How Does Aggregate Tax Policy Uncertainty Affect Default Risk?

Abstract

:1. Introduction

2. Related Literature and Hypothesis Development

3. Research Design

3.1. Data and Sample

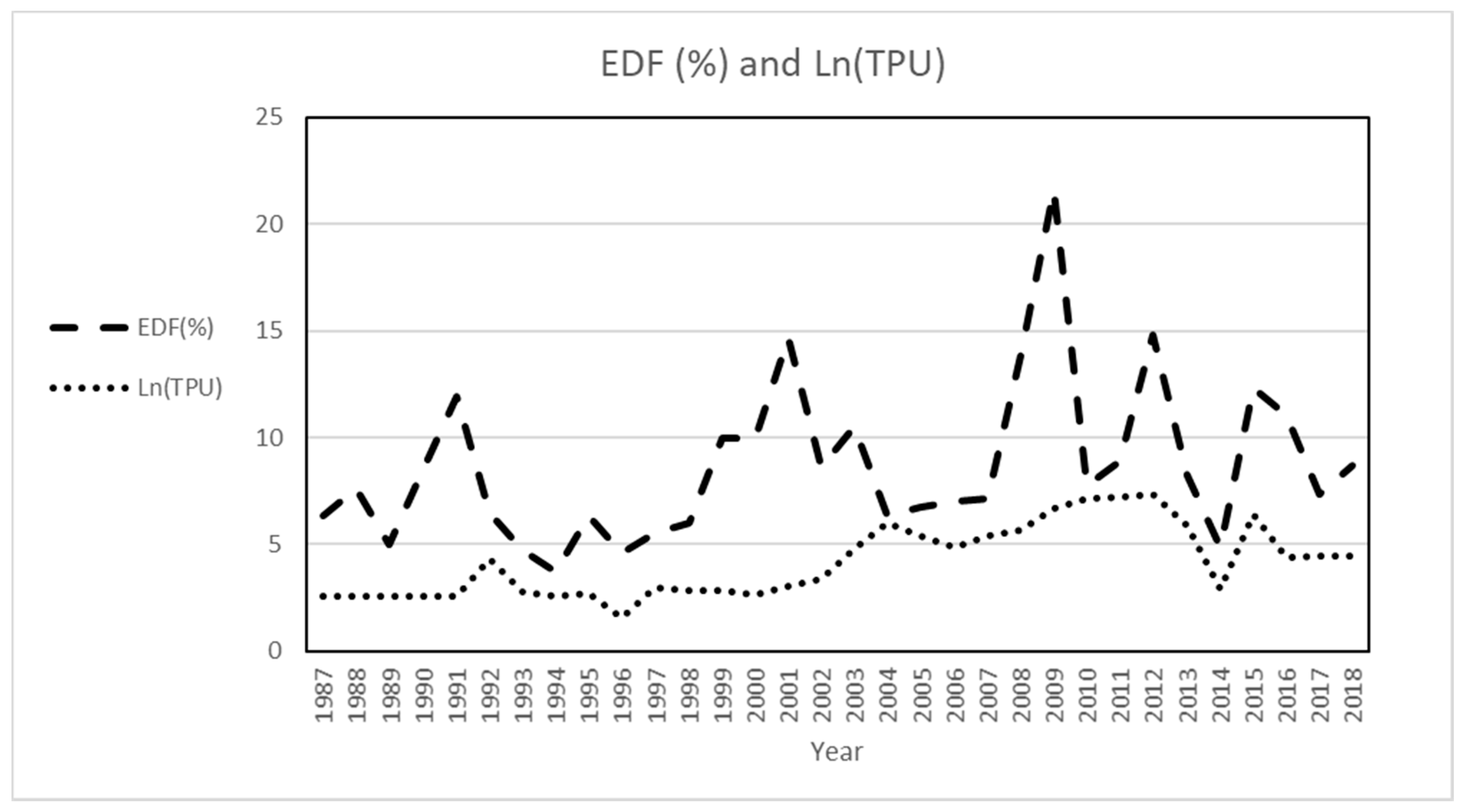

3.2. Measuring Tax Policy Uncertainty (TPU)

3.3. Variable Construction and Empirical Model

4. Empirical Results

4.1. Impact of Tax Policy Uncertainty on Default Risk: Main Regression Results

4.2. Impact of Tax Policy Uncertainty on Default Risk Conditioned on Overall Economy

4.3. Impact of Tax Policy Uncertainty on Default Risk Conditioned on Stock Market Conditions

4.4. Impact of Tax Policy Uncertainty on Default Risk Conditioned on Financial Constraints

4.5. Impact of Tax Policy Uncertainty on Default Risk Conditioned on Credit Quality and Access to Debt Market

4.6. Instrumental Variable Analysis

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Variable | Definition |

|---|---|

| Tax Policy Uncertainty (TPU) | Our TPU definition is similar to Gulen and Ion’s (2016) definition. Specifically, for each firm, the tax policy uncertainty variable (TPU) is measured as the natural logarithm of the arithmetic average of the Baker et al.’s (2016) index for policy uncertainty related to tax code in each year. We obtain tax policy uncertainty data from: http://www.policyuncertainty.com/index.html |

| Expected default frequency (EDF) | Expected default frequency, computed as N(-DD), where N(.) is the cumulative normal distribution function and DD is distance-to-default. DD is calculated following Brogaard et al. (2017) and Bharath and Shumway (2008). |

| Equity | Market value of equity (in millions of dollars) calculated as the product of the number of shares outstanding and stock price at the end of the year. |

| Debt | Face value of debt, in millions of dollars, computed as the sum of debt in current liabilities (Compustat quarterly data #45) and one-half of long-term debt (Compustat quarterly data #51). |

| Excess Return | Annual excess return, calculated as the difference between firm stock return and market return (the CRSP value-weighted market return) over the same period. |

| Inverse Stdev (1/ | One divided by annualized stock return volatility (). Annualized stock return volatility computed as the standard deviation of stock monthly returns over the prior year. |

| Income/Assets | Ratio of net income (Compustat quarterly data #69) to total asset (Compustat quarterly data #44). |

