Identification of the Efficiency Gap by Coupling a Fundamental Electricity Market Model and an Agent-Based Simulation Model

Abstract

:1. Introduction

- the economic calculation of the actors, including bounded-rationality aspects,

- imperfect foresight or decision-making under uncertainties, and

- distortions due to regulatory framework conditions.

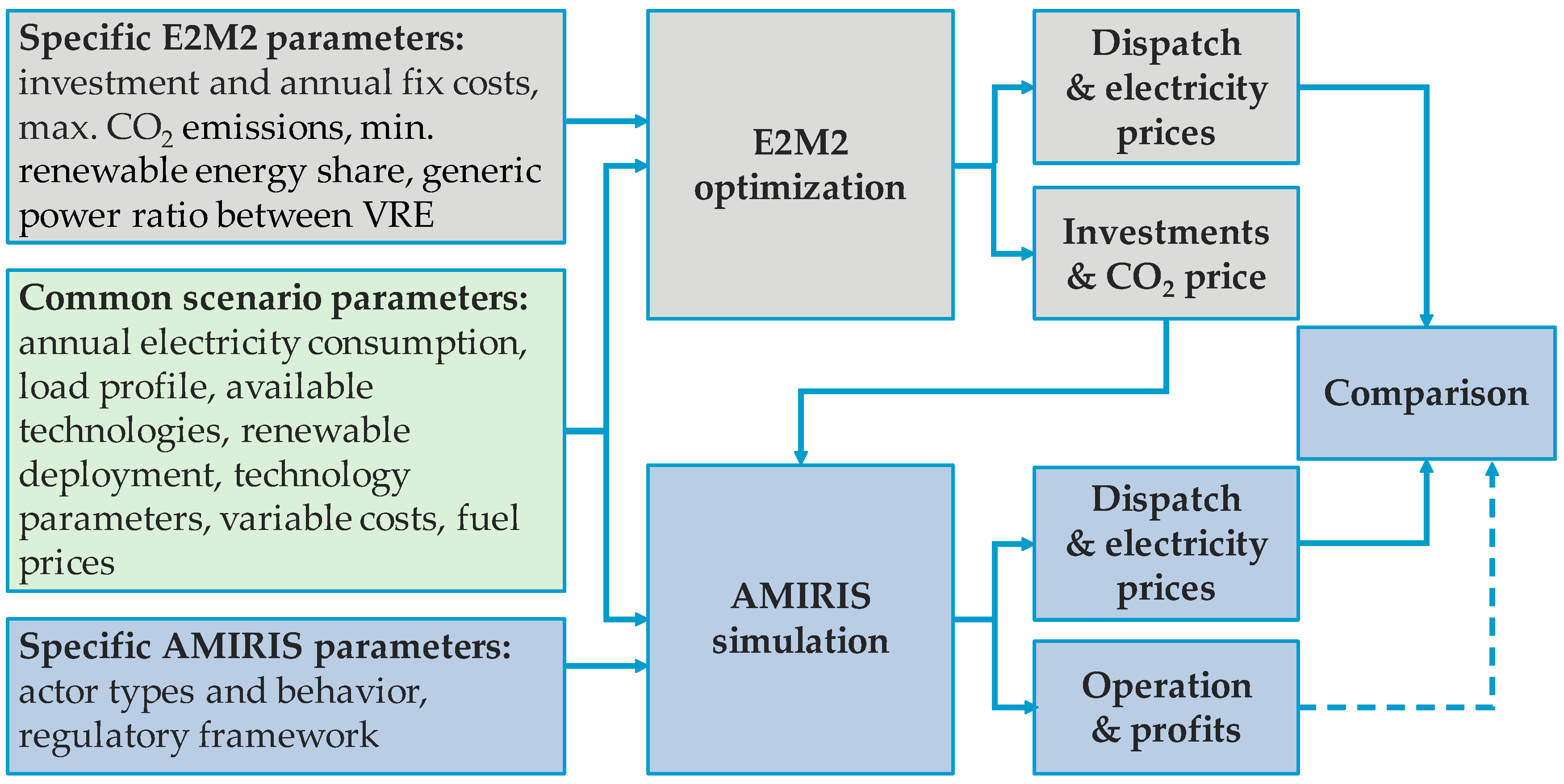

2. Methods

2.1. European Electricity Market Model (E2M2)

