Market Equilibrium and Impact of Market Mechanism Parameters on the Electricity Price in Yunnan’s Electricity Market

Abstract

:1. Introduction

2. Bidding Strategy and Market Equilibrium

2.1. Market Assumptions

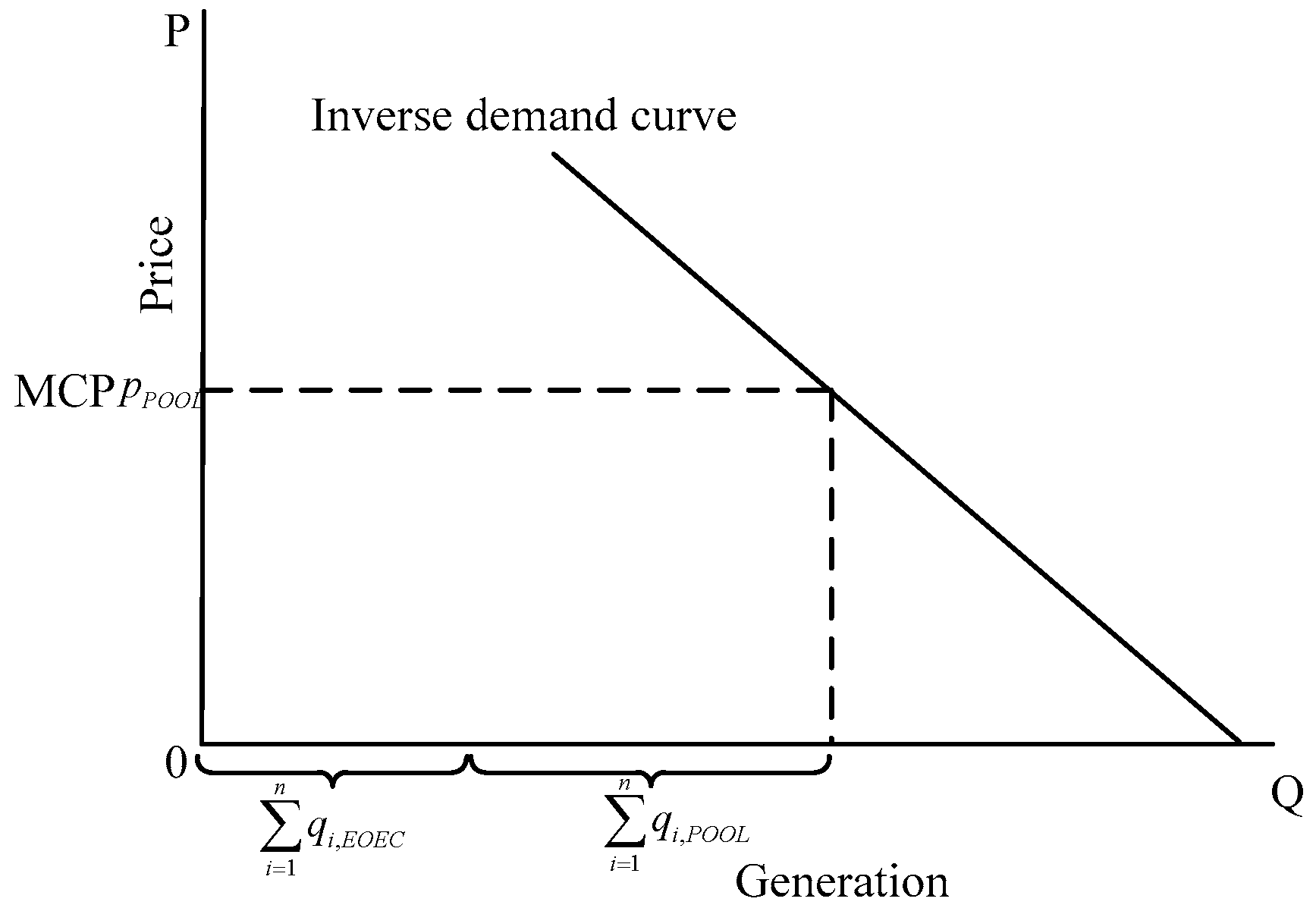

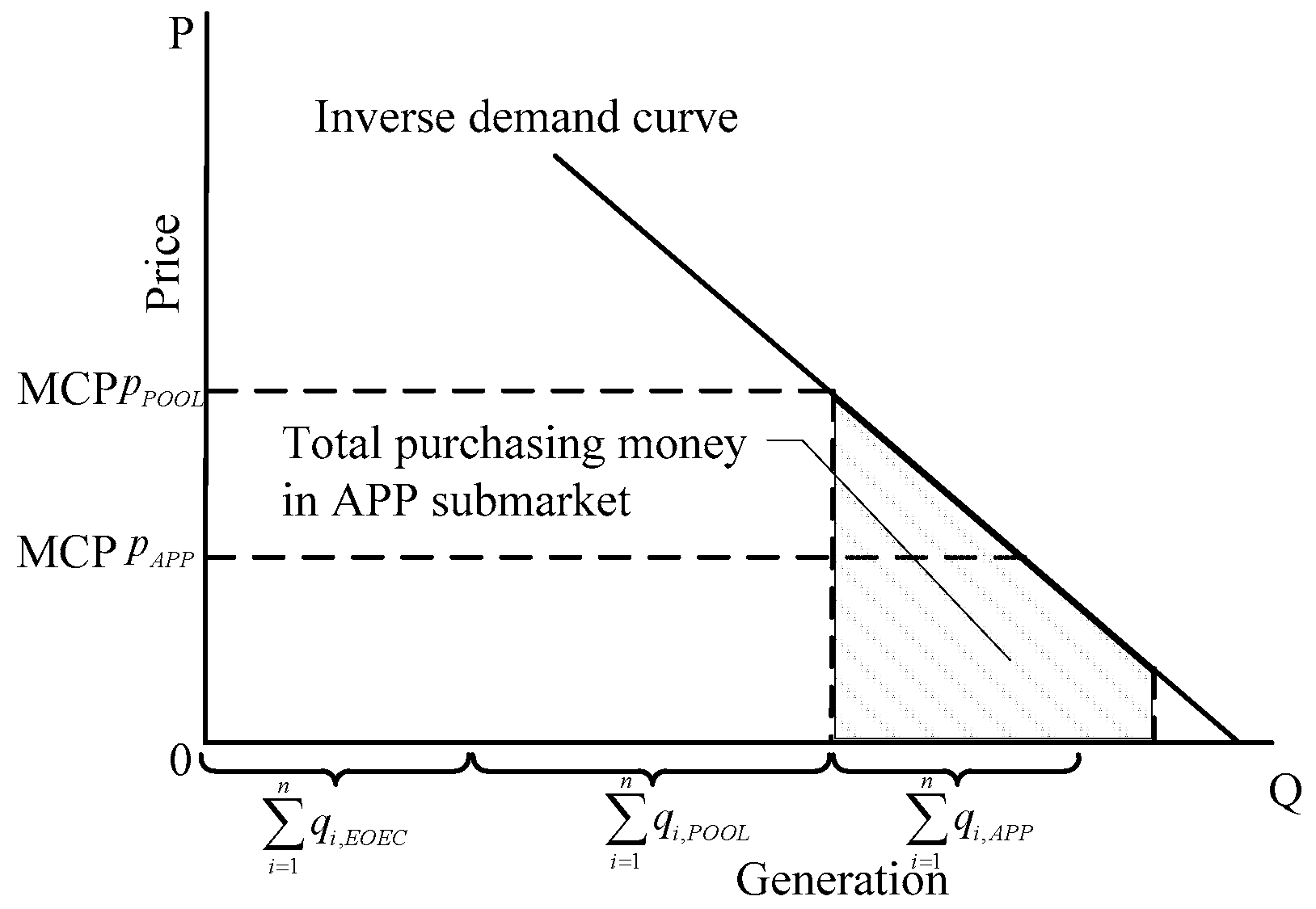

2.2. Hybrid Pricing Mechanism

2.3. Two-Dimensional Cournot Model

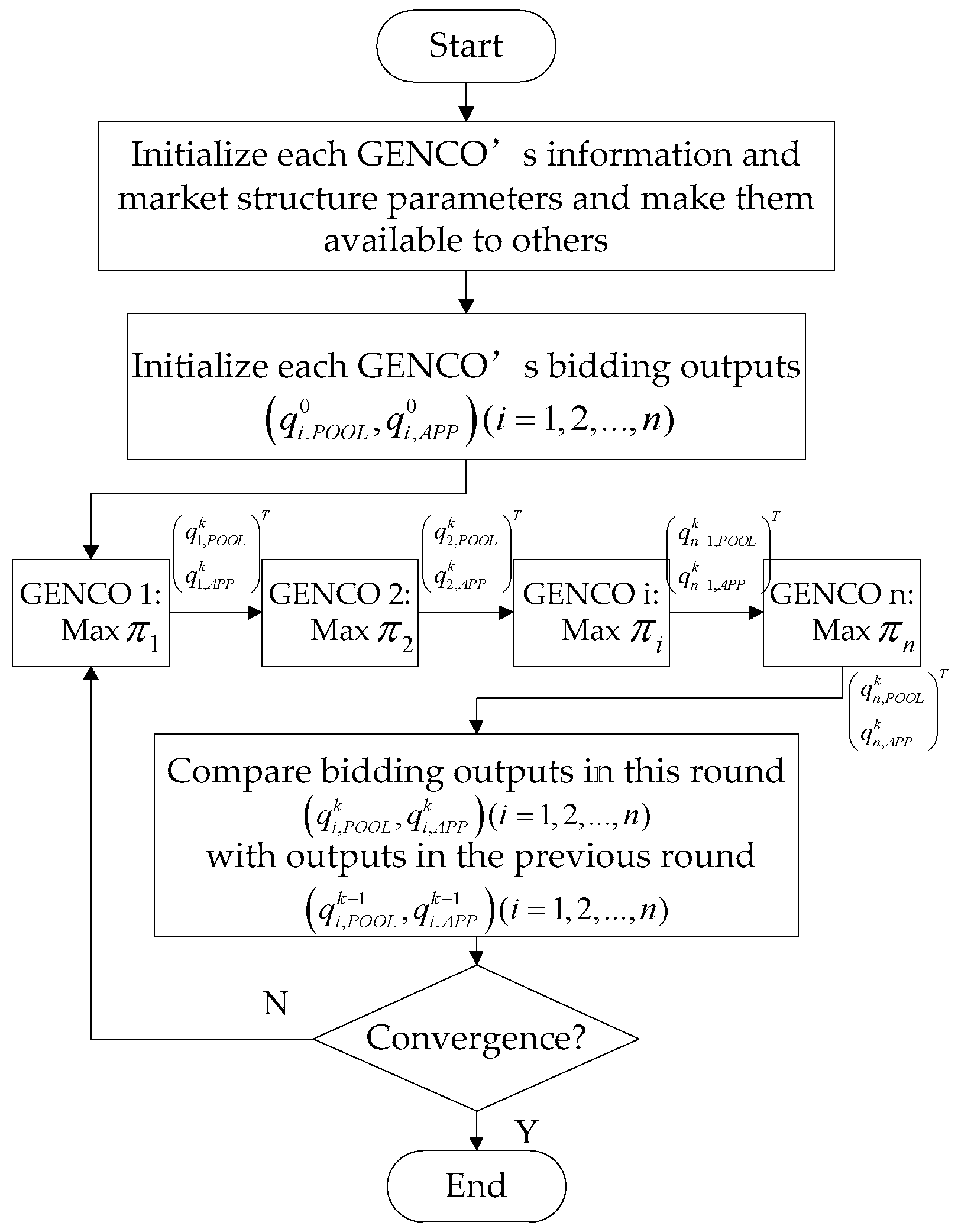

2.4. Market Equilibrium and Solution Methodology

- (1)

- Initialize the GENCOs’ bidding outputs in each submarket , market structure parameters, generation capacity caps and generation cost coefficients of each GENCO. Note that each GENCO’s information is available to others.

- (2)

- For the first GENCO in the market, regard other GENCOs’ bidding output as fixed values and solve the optimization problem in Equation (11) to obtain the optimal bidding output in this round, and pass this information to the second GENCO. The second GENCO regards other GENCOs’ bidding output as fixed values and solves the optimization problem in Equation (11) to obtain the optimal bidding output. Go on with the process until all GENCOs obtain new bidding outputs which provide iteration.

- (3)

- Compare each GENCO’s bidding output in this round with those in the previous round . If no GENCO’s bidding output is updated, it means that no one could unilaterally improve his profit, the algorithm is convergent and the market equilibrium is obtained. Otherwise, the iteration process goes to Equation (2) for a new round.