References

- Almeida, Heitor, and Thomas Philippon. 2007. The risk-adjusted cost of financial distress. The Journal of Finance 62: 2557–86. [Google Scholar] [CrossRef]

- Asquith, Paul, Robert Gertner, and David Scharfstein. 1994. Anatomy of financial distress: An examination of junk-bond issuers. The Quarterly Journal of Economics 109: 625–58. [Google Scholar] [CrossRef]

- Atanassov, Julian, Brandon Julio, and Tiecheng Leng. 2015. The Bright Side of Political Uncertainty: The Case of R&D. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2648252 (accessed on 11 December 2020).

- Baker, Malcolm, Jeremy C. Stein, and Jeffrey Wurgler. 2003. When does the market matter? Stock prices and the investment of equity-dependent firms. The Quarterly Journal of Economics 118: 969–1005. [Google Scholar] [CrossRef] [Green Version]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Bakke, Tor-Erik, and Toni M. Whited. 2010. Which firms follow the market? An analysis of corporate investment decisions. Review of Financial Studies 23: 1941–80. [Google Scholar] [CrossRef]

- Bharath, Sreedhar T., and Tyler Shumway. 2008. Forecasting default with the Merton distance to default model. The Review of Financial Studies 21: 1339–69. [Google Scholar] [CrossRef]

- Bonaime, Alice, Huseyin Gulen, and Mihai Ion. 2018. Does policy uncertainty affect mergers and acquisitions? Journal of Financial Economics 129: 531–58. [Google Scholar] [CrossRef]

- Brogaard, Jonathan, Dan Li, and Ying Xia. 2017. Stock liquidity and default risk. Journal of Financial Economics 124: 486–502. [Google Scholar] [CrossRef] [Green Version]

- Campbell, John Y., Jens Hilscher, and Jan Szilagyi. 2008. In search of distress risk. The Journal of Finance 63: 2899–939. [Google Scholar] [CrossRef] [Green Version]

- DeAngelo, Harry, and Ronald W. Masulis. 1980. Optimal capital structure under corporate and personal taxation. Journal of Financial Economics 8: 3–29. [Google Scholar] [CrossRef]

- Desai, Mihir A., and Dhammika Dharmapala. 2006. Corporate tax avoidance and high-powered incentives. Journal of Financial Economics 79: 145–79. [Google Scholar] [CrossRef] [Green Version]

- Desai, Mihir A., and Dhammika Dharmapala. 2009. Earnings management, corporate tax shelters, and book-tax alignment. National Tax Journal 62: 169–86. [Google Scholar] [CrossRef] [Green Version]

