Transactive Demand Side Management Programs in Smart Grids with High Penetration of EVs †

Abstract

:1. Introduction

- (1)

- The technical constraints of the power system need to be considered. EVs considerably increase the electricity demand and have significant influences on the power system. The adverse effects of high penetration level of EVs on the power grid when they charge themselves in the grid to vehicle (G2V) mode are briefly reviewed in [3]. However, in the vehicle to grid (V2G) mode, active and reactive power injected to the network by EVs, if controlled well, can decrease the peak power [12] and provide ancillary services [13] instead of causing adverse effects. Therefore, although most of existing DSM programs neglect the technical constraints of the power system to simplify mathematical calculations [11], considering the technical constraints is critical for practical deployment of future power systems.

- (2)

- Individual benefit of each customer needs to be taken into account. If whole network welfare is selected as a goal function, customers may be discouraged from participating in the DSM program. A multi-agent framework is proposed in [14] to minimize the electricity bill of each household while considering the piecewise linear function for each customer’s cost. Still, this method neglects the influence of customers’ decision on each other and so it cannot prevent rebounding peaks.

- (3)

- Indirect control methods are needed to give decision authorities to the customers. Generally, DSM programs can be categorized into two types based on the control method used: direct and indirect. In direct control methods, elastic loads, including EVs, are directly controlled by a central entity of aggregators or retailers in their region. On the other hand, in indirect control methods, customers make their own decisions on elastic loads. Here, the job of the retailers is to indirectly lead customers to the desirable optimum by changing the price electricity or giving incentives to them. Since direct methods can relatively better handle the uncertainties associated with charging of EVs, e.g., departure or arrival times, most of the researchers prefer direct methods. For example, the demand peak is minimized by directly controlling EVs in [15], the cost of the whole network is decreased using a day-ahead pricing model in the presence of EVs in [16], and the direct charging and discharging method is developed to sell spinning reserve in the wholesale market in [17]. However, the common problem of direct methods is that they take away the decision authority from customers, which may decrease the popularity and security of DSM programs [18]. Therefore, indirect methods are more promising as they are more likely to lead to consumer’s acceptance than the direct methods [19]. An indirect scheduling algorithm for EVs having an experimental demonstration at the National Technical University of Athens is presented in [20]. Although in indirect methods implementing, considering the effects of other customers’ decision is crucial. For instance, in a real system, since all customers want to optimize their own cost, they may make similar decisions, simultaneously and/or collectively, to produce a major impact on the power system known as an avalanche effect [19] or a rebound peak [8,9].

- (4)

- Imperfect competition model needs to be used to more accurately model the effects of independent customers. There are two models for competitive markets: perfect and imperfect. The perfect competition model assumes that the market price is not dependent on the decision of each participant. This model is relatively simple and many researchers adopt this model. However, an independent price may lead to rebound peaks. On the other hand, an imperfect competition or oligopoly model can be used to consider the effects of all customers’ decisions. In particular, Cournot competition model, which is an oligopoly model used to describe a market with multiple players competing for production, can be used to independently maximize their profit given their competitors’ decisions [21]. However, since using this model on a system having many participants increases the complexity of the problem, some simplification or approximation is necessary to have a feasible problem. In this direction, the authors of [22] used Cournot competition to model a dynamic price for an intelligent building without EVs and made some simplifying assumptions, such as linear inverse demand curve or having exclusive energy storage device, to solve their problem. This however limits the practicability of their approach.

- Solving the first challenge: Technical constraints of the power system are considered to prevent rebound peaks.

- Solving the second challenge: Customer participation is encouraged by minimizing the cost of each customer instead of the whole network.

- Solving the third challenge: Use of indirect method gives decision authorities to customers.

- Solving the fourth challenge: Cournot imperfect competition model takes into account the effect of decisions made by individual customers.

- Solving the implementation difficulties: The proposed heuristic two-stage iterative method solves the non-linear optimization problem quick enough for real-time operations.

