What Accelerates the Choice of Mobile Banking for Digital Banks in Indonesia?

Abstract

:1. Introduction

2. Literature Review

2.1. Decomposed Theory on Planned Behavior (DTPB)

2.2. Hypothesis Development

3. Methods

3.1. Data Collection and Sampling

3.2. Variable and Measure

3.3. Procedure and Data Analysis

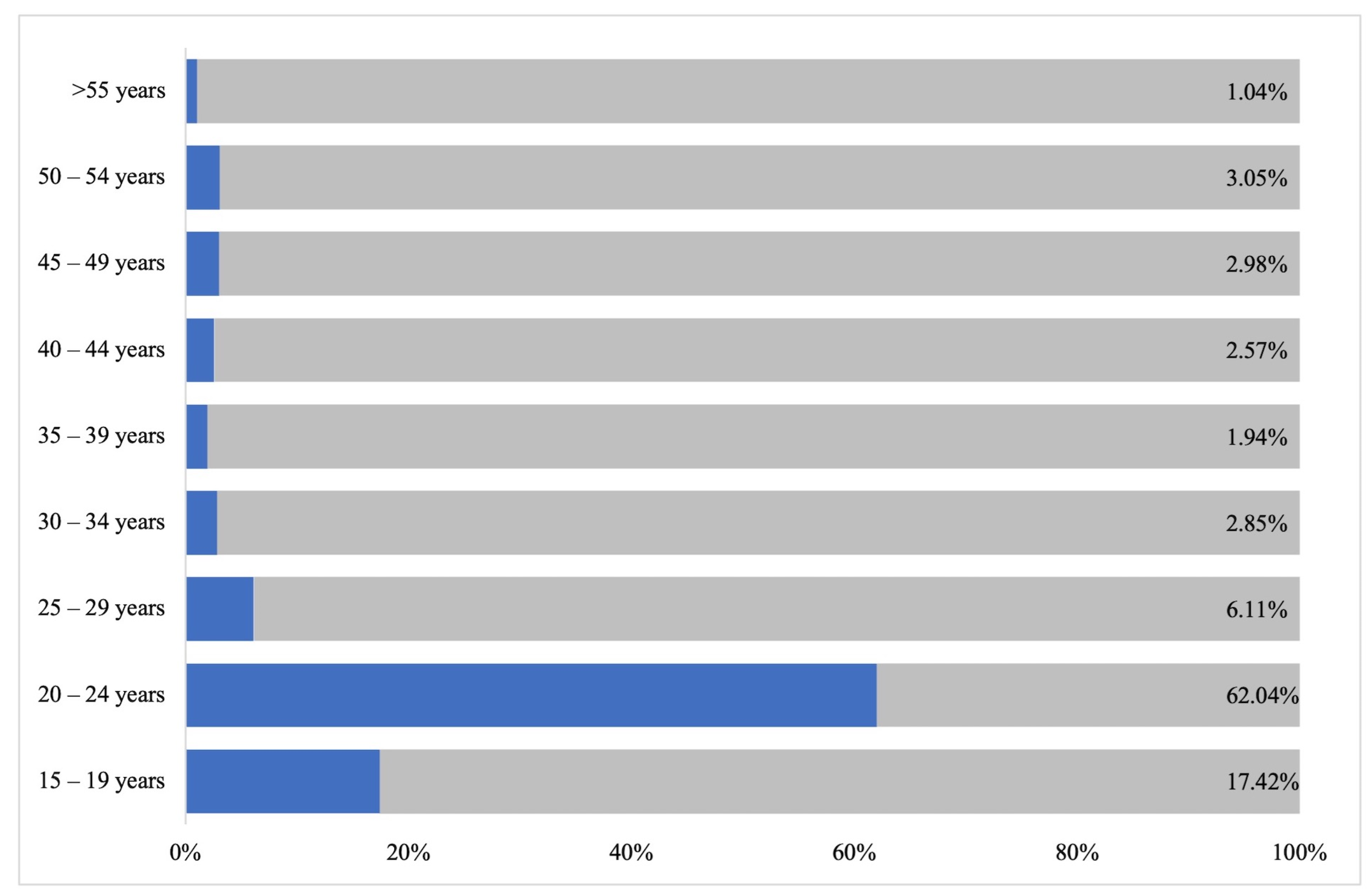

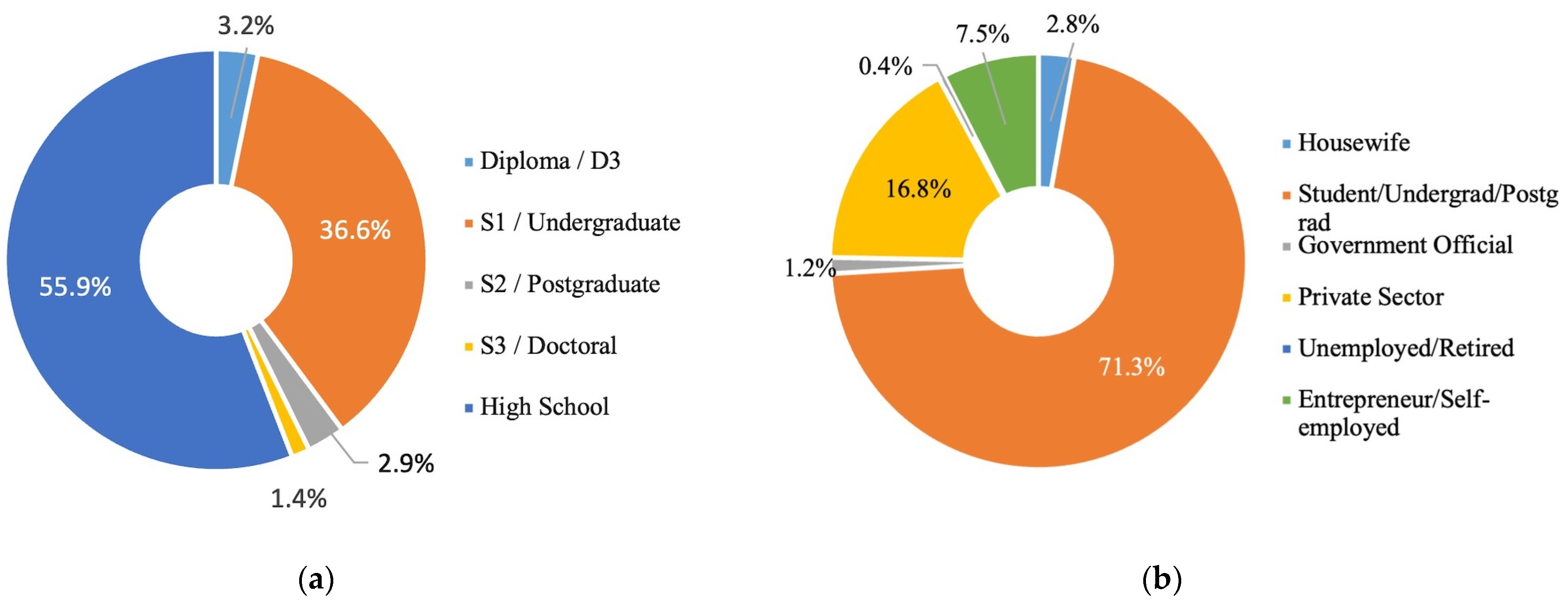

