1. Introduction

Environmental decision-makers are struggling mainly with social and political issues, which have arisen due to the views held on how to properly conduct investment decision-making and what the outcomes should be [

1]. A broad consensus has been established that the Sustainability Balanced Scorecard (SBSC) is one of the most effective tools in evaluating potential investments and initiatives by better integration of the environmental, social and economic aspects of corporate sustainability measurement and management [

2,

3]. The SBSC evolved from the traditional Balanced Scorecard (BSC). SBSC types are generally organized in one of two ways: (a) sustainability data embedded within the four perspectives scorecard; or (b) adding the sustainability perspective as an additional fifth perspective to the scorecard [

2].

Scholarly debate about SBSC types focuses on whether additional performance perspectives should be used to address sustainability objectives or whether sustainability issues should be integrated into the existing performance perspectives [

4,

5]. Corporate sustainability is increasingly becoming a knowledge-based practice to improve the quality of sustainable development and environmental investment decision-making [

6]. The SBSC was developed to support the corporate sustainability effort, although there still exists a lack of clarity on what aspects constitute the SBSC and how to best achieve it [

7].

The incremental SBSC improvement has added new environmental data which requires knowledge to transfer the data to the valuable information that could reduce resource intensity and minimize the environmental impact of production; together with value creation. In this regard, eco-efficiency is an improved measure of sustainability because it links environmental impacts directly with some kind of economic performance [

8] and it works as a valuable tool towards evaluating investment opportunities [

9,

10].

However, inadequate knowledge regarding eco-efficiency processes such as a lack of knowledge regarding the selection and composition of appropriate environmental data granularities and regarding the model quality to improve investment decision-making [

11] negatively influence the evaluation of sustainability goals and their achievement [

10]. The two types of knowledge established as being important for environmental decision-making are eco-efficiency knowledge and SBSC knowledge [

9,

12]. Eco-efficiency knowledge means the knowledge of all the processes related to the product lifecycle to properly prioritize a list of likely interventions of efficient sources and to make better environmental investment decisions to achieve a higher level of sustainability [

13]. Furthermore, this knowledge is also related to what people know and are concerned about regarding the natural environment, their responsibilities towards environmental protection and the relationship between the economy and sustainable development [

14]. With eco-efficiency knowledge, decision-makers are expected to process data (SBSC indicators), know what can be done about the environmental problems (action-related knowledge), and understand the benefits and effectiveness of environmentally responsible actions [

15] in enhancing environmental investment decision-making.

Hence, knowledge of eco-efficiency indicators may guide managers to design products using fewer environmentally harmful or resource-depleting raw materials which could significantly reduce direct manufacturing costs and increase inventory savings [

9]. Therefore, a better understanding of the efficient use of environmental data will guide the appropriate use of SBSC measures to enhance environmental investment decision-making [

7].

For SBSC type knowledge, the lack of such knowledge is said to cause insufficient use of the SBSC measurements [

16]. SBSC proponents have also found that managers’ knowledge deficiency regarding the unique measures (leading indicators) and common measures (lagging indicators) will confound their decision- making [

4,

17]. As such, insufficient understanding of the SBSC metrics can negatively affect decision-making. The level of knowledge and understanding of the SBSC metrics is likely to influence how evaluators use common and unique measures to evaluate the performance [

18].

Accordingly, weighting SBSC measures equally leads to SBSC disruption [

19]. Dilla and Steinbart [

20] argued that each measure must be properly understood to achieve the targets of a firm, as each business unit must acquire knowledge and receive training on the scorecard measures. In this context, it is likely that the lack of knowledge on SBSC measures may pose obstacles for the effective decision-making of managers, consequently seriously limiting their view of business performance. An example of this is when supervisors evaluate the performance of managers using the SBSC based only on common measures across different units and not on the measures that were unique to particular business unit [

17,

21]. Extant literature on SBSC and eco-efficiency has highlighted that knowledge about sustainable development may enhance environmental investment decision-making [

7,

22]. However, there is a lack of literature that examines the impact of the mediating role of eco-efficiency knowledge and SBSC knowledge on the relationship between SBSC types and environmental investment decision-making, signifying that this aspect may have been overlooked.

