1. Introduction

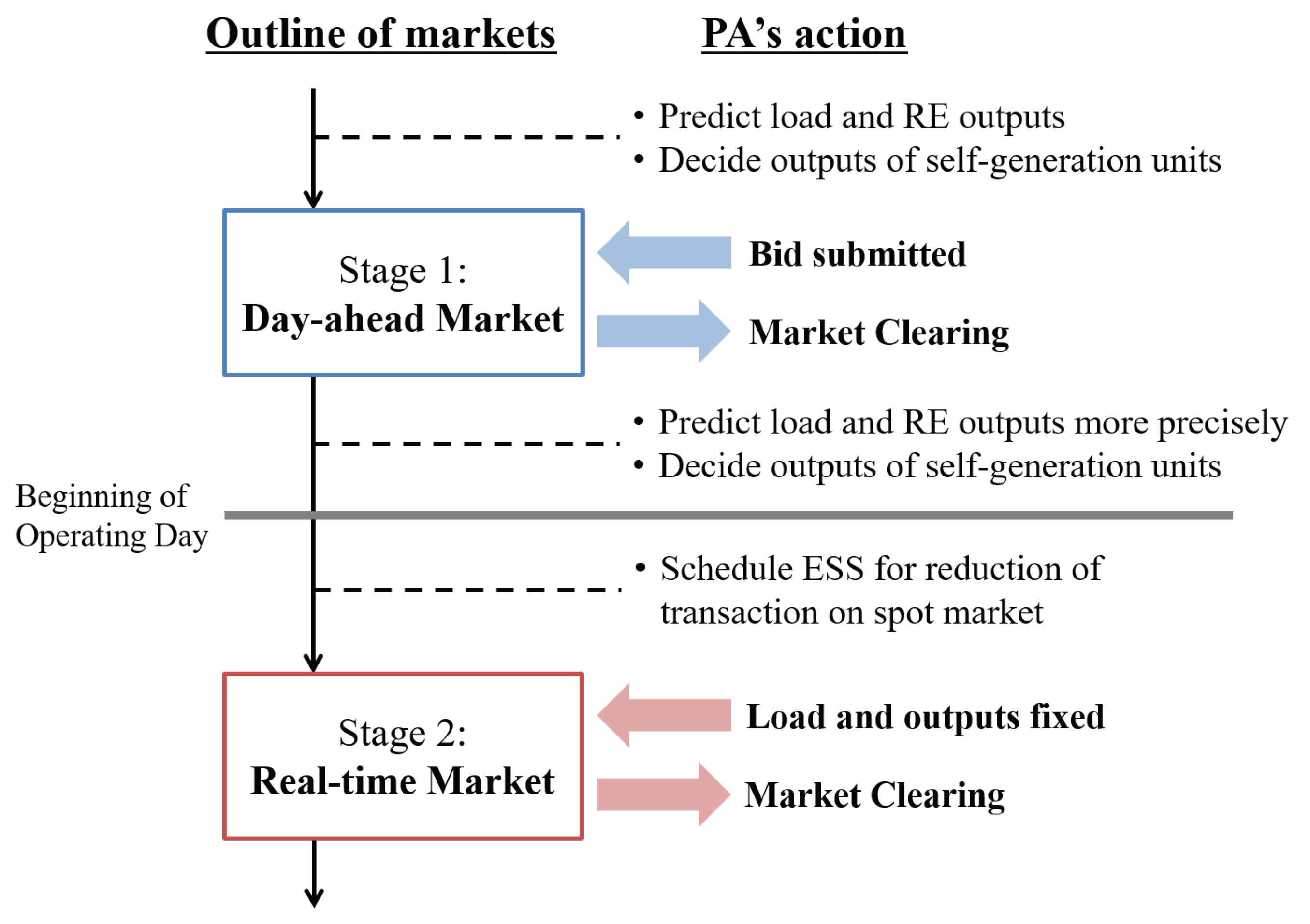

In many counties, electricity markets have been deregulated, resulting in several kinds of markets with different roles and time scales. A procurement agency (PA), such as a load-serving entity or an electric retailer, is an important player in a deregulated electricity market because it must meet two difficult requirements: the load obligation and profit maximization. One of the PA’s major concerns is to minimize procurement costs while satisfying its load obligation. As such, PAs usually have multiple procurement sources, such as electricity markets, self-generation units and bilateral contracts. In addition, renewable energy (RE) systems, such as photovoltaic (PV) systems, have become important sources of energy with the increasing concern about environmental issues. However, market prices and RE outputs include uncertainty; for example, the market price could spike in the event of an unpredicted power shortage, and PV outputs often fluctuate with rapid changes in solar radiation. PAs have to consider these kinds of uncertainties when procuring electricity because they can have a significant effect on procurement costs.

