Economic Value of Li-ion Energy Storage System in Frequency Regulation Application from Utility Firm’s Perspective in Korea

Abstract

:1. Introduction

2. Literature Review and Background

2.1. Energy Storage System (ESS) for Frequency Regulation (FR)

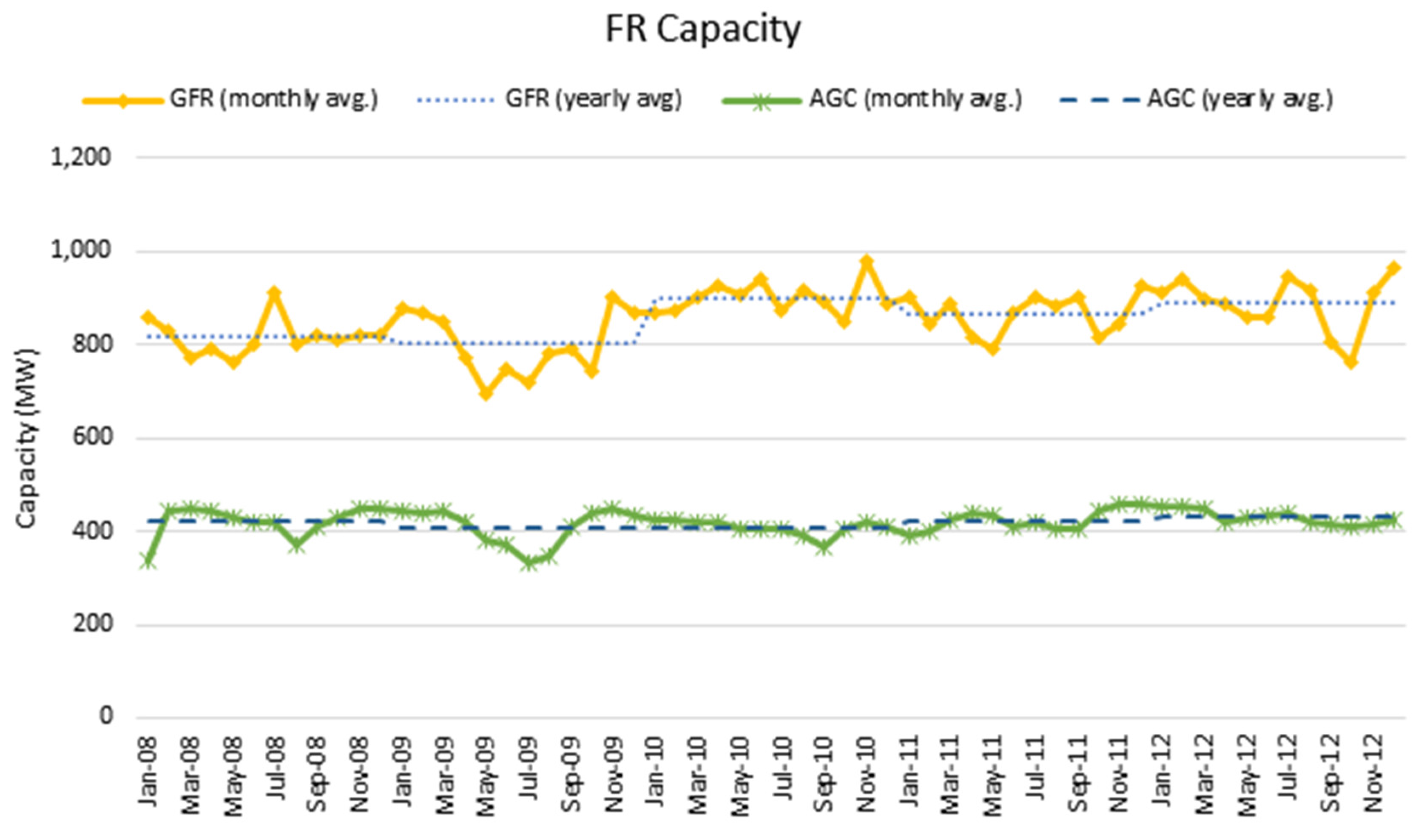

2.2. Frequency Regulation in Korea

2.3. Frequency Regulation and Constraint Cost

2.4. Economic Valuation Literature for Energy Storage System

3. Methodology

3.1. Valuation Principles

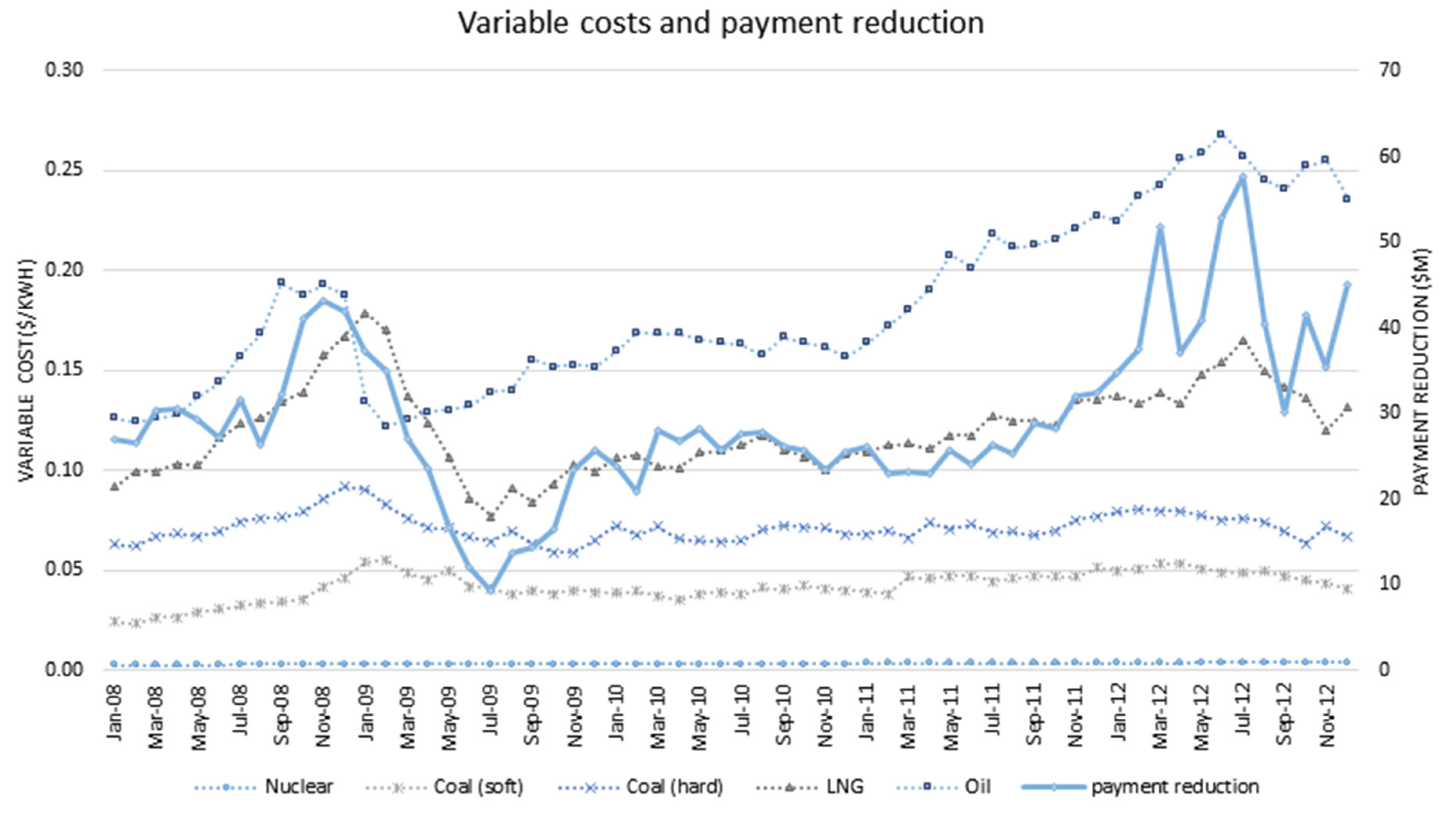

- Variable Cost (vc)—Variable cost is the cost of generating electricity incurred by a generator. Variable cost of a generator is mostly dependent on the price of fuel it consumes. In Korea, variable costs cannot be determined by generators but need to be evaluated by a central committee, the Generation Cost Evaluation Committee (GCEC). The committee finally determines variable costs based on the evaluation of various elements such as energy prices, fixed costs, efficiency, and/or the generator’s other technical features.

- System Marginal Price (smp)—smp is a market price of electricity determined after a dispatch schedule is established. As the name indicates, smp defines the system-wide cost incurred to produce a unit of electricity additional to the amount of electricity that has been generated so far. smp is very important in that it determines the wholesale price, which affects the energy payment given to generators involved in the production schedule.

- Price-Setting Scheduled Energy (Q_pse)—Q_pse is the scheduled amount of generation by each generator. It is determined based on offers by generators in the day-ahead electricity market. It should to be noted that Q_pse determines smp but is not equal to the actual amount of generation due to reserved capacity.

