Relative Greenhouse Gas Abatement Cost Competitiveness of Biofuels in Germany

Abstract

1. Introduction

- How may the greenhouse gas abatement of crop-based biofuels develop in a German context and are there differences between energetic and land use functional units?

- How may the relative greenhouse gas abatement costs of German crop-based biofuels develop in the future?

- How would the biofuel deployment develop if GHG abatement costs are the sole deciding factor, and how sensitive are the results to parameter variations?

2. Materials and Methods

2.1. Modeling

2.2. Data and Assumptions

2.3. Scenarios

2.4. Sensitivity Analysis

3. Results

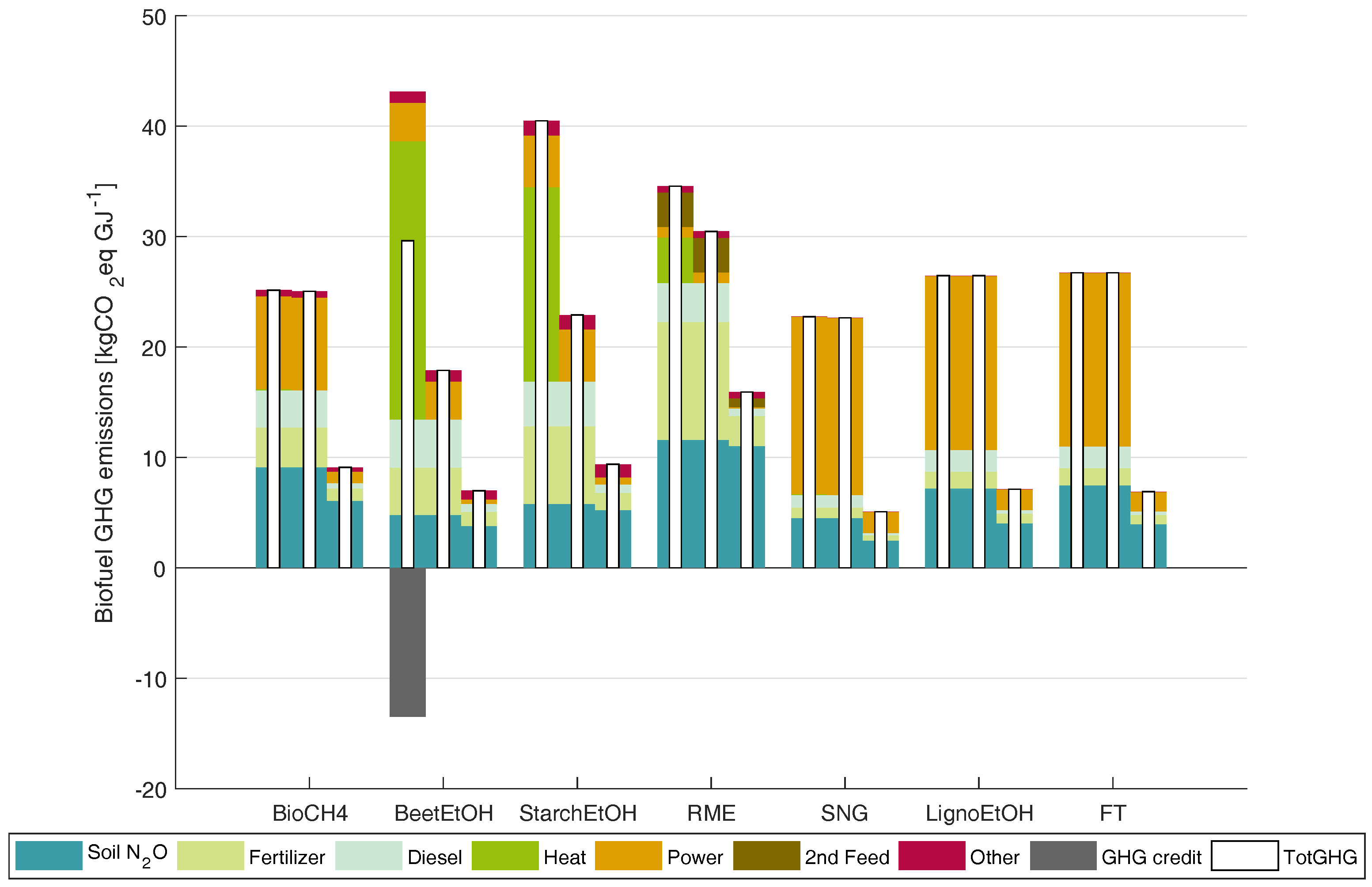

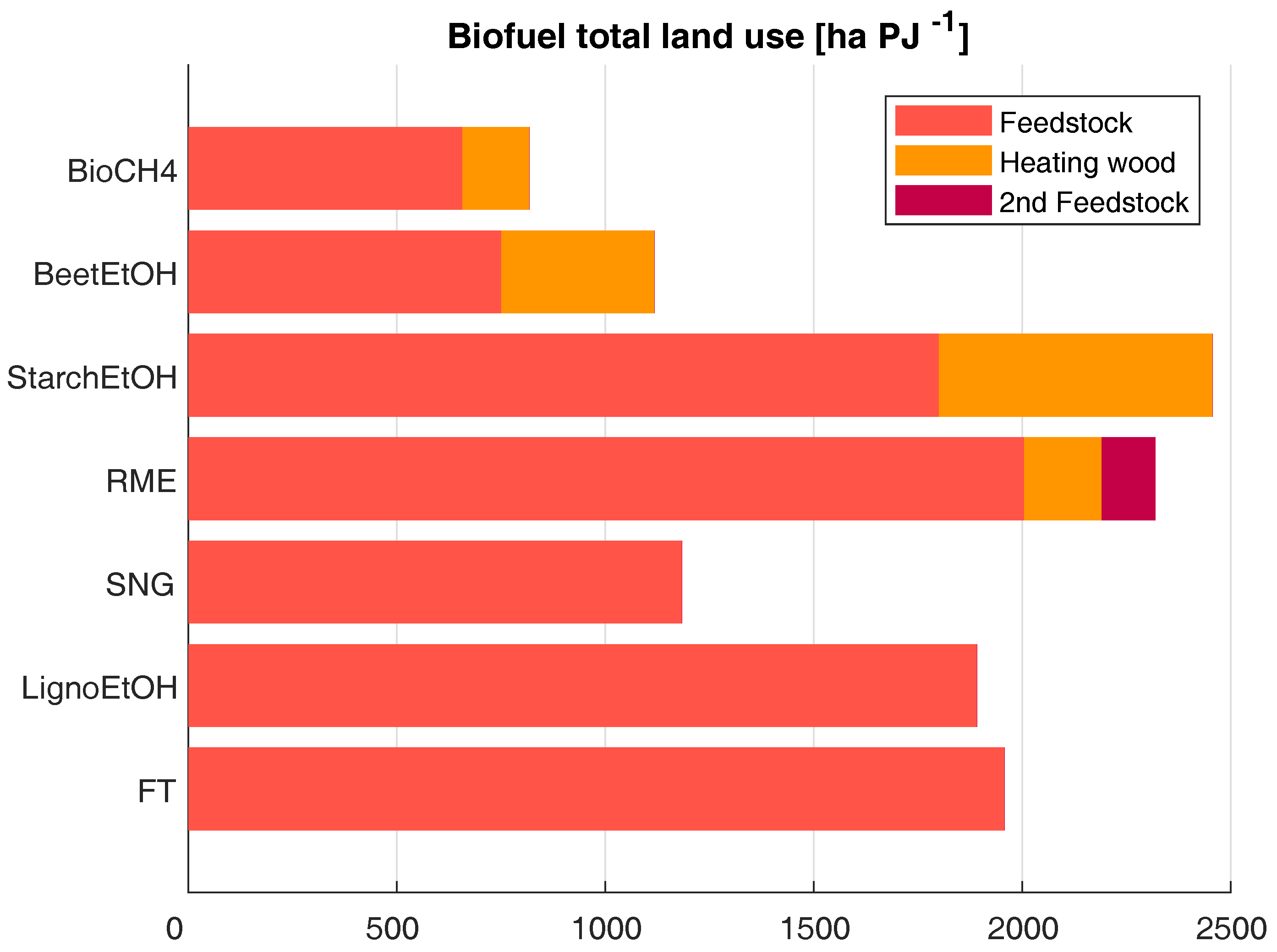

