Abstract

This paper investigates the horizontal Nash game and structure selection strategy in two competing dominant enterprises. Each firm decides whether to outsource the retail or manufacture to the exclusive third-party enterprise and thus forms a decentralized supply chain structure. On the premise that third-party enterprises have no advantage on sales and manufacture cost, the revenue-sharing contract is introduced between the manufacturer and retailer, and the influence of decentralized structure on the game equilibrium structure and supply chain profit is analyzed based on Hotelling model. The results show that, when compared with centralized structure, decentralized supply chain has the structural advantage to improving not only its supply chain profits but also the competing chain. This interesting insight is counterintuitive to the common “double marginalization” effect and explains the outsourcing strategy from the perspective of supply chain competition. In addition, we find the dominant strategy in the evolutionary game is that both two chains are decentralized or integrated.

1. Introduction

The competition between supply chains or channels has been increasingly acknowledged by both academy and industry, and the core enterprises not only compete with upstream and downstream firms in the same supply chain but also interact with the horizontal firms in other supply chain from the perspective of network [1,2,3,4]. Chain-to-chain competition exists in a variety of industries such as automotive, electronics, fashion clothing, and coal industry [5,6]. For these trades, the core firm is bound to consider the selection and optimization of supply chain structure in order to gain competitive advantages. In general, there are two critical options when the decision-maker adopts the strategy of production or sales, i.e., outsourcing or not. Essentially, outsourcing is a decentralized structure, while self-marketing belongs to vertically integrated supply chain. Which structure integrated or decentralized critically impacts the supply chain’s and core firm’s own performance in the horizontal chain-to-chain competition?

In fact, we observe that the strategic and structural choice varies with the individual. For example: as the follower in automobile supply chain, the retailers of China First Auto Works (FAW) usually sell cars and trucks through the franchises-in-disguise way, but Mercedes-Benz and Toyota entered Chinese market in the form of self-sale in the early stage, while cooperated with the domestic large auto retailers (such as Dachang Group), in recent years, and built a stable supply chain. In the coal industrial supply chain, the downstream marketing or trading companies of Datong Coal Mine Group are mostly fully controlled, while Yangquan Coal Group has formed a long-term supply chain partnership with downstream sales companies through sharing stock rather than holding way. In addition, core enterprise Jinneng Group (formerly the largest coal retailer in Shanxi, China) early engaged in sales business for upstream coal mines, but in recently, has adopted the forward mergers and acquisitions strategies to achieve the integration of production and marketing to enhance competence. Theoretically, the supply chain built by FAW and its retailers are decentralized, Mercedes-Benz and Toyota were initially centralized and then have collapsed with retailers to construct a decentralized supply chain. And the supply chain for Jinneng has changed from decentralization to centralization. Similarly, Datong Coal Mine Group belongs to integrated supply chain, but Yangquan Coal Group is decentralized in essence. It is worthwhile to consider what factors lead to such a different supply chain structure. Furthermore, in order to improve supply chain competitive advantage, how to design the supply chain structure of the core enterprises, that is, whether to outsource non-core businesses, such as production or sales, has become a primary issue in this field.

Thus, two key questions arise: (1) How do core enterprises make decisions on supply chain structure in regarding integration and decentralization? (2) Whether core enterprises outsource the non-core business when the third-party firm has no cost advantage? And what are specific conditions for outsourcing? In this paper, we attempt to address these questions.

Motivated by above facts and key questions, this paper aims to analyze how the choice of supply chain structure affects core firms’ profits and their strategies and what the game equilibrium is. To verify the influence of the bargaining power on the structure selection and equilibrium, two games under different dominant types, manufacturer-led and retailer-led, of the supply chain are compared. Furthermore, we consider two horizontal competing core firms (e.g., manufacturers in manufacturer-led supply chain, or retailers in retailer-led supply chain) who decide whether to introduce exclusive third-party companies (retailers in manufacturer-led supply chain, or manufacturers in retailer-led supply chain accordingly) to form a decentralized supply chain. We assume that the two core firms are balanced in bargaining power at first. In short, we will focus on bargaining power, chain-to-chain competition, and how the structure change affects the game equilibrium and what the final steady state is in this evolutionary game. The rest of this paper is organized as follows: Section 2 briefly provides a literature review concentrating on the internal and external supply chain competition. In Section 3, we propose the problem and competition game. The equilibriums under manufacturer-led and retailer-led bargaining power settings are derived in Section 4 and Section 5, respectively. The comparison of equilibriums in various supply chain structures is made in Section 6. The numerical experiments are presented in Section 7 to compare the profits of supply chains under three competitive structures in both MS and RS models. Finally, conclusions and future research suggestions are provided in Section 8.

2. Literature Review

In this section, we have provided a brief review of literature related to competition and structural choice in supply chain. There are two closely related research streams.

