Volatility Spillover among Japanese Sectors in Response to COVID-19

Abstract

:1. Introduction

2. Methodology

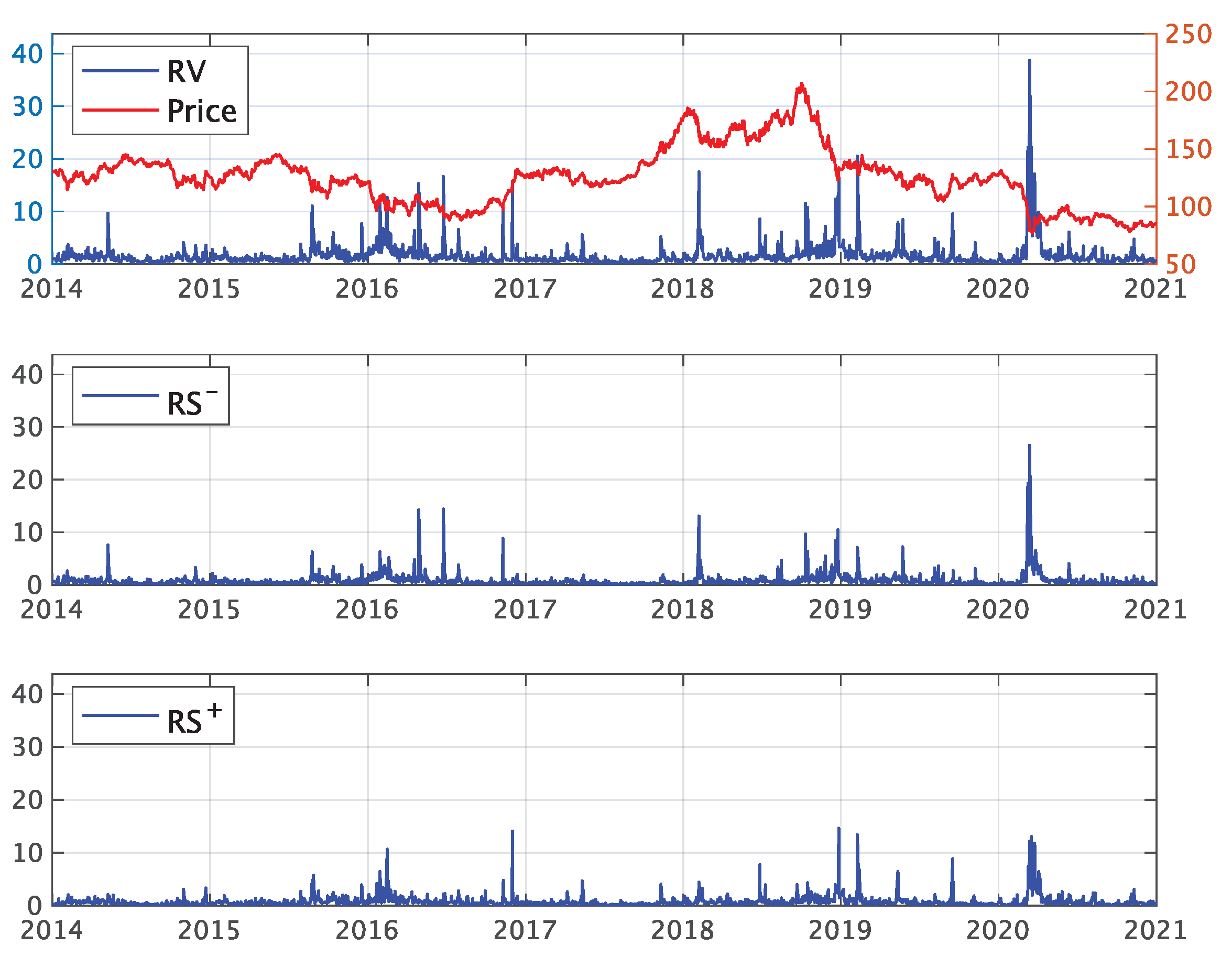

2.1. Realized Volatility

2.2. Realized Semivariance

2.3. Vector Autoregressive Model

2.4. Volatility Spillover Index

2.5. Asymmetric Spillovers

2.6. Data Collection

3. Empirical Analysis

3.1. Descriptive Statistics

3.2. Static Volatility Spillover Analysis

3.2.1. Volatility Spillover Based on RV

3.2.2. Volatility Spillover Based on RS

3.3. Dynamic Volatility Spillover Analysis Using Rolling Sample

Robustness Checks

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

| 1 | For the Japanese stock market, we note some information. According to the document reported by Tokyo Stock Exchange; at the end of March 2020, the value of equity holdings in all investment sectors, which is the market capitalization of all companies covered by the survey increased by 200 trillion yen () from the previous year. For the proportion of retail and institutional investors, the proportion of retail investors became , which increased by . Although this proportion is so small compared to the 1970s, the number of investors in 2020 is the largest. The proportion of institutional investors, that is, financial institutions, was , and it increased by . In particular, the proportion of trust banks is large because the Bank of Japan bought a huge amount of ETFs. Additionally, the proportion of foreign investors increased by and became , exceeding for the first time in two years. The document can be retrieved at: https://www.jpx.co.jp/english/markets/statistics-equities/examination/b5b4pj0000047w2y-att/e-bunpu2020.pdf, accessed on 30 September 2022. |

| 2 | TOPIX means the Tokyo Stock Price Index which is the representative index in Japan. The TOPIX-17 series is also an index in which the components of TOPIX are classified by sector for investment convenience. For more information, please review the documents at: https://www.jpx.co.jp/english/markets/indices/line-up/files/e_fac_13_sector.pdf, accessed on 30 September 2022. |

| 3 | MFE Toolbox: https://www.kevinsheppard.com/MFE_Toolbox, accessed on 3 June 2020. |

References

- Ahmad, Wasim, Jose Arreola Hernandez, Seema Saini, and Ritesh Kumar Mishra. 2021. The US equity sectors, implied volatilities, and COVID-19: What does the spillover analysis reveal? Resources Policy 72: 102102. [Google Scholar] [CrossRef]

- Andersen, Torben G., and Tim Bollerslev. 1998. Answering the Skeptics: Yes, Standard Volatility Models do Provide Accurate Forecasts. International Economic Review 39: 885–905. [Google Scholar] [CrossRef] [Green Version]

- Barndorff-Nielsen, Ole E., Silja Kinnebrouk, and Neil Shephard. 2010. Measuring downside risk realised semivariance. In Volatility and Time Series Econometrics: Essays in Honor of Robert F. Engle. Oxford: Oxford University Press, pp. 117–36. [Google Scholar]

- Baruník, Jozef, Evžen Kočenda, and Lukáš Vácha. 2016. Asymmetric connectedness on the U.S. stock market: Bad and good volatility spillovers. Journal of Financial Markets 27: 55–78. [Google Scholar] [CrossRef]

- Choi, Ki-Hong, Ron P. McIver, Salvatore Ferraro, Lei Xu, and Sang Hoon Kang. 2021. Dynamic volatility spillover and network connectedness across ASX sector markets. Journal of Economics and Finance 45: 677–91. [Google Scholar] [CrossRef]

