3.1. The Baseline Scenario: Temporal Development and Changes from 2007 to 2030

In the Baseline scenario, current trends and policies are carried forward (see

Section 2.1.1 and

Section 2.2 for details).

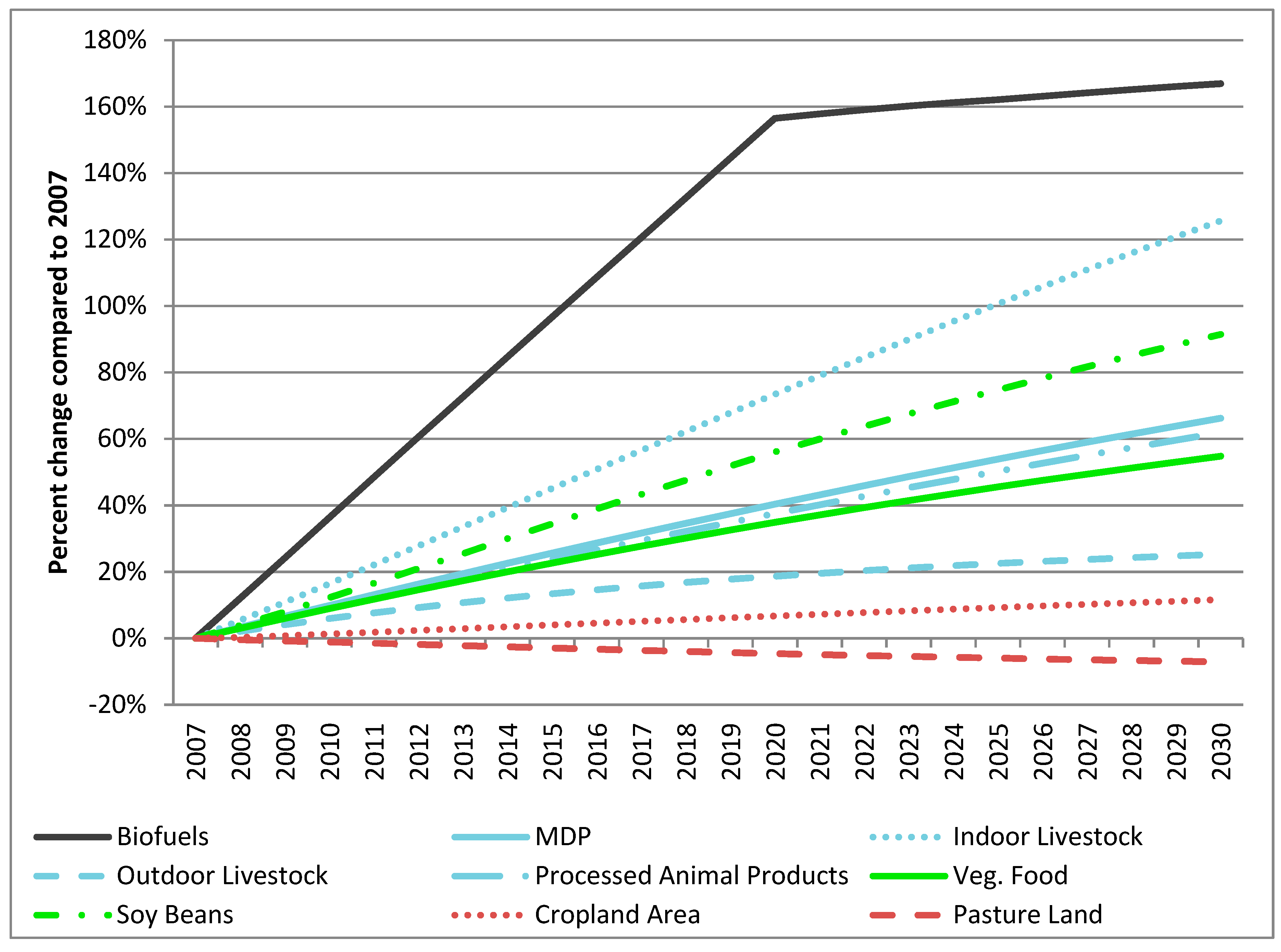

Figure 3 shows global trends in production of selected sectors from base year (2007) until the end of the modelled time period (2030) for the Baseline scenario. The temporal development is displayed as percentual change (compared to base year) of output. All sectors show a positive trend in production for the considered time, although to varying degrees.

The increase in production is strongest (+167%) for biofuels (see

Table 2 for aggregations used in this section), which is driven by the implemented biofuel policies. Also after 2020, when the enforced share of biofuels remains unchanged, there is an increase in production. This is mainly due to the growing consumption of fossile fuels induced by economic growth: to keep the share of biofuels constant, the output needs to be increased. It is worth mentioning that the increase in biodiesel production is stronger (+368%) than in bioethanol production (+118%), mainly caused by high shares of biodiesel in the European Union as indicated in the national action plans.

Global food production also increases between 2007 and 2030, although not as strong as for biofuels. The increase is stronger in the aggregated MDP sector (+66%) than in the aggregated sector for vegetarian food (+51%). When disaggregating MDP, indoor livestock has the strongest increase (+126%), followed by processed animal products (+62%) and outdoor livestock (+25%). The pattern is similar for per-capita consumption: Here, the aggregated MDP sector increases by 30% (indoor livestock: 61%; processed animal products: 29%; outdoor livestock: −1%, vegetarian food by 18%). Trends of other studies are not fully comparable, since the time horizon, exogenous drivers and aggregation of products differ. The baseline of the LEITAP model in [

25] for instance, includes an increase in the production volume of livestock of 55% between 2001 and 2030.

In

Figure 3 also production of soy beans is displayed. It increases stronger (+91%) than total MDP production, but less than indoor livestock, for which it is a major fodder input. We explain this by the increase of Dried Distillers Grains with Solubles (DDGS) and oilseed meal, which are by-products in the production of bioethanol and biodiesel, respectively. As these by-products are increasingly produced as a result of the increasing amount of produced biofuels, they can be used ever more to replace crops such as soy beans as fodder in the production of indoor livestock.

