1. Introduction

“Sustainable” and “sustainable development” are terms that are used today in an inflationary way and they always require a definition and explanation. The internationally and most widely accepted definition of sustainable development is that found in the 1987 United Nations Report of the World Commission on Environment and Development Our Common Future (the “Brundtland Report”): “a development that meets the needs of the present without compromising the ability of future generations to meet their own needs” [

1]. This, however is an abstract, normative principle. It requires practical guidelines. In 1993 the German Federal Parliament established a study commission, the Enquete Commission for the Protection of Man and the Environment, to formulate rules [

2]. One dealt with the use of non-renewable resources: “The consumption of non-renewable resources should not exceed the amount that can be substituted for by functionally equivalent renewable resource, or by attaining a higher efficiency in the use of renewable and non-renewable resources.” Yet this guideline is still fairly abstract. Wagner and Wellmer [

3] attempted to develop more practical guidelines for the use of non-renewable resources and concluded that these guidelines could be observed by consistently finding solutions for functions required by society with resources of the geosphere and technosphere using the most important resource: human ingenuity and creativity. Instruments to achieve this goal are a circular economy, the optimization of substitution processes and the development of new technologies.

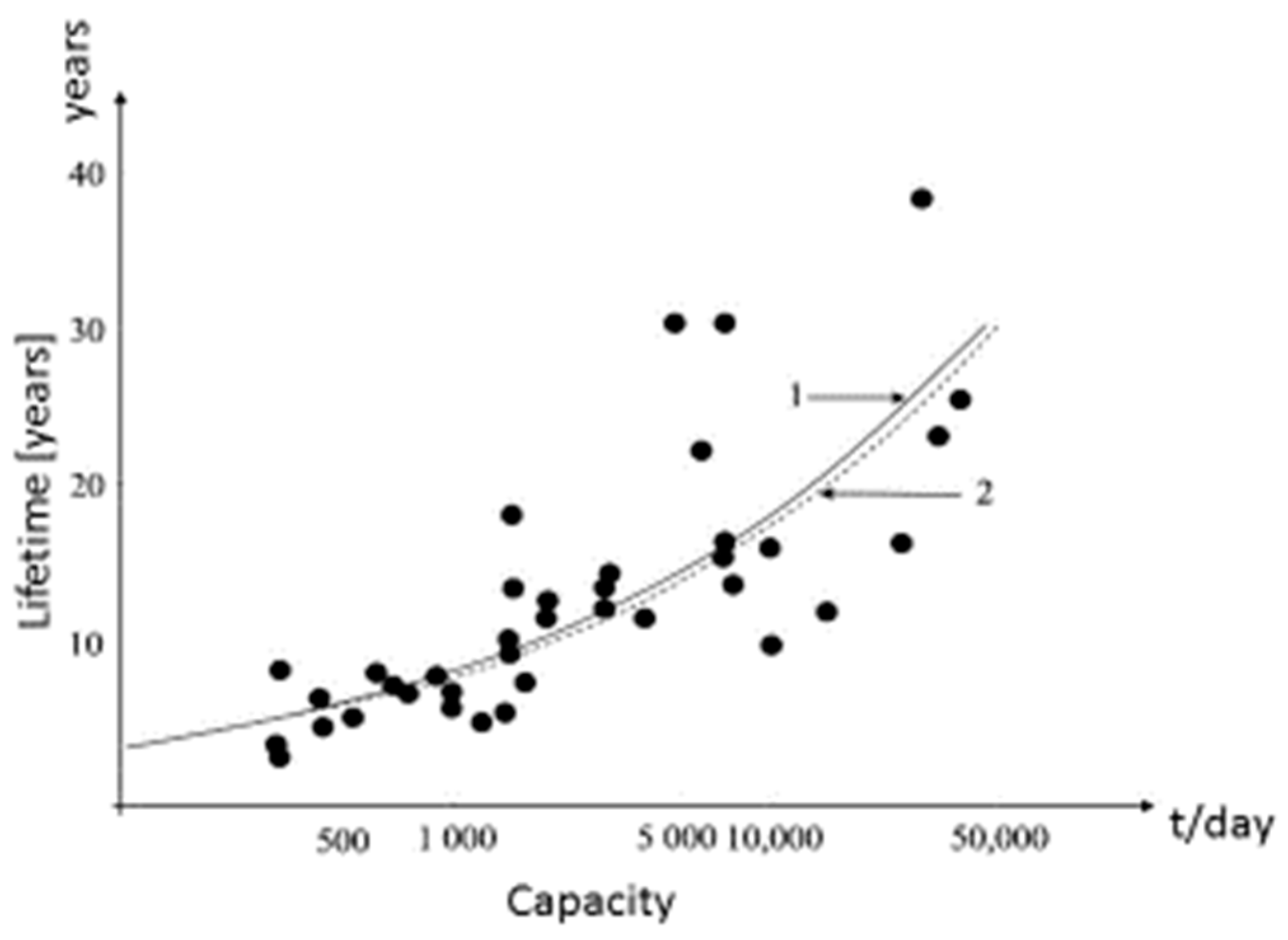

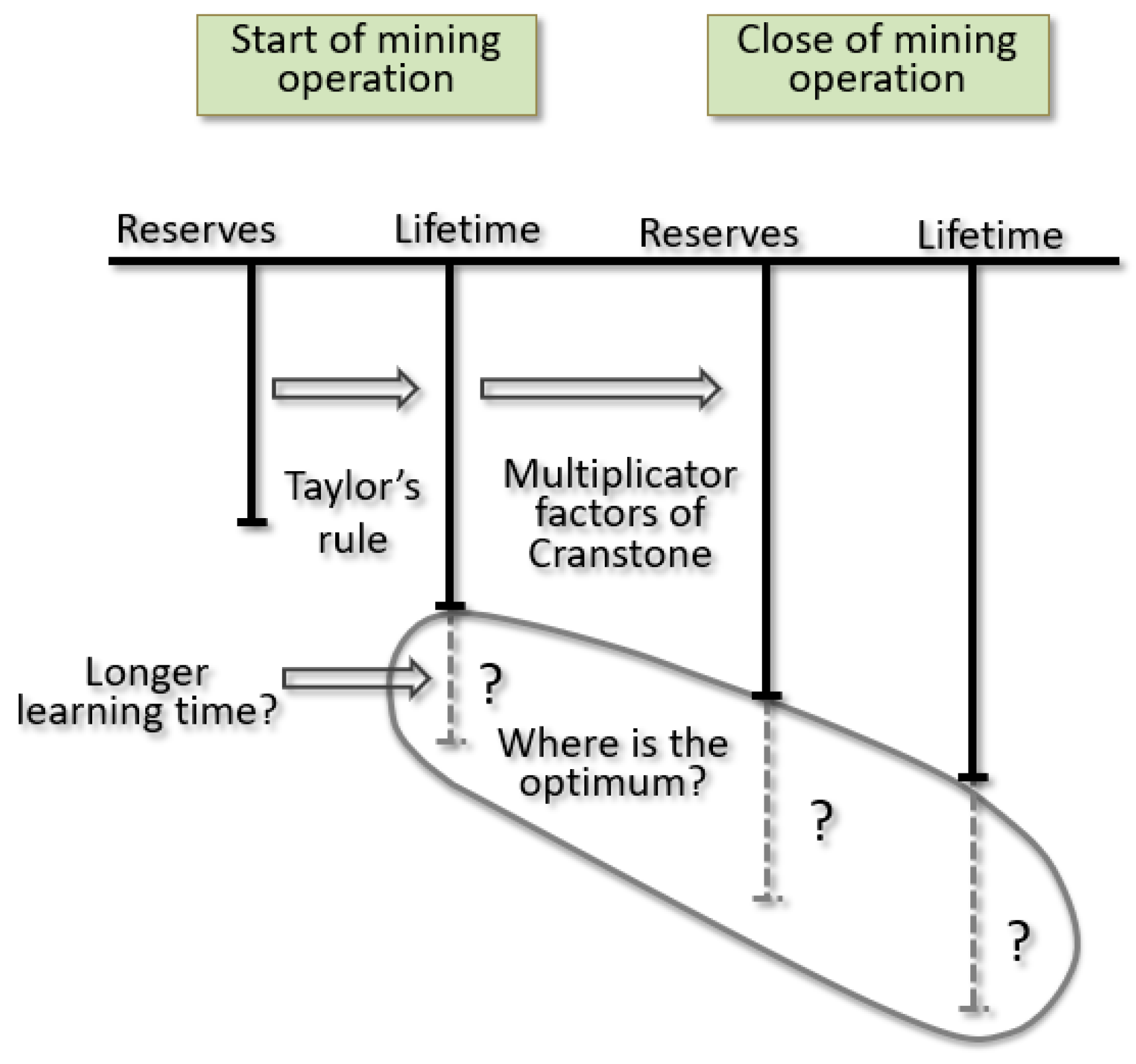

Like the nutrient elements nitrogen and potassium phosphorus is a bioessential element that cannot be substituted. As the lifetime of a mine can be linked to an increase of the extraction rate, the

longevity [

4] of access to phosphate rock is of interest from a sustainability perspective. Reflecting and improving future generations’ access to unsubstitutable mineral nutrients is an important issue. Consequently “A challenge of future sustainable resources management is to develop the proper knowledge to avoid bottlenecks of supply” [

5]. This can be achieved only if the mineral supply is approached from a dynamic of sustainable mining. With respect to phosphorus (P) mining, for instance, we suggested the following: “We can define a sustainable P cycle if—in the long run—the economically mineable (primary and secondary) reserves of P increase higher than the losses (i.e., dissipation) to sinks which are not economically mineable.” [

5]. This is in line with a systemic view of sustainability that conceives sustainable development as a proactive, ongoing inquiry on system-limit management (i.e., on preventing hard landings and collapses of valuable systems) in the framework of inter-and intragenerational justice [

