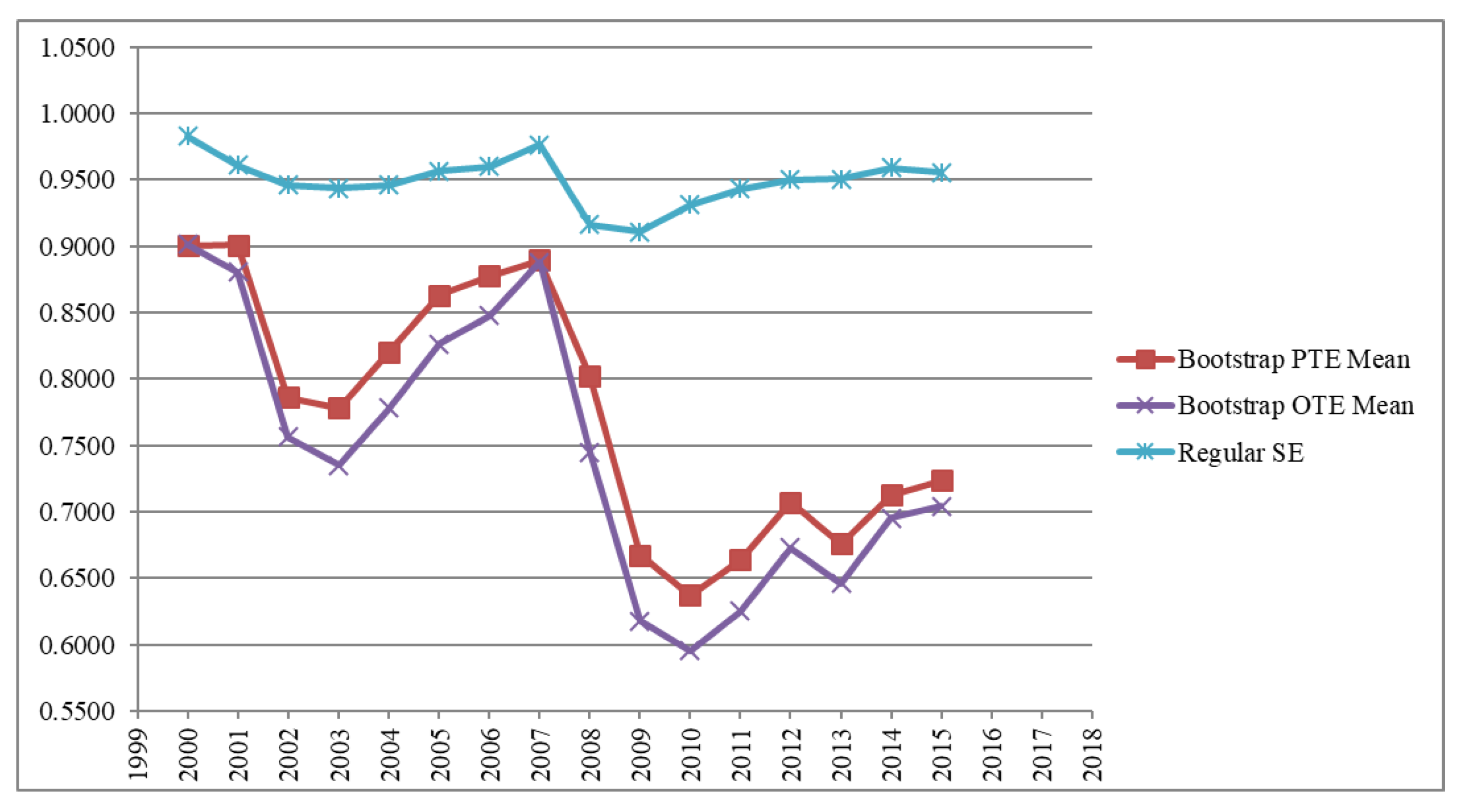

4.2.1. Annual Evaluation of Efficiencies

In this section, we analyze the behaviour of efficiencies for the years 2000–2017.

Table 2,

Table 3 and

Table 4 provide the calculated OTEs, PTEs, and the SEs for the first, second, and third stages, respectively.

The first observation from

Table 2 and

Table 3 is that the banking sector of Canada performed well in terms of the overall technical efficiency and the pure technical efficiency in the first and second stages. On average, the overall and pure technical efficiencies of the banks in the period 2000 to 2017 are 0.828 and 0.88 for the first stage, and 0.812 and 0.879 for the second stage. Besides, in the first two stages, the OTE is always above 0.74, and the PTE is above 0.8. In the third stage, the average OTE and PTE are relatively lower and are equal to 0.739 and 0.77, respectively (see

Table 4).

The measured scale efficiencies for three stages suggest that the main source of inefficiency in the sector is the managerial issues rather than scale issues.