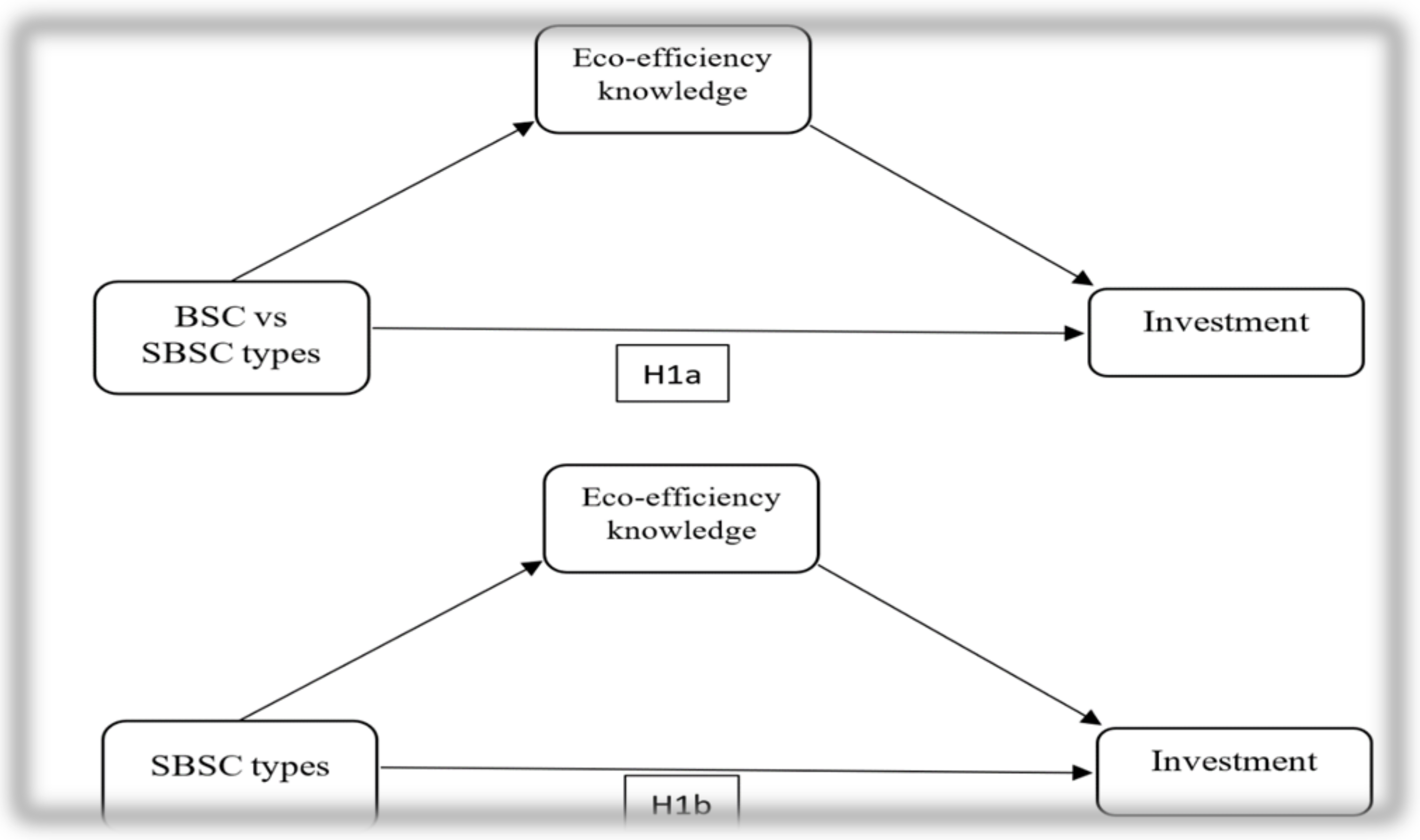

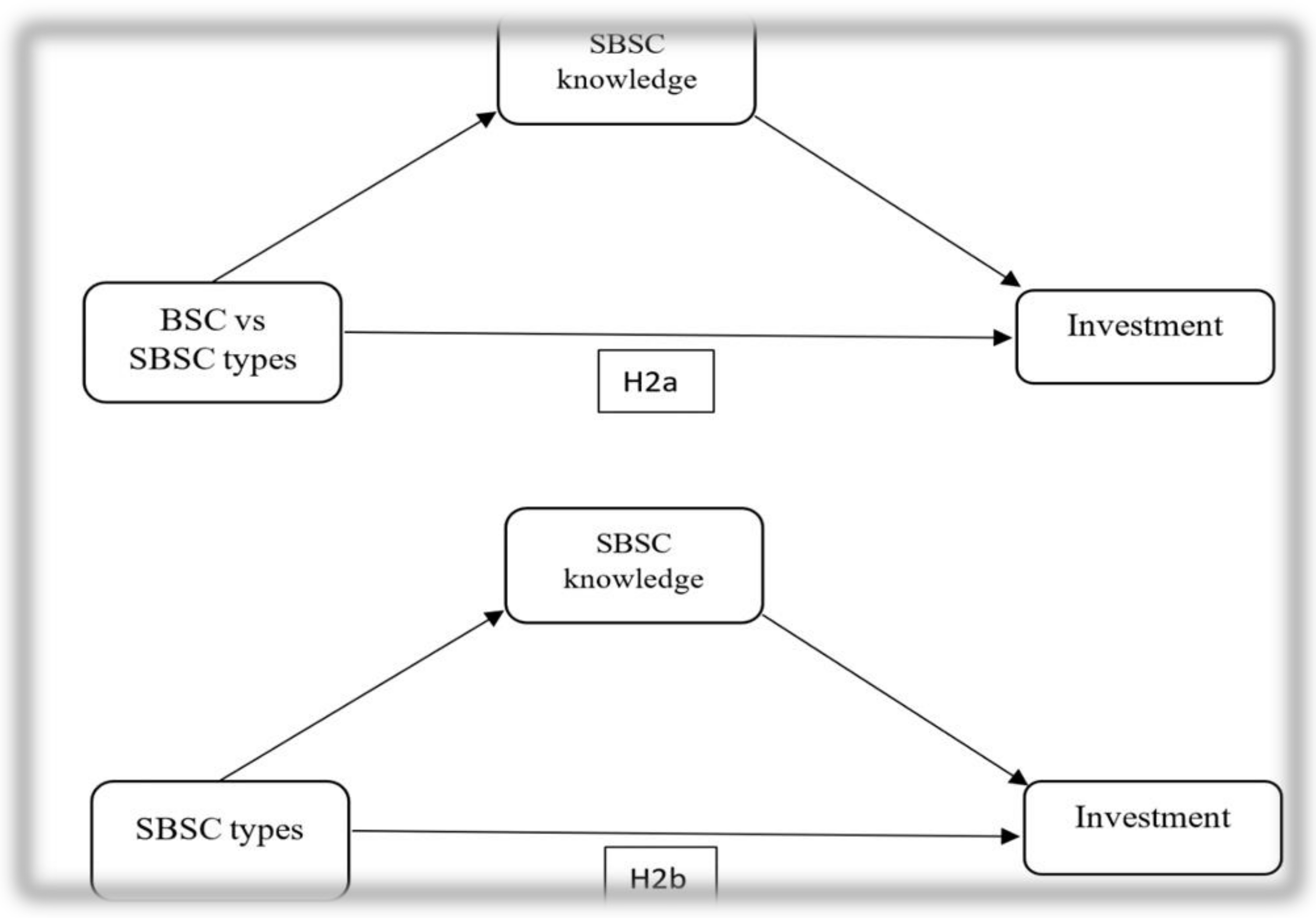

This study aims to examine the serial mediation effect of eco-efficiency knowledge and SBSC knowledge on the relationship between SBSC type and environmental investment decision-making. With this aim in mind, this study employs the experimental method by building on work done by Alewine and Stone [

2], with the target experimental method being a between-subjects study (3 × 1). This study contributes to the SBSC type and environmental investment literature by providing insights into how eco-efficiency knowledge and SBSC knowledge contribute to achieving a firm’s environmental objectives.

The rest of the paper is organized as follows.

Section 2 reviews relevant literature and proposes hypotheses.

Section 3 discusses the experimental method.

Section 4 presents the results.

Section 5 presents the discussion and conclusion.