6]. With respect to phosphorus management the avenues to achieving the goal of sustainability, meaning supply security for the basic nutrient phosphorus for future generation, are a circular economy and the development of better technologies. Based on this, we suggest that for unsubstitutable, essential minerals (such as phosphorus), the sustainable lifetime of a mine must acknowledge the finiteness of the phosphate rock and include the recovery rate (i.e., how much of the phosphorus of the deposit is used; see

Box 1, Part 1). In practice (see

Section 3), this is managed via the cut-off grade. With respect to lifetime, this paper focuses only on the long-term supply security, although other issues such as environmental and societal impacts must be included in any comprehensive definition of the lifetime of a mine.

In a circular economy, mining is the first stage in the chain of value creation. Although the mining stage has no direct influence on the recycling stage, its efficiency influences the overall efficiency of the circular economy. Therefore, it is useful to study strategies of mineral economics and mine planning to maximize the recovery in the first stage of the circular economy, mining. How fast and at what cut-off grade a reserve is mined or a resource depleted is a question of efficiency and effectiveness- and these influence the lifetime and capacity of a mine [

7]. We will examine methods and rules for determining the lifetime of both types of phosphate deposits: stratiform normally quite uniform sedimentary seam deposits that can be extrapolated over large distances and lens-like much more irregular magmatic deposits.

Standard procedure in mineral economics is to evaluate a deposit using dynamic evaluation methods [

8]. These take into account the time value of money. The standard method is a discounted cash-flow method (DCF). Cash flow is the net amount of cash moving in and out of a business, in our case a mining operation, i.e., only true flows of money and no depreciation, for example, which is a financial method used only to calculate the tax base. The time value of money is based on the assumption that money can earn money (interest) over time; a dollar today is worth more than the same dollar tomorrow. For example, assuming a formerly normal 5% annual interest rate, 1000€ in a savings account would be worth 1050€ in a year. Conversely, you have to earn 1050€ in one year to have a value today, the present value of 1000€, whereas 1000€ in one year would have a value of only 952€ today. This means you have to discount future money streams, the cash flows. These are the reverse formulae for compound interest. The discounting factors are, given

Hereby,

is the chosen interest rate and

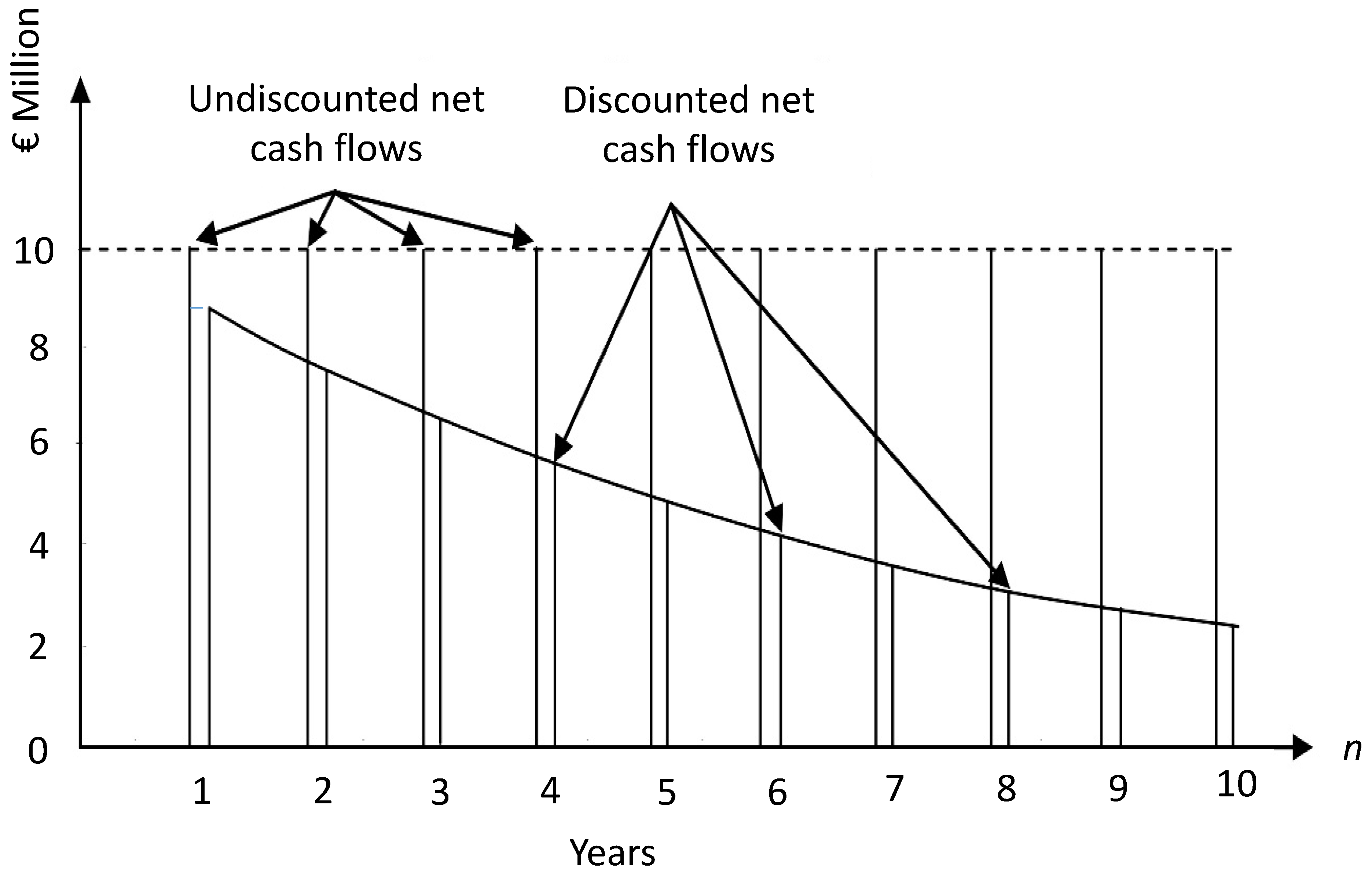

the number of years. These discounting factors decrease rapidly with increasing years and they decrease more rapidly the higher the interest rates are. For example, a cash flow of 10 mio € in 10 years at a discounting rate of 10% has a present value of only 3.86 mio € but in 20 years, a value of only 1.49 mio €. If the interest rate is increased to 15%, the values are only 2.47 mio € in 10 years and 0.61 mio € in 20 years. The decrease of the value of the discounted cash flows for

i = 15% for 10 years is shown in

Figure 1.

