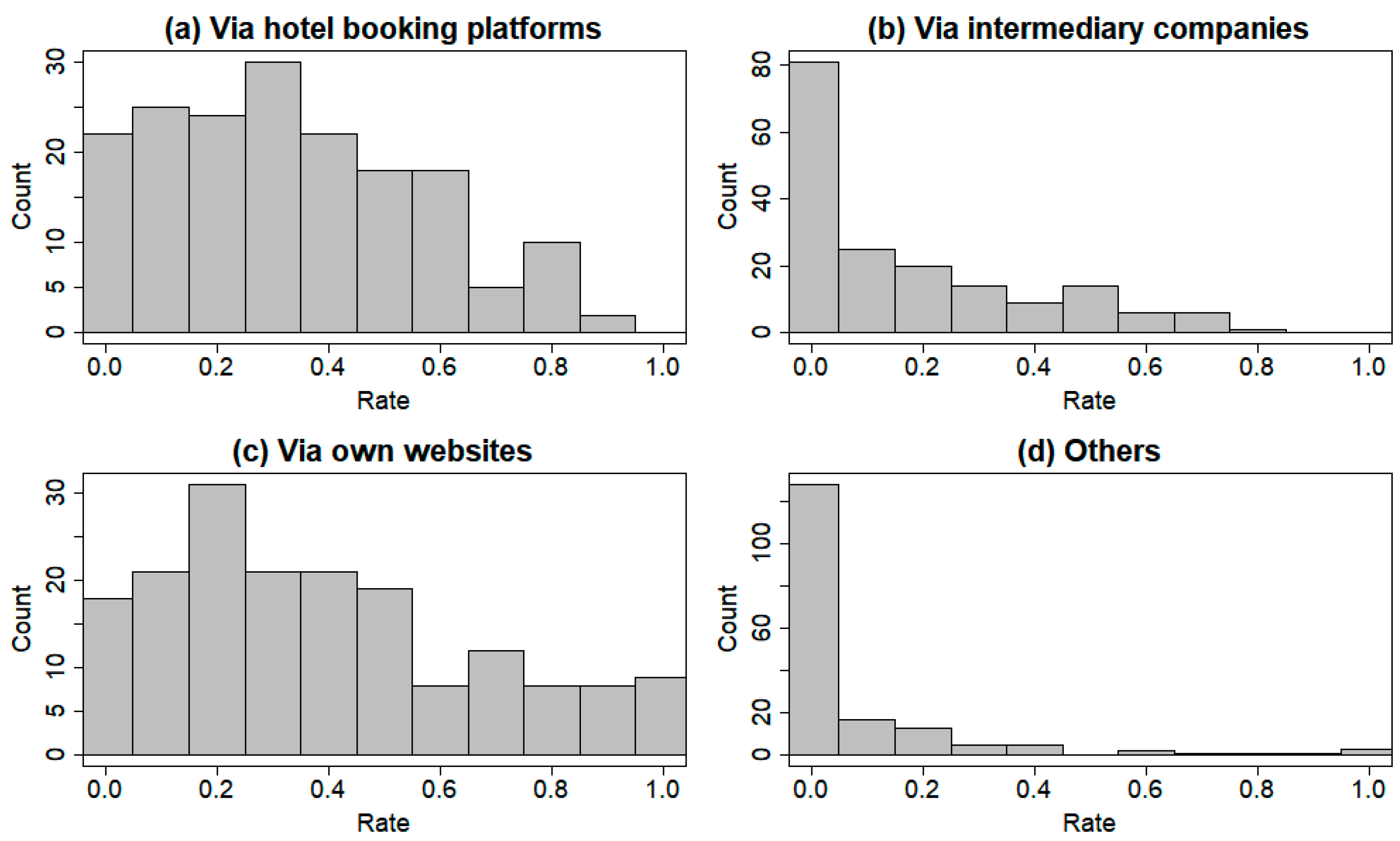

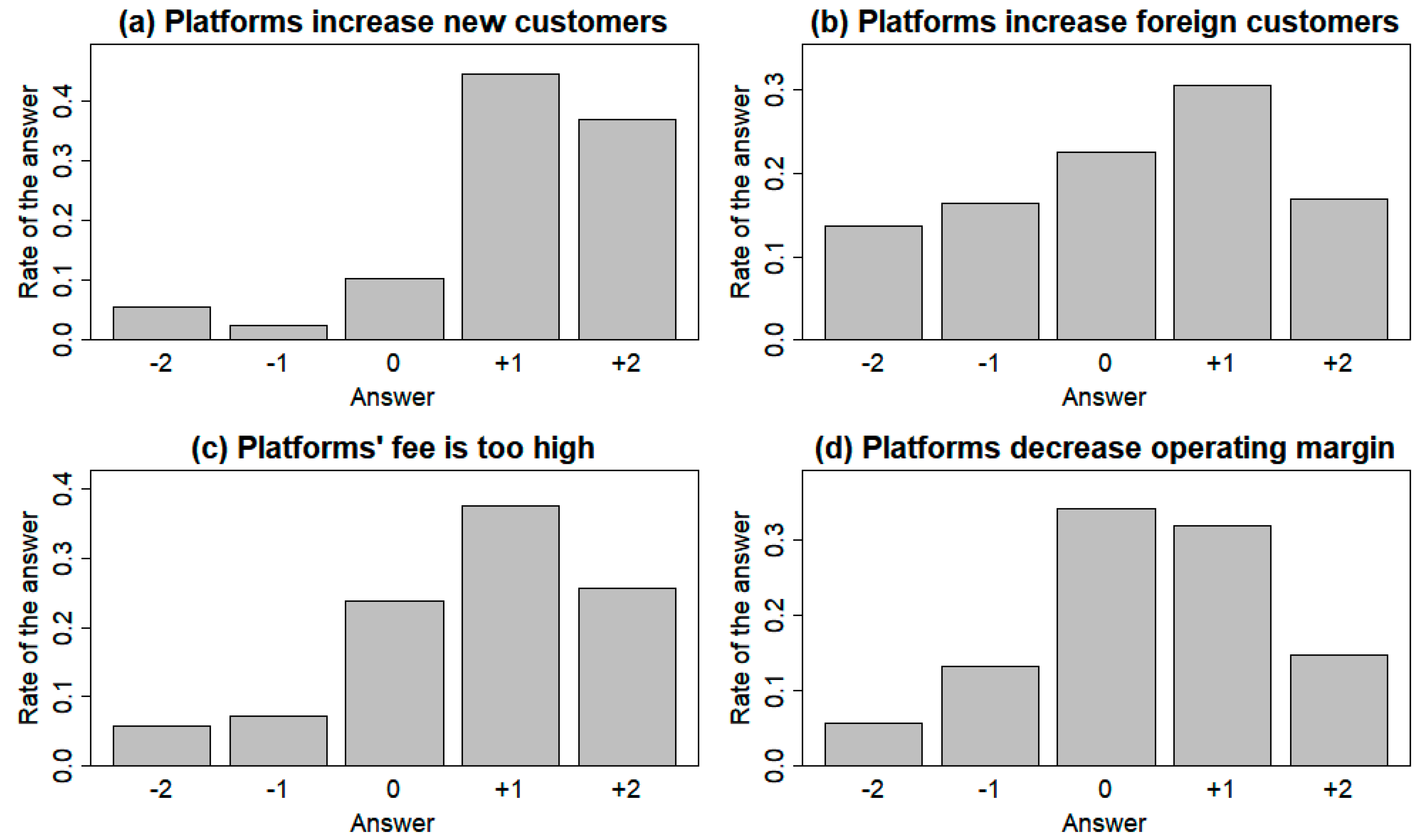

2.1.1. Platform Usage Status of Service Providers

2.1.2. Fee Settings of Hotel-Booking Platforms in Japan

2.2. Hypotheses Development

- (A)

- Participants with higher demand (or greater indirect network effects) should be charged a higher platform fee.

- (B)

- Participants with a transaction charge would more easily join the platform than would those on a fixed charge.

- (C)

- Multi-homing participants should be charged a higher platform fee than single-homing ones.

2.3. Overview of the Simulation

- (a)

- Each consumer agent searches services and buys one service. Here, the consumer agent buys the service that provides highest profits among the selected services. The subsequent consumers cannot select and buy the already purchased service. When all consumer agents finish these processes, the profits of each agent in the step are calculated.

- (b)

- Based on the acquired profits, service providers and consumer agents determine whether to use the platform for the next time step. To avoid obtaining results in any localized solution, this simulation uses the ε-greedy method at decision-making for platform use. In ε-greedy methods, agents select an optimal option at possibility of 1 − ε, and randomly select one at possibility of ε. In this simulation, we set ε as 0.1.

