Forecasting the Energy Embodied in Construction Services Based on a Combination of Static and Dynamic Hybrid Input-Output Models

Abstract

1. Introduction

2. Literature Review

3. Methodology and Data Preparation

3.1. CSDHI/O Model

- The first step (Step 1, the orange box in the middle of Figure 1) was to establish the HI/O tables and prepare data for forecasting, which can be considered establishing an HI/O model. Several coefficient matrices needed for forecasting were estimated based on historical data.

- The second step (Step 2, the red box in Figure 1) was to predict the economic development. Specifically, we predicted the final demand of each sector, which was the basis for the EECS forecasting. The economic prediction was the input of the CSDHI/O model.

- The third step (Step 3, the blue part in Figure 1) was to forecast the output of various sectors according to the economic prediction by applying the static method in the HI/O model.

- The fourth step (Step 4, the yellow part in Figure 1) involved estimating the EECS caused by the output increase of various sectors by applying the dynamic method in the HI/O model. The output increase of various sectors forecasted by Step 3 was the input of Step 4.

- The last step (Step 5, the green part in Figure 1) involved conducting sensitivity analysis of the various influencing factors of EECS and TPEC to identify the impact of each factor on EECS and TPEC growth. The GDP growth rate, proportion of final demand of each sector, fabrication level, and the positive capital coefficient are recommended for the sensitivity analysis.

3.1.1. Establishment of HI/O Tables

3.1.2. Prediction of Economic Development

- Estimate the final demand of the primary industry, the secondary industry and the tertiary industry in the future, respectively. In input-output models, the GDP of the economy equals the sum of the final demand of various sectors. Therefore, we can calculate the total GDP according to the historical GDP data and the future GDP growth rate predicted by other institutions, and regard it as the total amount of final demand. It is assumed that the proportion of the final demand of the primary industry to the total final demand logarithmic changes with time, and the proportion of the final demand of the tertiary industry to the total final demand changes linearly with time. Through historical data, the least square method is used to fit the change formula of these two proportions. The proportion of the final demand of the secondary industry can be calculated by subtracting the sum of the proportion of the primary industry and the proportion of the tertiary industry from 100%. The final demand of each industry can be estimated as:where is the final demand of each industry in t year; ft = (, , …, )T is n sectors’ final demands in t year; stands for the proportion of the final demand of each industry in t year.

- Predict the proportion of the final demand of each sector to the final demand of its industry. The final demand of sector i can be estimated as:where is the final demand of sector i in t year; stands for the proportion of the final demand of sector i to its industry in t year.