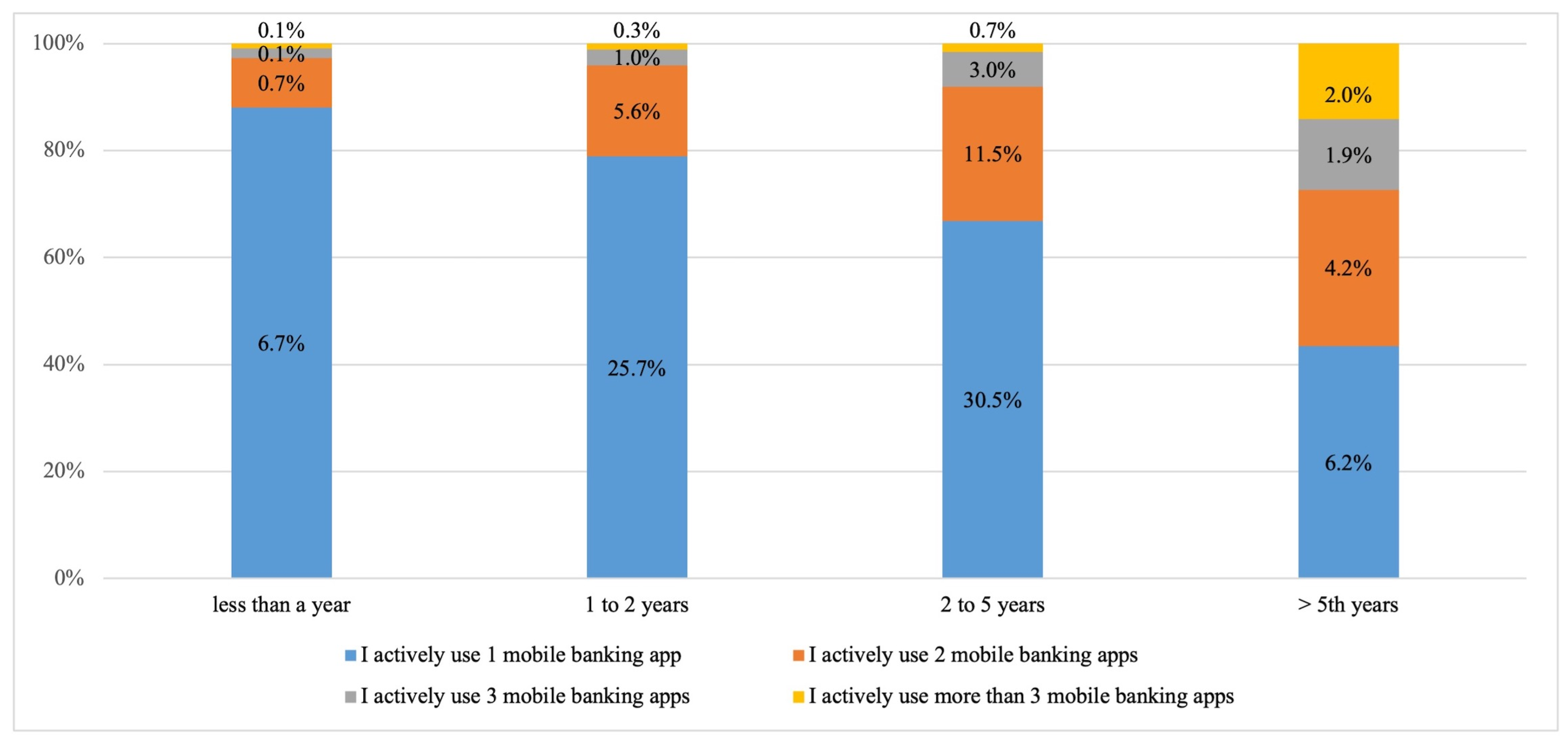

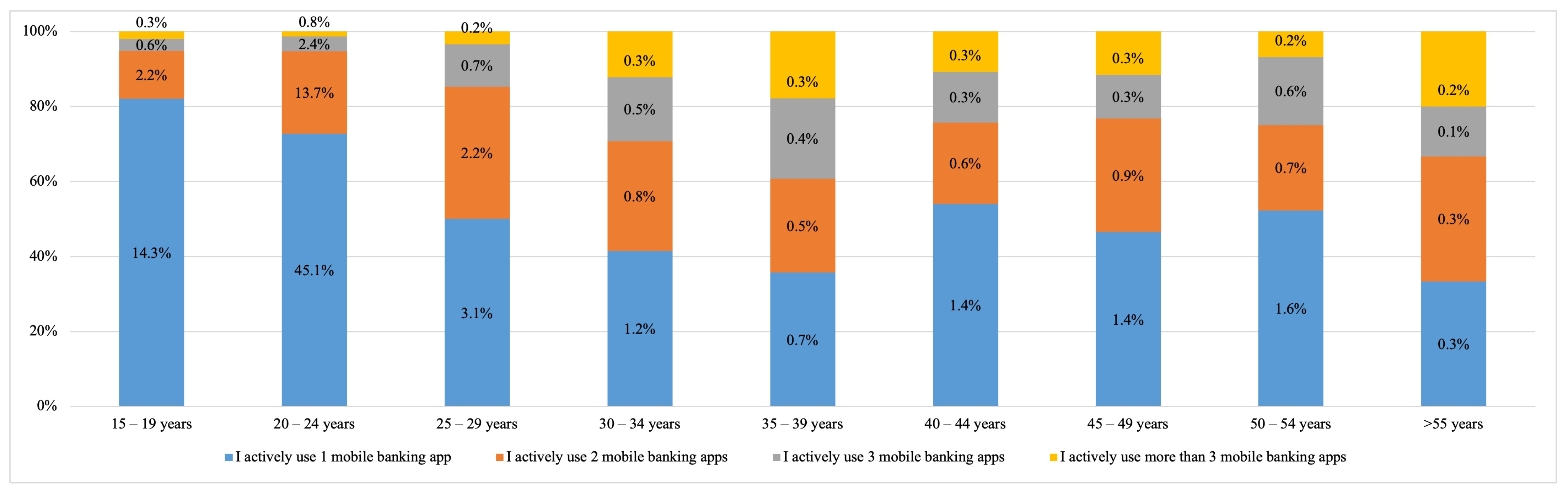

3.4. Descriptive Statistics

4. Results

4.1. The Measurement and Structural Models

4.2. The Model Fit

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Questionnaire Items

| (1) | (2) | (3) | (4) | (5) | (6) | (7) |

| Strongly Disagree | Disagree | Slightly Disagree | Neither Agree nor Disagree | Slightly Agree | Agree | Strongly Agree |

