Prospects of Passenger Vehicles in China to Meet Dual Carbon Goals and Bottleneck of Critical Materials from a Fleet Evolution Perspective

Abstract

:1. Introduction

2. Method

2.1. Fleet CO2 Emission Model for Passenger Vehicles in China

2.2. Vehicle Stock Evolution Model

2.3. Powertrain Type Penetration Forecast Model

2.4. Energy Consumption and CO2 Emission Model

2.5. Critical Battery Material Demand Model

3. Key Data and Scenario Design

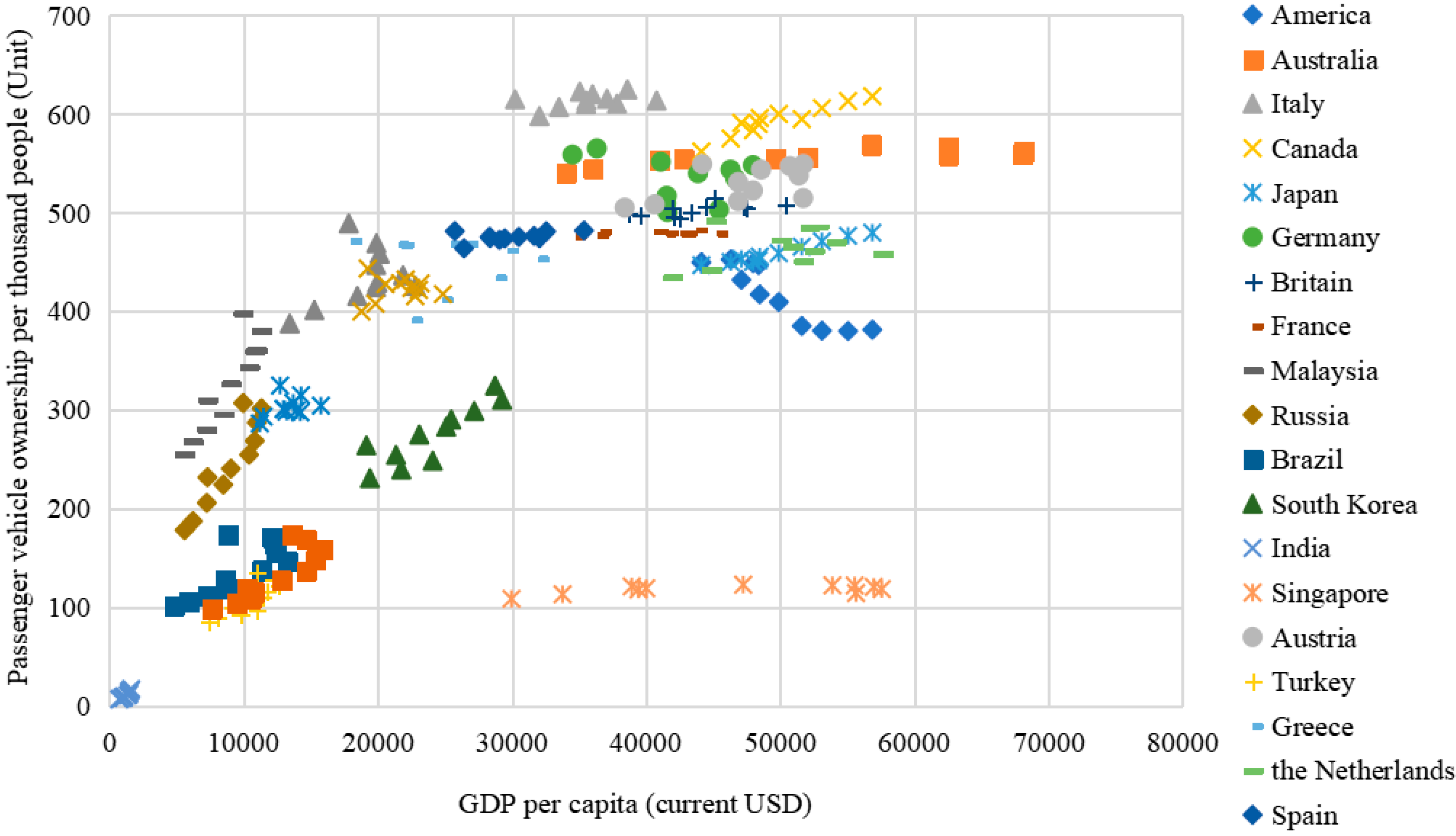