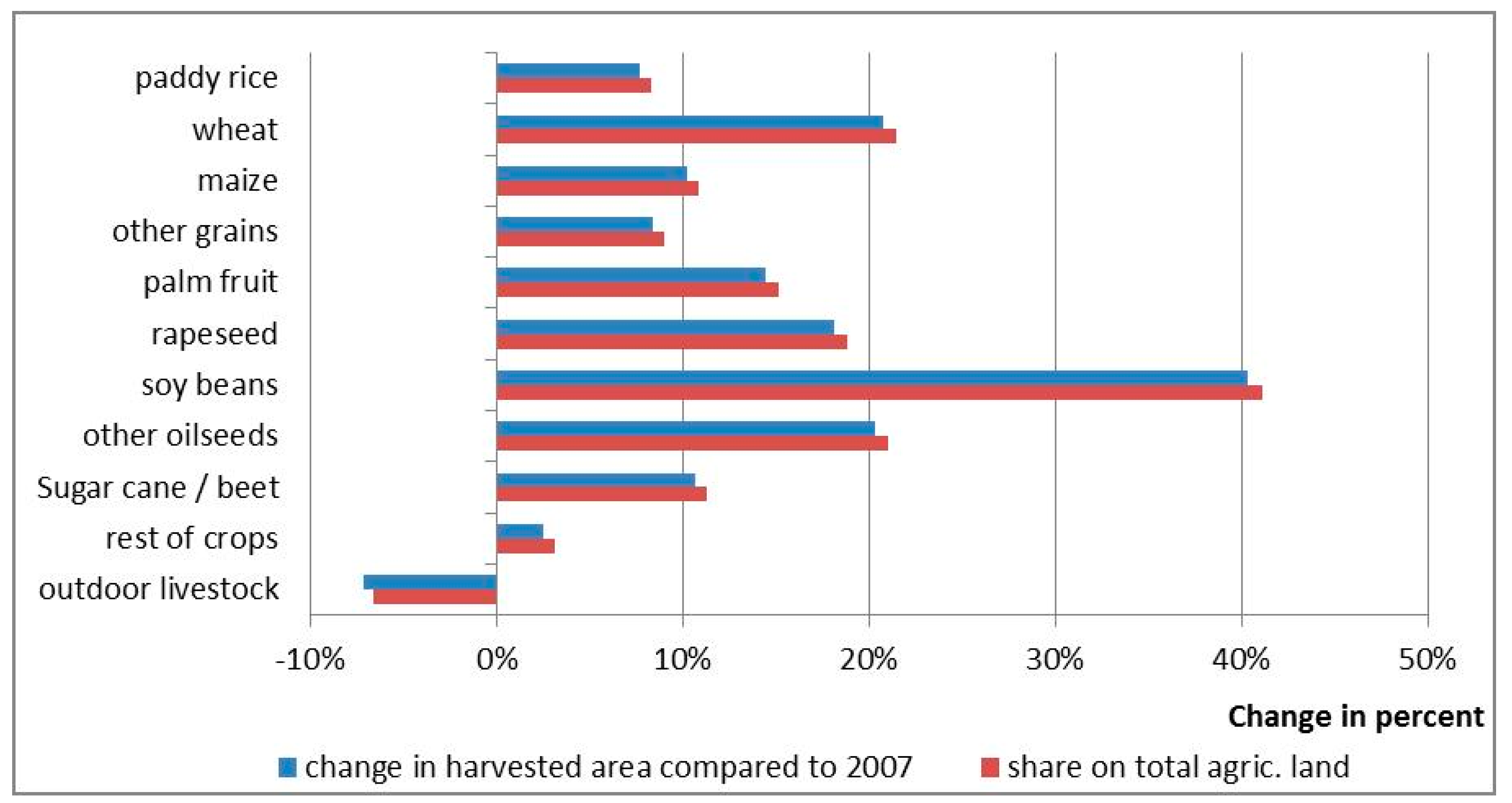

The trend between 2007 and 2030 shows an increase in cropland area by 12% which represents 152 mio. ha. This is due to the exogenous cropland expansion (see

Figure 1) and because of conversion of pasture land. Compared to other studies that simulate an increase of 10–25% in cropland [

43] our results are at the lower bound of this range. The additioal area is mainly used for soy beans and wheat production. They are important inputs for MDP and biofuel production. Interestingly, the global cropland area (input in production) increases to a much smaller degree than the outputs (crops and processed products) considered. This can be interpreted as an increasing efficiency in agricultural production, which is determined by the changes in total factor productivity over time and characteristics of agricultural production functions (

Section 2.1.1). Pasture land is reduced in 2030 compared to 2007 (−7%); it is the only form of land use which decreases, even without a tax on MDP. Its share in total agricultural land area decreases from 65% in 2007 to 60% in 2030. Amongst crops, soy beans show the strongest increase, both in terms of expansion of harvested area and in terms of its share in total harvested area (

Figure 4).

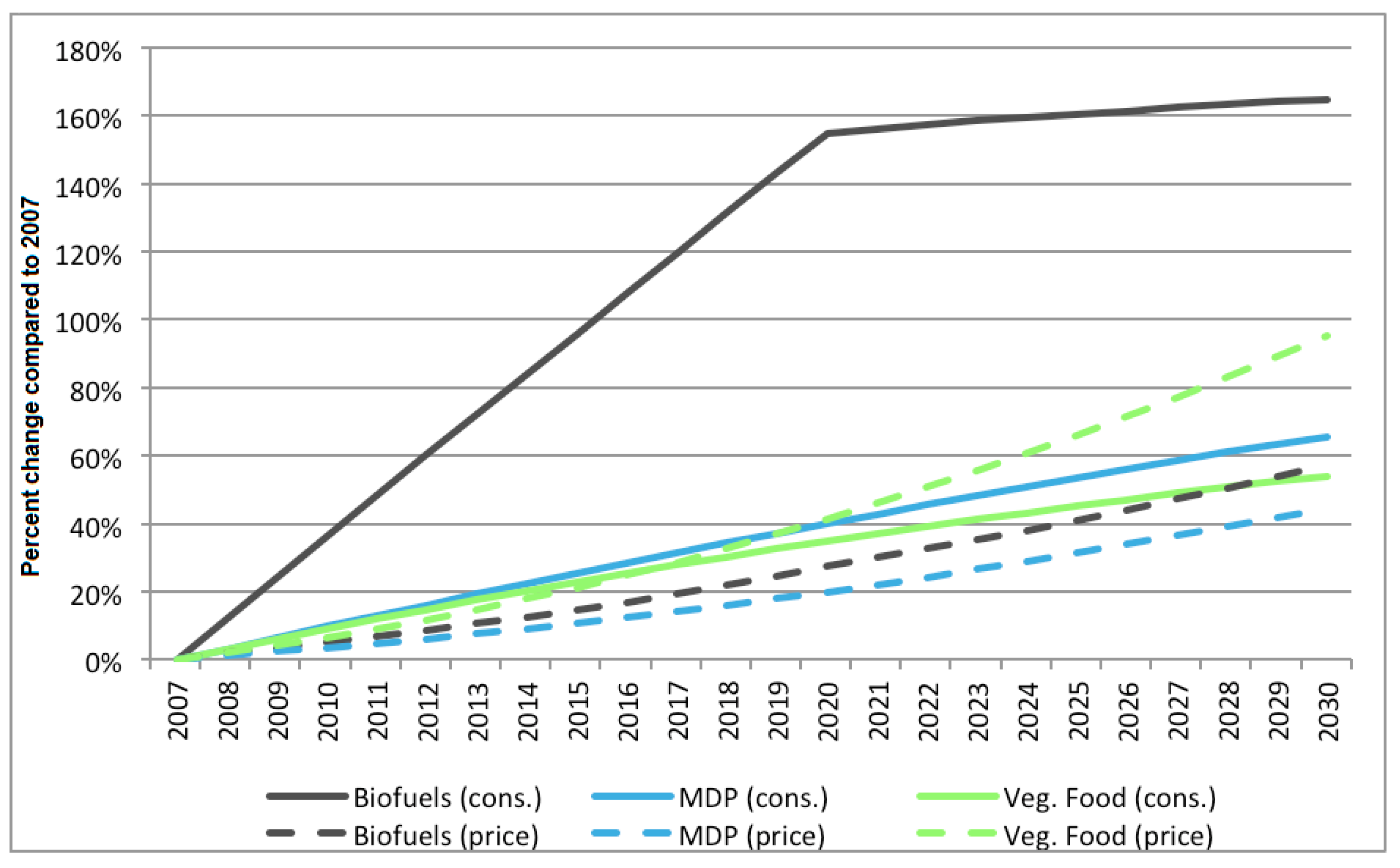

The temporal development of global private consumption nearly resembles that of production (see

Figure 5). The latest projections of demand for agricultural products of the IMPACT (International Model for Policy Analysis of Agricultural Commodities and Trade) model of the International Food Policy Research Institute IFPRI show an increase in demand for meat, including beef, pork, poultry, sheep and goats, of 39% between 2010 and 2030 [

44]. A comparison between our results and results generated by the IMPACT model is difficult, since the model structures differ (IMPACT as a partial equilibrium model is more detailed with respect to agricultural products, but does not take feedback effects with other sectors e.g., the energy sector into account). In addition, IMPACT takes different assumptions about the development of gross domestic product and population growth. If we now take a look at per capita consumption of MDP, it increases by 30% between 2007 and 2030 in our model, a number comparable to the 24.3% in per capita meat consumption calculated in [

45] for the period 1990–2009 on the basis of [

46].

Prices for biofuels, MDP and vegetarian food develop differently: They increase strongest for vegetarian food (+96% between 2007 and 2030), followed by biofuels (57%) and MDP (44%). This is due to increasing prices of cropland, which is required to produce vegetarian food. Since the preference of households for MDP is higher with rising incomes compared to vegetarian food, the scarcity of land causes prices for vegetarian food to increase stronger than for MDP and biofuels, which are fostered by the implemented policies. As production and consumption increase stronger in MDP and biofuels, so does the discrepancy between the respective prices.

In USA, Australia/New Zealand, and the Middle- and South American regions, the consumption of biodiesel is higher than the implemented quota. In case of bioethanol, France, Australia/New Zealand, Malaysia/Indonesia and Middle-East and Northern Africa exceed their quota. In these regions, the price of fossil transport fuels increases stronger over time than prices for biofuels.