| Variables | Item | |

| Firm Reputation | 1 | I trust my bank |

| 2 | I recommend the services my bank provides | |

| 3 | I recommend my bank as a secure institution | |

| Facilitating conditions | 4 | I have the resources necessary to use mobile banking |

| 5 | I have the knowledge necessary to use mobile banking | |

| Self-efficacy | 6 | If I felt that I wanted to, I could easily use mobile banking by myself |

| 7 | I feel that I am able to use mobile banking even if I currently do not | |

| 8 | I feel comfortable using mobile banking by myself | |

| Interpersonal influence | 9 | I think that my family thinks that I should use mobile banking |

| 10 | I think that my friends think that I should use mobile banking | |

| 11 | I think that people I know think that I should use mobile banking | |

| External influence | 12 | I have read/seen news reports that promote cashless payments using mobile banking |

| 13 | I have read/seen that the press adopts a positive view toward cashless payments using mobile banking | |

| 14 | I have read/seen social media reports that have influenced me to try mobile banking | |

| Perceived usefulness | 15 | During the COVID-19 pandemic, I feel using mobile banking is effective |

| 16 | During the COVID-19 pandemic, I feel using mobile banking makes payment easier | |

| 17 | During the COVID-19 pandemic, I feel using mobile banking increases productivity | |

| 18 | During the COVID-19 pandemic, I feel using mobile banking may improve performance | |

| Perceived Ease of Use | 19 | I think that it would be easy to become skillful in using mobile banking |

| 20 | I think that interactions with mobile banking are clear and understandable | |

| 21 | I think it is easy to follow all the steps to use mobile banking | |

| 22 | I think it is easy to interact with mobile banking | |

| Compatibility | 23 | I feel that using mobile banking is compatible with my lifestyle |

| 24 | I feel that using mobile banking fits well with the way I do my finances | |

| 25 | I feel that using mobile banking fits into my working style | |

| Performance Risk | 26 | I feel mobile banking may be unstable or blocked |

| 27 | I feel mobile banking might not work as expected | |

| 28 | I feel mobile banking may not match its communicated level | |

| Financial Risk | 29 | I feel the use of mobile banking would cause the exposure of capital accounts and passwords |

| 30 | I feel the use of mobile banking would cause malicious and unreasonable charges | |

| 31 | I feel the use of mobile banking can cause financial risk | |

| Privacy Risk | 32 | I feel that if I use mobile banking, privacy information could be misused, inappropriately shared, or sold |

| 33 | I feel that if I use mobile banking, my personal information could be intercepted or accessed | |

| 34 | I feel that if I use mobile banking, transaction information could be collected, tracked, and analyzed | |

| Psychological Risk | 35 | I feel that mobile banking would cause unnecessary tension, e.g., concerns about errors in operation |

| 36 | I feel that a breakdown in mobile banking systems could cause unwanted anxiety and confusion | |

| 37 | I feel that the usage of mobile banking could cause discomfort | |

| Time Risk | 38 | I have experienced time loss due to the instability and low speed of mobile banking |

| 39 | I feel that more time is required to fix mobile banking errors offline | |

| Trust | 40 | I trust my bank to offer secure mobile banking. |

| 41 | I find mobile banking is secure for conducting transactions | |

| 42 | I find mobile banking is safe for receiving bank statements | |

| Perceived Behavioral Control | 43 | If I wanted to, I could use mobile banking |

| 44 | I have the resources, knowledge, and ability to make use of mobile banking | |

| 45 | I would be able to use mobile banking | |

| Subjective Norms | 46 | I think that people whose opinions I value would approve that I use mobile banking |

| 47 | I think that people who influence my behavior would think that I should use mobile banking | |

| 48 | I think that people who are important to me would agree if I used mobile banking | |

| Attitude | 49 | I think that using mobile banking is a good idea |

| 50 | I think that using mobile banking is wise | |

| 51 | I think that using mobile banking is beneficial | |

| 52 | I think that using mobile banking is interesting | |

| Perceived Risk | 53 | Using mobile banking to pay my bills would be risky |

| 54 | Mobile banking is dangerous to use | |

| 55 | Using mobile banking would add great uncertainty to my bill-paying | |

| 56 | Using mobile banking exposes you to overall risk | |

| Disease Risk | 57 | I am worried about being infected by the coronavirus when using physical cash |

| 58 | I am not comfortable making payments using physical cash | |

| 59 | I am afraid there are coronavirus droplets on physical cash | |

| Behavioral Intention | 60 | I will use mobile banking for payment transactions during the COVID-19 pandemic |

| 61 | I prefer using mobile banking for payment transactions during the COVID-19 pandemic | |

| 62 | I will continue to use mobile banking for payment transactions after the COVID-19 pandemic has ended |

References

- Ahlstrom, David, Jean-Luc Arregle, Michael A. Hitt, Gongming Qian, Xufei Ma, and Dries Faems. 2020. Managing Technological, Sociopolitical, and Institutional Change in the New Normal. Journal of Management Studies 57: 411–37. [Google Scholar] [CrossRef]

- Aji, Hendy Mustiko, Izra Berakon, and Maizaitulaidawati Md Husin. 2020. COVID-19 and e-wallet usage intention: A multigroup analysis between Indonesia and Malaysia. Cogent Business and Management 7. [Google Scholar] [CrossRef]

- Ajzen, Icek. 1991. The Theory of Planned Behavior. Organization Behavior and Human Decision Process 50: 179–211. [Google Scholar] [CrossRef]

- Al Khasawneh, Mohammad Hamdi, and Rand Irshaidat. 2017. Empirical validation of the decomposed theory of planned behaviour model within the mobile banking adoption context. International Journal of Electronic Marketing and Retailing 8: 58–76. [Google Scholar] [CrossRef]

- Aldiabat, Khaled, Anwar Al-Gasaymeh, Mohannad M. Alebbini, Aktham A. Alsarayreh, Ali A. Alzoubi, and Eng. Abdulrahman A. Alhowas. 2022. The COVID-19 pandemic and its impact on consumer’s interaction on mobile banking application: Evidence from Jordan. International Journal of Data and Network Science 6: 953–60. [Google Scholar] [CrossRef]

- Anderson, Jamie. 2009. M-banking in developing markets: Competitive and regulatory implications. Info 12: 18–25. [Google Scholar] [CrossRef]

- Bank Indonesia. 2019a. Bank Indonesia: Menavigasi Sistem Pembayaran Nasional di Era Digital, p. 91. Available online: https://www.bi.go.id/id/publikasi/kajian/Documents/Blueprint-Sistem-Pembayaran-Indonesia-2025.pdf (accessed on 14 May 2023).

- Bank Indonesia. 2019b. Peraturan Anggota Dewan Gubernur Nomor 21/18/PADG/2019 Tentang Implementasi Standar Nasional Quick Response Code Untuk Pembayaran. Available online: https://www.bi.go.id/id/publikasi/peraturan/Documents/padg_211819.pdf (accessed on 10 November 2023).

