Impact of Drilling Costs on the US Gas Industry: Prospects for Automation

Abstract

:1. Introduction

1.1. Drilling Automation

- Significantly improved tripping speed.

- Significant improvement in time to run casing.

- Possibility of built-in continuous circulation and drilling.

- Improved personnel safety.

- Improved wellbore stability.

- Improved well safety.

- Avoidance of differential sticking.

- Lower power consumption.

- Less equipment wear.

1.2. Energy Systems Modelling

1.3. Methodology

2. Results

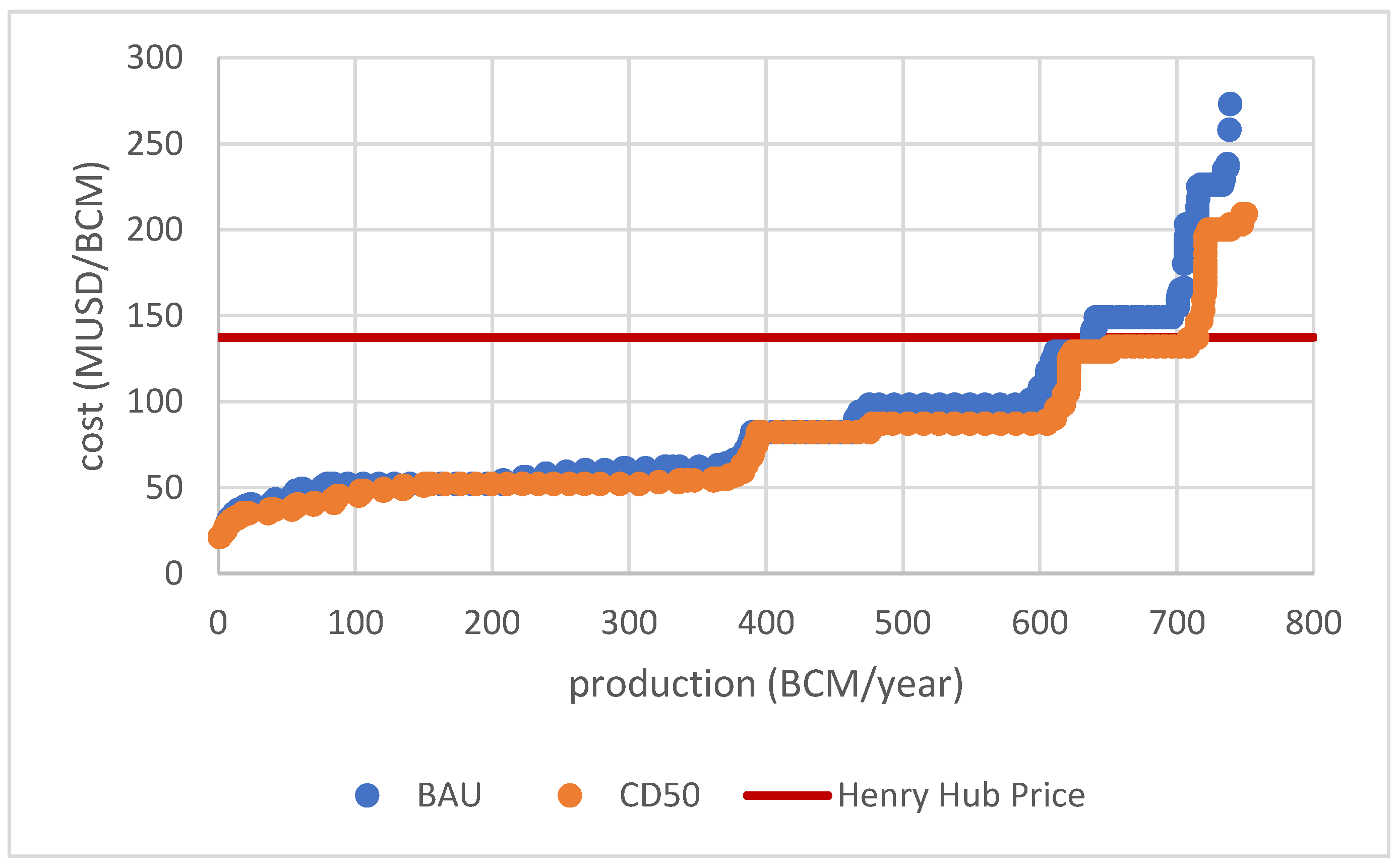

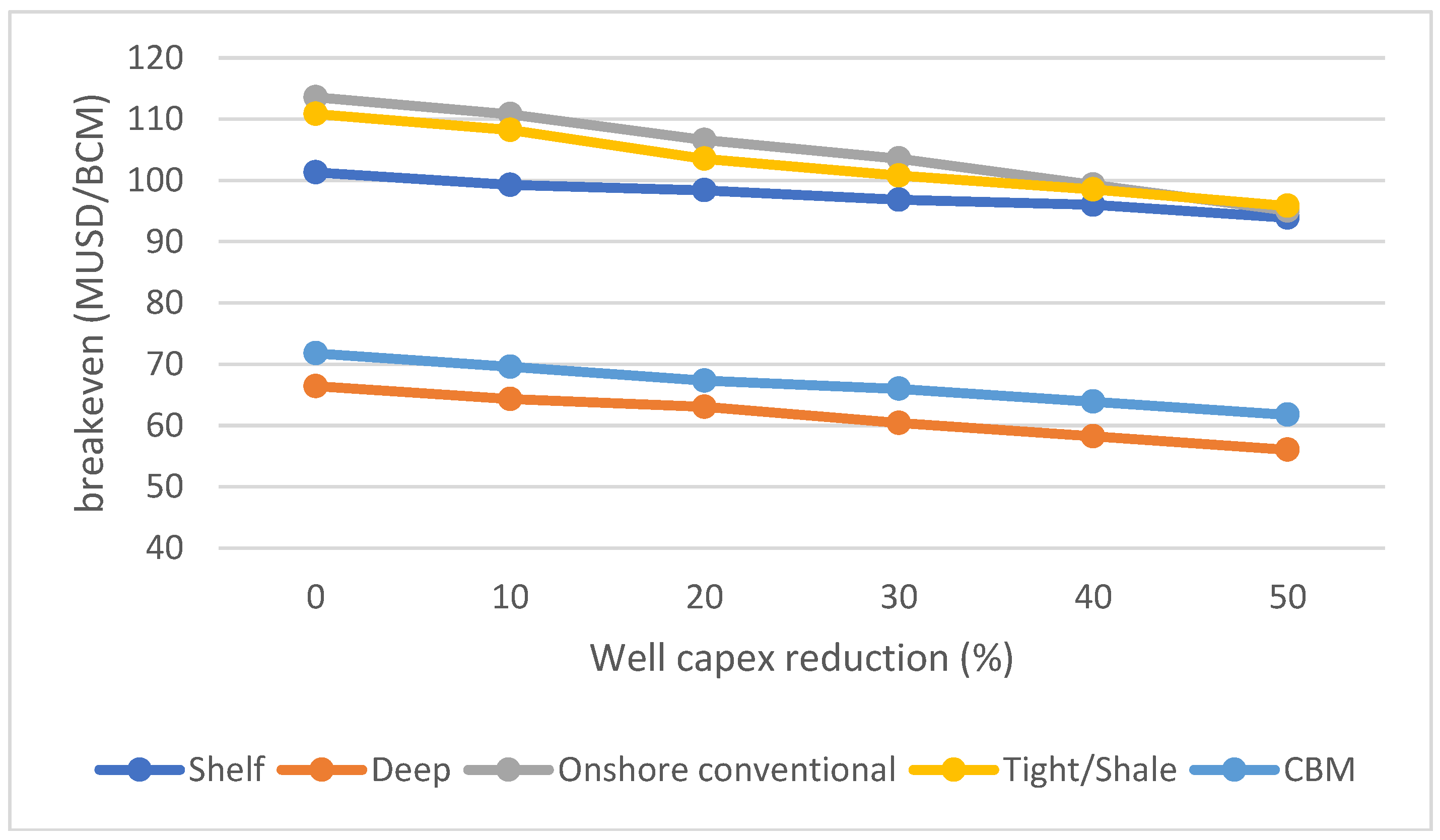

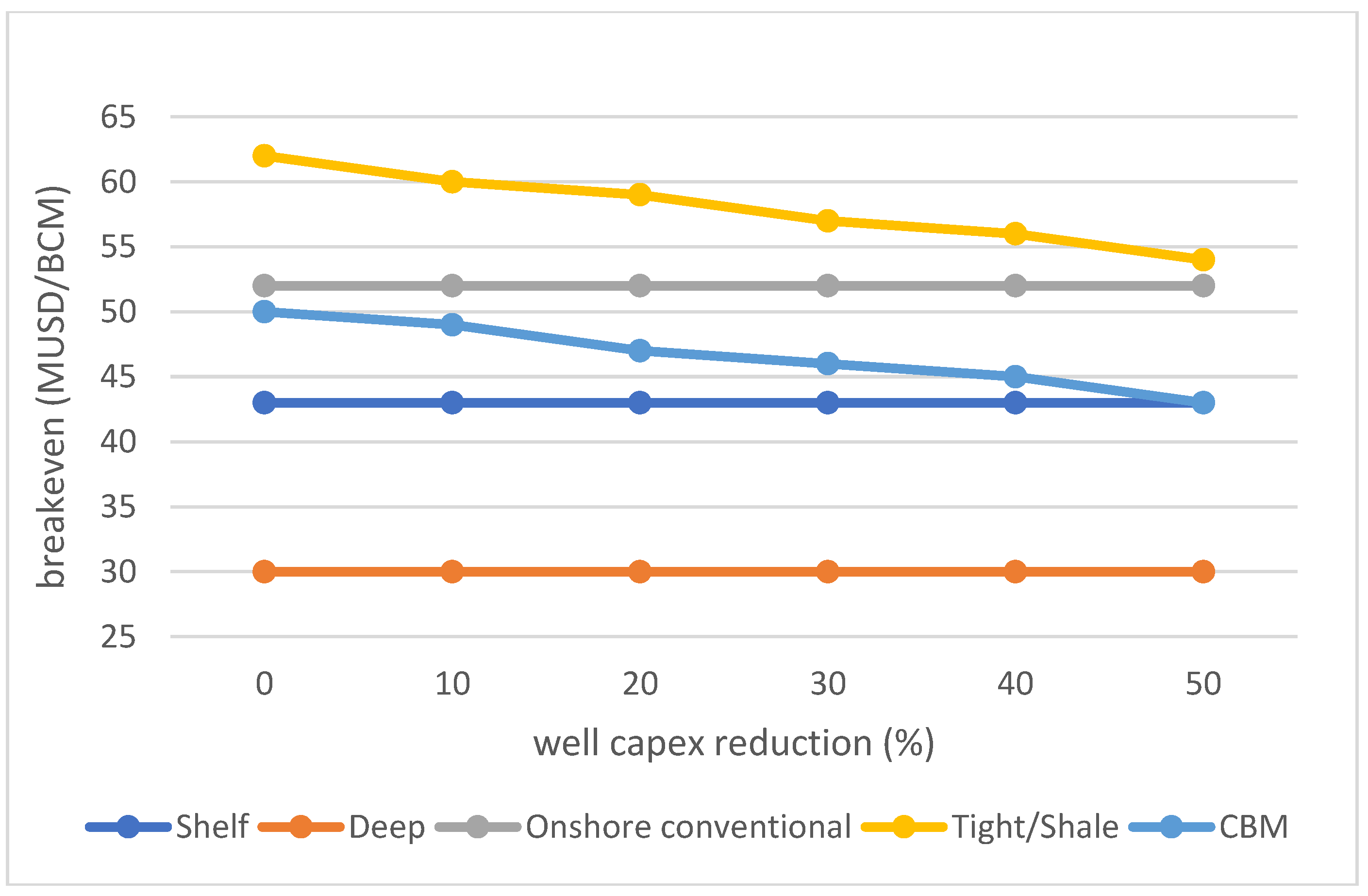

2.1. Breakeven Prices

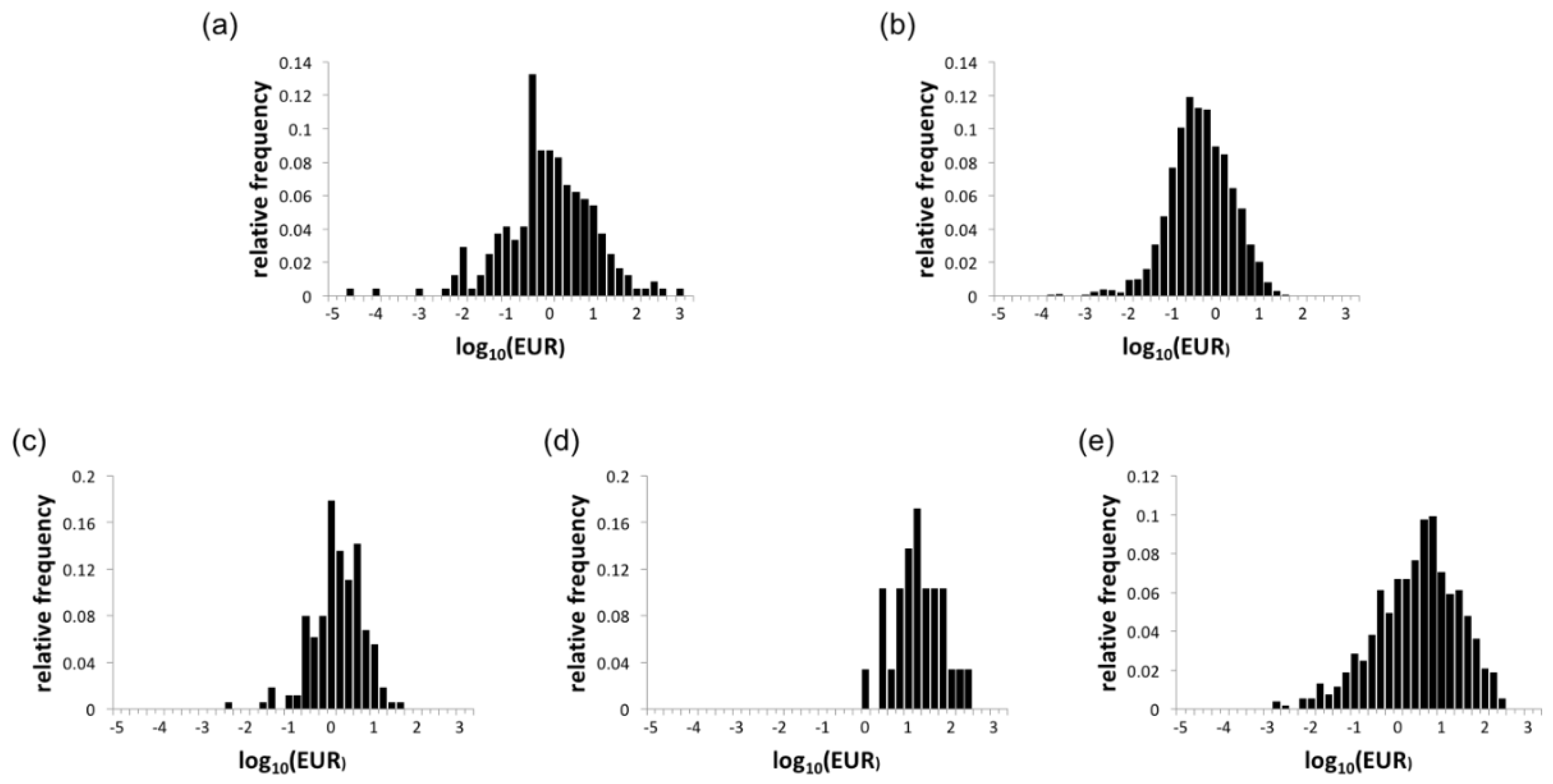

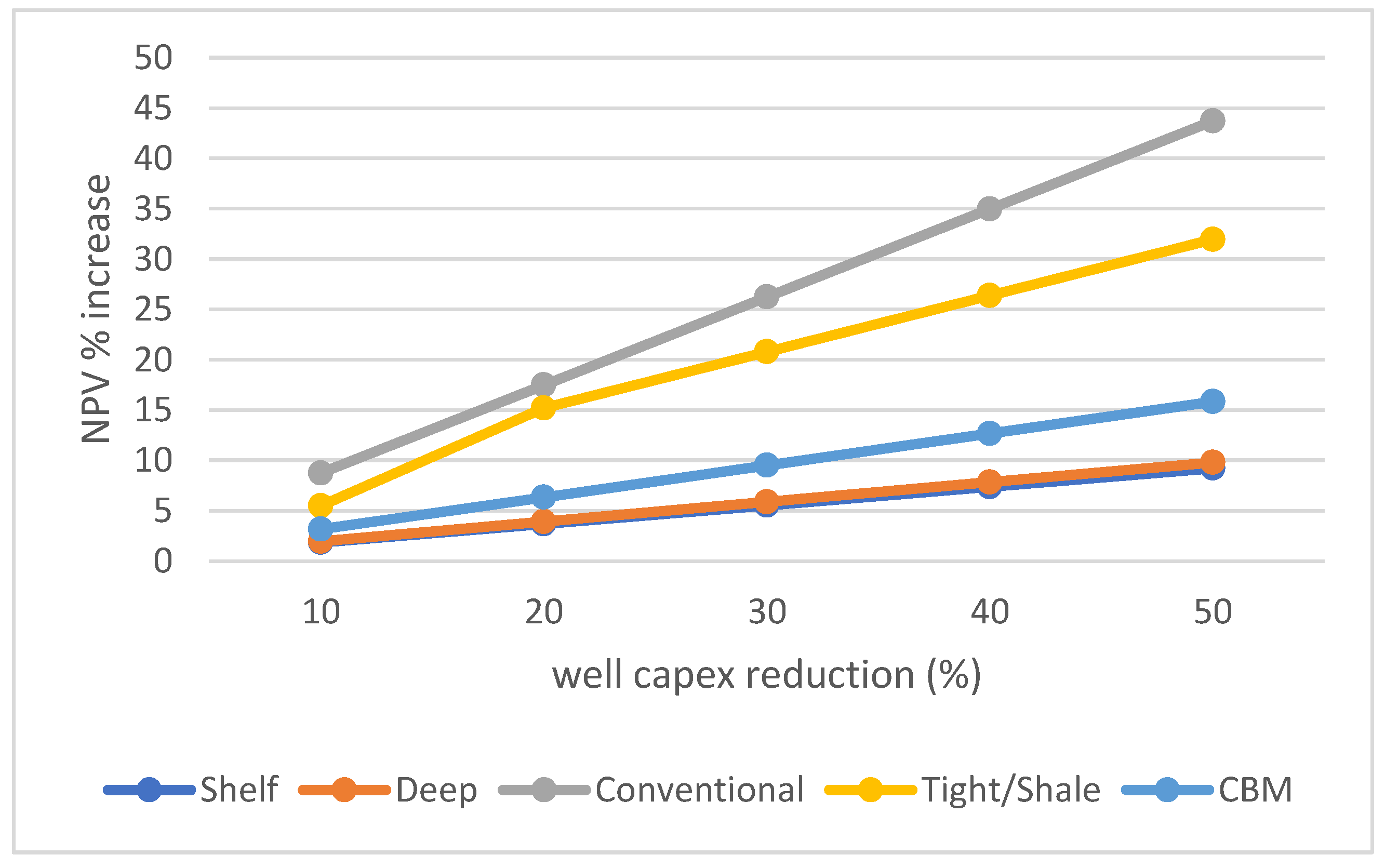

2.2. Net Present Value (NPV)

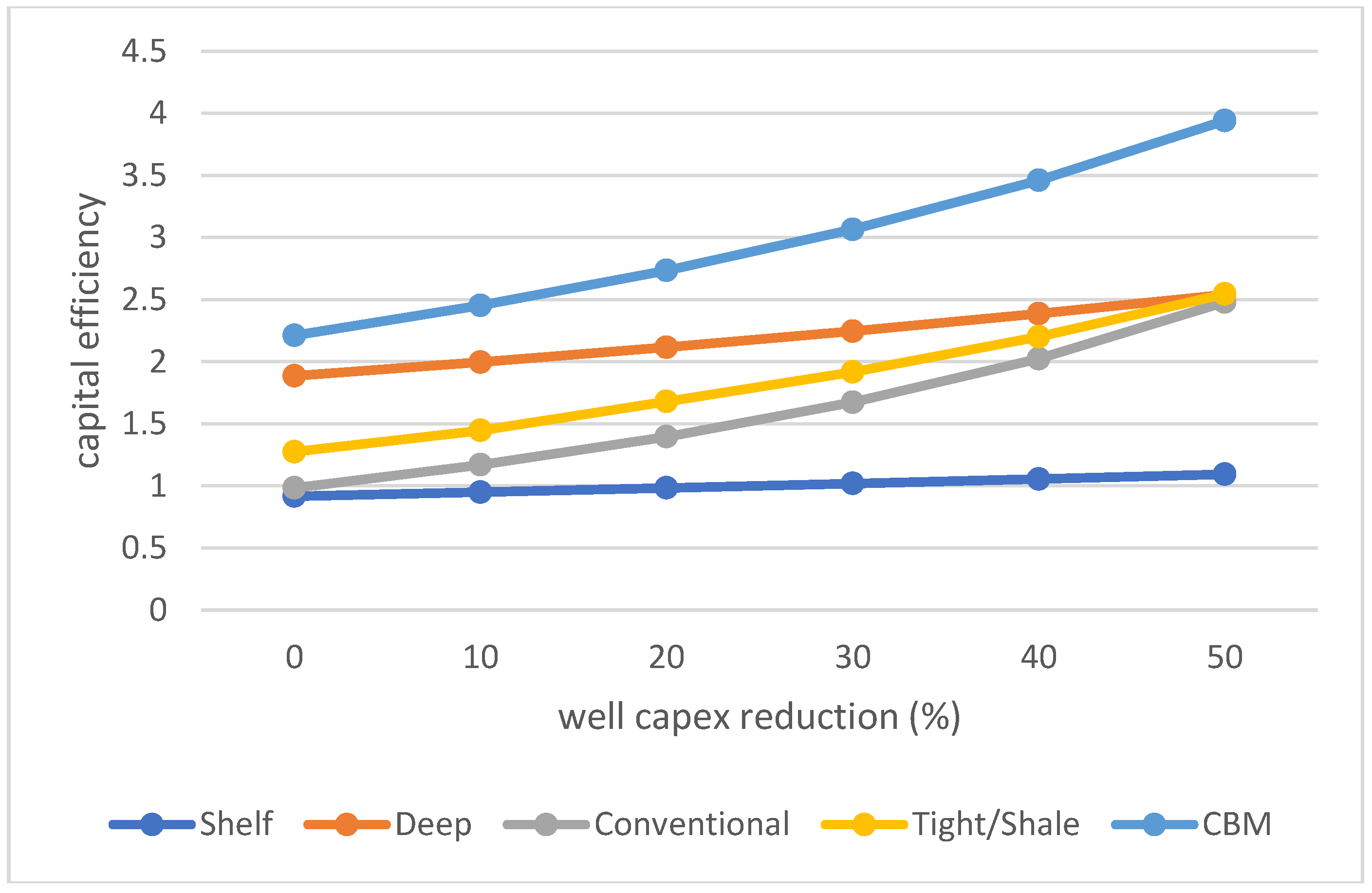

2.3. Capital Efficiency