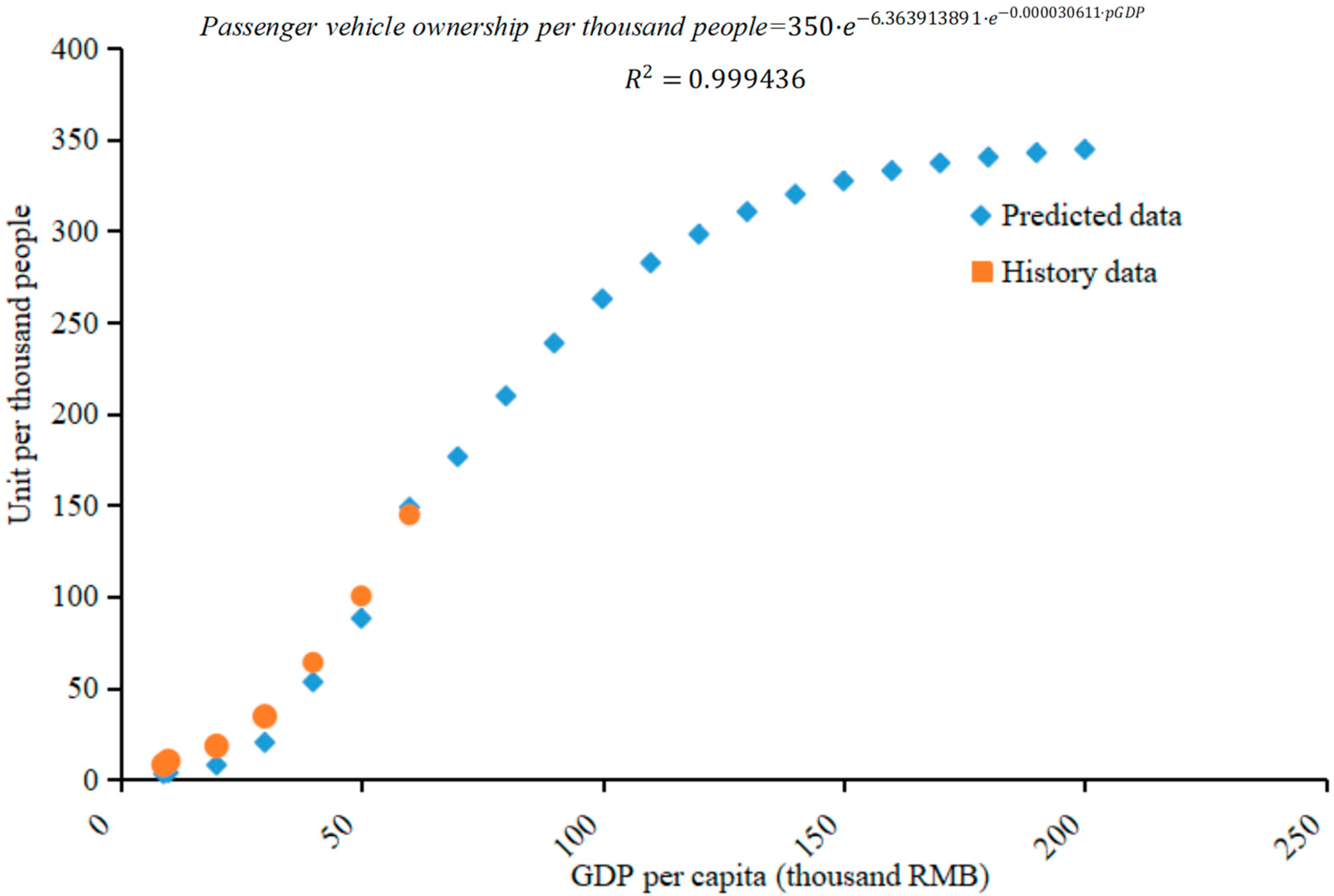

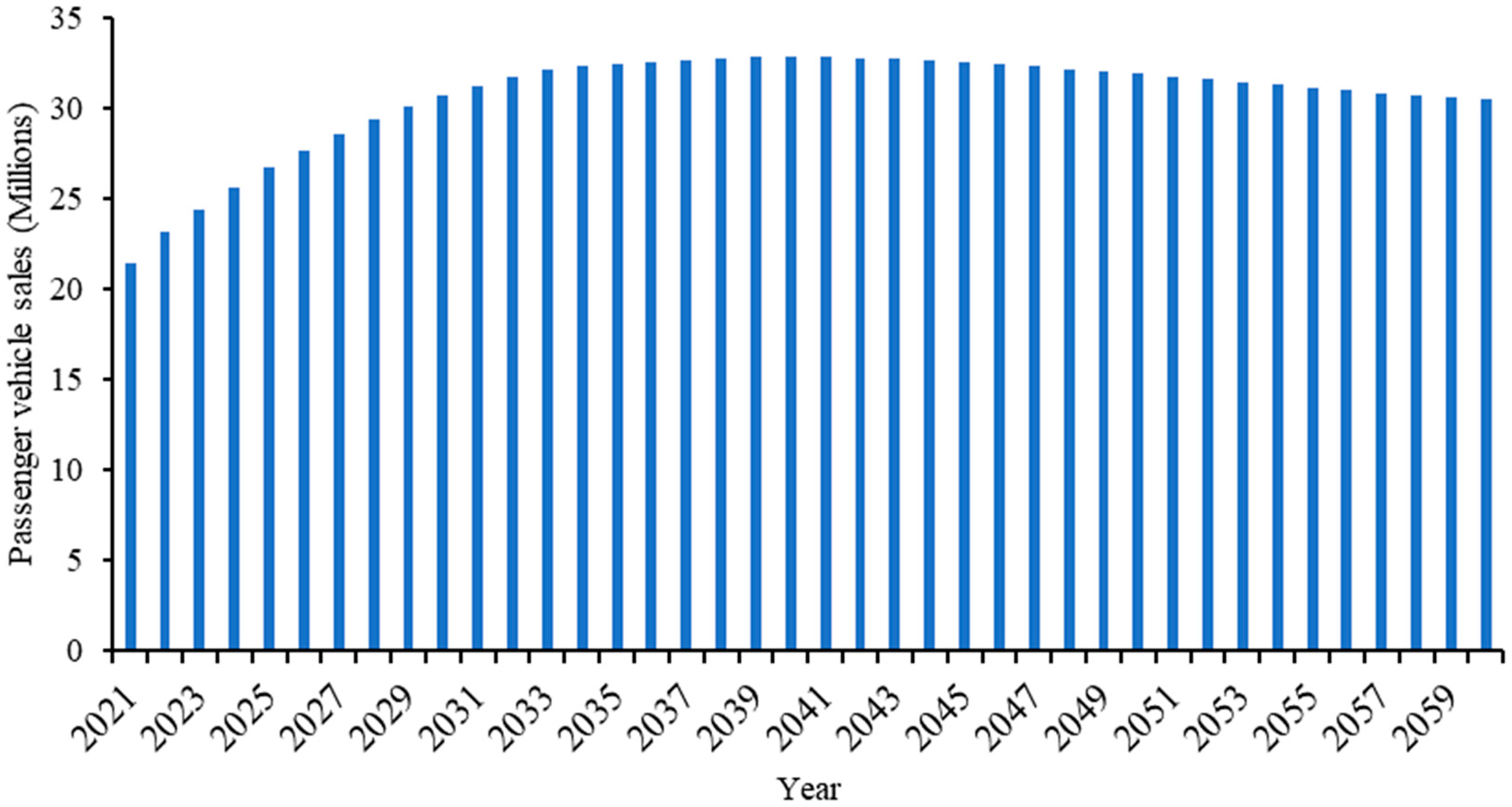

3.1. Vehicle Stock and Sales

3.2. Vehicle Powertrain Type Penetration

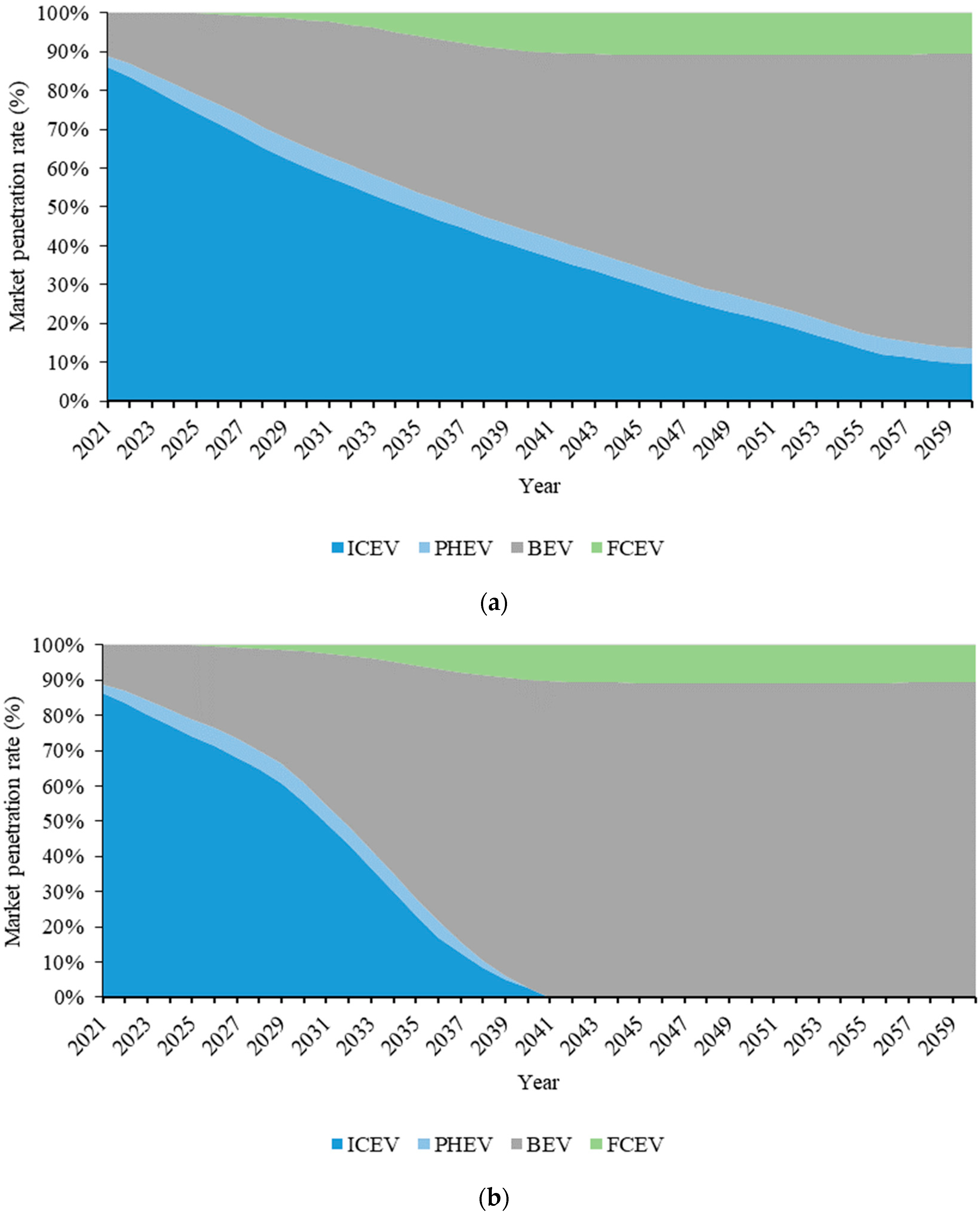

- Conservative scenario (CS): In this scenario, the future penetration rate of alternative powertrain type remains unchanged from the 2020 level. Even though this scenario is unlikely, it provides the likely upper limits for CO2 emissions and lower limits for the key battery materials needed.