The first is on the competition among core firms and upstream or downstream enterprises in the internal supply chain. This type of research is relatively rich in recent years, which may differ on one or more critical perspectives [7,8,9,10,11,12,13], such as pricing strategy [7,8,9], channel selection [8,10,11], network externality [11],demand uncertainty [11,12], product substitutability [13].The literature in the first research stream is relatively abundant and mature, both in the theoretical system and model methods, which can contribute to our analysis on the external competition and game for supply chain in this paper, but this research stream is not our focus.

Another stream of research related to our paper focuses on the external competition for two supply chains. One of the most fundamental studies is the work made by McGuire and Staelin, which analyzes various distribution structures in the context of two competitive suppliers. A primary conclusion is that the decentralized supply chain is preferable option for both core suppliers when products are relatively substitutable, reflecting that the competition plays a vital role in optimal channel and structure decision [14]. Coughlan introduces a general demand assumption, and indicates that integration is negatively associated with the products’ substitutability, and symmetric channel structures are stable [15]. Choi extends this research and considers two competitive manufacturers and a common retailer facing a newsvendor demand [16] while Zhao and Shi consider two competing supply chains include multiple suppliers and a single retailer, and demonstrate that the decentralization performs better under fierce competition, but when there are a large number of suppliers, integrated supply chains perform better [17]. More recently, Chen et al. [18] investigate the value of information and pricing decisions in competing supply chains based on [17], indicating that when the competition is more intense, information sharing makes supply chain better off, when less intense, sharing makes it worse off. Furthermore, Li et al. [19] extend this work to investigate the problem of channel choice game in two power-imbalanced supply chains. They find that integrated channel is the dominant strategy for the leader, and the follower will gradually switch from integration to decentralized distribution channel as the increasing degree of product substitutability in Stackelberg game. Moreover, Veldman and Gaalman analyze the effects of incentives for product quality and process improvement, utilizing a game considered two owners–manager pairs in competition. Their results reveal that the integration performs preferable when lower degree of substitutability in single structure (i.e., pure decentralized or integrated for both chains), but in hybrid channels (one chain is decentralized and another one is centralized), the integration performs better [20]. From the perspective of supply uncertainty, Fang and Shou propose a Cournot competition between two supply chains that consist of a retailer and an exclusive supplier which has random yield. The results show that the centralization is a dominant strategy which always makes the customers better off. Nevertheless, if the competition is intensive, the centralization could actually decrease the profit of supply chain, compared with the case where both chains do not choose centralization. On the other hand, if the competition level is low, the centralization always increases the supply chain profit [21]. Then Li and Nagurney develop a supply chain network consisting of competing suppliers and competing firms who decide whether purchase components or produce the components by themselves [22]. Li and Li further extend above work by analyzing the chain-to-chain competition for sustainable products and find that vertical integration is Pareto optimal only with low degree of competition [23]. Bian et al. study bilateral information sharing in two competing supply chains and a Bayesian Stackelberg game under horizontal supply chain competition, which is proposed based on Bertrand competition model and Winkler’s consensus model [24]. Then the green product design issues in supply chains are investigated with price and greenness competition. A horizontal retailer competition is considered in the model, and this paper finds that supply chain price competition at the retailer level may positively influence the equilibrium [25]. Chen et al. examine how a direct channel added can influence the decisions members’ profits in the context of a retailer Stackelberg supply chain [26]. Further, the model is expanded and examined the retailer’s backward integration strategy and discussed the effects of channel integration on the price and quality competition between two quality-differentiated brands and on the supply chain’s performance [27].

In summary, several primary conclusions can be obtained from above literatures regarding the internal and external supply chain competition: (1) The centralized supply chain is not always the best performance benchmark that is usually considered. On the contrast, the decentralization may perform preferable under certain conditions, such as competition, substitutability and supply uncertainty. This indicates that competition plays a vital role in performance optimal and structural choice, which inspires us to uncover this secret in the process; (2) There is a counterintuitive finding, that is, competition is not always a terrible thing by reducing members’ profits. It is also the necessity of research in this field; (3) The choice of supply chain contract is related to competition. Moreover, the revenue sharing contract has more advantages in supply chain coordination, especially when the competition is fierce. This conclusion also provides some reference for the contract in this study. In stark contrast to above literatures, this paper extends the existing research and primary contributions summarized as follows: (1) Existing literatures generally ascribe outsourcing to the cost advantage, expertise and other factors of third enterprise, but this paper explains the outsourcing strategy from the perspective of supply chain and detects a “double marginalization” paradox, that is, the decentralization has a particular structural advantage and performs better in comparison with the centralization when considering chain-to-chain competition; (2) We find that no matter in manufacture-led or retailer-led supply chain Nash competition, the steady state of the final game evolution is the consistency of the two chains, that is, both chains are centralized or decentralized. And we find that maintaining the same supply chain structure can generate dramatic spillover effect which benefits all the participants when faced with horizontal competition; (3) The supply chain competition in existing literatures mainly focuses on the external two chains, members in the internal chain or product market. On the contrary, this paper focuses on the horizontal Nash competition for two supply chains, including two core enterprises, whose bargaining powers are balanced, and two exclusive upstream or downstream third-party firms. Core firms outsource their noncore businesses, such as manufacturing or retail; (4) In the content, this model deliberately considers and compares supply chain competition and structural choice under two kinds of bargaining power structure: one is manufacturer-oriented Stackelberg supply chain competition, the other is retailer-led Stackelberg competition. The comparison is made to fully compare how the power structure affects supply chain competition and structural choice. However, previous literatures on this subject rarely involve the bargaining power of members or supply chains. This article covers this research gap; (5) For the model approach and method, most of existing papers propose a single Stackelberg/Cournot/Nash game. In contrast, we construct a new composite model by embedding Stackelberg game into Nash Bargain, and the game equilibriums under equal bargaining power for supply chains are derived. This may be a new replenishment in this field for future research.