3. Methods

This study deploys experimental research design building upon the work of [

2]. A between-subjects experimental study was used to investigate whether eco-efficiency knowledge and SBSC knowledge affected the direct relationship between BSC architectures (traditional four-perspective BSC, four-perspective SBSC, or five-perspective SBSC) and environmental investment decision-making. The procedure and instruments used in this study were adapted from [

2]. The experimental manipulation was conducted based on the two different SBSC types mentioned earlier. The traditional BSC architecture represented a control group with four perspectives, which were: financial, customer, internal business, and learning growth. For the SBSC type, there was a four-perspective SBSC and a five-perspective SBSC architecture. The former had environmental data embedded into the traditional four perspectives, while the latter contained the traditional four perspectives and environmental concerns as a stand-alone fifth perspective. The participants were randomly assigned to one of the three experimental conditions. In this study, the participants applied four metrics for each perspective, derived from [

17,

46,

47].

In total, 71 postgraduate students participated. This number of participants was precisely chosen according to suggestions by Hair and others who stated that the most acceptable way of determination in an experimental research is with a 10:1 ratio (10 samples for one variable) [

46]. Of those, 60 participants (80%) completed the instrument. The remaining participants, with incomplete answers, were discarded. The number of female students (55%) exceeded that of male students (45%). The participants were mostly between the ages 20 and 34 (62%). The mean work experience of the participants was 2.5 years, while most (65%) of the participants had more than three years of experience.

First, the participants were randomly assigned to one of the three conditions. Next, they were required to complete a demographic section which requested the following information: years of work experience, age, gender, tertiary education, and any past accounting courses taken at a tertiary level. The participants were also required to provide an e-mail address and were given a raffle ticket to participate in a draw. Five winners from the draw were awarded prizes. Next, the participants were given a summary of how the eco-efficiency concept is linked to an organization’s strategic objectives and tested on their understanding of this information. They were also given a summary of how the SBSC concept is linked to an organization’s strategic objectives (environmental information was not introduced at this stage) and tested on their understanding of this information. Both of the tests conducted above are further explained in

Section 3.1.

Then, the participants were required to assume the role of the manager for a hypothetical organization—Company ABC. As managers, they had to decide how to allocate

$20 million to two proposed investment projects (Investments A and B). The amount of money invested in each project had to be aligned with the company’s two strategic objectives: financial success and environmental stewardship. Additionally, the participants were given the SBSC instrument which contained four or five perspectives (depending on the randomized condition presented to them). Each perspective contained four measurement metrics.

Table 1 presents these perspectives and their measurement metrics.

Under each metric (presented side by side), the company’s goals for each metric and projected metric values for Investments A and B were included. The projected metric values for the two investment projects differed. One investment showed projected metric values that would achieve better financial goals, and the other showed values that would better achieve environmental goals. Specifically, one investment project would achieve three of the four metrics in the financial perspective, whereas the other project would only achieve one of the four financial metrics. For the environmental metrics in the SBSC conditions, the investment project that was better at achieving financial metrics would only achieve one of the four environmental metrics, whereas the investment project that was worse at achieving financial metrics would achieve three of the four environmental metrics. For the projected metric values in the customer, internal business, and learning growth perspectives, both investments were equally attractive and were projected to not influence the participants’ evaluation of the two investments. This case was designed to create a tension between the two strategic objectives (financial success and environmental stewardship) of a hypothetical Company ABC [2]. The instrument for this study took approximately 10–20 min to complete.

3.1. Measurement of Variables

BSC and SBSC type. There were three sets of conditions (20 respondents in each condition): a four-perspective BSC, a four-perspective SBSC, and a five-perspective SBSC. The perspectives in the four-perspective BSC were financial, customer, internal business, and learning and growth, with no environmental perspective. The four-perspective SBSC condition embedded the environmental perspectives within the traditional four-perspective scorecard. The five-perspective SBSC had the traditional four-perspective scorecard and the environmental perspective as a stand-alone fifth perspective. The measures for the SBSC type was based on Alewine and Stone [

2]. Their measurement was based on various scorecard research such as [

17,

47,

48]. Based on the sequence in [

2], a value of one was given to the four-perspective BSC conditions, a value of two to the four-perspective SBSC conditions, and a value of three to the five-perspective SBSC conditions.

Eco-efficiency knowledge. The participants were given a summary of how the eco-efficiency concept is linked to an organization’s strategic objectives. Then, they were tested on this understanding. Eco-efficiency was measured using six true/false questions that had been adopted from literature [

41]. The participants were given a value of zero for incorrect answers and a value of one for correct answers. Two questions were dropped because of low inter-item correlation.

