1. Introduction

Financial inclusion does not have a single acceptable definition around the world, but different countries refer to financial inclusion based on their own market perspective. In Tanzania, National Financial Inclusion (NFIF) [

1] defines financial inclusion as a frequent use of financial services and provides three dimensions of financial inclusion namely; the measurability and frequent usage of financial services meaning that the financial services are of required quality and can improve the life standard of users; the types of financial inclusion services offered which include savings, credit, payment (transfer and remittance), insurance and pension, and the last is the target group, which includes all Tanzanians but with emphasis on the poor, enterprise low income women and youth with children to build financial stability in society.

World bank [

2] refers to financial inclusion as strategies which show nationally agreed road maps of actions that provide guidance to stakeholders in achieving the goals of financial inclusion. The strategies which are termed superior and successful, according to World Bank [

2], are those which complement efforts with those of the major financial inclusion stakeholders, provide clear responsibilities of each stakeholder, and highlight transparently resource planning by giving priority targets. Such strategies should be able to encourage a more effective and efficient process of achieving substantial development of financial inclusion.

The National Framework for Financial Inclusion (NFIF) [

3] recognizes the position of mobile phone in facilitating the effort of financial inclusion in the financial market. The national financial inclusion recognizes that the access strand to financial services in Tanzania has improved from 11.2% of adult population accessing formal financial services in 2006 (before mobile money service emerged) to about 17% after evolution of mobile money service in 2009. According to FinScope Tanzania report [

4], about 65% of the adult population in Tanzania is now formally financially included. This abrupt increase in financial inclusion is acknowledged by the national financial inclusion framework to be contributed highly by what is referred to as the introduction of non-traditional players in delivery of financial services in Tanzania—the mobile network operators (MNOs) who have revolutionized the landscape of financial services delivery in the country by reaching the majority which was originally left aside and financially excluded in the country.

According to FinScope [

4], over the past three years, enhancements in accessibility of financial services have been remarkable as greater proximity of financial services and greater access to mobile phones have made substantial contributions to this outstanding growth. For instance, the proportion of the rural adult population living within 5 km of a financial service access point has now reached over 78% and the increased adoption of mobile phones within households which is now at 86%countrywide allows people to access mobile financial services more conveniently.

These developments provide an opportunity for Tanzania to deepen the financial system by leveraging technology to drive up usage and reduce transaction costs. It is also crucial to note that the use of mobile money is of a paramount importance because it also helps to reduce time of getting service by reducing long queues in banks and ensures security of carrying money. Following this remarkable increase in the financial inclusion, the contribution of mobile money services provided by the MNOs cannot be left unnoticed. Financial inclusion is a concern in developing economies. Finscope [

4] reveals that the banking system in Africa do include people financially in a slower pace than banking systems of developed countries such as America and Europe countries. Since financial inclusion is regarded as the pillar of financial sector development, which contributes greatly in economic growth, studying its determinants is of paramount importance.

The understanding of the determinants of financial inclusion has currently been an issue of concern to researchers. In Tanzania, this is even more crucial especially during the fifth Government regime in which the core agenda is industrial economy, and financial inclusion is definitely a back born of the agenda. This paper aims at coming up with the determinants of financial inclusion in Tanzania. The paper also assesses consumers’ preference on the mobile financial services channels available in Tanzania. Furthermore, the paper examines the trend of market share on the delivery of financial services between the mobile network operators and the traditional banking institutions.

The rest of the paper proceeds as follows.

Section 2 presents the related literature.

Section 3 presents the methodology of the paper. In

Section 4, the results of the paper are presented, and

Section 5 concludes the paper.

2. Related Literature

A main debate on informal finance concerns whether informal financing businesses may substitute the formally accepted financial services. Formal inclusion of people in financial services may never reduce the number of people using informal finance, and that owning a formal bank account would be directly related to the use of informal financial mechanisms.

Allen et al. [

5] conducted a study examining country characteristics influencing financial inclusion. The author found that high-quality institutions, efficient legal rules, strong contract enforcement and political stability bring about more financial inclusion. Moreover, according to Allen et al. [

5], characteristics about the banking sector also have an essential role to play. They recognized challenges of financial inclusion such as high costs of opening and using bank accounts, high distance and high disclosure requirements, while trust in the banking sector is also influential.

Demirgüç-Kunt et al. [

6] also recognizes religion as another factor which affect financial inclusion. The authors found that Muslims more likely own formal bank accounts and save more compared to their counterparts non-Muslims. According to the authors, other general factors which are considered to drive financial inclusion such as income, education, gender etc. also hold for both Muslims and non-Muslims categories. Therefore, according to the authors, in Sub-Saharan Africa, religion is considered as one of the hindrances to financial inclusion by Muslims because in some circumstances Muslims, due to their beliefs, are limited to participate in borrowing activities which usually are usually the catalyst to the financial inclusion development.