3.1. Biofuel GHG Emissions

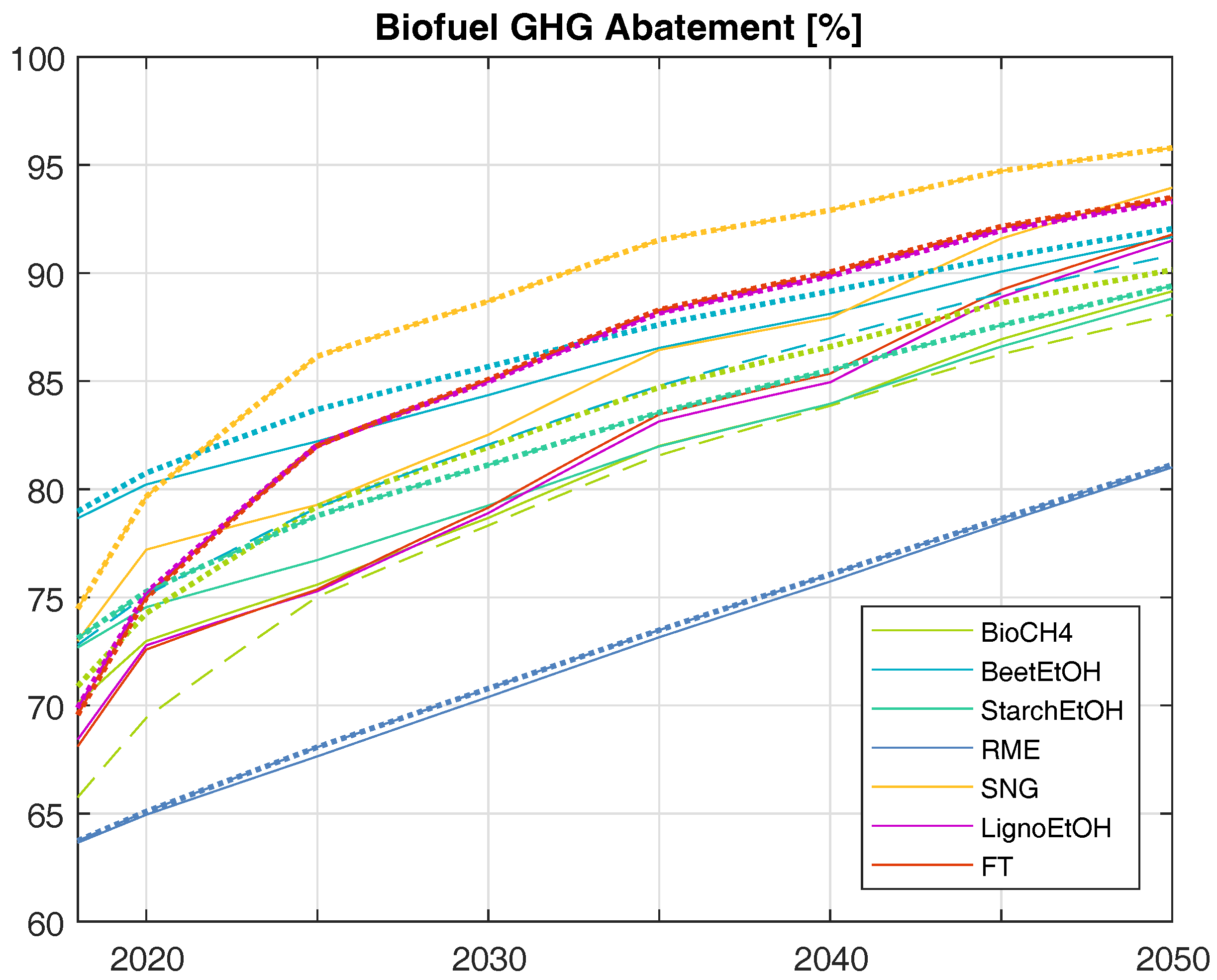

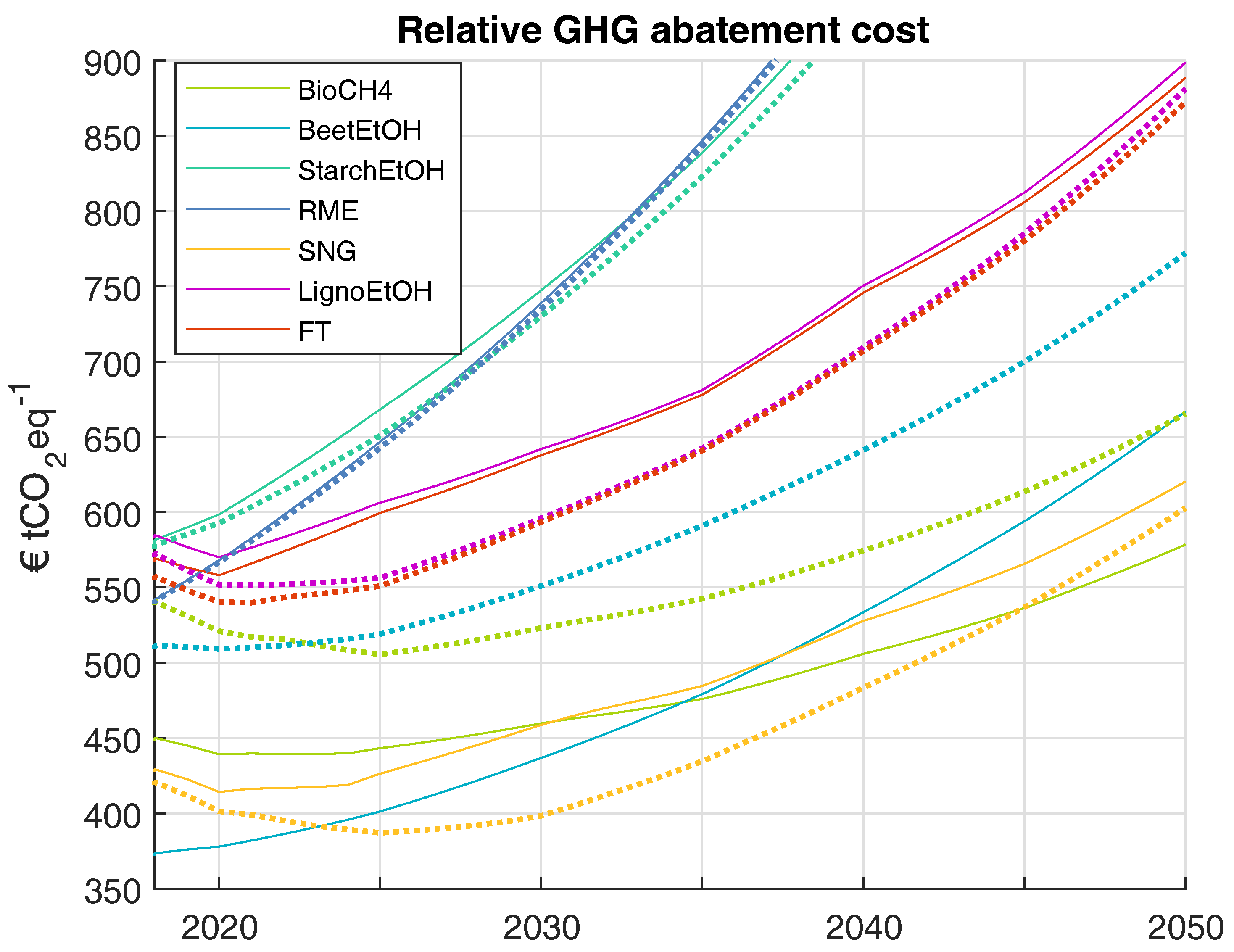

3.2. Biofuel Relative GHG Abatement Cost

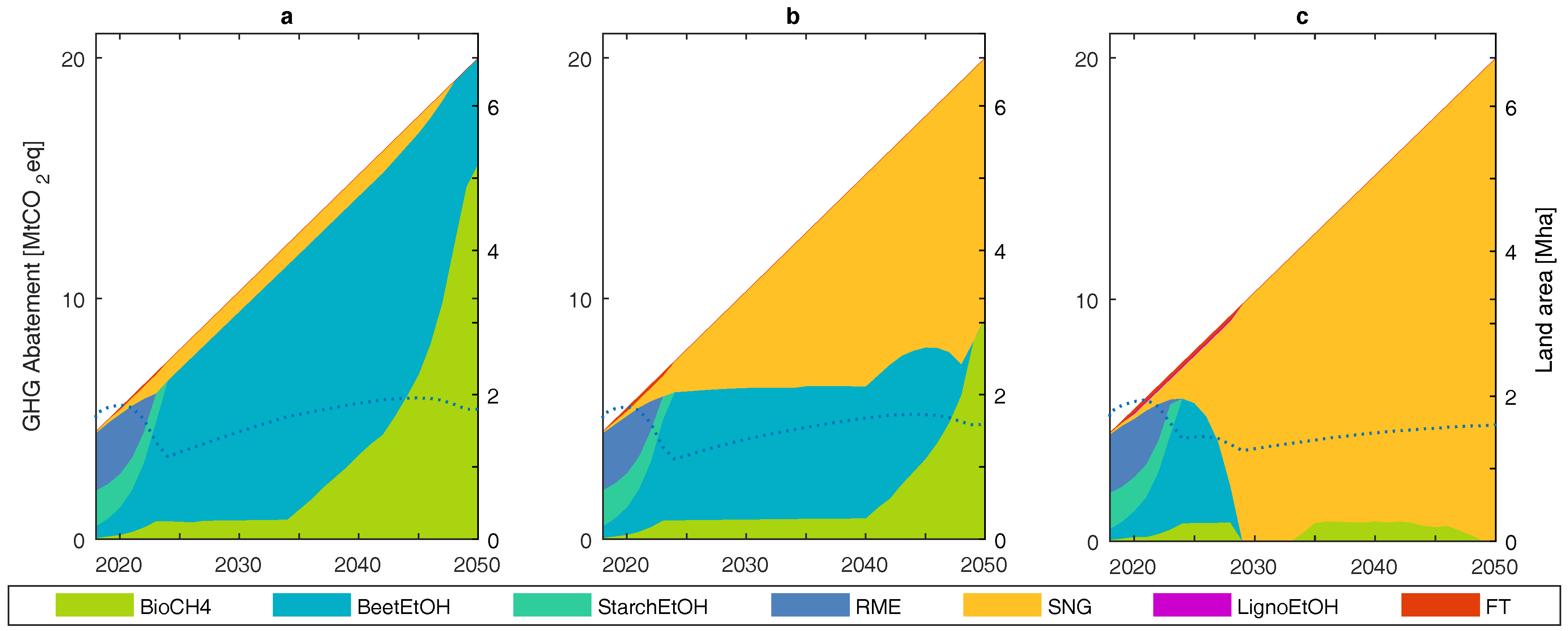

3.3. Scenario Modeling

3.4. Sensitivity Analysis

4. Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| BENSIM | Bioenergy simulation model |

