Does Short-Termism Influence the Market Value of Companies? Evidence from EU Countries

Abstract

:1. Introduction

2. Sustainable Development, Sustainable Finance, and Short-Termism

2.1. The Concepts of Sustainable Development and Sustainable Finance

2.2. Short-Termism Concept and Its Effect on the Capital Market

3. Materials and Methods

3.1. The Institutional Setting—Quarterly Reporting in the EU

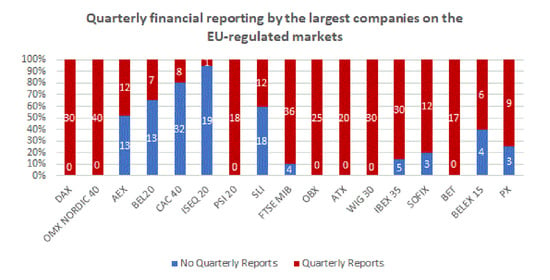

3.2. Research Sample—Characteristics

3.3. Research Methods

4. Results

4.1. Quarterly Reporting and the Market Value of European Companies—The Case of the EU-15 and the New Member States of the EU

4.2. The Disclosure of Quarterly Financial Reports and Long-Term Rates of Return—Evidence from European Stock Exchanges

5. Conclusions

6. Recommendations and Limitations

Author Contributions

Funding

Conflicts of Interest

References

- Abudy, Menachen, and Efrat Shust. 2020. What Happens to Trading Volume When the Regulator Bans Voluntary Disclosure? European Accounting Review 29: 555–80. [Google Scholar] [CrossRef]

- Amihud, Yakov, and Haim Mendelson. 1986. Asset pricing and the bid-ask spread. Journal of Financial Economics 17: 223–49. [Google Scholar] [CrossRef]

- Atherton, Alison, James Lewis, and Roel Plant. 2007. Causes of short-termism in the finance sector. In Discussion Paper Institute for Sustainable Futures. Ultimo: University of Technology Sidney, p. 2. [Google Scholar]

- Badertscher, Brad, Nemit Shroff, and Hal D. White. 2013. Externalities of public firm presence: Evidence from private firms’ investment decisions. Journal of Financial Economics 109: 682–706. [Google Scholar] [CrossRef] [Green Version]

- Badshah, Ihsan, Hardjo Koerniadi, and James Kolari. 2019. Testing the information-based trading hypothesis in the option market: Evidence from share repurchases. Journal of Risk and Financial Management 12: 1–11. [Google Scholar] [CrossRef] [Green Version]

- Barber, Brad M., and John D. Lyon. 1997. Detecting long-run abnormal stock returns: The empirical power and specification of test statistics. Journal of Financial Economics 43: 341–72. [Google Scholar] [CrossRef] [Green Version]

- Barton, Dominic, Jonathan Bailey, and Joshua Zoffer. 2016. Rising to the Challenge of Short-Termism. Report FCLT Global. Available online: https://www.fcltglobal.org/wp-content/uploads/fclt-global-rising-to-the-challenge.pdf (accessed on 29 September 2020).

- Bhojraj, Sanjeev, and Robert Libby. 2015. Retraction: Capital market pressure, disclosure frequency-induced earnings/cash flow conflict, and managerial myopia. The Accounting Review 90: 1715. First published 2005. [Google Scholar] [CrossRef]

- Broner, Fernando, and Jaume Ventura. 2016. Rethinking the effects of financial globalization. The Quarterly Journal of Economics 131: 1497–542. [Google Scholar] [CrossRef] [Green Version]

- Butler, Marty, Arthur Kraft, and Ira S. Weiss. 2007. The effect of reporting frequency on the timeliness of earnings: The cases of voluntary and mandatory interim reports. Journal of Accounting and Economics 43: 181–217. [Google Scholar] [CrossRef]

- Calcagno, Riccardo, and Florian Heider. 2007. Market based Compensation, Price Informativeness and Short-Term Trading. Working Paper Series 735; Frankfurt am Main, Germany: European Central Bank, p. 27. [Google Scholar]

- Carp, Lenuţa. 2014. Financial globalization and capital flows volatility effects on economic growth. Procedia Economics and Finance 15: 350–56. [Google Scholar] [CrossRef] [Green Version]

- Cheng, Mei, K. R. Subramanyam, and Yuan Zhang. 2005. Earnings Guidance and Managerial Myopia. Available online: https://ssrn.com/abstract=851545 (accessed on 29 September 2020).