- Business as usual (BAU): The BAU scenario follows the national plans and historical development trends. In this scenario, the market penetration rate of NEVs in 2025, 2030, and 2035 will be 20%, 40%, and 50%, respectively, based on the relevant industry plan. We further forecasted the market penetration rates of NEVs after 2035 based on Equations (4) and (5). As for the subdivided powertrain type penetration, with the progress in technology, the comprehensive cost advantage of BEVs will further appear and the market share will reach 75% in 2060. FCEVs will start to develop in scale after 2030 and stabilize at about 10% around 2040. The market share of PHEVs is stable at around 5%.

- Strengthening scenario under dual carbon goals (ST): Under this scenario, policies need to be designed to ensure that CO2 emitted from the operation stage of passenger vehicles is near-zero by 2060, which means the passenger vehicle fleet will be nearly 100% NEVs by 2060. The new passenger vehicle sales need to reach almost 100% NEVs by 2040 because the maximum lifespan of most conventional passenger vehicles is between 15 and 20 years [19]. With the implementation of the policy requirements for near-zero emissions goals, the comprehensive cost of BEVs decreases rapidly, the convenience of use increases significantly, and the proportion of BEVs will reach about 90% by 2045. At the same time, PHEVs will be considerably less attractive than BEVs and will gradually exit the market entirely.

3.3. Vehicle Energy Efficiency

- CS: In this scenario, the vehicle energy efficiency is unchanged from the 2020 level, as shown in Table 1.

- BAU scenario: The BAU scenario follows the regulation requirements and historical development trends. We set the future fuel consumption rate of ICEVs to 5.6 L/100 km in 2025, 4.8 L/100 km in 2030, and 4.0 L/100 km in 2035 under WLTP. We assumed that the fuel consumption rate of ICEVs will not change after 2035 because most carmakers plan to stop the development of new internal combustion engines. We set the annual improvement in the electricity consumption rate for passenger vehicles to 1% [37], which will remain unchanged after 2035. We used hydrogen consumption rates of 1.0 kg/100 km in 2025 and 0.8 kg/100 km in 2040, which will remain unchanged after 2040 [37].

- ST: In the ST scenario, under the dual carbon goals, the current national plan and regulation for vehicle fuel efficiency targets are further strengthened. The fuel consumption rate of ICEVs will continue to improve to 3.7 L/100 km by 2040. We set the annual improvement in the electricity consumption rate to 1% before 2035 and to 0.5% from 2036 to 2060. We used hydrogen consumption rates of 1.0 kg/100 km in 2025 and 0.8 kg/100 km in 2030, which will remain unchanged after 2030 [37].

3.4. Vehicle Travel Intensity

3.5. Energy Carbon Intensity

- CS: In this scenario, we assumed the carbon intensities of vehicle fuels will remain unchanged from the current level.

- BAU scenario: This scenario follows IEA’s Announced Pledges Scenario [36], which aims to reflect the announced ambitions and targets.

- ST: The ST scenario in this study followed IEA’s Sustainable Development Scenario (SDS) [40]. As a “well below 2 °C” pathway, this scenario represents a gateway to the outcomes targeted by the Paris Agreement.