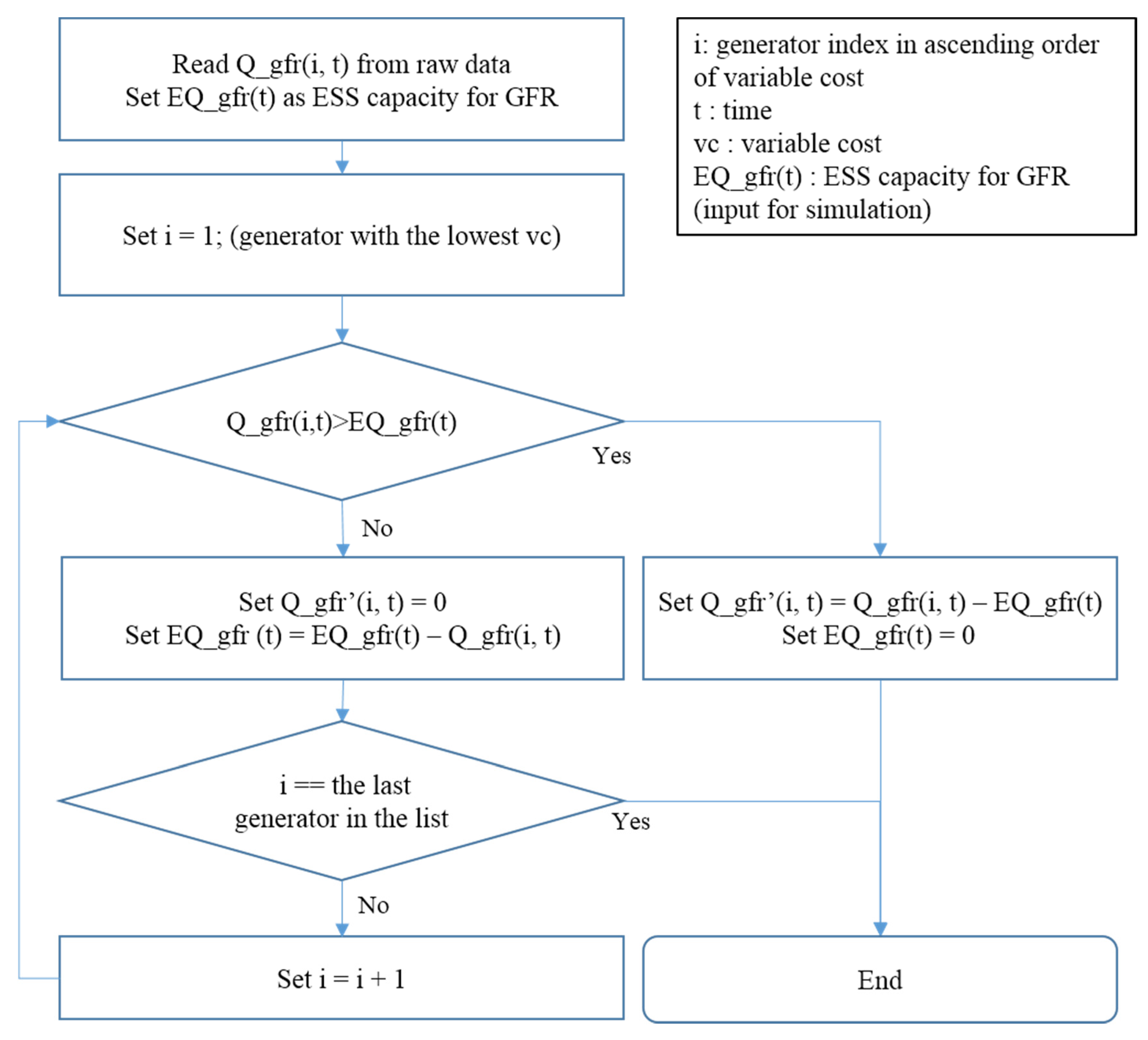

- Constrained-off capacity (Q_coff = Q_gfr + Q_act)—Q_coff represents constrained-off capacity reserved for FR service. Q_coff is allocated to each generator by reserving a part of the Q_pse it offered. Q_coff is the sum of Q_gfr and Q_act, which represent the two types of regulation operation: governor free and automatic generation control. If Q_coff is fully dispatched in real time, the actual generation of each generator becomes Q_pse-Q_coff.