- Costa, Antonio, Paulo Matos, and Cristiano da Silva. 2021. Sectoral connectedness: New evidence from US stock market during COVID-19 pandemics. Finance Research Letters 45: 102124. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2009. Measuring financial asset return and volatility spillovers, with application to global equity markets. Economic Journal 119: 158–71. [Google Scholar] [CrossRef] [Green Version]

- Diebold, Francis X., and Kamil Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28: 57–66. [Google Scholar] [CrossRef] [Green Version]

- Diebold, Francis X., and Kamil Yilmaz. 2014. On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics 182: 119–34. [Google Scholar] [CrossRef] [Green Version]

- Grobys, Klaus. 2015. Are volatility spillovers between currency and equity market driven by economic states? Evidence from the US economy. Economics Letters 127: 72–75. [Google Scholar] [CrossRef]

- Johansen, Søren, and Katarina Juselius. 1990. Maximum likelihood estimation and inference on cointegration-with applications to the demand for money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Johansen, Søren. 1988. Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Kang, Sanghoon, Jose Arreola Hernandez, Perry Sadorsky, and Ronald McIver. 2021. Frequency spillovers, connectedness, and the hedging effectiveness of oil and gold for US sector ETFs. Energy Economics 99: 105278. [Google Scholar] [CrossRef]

- Kanno, Masayasu. 2021. Assessing the Impact of COVID-19 on Major Industries in Japan: A Dynamic Conditional Correlation Approach. SSRN Electronic Journal 58: 101488. [Google Scholar]

- Koop, Gary, M. Hashem Pesaran, and Simon M. Potter. 1996. Impulse response analysis in nonlinear multivariate models. Journal of Econometrics 74: 119–47. [Google Scholar] [CrossRef]

- Kumar, Annop S., and Suvvari Anandarao. 2019. Volatility spillover in crypto-currency markets: Some evidences from GARCH and wavelet analysis. Physica A: Statistical Mechanics and Its Applications 524: 448–58. [Google Scholar] [CrossRef]

- Laborda, Ricardo, and Jose Olmo. 2021. Volatility spillover between economic sectors in financial crisis prediction: Evidence spanning the great financial crisis and COVID-19 pandemic. Research in International Business and Finance 57: 101402. [Google Scholar] [CrossRef]

- Lee, Woo Suk, and Hahn S. Lee. 2022. Asymmetric volatility transmission across Northeast Asian stock markets. Borsa Istanbul Review 22: 341–51. [Google Scholar] [CrossRef]

- Li, Wenqi. 2021. COVID-19 and asymmetric volatility spillovers across global stock markets. North American Journal of Economics and Finance 58: 101474. [Google Scholar] [CrossRef]

- Liow, Kim Hiang. 2015. Conditional volatility spillover effects across emerging financial markets. Asia-Pacific Journal of Financial Studies 44: 215–45. [Google Scholar] [CrossRef]

- Mensi, Walid, Ramzi Nekhili, Xuan Vinh Vo, Tahir Suleman, and Sang Hoon Kang. 2021. Asymmetric volatility connectedness among U.S. stock sectors. North American Journal of Economics and Finance 56: 101327. [Google Scholar] [CrossRef]

- Pesaran, H. Hashem, and Yongcheol Shin. 1998. Generalized impulse response analysis in linear multivariate models. Economics Letters 58: 17–29. [Google Scholar] [CrossRef]

- Ratner, Mitchell, Ilhan Meric, and Gulser Meric. 2006. Sector Dispersion and Stock Market Predictability. The Journal of Investing 15: 56–61. [Google Scholar] [CrossRef]

- Segal, Gill, Ivan Shaliastovich, and Amir Yaron. 2015. Good and bad uncertainty: Macroeconomic and financial market implications. Journal of Financial Economics 117: 369–97. [Google Scholar] [CrossRef] [Green Version]

- Shahzad, Syed Jawad Hussain, Muhammad Abubakr Naeem, Zhe Peng, and Elie Bouri. 2021. Asymmetric volatility spillover among Chinese sectors during COVID-19. International Review of Financial Analysis 75: 101754. [Google Scholar] [CrossRef]

- Sims, Christopher A. 1980. Macroeconomics and Reality. Econometrica 48: 1–48. [Google Scholar] [CrossRef] [Green Version]

- Wang, Gang-Jin, Chi Xie, Zhi-Qiang Jiang, and H. Eugene Stanley. 2016. Who are the net senders and recipients of volatility spillovers in China’s financial markets? Finance Research Letters 18: 255–62. [Google Scholar] [CrossRef]

- Yang, Lu. 2019. Connectedness of economic policy uncertainty and oil price shocks in a time domain perspective. Energy Economics 80: 219–33. [Google Scholar] [CrossRef]

- Yarovaya, Larisa, Janusz Brzeszczyński, and Chi Keung Marco Lau. 2016. Intra- and inter-regional return and volatility spillovers across emerging and developed markets: Evidence from stock indices and stock index futures. International Review of Financial Analysis 43: 96–114. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Dayong, Min Hu, and Qiang Ji. 2020. Financial markets under the global pandemic of COVID-19. Finance Research Letters 36: 101528. [Google Scholar] [CrossRef]

| Symbol | Sector | Symbol | Sector |

|---|---|---|---|

| Food | Food | IT | Information/Communications/Services/Others |

| Enrg | Energy Resources | ElGs | Electricity/Gas |

| Cnst | Construction/Materials | Tras | Transportation/Logistics |

| Matr | Materials/Chemicals | Whol | Trading/Wholesale |

| Medi | Pharmaceuticals | Reta | Retail |

| Cars | Automobiles/Transportation Equipment | Bank | Banks |

| Stel | Steel/Non-Ferrous | Fina | Finance (excluding banks) |

| Mach | Machinery | Real | Real Estate |

| ElEq | Electric/Precision Machinery |

| Pre-COVID-19 period (1 January 2014–21 February 2020) | |||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | |

| Mean | 0.66 | 1.51 | 0.64 | 0.62 | 0.86 | 0.83 | 1.11 | 0.88 | 0.77 | 0.61 | 1.12 | 0.63 | 0.63 | 0.57 | 1.18 | 1.12 | 1.20 |

| Std.dev | 1.03 | 1.70 | 1.09 | 1.04 | 1.28 | 1.58 | 1.52 | 1.36 | 1.38 | 1.09 | 1.27 | 0.98 | 1.08 | 0.92 | 2.20 | 1.96 | 2.00 |

| Max | 20.94 | 20.51 | 20.46 | 20.42 | 27.91 | 27.53 | 29.75 | 24.86 | 27.39 | 22.62 | 23.34 | 21.68 | 18.31 | 16.25 | 31.58 | 32.38 | 33.53 |

| Min | 0.06 | 0.18 | 0.05 | 0.06 | 0.09 | 0.07 | 0.11 | 0.08 | 0.06 | 0.04 | 0.09 | 0.05 | 0.06 | 0.05 | 0.08 | 0.07 | 0.09 |