In another study Naceur et al. [

7] used the sample of Muslim countries to determine the association between Islamic banking and financial inclusion, and the results show that in these countries the access to financial services has spread significantly although when it comes to the use of such services the countries are far behind though financial access has increased rapidly in these countries, financial usage has not increased as quickly. According to the authors there is a direct relationship between financial inclusion and credit for household and that for companies.

Demirgüç-Kunt et al. [

6] also considered gender as a factor which affects financial inclusion. According to the author gender and financial inclusion are strongly positively related. The authors reveal a substantial difference between men and women in as far as borrowing and savings are concerned. According to the authors men do formally borrow and save more likely than women due to factors related to income and asset ownership. One should understand that, being a woman increases the likelihood of one being financially excluded because of women having inferior level of income, lower financial literacy and less business experience, hence relying more on informal financial services.

Financial inclusion is made simple through communication technology. Hoernig and Bourreau [

8] recognize mobile money services as the tool to enhance financial inclusion. According to Hoernig and Bourreau [

8] mobile money services improves access to financial services for the un-banked population, and to them mobile banking is the extension of banking services delivery through a mobile phone. The example of such service is cited as M-PESA by Aron [

9]. The author recognizes technology as the major driver to fill the poor infrastructure of the conventional banking. Gibney et al. [

10] shared Aron’s [

9] position that mobile financial services are a solution towards financial inclusion outsmarting the traditional financial institution. In the same regard UNCTAD [

11] discredited conventional banking over the mobile financial services, as it is not inclusive.

The inclusiveness is attributed to wider reach of the mobile network operators beyond the scope of the traditional banking. This signals the shift pushing the traditional banking institutions into irrelevance as far as the delivery of financial services is concerned.

According to Klein and Mayer [

12] M-PESA facilitates cash store and remittance over the phone, and this service is easily available for all kind people ranging from poor to rich ones. Mobile money service is an alternative approach to actual money transfer via banks. Previously, customers had to go physically to bank branches to get this kind of service which they now have on their mobile phones. The mobile financial services are not limited to lower quintile; Deloitte [

13] posited that mobile money services are not only for the unbanked and poor, but also serves the upper quintile—rich people. It is further argued that what existing bank customer can be offered on the mobile channel among others may be customized banking solutions, which are available on the go, in real time and ensure fewer clicks. On the partnership between mobile network operators and banks within mobile money space, Malady and Buckely [

14] argued that the partnership is beneficial on several fronts. According to Malady and Buckely [

14], partnerships can assist in addressing the regulatory issues.

Anderson L.C., et al. [

15] further highlighted the difficulties on the side of the mobile financial services agent to maintain liquidity. This varies on whether one is in urban or rural areas. The mobile financial services agent based in rural area has transaction characterized as highly withdrawal—“high on e-floats while low in cash reserve”—while that located in urban areas has transactions characterized as deposit—“high on cash reserve while low in e-floats”. The mobile network operators have regulatory constraint to hold large sums of money, which is an opportunity for traditional banking institutions to step in to strengthen the delivery of financial services where mobile network operators fall short to fill the void and thus be part of the whole mobile money ecosystem to support mobile financial services agents and coordinate disbursement. It is no longer a myth that in developing countries mobile network operators have emerged as major providers of financial services bypassing the sparse retail network of traditional banks (Economides and Jeziorski [

16]). Anderson L.C., et al. [

15] further argued that the customers are expected to benefit from interoperability through lower prices and expanding network access. This helps users to get electronic financial services which saves cost and time and above all brings convenience to users. In Tanzania, Indonesia, Pakistan, and Sri Lanka, for instance, mobile network operators have entered into contracts that allows users of their respective mobile money scheme to transfer funds across mobile wallets, mobile money accounts and bank accounts, but this kind of agreements has not been brokered elsewhere.

On the other hand, Khiaonarong [

17] has more to say about financial inclusion in relation to mobile financial services. According to the author mobile money services simplify the service acquisition by reducing time to get service and getting it anywhere instead of queueing at the bank branches and have potential to reach out to a large unbanked population. Furthermore, the author reported on the exclusion of the majority in the developing world where mobile phone penetration becomes a new business model filling the existing void. It is further argued that globally, out of 2.5 billion people who are still denied access to financial system, 1.7 billion people have mobile phones. On the point of meeting customers’ expectations against the hurdles presented by the traditional financial institutions in delivery of financial services, Khiaonarong [

17] reported on the overall reduction of the channel operation cost on the premise that mobile financial services offer customers quick, convenient and frequent transactions.

