Pricing Path-Dependent Options under Stochastic Volatility via Mellin Transform

Abstract

:1. Introduction

2. Basic Model Set-Up and Path-Dependent Options

2.1. Stochastic Volatility Model

2.2. Path-Dependent Options

3. Asymptotic Expansions

4. Determining and for Down-and-Out Put Options

4.1. Term for Down-and-Out Put Options

4.2. Term for Down-and-Out Put Options

5. Determining and for Lookback Put Options

5.1. Term for Lookback Put Options

5.2. Term for Lookback Put Options

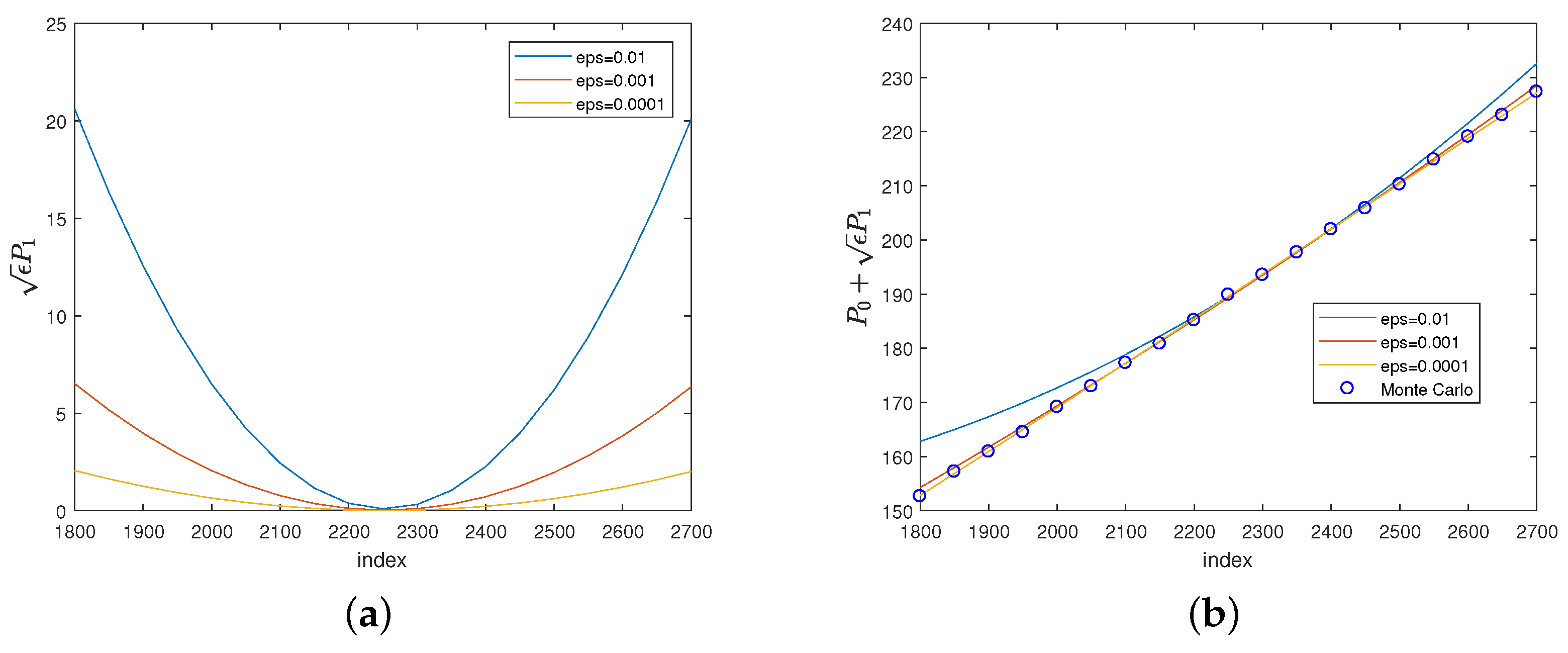

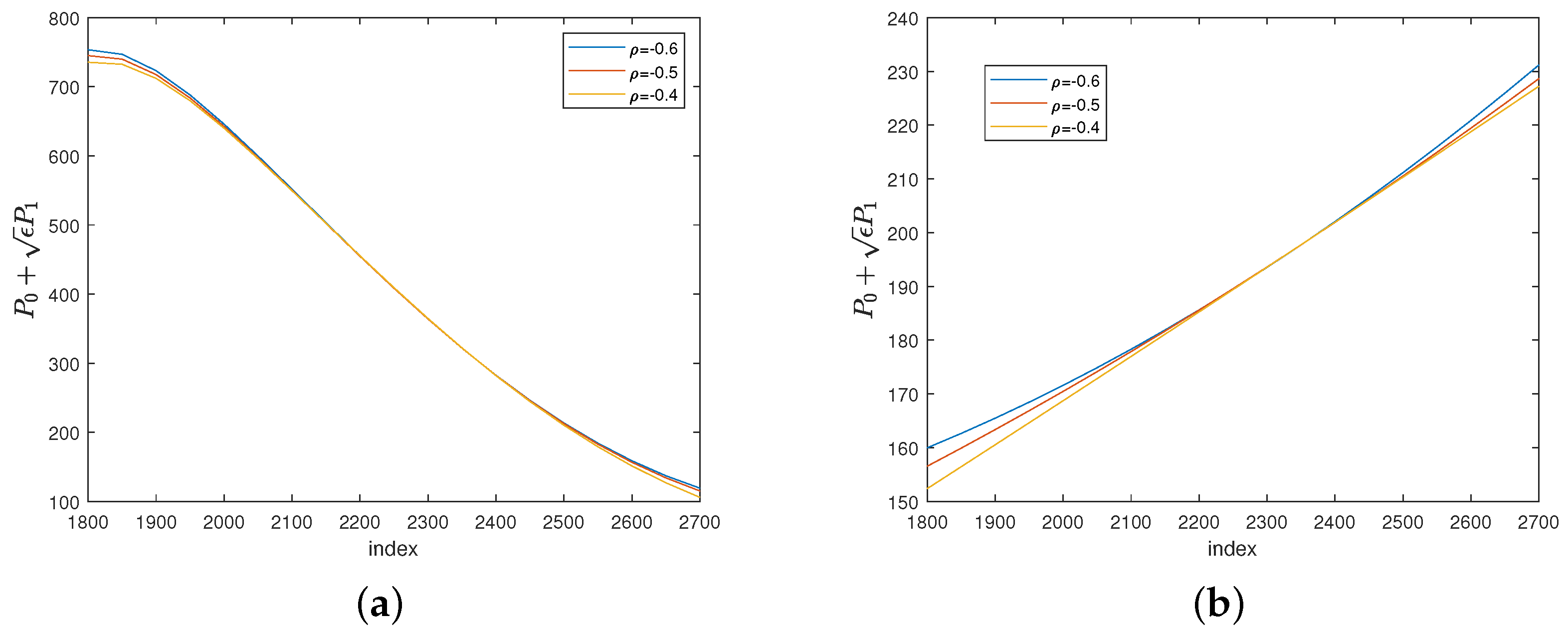

6. Numerical Results and Sensitivity Analysis

7. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Mellin Transform

| Function | Mellin Tansform |

|---|---|

| h | |

Appendix B. Derivation of Formulas (20) and (27)

Appendix B.1. Derivation of Formula (20)

Appendix B.2. Derivation of Formulas (27)

References

- Bates, David S. 1996. Jumps and stochastic volatility: Exchange rate processes implicit in Deutsche market options. The Review of Financial Studies 9: 69–107. [Google Scholar] [CrossRef]

- Black, Fischer, and Myron Scholes. 1973. The pricing of options and corporate liabilities. Journal of Political Economy 3: 637–54. [Google Scholar] [CrossRef]

- Boyle, Phelim P., and Yisong S. Tian. 1999. Pricing lookback and barrier options under the CEV process. Journal of Financial and Quantitative Analysis 34: 241–64. [Google Scholar] [CrossRef]