3. Problem Identification and Analysis

Existing literatures on supply chain competition or optimization generally assume a random or uncertain demand function in a newsvendor model, and build a game model to obtain the equilibrium through game or optimization methods [4,7,11,13,16,19,21]. However, this paper studies the optimal structural choice of two supply chains under horizontal competition based on Hotelling model. The reasons to use Hotelling model mainly based on two points. First of all, the Hotelling model aims at two core firms who produce or sell identical type product, and only involves the pricing problem without other aspects of the product differences. The choice of pursuing product depends on the location and retail price. The purpose and emphasis of this paper is to study the impacts of structure and horizontal competition on performance of supply chain. These factors, such as quality, brands, service, except price must be set as control variables that are consistent with assumptions of Hotelling model. Secondly, this paper mainly determines the optimal supply chain structure by comparing the consumer surplus and the performance of the core business through the price. However, the demand function in the existing literature of price competition and enterprise competition is usually a linear or exponential form of price, which may undoubtedly increase the complexity of this paper in the process of the game equilibrium. Meanwhile, the form of demand function and the influence of price on demand are not the focus of this study. Therefore, using the uniform linear market assumption in the Hotelling model is likely to simplify our model and game equilibrium process.

As noted in [17] in the study of two competing supply chain structures and contract types selection, revenue sharing contract is better than wholesale price contract in the decentralized structure for downstream retailers. Therefore, this paper introduces revenue sharing contract to ensure supply chain coordination.

We pose some key hypotheses and parameters to construct and simplify our game model.

First, we consider two horizontal competing core firms for i (i = 1, 2), who have the same bargaining power in Nash game. And the location () in a Hotelling linear market area whose length is 1. Without loss of generality, we assume that the core enterprise 1 is on the left side of 2 and the retail price is charged by enterprise i.

Secondly, this model assumes that manufacturers have no cost advantage on production and the retailers have no advantage on sales. General studies suggest that the outsourcing is due to the lower cost and service specialization of third parties. For example, compared with the manufacturer, the retailers’ location in the supply chain is closer to the consumer market, which leads to the strengths of sales channels, retail services, and market information, ultimately manifested as the form of cost advantage. Meanwhile, compared with retailers, manufacturers have strengths in terms of production technology and equipment, product development and design. In this paper, we presuppose that the third-parties have no cost advantage is to better analyze the impact of supply chain structure on the core business, that is, we will simply explore outsourcing options and competition from the perspective of the structural advantages of supply chain rather than the usual consideration of the 3P cost strengths. In addition, we will verify whether the core firms in the horizontal competition will still choose outsourcing (e.g., decentralized supply chain) when the 3P has no cost advantage.

Finally, we assume the products are completely inelastic, and utility, for U, is large enough to make the market completely covered. However, the linear form of the demand function is likely to lead to no equilibrium solution [28]. Therefore, in order to facilitate the formation and solution of game equilibrium and to ensure that the distance is non-negative, this paper assumes that the travel cost of consumers is proportional to the square of the distance, that is to say, the consumers’ surplus is . We define the following relevant variables and notations:

| Unit utility of product | |

| Profit of manufacturer i | |

| Profit of retailer i | |

| Unit retail price of product | |

| Unit wholesale price of product | |

| Revenue sharing ratio | |

| The location of core firm i | |

| Critical location | |

| Unit travel cost of product for customer | |

| Unit manufacturing cost of product | |

| Unit sales cost of product |

The model involves three types of supply chain, as shown in Table 1. Since (CD) and (DC) are the essentially same type of structure, that is, one chain is integrated and the other one chooses decentralization, we only use (CD) to denote the mixed type for ease of the comparison and differentiation with the other two structures.

Table 1.

Supply chain structures and symbols.

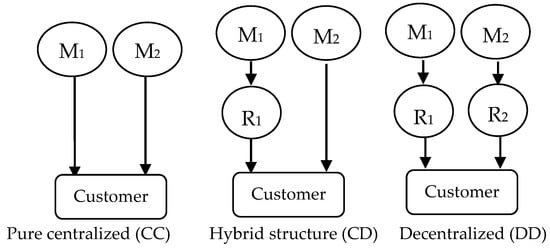

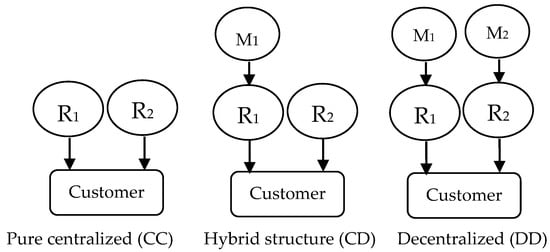

In order to better understand the effect of bargaining power of supply chains on the optimizing and equilibrium, two dominant types of supply chain and two Stackelberg models are established accordingly: manufacturer Stackelberg (MS) and retailer Stackelberg (RS). Three structures in MS and RS are illustrated in Figure 1 and Figure 2.