3.2. The MDP Tax Scenario: Changes in Global Average Prices, Production, Consumption And Harvested Area Compared to Baseline Scenario

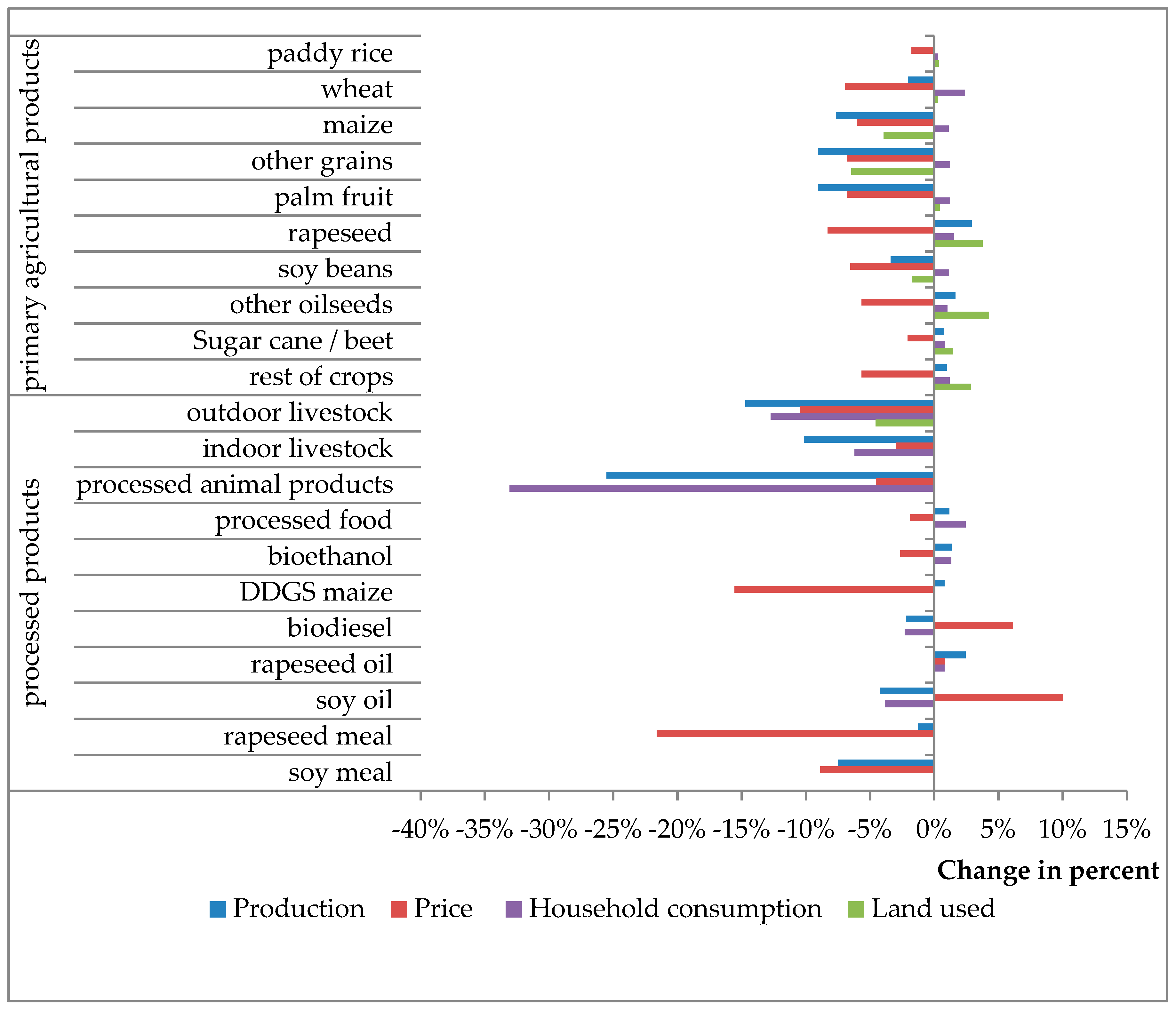

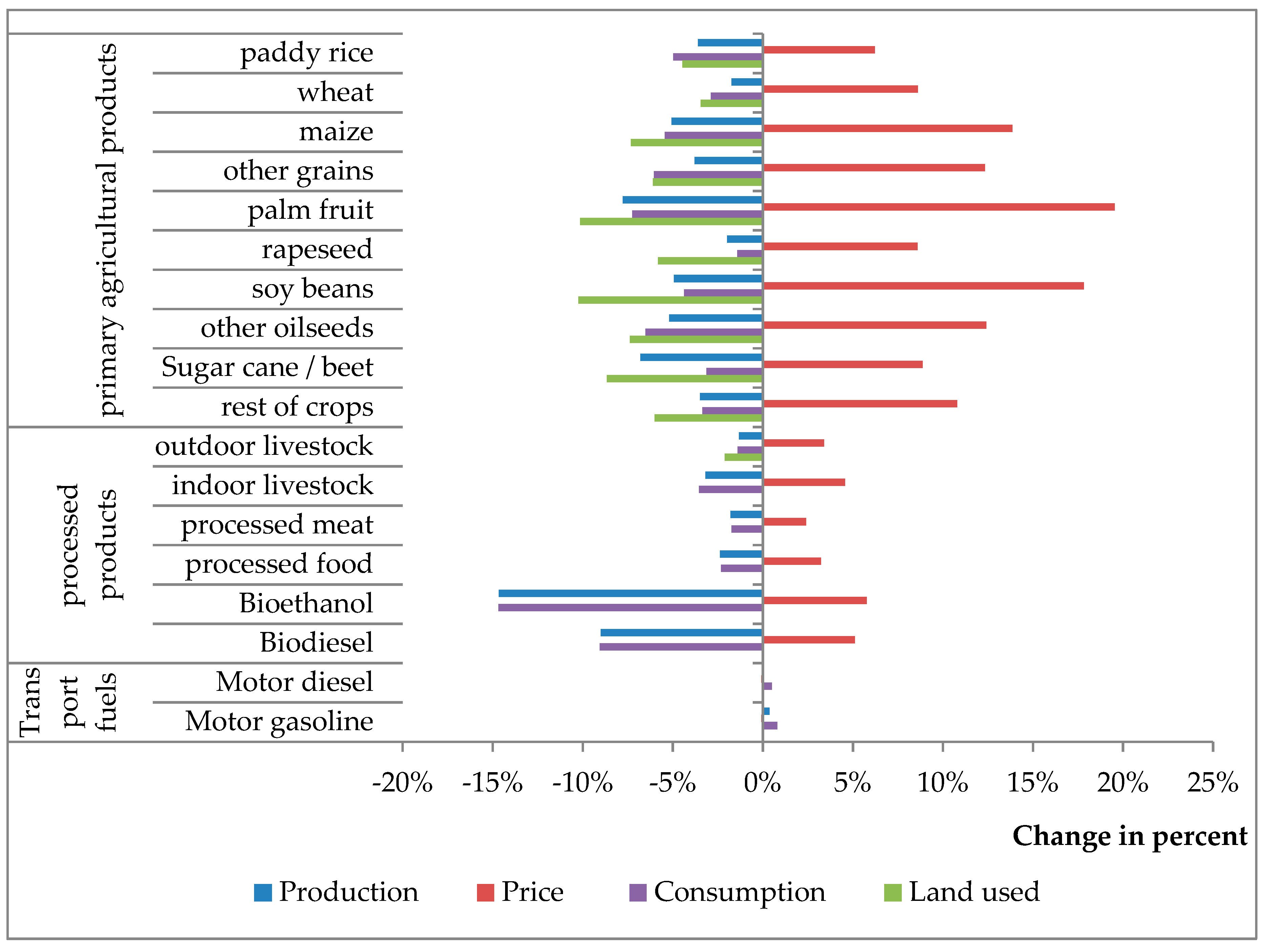

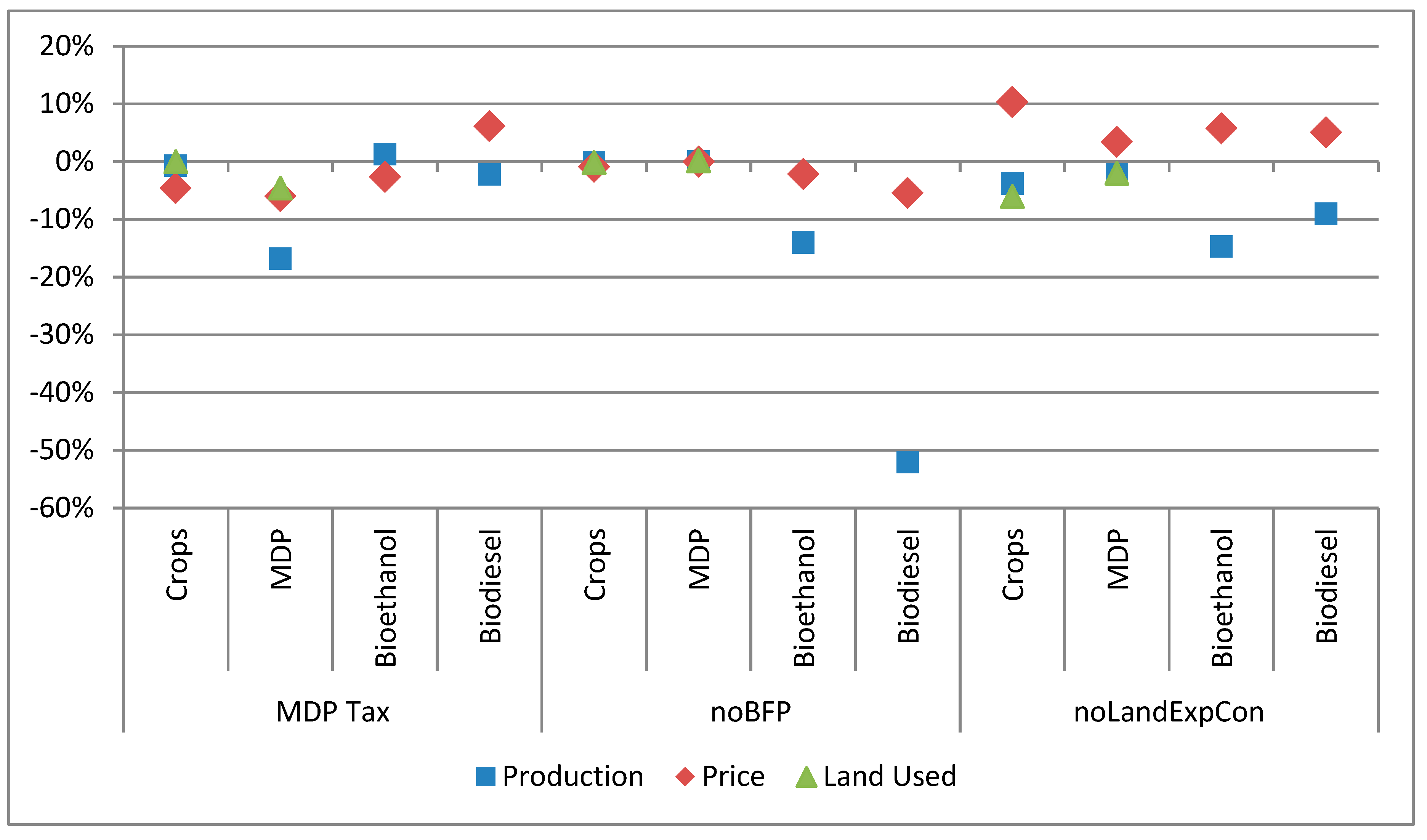

A tax on MDP consumption in industrialised countries causes global consumption of animal products to decline by 6–33% (see

Figure 6). These effects are different for the three animal products sectors: Since in industrialised countries the highest share of consumed animal products is processed, we see the highest reduction in consumption in the sector “Processed animal products (PCM)”. As a consequence of the MDP tax, global production and prices of processed animal products decrease. The price change for processed animal products is five times (5% vs. 26%) smaller than that of production, indicating that the supply side is less elastic than demand. This also holds true for indoor livestock but to a limited degree.

In case of outdoor livestock, production only decreases by 15%, while the price decreases by 10%. We explain this by a strong decline in prices for the production factor land. Land prices decline for two reasons: first, compared to the Baseline scenario, less pasture land is used for production of MDP; second, less cropland is needed to produce animal fodder. While the total agricultural area remains at Baseline scenario levels, the MDP tax causes shifts in land use. The share of land allocated to fodder production in industrialised countries (mainly maize, other grains and soy beans) and pasture land (−5%) declines (see

Figure 6), while managed forest areas increases. On global averages, the production of animals that are produced on pasture land (OLVS) uses less land per unit of output compared to the Baseline scenario implying that OLVS production is less land-intensive under a MDP tax.

Less demand for feedstuff for livestock production also has an impact on the vegetable oils and biofuel sectors. With less demand for vegetable meals (mainly rapeseed meal and soy meal), prices and production decline. Taking the soy industry as an example, production of meal drops by 7% and the price by 9%. Since meal and oils are produced jointly, the production of soy oils also decreases (−4%). With no exogenous decrease in demand for oil compared to the meal, the soy oil price increases (10%). This impacts on biodiesel production and prices: higher inputs costs (vegetable oils) cause biodiesel prices to rise and production to drop. The decrease in production and consumption is possible because in several regions the biofuel policy implemented is overachieved in the Baseline scenario. Technically speaking, the quota on biodiesel demand is not binding in some regions.