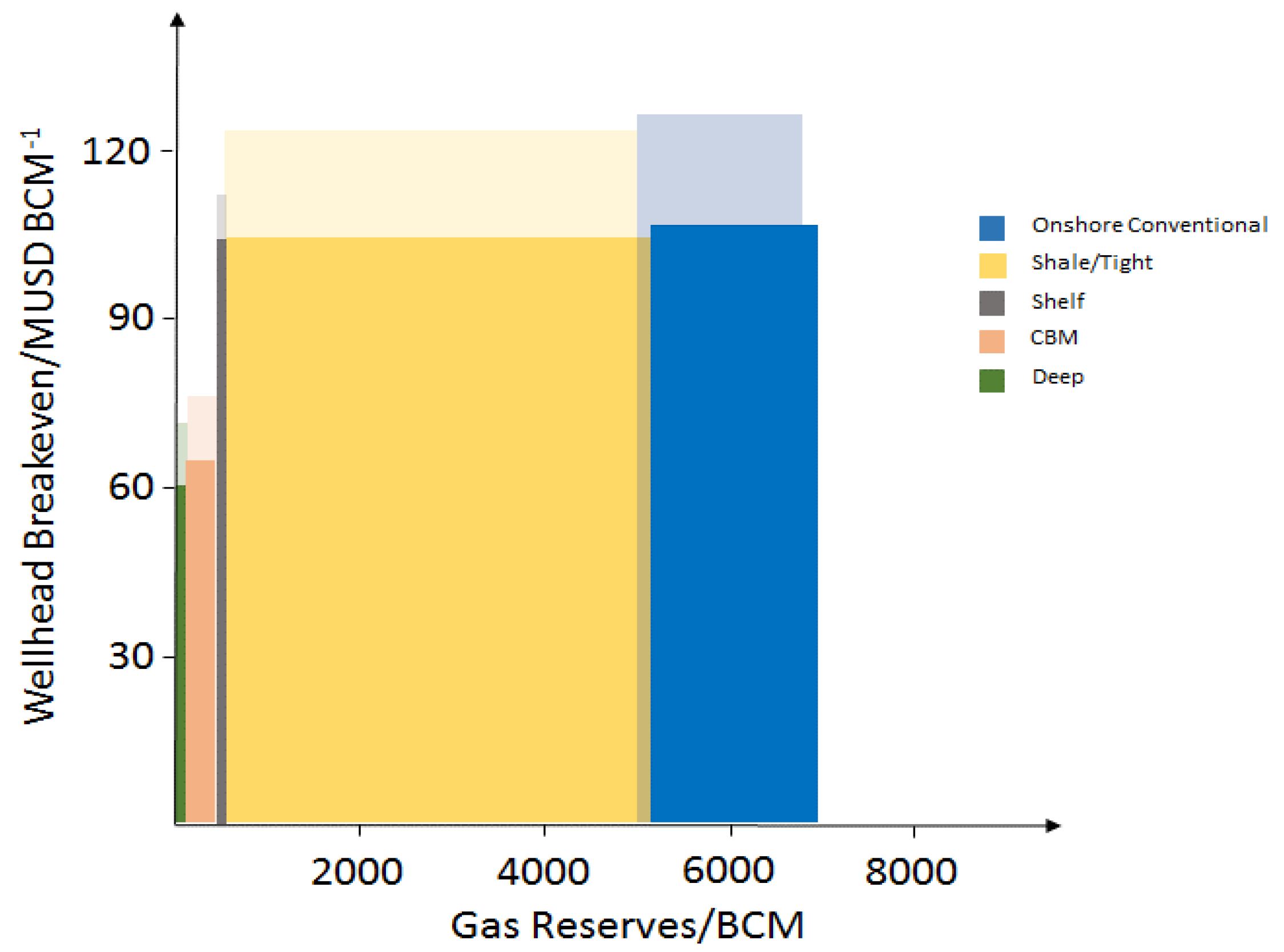

2.4. Wellhead Breakeven Price

3. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Energy Information Administration. Available online: https://www.eia.gov/analysis/studies/drilling/pdf/upstream.pdf (accessed on 12 December 2017).

- DNV GL. Available online: https://to2025.dnvgl.com/energy/oil-gas/ (accessed on 7 December 2017).

- Gheorghe, A.; Ioan, N.; Leon, D.; Ion, D. Automated System and Drilling Rig for Continuously and Automatically Pulling and Running a Drill-Pipe String. U.S. Patent 3404741A, 8 October 1968. [Google Scholar]

- Ambrus, A.; Pournazari, P.; Ashok, P.; Shor, R.; Oort, E. Overcoming Barriers to Adoption of Drilling Automation: Moving Towards Automated Well Manufacturing. In Proceedings of the SPE/IADC Drilling Conference and Exhibition, London, UK, 17–19 March 2015. [Google Scholar]

