1. Introduction

Although China has witnessed a massive wave of privatization in the past decades, many firms remain controlled by local governments, especially those that engage in such vital industries as energy, telecommunications, and public utilities. Those firms have been playing a crucial role in China’s economy (for example, in 2010, local SOEs account for 32% of all the listed firms in China and their market value and tax payment are both much higher than those of non-SOE firms (refer

Appendix B for more details)), even if privatization becomes more and more popular in China [

1]. Even though the Company Law (enacted in 1993 and amended several times afterwards) substantially mitigates government interference, China’s State Owned Enterprises (SOEs) CEO turnover is still subject not only to market factors, but also to bureaucratic factors.

Previous studies concerning CEO turnover in China mainly focuses on the link between CEO turnover and firm performance [

2,

3,

4,

5]. However, few, if any, studies specifically investigate the CEO turnover in those local SOEs. This paper aims to fill this gap. More importantly, because of their close connection with local governments, China’s local SOEs are an ideal sample to study the influence of authorities on corporate operations. To provide a new perspective, this paper investigates the political influence and undercovers the potential mechanism through which political factors may affect CEO turnover. Specifically, this paper posits that, for China’s local SOEs, CEO promotion is positively related to the Effective Tax Rate (ETR).

Contradicting the tax equity principle, the effective tax payment varies among firms that are supposed to pay the same amount of tax. Related studies document that the variation in ETR is likely resulted from political interference [

6,

7]. Built on the potential relation between ETR and political connections, this research inferences that ETR has substantial impact on the CEO turnover in China’s local SOEs. We attribute this relation to the fact that local governments, which ultimately control local SOEs and depend heavily on them for fiscal revenues, play an important role in evaluating the performance of local SOE’s CEO [

3]. Accordingly, when CEOs manage to yield more tax to the local governments, they are more likely to get promotion.

To enrich this paper, we also investigate the potential impact from pyramid structure on the CEO turnover and ETR relationship. Prior literature finds that the prevalence of pyramid structure influences corporate operations in various ways [

8,

9,

10,

11,

12]. Furthermore, this paper proposes that, when there are more layers in the pyramid structure, the interferences from local government will be further mitigated and, thus, the relation between ETR and CEO promotion will be weakened (hereafter, we refer this effect as the “mitigating effect” of the pyramid structure). Based on a sample consisting of 3367 observations from 719 local SOEs, we use Logit regression models to test the relationship between tax payment and CEO promotion and the moderating effect of pyramid structure. In the

Section 5.2, the results indicate that marketization significantly weakens the mitigating effect of the pyramid structure. The finding suggests that, with the development of market infrastructure, the role of pyramid structure in reducing political interference becomes less significant.

This paper contributes to both finance and accounting literature in the following ways: First, this paper investigates how ETR affects CEO turnover, which enriches literature on CEO turnover. Although the research samples is China’s local SOEs, the findings are also valuable to other developing economies where governments still have substantial power and incentive to intervene in corporations. Second, this paper highlights the function of pyramid structure in mitigating government interventions. The empirical findings on the CEO promotion lend support to the argument of Fan, Wong, and Zhang (2013) [

13]. Third, this paper also adds to the research on effective tax. The finding indicates that, for those firms ultimately controlled by local authority, top management has strong incentive to effectively pay more tax in exchange for their career promotion.

The rest of this paper proceeds as follows:

Section 2 reviews related literature and develops our hypotheses;

Section 3 presents data and methodology;

Section 4 reports empirical tests for our main findings;

Section 5 provides additional tests; and

Section 6 concludes.

2. Literature Review and Hypotheses Development

The issue of CEO turnover has been a widely-discussed research topic for the past decades. Prior literature has investigated the topic from various aspects. One popular stream of literature finds that firm performance plays an important role in CEO turnover. For example, according to Warner et al. (1988), when the stock price of a listed firm is very low, the probability of its CEO turnover will increase [

14]. In addition to stock price, other studies find that, if a firm’s actual performance does not reach securities analysts’ expectation, its CEO turnover is more likely to happen [

15,

16].

Another stream of literature analyzes the power dynamics within top management and identifies political reasons of CEO turnover. For example, Boeker (1992) founds that, if a firm’s performance decreases, its CEO is more likely get fired. In addition, the probability of being fired is higher for CEOs with greater power [

17]. Shen and Cannella (2002) used different variables to measure CEO power, and found that CEOs with less power are more likely to be fired [

18]. Zhang (2006) found that, if there is a successor of CEO inside a firm, its CEO is more likely to be fired, especially when its performance is not sufficient [

19]. Rizzotti et al. (2017) found that family owners are able to ensure a prompt replacement of an underperforming CEO only when the CEO is not a family member but rather an outside professional [

20].