Going forward, Khiaonarong [

17] also reported that mobile financial services are growing in terms of usage and adoption worldwide. According to the author, there are 203 million registered mobile money accounts and 60 million active users. Activeness was measured by the initiation of at least one transaction in the previous 90 days. Khiaonarong further argued that number of transactions through the mobile money accounts stand at 326 million, with a value amounted to 3.2 billion USD. There is a 25% increase in transaction, equivalent to 4.2 billion USD in value, if cash in and cash out items are included.

Traditional banking institutions have started exploiting the opportunities presented by the advent of the mobile network operators. as and Kumar [

18] argued that mobile banking presents customers with a reliable convenience to transact at any time, and anywhere provided relevant infrastructures are readily available to facilitate. The relevance of mobile financial services is highlighted in the Bank of Tanzania (BOT) [

19] that the mobile payment services provide an avenue for linking bank account holders to the unbanked population. In addition, the service has provided convenience in making payments for specified utilities and other consumer services.

BOT [

19] have also reiterated the relatedness of the technology with the use of financial services. They relate the technology with the easiness of the customers to get financial services. Against this background, therefore, there are many ways that financial institutions can fit in the new model of mobile financial services. As described by Choi and Gutierrez [

20] banks can partner with the mobile network operators. Raphael [

21] argued that the access to financial services in East African countries is very low, especially for the huge population in the rural areas. In Tanzania, for example, one in six Tanzanian have access to financial services from formal Institutions, i.e., over half of the people in Tanzania are excluded from financial services. Calleo [

22] similarly argued that, in Tanzania, many mobile money users find the service cheaper, quicker, easier to use, safer and more convenient than using either cash or other formal financial services. Traditional banks, on the other hand, offer a full range of financial services which allow for savings, payments, investment and credit options. The challenge is to find a way to provide these services to the unbanked that is as easy and convenient as mobile financial services and can therefore see the same level of adoption.

Literature does not conclude about factors influencing financial inclusion across countries. The debate is very hot among researchers. Sam and Pais [

23] consider income, income inequality and use of communications technology as the factors influencing financial inclusion. According to the authors nations whose GDP per capita are low experience poor connectivity and low level of literacy have lower level of financial inclusion. Using China sample Fungáčová & Weill [

24] shows level of education and income to significantly affect financial inclusion. The authors report high education level and income as the significant factors which determine financial inclusion in China. Similar results that shows the influence of education and income on financial inclusion was conducted by Tuesta, et al. [

25] in Argentina. On the other hand Chithra & Selvam [

26], using sample of India, reveal that income level, population, literacy level significantly relate to financial inclusion. Another study in Peru, conducted by Camara, Peña & Tuesta [

27], report income levels and education as significant explanatory variables for the status of financial inclusion.

5. Conclusions

Developing economies, such as Tanzania, have low financial inclusion as compared to their developed counterparts. Since financial inclusion can be considered as a tool for poverty reduction, studying its determinant is inevitable. This study investigated the determinants of financial inclusion in Tanzania using the survey data from Sauti za Wananchi, Africa’s first nationally representative high frequency mobile phone survey conducted by TWAWEZA. Employing the Probit regression, the findings of this paper reveal the following. First, if you are a man, financially sound, have a good education and are relatively older, then you stand a better chance of being financially included.

The results further show that, as the level of education increases, the individual is more likely to be financially included. The possible reason for this observation may be clearly linked with the financial ability of educated individuals to afford holding a bank account and presenting personal guarantees when required by the banks during loan application because the level of education goes parallel with the income level. In addition, the results confirm a gender gap in formal financial inclusion, and this may be due to inability of women to show collateral, their poor awareness on financial education and lower business experience.

This finding may be used as a wake-up call for policy makers to target certain groups of population such as women and young people so that they may not be left behind in Government’s effort towards financially including the entire population.