Figure 1.

Structures in MS supply chain.

Figure 2.

Structures in RS supply chain.

Next, horizontal Nash competition in the MS and RS supply chains is analyzed.

4. Horizontal Competition and Optimization in the MS Supply Chain

In this section, we analyze the game and optimization under CC, CD and DD structure in the MS supply chain by means of backward recursion, respectively, and finally derive equilibrium results under these three settings.

4.1. Pure Centralized Structures (CC)

We firstly characterize the game behavior for two centralized supply chains controlled by two manufacturers, respectively. This section can be used as a benchmark for the decentralized and the mixed case to analyze the impact of different supply chain structure on the equilibrium results in the next section.

In the first case, both chains are integrated, i.e., the manufacturer and the retailer in each chain are fully cooperative to gain the whole chain’s maximal profit. To simplify the model, here we can use a dominant firm or manufacturer i (i = 1, 2) to represent the members in each supply chain, and distribute the product to consumers through its own channel, having no retail and production outsourcing. Then the chain-to-chain competition becomes a Nash game between two dominant manufacturers.

The specific sequence of this game is as follows:

- (1)

- The core manufacturer i decides the retail price to simultaneously maximize the overall profit for supply chain i.

- (2)

- The consumers make purchase decision between two core firms to maximize their own consumer surplus.

We define a critical position, denoted by , where the consumer surplus for firm 1 and firm 2 is equal. It means that customers on the left of choose the product of manufacturer 1, while the right ones choose manufacturer 2. Easy to get:

and the critical position is solved as follows:

Thus, for the given retail price , the profit function of manufacturers can be expressed as follows:

Then we use backward recursion method in game theory to solve. The following theorem characterizes the unique pure strategy Nash equilibrium and the players’ optimal profits for the CC structure.

Theorem 1.

(CC Equilibrium) When both chains are centralized, the unique pure strategy Nash equilibrium of manufacturer Stackelberg (MS) game is given by:

and the corresponding optimal profits of players are as follows:

4.2. Mixed Structures (CD)

In this section, we study the structure where one supply chain is integrated, while the other is decentralized. We discuss how to design the optimal retail price and wholesale price to maximize the players’ profits in this mixed competition game.

Without loss of generality, we suppose that chain 1, composed of manufacturer 1 and retailer 1, is decentralized and chain 2 is centralized. Revenue sharing contract is introduced in order to achieve supply chain 1 coordination.

The specific sequence of this game is as follows:

- (1)

- The core manufacturer 1 announces the wholesale price to retailer1 to maximize the overall profit for supply chain 1.

- (2)

- The retailer 1 and manufacturer 2 announce the retail price and simultaneously to maximize each profit.

- (3)

- The revenue sharing contract parameter is decided to make chain 1 coordinate.

It is obvious that the profit of manufacturer 1 is:

and the profit of retailer 1 is:

the profit of manufacturer 2 is:

Then we can get the unique pure strategy sub-game perfect Nash equilibrium and the players’ optimal profits for the CD structure.

Theorem 2.

(CD Equilibrium) In hybrid structure, the unique pure strategy SPNE of manufacturer Stackelberg (MS) game is given by:

and the corresponding optimal profits of players are given by:

4.3. Decentralized Structures (DD)

In this scenario, we study the case where both chains are decentralized. For convenience, it is assumed that the supply chain i is compose of the manufacturer i as the leader in Stackelberg game, and the exclusive retailer i as the follower. Also, the revenue sharing contract is introduced to achieve both chains coordination. We focus on how to design the optimal retail price and wholesale price to maximize the players’ profits in the chain-to-chain Nash competition.

The specific sequence of this game is as follows:

- (1)

- As the leader of Stackelberg game, the core manufacturer i announces the wholesale price to retailer i simultaneously to maximize the overall profit for supply chain i.

- (2)

- The retailer i announces the retail price simultaneously to maximize each profit.

- (3)

- The revenue sharing contract parameter is decided to make chain i coordinate.

What we should note here is that the goal of core player (manufacturer i) is to maximize the total profit of chain i, whereas the retailer i focuses on the individual profit.

Obviously, the profits of manufacturers are:

and the profits of retailers are:

The following theorem is the unique pure strategy sub-game perfect Nash equilibrium and the players’ optimal profit for the DD structure.

Theorem 3.