Box 1. A rationale for assessing a sustainable lifetime.

Part 1: Characteristics of future and of sustainable mining

Sustainability

The sustainable mining of unsubstitutable mineral (mineral nutrients; see

Section 1) demands

Avoiding bottlenecks of supply

- ∘

By prospective resilient planning (not subject of this paper)

Providing long-term supply security for P from (terrestrial) deposits. This implies

- ∘

Low and efficient use of P

- ∘

Recycling (not subject of this paper)

Producing to the extent possible phosphate from mining bodies which includes lowering the cut-off grade as much as possible

Assumptions on the future of (phosphate) mining

Ore grade will decline in the long run, therefore:

Lower grades must be mined in the future

Planning of multi-phase mining of the same ore body is meaningful

What has previously been considered (uneconomic) waste may become reserves (the triaging of waste may be of interest)

Part 2: Optimal lifetime and principles of assessing sustainable lifetime for a case of open pit mining

For evaluating a mining project and comparing different projects, two methods are mainly applied: the net present value method (

) and the internal rate of return method (

). Given an interest rate,

letting

denote the

cash flow at time , the

net present value at time 0 is:

Hereby N is the entire period of N years for which the net present value is calculated and j is a specific year. The (in the following denoted as NPV) is the sum of all net cash flows () discounted with a predefined interest rate minus the initial investment (Equation (2)). The is the interest rate for which the discounted net cash flows equal the investment, , i.e., in Equation (2) the then equals zero.

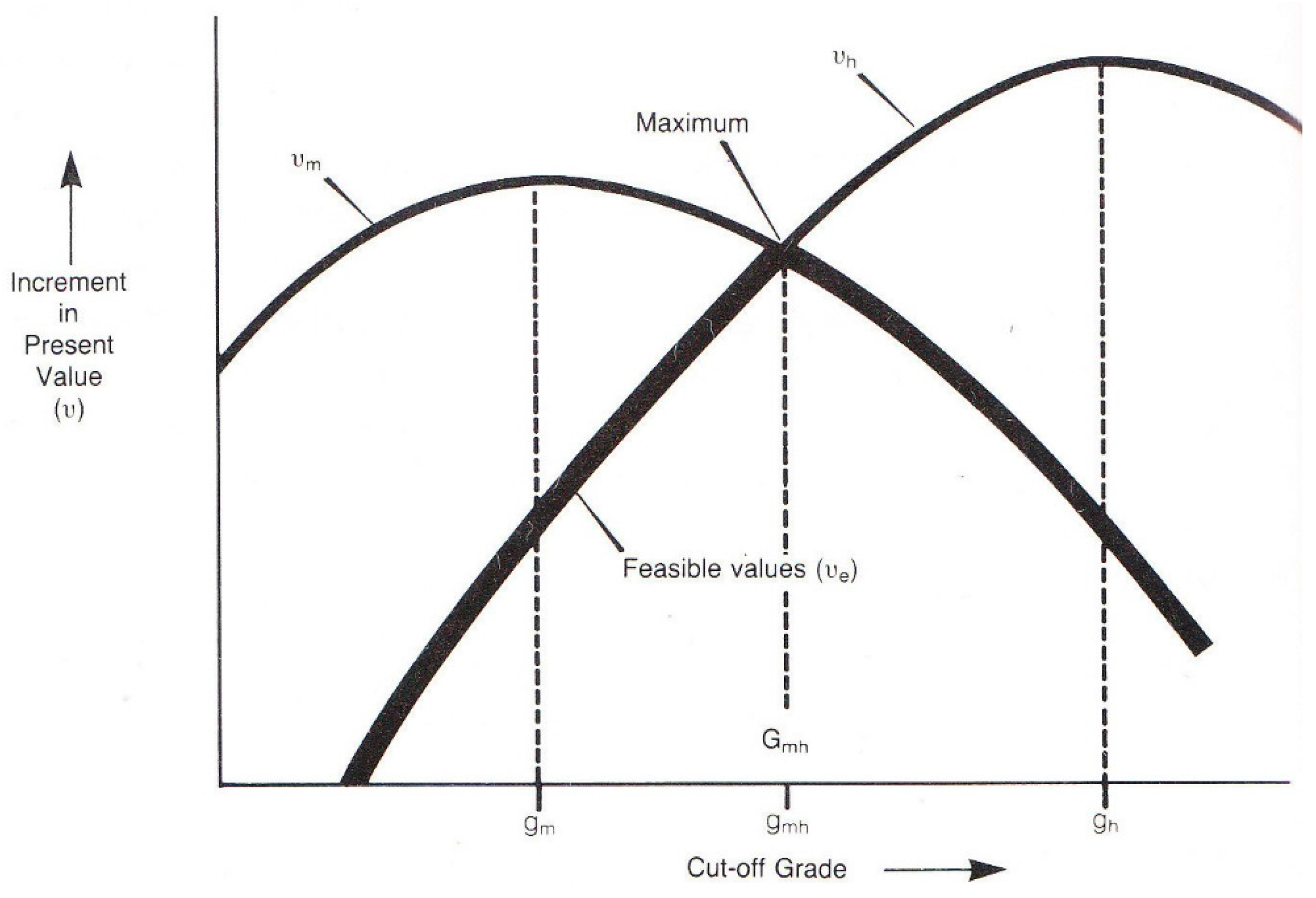

A second term to be discussed in the introduction is “cut-off grade.” The cut-off grade under the noted economic definitions is the lowest grade that can be mined economically; therefore, the cut-off grade separates ore from waste. Taking into account the dynamics of future cash flows, cut-off grades can also become dynamic, as will be shown below.

It shall at least briefly be mentioned that the DCF method has been further advanced by the option pricing method. For every mine planning a prefeasibility or feasibility study, a structure for investment and operating costs must be developed to arrive at annual cash flows and a future commodity price has to be assumed. The option pricing method also attempts to take into account the cyclical nature of commodity prices and complements the evaluation with the variability of prices. This method was developed by Black and Scholes [

9] and adapted to mineral properties by Brennan and Schwartz [

10]. It is beyond the scope of this paper to discuss the method in detail; however, the aspect of price variability is one that can have an influence on the lifetime of a mine and is discussed briefly in

Section 2.2.4.

3. The Aspect of Sustainability for Defining the Lifetime of a Mine

3.1. Principal Considerations

As introduced in

Section 1, the principle of intergenerational fairness is generally accepted as a starting point for achieving sustainable development, with the aim of ensuring that every future generation the privilege of being as well off as the preceding one [

1,

36]. We are looking far into the future, when investigating paths to the sustainable use of non-renewable mineral raw materials, because sustainability is a long-term concept that must be maintained over generations for as long as humans exist [

37,

38].