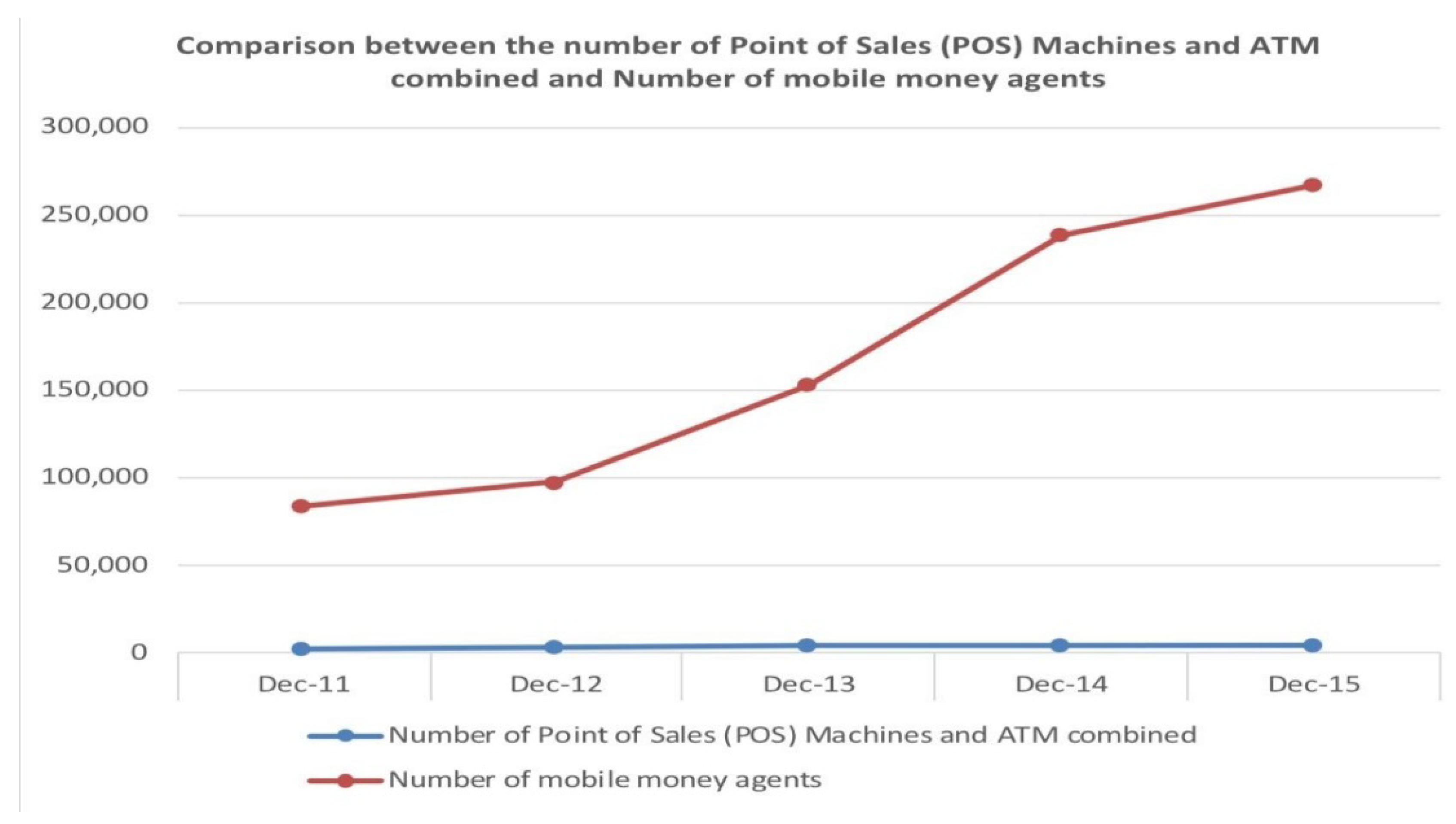

The paper also shows that similar determinants for traditional banking services apply also for mobile banking services reflecting similar patterns, except that mobile banking services simplify more provisions of financial services such as service time and costs. The descriptive analysis has shown the negative trend and a clear departure of customers’ usage from banking retail services to mobile financial services. This is observed in the value of transactions made in mobile financial services compared to value of transactions in traditional banking channel overtime. Although this gap has narrowed recently, the best option with the banking sector is to create more new delivery channels while using mobile financial services as an infrastructure to deepen financial access reaching more un-banked population.

From the outset, the banking industry has a clear choice. The competition is not likely an option at hand. The best option is to create more delivery channels while using mobile telecommunication network as an infrastructure to deepen financial access reaching more unbanked population. By any measure, the flow of new entrants in delivery of financial services to the excluded is inevitable. These new entrants have several competitive advantages, including the time factor; convenience; high accessibility; reliability, given the wider network they enjoy countrywide with penetration level of over 80%; and the trust already created among the users of the service.

This study would benefit very much from secondary data related to financial inclusion as the present one is based on only primary data. The future study should increase the scope to include other African countries and utilize secondary data to perform more detailed analysis.