(DD Equilibrium) When both chains are decentralized, the unique pure strategy SPNE of manufacturer Stackelberg (MS) game is given by:

and the corresponding optimal profits of players are given by:

5. Horizontal Competition and Optimization in the RS Supply Chain

In the previous parts, we have derived the equilibrium under three settings for MS competition games. In order to verify whether the power affects the optimal structural choice of supply chain under horizontal competition, this section further analyzes and derives the equilibrium under CC, CD and DD structures in the retailer Stackelberg (RS) supply chain, respectively.

5.1. Pure Centralized Structures (CC)

In this section, both of the two retailer-led chains are integrated. For convenience, we use a dominant firm retailer i (i = 1, 2) to represent the member in each supply chain and distribute the product to consumers through its own channel.

The specific sequence of this game is as follows:

- (1)

- The core retailer i decides the retail price simultaneously to maximize the overall profit for supply chain i.

- (2)

- The consumers make purchase decision between two core firms to maximize their own consumer surplus.

Similar to the case of MS, we can get the critical position as follows:

Then the retailers’ profit functions can be expressed as follows:

Then we can get the following theorem.

Theorem 4.

(CC Equilibrium) When both chains are centralized, the unique pure strategy Nash equilibrium of RS game is given by:

and the corresponding optimal profits of players are as follows:

5.2. Mixed Structures (CD)

Now we study the setting where one supply chain is integrated, while the other is decentralized. Without loss of generality, we suppose that chain 1, composed of manufacturer 1 and retailer 1, is decentralized and chain 2 is centralized. The revenue sharing contract is introduced in order to achieve the decentralized supply chain 1 coordination.

The specific sequence of this game is as follows:

- (1)

- As the Stackelberg leader, the core retailer i announces the retail price to maximize their own profits simultaneously.

- (2)

- The manufacturer 1 announces the wholesale price to maximize the profit for chain 1.

- (3)

- The revenue sharing contract parameter is decided to make chain 1 coordinate.

It is obvious that the profit of manufacturer 1 is:

and the profit of retailer 1 is:

the profit of manufacturer 2 is:

Then we can get the equilibrium below.

Theorem 5.

(CD Equilibrium) In hybrid structure, the unique pure strategy SPNE of RS game is given by:

and the corresponding optimal profits of players are given by:

5.3. Decentralized Structures (DD)

This scenario studies the case where both chains are decentralized. For convenience, we assume that the supply chain i is composed of a leader (retailer i) and an exclusive follower (manufacturer i). Revenue sharing contracts are also introduced to achieve both chains coordination.

The specific sequence is as follows:

- (1)

- The retailer i announces the retail price simultaneously to maximize each own profit.

- (2)

- As the follower, the manufacturer i decides the wholesale price to maximize the overall profit for supply chain i simultaneously.

- (3)

- The revenue sharing contract parameters are decided to make each chain coordinate.

Obviously, the profits of manufacturers are:

and the profits of retailers are:

Theorem 6.

(DD Equilibrium) When both chains are decentralized, the unique pure strategy SPNE of RS game is given by:

and the corresponding optimal profits of players are given by:

6. Results

In order to answer why many enterprises in practice outsource non-core business, i.e., choose the decentralized chain, under different bargaining power hypotheses from the perspective of supply chain, we need to skillfully change our mind by using reverse thinking. Firstly, it is obviously that the choice of supply chain or channel structure depends on whether core firms can gain higher profit. Therefore, if we can verify that the performance in decentralized supply chain is better than the centralized, this phenomenon or result can be explained from the perspective of supply chain competition. As a consequence, next, we compare these previous results and equilibriums derived under different competition games. For convenience, here, we use superscript “CC”, “CD”, “DD” to denote above three structures, and use “T” to denote the total profit of supply chain.

6.1. Comparison between CD and CC Structures

In order to better gain and compare the results, we must fix one chain’s structure as the control, and change the other at the same time.

For the chain 1, we find and in both MS and RS games. These results show that “double marginalization” effect really appears after that the supply chain structure shifts from the centralized to the decentralized, which directly results in customer loss. However, the total profit has increased over the decentralized () about 12.5%. This is a paradox different from the general view that “double marginalization” erodes supply chain profits. That is a really interesting and counterintuitive discovery in this paper. In addition, we find which illustrates that this structural change not only increases its own profit, but also promotes the profit of competing chain when the chain shifts from integrated to decentralized. Hence, Corollary 1 is summarized, as follows.

Corollary 1.

In the horizontal chain-to-chain Nash competition, when a core firm chooses integrated supply chain structure, another chain shifts to decentralized, not only enhancing the overall profit of its own chain, but also exerting positive external spillover effect which can benefit the competing chain at the same time.

This corollary is clearly counterintuitive to our general knowledge. Classical double marginalization theory holds that the overall profit of decentralized supply chain is lower than the centralized due to members’ selfishness and competitive behavior. But this model proves that decentralized chain has a special structural advantage that not only promotes its own performance, but also exerts positive externality that results in the improvement of opponent chain, especially with the consideration of the horizontal competition and game.