| Skewness | 9.22 | 5.19 | 9.21 | 8.99 | 9.88 | 9.28 | 8.27 | 8.01 | 9.32 | 9.77 | 8.10 | 11.06 | 8.79 | 8.88 | 8.07 | 8.09 | 8.70 |

| Kurtosis | 136.45 | 40.55 | 123.45 | 124.94 | 162.59 | 118.62 | 115.75 | 100.70 | 133.45 | 148.08 | 112.73 | 185.62 | 112.24 | 120.20 | 86.78 | 91.56 | 103.51 |

| COVID-19 period (25 February 2020–31 December 2020) | |||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | |

| Mean | 0.99 | 2.15 | 1.48 | 1.10 | 1.43 | 1.63 | 2.35 | 1.41 | 1.39 | 1.09 | 1.50 | 1.81 | 1.18 | 1.02 | 1.60 | 1.69 | 2.59 |

| Std.dev | 1.90 | 3.99 | 2.88 | 2.49 | 2.97 | 3.21 | 3.62 | 2.91 | 3.30 | 2.58 | 2.55 | 3.10 | 2.48 | 2.08 | 3.05 | 3.45 | 4.58 |

| Max | 19.76 | 38.77 | 28.69 | 28.67 | 35.72 | 36.36 | 38.31 | 32.14 | 38.43 | 28.36 | 19.80 | 31.04 | 29.63 | 20.41 | 32.31 | 37.90 | 46.70 |

| Min | 0.07 | 0.26 | 0.10 | 0.09 | 0.15 | 0.14 | 0.23 | 0.12 | 0.12 | 0.07 | 0.21 | 0.06 | 0.10 | 0.07 | 0.09 | 0.08 | 0.20 |

| Skewness | 5.67 | 5.27 | 5.64 | 7.40 | 7.67 | 6.83 | 5.69 | 6.63 | 7.34 | 6.87 | 4.33 | 5.36 | 7.47 | 5.64 | 6.00 | 6.32 | 5.46 |

| Kurtosis | 46.14 | 38.41 | 44.53 | 72.10 | 79.94 | 64.25 | 47.74 | 60.80 | 72.90 | 62.16 | 24.55 | 41.52 | 76.88 | 43.36 | 51.42 | 56.83 | 42.93 |

| Pre-COVID-19 period (1 January 2014–21 February 2020) | |||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | |

| Mean | 0.34 | 0.77 | 0.33 | 0.32 | 0.44 | 0.43 | 0.58 | 0.45 | 0.40 | 0.32 | 0.57 | 0.32 | 0.32 | 0.29 | 0.59 | 0.56 | 0.61 |

| Std.dev | 0.69 | 1.06 | 0.75 | 0.71 | 0.86 | 1.04 | 1.03 | 0.93 | 0.95 | 0.74 | 0.76 | 0.67 | 0.76 | 0.60 | 1.39 | 1.24 | 1.15 |

| Max | 16.81 | 14.42 | 16.71 | 16.86 | 21.78 | 20.79 | 23.54 | 20.84 | 21.10 | 17.26 | 15.23 | 16.99 | 15.48 | 13.43 | 28.43 | 25.55 | 21.29 |

| Min | 0.01 | 0.04 | 0.02 | 0.01 | 0.03 | 0.02 | 0.03 | 0.03 | 0.02 | 0.02 | 0.05 | 0.02 | 0.02 | 0.02 | 0.03 | 0.03 | 0.04 |

| Skewness | 13.47 | 6.87 | 12.68 | 12.98 | 14.34 | 12.36 | 12.31 | 12.23 | 12.90 | 12.96 | 9.88 | 15.90 | 13.10 | 11.89 | 12.43 | 12.32 | 10.66 |

| Kurtosis | 266.18 | 69.01 | 220.12 | 243.04 | 301.40 | 197.29 | 223.92 | 217.28 | 230.74 | 239.71 | 153.87 | 338.72 | 225.70 | 205.85 | 201.34 | 205.15 | 153.34 |

| COVID-19 period (25 February 2020–31 December 2020) | |||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | |

| Mean | 0.51 | 1.11 | 0.75 | 0.57 | 0.72 | 0.80 | 1.17 | 0.71 | 0.71 | 0.56 | 0.76 | 0.90 | 0.60 | 0.53 | 0.80 | 0.84 | 1.34 |

| Std.dev | 1.13 | 2.43 | 1.65 | 1.53 | 1.75 | 1.83 | 2.04 | 1.65 | 1.96 | 1.52 | 1.39 | 1.75 | 1.50 | 1.21 | 1.75 | 2.07 | 3.06 |

| Max | 13.70 | 26.54 | 19.69 | 20.73 | 23.42 | 24.07 | 24.81 | 20.68 | 26.03 | 19.11 | 14.44 | 21.22 | 20.22 | 14.13 | 21.67 | 27.07 | 38.85 |

| Min | 0.03 | 0.10 | 0.03 | 0.02 | 0.05 | 0.03 | 0.09 | 0.05 | 0.04 | 0.03 | 0.05 | 0.03 | 0.02 | 0.03 | 0.03 | 0.03 | 0.03 |

| Skewness | 7.54 | 7.13 | 7.43 | 10.08 | 9.64 | 9.21 | 7.30 | 8.23 | 9.55 | 8.57 | 5.64 | 7.45 | 9.78 | 7.16 | 8.09 | 9.19 | 8.66 |

| Kurtosis | 80.04 | 65.37 | 76.62 | 126.91 | 120.05 | 111.61 | 77.39 | 92.70 | 117.63 | 96.11 | 45.47 | 79.18 | 122.98 | 71.86 | 88.18 | 110.08 | 98.49 |

| RS+ | Pre-COVID-19 period (1 January 2014–21 February 2020) | ||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | |

| Mean | 0.32 | 0.74 | 0.31 | 0.30 | 0.42 | 0.41 | 0.54 | 0.42 | 0.37 | 0.29 | 0.55 | 0.31 | 0.31 | 0.27 | 0.59 | 0.55 | 0.59 |

| Std.dev | 0.45 | 0.99 | 0.48 | 0.46 | 0.57 | 0.73 | 0.69 | 0.65 | 0.60 | 0.46 | 0.63 | 0.44 | 0.48 | 0.40 | 1.15 | 1.02 | 1.16 |

| Max | 6.24 | 14.62 | 6.63 | 6.19 | 7.22 | 10.79 | 8.74 | 11.73 | 7.11 | 5.83 | 11.09 | 7.68 | 7.74 | 6.16 | 20.30 | 15.42 | 25.03 |

| Min | 0.02 | 0.05 | 0.02 | 0.01 | 0.04 | 0.03 | 0.04 | 0.03 | 0.02 | 0.01 | 0.02 | 0.02 | 0.01 | 0.01 | 0.02 | 0.03 | 0.03 |

| Skewness | 6.03 | 7.39 | 7.56 | 6.84 | 6.08 | 7.99 | 4.96 | 7.83 | 6.33 | 6.60 | 6.36 | 7.67 | 6.98 | 6.75 | 8.72 | 8.45 | 13.12 |