- Thorogood, J.L. Automation in drilling: Future evolution and lessons from aviation. IADC/SPE Drill. Complet. 2013, 28, 194–202. [Google Scholar] [CrossRef]

- Grinrod, M. Continuous motion rig: A step change in drilling equipment. In Proceedings of the IADC/SPE Drilling Conference and Exhibition, New Orleans, LA, USA, 2–4 February 2010. [Google Scholar]

- Skjaerseth, O.B. Continuous Motion Rig (CMR Technology)—A Step Change in Drilling Efficiency. In Proceedings of the Offshore Technology Conference—Asia, Kuala Lumpur, Malaysia, 25–28 March 2014. [Google Scholar]

- Grinrod, M.; Krohn, H. Continuous Motion Rig. A Detailed Study of a 750 ton capacity, 3600 m/hr trip speed rig. In Proceedings of the SPE/IADC Drilling Conference and Exhibition, Amsterdam, The Netherlands, 1–3 March 2011. [Google Scholar]

- Yarim, G.; Uchytil, R.J.; May, R.B.; Trejo, A. Stuck pipe prevention—A proactive solution to an old problem. In Proceedings of the SPE Annual Technical Conference and Exhibition, Anaheim, CA, USA, 11–14 November 2007. [Google Scholar]

- West Group. Available online: http://www.westgroup.no/products/continuous-motion-rig (accessed on 27 January 2017).

- Florence, F.; Porche, M.; Thomas, R.; Fox, R. Multi-parameter autodrilling capabilities provide drilling, economic benefits. In Proceedings of the SPE/IADC Drilling Conference and Exhibition, Amsterdam, The Netherlands, 17–19 March 2009. [Google Scholar]

- Hansen, M.D.; Abrahamsen, E. Improving safety performance through rig mechanization. In Proceedings of the SPE/IADC Drilling Conference, Amsterdam, The Netherlands, 27 February–1 March 2001. [Google Scholar]

- Brett, J. The perfect well ratio: Defining and using the theoretically minimum well duration to improve drilling performance. In Proceedings of the American Association of Drilling Engineers, Houston, TX, USA, 11 April 2006. [Google Scholar]

- Brett, J. Calculating the perfect-well time. Oil Gas J. 2004, 102, 43. [Google Scholar]

- De Wardt, J.P.; Rushmore, P.H.; Scott, P.W. True lies: Measuring drilling and completion efficiency. In Proceedings of the IADC/SPE Drilling Conference and Exhibition, Fort Worth, TX, USA, 1–3 March 2016. [Google Scholar]

- Rassenfoss, S.; Jacobs, T.; Whitfield, S. Four misconceptions that lead to drilling automation failure, in E&P Notes. J. Pet. Technol. 2017, 69, 22–27. [Google Scholar]

- Nygaard, G.; Gjeraldstveit, H.; Skjaeveland, O. Evaluation of automated drilling technologies for petroleum drilling and their potential when drilling geothermal wells. In Proceedings of the World Geothermal Congress, Bali, Indonesia, 25–29 April 2010. [Google Scholar]