Regarding non-renewable resources, humankind has to recognize that there is only one Earth and that it has limits. In addition, it must be recognized that exploring new deposits is expensive. Therefore, once raw materials have been discovered, it makes sense to use them to the maximum extent [

39].

In

Section 2.2.2, we looked into the future and questioned whether future learning effects about reserve extensions should be considered when determining the lifetime of a mine. This examination of future aspects shall also be done for the cut-off grade determining ore and waste. The cut-off grade is an economic parameter, and, therefore, we have to consider future outlook for the economic parameters of price and cost.

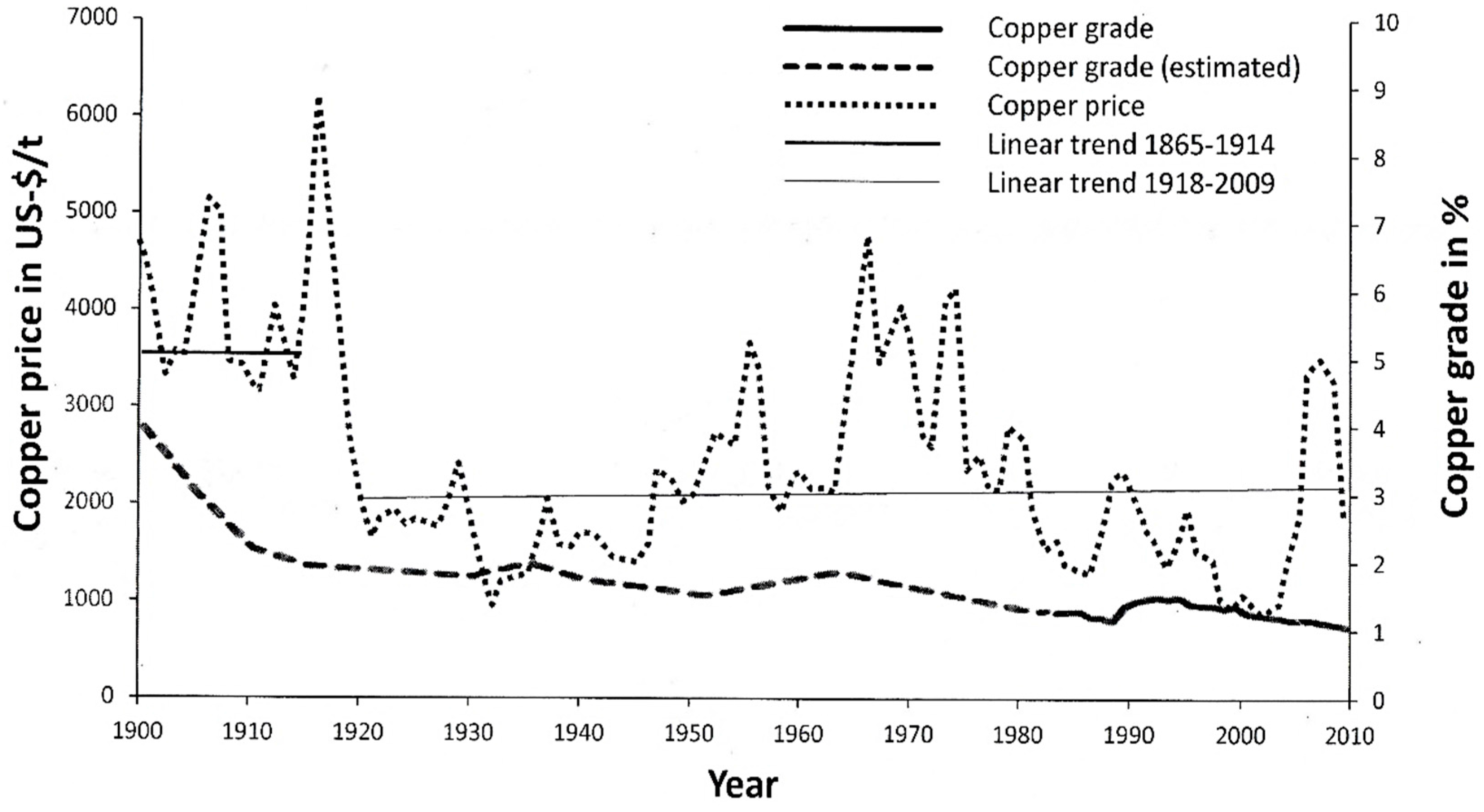

It can be observed that, for most major commodities, real prices since the end of WW I did not increase but stayed more or less constant for 100 years (or even decreased, for example, in the case of aluminium), as shown in

Figure 8 with the example of copper. For the real price, the inflation effect of nominal prices must be corrected by an inflation index, in this case, the US Consumer Price Index (CPI). This means, of course, that the nominal price increased over the span of a century. But despite constant price development, on average, over 100 years, the grade did not increase but decreased as shown in

Figure 8. This means that, due to technological developments, the cost to mine lower and lower grade ore has decreased. In the last century, the average copper grade declined from about 2% to 1% without an increase in the Cu price in real terms [

40,

41]. One of the lowest grade successfully mined today is from the Aitik Mine in Sweden, with a head grade of 0.22% Cu [

7]. However, it must be taken into account that normally copper mines have by-product credits. By-products for the Aitik mine are gold and silver, increasing revenues by 30 to 40%, estimated from the annual report [

42]. Moreover, it should be stressed that the decrease was not caused by the need to mine lower-grade deposits but by technological capabilities enabling companies to mine such lower-grade deposits economically at constant prices in real terms, meaning a learning effect has occurred.

In practice, a rule of thumb frequently realized is that the cut-off grade is about half of the average ore grade [

8], i.e., parallel to decreasing average ore grade, the cut-off grade also decreases. A subsequent effect is that tonnage increases. In general, the tonnages of deposits increase non-linearly (disproportionately, above average) if the ore grades decline.

It is possible to define the tonnage increase for mathematically defined grade distributions. For a log-normal distribution Samuel Lasky discovered a rule (“Lasky’s Law”) that the relationship between the cut-off grade and the average grade above cut-off is linear and that a linear decrease in grade is followed by a logarithmic increase in the cumulative tonnage of ore [

45,

46,

47]. It can be observed that much geological and biological data are log-normally distributed [

48]. Recent studies of more than 3000 well explored distributions of 17 metals show that less than 10% of all grade distributions “fail to be fit by the lognormal-distribution [

49].” However, this might not apply to phosphate deposits. According to the authors’ knowledge, no study exists that examines how well phosphate grade distributions can be fitted to the log-normal distribution and, therefore, Lasky’s law is applicable. The main phosphorus mineral is apatite with a P

2O

5 content of 41 to 42.3% [

50]. The grades of sedimentary phosphate deposits are usually higher than 50% of the theoretical upper grade. The probability, therefore, of a much-skewed grade distribution is not very high. For magmatic deposits with grades below 10%, this might be different [

51].

Although we do not know the exact mechanism by which reserves increase by lowering the cut-off, we can draw conclusions for aspects of sustainability, i.e., maximizing resource efficiency. The more we can lower the cut-off grade, the more we can increase the reserves for the supply of phosphorus for mankind and the longer a mine’s lifetime can be extended. This also has economic impacts because it reduces replacement costs. The replacement costs for huge stratabound phosphate deposits, in Morocco, for example, might be quite low but this is not the case for magmatic phosphate deposits. We are not aware of published figures for phosphate deposits, however as a rule of thumb, replacement costs in the mining industry vary between 2% and 5% (e.g., for gold [

52]).

3.2. Practical Applications for the Definition for Cut-Off Grades

In

Section 2.1, we considered various cut-off grades, their influence on investment and operating costs and on

NPV and how to optimize them. Looking at cut-off grades from the aspect of sustainability, the lowest possible cut-off grade should be chosen that still enables an economic operation but maximizes reserves. This is an

operating cost cut-off, i.e., a cut-off grade that covers all operating costs but no capital costs, also called a

break-even cut-off [

13]. In practice, such a cut-off is frequently applied [

8], thereby optimizing the lifetime of a mining operation under sustainability aspects.