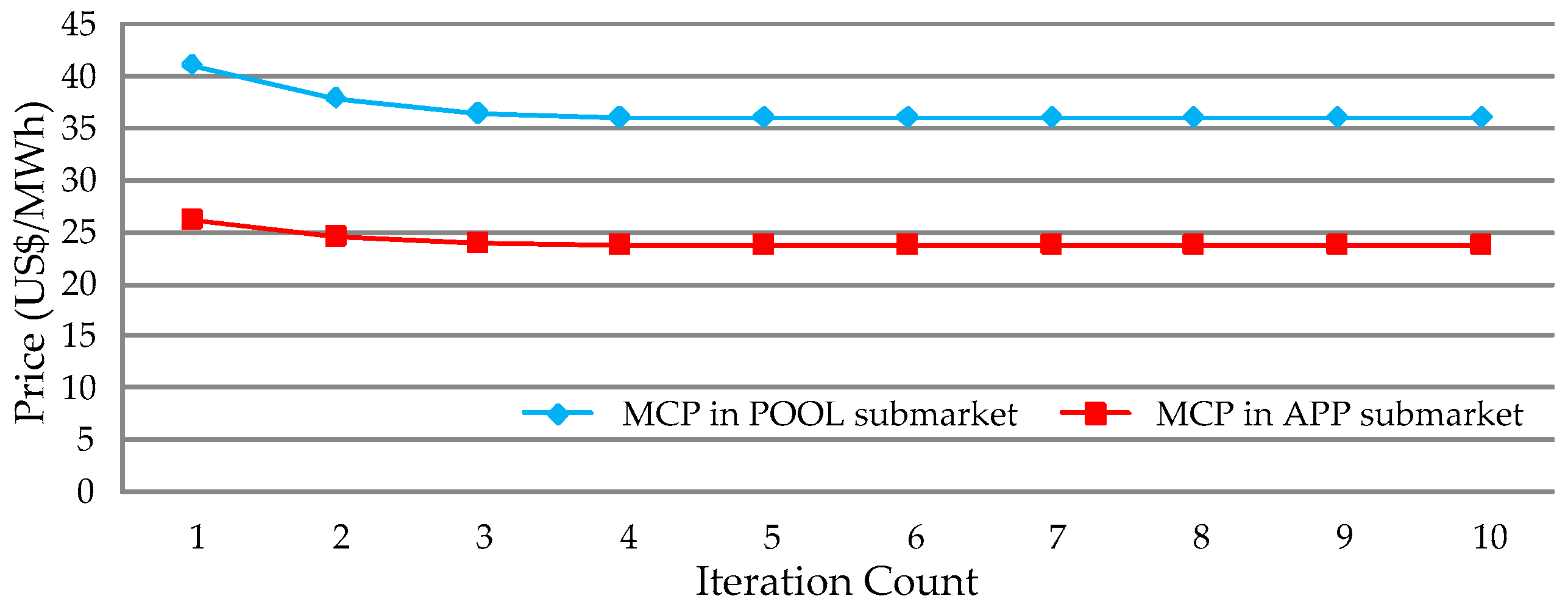

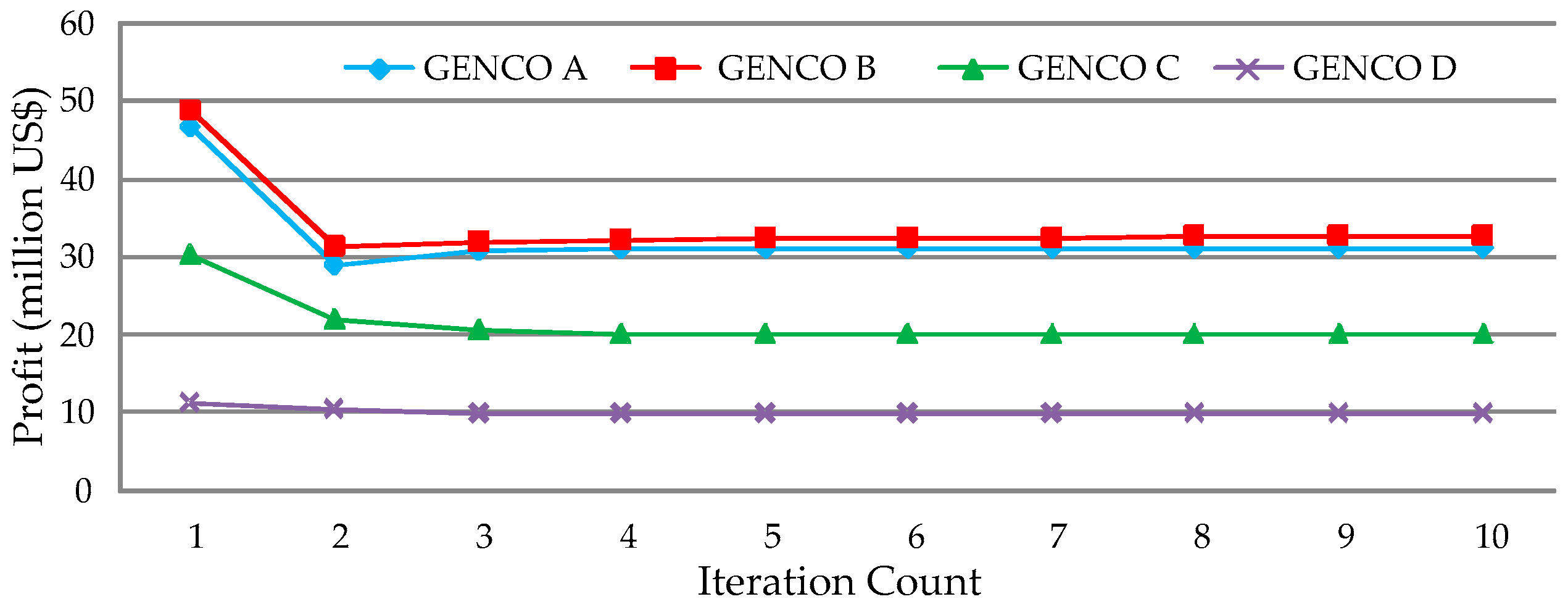

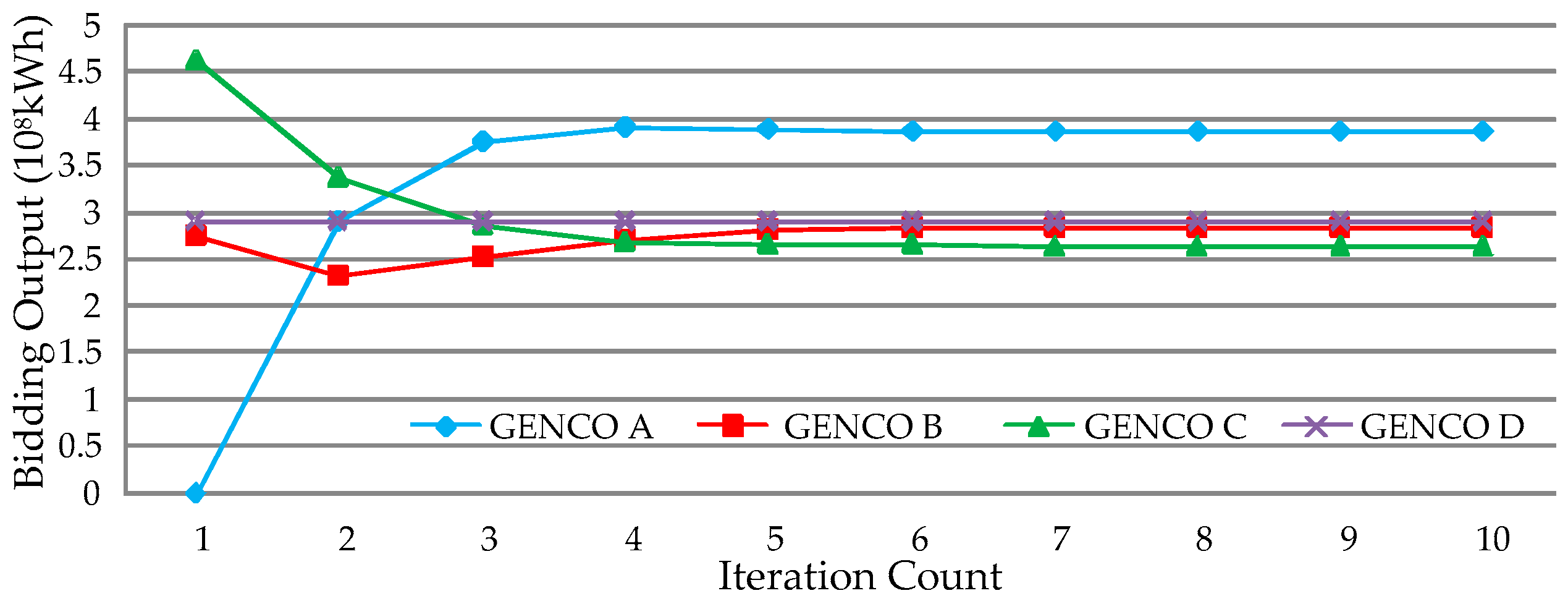

2.5. Numerical Results

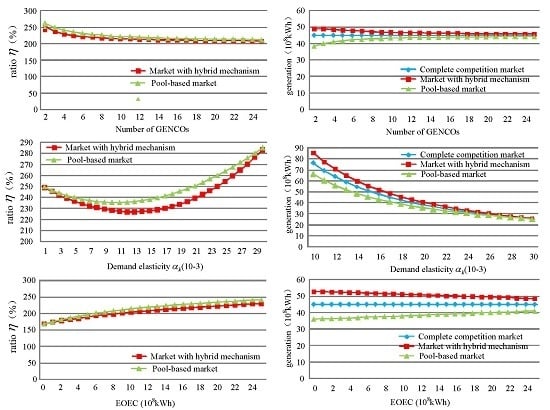

3. Impacts of Different Market Mechanism Parameters on Electricity Price

3.1. Market Equilibrium State in Different Market Mechanisms

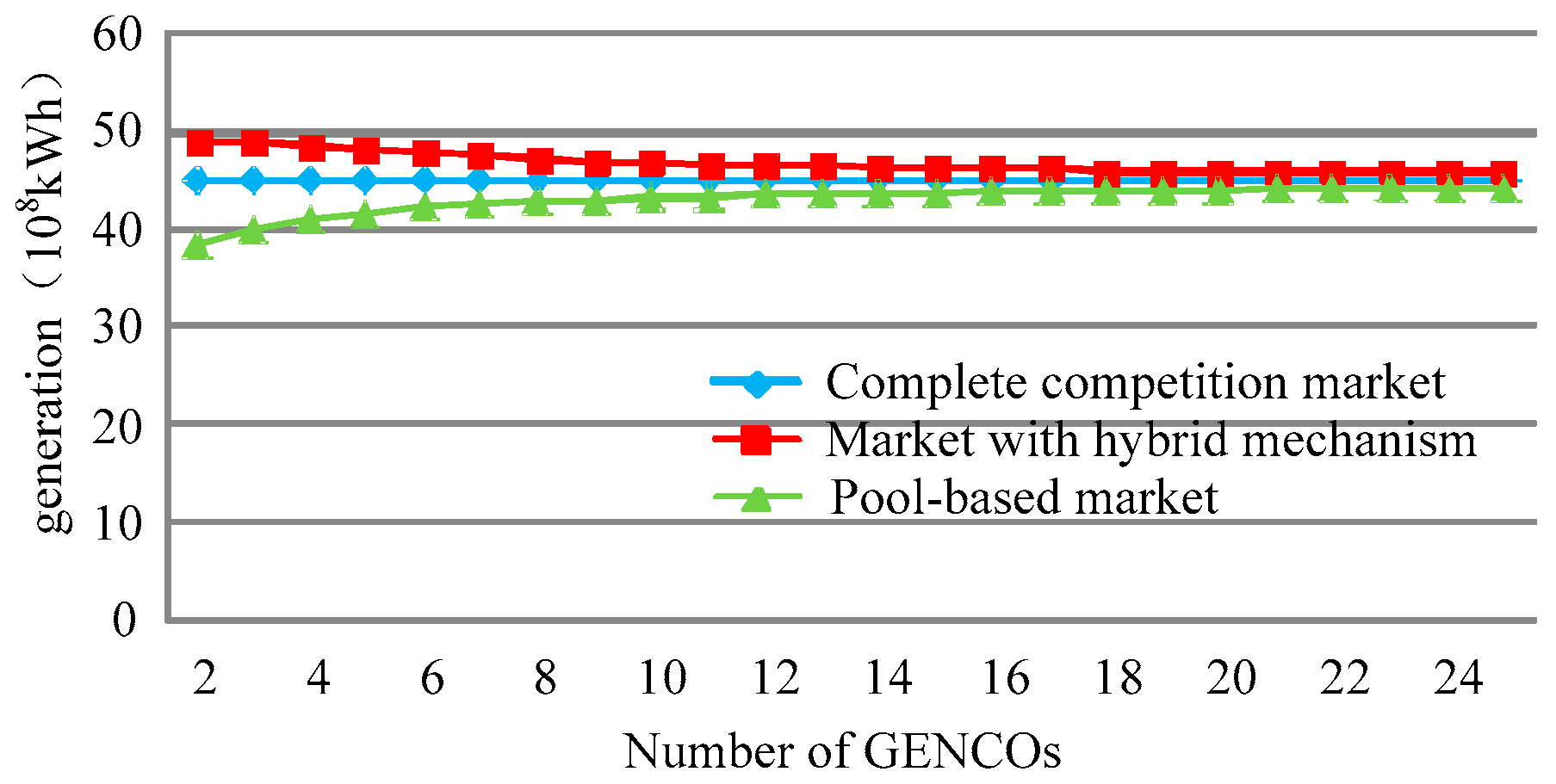

3.2. Impact of the Number of GENCOs

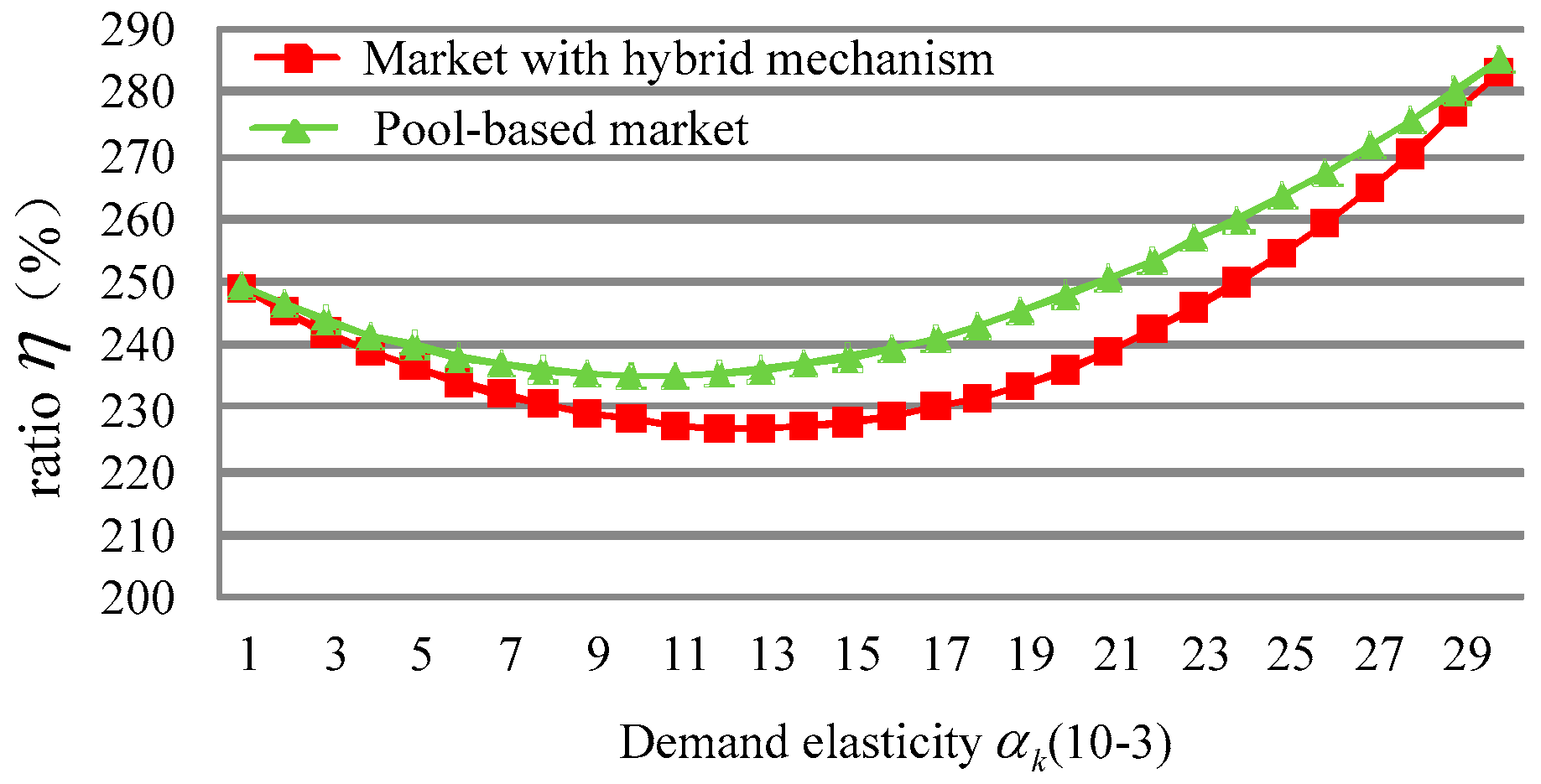

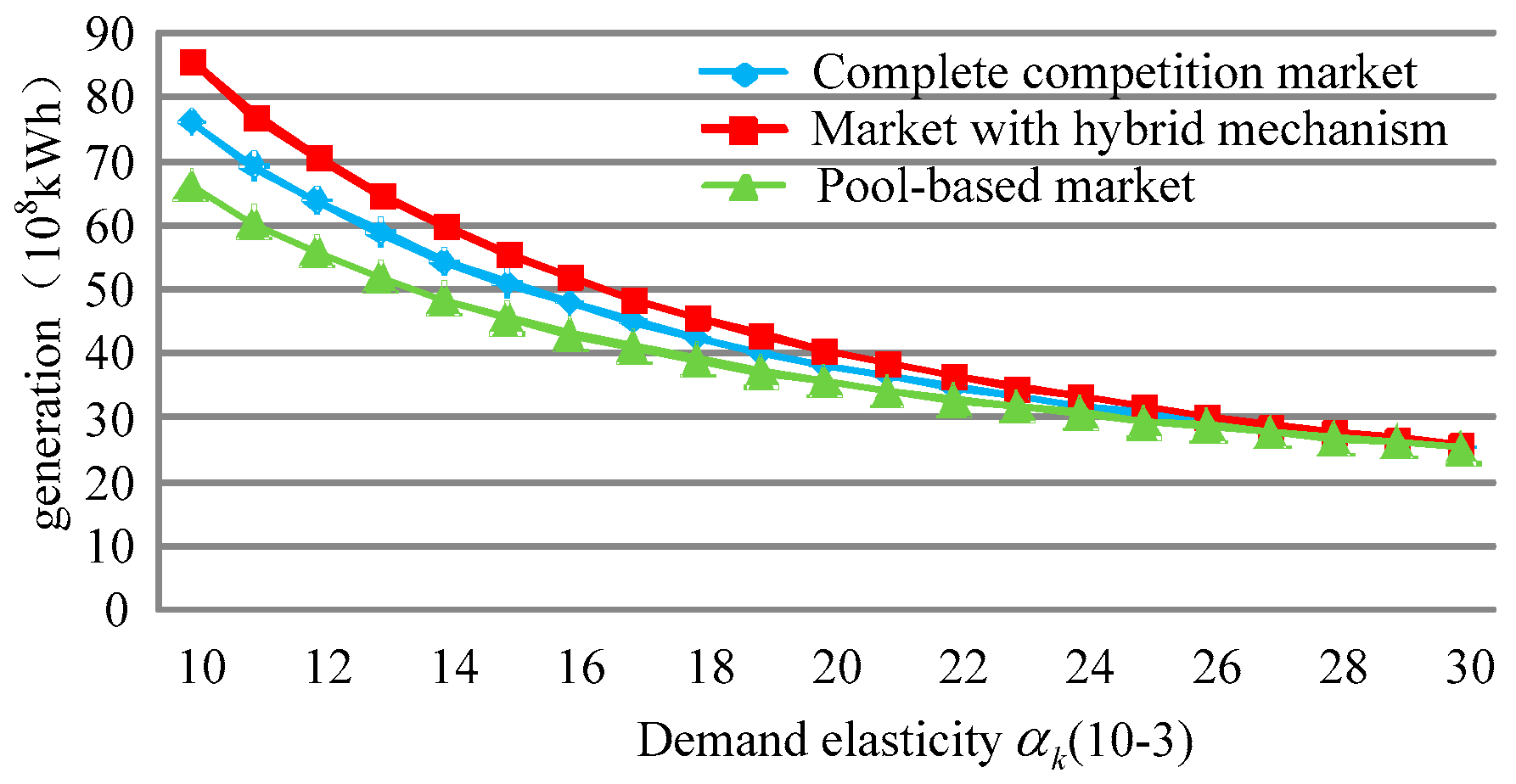

3.3. Impact of Demand Elasticity

3.4. Impact of EOEC

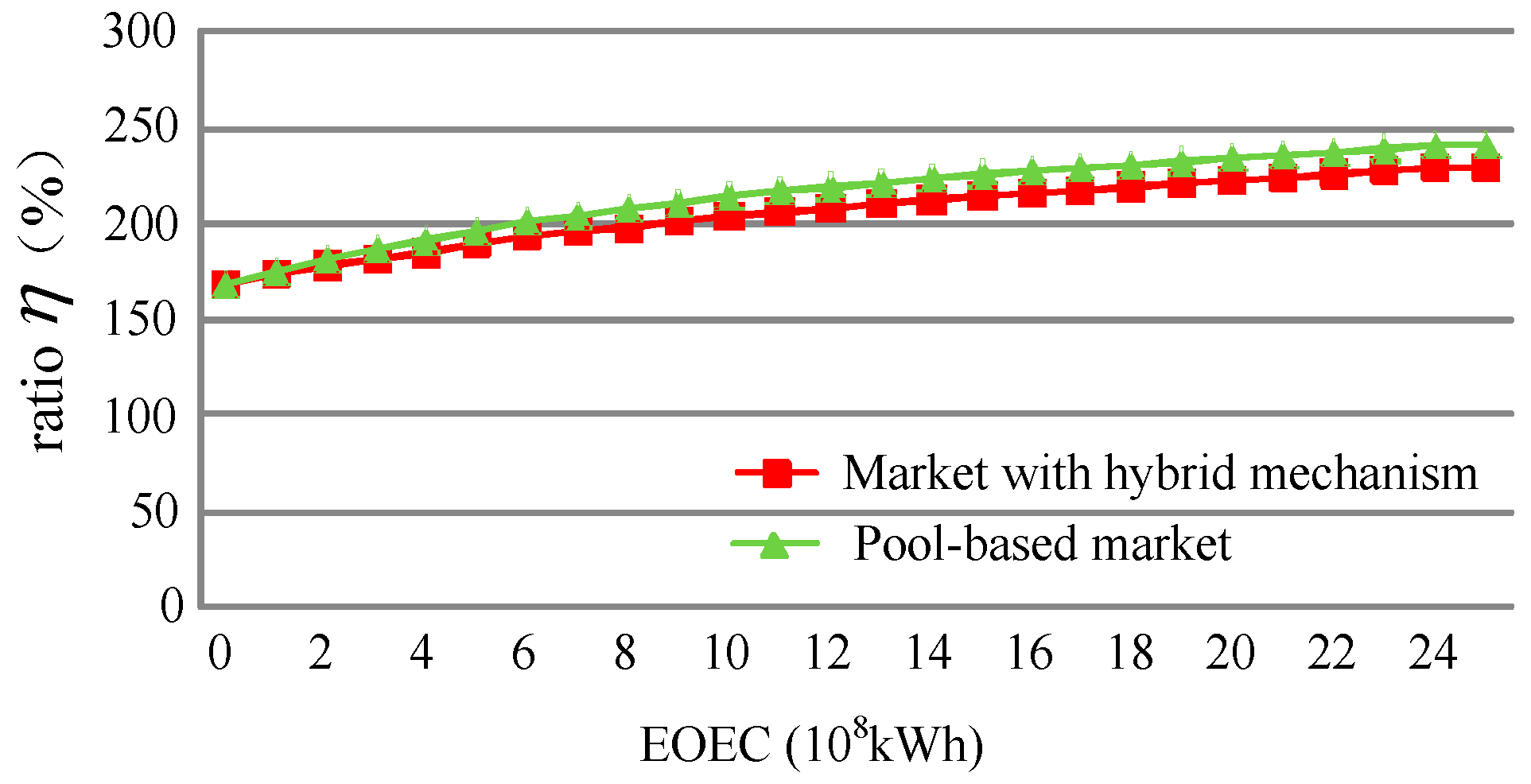

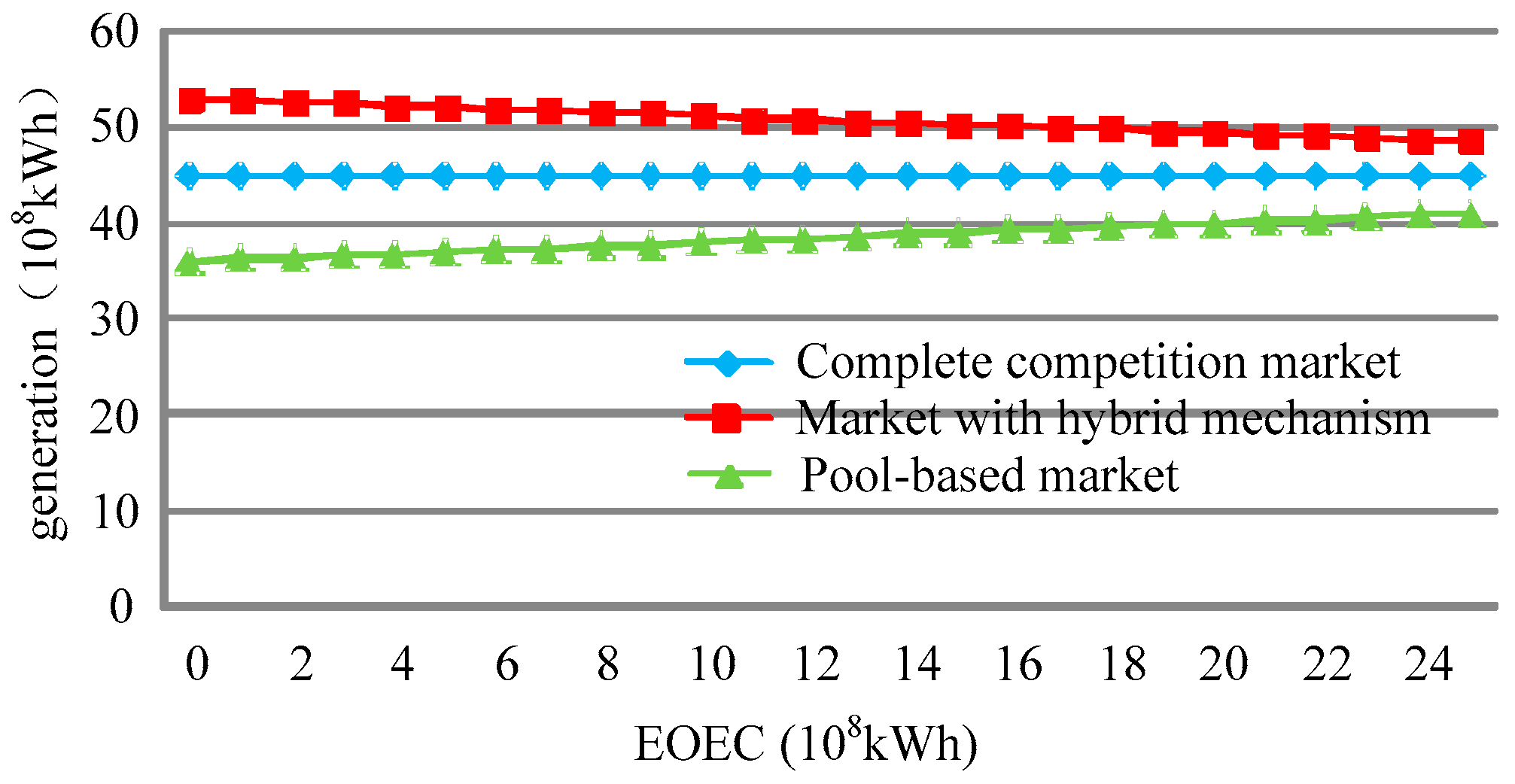

4. Conclusions

- (1)

- The electricity price in a market with hybrid pricing mechanism is always lower than those in the other two markets; and the power generated in a market with hybrid pricing mechanism is higher than those in the other two markets.

- (2)