6.2. Comparison between DD and CD Structures

For the chain 2, we find and in both MS and RS competition games. This presents that “double marginalization” really happens when the chain shifts from the integrated to the decentralized, directly leading to customer loss in the linear market. Even so, we find and , that is, the total profits are higher than before for not only the chain itself but another competing one. This consequence is also a “double marginalization” paradox. Therefore Corollary 2 is summarized as follows.

Corollary 2.

In the horizontal chain-to-chain Nash competition, when a supply chain is decentralized, another chain shifts to decentralized not only enhancing the overall profit itself but also exerting positive external spillover effect, the performance of competing chain is improved at the same time.

This result further provides evidence to support the “double marginalization” paradox obtained in Corollary 1. These two findings show that decentralized structure is better than centralized one from the perspective of supply chain performance when considering chain-to-chain competition in horizontal. That is a paradox different from the general academic view that “double marginalization” can reduce supply chain profits.

6.3. Comparison among CC, CD and DD Structures

In order to further analyze the evolutionary game and structure optimization under different bargaining powers and supply chain structures, a comprehensive comparison of the equilibriums under three settings has been undertaken in this section. Firstly, the following corollary can be obtained easily.

Corollary 3.

In the horizontal chain-to-chain Nash competition, both of the retail and wholesale prices of the product are cost-plus pricing based on the sum of manufacturing and retail costs.

This corollary clearly implies supply chain members’ behavior tend towards interest and profit, that is, both the manufacturing and retail costs are firstly taken into account when optimizing the wholesale and retail prices, no matter what structure or model the core enterprises choose. This above finding is also consistent with true circumstances.

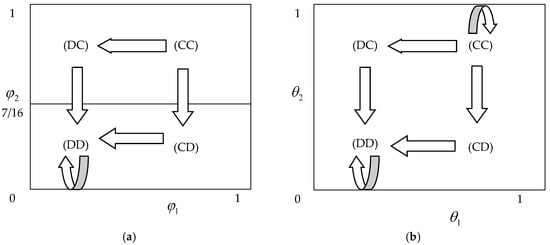

Next, the equilibriums of the three chain structures under the power assumptions of both MS and RS are analyzed in detail and the results of evolutionary game as shown in Figure 3. The arrows indicate the evolutionary direction of the game.

Figure 3.

The dynamic evolution paths under different bargaining powers. (a) The process of dynamic equilibrium of evolutionary game in MS model; (b) The process of dynamic equilibrium of evolutionary game in RS model.

It is easy to observe following three evolution paths from Figure 3. First of all, if the initial competition is DD, the equilibrium will always be stable under this structure both in power setting of MS and RS. Secondly, if the initial competition structure is CD or DD which is unstable, eventually it is possible to reach the stable state of DD with the development of evolutionary game. This result is also valid in both MS and RS game and can be easily deduced from the above Corollaries 1 and 2. Thirdly, if the structure is CC in the beginning, it inevitably evolves toward CD or DC, eventually reaching DD in the MS model, while very stable in the RS model. As a consequence, the steady state of evolutionary game is DD or CC.

According to the above analysis and comparison, we can get Corollary 4.

Corollary 4.

In the horizontal chain-to-chain Nash competition, regardless of the bargaining power and the structure of competing chain, decentralized structure can always improve the overall performance of the supply chain and also exerts dramatically positive external spillover effect, meanwhile, the performance of competing chain is vastly promoted.

This corollary reveals that decentralized supply chain has unique inherent structural advantages, and proves that business outsourcing is good for the core enterprise itself when confronts the horizontal competitor.

7. Numerical Experiments

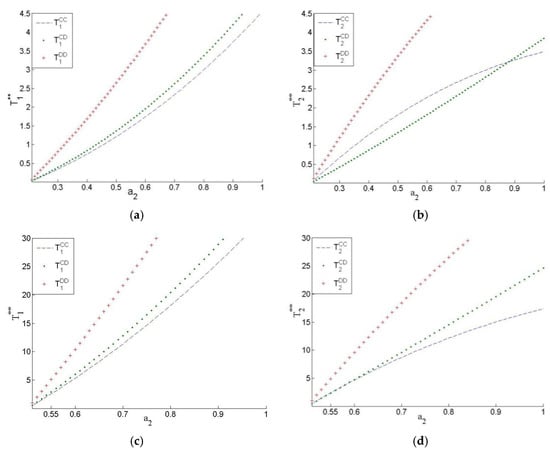

In order to further explore the impact of chain-to-chain competition on the evolutionary game equilibrium, in this section, the numerical experiments are compared the profits of supply chains under three competitive structures of CC, CD and DD in both MS and RS models respectively. It is easy to deduce that the total profits of supply chain are the function of , , from above theorems. Among them, the distance between two core firms in the Hotelling linear market, i.e., , reflects the degree of competition. The smaller the value of distance, the more intense the competition is. We characterize the variation of competition through fixing and gradually increasing . In consequence, two sets of comparative experiments are designed for the purpose of more comprehensive and detailed analysis, that is, how the competition between chains affects the change of optimal profits, from both internal and external perspectives. Parameter values are set based on the problem assumptions. Specifically, we set , and , , then let increase from 0.2 to 1 and from 0.5 to 1, accordingly. The experimental results are shown in Figure 4.