3.1.3. Forecast the Energy Consumption by the Static Method

3.1.4. Estimate the EECS Using the Dynamic Method

3.1.5. Sensitivity Analysis

3.2. Data Preparation

4. Results and Sensitivity Analysis

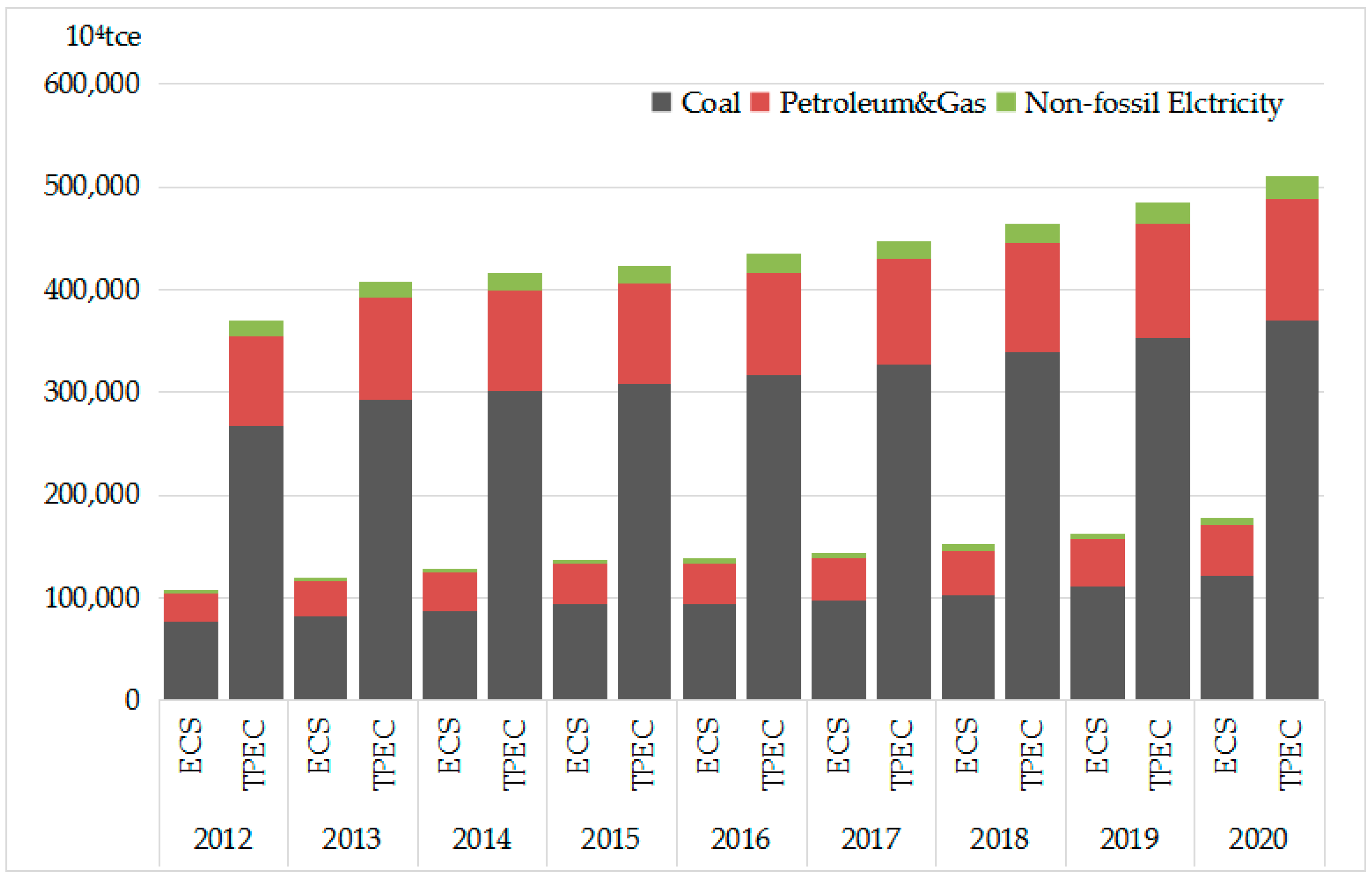

4.1. Forecast Results of Energy Consumption and EECS

4.2. Sensitivity Analysis of Each Influencing Factor

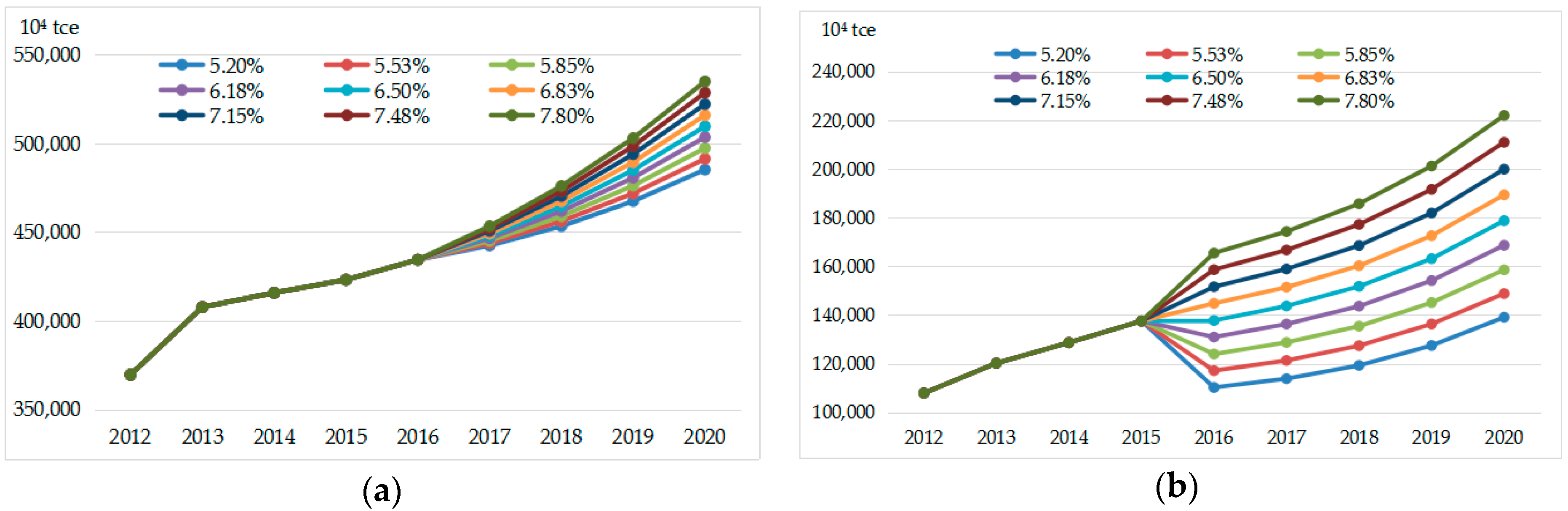

4.2.1. Sensitivity Analysis of GDP Growth Rate

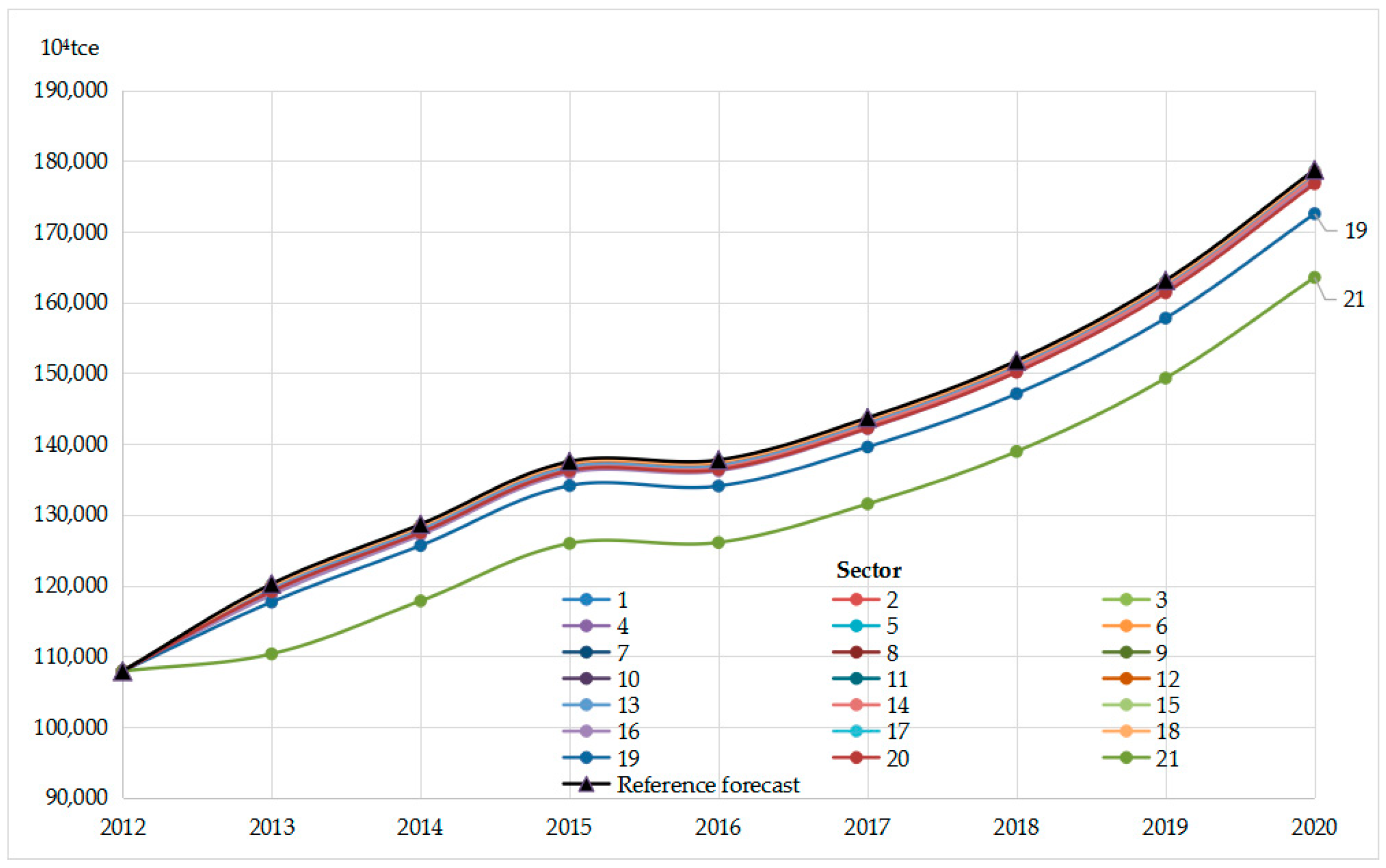