- BPS Indonesia. 2022. Statistik Indonesia 2022. Statistik Indonesia 1101001: 790. Available online: https://www.bps.go.id/publication/2020/04/29/e9011b3155d45d70823c141f/statistik-indonesia-2020.html (accessed on 4 October 2023).

- Dahlstrom, Robert, Arne Nygaard, Maria Kimasheva, and Arne M. Ulvnes. 2014. How to recover trust in the banking industry? A game theory approach to empirical analyses of bank and corporate customer relationships. International Journal of Bank Marketing 32: 268–78. [Google Scholar] [CrossRef]

- Daskalakis, Stylianos, and John Mantas. 2008. Evaluating the impact of a service-oriented framework for healthcare interoperability. Studies in Health Technology and Informatics 136: 285. [Google Scholar]

- Davis, Fred D. 1989. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly 13: 319–40. [Google Scholar] [CrossRef]

- Featherman, Mauricio S., and Paul A. Pavlou. 2003. Predicting e-services adoption: A perceived risk facets perspective. International Journal of Human Computer Studies 59: 451–74. [Google Scholar] [CrossRef]

- Financial Services Authority. 2018. Peraturan Otoritas Jasa Keuangan Republik Indonesia Nomor 12/POJK.03/2018 Tentang Penyelenggaraan Layanan Perbankan Digital oleh Bank Umum. Available online: https://www.ojk.go.id/id/regulasi/Documents/Pages/Penyelenggaraan-Layanan-Perbankan-Digital-oleh-Bank-Umum/POJK%2012-2018.pdf (accessed on 10 November 2023).

- Financial Services Authority. 2021. Peraturan Otoritas Jasa Keuangan Republik Indonesia Nomor 12/POJK.03/2021 Tentang Bank Umum. Available online: https://peraturan.go.id/files/ojk12-2021bt.pdf (accessed on 4 October 2023).

- Fornell, Claes, and David F. Larcker. 1981. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Giovanis, Apostolos, Pinelopi Athanasopoulou, Costas Assimakopoulos, and Christos Sarmaniotis. 2019. Adoption of mobile banking services. International Journal of Bank Marketing 37: 1165–89. [Google Scholar] [CrossRef]

- Google, Temasek, and Bain. 2020. 5th Edition of e-Conomy SEA, 5th ed. vol. 148, pp. 148–62. Available online: https://storage.googleapis.com/gweb-economy-sea.appspot.com/assets/pdf/e-Conomy_SEA_2020_Report.pdf (accessed on 14 May 2023).

- Ha, Kyung-Hun, Andrea Canedoli, Aaron W. Baur, and Markus Bick. 2012. Mobile banking—Insights on its increasing relevance and most common drivers of adoption. Electronic Markets 22: 217–27. [Google Scholar] [CrossRef]

- Hair, Joe F., Christian M. Ringle, and Marko Sarstedt. 2011. PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice 19: 139–52. [Google Scholar] [CrossRef]

- Hair, Joseph F. 2013. Multivariate Data Analysis. London: Pearson Education Limited. [Google Scholar]

- Hanafizadeh, Payam, Mehdi Behboudi, Amir Abedini Koshksaray, and Marziyeh Jalilvand Shirkhani Tabar. 2014. Jalilvand Shirkhani Tabar, Mobile-banking adoption by Iranian bank clients. Telematics and Informatics 31: 62–78. [Google Scholar] [CrossRef]

- Ho, Jonathan C., Chorng-Guang Wu, Chung-Shing Lee, and Thanh-Thao T. Pham. 2020. Factors affecting the behavioral intention to adopt mobile banking: An international comparison. Technology in Society 63: 101360. [Google Scholar] [CrossRef]

- Kazemi, Ali, Akbar Nilipour, Nastaran Kabiry, and Mahnaz Mohammad Hoseini. 2013. Factors Affecting Isfahanian Mobile Banking Adoption Based on the Decomposed Theory of Planned Behavior. International Journal of Academic Research in Business and Social Sciences 3: 230–45. [Google Scholar] [CrossRef]

- Kim, Gimun, BongSik Shin, and Ho Geun Lee. 2009. Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal 19: 283–311. [Google Scholar] [CrossRef]

- Koenig-Lewis, Nicole, Adrian Palmer, and Alexander Moll. 2010. Predicting young consumers’ take up of mobile banking services. International Journal of Bank Marketing 28: 410–32. [Google Scholar] [CrossRef]

- Koksal, Mehmet Haluk. 2016. The intentions of Lebanese consumers to adopt mobile banking. International Journal of Bank Marketing 34: 327–46. [Google Scholar] [CrossRef]

- Lassar, Walfried M., Chris Manolis, and Sharon S. Lassar. 2005. The relationship between consumer innovativeness, personal characteristics, and online banking adoption. International Journal of Bank Marketing 23: 176–99. [Google Scholar] [CrossRef]

- Latan, Hengky, and Richard Noonan. 2017. Partial Least Squares Path Modeling: Basic Concepts, Methodological Issues and Applications. Cham: Springer International Publishing. [Google Scholar] [CrossRef]

- Lee, Ming-Chi. 2009. Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce Research and Applications 8: 130–41. [Google Scholar] [CrossRef]

- Lin, Hsiu-Fen. 2007. Predicting consumer intentions to shop online: An empirical test of competing theories. Electronic Commerce Research and Applications 6: 433–42. [Google Scholar] [CrossRef]

- Malaquias, Fernanda, Rodrigo Malaquias, and Yujong Hwang. 2018. Understanding the determinants of mobile banking adoption: A longitudinal study in Brazil. Electronic Commerce Research and Applications 30: 1–7. [Google Scholar] [CrossRef]

- Malaquias, Rodrigo Fernandes, and Altieres Frances Silva. 2020. Understanding the use of mobile banking in rural areas of Brazil. Technology in Society 62: 101260. [Google Scholar] [CrossRef]

- Maser, Birgit, and Klaus Weiermair. 1998. Travel Decision-Making: From the Vantage Point of Perceived Risk and Information Preferences. Journal of Travel & Tourism Marketing 7: 107–21. [Google Scholar]

- Oliveira, Tiago, Miguel Faria, Manoj Abraham Thomas, and Aleš Popovič. 2014. Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM. International Journal of Information Management 34: 689–703. [Google Scholar] [CrossRef]

- Rogers, Everett M. 1995. Diffusion of Innovations, 4th ed. Hong Kong: The Free Press. [Google Scholar]

- Rosenblad, Andreas. 2009. Applied Multivariate Statistics for the Social Sciences, Fifth Edition by James P. Stevens. International Statistical Review 77: 476. [Google Scholar] [CrossRef]

- Saraswati, Dyah Annisa, Nita Suhanda Putra Praditta Syifa Desvi, and Evelyn Hendriana. 2021. Examination of the Extended UTAUT Model in Mobile Wallet Continuous Usage Intention during the COVID-19 Outbreak. Turkish Online Journal of Qualitative Inquiry 12: 1320–35. [Google Scholar] [CrossRef]