| Kurtosis | 54.72 | 83.17 | 83.08 | 67.22 | 53.65 | 88.92 | 39.10 | 99.47 | 56.83 | 62.13 | 75.40 | 92.96 | 76.52 | 72.05 | 108.68 | 98.73 | 240.48 |

| COVID-19 period (25 February 2020–31 December 2020) | |||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | |

| Mean | 0.47 | 1.04 | 0.73 | 0.53 | 0.71 | 0.83 | 1.18 | 0.69 | 0.67 | 0.53 | 0.74 | 0.90 | 0.58 | 0.49 | 0.81 | 0.86 | 1.25 |

| Std.dev | 0.88 | 1.89 | 1.38 | 1.11 | 1.39 | 1.60 | 1.86 | 1.39 | 1.51 | 1.17 | 1.30 | 1.56 | 1.13 | 1.00 | 1.49 | 1.65 | 1.99 |

| Max | 6.90 | 13.04 | 11.37 | 10.43 | 12.30 | 12.29 | 14.88 | 12.58 | 12.70 | 10.49 | 9.11 | 13.82 | 9.81 | 9.97 | 10.83 | 11.23 | 14.72 |

| Min | 0.03 | 0.06 | 0.05 | 0.04 | 0.04 | 0.04 | 0.12 | 0.06 | 0.05 | 0.04 | 0.06 | 0.03 | 0.04 | 0.03 | 0.03 | 0.02 | 0.05 |

| Skewness | 4.39 | 4.26 | 4.53 | 5.54 | 5.59 | 5.05 | 4.50 | 5.51 | 5.42 | 5.61 | 4.07 | 4.48 | 5.28 | 5.52 | 4.20 | 4.18 | 3.65 |

| Kurtosis | 25.50 | 23.09 | 27.54 | 39.94 | 40.66 | 32.23 | 28.02 | 40.38 | 37.36 | 40.41 | 21.64 | 28.77 | 37.55 | 42.61 | 23.73 | 22.44 | 18.10 |

| Pre-COVID-19 period (1 January 2014–21 February 2020) | ||||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | FROM | |

| Food | 7.9 | 2.4 | 6.6 | 6.5 | 6.5 | 6.1 | 5.9 | 5.9 | 6.3 | 6.7 | 5.2 | 6.4 | 5.9 | 6.9 | 4.5 | 5.7 | 4.6 | 92.1 |

| Enrg | 5.0 | 15.6 | 5.7 | 6.0 | 5.1 | 5.2 | 6.0 | 7.1 | 6.2 | 5.6 | 3.8 | 4.7 | 6.2 | 5.0 | 4.1 | 4.8 | 3.9 | 84.4 |

| Cnst | 6.5 | 2.6 | 7.2 | 6.8 | 5.9 | 6.3 | 6.1 | 6.4 | 6.6 | 6.6 | 5.1 | 6.2 | 6.2 | 6.5 | 4.8 | 5.7 | 4.6 | 92.8 |

| Matr | 6.4 | 2.9 | 6.8 | 7.2 | 6.1 | 6.2 | 6.2 | 6.6 | 6.8 | 6.5 | 4.9 | 6.1 | 6.1 | 6.4 | 4.8 | 5.7 | 4.3 | 92.8 |

| Medi | 6.9 | 2.5 | 6.4 | 6.6 | 7.7 | 6.0 | 6.1 | 6.1 | 6.5 | 6.6 | 4.9 | 6.3 | 6.0 | 6.6 | 4.7 | 5.7 | 4.3 | 92.3 |

| Cars | 6.3 | 2.5 | 6.6 | 6.5 | 5.7 | 7.1 | 6.1 | 6.3 | 6.6 | 6.2 | 4.8 | 5.9 | 6.2 | 6.1 | 5.5 | 6.3 | 5.1 | 92.9 |

| Stel | 6.3 | 3.0 | 6.6 | 6.6 | 5.9 | 6.3 | 7.6 | 6.7 | 6.7 | 6.3 | 4.7 | 5.9 | 6.3 | 6.0 | 5.0 | 5.8 | 4.4 | 92.4 |

| Mach | 6.1 | 3.4 | 6.7 | 6.8 | 5.8 | 6.3 | 6.5 | 7.3 | 6.9 | 6.4 | 4.5 | 5.8 | 6.3 | 5.9 | 4.9 | 5.9 | 4.5 | 92.7 |

| ElEq | 6.3 | 2.9 | 6.7 | 6.8 | 6.0 | 6.3 | 6.4 | 6.7 | 7.0 | 6.5 | 4.6 | 6.1 | 6.2 | 6.1 | 5.0 | 5.9 | 4.5 | 93.0 |

| IT | 6.7 | 2.6 | 6.7 | 6.7 | 6.2 | 6.0 | 6.0 | 6.3 | 6.5 | 7.4 | 5.1 | 6.2 | 6.0 | 6.6 | 4.7 | 5.7 | 4.5 | 92.6 |

| ElGs | 6.8 | 2.2 | 6.7 | 6.3 | 5.9 | 5.9 | 5.8 | 5.6 | 5.9 | 6.6 | 9.6 | 6.5 | 5.6 | 7.1 | 4.3 | 5.1 | 4.1 | 90.4 |

| Tras | 6.8 | 2.3 | 6.7 | 6.7 | 6.3 | 6.1 | 6.0 | 6.0 | 6.4 | 6.5 | 5.3 | 7.3 | 6.1 | 6.6 | 4.9 | 5.6 | 4.4 | 92.7 |

| Whol | 6.3 | 3.0 | 6.6 | 6.6 | 5.8 | 6.4 | 6.3 | 6.5 | 6.6 | 6.3 | 4.7 | 6.1 | 7.4 | 6.0 | 5.2 | 5.9 | 4.5 | 92.6 |

| Reta | 7.0 | 2.4 | 6.8 | 6.6 | 6.3 | 6.0 | 5.8 | 5.9 | 6.3 | 6.8 | 5.7 | 6.3 | 5.8 | 8.0 | 4.6 | 5.3 | 4.4 | 92.0 |

| Bank | 5.8 | 2.4 | 6.1 | 6.2 | 5.4 | 6.8 | 6.0 | 6.0 | 6.2 | 5.7 | 4.2 | 5.7 | 6.1 | 5.6 | 8.7 | 7.1 | 5.9 | 91.3 |

| Fina | 6.2 | 2.5 | 6.3 | 6.4 | 5.8 | 6.7 | 6.1 | 6.3 | 6.4 | 6.1 | 4.3 | 5.7 | 6.1 | 5.6 | 6.2 | 7.5 | 5.8 | 92.5 |

| Real | 6.0 | 2.5 | 6.2 | 5.9 | 5.4 | 6.6 | 5.5 | 6.0 | 6.0 | 5.9 | 4.1 | 5.6 | 5.8 | 5.7 | 6.3 | 6.9 | 9.6 | 90.4 |

| TO | 101.3 | 42.0 | 104.3 | 104.0 | 94.3 | 99.2 | 96.8 | 100.6 | 102.8 | 101.3 | 75.6 | 95.6 | 97.0 | 98.7 | 79.6 | 93.1 | 73.6 | Total: 91.8 |