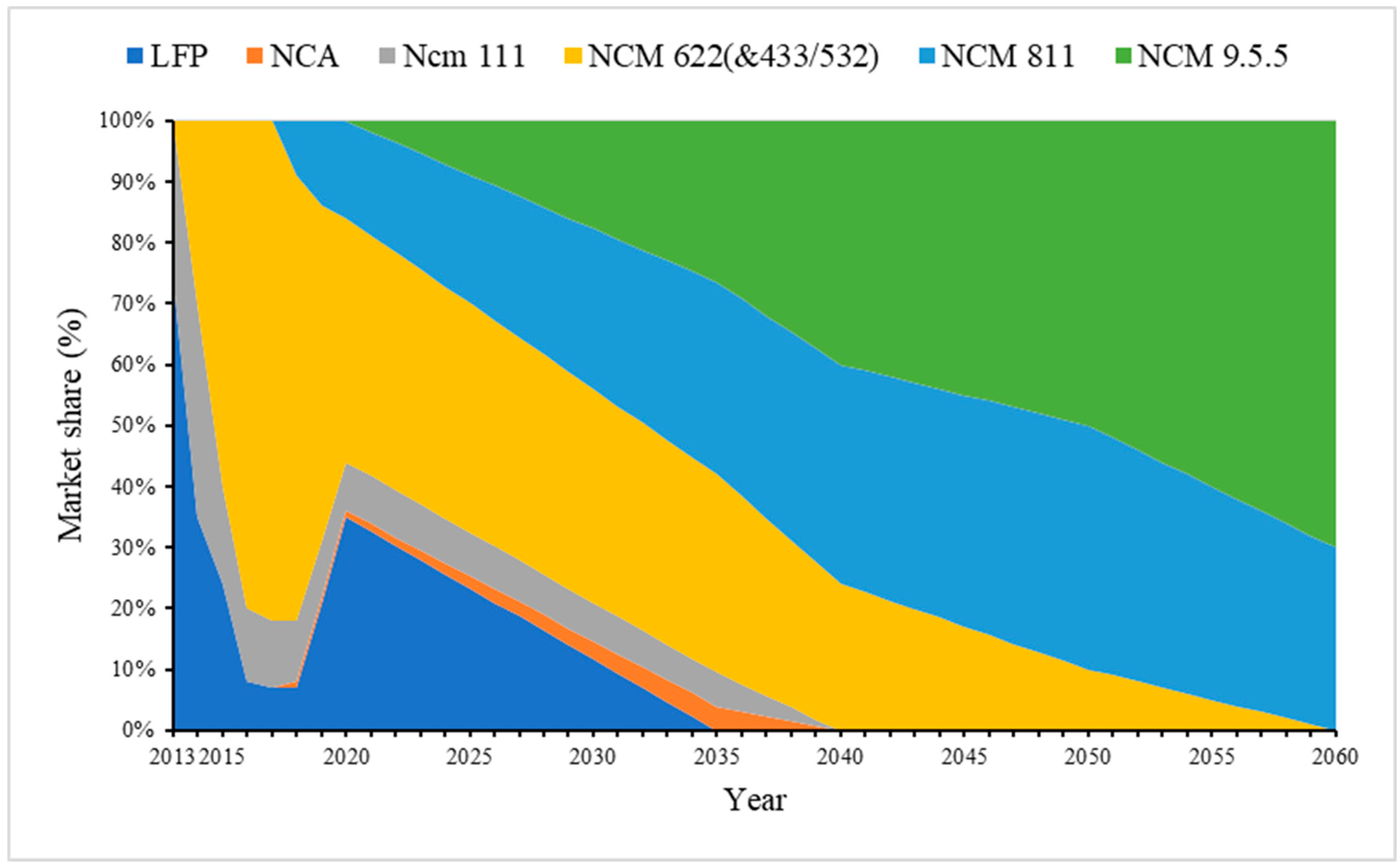

3.6. Technology Roadmap for Power Batteries

4. Results and Discussion

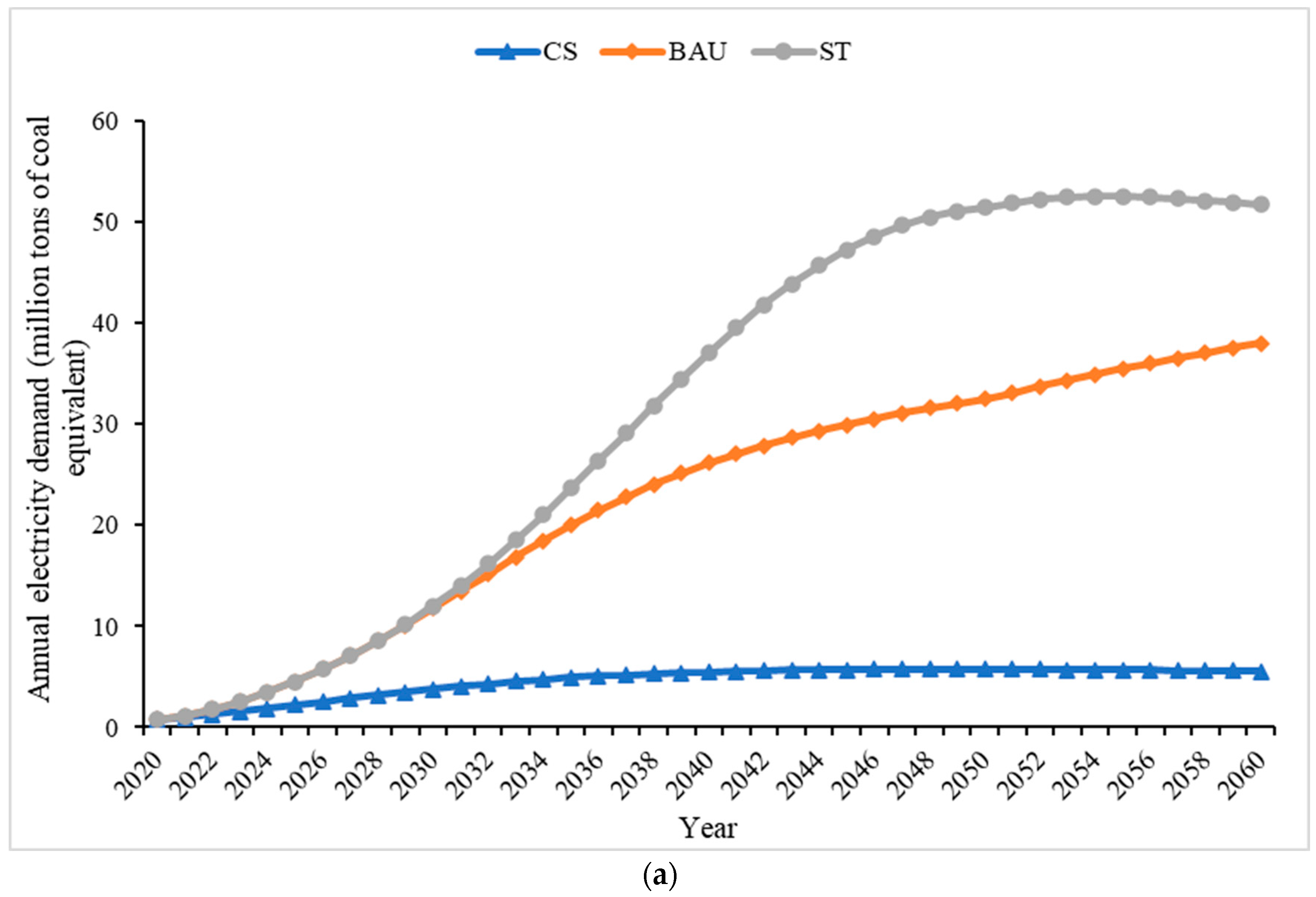

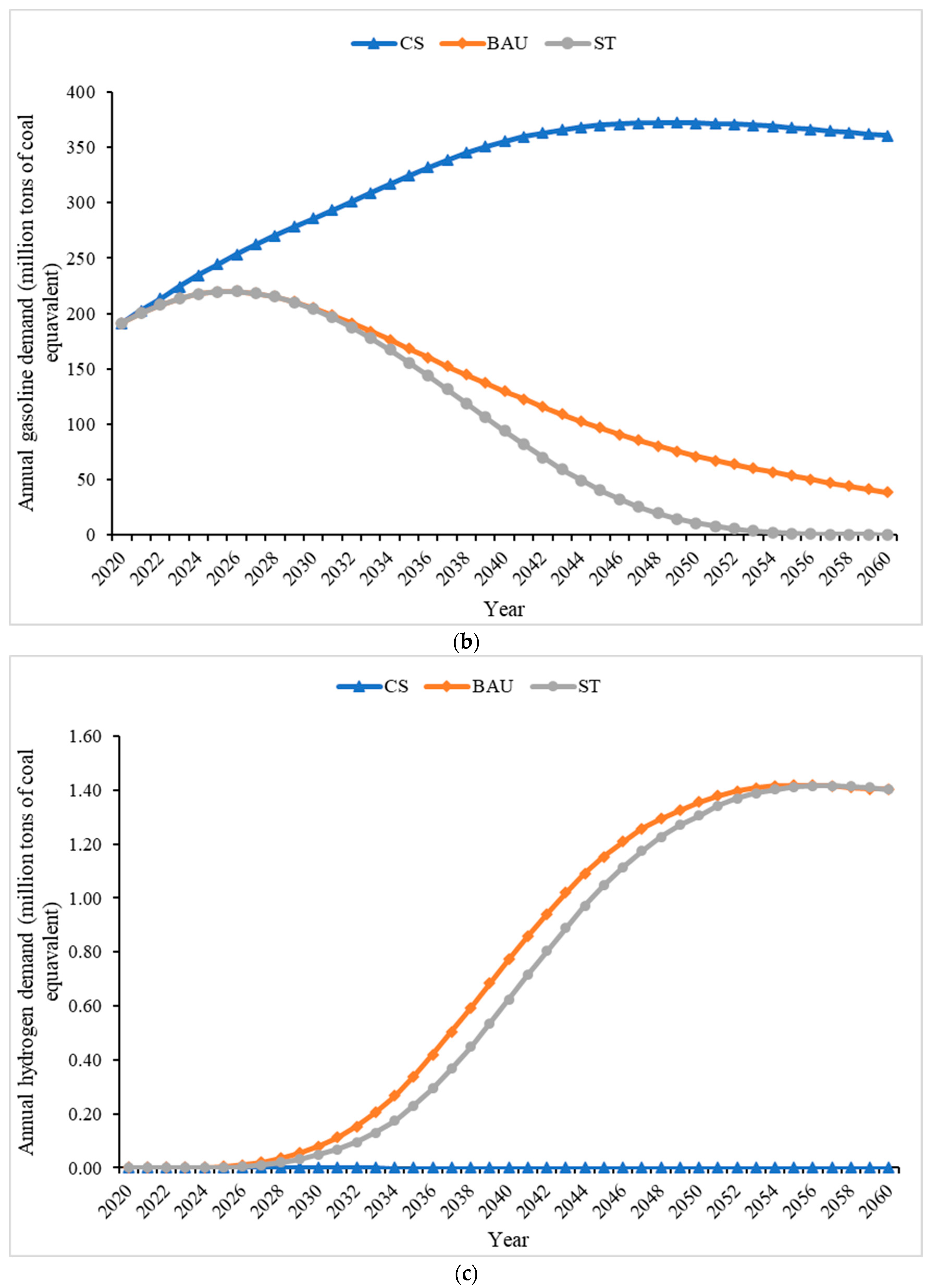

4.1. Projections of Passenger Vehicle Energy Demand and CO2 Emissions

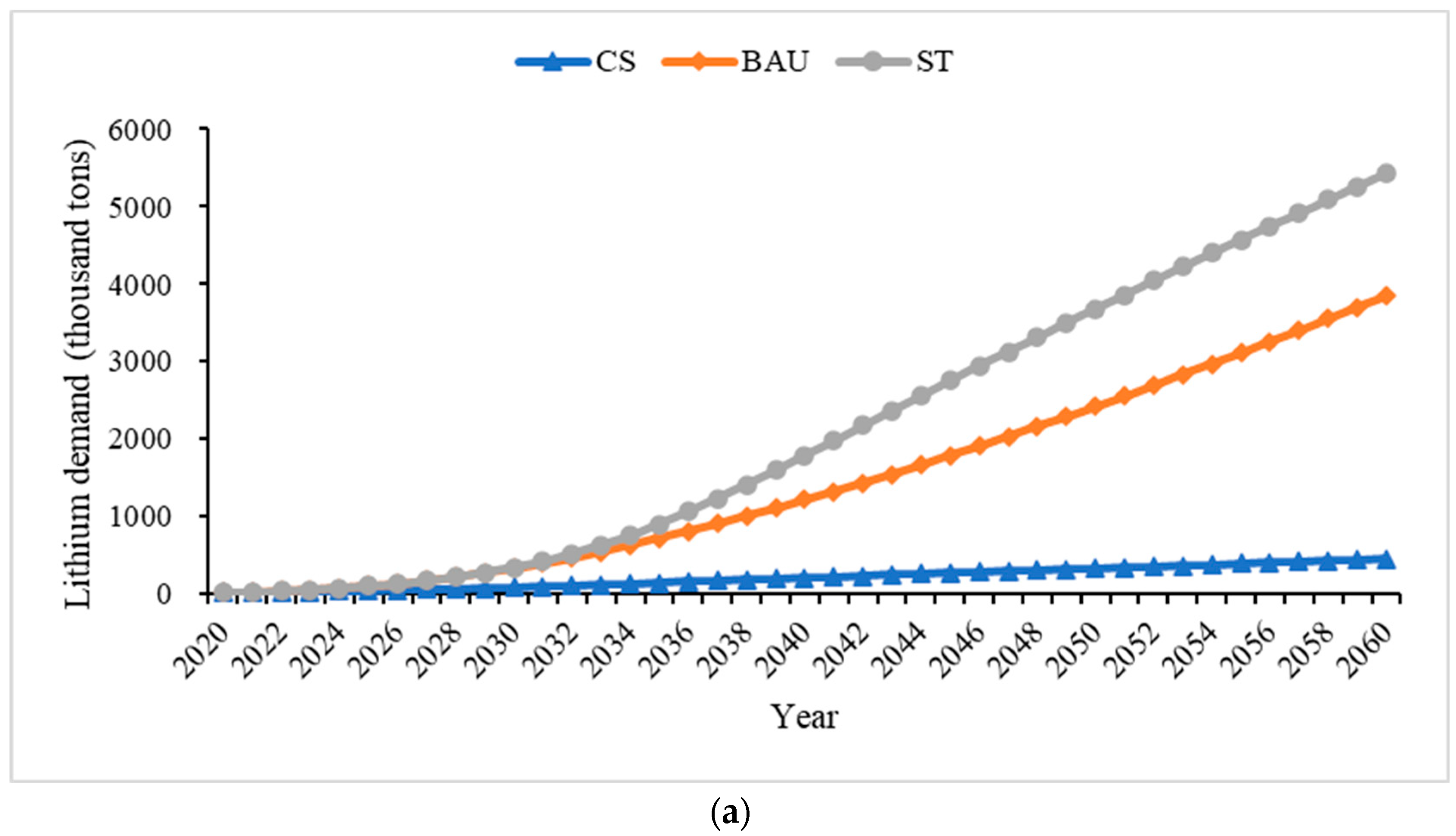

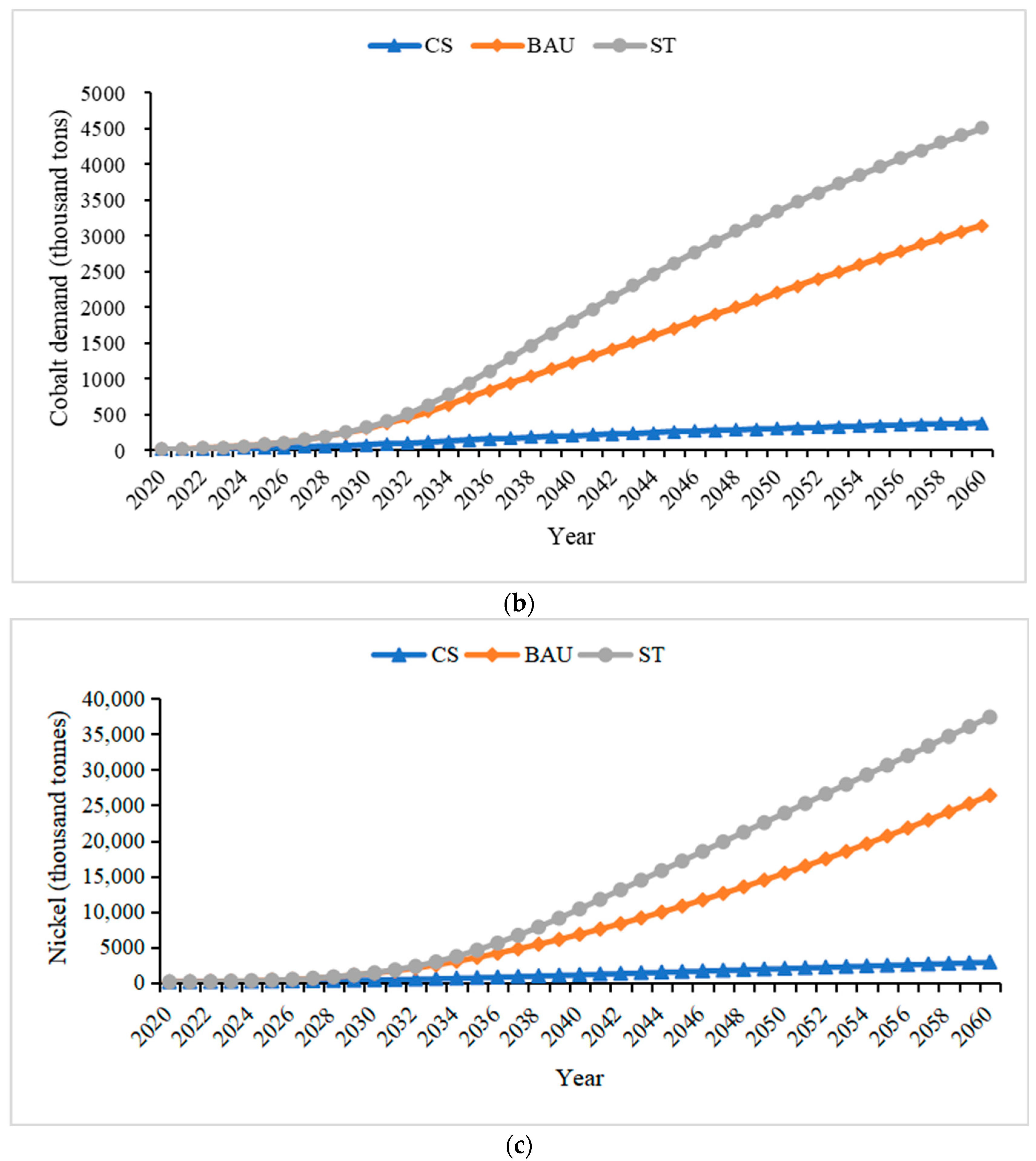

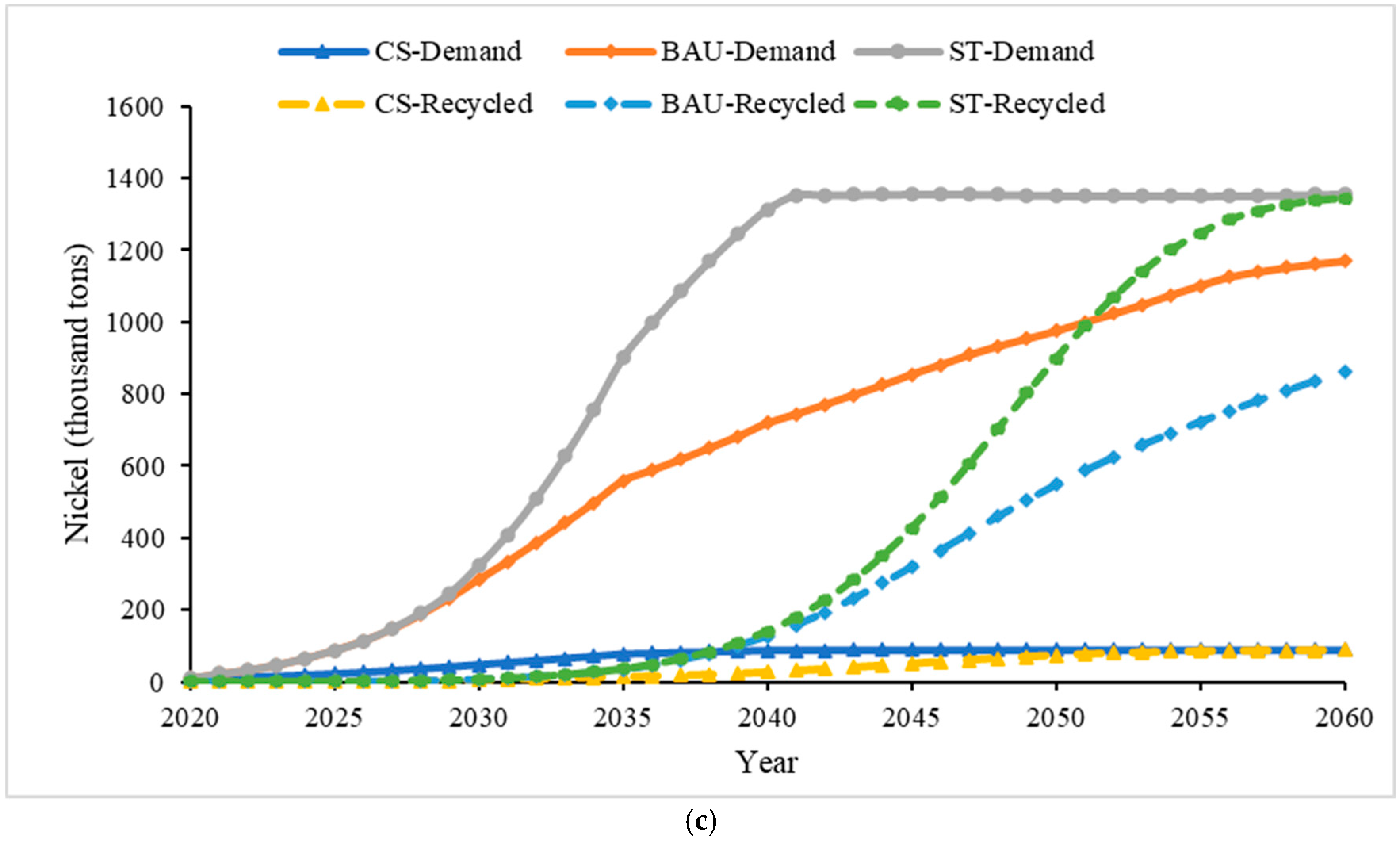

4.2. Critical Battery Material Demand and Material Potentially Recycled from Retired Batteries

5. Conclusions and Policy Implications

5.1. Conclusions

- Compared to the CS, the CO2 emissions in both the operation stage and the fuel cycle can achieve the goal of peak CO2 emissions by 2030. This result further verifies the rationality of the fuel consumption of Chinese passenger vehicles and the NEV development targets. Under the BAU scenario, the passenger vehicle CO2 emissions in the operation stage will be nearly zero by 2060. If the near-zero emissions target is achieved by 2050, the new vehicles sold must be almost 100% electric vehicles before 2040.

- The realization of achieving near-zero carbon emissions from the vehicle operation stage by 2060 will quickly change the energy structure of vehicles from gasoline to electricity based. We found that China’s passenger vehicle gasoline demand will peak around 2026 and rapidly decline