- Cuijpers, Rick, and Erik Peek. 2010. Reporting frequency, information precision and private information acquisition. Journal of Business Finance & Accounting 37: 27–59. [Google Scholar] [CrossRef]

- Edmans, Alex, Vivian W. Fang, and Katharina A. Lewellen. 2013. Equity Vesting and Managerial Myopia. NBER Working Paper No. 19407. Cambridge, MA, USA: NBER, Available online: http://www.nber.org/papers/w19407 (accessed on 29 September 2020).

- Ernstberger, Jürgen, Benedikt Link, Michael Stich, and Oliver Vogler. 2017. The real effects of mandatory quarterly reporting. The Accounting Review 92: 33–60. [Google Scholar] [CrossRef]

- Escrig-Olmedo, Elena, María Jesús Muñoz-Torres, and María Ángeles Fernández-Izquierdo. 2013. Sustainable development and the financial system: Society’s perceptions about socially responsible investing. Business Strategy and the Environment 22: 410–28. [Google Scholar] [CrossRef]

- ESMA. 2019. Report Undue Short-Term Pressure on Corporations. ESMA30-22-762. Paris: ESMA, p. 9. [Google Scholar]

- European Commission. 2015. 30.9.2015 COM(2015) 468 Final Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions Action Plan on Building a Capital Markets Union {SWD(2015) 183 Final} {SWD(2015) 184 Final}. Brussels: European Commission. [Google Scholar]

- European Commission. 2018. 8.3.2018r. COM(2018) 97 Final Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions Action Plan: Financing Sustainable Growth. Brussels: European Commission. [Google Scholar]

- European Commission. 2020. Brussels Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee of the Regions. Sustainable Europe Investment. Plan European Green Deal Investment Plan. 14.1.2020 COM(2020) 21 Final. Brussels: European Commission, p. 4. [Google Scholar]

- European Parliament and of the Council. 2004. On the Harmonisation of Transparency Requirements in Relation to Information about Issuers Whose Securities Are Admitted to Trading on a Regulated Market and Amending Directive 2001/34/EC, Directive 2004/109/EC. December 15. Available online: https://eur-lex.europa.eu/legal-content/GA/TXT/?uri=CELEX:32004L0109 (accessed on 28 September 2020).

- European Parliament and of the Council. 2013. Amending Directive 2004/109/EC of the European Parliament and of the Council on the Harmonisation of Transparency Requirements in Relation to Information about Issuers Whose Securities are Admitted to Trading on a Regulated Market. Directive 2013/50/EU. October 22. Available online: https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=celex%3A32013L0050 (accessed on 28 September 2020).

- EY Poland Report. 2014. Short-Termism in Business: Causes, Mechanisms and Consequences. p. 7. Available online: https://www.ey.com/Publication/vwLUAssets/EY_Poland_Report/%24FILE/Short-termism_raport_EY.pdf (accessed on 29 September 2020).

- Feldstein, Martin, and Charles Horioka. 1980. Domestic saving and international capital flows. The Economic Journal 90: 314–29. [Google Scholar] [CrossRef]

- Final Report. 2018. Financing a Sustainable European Economy. Brussels: The High-Level Expert Group on Sustainable Finance, the European Commission. [Google Scholar]

- Final Report of the Expert Panel on Sustainable Finance. 2019. Mobilizing Finance for Sustainable Growth. Gatineau: Environment and Climate Change Canada, Public Inquiries Centre, ISBN 978-0-660-30986-6. [Google Scholar]