SBSC knowledge. The participants were given a summary of how the SBSC concept is linked to an organization’s strategic objectives. Then, they were tested on this understanding. The SBSC knowledge was measured using four true/false questions that had been adopted from Alewine and Stone [

2]. The participants were given a value of zero for incorrect answers and a value of one for correct answers.

Environmental Investment Decision-making. To measure investment decision-making, the participants were asked to indicate amounts between $0 and $20 million for the two investment projects: Investments A and B. For the four-perspective scorecard conditions, Investment B was seen as the superior financial alternative to Investment A, whereas in the four-perspective and five-perspective SBSC conditions, Investment A was seen as the superior environmental alternative.

3.2. Testing Serial Mediators

The model with two serial mediators was tested using Hayes’ PROCESS macro [

49]. PROCESS is a computational tool for SPSS that can be used for mediation analyses. It utilizes an ordinary least squares logistic regression-based analytical framework to estimate the direct and indirect effects in mediator models. Additionally, the macro applies bootstrap methods of 5000 samples to estimate the bias-corrected bootstrap confidence intervals and makes inferences about the indirect effects in mediation models. As the PROCESS macro provides a formal test of indirect effects, it is suited for the serial multiple mediation model deployed in this study.

4. Research Results

Manipulation check questions related to perspectives were included in the scorecard. Twenty-two participants did not identify the number of perspectives correctly on the scorecard. The same results were obtained after excluding those participants who failed this manipulation check question.

To test the effect of the SBSC types on environmental investment decision-making, serial multiple mediation analyses were run.

Figure 4 and

Figure 5 represent the tested serial multiple mediation model for the BSC versus SBSC and the SBSC type (four-perspective versus five-perspective), respectively. The c-path in the model includes the direct effect of the BSC versus SBSC on environmental investment decision-making, independent of the effect of the mediators (

c1) and the total effect of the BSC versus SBSC on environmental investment decision-making that attempts to achieve environmental objectives (

c), which is the sum of the direct effect and the indirect effect via the mediators [

49].

