Optimism Bias Evaluation and Decision-Making Risk Forecast on Bridge Project Cost Based on Reference Class Forecasting: Evidence from China

Abstract

:1. Introduction

2. Theoretical Background

2.1. Theory of Optimism Bias

2.2. Optimism Bias in Project Decision-making

3. Optimism Bias Measurement of Bridges in China

3.1. Data Collection

3.2. Measurement of Optimism Bias

4. Model of Decision-Making Risk Forecast Based on RCF

4.1. Initial Model

4.2. Description of Variables

4.2.1. Explicit Benefits

4.2.2. Implicit Benefits

4.2.3. Cost

4.3. Modified Model

5. Case Study: Hangzhou Bay Bridge

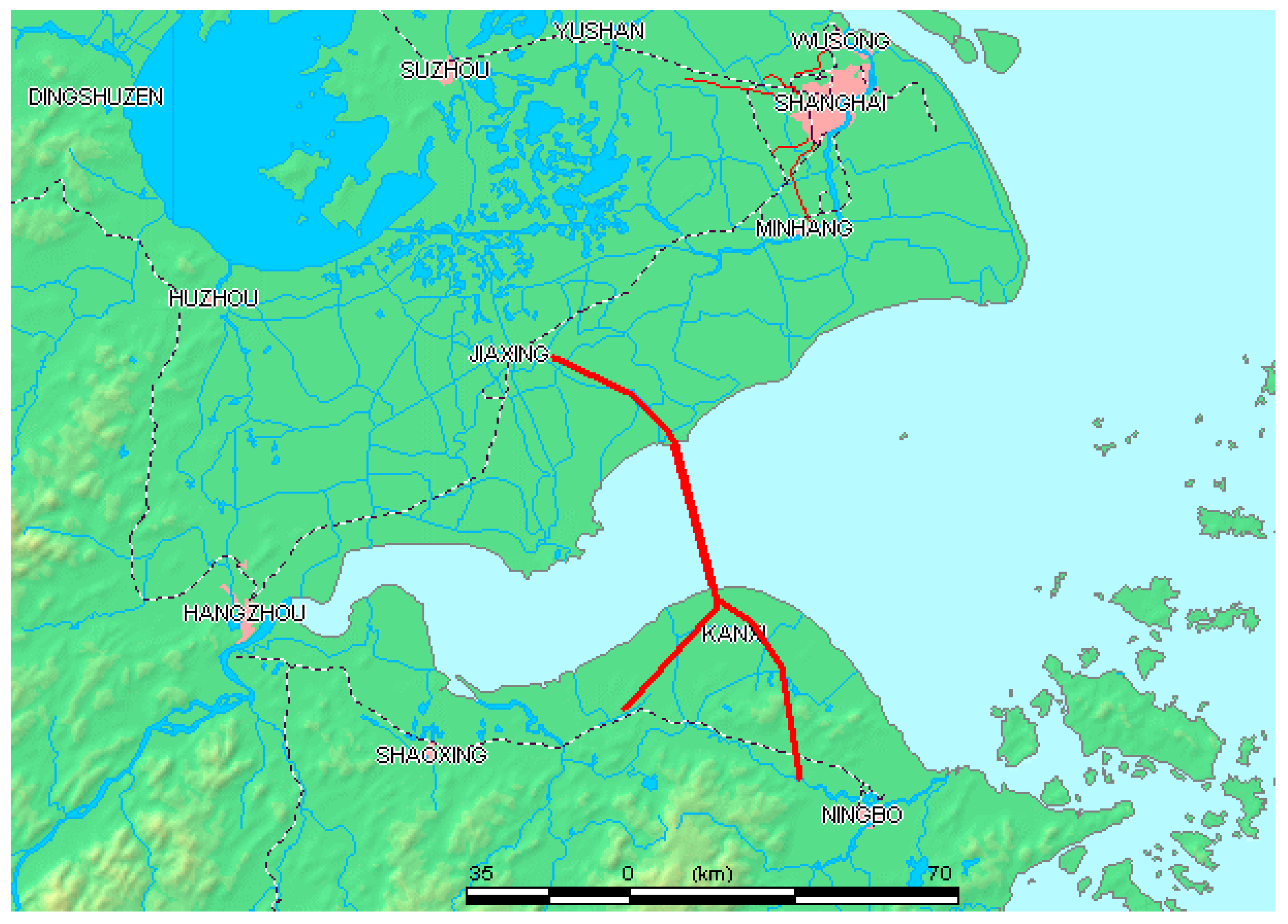

5.1. Introduction of Hangzhou Bay Bridge

5.2. Parameters Hypothesis

5.3. Discussion

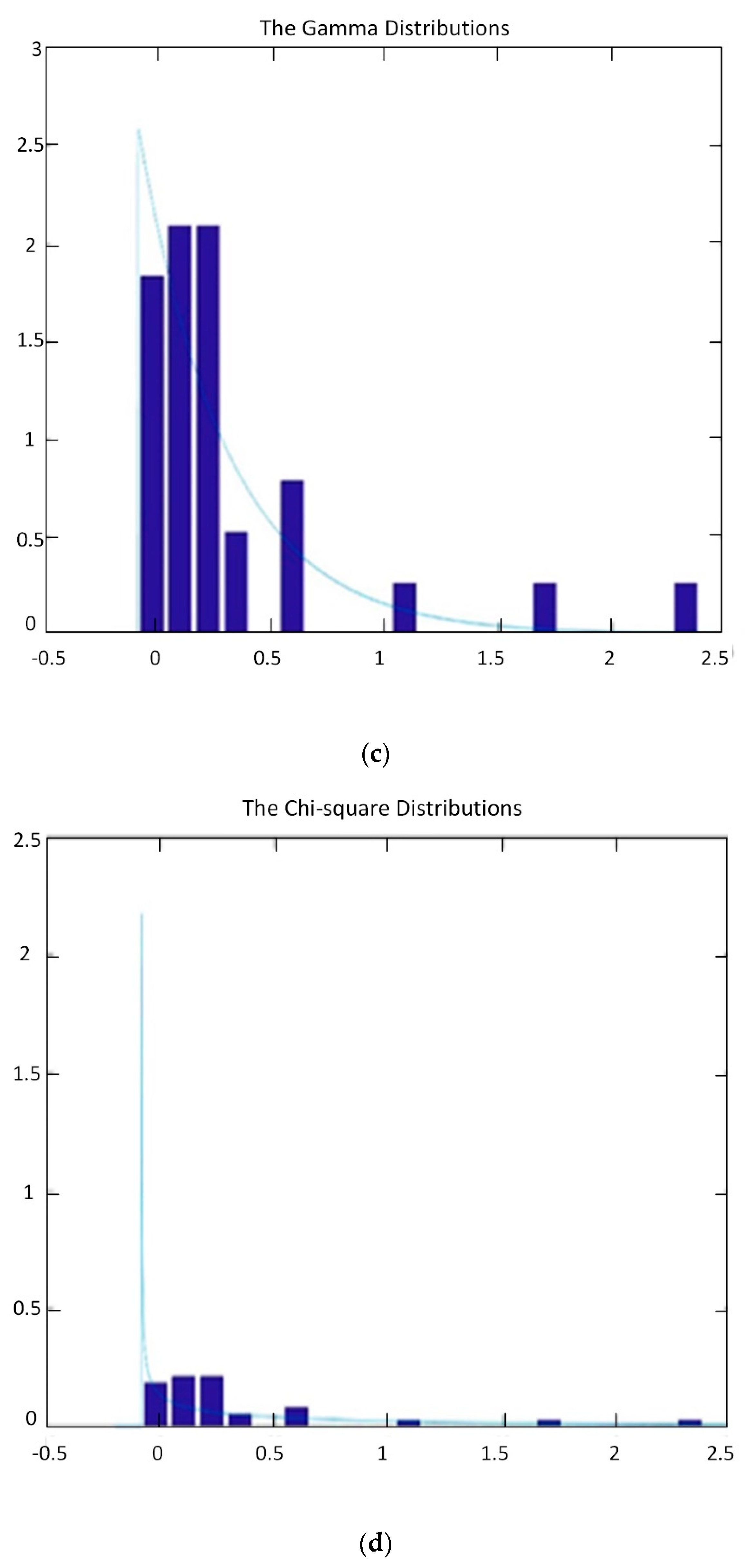

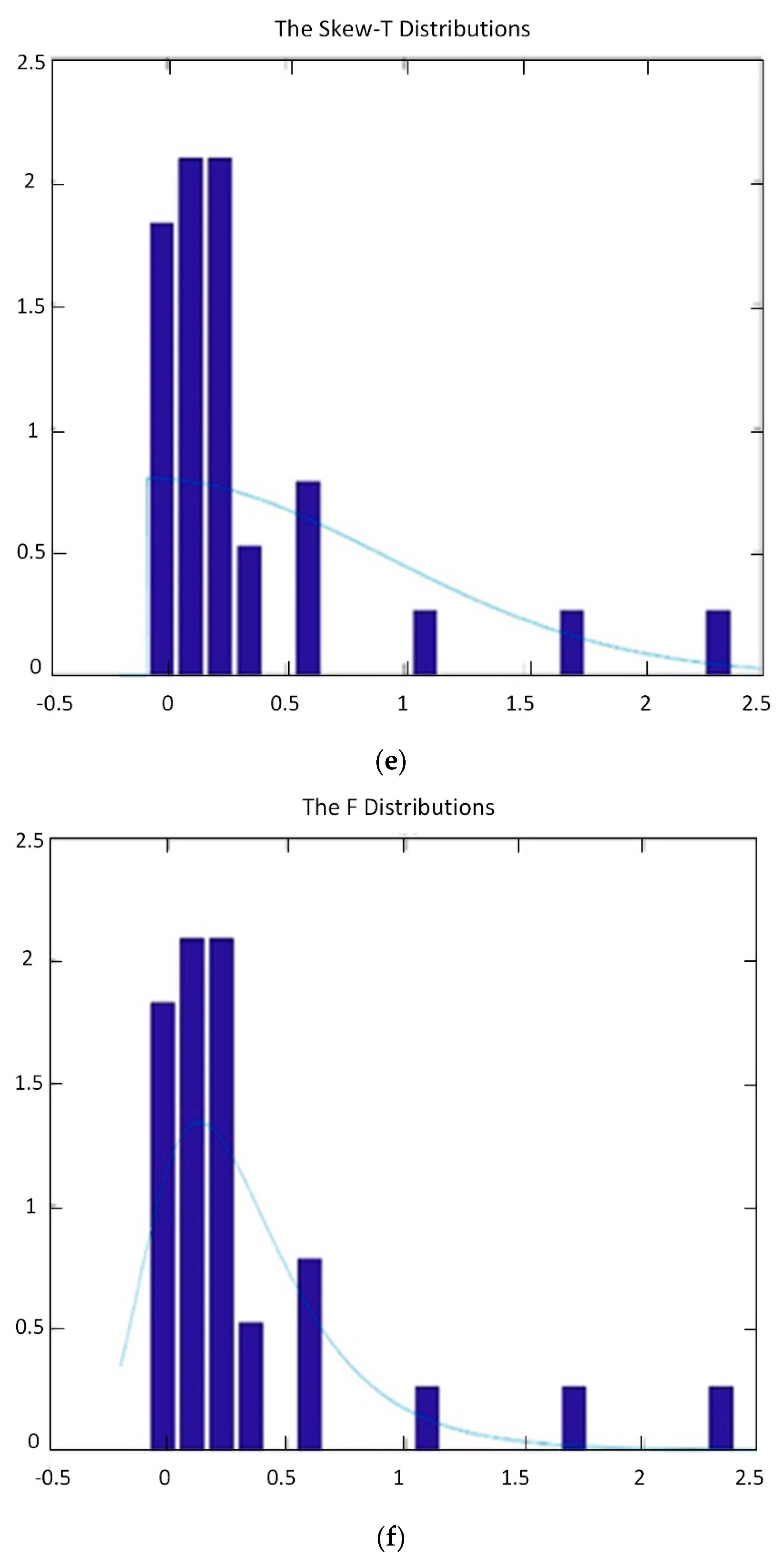

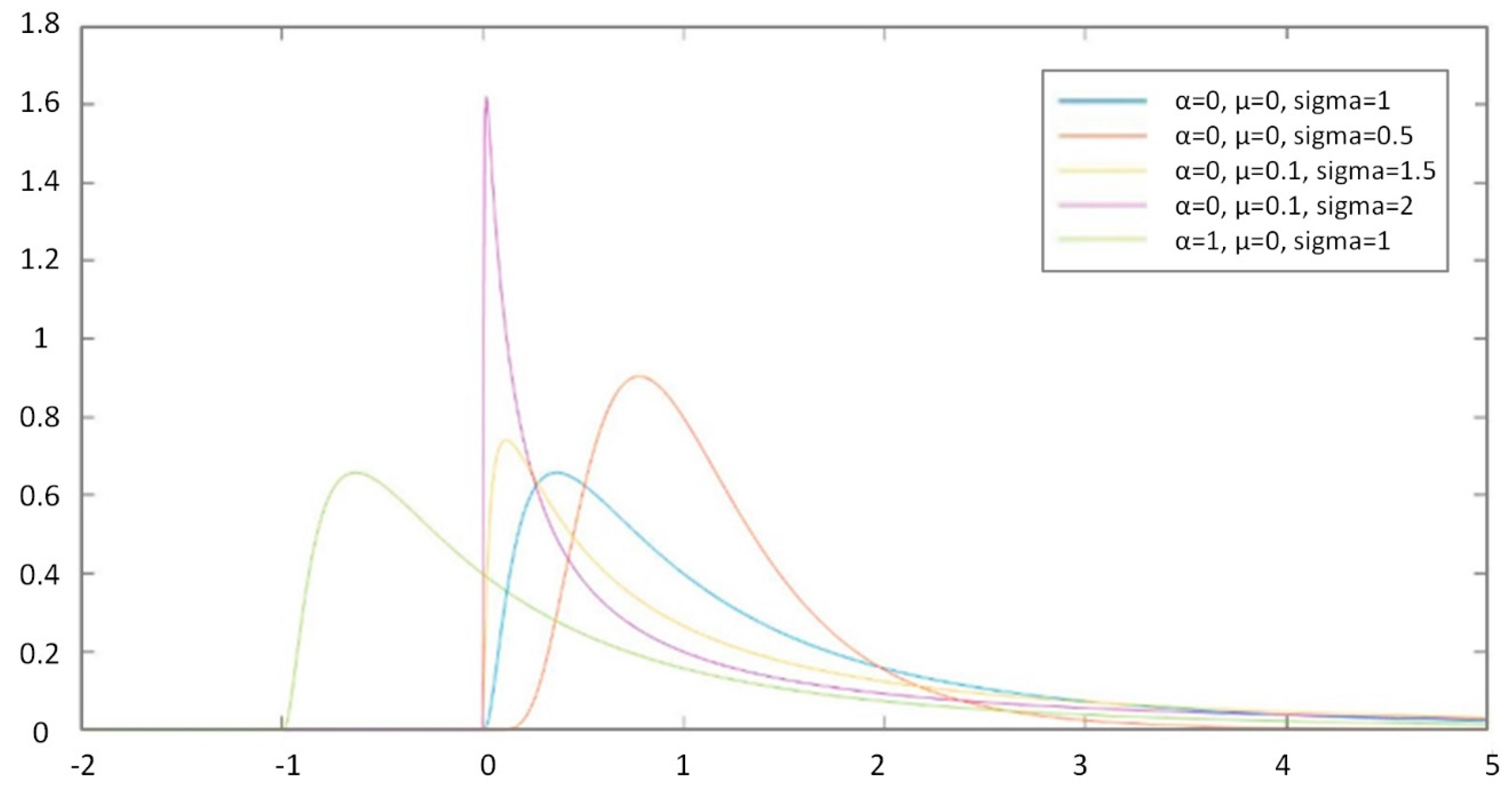

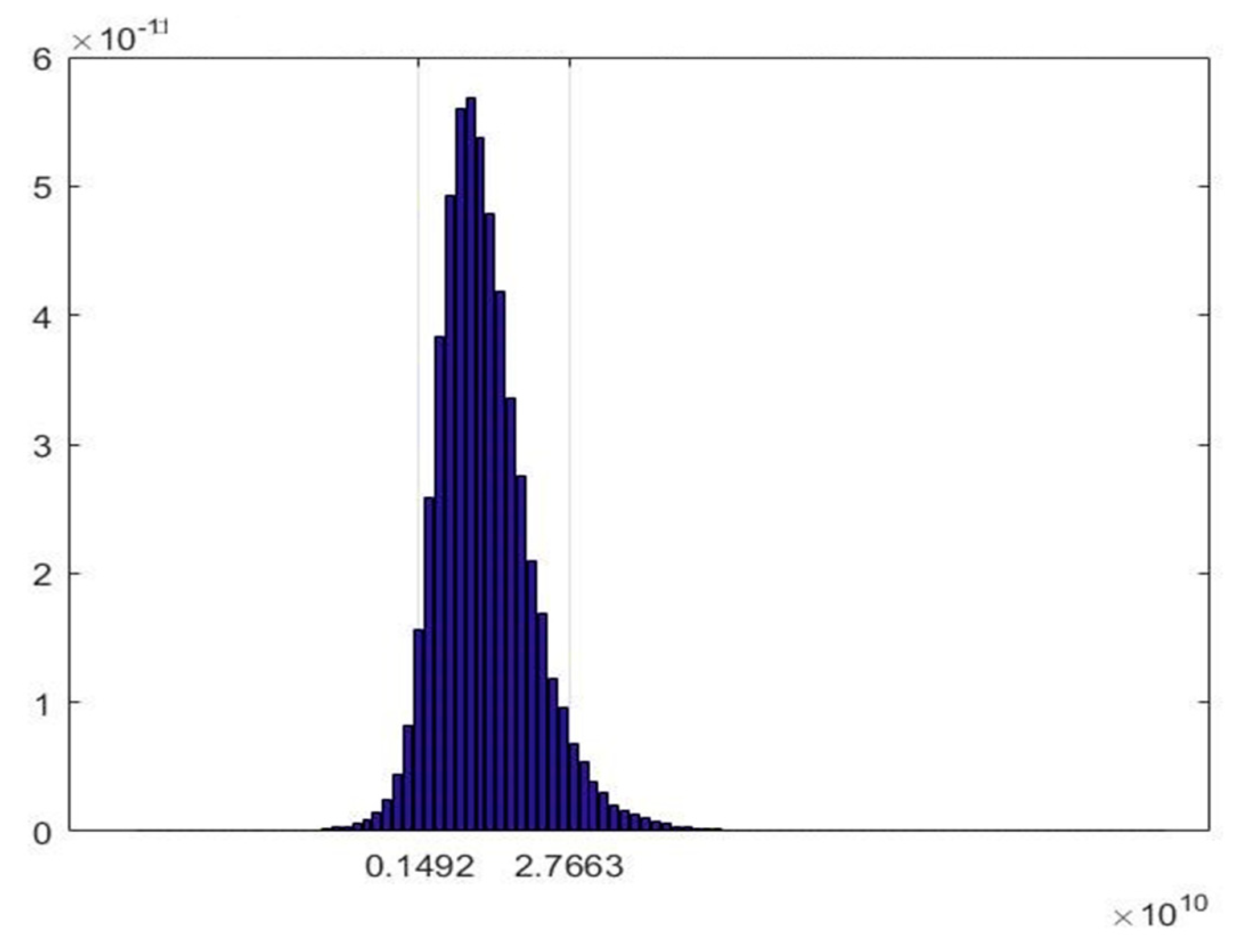

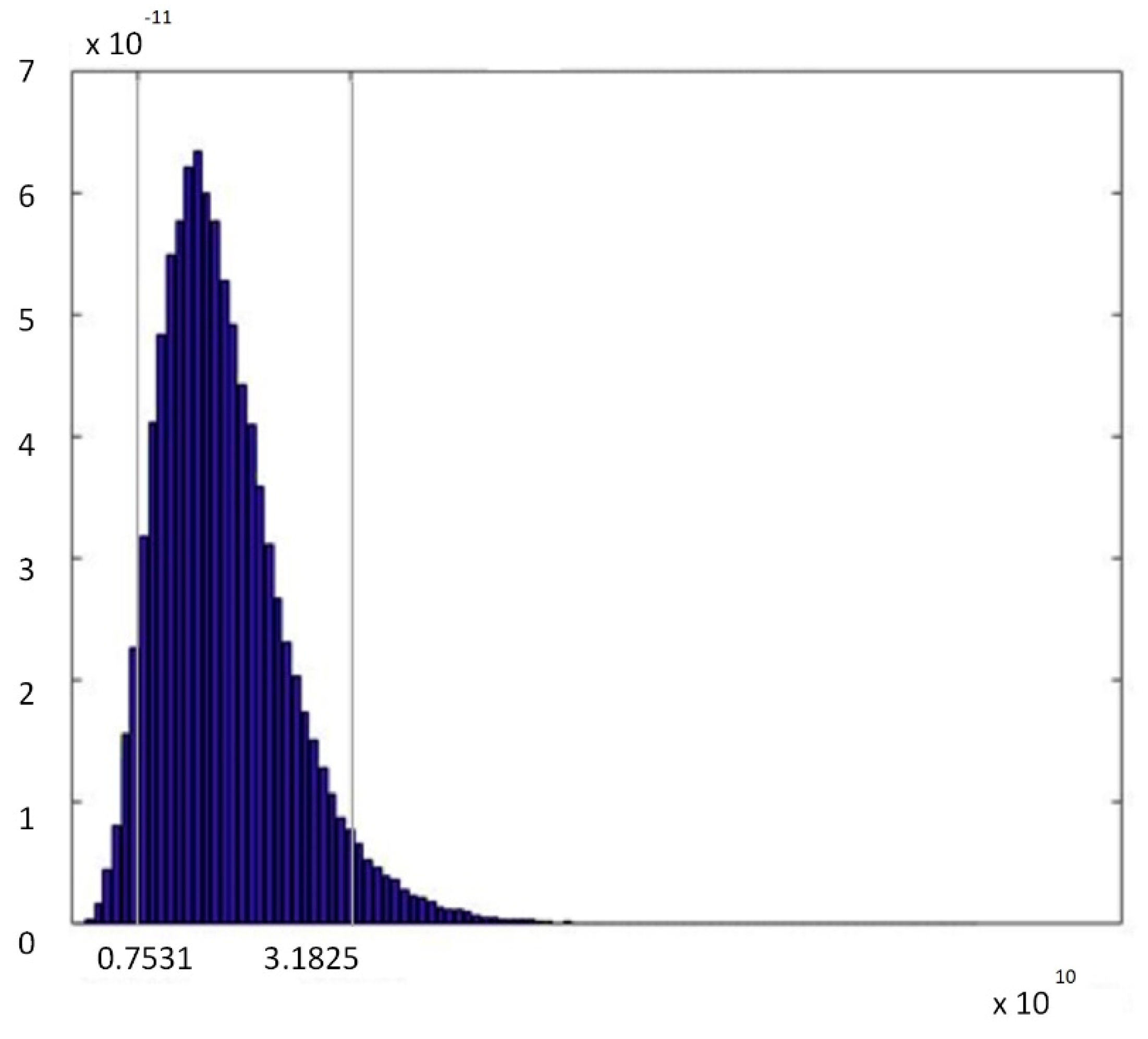