Phosphate deposits are mined mostly in open-pit operations. Open-pit operating costs largely depend on the waste:ore ratio. The final depth of an open pit is often determined by an operating-cost cut-off, the so-called marginal stripping ratio, defined as the maximum allowable waste:ore ratio beyond which the operation becomes uneconomic. Hereby, we have to distinguish between a hanging-wall and a footwall cut-off [

8]. For the definition of the hanging-wall cut-off, one must remember that, at any rate, the material, whether ore or waste, must be extracted, loaded and transported, i.e., mining costs will accrue regardless of whether ore or waste is mined. Therefore, an operating-cost cut-off takes into consideration only the additional costs, i.e., the beneficiation costs.

Extending the concept of maximizing reserves, taking into account price fluctuations as discussed in

Section 2.2.4 and learning effects with regard to operating costs, one should operate with low-grade stockpiles that can be processed at economically favourable times, as suggested by [

11]; doing so could also extend the lifetime of a mine. A totally different and even more forward-looking approach, is taken in the examples described below by the Anthropogenic Resources Working Group of the Expert Group on Resource Classification (EGRC) of the UN Economic Commission of Europe (UNECE) [

53] and by Scholz and Wellmer [

7].

3.3. Concept of the Anthropogenic Resources Working Group of the Expert Group on Resource Classification (EGRC) of the UN Economic Commission of Europe (UNECE)

Based on the UNECE definition for geothermal energy resources, the Anthropogenic Resources Working Group of the Expert Group on Resource Classification (EGRC) [

53] defines

project lifetime as follows:

The Project Lifetime will be the minimum of the economic limit ... The ‘economic limit’ is defined as the time at which the Project reaches a point beyond which the subsequent cumulative discounted net operating cash flows from the Project would be negative. For an Extraction Project, the economic limit may be the time when the expected extraction rate declines to a level that makes the Project uneconomic, or when it is uneconomic to invest in further extraction infrastructure such as additional recycling plants.

Although this definition stems from practically unlimited reserves but with declining quality (heat value), as in the case of geothermal energy and, regarding recycling, by more or less continuous replenishment of secondary material, one could extend the definition to mining under the aspects of sustainability.

Consider the following thought experiment: A high-grade deposit, , has been discovered with tonnage and grade , which can be mined economically. In addition, nearby there exists a low-grade deposit, , with tonnage c and grade . As a stand-alone operation, it is uneconomic. However, by blending ore from the uneconomic deposit, , with the high-grade deposit, A, one could still achieve a profitable operation but with a lower and . Is it justified? Not under purely economic conditions; however, under sustainability aspects and social aspects, prolonging the lifetime despite sacrificing a certain economic level can make sense. Indeed, once a company has invested in a mining operation as well as infrastructure—especially housing in remote areas such as those in Canada or Australia—the aim of a responsible mine manager is to maximize the mine’s lifetime, mainly for social reasons.

A useful example is the Nanisivik Mine at the northern end of Baffin Island in Canada, a lead–zinc mine in carbonates 750 km north of the Arctic Circle and Canada’s first mine in the high Arctic, as well as one of the most northerly mines in the world and located about 20 km from the Inuit village of Arctic Bay [

54]. The Canadian government was interested in developing employment opportunities for the Inuit population and supported infrastructure, such as building an airport, with the condition that the mining operation would last at least 13 years. In the end, the operation lasted for 26 years, from 1976 to 2002.

3.4. Development of a Discounting Factor under Sustainability Aspects

In

Section 1, we discussed two dynamic economic evaluation methods, net present value (

) and internal rate of return (

). In the

method, a discounting factor is determined such that investment

I equals the sum of the discounted annual net cash flows

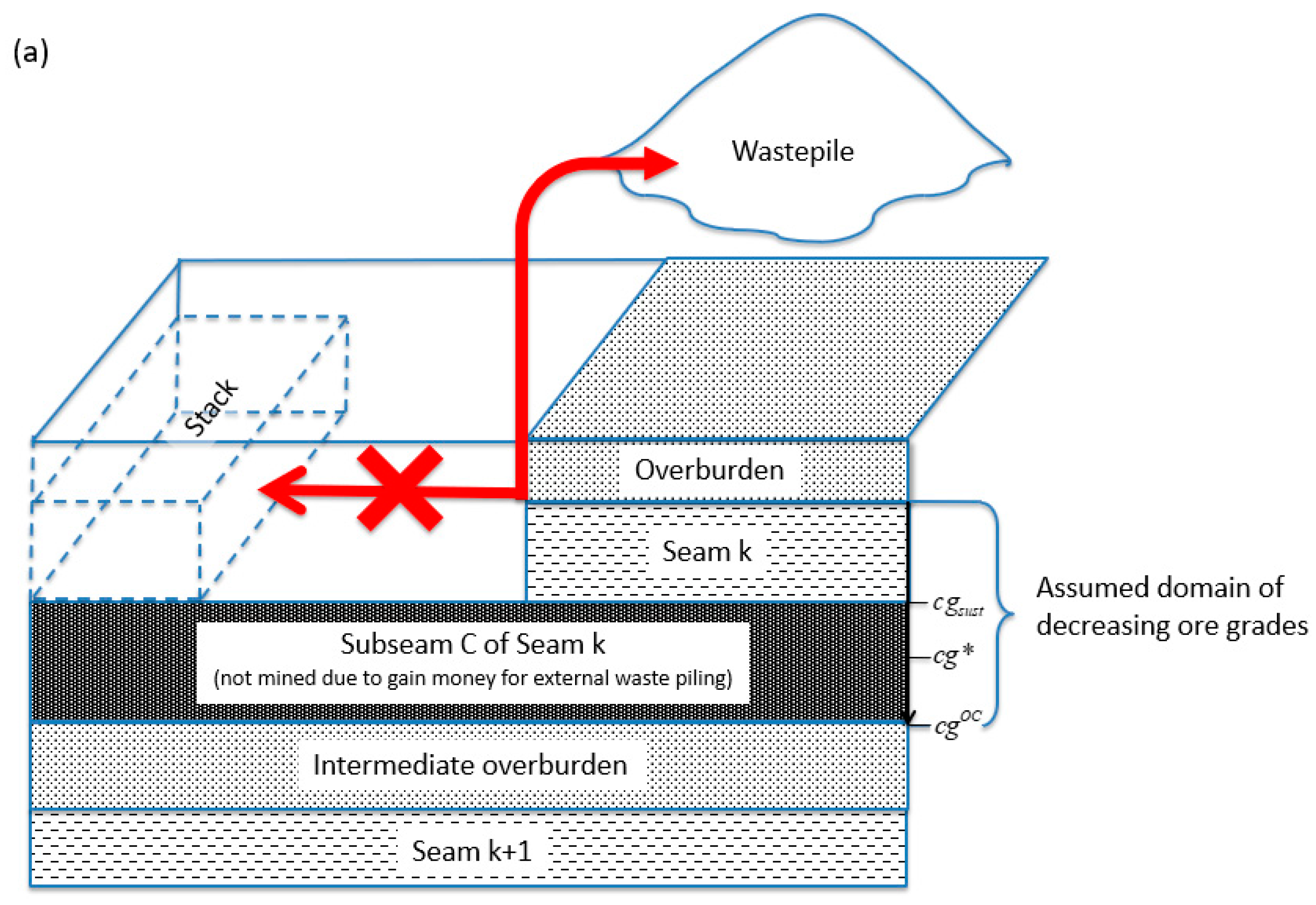

NC (Equation (2)). In this approach, only economic parameters based on costs and prices forecast for the lifetime of the mine influence the discounting factor. We will discuss an approach for developing a discounting factor with a thought experiment taking into account future sustainability aspects, with a phosphate seam model mine, an open-pit mine with multiple seams, more or less flat lying—and thereby extending the life of the mine (

Figure 9a). This is similar to Rendu’s opportunity-cost cut-off approach [

13]. These ideas were first presented by the authors in [

7]. The reader may follow the second part of Box A in the Introduction.