thereafter. The electricity demand from passenger vehicles will soon rise. Under the ST scenario, electricity demand in 2035 and 2060 will account for 2.1% and 4.0% of China’s total power generation in 2020, respectively. Hydrogen demand will rapidly rise after 2030 and remain above 3.8 million tons annually after 2055.

- We found that achieving the dual carbon goals will further lead to a rapid increase in the demand for critical raw materials required for batteries. We identified potential risks in the supply of some raw materials, such as cobalt. We found that the lithium and nickel reserves can meet the increasing demand for power batteries, but the potential risks caused by short-term supply and demand imbalance still need attention. However, the cumulative demand for cobalt for new energy passenger vehicles in China will be 5.7 to 7.3 times larger than China’s total cobalt reserves. The imbalance in geographical cobalt distribution poses risks for the automotive battery supply chain.

- The amount of critical materials that can be recycled from retired power batteries will rapidly increase in the future. However, new demand for critical battery materials will grow faster. The potential recycling of critical raw materials from retired power batteries will not substantially help meet the need for critical materials before 2035.

5.2. Policy Implications

- The current Chinese passenger vehicle fuel consumption rate and NEV penetration targets are sufficient to meet the 2030 carbon peak goal. The achievement of the macroplanning goals requires the support of specific standards and policies. Therefore, China needs to improve passenger vehicle fuel consumption standards and fiscal and tax subsidies for NEVs and strengthen the role of standards and regulations in ensuring the implementation of planning goals.

- China’s NEV promotion policies and key resource supply risks must be systematically coordinated under the dual carbon goals. NEVs are an essential aspect of achieving the dual carbon goals in the transportation sector but will lead to demand growth for critical raw materials. Our findings show that the electrification of passenger vehicles in China will produce a rapid increase in the demand for lithium, cobalt, and nickel and that the new demand for critical raw materials, such as cobalt, will far exceed the current reserves. The dependence on foreign critical raw materials is relatively high, even more than that for oil in China.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- United Nations (UN). The Paris Agreement. 2021. Available online: https://www.un.org/en/climatechange/paris-agreement (accessed on 17 September 2022).