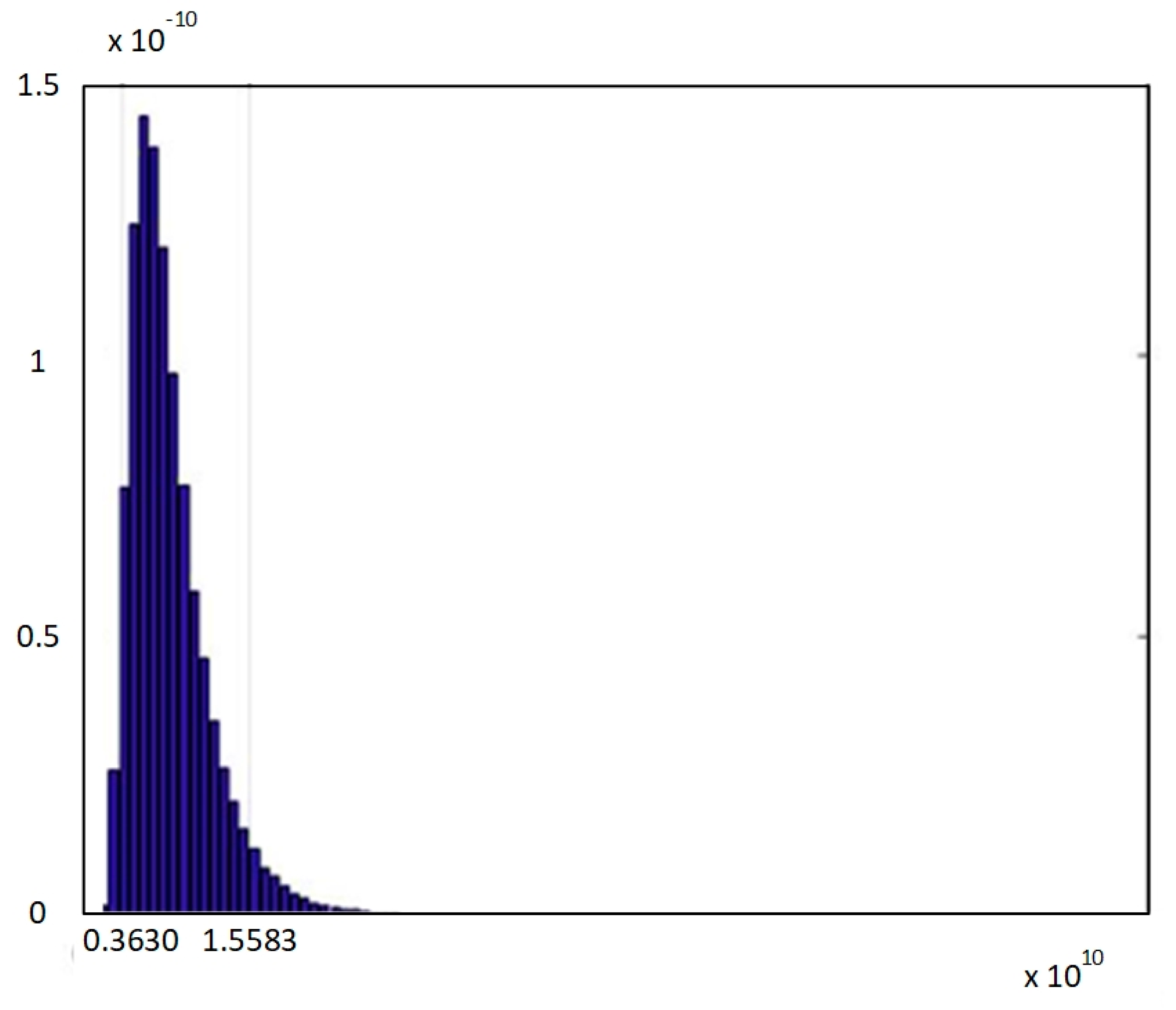

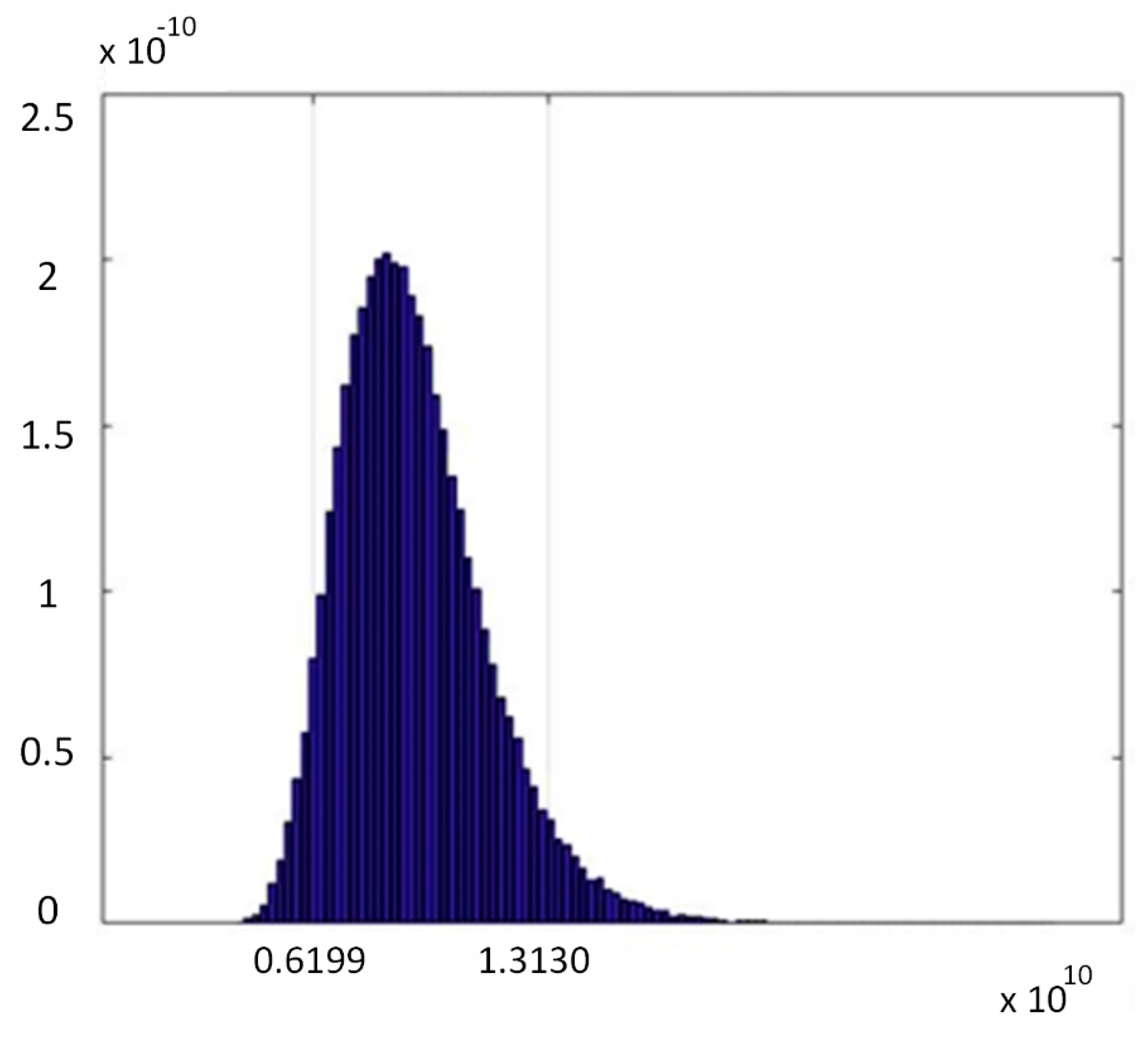

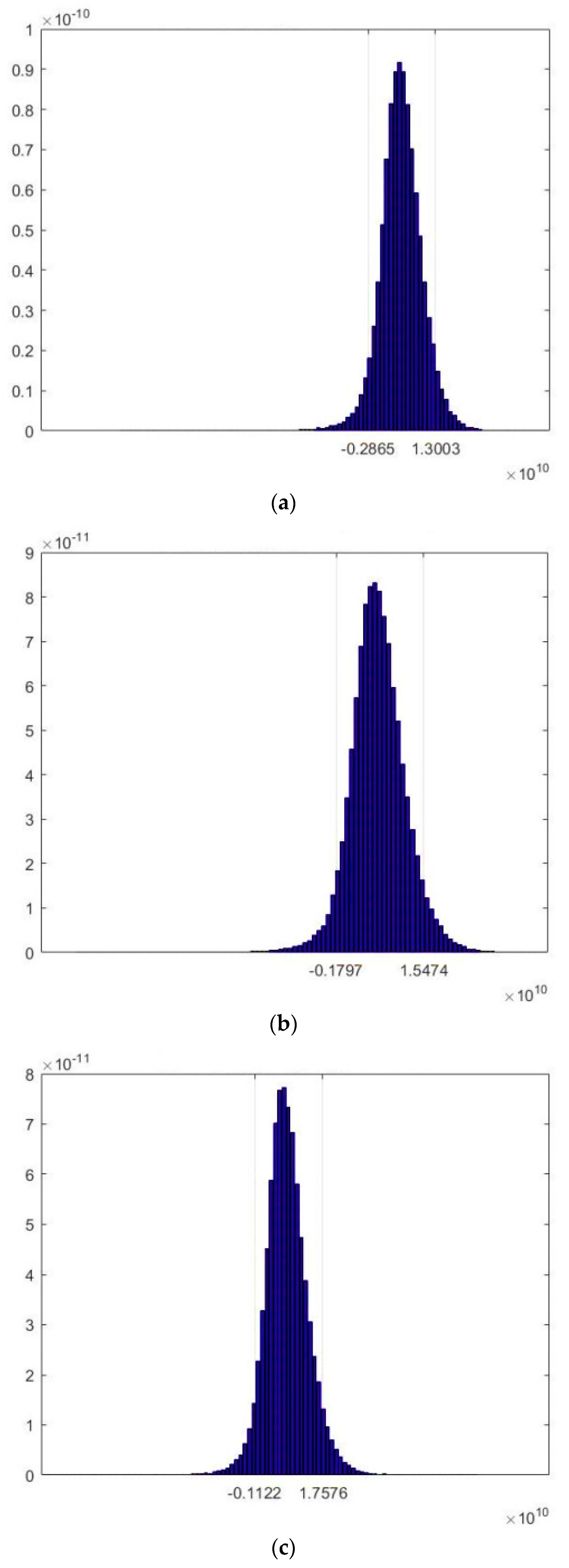

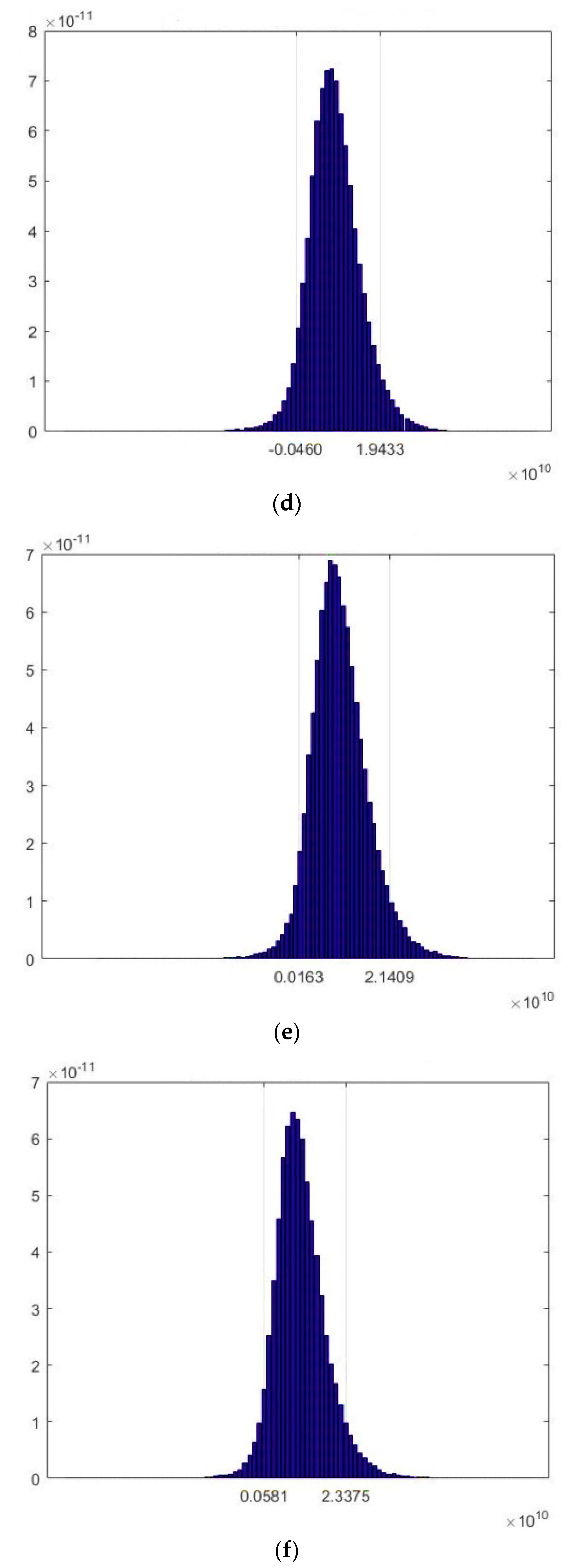

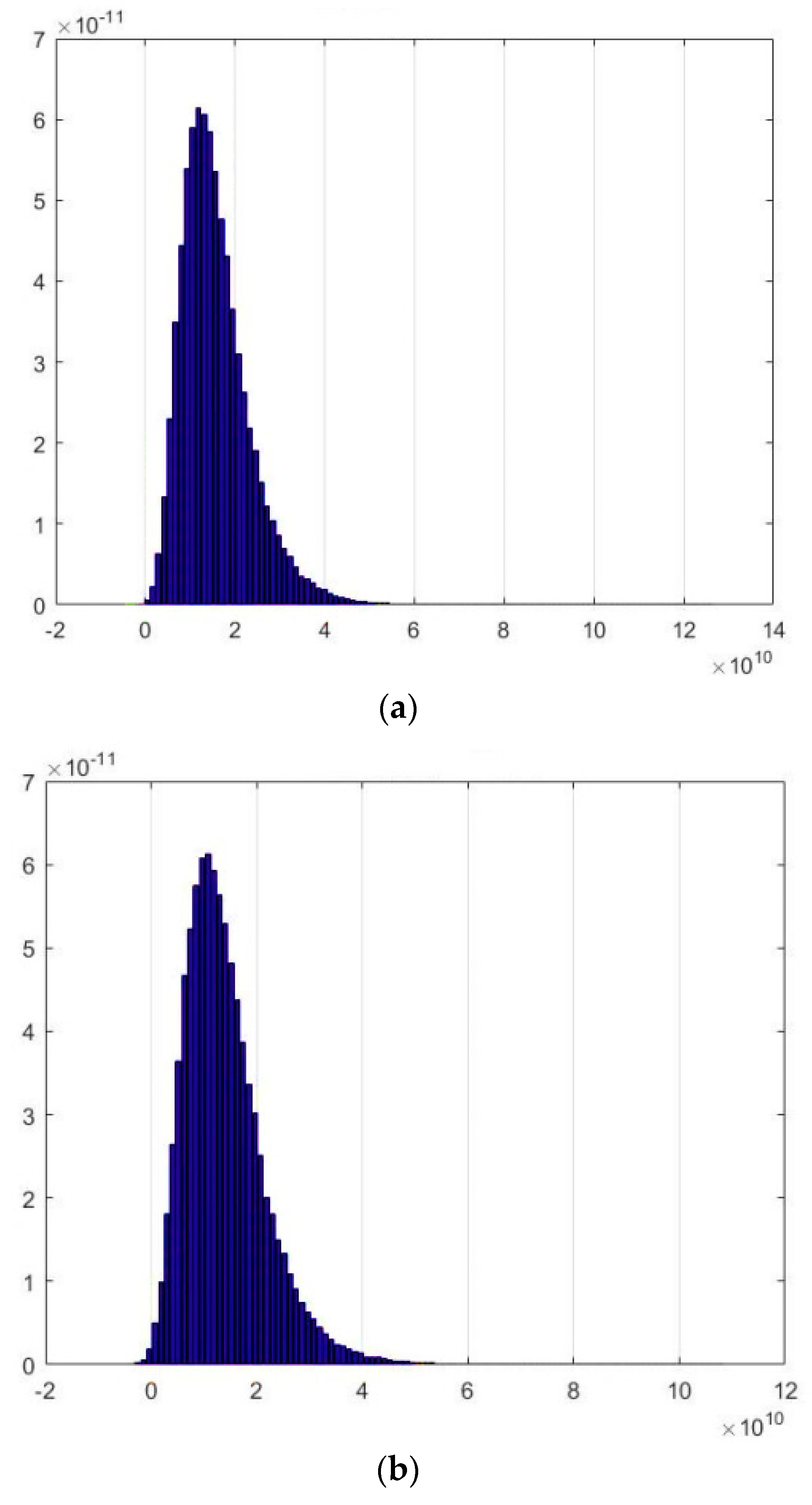

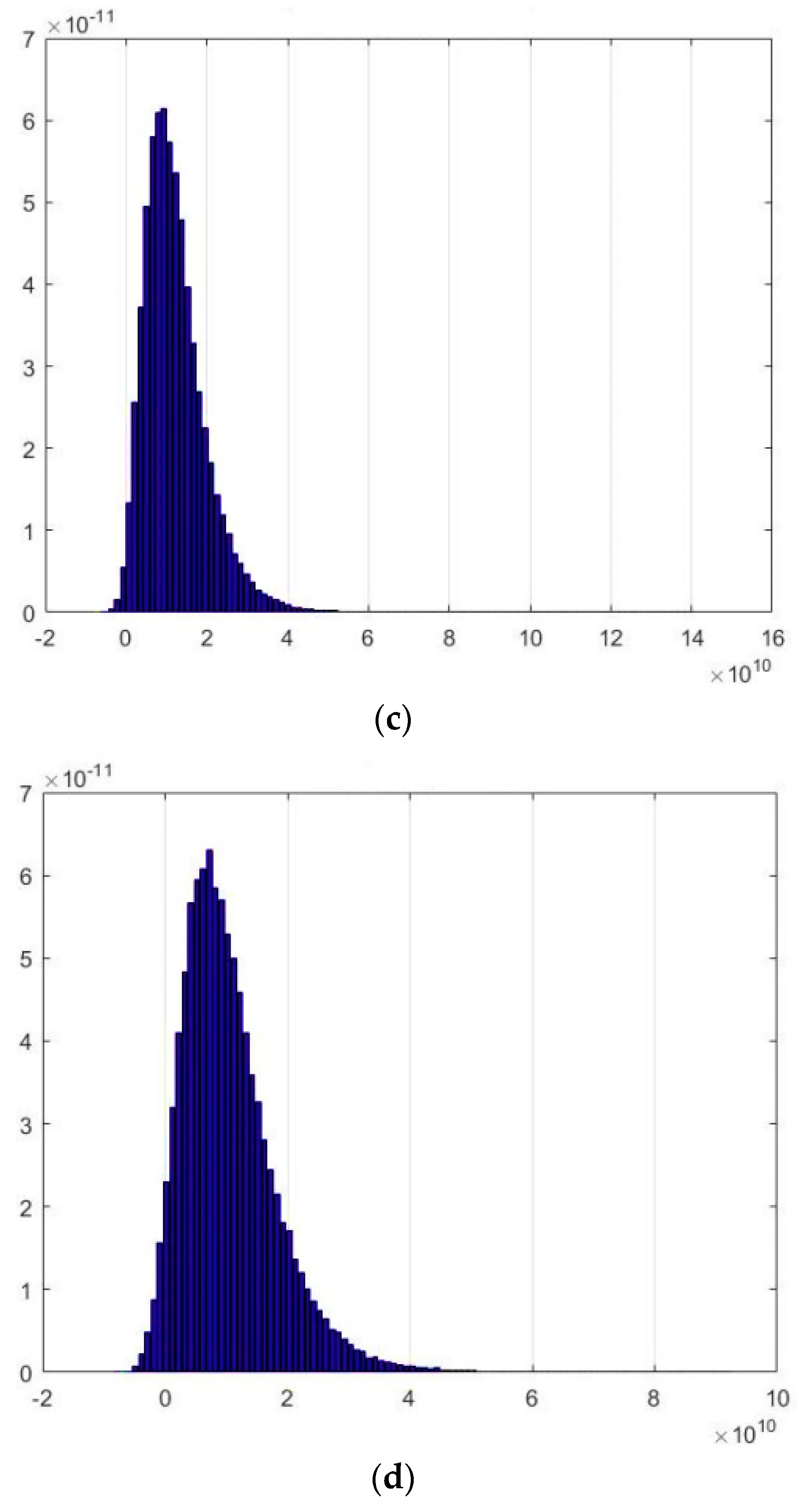

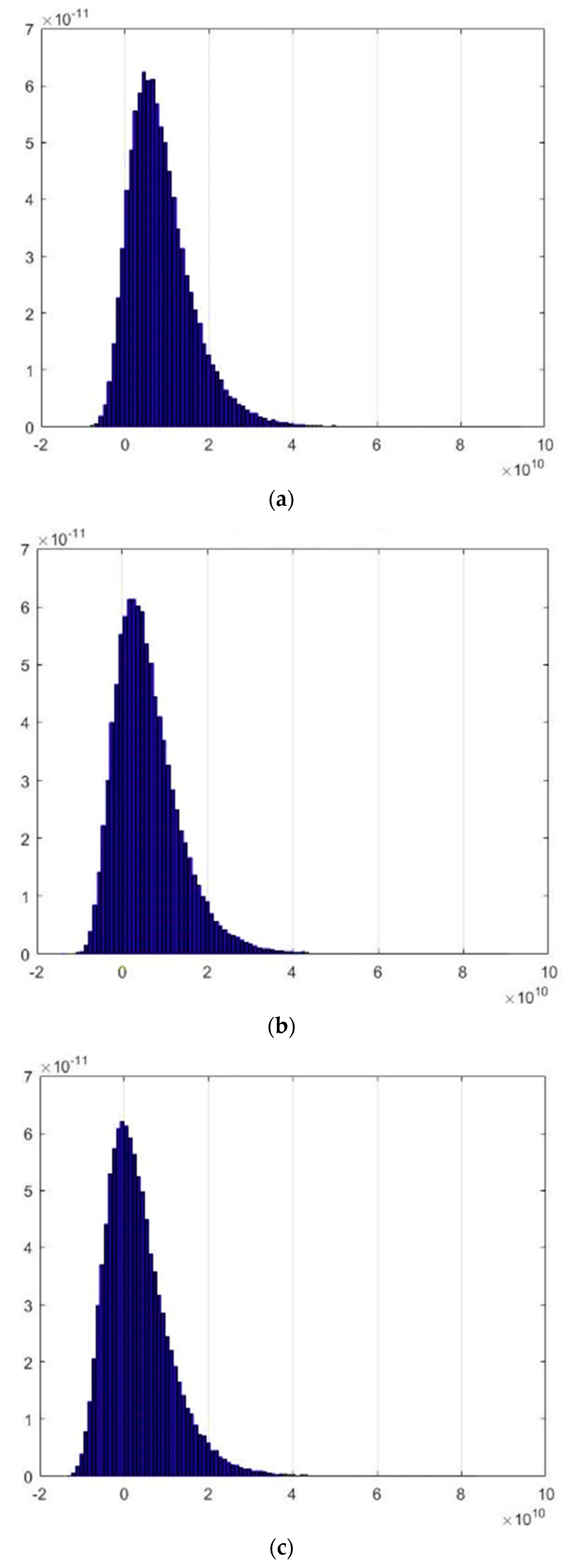