2. Problem Formulation

2.1. Power System Model

2.2. Electrical Vehicle Model

2.3. Elastic Appliances Model

2.4. Transactive DSM Model

3. The Heuristic Two-Stage Iterative Method

3.1. First Stage: Customer Side

3.2. Scheduling Start Time of Elastic Appliances

| Algorithm 1. First Stage—Part 1: Schedule Elastic Appliances |

| 1: Order the i-th customer’s elastic appliances from the smallest tend,ik − td,ik (k = 1) to the largest tend,ik − td,ik (k = ne,i). |

| 2: For k = 1 to ne,i do |

| 3: Calculate for |

| 4: Check the constraint (5) for all |

| 5: Select the lowest cost that satisfies (5). |

3.3. Scheduling Charging and Discharging of EVs

| Algorithm 2. First Stage—Part 2: Schedule EVs |

| 1: Calculate Et,i from (15). |

| 2: Order the time interval (from the lowest price to the highest price). |

| 3: While Et,i > 0 do (sequentially from the list of line 2) |

| 4: Calculate PEV,i(t) using (16). |

| 5: Update Et,i and pmax,ch,i(t) using (17) and (18). |

| 6: Calculate the SOC for all intervals from (7). |

| 7: Order all possible combinations of (th − tl) (in decreasing order). |

| 8: While ProfitV2G,ihl > 0 do (sequentially from the list created in line 7) |

| 9: Calculate ProfitV2G,ihl using (19) and (20). |

| 10: Update pEV,i, pmax,dch,i(td), and pmax,ch,i(tl) using (21)–(24). |

3.4. Second Stage: Grid Side

| Algorithm 3. Second Stage—Part 1: Update New Price and Equilibrium Limits |

| 1: For i = 1 to k (k = the iteration count) do |

| 2: If πi < πi+1 then πmin = min(πmin, πi) |

| 3: If πi > πi+1 then πmax = max(πmax, πi) |

| 4: πnew = (πmin + πmax)/2 |

| Algorithm 4. Second Stage—Part 2: Allocate of Residual Power |

| 1: Select πmax as π*. |

| 2: Calculate P (πmax) from Algorithm 1 and 2. |

| 3: Calculate P* from supply curve. |

| 4: Pres = P* − P (πmax) |

| 3: While Pres > 0 do |

| 4: Select an EV randomly, change its price to πmin, and calculate Pi (πmax). |

| 5: Pres = Pres − (Pi (πmin) − Pi (πmax)) |

4. Case Study

4.1. Simulation Setup

4.2. Simulation Result

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

References

- Richardson, D.B. Electric vehicles and the electric grid: A review of modeling approaches, impacts, and renewable energy integration. Renew. Sustain. Energy Rev. 2013, 19, 247–254. [Google Scholar] [CrossRef]

- Al-Alawi, B.M.; Bradley, T.H. Review of hybrid, plug-in hybrid, and electric vehicle market modeling studies. Renew. Sustain. Energy Rev. 2013, 21, 190–203. [Google Scholar] [CrossRef]

- Han, X.; Yuan, H.; Wei, C.; Li, H. A survey of influence of electrics vehicle charging on power grid. In Proceedings of the 2014 IEEE 9th Conference on Industrial Electronics and Applications (ICIEA), Hangzhou, China, 9–11 June 2014; pp. 121–126. [Google Scholar]

- Benefits of Demand Response in Electricity Markets and Recommendations for Achieving Them; Department of Energy: Washington, DC, USA, 2006.

- Parvania, M.; Fotuhi-Firuzabad, M. Demand response scheduling by stochastic scuc. IEEE Trans. Smart Grid 2010, 1, 89–98. [Google Scholar] [CrossRef]

- Braithwait, S. Behavior modification. IEEE Power Energy Mag. 2010, 8, 36–45. [Google Scholar] [CrossRef]

- Berger, A.W.; Schweppe, F.C. Real time pricing to assist in load frequency control. IEEE Trans. Power Syst. 1989, 4, 920–926. [Google Scholar] [CrossRef]

- Safdarian, A.; Fotuhi-Firuzabad, M.; Lehtonen, M. A distributed algorithm for managing residential demand response in smart grids. IEEE Trans. Ind. Inform. 2014, 10, 2385–2393. [Google Scholar] [CrossRef]

- Chang, T.-H.; Alizadeh, M.; Scaglione, A. Real-time power balancing via decentralized coordinated home energy scheduling. IEEE Trans. Smart Grid 2013, 4, 1490–1504. [Google Scholar] [CrossRef]

- Vardakas, J.S.; Zorba, N.; Verikoukis, C.V. A survey on demand response programs in smart grids: Pricing methods and optimization algorithms. Commun. Surv. Tutor. 2015, 17, 152–178. [Google Scholar] [CrossRef]

- Divshali, P.H.; Choi, B.J. Electrical market management considering power system constraints in smart distribution grids. Energies 2016, 9, 405. [Google Scholar] [CrossRef]

- Kempton, W.; Letendre, S.E. Electric vehicles as a new power source for electric utilities. Transp. Res. Part D Transp. Environ. 1997, 2, 157–175. [Google Scholar] [CrossRef]

- Weiller, C. Plug-in hybrid electric vehicle impacts on hourly electricity demand in the united states. Energy Policy 2011, 39, 3766–3778. [Google Scholar] [CrossRef]