We must stress that this is a model that in a real life situation would have to be adjusted to the then existing frame conditions. It requires for example space and the freedom to move overburden to far-off locations (which is the situation in arid or semiarid areas, e.g., many North African deposits), availability of equipment, and a legal framework allowing an open pit mine remaining open for an extended period. The lignite mining operations in the Cologne area of Germany might serve as an example of how this can be done. There overburden is removed to locations often farther away from the mining front. A populated area, many constraints have to be taken into account (villages, infrastructure like rail, roads or electric transmission lines) to reach practical solutions [

55,

56].

For running the mining operations, mining companies have to assess a cut-off grade

that either maximizes the rate of return of the capital invested,

Another common option is to define the cutoff grade based that covers the operating costs (index

OC). This cut-off grade

maximizes the mining rate. Naturally, as discussed above, also cut-off grades in between are meaningful. Let us consider a mining company which takes a very forward-looking perspective that takes an intergenerational equity approach. This is unusual in common practice. The mining company is supposed not only (i) to put lower-grade material on

low-grade stockpiles in order to beneficiate later at times of higher prices if possible (see

Section 3.2); The company is (ii) aiming to

utilize deeper seams (e.g., Seam

) that are today below cutoff at some point in the future. The situation is that, with either of the cut-off grades, it can go to a certain depth but—when following an economic strategy—then the remaining phosphate seams stay in the ground. The company then may hope to mine these phosphate seams later when the technology has improved and/or higher prices are available on the market. If the company is able to mine these lower seams effectively and efficiently in the future without the costs for having to move the overburden material that has been removed during the

first round of mining, there will be an increase the sustainable present cut-off grade. We denote this cut-off grade as

.

The key idea of the presented case is: the mining company can increase the tolerable specific operating costs per ton of ore by increasing the cut-off grade to ,. This provides extra gains. Thus, higher operating costs can be covered and the mining company can remove all the overburden material and transport it to a distant area with no phosphate rock. This implies that the company is not burdening a future mining operation with old waste dumps. The follow up mining can be done with a reduced stripping ratio and lower costs for future operations. This has the consequence that the mining company has to apply another mining method. The dragline technology cannot be used, because it deposits the overburden close to its working area. Technologies must be used that remove the overburden to areas farther away like bucket wheel excavators and belt conveyors used in the German lignite open pit mines or even very large trucks like for example in copper open pit mines. This opens opportunities when prices might have improved or new cheaper technologies are available. The company can start again “with a clean slate”. Practically the company is in the same position as it was when it started the first round of mining to mine the virgin deposit. The average grade of the mineable deposit is the only difference. In the first round, it was above. In the second round, it is , which is below . whereas in the first round it was above .

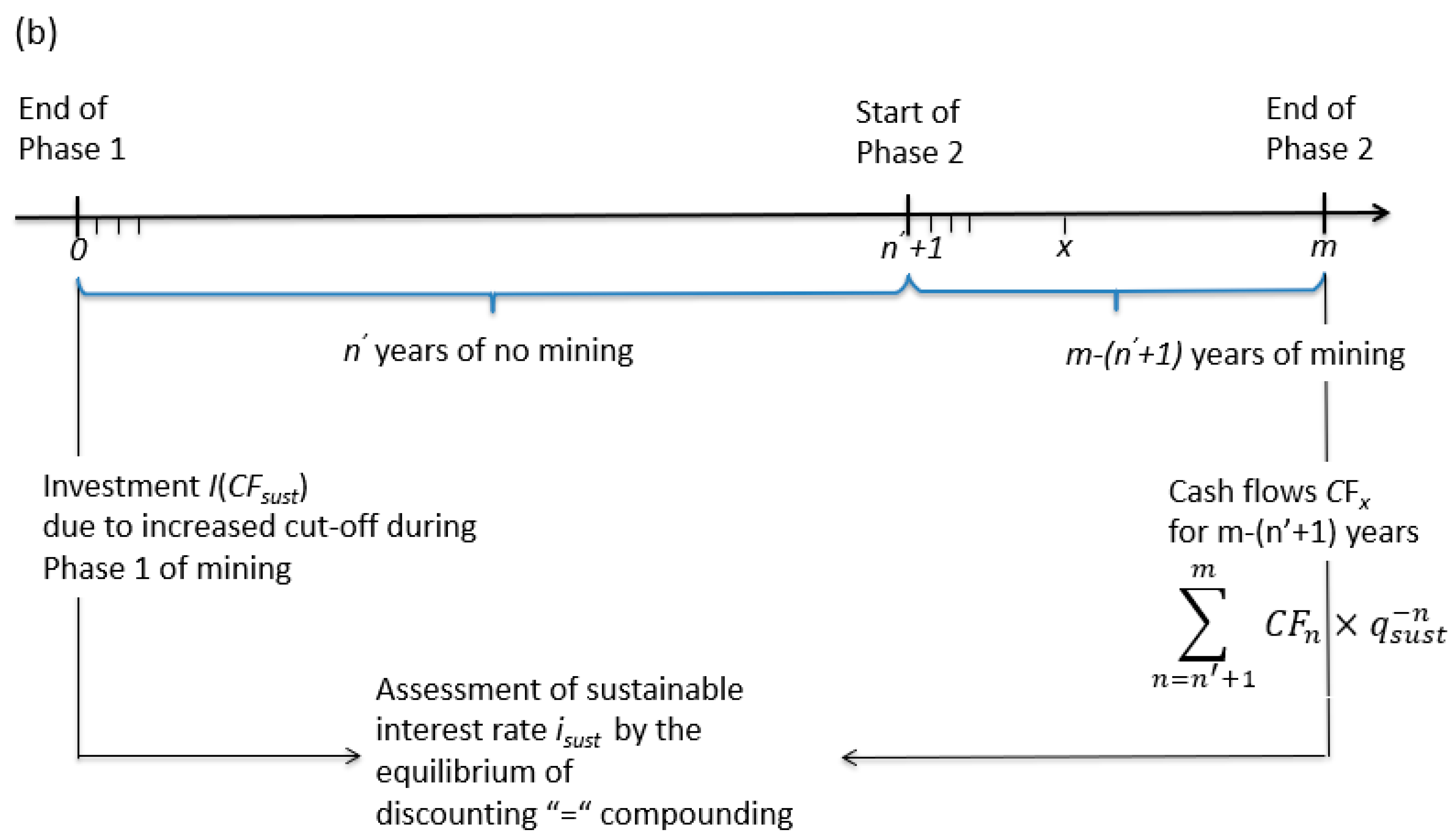

For a

second round of mining there is the advantage that any investment costs incurred for the infrastructure and the beneficiation plant were previously covered by the first round of mining. The only investment costs to consider are the foregone cash flow of the first round, applying the higher cut-off grade,

, instead of

or

(or one in between) and any maintenance costs until the start of the second round of mining. These can be considered as investments for the company’s future mining operations,

and we can model this case (see

Figure 9b).

