Historical and Empirical Basis for Communal Title in Minerals at the National Level: Does Ownership Matter for Human Development?

Abstract

:1. Introduction

1.1. What is the Economic Commonwealth in the Mining Sector?

1.2. Research Question and Methods

1.3. The Importance of Ownership

1.4. A Short Summary of the “Resource Curse”

1.5. The Rentier State Theory of the Resource Curse

1.6. Sustainability in the Mining Industry

1.7. Categories of Property Rights in Land

- Open access: Rights are not assigned, resulting in no motivation to conserve and resources are often degraded, the so-called “tragedy of the commons”, which is actually the “tragedy of open-access”.

- Communal property: Exclusive ownership rights are given to a group of individuals, community, corporation, association, or other group.

- State Property: Natural resources are managed by the government or the public sector.

- Private property: Exclusive rights are assigned to individuals.

2. History of Communal Property Rights

2.1. Roman Law-Institutes of Justinian, Ius Gentium (Law of Nations)

2.2. Communal Property in Roman Law

- Res nullius: Things that belong to no one but can be appropriated. It means the same as open access. The doctrine of res nullius was used by Western Europeans as a basis for making claims over supposedly uninhabited territory, such as Australia, which was actually inhabited by aboriginal peoples.

- Res communis: Items that (1) may not be appropriated (claimed as private property); and (2) use rights belong equally to everyone. For an example they cite, “the high seas, res communis omnium, as something that cannot be claimed as individual property, since its use for fishing as an example must be open to everybody. Although the sea cannot be appropriated, fish in the sea become private property after they are caught. Similarly, even if mineral ownership rights were communal, minerals could become private property after being removed from the ground.

2.3. British Civil and Common Law

2.4. Ad Coelum Doctrine

3. Communal Property Rights in Western Thought

3.1. Locke’s Proviso

3.2. Paine’s Justification for Communal Ownership of the Earth

3.3. Governing the Commons

3.4. The Public Trust Doctrine

4. Contemporary Mineral Title Regimes

4.1. Supra-National Communal Ownership Regimes: International Law, Law of the Sea, Antarctica, and Space Law

- Common Heritage of Mankind Principle,

- High Seas (Convention on the High Seas, 1958),

- Deep seabed (ISA, 1994 and UNCLOS III),

- Antarctica (Treaty 1959),

- Outer Space (Outer Space Treaty, 1967),

- Moon (Moon Agreement, 1984),

- Geo-synchronous orbital slots (ITU, ITC),

- UN International Law Concepts or Principles.

4.1.1. Common Heritage of Mankind (CHM) Principle

- (1)

- The area under consideration cannot be subject to appropriation;

- (2)

- All countries must share in the management of the region;

- (3)

- There must be an active sharing of the benefits reaped from the exploitation of the area’s resources; and

- (4)

- The area must be dedicated to exclusively peaceful purposes

4.1.2. High Seas (Convention on the High Seas, 1958)

4.1.3. Deep Sea Bed (ISA, 1994 and UNCLOS III)

4.1.4. Antarctica (Treaty 1959)

4.1.5. Outer Space (Outer Space Treaty, 1967)

4.1.6. Moon (Moon Agreement, 1984)

4.1.7. Geo-Synchronous Orbital Slots-International Telecommunication Union (ITU), International Telecommunication Convention (ITC)

4.1.8. UN International Law Concepts or Principles

4.2. Sub-National Communal Ownership Regimes

4.2.1. Australian Communal Native Title

4.2.2. Native Americans

4.2.3. Canadian First Nations

4.2.4. Royal Bafokeng Nation

4.2.5. Alaska Permanent Fund Dividend

4.3. National Mineral Title Regimes

4.3.1. Compilation of National Mineral Title Laws

- 0

- No minerals

- 1

- President or Ruler

- 2

- State or Crown

- 3

- Communal (People/Common/Collective)