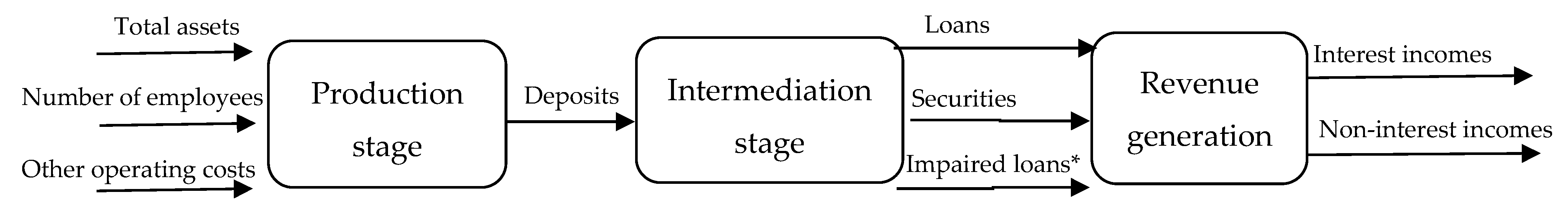

Figure 2,

Figure 3 and

Figure 4 show the variations of OTE, PTE, and SE for the period 2000 to 2017.

From

Figure 2, it can be observed that, for the period 2000 to 2007, the OTE and the PTE are gradually decreasing. This shows that, during this period, the Canadian banks were gradually losing their ability to turn their resources into deposits. The data from the Office of the Superintendent of Financial Institutions Canada show that, during this period, the assets to capital ratio for Canadian banks was increasing (

Office of Superintendent of Financial Institutions 2019), which results in lower efficiency in the first stage.