In this study, we focus mainly on two methods to resolve the above issues: transactions in multi-period markets and the installation of energy storage systems (ESSs). First, while there is a wide variety of markets in each country, multi-period markets are playing the principal role in market trade. Multi-period markets include forward and spot markets, used to hedge against price risks, and are used for many kinds of economic goods [

1]. Even within the context of electricity markets, there are many types of multi-period markets, including a day-ahead market (DAM) and real-time market (RTM), a DAM and hourly ahead market and a DAM and imbalanced payments. Specifically, we focus on a set of DAMs and RTMs, which PAs can use to reduce the risks associated with an increase in procurement costs. Second, we consider that PAs own their ESSs, such as large-scale batteries. In order to minimize procurement costs, ESSs can be used for time arbitrage in a DAM and to reduce the number of transactions in the DAM. The former means that PAs earn profits by charging low and discharging high in their ESSs. The latter indicates that PAs avoid purchasing or selling electricity on an RTM at unfavorable prices. Although ESSs can be used to avoid unexpected increases in procurement costs, PAs have to install the appropriate size of ESS, owing to the high costs of such systems.

Many previous studies have addressed the energy procurement problem (EPP), with uncertainties, of different kinds of PAs in deregulated electricity markets [

2,

3,

4,

5,

6,

7,

8], including studies that focus on single-period markets. In the case of electricity markets, there are two major approaches used to evaluate the impact of uncertainties: a scenario-based approach and a probabilistic approach. The advantage of a scenario-based approach is that the type of optimization problem is retained, resulting in it being employed in numerous studies [

2,

3,

4,

5,

6]. However, the disadvantage of the approach is that the scale of a problem becomes much larger, based on the number of scenarios. This is why the number of scenarios is limited. As a result, several effective methods to reduce the number of scenarios have been proposed [

5,

6,

9,

10]. Of course, it is important to eliminate unnatural scenarios that are not based on actual historical data, but instead are generated by algorithms. However, it is better to deal with a larger number of scenarios in order to consider a wider variety of scenarios, especially if a large amount of actual data is available. On the other hand, a probabilistic approach assumes probability density functions and evaluates uncertainty using mean values or variances. This kind of approach is also used [

7,

8] because it can consider an entire case within a probability distribution. However, it is difficult to derive exact solutions in this way because formulations can be nonlinear.

In addition to previous studies related to the EPP, researchers have focused on ESSs in multi-period markets [

11,

12,

13,

14,

15], considering the size and scheduling of an ESS in order to maximize profits or to minimize procurement costs. For example, studies have examined time arbitrage [

14] and how to reduce payment imbalances [

15]. However, to the best of our knowledge, few studies have attempted to determine the size and schedule of an ESS based on both time arbitrage and reductions in RTM transactions, although these specifications could differ depending on each purpose.

Based on the above discussion, our literature review identified the following two issues. First, there are difficulties in dealing with the large number of scenarios in scenario-based approaches and in deriving exact solutions using probabilistic approaches. Second, there is insufficient consideration of the two different purposes when determining the size and scheduling of an ESS. To address the first issue, we employ both a scenario-based and a probabilistic approach to evaluate the uncertainties, preserving the advantages of each approach. The proposed combined approach makes the optimization problem more difficult owing to its large scale and nonlinearity. However, we propose finding exact solutions within a realistic computational burden by making reasonable assumptions. To address the second issue, we employ the concepts of “slow” and “fast” ESSs, as proposed in [

16,

17], which enable us to divide the effects of means and variances. This study shows that slow and fast ESSs can quantify the time arbitrage in a DAM and reduce the number of transactions in an RTM, respectively. In order to verify the effectiveness of our proposed approach, we perform simulations using a generalized model of electricity markets, as well as a large amount of actual historical data.