In case of bioethanol, the impact of the MDP tax is different. Again, the quota for bioethanol is not binding in the Baseline scenario in some regions (see

Section 3.1), but these countries are only minor producers. In the major production/consumption regions USA and Brazil, the MDP tax causes the consumption of bioethanol to increase (USA: 1%; Brazil: 3%). In the USA, DDGS, the by-product from bioethanol production, has an input share of only 2% in livestock production. In comparison, soy meals, the by-product from biodiesel production, have a share of 18% in livestock production. Consequently, the feedback effect between a tax on MDP and bioethanol is less pronounced than between a MDP tax and biodiesel. In addition, the increase in global bioethanol production is influenced by the second biggest producer, Brazil. The main feedstock to produce bioethanol in Brazil is sugar cane. Since the by-product of bioethanol production from sugar cane is not used for livestock production, there is no feedback from a tax on MDP via by-products. However, with prices of crops decreasing under lower demand for feedstuff, the Brazilian production of bioethanol increases by 2% compared to the Baseline scenario.

In the industrialised countries, we observe an increase in per capita consumption of fossil fuels in transportation in the MDP tax scenario compared to the Baseline scenario. This is caused by relatively high income elasticities of demand for fossil fuel products compared to other goods, while the fixed budget share (subsistence consumers, see

Section 2.1.1) is small. This implies that consumers in industrialised countries react strongly to changes on prices, and reallocate the budget they spent accordingly. Overall, prices, production and consumption of fossil energy products increase globally (

Figure 7). The MDP tax leaves private consumers, which now consume less of costly processed animal products, with more money to spend on other products, for example, fuels or fuel intensive products from other sectors. Also in [

25] the author finds an increase in fossil energy consumption following a reduction in MDP consumption in the EU27 for the same reasons.