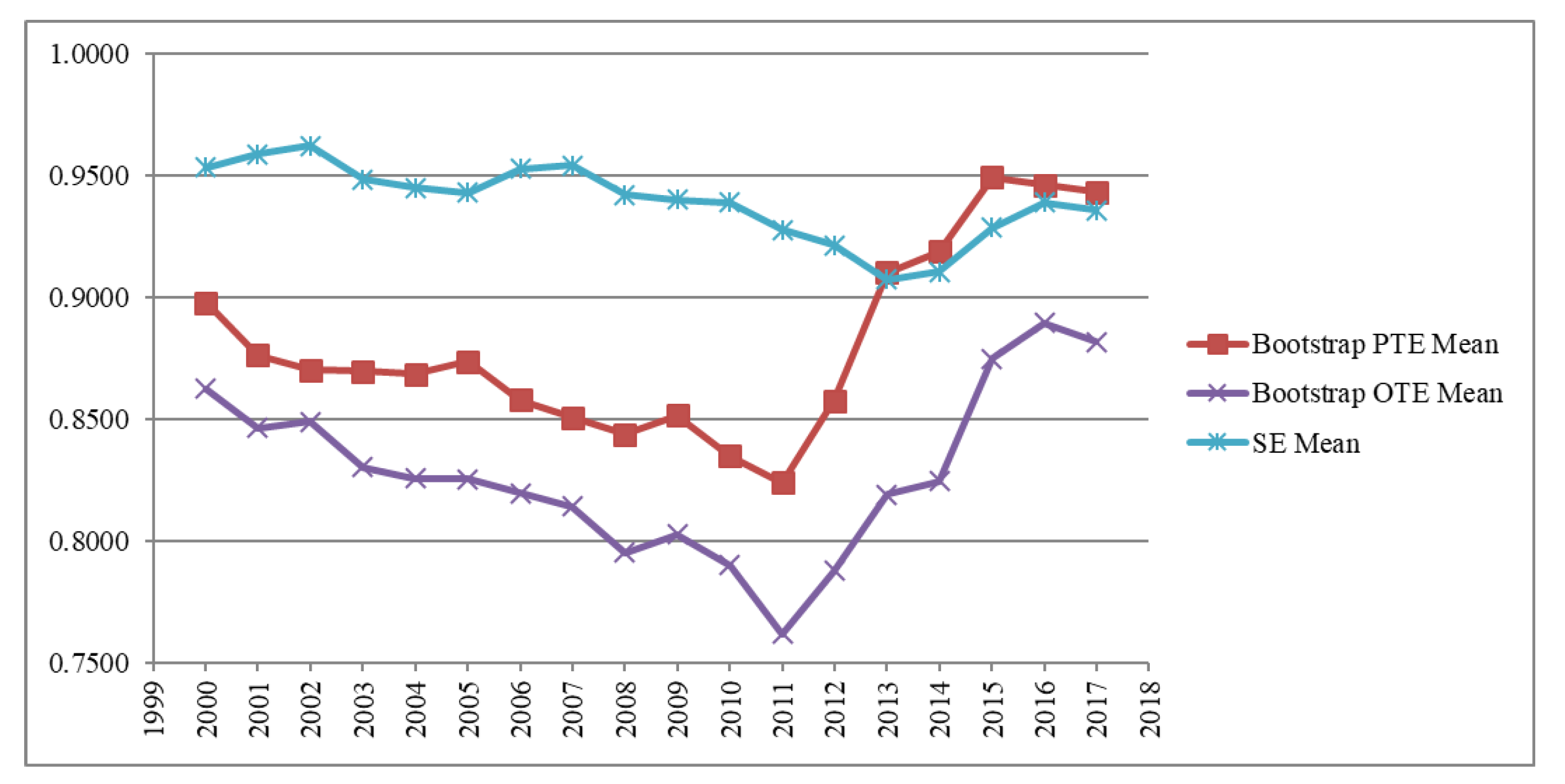

Figure 3 and

Figure 4 demonstrate that the average efficiency of the Canadian banks for the investment and revenue generation stages was increasing before the 2007 financial crisis. In the period 2002 to 2007, the demand for mortgages increased, which resulted in higher mortgage interest rates (

Bank of Canada 2019). Hence, in this period, we observe increasing trends in the efficiencies for the second and the third stages.

In the period 2007 to 2011, we can observe a swift decline in the OTE and PTE for all three stages. This behaviour can be traced back to the 2007 financial crisis. Nevertheless, the decline in the measured efficiencies is not substantial. In the studied period, neither OTE nor PTE has ever gone below 0.74 for the first two stages and below 0.59 for the third stage. This pattern can be associated with the resilience of the Canadian banking system. In fact, according to a recent survey by the World Economic Forum, Canada has one of the most stable banking systems in the world (

World Economic Forum 2018). Another explanatory element that describes the relatively good performance of the Canadian banks during the 2007 financial crisis is the high reliance of Canadian banks on retail and commercial deposits in comparison to American and European counterparts (

Gauthier and Tomura 2011). Retail and Commercial deposits provide a more stable source of funds for the banks and, consequently, impose less risk during financial crises (

Truno et al. 2017). Moreover, researchers have suggested other elements, such as stiff government supervision and regulations and a centralized structure of the Canadian banking system, as important factors that helped the Canadian banking sector to have a smooth transition during the 2007 financial crisis (

Seccareccia 2012).

After 2011, we observe a gradual increase in the OTE and PTE of all stages. In fact, in the first stage, the OTEs and the PTEs for 2015, 2016, and 2017 are even higher than similar measures in 2000. Most of the banks responded to the financial crisis by reducing their operating and non-operating costs (

Tsionas and Mamatzakis 2017). Canadian banks also followed a similar strategy that resulted in higher efficiencies in the first stage after 2011.

We observe similar behaviour for the PTE of the second stage. The PTE in the last three years is increasing and is higher than the PTE in 2000.