- Shepherd, Morgan M., Debbie B. Tesch, and Jack S. C. Hsu. 2006. Environmental Traits That Support a Learning Organization The Impact on Information System Development Projects. Comparative Technology Transfer and Society 4: 196–218. [Google Scholar] [CrossRef]

- Taylor, Shirley, and Peter A. Todd. 1995. Understanding information technology usage: A test of competing models. Information Systems Research 6: 144–76. [Google Scholar] [CrossRef]

- Urbach, Nils, and Frederik Ahlemann. 2010. Structural Equation Modeling in Information Systems Research Using Partial Least Squares. Journal of Information Technology Theory and Application (JITTA) 11: 2. [Google Scholar]

- Venkatesh, Viswanath, Gordon B. Davis Michael G. Morris, and Fred D. Davis. 2003. User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly 27: 425–478. [Google Scholar] [CrossRef]

- Wessels, Lisa, and Judy Drennan. 2010. An investigation of consumer acceptance of M-banking. International Journal of Bank Marketing 28: 547–68. [Google Scholar] [CrossRef]

- West, Stephen G., John F. Finch, and Patrick J. Curran. 1995. Structural Equation Models with Nonnormal Variables: Problems and Remedies. Thousand Oaks: Sage Publications. [Google Scholar]

- Wixom, Barbara H., and Hugh J. Watson. 2001. An Empirical Investigation of the Factors Affecting Data Warehousing Success. MIS Quarterly 25: 17. Available online: http://www.jstor.org/stable/3250957 (accessed on 13 May 2008). [CrossRef]

- World Bank. 2022. The Global Findex Database 2021. Available online: https://www.worldbank.org/en/publication/globalfindex/Report (accessed on 14 May 2023).

- Yang, Qing, Chuan Pang, Liu Liu, David C. Yen, and J. Michael Tarn. 2015. Exploring consumer perceived risk and trust for online payments: An empirical study in China’s younger generation. Computers in Human Behavior 50: 9–24. [Google Scholar] [CrossRef]

- Zhou, Tao. 2012. Understanding users’ initial trust in mobile banking: An elaboration likelihood perspective. Computers in Human Behavior 28: 1518–25. [Google Scholar] [CrossRef]

| No. | Bank Name | Mobile Banking Services | Equity (in Trillion) | Bank Category | Source |

|---|---|---|---|---|---|

| 1 | Bank BRI | BRI Mo | IDR 291.79 | KBMI 4 | Annual Report 2021 |

| 2 | Bank BCA | BCA Mobile | IDR 202.85 | KBMI 4 | Annual Report 2021 |

| 3 | Bank Mandiri | Livin’ by Mandiri | IDR 222.11 | KBMI 4 | Annual Report 2021 |

| 4 | Bank BNI | BNI Mobile | IDR 126.52 | KBMI 4 | Annual Report 2021 |

| 5 | Bank Panin | Mobile Panin | IDR 47.46 | KBMI 3 | Annual Report 2020 |

| 6 | Bank Danamon | D-Bank PRO | IDR 45 | KBMI 3 | Annual Report 2021 |

| 7 | Bank CIMB Niaga | OCTO Mobile | IDR 43.39 | KBMI 3 | Annual Report 2021 |

| 8 | Bank Permata | PermataMobileX | IDR 36.61 | KBMI 3 | Annual Report 2021 |

| 9 | Bank BTPN | BTPN Wow! Jenius | IDR 36.08 | KBMI 3 | Annual Report 2021 |

| 10 | Bank OCBC NISP | One Mobile by OCBC NISP | IDR 32.33 | KBMI 3 | Annual Report 2021 |

| 11 | Bank Maybank Indonesia | M2U ID App | IDR 28.70 | KBMI 3 | Annual Report 2021 |

| 12 | Bank Syariah Indonesia | BSI Mobile | IDR 25 | KBMI 3 | Annual Report 2021 |

| 13 | Bank Tabungan Negara | BTN Mobile Banking | IDR 21.41 | KBMI 3 | Annual Report 2021 |

| 14 | Bank HSBC | HSBCnet Mobile | IDR 19.29 | KBMI 3 | Annual Report 2020 |

| 15 | Bank Mega | M-SMILE | IDR 19.14 | KBMI 3 | Annual Report 2021 |

| 16 | Citibank | Citi Mobile | IDR 15.17 | KBMI 3 | Annual Report 2021 |

| Attributes of Mobile Banking Services | Mean | Standard Deviation | Skewness | Kurtosis |