- Yue, M.; Wang, X. Grid inertial response-based probabilistic determination of energy storage system capacity under high solar penetration. IEEE Trans. Sustain. Energy 2015, 6, 1039–1049. [Google Scholar] [CrossRef]

- McNamara, P.; McLoone, S. Hierarchical demand response for peak minimization using dantzig-wolfe decomposition. IEEE Trans. Smart Grid 2015, 6, 2807–2815. [Google Scholar] [CrossRef]

- Logenthiran, T.; Srinivasan, D.; Shun, T.Z. Demand side management in smart grid using heuristic optimization. IEEE Trans. Smart Grid 2012, 3, 1244–1252. [Google Scholar] [CrossRef]

- O’Brien, G.; El Gamal, A.; Rajagopal, R. Shapley value estimation for compensation of participants in demand response programs. IEEE Trans. Smart Grid 2015, 6, 2837–2844. [Google Scholar] [CrossRef]

- Kuran, M.S.; Viana, A.C.; Iannone, L.; Kofman, D.; Mermoud, G.; Vasseur, J.P. A smart parking lot management system for scheduling the recharging of electric vehicles. IEEE Trans. Smart Grid 2015, 6, 2942–2953. [Google Scholar] [CrossRef]

- Dallinger, D.; Wietschel, M. Grid integration of intermittent renewable energy sources using price-responsive plug-in electric vehicles. Renew. Sustain. Energy Rev. 2012, 16, 3370–3382. [Google Scholar] [CrossRef]

- Xydas, E.; Marmaras, C.; Cipcigan, L.M. A multi-agent based scheduling algorithm for adaptive electric vehicles charging. Appl. Energy 2016, 177, 345–365. [Google Scholar] [CrossRef]

- Kirschen, D.S.; Strbac, G. Fundamentals of Power System Economic; John Wiley & Sons: New York, NY, USA, 2004. [Google Scholar]

- La, Q.D.; Chan, Y.W.E.; Soong, B.-H. Power management of intelligent buildings facilitated by smart grid: A market approach. IEEE Trans. Smart Grid 2016, 7, 1389–1400. [Google Scholar] [CrossRef]

- Kok, K.; Widergren, S. A society of devices: Integrating intelligent distributed resources with transactive energy. IEEE Power Energy Mag. 2016, 14, 34–45. [Google Scholar] [CrossRef]

- Grainger, J.G.; Stevenson, W.D., Jr. Power System Analysis; McGraw-Hill Education: Bhopal, Madhya Pradesh, India, 2003. [Google Scholar]

- Chang, G.; Chu, S.; Wang, H. An improved backward/forward sweep load flow algorithm for radial distribution systems. IEEE Trans. Power Syst. 2007, 22, 882–884. [Google Scholar] [CrossRef]

- Shafie-Khah, M.; Heydarian-Forushani, E.; Osorio, G.J.; Gil, F.A.; Aghaei, J.; Barani, M.; Catalao, J.P. Optimal behavior of electric vehicle parking lots as demand response aggregation agents. IEEE Trans. Smart Grid 2016, 7, 2654–2665. [Google Scholar] [CrossRef]

- Divshali, P.H.; Choi, B.J. Indirect demand side management program under realtime pricing in smart grids using oligopoly market model. In Proceedings of the First International Conference on Green Communications, Computing and Technologies (GREEN 2016), Nice, France, 24–28 July 2016. [Google Scholar]

- Della Vedova, M.L.; Facchinetti, T. Real-time scheduling for peak load reduction in a large set of hvac loads. In Proceedings of the Third International Conference on Smart Grids, Green Communications and IT Energy-aware Technologies (ENERGY), Lisbon, Portugal, 24–29 March 2013; IARIA: Lisbon, Portugal, 2013; pp. 161–166. [Google Scholar]

- Divshali, P.H.; Choi, B.J. Indirect real-time evs charging technique based on an imperfect competition market. In Proceedings of the IEEE International Conference on Smart Grid Communications (SmartGridComm), Sydney, Australia, 6–9 November 2016. [Google Scholar]

- Moradzadeh, B.; Tomsovic, K. Two-stage residential energy management considering network operational constraints. IEEE Trans. Smart Grid 2013, 4, 2339–2346. [Google Scholar] [CrossRef]

- Al-Hinai, A.; Sedhisigarchi, K.; Feliachi, A. Stability enhancement of a distribution network comprising a fuel cell and a microturbine. In Proceedings of the IEEE Power Engineering Society General Meeting, Denvor, CO, USA, 6–10 June 2004; IEEE: Denvor, CO, USA, 2014; pp. 2156–2161. [Google Scholar]

- Richardson, I.; Thomson, M.; Infield, D.; Clifford, C. Domestic electricity use: A high-resolution energy demand model. Energy Build. 2010, 42, 1878–1887. [Google Scholar] [CrossRef]

- Richardson, I.T. Domestic Electricity Demand Model—Simulation Example. Available online: https://dspace.lboro.ac.uk/dspace-jspui/handle/2134/5786CREST_Domestic_electricity_demand_model_1.0e(1).xlsm (accessed on 13 June 2016).

