Sources of China’s Fossil Energy-Use Change

Abstract

:1. Introduction

2. Methodology

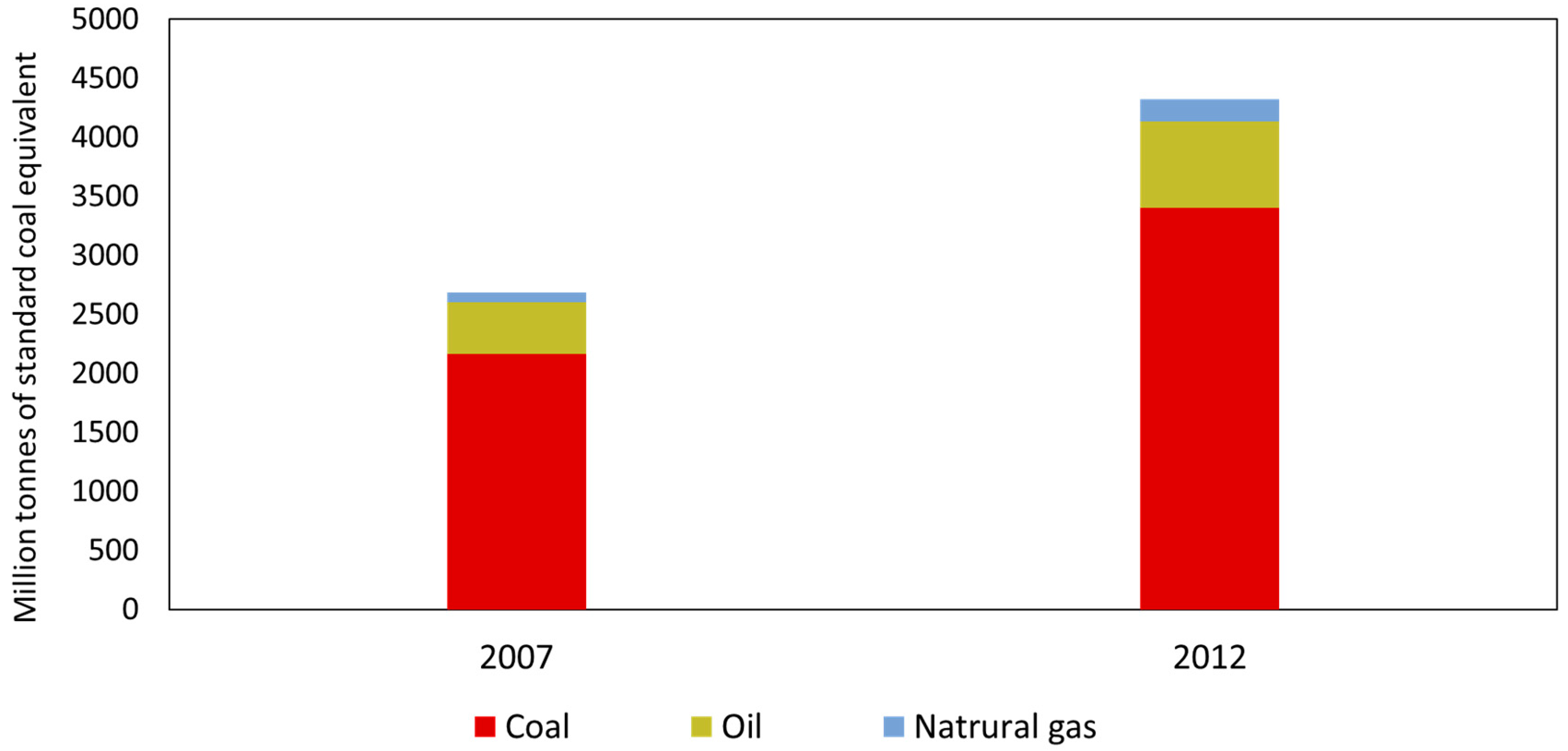

2.1. Primary Fossil Energy Consumed in China

2.2. Structural Decomposition Analysis (SDA)

3. Data Sources

4. Results and Discussion

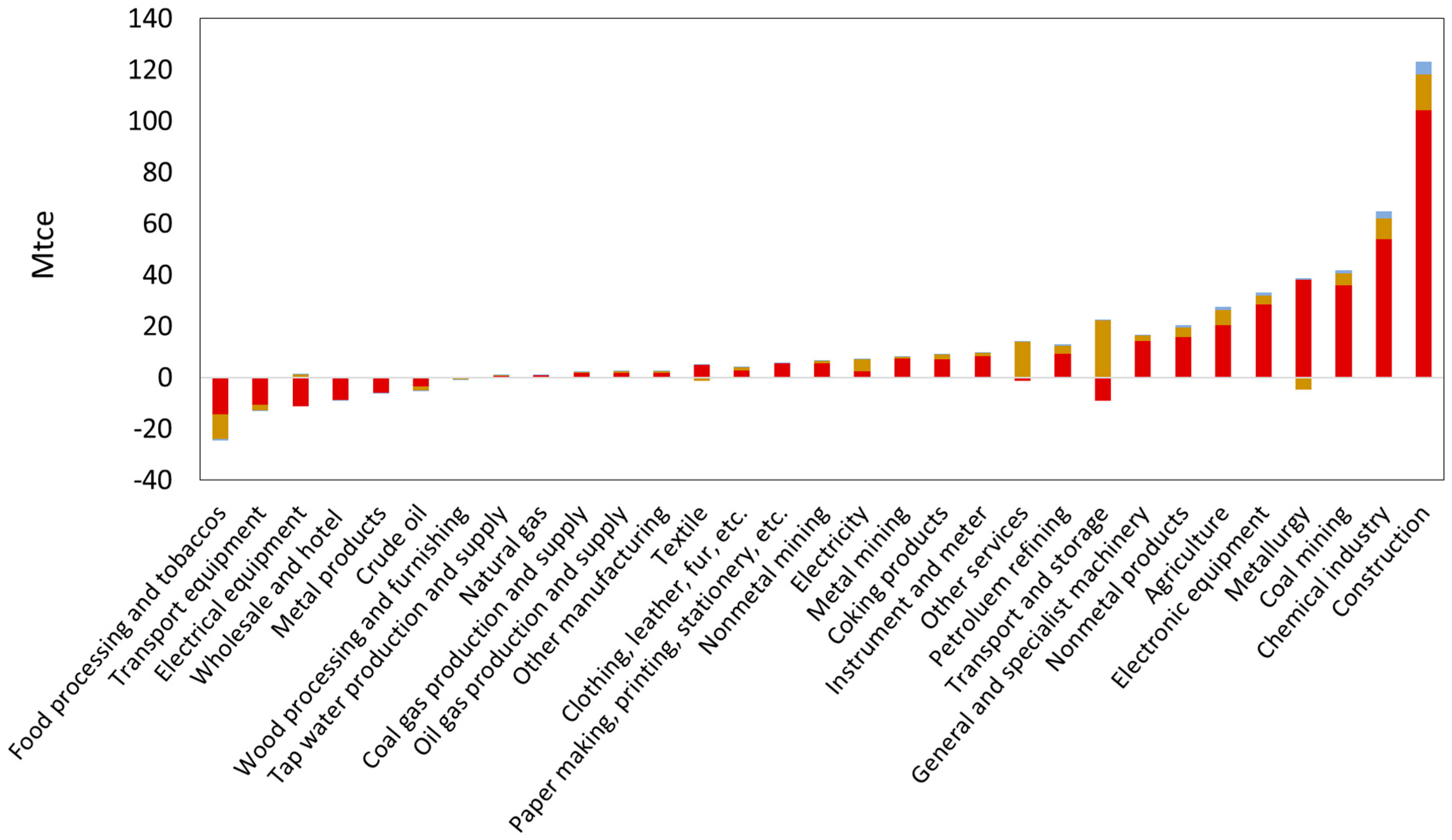