|---|---|---|---|---|

| Attitude #1 | 6.03 | 0.982 | −1.289 | 2.581 |

| Attitude #2 | 5.81 | 0.997 | −0.705 | 0.007 |

| Attitude #3 | 6.03 | 0.934 | −1.041 | 1.216 |

| Attitude #4 | 5.90 | 1.001 | −0.883 | 0.499 |

| Perceived Usefulness #1 | 6.37 | 0.917 | −1.867 | 4.299 |

| Perceived Usefulness #2 | 6.40 | 0.848 | −1.574 | 2.273 |

| Perceived Usefulness #3 | 6.10 | 1.039 | −1.176 | 1.017 |

| Perceived Usefulness #4 | 6.10 | 1.017 | −1.058 | 0.480 |

| Perceived Ease of Use #1 | 6.08 | 0.941 | −1.226 | 1.981 |

| Perceived Ease of Use #2 | 6.09 | 0.888 | −1.022 | 0.947 |

| Perceived Ease of Use #3 | 6.07 | 0.907 | −1.026 | 0.987 |

| Perceived Ease of Use #4 | 6.18 | 0.857 | −1.137 | 1.410 |

| Compatibility #1 | 5.97 | 1.030 | −1.105 | 1.337 |

| Compatibility #2 | 5.65 | 1.162 | −0.825 | 0.348 |

| Compatibility #3 | 5.89 | 1.023 | −0.895 | 0.608 |

| Perceived Behavior Control #1 | 5.99 | 0.993 | −1.237 | 2.141 |

| Perceived Behavior Control #2 | 6.00 | 0.934 | 0.942 | 0.716 |

| Perceived Behavior Control #3 | 6.15 | 0.923 | −1.352 | 2.473 |

| Facilitating conditions #1 | 5.98 | 0.970 | −1.346 | 2.990 |

| Facilitating conditions #2 | 5.93 | 0.954 | −0.992 | 1.208 |

| Facilitating conditions #3 | 5.71 | 1.191 | −1.184 | 1.564 |

| Self-efficacy #1 | 6.24 | 0.894 | −1.463 | 3.083 |

| Self-efficacy #2 | 5.93 | 1.163 | −1.322 | 1.632 |

| Self-efficacy #3 | 6.25 | 0.856 | −1.363 | 2.641 |

| Subjective Norm #1 | 5.68 | 1.111 | −0.900 | 0.703 |

| Subjective Norm #2 | 5.55 | 1.124 | −0.639 | −0.088 |

| Subjective Norm #3 | 5.75 | 1.061 | −0.805 | 0.175 |

| Interpersonal Influence #1 | 5.76 | 1.157 | −0.940 | 0.685 |

| Interpersonal Influence #2 | 5.87 | 1.110 | −1.045 | 0.835 |

| Interpersonal Influence #3 | 5.84 | 1.078 | −0.901 | 0.434 |

| External Influence #1 | 5.60 | 1.219 | −0.955 | 0.698 |

| External Influence #2 | 5.45 | 1.236 | −0.884 | 0.723 |

| External Influence #3 | 5.46 | 1.256 | −0.901 | 0.668 |

| Trust #1 | 5.80 | 1.008 | −0.852 | 0.748 |

| Trust #2 | 5.88 | 0.920 | −0.781 | 0.499 |

| Trust #3 | 5.78 | 1.003 | −0.764 | 0.333 |

| Firm Reputation #1 | 6.11 | 0.955 | −1.478 | 3.449 |

| Firm Reputation #2 | 5.91 | 1.001 | −0.959 | 0.675 |

| Firm Reputation #3 | 6.01 | 0.936 | −0.930 | 0.650 |

| Performance Risk #1 | 5.15 | 1.321 | −0.671 | 0.256 |

| Performance Risk #2 | 5.26 | 1.327 | −0.744 | 0.259 |

| Performance Risk #3 | 4.90 | 1.383 | −0.486 | −0.190 |

| Privacy Risk #1 | 4.62 | 1.574 | −0.367 | −0.536 |

| Privacy Risk #2 | 4.75 | 1.516 | −0.449 | −0.350 |

| Privacy Risk #3 | 4.96 | 1.462 | −0.587 | −0.095 |

| Financial Risk #1 | 4.68 | 1.566 | −0.394 | −0.513 |

| Financial Risk #2 | 4.67 | 1.547 | −0.340 | −0.625 |

| Financial Risk #3 | 4.73 | 1.487 | −0.350 | −0.446 |

| Psychological Risk #1 | 4.41 | 1.613 | −0.302 | −0.706 |

| Psychological Risk #2 | 4.92 | 1.458 | −0.630 | −0.157 |

| Psychological Risk #3 | 4.27 | 1.659 | −0.122 | −0.850 |

| Time Risk #1 | 3.93 | 1.675 | 0.089 | −0.954 |

| Time Risk #2 | 3.52 | 1.784 | 0.399 | −0.919 |

| Time Risk #3 | 4.57 | 1.489 | −0.315 | −0.396 |

| Perceived Risk#1 | 4.05 | 1.587 | 0.168 | −0.828 |

| Perceived Risk#2 | 3.65 | 1.737 | 0.383 | −0.871 |

| Perceived Risk#3 | 3.66 | 1.677 | 0.373 | −0.787 |

| Perceived Risk#4 | 3.94 | 1.629 | 0.133 | −0.820 |

| Disease Risk #1 | 4.61 | 1.498 | −0.522 | −0.169 |

| Disease Risk #2 | 4.70 | 1.568 | −0.246 | −0.616 |

| Disease Risk #3 | 4.83 | 1.545 | −0.370 | −0.479 |

| Disease Risk #4 | 5.73 | 1.523 | −0.482 | −0.307 |

| Demographic Characteristic | Frequency | % | |

|---|---|---|---|

| Cities | Greater Jakarta (Jakarta, Bogor, Depok, Tangerang, Bekasi) | 1171 | 81.3 |