- Neubauer, J.; Brooker, A.; Wood, E. Sensitivity of battery electric vehicle economics to drive patterns, vehicle range, and charge strategies. J. Power Sources 2012, 209, 269–277. [Google Scholar] [CrossRef]

- Morrow, K.; Karner, D.; Francfort, J. Plug-In Hybrid Electric Vehicle Charging Infrastructure Review. Available online: https://avt.inl.gov/sites/default/files/pdf/phev/phevInfrastructureReport08.pdf (accessed on 18 October 2017).

- Smartgridcity Pricing Plan Comparison Chart. Available online: http://smartgridcity.xcelenergy.com/media/pdf/SGC-pricing-plan-chart.pdf (accessed on 13 June 2016).

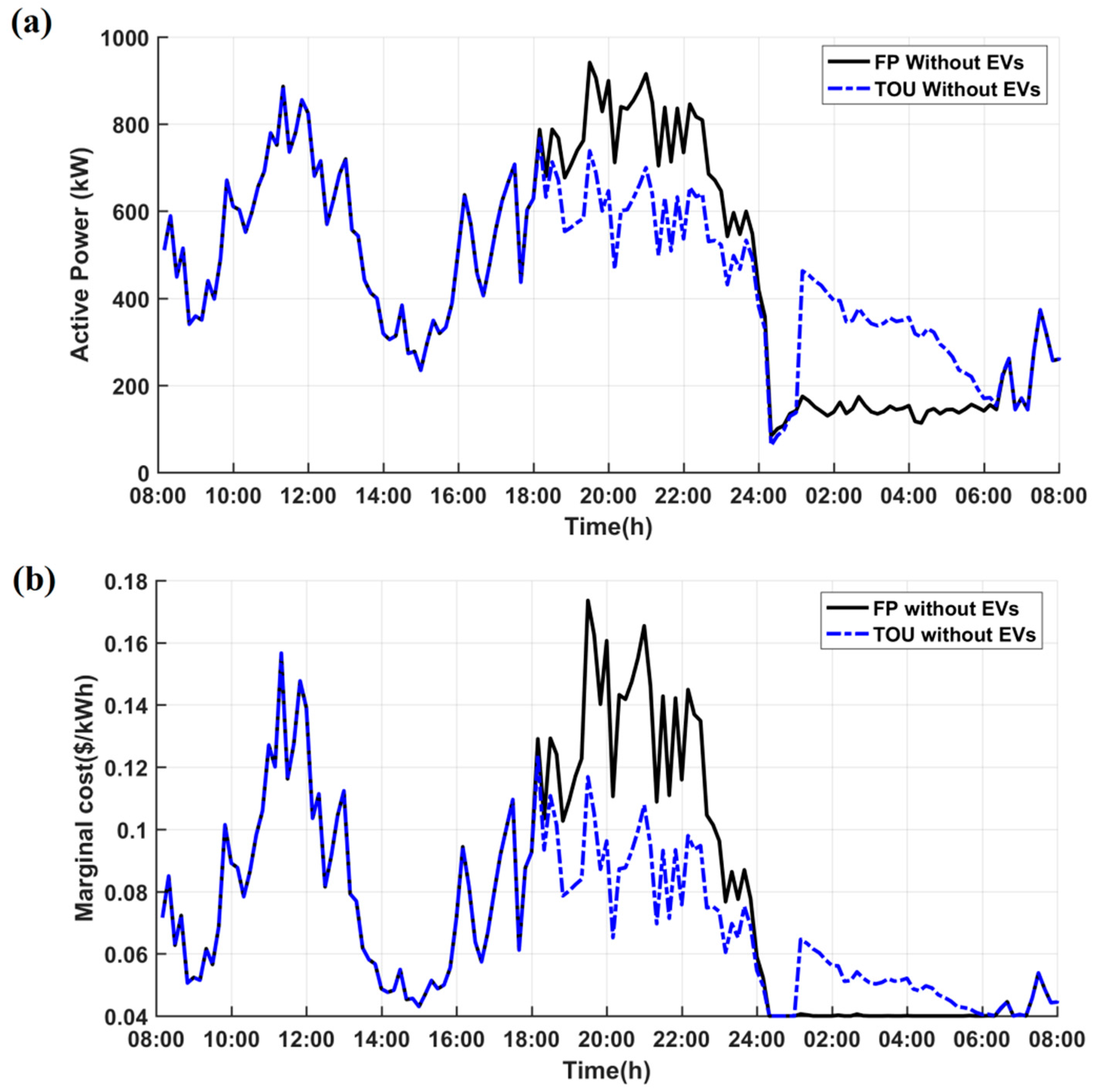

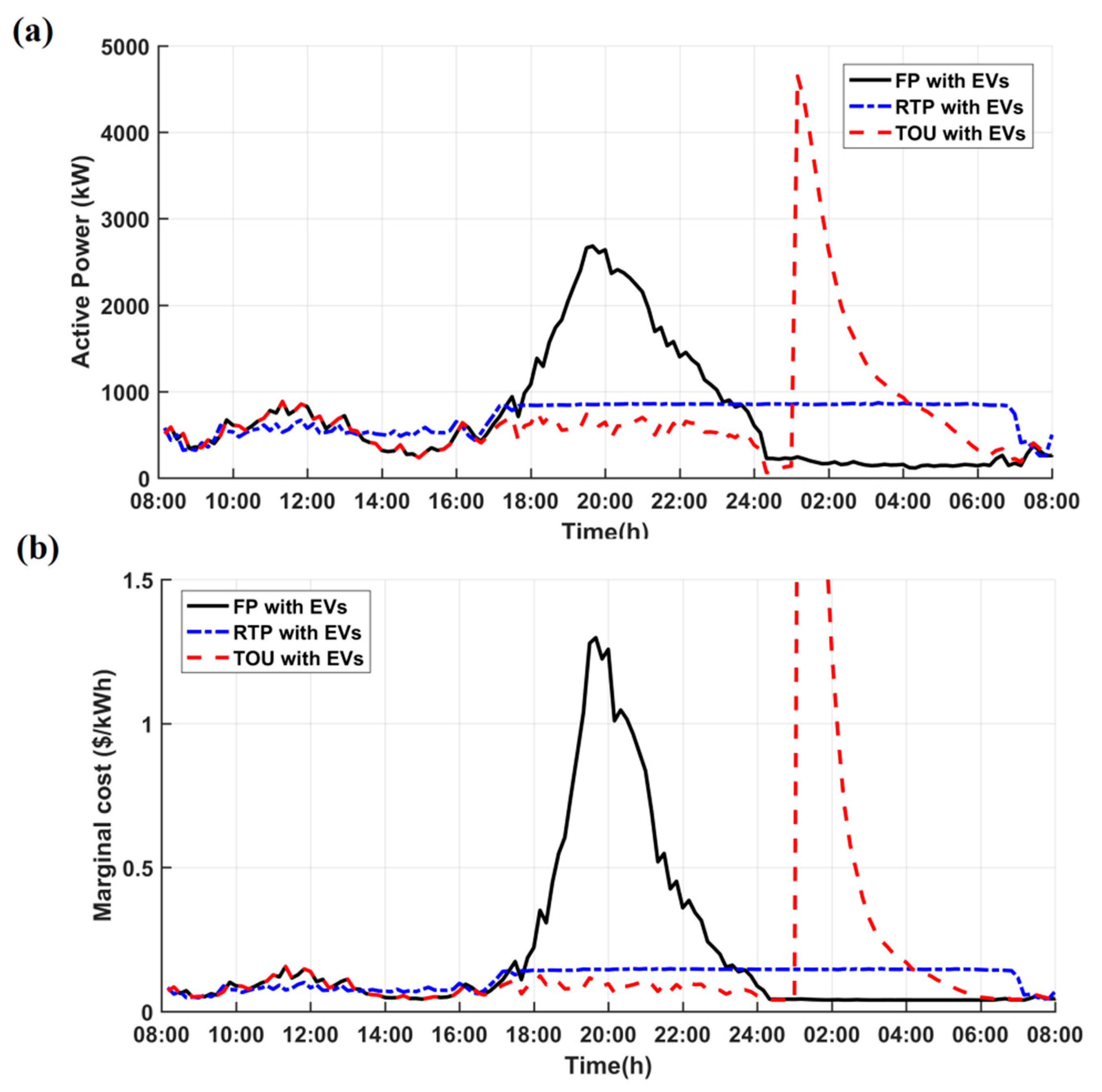

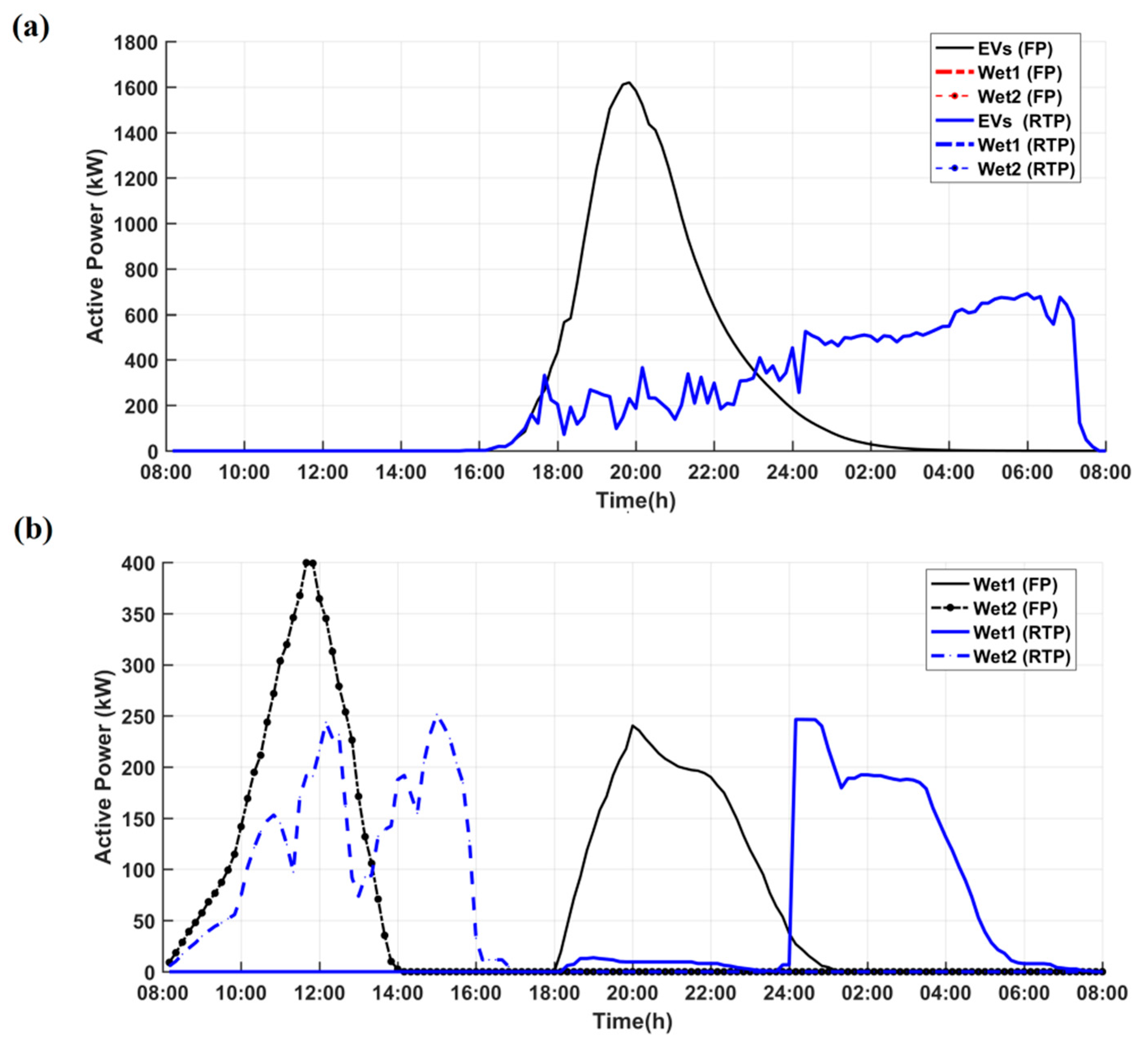

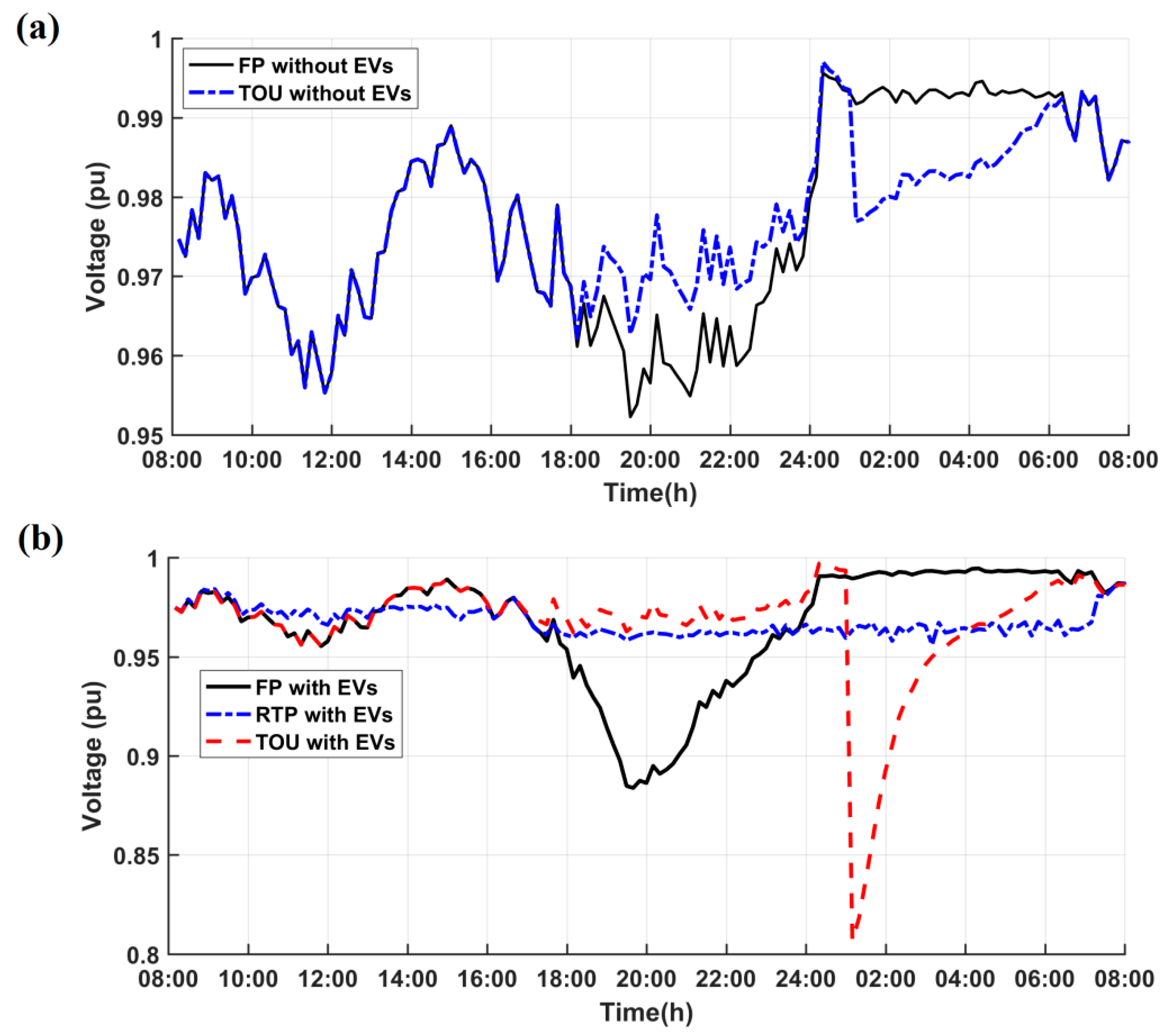

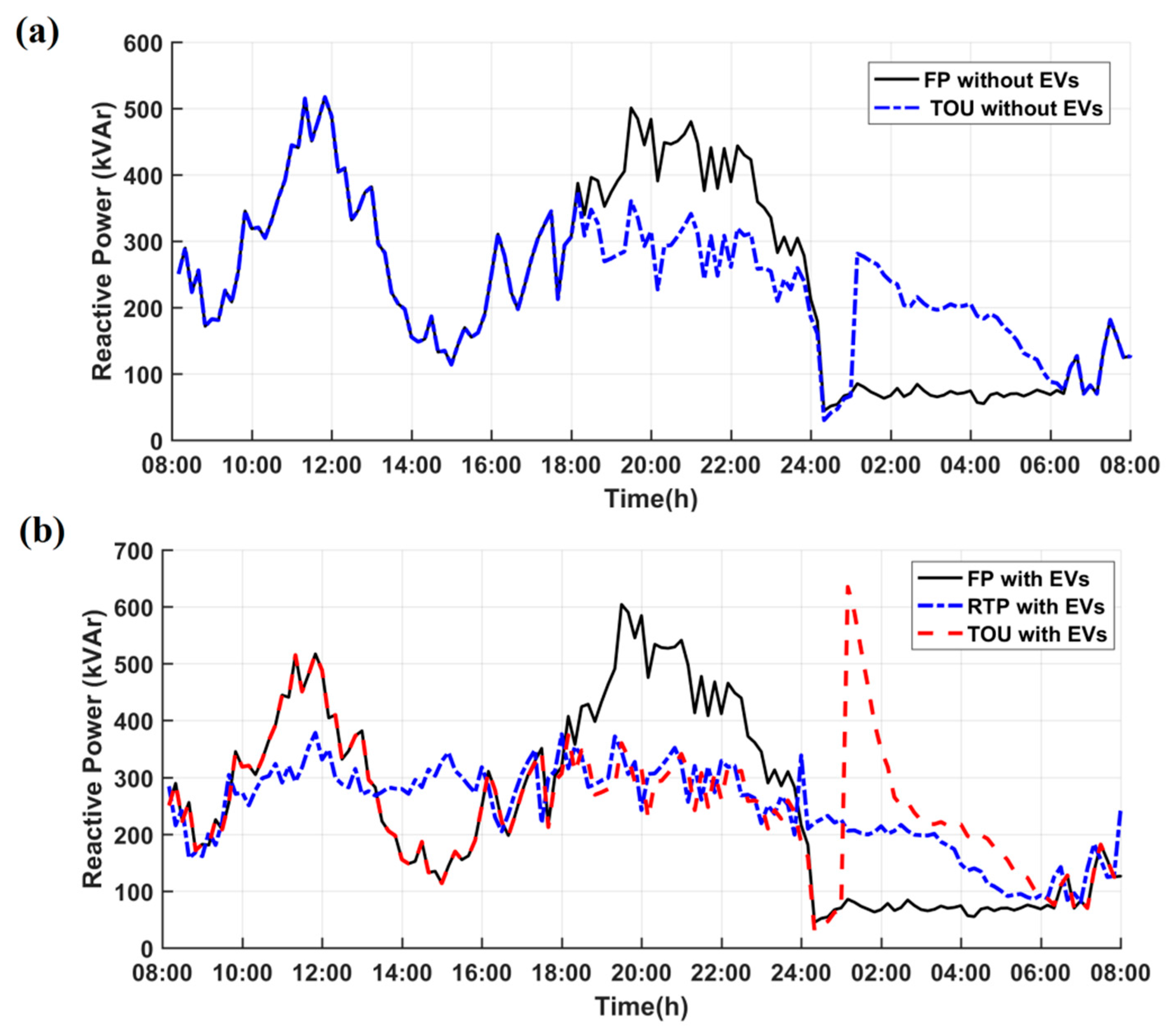

| Case | Description | Pmax (kW) | Qmax (kVAr) | MCmax ($/kW) | Eloss/∑P (%) | Vmin (%) | Inelastic Cost ($) | Wet1 Cost ($) | Wet2 Cost ($) | EVs Cost ($) | Total Energy Cost ($) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | FR without EVs | 941 | 517 | 0.1736 | 1.86 | 95.23 | 5019 | 720 | 677 | - | 6416 |

| 2 | FR with EVs | 2682 | 604 | 1.2979 | 3.57 | 88.38 | 15,496 | 3871 | 677 | 25,370 | 45,414 |

| 3 | TOU without EVs | 886 | 517 | 0.1567 | 1.63 | 95.53 | 4301 | 298 | 677 | - | 5275 |

| 4 | TOU with EVs | 4650 | 635 | 3.9418 | 3.74 | 80.64 | 7340 | 5484 | 677 | 54,465 | 67,966 |

| 5 | Proposed RTP without EVs | 767 | 378 | 0.1239 | 1.55 | 96.22 | 4160 | 269 | 486 | - | 4915 |

| 6 | Proposed RTP with EVs | 860 | 379 | 0.1481 | 2.03 | 95.82 | 6159 | 808 | 499 | 4849 | 12,314 |

| 7 | Proposed RTP with EVs in V2G mode (rb = 5 ¢/kW) | 861 | 379 | 0.1473 | 2.03 | 95.82 | 6150 | 807 | 499 | 4848 | 12,304 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Astero, P.; Choi, B.J.; Liang, H.; Söder, L. Transactive Demand Side Management Programs in Smart Grids with High Penetration of EVs. Energies 2017, 10, 1640. https://doi.org/10.3390/en10101640

Astero P, Choi BJ, Liang H, Söder L. Transactive Demand Side Management Programs in Smart Grids with High Penetration of EVs. Energies. 2017; 10(10):1640. https://doi.org/10.3390/en10101640

Chicago/Turabian StyleAstero, Poria, Bong Jun Choi, Hao Liang, and Lennart Söder. 2017. "Transactive Demand Side Management Programs in Smart Grids with High Penetration of EVs" Energies 10, no. 10: 1640. https://doi.org/10.3390/en10101640