- China’s Pledge to Cut CO2 Emissions Boosts Global Confidence in Climate Change. China Daily, 2020. Available online: https://www.chinadaily.com.cn/a/202009/25/WS5f6d9edfa31024ad0ba7be3f.html(accessed on 17 September 2022).

- Zahoor, A.; Yu, Y.; Zhang, H.; Nihed, B.; Afrane, S.; Peng, S.; Mao, G. Can the new energy vehicles (NEVs) and power battery industry help China to meet the carbon neutrality goal before 2060? J. Environ. Manag. 2023, 336, 117663. [Google Scholar] [CrossRef] [PubMed]

- China Automotive Technology and Research Center (CATARC). Annual Report on Energy-Saving and New Energy Vehicle in China 2022; China Automotive Technology and Research Center: Beijing, China, 2022. [Google Scholar]

- Jiao, Y.; Yu, L.; Wang, J.; Wu, D.; Tang, Y. Diffusion of new energy vehicles under incentive policies of China: Moderating role of market characteristic. J. Clean. Prod. 2022, 353, 131660. [Google Scholar] [CrossRef]

- Wang, X.; Dai, M.; Wang, W.; Gao, Y.; Qi, T.; Dong, X.; Ding, N. Greenhouse gas emissions and peak trend of commercial vehicles in China. J. Environ. Manag. 2023, 331, 117262. [Google Scholar] [CrossRef] [PubMed]

- Zheng, J.; Sun, X.; Jia, L.; Zhou, Y. Electric passenger vehicles sales and carbon dioxide emission reduction potential in China’s leading markets. J. Clean. Prod. 2020, 243, 118607. [Google Scholar] [CrossRef]

- MIIT (Ministry of Industry and Information Technology). Medium and Long-Term Development Plan for the Automotive Industry. 2017. Available online: https://www.miit.gov.cn/jgsj/zbys/wjfb/art/2020/art_a4bbca490fdd47209293e04ec811dae8.html (accessed on 17 September 2022).

- State Council. Notice of the General Office of the China State Council on Issuing the Development Plan for the New Energy Automobile Industry (2021–2035). 2020. Available online: http://www.gov.cn/zhengce/content/2020-11/02/content_5556716.htm (accessed on 17 September 2022).

- Tang, Y.; Tao, Y.; Li, Y. Collection policy analysis for retired electric vehicle batteries through agent-based simulation. J. Clean. Prod. 2023, 382, 135269. [Google Scholar] [CrossRef]

- Lyu, C.; Ou, X.; Zhang, X. China automotive energy consumption and greenhouse gas emissions outlook to 2050. Mitig. Adapt. Strateg. Glob. Chang. 2015, 20, 627–650. [Google Scholar] [CrossRef]

- González Palencia, J.C.; Otsuka, Y.; Araki, M.; Shiga, S. Scenario analysis of lightweight and electric-drive vehicle market penetration in the long-term and impact on the light-duty vehicle fleet. Appl. Energy 2017, 204, 1444–1462. [Google Scholar] [CrossRef]

- Osei, L.K.; Ghaffarpasand, O.; Pope, F.D. Real-World Contribution of Electrification and Replacement Scenarios to the Fleet Emissions in West Midland Boroughs, UK. Atmosphere 2021, 12, 332. [Google Scholar] [CrossRef]

- Simon, B.; Ziemann, S.; Weil, M. Potential metal requirement of active materials in lithium-ion battery cells of electric vehicles and its impact on reserves: Focus on Europe. Resour. Conserv. Recycl. 2015, 104, 300–310. [Google Scholar] [CrossRef]

- Martins, L.; Guimarães, L.; Junior, A.; Tenório, J.; Espinosa, D. Electric car battery: An overview on global demand, recycling and future approaches towards sustainability. J. Environ. Manag. 2021, 295, 113091. [Google Scholar] [CrossRef]

- Du, S.; Gao, F.; Nie, Z.; Liu, Y.; Sun, B.; Gong, X. Assessing resource depletion of NCM lithium-ion battery production for electric vehicles: An exergy-based perspective. J. Clean. Prod. 2023, 420, 138415. [Google Scholar] [CrossRef]

- Olivetti, E.A.; Ceder, G.; Gaustad, G.G.; Fu, X. Lithium-Ion Battery Supply Chain Considerations: Analysis of Potential Bottlenecks in Critical Metals. Joule 2017, 1, 229–243. [Google Scholar] [CrossRef]

- Ou, S.; Hsieh, I.Y.L.; He, X.; Lin, Z.; Yu, R.; Zhou, Y.; Bouchard, J. China’s vehicle electrification impacts on sales, fuel use, and battery material demand through 2050: Optimizing consumer and industry decisions. iScience 2021, 24, 103375. [Google Scholar] [CrossRef] [PubMed]

- Zheng, J.; Zhou, Y.; Yu, R.; Zhao, D.; Lu, Z.; Zhang, P. Survival rate of China passenger vehicles: A data-driven approach. Energy Policy 2019, 129, 587–597. [Google Scholar] [CrossRef]

- Huo, H.; Zhang, Q.; He, K.; Yao, Z.; Wang, M. Vehicle-use intensity in China: Current status and future trend. Energy Policy 2012, 43, 6–16. [Google Scholar] [CrossRef]

- IEA. Carbon Intensity of Electricity Generation in Selected Regions in the Announced Pledges and Net Zero Scenarios, 2000–2040; IEA: Paris, France, 2020. [Google Scholar]

- IEA. Carbon Intensity of Electricity Generation in Selected Regions in the Sustainable Development Scenario, 2000–2040; IEA: Paris, France, 2020. [Google Scholar]

- CCG (China City Greenhouse Gas Working Group) (Ed.) China Products Carbon Footprint Factors Database; China Environmental Science Press: Beijing, China, 2022. [Google Scholar]

- The Faraday Institution. Lithium, Cobalt and Nickel: The Gold Rush of the 21st Century; The Faraday Institution: London, UK, 2020. [Google Scholar]

- Winsor, C.P. The Gompertz curve as a growth curve. Proc. Natl. Acad. Sci. USA 1932, 18, 1–8. [Google Scholar] [CrossRef]

- Hawkins, T.; Hendrickson, C.; Higgins, C.; Matthews, H.S.; Suh, S. A mixed-unit input-output model for environmental life-cycle assessment and material flow analysis. Environ. Sci. Technol. 2007, 41, 1024–1031. [Google Scholar] [CrossRef]

- Islam, M.T.; Huda, N. Material flow analysis (MFA) as a strategic tool in E-waste management: Applications, trends and future directions. J. Environ. Manag. 2019, 244, 344–361. [Google Scholar] [CrossRef]

- Sierzchula, W.; Bakker, S.; Maat, K.; Van Wee, B. The influence of financial incentives and other socio-economic factors on electric vehicle adoption. Energy Policy 2014, 68, 183–194. [Google Scholar] [CrossRef]

- Mcfadden, D.L. Condition Logit Analysis of Qualitative Choice Behavior; Academic Press: Cambridge, MA, USA, 1974; pp. 105–142. [Google Scholar]

- Manski, C.F. The structure of random utility models. Theory Decis. 1977, 8, 229. [Google Scholar] [CrossRef]

- China Automotive Technology and Research Center (CATARC). Research on the Development Trend of Conventional and New Energy Vehicles to 2050; China Automotive Technology and Research Center: Beijing, China, 2019. [Google Scholar]

- Lu, Z.; Zhou, Y.; Cai, H.; Wang, M.; He, X.; Przesmitzki, S. China Vehicle Fleet Model: Estimation of Vehicle Stocks, Usage, Emissions, and Energy Use—Model Description, Technical Documentation, and User Guide; Argonne National Laboratory: Lemont, IL, USA, 2018.