| Bandung, Surabaya, Bali | 270 | 18.7 | |

| Gender | Male | 777 | 53.9 |

| Female | 664 | 46.1 | |

| Experience using Mobile Banking | <1 year/less than a year | 109 | 7.6 |

| 1–2 year/1 to 2 years | 469 | 32.5 | |

| 2–5 years/2 to 5 years | 658 | 45.7 | |

| >5 years/more than 5 years | 205 | 14.2 | |

| Age | 15–19 years | 251 | 17.4 |

| 20–24 years | 894 | 62.0 | |

| 25–29 years | 88 | 6.1 | |

| 30–34 years | 41 | 2.8 | |

| 35–39 years | 28 | 1.9 | |

| 40–44 years | 37 | 2.6 | |

| 45–49 years | 43 | 3.0 | |

| 50–54 years | 44 | 3.1 | |

| >55 years | 15 | 1.0 | |

| Education Level | High School/Equivalent | 805 | 55.9 |

| Diploma/D3 | 46 | 3.2 | |

| S1/Undergraduate | 528 | 36.6 | |

| S2/Postgraduate | 42 | 2.9 | |

| S3/Doctoral | 20 | 1.4 | |

| Occupation/Work | Housewife | 41 | 2.8 |

| Student/Undergrad/Postgrad | 1031 | 71.3 | |

| Government Official | 18 | 1.2 | |

| Private Sector | 242 | 16.7 | |

| Entrepreneur/Self-employed | 108 | 7.5 | |

| Unemployed/Retired | 6 | 0.4 | |

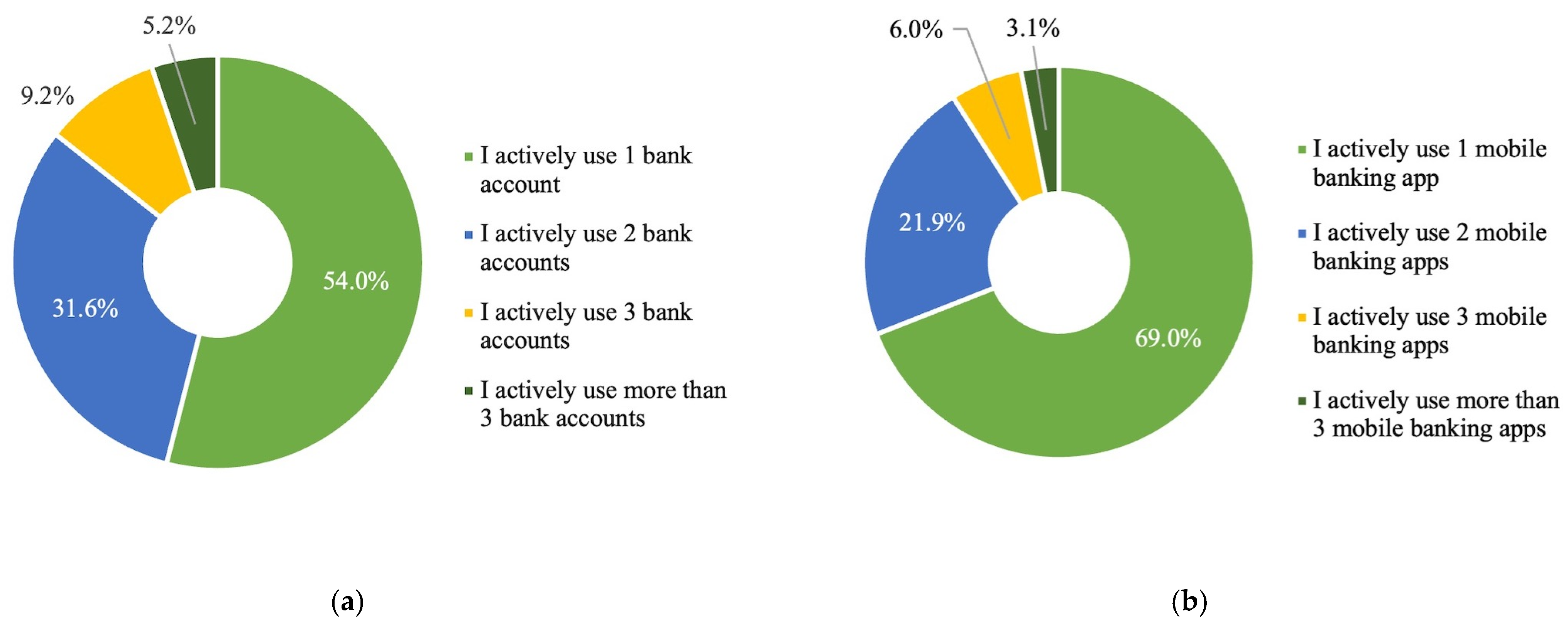

| Number of Bank Account(s) | Using 1 Bank account | 778 | 54.0 |

| Using 2 Bank accounts | 456 | 31.6 | |

| Using 3 Bank accounts | 132 | 9.2 | |

| Using >3 Bank accounts | 75 | 5.2 | |

| Number of Mobile Banking(s) | Using 1 Mobile Banking | 995 | 69.0 |

| Using 2 Mobile Banking | 315 | 21.9 | |

| Using 3 Mobile Banking | 86 | 6.0 | |

| Using >3 Mobile Banking | 45 | 3.1 | |

| Household Expenditure | < $ 200 | 839 | 58.2 |

| $ 200–$ 500 | 404 | 28.0 | |

| > $ 500 | 198 | 13.7 | |

| Mobile Banking(s) Evaluated | MobilePanin—Bank Panin | 1 | 0.1 |

| D-Bank PRO—Bank Danamon | 1 | 0.1 | |

| BTPN WOW!—Bank BTPN | 2 | 0.1 | |

| Citi Mobile Indonesia—Bank Citibank | 2 | 0.1 | |

| BTN Mobile Banking—Bank BTN | 3 | 0.2 | |

| ONE Mobile—Bank OCBC NISP | 7 | 0.5 | |

| PermataMobileX—Bank Permata | 8 | 0.6 | |

| Maybank2U—Bank Maybank | 8 | 0.6 | |

| BSI Mobile—Bank BSI | 24 | 1.7 | |

| BriMo—Bank BRI | 40 | 2.8 | |

| OCTO Mobile—Bank CIMB Niaga | 41 | 2.8 | |

| BNI Mobile Banking—Bank BNI | 61 | 4.2 | |

| Livin’ by Mandiri—Bank Mandiri | 111 | 7.7 | |

| BCA Mobile—Bank BCA | 1132 | 78.6 | |

| USD = IDR 15,000 | |||

| Construct | Dimension | Item | Load | CA | Rho_A | CR | AVE |

|---|---|---|---|---|---|---|---|

| Attitude | PU | PU1 | 0.761 | 0.933 | 0.935 | 0.943 | 0.603 |

| PU2 | 0.777 | ||||||

| PU3 | 0.773 | ||||||

| PU4 | 0.765 | ||||||

| PEOU | PEOU1 | 0.810 | |||||

| PEOU2 | 0.804 | ||||||

| PEOU3 | 0.830 | ||||||

| PEOU4 | 0.848 | ||||||

| COMP | COMP1 | 0.785 | |||||

| COMP2 | 0.635 | ||||||

| COMP3 | 0.730 | ||||||

| Subjective Norm | IPI | IPI1 | 0.701 | 0.858 | 0.860 | 0.894 | 0.585 |

| IPI2 | 0.811 | ||||||

| IPI3 | 0.800 | ||||||

| EXI | EXI1 | 0.762 | |||||

| EXI2 | 0.761 | ||||||

| EXI3 | 0.750 | ||||||

| Behavioral Intention | BI1 | 0.866 | 0.849 | 0.850 | 0.908 | 0.768 | |

| BI2 | 0.896 | ||||||

| BI3 | 0.866 | ||||||

| Perceived Behavior Control | FC | FC1 | 0.756 | 0.846 | 0.851 | 0.891 | 0.621 |

| FC2 | 0.792 | ||||||

| SEF | SEF1 | 0.843 | |||||

| SEF2 | 0.705 | ||||||

| SEF3 | 0.837 | ||||||

| Firm Reputation | FIRM1 | 0.852 | 0.861 | 0.864 | 0.915 | 0.782 | |

| FIRM2 | 0.897 | ||||||

| FIRM3 | 0.903 | ||||||

| Trust | TRU1 | 0.890 | 0.882 | 0.884 | 0.927 | 0.809 | |

| TRU2 | 0.925 | ||||||

| TRU3 | 0.883 | ||||||

| Performance Risk | PERF1 | 0.851 | 0.930 | 0.933 | 0.940 | 0.528 | |

| PERF2 | 0.936 | ||||||

| PERF3 | 0.781 | ||||||

| Privacy Risk | PRI1 | 0.872 | 0.910 | 1.140 | 0.939 | 0.836 | |

| PRI2 | 0.914 | ||||||

| PRI3 | 0.955 | ||||||

| Psychological Risk | PSI1 | 0.767 | 0.785 | 1.974 | 0.874 | 0.780 | |

| PSI2 | 0.985 | ||||||

| Financial Risk | FR1 | 0.919 | 0.849 | 0.912 | 0.893 | 0.737 | |

| FR2 | 0.753 | ||||||

| FR3 | 0.984 | ||||||

| Time Risk | TR1 | 0.726 | 0.803 | 5.288 | 0.861 | 0.761 | |

| TR3 | 0.997 | ||||||

| Perceived Risk | PR1 | 0.800 | 0.930 | 1.143 | 0.945 | 0.813 | |

| PR2 | 0.968 | ||||||

| PR3 PR4 | 0.952 0.877 | ||||||

| Disease Risk | DSR1 | 0.892 | 0.862 | 0.864 | 0.916 | 0.783 | |

| DSR2 | 0.860 | ||||||

| DSR4 | 0.903 |

| Construct | ATT | BI | DSR | FIR | FIRM | PBC | PR | PER | PRI | PSR | SN | TR | TRU |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ATT | 0.776 | ||||||||||||