- Buchen, Peter. 2001. Image options and the road to barriers. Risk Magazine 14: 127–30. [Google Scholar]

- Cao, Jiling, Jeong-Hoon Kim, and Wenjun Zhang. 2021. Pricing variance swaps under hybrid CEV and stochastic volatility. Journal of Computational and Applied Mathematics 386: 113220. [Google Scholar] [CrossRef]

- Cao, Jiling, Jeong-Hoon Kim, and Wenjun Zhang. 2023. Valuation of barrier and lookback options under hybrid CEV and stochastic volatility. Mathematics and Computers in Simulation 208: 660–76. [Google Scholar] [CrossRef]

- Chiarella, Carl, Boda Kang, and Gunter H. Meyer. 2012. The evaluation of barrier option prices under stochastic volatility. Computers & Mathematics with Applications 64: 2034–48. [Google Scholar]

- Choi, Sun-Yong, Jean-Pierre Fouque, and Jeong-Hoon Kim. 2013. Option pricing under hybrid stochastic and local volatility. Quantitative Finance 13: 1157–65. [Google Scholar] [CrossRef]

- Clewlow, Les, Javier Llanos, and Chris Strickland. 1994. Pricing Exotic Options in a Black-Scholes World. Coventry: Financial Operations Research Centre, University of Warwick, vol. 54, 32p. [Google Scholar]

- Conze, Antoine, and R. Vishwanathan. 1991. Path-dependent options: The case of lookback options. The Journal of Finance 46: 1893–907. [Google Scholar] [CrossRef]

- Cox, John. 1975. Notes on Option Pricing I: Constant Elasticity of Variance Diffusions. Working Paper. Stanford: Stanford University. [Google Scholar]