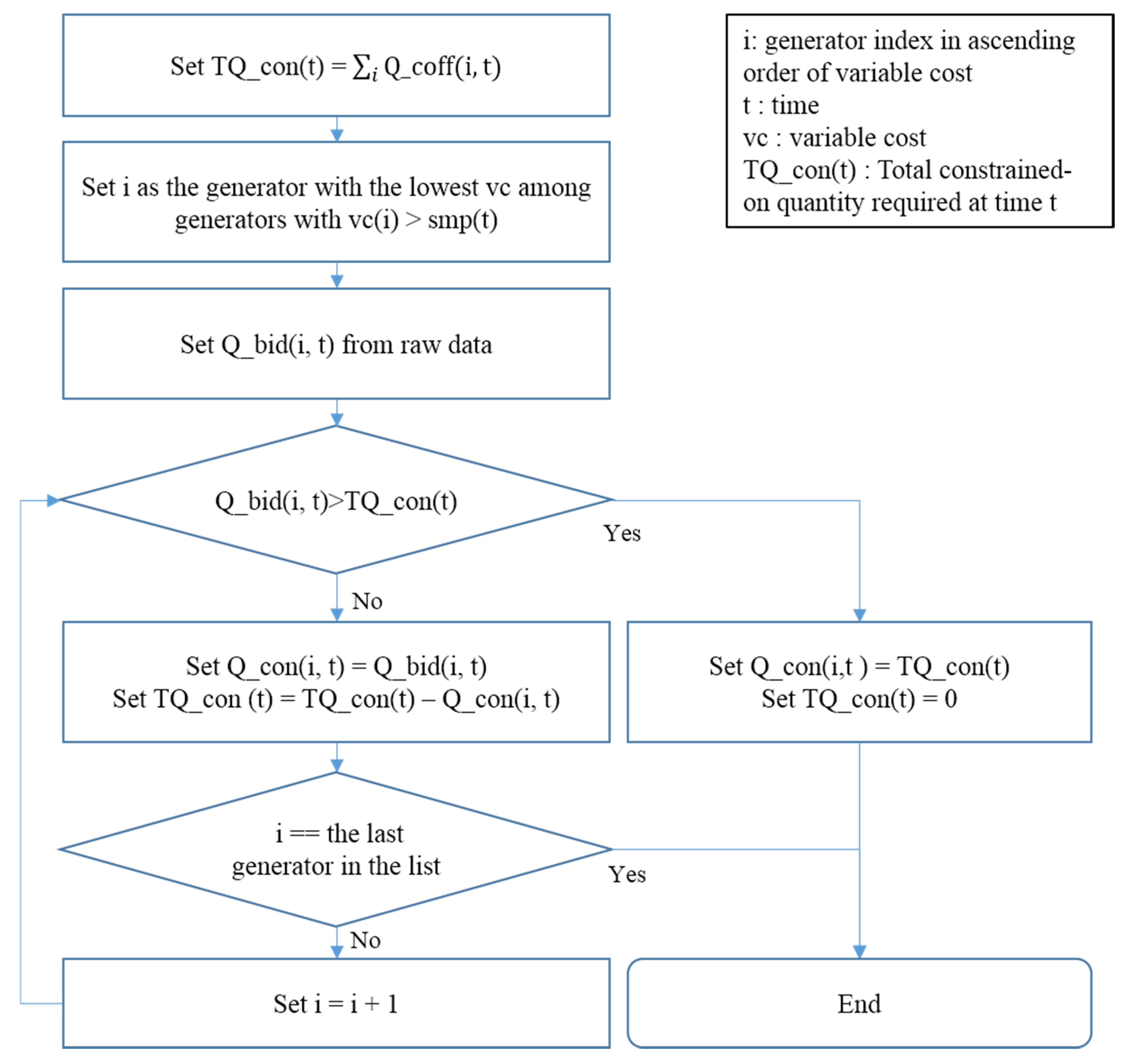

- Constrained-on capacity (Q_con)—Q_con is the amount of constrained-on generation requested for making up the loss of scheduled supply due to Q_coff. Generators with available capacity are dispatched in real time. It is worth noting that Q_con here considers constrained-on generation only for compensating the loss due to FR service, meaning that it does not account for any other constrained-on generations that might occur in real-time situations such as forecast errors or failures in distribution/transmission.