More recent research sheds light on the influence of legitimacy in organizational sociology on CEO dismissal. For example, Arthaud-Day et al. (2006) found that, if financial restatement occurs, the CEO, CFO, outside directors and directors in audit committee are more likely to leave the firm, so that the firm can get legitimacy again [

21]. Cowen and Marcel (2011) found that, to get resources and other kinds of support from stakeholders, firms tend to fire those directors involved in a financial fraud [

22]. There are also some studies directly examining how outside stakeholders affect CEO turnover, such as securities analysts [

23] and media [

24].

In the context of China, related literature has largely focused on the relationship between firm performance and CEO turnover. For example, Pessarossi and Weill (2012) found that CEO turnovers are generally followed by positive stock market reactions for the enterprises owned by the central government (the central SOEs) [

2]. Kato and Long (2006) found that CEO turnover and firm performance are negatively related. They point out that, however, the relation is less significant for central SOEs which are subject to mutually conflicting objectives [

3]. Chang and Wong (2009) found that the firm performance improves after CEO turnover only for loss-making SOEs [

4]. Chen, Li, Su and Yao (2012) studied the business groups in China and found that the turnover–performance link in member firms is weakened by the delegation of decision rights [

5]. Using a sample of listed non-SOEs in China, Cao et al. (2017) found that the existence of political connection weakens the turnover–performance sensitivity [

25].

Some studies also focus on the political issues. For example, You and Du (2012) examined the political connections of SOEs in China. They found that CEOs with close political connections are less likely to be fired and that the sensitivity of forced turnover to firm performance is weaker for connected CEOs than for non-connected firms [

26].

Although prior literature sheds some light on the political influence on CEO turnover in China, the mechanism remains obscure. Therefore, this paper tries to capture one mechanism through which political factors cast influences on corporate operations by observing the relationship between ETR and CEO turnover of local SOEs.

According to a thorough review on tax research [

27], ETR is generally viewed as a measure of tax avoidance in most accounting literature. Some related studies document that the variation in ETR is likely to result from political issues. For example, Zimmerman (1983) studied the US market and argued that firms with political connection pay more effective tax than those without this kind of connection [

6]. Adhikari, Derashid, and Zhang (2006) investigated the developing market of Malaysia and found that ETR is significantly lower for the firms with political connections. They concluded that, in a “relationship-based” economy, political connections are a significant determinant of effective taxation [

7].

In such a transitional economy as China, although listed on the stock market and partially tradable to the public, the local SOEs are ultimately owned by local governments which have great influence on CEO promotion [