| BeetEtOH | Sugar beet based bioethanol |

| BioCH4 | Silage maize based biomethane |

| DM | Dry matter |

| EF | Emission factor |

| FM | Fresh matter |

| FT | Fischer–Tropsch-diesel, in this work based on woody biomass (poplar) |

| GHG | Greenhouse gas |

| iLUC | Indirect land use change |

| LignoEtOH | Woody biomass (poplar)-based bioethanol |

| LUC | Land use change |

| MC | Marginal cost |

| NG | Natural gas |

| RME | Rape seed methyl ester biodiesel |

| SNG | Substitute natural gas |

| SRC | Short rotation coppice |

| StarchEtOH | Starch crop based bioethanol |

| TC | Total cost |

| WTT | Well to tank |

Appendix A. Model Description

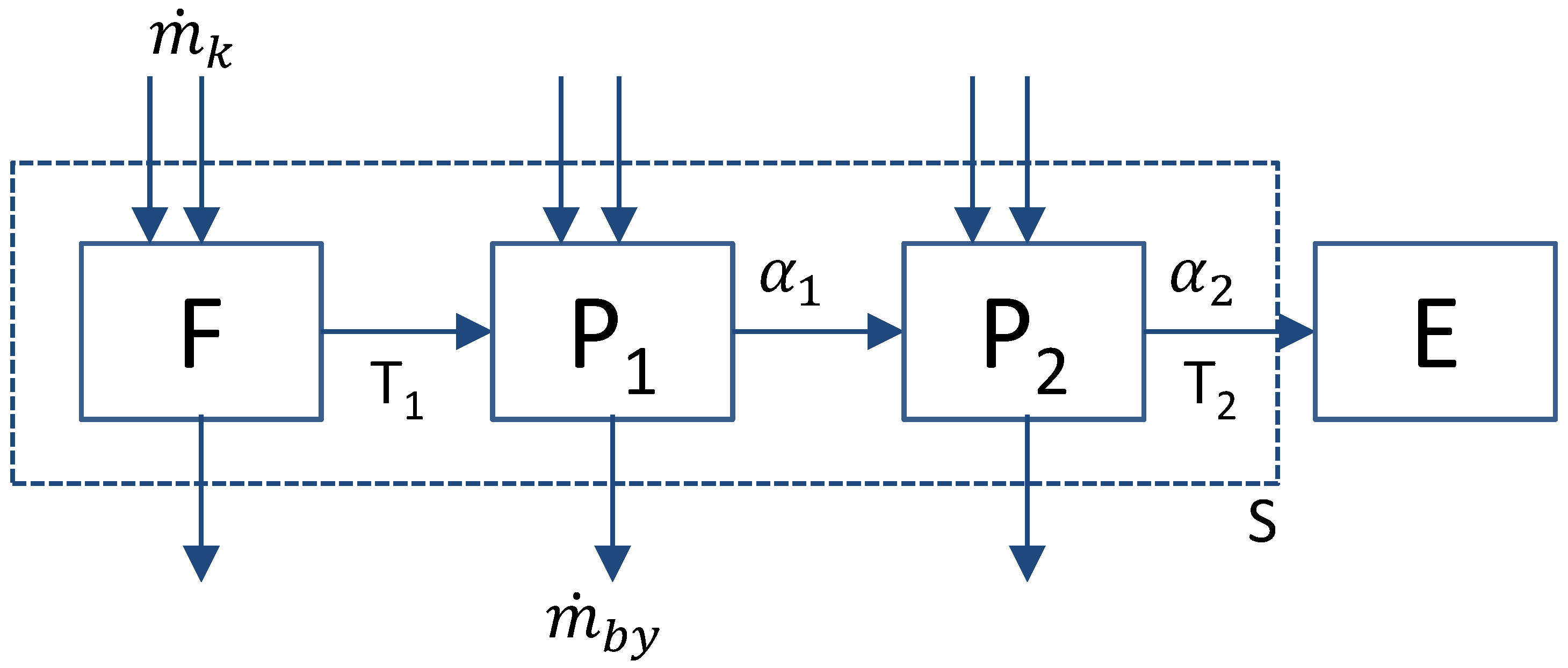

Appendix A.1. Biofuel Costs

Appendix A.1.1. Feedstock Costs

References

- European Environment Agency (EEA). European Environment Agency Greenhouse Gas Data Viewer; European Environment Agency: Copenhagen, Denmark, 2017; Available online: www.eea.europa.eu/data-and-maps/data/data-viewers/greenhouse-gases-viewer (accessed on 10 November 2017).

- Bundesanstalt für Landwirtschaft und Ernährung (BLE). Hintergrunddaten zum Evaluations-und Erfahrungsbericht 2016; Bundesanstalt für Landwirtschaft und Ernährung: Bonn, Germany, 2017. [Google Scholar]

- Millinger, M.; Thrän, D. Biomass price developments inhibit biofuel investments and research in Germany: The crucial future role of high yields. J. Clean. Prod. 2018, 172, 1654–1663. [Google Scholar] [CrossRef]

- Bundesministerium für Verkehr, Bau und Stadtentwicklung (BMVBS). Die Mobilitäts-und Kraftstoffstrategie der Bundesregierung (MKS): Energie auf Neuen Wegen; Bundesministerium für Verkehr, Bau und Stadtentwicklung: Berlin, Germany, 2013. [Google Scholar]

- Millinger, M.; Ponitka, J.; Arendt, O.; Thrän, D. Competitiveness of advanced and conventional biofuels: Results from least-cost modeling of biofuel competition in Germany. Energy Policy 2017, 107, 394–402. [Google Scholar] [CrossRef]

- Menten, F.; Chèze, B.; Patouillard, L.; Bouvart, F. A review of LCA greenhouse gas emissions results for advanced biofuels: The use of meta-regression analysis. Renew. Sustain. Energy Rev. 2013, 26, 108–134. [Google Scholar] [CrossRef]

- Cherubini, F.; Strømman, A.H. Life cycle assessment of bioenergy systems: State of the art and future challenges. Bioresour. Technol. 2011, 102, 437–451. [Google Scholar] [CrossRef] [PubMed]