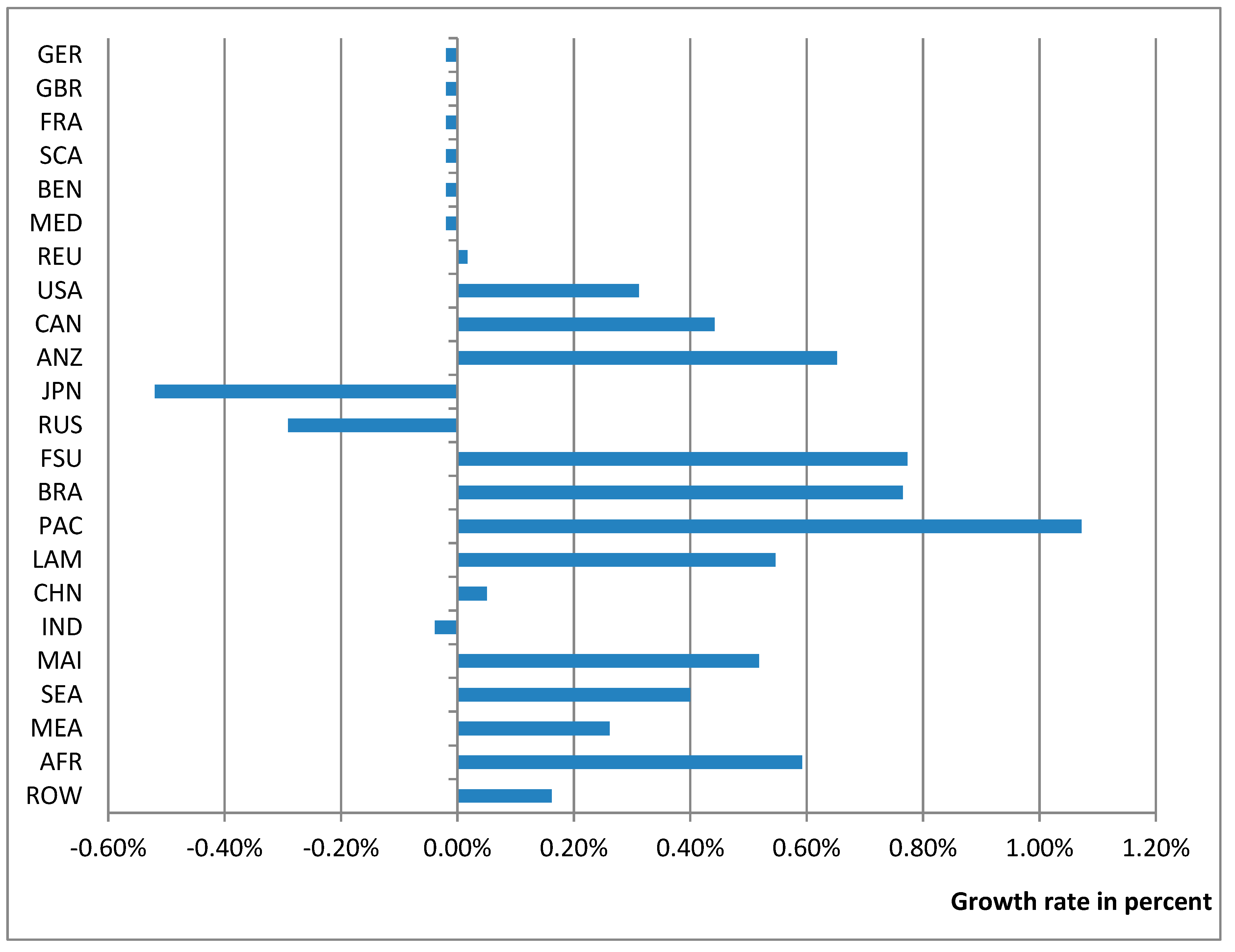

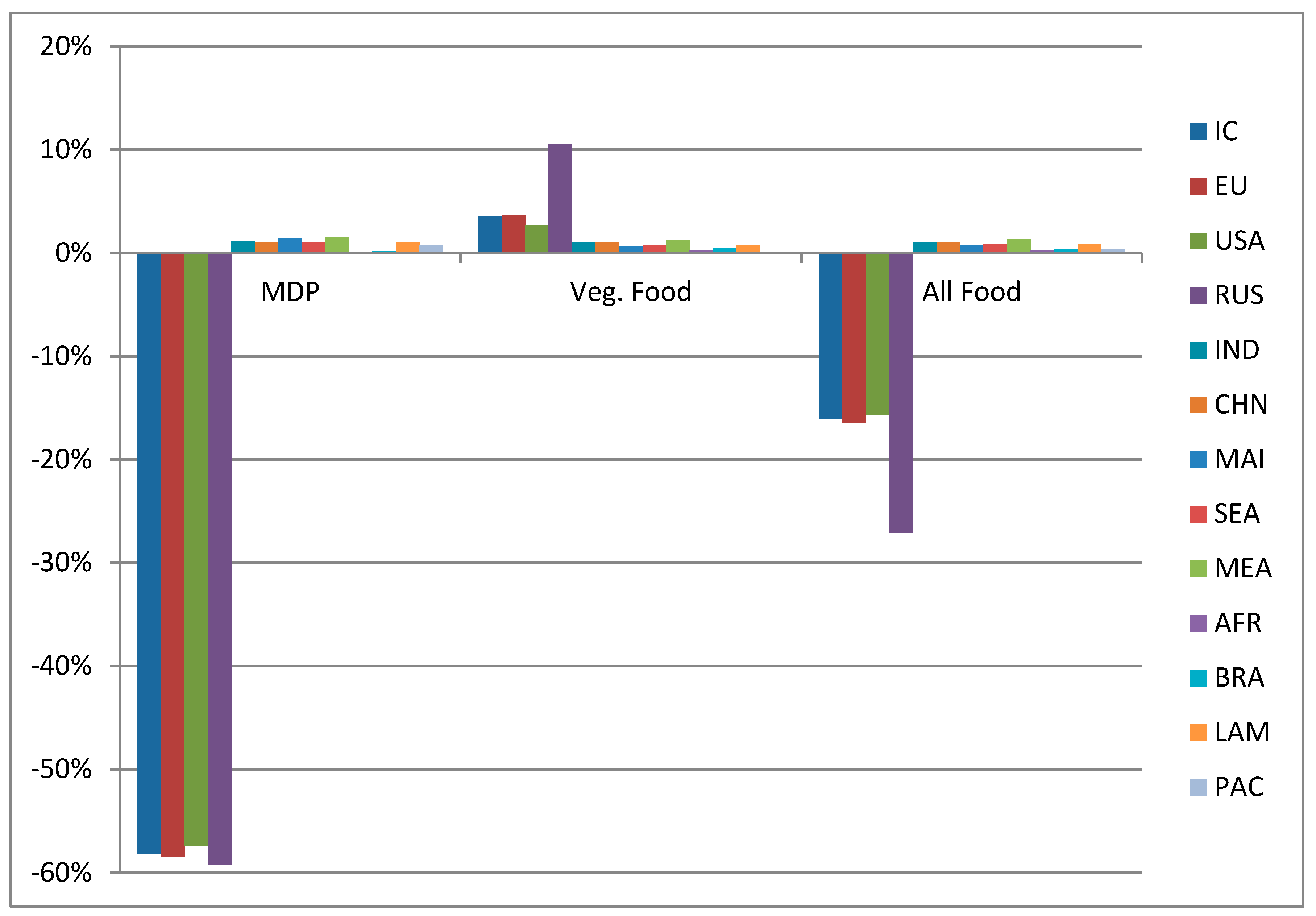

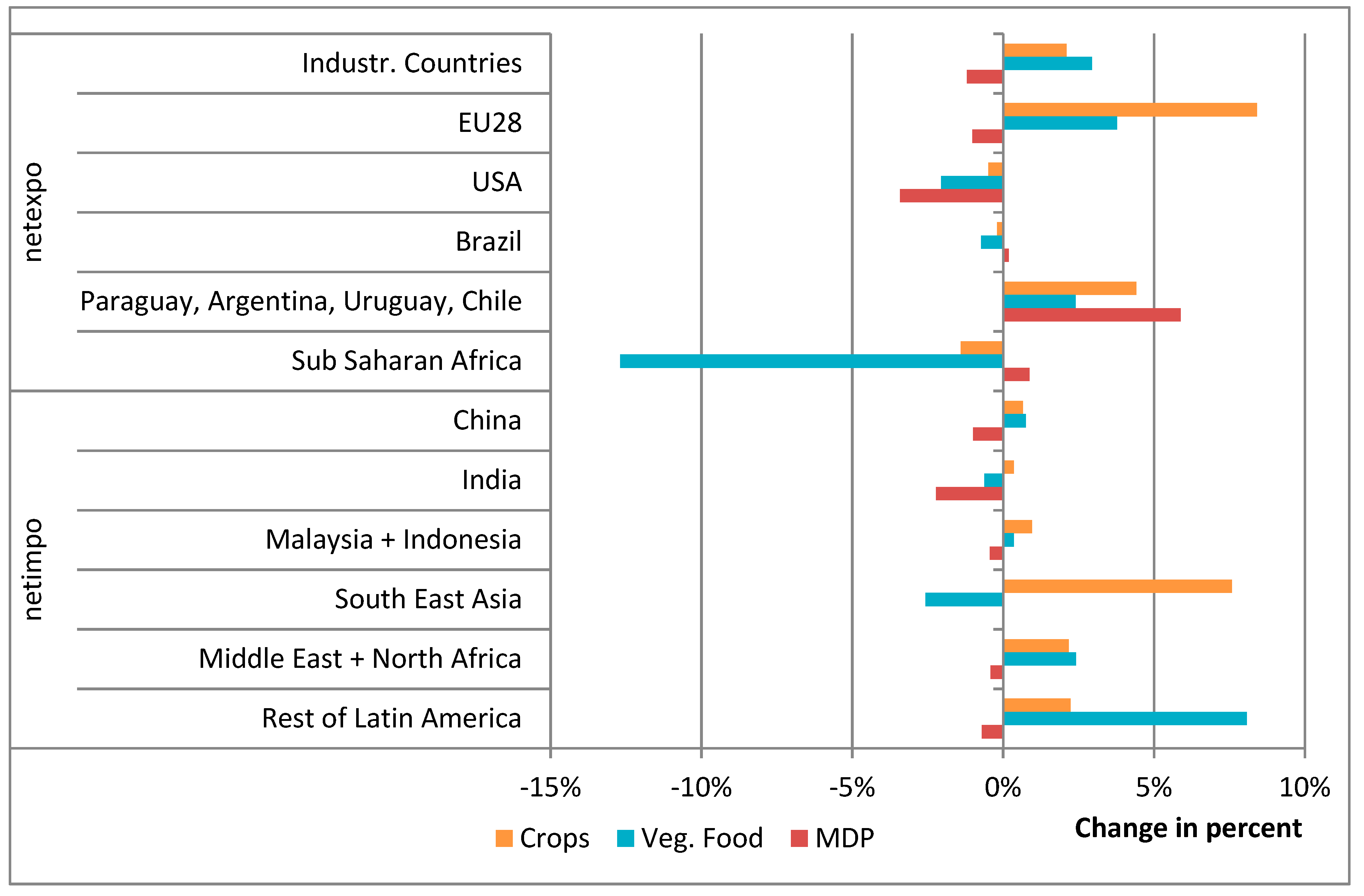

On the global average, total food consumption drops by 7% in this scenario, but regional impacts of the MDP tax differ (see

Figure 8). In industrialised countries, the MDP tax causes consumption of MDP to decrease by about 58%, while it increases consumption of vegetarian food by 4–10%. Total food consumption in these countries drops by 16–27%. The tax has the strongest impact on Russia, since the share of MDP in total food consumption is high in Russia (54% in the Baseline scenario, compared to e.g., 19% in Germany) and total food consumption is low in Russia. At the same time, in Russia income elasticities of demand are lower for vegetarian food (e.g., for AGR: 0.2, processed food 0.72 ) than for many other goods (e.g., for COL: 1.09, OTH 1.14). As a consequence of these three factors, the MDP tax has a large influence on Russia, causing a reduction of overall food consumption of 27%. Regions without the MDP tax benefit from decreasing prices of food such that consumption of both MDP and vegetarian food increases by up to 1.3%. The smallest increases in food consumption are simulated for Sub-Saharan Africa and South American regions. Since they are net-exporters of food products, consumers profit less from lower world market prices. At the same time, producers are faced with lower export prices such that real gross domestic product (GDP; price differences are adjusted) decreases by 0.1–0.7% in these regions.