3.2. Probabilistic EPP

Based on the formulation of the EPP, probabilistic indices are employed to evaluate the uncertainties. The modeling targets in this section are and in order to quantify the expectations of purchasing/selling electricity on an RTM. In order to simplify the modeling of the indices, we assume that the PV output and the demand for 1 h follow a Gaussian distribution. The use of other probability distributions is reserved for future work.

Equation (

8) denotes the expected imbalances after DAM clearing, based on

and

, and the expectations of

and

:

The negative and positive values of denote a power shortage and surplus, respectively. PAs have to purchase electricity from the RTM in the case of a shortage and have to sell electricity in the RTM in the case of a surplus.

In addition, Equation (

9) shows that

is bounded by the upper and lower limits of

,

and

, respectively:

From the viewpoint of transactions in multi-period markets, both and denote the degree of virtual bidding allowed on a DAM. If and are set to zero, the secondary market can be regarded as a system of imbalanced payments because it is prohibited from practicing arbitrage between the two markets.

Equation (

10) shows the relational expression for the standard deviation of imbalances,

:

where

,

and

indicate the standard deviations of

and

and the covariance between

and

, respectively. Here, the standard deviations of the imbalances are simply parameters, because they do not include any decision variables.

Using this assumption for the probability density function,

, two probabilistic indices are formulated: expected energy not supplied (EENS,

) [

18] and expected energy not used (EENU,

) [

19], as shown in Equations (

11) and (

12). The former measures the incidence of power shortages, denoting expected purchases of electricity, and the latter is a metric for power surpluses, denoting the expected selling of electricity in the RTM:

where

can be expressed as Equation (

13), and

denotes the error function, as shown in Equation (

14):

Therefore, the expected purchasing/selling of electricity in the RTM is given as Equation (

15):

Thus, the part of the objective function related to transaction costs in the RTM (set to

) can be formulated as Equation (

16):

In the next step, we model the reduction in RTM transactions by charging and discharging within an ESS, because the price of the DAM is usually unfavorable to a PA.

where

and

indicate the expected reductions in purchases and sales of electricity at

t, respectively. Here, the term

is added as the investment cost of an ESS associated with reducing the number of RTM transactions.

In the following step,

and

are determined, but it is required that PAs derive the size of an ESS to be installed. Therefore, a term with the same dimension as

can be extracted from the difference between the original expected electricity transaction and the reduced transaction using the inverse functions of EENS and EENU, as shown in Equations (

18) and (

19).

The new variables,

and

, constrain purchases and sales of electricity caused by sudden changes in power supply and demand. Thus, these variables can be regarded as “fast” discharging and charging in an ESS. Here, we refer to these as “fast” ESSs for shortages (

) and surpluses (

). In order to simplify the problem, we assume that fast ESSs for shortages and surpluses can only discharge and charge, respectively. Based on this assumption, the required capacities of fast ESSs,

and

, can be easily determined, as expressed in Equations (

20) and (

21).

In order to distinguish a conventional ESS () from a fast ESS, we refer to ESSs that do not consider uncertainties as “slow” ESSs.

Using the characteristics related to

and

, as shown in Equation (

22), Equation (

17) can be simplified as shown in Equation (

23):

Finally, Equations (

24) and (

25) must be installed to keep the amount of electricity purchased/sold non-negative:

These are reverse-convex constraints because both

and

are convex functions (see

Appendix A).

In summary, the probabilistic EPP (P-EPP) is formulated as follows:

3.3. Probabilistic and Scenario-Based EPP

Even though stochastic decision variables are removed, the P-EPP includes stochastic parameters of and . We fix these stochastic parameters based on the number of scenarios.

Equation (

26) defines the occurrence probability of the

-th scenario, with values ranging from one to

.

In other words, one scenario provides two prices (i.e., for the DAM and the RTM).

The variables are decided according to each scenario, so the expected procurement costs should be taken into account in the objective function. In addition, for the constraints, Equations (

4)–(

9), (

24) and (

25) are generated for each scenario. However, this does not affect the characteristics of the optimization problem. Therefore, the probabilistic and scenario-based EPP (PS-EPP) is formulated as follows:

3.4. Quadratic Probabilistic and Scenario-Based EPP

The PS-EPP is formulated as in

Section 3.3 and has a quadratic objective function. However, the feasible region consists of nonlinear and non-convex functions, as shown in Equations (

24) and (

25). This section describes the method to solve the PS-EPP, considering the structural features and making several reasonable assumptions.