- (c)

- For the next step, service provider agents set their services as available.

2.3.1. Conditions of Simulation Experiment

2.3.2. Evaluation Indicators of Simulation Results

2.4. Parameter Settings and Decision-Making of Agents

2.4.1. Platform Provider Agent

2.4.2. Service Provider Agents

2.4.3. Consumer Agents

2.5. Simulation Experiment

3. Results

3.1. Correspondence between Platform Fee Settings and Balance of Supply and Demand

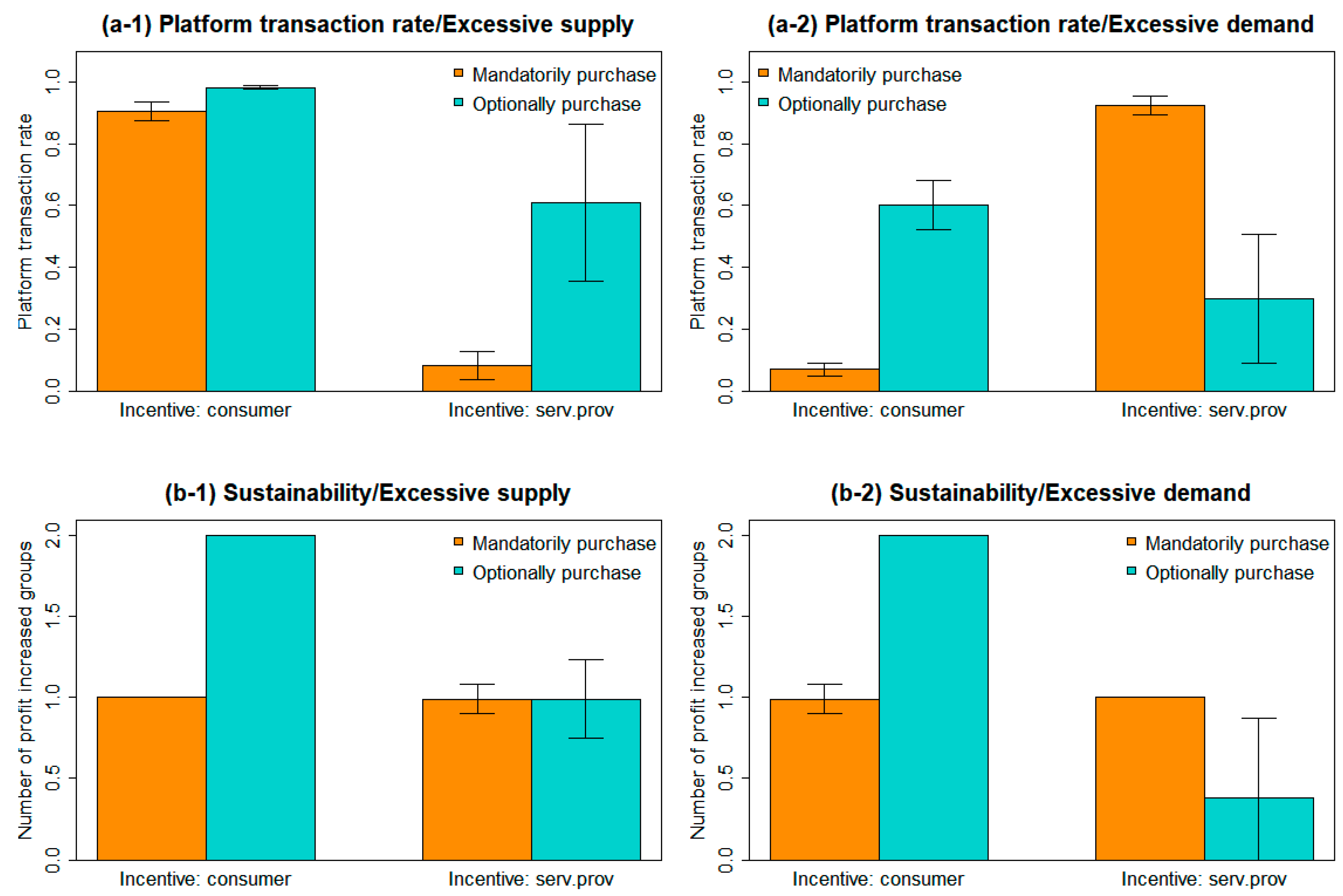

3.2. Comparison between Results on the Market of Mandatorily Purchasing Consumers and Those of Optionally Purchasing Consumers