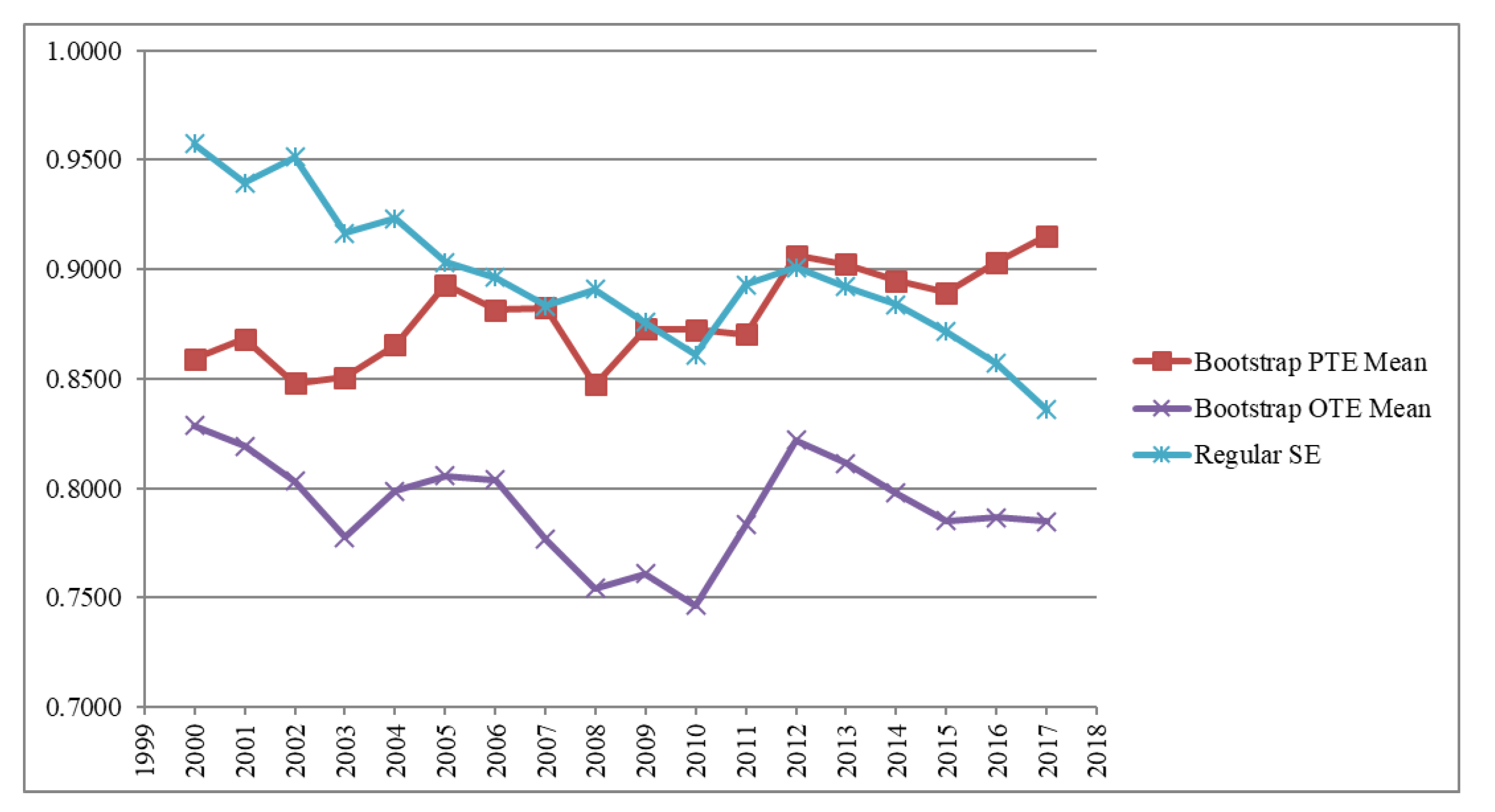

According to

Figure 4, the revenue generation stage of the banks is also gently recovering. After 2010, we can observe a gradual increase in the OTE and PTE of the final stage. In fact, after 2011, the mortgage rate was relatively constant (

Statistics Canada 2019); however, the decrease in the amount of impaired loans and the higher reliance of the Canadian banks on non-interest incomes, such as deposit and transfer fees (

Seccareccia 2012), have resulted in higher efficiency in the last stage. In fact, the share of non-interest incomes in the total income of the studied banks has increased from 22% in 2007 to 39% in 2017.

In order to develop a better understanding of the variation of efficiency in different years, we conducted pairwise

t-tests and compared the OTE, PTE, and SE of the studied years for all three stages. The results of this comparison are presented in

Table 5. Please note that, in this table, we have only reported the

p-values for the years with a significant difference at 1%, 5%, and 10%.

According to

Table 5, in the first stage, although we observe a swift decrease in overall technical efficiency in the period 2009 to 2011, this decrease is not statistically significant. We have a similar situation for SE. In addition, the PTE during the financial crisis does not show a statistically significant difference to the years prior to the financial crisis. As mentioned before, this behaviour can be traced back to the resilience of the Canadian banking system. However, the improvement in PTE after the financial crisis is significant. It can be observed that the PTEs of 2008, 2010, and 2011 are significantly different from the years 2015, 2016, and 2017. After 2011, most of the banks around the world tried to reduce their costs to become more resilient to the fluctuations of the financial markets, and Canadian banks were no exception to this (

Tsionas and Mamatzakis 2017).

Table 5 reveals that Canadian banks were indeed successful in this process.

In the second stage, the big six Canadian banks demonstrate a stable performance. We did not observe any statistically significant difference between the OTEs, PTEs, and SEs prior, during, or after the financial crisis. According to the results, the financial crisis did not substantially impair the loaning and investment processes of the big six Canadian banks (and therefore, no number is reported in

Table 5 for Stage 2). This shows that the Canadian banks have not made a drastic change in the rate of turning deposits into loans and securities, and although the lower rate of impaired loans has caused an increase in the efficiencies, this increase is not statistically significant.

The third stage indicates the largest variations in efficiency from 2000 to 2017. According to

Table 5, during the financial crisis, the efficiency of Canadian banks’ revenue generation stage dropped significantly. The OTEs and PTEs during the financial crisis are significantly different from the years 2000 and 2001, in which the banks had the highest efficiencies. In addition, the performance of the banks before the financial crisis is significantly different from the years 2010 and 2011. These observations are due to the fact that, before the financial crisis, the banks were benefiting from a high mortgage demand and high mortgage rates, and the loss of this source of income resulted in significantly lower efficiencies in Stage 3 after the financial crisis.