Figure 4.

Variation of supply chain profits under different bargaining powers and competitive structures for various . (a) Variation of chain 1 profit when , in MS model; (b) Variation of chain 2 profit when , in MS model; (c) Variation of chain 1 profit when , in RS model; (d) Variation of chain 2 profit when , in RS model.

Two insights can be briefly extrapolated from Figure 4.

Firstly, supply chain profits gradually increase with . This result shows that the farther the two core enterprises in the Hotelling linear market, the better the two supply chains. It reflects that the spillover effects of the two chains become larger and larger as the degree of competition slows. The first insight is obviously consistent with common sense, that is, under certain conditions, the more intense the market competition, the less profitable the enterprises, but the larger the surplus from the consumer’s point of view.

Secondly, the supply chain profit in DD structure is higher than that in CD, and in most cases, CD is higher than CC, especially when the competition is assuasive, which depicts the process of game evolution, i.e., CC->CD->DD. This result further supports Corollary 1, 2, 4 that the profit for decentralized chain is higher than that for integrated one, and it is different from the case for a single supply chain without any competition.

8. Conclusions

This paper constructs a chain-to-chain Nash competition game based on Hotelling model and studies the optimal supply chain structural choice problem under two different bargaining power structures. Assuming that the third party has no cost advantage, this model explains the outsourcing strategy from the perspective of supply chain and detects a “double marginalization” paradox. The main conclusions in this paper are:

- (1)

- In the horizontal chain-to-chain Nash competition, regardless of the bargaining power and the structure of competing chain, shifting to decentralized structure will increase the profit of its own chain, and exert dramatically positive external spillover effect, which benefits the opponent chain. This conclusion is apparently counterintuitive to our general knowledge that the decentralization always leads to a lower profit for a supply chain than the integration (e.g., [29,30,31]), which is referred to the effect of “double marginalization”. However, this research finds that the decentralization has a particular advantage when considering chain-to-chain competition regardless of the bargaining power.

- (2)

- Even if the cost advantage, expertise and other factors of third enterprise are ignored, outsourcing itself has some structural advantages in competition. This article explains the research question why more and more enterprises in the practical production choose to outsource when faced with competition from the unique perspective of the structural advantage of decentralized supply chain.

- (3)

- No matter in manufacture-led or retailer-led supply chain Nash competition, the steady state of the final game evolution is the consistency of the two chains, that is, both chains are centralized or decentralized.

Therefore, two vital managerial implications are:

- (1)

- Core firms outsource the “non-core” businesses, such as production or sales, to the third-party enterprises is more favorable than the ways of self-production. They only need to focus on their own professional businesses, especially facing competition. Furthermore, it provides some basis for outsourcing strategy.

- (2)

- When faced with horizontal competition, either both two firms adopt outsourcing strategy or both produce and sell by themselves at the same time. It verifies an old Chinese saying that “Concerted action alone leads to victory”. That is, maintaining the same supply chain structure can generate dramatic spillover effect, which benefits all the participants.

There are several future research directions. In this paper, we assume that there is equal bargaining power between two supply chains and the third firms are exclusive. Further research can be done by relaxing power structure assumption, e.g., considering one chain is the leader and another is the follower in Stackelberg game(like [19]). Moreover, the Hotelling model is used in our paper, another future research direction is to introduce a more general demand function (e.g., [9,11,17]) to verify the conclusions obtained in this model. In addition, we can also consider risk management and disruption.

Author Contributions

Yucai Wu and Jiguang Wang designed the research and game model. Yucai Wu, Changhong Li and Kan Su discussed the optimization method. Yucai Wu and Kan Su designed numerical experiment. Yucai Wu wrote the paper. All authors read and discussed the final manuscript.

Acknowledgments

This research was funded by the MOE (Ministry of Education in China) Project of Humanities and Social Sciences (grant numbers 16YJC630116).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Choi, S.C. Price competition in a duopoly common retailer channel. J. Retail. 1996, 72, 117–134. [Google Scholar] [CrossRef]

- Tsay, A.; Agrawal, N. Channel dynamics under price and service competition. Manuf. Serv. Oper. Manag. 2000, 2, 372–391. [Google Scholar] [CrossRef]

- Bernstein, F.; Federgruen, A. Decentralized supply chains with competing retailers under demand uncertainty. Manag. Sci. 2005, 51, 18–29. [Google Scholar] [CrossRef]

- Zhao, X.; Atkins, D. Newsvendors under simultaneous price and inventory competition. Manuf. Serv. Oper. Manag. 2008, 10, 539–546. [Google Scholar] [CrossRef]

- McIvor, R. Outsourcing: Insights from the telecommunications industry. Supply Chain Manag. 2003, 8, 380–394. [Google Scholar] [CrossRef]

- Jin, Y.; Ryan, J.K. Price and service competition in an outsourced supply chain. Prod. Oper. Manag. 2012, 21, 331–344. [Google Scholar] [CrossRef]

