Causality between Arbitrage and Liquidity in Platinum Futures

Abstract

:1. Introduction

2. Platinum Futures Market Details and Data

2.1. Market Institutional Details

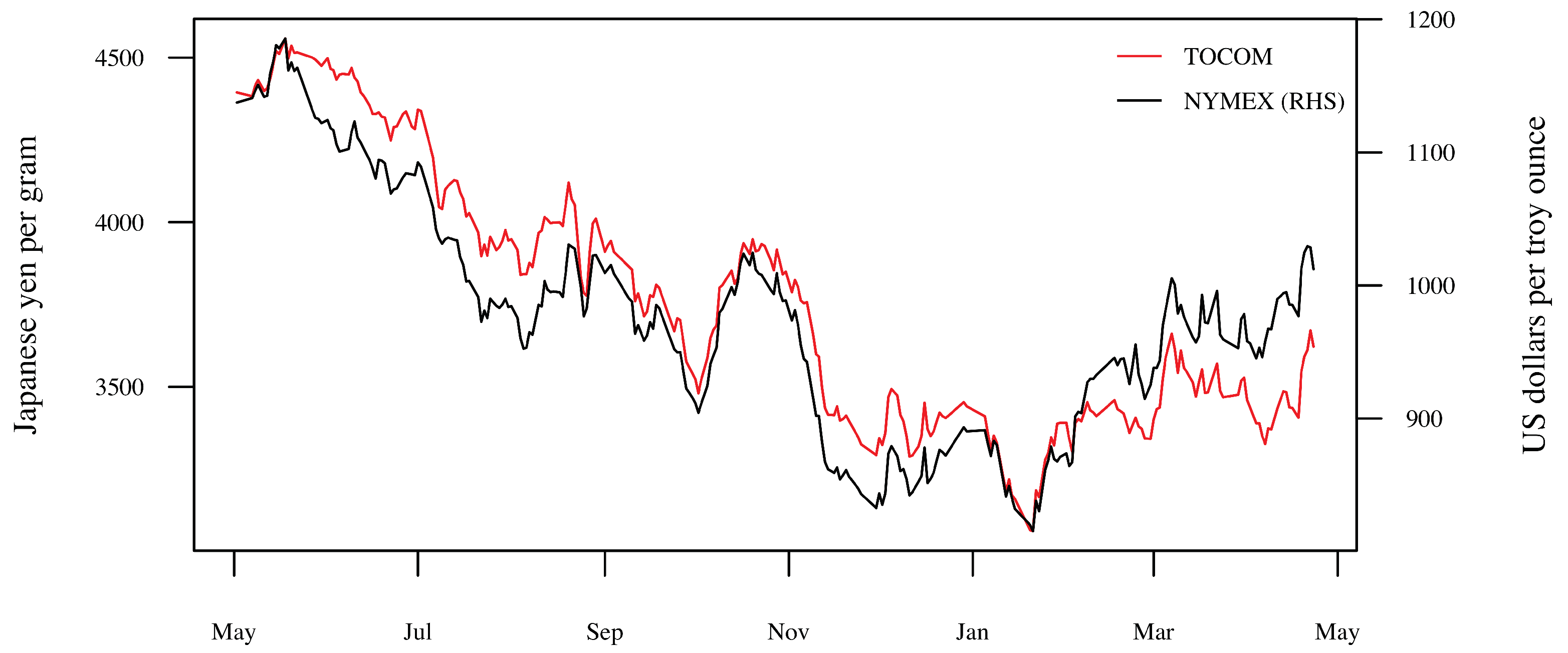

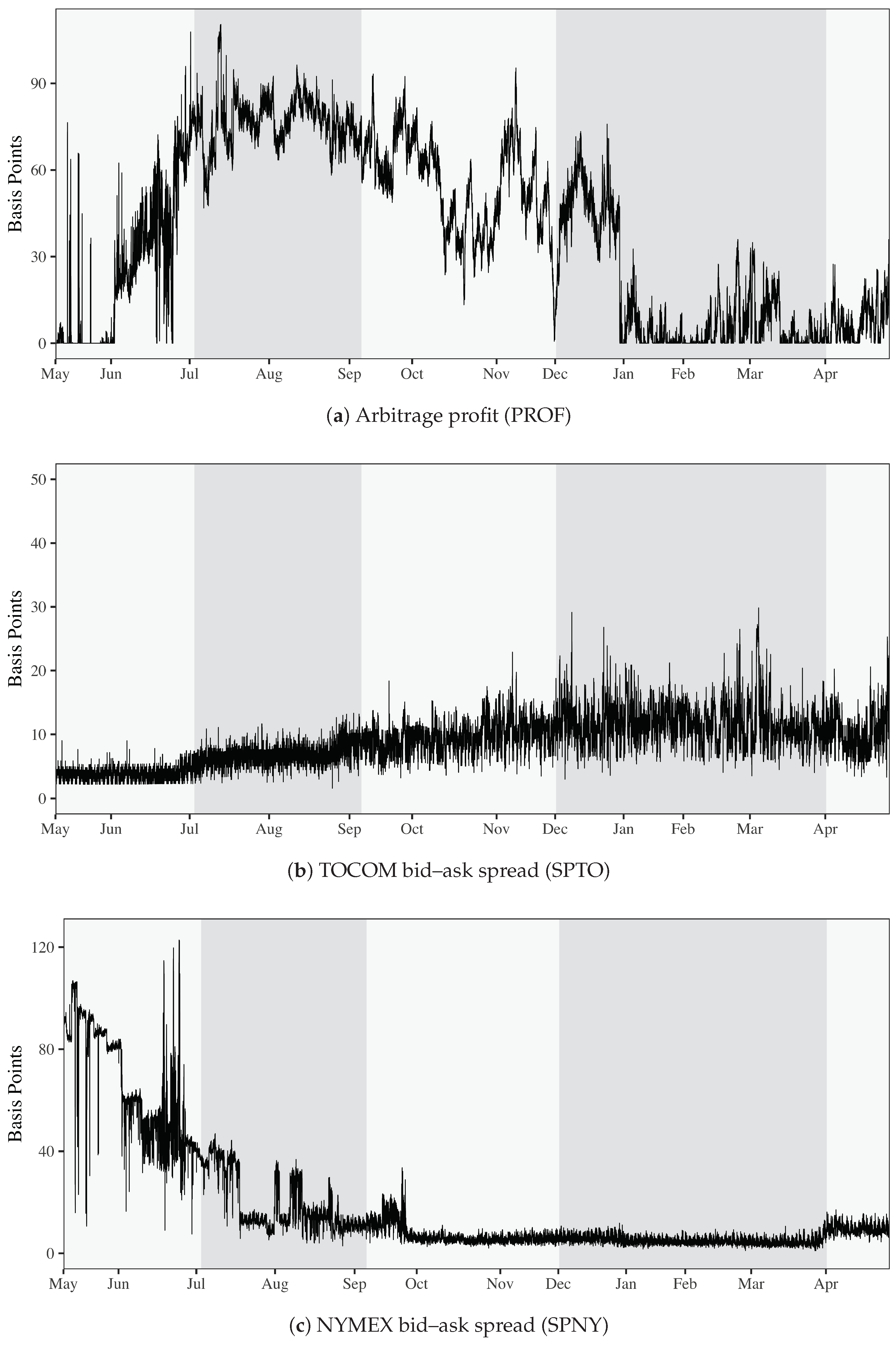

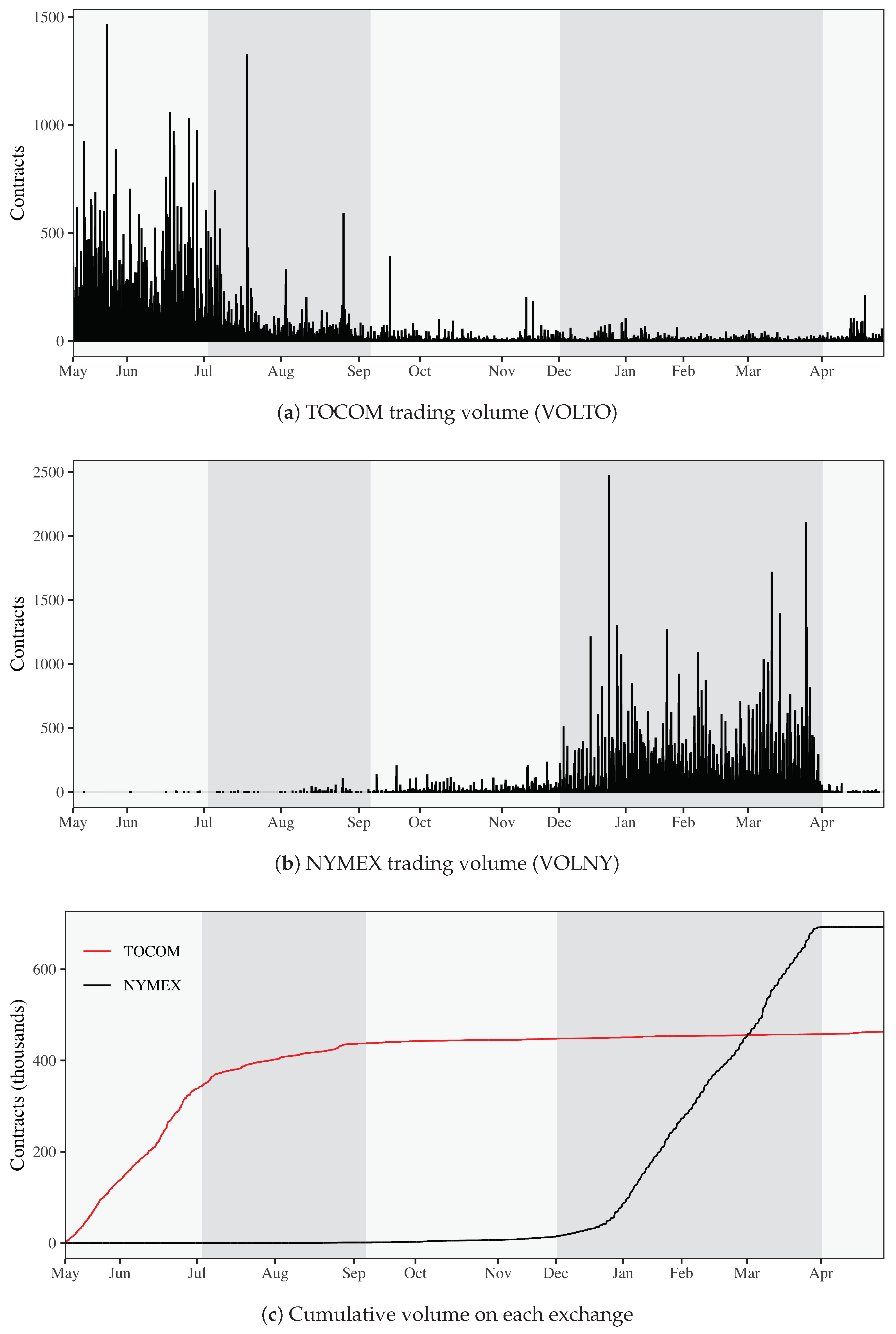

2.2. Data and Sample

2.3. Variable Construction

3. Methodology

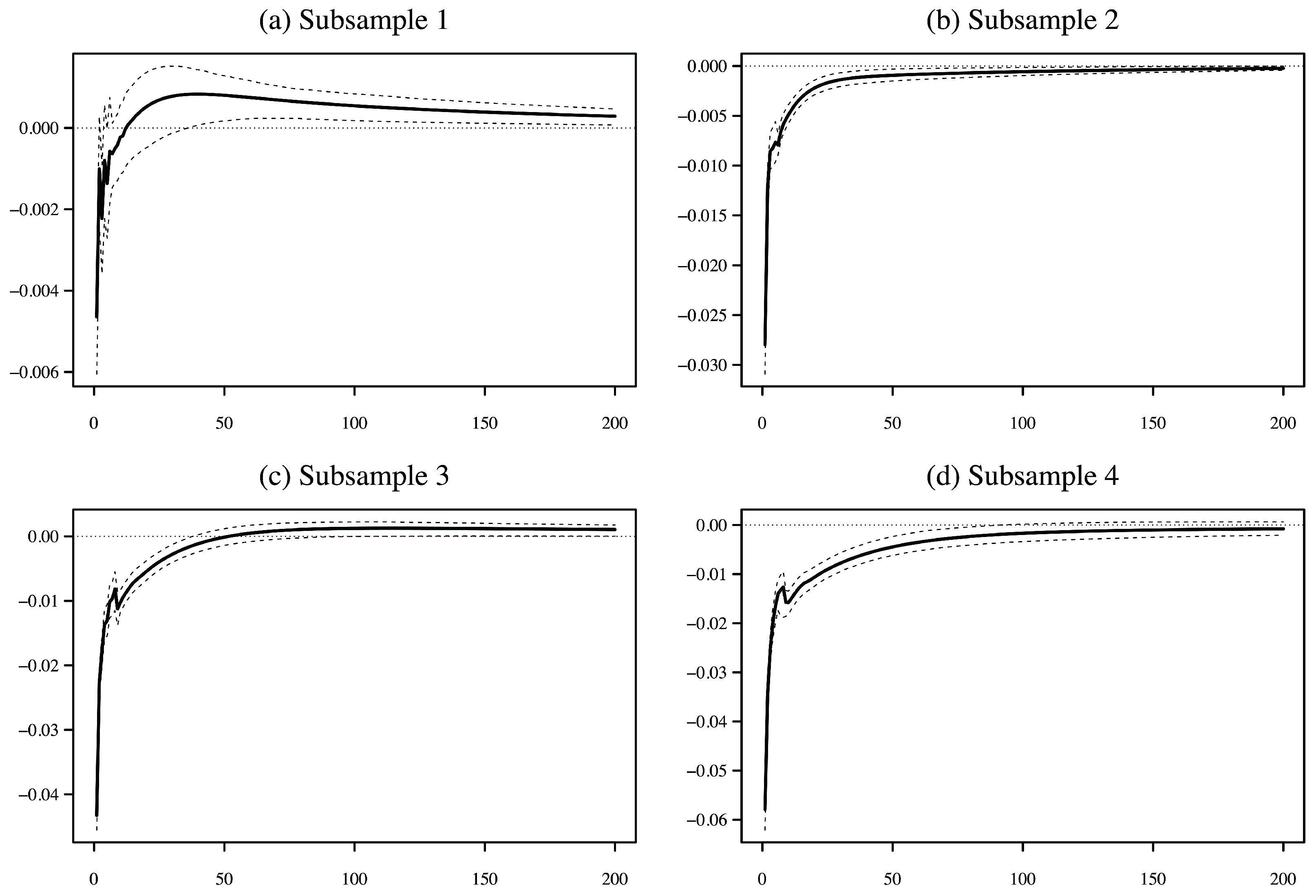

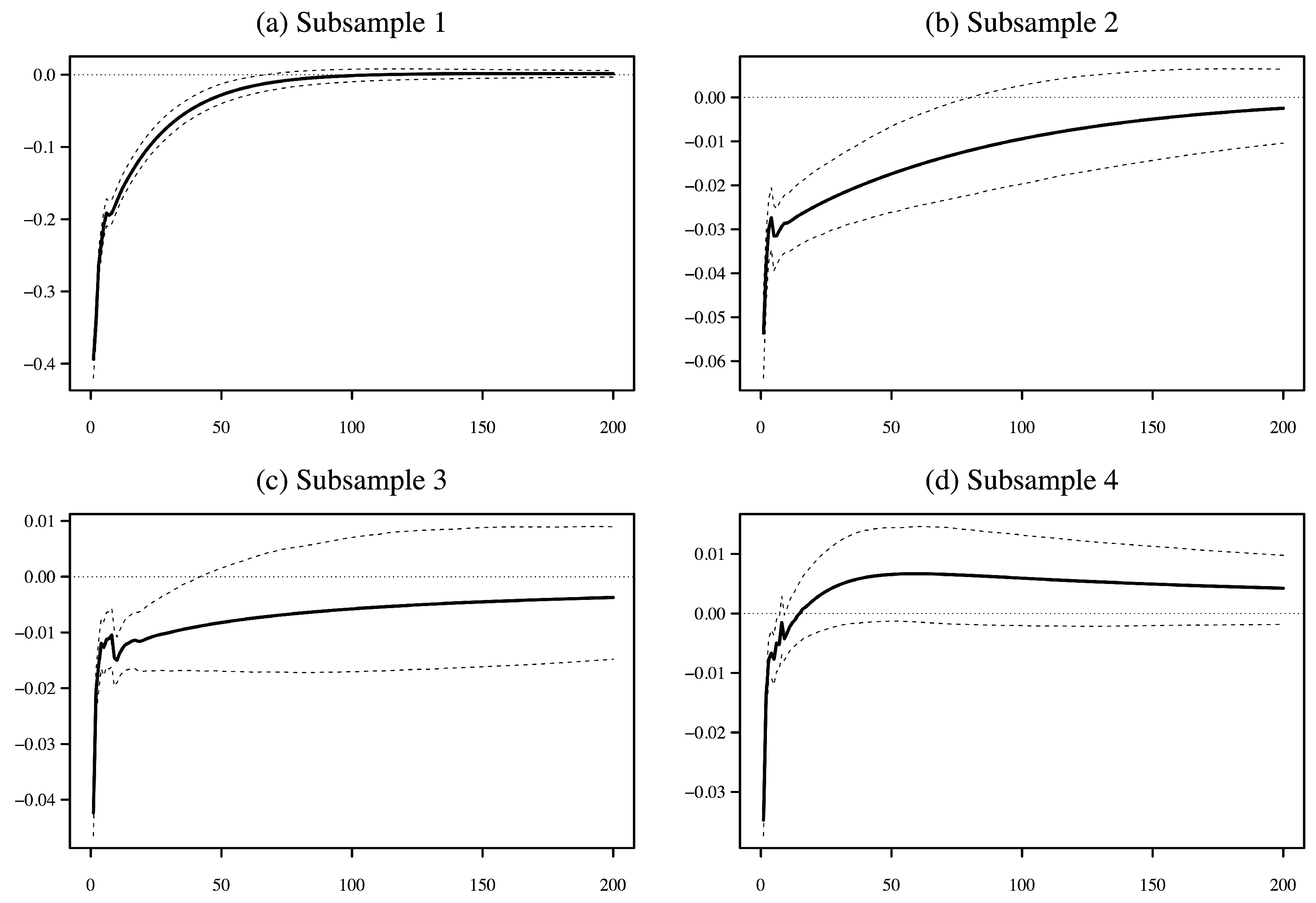

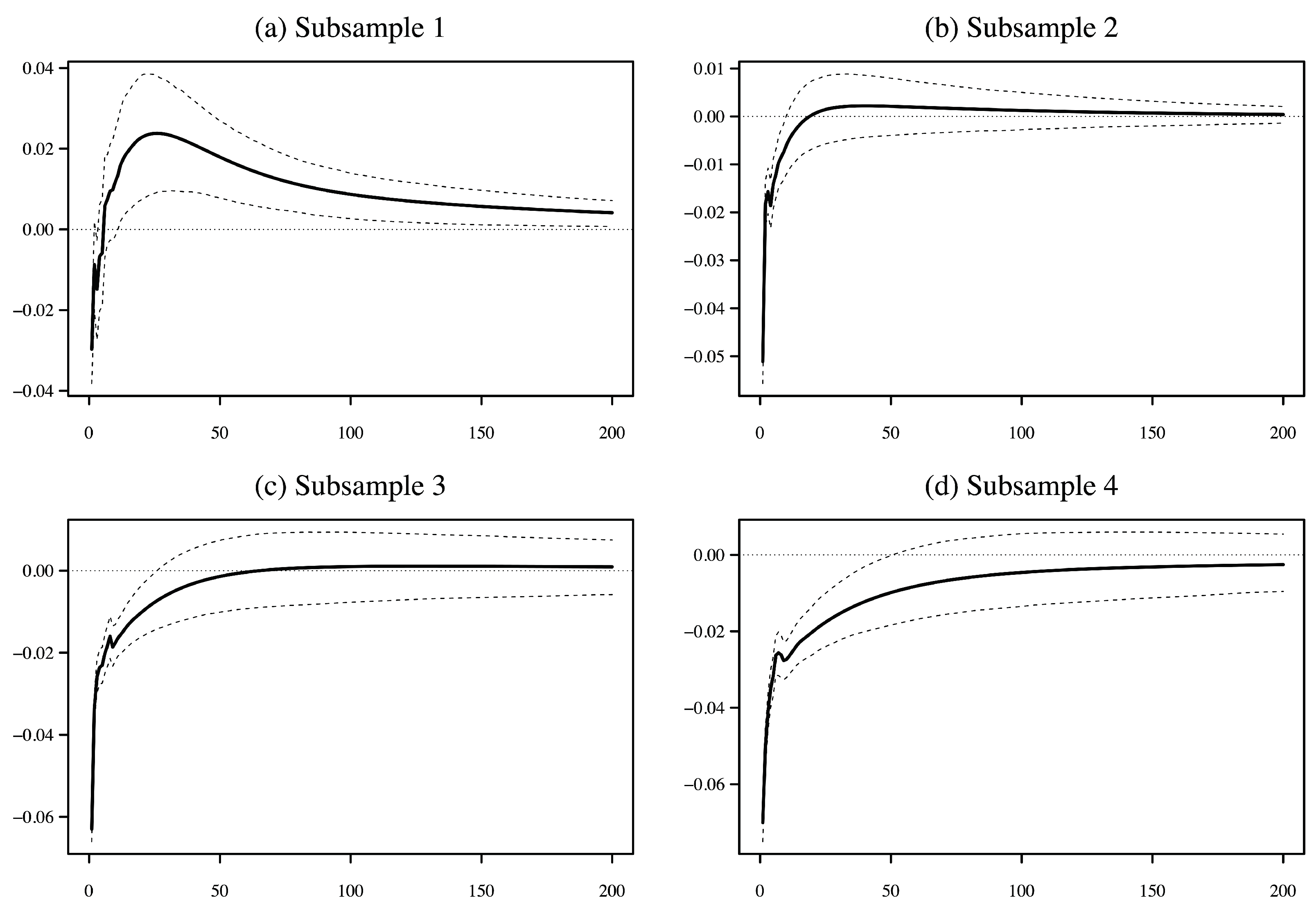

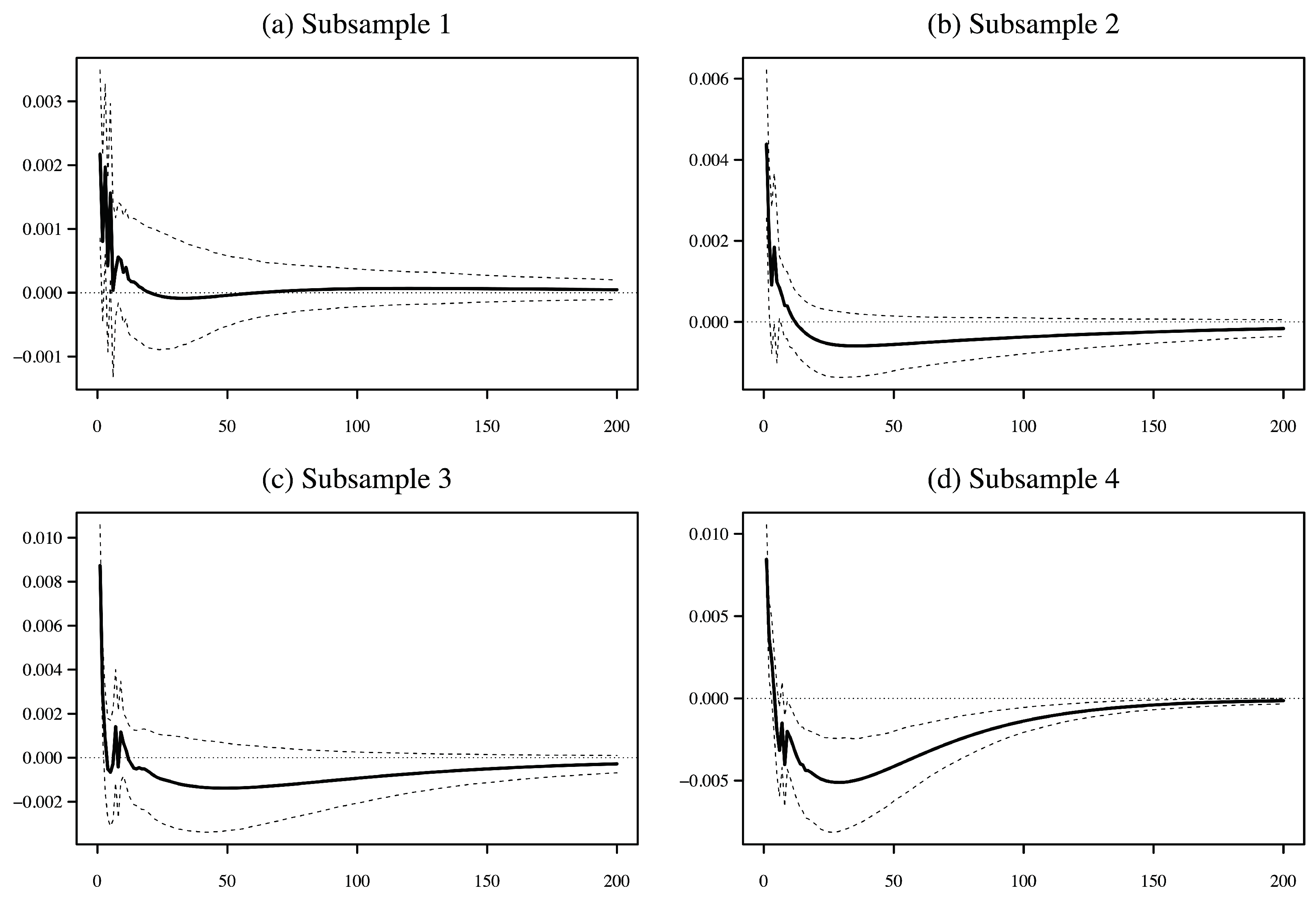

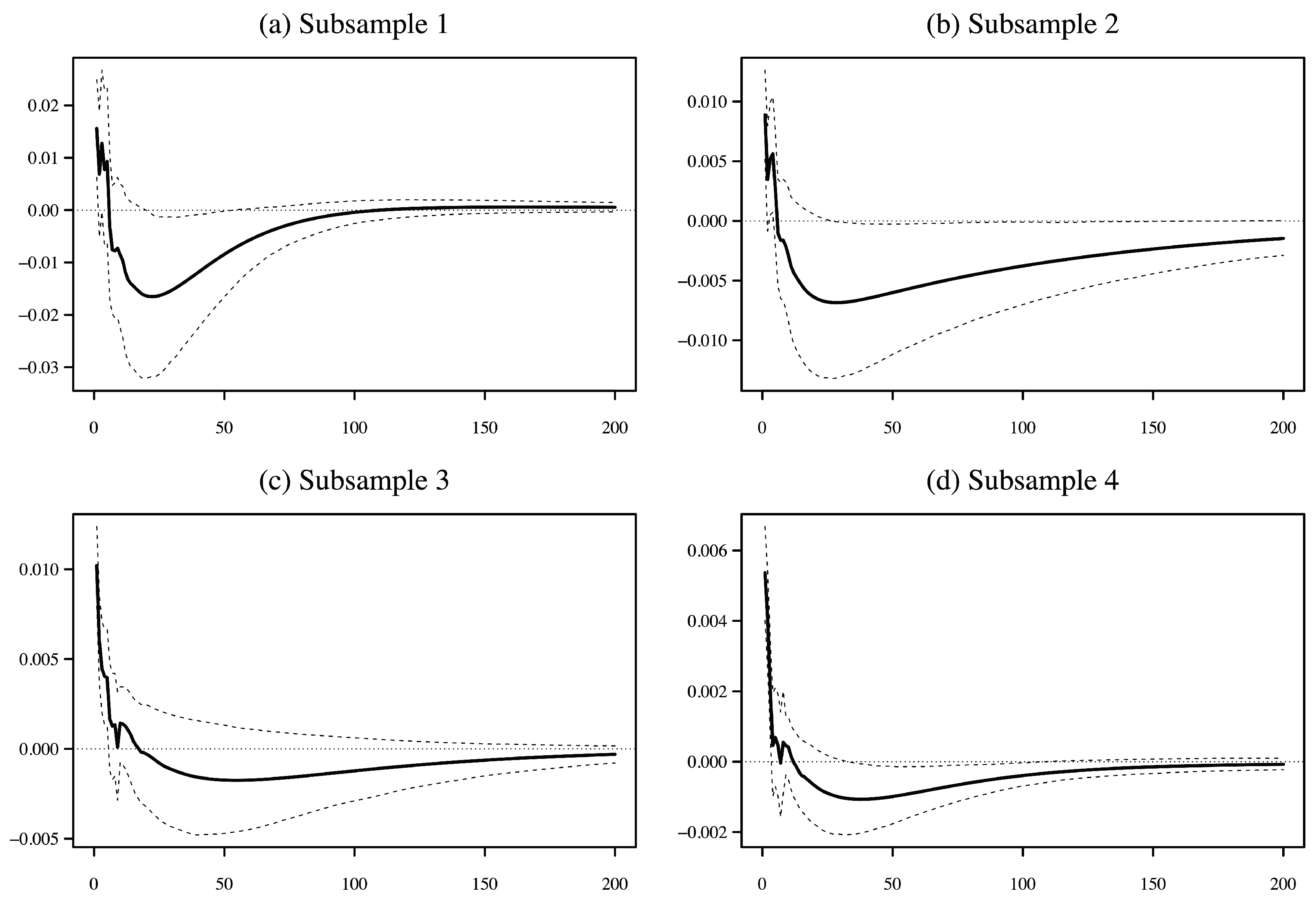

4. Empirical Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | NYMEX is part of the CME Group, and TOCOM is part of the Japan Exchange Group. |