Focusing only on the decision variables

and

, the objective function of the PS-EPP is separable and linear, and both are bounded by Equations (

24) and (

25). Owing to these structural features, the solution of

and

can be derived automatically, as shown in Equations (

27) and (

28).

As a result,

and

can be eliminated, and the reverse-convex constraints of Equations (

24) and (

25) can be ignored. Equation (

29) shows the transaction costs in the RTM, after reformulating using Equations (

22), (

24) and (

25).

where

and

are defined as follows:

Here, , and because is greater than zero.

Although non-convex constraints are eliminated,

is non-convex (and more specifically, concave; see

Appendix B), which could make it difficult to find the global optimal solution. In addition, the nonlinearity could be a factor causing high computational costs.

Therefore, in order to simplify and relax the problem, we assume that is set to at and that is set to at , showing some of the features that make these assumptions reasonable.

The first feature of the PS-EPP is that we can determine the

that minimizes

in the case of

, as shown in Equations (

30) and (

31), because the functions are monotonically decreasing or monotonically increasing (see

Appendix B):

Note that the global optimal solution is not guaranteed, because

is fixed considering only

, even though Equation (

8) includes

.

The second feature is that the fixed at does not conflict with reasonable PA actions in the RTM. Specifically, in the case of , the real-time (RT) price is so unfavorable as to install an ESS, as described in the inequality constraints. This is why and should be greater than zero, which means installing fast ESSs.

Finally, the quadratic PS-EPP (QPS-EPP) can be formulated as follows:

This optimization problem can be solved easily using quadratic programming, even if the scale of the problem is large.

4. Simulation

4.1. Parameter Setting and Data

This section describes the parameters related to a PA and to the multi-period markets. As described in

Section 2.1, a PA has the following procurement sources: transactions in a DAM and an RTM, self-generation, PVs and ESSs.

4.1.1. PVs and Contracted Demands

The capacity of PVs and the contracted demand are set to 50 MW and 100 MW, respectively. Moreover, we use data provided by Pennsylvania-New Jersey-Maryland interconnection (PJM)through Data Miner 2 [

20] to create the profiles for PV output and demand for the operating day. Specifically, PV output uses data on generating power based on the fuel type of “solar” [

21]. Then, the demand is hourly data of metered loads in PJM (RTO region) [

22]. Both sets of data cover the period 1 July 2017–30 September 2017, because they both include seasonal characteristics. Then, both sets of data are adjusted using the capacity of PVs and the contracted demand, comparing them with the maximum values for the study period.