4. Discussion

4.1. Theoretical Implications

4.2. Managerial Implications

4.3. Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

References

- Gawer, A. Bridging differing perspectives on technological platforms: Toward an integrative framework. Res. Policy 2014, 43, 1239–1249. [Google Scholar] [CrossRef] [Green Version]

- Thomas, L.D.W.; Autio, E.; Gann, D.M. Architectural leverage: Putting platforms in context. Acad. Manag. Perspect. 2014, 28, 198–219. [Google Scholar] [CrossRef]

- Gawer, A.; Cusumano, M.A. Industry platforms and ecosystem innovation. J. Prod. Innov. Manag. 2014, 31, 417–433. [Google Scholar] [CrossRef]

- Boudreau, K.J.; Jeppesen, L.B. Unpaid crowd complementors: The platform network effect mirage. Strat. Manag. J. 2015, 36, 1761–1777. [Google Scholar] [CrossRef]

- Moore, J.F. Predators and prey: A new ecology of competition. Harv. Bus. Rev. 1993, 71, 75–86. [Google Scholar] [PubMed]

- Moore, J.F. The Death of Competition: Leadership & Strategy in the Age of Business Ecosystems; Harper Collins Publishers: New York, NY, USA, 1996. [Google Scholar]

- Inoue, Y. Winner-takes-all or co-evolution among platform ecosystems: A look at the competitive and symbiotic actions of complementors. Sustainability 2019, 11, 726. [Google Scholar] [CrossRef]

- Ceccagnoli, M.; Forman, C.; Huang, P.; Wu, D.J. Cocreation of value in a platform ecosystem: The case of enterprise software. MIS Q. 2012, 36, 263–290. [Google Scholar] [CrossRef]

- Wan, X.; Cenamor, J.; Parker, G.; Van Alstyne, M.W. Unraveling platform strategies: A review from an organizational ambidexterity perspective. Sustainability 2017, 9, 734. [Google Scholar] [CrossRef]

- Inoue, Y.; Tsujimoto, M. New market development of platform ecosystems: A case study of the Nintendo Wii. Technol. Forecast. Soc. Chang. 2018, 16, 235–253. [Google Scholar] [CrossRef]

- Inoue, Y.; Tsujimoto, M. Genres of complementary products in platform-based markets: Changes in evolutionary mechanisms by platform diffusion strategies. Int. J. Innov. Manag. 2018, 22, 1850004. [Google Scholar] [CrossRef]

- Zeithaml, V.A.; Parasuraman, A.P.; Berry, L.L. Problems and strategies in services marketing. J. Mark. 1985, 49, 33–46. [Google Scholar] [CrossRef]

- Yoo, B.; Choudhary, V.; Mukhopadhyay, T. A model of neutral b2b intermediaries. J. Manag. Inf. Syst. 2002, 19, 43–68. [Google Scholar] [CrossRef]

- Evans, D.S. Some empirical aspects of multi–sided platform industries. Rev. Netw. Econ. 2003, 2, 1–19. [Google Scholar] [CrossRef]

- Rochet, J.C.; Tirole, J. Platform competition in two-sided markets. J. Eur. Econ. Assoc. 2003, 1, 990–1029. [Google Scholar] [CrossRef]

- Rochet, J.C.; Tirole, J. Two-sided markets: A progress report. Rand. J. Econ. 2006, 37, 645–667. [Google Scholar] [CrossRef]

- Hagiu, A.; Wright, J. Multi-Sided Platforms; Working paper no. 12-024; Harvard Business School: Boston, MA, USA, 2011. [Google Scholar]

- Hagiu, A.; Wright, J. Multi-sided platforms. Int. J. Ind. Organ. 2015, 43, 162–174. [Google Scholar] [CrossRef]

- Caillaud, B.; Jullien, B. Chicken and egg: Competition among intermediation service providers. Rand. J. Econ. 2003, 34, 309–328. [Google Scholar] [CrossRef]

- Armstrong, M. Competition in two-sided markets. Rand. J. Econ. 2006, 37, 668–691. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.; Xie, J. Online consumer review: Word-of-mouth as a new element of marketing communication mix. Manag. Sci. 2008, 54, 477–491. [Google Scholar] [CrossRef]

- Matzler, K.; Waiguny, M. Consequences of Customer Confusion in Online Hotel Booking. In Information and Communication Technologies in Tourism; Frew, A.J., Ed.; Springer: Vienna, Austria, 2005. [Google Scholar]