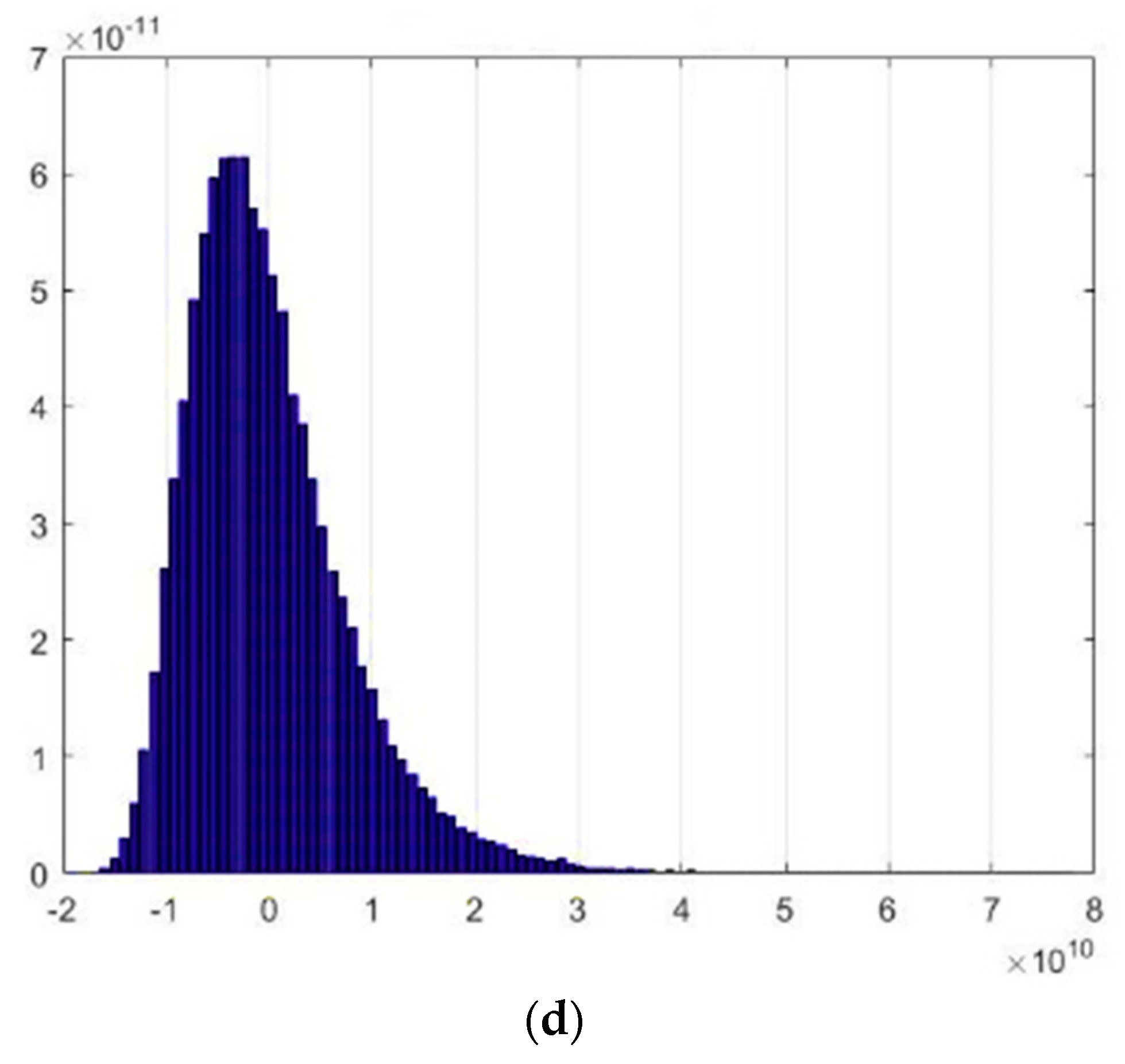

5.3.1. Discussion under Given Situations of Cost Optimism Bias Distributions

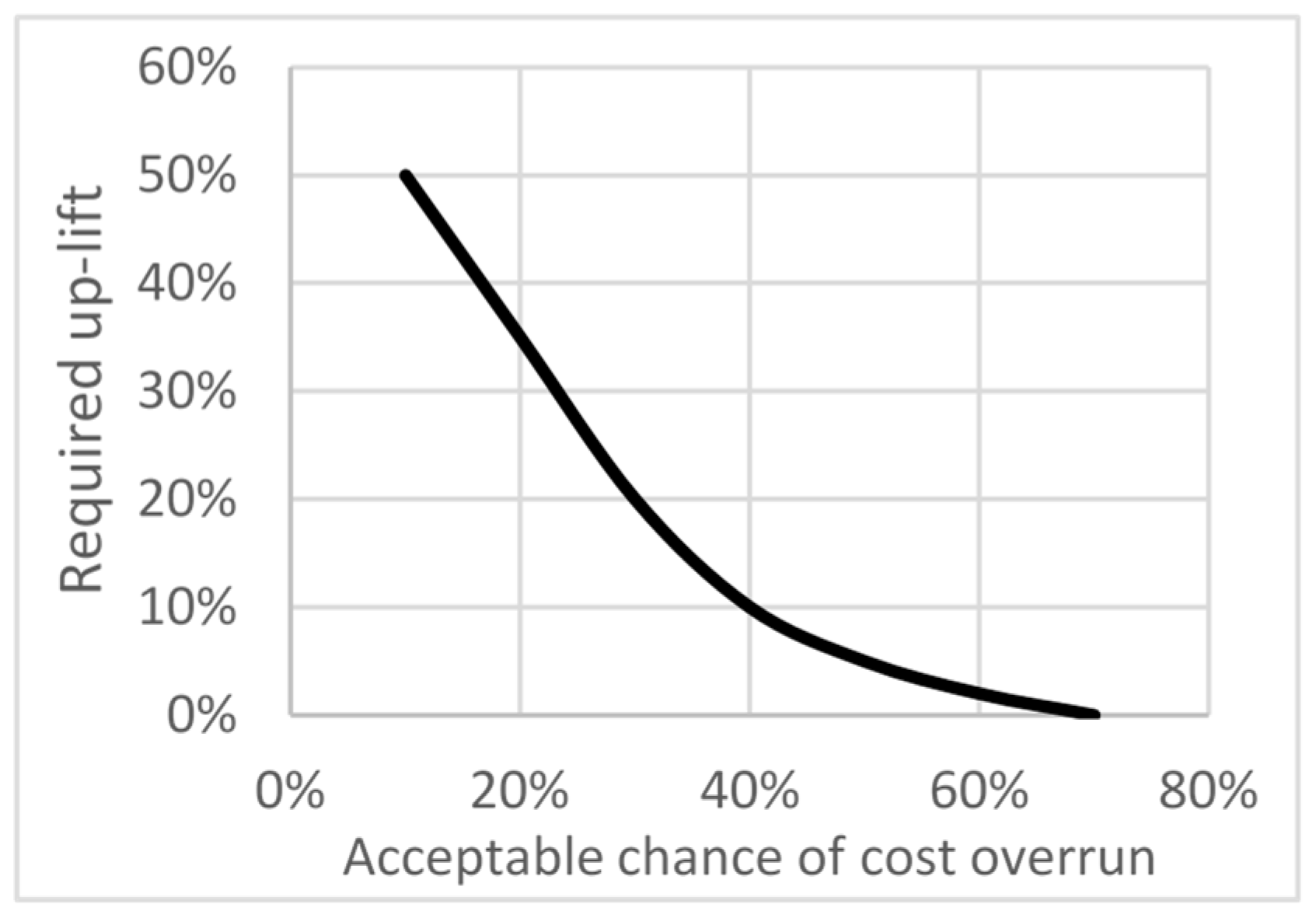

5.3.2. Discussion under Different Degrees of Cost Optimism Bias

6. Conclusions

6.1. Theoretical Contributions

- (1)

- It quantifies the optimism cost overrun and takes them into consideration. In this way, it can eliminate the effects of optimism bias that result from the cognitive limitations of decision-makers. Compared with Flyvbjerg’s study on optimism bias [5], this article provides suggestions about whether the project as a whole is worth construction.