- Friedman, Henry L., John S. Hughes, and B. Michaeli. 2020. Optimal reporting when additional information might arrive. Journal of Accounting and Economics 69: 1–52. [Google Scholar] [CrossRef]

- Fu, Renhui, Arthur Kraft, and Huai Zhang. 2012. Financial reporting frequency, information asymmetry, and the cost of equity capital. Journal of Accounting and Economics 54: 132–49. [Google Scholar] [CrossRef]

- Gigler, Frank, Chandra Kanodia, Haresh Sapra, and Raghu Venugopalan. 2014. How frequent financial reporting can cause managerial short-termism: An analysis of the costs and benefits of increasing reporting frequency. Journal of Accounting Research 52: 357–87. [Google Scholar] [CrossRef]

- Glosten, Lawrence R., and Paul R. Milgrom. 1985. Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. Journal of Financial Economics 14: 71–100. [Google Scholar] [CrossRef] [Green Version]

- Goldstein, Itay, and Liyan Yang. 2017. Information disclosure in financial markets. Annual Review of Financial Economics 9: 101–25. [Google Scholar] [CrossRef]

- Graham, John R., Campbell R. Harvey, and Shiva Rajgopal. 2005. The economic implications of corporate financial reporting. Journal of Accounting and Economics 40: 3–73. [Google Scholar] [CrossRef] [Green Version]

- Greenwald, Bruce, Joseph E. Stiglitz, and Andrew Weiss. 1984. Informational imperfections on the capital market and macro-economic fluctuations. The American Economic Review 74: 194–99. [Google Scholar]

- Grossman, Sanford J., and Joseph E. Stiglitz. 1980. On the impossibility of informationally efficient markets. American Economic Review 70: 393–408. [Google Scholar] [CrossRef]

- Gryglewicz, Sebastian, Simon Mayer, and Erwan Morelec. 2020. Agency Conflicts and Short- vs. Long-Termism in Corporate Policies. Journal of Financial Economics 163: 718–42. [Google Scholar] [CrossRef]

- Hackbarth, Dirk, Alejandro Rivera, and Tak-Yuen Wong. 2018. Optimal Short-Termism (29 October 2018). Finance Working Paper No. 546, Asian Finance Association (AsianFA) 2018 Conference. Brussels, Belgium: European Corporate Governance Institute (ECGI). Available online: https://ssrn.com/abstract=3060869 (accessed on 29 September 2020).

- Haldane, Andrew G. 2011. Executive Director, Financial Stability and Richard Davies. The short long. Paper presented at Speech Delivered during 29th Société Universitaire Européene de Recherches Financières Colloquium, Brussels, Belgium, May 11; Available online: https://www.tradinggame.com.au/wp-content/uploads/2011/05/here.pdf (accessed on 29 September 2020).

- Healy, Paul M., and Krishna G. Palepu. 2001. Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics 31: 405–40. [Google Scholar] [CrossRef]

- Hubbard, R. Glenn. 1998. Capital-market imperfections and investment. Journal of Economic Literature 36: 193–225. [Google Scholar]

- Ionescu, Luminița. 2020. Pricing Carbon Pollution: Reducing Emissions or GDP Growth? Economics, Management, and Financial Markets 15: 37–43. [Google Scholar] [CrossRef]

- Jackson, Gregory, and Anastasia Petraki. 2011a. How does corporate governance lead to short-termism? In The Sustainable Company: A New Approach to Corporate Governance. Edited by Sigurt Vitols and Norbert Kluge. Brussels: European Trade Union Institute, pp. 199–226. [Google Scholar]

- Jackson, Gregory, and Anastasia Petraki. 2011b. Understanding Short-Termism: The Role of Corporate Governance. Report to the Glasshouse Forum. Stockholm: Glasshouse Forum, pp. 9–10. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kajuter, Peter, Florian Klassmann, and Martin Nienhaus. 2018. The effect of mandatory quarterly reporting on firm value. The Accounting Review 94: 251–77. [Google Scholar] [CrossRef]