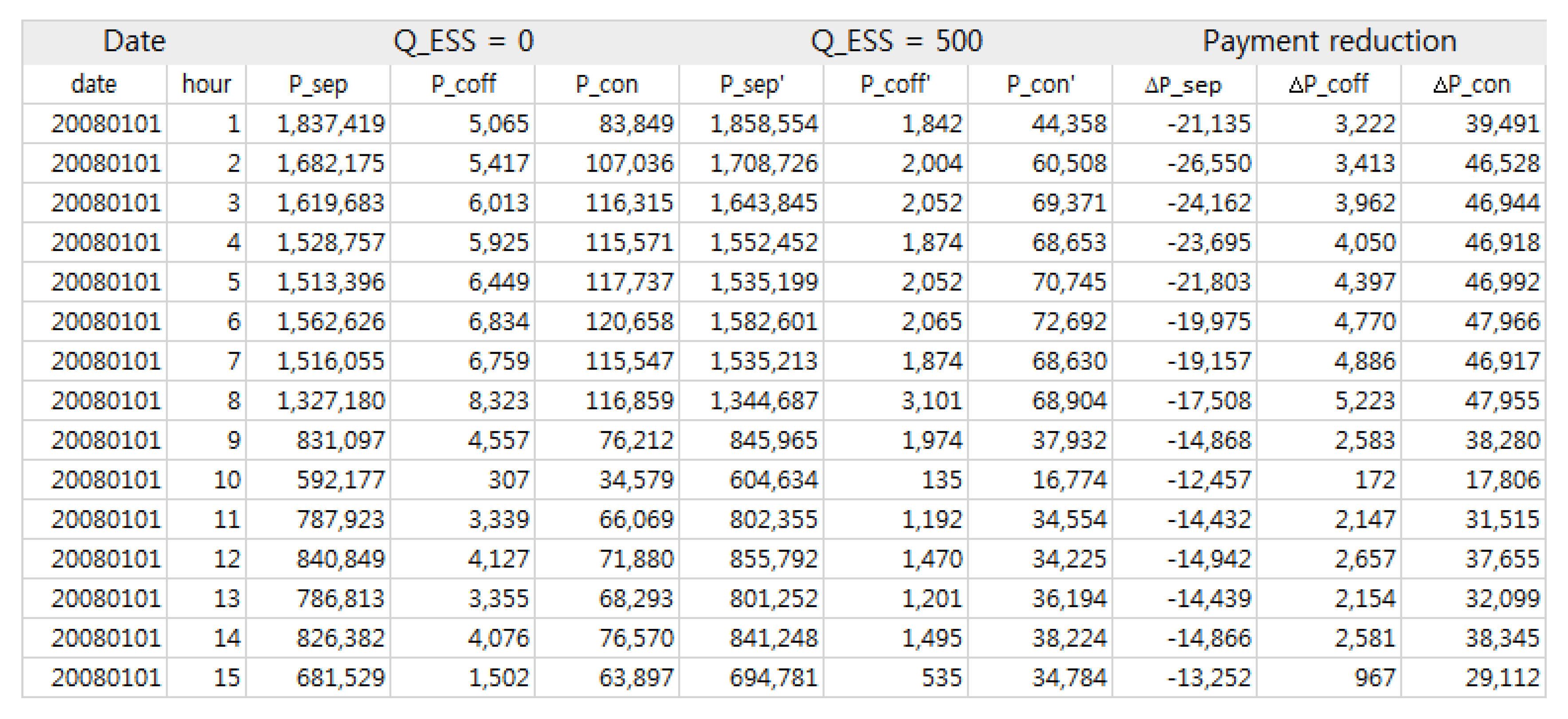

3.2. Payment Equations

3.3. Q_coff and Q_con

| Generator Index | Variable Cost ($/MWh) | Q_ESS = 0 (Benchmark) | Q_ESS = 500 MW | ∆Q_gfr (MW) |

|---|---|---|---|---|

| Q_gfr (MW) | Q_gfr’ (MW) | |||

| 1 | 3.5 | 0 | 0 | 0 |

| 2 | 35.0 | 213.8 | 0 | −213.8 |

| 3 | 48.0 | 13.5 | 0 | −13.5 |

| 4 | 100.0 | 492.2 | 219.5 | −272.7 |

| 5 | 126.6 | 9.9 | 9.9 | 0 |

| 6 | 162.3 | 132.0 | 132.0 | 0 |

| Total | −500 | |||

| Generator Index | Capacity (MW) | Q_bid (MW) | Variable Cost (A) ($/MWh) | Q_ESS = 0 (Benchmark) | Q_ESS = 500 MW | ||

|---|---|---|---|---|---|---|---|

| Q_con (B) (MW) | P_con (B × A) ($) | Q_con’ (C) (MW) | P_con’ (C × B) ($) | ||||