- 4

- “Customary” Landowners

- 5

- Decentralized/Mixed

- 6

- Claimant/Ownerless/Landowner

4.3.2. Myanmar-Mineral Ownership in an Authoritarian State

4.3.3. Examples of Communal Ownership at the National Level

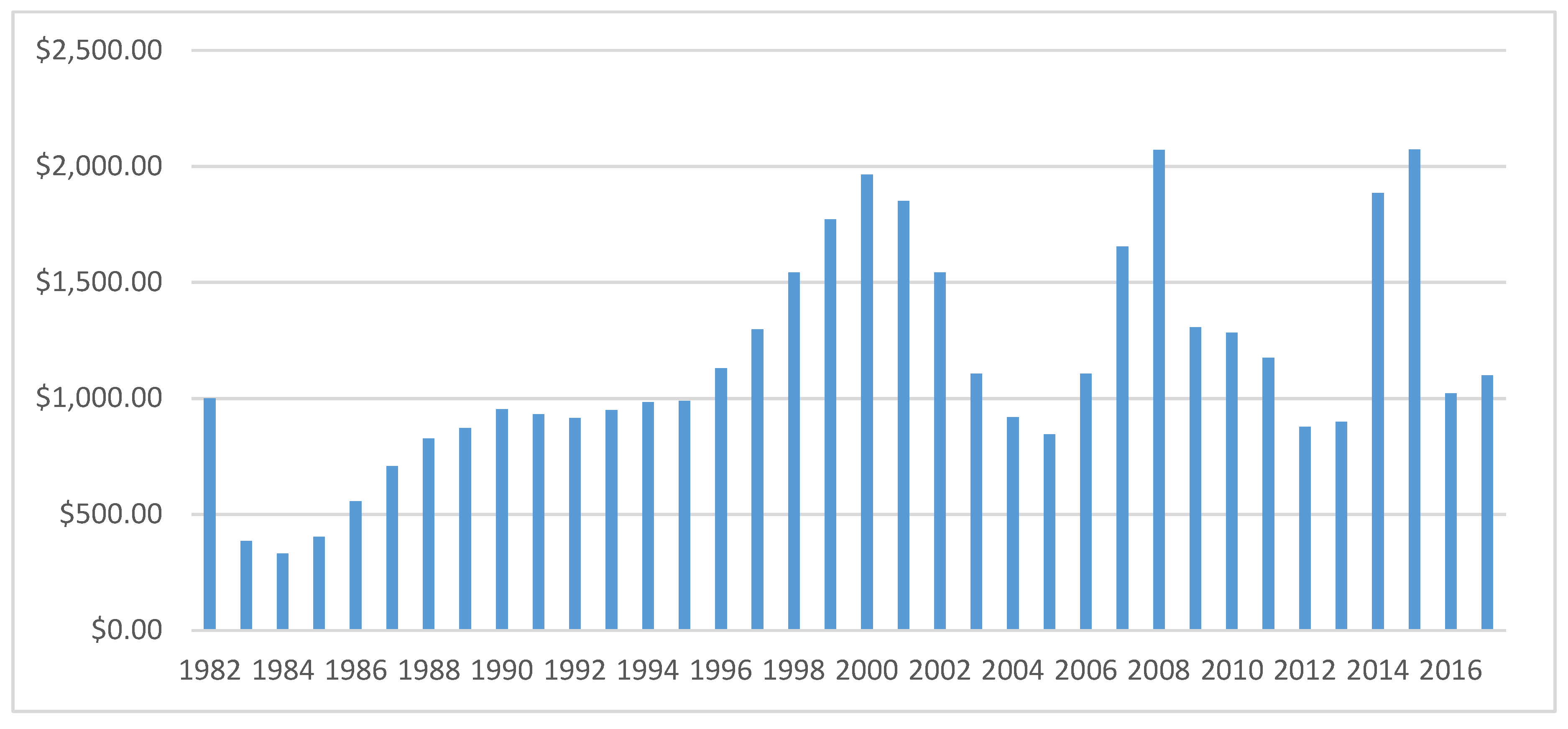

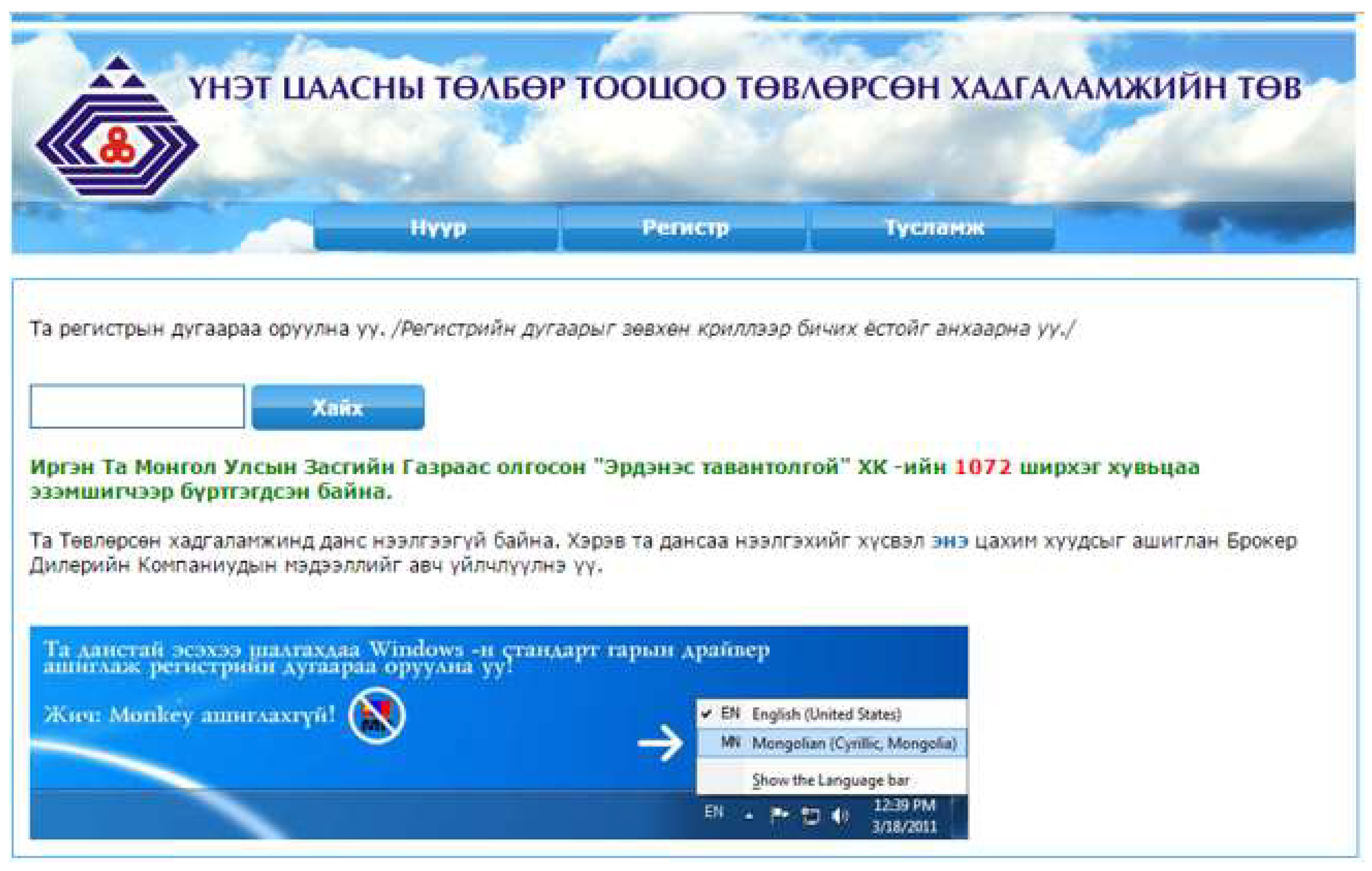

Mongolian Mining Stock Ownership

Bougainville-Individual Payments

Nauru-Customary Landowners

4.3.4. Human Development Index Evaluation

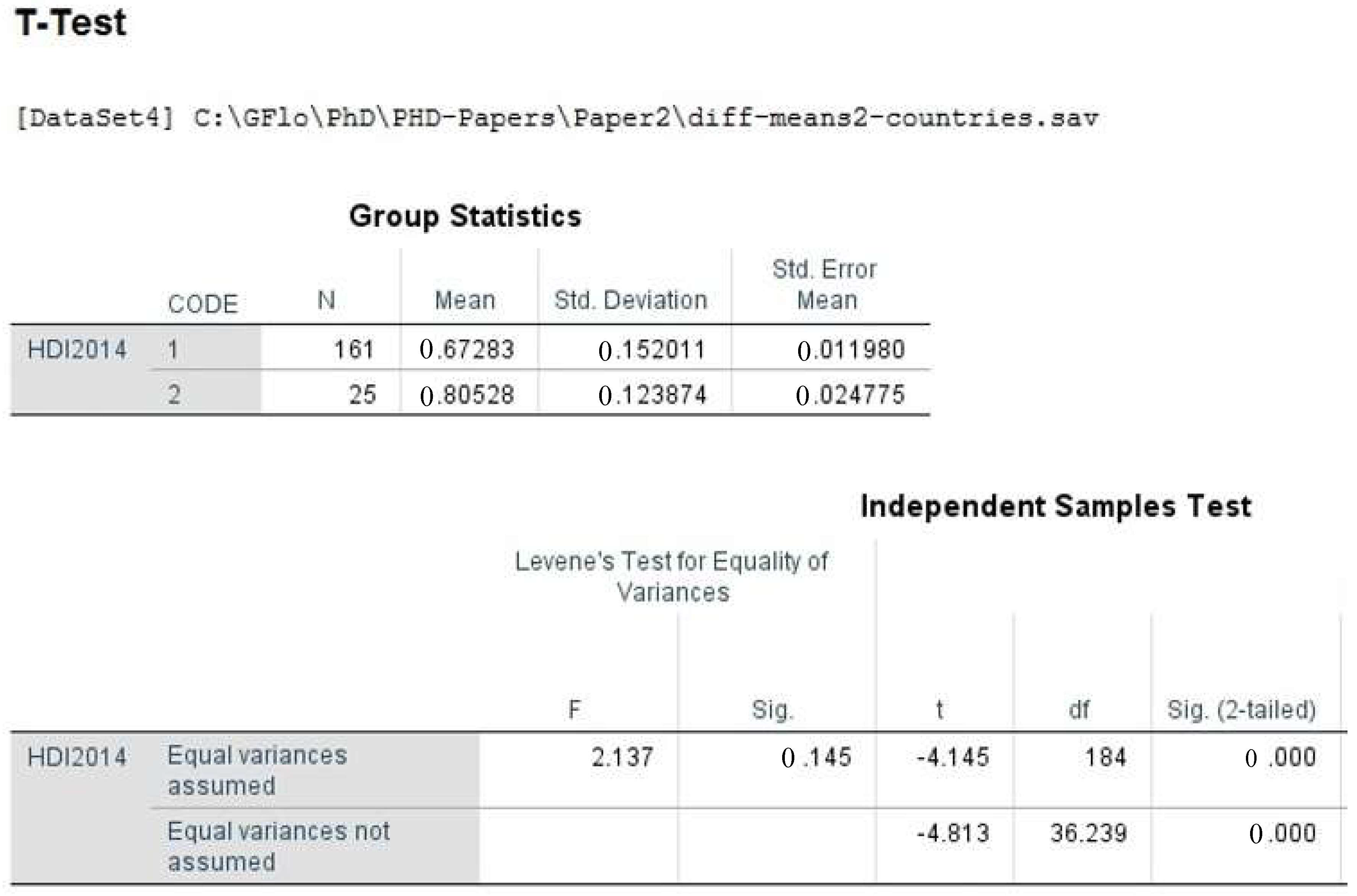

4.3.5. Analysis of Decentralized versus Centralized Ownership

Equal Variances Assumed

- = Mean of first sample

- = Mean of second sample

- n1 = Sample Size (i.e., number of observations) of first sample

- n2 = Sample Size (i.e., number of observations) of second sample

- s1 = standard deviation of first sample

- s2 = standard deviation of second sample

- sp = pooled standard deviation

Equal Variance Not Assumed

- = Mean of first sample

- = Mean of second sample

- n1 = Sample Size (i.e. number of observations) of first sample

- n2 = Sample Size (i.e. number of observations) of second sample

- s1 = standard deviation of first sample

- s2 = standard deviation of second sample

Results

4.3.6. Why do National Government Claim Mineral Titles?

5. Sense of Fairness-Basis in Ethology and Anthropology

6. Overcoming the Resource Curse through Distribution of Revenues and Mineral Titles

7. Conclusions

Acknowledgments

Conflicts of Interest

Appendix A. National Mineral Title Laws

| Country Total = 199 | Ownership | HDI 2014 |

| No Minerals n = 7 | ||

| Monaco | None | .. |

| Saint Lucia | None | 0.729 |

| Saint Vincent and Grenadines | None | 0.720 |

| Samoa | None | 0.702 |

| San Marino | None | .. |

| Hong Kong, China (SAR) | None | 0.910 |

| Palestine, State of | None | 0.677 |

| Mean HDI | 0.748 | |

| President/Ruler n = 5 | ||

| Zambia | President/state | 0.586 |

| Zimbabwe | President | 0.509 |

| Brunei Darussalam | President/Ruler | 0.856 |

| Ghana | Republic/President/people | 0.579 |

| Malawi | President on behalf of people | 0.445 |

| Mean HDI | 0.595 | |

| State/Crown n = 142 | ||

| Afghanistan | State | 0.465 |

| Albania | State | 0.733 |

| Andorra | State | 0.845 |

| Angola | State | 0.532 |

| Antigua and Barbuda | Crown | 0.783 |

| Armenia | State | 0.733 |

| Azerbaijan | State | 0.751 |

| Bahamas | State | 0.790 |

| Bahrain | State | 0.824 |

| Bangladesh | State | 0.570 |

| Barbados | State | 0.785 |

| Belarus | State | 0.798 |

| Belize | State | 0.715 |

| Benin | State | 0.480 |

| Bhutan | State | 0.605 |

| Botswana | State | 0.698 |