- Crutzen, P.J.; Mosier, A.R.; Smith, K.A.; Winiwarter, W. N2O release from agro-biofuel production negates global warming reduction by replacing fossil fuels. Atmos. Chem. Phys. 2008, 8, 389–395. [Google Scholar] [CrossRef]

- BImSchV. Achtunddreißigste Verordnung zur Durchführung des Bundes-Immissionsschutzgesetzes (Verordnung zur Festlegung weiterer Bestimmungen zur Treibhausgasminderung bei Kraftstoffen): 38. BImSchV. Bundesgesetzblatt 2017, 1, 3892. [Google Scholar]

- Yan, X.; Inderwildi, O.R.; King, D.A. Biofuels and synthetic fuels in the US and China: A review of Well-to-Wheel energy use and greenhouse gas emissions with the impact of land-use change. Energy Environ. Sci. 2010, 3, 190–197. [Google Scholar]

- Malça, J.; Freire, F. Life-cycle studies of biodiesel in Europe: A review addressing the variability of results and modeling issues. Renew. Sustain. Energy Rev. 2011, 15, 338–351. [Google Scholar] [CrossRef]

- Haarlemmer, G.; Boissonnet, G.; Imbach, J.; Setier, P.A.; Peduzzi, E. Second generation BtL type biofuels—A production cost analysis. Energy Environ. Sci. 2012, 5, 8445–8456. [Google Scholar] [CrossRef]

- Haarlemmer, G.; Boissonnet, G.; Peduzzi, E.; Setier, P.A. Investment and production costs of synthetic fuels—A literature survey. Energy 2014, 66, 667–676. [Google Scholar] [CrossRef]

- Festel, G.; Würmseher, M.; Rammer, C.; Boles, E.; Bellof, M. Modeling production cost scenarios for biofuels and fossil fuels in Europe. J. Clean. Prod. 2014, 66, 242–253. [Google Scholar] [CrossRef]

- Browne, J.; Nizami, A.S.; Thamsiriroj, T.; Murphy, J.D. Assessing the cost of biofuel production with increasing penetration of the transport fuel market: A case study of gaseous biomethane in Ireland. Renew. Sustain. Energy Rev. 2011, 15, 4537–4547. [Google Scholar] [CrossRef]

- Dwivedi, P.; Khanna, M. Abatement cost of GHG emissions for wood-based electricity and ethanol at production and consumption levels. PLoS ONE 2014, 9, e100030. [Google Scholar] [CrossRef] [PubMed]

- Dwivedi, P.; Wang, W.; Hudiburg, T.; Jaiswal, D.; Parton, W.; Long, S.; DeLucia, E.; Khanna, M. Cost of abating greenhouse gas emissions with cellulosic ethanol. Environ. Sci. Technol. 2015, 49, 2512–2522. [Google Scholar] [CrossRef] [PubMed]

- Rehl, T.; Müller, J. CO2 abatement costs of greenhouse gas (GHG) mitigation by different biogas conversion pathways. J. Environ. Manag. 2013, 114, 13–25. [Google Scholar] [CrossRef] [PubMed]