- Wang, J.; Wang, A.; Wang, Y. Markup pricing strategies between a dominant retailer and competitive manufacturers. Comput. Ind. Eng. 2013, 64, 235–246. [Google Scholar] [CrossRef]

- Liu, Y.; Tyagi, R. The benefits of competitive upward channel decentralization. Manag. Sci. 2011, 57, 741–751. [Google Scholar] [CrossRef]

- Yang, S.; Shi, C.; Zhang, Y.; Zhu, J. Price competition for retailers with profit and revenue targets. Int. J. Prod. Econ. 2014, 154, 233–242. [Google Scholar] [CrossRef]

- Glock, C.H.; Kim, T. The effect of forward integration on a single-vendor–multi-retailer supply chain under retailer competition. Int. J. Prod. Econ. 2015, 164, 179–192. [Google Scholar] [CrossRef]

- Wu, X.; Zhou, Y. The optimal reverse channel choice under supply chain competition. Eur. J. Oper. Res. 2017, 259, 63–66. [Google Scholar] [CrossRef]

- Liu, X. Contracting for competitive supply chains under network externalities and demand uncertainty. Discret. Dyn. Nat. Soc. 2016, 2016, 1–9. [Google Scholar] [CrossRef]

- Wang, F.; Zhuo, X.; Niu, B. Sustainability analysis and buy-back coordination in a fashion supply chain with price competition and demand uncertainty. Sustainability 2016, 9, 25. [Google Scholar] [CrossRef]

- McGuire, T.W.; Staelin, R. An industry equilibrium analysis of downstream vertical integration. Manag. Sci. 1983, 2, 161–191. [Google Scholar] [CrossRef]

- Coughlan, A.T. Competition and cooperation in marketing channel choice: Theory and application. Manag. Sci. 1985, 4, 110–129. [Google Scholar] [CrossRef]

- Choi, S.C. Price competition in a channel structure with a common retailer. Manag. Sci. 1991, 10, 271–296. [Google Scholar] [CrossRef]

- Zhao, X.; Shi, C. Structuring and contracting in competing supply chains. Int. J. Prod. Econ. 2011, 134, 434–446. [Google Scholar] [CrossRef]

- Chen, K.; Liang, J.; Li, J. Information structures and pricing decisions in competing supply chains. J. Syst. Sci. Syst. Eng. 2012, 21, 226–254. [Google Scholar] [CrossRef]

- Li, B.; Zhou, Y.; Wang, X. Equilibrium analysis of distribution channel structures under power imbalance and asymmetric information. Int. J. Prod. Res. 2013, 51, 2698–2714. [Google Scholar] [CrossRef]

- Veldman, J.; Gaalman, G. A model of strategic product quality and process improvement incentives. Int. J. Prod. Econ. 2014, 149, 202–210. [Google Scholar] [CrossRef]

- Fang, Y.; Shou, B. Managing supply uncertainty under supply chain Cournot competition. Eur. J. Oper. Res. 2015, 243, 156–176. [Google Scholar] [CrossRef]

- Li, D.; Nagurney, A. A general multitiered supply chain network model of quality competition with suppliers. Int. J. Prod. Econ. 2015, 170, 336–356. [Google Scholar] [CrossRef]

- Li, X.; Li, Y. Chain-to-chain competition on product sustainability. J. Clean. Prod. 2016, 112, 2058–2065. [Google Scholar] [CrossRef]

- Bian, W.; Shang, J.; Zhang, J. Two-way information sharing under supply chain competition. Int. J. Prod. Econ. 2016, 178, 82–94. [Google Scholar] [CrossRef]

- Zhu, W.; He, Y. Green product design in supply chains under competition. Eur. J. Oper. Res. 2017, 258, 165–180. [Google Scholar] [CrossRef]

- Chen, X.; Zhang, H.; Zhang, M. Optimal decisions in a retailer Stackelberg supply chain. Int. J. Prod. Econ. 2017, 187, 260–270. [Google Scholar] [CrossRef]

- Li, W.; Chen, J. Backward integration strategy in a retailer Stackelberg supply Chain. Omega 2018, 75, 118–130. [Google Scholar] [CrossRef]

- D’Aspremont, C.; Thisse, J. On Hotelling’s “stability in competition”. Econometrica 1979, 47, 1145–1150. [Google Scholar] [CrossRef]

- Gaudet, G.; Long, N. Vertical integration, foreclosure, and profits in the presence of double marginalization. J. Econ. Manag. Strateg. 1996, 5, 409–432. [Google Scholar] [CrossRef]

- Li, X.; Li, Y.; Cai, X. Double marginalization and coordination in the supply chain with uncertain supply. Eur. J. Oper. Res. 2013, 226, 228–236. [Google Scholar] [CrossRef]

- Agrell, P.J.; Lundin, J.; Norrman, A. Supply chain management: Horizontal carrier coordination through cooperative governance structure. Int. J. Prod. Econ. 2017, 194, 59–72. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).