| Brazil | State | 0.755 |

| Bulgaria | State | 0.782 |

| Burkina Faso | State | 0.402 |

| Burundi | State | 0.400 |

| Cambodia | State | 0.555 |

| Cameroon | State | 0.512 |

| Cape Verde | State | 0.646 |

| Central African Republic | State | 0.350 |

| Chad | State | 0.392 |

| Chile | State | 0.832 |

| China | State | 0.727 |

| Colombia | State | 0.720 |

| Comoros | State | 0.503 |

| Congo-Rep | State | 0.591 |

| Congo-DPR | State | 0.433 |

| Costa Rica | State | 0.766 |

| Cote d’Ivoire | State | 0.462 |

| Croatia | State | 0.818 |

| Cuba | State | 0.769 |

| Cyprus | Crown | 0.850 |

| Czech Republic | State | 0.870 |

| Denmark | State | 0.923 |

| Djibouti | State | 0.470 |

| Dominica | State | 0.724 |

| Dominican Republic | State | 0.715 |

| Ecuador | State | 0.732 |

| El Salvador | State | 0.666 |

| Equatorial Guinea | State | 0.587 |

| Eritrea | State | 0.391 |

| Estonia | State | 0.861 |

| Fiji | State | 0.727 |

| France | State | 0.888 |

| Gabon | State | 0.684 |

| Gambia | Crown | 0.441 |

| Georgia | State | 0.754 |

| Grenada | Crown | 0.750 |

| Guatemala | State | 0.627 |

| Guinea | State | 0.411 |

| Guinea-Bissau | State | 0.420 |

| Guyana | State | 0.636 |

| Haiti | State | 0.483 |

| Honduras | State | 0.606 |

| Hungary | State | 0.828 |

| Indonesia | State to the benefit of the people | 0.684 |

| Iran | State | 0.766 |

| Ireland | State | 0.916 |

| Israel | State | 0.894 |

| Italy | State | 0.873 |

| Jamaica | Crown (mainly) | 0.719 |

| Japan | State | 0.891 |

| Jordan | State | 0.748 |

| Kazakhstan | State | 0.788 |

| Kenya | State | 0.548 |

| Korea (DPR) | State | .. |

| Kosovo | State | .. |

| Kuwait | State | 0.816 |

| Kyrgyz Republic | State | 0.655 |

| Lesotho | State | 0.497 |

| Liberia | State | 0.430 |

| Libya | State | 0.724 |

| Liechtenstein | State | 0.908 |

| Lithuania | State | 0.839 |

| Luxemburg | State | 0.892 |

| Macedonia | State | 0.747 |

| Madagascar | State | 0.510 |

| Malaysia | State | 0.779 |

| Maldives | State | 0.706 |

| Mali | State | 0.419 |

| Malta | State | 0.839 |

| Mauritania | State | 0.506 |

| Mauritius | State | 0.777 |

| Mexico | State | 0.756 |

| Montenegro | State | 0.802 |

| Morocco | State | 0.628 |

| Mozambique | State | 0.416 |

| Myanmar | State | 0.536 |

| Namibia | State | 0.628 |

| Nepal | State | 0.548 |

| Netherlands | State | 0.922 |

| New Caledonia | State | .. |

| New Zealand | Crown | 0.913 |

| Nicaragua | State | 0.631 |

| Niger | State | 0.348 |

| Nigeria | State on behalf of the people | 0.514 |

| Norway | State | 0.944 |