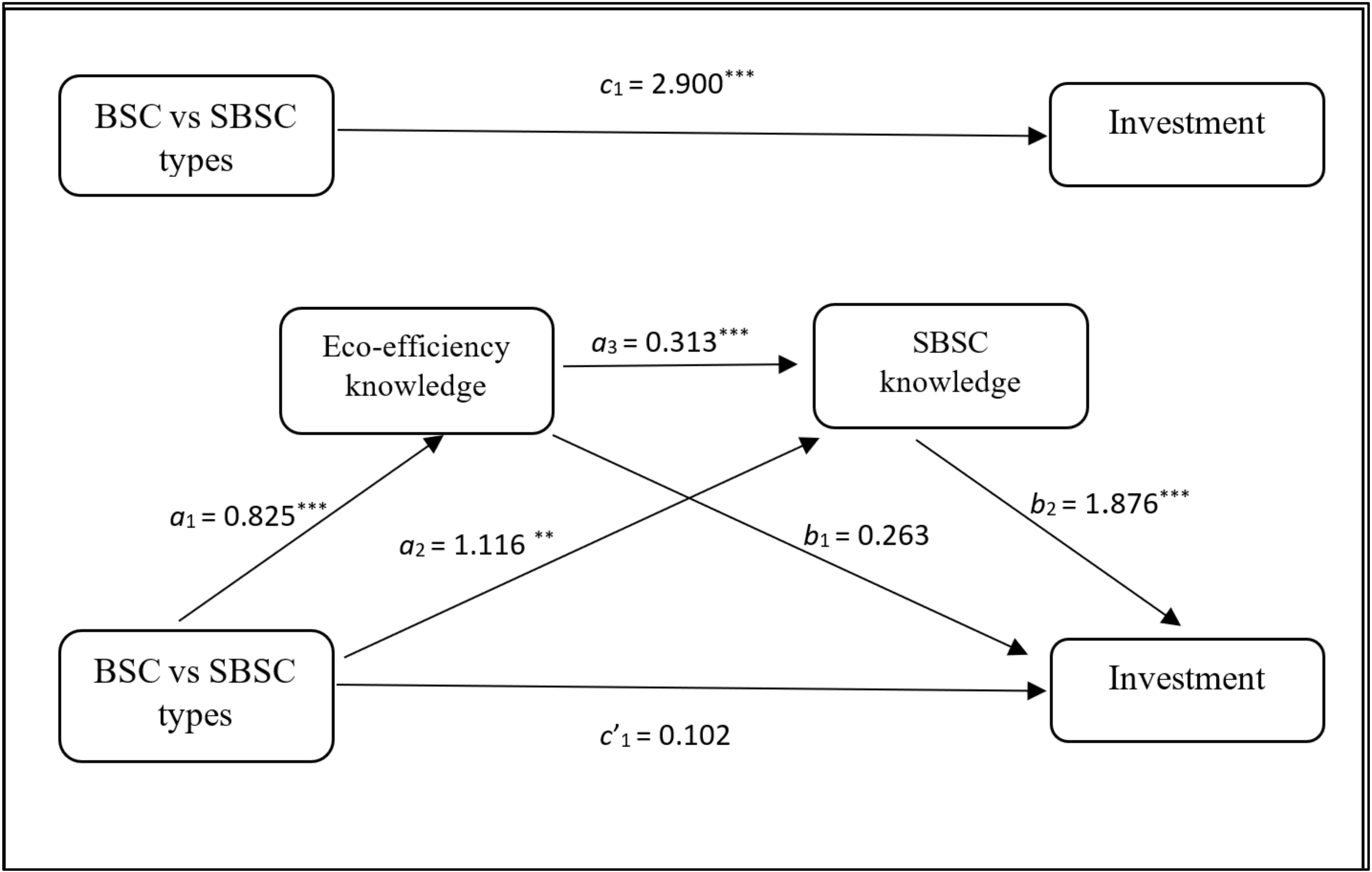

The total effect remains c1 = 2.900 (p < 0.001), as it is not influenced by the variables that are proposed as intervening between the BSC versus SBSC (BSC: n = 20, mean = 9.050, SD = 2.742) (SBSC: n = 40, mean = 11.950, SD = 3.281) and investment decisions that achieve environmental objectives. The direct effect of c′1 = 0.102 is not statistically significant (p = 0.941). One specific indirect effect is not significant, however, there are two specific indirect effects that are significant, as evidenced by the bootstrap confidence intervals that do not contain zero. The first indirect effect, H1a, is not significant. It carries the effect of the BSC versus SBSC through eco-efficiency knowledge only, bypassing SBSC knowledge. This indirect effect is the product of a1 = 0.825 and b1 = 0.263, with a 95% bootstrap confidence interval of −0.457–1.396. Eco-efficiency knowledge did not have any effect on the BSC versus SBSC and this did not result in better environmental investment decision-making, independent of SBSC knowledge. Therefore, H1a is not supported.

The next indirect effect, H2a, flows from the BSC versus SBSC directly to the SBSC knowledge and then to investment decisions that achieve environmental objectives, bypassing eco-efficiency knowledge, and is defined as the product of a2 = 1.116 and b2 = 1.876, with a 95% bootstrap confidence interval of 0.328–4.439. Therefore, for those who were given SBSCs with the environmental aspects and who had more SBSC knowledge (1.116 units more) than those who were not given SBSCs, this increased the SBSC knowledge associated with better investment decisions that achieved environmental objectives, independent of eco-efficiency knowledge. Hence, H2a is supported.

The last indirect effect of the BSC versus SBSC passes through both the eco-efficiency knowledge and the SBSC knowledge, which is H3a. It is estimated as the product of a1, a3 = 0.313, and b2, with a 95% bootstrap confidence interval of 0.020–1.953. Greater eco-efficiency knowledge resulting from the BSC versus SBSC translated into an increased SBSC knowledge, which in turn led to better investment decisions that achieved environmental objectives. Hence, H3a is supported. Thus, the evidence is consistent with the claim that eco-efficiency and SBSC knowledge influences the relationship between the BSC versus SBSC and investment decisions that achieve environmental objectives, indirectly through two of the three pathways.