4.2.2. Evaluation of the Banks’ Efficiencies

In this section, we analyze and compare the efficiencies of the big six Canadian banks.

Table 6 provides the OTE, PTE, and the SE of the banks for all three stages.

The first observation from

Table 6 is that the six big Canadian banks, on average, have a lower performance in the second stage in terms of overall technical efficiency. The average OTE for the first and the third stages are 0.837 and 0.915, while this number for the second stage is 0.791. In terms of pure technical efficiency, the banks have the best performance in the third stage. The average PTE for the first, second, and third stages are 0.880, 0.879, and 0.948, respectively.

Our second observation is that the standard deviations of the efficiencies for all the stages are relatively low. In the first and the second stages, the highest coefficient of variation for OTE, PTE, and SE is 0.118. In the third stage, we have a larger variation in the measured efficiencies; nevertheless, the coefficients of variation are still relatively low. The highest coefficient of variation in this stage is 0.248. This observation shows that due to the high centralization of the Canadian banking system and the higher level supervision of the government, Canadian banks are remarkably resilient to the fluctuations of the financial markets (

World Economic Forum 2018).

Finally, we can see that the banks do not show consistent performance in all stages. For instance, NBC, despite having the highest OTE and PTE in the second stage, has the lowest OTE in the third stage.

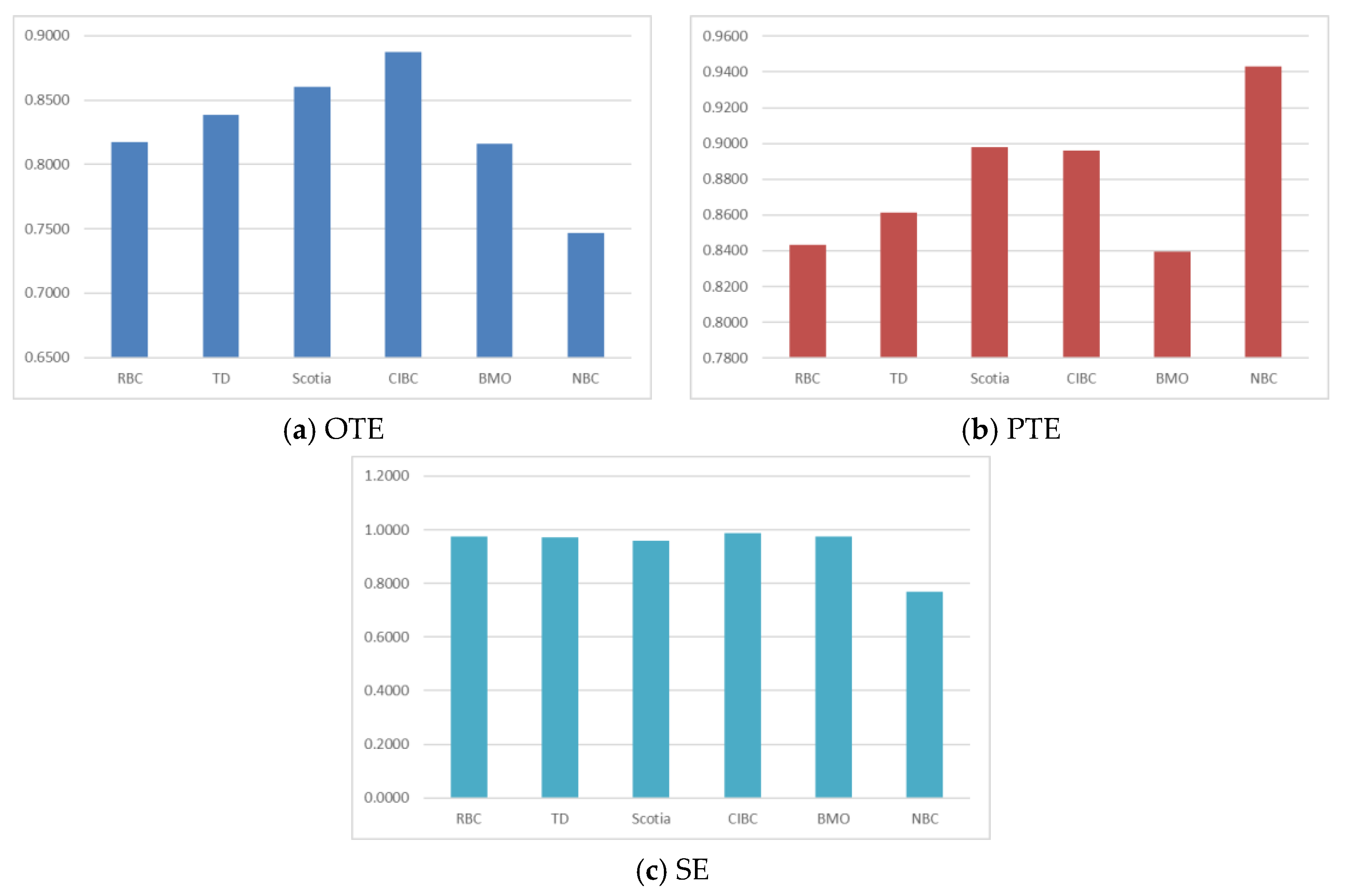

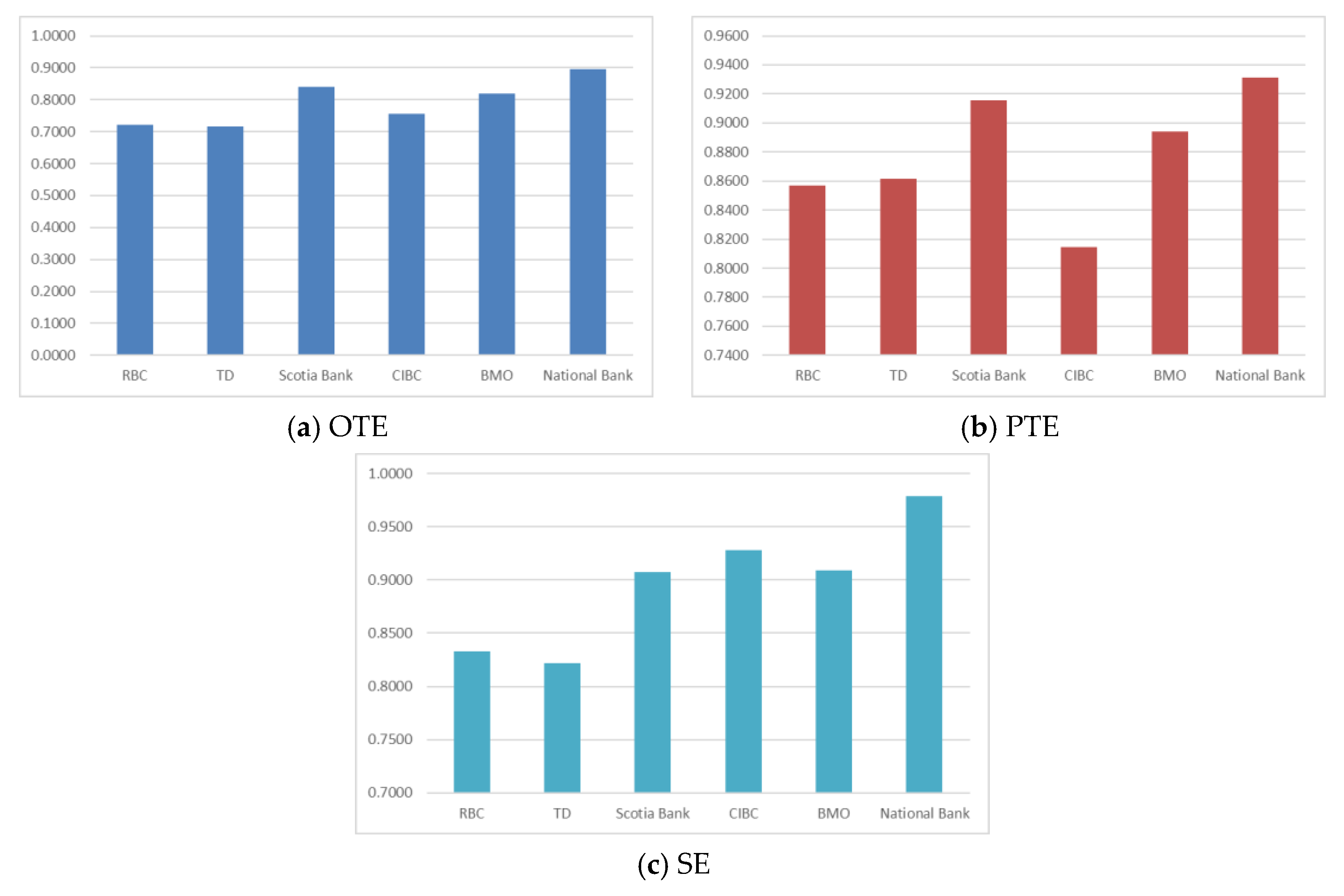

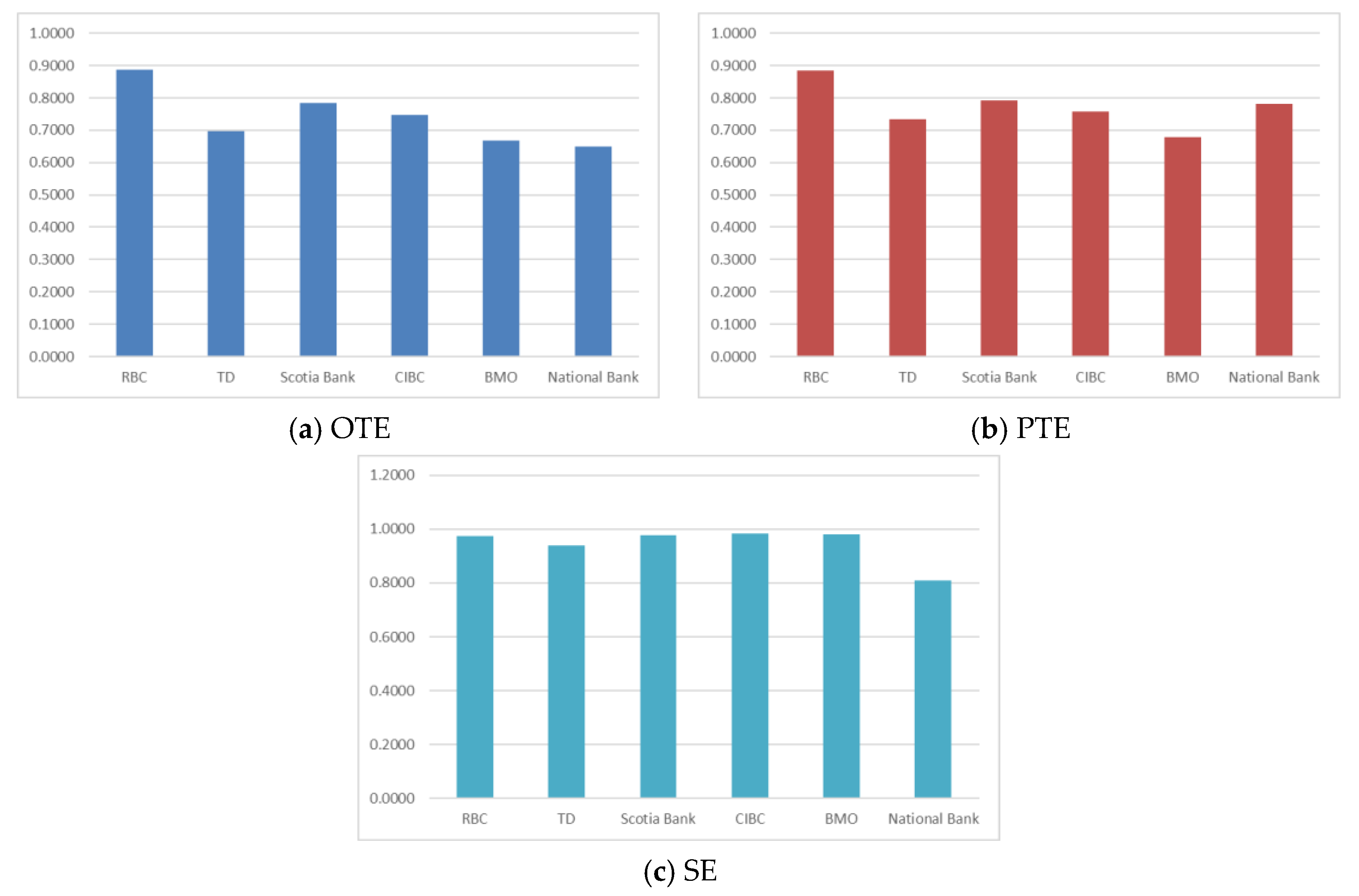

Figure 5,

Figure 6 and

Figure 7 show the efficiencies of the banks in all three stages.

In the first stage, in terms of overall technical efficiency, CIBC has the best performance. Interestingly, although NBC has the lowest OTE, it has the highest pure technical efficiency. This observation shows that managerial issues play a greater role in NBC in comparison to other banks.

In the second stage, NBC is the most efficient bank in terms of overall technical efficiency and pure technical efficiency. In fact, by comparing the results with

Table 1, we can see that NBC has a very low rate of impaired loans. This indicates that NBC has a proper process of risk measurement in their loans, and that is one of the main reasons they have high efficiency in the second stage. In addition, the results indicate that, in the second stage, the larger banks in terms of total assets have a lower performance. In terms of overall technical efficiency and scale efficiency, TD has the lowest score. Moreover, RBC is in the fifth position in terms of OTE, PTE, and SE.

Although RBC does not have a good performance in the second stage, it has the highest OTE and PTE in the third stage, followed by Scotia Bank. Despite the good performance of NBC in the second stage, it has the lowest OTE and SE. In terms of pure technical efficiency, BMO is in last place. Besides, note that although Scotia Bank does not have the highest OTE or PTE in any of the stages, it performs consistently well in all stages. Scotia Bank is in the second position in all the stages in terms of overall and pure technical efficiencies.