- Kanodia, Chandra, and Deokheon Lee. 1998. Investment and disclosure: The disciplinary role of periodic performance reports. Journal of Accounting Research 36: 33–55. [Google Scholar] [CrossRef]

- Kraft, Arthur G., Rahul Vashishtha, and Mohan Venkatachalam. 2018. Frequent financial reporting and managerial myopia. The Accounting Review 93: 249–75. [Google Scholar] [CrossRef]

- Ladika, Tomislav, and Zacharias Sautner. 2019. Managerial Short-Termism and Investment: Evidence from Accelerated Option Vesting. Available online: https://ssrn.com/abstract=2286789 (accessed on 29 September 2020).

- Lane, Philip R., and Gian Maria Milesi-Ferretti. 2008. The drivers of financial globalization. American Economic Review: Papers & Proceedings 98: 327–32. [Google Scholar] [CrossRef] [Green Version]

- Lang, Mark, and Mark Maffett. 2010. Economic effects of transparency in international equity markets: A review and suggestions for future research. Foundations and Trends in Accounting 5: 175–241. [Google Scholar] [CrossRef]

- Lannoo, Karel, and Apostolos Thomadakis. 2020. Derivatives in Sustainable Finance. CEPS-ECMI Study. Brussels: Centre for European Policy Studies, p. 3. [Google Scholar]

- Laverty, Kevin J. 2004. Managerial myopia or systemic short-termism? The importance of managerial systems in valuing the long term. Management Decision 42: 949–62. [Google Scholar] [CrossRef]

- Link, Benedikt. 2012. The struggle for a common interim reporting frequency regime in Europe. Accounting in Europe 9: 191–226. [Google Scholar] [CrossRef]

- Marinovic, Ivan, and Feliepe Varas. 2019. CEO horizon, optimal pay duration, and the escalation of short-termism. The Journal of Finance 74: 2011–53. [Google Scholar] [CrossRef]

- McNichols, Maureen, and James G. Manegold. 1983. The effect of the information environment on the relationship between financial disclosure and security price variability. Journal of Accounting and Economics 5: 49–74. [Google Scholar] [CrossRef]

- Park, James J. 2020. Do the securities laws promote short-termism? UC Irvine Law Review 10: 991–1044. [Google Scholar]

- Rappaport, Alfr. 2005. The economics of short-term performance obsession. Financial Analyst Journal 61: 65–79. [Google Scholar] [CrossRef]

- Reilly, Greg, David Souder, and Rebecca Ranucci. 2016. Time horizon of investments in the resource allocation process: Review and framework for next steps. Journal of Management 42: 1169–94. [Google Scholar] [CrossRef]

- Sachsida, Adolfo, and Marcelo Abi-Ramia Caetano. 2000. The Feldstein–Horioka puzzle revisited. Economics Letters 68: 85–88. [Google Scholar] [CrossRef]

- Sappideen, Razzen. 2011. Focusing on Corporate Short-termism. Singapore Journal of Legal Studies 53: 412–31. [Google Scholar]

- Securities and Exchange Commission (SEC). 2018. Request for Comment on Earnings Releases and Quarterly Reports. Release No. 33-10588; 34-84842. Washington, DC: SEC. [Google Scholar]

- Shleifer, Andrei, and Robert W. Vishny. 1990. Equilibrium short horizons of investors and firms. American Economic Review 80: 148–53. [Google Scholar]

- Souder, David, Greg Reilly, Philip Bromiley, and Scott Mitchell. 2016. A behavioral understanding of investment horizon and firm performance. Organization Science 27: 1065–341. [Google Scholar] [CrossRef]

- Stulz, René M. 2009. Securities laws, disclosure, and national capital markets in the age of financial globalization. Journal of Accounting Research 47: 349–90. [Google Scholar] [CrossRef] [Green Version]

- Thakor, Anjan V. 1990. Investment myopia and the internal organization of capital allocation decisions. Journal of Law, Economics, and Organization 1: 129–54. [Google Scholar] [CrossRef]

- The G20 Green Finance Study Group. 2016. G20 Green Finance Synthesis Report. p. 3. Available online: http://unepinquiry.org/g20greenfinancerepositoryeng (accessed on 29 September 2020).