- A larger number of GENCOs or fewer EOECs contracted with GENCOs will have positive effects on reducing the price. While, with the increase of demand elasticity, the price falls first and then rises because the existence of EOEC contracts.

- (3)

- There is a restrictive relation between demand elasticity and EOECs in markets.

Acknowledgments

Author Contributions

Conflicts of Interest

References

- The Central People’s Government of PRC. Relative Policies on Deepening the Reform of Power Industry. Available online: http://www.ne21.com/news/show-64828.html (accessed on 24 March 2015).

- Cheng, C.; Liu, B.; Chau, K.; Li, G.; Liao, S. China’s small hydropower and its dispatching management. Renew. Sustain. Energy Rev. 2015, 42, 43–55. [Google Scholar] [CrossRef]

- Hennig, T.; Wang, W.; Feng, Y.; Ou, X.; He, D. Review of Yunnan’s hydropower development. Comparing small and large hydropower projects regarding their environmental implications and socio-economic consequences. Renew. Sustain. Energy Rev. 2013, 27, 585–595. [Google Scholar] [CrossRef]

- Yunnan Provincial Industry & Information Technology Commission. Working Program of Yunnan’s 2015 Electricity Market. Available online: http://www.ynetc.gov.cn/Item/11399.aspx (accessed on 29 December 2014).

- Woo, C.; Lloyd, D.; Tishler, A. Electricity market reform failures: UK, Norway, Alberta and California. Energy Policy 2003, 31, 1103–1115. [Google Scholar] [CrossRef]

- Woo, C.K. What went wrong in California’s electricity market? Energy 2001, 26, 747–758. [Google Scholar] [CrossRef]

- Yunnan Provincial Industry & Information Technology Commission. Detailed Rules of Yunnan’s 2015 Electricity Market. Available online: http://www.ynetc.gov.cn/Item/11399.aspx (accessed on 29 December 2014).