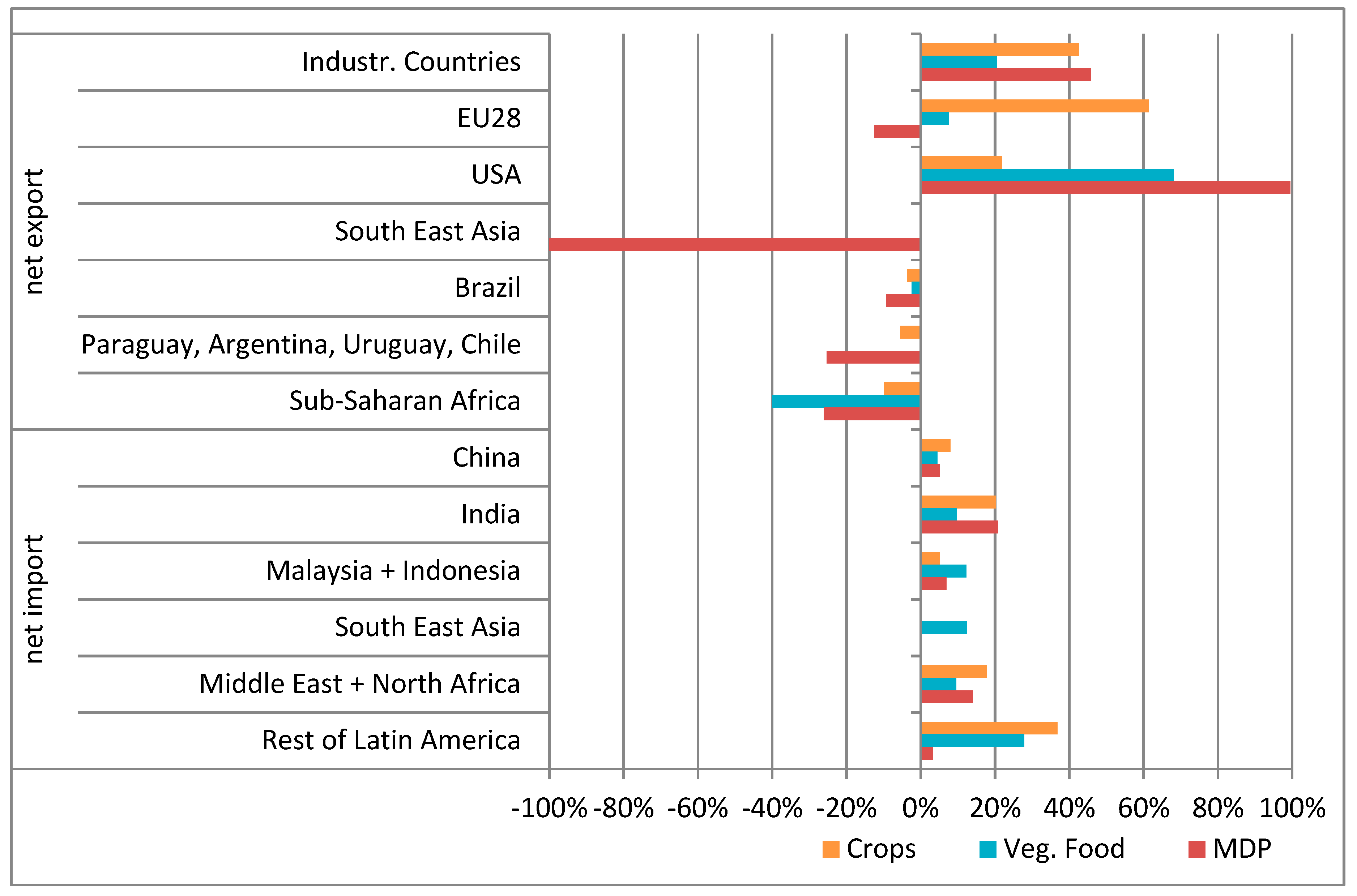

The resulting changes in net trade are illustrated in

Figure 9. With the tax on MDP consumption implemented, industrialised countries increase net-exports by about 40% in case of crops and processed animal products, but also of processed vegetarian food (Veg. Food: 20%). However, there are regional differences. The EU, on the one hand, increases mainly its net-exports of crops (61%), while those of vegetarian food increase only slightly (8%) and of MDP even decrease. This counter-intuitive result can be explained by the strong reduction of EU-exports to other industrialised countries, mainly Russia and the USA. On the other hand, the USA increase its net-exports of crops by 22% and those of vegetarian food by 68%, while they nearly double their net-exports of MDP. The USA’s main trading partners of MDP are China, Middle-and South American countries, and Canada. Interestingly, in the USA both exports and imports of MDP are smaller in the MDP tax scenario than they are in the Baseline scenario; however, imports decline less than exports, so net-exports increase.

The industrialised countries increase their net-exports at the expense of all other net-exporting regions. Net-exports of processed animal products from South American regions (Brazil and Paraguay, Argentina, Uruguay, Chile) decline by 9% and 25%, respectively. Net-exports of MDP products in South-East Asia (SEA) are reduced by almost 100%. We can explain this quite extreme result by taking a look at the trading partners. South-East Asia exports target the USA, Europe and Japan. Since these regions have strong reductions in MDP consumption under this scenario, net-exports of South-East Asia drop so drastically. For the South-East Asian economic the drop in net-exports of MDP products is negligible since the net-exports only have a share of 0.2% on MDP production. With lower world market prices of crops, processed food and processed animal products, also net-exports from Sub-Saharan Africa are reduced by up to 40% compared to the Baseline scenario. Net importers such as India and China benefit from a tax on MDP consumption in industrialised countries: Lower world market prices cause net-imports of processed animal products, and also of crops and vegetarian products to rise.

Another effect of the MDP tax is a decrease in exports of processed animal products to industrialised countries. Brazil, for instance, exports 26% of its net-exports of processed animal products to Russia and 32% to Middle-East and Northern Africa (MEA) under the Baseline scenario. With the MDP tax implemented, the share of its net-exports of processed animal products targeting Russia is reduced to 8%, while those to MEA rise by 10 percent points to 42%.

In summary, our results of the MDP tax scenario show a decrease in pasture land and less land used per unit of OLVS compared to the Baseline scenario in 2030. At the same time, the total cropland area does not change, while the share of land allocated to fodder production (mainly maize, other grains and soy beans) increases. In addidtion, we find an increase in bioethanol production and a decrease in biodiesel production.

Comparing our results with other studies, such as [

25], is difficult since macroeconomic drivers such as population growth, gross domestic product, as well as parameters such as elasticities are different. In fact, even after harmonising macroeconomic parameter choices and external drivers, important differences remain across models [

47]. Nevertheless we can compare the overall direction of results. Similar to the MDP tax in this study, in [

25] the author targets consumption of cattle, other animal products and milk by using a tariff rate in order to decrease consumption in 2020 compared to 2010 by 10, 20 and 50% in the EU27. Comparable to our study, the results are a global decrease in consumption and production of MDPs which is partly compensated by an increase in consumption of grains and other food products in EU27. Following price decreases, he also finds increases in total food consumption in the regions without a tariff or taxes. As a major difference to our results, in [

25] the author finds an increase in biofuel production as a result of the tariff on MDPs which he explains by the reduction in prices for crops. We have a similar effect in case of bioethanol, but an opposite effect for biodiesel. We explain this by the differences in the representation of biofuels and related by-products in the two models: DART-BIO takes into account different vegetable oils, since in the joint production of vegetable oils and meals, the respective output ratios of oils and meals differ across oil seeds. For instance, when using soy beans 41% of the output is oil and 59% is meal, while for palm fruit 98% is oil and 2% is meal (this is based on monetary terms, for an overview on different oilseeds see

Table 3 in [

12]). Independent of the oilseed, in [

25] the author assumes a share of 20% of by-products and 80% of the value of vegetable oil as outputs.