The direct effect of c’1 = 3.121 is statistically significant (p = 0.03), for it is not affected by the variables that are proposed as intervening between the SBSC type (four-perspective versus five-perspective) (four-perspective SBSC: n = 20, mean = 11.000, SD = 1.025 or the five-perspective SBSC: n = 20, mean = 13.100, SD = 4.228) and investment decision-making that achieves environmental objectives. Two specific indirect effects are not significant. However, one specific indirect effect is significant, as evidenced by the bootstrap confidence intervals that do not contain zero. The first indirect effect, H1b, is not significant. It carries the effect of the SBSC type (four-perspective versus five-perspective) through eco-efficiency knowledge only, bypassing SBSC knowledge. This indirect effect is the product of a1 = 0.500 and b1 = 0.611, with a 95% bootstrap confidence interval of −1.132–0.232. Eco-efficiency knowledge did not have any effect on the SBSC type and this did not result in better investment decision-making that achieved environmental objectives, independent of SBSC knowledge. Therefore, H1b is not supported.

The next indirect effect, H2b, flows from the SBSC type (four-perspective versus five-perspective) directly to the SBSC knowledge and then to investment decision-making that achieves environmental objectives, bypassing eco-efficiency knowledge. It is defined as the product of a2 = −0.491 and b2 = 1.300, with a 95% bootstrap confidence interval of −1.639 to −0.141. Therefore, those who were given SBSC with five perspectives and had more SBSC knowledge made better investment decisions that achieved environmental objectives. H2b is supported.

In contrast, the last indirect effect of the four-perspective versus five-perspective SBSC passes through both the eco-efficiency knowledge and SBSC knowledge, which is H3b. It is estimated as the product a1, a3 = 0.117, and b2, with a 95% bootstrap confidence interval of −0.267–0.061. Thus, the combined effect of eco-efficiency knowledge and SBSC knowledge had no effect on the relationship between the SBSC type (four-perspective vs. five-perspective) and investment decision-making that achieved environmental objectives. This leads us to conclude that H3b is not supported.

5. Discussion and Conclusions

The purpose of the current study is to investigate whether eco-efficiency knowledge and SBSC knowledge mediate the relationship between the BSC versus SBSC or the SBSC type (SBSC four-perspective versus five-perspective) and environmental investment decision-making. Our findings lead us to conclude that eco-efficiency knowledge alone does not mediate the relationship between the BSC versus SBSC (H1a), the SBSC type (SBSC four-perspective versus five-perspective) (H1b) and investment decision-making that aims to achieve environmental objectives. This result is inconsistent with the findings of literature [

39] that proved that increasing the knowledge of the efficient use of capital and environmental resources guides better decision-making, thereby asserting that it is essential that information should be managed properly to enhance eco-efficiency knowledge for better investment decision-making [

13]. This conflicting result may be because knowledge of the efficient use of the process is not enough to interpret the data from the BSC and SBSC types unless it is combined with a knowledge of the SBSC architecture as well (e.g., [

28]).

In relation to the SBSC knowledge, this study confirms the findings of prior studies (e.g., [

5,

7,

20,

44]) which observed that knowledge of SBSC measures impacts the weight of investment decision-making that places importance on environmental performance. This knowledge, as predicted, improves the relationship between the BSC/SBSC types and environmental investment decision-making by enabling proper attention to be given to the different SBSC measures, (H2a and H2b). Thus, decision-makers who have no innate knowledge of the complex environmental measures may struggle to evaluate the decision relevance of such complex measures. Hence, there is a need for managers to have sufficient knowledge of SBSC measures and design to make good environmental investment decisions. SBSC knowledge also reduces the confusion of SBSC types by enabling the SBSC metrics to stand out by recognizing the most appropriate SBSC measures when choosing between alternatives (for example, the Common and Unique measures) [

4].

The combined effect of eco-efficiency knowledge and SBSC knowledge significantly influences the relationship between the BSC versus SBSC and better investment decision-making that achieves environmental objectives, (H3a). This is because eco-efficiency knowledge stands to expresses a relationship between the positive and negative effects of a decision. Besides that, eco-efficiency knowledge reflects the trade-offs between the economic and the environmental business performances and can be used to promote improvements along the value chain and the sustainability of products, processes, and services [

12], which in turn facilitates an increase of SBSC knowledge. However, these knowledge combinations did not have an impact on the relationship between the SBSC type and environmental investment decisions (H3b).