28,

29,

30,

31,

32,

33,

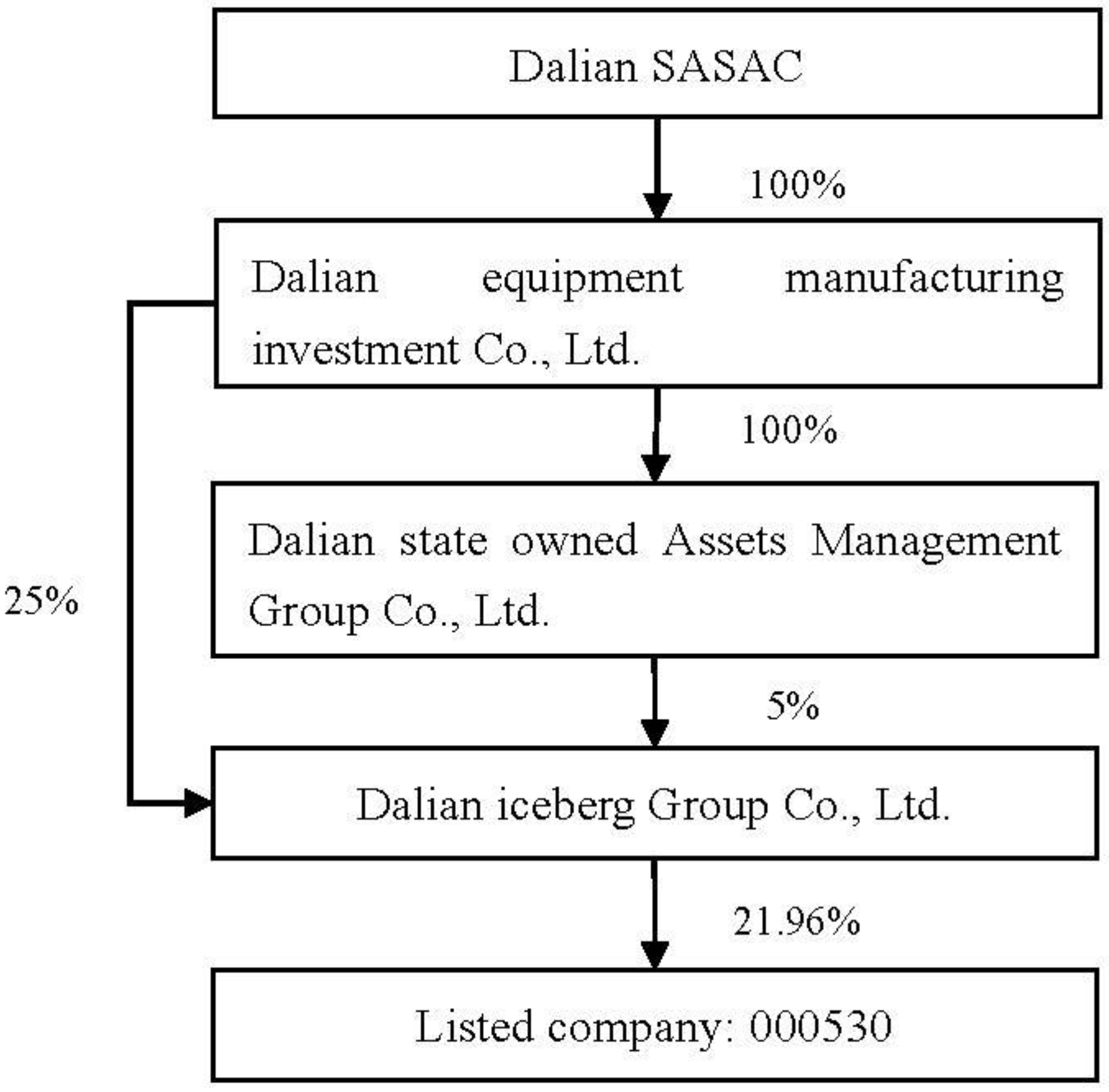

34]. In China’s capital market, there are three kinds of listed companies in terms of the nature of ultimate controller: central SOEs, local SOEs and non-SOEs. Central SOEs are those state-owned enterprises owned by the central government, while local SOEs are those state-owned enterprises owned by the local (province-level) government [

35,

36,

37,

38,

39,

40,

41]. In this paper, we focus on local state-owned listed companies as they are so important in China’s economic development (see

Appendix B). In addition, local government has direct impact on local SOEs, and local government officials are faced with the pressure of tax assessment, which is related to our topic of the relationship between tax payment and CEO turnover. When it comes to taxation, CEOs of local SOEs have two conflicting goals: on the one hand, they are expected by shareholders to reduce tax payment through tax avoidance, while, on the other hand, they have great incentives to please local government by aggressive tax payment.

Since a local government relies heavily on the actual tax paid by local SOEs for its fiscal revenue, a CEO is more likely to be promoted if the local SOE pays more tax to local government. That yields the first hypothesis:

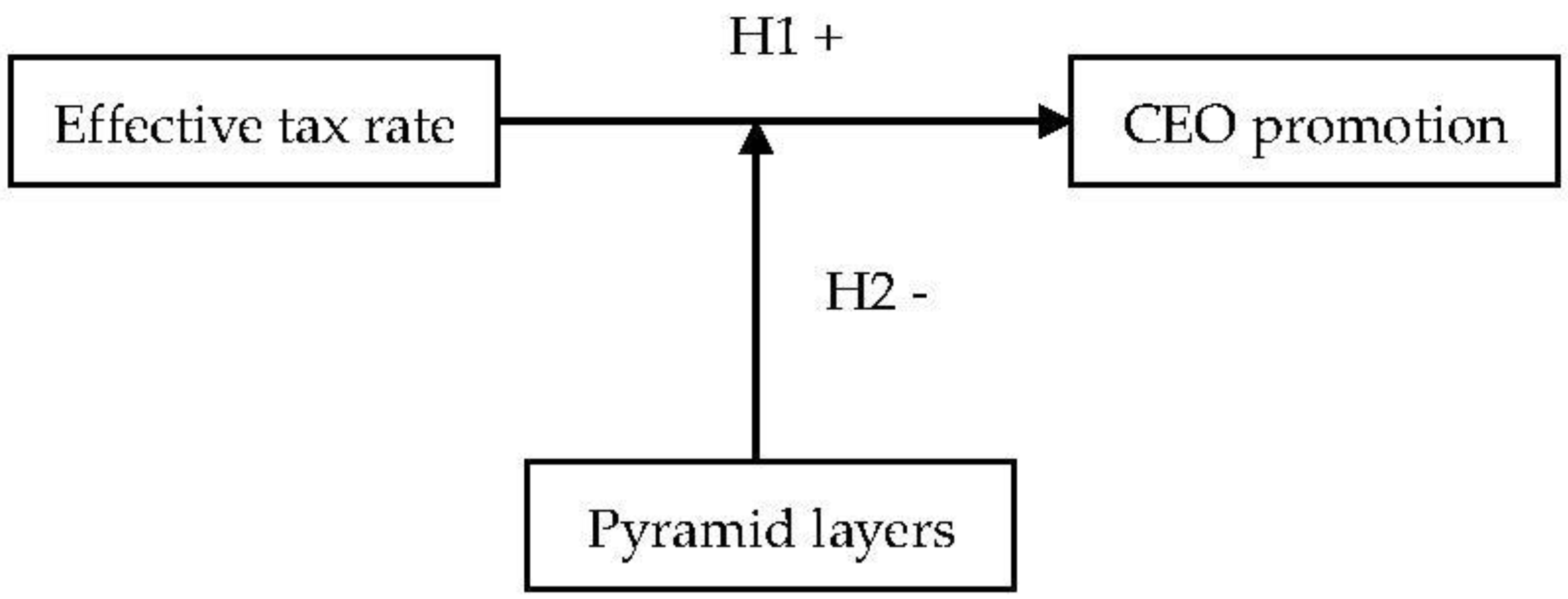

Hypothesis (H1): CEO promotion is positively related to ETR in China’s local SOEs.

SOEs generally bear policy costs such as excessive taxation, employment duties or other policy burdens which substantially lower the operating efficiency [

42,

43]. To mitigate the political costs, some local governments employ pyramids structure to credibly reduce government interference on SOE. Fan, Wong and Zhang (2013) found that the number of a firm’s pyramidal layers is negatively related to local government’s incentive to intervene in the firm’s operating decisions [

13]. Thus, one can make reasonable inference that, for SOEs with extensive pyramidal structures, local governments have less influence on the CEO’s promotion. That yields the second hypothesis:

Hypothesis (H2): The relation between ETR and CEO promotion is weakened for local SOEs with more pyramidal layers.

Our theoretical model consisting of the above hypotheses is shown in

Figure 1.

6. Conclusions

This paper investigates CEO turnover in local SOEs in China from a new perspective. Specifically, we find positive relationship between CEO promotion and effective tax rate (ETR) for those SOEs controlled by local governments in China. The finding suggests that CEOs tend to aggressively pay more tax to local governments for their own career promotion at the expense of minority shareholders’ interest. We further find that the CEO promotion-ETR relationship is weakened when there are more layers in pyramid structure between a SOE and its ultimate owner. The mitigating effect arises from the pyramidal structure’s role in separating governmental intervention from corporate operations. Furthermore, we find that the mitigating effect is only evident in less marketized regions where SOEs are subject to greater governmental intervention.

Our findings are robust to several sensitivity tests: First, we eliminate the possibility that CEO promotion is resulted from dividend payment rather than tax payment by including dividend paid to local government as a control variable. Second, the results find that there is no significant mitigating effect of the separation of the right of control and the right of cash flow, which excludes the alternative explanation that local state-owned pyramid structure plays a role of “tunneling” resources.

This paper adds to the accounting and finance literature concerning the CEO turnover topic and contributes to the growing body of research literature regarding the developing market of China. Our conclusions also have practical implications. For example, in the new round of state-owned enterprise reform, government intervention should be reduced, and CEOs of SOEs should be evaluated in a market-oriented way. In addition, the minority shareholders of state-owned listed companies should pay attention to protecting their interests, since the interests of the government (the largest shareholder) and CEO are aligned together.

There is no doubt that this paper has limitations, and these limitations are the future research directions. For instance, in addition to tax payment, there may be other bureaucratic factors which can affect CEO turnover in SOEs. In the future, these factors should be identified and empirically tested. In addition, we have only examined the role of pyramid structure in reducing government intervention in this paper. In the future, we can explore more situational variables which can affect the relationship between bureaucratic factors and CEO turnover in SOEs. This kind of exploration will not only enrich literature, but also be helpful for SOEs reform in China and other developing countries.