| BI | 0.609 | 0.876 | |||||||||||

| DSR | 0.204 | 0.363 | 0.885 | ||||||||||

| FIR | 0.042 | 0.044 | 0.217 | 0.858 | |||||||||

| FIRM | 0.686 | 0.490 | 0.145 | −0.021 | 0.884 | ||||||||

| PBC | 0.794 | 0.539 | 0.153 | 0.034 | 0.692 | 0.788 | |||||||

| PR | −0.139 | −0.066 | 0.364 | 0.449 | −0.133 | −0.156 | 0.901 | ||||||

| PER | 0.164 | 0.158 | 0.170 | 0.590 | 0.115 | 0.169 | 0.257 | 0.858 | |||||

| PRI | 0.043 | 0.074 | 0.221 | 0.749 | −0.015 | 0.050 | 0.417 | 0.534 | 0.914 | ||||

| PSR | 0.069 | 0.114 | 0.224 | 0.561 | 0.050 | 0.051 | 0.374 | 0.493 | 0.562 | 0.883 | |||

| SN | 0.620 | 0.416 | 0.244 | 0.114 | 0.558 | 0.552 | 0.034 | 0.187 | 0.096 | 0.158 | 0.765 | ||

| TR | −0.161 | −0.067 | 0.320 | 0.397 | −0.098 | −0.168 | 0.604 | 0.274 | 0.363 | 0.387 | 0.061 | 0.872 | |

| TRU | 0.646 | 0.529 | 0.202 | 0.006 | 0.643 | 0.614 | −0.094 | 0.155 | 0.018 | 0.077 | 0.546 | −0.055 | 0.899 |

| Construct | ATT | BI | DSR | FIR | FIRM | PBC | PR | PER | PRI | PSR | SN | TR | TRU |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ATT | 0.000 | ||||||||||||

| BI | 0.682 | 0.000 | |||||||||||

| DSR | 0.230 | 0.425 | 0.000 | ||||||||||

| FIR | 0.042 | 0.047 | 0.254 | 0.000 | |||||||||

| FIRM | 0.765 | 0.572 | 0.167 | 0.034 | 0.000 | ||||||||

| PBC | 0.889 | 0.633 | 0.182 | 0.044 | 0.809 | 0.000 | |||||||

| PR | 0.140 | 0.065 | 0.407 | 0.550 | 0.134 | 0.154 | 0.000 | ||||||

| PER | 0.159 | 0.168 | 0.219 | 0.719 | 0.115 | 0.176 | 0.341 | 0.000 | |||||

| PRI | 0.044 | 0.079 | 0.251 | 0.860 | 0.038 | 0.052 | 0.492 | 0.632 | 0.000 | ||||

| PSR | 0.079 | 0.113 | 0.301 | 0.740 | 0.052 | 0.053 | 0.525 | 0.628 | 0.698 | 0.000 | |||

| SN | 0.694 | 0.487 | 0.287 | 0.131 | 0.648 | 0.646 | 0.106 | 0.208 | 0.110 | 0.193 | 0.000 | ||

| TR | 0.148 | 0.066 | 0.379 | 0.585 | 0.098 | 0.157 | 0.706 | 0.439 | 0.517 | 0.666 | 0.105 | 0.000 | |

| TRU | 0.721 | 0.611 | 0.232 | 0.021 | 0.738 | 0.708 | 0.089 | 0.163 | 0.031 | 0.071 | 0.629 | 0.053 | 0.000 |

| BI | ATT | DSR | FIR | FIRM | PBC | PR | PER | PRI | PSR | SN | TR | TRU | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BI | 3.518 | 1.303 | 2.799 | 2.433 | 3.159 | 1.873 | 1.725 | 2.519 | 1.721 | 1.876 | 1.783 | 2.090 |

| Hypo- thesis | Relation | f2 | β | T-Stat | p- Values | Result |

|---|---|---|---|---|---|---|

| H1 | PU positively related to the ATT to adopt mobile banking | 3.94 | 0.01 | 124.23 | 0.00 | Do Not Reject |

| H2 | PEOU will positively affect the ATT to mobile banking. | 4.58 | 0.01 | 136.81 | 0.00 | Not Rejected |

| H3 | COMP will positively affect the ATT to adopt mobile banking | 2.30 | 0.01 | 73.39 | 0.00 | Not Rejected |

| H4 | ATT will positively affect the intention to adopt mobile banking | 0.06 | 0.04 | 7.90 | 0.00 | Not Rejected |

| H5 | IPI will positively affect the SN to adopt mobile banking | 3.39 | 0.01 | 121.54 | 0.00 | Not Rejected |

| H6 | EXI will positively affect the SN to adopt mobile banking | 3.08 | 0.01 | 106.36 | 0.00 | Not Rejected |

| H7 | SN will positively affect the intention to adopt mobile banking | 0.00 | 0.04 | 1.55 | 0.24 | Rejected |

| H8 | FC will positively affect the PBC to adopt mobile banking | 3.35 | 0.01 | 101.82 | 0.00 | Not Rejected |

| H9 | SEF will positively affect PBC to adopt mobile banking | 7.59 | 0.00 | 225.36 | 0.00 | Not Rejected |

| H10 | PBC will positively affect the intention to adopt mobile banking | 0.00 | 0.04 | 2.06 | 0.01 | Not Rejected |

| H11 | FIRM will positively affect the intention to adopt mobile banking | 0.00 | 0.04 | 1.39 | 0.16 | Rejected |

| H12 | TRU will positively affect the intention to adopt mobile banking. | 0.03 | 0.04 | 5.53 | 0.00 | Not Rejected |

| H13 | PER will negatively affect the intention to adopt mobile banking | 0.00 | 0.03 | 1.28 | 0.20 | Rejected |

| H14 | PRI will negatively affect the intention to adopt mobile banking | 0.00 | 0.03 | 1.12 | 0.26 | Rejected |

| H15 | PSR will negatively affect the intention to adopt mobile banking | 0.00 | 0.03 | 2.12 | 0.03 | Not Rejected |

| H16 | FIR will negatively affect the intention to adopt mobile banking | 0.00 | 0.03 | 1.62 | 0.11 | Rejected |

| H17 | TIR will negatively affect the intention to adopt mobile banking. | 0.00 | 0.03 | 1.60 | 0.11 | Rejected |

| H18 | PR will negatively affect the intention to adopt mobile banking. | 0.01 | 0.03 | 2.34 | 0.02 | Not Rejected |

| H19 | DSR will positively affect the intention to adopt mobile banking. | 0.11 | 0.03 | 10.71 | 0.000 | Not Rejected |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sebayang, T.E.; Hakim, D.B.; Bakhtiar, T.; Indrawan, D. What Accelerates the Choice of Mobile Banking for Digital Banks in Indonesia? J. Risk Financial Manag. 2024, 17, 6. https://doi.org/10.3390/jrfm17010006

Sebayang TE, Hakim DB, Bakhtiar T, Indrawan D. What Accelerates the Choice of Mobile Banking for Digital Banks in Indonesia? Journal of Risk and Financial Management. 2024; 17(1):6. https://doi.org/10.3390/jrfm17010006

Chicago/Turabian StyleSebayang, Toto Edrinal, Dedi Budiman Hakim, Toni Bakhtiar, and Dikky Indrawan. 2024. "What Accelerates the Choice of Mobile Banking for Digital Banks in Indonesia?" Journal of Risk and Financial Management 17, no. 1: 6. https://doi.org/10.3390/jrfm17010006