A reason for this result could be due to the way that environmental interrelated knowledge functions when changing from four to five SBSC perspectives and the way it has an impact on environmental investment decision-making. Since the literature has found that the way that the SBSC data are presented has different levels of influence on the decision-maker to make environmental decisions which require knowledge based on experience and practices instead of academic knowledge, Frick and Wilson [

15] argued that different forms of environmental knowledge do not work together unless knowledgeable participants are included. Therefore, this result could be quite motivational for researchers to conduct experimental methods with people such as a manager who have sufficient knowledge of SBSC architecture and knowledge related to environmental issues to examine the serial mediation effect of eco-efficiency knowledge and SBSC knowledge on the relationship between SBSC type and environmental investment decision-making and to compare the results to each conclusions which is necessary for successful environmental investment decision-making.

Consistent with previous research (e.g., [

12,

38,

48]), eco-efficiency knowledge and SBSC knowledge both influence environmental investment decision-making. This theory may be useful in explaining how environmental investment decision-making processes evolve with the increasing knowledge of eco-efficiency processes and SBSC metrics.

Consequently, this study can be useful in understanding the effect of knowledge, particularly eco-efficiency knowledge and SBSC knowledge, and in explaining the association between the BSC versus SBSC and investment decision-making that achieves environmental objectives. The results of the mediation effects show that appropriate sequential implementation of eco-efficiency knowledge and SBSC knowledge may enable manufacturers to reap environmental, economic, and investment benefits. In addition, its guide as a decision maker depends on the SBSC architecture (four or five perspectives) to achieve a better investment decision that achieves environmental objectives.

Based on this study, it can be concluded that knowledge on the quality of performance evaluation is essential to enhance investment decision-making and achieve environmental objectives. A lack of effective knowledge on the efficient use of environmental information and SBSC type can negatively affect the outcomes of environmental investment decisions. Thus, the current study uses the experimental method to demonstrate the role of eco-efficiency knowledge and SBSC knowledge in the relationship between SBSC types and environmental investment decision-making that emphasize environmental objectives. The results indicate that the direct proportional relationship between SBSC types and environmental investment decision-making is most significant with the presence of both eco-efficiency knowledge and SBSC knowledge. Meanwhile, the indirect impact of eco-efficiency knowledge and SBSC knowledge on the direct effect of SBSC type and environmental investment decision-making has not been seen. This is perhaps because eco-efficiency knowledge and SBSC knowledge are not specified as a set of measurements.

This study has certain limitations. Firstly, in determining the scope of the study, motivation by a real-world phenomenon is challenging. It can be difficult to identify appropriate measures for a certain construct. This study measured the SBSC knowledge by using four true/false questions that were adopted from [

2] and six true/false questions that were adopted from [

41] to examine eco-efficiency knowledge. These questions may not have addressed the different aspects of eco-efficiency knowledge and SBSC knowledge. The reason behind this is simply because knowledge is quite a broad aspect and thus the number of questions that have been used in the current study may not have been enough. Measuring knowledge requires a greater variety of questions to increase the reliability of the results obtained. However, there is an unavailability of studies that measure eco-efficiency knowledge and SBSC knowledge that could be adopted from. Thus, there is need to develop this study’s scales with more aspects to measure the individual’s knowledge of eco-efficiency and SBSC and figuring out its outcomes.

Another limitation of this study is that the participants were postgraduate students with very low levels of knowledge about the SBSC utilization in the real world and, probably, with no experience at all on allocating such an amount of money into competing projects. If the same experiment were conducted on participants who were experienced managers that utilize these tools in their work and are familiar with these concepts in their daily decision-making, the results could be improved.

Furthermore, this study adds to the SBSC and environmental investment literature [

2] by examining how eco-efficiency knowledge and SBSC knowledge impacts the relationship between the outcomes in a sustainability scorecard type context and environmental investment decision-making. Regarding the implication for the practice many organizations tend to adopt new ideas without providing adequate levels of training to their operational decision makers. Hence, a superficial understanding of concepts such as Eco Efficiency and SBSC architecture may not be able to link SBSC with decision-making that are geared towards fulfilling environmental objectives. Furthermore, the testing of the two mediators, Eco efficiency knowledge and SBSC knowledge, has practical significance because organizations would then realize that gearing up the depth and breadth of their managerial training programs is likely to create significantly higher results.

Further research may be contributed by answering which type of SBSC has more impact on environmental decision-making with the introduction of eco-efficiency knowledge and SBSC knowledge as mediators, as well as other factors such as risk management that may ultimately impact the evaluative effectiveness of decisions involving environmental accounting information to bring to conclusion the current debate regarding SBSC architecture [

50].