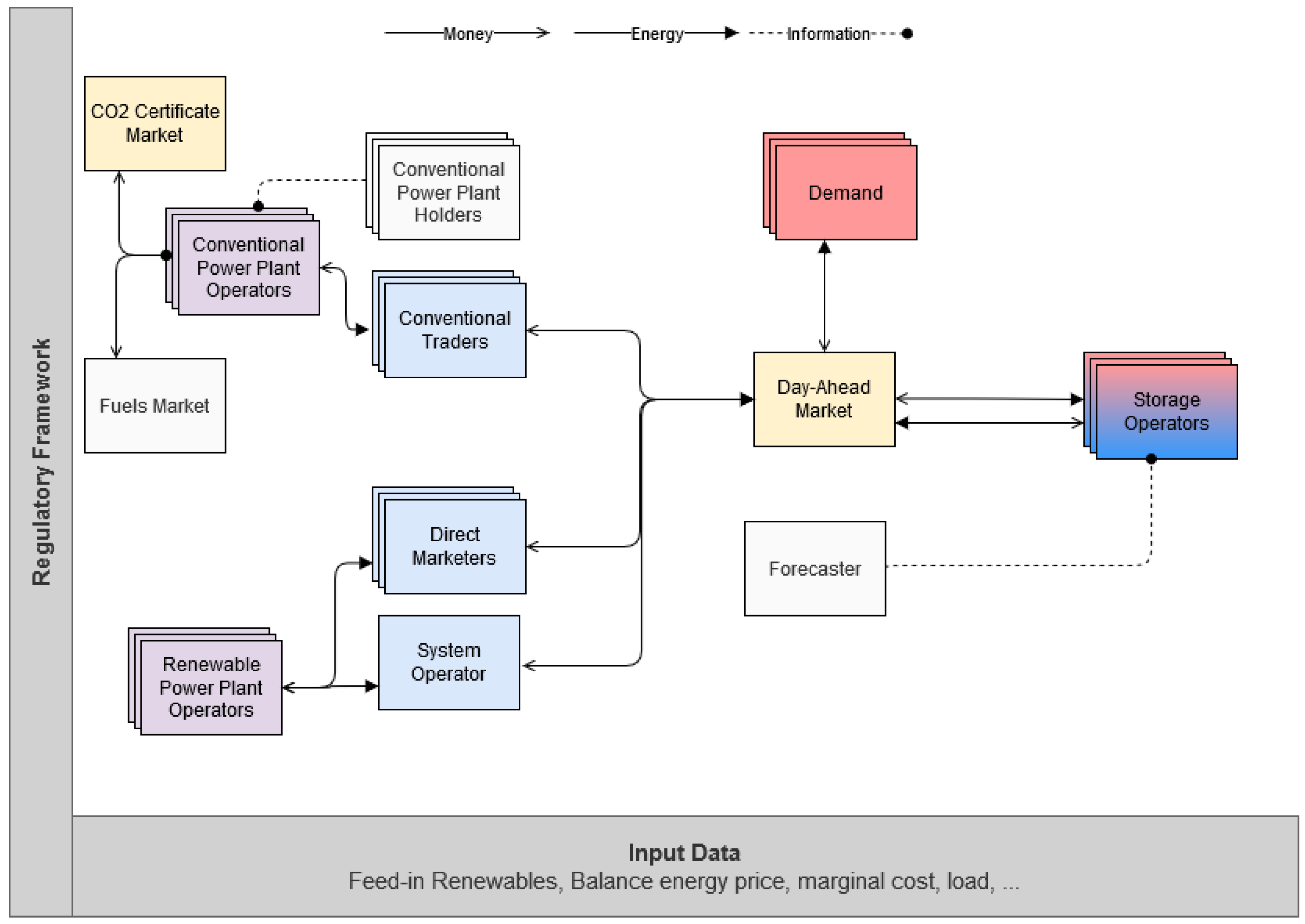

2.2. Agent-Based Model for the Integration of Renewables into Electricity Markets (AMIRIS)

2.3. Model Coupling Methodology

2.3.1. E2M2 Multistage Optimization

2.3.2. AMIRIS Strategies for Market Actors

3. Case Study

3.1. Scenario Assumptions

- the rising share of renewable energies,

- the expansion of flexibility options, and

- influences of market design and support schemes.