| Oman | State | 0.793 |

| Pakistan | State | 0.538 |

| Panama | State | 0.780 |

| Papua New Guinea | State | 0.505 |

| Paraguay | State | 0.679 |

| Peru | State | 0.734 |

| Philippines | State | 0.668 |

| Poland | State | 0.843 |

| Qatar | State | 0.850 |

| Russian Federation | State | 0.798 |

| Rwanda | State | 0.483 |

| Saint Kitts and Nevis | Crown | 0.752 |

| Sao Tome & Principe | State | 0.555 |

| Saudi Arabia | State | 0.837 |

| Senegal | State | 0.466 |

| Serbia | State | 0.771 |

| Seychelles | State | 0.772 |

| Sierra Leone | State | 0.413 |

| Slovakia | State | 0.844 |

| Slovenia | State | 0.880 |

| Somalia | State | .. |

| South Sudan | State for the people | 0.467 |

| Spain | State | 0.876 |

| Sri Lanka | State | 0.757 |

| Sudan | State | 0.479 |

| Suriname | State | 0.714 |

| Swaziland | State | 0.531 |

| Taiwan | State | .. |

| Tajikistan | State | 0.624 |

| Tanzania (United Republic of) | State | 0.521 |

| Thailand | State | 0.726 |

| Timor-Leste | State | 0.595 |

| Togo | State/public domain | 0.484 |

| Tonga | Crown | 0.717 |

| Turkey | State | 0.761 |

| Trinidad & Tobago | State/President | 0.772 |

| Uganda | State | 0.483 |

| United Kingdom | Crown | 0.907 |

| Uruguay | State | 0.793 |

| Uzbekistan | State | 0.675 |

| Yemen | State | 0.498 |

| Mean HDI | 0.650 | |

| People/Common/Collective n = 19 | ||

| Algeria | Common/public/collective | 0.736 |

| Bolivia | People and state | 0.662 |

| Egypt | People managed by the state | 0.690 |

| Ethiopia | Common/state/people | 0.442 |

| Iraq | People/regions | 0.654 |

| Laos | National community/state mgmt. | 0.575 |

| Moldova | Public | 0.693 |

| Mongolia | People under state protection | 0.727 |

| Portugal | Public domain | 0.830 |

| Romania | Public/state | 0.793 |

| Solomon islands | People and state | 0.506 |

| South Africa | Common/state custodian | 0.666 |

| Syrian Arab Republic | Public/state | 0.594 |

| Tunisia | Public domain of the state | 0.721 |

| Ukraine | People/state | 0.747 |

| United Arab Emirates | Public | 0.835 |

| Vietnam | Public/people/managed by the state | 0.666 |

| Turkmenistan | People and state | 0.688 |

| Venezuela | Public/state | 0.762 |

| Mean HDI | 0.683 | |

| “Customary” landowners n = 8 | ||

| Marshall Isles | landowners | .. |

| Micronesia | landowner | 0.640 |

| Nauru | landowner | .. |

| Palau | landowner/state | 0.780 |

| Kiribati | customary landowners | 0.590 |

| Bougainville | customary landowners | .. |

| Tuvalu | customary landowners | .. |

| Vanuatu | customary landowners | 0.594 |