- UN (United Nations) (Ed.) World Population Prospects 2019. 2019. Available online: https://population.un.org/wpp/ (accessed on 17 September 2022).

- MIIT-EIDC (Ministry of Industry and Information Technology Eauipment Industry Development Center). China Automobile Industry Development Annual Report (2021); MIIT-EIDC: Beijing, China, 2021.

- State Council. Carbon Peak Action Plan by 2030. 2021. Available online: http://www.gov.cn/zhengce/content/2021-10/26/content_5644984.htm (accessed on 17 September 2022).

- Marotta, A.; Pavlovic, J.; Ciuffo, B.; Serra, S.; Fontaras, G. Gaseous Emissions from Light-Duty Vehicles: Moving from NEDC to the New WLTP Test Procedure. Environ. Sci. Technol. 2015, 49, 8315–8322. [Google Scholar] [CrossRef] [PubMed]

- CSAE (China Society of Automotive Engineers). Energy-Saving and New Energy Vehicle Technology Roadmap 2.0; China Machine Press: Beijing, China, 2021. [Google Scholar]

- Ou, S.; Yu, R.; Lin, Z.; Ren, H.; He, X.; Przesmitzki, S.; Bouchard, J. Intensity and daily pattern of passenger vehicle use by region and class in China: Estimation and implications for energy use and electrification. Mitig. Adapt. Strateg. Glob. Chang. 2020, 25, 307–327. [Google Scholar] [CrossRef]

- IEA. An Energy Sector Roadmap to Carbon Neutrality in China; IEA: Paris, France, 2021. [Google Scholar]

- IEA. World Energy Model; IEA: Paris, France, 2021. [Google Scholar]

- State Council. Energy-Saving and New Energy Vehicle Industry Development Plan (2012–2020). 2012. Available online: http://www.gov.cn/zwgk/2012-07/09/content_2179032.htm (accessed on 17 September 2022).

- State Council. Notice of the Four Ministries and Commissions on Adjusting the Fiscal Subsidy Policy for the Promotion and Application of New Energy Vehicles. 2016. Available online: http://www.gov.cn/xinwen/2016-12/30/content_5154971.htm#1 (accessed on 17 September 2022).

- Baars, J.; Domenech, T.; Bleischwitz, R.; Melin, H.E.; Heidrich, O. Circular economy strategies for electric vehicle batteries reduce reliance on raw materials. Nat. Sustain. 2021, 4, 71–79. [Google Scholar] [CrossRef]

- Wentker, M.; Greenwood, M.; Leker, J. A Bottom-Up Approach to Lithium-Ion Battery Cost Modeling with a Focus on Cathode Active Materials. Energies 2019, 12, 504. [Google Scholar] [CrossRef]

- IEA (International Energy Agency). Global EV Outlook 2018; IEA: Paris, France, 2018. [Google Scholar]

- NBS (National Bureau of Statistics). China’s 2020 Year National Economic and Social Development of Statistical Bulletin. 2021. Available online: http://www.stats.gov.cn/tjsj/zxfb/202102/t20210227_1814154.html (accessed on 17 September 2022).

- USGS (U.S. Geological Survey). Mineral Commodity Summaries 2022, Mineral Commodity Summaries; U.S. Geological Survey: Reston, VA, USA, 2022; p. 202.

| Parameter | ICEVs | BEVs | PHEVs | FCEVs |

|---|---|---|---|---|

| Energy efficiency | 6.88 L/100 km in WLTP [4] Converted to 6.91 L/100 km in WLTP [36] | 12.45 kWh/100 km [4] | Charge depletion mode: 14.25 kWh/100 km Charge sustaining mode: 4.3 L/100 km | 1.2 kg/100 km |

| Scenario | Fuel Type | Stage | Current | 2030 | 2040 | 2060 |

|---|---|---|---|---|---|---|

| CS | Gasoline (kg CO2/kg) [23] | Upstream | 0.81 | 0.81 | 0.81 | 0.81 |

| Downstream | 3.04 | 3.04 | 3.04 | 3.04 | ||

| Electricity (kg CO2/kWh) | Upstream | 0.53 | 0.53 | 0.53 | 0.53 | |

| Downstream | 0 | 0 | 0 | 0 | ||

| Hydrogen (kg CO2/kg) [23] | Upstream | 24.67 | 24.67 | 24.67 | 24.67 | |

| Downstream | 0 | 0 | 0 | 0 | ||

| BAU | Gasoline (kg CO2/kg) [23] | Upstream | 0.81 | 0.81 | 0.81 | 0.81 |

| Downstream | 3.04 | 3.04 | 3.04 | 3.04 | ||

| Electricity (kg CO2/kWh) [21] | Upstream | 0.53 | 0.416 | 0.20 | 0.10 | |

| Downstream | 0 | 0 | 0 | 0 | ||

| Hydrogen (kg CO2/kg) [23] | Upstream | 24.67 | 20.00 | 10.77 | 8.25 | |

| Downstream | 0 | 0 | 0 | 0 | ||

| ST | Gasoline (kg CO2/kg) [23] | Upstream | 0.81 | 0.81 | 0.81 | 0.81 |

| Downstream | 3.04 | 3.04 | 3.04 | 3.04 | ||

| Electricity (kg CO2/kWh) [22] | Upstream | 0.53 | 0.34 | 0.101 | 0.05 | |

| Downstream | 0 | 0 | 0 | 0 | ||

| Hydrogen (kg CO2/kg) [23] | Upstream | 24.67 | 10.00 | 8.00 | 6.00 | |

| Downstream | 0 | 0 | 0 | 0 |

| Lithium | Nickel | Cobalt | |

|---|---|---|---|

| NCA | 0.10 | 0.67 | 0.13 |

| NMC 111 | 0.15 | 0.40 | 0.40 |

| NMC 433 | 0.14 | 0.47 | 0.35 |

| NMC 532 | 0.14 | 0.59 | 0.23 |

| NMC 622 | 0.13 | 0.61 | 0.19 |

| NMC 811 | 0.11 | 0.75 | 0.09 |

| NMC 9.5.5 | 0.10 | 0.86 | 0.05 |

| LFP | 0.10 | × | × |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, R.; Cong, L.; Li, Y.; Ran, C.; Zhao, D.; Li, P. Prospects of Passenger Vehicles in China to Meet Dual Carbon Goals and Bottleneck of Critical Materials from a Fleet Evolution Perspective. World Electr. Veh. J. 2024, 15, 14. https://doi.org/10.3390/wevj15010014

Yu R, Cong L, Li Y, Ran C, Zhao D, Li P. Prospects of Passenger Vehicles in China to Meet Dual Carbon Goals and Bottleneck of Critical Materials from a Fleet Evolution Perspective. World Electric Vehicle Journal. 2024; 15(1):14. https://doi.org/10.3390/wevj15010014

Chicago/Turabian StyleYu, Rujie, Longze Cong, Yaoming Li, Chunjia Ran, Dongchang Zhao, and Ping Li. 2024. "Prospects of Passenger Vehicles in China to Meet Dual Carbon Goals and Bottleneck of Critical Materials from a Fleet Evolution Perspective" World Electric Vehicle Journal 15, no. 1: 14. https://doi.org/10.3390/wevj15010014