4.1. Nationwide SDA of China

4.2. Decomposition of Technology Effects by Province and Sector

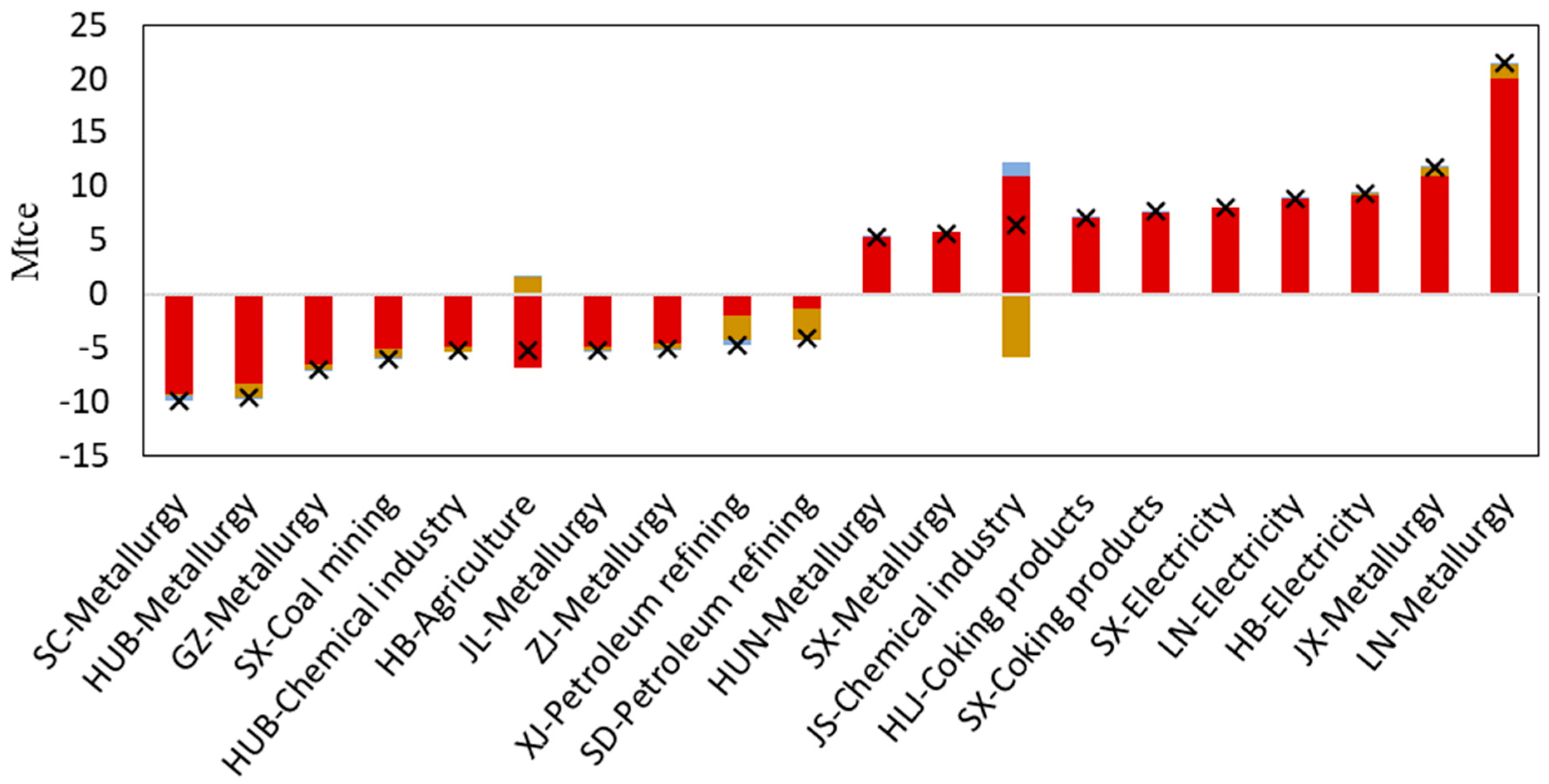

4.2.1. Energy Input Level Effect

4.2.2. Energy Composition Effect

4.2.3. Non-Energy Input Effect

4.3. Analysis Combining the Present and Previous Studies

5. Conclusions and Policy Implication

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Sher, F.; Pans, M.A.; Sun, C.; Snape, C.; Liu, H. Oxy-fuel combustion study of biomass fuels in a 20 kWth fluidized bed combustor. Fuel 2018, 215, 778–786. [Google Scholar] [CrossRef]