4.2.2. Sensitivity Analysis of Proportion of Final Demand

4.2.3. Sensitivity Analysis of Fabrication Level

4.2.4. Sensitivity Analysis of the Positive Capital Coefficient

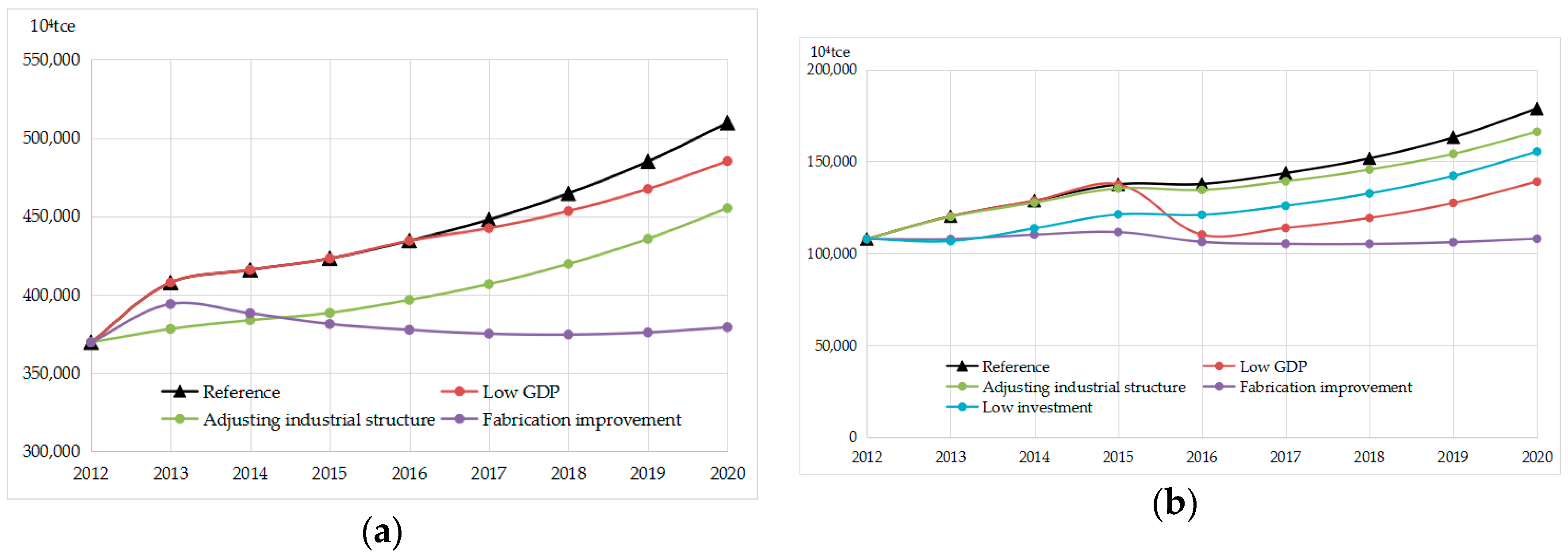

4.2.5. Comparison of Various Scenarios

- (1)

- Reference scenario: GDP growth rate, the proportion of final demand of each sector, fabrication level, and the positive capital coefficient are set as the forecast data in this paper.