- Eckbo, B. Espen, Karin S. Thorburn, and Wei Wang. 2016. How costly is corporate bankruptcy for the CEO? Journal of Financial Economics 121: 210–29. [Google Scholar] [CrossRef] [Green Version]

- Fama, Eugene F., and Kenneth R. French. 2002. Testing trade-off and pecking order predictions about dividends and debt. The Review of Financial Studies 15: 1–33. [Google Scholar] [CrossRef]

- Ferris, Stephen P., Narayanan Jayaraman, and Anil K. Makhija. 1997. The response of competitors to announcements of bankruptcy: An empirical examination of contagion and competitive effects. Journal of Corporate Finance 3: 367–95. [Google Scholar] [CrossRef]

- Graham, John R. 2000. How big are the tax benefits of debt? The Journal of Finance 55: 1901–41. [Google Scholar] [CrossRef]

- Guenther, David A., Steven R. Matsunaga, and Brian M. Williams. 2017. Is tax avoidance related to firm risk? The Accounting Review 92: 115–36. [Google Scholar] [CrossRef]

- Gulen, Huseyin, and Mihai Ion. 2016. Policy uncertainty and corporate investment. Review of Financial Studies 29: 523–64. [Google Scholar] [CrossRef]

- Hertzel, Michael G., Micah S. Officer, Zhi Li, and Kimberly J. Rodgers. 2008. Inter-firm linkages and the wealth effects of financial distress along the supply chain. Journal of Financial Economics 87: 374–87. [Google Scholar] [CrossRef]

- Jalan, Akanksha, Jayant R. Kale, and Costanza Meneghetti. 2016. Debt, Bankruptcy Risk, and Corporate Tax Aggressiveness. Available online: https://finance.business.uconn.edu/wp-content/uploads/sites/723/2014/08/Debt-Bankruptcy-Risk-and-Corporate-Tax-Aggressiveness.pdf (accessed on 11 December 2020).

- Kaplan, Steven N., and Luigi Zingales. 1997. Do Investment-Cash Flow Sensitivities Provide Useful Measures of Financing Constraints? Quarterly Journal of Economics 112: 169–215. [Google Scholar] [CrossRef] [Green Version]

- Kashyap, Anil K., Owen A. Lamont, and Jeremy C. Stein. 1994. Credit conditions and the cyclical behavior of inventories. The Quarterly Journal of Economics 109: 565–92. [Google Scholar] [CrossRef]

- Kaviani, Mahsa S., Lawrence Kryzanowski, Hosein Maleki, and Pavel Savor. 2020. Policy uncertainty and corporate credit spreads. Journal of Financial Economics 138: 838–65. [Google Scholar] [CrossRef]

- Kim, Jeong-Bon, Yinghua Li, and Liandong Zhang. 2011. Corporate tax avoidance and stock price crash risk: Firm-level analysis. Journal of Financial Economics 100: 639–62. [Google Scholar] [CrossRef]

- Kisgen, Darren J. 2006. Credit ratings and capital structure. The Journal of Finance 61: 1035–72. [Google Scholar] [CrossRef]

- Lang, Larry H., and Rene M. Stulz. 1992. Contagion and competitive intra-industry effects of bankruptcy announcements: An empirical analysis. Journal of Financial Economics 32: 45–60. [Google Scholar] [CrossRef]

- Lemmon, Michael, and Michael Roberts. 2010. The response of corporate financing and investment to changes in the supply of credit. Journal of Financial and Quantitative Analysis 45: 555–87. [Google Scholar] [CrossRef]

- Liu, Jinyu, and Rui Zhong. 2017. Political uncertainty and a firm’s credit risk: Evidence from the international CDS market. Journal of Financial Stability 30: 53–66. [Google Scholar] [CrossRef]

- Löffler, Gunter, and Alina Maurer. 2011. Incorporating the dynamics of leverage into default prediction. Journal of Banking and Finance 35: 3351–61. [Google Scholar] [CrossRef] [Green Version]

- McCarty, Nolan M. 2012. The policy consequences of partisan polarization in the united states 563–88. Unpublished paper. [Google Scholar]

- McCarty, Nolan M. 2011. The limits of electoral and legislative reform in addressing polarization. California Law Review 99: 359–71. [Google Scholar]