| NET | 9.2 | −42.4 | 11.4 | 11.2 | 2.0 | 6.3 | 4.4 | 7.9 | 9.8 | 8.7 | −14.8 | 2.9 | 4.4 | 6.8 | −11.7 | 0.6 | −16.7 | |

| COVID-19 period (25 February 2020–31 December 2020) | ||||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | FROM | |

| Food | 6.4 | 6.1 | 6.1 | 6.2 | 5.5 | 5.9 | 5.5 | 6.4 | 6.4 | 6.4 | 4.8 | 5.3 | 6.0 | 5.7 | 6.1 | 5.8 | 5.2 | 93.6 |

| Enrg | 5.6 | 9.4 | 6.0 | 5.9 | 5.0 | 5.8 | 5.8 | 6.3 | 6.3 | 6.2 | 4.1 | 4.8 | 5.9 | 5.1 | 6.9 | 5.8 | 4.9 | 90.6 |

| Cnst | 6.0 | 6.3 | 6.3 | 6.2 | 5.4 | 6.1 | 5.8 | 6.5 | 6.4 | 6.3 | 4.5 | 5.1 | 6.0 | 5.6 | 6.3 | 5.9 | 5.4 | 93.7 |

| Matr | 6.2 | 5.8 | 6.1 | 6.4 | 5.6 | 6.0 | 5.6 | 6.4 | 6.4 | 6.4 | 4.5 | 5.2 | 6.1 | 5.7 | 6.2 | 5.9 | 5.4 | 93.6 |

| Medi | 6.3 | 5.3 | 6.1 | 6.3 | 6.3 | 6.0 | 5.5 | 6.4 | 6.4 | 6.3 | 4.9 | 5.2 | 6.2 | 5.6 | 5.9 | 5.9 | 5.4 | 93.7 |

| Cars | 6.0 | 5.9 | 6.2 | 6.2 | 5.5 | 6.4 | 5.9 | 6.4 | 6.3 | 6.2 | 4.7 | 5.2 | 6.0 | 5.5 | 6.2 | 5.9 | 5.3 | 93.6 |

| Stel | 5.9 | 6.0 | 6.1 | 6.0 | 5.3 | 6.2 | 6.6 | 6.4 | 6.1 | 5.9 | 4.6 | 5.2 | 6.0 | 5.3 | 6.6 | 6.1 | 5.6 | 93.4 |

| Mach | 6.1 | 6.1 | 6.2 | 6.3 | 5.6 | 6.1 | 5.8 | 6.6 | 6.4 | 6.3 | 4.5 | 5.1 | 6.1 | 5.6 | 6.3 | 5.9 | 5.3 | 93.4 |

| ElEq | 6.1 | 6.2 | 6.2 | 6.3 | 5.6 | 6.0 | 5.6 | 6.5 | 6.6 | 6.5 | 4.4 | 5.0 | 6.1 | 5.7 | 6.2 | 5.8 | 5.3 | 93.4 |

| IT | 6.2 | 6.4 | 6.1 | 6.3 | 5.5 | 5.8 | 5.4 | 6.5 | 6.6 | 6.8 | 4.3 | 5.0 | 6.1 | 5.8 | 6.2 | 5.8 | 5.2 | 93.2 |

| ElGs | 6.2 | 6.1 | 6.2 | 6.2 | 5.5 | 6.0 | 5.6 | 6.3 | 6.2 | 6.3 | 6.1 | 5.2 | 5.9 | 5.5 | 6.0 | 5.9 | 5.0 | 93.9 |

| Tras | 6.2 | 5.6 | 6.0 | 6.2 | 5.4 | 6.0 | 5.6 | 6.1 | 6.0 | 6.1 | 5.0 | 6.4 | 5.9 | 5.8 | 6.1 | 5.9 | 5.5 | 93.6 |

| Whol | 6.1 | 6.0 | 6.1 | 6.2 | 5.6 | 5.9 | 5.7 | 6.4 | 6.4 | 6.3 | 4.6 | 5.2 | 6.4 | 5.6 | 6.2 | 5.9 | 5.3 | 93.6 |

| Reta | 6.1 | 6.4 | 6.2 | 6.2 | 5.3 | 5.8 | 5.5 | 6.4 | 6.4 | 6.6 | 4.4 | 5.2 | 6.0 | 6.2 | 6.2 | 5.7 | 5.3 | 93.8 |

| Bank | 5.9 | 6.9 | 6.0 | 6.2 | 5.2 | 6.1 | 5.9 | 6.3 | 6.1 | 6.1 | 4.2 | 5.2 | 5.9 | 5.2 | 7.5 | 6.2 | 5.3 | 92.5 |

| Fina | 6.0 | 5.9 | 6.0 | 6.2 | 5.4 | 6.0 | 5.9 | 6.3 | 6.2 | 6.1 | 4.6 | 5.2 | 6.0 | 5.3 | 6.7 | 6.5 | 5.5 | 93.5 |

| Real | 6.0 | 5.5 | 6.1 | 6.1 | 5.3 | 5.9 | 6.0 | 6.2 | 6.1 | 6.1 | 4.8 | 5.5 | 5.9 | 5.7 | 6.1 | 6.2 | 6.4 | 93.6 |

| TO | 96.9 | 96.6 | 97.6 | 99.0 | 86.7 | 95.6 | 91.0 | 102.0 | 100.6 | 100.2 | 73.1 | 82.7 | 95.8 | 88.7 | 100.3 | 94.8 | 85.0 | Total: 93.3 |

| NET | 3.3 | 6.0 | 3.9 | 5.4 | −7.0 | 2.0 | −2.4 | 8.6 | 7.2 | 7.0 | −20.9 | −10.9 | 2.2 | −5.1 | 7.9 | 1.3 | −8.6 | |

| Pre-COVID-19 period (1 January 2014–21 February 2020) | ||||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | FROM | |

| Food | 7.3 | 3.0 | 6.4 | 6.4 | 6.3 | 6.0 | 5.9 | 6.0 | 6.1 | 6.4 | 5.5 | 6.3 | 5.8 | 6.5 | 5.2 | 6.1 | 4.8 | 92.7 |

| Enrg | 5.0 | 12.2 | 5.8 | 6.1 | 5.4 | 5.4 | 6.2 | 7.0 | 6.4 | 5.6 | 4.4 | 4.7 | 6.0 | 5.1 | 4.9 | 5.4 | 4.4 | 87.8 |

| Cnst | 6.2 | 3.4 | 6.8 | 6.5 | 5.8 | 6.2 | 6.2 | 6.3 | 6.4 | 6.3 | 5.3 | 5.9 | 6.0 | 6.2 | 5.2 | 6.1 | 5.1 | 93.2 |

| Matr | 6.1 | 3.6 | 6.5 | 6.8 | 5.9 | 6.2 | 6.2 | 6.4 | 6.5 | 6.3 | 5.1 | 6.0 | 5.9 | 6.1 | 5.1 | 6.1 | 4.9 | 93.2 |

| Medi | 6.5 | 3.3 | 6.2 | 6.4 | 7.3 | 5.9 | 6.1 | 6.2 | 6.3 | 6.4 | 5.2 | 6.3 | 5.9 | 6.2 | 5.2 | 6.0 | 4.8 | 92.7 |