- (2)

- Low GDP scenario: GDP growth rate after 2016 is assumed to be 20% lower than forecast in the reference scenario. Other parameter settings are the same as in the reference scenario.

- (3)

- Adjusting industrial structure scenario: the final demand proportion of each sector is adjusted. The final demand proportions of Sectors 02 (Petroleum and Natural Gas), 12 (Machinery), 13 (Automobiles), 16 (Other Manufacture), and 18 (Construction) are assumed to be 20% lower than the proportion of the sector in the forecast; whereas the final demand proportions of Sectors 04 (Electric Power), 20 (Wholesale), and 11 (Foods) are assumed to be 20% higher. Other parameter settings are the same as in the reference scenario.

- (4)

- Fabrication improvement scenario: the elements of the S matrix that represent the fabrication level of four sectors—Sectors 18 (Construction), 04 (Electric Power), 19 (Transport), and 16 (Other Manufacture)—are decreased by 2% lower than the reference scenario, which means the improvement of fabrication level in these sectors is 2% faster annually than predicted. Other parameter settings are the same as in the reference scenario.

- (5)

- Low investment scenario: the positive capital coefficients of Sectors 19 (Transport), 20 (Wholesale), and 21 (Other tertiary industry) are assumed to be 20% lower than in the reference scenario. Other parameter settings are the same as in the reference scenario.

4.3. Discussion

5. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| CSDHI/O | Combination of Static and Dynamic Hybrid Input-Output |

| CSFAI | Constructive Services-related Fixed Assets Investment |

| EECS | Energy Embodied in Construction Services |

| FAI | Fixed Assets Investment |

| GDP | Gross Domestic Product |

| HI/O | Hybrid Input-Output |

| NBS | National Bureau of Statistics |

| tce | Tons of Coal Equivalent |

| TPEC | Total Primary Energy Consumption |

Appendix A

Appendix B

Appendix C

| Sector | Sector in This Paper | Sector of I/O Table, 2007 | Sector of I/O Table, 2010 | Sector of I/O Table, 2012 |

|---|---|---|---|---|

| Mining and Washing of Coal | 01 | 006 | 02 | 06006 |

| Extraction of Petroleum and Natural Gas | 02 | 007 | 03 | 07007 |

| Processing of Petroleum, Coking, and Processing of Nuclear Fuel | 03 | 037 038 | 11 | 25039 25040 |

| Production and Supply of Electric Power, Heat Power, and Gas | 04 | 092 093 | 23 24 | 44096 45097 |

| Agriculture, Forestry, Animal Husbandry, and Fishing | 05 | 001 002 003 004 | 01 | 01001 02002 03003 04004 |

| Smelting and Pressing of Ferrous Metals | 06 | 057 058 059 060 | 14 | 31059 31060 31061 |

| Smelting and Pressing of Non-Ferrous Metals | 07 | 061 062 | 32062 32063 | |

| Manufacture of Non-Metallic Mineral Products | 08 | 050 051 052 053 054 055 056 | 13 | 30052 30053 30054 30055 30056 30057 30058 |

| Manufacture of Raw Chemical Materials and Chemical Products | 09 | 039 040 041 042 043 044 045 046 047 048 049 | 12 | 26041 26042 26043 26044 26045 26046 26047 27048 28049 29050 29051 |

| Non-Energy Mining | 10 | 008 009 010 | 04 05 | 08008 09009 10010 |

| Manufacture of Foods, Drinks, and Tobacco | 11 | 011 012 013 014 015 016 017 018 019 020 021 022 023 024 | 06 | 13012 13013 13014 13015 13016 13017 13018 14019 14020 14021 14022 15023 15024 16025 |

| Manufacture of Machinery | 12 | 064 065 066 067 068 069 070 071 072 | 16 | 34065 34066 34067 34068 34069 34070 35071 35072 35073 35074 |

| Manufacture of Automobiles, Railway, Ship, Aerospace and Other Equipment | 13 | 073 074 075 076 | 17 | 36075 36076 37077 37078 37079 |

| Manufacture of Textile, Wearing Apparel, Accessories, Leather, Fur, Feather, and Related Products and Footwear | 14 | 025 026 027 028 029 030 031 | 07 08 | 17026 17027 17028 17029 17030 18031 19032 19033 |

| Manufacture of Paper; Paper Products; Articles for Culture, Education, and Arts and Crafts; and Printing and Reproduction of Recording Media | 15 | 034 035 036 | 10 | 22036 23037 24038 |

| Other Manufacture | 16 | 063 077 078 079 080 081 082 083 084 085 086 087 088 089 090 | 15 18 19 20 21/22 | 33064 38080 38081 38082 38083 38084 38085 39086 39087 39088 39089 39090 39091 40092 41093 |

| Other Industries | 17 | 032 033 091 094 | 09 25 | 20034 21035 42094 46098 |

| Construction | 18 | 095 | 26 | 47099 48100 49101 50102 |

| Transport, Storage, and Post | 19 | 096 097 098 099 100 101 102 103 104 | 27 28 | 53104 54105 55106 56107 57108 58109 59110 60111 |

| Wholesale, Retail Trade, and Hotel, Restaurants | 20 | 108 109 110 | 30 31 | 51103 61112 62113 |