- (2)

- Based on the cost-benefit theory, the model takes the implicit benefits into account and more rationally depicts the value of a public project.

6.2. Practical Implications

- (1)

- In the quantification of optimism bias distributions, the measuring results of optimism bias in China and international bridge projects are compared and it is found that there are considerable differences between the cost overrun distributions and the budget enhancement under optimism bias, which can help decision-makers understand the possible cost variance and probabilities in advance and increase the budget to ease the negative effects brought about by cost overrun during the actual operation period.

- (2)

- Decision-makers can predict the probability of a cost overrun in the project’s decision-making using the model in this study and they can decide whether to build the project according to their risk tolerance. As the model takes the expectation of cost overrun into consideration, it helps decision-makers reduce the risks caused by cognitive bias as much as possible.

- (3)

- Moreover, the model can help decision-makers identify the direct economic benefits and potential social value to help them obtain a more rational understanding of the project.

6.3. Limitations

- (1)

- In this model, only the optimism bias of costs is taken into consideration; however, the optimism bias of the traffic volume estimate is not considered. This can be improved in future research.

- (2)

- The optimism bias distributions discussed in this paper are collected from the cost data of 30 long bridges in China. Although the 30 bridges are statistically significant, it is still necessary to expand the database of the bridges’ costs to enhance the accuracy of the model.

- (3)

- The model takes the implicit benefits into account, improving the feasibility of the project’s implementation to some extent. In the future, the financial conditions of the government and the decision-makers can be considered further to narrow the feasible region of the project’s implementation. In the case in which the direct economic revenues of the project fail to cover its cost, the impact of social benefits is implicit and subtle. Additionally, these benefits are counted into different “accounts” of the national economy. This means that project repayment is still stressful for the government. Decision-makers should be considered as a limitation in the future decision-making model. If the repayment cannot be dependent only on the project itself, the decision-makers’ financial capability should be considered. Otherwise, the project’s limitation should be that the economic revenues of the project must cover 80% of the cost.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Nomenclature

| Parameter | Notations |

| T | the time point at which the whole bridge project finally ends (namely, the lifecycle of the bridge project) |

| T0 | the time point for the project completion or regarded as the construction period of the bridge project |

| T − T0 | the operation period |

| Ttoll | the time point at which tolls end (that means the toll period is Ttoll − T0); |

| r | discount rate |

| P | tolls for one single pass (yuan/vehicle/pass) |

| P0 | tolls for one single pass in the first year of the operation period (yuan/vehicle/pass); |

| Qi, j | the traffic flow from Place i to Place j. |

| Q(i,j), t | the bridge traffic flow from Place i to Place j in the tth year. |

| EBt | the direct economic benefits gained in the tth year (yuan); |

| PBt | passengers’ benefits in the tth year (yuan); |

| rp | the annual average growth rate of one single pass toll |

| k | the type of released gases (CO2, CO, etc.). |

| λk | the emission factor (g/m) |

| α | the average number of passengers on a car (people/vehicle/pass); |

| βt | the monetary value of time ($/h) |

| the cost of the emission of gas k ($/t). | |

| β0 | the monetary value of unit time for the urban population in the first year of the operation period (yuan/h); |

| ω | the proportion of time value that is put into production, generally 0.4–0.6 |

| Δmi,j | reduction in transit time from Place i to Place j after the bridge completion, in hours (h); |

| mi,j | Transit time between city i and city j after the completion of the bridge. |

| m0i,j | Transit time between city i and city j after the completion without the bridge. |

| rβ | the growth rate of the monetary value of unit time for the urban population; |

| V | the average velocity of vehicles (km/h); |

| Pg0 | the fuel price in the first year of the operation period, yuan/km; |

| rpg | the growth rate of the fuel price, generally regarded as the inflation rate |

| MAh,t | the access capability of the city h at time t. |

| GDPg,t | represents the size of the city g at time t. |

| tthg, t | the distance between the city h and g (Both the geographical distance and transit time between the two places can be used to refer to the distance. Transit time is used in this context) |

| χh | the “market potential” change of the city h, namely, the change of radiation effects on the surrounding cities after the realization of the traffic connection and the shortening of distances. |

| tthg, t+1 | the new transit time between the city h and g. |

| MPj,t | the radiation effects of the surrounding city j on the city i and the market potential which the city i receives in total |

| MPj,tt0 | refers to the radiation effects of the surrounding city j assuming the bridge was not constructed during the period t |

| POPj,t | the non-agricultural population in the city j during the period t; |

| POPj,T0 | the non-agricultural population in the city j shortly after the completion of bridge construction. |

| INCOME–PCj,t | per capital income of the non-agricultural population in the city j during the period t; |

| INCOMEj,t | the total income of the non-agricultural population in the city j during the period t; |

| Tij,t | transit time from the city j to the city i during the period t; |

| λ | the attenuation coefficient of space. According to the research results from several scholars, the coefficient is 0.02; |

| rpop,j | the natural growth rate of the non-agricultural population in the city j |

| rinc,j | the natural growth rate of average income of the non-agricultural population in the city j |

| RV | Number of road passengers in the radiation region of the bridge |

| rRV | The growth rate of the number of road passengers in the radiation region of the bridge |

| M | the fixed cost |

| C0 | initial investment cost, generally regarded as the budget cost estimate |

| CCt | the construction cost in the tth year; |

| CC0 | initial investment cost, generally regarded as the budget cost estimate |

| T1 | the modified coefficient of traffic volume |

| T2 | the modified coefficient of road service time |

| CCt | the construction cost in the tth year |

| OCt | the operation cost in the tth year |

| k, k2 | respectively refer to the parameters related to road service time and the modified coefficient of traffic volume |

| k1, α | respectively refer to the parameters related to the operation cost and the construction cost |

| n | the proportion of the construction cost that exceeds the initial planning investment amount |

References

- Sheng, Z. Fundamental Principles Behind the Theory of Mega Infrastructure Construction Management. In Fundamental Theories of Mega Infrastructure Construction Management; Springer: Berlin, Germany, 2018; pp. 135–183. [Google Scholar]

- Salem, O.M.; Miller, R.A.; Deshpande, A.S.; Arurkar, T.P. Multi-criteria decision-making system for selecting an effective plan for bridge rehabilitation. Struct. Infrastruct. Eng. 2013, 9, 806–816. [Google Scholar] [CrossRef]

- Brauers, W.K.M.; Zavadskas, E.K.; Peldschus, F.; Turskis, Z. Multi-objective decision-making for road design. Transport 2008, 23, 183–193. [Google Scholar] [CrossRef]

- Hertogh, M.; Baker, S.; Staal-Ong, P.L.; Westerveld, E. Managing Large Infrastructure Projects Research on Best Practices and Lessons Learnt in Large Infrastructure Projects in Europe. Utr. Netlipse 2008, 13–15. [Google Scholar]

- Flyvbjerg, B. Curbing optimism bias and strategic misrepresentation in planning: Reference class forecasting in practice. Eur. Plan. Stud. 2008, 16, 3–21. [Google Scholar] [CrossRef]

- Boltz, M.G.; Yum, Y.N. Temporal concepts and predicted duration judgments. J. Exp. Soc. Psychol. 2010. [Google Scholar] [CrossRef]

- Sanna, L.J.; Chang, E.C.; Parks, C.D.; Carter, S.E. The hourglass is half full or half empty: Temporal framing and the group planning fallacy. Gr. Dyn. 2005, 9, 173–188. [Google Scholar] [CrossRef]

- Kahneman, D.; Lovallo, D. Timid Choices and Bold Forecasts: A Cognitive Perspective on Risk Taking. Manag. Sci. 1993. [Google Scholar] [CrossRef]

- Cantarelli, C.C.; van Wee, B.; Molin, E.J.E.; Flyvbjerg, B. Different cost performance: Different determinants?: The case of cost overruns in Dutch transport infrastructure projects. Transp. Policy 2012, 22, 88–95. [Google Scholar] [CrossRef]

- Lovallo, D.; Kahneman, D. Delusions of Success: How Optimism Undermines Executives’ Decisions. Harv. Bus. Rev. 2003, 81, 56–63. [Google Scholar] [PubMed]

- Flyvbjerg, B.; Holm, M.K.S.; Buhl, S.L. How common and how large are cost overruns in transport infrastructure projects? Transp. Rev. 2003, 23, 71–88. [Google Scholar] [CrossRef] [Green Version]

- Snow, A.P.; Keil, M.; Wallace, L. The effects of optimistic and pessimistic biasing on software project status reporting. Inf. Manag. 2007. [Google Scholar] [CrossRef]

- Johnston, R.; Shabazian, D.; Gao, S. UPlan: A versatile urban growth model for transportation planning. Transp. Res. Rec. J. Transp. Res. Board 2003, 1831, 202–209. [Google Scholar] [CrossRef]