| 2 | The NYMEX platinum contract specifications can be found at https://www.cmegroup.com/markets/metals/precious/platinum.contractSpecs.html (accessed on 3 May 2019). The TOCOM platinum standard contract specifications can be found at https://www.jpx.co.jp/english/derivatives/products/precious-metals/platinum-standard-futures/01.html (accessed on 3 May 2019). |

| 3 | Note that in addition to limits in the expiry month, TOCOM imposes looser position limits in the month before the expiry month and the second contract month. There is also a position limit for all contract months combined. |

| 4 | TOCOM extended its trading hours after the sample period of our study. The day session now opens at 8:45 a.m. JST and closes at 3:15 p.m. The night session runs from 4:30 p.m. to 6:00 a.m. the next day. |

| 5 | Forward exchange rates are used for the currency conversion presuming that the arbitrage trades between the New York and Tokyo markets are held to expiry. 12-month LIBOR rates are used when the futures have between 12 and 6 months to expiry, 6-month rates for when the contracts have between 6 and 3 months to expiry, the 2-month rates for when the contracts have between 2 months and 1 month to expiry, 1-month rates for when the contracts have between 1 month and 1 week to expiry, and 1-week rates are used for the contracts when they have less than 1 week to expiry. One gram is equivalent to 0.03215 troy ounces. |

References

- Admati, Anat R., and Paul Pfleiderer. 1988. Theory of Intraday Patterns: Volume and Price Variability A Theory of Intraday Patterns: Volume and Price Variability. The Review of Financial Studies 1: 3–40. [Google Scholar] [CrossRef] [Green Version]

- Bohl, Martin T., Alexander Pütz, and Christoph Sulewski. 2021. Speculation and the informational efficiency of commodity futures markets. Journal of Commodity Markets 23: 100159. [Google Scholar] [CrossRef]