| Mean HDI | 0.651 | |

| Decentralized/Mixed, n = 10 | ||

| Argentina | Province/canton | 0.836 |

| Australia | Crown in right of the states, some landowners | 0.935 |

| Austria | mixed: State, claimant, landowner | 0.885 |

| Belgium | Province/regional/claimant | 0.890 |

| Bosnia & Herzegovina | mixed: federal/Cantons | 0.733 |

| Canada | Crown/Provincial/landowner | 0.913 |

| Greece | mixed: state, claimant, landowner | 0.865 |

| India | states and federal government | 0.609 |

| Switzerland | Province/canton | 0.930 |

| United States | mixed: State, claimant, landowner | 0.915 |

| Mean HDI | 0.851 | |

| Claimant/Ownerless/Landowner n = 8 | ||

| Finland | Claimant/ownerless | 0.883 |

| Germany | Claimant/ownerless | 0.916 |

| Iceland | Landowner | 0.899 |

| Korea(Rep) | Claimant/state mgmt. | 0.898 |

| Latvia | Landowner | 0.819 |

| Lebanon | Landowner | 0.769 |

| Singapore | Claimant/ownerless | 0.912 |

| Sweden | Claimant/landowner | 0.907 |

| Mean HDI | 0.875 | |

Appendix B. Two-Correlation of Decentralized vs. Centralized Mineral Ownership with HDI

References and Notes

- Dictionary.com Dictionary.com. Available online: http://www.dictionary.com/browse/wealth?s=t (accessed on 14 May 2018).

- Farzanegan, M.R.; Lessmann, C.; Markwardt, G. Natural resource rents and internal conflicts: Can decentralization lift the curse? Econ. Syst. 2018. Available online: https://www.sciencedirect.com/science/article/abs/pii/S0939362518300931 (accessed on 14 May 2018). [CrossRef]

- Weinthal, E.; Luong, P.J. Combating the Resource Curse: An Alternative Solution to Managing Mineral Wealth. Perspect. Polit. 2006, 4, 35–53. [Google Scholar] [CrossRef]

- Luong, P.J.; Weinthal, E. Rethinking the Resource Curse: Ownership Structure, Institutional Capacity, and Domestic Constraints. Annu. Rev. Polit. Sci. 2006, 9, 241–263. [Google Scholar] [CrossRef]

- Cawood, F.T.; Minnitt, R.C.A. A historical perspective on the economics of the ownership of mineral rights ownership. J. S. Afr. Inst. Min. Metall. 1998, 98, 369–370. [Google Scholar]

- De Soto, H. The Mystery Of Capital, Why Capitalism Succeeds in the West And Fails Everywhere Else, 1st ed.; Basic Books: New York, NY, USA, 2000; p. 288. [Google Scholar]

- Wegenast, T.; Schneider, G. Ownership matters: Natural resources property rights and social conflict in Sub-Saharan Africa. Polit. Geogr. 2017, 61, 110–122. [Google Scholar] [CrossRef]

- Cleary, P. How Australia Wasted the Mining Boom. Available online: https://johnmenadue.com/paul-cleary-how-australia-wasted-the-mining-boom/ (accessed on 15 May 2018).