- David, A.K. Competitive Bidding in Electricity Supply. IEE Proc. C 1993, 140, 421–426. [Google Scholar] [CrossRef]

- Conejo, A.J.; Nogales, F.J.; Arroyo, J.M. Price-taker bidding strategy under price uncertainty. IEEE Trans. Power Syst. 2002, 17, 1081–1088. [Google Scholar] [CrossRef]

- Song, H.L.; Liu, C.C.; Lawarree, J.; Dahlgren, R.W. Optimal electricity supply bidding by Markov decision process. IEEE Trans. Power Syst. 2000, 15, 618–624. [Google Scholar] [CrossRef]

- Krause, T.; Beck, E.V.; Cherkaoui, R.; Germond, A.; Andersson, G.; Ernst, D. A comparison of Nash equilibria analysis and agent-based modelling for power markets. Int. J. Electr. Power 2006, 28, 599–607. [Google Scholar] [CrossRef]

- Kang, D.; Kim, B.H.; Hur, D. Supplier bidding strategy based on non-cooperative game theory concepts in single auction power pools. Electr. Power Syst. Res. 2007, 77, 630–636. [Google Scholar] [CrossRef]

- Zhang, H.; Gao, F.; Wu, J.; Liu, K.; Liu, X. Optimal Bidding Strategies for Wind Power Producers in the Day-ahead Electricity Market. Energies 2012, 5, 4804–4823. [Google Scholar] [CrossRef]

- Contreras, J.; Candiles, O.; de la Fuente, J.I.; Gomez, T. A cobweb bidding model for competitive electricity markets. IEEE Trans. Power Syst. 2002, 17, 148–153. [Google Scholar] [CrossRef]

- Song, Y.; Ni, Y.; Wen, F.; Hou, Z.; Wu, F.F. Conjectural variation based bidding strategy in spot markets: fundamentals and comparison with classical game theoretical bidding strategies. Electr. Power Syst. Res. 2003, 67, 45–51. [Google Scholar] [CrossRef]

- Song, Y.Q.; Ni, Y.X.; Wen, F.S.; Wu, F.F. Analysis of strategic interactions among generation companies using conjectured supply function equilibrium model. In Proceedings of the 2003 IEEE Power Engineering Society General Meeting, Toronto, ON, Canada, 13–17 July 2003; pp. 849–853.