- Tomaschek, J.; Özdemir, E.D.; Fahl, U.; Eltrop, L. Greenhouse gas emissions and abatement costs of biofuel production in South Africa. GCB Bioenergy 2012, 4, 799–810. [Google Scholar] [CrossRef]

- Schmidt, J.; Leduc, S.; Dotzauer, E.; Kindermann, G.; Schmid, E. Cost-effective CO2 emission reduction through heat, power and biofuel production from woody biomass: A spatially explicit comparison of conversion technologies. Appl. Energy 2010, 87, 2128–2141. [Google Scholar] [CrossRef]

- Martinez-Hernandez, E.; Campbell, G.M.; Sadhukhan, J. Economic value and environmental impact (EVEI) analysis of biorefinery systems. Chem. Eng. Res. Des. 2013, 91, 1418–1426. [Google Scholar] [CrossRef]

- Martinez-Hernandez, E.; Campbell, G.M.; Sadhukhan, J. Economic and environmental impact marginal analysis of biorefinery products for policy targets. J. Clean. Prod. 2014, 74, 74–85. [Google Scholar] [CrossRef]

- Budzinski, M.; Nitzsche, R. Comparative economic and environmental assessment of four beech wood based biorefinery concepts. Bioresour. Technol. 2016, 216, 613–621. [Google Scholar] [CrossRef] [PubMed]

- Zech, K.; Meisel, K.; Brosowski, A.; Villadsgaard Toft, L.; Müller-Langer, F. Environmental and economic assessment of the Inbicon lignocellulosic ethanol technology. Appl. Energy 2016, 171, 347–356. [Google Scholar] [CrossRef]

- McKinsey & Company. Costs and Potentials of Greenhouse Gas Abatement in Germany: A Report by McKinsey & Company, Inc., on Behalf of “BDI Initiativ—Business for Climate”; McKinsey & Company, Inc.: New York, NY, USA, 2007; Available online: www.mckinsey.com (accessed on 21 February 2018).

- McKinsey & Company. Pathways to a Low-Carbon Economy: Version 2 of the Global Greenhouse Gas Abatement Cost Curve; McKinsey & Company, Inc.: New York, NY, USA, 2009; Available online: www.mckinsey.com (accessed on 23 March 2017).

- Thrän, D.; Schaldach, R.; Millinger, M.; Wolf, V.; Arendt, O.; Ponitka, J.; Gärtner, S.; Rettenmaier, N.; Hennenberg, K.; Schüngel, J. The MILESTONES modeling framework: An integrated analysis of national bioenergy strategies and their global environmental impacts. Environ. Model. Softw. 2016, 86, 14–29. [Google Scholar] [CrossRef]

- Thrän, D.; Arendt, O.; Banse, M.; Braun, J.; Fritsche, U.; Gärtner, S.; Hennenberg, K.J.; Hünneke, K.; Millinger, M.; Ponitka, J.; et al. Strategy Elements for a Sustainable Bioenergy Policy Based on Scenarios and Systems Modeling: Germany as Example. Chem. Eng. Technol. 2017, 40, 211–226. [Google Scholar] [CrossRef]

- DIN’s Standards Committee Principles of Environmental Protection (NAGUS). DIN EN 16214-4. In Sustainability Criteria for the Production of Biofuels and Bioliquids for Energy Applications—Principles, Criteria, Indicators and Verifiers—Part 4: Calculation Methods of the Greenhouse Gas Emission Balance Using a Life Cycle Analysis Approach; German Version EN 16214-4:2013; NAGUS: Berlin, Germany, 2013. [Google Scholar]

- Ponitka, J.; Arendt, O.; Lenz, V.; Daniel-Gromke, J.; Stinner, W.; Ortwein, A.; Zeymer, M.; Gröngröft, A.; Müller-Langer, F.; Klemm, M.; et al. Focus on: Bioenergy-Technologies: Conversion Pathways—Towards Biomass Energy Use in the 21st Century, 2nd ed.; DBFZ: Leipzig, Germany, 2016. [Google Scholar]

- International Council on Clean Transportation Europe (ICCT). European Vehicle Market Statistics: Pocketbook 2016/2017; International Council on Clean Transportation Europe: Berlin, Germany, 2016. [Google Scholar]

- Majer, S.; Gröngröft, A.; Drache, C.; Braune, M.; Meisel, K.; Müller-Langer, F.; Naumann, K.; Oehmichen, K. Technical Principles and Methodology for Calculating GHG Balances of Biodiesel: Guidance Document: Version 1.0; DBFZ: Leipzig, Germany, 2016. [Google Scholar]

- Meisel, K.; Braune, M.; Gröngröft, A.; Majer, S.; Müller-Langer, F.; Naumann, K.; Oehmichen, K. Technical Principles and Methodology for Calculating GHG Balances of Bioethanol: Guidance Document: Version 1.0; DBFZ: Leipzig, Germany, 2016. [Google Scholar]

- Oehmichen, K.; Naumann, K.; Postel, J.; Drache, C.; Braune, M.; Gröngröft, A.; Majer, S.; Meisel, K.; Müller-Langer, F. Technical Principles and Methodology for Calculating GHG Balances of Biomethane: Guidance Document: Version 1.0; DBFZ: Leipzig, Germany, 2016. [Google Scholar]

- Kuratorium für Technik u. Bauwesen i. d. Landwirtschaft e.V. (KTBL). Energiepflanzen: Daten für die Planung des Energiepflanzenanbaus: KTBL Datensammlung, 2nd ed.; KTBL: Darmstadt, Germany, 2012. [Google Scholar]

- Neeft, J.; Ludwiczek, N. BioGrace II—Harmonized Greenhouse Gas Calculations for Electricity, Heating and Cooling from Biomass; European Union: Brussels, Belgium, 2015; Available online: www.biograce.net (accessed on 13 December 2017).