- Widerquist, K.; Howard, M. Exporting the Alaska Model: Adapting the Permanent Fund Dividend for Reform Around the World; Palgrave Macmillan: New York, NY, USA, 2012. [Google Scholar]

- Paine, T. Agrarian Justice: Opposed to Agrarian Law, and to Agrarian Monopoly; W. Adlard, Rue Menilmontant: Paris, France; Paternoster Row: London, UK, 1797. [Google Scholar]

- Blackburn, R.A.; Milirrpum; Territory, N.; Leslie, A.J. Milirrpum v. Nabalco Pty. Ltd. and the Commonwealth of Australia: (Gove Land Rights Case): A claim by Aborigines That Their Interests in Certain Land Had Been Invaded Unlawfully by the Defendents: Judgement of the Honourable Mr. Justice Blackburn; Law Book Co.: Hong Kong, 1971. [Google Scholar]

- Sachs, J.D. Warner Natural Resource Abundance and Economic Growth; National Bureau of Economic Research: Cambridge, MA, USA, 1995. [Google Scholar]

- Dauvin, M.; Guerreiro, D. The Paradox of Plenty: A Meta-Analysis. World Dev. 2017, 94, 212–231. [Google Scholar] [CrossRef]

- Mahdavi, P. Why do leaders nationalize the oil industry? The politics of resource expropriation. Energy Policy 2014, 75, 228–243. [Google Scholar] [CrossRef]

- Shambayati, H. The Rentier State, Interest Groups, and the Paradox of Autonomy: State and Business in Turkey and Iran. Comp. Polit. 1994, 26, 307–331. [Google Scholar] [CrossRef]

- Ross, M.L. The Oil Curse: How Petroleum Wealth Shapes the Development of Nations; Princeton University Press: Princeton, NJ, USA, 2012. [Google Scholar]

- Revenue Watch. 2013 Resource Governance Index; Revenue Watch: New York, NY, USA, 2013. [Google Scholar]

- Institute, N.R.G. 2017 Resource Governance Index. Available online: https://resourcegovernance.org/analysis-tools/publications/2017-resource-governance-index (accessed on 15 May 2018).

- Economist Intelligence Unit. Democracy Index 2014, Democracy and Its Discontents; Economist Intelligence Unit: London, UK, 2014. [Google Scholar]

- ICMM. Sustainable Development Framework: ICMM Principles; International Council on Mining and Metals: London, UK, 2015. [Google Scholar]

- Anderson, T.L.; Hill, P.J. Privatizing the Commons: An Improvement? South. Econ. J. 1983, 50, 438. [Google Scholar] [CrossRef]

- Barnes, R. Property Rights and Natural Resources; Hart: Oxford, UK; Portland, OR, USA, 2009. [Google Scholar]

- Dannreuther, R.; Ostrowski, W. Global Resources: Conflict and Cooperation; Palgrave Macmillan: Basingstoke, UK, 2013. [Google Scholar]

- Feder, G.; Feeny, D. Land Tenure and Property Rights: Theory and Implications for Development Policy. World Bank Econ. Rev. 1991, 5, 135–153. [Google Scholar] [CrossRef]

- Friedman, A.E. The Economics of the Common Pool: Property Rights in Exhaustible Resources. UCLA Law Rev. 1970, 18, 855. [Google Scholar]

- Levine, R. Law, Endowments and Property Rights. J. Econ. Perspect. 2005, 19, 61–88. [Google Scholar] [CrossRef] [Green Version]

- Sprankling, J.G. The International Law of Property; Oxford University Press: Oxford, UK, 2014; Volume 1. [Google Scholar]

- Stephenson, M.A. Property. Chapter 22; University of Queensland: St. Lucia, Australia, 2013. [Google Scholar]

- Dictionary.com. Available online: http://www.dictionary.com/browse/inalienable?s=t (accessed on 14 May 2018).

- Thomas, J.A.C. The Institutes of Justinian: Text, translation, and commentary; North-Holland: Amsterdam, The Netherlands, 1975. [Google Scholar]

- Williams, R.A. The Medieval and Renaissance Origins of the Status of the American-Indian in Western Legal Thought. South. Calif. Law Rev. 1983, 57, 1. [Google Scholar]

- Dobra, J. Divergent Mineral Rights Regimes a Natural Experiment in Canada and the United States Yields Lessons; Fraser Institute: Vancouver, BC, USA, 2014. [Google Scholar]

- Jagger, K. Minerals, mining leases and native title. Aust. Min. Pet. Law J. 2002, 21, 236–243. [Google Scholar]

- Johnson, E.L. Mineral Rights—Legal Systems Governing Exploration and Exploitation; Royal Institute of Technology (KTH): Stockholm, Sweden, 2010. [Google Scholar]

- Lindley, C.H. A Treatise on the American Law Relating to Mines and Mineral Lands within the Public Land States and Territories and Governing the Acquisition and Enjoyment of Mining Rights in Lands of the Public Domain; F.B. Rothman: Littleton, CO, USA, 1988; Volume 3. [Google Scholar]

- Rose, C.M. Expanding the choices for the global commons: Comparing newfangled tradable allowance schemes to old-fashioned common property regimes. Duke Environ. Law Policy Forum 1999, 10, 45–72. [Google Scholar]

- Larschan, B.; Brennan, B.C. The common heritage of mankind principle in international law. Columbia J. Trans. Law 1983, 21, 305. [Google Scholar]

- Blackstone, W.S.; Warren, S. Blackstone’s Commentaries: Systematically Abridged and Adapted to the Existing State of the Law and Constitution: With Great Additions; W. Maxwell: London, UK, 1856; Volume 2. [Google Scholar]

- Ryan, B. The law surrounding “miner’s right”: Origin of the Mining Law of Queensland. J. R. Hist. Soc. Qld. Brisbane 1974, 9, 101–114. [Google Scholar]

- Blackstone, W.S. Blackstone’s Commentaries. Book Two. Chapter 2. p. 18. Available online: http://avalon.law.yale.edu/18th_century/blackstone_bk2ch2.asp (accessed on 14 May 2018).