| Cars | 6.0 | 3.3 | 6.4 | 6.3 | 5.7 | 6.9 | 6.1 | 6.2 | 6.4 | 6.1 | 5.1 | 5.8 | 6.2 | 5.9 | 5.8 | 6.5 | 5.3 | 93.1 |

| Stel | 5.9 | 3.8 | 6.4 | 6.5 | 5.9 | 6.2 | 7.1 | 6.6 | 6.5 | 6.1 | 5.1 | 5.8 | 6.1 | 5.8 | 5.3 | 6.2 | 4.9 | 92.9 |

| Mach | 5.9 | 4.2 | 6.4 | 6.5 | 5.9 | 6.1 | 6.4 | 6.9 | 6.6 | 6.2 | 5.0 | 5.7 | 6.1 | 5.8 | 5.2 | 6.1 | 4.9 | 93.1 |

| ElEq | 5.9 | 3.8 | 6.4 | 6.6 | 5.9 | 6.2 | 6.3 | 6.6 | 6.8 | 6.2 | 4.9 | 5.9 | 6.1 | 5.8 | 5.4 | 6.2 | 5.1 | 93.2 |

| IT | 6.3 | 3.4 | 6.5 | 6.5 | 6.1 | 6.0 | 6.1 | 6.3 | 6.3 | 7.0 | 5.2 | 6.0 | 5.9 | 6.3 | 5.2 | 6.1 | 4.9 | 93.0 |

| ElGs | 6.5 | 3.1 | 6.4 | 6.1 | 5.8 | 5.9 | 5.9 | 5.8 | 5.8 | 6.2 | 8.6 | 6.3 | 5.6 | 6.5 | 4.7 | 5.8 | 5.0 | 91.4 |

| Tras | 6.5 | 2.9 | 6.3 | 6.3 | 6.2 | 6.0 | 5.9 | 5.9 | 6.2 | 6.3 | 5.6 | 7.1 | 5.9 | 6.3 | 5.4 | 6.0 | 5.0 | 92.9 |

| Whol | 5.9 | 3.7 | 6.3 | 6.2 | 5.7 | 6.4 | 6.2 | 6.3 | 6.4 | 6.1 | 5.0 | 5.9 | 7.1 | 5.7 | 5.7 | 6.3 | 5.1 | 92.9 |

| Reta | 6.7 | 3.1 | 6.5 | 6.4 | 6.1 | 6.0 | 5.9 | 6.0 | 6.1 | 6.5 | 5.7 | 6.2 | 5.7 | 7.4 | 5.0 | 5.8 | 4.9 | 92.6 |

| Bank | 5.8 | 3.3 | 6.0 | 5.9 | 5.6 | 6.6 | 5.9 | 5.9 | 6.2 | 5.9 | 4.5 | 5.9 | 6.2 | 5.5 | 8.0 | 6.9 | 5.9 | 92.0 |

| Fina | 6.0 | 3.2 | 6.3 | 6.2 | 5.8 | 6.4 | 6.1 | 6.2 | 6.3 | 6.1 | 4.8 | 5.8 | 6.1 | 5.6 | 6.1 | 7.1 | 5.7 | 92.9 |

| Real | 5.7 | 3.2 | 6.2 | 5.9 | 5.5 | 6.3 | 5.8 | 6.0 | 6.1 | 5.8 | 4.9 | 5.7 | 5.9 | 5.5 | 6.2 | 6.8 | 8.6 | 91.4 |

| TO | 96.9 | 54.3 | 101.0 | 100.8 | 93.6 | 97.9 | 97.1 | 99.6 | 100.7 | 98.7 | 81.2 | 94.1 | 95.4 | 94.8 | 85.8 | 98.3 | 80.7 | Total: 92.4 |

| NET | 4.2 | −33.5 | 7.9 | 7.7 | 0.9 | 4.8 | 4.2 | 6.6 | 7.4 | 5.7 | −10.2 | 1.2 | 2.5 | 2.3 | −6.2 | 5.3 | −10.6 | |

| COVID-19 period (25 February 2020–31 December 2020) | ||||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | FROM | |

| Food | 6.4 | 5.0 | 6.1 | 6.1 | 5.7 | 5.8 | 5.9 | 6.1 | 6.2 | 6.3 | 5.0 | 5.6 | 6.0 | 5.9 | 6.0 | 6.0 | 5.6 | 93.6 |

| Enrg | 5.1 | 10.1 | 5.9 | 5.6 | 4.9 | 5.9 | 6.4 | 6.3 | 6.5 | 6.0 | 3.9 | 4.5 | 5.7 | 5.0 | 7.7 | 5.9 | 4.6 | 89.9 |

| Cnst | 6.0 | 5.3 | 6.4 | 6.1 | 5.6 | 6.0 | 6.3 | 6.3 | 6.3 | 6.3 | 4.6 | 5.2 | 6.0 | 5.6 | 6.3 | 6.1 | 5.6 | 93.6 |

| Matr | 6.0 | 4.9 | 6.1 | 6.3 | 5.9 | 6.0 | 5.9 | 6.3 | 6.3 | 6.3 | 4.8 | 5.4 | 6.1 | 5.7 | 6.2 | 6.2 | 5.6 | 93.7 |

| Medi | 6.1 | 4.5 | 6.1 | 6.2 | 6.4 | 6.0 | 5.8 | 6.2 | 6.3 | 6.2 | 5.0 | 5.6 | 6.1 | 5.7 | 6.0 | 6.2 | 5.6 | 93.6 |

| Cars | 5.9 | 5.1 | 6.2 | 6.1 | 5.7 | 6.3 | 6.2 | 6.3 | 6.3 | 6.2 | 4.8 | 5.3 | 6.1 | 5.6 | 6.2 | 6.1 | 5.7 | 93.7 |

| Stel | 5.8 | 5.5 | 6.3 | 6.0 | 5.5 | 6.2 | 6.8 | 6.3 | 6.2 | 6.0 | 4.6 | 5.2 | 6.0 | 5.5 | 6.4 | 6.1 | 5.6 | 93.2 |

| Mach | 5.8 | 5.6 | 6.2 | 6.1 | 5.7 | 6.1 | 6.2 | 6.5 | 6.3 | 6.3 | 4.6 | 5.3 | 6.0 | 5.5 | 6.4 | 6.1 | 5.4 | 93.5 |

| ElEq | 5.9 | 5.6 | 6.1 | 6.2 | 5.7 | 6.0 | 6.0 | 6.3 | 6.5 | 6.4 | 4.6 | 5.2 | 6.1 | 5.6 | 6.3 | 6.1 | 5.4 | 93.5 |

| IT | 5.9 | 5.7 | 6.1 | 6.2 | 5.6 | 5.9 | 6.0 | 6.3 | 6.4 | 6.6 | 4.6 | 5.1 | 6.0 | 5.6 | 6.3 | 6.1 | 5.4 | 93.4 |

| ElGs | 6.1 | 5.0 | 6.1 | 5.9 | 5.5 | 5.8 | 5.9 | 6.0 | 6.0 | 6.1 | 6.8 | 5.5 | 5.9 | 5.8 | 5.9 | 6.0 | 5.5 | 93.2 |