| 23 | 523.00 | 458.36 | 90.44 | 458.36 | 41,452.85 | 458.36 | 41,452.85 |

| 24 | 267.00 | 234.00 | 92.50 | 234.00 | 21,645.64 | 205.99 | 19,054.81 |

| 25 | 267.00 | 234.00 | 92.56 | 234.00 | 21,658.21 | ||

| 26 | 267.00 | 234.00 | 93.58 | 234.00 | 21,897.04 | ||

| 27 | 543.00 | 475.89 | 95.86 | 3.99 | 382.32 | ||

| 28 | 708.00 | 620.50 | 96.14 | ||||

| 29 | 377.00 | 330.41 | 97.14 | ||||

| Total | 1,164.36 | 107,036.06 | 664.36 | 60,507.66 | |||

3.4. Benefit Equation

4. Results

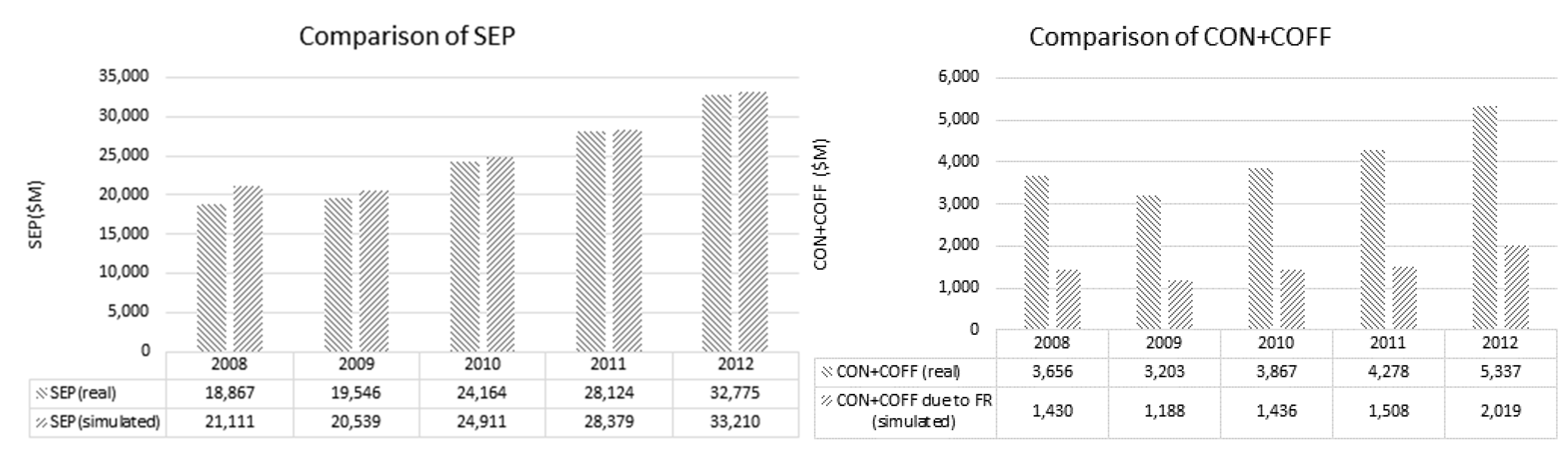

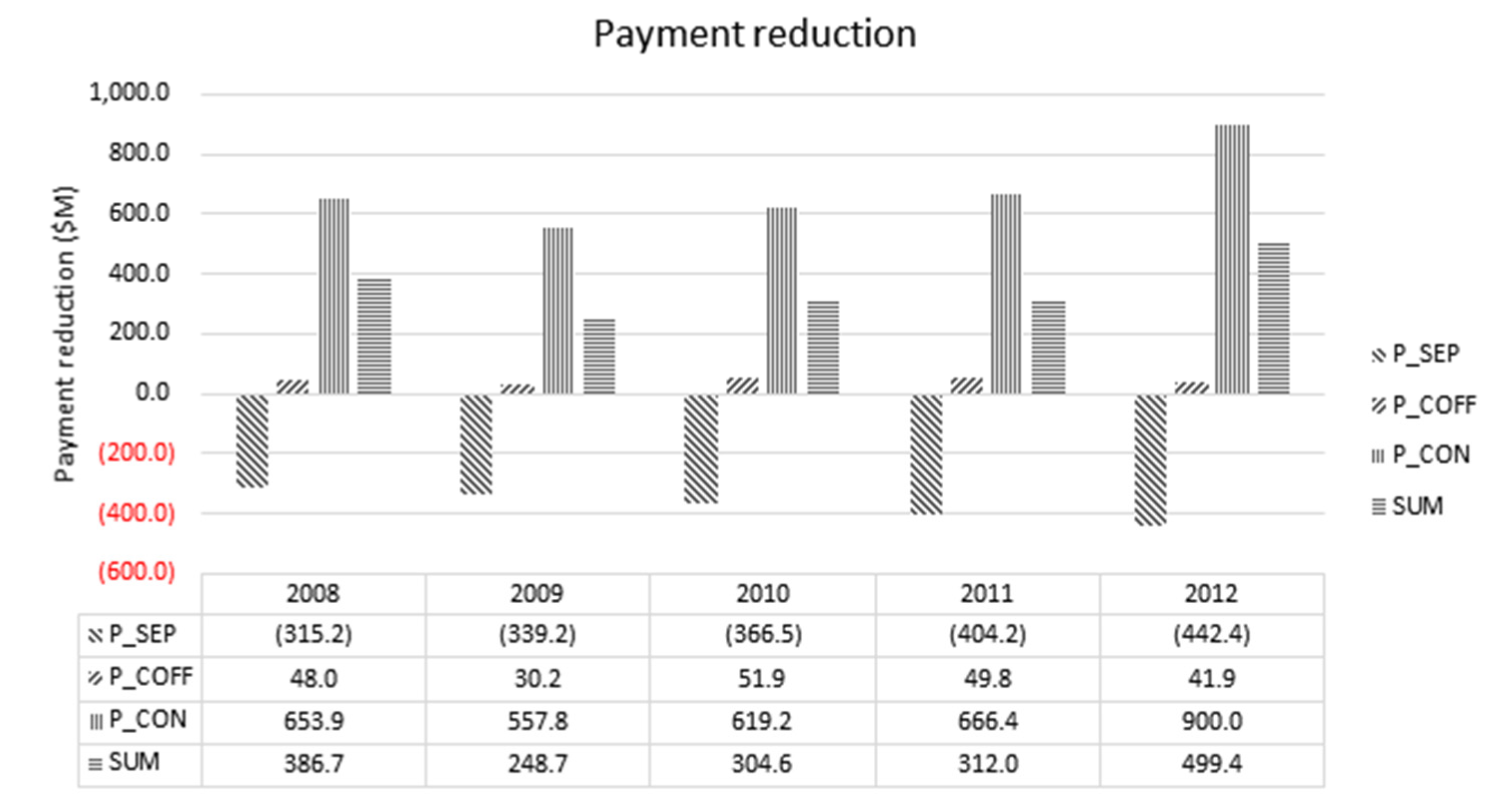

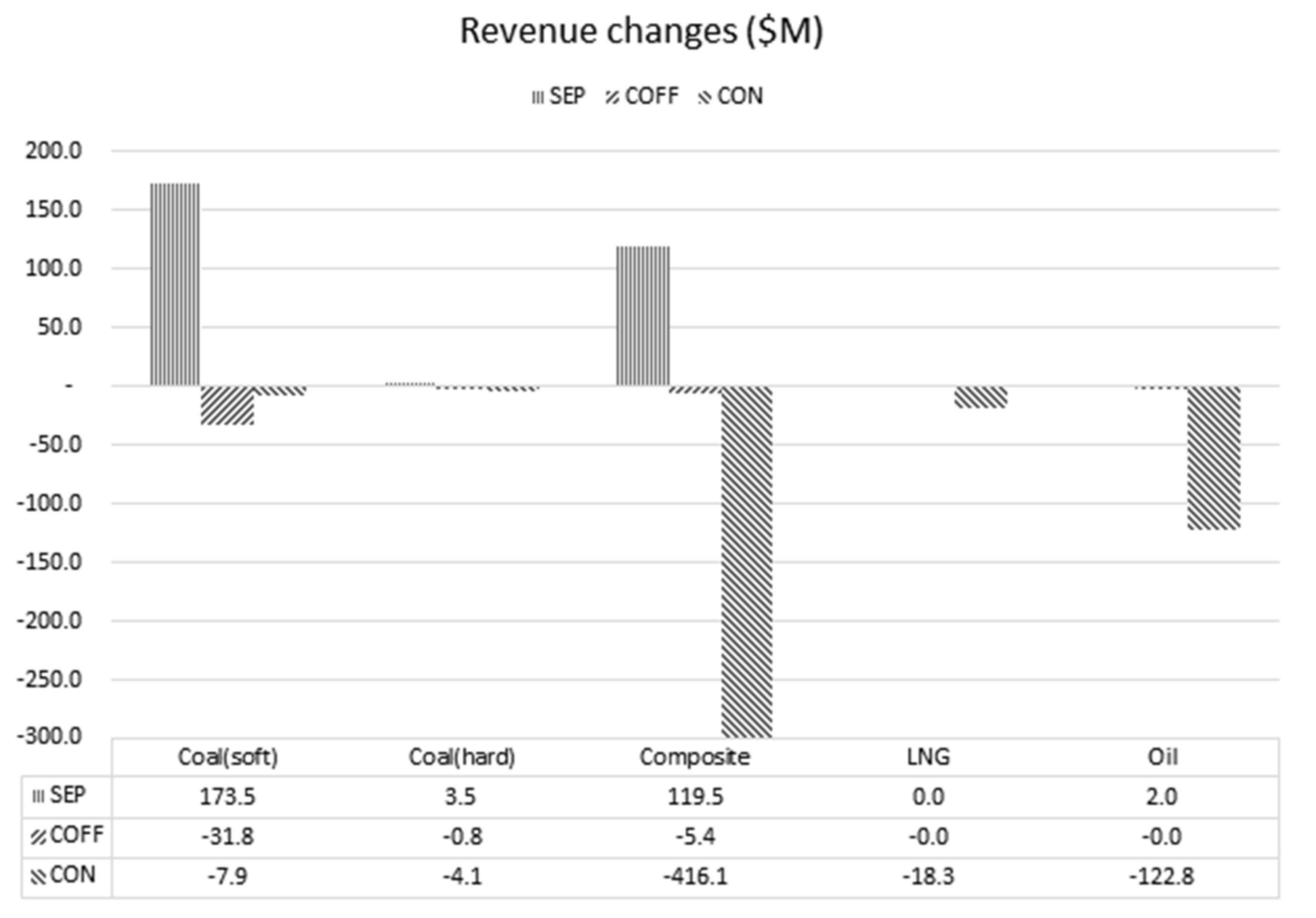

4.1. Estimated Benefits

4.2. Estimated Benefit–Cost Ratio (BCR)

| Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | NPV |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Benefit | 349.6 | 233.4 | 282.3 | 292.5 | 465.6 | 465.6 | 465.6 | 465.6 | 465.6 | 465.6 | 2747.4 |

| Cost | 721.9 | 62.9 | 62.9 | 62.9 | 62.9 | 62.9 | 62.9 | 62.9 | 62.9 | 62.9 | 1071.2 |

| BCR | 2.56 | ||||||||||

5. Conclusions

Author Contributions

Conflicts of Interest

References

- Bradbury, K.; Pratson, L.; Patiño-Echeverri, D. Economic viability of energy storage systems based on price arbitrage potential in real-time U.S. electricity markets. Appl. Energy 2014, 114, 512–519. [Google Scholar]