- Roark, E. Applying Locke’s Proviso to Unappropriated Natural Resources. Polit. Stud. 2012, 60, 687–702. [Google Scholar] [CrossRef]

- Ostrom, E.; Ebooks, C. Governing the Commons: The Evolution of Institutions for Collective Action; Cambridge University Press: New York, NY, USA; Cambridge, UK, 1990. [Google Scholar]

- Sax, J.L. The Public Trust Doctrine in Natural Resource Law: Effective Judicial Intervention. Mich. Law Rev. 1970, 68, 471–566. [Google Scholar] [CrossRef]

- Rose, C.M. Joseph Sax and the idea of the public trust. Ecol. Law Q. 1998, 25, 351–362. [Google Scholar] [CrossRef]

- Wood, M.C. Nature’s trust: Reclaiming and environmental discourse. Va. Environ. Law J. 2007, 25, 243. [Google Scholar]

- Farley, J.; Costanza, R.; Flomenhoft, G.; Kirk, D. The Vermont Common Assets Trust: An institution for sustainable, just and efficient resource allocation. Ecol. Econ. 2015, 109, 71–79. [Google Scholar] [CrossRef]

- Buxton, C.R. Property in outer space: The common heritage of mankind principle vs. the “first in time, first in right” rule of property law. J. Air Law Commer. 2004, 69, 689. [Google Scholar]

- Coffey, S. Establishing a legal framework for property rights to natural resources in outer space. Case West. Reserve J. Int. Law 2009, 41, 119. [Google Scholar]

- Zell, J.L. Putting a mine on the moon: Creating an international authority to regulate mining rights in outer space. Minn. J. Int. Law 2006, 15, 489. [Google Scholar]

- Leach, M. Property Rights In Outer Space. Scitech Lawyer 2014, 10, 4. [Google Scholar]

- Lee, R.J. Law and Regulation of Commercial Mining of Minerals in Outer Space; Springer: Dordrecht, The Netherlands; New York, NY, USA, 2012; Volume 7. [Google Scholar]

- Pop, V. Who Owns the Moon?: Extraterrestrial Aspects of Land and Mineral Resources Ownership; Springer: New York, NY, USA, 2009; Volume 4. [Google Scholar]

- Nations, U. Antarctic Treaty Parties. Available online: http://www.ats.aq/devAS/ats_parties.aspx?lang=e (accessed on 14 May 2018).

- Koeber, J. The US Mulls Breaking an International Treaty So Americans Can Mine Asteroids. Available online: https://motherboard.vice.com/en_us/article/4x3m99/the-us-mulls-breaking-an-international-treaty-so-americans-can-mine-asteroids (accessed on 14 May 2018).

- Majinge, C.R. The Doctrine of Permanent Sovereignty over Natural Resources in International Law and Its Application in Developing Countries: The Case of the Mining Sector in Tanzania. Afr. Yearbook Int. Law 2008, 34, 235–268. [Google Scholar] [CrossRef]

- Pereira, R.; Gough, O. Permanent sovereignty over natural resources in the 21st century: Natural resource governance and the right to self-determination of indigenous peoples under international law. Melb. J. Int. Law 2013, 14, 451–495. [Google Scholar]

- United Nations. Un Declaration on the Rights of Indigenous Peoples, 2007; United Nations: New York, NY, USA, 2007. [Google Scholar]

- Niblock, T. The American Indian and Alaskan Native Development Index: The Progress of and Prospects for. Indian Country. Undergrad. Econ. Rev. 2007, 3, 7. [Google Scholar]

- Dippel, C. Forced Coexistence and Economic Development: Evidence from Native American Reservations. Econometrica 2014, 82, 2131–2165. [Google Scholar] [CrossRef]

- Henson, E.C. The State of the Native Nations: Conditions under U.S. Policies of Self-Determination: The Harvard Project on American Indian Economic Development; Oxford University Press: New York, NY, USA, 2008. [Google Scholar]

- Hurst, M. The determinants of earnings differentials for indigenous Americans: Human capital, location, or discrimination? Q. Rev. Econ. Financ. 1997, 37, 787–807. [Google Scholar] [CrossRef]

- Necefer, L.; Wong-Parodi, G.; Jaramillo, P.; Small, M.J. Energy development and Native Americans: Values and beliefs about energy from the Navajo Nation. Energy Res. Soc. Sci. 2015, 7, 1–11. [Google Scholar] [CrossRef]

- Randall, K.Q.A.; Spilde, K.A.; Taylor, J.B. Social and Economic Changes on American Indian Reservations in California: An Examination of Twenty Years of Tribal Government Gaming1. UNLV Gaming Res. Rev. J. 2014, 18, 39. [Google Scholar]

- Grogan, M.; Morse, R.; Youpee-Roll, A. Native American Lands and Natural Resource Development; Revenue Watch Institute: New York, NY, USA, 2011. [Google Scholar]

- Government of Canada, Indigenous and Northern Affairs. FAQ about Mining Royalty in Nunavut and the Northwest Territories; Government of Canada, Indigenous and Northern Affairs: Ottawa, ON, Canada, 2018.

- Government of Canada, Indigenous and Northern Affairs. Tlicho Agreement; Government of Canada, Indigenous and Northern Affairs: Ottawa, ON, Canada, 2018.

- Cook, S.E. Community management of mineral resources: The case of the Royal Bafokeng Nation. J. S. Afr. Inst. Min. Metall. 2013, 113, 61–66. [Google Scholar]

- Mbenga, B.; Manson, A. ‘The Richest Tribe in Africa’: Platinum-Mining and the Bafokeng in South Africa’s North West Province, 1965–1999. J. S. Afr. Stud. 2003, 29, 25–47. [Google Scholar]

- Alaska Department of Revenue, Permanent Fund Dividend Division. Summary of Dividend Applications & Payments. Available online: https://pfd.alaska.gov/Division-Info/Summary-of-Applications-and-Payments (accessed on 14 April 2018).