- Sher, F.; Pans, M.A.; Afilaka, D.T.; Sun, C.; Liu, H. Experimental investigation of woody and non-woody biomass combustion in a bubbling fluidised bed combustor focusing on gaseous emissions and temperature profiles. Energy 2017, 141, 2069–2080. [Google Scholar] [CrossRef]

- NDRC (China National Development and Reform Commission). Revolutionary Strategy for Energy Production and Consumption (2016–2030); NDRC: Beijing, China, 2016.

- IPCC (Intergovernmental Panel on Climate Change). Global Warming of 1.5 °C; IPCC: Geneva, Switzerland, 2018. [Google Scholar]

- Su, B.; Ang, B.W. Structural decomposition analysis applied to energy and emissions: Some methodological developments. Energy Econ. 2012, 34, 177–188. [Google Scholar] [CrossRef]

- Lenzen, M. Structural analyses of energy use and carbon emissions—An overview. Econ. Syst. Res. 2016, 28, 119–132. [Google Scholar] [CrossRef]

- Weber, C.L. Measuring structural change and energy use: Decomposition of the US economy from 1997 to 2002. Energy Policy 2009, 101, 115–126. [Google Scholar] [CrossRef]

- Cellura, M.; Longo, S.; Mistretta, M. Application of the Structural Decomposition Analysis to assess the indirect energy consumption and air emission changes related to Italian households consumption. Renew. Sustain. Energy Rev. 2012, 16, 1135–1145. [Google Scholar] [CrossRef]

- Kagawa, S.; Inamura, H. A structural decomposition of energy consumption based on a hybrid rectangular input-output framework: Japan’s case. Econ. Syst. Res. 2001, 13, 339–364. [Google Scholar] [CrossRef]

- Wachsmann, U.; Wood, R.; Lenzen, M.; Schaeffer, R. Structural decomposition of energy use in Brazil from 1970 to 1996. Appl. Energy 2009, 86, 578–587. [Google Scholar] [CrossRef]

- BP. Statistical Review of World Energy; BP: London, UK, 2018. [Google Scholar]

- Xie, S.C. The driving forces of China’s energy use from 1992 to 2010: An empirical study of input-output and structural decomposition analysis. Energy Policy 2014, 73, 401–415. [Google Scholar] [CrossRef]

- Mi, Z.; Li, Z.; Meng, J.; Shan, Y.; Zheng, H.; Ou, J.; Guan, D.; Wei, Y. China’s Energy Consumption in the New Normal. Earth’s Future 2018, 6, 1007–1016. [Google Scholar] [CrossRef]

- Zhang, H.; Lahr, M.L. China’s energy consumption change from 1987 to 2007: A multi-regional structural decomposition analysis. Energy Policy 2014, 67, 682–693. [Google Scholar] [CrossRef]

- Zhang, B.; Qiao, H.; Chen, Z.M.; Chen, B. Growth in embodied energy transfers via China’s domestic trade: Evidence from multi-regional input–output analysis. Appl. Energy 2016, 184, 1093–1105. [Google Scholar] [CrossRef]

- Dietzenbacher, E.; Stage, J. Mixing oil and water? Using hybrid input-output tables in a structural decomposition analysis. Econ. Syst. Res. 2006, 18, 85–95. [Google Scholar] [CrossRef]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions, 2nd ed.; Cambridge University Press: Cambridge, UK, 2009; ISBN 9780511626982. [Google Scholar]

- Weinzettel, J.; Steen-Olsen, K.; Hertwich, E.G.; Borucke, M.; Galli, A. Ecological footprint of nations: Comparison of process analysis, and standard and hybrid multiregional input-output analysis. Ecol. Econ. 2014, 101, 115–126. [Google Scholar] [CrossRef]

- NBS (China National Bureau of Statistics). Total Consumption of Energy and Its Composition. Available online: http://www.stats.gov.cn/tjsj/ndsj/2018/indexeh.htm (accessed on 23 December 2018).