- Cox, John. 1996. The constant elasticity of variance option pricing model. Journal of Portfolio Management 5: 15–17. [Google Scholar] [CrossRef]

- Davydov, Dmitry, and Vadim Linetsky. 2001. Pricing and hedging path-dependent options under the CEV process. Management Science 47: 881–1027. [Google Scholar] [CrossRef]

- Fouque, Jean-Pierre, George Papanicolaou, and Ronnie Sircar. 2000. Derivatives in Financial Markets with Stochastic Volatility. Cambridge: Cambridge University Press. [Google Scholar]

- Fouque, Jean-Pierre, George Papanicolaou, Ronnie Sircar, and Knut Sølna. 2011. Multiscale Stochastic Volatility for Equity, Interest Rate, and Credit Derivatives. Cambridge: Cambridge University Press. [Google Scholar]

- Funahashi, Hideharu, and Tomohide Higuchi. 2018. An analytical approximation for single barrier options under stochastic volatility models. Annals of Operations Research 266: 129–57. [Google Scholar] [CrossRef]

- Goldman, M. Barry, Howard B. Sosin, and Marry Ann Gatto. 1979. Path dependent options: “Buy at the low, sell at the high”. The Journal of Finance 34: 1111–27. [Google Scholar]

- Haug, Espen. 2006. The Complete Guide to Option Pricing Formulas, 2nd ed. New York: McGraw-Hill. [Google Scholar]

- Heston, Steven. 1993. A closed-form solution for options with stochastic volatility with applications to bond and currency options. The Review of Financial Studies 6: 327–43. [Google Scholar] [CrossRef]

- Hull, John C. 2015. Options, Futures and Other Derivatives, 9th ed. London: Pearson. [Google Scholar]

- Kato, Takashi, Akihiko Takahashi, and Toshihiro Yamada. 2013. An asymptotic expansion formula for up-and-out barrier option price under stochastic volatility model. Japan Society for Industrial and Applied Mathematics Letters 5: 17–20. [Google Scholar] [CrossRef]

- Kim, Hyun-Gyoon, Jiling Cao, Jeong-Hoon Kim, and Wenjun Zhang. 2023. A Mellin transform approach to pricing barrier options under stochastic elasticity of variance. Applied Stochastic Models in Business and Industry 39: 160–76. [Google Scholar] [CrossRef]

- Kim, So-Yeun, and Ji-Hun Yoon. 2018. An approximated European option price under stochastic elasticity of variance using Mellin transforms. East Asian Mathematical Journal 34: 239–48. [Google Scholar]

- Leung, Kwai Sun. 2013. An analytic pricing formula for lookback options under stochastic volatility. Applied Mathematics Letters 26: 145–49. [Google Scholar] [CrossRef]

- Merton, Robert C. 1973. The theory of rational option pricing. Bell Journal of Economics and Management Science 1: 141–83. [Google Scholar] [CrossRef]

- Panini, Radha, and Ram P. Srivastav. 2004. Option pricing with Mellin transforms. Mathematical and Computer Modelling 40: 43–56. [Google Scholar] [CrossRef]

- Park, Sang-Hyeon, and Jeong-Hoon Kim. 2013. A semi-analytic pricing formula for lookback options under a general stochastic volatility model. Statistics & Probability Letters 83: 2537–43. [Google Scholar]

- Reiner, Eric, and M. Rubinstein. 1991. Breaking down the barriers. Risk 4: 28–35. [Google Scholar]

- Wirtu, Teferi Dereje, Philip Ngare, and Ananda Kube. 2017. Pricing floating strike lookback put option under Heston stochastic volatility. Global Journal of Mathematical Sciences: Theory and Practical 9: 427–39. [Google Scholar]

- Yoon, Ji-Hun. 2014. Mellin transform method for European option pricing with Hull-White stochastic interest rate. Journal of Applied Mathematics 2014: 759562. [Google Scholar] [CrossRef]

- Zaevski, Tsvetelin S., Young Shin Kim, and Frank J. Fabozzi. 2014. Option pricing under stochastic volatility and tempered stable Lévy jumps. International Review of Financial Analysis 31: 101–8. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cao, J.; Li, X.; Zhang, W. Pricing Path-Dependent Options under Stochastic Volatility via Mellin Transform. J. Risk Financial Manag. 2023, 16, 456. https://doi.org/10.3390/jrfm16100456

Cao J, Li X, Zhang W. Pricing Path-Dependent Options under Stochastic Volatility via Mellin Transform. Journal of Risk and Financial Management. 2023; 16(10):456. https://doi.org/10.3390/jrfm16100456

Chicago/Turabian StyleCao, Jiling, Xi Li, and Wenjun Zhang. 2023. "Pricing Path-Dependent Options under Stochastic Volatility via Mellin Transform" Journal of Risk and Financial Management 16, no. 10: 456. https://doi.org/10.3390/jrfm16100456