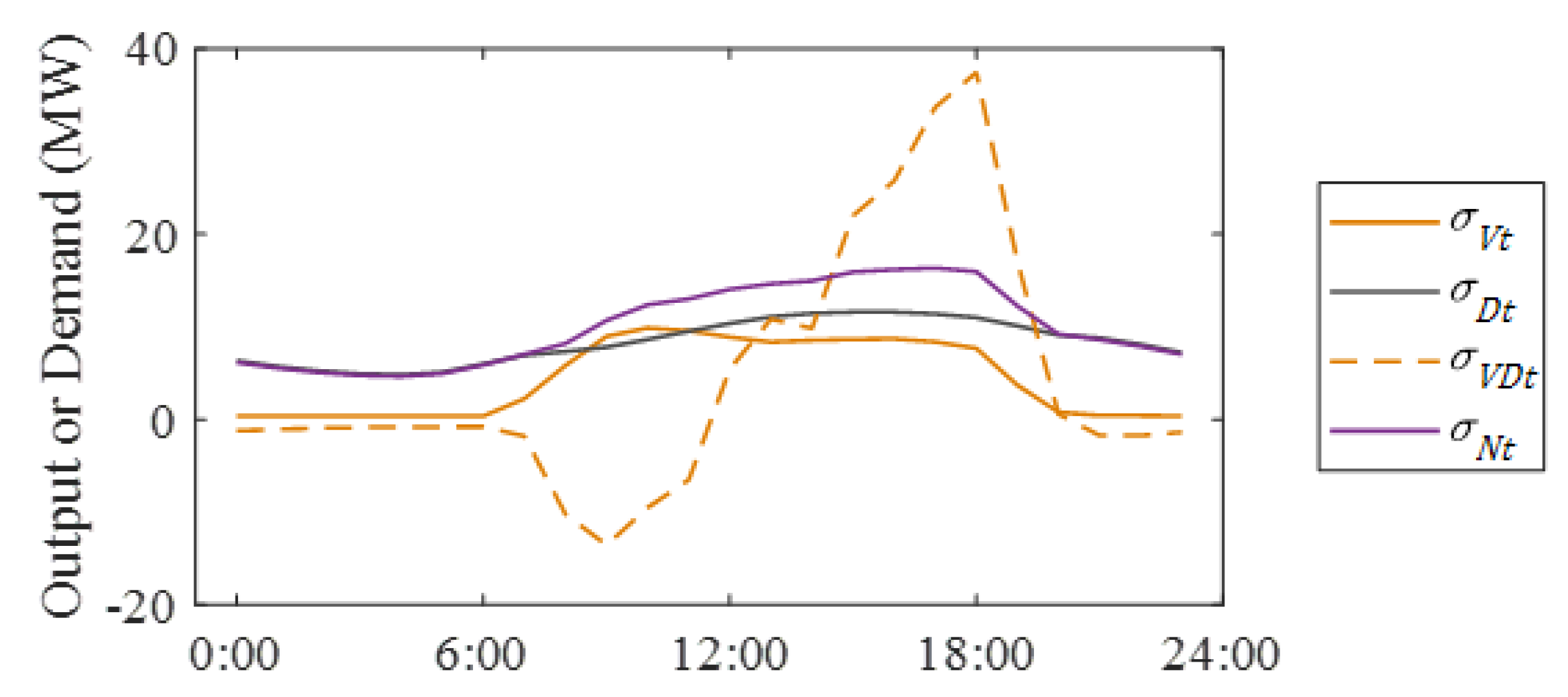

Figure 3 shows the mean PV output (

) and mean demand (

) for the study period, as well as the standard deviations of imbalances (

), derived from each standard deviation and the covariance (i.e.,

,

and

).