3.3. The “No Biofuel Policy Scenario”: Changes in Global Average Prices, Production, Consumption and Harvested Area Compared to MDP Tax Scenario

The Baseline scenario and the MDP tax scenario include current biofuel policies. With this scenario (noBFP scenario), in which biofuel policies are abolished, we aim to analyse the interplay of biofuels and livestock production, since by-products of biofuel production are used as fodder in livestock production. To analyse the additional effect of no biofuel policies, we compare this scenario to the MDP tax scenario.

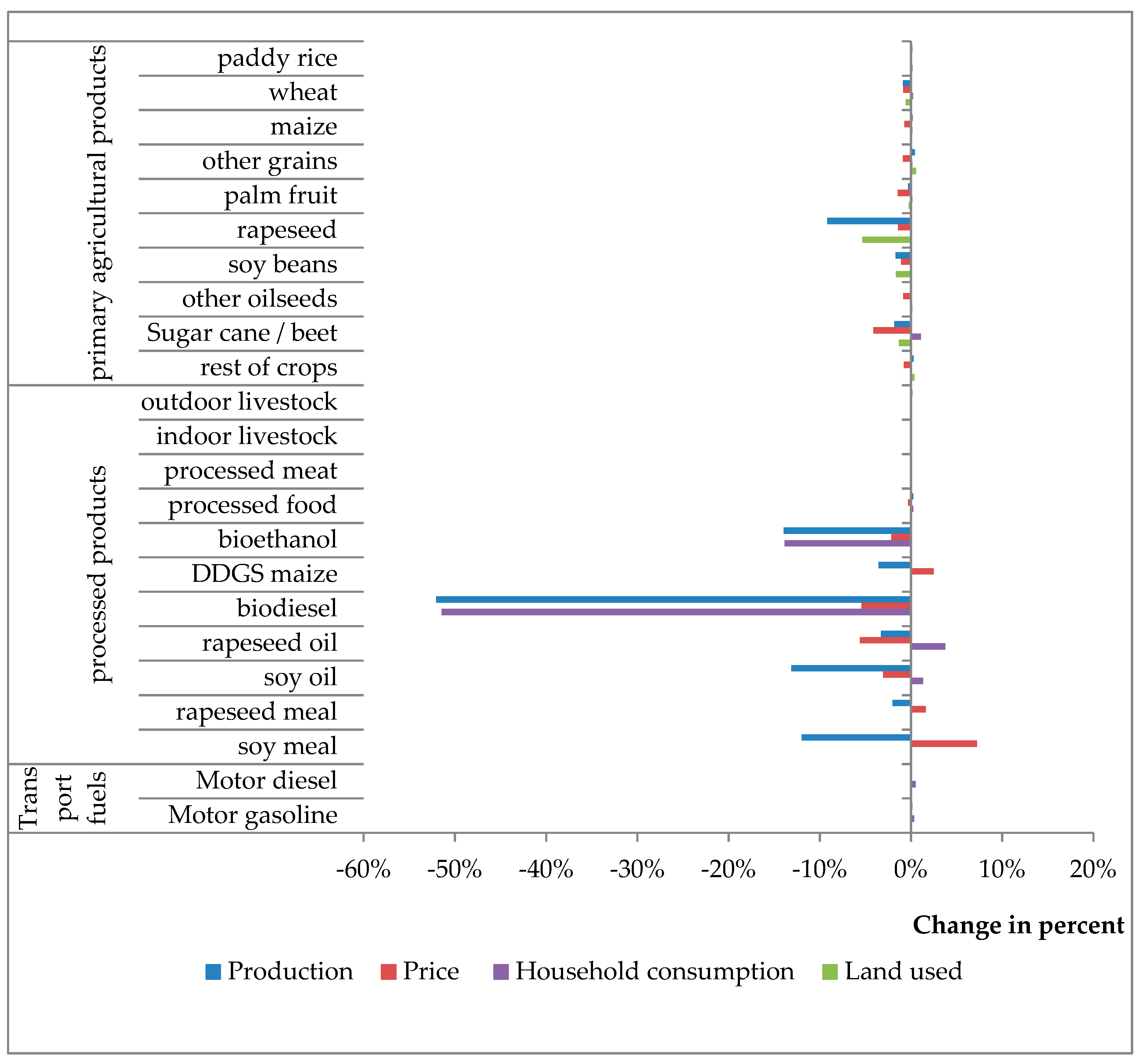

The abolishment of biofuel policies results in a global reduction of biodiesel production by 52%, and a global reduction of bioethanol production of 14% (

Figure 10). This difference between the two types of biofuels is caused by the different shares of each type in transport fuels. The shares of biodiesel in transport diesel are higher compared to the shares of bioethanol (see

Figure 2) in transport gasoline. Consequently, the “demand shock” and therefore the reduction in demand is higher in the biodiesel market. (Note that the share of 72% of bioethanol in Brazil (see

Figure 2) is not forced into the model, since Brazil produces bioethanol and sugar in plants that can easily switch production depending on prices [

12]). A minor effect is a change in relative prices of biodiesel and bioethanol compared to their fossil alternative: the relative price of biodiesel compared to fossil diesel increases, the relative price of bioethanol compared to fossil gasoline decreases.

Less demand for biodiesel causes vegetable oil price and production to decline. The production of jointly produced meals also decreases, while their prices rise. The impact on global crop production and prices as well as land use is relatively small. Production of rape seed decreases by 9%, as does production of soy bean and sugar cane/beet, since less of these feedstocks are used for biofuel production. With respect to changes in crop prices caused by biofuel policies, compared to studies (as analysed in [

16]) that do not implement a MDP tax simultaneously, the changes in crop prices are at the lower bound of the range in results. This is in line with [

12,

22] (using the same model that we do), which also simulate relatively low increases in crop prices compared to studies quoted in [

16]. Moreover, in [

12] the authors show that the implementation of biofuel policies results in decreasing prices of indoor livestock which is mainly fed by feed crops. They explain this effect by the increases in the availability of animal feed on the market resulting from by-products of the biofuel industry. The restrictions on demand set by the MDP tax oppress this mechanism in our analysis.

While results of

Section 3.2 illustrate that the MDP tax has an impact on the biofuel sector, an abolishment of biofuel policies does not impact on global prices, production or consumption of MDP, if the MDP tax is implemented at the same time.

Also with respect to land use change, on the global scale the abolishment of biofuel policies does not have a big impact: the total cropland area does not change, but the share of rapeseed, soy beans and sugar cane/beet is reduced. Pasture land increases by 0.3%. For an abolishment of biofuel policies without a simultaneous MDP tax, in [

22] the authors also find low land use change effects, but with regional differences: less land is used for crop production in the EU, Paraguay, Argentina, Uruguay, Chile, and cropland area increases in in India. In [

14], where the land use impact of the EU biofuel mandate in 2020 is simulated with the CGE model MIRAGE, the authors find an increase in the global cropland area of around 0.22% (2708 thousand hectares) and a decrease of 0.04% (357 thousand hectares) of pasture land in 2020 compared to a Baseline scenario. Substiantial differences in the underlying modelling of land use change ([

14] allows for an endogenous expansion into uncultivated land in addition to land use substitution between cropland and managed pasture and forest) make results hard to compare to ours. We conclude that the abolishment of biofuel policies does not reduce land use substantially, since the by-products used for animal feeding need to be replaced by primary production of feed crops.