- Cho, C.H.; Kang, J.; Cheon, H.J. Online Shopping hesitation. Cyberpsychol. Behav. 2006, 9, 261–274. [Google Scholar] [CrossRef] [PubMed]

- Swarbrooke, J.; Horner, S. Business Travel and Tourism; Butterworth-Heinemann: Oxford, UK, 2001. [Google Scholar]

- Harrison, J.R.; Lin, Z.; Carrol, G.R.; Carley, K.M. Simulation modeling in organizational and management research. Acad. Manag. Rev. 2007, 32, 1229–1245. [Google Scholar] [CrossRef]

- Fioretti, G. Agent-based simulation models in organization science. Organ. Res. Methods 2012, 16, 227–242. [Google Scholar] [CrossRef]

- Ganco, M.; Agarwal, R. Performance differentials between diversifying entrants and entrepreneurial start-ups: A complexity approach. Acad. Manag. Rev. 2009, 34, 228–252. [Google Scholar] [CrossRef]

- Kiesling, E.; Günther, M.; Stummer, C.; Wakolbinger, L.M. Agent-based simulation of innovation diffusion: A review. Cent. Eur. J. Oper. Res. 2012, 20, 183–230. [Google Scholar] [CrossRef]

- Zhang, T.; Zhang, D. Agent-based simulation of consumer purchase decision-making and the decoy effect. J. Bus. Res. 2007, 60, 912–922. [Google Scholar] [CrossRef]

- Chang, M.H.; Harrington, J.E. Centralization vs. decentralization in a multi-unit organization: A computational model of a retail chain as a multi-agent adaptive system. Manag. Sci. 2000, 46, 1427–1440. [Google Scholar] [CrossRef]

- Nishino, N.; Okazaki, M.; Akai, K. Effects of ability difference and strategy imitation on cooperation network formation: A study with game theoretic modeling and multi-agent simulation. Technol. Forecast. Soc. Chang. 2017, 136, 145–156. [Google Scholar] [CrossRef]

- Huotari, P.; Järvi, K.; Kortelainen, S.; Huhtamäki, J. Winner does not take all: Selective attention and local bias in platform-based markets. Technol. Forecast. Soc. Chang. 2017, 114, 313–326. [Google Scholar] [CrossRef]

- Inoue, Y.; Takenaka, T.; Kurumatani, K. Agent-based simulation approach to evaluate platform business models: Fee settings of travel agent platforms. Bus. Model Assoc. J. 2018, 18, 31–43. (In Japanese) [Google Scholar]

- Clements, M.T.; Ohashi, H. Indirect network effects and the product cycle: Video games in the U.S., 1994–2002. J. Ind. Econ. 2005, 53, 515–542. [Google Scholar] [CrossRef]

- Zhu, F.; Iansiti, M. Entry into platform-based markets. Strat. Manag. J. 2012, 33, 88–106. [Google Scholar] [CrossRef]

- Kang, J.S.; Downing, S. Keystone effect on entry into two-sided markets: An analysis of the market entry of WiMAX. Technol. Forecast. Soc. Chang. 2015, 94, 170–186. [Google Scholar] [CrossRef]

- Eisenmann, T.R.; Parker, G.; Van Alstyne, M.W.V. Strategies for two sided markets. Harv. Bus. Rev. 2006, 84, 92–101. [Google Scholar]

- Tolbert, P.S.; Zucker, L.G. Institutional sources of change in the formal structure of organizations: The diffusion of civil service reform, 1880–1935. Adm. Sci. Q. 1983, 28, 22–39. [Google Scholar] [CrossRef]

- Abrahamson, E. Managerial fads and fashions: The diffusion and rejection of innovations. Acad. Manag. Rev. 1991, 16, 586–612. [Google Scholar] [CrossRef]

- Abrahamson, E.; Rosenkopf, L. Institutional and competitive bandwagons: Using mathematical modeling as a tool to explore innovation diffusion. Acad. Manag. Rev. 1993, 18, 487–517. [Google Scholar] [CrossRef]

- Berry, S.T. Estimating discrete-choice models of product differentiation. Rand J. Econ. 1994, 25, 242–262. [Google Scholar] [CrossRef]

- Clemons, E.K.; Hann, I.H.; Hitt, L.M. Price dispersion and differentiation in online travel: An empirical investigation. Manag. Sci. 2002, 48, 534–549. [Google Scholar] [CrossRef]