For this case, we may formally assess the

sustainable mining rate by the rationales of compounding and discounting. Let us assume that the company must wait

years for the technology and/or prices to improve in order to justify beginning its second round of mining. According to reports, Moroccan company OCP may already have used this strategy for one of its large beds of deposits [

39]. Then, the second round will begin in year

and continue to year

. This means that the mining operation for the second round would last for

) years. The year

can be taken as the reference year for

compounding and

discounting for deriving a sustainability interest factor. The investment,

must be compounded to the year

. The sum of the annual cash flows may serve for the second-round mining operation

of a year

discounted to year

. Of course, in our case, for discounting and compounding, the interest rate is the same. We can label this the sustainability interest rate,

. The equation can be shortened

Thus, we have an equation for calculating

(assuming

remains consistent during each annual mining operation; for the calculation, we use Formula (2)).

Since

is a monotonically decreasing sequence and

we can write

The presented fictive case took the

industrial business management perspective. The basic idea and rationale is the assessment of a break-even point between the

compounding of today’s investments and the

discounting of future gains. Naturally, this has to be done under certain assumptions and specific constraints from the perspective of a mining company and the deposit. In the given fictive case, a second round of mining becomes possible as the average cut-off grades in the different regions of the world are declining [

57,

58]. The case was presented in the frame of the normal constraints of economic mining.

Given the presented case, we may ask the following question: is it possible to generally answer whether from a long-term sustainable development perspective the mining ratio should be decreased by increasing the cut-off grade to the level of ? Clearly this question is beyond the common planning horizon of any company if long-term is interpreted in this place as more than 100 years. We think that such long-term thinking or projecting does not allow for quantitative but rather, if any at all, qualitative or semi-quantitative reasoning. Although similar questions could be posed for other properties of mines, let us restrict to the mining rate and assume (see above) that the cut-off grade in the future, , is lower than that optimal cut-off grade today, (i.e., ). We may argue in this place that a decrease in today’s mining rate would have the impact that the likelihood of secondary mining in the future would increase and there is a positive effect on resource conservation. Such a strategy would reduce the mining in other places. and would most likely be considered as a sustainable action. Naturally, such action would reduce the gains and thus not meet the rationale of a common mining company. For doing this, mining companies would request some proper legislative framework or governmental compensation. We may consider the latter as a new form of external costs. Yet, also the opposite argumentation can be applied. We may similarly argue that we should increase today’s cut-off grade. This would imply that the mine becomes less excavated. This was illustrated as for open pit mining in the above example. We may assume that this would increases the likelihood that future generations would mine the remaining phosphate rock with a more efficient method. Today, this would result in mining at other places with the consequence that more money has to be spent now to replace that part of the reserves saved for the future.

4. Discussion

In

Section 3.1, we introduced the principle of intergenerational fairness. This principle is taken as a starting point for sustainable development. A key normative aim is to allow every future generation of having the privilege of being as well off as preceding generations [

20,

21]. For sustainability, we have to add another element: intragenerational fairness. This has been defined in Agenda 21 [

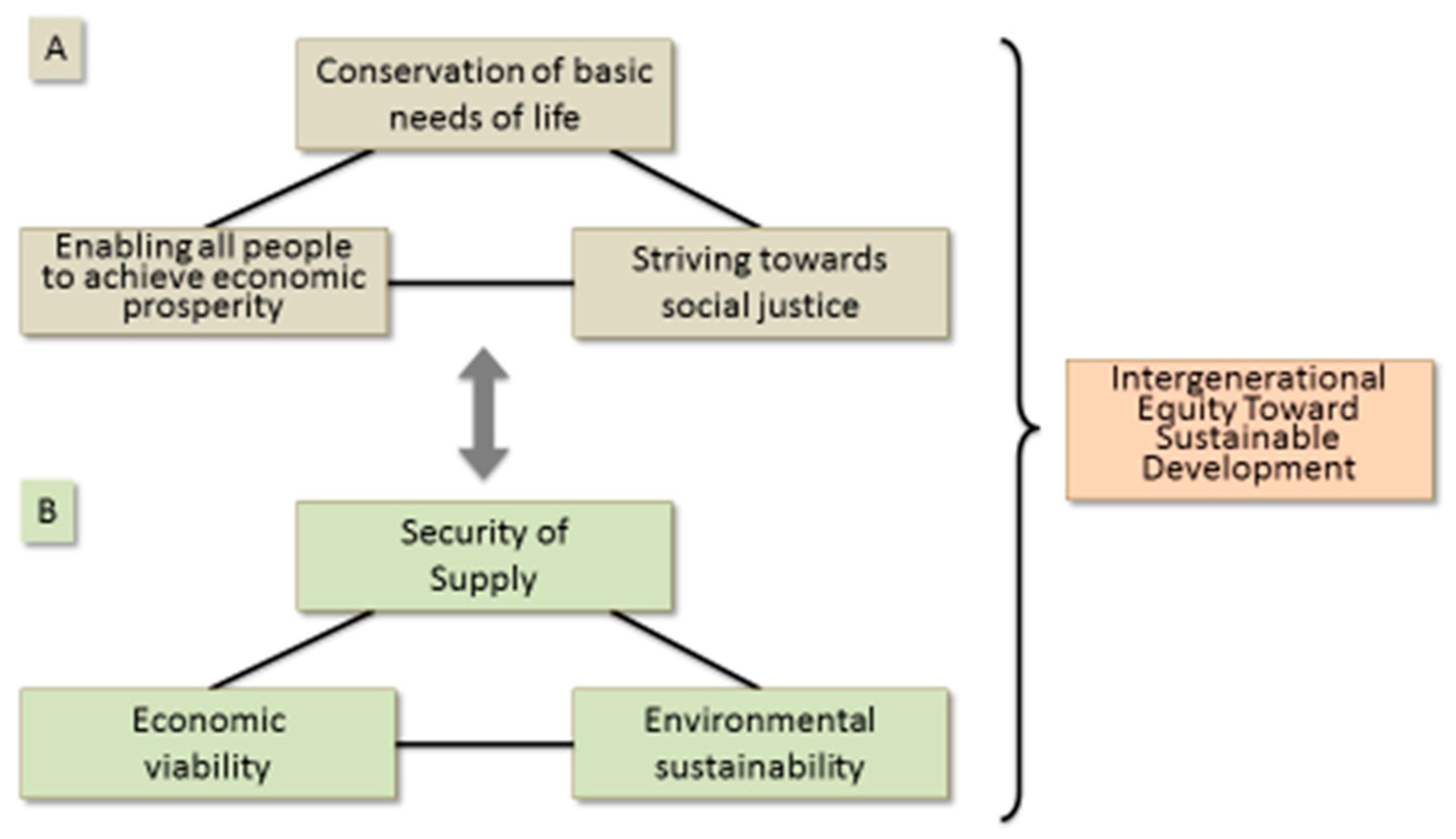

23] as a triangle or pillars of three humanitarian objectives. These are (1) to conserve the basic needs of life; (2) to enable all people to achieve economic prosperity; and (3) to strive toward and to establish social justice. These three universal goals have been globally accepted by the Rio Declaration at the UN Conference on Environment and Development in Rio de Janeiro in 1992. All three were initially assigned the same priority. To achieve these goals, humankind needs raw materials: energy and mineral resources for its technological and cultural evolution [

38]. In the case of phosphate, we are faced with a special situation:

Phosphate is, by far, the most important raw material for phosphorus (P). P belongs to the family of macronutrients including potassium (K) and nitrogen (N). They are indispensably involved in all organisms’ metabolism or enzyme activation. They are essential and (practically) unsubstitutable elements for food production and life and as necessary as water and soil. For K and N, a future supply problem does not exist; given enough energy, seawater or air can provide a practically inexhaustible source. However, the same situation does not apply to P [5].