| Other Tertiary Industry | 21 | 005 | 29 32 33 34 35 36 37 38 39 40 41 42 | 05005 |

| 105 | 11011 | |||

| 106 | 43095 | |||

| 107 | 63114 | |||

| 111 | 65115 | |||

| 112 | 66116 | |||

| 113 | 67117 | |||

| 114 | 68118 | |||

| 115 | 70119 | |||

| 116 | 71120 | |||

| 117 | 72121 | |||

| 118 | 73122 | |||

| 119 | 74123 | |||

| 120 | 75124 | |||

| 121 | 76125 | |||

| 122 | 77126 | |||

| 123 | 78127 | |||

| 124 | 79128 | |||

| 125 | 80129 | |||

| 126 | 82130 | |||

| 127 | 83131 | |||

| 128 | 84132 | |||

| 129 | 85133 | |||

| 130 | 86134 | |||

| 131 | 87135 | |||

| 132 | 88136 | |||

| 133 | 89137 | |||

| 134 | 93138 | |||

| 135 | 90139 |

References

- Ma, L.; Liu, P.; Fu, F.; Li, Z.; Ni, W. Integrated energy strategy for the sustainable development of China. Energy 2010, 36, 1143–1154. [Google Scholar] [CrossRef]

- Fu, F.; Ma, L.; Li, Z.; Polenske, K.R. The implications of China’s investment–driven economy on its energy consumption and carbon emissions. Energy Convers. Manag. 2014, 85, 573–580. [Google Scholar] [CrossRef]

- Li, J.S.; Xia, X.H.; Chen, G.Q.; Alsaedi, A.; Hayat, T. Optimal embodied energy abatement strategy for Beijing economy: Based on a three–scale input–output analysis. Renew. Sustain. Energy Rev. 2016, 53, 1602–1610. [Google Scholar] [CrossRef]

- Wang, Y.; Liang, S. Carbon dioxide mitigation target of China in 2020 and key economic sectors. Energy Policy 2013, 58, 90–96. [Google Scholar] [CrossRef]

- Pan, L.; Liu, P.; Li, Z.; Wang, Y. A dynamic input–output method for energy system modeling and analysis. Chem. Eng. Res. Des. 2018, 131, 183–192. [Google Scholar] [CrossRef]

- Song, J.; Yang, W.; Higano, Y.; Wang, X.E. Dynamic integrated assessment of bioenergy technologies for energy production utilizing agricultural residues: An input–output approach. Appl. Energy 2015, 158, 178–189. [Google Scholar] [CrossRef]

- Yu, S.; Zheng, S.; Ba, G.; Wei, Y.M. Can China realise its energy-savings goal by adjusting its industrial structure? Econ. Syst. Res. 2016, 28, 273–293. [Google Scholar] [CrossRef]

- Zheng, H.; Fang, Q.; Wang, C.; Wang, H.; Ren, R. China’s Carbon Footprint Based on Input-Output Table Series: 1992–2020. Sustainability 2017, 9, 387. [Google Scholar] [CrossRef]

- Su, B.; Ang, B.W. Structural Decomposition Analysis Applied to Energy and Emissions: Aggregation Issues. Econ. Syst. Res. 2012, 24, 299–317. [Google Scholar] [CrossRef]

- BP. BP Energy Outlook 2017 Edition. Available online: https://www.bp.com/zh_cn/china/reports-and-publications/_bp_2017_.html (accessed on 15 November 2017).

- BP. BP Energy Outlook 2018 Edition. Available online: https://www.bp.com/content/dam/bp/en/corporate/pdf/energy-economics/energy-outlook/bp-energy-outlook-2018.pdf (accessed on 15 November 2017).

- International Energy Agency. World Energy Outlook 2017; International Energy Agency: Paris, France, 2017. [Google Scholar]

- Xie, K.C.; Du, X.W.; Zhang, Y.Z.; He, J.S.; Huang, Q.L.; Yuan, Q.S.; Ni, W.D.; Jin, Y.; Cen, K.F.; Ren, X.K.; et al. Research on the Revolutionary Strategy of Promoting Energy Production and Consumption; Integrated Volume; Science Press: Beijing, China, 2017. [Google Scholar]

- Dai, Y.D.; Tian, Z.Y.; Zhu, Y.Z.; Bai, Q.; Yang, H.W. Rebuilding Energy: China: A Road Map for Energy Consumption and Production Revolution in 2050; Integrated Volume; Science Press: Beijing, China, 2017. [Google Scholar]

- Yu, S.; Zhu, K. A hybrid procedure for energy demand forecasting in China. Energy 2012, 37, 396–404. [Google Scholar] [CrossRef]

- Yu, S.; Wei, Y.; Wang, K. A PSO–GA optimal model to estimate primary energy demand of China. Energy Policy 2012, 42, 329–340. [Google Scholar] [CrossRef]

- Sözen, A.; Gülseven, Z.; Arcaklioğlu, E. Forecasting based on sectoral energy consumption of GHGs in Turkey and mitigation policies. Energy Policy 2007, 35, 6491–6505. [Google Scholar] [CrossRef]

- Ardakani, F.J.; Ardehali, M.M. Long-term electrical energy consumption forecasting for developing and developed economies based on different optimized models and historical data types. Energy 2014, 65, 452–461. [Google Scholar] [CrossRef]

- Pao, H.T. Forecasting energy consumption in Taiwan using hybrid nonlinear models. Energy 2009, 34, 1438–1446. [Google Scholar] [CrossRef]