4. Results

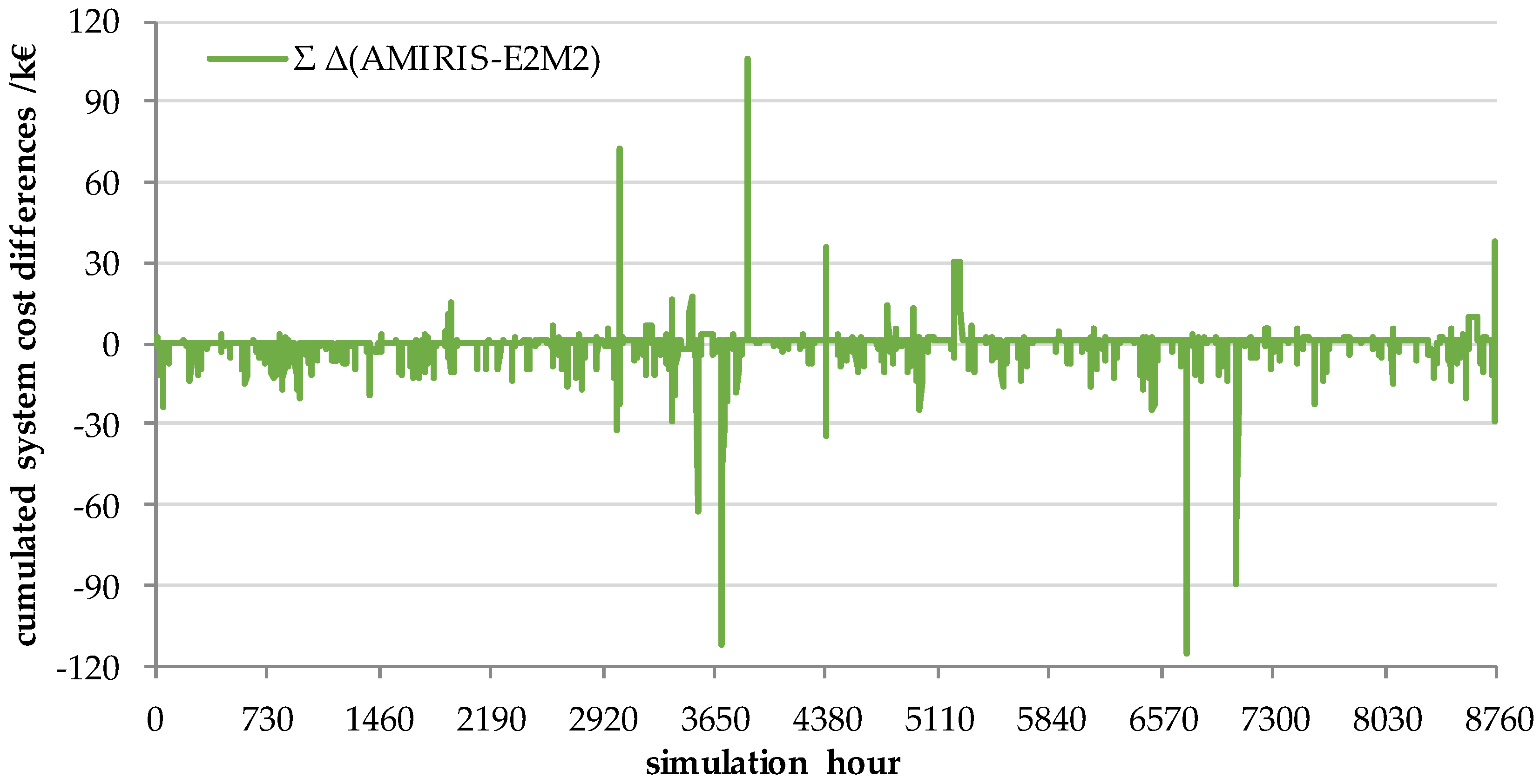

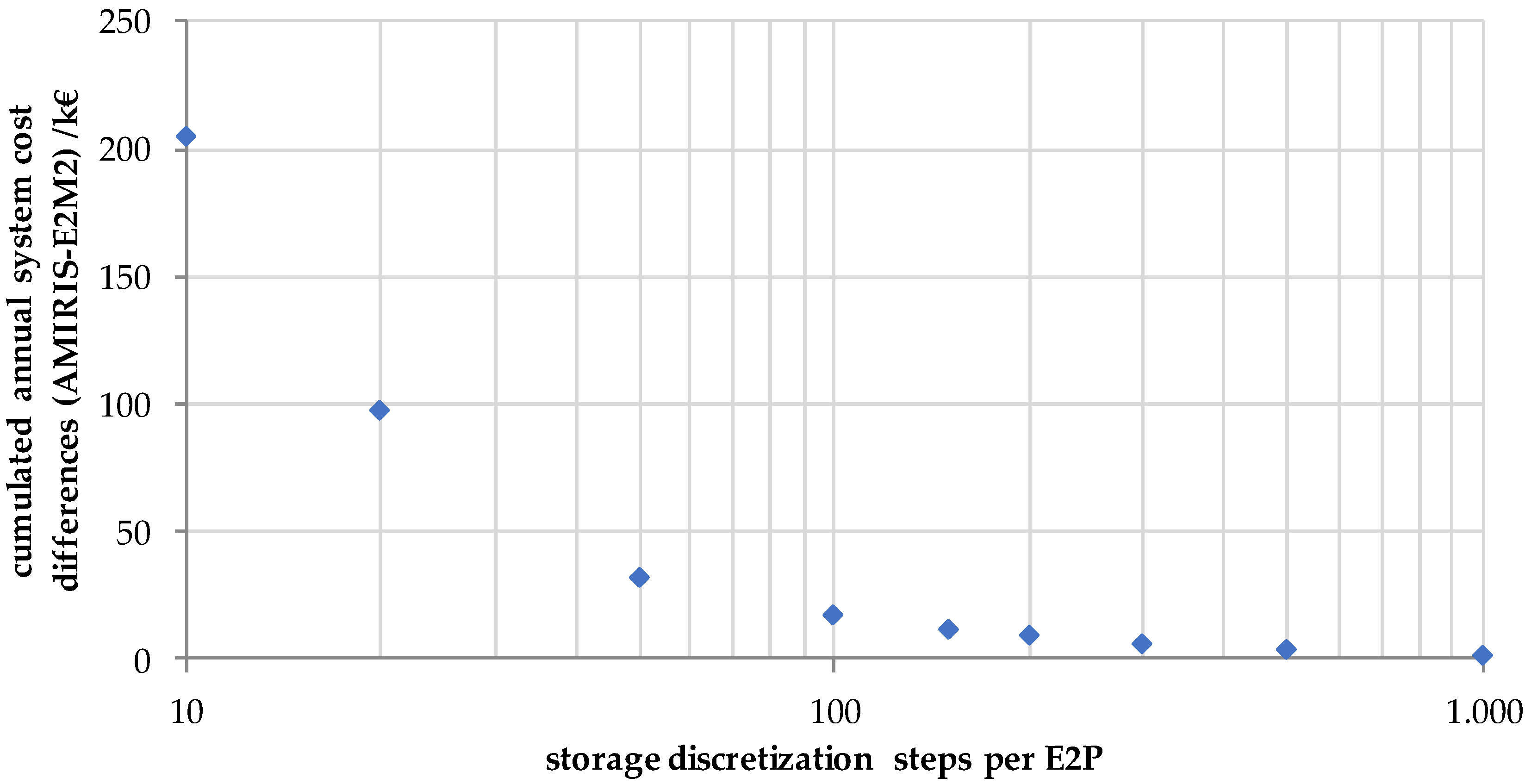

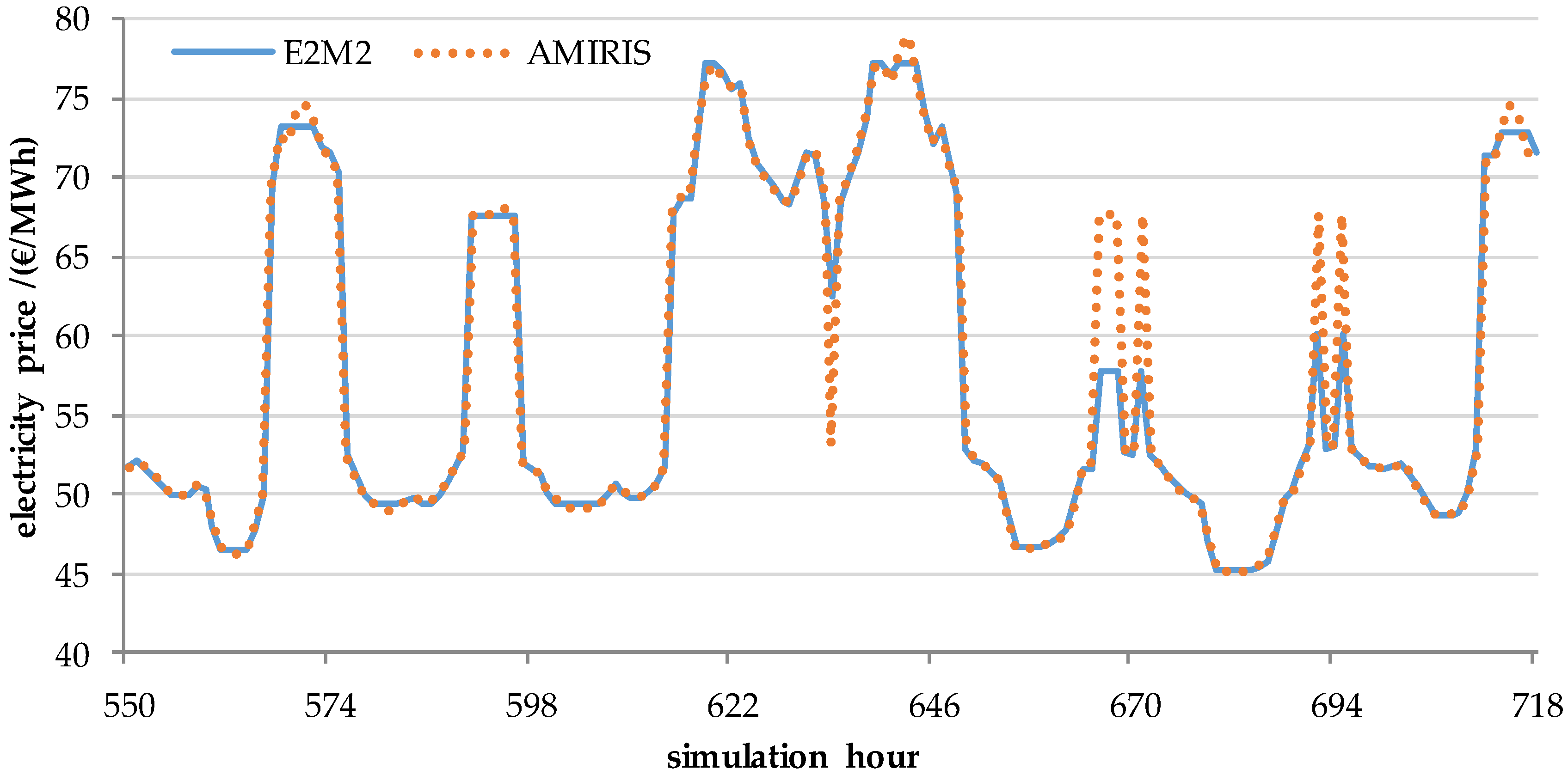

4.1. Model Harmonization

4.2. Efficiency Gap Quantification