- Zha, Y.; Zhang, J.; Yue, X.; Hua, Z. Service supply chain coordination with platform effort-induced demand. Ann. Oper. Res. 2015, 235, 785–806. [Google Scholar] [CrossRef]

- Kung, L.C.; Zhong, G.Y. The optimal pricing strategy for two-sided platform delivery in the sharing economy. Transp. Res. Part E Logist. Transp. Rev. 2017, 101, 1–12. [Google Scholar] [CrossRef]

| Conditions | Number of Patterns | Values and Specifications |

|---|---|---|

| Platform fee settings | 8 | (platform fee of service provider agents, platform fee of consumer agents) {(0.2, −0.15), (0.15, −0.1), …, (−0.15, 0.2)} |

| Balance of supply and demand of services | 2 | A: excessive supply (the ratio of the number of service provider agents to consumer agents is set as 100:50); B: excessive demand (the ratio of the number of service provider agents to consumer agents is set as 50:100) |

| Situation of consumers’ purchase of services | 2 | α: mandatory purchase (consumer agents purchase any services even though the service does not satisfy their requirement); β: optional purchase (consumer agents purchase certain services that satisfy both the price and quality requirements of the consumers) |

| Variable | Symbol | Values in the Simulation | Note |

|---|---|---|---|

| Simulation step | 1, …, 250 | Since we confirm that our simulation results can converge until about 200 steps, we set the last step at 250 | |

| Platform fee of service provider agents | −0.2, −0.15, −0.1, −0.05, 0, 0.05, 0.1, 0.15, 0.2 | Negative value of denotes setting incentives for service providers | |

| Platform fee of consumer agents | −0.2, −0.15, −0.1, −0.05, 0, 0.05, 0.1, 0.15, 0.2 | Negative value of denotes setting incentives for service providers | |

| ID of service provider agents (and their service) | Situation of excessive supply: 1, …, 100 Situation of excessive demand: 1, …, 50 | Each service provider agent provides one service to the market | |

| ID of consumer agents | Situation of excessive supply: 1, …, 50 Situation of excessive demand: 1, …, 100 | Each consumer agent purchases one service at one simulation step | |

| Service price | Random value based on standard distribution with mean of 10,000 and standard deviation of 1250 | We set the values using Japanese hotel prices (Japanese Yen) | |

| Service quality | Sum of and random value, which is based on standard distribution with mean of 0 and standard deviation of 0.25 | We set the values referring to the evaluation score of consumer review in actual hotel-booking platforms. The value is modified to satisfy the 0–5 range and the sales profit of the service provider exceeding zero | |