- Srinivasan, D. Energy demand prediction using GMDH networks. Neurocomputing 2008, 72, 625–629. [Google Scholar] [CrossRef]

- Yu, S.; Wei, Y.; Wang, K. China’s primary energy demands in 2020: Predictions from an MPSO–RBF estimation model. Energy Convers. Manag. 2012, 61, 59–66. [Google Scholar] [CrossRef]

- Xie, N.; Yuan, C.; Yang, Y. Forecasting China’s energy demand and self-sufficiency rate by grey forecasting model and Markov model. Int. J. Electr. Power Energy Syst. 2015, 66, 1–8. [Google Scholar] [CrossRef]

- Lee, Y.; Tong, L. Forecasting energy consumption using a grey model improved by incorporating genetic programming. Energy Convers. Manag. 2011, 52, 147–152. [Google Scholar] [CrossRef]

- Pao, H.; Fu, H.; Tseng, C. Forecasting of CO2 emissions, energy consumption and economic growth in China using an improved grey model. Energy 2012, 40, 400–409. [Google Scholar] [CrossRef]

- Kumar, U.; Jain, V.K. Time series models (Grey-Markov, Grey Model with rolling mechanism and singular spectrum analysis) to forecast energy consumption in India. Energy 2010, 35, 1709–1716. [Google Scholar] [CrossRef]

- Rout, U.K.; Voβ, A.; Singh, A.; Fahl, U.; Blesl, M.; Gallachóir, B.P. Energy and emissions forecast of China over a long-time horizon. Energy 2011, 36, 1–11. [Google Scholar] [CrossRef]

- Crompton, P.; Wu, Y. Energy consumption in China: Past trends and future directions. Energy Econ. 2005, 27, 195–208. [Google Scholar] [CrossRef]

- Yuan, C.; Liu, S.; Fang, Z. Comparison of China’s primary energy consumption forecasting by using ARIMA (the autoregressive integrated moving average) model and GM(1,1) model. Energy 2016, 100, 384–390. [Google Scholar] [CrossRef]

- Saab, S.; Badr, E.; Nasr, G. Univariate modeling and forecasting of energy consumption: The case of electricity in Lebanon. Energy 2014, 26, 1–14. [Google Scholar] [CrossRef]

- Chavez, S.G.; Bernat, J.X.; Coalla, H.L. Forecasting of energy production and consumption in Asturias (northern Spain). Energy 1999, 24, 183–198. [Google Scholar] [CrossRef]

- Li, L.; Qi, P. The impact of China’s investment increase in fixed assets on ecological environment: An empirical analysis. Energy Procedia 2011, 5, 501–507. [Google Scholar] [CrossRef]

- Acquaye, A.A.; Duffy, A.P. Input–output analysis of Irish construction sector greenhouse gas emissions. Build. Environ. 2010, 45, 784–791. [Google Scholar] [CrossRef]

- Skelton, A.; Guan, D.; Peters, G.P.; Crawford-Brown, D. Mapping flows of embodied emissions in the global production system. Environ. Sci. Technol. 2011, 45, 10516–10523. [Google Scholar] [CrossRef]

- Lenzen, M.; Dey, C.; Foran, B. Energy requirements of Sydney households. Ecol. Econ. 2004, 49, 375–399. [Google Scholar] [CrossRef]

- Lenzen, M. Primary energy and greenhouse gases embodied in Australian final consumption: An input–output analysis. Energy Policy 1998, 26, 495–506. [Google Scholar] [CrossRef]

- Cohen, C.; Lenzen, M.; Schaeffer, R. Energy requirements of households in Brazil. Energy Policy 2005, 33, 555–562. [Google Scholar] [CrossRef]

- Liu, Z.; Geng, Y.; Lindner, S.; Zhao, H.; Fujita, T.; Guan, D. Embodied energy use in China’s industrial sectors. Energy Policy 2012, 49, 751–758. [Google Scholar] [CrossRef]

- Liu, H.; Xi, Y.; Guo, J.E.; Li, X. Energy embodied in the international trade of China: An energy input–output analysis. Energy Policy 2010, 38, 3957–3964. [Google Scholar] [CrossRef]

- Su, B.; Huang, H.C.; Ang, B.W.; Zhou, P. Input–output analysis of CO2 emissions embodied in trade: The effects of sector aggregation. Energy Econ. 2010, 32, 166–175. [Google Scholar] [CrossRef]

- Zhang, Y.; Nie, R. The Energy Input-Output Model of Nine Pieces and the Demand Prediction of Jiangsu Province. Sci. Technol. Rev. 2007, 25, 25–29. [Google Scholar]

- Hamilton, T.G.A.; Kelly, S. Low carbon energy scenarios for sub-Saharan Africa: An input-output analysis on the effects of universal energy access and economic growth. Energy Policy 2017, 105, 303–319. [Google Scholar] [CrossRef]

- Dejuán, Ó.; Córcoles, C.; Gómez, N.; Tobarra, M.Á. Forecasting energy demand through a dynamic input-output model. Econ. Bus. Lett. 2015, 4, 108–115. [Google Scholar] [CrossRef]

- Leontief, W. The Dynamic Inverse. In Contributions to Input-Output Analysis; Carter, A.P., Brody, A., Eds.; North Holland: Amsterdam, The Netherlands, 1970. [Google Scholar]