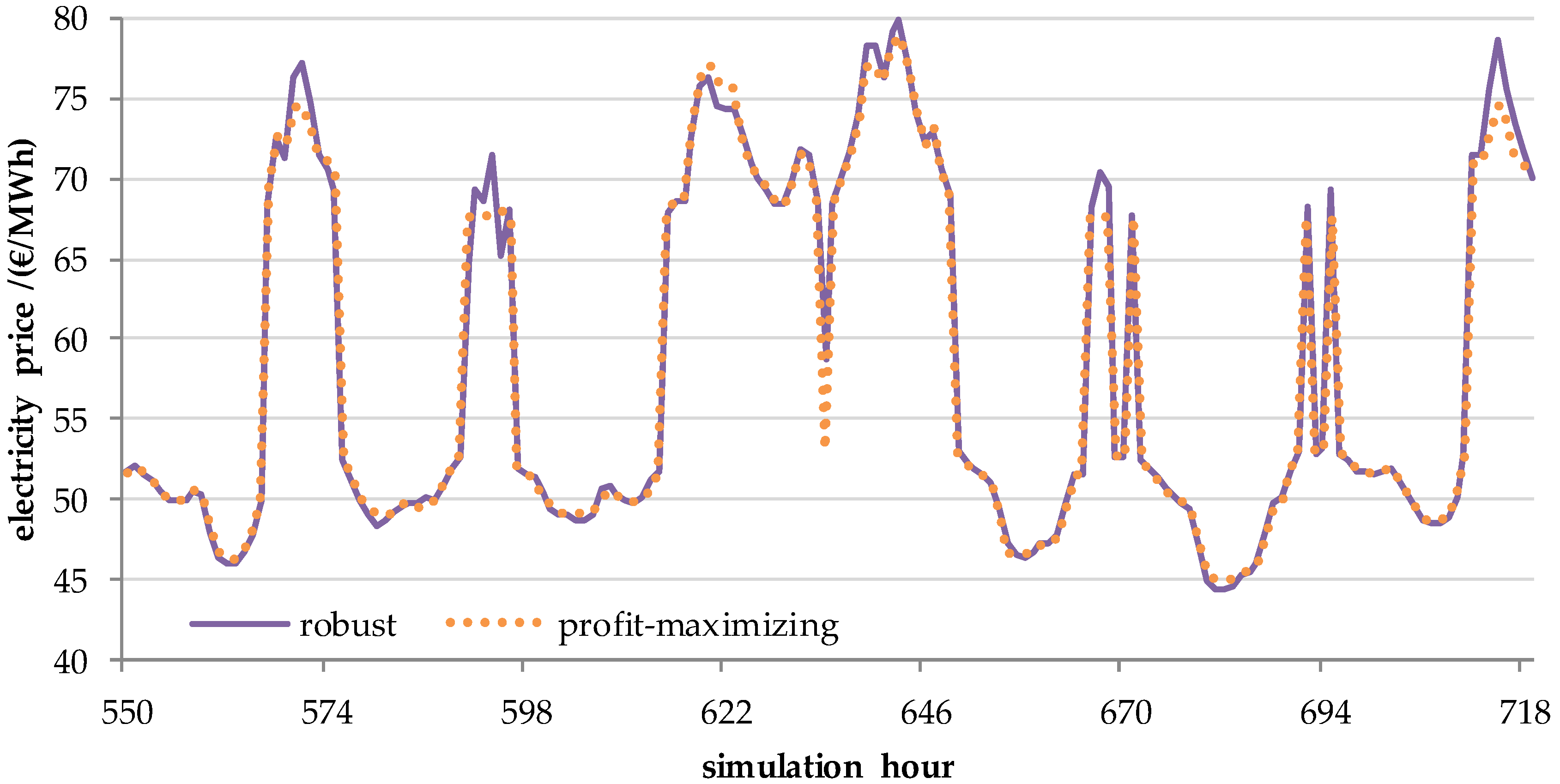

4.2.1. Effects of Market Imperfections

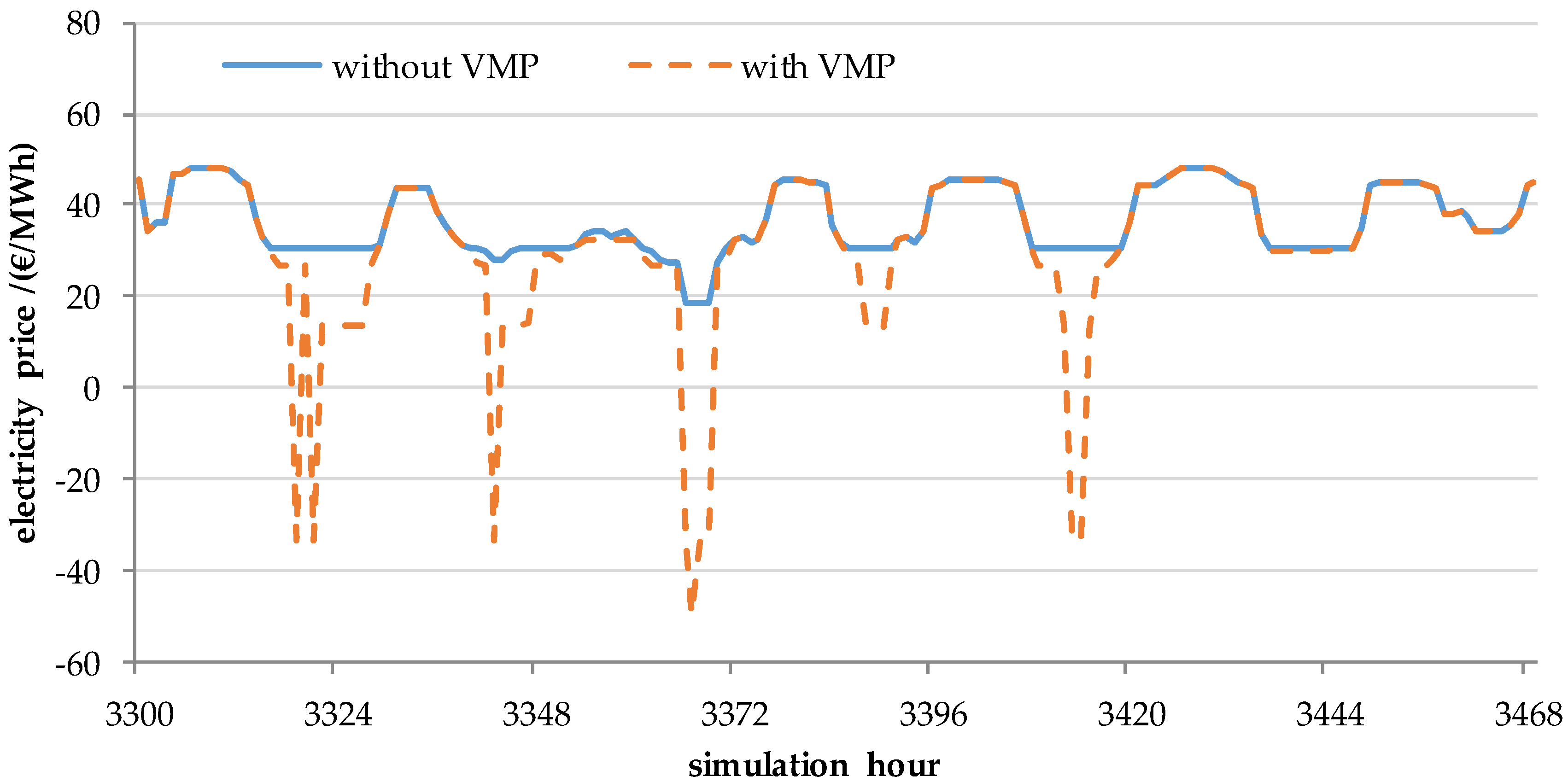

4.2.2. Impact of Higher Shares of VRE

5. Discussion and Outlook

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Nomenclature

| Abbreviations | |

| ABM | Agent-Based Model |

| AMIRIS | Agent-based Model for the Integration of Renewables Into electricity marketS |