- TTA3 Group. Technologies to improve drilling efficiency and reduce costs. Presented at the Oil and Gas in the 21 Century—OG21, Oslo, Norway, 15 October 2014. [Google Scholar]

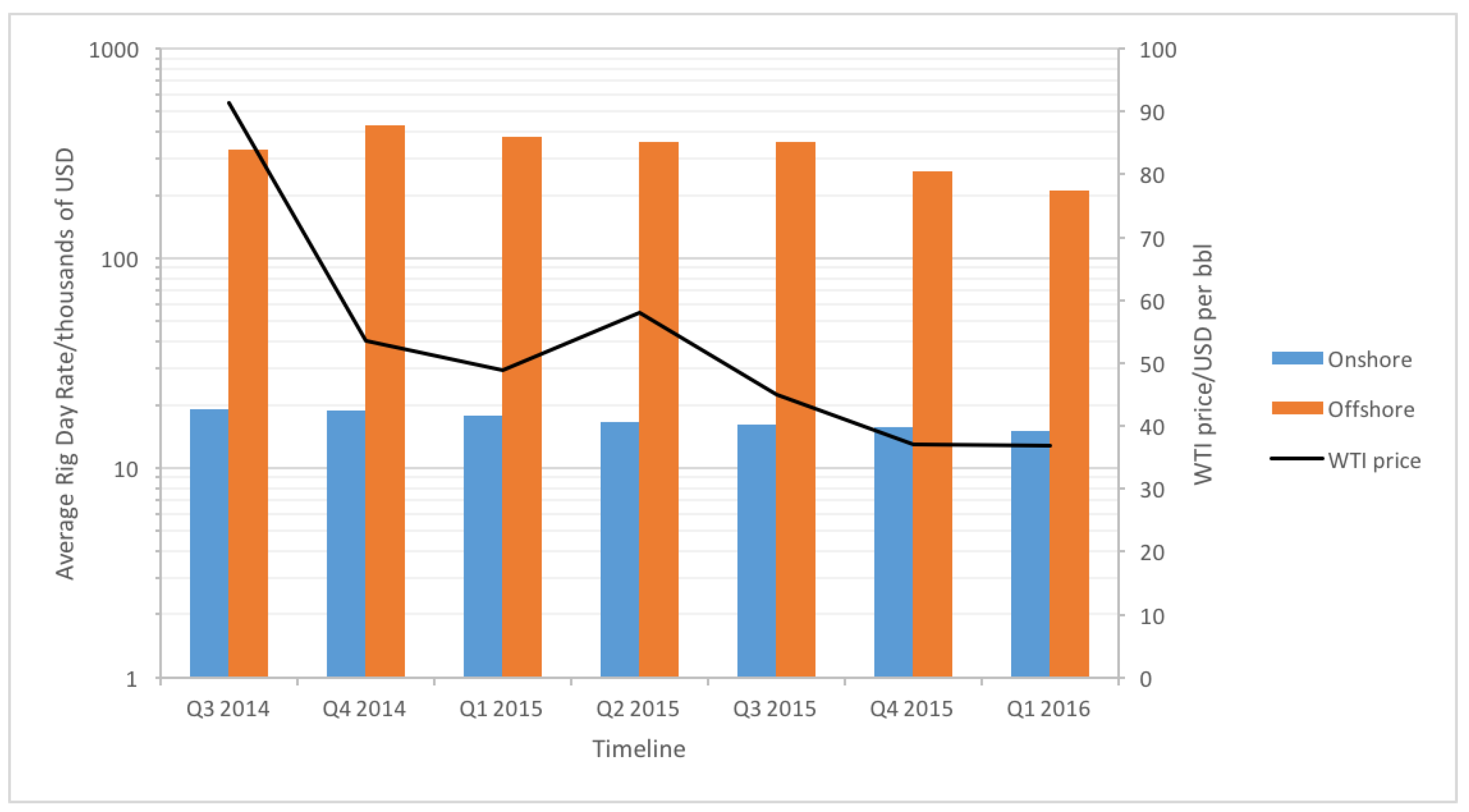

- Platts, S.P.G. Day Rate Report. Available online: https://rigdata.com/day-rate-report (accessed on 2 December 2017).

- IHS. Petrodata Offshore Rig Day Rate Trends. Available online: https://www.ihs.com/products/oil-gas-drilling-rigs-offshore-day-rates.html (accessed on 2 December 2017).

- Energy Information Administration. Weekly Cushing, OK WTI Spot Price FOB. Available online: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=rwtc&f=w (accessed on 14 December 2017).

- Qadir, Z. Available online: http://www.sustainablegasinstitute.org/ (accessed on 8 December 2017).

- Crow, D.J.G.; Balcombe, P.; Hawkes, A.D. Modelling investment in US natural gas: Upstream emissions and the carbon price. In Proceedings of the International Energy Workshop, College Park, MD, USA, 12–14 July 2017. [Google Scholar]

- Crow, D.J.G.; Giarola, S.; Hawkes, A.D. A dynamic model of global natural gas supply. Appl. Energy 2018, 218, 452–469. [Google Scholar] [CrossRef]

- Rystad Energy. UCube (Upstream Database). Available online: https://www.rystadenergy.com/Products/EnP-Solutions/UCube/Default (accessed on 8 December 2017).