- Day, C.J.; Hobbs, B.F.; Pang, J.S. Oligopolistic competition in power networks: A conjectured supply function approach. IEEE Trans. Power Syst. 2002, 17, 597–607. [Google Scholar] [CrossRef]

- Rahimiyan, M.; Rajabi Mashhadi, H. Supplier’s optimal bidding strategy in electricity pay-as-bid auction: Comparison of the Q-learning and a model-based approach. Electr. Power Syst. Res. 2008, 78, 165–175. [Google Scholar] [CrossRef]

- Gountis, V.P.; Bakirtzis, A.G. Bidding Strategies for Electricity Producers in a Competitive Electricity Marketplace. IEEE Trans. Power Syst. 2004, 19, 356–365. [Google Scholar] [CrossRef]

- Song, H.L.; Liu, C.C.; Lawarree, J. Nash equilibrium bidding strategies in a bilateral electricity market. IEEE Trans. Power Syst. 2002, 17, 73–79. [Google Scholar] [CrossRef]

- Hobbs, B.F. Linear complementarity models of Nash-Cournot competition in bilateral and POOLCO power markets. IEEE Trans. Power Syst. 2001, 16, 194–202. [Google Scholar] [CrossRef]

- Bathurst, G.N.; Weatherill, J.; Strbac, G. Trading wind generation in short term energy markets. IEEE Trans. Power Syst. 2002, 17, 782–789. [Google Scholar] [CrossRef]

- Fujii, Y.; Okamura, T.; Inagaki, K.; Yamaji, K. Basic analysis of the pricing processes in modeled electricity markets with multi-agent simulation. In Proceedings of the 2004 IEEE International Conference on Electric Utility Deregulation, Restructuring and Power Technologies, Hong Kong, China, 5–8 April 2004.

- Steeger, G.; Barroso, L.A.; Rebennack, S. Optimal Bidding Strategies for Hydro-Electric Producers: A Literature Survey. IEEE Trans. Power Syst. 2014, 29, 1758–1766. [Google Scholar] [CrossRef]

- Li, G.; Shi, J.; Qu, X. Modeling methods for GenCo bidding strategy optimization in the liberalized electricity spot market—A state-of-the-art review. Energy 2011, 36, 4686–4700. [Google Scholar] [CrossRef]

- David, A.K.; Wen, F.S. Strategic bidding in competitive electricity markets: A literature survey. In Proceedings of the 2000 IEEE Power Engineering Society Summer Meeting, Seattle, WA, USA, 16–20 July 2000.

- Díaz, C.A.; Villar, J.; Campos, F.A.; Reneses, J. Electricity market equilibrium based on conjectural variations. Electr. Power Syst. Res. 2010, 80, 1572–1579. [Google Scholar] [CrossRef]

- Tan, D.; Hu, P. Model of multidimensional game between two Oligarchs and its analysis on output strategies. J. Ind. Eng. Eng. Manag. 2004, 1, 123–125. [Google Scholar]

- Zhang, H.; Gao, F.; Wu, J.; Liu, K.; Zhai, Q. A stochastic Cournot bidding model for wind power producers. In Proceedings of the 2011 IEEE International Conference on Automation and Logistics (ICAL), Chongqing, China, 15–16 August 2011.

- Kelman, R.; Barroso, L.; Pereira, M. Market power assessment and mitigation in hydrothermal systems. IEEE Trans. Power Syst. 2001, 16, 354–359. [Google Scholar] [CrossRef]

- Zeng, M.; Yang, Y.; Wang, L.; Sun, J. The power industry reform in China 2015: Policies, evaluations and solutions. Renew. Sustain. Energy Rev. 2016, 57, 94–110. [Google Scholar] [CrossRef]

| GENCO | Type | ai | bi | ci | Ki (US$/MWh) | EOEC (108 kWh) | Capacity Caps (108 kWh) |

|---|---|---|---|---|---|---|---|

| A | Hydro | 0 | 0.1 | 0 | 48.92 | 6.5 | 12 |

| B | Hydro | 0 | 0.08 | 0 | 43.38 | 7.0 | 13.5 |

| C | Hydro | 0 | 0.11 | 0 | 36.15 | 6.3 | 13 |

| D | Thermal | 0.0012 | 0.18 | 0.08 | 49.85 | 5.1 | 8 |

| GENCO | Bid in POOL (108 kWh) | Bid in APP (108 kWh) | MCP in POOL (US$/MWh) | MCP in APP (US$/MWh) | Profit (Million US$) |

|---|---|---|---|---|---|

| A | 3.861 | 1.639 | 35.85 | 23.69 | 31.09 |

| B | 2.847 | 3.653 | 32.63 | ||

| C | 2.64 | 4.06 | 19.88 | ||

| D | 2.9 | 0 | 9.68 |

| Month | GENCO A | GENCO B | GENCO C | GENCO D | ||||

|---|---|---|---|---|---|---|---|---|

| EOEC | Caps | EOEC | Caps | EOEC | Caps | EOEC | Caps | |

| 1 | 7.5 | 13 | 7.0 | 13.5 | 6.3 | 13 | 4.1 | 7 |

| 2 | 7.5 | 13 | 7.0 | 13.5 | 6.3 | 13 | 4.1 | 7 |

| 3 | 6.5 | 12 | 7.0 | 13.5 | 6.3 | 13 | 5.1 | 8 |

| 4 | 6.5 | 12 | 7.0 | 13.5 | 6.3 | 13 | 5.1 | 8 |

| 5 | 7.5 | 13 | 7.0 | 13.5 | 7.3 | 14 | 3.1 | 6 |

| 6 | 7.5 | 13 | 8.0 | 15.5 | 8.3 | 16 | 2 | 2 |

| 7 | 7.5 | 14.5 | 8.3 | 15.5 | 8.6 | 16 | 2 | 2 |

| 8 | 7.5 | 14.5 | 8.3 | 15.5 | 8.6 | 16 | 2 | 2 |

| 9 | 7.5 | 14.5 | 8.3 | 15.5 | 8.6 | 16 | 2 | 2 |

| 10 | 7.5 | 14.5 | 8.3 | 15.5 | 8.6 | 16 | 2 | 2 |

| 11 | 7.5 | 13 | 8.0 | 15.5 | 8.3 | 16 | 2 | 2 |

| 12 | 7.5 | 13 | 7.0 | 13.5 | 7.3 | 14 | 3.1 | 6 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, C.; Chen, F.; Li, G.; Tu, Q. Market Equilibrium and Impact of Market Mechanism Parameters on the Electricity Price in Yunnan’s Electricity Market. Energies 2016, 9, 463. https://doi.org/10.3390/en9060463

Cheng C, Chen F, Li G, Tu Q. Market Equilibrium and Impact of Market Mechanism Parameters on the Electricity Price in Yunnan’s Electricity Market. Energies. 2016; 9(6):463. https://doi.org/10.3390/en9060463

Chicago/Turabian StyleCheng, Chuntian, Fu Chen, Gang Li, and Qiyu Tu. 2016. "Market Equilibrium and Impact of Market Mechanism Parameters on the Electricity Price in Yunnan’s Electricity Market" Energies 9, no. 6: 463. https://doi.org/10.3390/en9060463