| CCGT | Combined Cycle Gas Turbine |

| CGE | Computable General Equilibrium |

| CM | Cost Minimizing |

| E2M2 | European Electricity Market Model |

| E2P | Energy-to-Power |

| GT | Gas Turbine |

| IAM | Integrated Assessment Model |

| LP | Linear Programming |

| O&M | Operation and Maintenance |

| PM | Profit Maximizing |

| PV | Photovoltaic |

| RB | Robust Bidding |

| VMP | Variable Market Premium |

| VRE | Variable Renewable Energy |

| E2M2 | |

| Indices and sets | |

| Index and set of units | |

| Index and set of invested units | |

| Index and set of time steps | |

| Parameters and Variables | |

| Total system costs | |

| Annualized investment costs | |

| Annual fixed O&M costs | |

| Variable O&M costs | |

| Fuel costs | |

| CO2 certificate costs | |

Appendix A. Input Data

| Max. CO2/Mt | Elec. Demand/TWh | Wind Offshore/GW | Wind Onshore/GW | PV/GW | Lignite/GW | Gas CCGT/GW | Gas GT /GW | Storage | |

|---|---|---|---|---|---|---|---|---|---|

| Total Power/GW | Total Capacity/GWh | ||||||||

| 201.3 | 545 | 14.1 | 56.3 | 70.3 | 13.8 | 42 | 18.6 | 7.3 | 14.5 |

| Marginal costs/(€/MWh) | 30.4 | 18.5 | 0 | 31.10–45.65 | 43.78–53.08 | 67.63–87.47 | - | - | |

| Max. CO2/Mt | Elec. Demand/TWh | Wind Offshore/GW | Wind Onshore/GW | PV/GW | Nuclear /GW | Lignite/GW | Gas CCGT/GW | Gas GT /GW | Storage | |

|---|---|---|---|---|---|---|---|---|---|---|

| Total Power/GW | Total Capacity/GWh | |||||||||

| 201.3 | 545 | 14.1 | 56.3 | 70.3 | 8 | 13.8 | 42 | 18.6 | 7.3 | 14.5 |

| Marginal costs/(€/MWh) | 30.4 | 18.5 | 0 | 10.67– 13.94 | 26.65– 38.98 | 43.78– 53.08 | 67.63– 87.47 | - | - | |

| Max. CO2/Mt | Elec. Demand/TWh | Wind Offshore/GW | Wind Onshore/GW | PV/ GW | Lignite/ GW | Gas CCGT /GW | Gas GT /GW | Storage | |

|---|---|---|---|---|---|---|---|---|---|

| Total Power/GW | Total Capacity/GWh | ||||||||

| 128.1 | 545 | 21.5 | 86.2 | 107.7 | 9.6 | 38.6 | 11.8 | 24 | 142 |

| Marginal costs/(€/MWh) | 30.4 | 18.5 | 0 | 32.48–47.72 | 44.29–53.70 | 68.43–88.51 | - | - | |

| Max. CO2/Mt | Elec. Demand/TWh | Wind Offshore/GW | Wind Onshore/GW | PV/ GW | Lignite/ GW | Gas CCGT/GW | Gas GT /GW | Storage | |

|---|---|---|---|---|---|---|---|---|---|

| Total Power/GW | Total Capacity/GWh | ||||||||

| 54.9 | 545 | 31 | 123.9 | 154.9 | 3.6 | 32.6 | 12.2 | 62 | 494 |

| Marginal costs/(€/MWh) | 30.4 | 18.5 | 0 | 34.77–51.16 | 45.15–54.75 | 69.77–90.25 | - | - | |

References

- Savvidis, G.; Siala, K.; Weissbart, C.; Schmidt, L.; Borggrefe, F.; Kumar, S.; Pittel, K.; Madlener, R.; Hufendiek, K. The gap between energy policy challenges and model capabilities. Energy Policy 2019, 125, 503–520. [Google Scholar] [CrossRef]

- Herbst, A.; Toro, F.; Reitze, F.; Jochem, E. Introduction to Energy Systems Modelling. Swiss J. Econ. Stat. 2012, 148, 111–135. [Google Scholar] [CrossRef] [Green Version]

- Sun, N. Modellgestützte Untersuchung des Elektrizitätsmarktes: Kraftwerkseinsatzplanung und –Investitionen; Institute of Energy Economics and Rational Energy Use, University of Stuttgart: Stuttgart, Germany, 2013. [Google Scholar]

- Gillich, A.; Brodecki, L.; Hufendiek, K. Impacts of complementing goals besides emission targets on CO2 mitigation cost: A model-based analysis. Energy Strategy Rev. 2019, 26, 100395. [Google Scholar] [CrossRef]

- Fleischer, B. Systemeffekte von Bioenergie in der Elektrizitäts- und Fernwärmewirtschaft: Eine Modellgestützte Analyse Langfristiger Energiewendeszenarien in Deutschland; Institute of Energy Economics and Rational Energy Use, University of Stuttgart: Stuttgart, Germany, 2019. [Google Scholar]

- Steurer, M. Analyse von Demand Side Integration im Hinblick auf Eine Effiziente und Umweltfreundliche Energieversorgung; Institute of Energy Economics and Rational Energy Use, University of Stuttgart: Stuttgart, Germany, 2017. [Google Scholar]

- Gils, H.C. Economic potential for future demand response in Germany—Modeling approach and case study. Appl. Energy 2016, 162, 401–415. [Google Scholar] [CrossRef] [Green Version]

- Schill, W.-P.; Zerrahn, A. Long-run power storage requirements for high shares of renewables: Results and sensitivities. Renew. Sustain. Energy Rev. 2018, 83, 156–171. [Google Scholar] [CrossRef]