- Boos, Dominik, and Linus Grob. 2022. Tracking speculative trading. Journal of Financial Markets, 100774. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Zhenya Liu, Shanglin Lu, and Yifan Zhang. 2021. Trading signal, functional data analysis and time series momentum. Finance Research Letters 42: 101933. [Google Scholar] [CrossRef]

- Caporin, Massimiliano, Angelo Ranaldo, and Gabriel G Velo. 2015. Precious metals under the microscope: A high-frequency analysis. Quantitative Finance 15: 743–59. [Google Scholar] [CrossRef] [Green Version]

- Chordia, Tarun, Richard Roll, and Avanidhar Subrahmanyam. 2000. Commonality in liquidity. Journal of Financial Economics 56: 3–28. [Google Scholar] [CrossRef]

- Foucault, Thierry, Roman Kozhan, and Wing Wah Tham. 2017. Toxic arbitrage. Review of Financial Studies 30: 1053–94. [Google Scholar] [CrossRef]

- Ghadhab, Imen. 2018. Arbitrage opportunities and liquidity: An intraday event study on cross-listed stocks. Journal of Multinational Financial Management 46: 1–10. [Google Scholar] [CrossRef]

- Gromb, Denis, and Dimitri Vayanos. 2010. Limits of Arbitrage: The State of the Theory. National Bureau of Economic Research, Working Paper 15821. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Holden, Craig W. 1995. Index arbitrage as cross-sectional market making. Journal of Futures Markets 15: 423–55. [Google Scholar] [CrossRef]