- Parsons Brinckerhoff. Accelerating the Uptake of CCS: Industrial Use of Captured Carbon Dioxide; Global CCS Institute: Docklands, Australia, 2011. [Google Scholar]

- Brosowski, A.; Thrän, D.; Mantau, U.; Mahro, B.; Erdmann, G.; Adler, P.; Stinner, W.; Reinhold, G.; Hering, T.; Blanke, C. A review of biomass potential and current utilisation—Status quo for 93 biogenic wastes and residues in Germany. Biomass Bioenergy 2016, 95, 257–272. [Google Scholar] [CrossRef]

- Bundesministerium für Wirtschaft und Energie (BMWi). Energiedaten: Gesamtausgabe: Stand: Oktober 2017; Bundesministerium für Wirtschaft und Energie: Berlin, Germany, 2017. [Google Scholar]

- Majer, S.; Gröngröft, A. Ökologische und ökonomische Bewertung der Produktion von Biomethanol für die Biodieselherstellung; Deutsches Biomasseforschungszentrum (DBFZ): Leipzig, Germany, 2010. [Google Scholar]

- Cherkasov, N.; Ibhadon, A.O.; Fitzpatrick, P. A review of the existing and alternative methods for greener nitrogen fixation. Chem. Eng. Process. Process Intensif. 2015, 90, 24–33. [Google Scholar] [CrossRef]

- Dulles, V.A. Sustainable Ammonia Synthesis: Exploring the Scientific Challenges Associated with Discovering Alternative, Sustainable Processes for Ammonia Production: DOE Roundtable Report; United States Department of Energy: Washington, DC, USA, 2016.

- World Wildlife Foundation (WWF). Zukunft Stromsystem: Kohleausstieg 2035—Vom Ziel her Denken; World Wildlife Foundation: Berlin, Germany, 2017. [Google Scholar]

- Neeft, J.; te Buch, S.; Gerlagh, T.; Gagnepain, B.; Bacovsky, D.; Ludwiczek, N.; Lavelle, P.; Thonier, G.; Lechon, Y.; Lago, C.; et al. BioGrace—Harmonized Calculations of Biofuel Greenhouse Gas Abatement: Publishable Final Report for Grant Agreement IEE/09/736; European Union: Brussels, Belgium, 2012; Available online: www.biograce.net (accessed on 13 December 2017).

- European Union (EU). Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC; European Union: Brussels, Belgium, 2009. [Google Scholar]

- Bundesministerium für Umwelt, Naturschutz, Bau und Reaktorsicherheit (BMUB). Klimaschutzplan 2050—Klimaschutzpolitische Grundsätze und Ziele der Bundesregierung; BMUB: Rostock, Germany, 2016; Available online: www.bmub.bund.de (accessed on 4 September 2017).

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 2014: Mitigation of Climate Change: Chapter 8—Transport. In Climate Change 2014: Mitigation of Climate Change; IPCC, Ed.; IPCC: Geneva, Switzerland; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2014. [Google Scholar]

- U.S. DOE. Fuel Economy of New Flex-Fuel Vehicles; U.S. Department of Energy: Washington, DC, USA, 2018. Available online: www.fueleconomy.gov (accessed on 23 February 2018).

- International Council on Clean Transportation Europe (ICCT). European Vehicle Market Statistics: Pocketbook 2017/2018; International Council on Clean Transportation Europe: Berlin, Germany, 2017. [Google Scholar]

- Allgemeiner Deutscher Automobil-Club e.V. (ADAC). ADAC Kostenvergleich: Erd-und Autogas Gegen Benziner und Diesel; Allgemeiner Deutscher Automobil-Club e.V.: Munich, Germany, 2018; Available online: www.adac.de (accessed on 23 February 2018).

- Skenhall, S.A.; Berndes, G.; Woods, J. Integration of bioenergy systems into UK agriculture—New options for management of nitrogen flows. Biomass Bioenergy 2013, 54, 219–226. [Google Scholar] [CrossRef]

- O’Keeffe, S.; Majer, S.; Drache, C.; Franko, U.; Thrän, D. Modeling biodiesel production within a regional context—A comparison with RED Benchmark. Renew. Energy 2017, 108, 355–370. [Google Scholar] [CrossRef]

- Rockstrom, J.; Steffen, W.; Noone, K.; Persson, A.; Chapin, F.S.; Lambin, E.F.; Lenton, T.M.; Scheffer, M.; Folke, C.; Schellnhuber, H.J.; et al. A safe operating space for humanity. Nature 2009, 461, 472–475. [Google Scholar] [CrossRef] [PubMed]

- Vadenbo, C.; Tonini, D.; Astrup, T.F. Environmental Multiobjective Optimization of the Use of Biomass Resources for Energy. Environ. Sci. Technol. 2017, 51, 3575–3583. [Google Scholar] [CrossRef] [PubMed]

- Tilman, D.; Hill, J.; Lehman, C. Carbon-Negative Biofuels from Low-Input High-Diversity Grassland Biomass. Science 2006, 314, 1598–1600. [Google Scholar] [CrossRef] [PubMed]

- Searle, S.Y.; Malins, C.J. Will energy crop yields meet expectations? Biomass Bioenergy 2014, 65, 3–12. [Google Scholar] [CrossRef]

- Grubler, A. Technology and Global Change; Cambridge University Press: Cambridge, UK, 1998. [Google Scholar]

- International Energy Agency (IEA). Experience Curves for Energy Technology Policy; IEA Publications: Paris, France, 2000. [Google Scholar]

- Hamelinck, C.N.; van Hooijdonk, G.; Faaij, A.P.C. Ethanol from lignocellulosic biomass: Techno-economic performance in short-, middle- and long-term. Biomass Bioenergy 2005, 28, 384–410. [Google Scholar] [CrossRef]

- Lange, J.P. Fuels and Chemicals Manufacturing: Guidelines for Understanding and Minimizing the Production Costs. CatTech 2001, 5, 82–95. [Google Scholar] [CrossRef]

- Bridgwater, A. Technical and Economic Assessment of Thermal Processes for Biofuels: NNFCC Project 08/018; Consultants on Process Engineering Ltd.: Calgary, AB, Canada, 2009; Available online: http://www.globalbioenergy.org (accessed on 10 September 2015).