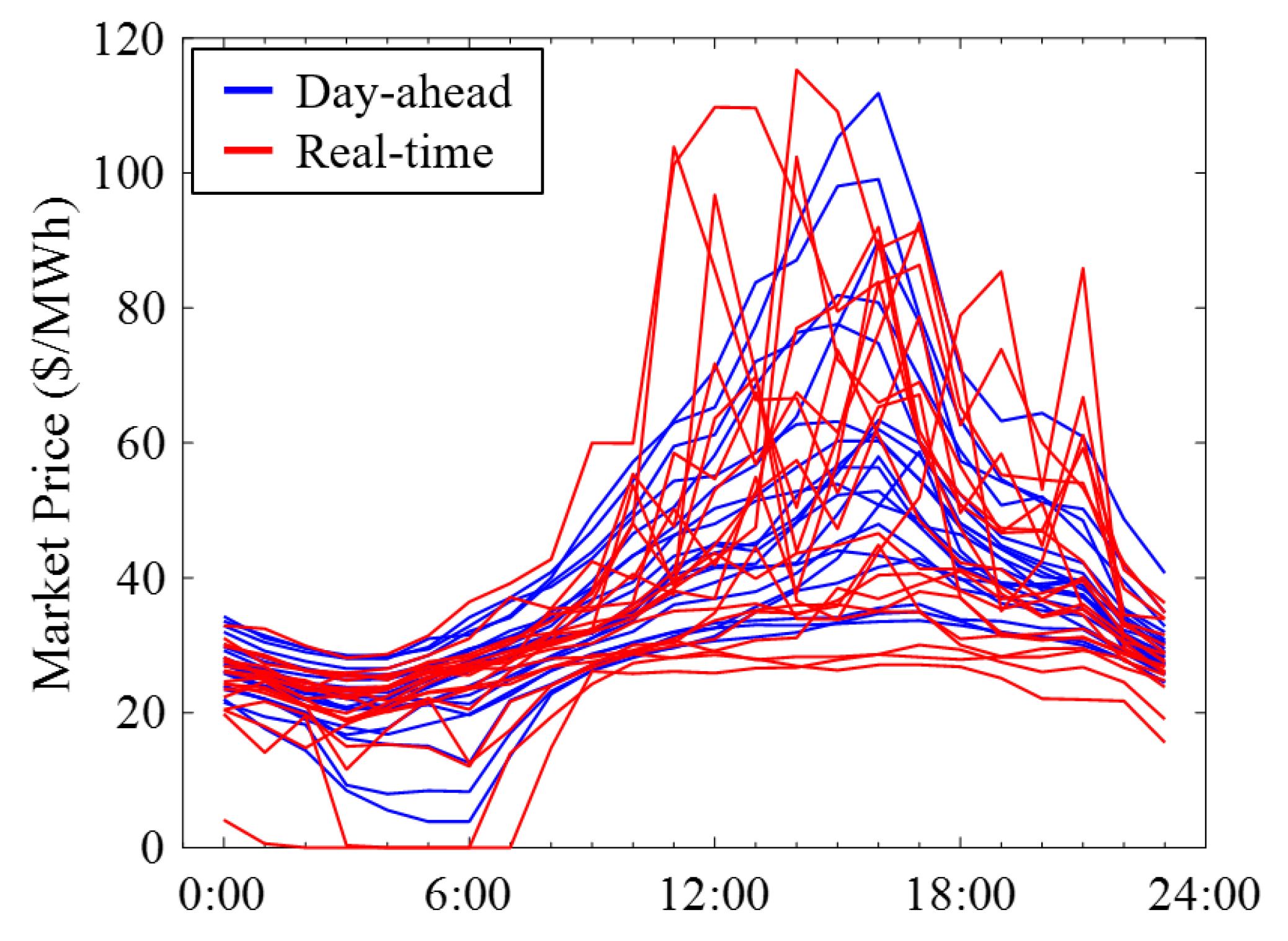

4.1.2. Market Prices

We use the data on prices in the DAM and RTM given in PJM (pricing node: PJM-RTO) [

23,

24], as well as the PV output and demand. The data cover the period 1 July–30 September, which is the same period used for the PV output and demand, for the four years between 2014 and 2017. Therefore, there are 368 scenarios. The probability of each scenario is divided equally:

.

Figure 4 shows samples of the DAM and RTM prices.

4.1.3. Self-Generation

The number of self-generating units is set to one (i.e.,

), and the type of generator is set as an oil-fired power plant as a dispatchable generator. The capacity of generation is set to 100 MW, and all parameters are taken from the generation unit at bus 7 in the IEEE Reliability Test System (RTS) [

25]. As for the generation costs for the above unit,

,

and

are

,

and

, respectively. The parameters related to generator outputs are as follows:

,

and

are set to 0 MW, 100 MW and 100 MW, respectively.

4.1.4. ESSs

The installation cost of an ESS,

, is 0.50 million [

26], and the daily cost of an ESS,

, is 177

$/day, from Equation (

2). Moreover, we add upper limits to the installed capacities of ESSs of 50 MWh, which is equal to the size of settled PVs. This is because the optimization problem is unbounded in some cases.

4.1.5. Others

All the simulations in

Section 3 are carried out on a computer configured as Intel(R) Core(TM) i7-6700 CPU (Intel Corporation, Santa Clara, CA, USA) 3.40 GHz and 32.0 GB of RAM and using MATLAB (2017a, The MathWorks, Inc., Natick, MA, USA).