- Sun, N.; Ellersdorfer, I.; Swider, D.J. Model-based long-term electricity generation system planning under uncertainty. In Proceedings of the Third International Conference on Electric Utility Deregulation and Restructuring and Power Technologies, Nanjing, China, 6–9 April 2008; pp. 1298–1304. [Google Scholar]

- Meibom, P.; Barth, R.; Hasche, B.; Brand, H.; Weber, C.; O’Malley, M. Stochastic Optimization Model to Study the Operational Impacts of High Wind Penetrations in Ireland. IEEE Trans. Power Syst. 2011, 26, 1367–1379. [Google Scholar] [CrossRef]

- Scheben, H.; Klempp, N.; Hufendiek, K. Impact of Long-Term Water Inflow Uncertainty on Wholesale Electricity Prices in Markets with High Shares of Renewable Energies and Storages. Energies 2020, 13, 2347. [Google Scholar] [CrossRef]

- Trutnevyte, E. Does cost optimization approximate the real-world energy transition? Energy 2016, 106, 182–193. [Google Scholar] [CrossRef]

- Reeg, M.; Nienhaus, K.; Roloff, N.; Pfenning, U.; Deissenroth, M.; Wassermann, S.; Hauser, W.; Weimer-Jehle, W.; Klann, U.; Kast, T. AMIRIS—Weiterentwicklung Eines Agentenbasierten Simulationsmodells zur Untersuchung des Akteursverhaltens bei der Marktintegration von Strom aus Erneuerbaren Energien unter Verschiedenen Fördermechanismen; Deutsches Zentrum für Luft und Raumfahrt (DLR), Institut für ZukunftsEnergieSysteme (IZES), Thomas Kast Simulation Solutions, Zentrum für Interdisziplinäre Risiko- und Innovationsforschung der Universität Stuttgart (ZIRIUS): Stuttgart, Germany; Vilsholfen, Germany; Saarbrücken, Germany, 2013. [Google Scholar]

- Reeg, M. AMIRIS—Ein Agentenbasiertes Simulationsmodell zur Akteursspezifischen Analyse Techno-Ökonomischer und Soziotechnischer Effekte bei der Strommarktintegration und Refinanzierung Erneuerbarer Energien; Faculty of Mechanical Science and Engineering, University of Dresden: Dresden, Germany, 2019. [Google Scholar]

- Sensfuß, F.; Ragwitz, M.; Genoese, M.; Möst, D. Agent-based Simulation of Electricity Markets -A Literature Review. Energy Stud. Rev. 2007, 15. [Google Scholar] [CrossRef] [Green Version]

- Genoese, M. Energiewirtschaftliche Analysen des Deutschen Strommarkts Mit Agentenbasierter Simulation; Nomos Verlagsgesellschaft mbH &, Co. KG: Baden-Baden, Germany, 2010; ISBN 978-3-8452-2744-3. [Google Scholar]

- Bower, J.; Bunn, D. Experimental analysis of the efficiency of uniform-price versus discriminatory auctions in the England and Wales electricity market. J. Econ. Dyn. Control 2001, 25, 561–592. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Stavins, R.N. The energy-efficiency gap—What does it mean? Energy Policy 1994, 22, 804–810. [Google Scholar] [CrossRef]

- Gillingham, K.; Newell, R.G.; Palmer, K. Energy Efficiency Economics and Policy. Annu. Rev. Resour. Econ. 2009, 1, 597–620. [Google Scholar] [CrossRef]

- Stoft, S. Power System Economics: Designing Markets for Electricity; IEEE Press Wiley Interscience: Piscataway, NJ, USA, 2002; ISBN 978-0-471-15040-4. [Google Scholar]

- Wene, C.-O. Energy-economy analysis: Linking the macroeconomic and systems engineering approaches. Energy 1996, 21, 809–824. [Google Scholar] [CrossRef] [Green Version]

- Helgesen, P.I.; Lind, A.; Ivanova, O.; Tomasgard, A. Using a hybrid hard-linked model to analyze reduced climate gas emissions from transport. Energy 2018, 156, 196–212. [Google Scholar] [CrossRef]

- Deane, J.P.; Chiodi, A.; Gargiulo, M.; Gallachóir, B.P.Ó. Soft-linking of a power systems model to an energy systems model. Energy 2012, 42, 303–312. [Google Scholar] [CrossRef]

- Poncelet, K.; Delarue, E.; Six, D.; Duerinck, J.; D’haeseleer, W. Impact of the level of temporal and operational detail in energy-system planning models. Appl. Energy 2016, 162, 631–643. [Google Scholar] [CrossRef] [Green Version]

- Pina, A.; Silva, C.A.; Ferrão, P. High-resolution modeling framework for planning electricity systems with high penetration of renewables. Appl. Energy 2013, 112, 215–223. [Google Scholar] [CrossRef]

- Belderbos, A.; Delarue, E. Accounting for flexibility in power system planning with renewables. Int. J. Electr. Power Energy Syst. 2015, 71, 33–41. [Google Scholar] [CrossRef] [Green Version]

- Korkmaz, P.; Cunha Montenegro, R.; Schmid, D.; Blesl, M.; Fahl, U. On the Way to a Sustainable European Energy System: Setting Up an Integrated Assessment Toolbox with TIMES PanEU as the Key Component. Energies 2020, 13, 707. [Google Scholar] [CrossRef] [Green Version]

- Niamir, L. Behavioural Climate Change Mitigation: From Individual Energy Choices to Demand-Side Potential; University of Twente: Enschede, The Netherlands, 2019. [Google Scholar]