- Iwatsubo, Kentaro, and Clinton Watkins. 2020. Who influences the fundamental value of commodity futures in Japan? International Review of Financial Analysis 67: 1–15. [Google Scholar] [CrossRef]

- Iwatsubo, Kentaro, Clinton Watkins, and Tao Xu. 2018. Intraday seasonality in efficiency, liquidity, volatility and volume: Platinum and gold futures in Tokyo and New York. Journal of Commodity Markets 11: 59–71. [Google Scholar] [CrossRef] [Green Version]

- Johannsen, Kolja. 2017. Toxic Arbitrage and Price Discovery. Available online: https://ssrn.com/abstract=2950161 (accessed on 6 March 2019). [CrossRef]

- Johnson Matthey. 2016. PGM Market Report May 2016. Johnson Matthey Technology Review, 60. London: Johnson Matthey. [Google Scholar] [CrossRef]

- Kumar, Praveen, and Duane J. Seppi. 1994. Information and Index Arbitrage. The Journal of Business 67: 481–509. [Google Scholar] [CrossRef]

- Kwon, Kyung Yoon, Jangkoo Kang, and Jaesun Yun. 2020. Weekly momentum in the commodity futures market. Finance Research Letters 35: 1–8. [Google Scholar] [CrossRef]

- Kyle, Albert S. 1985. Continuous Auctions and Insider Trading. Econometrica 53: 1315–35. [Google Scholar] [CrossRef] [Green Version]

- Lauter, Tobias, and Marcel Prokopczuk. 2022. Measuring commodity market quality. Journal of Banking and Finance 145: 106658. [Google Scholar] [CrossRef]

- Ludwig, Michael. 2019. Speculation and its impact on liquidity in commodity markets. Resources Policy 61: 532–47. [Google Scholar] [CrossRef]

- Marshall, Ben R., Nhut H. Nguyen, and Nuttawat Visaltanachoti. 2013a. ETF arbitrage: Intraday evidence. Journal of Banking and Finance 37: 3486–98. [Google Scholar] [CrossRef]

- Marshall, Ben R., Nhut H. Nguyen, and Nuttawat Visaltanachoti. 2013b. Liquidity commonality in commodities. Journal of Banking and Finance 37: 11–20. [Google Scholar] [CrossRef]

- McDonald, Donald, and Leslie B. Hunt. 1982. A History of Platinum and Its Allied Metals. London: Johnson Matthey. [Google Scholar]

- Pesaran, H. Hashem, and Yongcheol Shin. 1998. Generalized impulse response analysis in linear multivariate models. Economics Letters 58: 17–29. [Google Scholar] [CrossRef]

- Rappoport, David Elias, and Tugkan Tuzun. 2020. Arbitrage and Liquidity: Evidence from a Panel of Exchange Traded Funds. Finance and Economics Discussion Series 2020-097; Washington, DC: Board of Governors of the Federal Reserve System. [Google Scholar] [CrossRef]

- Roll, Richard, Eduardo Schwartz, and Avanidhar Subrahmanyam. 2007. Liquidity and the Law of One Price: The Case of the Futures-Cash Basis. Journal of Finance 62: 2201–34. [Google Scholar] [CrossRef] [Green Version]

- Rösch, Dominik. 2021. The impact of arbitrage on market liquidity. Journal of Financial Economics 142: 195–213. [Google Scholar] [CrossRef]

- Sakkas, Athanasios, and Nikolaos Tessaromatis. 2020. Factor based commodity investing. Journal of Banking and Finance 115: 105807. [Google Scholar] [CrossRef]

- Schultz, Paul, and Sophie Shive. 2010. Mispricing of dual-class shares: Profit opportunities, arbitrage, and trading. Journal of Financial Economics 98: 524–49. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1997. The limits of arbitrage. Journal of Finance 52: 35–55. [Google Scholar] [CrossRef]

- Sun, Hang, Jaap W. B. Bos, and Paulo Rodrigues. 2023. Destabilizing or passive? The impact of commodity index traders on equilibrium prices. International Review of Economics and Finance 83: 271–85. [Google Scholar] [CrossRef]

- Vigne, Samuel A., Brian M. Lucey, Fergal A. O’Connor, and Larisa Yarovaya. 2017. The financial economics of white precious metals—A survey. International Review of Financial Analysis 52: 292–308. [Google Scholar] [CrossRef]

- Wilson, Paul. 2015. WPIC Platinum Quarterly Q2 2015. London: World Platinum Investment Council. [Google Scholar]

| 2015 | 2016 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Exchange | May | Jun. | Jul. | Aug. | Sep. | Oct. | Nov. | Dec. | Jan. | Feb. | Mar. | Apr. |

| TOCOM | Farthest | 2nd Farthest | 3rd Farthest | 3rd Nearest | 2nd Nearest | Nearest | ||||||

| NYMEX | 11 | 10 | 9 | 8 | 7 | 6 | 5 | 4 | 3 | 2 | 1 | Expiry |

| Subsamples | 1 | 2 | 3 | 4 | 5 | |||||||

| Full Sample | Subsample 1 | Subsample 2 | |||||||

| PROF | SPTO | SPNY | PROF | SPTO | SPNY | PROF | SPTO | SPNY | |

| Mean | 0.0040 | 0.0009 | 0.0020 | 0.0024 | 0.0004 | 0.0066 | 0.0077 | 0.0007 | 0.0020 |

| Median | 0.0043 | 0.0009 | 0.0007 | 0.0021 | 0.0004 | 0.0061 | 0.0077 | 0.0007 | 0.0014 |