- McCarty, Nolan M., Keith T. Poole, and Howard Rosenthal. 1997. Income Redistribution and the Realignment of American Politics. Washington, DC: AEI Press. [Google Scholar]

- Merton, Robert C. 1974. On the pricing of corporate debt: The risk structure of interest rates. The Journal of Finance 29: 449–70. [Google Scholar]

- Nguyen, Nam H., and Hieu V. Phan. 2017. Policy uncertainty and mergers and acquisitions. Journal of Financial and Quantitative Analysis 52: 613–44. [Google Scholar] [CrossRef] [Green Version]

- Pastor, Lubos, and Pietro Veronesi. 2012. Uncertainty about government policy and stock prices. Journal of Finance 67: 1219–64. [Google Scholar] [CrossRef]

- Pástor, Ľubos, and Pietro Veronesi. 2013. Political uncertainty and risk premia. Journal of Financial Economics 110: 520–45. [Google Scholar] [CrossRef] [Green Version]

- Poole, Keith T., and Howard Rosenthal. 1985. A Spatial Model for Legislative Roll Call Analysis. American Journal of Political Science 29: 357–84. [Google Scholar] [CrossRef]

- Poole, Keith T., and Howard Rosenthal. 2000. Congress: A Political-Economic History of Roll Call Voting. Oxford: Oxford University Press on Demand. [Google Scholar]

- Rego, Sonja Olhoft, and Ryan Wilson. 2012. Equity Risk Incentives and Corporate Tax Aggresiveness. Journal of Accounting Research 50: 775–810. [Google Scholar] [CrossRef]

- Vassalou, Maria, and Yuhang Xing. 2004. Default risk in equity returns. The Journal of Finance 59: 831–68. [Google Scholar] [CrossRef]

- Waisman, Maya, Pengfei Ye, and Yun Zhu. 2015. The effect of political uncertainty on the cost of corporate debt. Journal of Financial Stability 16: 106–17. [Google Scholar] [CrossRef]

- Wang, Xinjie, Weike Xu, and Zhaodong Zhong. 2019. Economic policy uncertainty, CDS spreads, and CDS liquidy provision. The Journal of Futures Markets 39: 461–80. [Google Scholar]

| 1 | The Securities and Exchange Commission (SEC) decreased the minimum tick size from a 16th of a dollar to a 100th of a dollar in 2001. |

| 2 | Debt financing increases firm value because of the tax shield on interest payments (e.g., Graham 2000). |

| 3 | We winsorize all variables, except EDF, at 1st and 99th percentiles to mitigate the impacts of outliers. |

| 4 | We downloaded the TPU index data from Nick Bloom’s Web site (www.policyuncertainty.com). |

| 5 | (Baker et al. 2016) index is used by many influential studies such as (Pástor and Veronesi 2013; Gulen and Ion 2016). |

| 6 | The economic significance calculation procedure is the same as the overall sample procedure we explained above. |

| 7 | We winsorize the ingredients of the index at 1% and 99% before constructing it, as in (Baker et al. 2003). |

| 8 | The original Nominal Three-Step Estimation (NOMINATE) was developed in the 1980s by Keith T. Poole and Howard Rosenthal (Poole and Rosenthal 1985). |

| 9 | (Poole and Rosenthal 2000) state that the first dimension of the DW-NOMINATE scores be interpreted as the legislators’ position on government intervention in the economy. |