4.2. Simulation Results

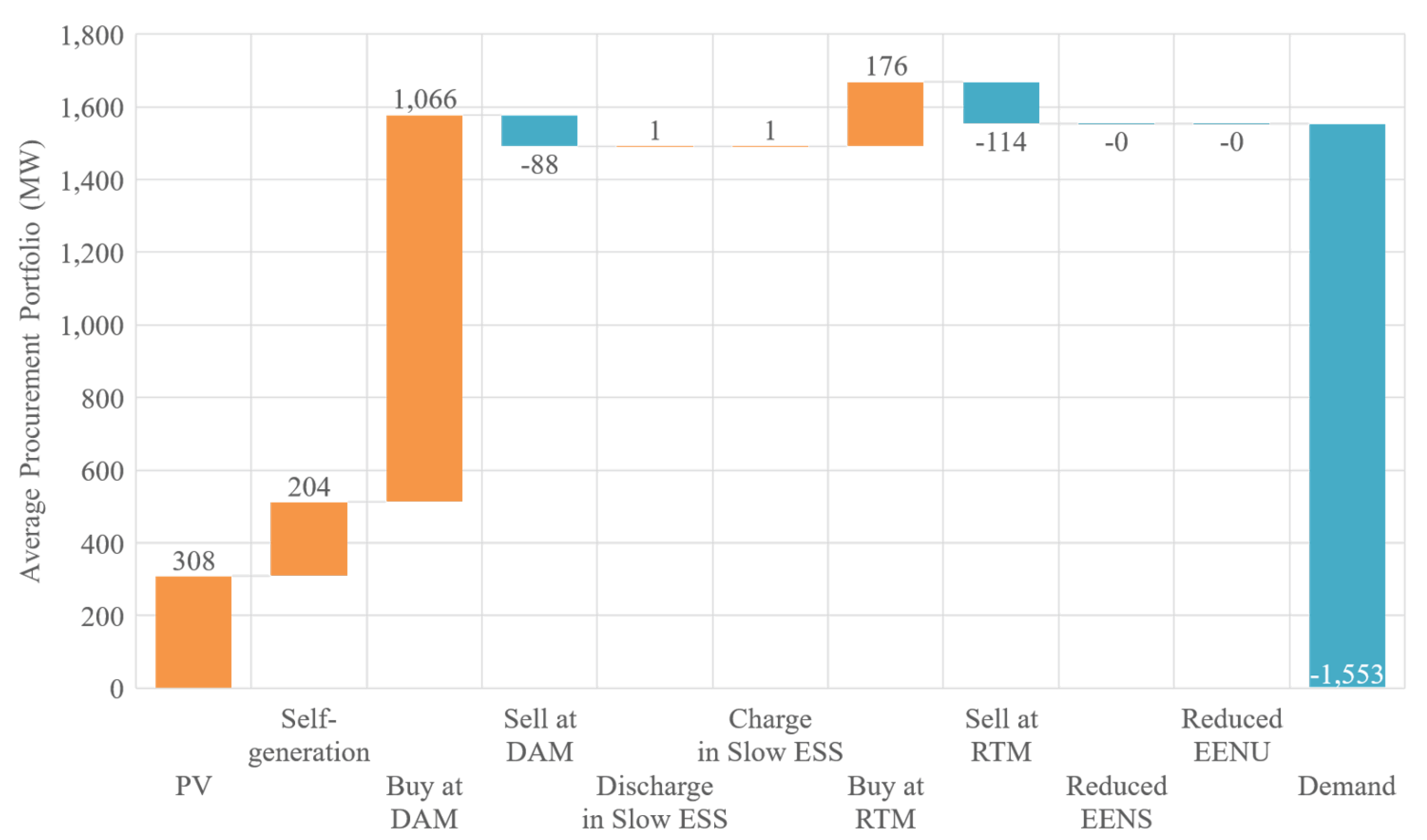

Figure 5 and

Figure 6 shows the aggregated results of all scenarios derived from the QPS-EPP.

Figure 5 shows the average profit and loss of procurement, divided into each source, and

Figure 6 shows the average power procurement portfolio for all scenarios. Several findings are evident from these simulation results: (1) the amount of procured electricity from self-generation is not large, but the procurement cost is high; (2) PAs procure electricity mainly from a DAM; (3) the amount of electricity sold is smaller than bought; and (4) ESSs are only installed in a few cases.

First, almost half the total procurement cost is for self-generation, with the remainder comprising purchases from the DAM. On the other hand, the amount of power procured from the DAM is much larger than that from self-generation. This is because of the generation cost is independent of (i.e., ). However, some results described later show that self-generation is used effectively when the price on the DAM is relatively high.

Second, PAs bought a large amount of electricity on the DAM because this market had the greatest price advantage. This is obvious after comparing the amount of bought electricity and the procured amount.

Third, the amount of electricity sold is smaller than that bought. The first reason for this is that the operating duration was mainly in summer, when power shortages often occur, which may have resulted in higher market prices. The second reason is that the size of settled PVs is not sufficient to cause power surpluses. Even though power shortages are likely to occur in the overall market, PAs that have large sources can sell electricity in the markets. PV output is the best source of electricity to be sold because the operational costs are zero. However, PAs do not have sufficient PVs for this option.