- Rudolf, V.; Papastergiou, K.D. Financial analysis of utility scale photovoltaic plants with battery energy storage. Energy Policy 2013, 63, 139–146. [Google Scholar] [CrossRef]

- Sioshansi, R.; Denholm, P.; Jenkin, T.; Weiss, J. Estimating the value of electricity storage in PJM: Arbitrage and some welfare effects. Energy Econ. 2009, 31, 269–277. [Google Scholar] [CrossRef]

- Oudalov, A.; Chartouni, D.; Ohler, C. Optimizing a battery energy storage system for primary frequency control. IEEE Trans. Power Syst. 2007, 22, 1259–1266. [Google Scholar] [CrossRef]

- Walawalkar, R.; Apt, J.; Mancini, R. Economics of electric energy storage for energy arbitrage and regulation in New York. Energy Policy 2007, 35, 2558–2568. [Google Scholar] [CrossRef]

- Eyer, J.; Corey, G. Energy Storage for the Electricity Grid: Benefits and Market Potential Assessment Guide; Sandia Report No. SAND2010-0815; Sandia National Laboratories: Albuquerque, NM, USA, 2010. [Google Scholar]

- Alt, J.T.; Anderson, M.D.; Jungst, R.G. Assessment of utility side cost savings from battery energy storage. IEEE Trans. Power Syst. 1997, 12, 1112–1120. [Google Scholar] [CrossRef]

- Mercier, P.; Cherkaoui, R.; Oudalov, A. Optimizing a Battery Energy Storage System for Frequency Control Application in an Isolated Power System. IEEE Trans. Power Syst. 2009, 24, 1469–1477. [Google Scholar] [CrossRef]

- Suazo-Martínez, C.; Pereira-Bonvallet, E.; Palma-Behnke, R. A Simulation Framework for Optimal Energy Storage Sizing. Energies 2014, 7, 3033–3055. [Google Scholar] [CrossRef]

- Kottick, D.; Blau, M.; Edelstein, D. Battery energy storage for frequency regulation in an island power system. IEEE Trans. Energy Convers. 1993, 8, 455–459. [Google Scholar] [CrossRef]

- Divya, K.C.; Østergaard, J. Battery energy storage technology for power systems—An overview. Electr. Power Syst. Res. 2009, 79, 511–520. [Google Scholar] [CrossRef]

- Jung, K.-H.; Kim, H.; Rho, D. Determination of the installation site and optimal capacity of the battery energy storage system for load leveling. IEEE Trans. Energy Convers. 1996, 11, 162–167. [Google Scholar] [CrossRef]

- Lo, C.H.; Anderson, M.D. Economic dispatch and optimal sizing of battery energy storage systems in utility load-leveling operations. IEEE Trans. Energy Convers. 1999, 14, 824–829. [Google Scholar] [CrossRef]

- Yilmaz, M.; Krein, P.T. Review of the impact of vehicle-to-grid technologies on distribution systems and utility interfaces. IEEE Trans. Power Electron. 2013, 28, 5673–5689. [Google Scholar] [CrossRef]

- Kempton, W.; Tomić, J. Vehicle-to-grid power fundamentals: Calculating capacity and net revenue. J. Power Sources 2005, 144, 268–279. [Google Scholar] [CrossRef]

- Oudalov, A.; Chartouni, D.; Ohler, C.; Linhofer, G. Value analysis of battery energy storage applications in power systems. In Proceedings of the 2006 IEEE PES Power Systems Conference and Exposition (PSCE’06), Atlanta, GA, USA, 29 October–1 November 2006; pp. 2206–2211.

- Sandia National Laboratories. Electricity Storage Handbook in Collaboration with NRECA; Sandia National Laboratories: Albuquerque, NM, USA, 2013. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hur, W.; Moon, Y.; Shin, K.; Kim, W.; Nam, S.; Park, K. Economic Value of Li-ion Energy Storage System in Frequency Regulation Application from Utility Firm’s Perspective in Korea. Energies 2015, 8, 5000-5017. https://doi.org/10.3390/en8065000

Hur W, Moon Y, Shin K, Kim W, Nam S, Park K. Economic Value of Li-ion Energy Storage System in Frequency Regulation Application from Utility Firm’s Perspective in Korea. Energies. 2015; 8(6):5000-5017. https://doi.org/10.3390/en8065000

Chicago/Turabian StyleHur, Wonchang, Yongma Moon, Kwangsup Shin, Wooje Kim, Suchul Nam, and Kijun Park. 2015. "Economic Value of Li-ion Energy Storage System in Frequency Regulation Application from Utility Firm’s Perspective in Korea" Energies 8, no. 6: 5000-5017. https://doi.org/10.3390/en8065000