| Panel A: Descriptive Statistics for Tax Policy Uncertainty | ||||||

| N | Mean | Min | Median | Max | Stdev | |

| Ln(TPU) | 33 | 4.2018 | 1.5796 | 4.2992 | 7.3760 | 1.6707 |

| Panel B: Descriptive Statistics for Firm-Level Variables | ||||||

| N | Mean | Min | Median | Max | Stdev | |

| EDF | 84,132 | 0.0462 | 0.0000 | 0.0000 | 1.0000 | 0.1960 |

| Debt | 84,132 | 664.12 | 0.0005 | 59.4100 | 11,199.00 | 1797.45 |

| Ln(debt) | 84,132 | 3.8435 | −7.6009 | 3.9636 | 9.32358 | 2.6949 |

| Equity | 84,132 | 2911.47 | 2.6600 | 320.45 | 53,823.84 | 8176.10 |

| Ln(equity) | 84,132 | 5.7486 | 0.9798 | 5.7100 | 10.8934 | 2.1993 |

| Excess Ret. | 84,132 | 0.0329 | −1.5075 | 0.0124 | 1.9407 | 0.5219 |

| Inverse Stdev | 84,132 | 10.1572 | 1.7367 | 8.7396 | 32.5912 | 5.9122 |

| Income/Assets | 84,132 | −0.0081 | −0.5555 | 0.0086 | 0.1103 | 0.0734 |

| Panel C: Pearson Correlation Coefficients | ||||||

| EDF | Ln(debt) | Ln(equity) | Excess Ret. | Inverse Stdev | Income/Asset | |

| Ln(debt) | 0.0785 | |||||

| Ln(equity) | −0.1003 | 0.9443 *** | ||||

| Excess Ret. | −0.4416 ** | 0.0397 | 0.1155 | |||

| Inverse Stdev | −0.4096 ** | 0.3627 ** | 0.4307 ** | −0.2502 | ||

| Income/Asset | −0.5756 *** | −0.1835 | −0.1239 | −0.0434 | 0.4877 *** | |

| Ln(TPU) | 0.0149 | 0.6919 *** | 0.7093 ** | 0.2178 | 0.0892 | −0.0734 |

| Panel A: Overall Sample | Panel B: Within Industry Regressions. | |||||

|---|---|---|---|---|---|---|

| Variables | EDF | Industry: Description | TPU | R2 | N | Eco. Imp. |

| Nondurables: Food, tobacco, textiles, apparel, leather, toys | 0.0063 *** | 0.1782 | 5790 | 22.78% | ||

| TPU | 0.0041 *** | (3.78) | ||||

| (8.48) | Durables: Cars, TVs, furniture, household appliances | 0.0104 *** | 0.1992 | 2952 | 37.60% | |

| ln(equity) | −0.0245 *** | (3.43) | ||||

| (−23.68) | Manufacturing: Machinery, trucks, planes, office furniture, paper, commercial printing | 0.0053 *** | 0.1699 | 11,859 | 19.17% | |

| ln(debt) | 0.0142 *** | (4.39) | ||||

| (22.42) | Energy: Oil, gas, and coal extraction and products | 0.0030 | 0.2547 | 4768 | 0.00% | |

| Inc./Asset | −0.1393 *** | (1.39) | ||||

| (−8.10) | Chemicals: Chemicals and allied products | 0.0062 ** | 0.1684 | 2985 | 22.42% | |

| Exc. Ret. | −0.1137 *** | (2.74) | ||||

| (−47.58) | Business equipment: Computers, software, and electronic equipment | 0.0006 | 0.1086 | 15,259 | 0.00% | |

| Inv. Stdev | −0.0034 *** | (0.61) | ||||

| (−23.45) | Telecommunications: Telephone and television transmission | 0.0051 | 0.2741 | 3139 | 0.00% | |

| (1.54) | ||||||

| Utilities: Utilities | 0.0030 * | 0.1975 | 4118 | 10.85% | ||

| Constant | 0.1524 *** | (1.91) | ||||

| (32.67) | Shops: Wholesale, retail, and some services (laundries, repair shops) | 0.0069 *** | 0.2186 | 9993 | 24.95% | |

| (4.62) | ||||||

| Obs. | 84,132 | Health: Health care, medical equipment, and drugs | 0.0004 | 0.1011 | 9613 | 0.00% |

| R-squared | 0.1676 | (0.40) | ||||

| Firm FE | YES | Other: Mines, construction, building materials, transportation, hotels, business services, entertainment | 0.0067 *** | 0.2318 | 13,656 | 24.22% |

| Clus. SE | YES | (4.96) | ||||

| (1) | (2) | (3) | |||

|---|---|---|---|---|---|

| Variables | EDF | Variables | EDF | Variables | EDF |

| TPU | 0.0024 *** | TPU | 0.0028 *** | TPU | 0.0018 *** |

| (4.89) | (6.12) | (4.07) | |||

| IPG | 0.0671 *** | Recession | 0.0173 *** | CFI | −0.0042 *** |

| (9.15) | (19.93) | (−24.46) | |||

| Ln(equity) | −0.0286 *** | Ln(equity) | −0.0237 *** | Ln(equity) | −0.0243 *** |