- Rhoten, R.P. Dynamic input-output analysis of the economics of energy. In Proceedings of the Energy ’78. IEEE 1978 Region V Annual Conference, Tulsa, OK, USA, 16–18 April 1978. [Google Scholar]

- Penner, P.S. A dynamic input-output analysis of net energy effects in single-fuel economies. Energy Syst. Policy 1981, 5, 89–116. [Google Scholar]

- Dobos, I.; Tallos, P. A dynamic input-output model with renewable resources. Cent. Eur. J. Oper. Res. 2013, 21, 295–305. [Google Scholar] [CrossRef]

- Cruz, J.B., Jr.; Tan, R.R.; Culaba, A.B.; Ballacillo, J.A. A dynamic input-output model for nascent bioenergy supply chains. Appl. Energy 2009, 861, S86–S94. [Google Scholar] [CrossRef]

- Holz, C.A. New capital estimates for China. China Econ. Rev. 2006, 17, 142–185. [Google Scholar] [CrossRef]

- Leontief, W. Environmental repercussions and the economic structure: An input–output approach. Rev. Econ. Stat. 1970, 52, 262–271. [Google Scholar] [CrossRef]

- Guo, C.; Tang, H. Stability analysis of the dynamic input-output system. Appl. Math. A J. Chin. Univ. 2002, 17, 473–478. [Google Scholar] [CrossRef]

- Zhou, P.; Fan, L.W.; Tang, H.W. On stability analysis of multiple objective dynamic input–output model. Appl. Math. Comput. 2006, 177, 79–84. [Google Scholar] [CrossRef]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions; Cambridge University Press: New York, NY, USA, 2009. [Google Scholar]

- Toh, M.H. The RAS Approach in Updating Input–Output Matrices: An Instrumental Variable Interpretation and Analysis of Structural Change. Econ. Syst. Res. 1998, 10, 63–78. [Google Scholar] [CrossRef]

- National Bureau of Statistics. The Input-Output Table of CHINA 2007. Available online: http://data.stats.gov.cn/ifnormal.htm?u=/files/html/quickSearch/trcc/trcc01.html&h=740 (accessed on 29 December 2018).

- National Bureau of Statistics. The Input-Output Table of CHINA 2010. Available online: http://data.stats.gov.cn/ifnormal.htm?u=/files/html/quickSearch/trcc/trcc01.html&h=740 (accessed on 29 December 2018).

- National Bureau of Statistics. The Input-Output Table of CHINA 2012. Available online: http://data.stats.gov.cn/ifnormal.htm?u=/files/html/quickSearch/trcc/trcc01.html&h=740 (accessed on 29 December 2018).

- National Bureau of Statistics. China Energy Statistical Yearbook 2013; China Statistics Press: Beijing, China, 2014.

- National Bureau of Statistics. China Statistical Yearbook 2016; China Statistics Press: Beijing, China, 2017.

- The World Bank. China Economic Update—May 2018. Available online: http://www.worldbank.org/en/country/china/publication/china-economic-update-may-2018 (accessed on 28 December 2018).

| Intermediate Sector | Final Demand | Output | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | … | n | Final Consumption | Net Export | Fixed Assets Investment | Other Final Demand | |||

| Intermediate Sectors | 1 | … | ||||||||

| 2 | … | |||||||||

| ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | |

| m | … | |||||||||

| m + 1 | … | |||||||||

| ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | |

| n | … | |||||||||

| Code | Sector (Abbreviation) | Sector (Full Name) |

|---|---|---|

| 01 | Coal | Mining and Washing of Coal |

| 02 | Petroleum and Natural Gas | Extraction of Petroleum and Natural Gas |

| 03 | Petroleum Processing | Processing of Petroleum, Coking, and Processing of Nuclear Fuel |

| 04 | Electric Power | Production and Supply of Electric Power, Heat Power, and Gas |

| 05 | Agriculture | Agriculture, forestry, animal husbandry, and fishing |

| 06 | Ferrous Metals | Smelting and Pressing of Ferrous Metals |

| 07 | Non-ferrous Metals | Smelting and Pressing of Non-ferrous Metals |

| 08 | Non-metallic | Manufacture of Non-metallic Mineral Products |

| 09 | Chemical | Manufacture of Raw Chemical Materials and Chemical Products |

| 10 | Mining of Non-energy | Mining of Non-energy |

| 11 | Foods | Manufacture of Foods, Drinks, and Tobacco |

| 12 | Machinery | Manufacture of Machinery |

| 13 | Automobiles | Manufacture of Automobiles, Railway, Ship, Aerospace, and Other Equipment |

| 14 | Textile | Manufacture of Textile, Wearing Apparel, Accessories, Leather, Fur, Feather and Related Products, and Footwear |

| 15 | Paper | Manufacture of Paper; Paper Products; Articles for Culture, Education, Arts, and Crafts; and Printing and Reproduction of Recording Media |