- Belete, G.F.; Voinov, A.; Arto, I.; Dhavala, K.; Bulavskaya, T.; Niamir, L.; Moghayer, S.; Filatova, T. Exploring Low-Carbon Futures: A Web Service Approach to Linking Diverse Climate-Energy-Economy Models. Energies 2019, 12, 2880. [Google Scholar] [CrossRef] [Green Version]

- Deissenroth, M.; Klein, M.; Nienhaus, K.; Reeg, M. Assessing the Plurality of Actors and Policy Interactions: Agent-Based Modelling of Renewable Energy Market Integration. Complexity 2017, 2017, 1–24. [Google Scholar] [CrossRef]

- Torralba Díaz, L.; Deissenroth, M.; Fleischer, B.; Guthoff, F.; Hufendiek, K.; Reeg, M.; Savvidis, G.; Schimeczek, C. ERAFlex—Effektive Rahmenbedingungen für Einen Kostenoptimalen EE-Ausbau Mit Komplementären Dezentralen Flexibilitätsoptionen im Elektrizitätssektor; Institut für Energiewirtschaft und Rationelle Energieanwendung (IER), Deutsches Zentrum für Luft und Raumfahrt (DLR): Stuttgart, Germany, 2019. [Google Scholar]

- Jevons, W.S. The Theory of Political Economy, 5th ed.; Kelley & Millman, Inc.: New York, NY, USA, 1957. [Google Scholar]

- OECD PUBLISHING. OECD Glossary of Statistical Terms; Organisation for Economic Co-operation and Development: Paris, France, 2008. [Google Scholar]

- Williams, H.P. Model Building in Mathematical Programming, 5th ed.; John Wiley & Sons Ltd.: Hoboken, NJ, USA; London School of Economics: London, UK, 2013. [Google Scholar]

- Erneuerbare-Energien-Gesetz Vom 21. Juli 2014 (BGBl. I S. 1066). Available online: https://www.bgbl.de/xaver/bgbl/start.xav?start=%2F%2F*[%40attr_id%3D%27bgbl114s1066.pdf%27]#__bgbl__%2F%2F*%5B%40attr_id%3D%27bgbl114s1066.pdf%27%5D__1596178008635 (accessed on 1 July 2019).

- Icha, P.; Kuhs, G. Entwicklung der Spezifischen Kohlendioxid-Emissionen des Deutschen Strommix in den Jahren 1990–2017; Umweltbundesamt: Dessau-Roßlau, Germany, 2018. [Google Scholar]

- Adamnek, F.; Pluntke, H.; Rotering, N.; Sauer, D.U.; Sterner, M.; Wellßow, W.; Aundrup, T.; Glaunsinger, W.; Kleinmaier, M.; Landinger, H.; et al. Energiespeicher für die Energiewende: Speicherungsbedarf und Auswirkungen auf das Übertragungsnetz für Szenarien bis 2050; VDE Verband der Elektrotechnik Elektronik Informationstechnik e.V.: Frankfurt am Main, Germany, 2012. [Google Scholar]

- Fahl, U.; Welsch, J.; Eberl, T.; Vu, T.; Steurer, M.; Bothor, S. Systemanalyse Energiespeicher: Schlussbericht; Institute of Energy Economics and Rational Energy Use, University of Stuttgart: Stuttgart, Germany, 2015. [Google Scholar]

| Scenario | Share of VRE/% | Storage Strategy in AMIRIS | Number of Storage Operators | VMP |

|---|---|---|---|---|

| 40_CM1 | 40 | Cost minimizing | 1 | no |

| 40_PM1 | 40 | Profit maximizing | 1 | no |

| 40_RB1 | 40 | Robust bidding | 1 | no |

| 40_CM1_VMP | 40 | Cost minimizing | 1 | yes |

| 40_RB10_VMP | 40 | Robust bidding | 10 | yes |

| 60_RB10_VMP | 60 | Robust bidding | 10 | yes |

| 80_RB10_VMP | 80 | Robust bidding | 10 | yes |

| Scenario | Absolute Cost Increase/(k€/a) | Relative Cost Increase/(%/a) |

|---|---|---|

| 40_PM1 | 600 | 0.003 |

| 40_RB1 | 18,995 | 0.11 |

| 40_CM1_VPM | 19,374 | 0.13 |

| Scenario | Absolute Cost Increase/(k€/a) | Relative Cost Increase/(%/a) |

|---|---|---|

| 40_RB10_VMP | 21,178 | 0.12 |

| 60_RB10_VMP | 120,180 | 0.8 |

| 80_RB10_VMP | 490,934 | 4.1 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Torralba-Díaz, L.; Schimeczek, C.; Reeg, M.; Savvidis, G.; Deissenroth-Uhrig, M.; Guthoff, F.; Fleischer, B.; Hufendiek, K. Identification of the Efficiency Gap by Coupling a Fundamental Electricity Market Model and an Agent-Based Simulation Model. Energies 2020, 13, 3920. https://doi.org/10.3390/en13153920

Torralba-Díaz L, Schimeczek C, Reeg M, Savvidis G, Deissenroth-Uhrig M, Guthoff F, Fleischer B, Hufendiek K. Identification of the Efficiency Gap by Coupling a Fundamental Electricity Market Model and an Agent-Based Simulation Model. Energies. 2020; 13(15):3920. https://doi.org/10.3390/en13153920

Chicago/Turabian StyleTorralba-Díaz, Laura, Christoph Schimeczek, Matthias Reeg, Georgios Savvidis, Marc Deissenroth-Uhrig, Felix Guthoff, Benjamin Fleischer, and Kai Hufendiek. 2020. "Identification of the Efficiency Gap by Coupling a Fundamental Electricity Market Model and an Agent-Based Simulation Model" Energies 13, no. 15: 3920. https://doi.org/10.3390/en13153920