| (−23.38) | (−23.28) | (−23.88) | |||

| Ln(debt) | 0.0131 *** | Ln(debt) | 0.0140 *** | Ln(debt) | 0.0128 *** |

| (20.71) | (22.10) | (20.58) | |||

| Income/Assets | −0.1324 *** | Income/Assets | −0.1346 *** | Income/Assets | −0.1332 *** |

| (−7.69) | (−7.91) | (−7.83) | |||

| Excess Ret. | −0.1121 *** | Excess Ret. | −0.1125 *** | Excess Ret. | −0.1114 *** |

| (−46.97) | (−47.75) | (−47.68) | |||

| Inverse Stdev | −0.0034 *** | Inverse Stdev | −0.0031 *** | Inverse Stdev | −0.0032 *** |

| (−23.62) | (−22.06) | (−22.22) | |||

| Constant | 0.1164 ** | Constant | 0.1389 *** | Constant | 0.1616 *** |

| (22.56) | (28.89) | (34.39) | |||

| Observations | 84,132 | Observations | 84,132 | Observations | 84,132 |

| R-squared | 0.1691 | R-squared | 0.1760 | R-squared | 0.1792 |

| Firm FE | YES | Firm FE | YES | Firm FE | YES |

| Clustered SE | YES | Clustered SE | YES | Clustered SE | YES |

| Economic impact | 8.68% | Economic impact | 10.12% | Economic impact | 6.51% |

| Market Conditions | Adjusted P/E | Down Market | Up Market |

|---|---|---|---|

| Models | (1) | (2) | (3) |

| Variables | EDF | EDF | EDF |

| TPU | 0.0051 *** | 0.0077 *** | 0.0057 *** |

| (10.07) | (5.02) | (11.30) | |

| Ln(equity) | −0.0258 *** | −0.0206 | −0.0259 *** |

| (−23.56) | (−8.89) | (−23.46) | |

| Ln(debt) | 0.0140 *** | 0.0147 *** | 0.0133 *** |

| (22.13) | (10.23) | (20.02) | |

| Income/Assets | −0.1377 *** | −0.1839 *** | −0.1366 *** |

| (−8.01) | (−4.56) | (−6.58) | |

| Excess return | −0.1131 *** | −0.1197 *** | −0.1107 *** |

| (−47.38) | (−27.43) | (−41.49) | |

| Inverse Stdev | −0.0033 *** | −0.0039 *** | −0.0029 |

| (−22.71) | (−12.99) | (−19.43) | |

| Adjusted P/E | 0.0006 *** | ||

| (4.71) | |||

| Constant | 0.1411 | 0.1221 *** | 0.1372 *** |

| (29.09) | (12.81) | (26.34) | |

| Observations | 84,132 | 20,604 | 63,528 |

| R-squared | 0.1680 | 0.1813 | 0.1677 |

| Firm FE | YES | YES | YES |

| Clustered SE | YES | YES | YES |

| Economic impact | 18.44% | 27.84% | 20.61% |

| Subsamples | (Q1) | (Q2) | (Q3) | (Q4) |

|---|---|---|---|---|

| Least Constrained | Most Constrained | |||

| Models | (1) | (2) | (3) | (4) |

| Variables | EDF | EDF | EDF | EDF |

| TPU | 0.0013 * | 0.0015 *** | 0.0018 ** | 0.0043 *** |

| (1.91) | (2.77) | (2.35) | (3.45) | |

| Ln(equity) | −0.0038 *** | −0.0068 *** | −0.0243 *** | −0.0623 |

| (−2.63) | (−5.08) | (−10.25) | (−21.31) | |

| Ln(debt) | 0.0026 *** | 0.0048 *** | 0.0239 *** | 0.0607 *** |

| (3.76) | (6.45) | (9.92) | (17.00) | |

| Income/Assets | −0.0209 | −0.0119 | −0.1062 *** | −0.1968 *** |

| (−0.55) | (−0.56) | (−3.35) | (−5.94) | |

| Excess Return | −0.0273 *** | −0.0231 *** | −0.0667 *** | −0.2140 *** |

| (−8.09) | (−9.86) | (−18.15) | (−47.38) | |

| Inverse Stdev | −0.0011 *** | −0.0008 *** | −0.0015 *** | −0.0061 *** |

| (−5.49) | (−5.17) | (−7.59) | (−14.95) | |

| Constant | 0.0382 *** | 0.0410 *** | 0.0761 *** | 0.1799 *** |

| (5.23) | (6.89) | (11.01) | (13.63) | |

| Observations | 14,597 | 19,809 | 24,993 | 24,201 |

| R-squared | 0.0333 | 0.0319 | 0.0992 | 0.3265 |

| Firm FE | YES | YES | YES | YES |

| Clustered SE | YES | YES | YES | YES |

| Economic impact | 4.70% | 5.42% | 6.51% | 15.55% |

| Subsamples | Investment Grade | Non-Investment Grade | Firms without Bond Rating | Firms with Bond Rating |