- Hoekstra, R.; Van Den Bergh, J.C.J.M. Structural decomposition analysis of physical flows in the economy. Environ. Resour. Econ. 2002, 23, 357–378. [Google Scholar] [CrossRef]

- Dietzenbacher, E.; Los, B. Structural Decomposition Techniques: Sense and Sensitivity. Econ. Syst. Res. 1998, 10, 307–324. [Google Scholar] [CrossRef]

- Lin, X.; Polenske, K.R. Input-Output Anatomy of China’s Energy Use Changes in the 1980s. Econ. Syst. Res. 1995, 7, 67–84. [Google Scholar] [CrossRef]

- Mi, Z.; Meng, J.; Guan, D.; Shan, Y.; Song, M.; Wei, Y.-M.; Liu, Z.; Hubacek, K. Chinese CO2 emission flows have reversed since the global financial crisis. Nat. Commun. 2017, 8, 1712. [Google Scholar] [CrossRef]

- Liu, W.; Chen, J.; Tang, Z.; Liu, H.; Han, D.; Li, F. Theories and Practice of Constructing China’s Interregional Input-Output Tables between 30 Provinces in 2007; China Statistics Press: Beijing, China, 2012.

- CEADs (China Emission Accounts and Datasets). Provincial Energy Inventory. Available online: http://www.ceads.net/data/energy-inventory/ (accessed on 19 February 2019).

- NBS (China National Bureau of Statistics). Regional energy balance sheet. In China Energy Statistics Yearbook; China Statistics Press: Beijing, China, 2013. [Google Scholar]

- NBS (China National Bureau of Statistics). Regional energy balance sheet of. In China Energy Statistics Yearbook; China Statistics Press: Beijing, China, 2008. [Google Scholar]

- Dietzenbacher, E.; Hoen, A.R. Deflation of input-output tables from the user’s point of view: A heuristic approach. Rev. Income Wealth 1998, 44, 111–122. [Google Scholar] [CrossRef]

- NBS (China National Bureau of Statistics). Price Index. Available online: http://www.stats.gov.cn/tjsj/ndsj/2013/indexch.htm (accessed on 19 February 2019).

- NBS (China National Bureau of Statistics). Price Index. Available online: http://www.stats.gov.cn/tjsj/ndsj/2010/indexch.htm (accessed on 19 February 2019).

- CEC (China Electricity Council). China Coal Power Clean Development Report; CEC: Beijing, China, 2017. [Google Scholar]

- RITE (The Research Institute of Innovative Technology for the Earth). Estimation of Energy Consumption per unit in 2015 (Steel Department-Converter Steel); RITE: Kyoto, Japan, 2015. [Google Scholar]

- Gu, Y.; Yu, W.; Ma, X. Comparative study on current situation of coal preparation and policy at home and abroad. Coal Prep. Technol. 2012, 4, 110–116. [Google Scholar]

- Guan, X. Study on Reinforcement Design for Open-Pit Slope under the Underground Mining. Master’s Thesis, Qingdao Technological University, Qingdao, China, 2010. [Google Scholar]

- Wu, D.; Zhang, T.; Zhao, Z. Private Enterprises in Shanxi Coking Explore Energy Conversation Issues. Sci. Technol. Ind. 2010, 10, 67–71. [Google Scholar]

- Wang, M.; Deng, S.; Jiang, Y.; Xiong, C.; Song, H. 12th 5 year Energy Saving Study of Coke Industry in Shanxi Province. Shanxi Energy Conserv. 2010, 5, 57–60. [Google Scholar]

- Wang, M. Discussions on Energy Saving Measures for Continuous Catalytic Reforming Unit at Low Load. Qilu Petrochem. Technol. 2009, 37, 1–3. [Google Scholar]

- NPCPI (China National Petroleum and Chemical Planning Institute). Current Situation and Development Suggestion of Refining Industry in China; NPCPI: Beijing, China, 2013. [Google Scholar]

- Zhuang, J.; Hou, K.; Yan, C.; Li, Z. Energy Consumption and Analysis on Energy Saving Measures at SINOPEC’s Large Refineries. China Pet. Process. Petrochem. Technol. 2007, 3, 1–8. [Google Scholar]

- The People’s Government of Shanxi. The 12th Five-Year Plan of Shanxi Electric Power Industry Development; The People’s Government of Shanxi: Taiyuan, China, 2012.