| Tras | 6.3 | 4.5 | 6.0 | 6.1 | 5.8 | 5.9 | 5.8 | 6.1 | 6.0 | 6.1 | 5.3 | 6.5 | 5.9 | 6.0 | 5.8 | 6.0 | 5.8 | 93.5 |

| Whol | 6.0 | 5.1 | 6.1 | 6.1 | 5.7 | 6.0 | 6.0 | 6.2 | 6.3 | 6.2 | 5.0 | 5.4 | 6.3 | 5.7 | 6.2 | 6.2 | 5.7 | 93.7 |

| Reta | 6.2 | 5.3 | 6.1 | 6.0 | 5.6 | 5.8 | 6.0 | 6.1 | 6.2 | 6.3 | 4.9 | 5.6 | 6.0 | 6.4 | 6.0 | 5.9 | 5.7 | 93.6 |

| Bank | 5.6 | 6.3 | 6.0 | 6.1 | 5.5 | 6.0 | 6.2 | 6.3 | 6.3 | 6.1 | 4.6 | 5.1 | 6.0 | 5.2 | 7.3 | 6.2 | 5.2 | 92.7 |

| Fina | 5.9 | 5.2 | 6.1 | 6.2 | 5.7 | 6.0 | 6.0 | 6.3 | 6.3 | 6.3 | 4.8 | 5.3 | 6.1 | 5.4 | 6.4 | 6.4 | 5.6 | 93.6 |

| Real | 6.1 | 4.4 | 6.1 | 6.1 | 5.7 | 6.0 | 6.1 | 6.0 | 6.1 | 6.1 | 5.1 | 5.6 | 6.2 | 6.0 | 5.8 | 6.1 | 6.5 | 93.5 |

| TO | 94.7 | 83.2 | 97.6 | 97.1 | 89.7 | 95.4 | 96.8 | 99.4 | 99.9 | 99.1 | 76.4 | 85.0 | 96.3 | 89.9 | 99.8 | 97.4 | 87.9 | Total: 93.3 |

| NET | 1.1 | −6.7 | 4.0 | 3.5 | −3.9 | 1.7 | 3.6 | 5.9 | 6.4 | 5.7 | −16.9 | −8.5 | 2.6 | −3.6 | 7.2 | 3.8 | −5.6 | |

| Pre-COVID-19 period (1 January 2014–21 February 2020) | ||||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | FROM | |

| Food | 11.3 | 1.1 | 6.7 | 6.4 | 7.0 | 5.9 | 4.5 | 4.3 | 6.4 | 7.9 | 5.2 | 7.1 | 5.5 | 8.7 | 2.7 | 4.3 | 4.9 | 88.7 |

| Enrg | 4.1 | 26.3 | 5.2 | 6.1 | 4.5 | 4.7 | 5.5 | 6.4 | 6.1 | 5.5 | 2.5 | 4.2 | 6.5 | 4.1 | 2.3 | 3.7 | 2.4 | 73.7 |

| Cnst | 6.4 | 1.2 | 8.5 | 7.7 | 6.1 | 6.6 | 5.7 | 6.3 | 7.3 | 7.1 | 4.5 | 6.8 | 6.5 | 6.6 | 3.5 | 5.1 | 4.0 | 91.5 |

| Matr | 6.0 | 1.5 | 7.7 | 8.8 | 6.3 | 6.5 | 5.9 | 6.8 | 7.8 | 6.9 | 4.0 | 6.5 | 6.6 | 6.3 | 3.7 | 5.2 | 3.5 | 91.2 |

| Medi | 7.4 | 1.2 | 6.9 | 7.1 | 10.2 | 5.8 | 5.1 | 5.2 | 7.1 | 7.5 | 4.6 | 6.6 | 5.9 | 7.6 | 3.4 | 4.8 | 3.5 | 89.8 |

| Cars | 5.8 | 1.3 | 7.1 | 7.1 | 5.6 | 8.6 | 6.0 | 6.8 | 7.6 | 6.3 | 3.7 | 6.0 | 6.5 | 5.6 | 4.4 | 6.6 | 4.8 | 91.4 |

| Stel | 5.8 | 1.7 | 7.1 | 7.1 | 5.4 | 6.8 | 9.8 | 7.3 | 7.5 | 6.3 | 3.8 | 5.6 | 7.1 | 5.4 | 4.0 | 5.3 | 4.1 | 90.2 |

| Mach | 5.0 | 1.9 | 7.4 | 7.9 | 5.6 | 7.2 | 7.0 | 8.9 | 8.2 | 6.3 | 3.2 | 5.7 | 7.0 | 5.1 | 3.9 | 6.0 | 3.8 | 91.1 |

| ElEq | 6.0 | 1.5 | 7.3 | 7.7 | 6.1 | 7.0 | 6.1 | 7.0 | 8.6 | 7.1 | 3.9 | 6.1 | 6.4 | 6.1 | 3.6 | 5.6 | 4.0 | 91.4 |

| IT | 7.2 | 1.4 | 7.3 | 7.1 | 6.6 | 6.0 | 5.0 | 5.4 | 7.3 | 9.4 | 4.9 | 7.0 | 6.1 | 7.5 | 3.2 | 4.7 | 4.0 | 90.6 |

| ElGs | 7.8 | 0.8 | 7.0 | 6.0 | 6.2 | 5.5 | 4.7 | 3.9 | 6.0 | 7.6 | 14.3 | 7.1 | 5.1 | 8.4 | 3.0 | 3.8 | 3.1 | 85.7 |

| Tras | 7.3 | 1.1 | 7.5 | 7.2 | 6.6 | 6.1 | 5.0 | 5.2 | 6.8 | 7.5 | 5.1 | 9.0 | 6.3 | 7.2 | 3.6 | 4.8 | 3.7 | 91.0 |

| Whol | 6.0 | 1.8 | 7.3 | 7.4 | 6.0 | 6.6 | 6.4 | 6.6 | 7.3 | 6.9 | 3.8 | 6.4 | 8.9 | 5.8 | 3.7 | 5.4 | 3.7 | 91.1 |

| Reta | 8.3 | 1.2 | 7.2 | 6.9 | 7.1 | 5.6 | 4.6 | 4.6 | 6.6 | 8.0 | 5.7 | 7.0 | 5.6 | 10.5 | 3.0 | 4.1 | 4.1 | 89.5 |

| Bank | 4.5 | 1.1 | 6.2 | 6.7 | 5.2 | 7.2 | 6.2 | 6.1 | 6.5 | 5.3 | 3.4 | 5.6 | 5.9 | 4.7 | 13.0 | 9.0 | 3.5 | 87.0 |

| Fina | 5.4 | 1.3 | 6.6 | 6.8 | 5.7 | 7.7 | 5.7 | 6.6 | 7.1 | 6.0 | 3.2 | 5.7 | 6.2 | 5.0 | 6.4 | 9.3 | 5.3 | 90.7 |