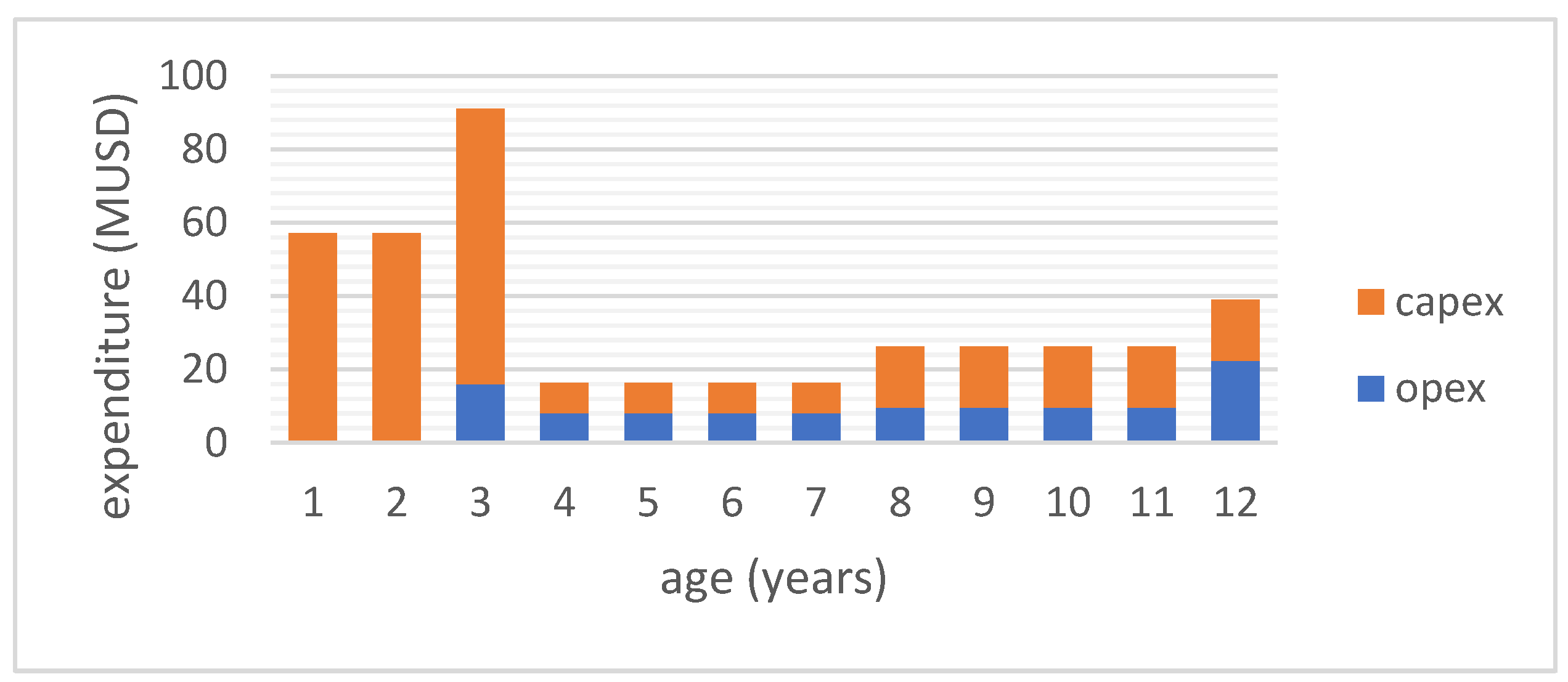

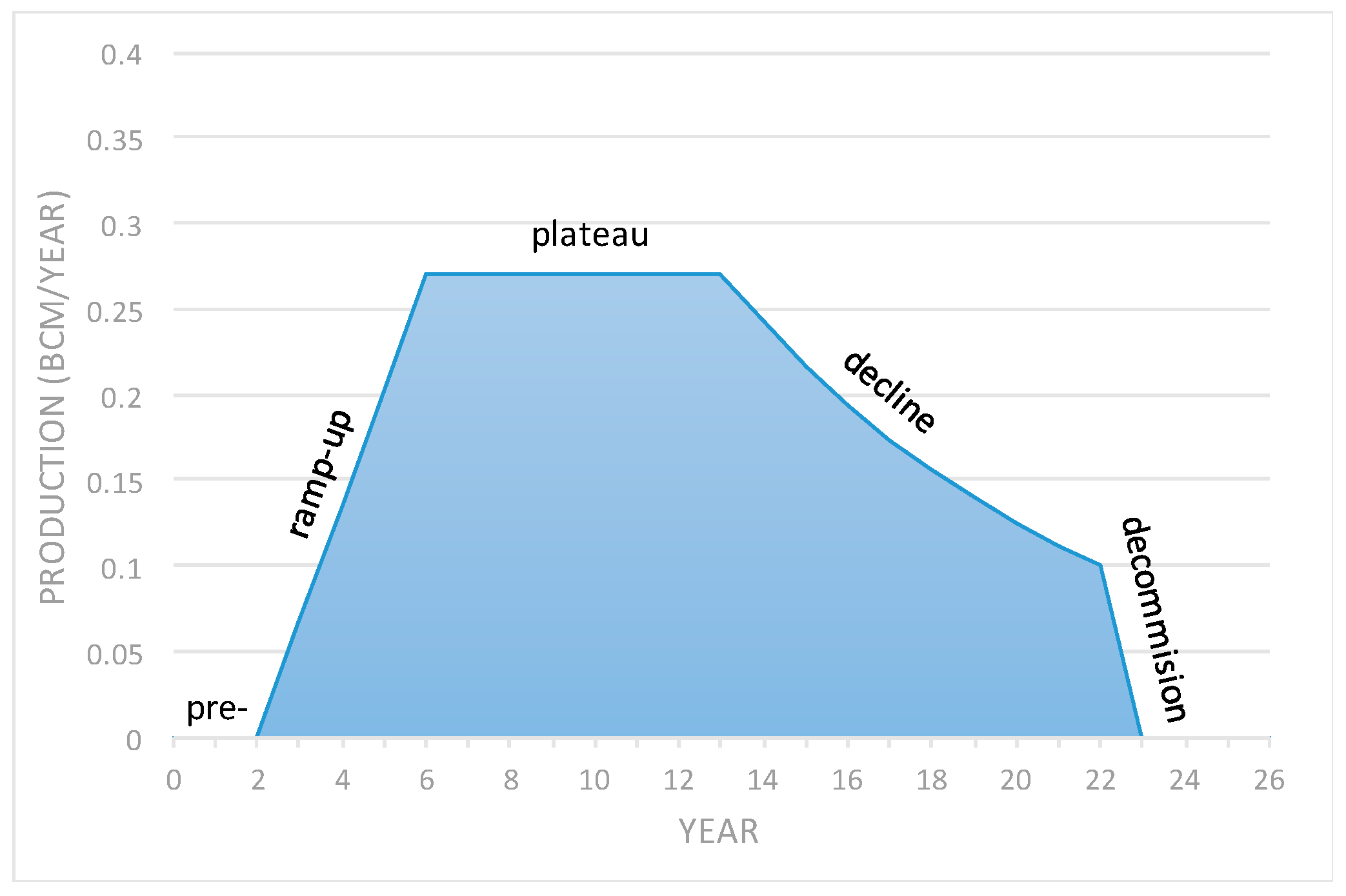

- Jahn, F.; Cook, M.; Graham, M. Chapter 9 Reservoir Dynamic Behaviour. In Developments in Petroleum Science; Jahn, F., Cook, M., Graham, M., Eds.; Elsevier: Oxford, UK, 2008; pp. 201–227. [Google Scholar]

- Söderbergh, B.; Jakobsson, K.; Aleklett, K. European energy security: An analysis of future Russian natural gas production and exports. Energy Policy 2010, 38, 7827–7843. [Google Scholar] [CrossRef]

- Administration, E.I. Natural Gas Wellhead Price. Available online: https://www.eia.gov/dnav/ng/hist/n9190us3m.htm (accessed on 12 December 2017).