Therefore, a secure and sustainable supply of phosphorus is essential in order to achieve sustainable development, especially to conserve the basic needs of life and to strive for social justice, two angles of the triangle of intragenerational fairness. Under the aspect of securing supply, another triangle of goals must be considered (

Figure 10): security of supply under the conditions of economic viability and environmental sustainability. As for the long-term challenge of intergenerational equity, its attainment depends on the security of supply of natural resources just as much as that of intragenerational equity, i.e., we have to combine the two triangles (

Figure 10). Although phosphorus is not scarce, its net use resource efficiency is low at approximately 5% [

5,

7].

Therefore, endeavours are required to increase resource efficiency. These can be measures in the system of the circular economy such as recycling as well as measures to optimize the lifetime exploiting of primary resources. The circular economics of phosphorus, i.e., the increase in the number of times a phosphorus atom is used anthropogenically before becoming bound to marine sediments, is one element of sustainable phosphorus management. However, losses and efficiency are inextricably coupled. We also revealed in the above-mentioned losses and efficiency paper [

7] that large amounts of phosphorus above and below the cut-off grade are lost in mining. This is a major disturbance factor of circular economics and part of the economic-use cycle that begins—within the perspective of this paper—with a phosphorus atom becoming the subject of economic action.

5. Conclusions

The most widely and internationally accepted definition of sustainable development: “a development that meets the needs of the present without compromising the ability of future generations to meet their own needs [

1]” is an abstract, normative principle. For non-renewable resources, it can be made operational by consistently finding solutions for functions required by society with resources of the geosphere and technosphere by using the most important resource: human ingenuity and creativity. Instruments to achieve this goal are a circular economy, the optimization of substitution processes and the development of new technologies [

3]. Like the nutrient elements nitrogen and potassium phosphorus is a bioessential element that cannot be substituted. Therefore, for phosphorus the only avenues are a circular economy and the development of new technologies. Generally it can be stated that a P cycle will become sustainable, if—in the long run—the economically mineable (primary and secondary) reserves of P increase to a level higher than the losses (i.e., dissipation) to sinks that are not economically mineable [

5].

In a circular economy, mining is the first stage in the chain of value creation. Although the mining stage has no direct influence on the recycling stage, its efficiency influences the overall efficiency of the circular economy. As the lifetime of a mine can be linked to an increase of the extraction rate, the longevity [

4] of access to phosphate rock is of interest from a sustainability perspective, i.e., the definition of the cut-off grade, defining ore and waste. Since in a market economy ore is defined as a mineral substance that can be exploited economically, mine planning and the definition of cut-off grades must be optimized, i.e., a dependent variable is needed, which normally is the net present value (

NPV) of a mining operation. Practical experience shows, however, that theoretical optimal extraction rates can be achieved only rarely. Physical factors limit mine capacity which can grow only about half to two-thirds of the rate of increase of reserves [

22,

23]. This rule was developed by the experienced Canadian mining engineer, Taylor, who found as a reason that reserves are a three-dimensional volume function, however, the sustainable rate of extraction depends on the available working area, which is two-dimensional [

22].

Whereas there are clear limitations to shortening the lifetime to maximize the

NPV, obviously there are no economic limitations to prolong the lifetime as long as the operations remains profitable, i.e., the

NPV is positive. The lowest cut-off-grade possible for a continuous operation is an operating cost cut-off grade [

8,

13]. Once certain economic parameters have been achieved, operations sometimes revert to strategies once certain economic parameters have been achieved to attempt to keep the mine operational as long as possible, e.g., by raising the cut-off grade in the starting phase to increase the mill-head grade and lowering the cut-off grade later or using low-grade stockpiles in the beginning that can be processed later [

11] or triaging waste into various categories (low, middle and high grade waste that could become ore under changed economic conditions). Another forward-looking concept would be to create a situation where a mining operation creates the possibility once a certain depth of an open pit (the marginal pit) has been reached, to restart mining under conditions of higher prices and/or improved prices. This requires an investment in the first phase of mining in higher operating costs to transport overburden by belt conveyors to locations farther away so that the overburden does not impede a renewed mining operation.

These examples represent an appeal to mining operators to take into account the longevity of a phosphorus deposit. Thus, losses that occur in mining and the assessment of a mine’s optimal lifetime should become important factors of circular economies.

The message of this paper is that the

lifetime of a mine is an issue of sustainable resource management. This holds particularly true for essential materials such as

phosphorus. Given today’s agriculture, half of all food production depends on mineral fertilizers. Explorative studies on what a long-term food supply without phosphorus from minerals would mean have indicated that there would not be enough food for about a quarter of the human population [

59]. As long-term supply from other sources (seawater or deep-sea mining, for example) with feasible costs seems to be highly unlikely, the physical losses of phosphorus from mines may become a concern from a future generation’s perspective.

Given our present knowledge about phosphorus reserves, the geopotential, mining technology, the price of phosphate rock and the dynamics of these entities, there will be no physical supply scarcity in the next several hundred or even in a thousand years or more. Yet this picture changes if a perspective under sustainability aspects for an even longer period is considered. Thus, future generations’ opportunity costs to access essential minerals is a matter of global resources and environmental policy. Increasing the lifetime of a mine is linked to reducing losses by decreasing cut-off grades, although the extraction rate can be increased by other means as well, such as carefully triaging waste into lower-, medium- and higher-grade waste that could become ore with better technology and/or higher prices. In European metal mines with a long history of mining, for example, materials from tailing dams have often been retreated successfully several times—each time with better technology.

Against this background, we may reflect on a new form of external costs that could motivate an increase in the extraction rate of an ore deposit’s commercial mineral or minerals. In the case of phosphorus, multiple fundamental uncertainties related to future mining technologies, agricultural demands, geopotential, etc. do not allow us to quantify these costs for a mid- and long-term perspective. Yet, as we have outlined, given the current market economy perspective, there are two strategies that call for closer attention in a short term. One is lowering cut-off grades in an economically feasible frame. Here, the mining companies’ orientations toward covering their operating costs instead of maximizing their return of investment is involved. The other is the idea of a “standby” option with explicit plans to reopen mines. We presented a fictive—but, as we know from the planning of North African mining companies, not far from reality—example including an economic rationale for an open-pit phosphorus mine for this purpose. This case included the somewhat counterintuitive means that, in the first phase of mining, the cut-off grade has to be increased to account for higher operating costs for removing waste to more-distant locations in order to economically enable a second phase of mining and the mostly (unforeseen) expenses involved in reopening a mine.

Although the volcanogenic cupriferous pyrite bodies in Cyprus are a different ore deposit type than the stratiform sedimentary phosphate deposit for which we developed our model, we think that the multiple operation of mines can be well illustrated by the history of Cyprus’s copper mines [

60,

61]. At least 4000 years ago, when melting processes were mastered, copper (Greek: kúpros) mining started in Cyprus. Wealth was generated by grossly satisfying the world’s copper demands during the time of the Romans but came to a first end. Modern pyrite mining with copper as a by-product restarted around 1921. In 1979, this mining became uneconomic, leading to mine closings. However, in the midst of the 1990s, mining was restarted using a new technology for exploiting the copper content, i.e., acid leaching of mined heaps that might utilize former uneconomically grades. What can be learned from this case history? Waste and, at times of first mining, sub economic mineral substances have to remain accessible for possible future exploitation, even if higher operating costs of mining are, at times, necessary. Under sustainability aspects, this is a justified investment for the future.

Globally, mining activities were begun by Homo erectus digging for flint some 400,000 years ago. They advanced in the Mesolithic era [

62] and in the Industrial Age, mining developed exponentially [

62]. Thus, the lifetime or chronicle of a mine extends far beyond the lifetime of a human individual or a mining company (although the oldest [copper] mining company, now known as Sumitomo, has been in existence for approximately 500 years). Today, science is on the cusp of understanding basic mechanisms of technology development and past and future resource management. This is of interest from the perspectives of future environmental, economic and social development. Thus, we believe that assessing the lifetime of a mine may become part of sustainability science.