| Real | 7.0 | 1.2 | 6.9 | 6.2 | 5.3 | 7.1 | 4.9 | 5.5 | 6.1 | 6.6 | 3.1 | 5.8 | 5.9 | 6.3 | 3.4 | 6.0 | 12.8 | 87.2 |

| TO | 100.2 | 21.0 | 111.5 | 111.4 | 95.1 | 102.4 | 88.2 | 94.1 | 111.6 | 108.6 | 64.6 | 99.2 | 99.2 | 100.3 | 57.6 | 84.5 | 62.5 | Total: 88.9 |

| NET | 11.6 | −52.8 | 20.0 | 20.2 | 5.4 | 11.0 | −2.0 | 3.0 | 20.1 | 17.9 | −21.1 | 8.2 | 8.0 | 10.7 | −29.4 | −6.2 | −24.7 | |

| RS+ | COVID-19 period (25 February 2020–31 December 2020) | |||||||||||||||||

| Food | Enrg | Cnst | Matr | Medi | Cars | Stel | Mach | ElEq | IT | ElGs | Tras | Whol | Reta | Bank | Fina | Real | FROM | |

| Food | 8.3 | 6.9 | 6.5 | 7.5 | 6.1 | 5.7 | 3.7 | 7.1 | 7.5 | 8.6 | 4.5 | 4.6 | 6.3 | 6.4 | 5.0 | 3.8 | 1.4 | 91.7 |

| Enrg | 7.2 | 10.7 | 6.2 | 6.7 | 4.7 | 5.3 | 4.4 | 6.3 | 6.6 | 7.6 | 5.9 | 4.8 | 6.0 | 5.6 | 5.4 | 4.3 | 2.4 | 89.3 |

| Cnst | 7.0 | 7.5 | 7.3 | 7.2 | 5.4 | 6.1 | 4.6 | 7.3 | 7.4 | 8.0 | 4.1 | 4.2 | 6.3 | 6.0 | 5.3 | 4.1 | 2.2 | 92.7 |

| Matr | 7.5 | 6.9 | 6.7 | 7.7 | 6.1 | 6.0 | 4.1 | 7.7 | 7.9 | 8.7 | 3.6 | 4.1 | 6.4 | 6.2 | 5.2 | 3.8 | 1.5 | 92.3 |

| Medi | 7.7 | 6.2 | 6.5 | 7.3 | 8.3 | 6.2 | 4.2 | 7.9 | 7.6 | 8.0 | 4.0 | 3.8 | 6.5 | 5.6 | 4.8 | 4.0 | 1.3 | 91.7 |

| Cars | 7.2 | 6.6 | 6.9 | 7.1 | 6.0 | 7.5 | 5.0 | 7.6 | 7.3 | 7.8 | 3.6 | 4.3 | 6.4 | 5.6 | 5.1 | 4.1 | 2.0 | 92.5 |

| Stel | 6.2 | 6.5 | 7.0 | 6.5 | 5.0 | 6.8 | 7.6 | 6.9 | 6.4 | 6.1 | 3.6 | 4.6 | 6.3 | 4.7 | 6.2 | 5.7 | 3.9 | 92.4 |

| Mach | 7.0 | 6.9 | 7.0 | 7.4 | 6.2 | 6.4 | 4.6 | 8.1 | 7.8 | 8.2 | 3.6 | 3.6 | 6.6 | 5.9 | 5.1 | 3.8 | 1.7 | 91.9 |

| ElEq | 7.1 | 6.9 | 6.9 | 7.6 | 5.8 | 5.7 | 4.2 | 7.7 | 8.3 | 9.0 | 3.4 | 3.6 | 6.4 | 6.4 | 5.2 | 3.8 | 1.8 | 91.7 |

| IT | 7.6 | 7.0 | 6.6 | 7.6 | 5.9 | 5.4 | 3.7 | 7.8 | 8.4 | 9.8 | 3.4 | 3.8 | 6.5 | 6.9 | 5.1 | 3.3 | 1.3 | 90.2 |

| ElGs | 8.2 | 7.4 | 6.2 | 7.4 | 6.5 | 5.5 | 3.4 | 7.1 | 7.2 | 8.5 | 7.0 | 4.7 | 6.1 | 6.2 | 4.5 | 3.4 | 0.9 | 93.0 |

| Tras | 7.8 | 6.5 | 6.0 | 6.9 | 5.4 | 6.0 | 4.2 | 6.4 | 6.4 | 7.4 | 4.4 | 7.4 | 6.4 | 5.9 | 5.7 | 4.7 | 2.5 | 92.6 |

| Whol | 7.2 | 6.8 | 6.6 | 7.2 | 5.9 | 6.0 | 4.5 | 7.5 | 7.2 | 8.0 | 3.6 | 4.5 | 8.2 | 5.9 | 5.2 | 3.9 | 1.8 | 91.8 |

| Reta | 7.7 | 6.9 | 6.6 | 7.6 | 6.2 | 5.7 | 3.5 | 7.6 | 8.0 | 9.1 | 3.9 | 4.2 | 6.6 | 7.5 | 4.9 | 3.1 | 1.2 | 92.5 |

| Bank | 6.8 | 7.1 | 6.4 | 6.7 | 4.7 | 5.7 | 5.1 | 6.4 | 6.4 | 7.3 | 3.3 | 5.3 | 6.0 | 5.1 | 8.3 | 5.8 | 3.5 | 91.7 |

| Fina | 6.8 | 7.2 | 6.1 | 6.5 | 4.7 | 5.6 | 5.3 | 6.2 | 6.2 | 6.8 | 3.7 | 5.3 | 5.7 | 4.4 | 7.2 | 7.5 | 4.7 | 92.5 |

| Real | 5.7 | 8.8 | 5.9 | 5.5 | 3.4 | 5.1 | 5.7 | 5.5 | 5.6 | 6.1 | 4.7 | 5.3 | 5.0 | 4.3 | 6.7 | 7.7 | 9.0 | 91.0 |

| TO | 114.8 | 112.1 | 104.1 | 112.8 | 88.0 | 93.3 | 70.2 | 112.8 | 113.8 | 125.2 | 63.1 | 70.6 | 99.6 | 91.3 | 86.6 | 69.4 | 34.0 | Total: 91.9 |

| NET | 23.1 | 22.7 | 11.4 | 20.5 | −3.8 | 0.8 | −22.2 | 20.9 | 22.1 | 35.0 | −29.9 | −22.0 | 7.7 | −1.2 | −5.1 | −23.1 | −57.1 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shigemoto, H.; Morimoto, T. Volatility Spillover among Japanese Sectors in Response to COVID-19. J. Risk Financial Manag. 2022, 15, 480. https://doi.org/10.3390/jrfm15100480

Shigemoto H, Morimoto T. Volatility Spillover among Japanese Sectors in Response to COVID-19. Journal of Risk and Financial Management. 2022; 15(10):480. https://doi.org/10.3390/jrfm15100480

Chicago/Turabian StyleShigemoto, Hideto, and Takayuki Morimoto. 2022. "Volatility Spillover among Japanese Sectors in Response to COVID-19" Journal of Risk and Financial Management 15, no. 10: 480. https://doi.org/10.3390/jrfm15100480