- Jennings, W. Why costs overrun: Risk, optimism and uncertainty in budgeting for the London 2012 Olympic Games. Constr. Manag. Econ. 2012. [Google Scholar] [CrossRef]

- Caponecchia, C.; Sheils, I. Perceptions of personal vulnerability to workplace hazards in the Australian construction industry. J. Saf. Res. 2011. [Google Scholar] [CrossRef] [PubMed]

- Flyvbjerg, B. Measuring inaccuracy in travel demand forecasting: Methodological considerations regarding ramp up and sampling. Transp. Res. Part A Policy Pract. 2005. [Google Scholar] [CrossRef]

- Flyvbjerg, B. From Nobel Prize To Project Management: Getting Risks Right. Proj. Manag. J. 2006. [Google Scholar] [CrossRef]

- Salling, K.B.; Leleur, S. Accounting for the inaccuracies in demand forecasts and construction cost estimations in transport project evaluation. Transp. Policy 2015, 38, 8–18. [Google Scholar] [CrossRef]

- Kutsch, E.; Maylor, H.; Weyer, B.; Lupson, J. Performers, trackers, lemmings and the lost: Sustained false optimism in forecasting project outcomes—Evidence from a quasi-experiment. Int. J. Proj. Manag. 2011. [Google Scholar] [CrossRef] [Green Version]

- Batselier, J.; Vanhoucke, M. Improving project forecast accuracy by integrating earned value management with exponential smoothing and reference class forecasting. Int. J. Proj. Manag. 2017. [Google Scholar] [CrossRef]

- Pichayapan, P.; Hino, S.; Kishi, K.; Satoh, K. Real option analysis in evaluation of expressway projects under uncertainties. J. East. Asia Soc. Transp. Stud. 2003, 5, 3015–3030. [Google Scholar]

- Verhoef, E.T. Second-best road pricing through highway franchising. J. Urban Econ. 2007. [Google Scholar] [CrossRef]

- Rouhani, O.M.; Geddes, R.R.; Gao, H.O.; Bel, G. Social welfare analysis of investment public-private partnership approaches for transportation projects. Transp. Res. Part A Policy Pract. 2016. [Google Scholar] [CrossRef]

- Bai, S.; Eisinger, D.; Niemeier, D. MOVES vs. EMFAC: A comparison of greenhouse gas emissions using Los Angeles County. In Proceedings of the Transportation Research Board 88th Annual Meeting, Washington, DC, USA, 11–15 January 2009. [Google Scholar]

- Wang, M.Q.; Santini, D.J.; Warinner, S.A. Methods of Valuing Air Pollution and Estimated Monetary Values of Air Pollutants in Various US Regions; Argonne National Lab.: Lemont, IL, USA; Center for Transportation Research: Austin, TX, USA, 1994. [Google Scholar]

- McCubbin, D.R.; Delucchi, M.A. The health costs of motor-vehicle-related air pollution. J. Transp. Econ. Policy 1999, 33, 253–286. [Google Scholar] [CrossRef]

- Schrank, D.; Eisele, B.; Lomax, T. TTI’s 2012 Urban Mobility Report; Texas A&M Transportation Institute, Texas A&M University: College Station, TX, USA, 2012; Volume 4. [Google Scholar]

- Song, Y.; Tan, Y.; Song, Y.; Wu, P.; Cheng, J.C.P.; Kim, M.J.; Wang, X. Spatial and temporal variations of spatial population accessibility to public hospitals: A case study of rural–urban comparison. GISci. Remote Sens. 2018, 55, 718–744. [Google Scholar] [CrossRef]

- Sassen, S. The Global City: Strategic Site, New Frontier. In Managing Urban Futures; Routledge: Abingdon, UK, 2016; pp. 89–104. [Google Scholar]

- Zheng, S.; Kahn, M.E. China’s bullet trains facilitate market integration and mitigate the cost of megacity growth. Proc. Natl. Acad. Sci. USA 2013, 201209247. [Google Scholar] [CrossRef] [PubMed]

- Harris, C.D. The, Market as a Factor in the Localization of Industry in the United States. Ann. Assoc. Am. Geogr. 1954, 44, 315–348. [Google Scholar]

- Hanson, G.H. Market potential, increasing returns and geographic concentration. J. Int. Econ. 2005. [Google Scholar] [CrossRef]

- Faber, B. Trade integration, market size, and industrialization: Evidence from China’s National Trunk Highway System. Rev. Econ. Stud. 2014, 81, 1046–1070. [Google Scholar] [CrossRef]

- Ahlfeldt, G.M.; Feddersen, A. From Periphery to Core: Economic Adjustments to High Speed Rail. IEB Working papers. Available online: http://diposit.ub.edu/dspace/handle/2445/116855 (accessed on 31 October 2018).

| Project No. | Budget Source | Cost Source | Cost Overrun | Completion Time | Type of Bridge |

|---|---|---|---|---|---|

| 1 | Instruction of project feasibility | Interview with Fujian Department for transportation | 15% | 2014.1 | Cross-river |

| 2 | Bridge feasibility report | Interview with Hunan Department for transportation | 108% | 2012.3 | Cross-valley |

| 3 | Interview with company | Official website | 5% | 2001.3 | Cross-river |

| 4 | Interview with company | Official website | 3% | 2005.10 | Cross-river |

| 5 | Interview with company | Interview with Jiangsu Department for transportation | 4% | 2012.12 | Cross-river |

| 6 | Interview with Jiangsu Department for transportation | Official website | −8% | 2004.4 | Cross-river |

| 7 | Interview with Command Department for Bridge | Interview with Command Department for Bridge | 24% | 2008.6 | Cross-river |

| 8 | Bridge feasibility report | Interview with Jiangsu Department for transportation | 4% | 2012.11 | Cross-river |

| 9 | Interview with Shandong Department for transportation | Interview with Shandong Department for transportation | 11% | 2011.6 | Cross-sea |

| 10 | Completed acceptance report | Completed acceptance report | 14% | 2007.6 | Cross-sea |

| 11 | Interview with Command Department for Bridge | Interview with Zhejiang Department for transportation | 2% | 2013.7 | Cross-sea |

| 12 | Bridge feasibility report | Interview with company | 57% | 2013.5 | Cross-sea |

| 13 | Interview with company | Interview with company | −8% | 2009.10 | Cross-river |

| 14 | Interview with Command Department for Bridge | Interview with Command Department for Bridge | 23% | 2016.12 | Cross-valley |

| 15 | Interview with company | Interview with Command Department for Bridge | 18% | 2013.12 | Cross-river |

| 16 | Interview with Shanghai Department for transportation | Interview with Shanghai Department for transportation | 54% | 1991.12 | Cross-river |

| 17 | Interview with Shanghai Department for transportation | Interview with Shanghai Department for transportation | 10% | 1993.10 | Cross-river |

| 18 | Interview with Jiangsu Department for transportation | Interview with Jiangsu Department for transportation | −7% | 2011.12 | Cross-river |

| 19 | Interview with Shanghai Department for transportation | Interview with Shanghai Department for transportation | 57% | 2005.5 | Cross-sea |

| Parameter | Value | Parameter | Value | Parameter | Value |

|---|---|---|---|---|---|

| T | 105 | ϒ | 0.08 | 0 | |

| T0 | 5 | ΔmA,B | 1.3 | POPA,T0 | 18,588,300 |

| Ttoll | 34.5 | 3 | 3.86% | ||

| r | 10% | β0 | 8.9 | INCOME_PCA,T0 | 26675 |

| P0 | 93.7 | 6% | 10.8% | ||

| 2% | V | 100 | POPB,T0 | 2,770,300 | |

| 4.27% | Pg0 | 0.8 | 9.15% | ||

| 0.02 | 3.3 | INCOME_PCB,T0 | 25,304 | ||

| 2 | C0 | 11,760,000,000 | 8.5% | ||

| 0.02 | k1 | 0.6 | k2 | 6 | |

| 0.01 | Q0 | 8,747,590 | rRV | 8% | |

| RV | 520,000,000 |

| n | 20% | 40% | 60% | 80% | |

| n/p | 0.00075 | 0.00575 | 0.0195 | 0.048125 | |

| n | 100% | 130% | 160% | 200% | |

| n/p | 0.0902 | 0.166462 | 0.234 | 0.2901 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Jiang, C.; Liu, Y.; Hertogh, M.; Lyu, X. Optimism Bias Evaluation and Decision-Making Risk Forecast on Bridge Project Cost Based on Reference Class Forecasting: Evidence from China. Sustainability 2018, 10, 3981. https://doi.org/10.3390/su10113981

Liu H, Jiang C, Liu Y, Hertogh M, Lyu X. Optimism Bias Evaluation and Decision-Making Risk Forecast on Bridge Project Cost Based on Reference Class Forecasting: Evidence from China. Sustainability. 2018; 10(11):3981. https://doi.org/10.3390/su10113981

Chicago/Turabian StyleLiu, Huimin, Canhui Jiang, Yan Liu, Marcel Hertogh, and Xue Lyu. 2018. "Optimism Bias Evaluation and Decision-Making Risk Forecast on Bridge Project Cost Based on Reference Class Forecasting: Evidence from China" Sustainability 10, no. 11: 3981. https://doi.org/10.3390/su10113981