- Weijermars, R. Economic appraisal of shale gas plays in Continental Europe. Appl. Energy 2013, 106, 100–115. [Google Scholar] [CrossRef]

- Ernst and Young. Available online: http://www.ey.com/Publication/vwLUAssets/Shale_gas_and_coal_bed_methane/$File/Shale_gas_and_coal_bed_methane_-__Potential_sources_of_sustained_energy_in_the_future.pdf (accessed on 18 December 2017).

- Energy Information Administration. Federal Offshore-Gulf of Mexico Dry Natural Gas Production. Available online: https://www.eia.gov/dnav/ng/hist/na1160_r3fm_2A.htm (accessed on 8 December 2017).

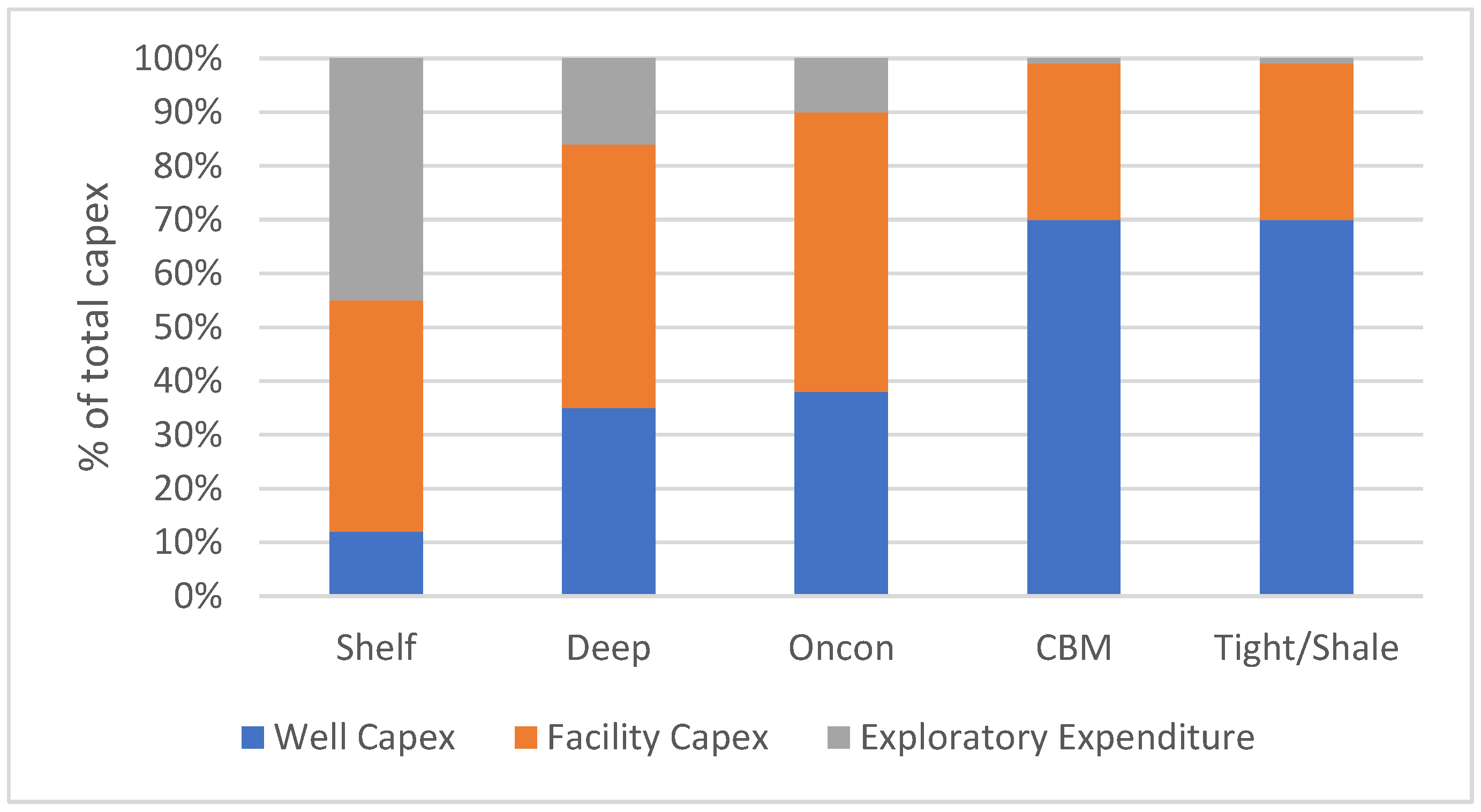

| Field Environment | Definition | |

|---|---|---|

| 1 | Shelf | Offshore sandstone reservoirs in water depths <125 m |

| 2 | Deep offshore | Offshore sandstone reservoirs in water depths >125 m |

| 3 | Onshore conventional | Onshore sandstone reservoirs that do not rely upon hydraulic fracturing to achieve economically viable production rates |

| 4 | Tight/shale | Onshore sandstone and shale reservoirs that require horizontal wells with extensive hydraulic fracturing to achieve production rates that are economically viable |

| 5 | Coal bed methane (CBM) | Natural gas extracted from coal seams |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Crow, D.J.G.; Anderson, K.; Hawkes, A.D.; Brandon, N. Impact of Drilling Costs on the US Gas Industry: Prospects for Automation. Energies 2018, 11, 2241. https://doi.org/10.3390/en11092241

Crow DJG, Anderson K, Hawkes AD, Brandon N. Impact of Drilling Costs on the US Gas Industry: Prospects for Automation. Energies. 2018; 11(9):2241. https://doi.org/10.3390/en11092241

Chicago/Turabian StyleCrow, Daniel J. G., Kris Anderson, Adam D. Hawkes, and Nigel Brandon. 2018. "Impact of Drilling Costs on the US Gas Industry: Prospects for Automation" Energies 11, no. 9: 2241. https://doi.org/10.3390/en11092241