- Cummine, A. Citizens’ Wealth: Why (and How) Sovereign Funds Should be Managed by the People for the People; Yale University Press: New Haven, CT, USA, 2016. [Google Scholar]

- Project, C.C. Constitute. Available online: https://www.constituteproject.org/search (accessed on 14 May 2018).

- EISourceBook. Policy, Legal and Contractual Framework. Available online: http://www.eisourcebook.org/642_5PolicyLegalandContractualFramework.html (accessed on 14 May 2018).

- Otto, J. Mining Royalties: A Global Study of Their Impact on Investors, Government, and Civil Society; World Bank: Washington, DC, USA, 2006. [Google Scholar]

- Otto, J.; Cordes, J. The Regulation of Mineral Enterprises: A Global Perspective on Economics, Law and Policy; Rocky Mountain Mineral Law Foundation: Westminster, CO, USA, 2002. [Google Scholar]

- Otto, J.M. A national mineral policy as a regulatory tool. Resour. Policy 1997, 23, 1–7. [Google Scholar] [CrossRef]

- Otto, J.M. Global changes in mining laws, agreements and tax systems. Resour. Policy 1998, 24, 79–86. [Google Scholar] [CrossRef]

- Bastida, E.; Wälde, T.; Warden-Fernández, J. International and Comparative Mineral Law and Policy; Kluwer Law International: Hague, The Netherlands, 2005. [Google Scholar]

- Vietnam Vietnam Constitution 1992 (rev. 2013). Available online: https://www.constituteproject.org/constitution/Socialist_Republic_of_Vietnam_2013?lang=en (accessed on 14 May 2018).

- Fong-Sam, Y. The Mineral Industry of Vietnam; USGS, US Department of the Interior: Washington, DC, USA, 2017.

- Government of Myanmar. Mining Law of 1994; Government of Myanmar: Naypidaw, Myanmar, 1994; Chapter VII.

- Yeung, Y.; Howes, S. Resources-to-Cash: A Cautionary Tale from Mongolia; Development Policy Centre, Australian National University: Canberra, Australia, 2015. [Google Scholar]

- Denoon, D. Getting under the Skin: The Bougainville Copper Agreement and the Creation of the Panguna Mine; Melbourne University Press: Carlton, Australia, 2000. [Google Scholar]

- Hermkens, A.-K. Marian Movements and Secessionist Warfare in Bougainville, Papua New Guinea. J. Altern. Emerg. Relig. 2015, 18, 35–54. [Google Scholar] [CrossRef]

- Lasslett, K. State Crime on the Margins of Empire: Rio Tinto, the War on Bougainville and Resistance to Mining; Pluto Press: London, UK, 2014. [Google Scholar]

- Regan, A.J.; Griffin, H.-M. Bougainville before the Conflict; Pandanus Books: Canberra, Australia, 2005. [Google Scholar]

- Ciaran O’Faircheallaigh, G.B.S., phone conversation with Flomenhoft, G., 15 May 2015.

- Thomas, T. The naughty nation of Nauru; Quadrant Magazine Company, Inc.: Balmain, Australia, 2013; Volume 57, pp. 30–34. [Google Scholar]

- Kent State University Libraries. SPSS Tutorials: Independent Samples t Test. Available online: https://libguides.library.kent.edu/SPSS/IndependentTTest (accessed on 16 May 2018).

- Hepburn, S. Feudal tenure and native title: Revising an enduring fiction. Syd. Law Rev. 2005, 27, 49–86. [Google Scholar]

- Belmessous, S. Empire by Treaty: Negotiating European Expansion, 1600–1900; Oxford University Press USA—OSO: Cary, NC, USA, 2014. [Google Scholar]

- Waal, F.D.; Macedo, S.; Ober, J.; Wright, R. Primates and Philosophers: How Morality Evolved; Princeton University Press: Princeton, NJ, USA, 2006. [Google Scholar]

- Yamamoto, S.; Takimoto, A. Empathy and Fairness: Psychological Mechanisms for Eliciting and Maintaining Prosociality and Cooperation in Primates. Soc. Justice Res. 2012, 25, 233–255. [Google Scholar] [CrossRef]

- Sandbu, M.E. Natural wealth accounts: A proposal for alleviating the natural resource curse. World Dev. 2006, 34, 1153–1170. [Google Scholar] [CrossRef]

- Segal, P. Resource Rents, Redistribution, and Halving Global Poverty: The Resource Dividend. World Dev. 2011, 39, 475–489. [Google Scholar] [CrossRef] [Green Version]

| Type of Ownership | CODE | Mean HDI 2014 | #n |

|---|---|---|---|

| No minerals | 0 | 0.748 | 7 |

| President | 1 | 0.599 | 4 |

| State/crown | 2 | 0.673 | 143 |

| People (common, communal) | 3 | 0.683 | 19 |

| customary (traditional) landowners | 4 | 0.651 | 8 |

| Decentralized/mixed | 5 | 0.851 | 10 |

| Claimant/landowner | 6 | 0.875 | 8 |

| Total | 199 |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Flomenhoft, G. Historical and Empirical Basis for Communal Title in Minerals at the National Level: Does Ownership Matter for Human Development? Sustainability 2018, 10, 1958. https://doi.org/10.3390/su10061958

Flomenhoft G. Historical and Empirical Basis for Communal Title in Minerals at the National Level: Does Ownership Matter for Human Development? Sustainability. 2018; 10(6):1958. https://doi.org/10.3390/su10061958

Chicago/Turabian StyleFlomenhoft, Gary. 2018. "Historical and Empirical Basis for Communal Title in Minerals at the National Level: Does Ownership Matter for Human Development?" Sustainability 10, no. 6: 1958. https://doi.org/10.3390/su10061958