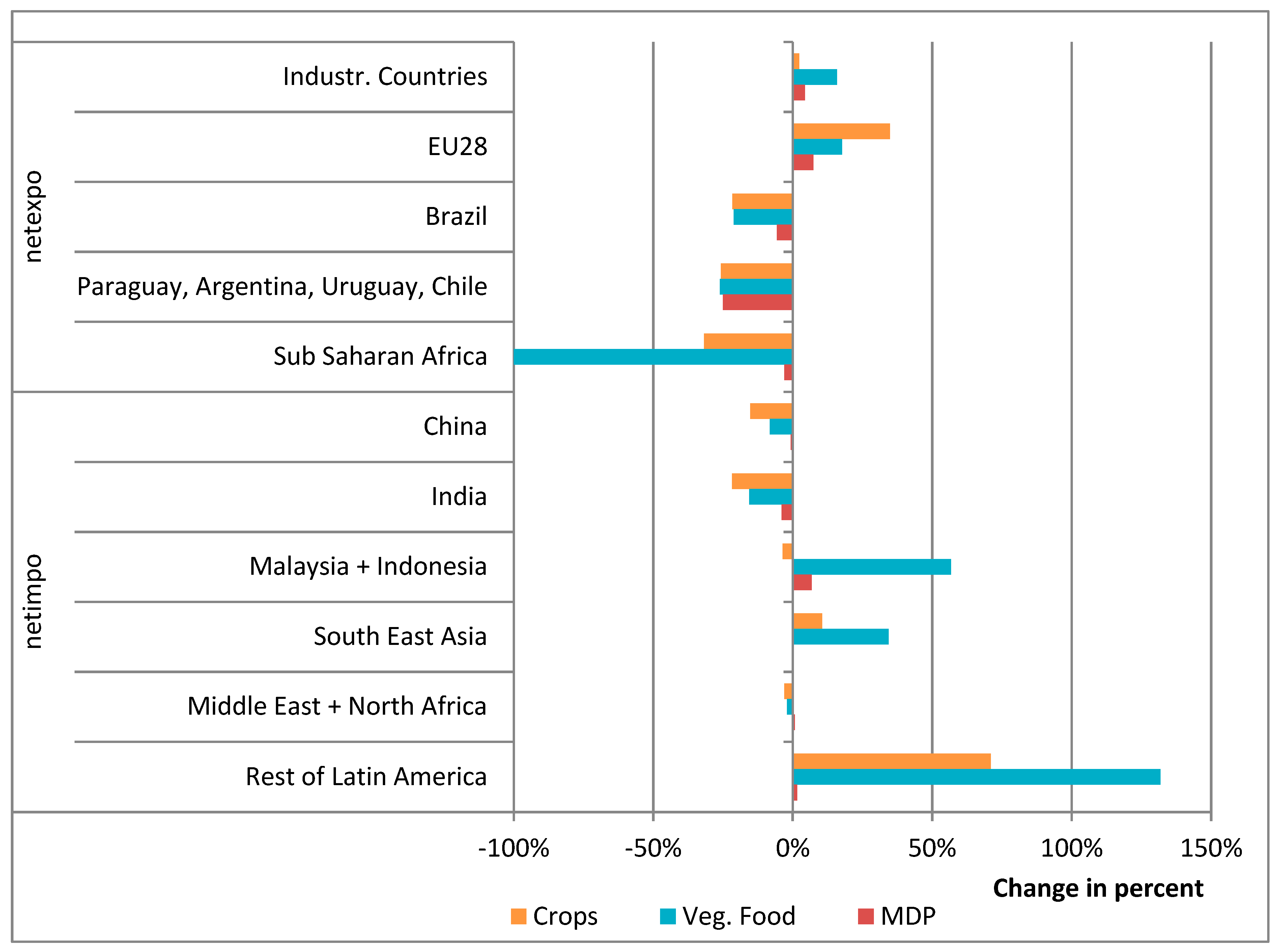

However, the abolishment of biofuel policies has some influence on international trade of MDP. It causes net-exports of MDP for most industrialised countries to decrease by 1% (see

Figure 11). With less by-products being produced in the biofuel industries, prices of vegetable oils decrease, while in the joint production process DDGS and meal prices increase. This causes a reduction of MDP production in industrialised countires. With MDP consumption remaining stable, this leads to decreasing net-exports.

With a strong reduction in biofuel consumption in the EU (mainly biodiesel), EU net-exports of crops and total vegetarian food increases. The largest share of EU’s net-exports of crops go to the regions “Rest of the World”, Russia and Middle East and Northern Africa. The increases in EU net-exports of crops are highest for the target regions Sub-Saharan Africa (+18%), “Rest of Latin America” (+15%), Australia and New Zealand (+11%), and China (+10%).

The changes in trade patterns of the USA are different to the EU: Here, net-exports of crops and total vegetarian food decrease. For total vegetarian food the strongest changes in US net-exports are a decrease in net-exports to the region “Paraguay, Argentina, Uruguay, Chile” (−10%) and an increase in net-exports to “Rest of Latin America” (+27%). While the absolute quantity of changes in net-exports is negligible for the USA, this is not the case for “Rest of Latin America”: Here, net-imports increase by 8%. This is also due to strongly increased net-imports (+40%) from EU region “Mediterranean”.

The region “Paraguay, Argentina, Uruguay, Chile”, on the other hand, increases its net-exports of vegetarian food, mainly to USA, Sub-Saharan Africa and “Rest of Latin America”. At the same time, net-exports to several EU regions decrease strongly. Furthermore, “Paraguay, Argentina, Uruguay, Chile” increases its net-exports of MDP (5.9%), mainly to “Rest of the World” and USA. Sub-Saharan Africa decreases its net-exports of crops and, even more so, of other vegetarian food (13%) compared to the MDP tax scenario, mainly due to decreasing net-exports to EU countries.

3.4. The “No Cropland Expansion/Contraction Scenario”: Changes in Global Average Prices, Production, Consumption and Harvested Area Compared to “No Biofuel Policy Scenario”

In all previous scenarios we implemented cropland expansion/contraction. In this scenario, we analyse the effects of an increased land scarcity by assuming no cropland expansion into uncultivated areas. This scenario is compared to the “no biofuel policy scenario”.

If no cropland expansion/contraction is assumed, global prices for all products using land increase as expected, due to the relative global land scarcity (

Figure 12). This price increase averages 8.9% (mean of all products using land) and ranges from 2.3% (“Processed animal products”) to 19% (“Palm fruit”). The range in prices changes across crops is caused by the regional distribution of crop production combined with regionally different changes in growth rates of land expansion/contraction. Palm fruit, for instance is produced in regions with strongest incrases in land expansion under baseline conditions (South-East Asia, Malaysia/Indonesia), so when restricting cropland expansion the decrease in production is above average. Furthermore, effects are smaller for processed food products compared to crops; for processed food products there are other production factors than land, which dampen the effects of increased land prices. Biofuels are an exception to this: their production and consumption decrease stronger than that of crops (~15% for bioethanol and ~9% for biodiesel), compared to an average (over all sectors) decrease of ~5% in both production and consumption. We explain this by changes of relative prices; while prices for biofuels increase as an effect of rising land prices, prices for conventional fuels do not chage considerably between scenarios. Given a high elasticity of substition between biofules and conventional fuels, biofuels are replaced by fossil fuels if land prices increase.

As a result of the increased land scarcity, production of both MDP and vegetarian food decrease in all regions. Changes differ across regions, since regional production of agricultural products is directly affected by the assumed cropland expansion/contraction. Prices react on the altered production, and consequently also consumption patterns adjust, with regional differences (−3.9% on average). The effects in private consumption can be dampened by adjusting net trade. In total, the industrialised countries react only marginally on the globally increased land scarcity (

Figure 13). Their MDP consumption decreases by 1.1%. (Only Sub-Saharan Africa has a lower value (−0.9%)). Similarly, the consumption of vegetarian food (“Veg. Food”) decreases by 1.4%. Along with India, the aggregate of industrialised countries are the regions least affected by the altered land scarcity. There are, however, regional differences, which stem from the assumptions regarding land expansion/contraction in the other scenarios: India, Japan, Russia, and the EU are characterised by land contraction in the other scenarios, so their available cropland is increased in the NoLandExpCon scenario. On the other hand, land use is expanded in other regions of the “Industrialised countries aggregate”, for example, in the USA. Consequently, private consumption of MDP decreases stronger for the USA (−2.4%) than for the EU (−0.6%). In Russia, where in the other scenarios land contraction is more severe than for the EU (

Figure 1), the effect is even smaller (−0.2%). The pattern is the same for vegetarian food, although the effect is less pronounced.

The most affected regions are those which hold large potentials for land expansion: South- and Middle America, Malaysia/Indonesia and South East Asia as well as Sub-Saharan Africa.

As mentioned above, the changes in regional availability of cropland also affect international trade (

Figure 14). Sub-Saharan Africa changes from a net-exporter of vegetarian food to a net importer. Here, net-exports of crops and, to a lesser extent, MDP decrease. South America remains a big net-exporter of food products, but net-exports of all food sectors decrease. The industrialised countries aggregate is the only region where net-exports increase under the assumption of no land expansion/contraction. It benefits from the globally decreased availability of cropland as well as from the increased availability of cropland in EU, Russia and Japan. In the USA, which face a decrease in available cropland, net-exports decrease.

We obsever the strongest change on the import side for net-imports of vegetarian food in “Rest of Latin America”, where net-imports more than double (+132%) compared to the “no biofuel” scenario. This is caused by the large expansion of cropland areas which is conducted in this region in the other scenarios. Also Malaysia/Indonesia and South East Asia show a strong increase of net-imports in vegetarian food (57% and 34%, respectively). China and India are big net food importers. China has only small expansion potentials in the Baseline scenario, while in India cropland area decreases. Hence, under the NoLandExpCon scenario net-imports of food decrease in both regions.