| Minimum | 0.0000 | 0.0002 | 0.0001 | 0.0000 | 0.0002 | 0.0008 | 0.0047 | 0.0002 | 0.0003 |

| Maximum | 0.0110 | 0.0030 | 0.0127 | 0.0108 | 0.0009 | 0.0127 | 0.0110 | 0.0013 | 0.0047 |

| St. Dev. | 0.0031 | 0.0004 | 0.0025 | 0.0025 | 0.0001 | 0.0021 | 0.0009 | 0.0001 | 0.0011 |

| Skewness | −0.03 | 0.56 | 1.83 | 0.66 | 0.38 | 0.12 | 0.18 | 0.53 | 0.75 |

| Ex. Kurtosis | −1.46 | 0.81 | 2.32 | −0.73 | 0.84 | −1.19 | 1.75 | 1.51 | −1.00 |

| Unit Root | −5.66 | −61.13 | −10.09 | −12.76 | −54.53 | −16.92 | −7.23 | −58.49 | −8.05 |

| P-value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Observations | 41,322 | 41,322 | 41,322 | 7455 | 7455 | 7455 | 8946 | 8946 | 8946 |

| Subsample 3 | Subsample 4 | Subsample 5 | |||||||

| PROF | SPTO | SPNY | PROF | SPTO | SPNY | PROF | SPTO | SPNY | |

| Mean | 0.0055 | 0.0010 | 0.0007 | 0.0015 | 0.0012 | 0.0005 | 0.0007 | 0.0011 | 0.0010 |

| Median | 0.0057 | 0.0010 | 0.0006 | 0.0005 | 0.0012 | 0.0005 | 0.0006 | 0.0010 | 0.0010 |

| Minimum | 0.0001 | 0.0003 | 0.0002 | 0.0000 | 0.0003 | 0.0001 | 0.0000 | 0.0003 | 0.0004 |

| Maximum | 0.0095 | 0.0023 | 0.0034 | 0.0076 | 0.0030 | 0.0013 | 0.0036 | 0.0025 | 0.0017 |

| St. Dev. | 0.0016 | 0.0002 | 0.0004 | 0.0019 | 0.0003 | 0.0001 | 0.0006 | 0.0003 | 0.0002 |

| Skewness | −0.33 | 0.49 | 2.01 | 1.17 | 1.22 | 0.83 | 0.68 | 1.31 | 0.55 |

| Ex. Kurtosis | −0.29 | 0.63 | 4.02 | −0.09 | 3.51 | 1.04 | −0.28 | 2.64 | 0.37 |

| Unit Root | -3.91 | −34.24 | −22.98 | −5.12 | −30.88 | -60.67 | −7.24 | −13.37 | −24.26 |

| P-value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Observations | 10,437 | 10,437 | 10,437 | 14,484 | 14,484 | 14,484 | 3408 | 3408 | 3408 |

| Full Sample | Subsample 1 | Subsample 2 | ||||

| VOLTO | VOLNY | VOLTO | VOLNY | VOLTO | VOLNY | |

| Mean | 11.08 | 16.75 | 46.02 | 0.00 | 10.51 | 0.10 |

| St. Dev. | 39.65 | 58.04 | 77.36 | 0.10 | 29.96 | 1.59 |

| Skewness | 10.90 | 10.32 | 5.57 | 31.34 | 15.89 | 36.71 |

| Ex. Kurtosis | 202.98 | 215.55 | 50.81 | 1150.56 | 501.97 | 1885.75 |

| Maximum | 1464 | 2471 | 1464 | 5 | 1323 | 99 |

| Sum | 457,723 | 692,167 | 343,072 | 30 | 94,006 | 904 |

| Subsample 3 | Subsample 4 | Subsample 5 | ||||

| VOLTO | VOLNY | VOLTO | VOLNY | VOLTO | VOLNY | |

| Mean | 1.03 | 1.33 | 0.69 | 46.77 | 1.56 | 0.19 |

| St. Dev. | 6.48 | 7.83 | 3.47 | 90.43 | 6.98 | 2.07 |

| Skewness | 29.02 | 15.88 | 11.36 | 6.76 | 13.71 | 21.45 |

| Ex. Kurtosis | 1403.95 | 340.72 | 189.45 | 93.15 | 292.49 | 526.09 |

| Maximum | 388 | 230 | 102 | 2471 | 209 | 62 |

| Sum | 10,713 | 13,833 | 9932 | 677,400 | 5321 | 632 |

| Null Hypothesis | Subsample 1 | Subsample 2 | Subsample 3 | Subsample 4 |

|---|---|---|---|---|

| PROF does not Granger cause SPNY or SPTO | 5.40 *** | 2.12 *** | 2.32 *** | 3.70 *** |

| SPTO does not Granger cause SPNY or PROF | 5.55 *** | 16.89 *** | 6.73 *** | 6.21 *** |

| SPNY does not Granger cause SPTO or PROF | 6.48 *** | 1.63 *** | 4.14 *** | 11.63 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Iwatsubo, K.; Watkins, C. Causality between Arbitrage and Liquidity in Platinum Futures. J. Risk Financial Manag. 2022, 15, 593. https://doi.org/10.3390/jrfm15120593

Iwatsubo K, Watkins C. Causality between Arbitrage and Liquidity in Platinum Futures. Journal of Risk and Financial Management. 2022; 15(12):593. https://doi.org/10.3390/jrfm15120593

Chicago/Turabian StyleIwatsubo, Kentaro, and Clinton Watkins. 2022. "Causality between Arbitrage and Liquidity in Platinum Futures" Journal of Risk and Financial Management 15, no. 12: 593. https://doi.org/10.3390/jrfm15120593