By comparing the results in the second and the third stages, we can observe the importance of considering revenue generation as a separate stage. Performing well in terms of the level of loans and investments does not necessarily translate to higher income. For instance, RBC and NBC have a substantially inconsistent performance in these two stages. It can be concluded that separating these two stages can provide a better insight about the efficiencies of the banks.

We also conducted a pairwise

t-test to compare the efficiencies of the banks in the first, second, and third stages.

Table 7 presents the results of these tests. In this table, the first column shows the pair of banks that are compared, the second column shows the type of efficiency that is calculated, and the

p-value of the

t-test is reported in the third column. Please note that, in this table, we only report the

p-values for the tests that are statistically significant at 1%, 5%, and 10%.

In the first stage, the difference between the overall technical efficiency of NBC and the other banks is statistically significant. This result suggests that NBC has a problem in attracting deposits. However, this problem is mainly due to managerial issues rather than the smaller size of NBC. This fact can be concluded from the higher PTE of NBC in comparison to other banks. CIBC has the highest OTE, and it is significantly higher than RBC’s, TD’s, and Scotia’s OTE. One of the reasons for this observation is the proficiency of CIBC in online banking and digital services, which has resulted in lower costs for CIBC while maintaining a high level of deposits. According to Global Finance magazine, in 2019, CIBC was the best consumer digital bank in North America. In this stage, in terms of pure technical efficiency, NBC has the highest score. In fact, the difference between NBC’s PTE and the other banks’ PTE is statistically significant. One important factor that has resulted in high NBC’s PTE is the relatively smaller size of NBC in terms of assets. The substantial difference between the performance of NBC in terms of OTE and PTE has resulted in a statistically significant lower performance of this bank in terms of scale efficiency.

In the second stage, NBC is the most efficient bank in terms of overall technical efficiency, and the difference between NBC and other banks is statistically significant. NBC also has the highest score in terms of pure technical efficiency and scale efficiency. In terms of PTE, the difference between NBC and Scotia and BMO is not statistically significant; however, in terms of SE, NBC has a significantly higher score compared to other banks. These observations indicate that NBC has an efficient risk management process. In fact, the percentage of impaired loans for NBC is 0.5%, which is the lowest among the studied banks. The percentage of impaired loans for the rest of the banks, on average, is 0.9%.

RBC has the best performance in terms of overall and technical efficiencies in the last stage. In fact, in terms of OTE, Scotia is the only bank that has difference with RBC that is not significant. In terms of PTE, RBC has a significantly higher efficiency in comparison to TD, CIBC, and BMO. In terms of scale efficiency, the top five Canadian banks do not show a significant difference in their efficiencies. Nevertheless, NBC has a significantly lower efficiency compared to these banks.

4.2.3. Network DEA vs. Black Box DEA

The network DEA provides a clear view of how different banks operate in different stages. Hence, banks can identify the operations that create inefficiencies in their system and implement more precise improvement strategies. In this section, we investigate the difference between the overall efficiencies measured by network DEA and Black box DEA. In the network DEA, we utilized a multiplicative approach to measure the overall efficiencies of the banks. In this approach, the overall efficiency is equal to the product of efficiencies in the three stages. In addition, in the black box model, we assumed that the banking process has one stage in which the total assets, number of employees, and the other operating costs are the inputs, and the interest and non-interest incomes are the outputs. The average values of the efficiency scores obtained from both DEA models over the study period (2000–2017) are presented in

Table 8.

A quick glance at

Table 8 reveals that the calculated efficiencies in the network DEA are relatively lower than that of the black box model. This can be associated with the multiplicative approach that we have implemented to calculate the overall efficiencies in the network DEA.

However, it can be observed that the two models rank the banks differently in terms of their efficiencies. The results of the network DEA suggest that Scotia has the highest overall OTE, while black box model recommends RBC as the most efficient bank. We also see a discrepancy between the results of network and black box DEA in terms of PTE. For instance, while in the network DEA Scotia has the second-highest score, black box DEA suggests that Scotia has the fifth highest score. The results are even more divergent in terms of scale efficiency. The only alignment between the results is NBC, which is ranked last by both models.

The results of black box DEA is significantly affected by the revenue generation stage. In terms of OTE, the results of black box DEA and the revenue generation stage are completely aligned. This observation can be due to the importance of interest and non-interest incomes in black box DEA and the revenue generation stage. In addition, it shows how other aspects of the banking process are ignored in the black box DEA. For instance, the production stage can be significantly impacted by the digitization of the processes, which is an important facet of modern businesses. Nevertheless, black box DEA does not provide a clear picture of this aspect of the banking process.