- Witzel, C.P.; Finger, R. Economic evaluation of Miscanthus production—A review. Renew. Sustain. Energy Rev. 2016, 53, 681–696. [Google Scholar] [CrossRef]

- Ericsson, K.; Rosenqvist, H.; Nilsson, L.J. Energy crop production costs in the EU. Biomass Bioenergy 2009, 33, 1577–1586. [Google Scholar] [CrossRef]

- Krasuska, E.; Rosenqvist, H. Economics of energy crops in Poland today and in the future. Biomass Bioenergy 2012, 38, 23–33. [Google Scholar] [CrossRef]

- Faasch, R.J.; Patenaude, G. The economics of short rotation coppice in Germany. Biomass Bioenergy 2012, 45, 27–40. [Google Scholar] [CrossRef]

- James, L.K.; Swinton, S.M.; Thelen, K.D. Profitability Analysis of Cellulosic Energy Crops Compared with Corn. Agron. J. 2010, 102, 675–687. [Google Scholar] [CrossRef]

- Khanna, M.; Dhungana, B.; Clifton-Brown, J. Costs of producing miscanthus and switchgrass for bioenergy in Illinois. Biomass Bioenergy 2008, 32, 482–493. [Google Scholar] [CrossRef]

- Destatis. Statistisches Jahrbuch 2017: Deutschland und Internationales, 1st ed.; Statistisches Bundesamt: Wiesbaden, Germany, 2017.

| Fuel | BioCH4 | BeetEtOH | StarchEtOH | RME | BioSNG | LignoEtOH | FT | |

|---|---|---|---|---|---|---|---|---|

| Feedstock | Maize silage | Sugar beet | Wheat | Rape seed | Poplar | Poplar | Poplar | |

| Yield medium | ha−1 | 268–327 | 254 | 115 | 84 | 143–214 | 143–214 | 143–214 |

| Yield low | ha−1 | 208–268 | 176–215 | |||||

| N fertilizer | kgN (ha-a)−1 | 63.2 | 119.7 | 109.3 | 137.4 | |||

| Diesel equivalent | l (ha-a)−1 | 96 | 175.9 | 106 | 82.6 | 2.1 | 2.1 | 2.1 |

| N2O field emis base | kgN2O (ha-a)−1 | 4.66 | 4.59 | 2.92 | 4.19 | 1.28 | 1.28 | 1.28 |

| N2O field emis low | kgN2O (ha-a)−1 | 1.06 | 1.11 | 0.71 | 1.0 | 0.28 | 0.28 | 0.28 |

| N2O field emis high | kgN2O (ha-a)−1 | 23.37 | 20.78 | 13.27 | 19.45 | 6.72 | 6.72 | 6.72 |

| Co-products P1 | Beet pulp | DDGS | Rapeseed meal | |||||

| Alloc.factor P1 | (frac) | 0.94 | 0.595 | 0.65 | ||||

| Co-products P2 | Vinasse | Glycerol | ||||||

| Alloc. factor P2 | (frac) | 0.7 | 0.96 | |||||

| Conv.eff.tot | 0.56–0.70 | 0.6–0.66 | 0.48–0.53 | 0.59–0.62 | 0.58–0.73 | 0.36–0.44 | 0.35–0.45 | |

| 2nd feedstock | kg GJ−1 | 3.3 (MeOH) | ||||||

| Net heat input | kWh GJ−1 | 65 | 134 | 123 | 22 | 0 | 0 | 0 |

| Net power input | kWh GJ−1 | 14 | 10 | 17 | 1.6 | 31 | 35 | 35 |

| Description | |

|---|---|

| a | Base case |

| b | Progressive power mix development ([43], p. 120) |

| c | Prog.power mix, low yields for sugar beet and maize |

| Parameter | Unit | Span | |

|---|---|---|---|

| Initial investment cost | M€ | ±25% | |

| Exogenous learning | years | 3–10 | |

| Discount rate | % | 5–10 | |

| Conversion efficiency | min-max | ||

| Yield | ha−1 | min-max | |

| Establishment cost (perennials) | € ha−1 | ±25% | |

| Investment distribution limit | % | 10–20 | |

| Path dependency factor | % | 15–25 | |

| Capacity ramp | % | 100–200% | |

| Soil N2O emissions | % | low–high |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Millinger, M.; Meisel, K.; Budzinski, M.; Thrän, D. Relative Greenhouse Gas Abatement Cost Competitiveness of Biofuels in Germany. Energies 2018, 11, 615. https://doi.org/10.3390/en11030615

Millinger M, Meisel K, Budzinski M, Thrän D. Relative Greenhouse Gas Abatement Cost Competitiveness of Biofuels in Germany. Energies. 2018; 11(3):615. https://doi.org/10.3390/en11030615

Chicago/Turabian StyleMillinger, Markus, Kathleen Meisel, Maik Budzinski, and Daniela Thrän. 2018. "Relative Greenhouse Gas Abatement Cost Competitiveness of Biofuels in Germany" Energies 11, no. 3: 615. https://doi.org/10.3390/en11030615

APA StyleMillinger, M., Meisel, K., Budzinski, M., & Thrän, D. (2018). Relative Greenhouse Gas Abatement Cost Competitiveness of Biofuels in Germany. Energies, 11(3), 615. https://doi.org/10.3390/en11030615