- Thomas, Jacob, and Frank Zhang. 2008. Overreaction to intra-industry information transfers? Journal of Accounting Research 46: 909–40. [Google Scholar] [CrossRef]

- United Nations. 2015. Transforming our World: The 2030 Agenda for Sustainable Development. Available online: https://sustainabledevelopment.un.org/post2015/transformingourworld (accessed on 29 September 2020).

- Van Buskirk, Andrew. 2012. Disclosure frequency and information asymmetry. Review of Quantitative Finance and Accounting 38: 411–40. [Google Scholar] [CrossRef]

- World Bank Group Initiative. 2017. Roadmap for a Sustainable Financial System. Nairobi: UN Environment. [Google Scholar]

- World Commission on Environment and Development. 1987. Report of the World Commission on Environment and Development: Our Common Future. Available online: https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf (accessed on 29 September 2020).

- Yanovski, Boyan, Lessmann Kai, and Tahri Ibrahim. 2020. The Link between Short-Termism and Risk: Barriers to Investment in Long-Term Projects. Available online: https://ssrn.com/abstract=3550501 (accessed on 29 September 2020).

- Yongtae, Kim, Lixin Su, and Xindong Zhu. 2017. Does the cessation of quarterly earnings guidance reduce investors’ short-termism? Review of Accounting Studies 22: 715–52. [Google Scholar] [CrossRef]

- Zhou, Mengchen. 2018. Potential consequences of U.S. Securities and Exchange Commission’s Replacement of the Quarterly Reporting Requirement for Semi-Annual Reporting. Accounting Undergraduate Honors Theses. Available online: https://scholarworks.uark.edu/acctuht/37 (accessed on 22 September 2020).

| 1 | Currently ESG investments are equated with Socially Responsible Investment (SRI), although this was not always the case. SRI has its origins in what was termed ethical investment with moral screening (Escrig-Olmedo et al. 2013). |

| 2 | “Given the complexity of the financial system and its policy and regulatory framework, there is no single lever to achieve these ambitions and ‘switch’ the financial system to sustainability.” (Final Report 2018, p. 5). |

| 3 | “As the investment pillar of the European Green Deal, the Sustainable Europe Investment Plan will mobilize at least EUR 1 trillion of sustainable investments over the next decade. This amount of financing for the green transition is achieved through spending under the EU’s long-term budget, a quarter of which will go to climate-related purposes, and including estimated EUR 39 billion for environmental expenditures. Moreover, the Plan will crowd in additional private funding through leveraging the EU’s budget guarantee under the InvestEU Programme.” (European Commission 2020, p. 4). |

| 4 | We have ignored the London Stock Exchange in our research for two reasons. Firstly, the UK is no longer a member of the EU. Secondly, the UK has adopted the Anglo–American model of corporate governance, while our study focuses on countries, which has adopted the Continental Model as the most appropriate. To provide a broader view of the practical publication of quarterly financial statements by European companies, we additionally included the Swiss Stock Exchange and the Oslo Bors & Oslo Axess (similar accounting principles, reporting regulations, financial disclosure, and reporting frequency to the rest of the EU countries). |

| 5 | “The evidence most clearly points to projections as the main source of pressure on public companies. Public companies reported quarterly earnings for decades without feeling the pressure of short-termism. It was not until quarterly projections became widely distributed that short-termism became an issue” (Park 2020, p. 996). |

| Member of the EU | Quarterly Financial Reporting Mandatory? | Quarterly Reporting Rules? |