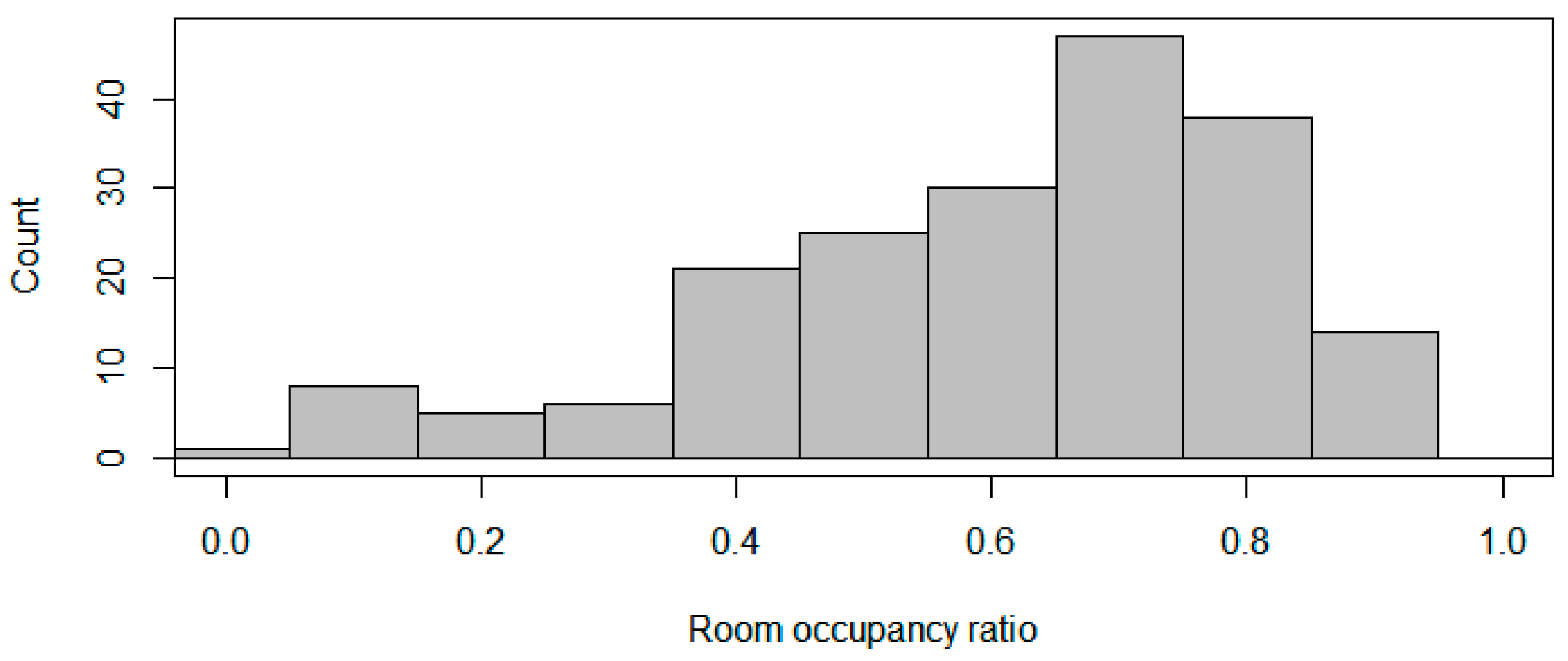

| Maintenance cost of service providers | We set the value of 0.4 referring to the distribution of room occupancy ratio in the Japanese hotel industry | ||

| Requirement for service price | Value multiplied by 1.1 and random value based on standard distribution with mean of 10,000 and standard deviation of 1250 | We set the mean value of to be slightly higher than that of | |

| Requirement for service quality | Sum of and random value, which is based on standard distribution with mean of 0 and standard deviation of 0.25 | We set the same distribution between and | |

| Coefficients of standardization for price value in calculating consumers’ profit | 1 | Since this study unifies values of profit for all agents as unit of price, is set as 1 | |

| Coefficients of standardization for quality value in calculating consumers’ profit | 1/3000 | Since this study unifies values of profit of all agents as unit of price, the quality value is standardized as unit of price | |

| Quantity of service sales | (on direct transaction), (on the platform) | 0 or 1 | The sum of and becomes 1 |

| Profit of the platform provider agent | The values are calculated in the simulation process | Referring to Equation (1) | |

| Profit of the service provider agents | The values are calculated in the simulation process | Referring to Equation (2) | |

| Profit of the consumer agents | The values are calculated in the simulation process | Referring to Equation (3) |

| Markets of Mandatorily Purchasing Consumers | Markets of Optionally Purchasing Consumers | |

|---|---|---|

| (a) Acquisition of a larger number of platform users | Supported | Not supported |

| (b) Achievement of sustainability | Not supported | Not supported |

| Excessive Supply | Excessive Demand | |||

|---|---|---|---|---|

| Consumer Incentive Settings | Service Provider Incentive Settings | Consumer Incentive Settings | Service Provider Incentive Settings | |

| (a) Acquisition of a larger number of platform users | Supported | Supported | Supported | Not supported |

| (b) Achievement of sustainability | Supported | Not supported | Supported | Not supported |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Inoue, Y.; Takenaka, T.; Kurumatani, K. Sustainability of Service Intermediary Platform Ecosystems: Analysis and Simulation of Japanese Hotel Booking Platform-Based Markets. Sustainability 2019, 11, 4563. https://doi.org/10.3390/su11174563

Inoue Y, Takenaka T, Kurumatani K. Sustainability of Service Intermediary Platform Ecosystems: Analysis and Simulation of Japanese Hotel Booking Platform-Based Markets. Sustainability. 2019; 11(17):4563. https://doi.org/10.3390/su11174563

Chicago/Turabian StyleInoue, Yuki, Takeshi Takenaka, and Koichi Kurumatani. 2019. "Sustainability of Service Intermediary Platform Ecosystems: Analysis and Simulation of Japanese Hotel Booking Platform-Based Markets" Sustainability 11, no. 17: 4563. https://doi.org/10.3390/su11174563