Fourth, as shown in

Figure 5 and

Figure 6, the sizes of the slow and fast ESSs are small, overall. This is obviously because of their high costs, although both ESSs were installed and used effectively and sufficiently in some cases.

Figure 7 and

Figure 8 shows some of the cases when ESSs were installed and utilized, including the operations in each scenario. The first figure shows the procurement result on 25 September 2017, when slow ESSs were installed and utilized. The second figure shows the result on 20 July 2015, when fast ESSs were installed. In general, as shown in

Figure 7 and

Figure 8, PAs procure electricity from the DAM when the day-ahead (DA)price is low and use self-generation when the price is high. Moreover,

is

in the case of

, and vice versa.

On 25 September 2017, slow ESSs were installed up to the upper limits because the DA price was relatively higher than on other days. Given the expected operation at , slow ESSs were charged when the DA price was lower and then discharged immediately after the price increased. This means that arbitrage using slow ESSs in the DAM was practiced perfectly. On the other hand, fast ESSs were not installed because the real-time (RT)price was low. Moreover, the amount of electricity bought on the RTM was large because the RT price was lower than the DA almost all day, resulting in .

On 20 July 2015, fast ESSs for shortages were installed and discharged at some t in the case of . As a result, PAs were able to avoid buying electricity on the RTM. The sizes of the installed fast ESSs, , were 139.7 MWh, which depended on and , owing to the functions .

Finally, we explain the principal used to determine the size of an installed slow and fast ESSs, based on simulation results and the above discussion.

Table 1 shows the data on ESS sizes, which include the minimum, maximum and average capacity of each ESS in all scenarios, the number of scenarios in which each ESS was installed and the average capacity of each ESS among those scenarios. Several viewpoints can be considered by decision-makers when determining the size of each ESS: conservative, cost-savings and balanced. First, conservative decision-makers should install the maximum size because they can avoid paying more than usual in any cases considered. Second, cost-saving-minded decision-makers should install the minimum or average sizes for all scenarios. However, it might be meaningless to install a limited size of ESS, because a certain size is required to adapt to a day when PAs charge or discharge ESSs. Third, balanced-minded decision-makers should install the average size for days with ESSs, because this will enable them to employ intermediate scenarios, when PAs without ESSs could pay more. Regardless of the nature of a decision-maker, we need to note the following. The simulation results are based only on the given scenarios, and are underestimated owing to certain assumptions. In addition, decision-makers should consider how to utilize ESSs in ways other than arbitrage and to reduce payments in an RTM, such as ancillary services and demand response programs.

5. Conclusions

Minimizing the procurement costs of electricity is a critical problem for PAs, but multiple factors associated with uncertainties are inevitable, including market prices, PV output and demand. To hedge against risks in energy procurement, this study focused on settlements in multi-period markets (a DAM and an RTM) and on the installation of ESSs. Although ESSs can be utilized for time arbitrage in the DAM and to reduce purchases/sales of electricity in the RTM, the size of ESSs should be minimized owing to their high costs. Furthermore, it is important that we distinguish between the sizes of ESSs appropriate for different roles. Therefore, we proposed an evaluation method that combines probabilistic and scenario-based approaches and employed the concept of “slow” and “fast” ESSs to quantify the sizes of the different roles. Because the optimization problem is formulated as a large-scale quadratic problem with nonlinear and non-convex constraints, it is generally difficult to derive exact solutions within a realistic computational burden. To overcome this issue, we made several reasonable assumptions based on the characteristics of the problems and then transformed the problem into a linear-constrained quadratic problem. Using simulations on a large amount of historical data, we verified that the sizes and schedules of ESSs were determined appropriately, distinguishing between time arbitrage and reductions of settlements in the RTM.

In future work, we intend to incorporate bidding models in the markets to investigate the optimality of the proposed framework by solving the EPP directly. In addition, it is expected that our methodology can determine the sizes of ESSs considering prediction errors, by preparing several kinds of scenarios. However, the proposed method does not include prediction errors in terms of the formulations, so our future work is to propose the systematic methodology which can include the prediction errors related to market prices, PV output and demand.