|---|---|---|

| Belgium | No—only IMS | No |

| Denmark | No—only IMS | No |

| Germany | No—only IMS | No—except companies listed in the “Prime Standard” |

| Greece | Yes | Obligatory for all listed firms |

| Spain | No—only IMS | No |

| France | No—only IMS | No |

| Ireland | No—only IMS | No |

| Italy | No—only IMS | No |

| Luxembourg | No—only IMS | No |

| The Netherlands | No—only IMS | No |

| Austria | No—only IMS | No—except companies listed in the “Prime Market” |

| Portugal | Yes | Obligatory for all listed firms |

| Finland | Yes | Obligatory for all listed firms |

| Sweden | Yes | Obligatory for all listed firms on two regulated markets |

| United Kingdom | No—only IMS | No |

| Member of the EU | Quarterly Financial Reporting Mandatory? | Quarterly Reporting Rules? |

|---|---|---|

| Bulgaria | Yes | Yes |

| Croatia | Yes | Yes |

| Cyprus | No | No—except companies listed on the “Main Market” |

| Czechia | No | No—except companies listed on the “Prime Market” |

| Estonia | Yes | Obligatory for firms listed on the regulated market |

| Hungary | Yes/No | It depends on the capitalization or the number of shareholders |

| Latvia | No | No |

| Lithuania | No | No |

| Malta | No | No |

| Poland | Yes | Yes |

| Romania | No | No |

| Slovakia | No | Interim statement |

| Slovenia | No | Interim statements or key operations data |

| EU-Regulated Markets | Stock Indexes | Number of Companies | Quarterly Reports (In Any Year) | |

|---|---|---|---|---|

| Number of Companies | Share [%] | |||

| Deutsche Boerse—Prime and General Standard | DAX | 30 | 30 | 100.00 |

| Nasdaq Nordic—Main | OMX NORDIC 40 | 40 | 40 | 100.00 |

| Euronext | AEX | 25 | 12 | 48.00 |

| BEL20 | 20 | 7 | 35.00 | |

| CAC 40 | 40 | 8 | 20.00 | |

| ISEQ 20 | 20 | 1 | 5.00 | |

| PSI 20 | 18 | 18 | 100.00 | |

| SIX Swiss Exchange | SLI | 30 | 12 | 40.00 |

| Borsa Italiana—Main | FTSE MIB | 40 | 36 | 90.00 |

| Oslo Bors & Oslo Axess | OBX | 25 | 25 | 100.00 |

| Wiener Boerse | ATX | 20 | 20 | 100.00 |

| Warsaw—Main | WIG 30 | 30 | 30 | 100.00 |

| BME (Spanish Exchange)—Main | IBEX 35 | 35 | 30 | 85.71 |

| Sofia | SOFIX | 15 | 12 | 80.00 |

| Bucharest | BET | 17 | 17 | 100.00 |

| Belgrade Stock Exchange | BELEX 15 | 10 | 6 | 60.00 |

| Prague | PX | 12 | 9 | 75.00 |

| Total | 427 | 313 | 73.30 | |

| EU Members | Stock Index | At Least 5 Years of Available Data | Quarterly Financial Reports | ||