| 16 | Other Manufacture | Other Manufacture |

| 17 | Other Industries | Other Industries |

| 18 | Construction | Construction |

| 19 | Transport | Transport, Storage, and Post |

| 20 | Wholesale | Wholesale, Retail Trade, and Hotel, Restaurants |

| 21 | Other tertiary industry | Other tertiary industry |

| Sector No. | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|

| 01 | 1.4% | 1.4% | 1.3% | 1.6% | 1.5% | 1.4% |

| 02 | 1.5% | 1.6% | 1.4% | 1.1% | 1.0% | 1.0% |

| 03 | 1.5% | 1.5% | 1.5% | 1.4% | 1.5% | 1.6% |

| 04 | 6.9% | 6.4% | 6.4% | 5.6% | 4.7% | 4.4% |

| 05 | 2.5% | 2.9% | 3.1% | 2.8% | 2.8% | 2.9% |

| 06 | 2.9% | 2.9% | 2.8% | 2.6% | 2.6% | 2.8% |

| 07 | 1.5% | 1.5% | 1.4% | 1.3% | 1.3% | 1.6% |

| 08 | 1.6% | 1.7% | 1.6% | 1.9% | 1.9% | 1.9% |

| 09 | 4.4% | 4.5% | 4.3% | 4.4% | 4.5% | 4.9% |

| 10 | 1.4% | 1.5% | 1.4% | 1.3% | 1.2% | 1.1% |

| 11 | 3.0% | 3.0% | 2.9% | 3.2% | 3.3% | 3.6% |

| 12 | 3.0% | 3.0% | 2.9% | 3.1% | 3.2% | 3.0% |

| 13 | 2.4% | 2.4% | 2.3% | 2.8% | 2.8% | 2.6% |

| 14 | 3.1% | 3.1% | 3.0% | 2.7% | 2.8% | 2.7% |

| 15 | 1.1% | 1.1% | 1.0% | 1.0% | 1.0% | 1.2% |

| 16 | 6.8% | 6.9% | 6.6% | 6.9% | 7.2% | 6.3% |

| 17 | 1.2% | 1.2% | 1.1% | 0.8% | 0.8% | 1.0% |

| 18 | 0.9% | 0.9% | 0.9% | 1.0% | 1.1% | 1.0% |

| 19 | 10.3% | 9.9% | 11.1% | 10.8% | 9.1% | 8.4% |

| 20 | 3.2% | 3.3% | 3.5% | 3.4% | 3.7% | 4.0% |

| 21 | 39.5% | 39.4% | 39.5% | 40.5% | 41.9% | 42.4% |

| Ratio of CSFAI | 2007 | 2010 | 2012 |

|---|---|---|---|

| Sector 04 (Electric Power) | 74% | 65% | 61% |

| Year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GDP | 23.93 | 26.22 | 28.64 | 31.67 | 34.68 | 37.35 | 40.23 | 43.16 | 45.92 | 49.00 | 52.19 | 55.58 | 59.19 | 63.04 |

| Sector | 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 | 09 | 10 | 11 |

| −0.48% | −4.07% | 0.33% | 0.94% | 100.00% | 0.40% | −2.05% | 0.71% | 1.17% | −2.85% | 13.11% | |

| Sector | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | |

| 11.92% | 11.30% | 8.63% | 2.26% | 14.28% | 1.47% | 42.91% | 6.22% | 19.48% | 74.30% |

| Sector | 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 | 09 | 10 | 11 |

| R | 0.9986 | 1.0523 | 0.9896 | 1.0078 | 1.0000 | 0.9362 | 0.9652 | 1.0113 | 0.9702 | 1.0738 | 1.0212 |

| S | 1.0103 | 1.0103 | 0.9217 | 1.0013 | 0.9776 | 1.0146 | 1.0248 | 0.9985 | 0.9993 | 1.0103 | 0.9801 |

| Sector | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | |

| R | 0.9700 | 0.9700 | 0.9803 | 0.9503 | 0.9700 | 0.9797 | 1.0182 | 1.0402 | 1.0435 | 1.0171 | |

| S | 1.0248 | 1.0248 | 0.9899 | 1.0136 | 1.0248 | 1.0136 | 0.9800 | 1.0392 | 0.9213 | 0.9549 |

| Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|

| cc | 1.20 | 1.45 | 1.75 | 1.75 | 1.75 | 1.75 | 1.75 | 1.75 | 1.75 |

| Parameters | Specific Categories of Parameters | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|

| TPEC | Data from NBS | 4.17 | 4.26 | 4.30 | 4.36 |

| Forecast of this paper | 4.08 | 4.16 | 4.23 | 4.34 | |

| Deviation | −2.22% | −2.36% | −1.59% | −0.33% | |

| FAI | Data from NBS | 116% | 133% | 145% | 154% |

| Forecast of this paper | 116% | 130% | 146% | 151% | |

| Deviation | −0.33% | −1.53% | 0.63% | −2.08% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Li, Z.; Ma, L.; Chong, C.; Ni, W. Forecasting the Energy Embodied in Construction Services Based on a Combination of Static and Dynamic Hybrid Input-Output Models. Energies 2019, 12, 300. https://doi.org/10.3390/en12020300

Zhang X, Li Z, Ma L, Chong C, Ni W. Forecasting the Energy Embodied in Construction Services Based on a Combination of Static and Dynamic Hybrid Input-Output Models. Energies. 2019; 12(2):300. https://doi.org/10.3390/en12020300

Chicago/Turabian StyleZhang, Xi, Zheng Li, Linwei Ma, Chinhao Chong, and Weidou Ni. 2019. "Forecasting the Energy Embodied in Construction Services Based on a Combination of Static and Dynamic Hybrid Input-Output Models" Energies 12, no. 2: 300. https://doi.org/10.3390/en12020300

APA StyleZhang, X., Li, Z., Ma, L., Chong, C., & Ni, W. (2019). Forecasting the Energy Embodied in Construction Services Based on a Combination of Static and Dynamic Hybrid Input-Output Models. Energies, 12(2), 300. https://doi.org/10.3390/en12020300