|---|---|---|---|---|

| Models | (1) | (2) | (3) | (4) |

| Variables | EDF | EDF | EDF | EDF |

| TPU | 0.0014 ** | 0.0038 *** | 0.0037 *** | 0.0039 *** |

| (2.27) | (6.60) | (5.90) | (5.15) | |

| Ln(equity) | −0.0113 *** | −0.0245 *** | −0.0206 *** | −0.0372 *** |

| (−4.56) | (−21.80) | (−17.87) | (−14.47) | |

| Ln(debt) | 0.0072 *** | 0.0143 *** | 0.0125 *** | 0.0229 |

| (4.37) | (21.32) | (18.43) | (10.55) | |

| Income/Assets | −0.2367 *** | −0.1309 *** | −0.1177 *** | −0.2649 *** |

| (−2.86) | (−7.49) | (−6.57) | (−4.79) | |

| Excess Return | −0.0754 *** | −0.1169 *** | −0.0998 *** | −0.1647 *** |

| (−9.84) | (−46.81) | (−39.83) | (−29.30) | |

| Inverse Stdev | −0.0011 *** | −0.0044 *** | −0.0035 *** | −0.0025 *** |

| (−6.47) | (−23.85) | (−18.87) | (−11.86) | |

| Constant | 0.0754 *** | 0.1606 | 0.1329 *** | 0.2014 *** |

| (6.04) | (31.77) | (26.70) | (15.93) | |

| Observations | 14,211 | 69,921 | 58,693 | 25,439 |

| R-squared | 0.0598 | 0.1767 | 0.1517 | 0.2219 |

| Firm FE | YES | YES | YES | YES |

| Clustered SE | YES | YES | YES | YES |

| Economic impact | 5.06% | 13.74% | 13.38% | 14.10% |

| First Stage | Second Stage | ||

|---|---|---|---|

| Variables | TPU | Variables | EDF |

| IV(Polarization) | 6.6334 *** | Fitted TPU | 0.0792 *** |

| (57.69) | (10.41) | ||

| Ln(equity) | 0.1367 *** | Ln(equity) | −0.0296 *** |

| (11.90) | (−21.10) | ||

| Ln(debt) | 0.0397 *** | Ln(debt) | 0.0113 *** |

| (4.98) | (16.59) | ||

| Income/Assets | −0.2819 *** | Income/Assets | −0.1421 *** |

| (−2.97) | (−7.32) | ||

| Excess Return | 0.0405 *** | Excess Return | −0.1071 *** |

| (4.00) | (−41.85) | ||

| Inverse Stdev | −0.0224 *** | Inverse Stdev | −0.0031 *** |

| (−15.42) | (−21.14) | ||

| Constant | −1.5909 *** | Constant | 0.0975 *** |

| (−25.54) | (15.51) | ||

| Observations | 81,892 | Observations | 72,178 |

| R-squared | 0.1768 | R-squared | 0.1641 |

| Firm FE | YES | Firm FE | YES |

| Clustered SE | YES | Clustered SE | YES |

| p-value of F-test for IV validity | 0.0000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tosun, M.S.; Yildiz, S. How Does Aggregate Tax Policy Uncertainty Affect Default Risk? J. Risk Financial Manag. 2020, 13, 319. https://doi.org/10.3390/jrfm13120319

Tosun MS, Yildiz S. How Does Aggregate Tax Policy Uncertainty Affect Default Risk? Journal of Risk and Financial Management. 2020; 13(12):319. https://doi.org/10.3390/jrfm13120319

Chicago/Turabian StyleTosun, Mehmet Serkan, and Serhat Yildiz. 2020. "How Does Aggregate Tax Policy Uncertainty Affect Default Risk?" Journal of Risk and Financial Management 13, no. 12: 319. https://doi.org/10.3390/jrfm13120319