|---|---|---|---|---|---|

| Number of Companies | Share [%] | Number of Reports | Share [%] | ||

| EU-15 | DAX | 30 | 13.22 | 1460 | 14.21 |

| OMX NORDIC 40 | 39 | 17.18 | 1897 | 18.46 | |

| PSI 20 | 17 | 7.49 | 697 | 6.78 | |

| FTSE MIB | 26 | 11.45 | 1008 | 9.81 | |

| OBX | 25 | 11.01 | 1138 | 11.08 | |

| ATX | 19 | 8.37 | 988 | 9.62 | |

| IBEX 35 | 15 | 6.61 | 684 | 6.66 | |

| New EU member states | WIG 30 | 28 | 12.33 | 1260 | 12.26 |

| SOFIX | 13 | 5.73 | 496 | 4.83 | |

| BET | 7 | 3.08 | 280 | 2.73 | |

| PX | 8 | 3.52 | 367 | 3.57 | |

| Total | 227 | 100.00 | 10,275 | 100.00 | |

| Specification | EU-15 | New EU Member States |

|---|---|---|

| Intercept | 0.037 | 0.820 |

| QUARTER | 0.019 *** | −0.017 |

| ΔROA | −0.009 ** | 0.387 |

| ΔROE | 0.025 ** | −1.765 *** |

| Δ(D/E) | −0.026 *** | 0.009 |

| Δ(P/E) | 0.000 | −0.005 |

| Δln(Assets) | 0.159 ** | 0.075 |

| Δ(MV/BV) | 0.638 ** | 6.661 *** |

| R2 | 0.155 | 0.268 |

| R2 adj. | 0.154 | 0.264 |

| F stat. | 131.630 | 56.437 |

| p-value | 0.000 | 0.000 |

| Specification | DAX | OMX NORDIC40 | PSI20 | FTSE MIB | OBX | ATX | IBEX35 | WIG30 | SOFIX | BET | PX |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Intercept | −0.544 *** | 0.102 ** | −0.101 * | 0.123 *** | −0.075 | −0.188 *** | 0.184 *** | −0.644 *** | 0.019 | −0.755 *** | 0.008 |

| QUARTER | −0.001 | 0.019 *** | 0.021 *** | 0.024 *** | 0.005 *** | 0.007 *** | 0.006 *** | 0.004 | 0.016 *** | −0.054 *** | −0.002 |

| ΔROA | 0.018 *** | 0.212 *** | 0.086 *** | −0.010 | −0.007* | −0.001 | −0.039 ** | 0.030 | 0.507 *** | −0.092 | 0.067 * |

| ΔROE | 0.016 | 0.015 | 0.34 0 *** | 0.190 *** | 0.089 *** | 0.004 | 0.088 *** | −0.175 *** | −0.460 *** | 1.090 *** | −0.023 *** |

| Δ(D/E) | −0.098 *** | −0.019 *** | −0.049 *** | 0.006 | −0.092 *** | −0.217 *** | −0.077 *** | 0.000 | −0.157 *** | 0.278 | 0.069 *** |

| Δ(P/E) | 0.025 * | 0.000 | 0.019 * | −0.001 | −0.001 ** | −0.002 | −0.003 | −0.001 | 0.001 | 0.027 | −0.007 |

| Δln(Assets) | 22.838 *** | 0.073 ** | 5.216 *** | 6.550 *** | 4.459 *** | 9.802 *** | 6.783 *** | −1.001 *** | −0.003 | −0.113 *** | −0.087 |

| Δ(MV/BV) | 0.866 *** | 0.664 *** | 0.092 * | 1.266 *** | 0.742 *** | 0.523 *** | 0.761 *** | 1.633 *** | 0.815 *** | 2.636 *** | 0.027 |

| R2 | 0.619 | 0.408 | 0.480 | 0.840 | 0.497 | 0.696 | 0.665 | 0.696 | 0.766 | 0.139 | 0.340 |

| R2 adj. | 0.616 | 0.405 | 0.471 | 0.838 | 0.491 | 0.693 | 0.658 | 0.693 | 0.757 | 0.068 | 0.313 |

| F stat. | 233.520 | 140.640 | 49.807 | 435.270 | 87.121 | 204.340 | 94.978 | 204.340 | 86.479 | 1.943 | 12.728 |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Janicka, M.; Pieloch-Babiarz, A.; Sajnóg, A. Does Short-Termism Influence the Market Value of Companies? Evidence from EU Countries. J. Risk Financial Manag. 2020, 13, 272. https://doi.org/10.3390/jrfm13110272

Janicka M, Pieloch-Babiarz A, Sajnóg A. Does Short-Termism Influence the Market Value of Companies? Evidence from EU Countries. Journal of Risk and Financial Management. 2020; 13(11):272. https://doi.org/10.3390/jrfm13110272

Chicago/Turabian StyleJanicka, Małgorzata, Aleksandra Pieloch-Babiarz, and Artur Sajnóg. 2020. "Does Short-Termism Influence the Market Value of Companies? Evidence from EU Countries" Journal of Risk and Financial Management 13, no. 11: 272. https://doi.org/10.3390/jrfm13110272