- Ma, Y. Analysis on development of thermal power industry in Inner Mongolia Autonomous Region. Dev. Environ. 2017, 10, 14. [Google Scholar]

- Liu, G.; Jiang, X.; Li, Z. Investigation on Affects of Generation Load on Coal Consumption Rate in Fossil Power Plant. Power Syst. Eng. 2008, 24, 47–49. [Google Scholar]

- Shi, X.; Wang, X.; Pang, L. A survey of coal-fired power generation in Shanxi. Shanxi Electr. Power 2015, 6, 51–54. [Google Scholar]

- World Bank. Electricity Production from Oil Sources. Available online: https://data.worldbank.org.cn/indicator/EG.ELC.PETR.ZS?locations=CN (accessed on 15 November 2018).

- NEA (China National Energy Administration). Development Status of Key Technologies for Energy Conservation in China’s Power Industry. Available online: http://www.nea.gov.cn/2012-01/12/c_131355690_2.htm (accessed on 15 November 2018).

- NDRC (China National Development and Reform Commission). China’s Energy 11th 5-Year Plan; NDRC: Beijing, China, 2007.

- EIA (U.S. Energy Information Administration). Spot Prices. Available online: https://www.eia.gov/dnav/pet/pet_pri_spt_s1_d.htm (accessed on 15 November 2018).

- Ren, H. Future Development Situation Analysis of Natural Gas Power Industry. East China Electr. Power 2014, 42, 1457–1459. [Google Scholar]

- Wang, S.; Ran, W.; Chen, F. Discuss on the energy-saving measures of low-load operation of natural gas purification device. Pet. Nat. Gas Chem. Ind. 2013, 42, 447–456. [Google Scholar]

- NDRC (China National Development and Reform Commission). Natural Gas Utilization Policy; NDRC: Beijing, China, 2007.

- MPI (China Metallurgical Industry Planning and Research Institute). Review of 11th five year and prospect 12th five year development of circular economy in China’s iron and steel industry. Metall. Econ. Manag. 2012, 2, 8–12. [Google Scholar]

- Liang, J.; Zheng, W.; Cai, J. The decomposition of Energy consumption growth in China based on input-output model. J. Nat. Resour. 2007, 22, 853–864. [Google Scholar]

| Factor | Source sector | Source province |

|---|---|---|

| Energy level effect | Coking products | Shanxi and Shanghai |

| Coal mining | Shandong and Henan | |

| Petroleum refining | Xinjiang, Shandong and Guangdong | |

| Electricity | Inner Mongolia and Shanxi | |

| Non-metal products | Inner Mongolia | |

| Energy composition effect | Electricity | Hebei, Liaoning, and Shanxi |

| Chemical industry | Jiangsu | |

| Metallurgy | Liaoning, Jiangxi, Hunan, and Shanxi | |

| Coking products | Shanxi, Heilongjiang | |

| Non-energy input effect | Construction | Jiangsu, Hebei, Shanxi, and Chongqing |

| Metallurgy | Jiangsu, Shandong, and Jiangxi | |

| Coal mining | Shanxi | |

| Chemical industry | Shandong | |

| Electronic equipment | Jiangsu |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Han, Y.; Kagawa, S.; Nagashima, F.; Nansai, K. Sources of China’s Fossil Energy-Use Change. Energies 2019, 12, 699. https://doi.org/10.3390/en12040699

Han Y, Kagawa S, Nagashima F, Nansai K. Sources of China’s Fossil Energy-Use Change. Energies. 2019; 12(4):699. https://doi.org/10.3390/en12040699

Chicago/Turabian StyleHan, Yawen, Shigemi Kagawa, Fumiya Nagashima, and Keisuke Nansai. 2019. "Sources of China’s Fossil Energy-Use Change" Energies 12, no. 4: 699. https://doi.org/10.3390/en12040699