1. Introduction

Are currency and equity markets interrelated? If these markets are interdependent then what kind of relationship do they have? Are these markets linearly or non-linearly related? All these questions have gained substantial consideration with the development of money and asset markets, increased flexibility in currency market policies, and recreation of foreign exchange policies. To test the relationship between currency and equity market, there are two theoretical approaches. According to asset approach by

Branson (

1983) and

Frankel (

1983), stock price is one of the main determinants of exchange rate. If there is increase in the stock price, it will lead to an increase in the wealth of the country. This will lead to increasing demand for domestic currency and currency will appreciate as a result. According to flow approach by

Dornbusch et al. (

1980), exchange rate leads stock prices. But if domestic currency depreciates, it will increase the profits of export firms. If profits of the export-oriented firms are high, this can lead to the increase in the stock prices of firms. But at the same time, it will lead to an increase in the cost of imported goods, so if firms are not export-oriented they suffer losses in the form of high production costs due to currency depreciation. If costs are rising, profits will be lower and in turn stock prices will decline. So, one can conclude that stock prices can move each way. The first approach is based on the expectations of investors, if they expect that the company is going to be in profit they invest more and this would result in appreciation of currency. The second approach is based on the wealth effect if domestic currency appreciates or depreciates, which will change the stock price.

2. Literature Review

Bahmani-Oskooee and Saha (

2015) reviewed all the studies on the relationship of currency and equity markets and proposed a new method to estimate the relation. All research had the same assumption that currency market changes had symmetrical effect on the equity market.

Shin et al. (

2014) apply the non-linear autoregressive distributed lag (NARDL) method to check the short- and long-run asymmetrical effects of exchange rates and stock prices.

Bahmani-Oskooee and Saha (

2015) studied the asymmetrical effects by using the US data as sample and suggested applying this to other countries.

Bahmani-Oskooee and Saha (

2016) applied the same bivariate model for the nine countries to check the both symmetrical and asymmetrical effects between the equity market and currency markets.

Bahmani-Oskooee and Saha (

2017) apply the non-linear ARDL to check the asymmetries between the exchange rate and stock price by using the monthly data for 24 countries included in the sample. The main objective is to check the long-term and short-run relationships and the symmetrical and asymmetrical effects between these two variables; simple linear ARDL is applied for the symmetrical effect and non-linear ARDL is applied for checking the asymmetrical effect. The sample countries for this study are G-8 Countries (Canada, France, Germany, Italy, Japan, UK, USA and Russia), five emerging economies (Brazil, China, India, Mexico and South Africa), and Pakistan. There has been no study conducted for daily data using these countries for the 2000–2016-time period.

3. The Models and Methods

To check the long-run relationship between the stock price indices and real exchange rate, the following equation is used as given by

Bahmani-Oskooee and Sohrabian (

1992):

In this equation SP denotes the stock price index for each country and EX denotes the exchange rate for each country. The relationship between exchange rates and stock prices can be either positive or negative depending on whether the firm is export-oriented or import-oriented. An export-orientated firm will benefit from depreciation of the home currency as depreciation makes exports cheaper. This will lead to an increase in competitiveness and increase in earnings of the firm, hence, stock prices will increase (a positive relationship). Whereas an import-oriented firm is hurt by depreciation of the home currency as the cost of imported inputs is increased as a result of depreciation of home currency. This will lead to a decline in profitability, and thus stock prices will decrease (a negative relationship).

β slope coefficient will be statistically significant if residuals of Equation (1) are stationary at order less than the variables given in the equation. If variables are stationary at order 1 then residuals must be stationary at a level that also indicates that there is long-term integration between the variables of

Engle and Granger (

1987). To check the short-run integration, an error correction model can be applied as follows:

By Equation (1), we can obtain the error correction variable; the slope of the ECM must be negative and significant to confirm that there is short-run relationship between the variables. That also indicates the speed of adjustment towards the long-run relationship of

Banerjee et al. (

1998).

3.1. Linear Auto Regressive Distributed Lag Model (ARDL)

When the order of integration is not same of all variables then we use the lagged variables as proposed by

Pesaran et al. (

2001):

The F-test is used to check the joint significance of all variables included in the Equation (3). By this equation, both short-run and long-run effects between the variables can be measured.

3.2. Non-Linear Auto Regressive Distributed Lag Model (NARDL)

To check the asymmetries, we have to make a separate series for appreciation and depreciation as proposed by

Bahmani-Oskooee and Saha (

2015,

2016). A series of exchange rate will be divided in its positive movements or appreciation, as indicated by POS^EX, and negative movements or depreciation, as indicated by NEG^EX, and is given as follows:

To check the impact of positive and negative movements of one variable on the other variable, Equation (3) will be transformed as:

Due to the nature of variables of

POSEX and

NEGEX, the linear ARDL model is now converted into the non-linear ARDL. By using this model, we can check the asymmetries as positive and negative changes that have same effect or a different impact on stock prices according to

Shin et al. (

2014). If the estimated values of positive and negative coefficients of the exchange rate have the same numerical value and the same sign (either both positive or both negative) then it can be concluded that exchange rate changes have symmetrical short-run effects on stock prices. The long-run effects are interpreted from the estimates of the coefficients of the lagged level values. The symmetrical or asymmetrical long-run effects of changes in exchange rates on stock prices are given by lamda two and lamda three. We can change the dependent variable to check the asymmetrical impact of stock prices on exchange rates. The linear ARDL and the non-linear ARDL model can be described as follows:

In these equations, a series of stock price is divided in partial sums of positive and negative changes. They are created by using the same formula as used by Equation (4). Error-correction models (3) and (5) as well as (6) and (7) are estimated in the next section for each of the 24 countries in our sample.

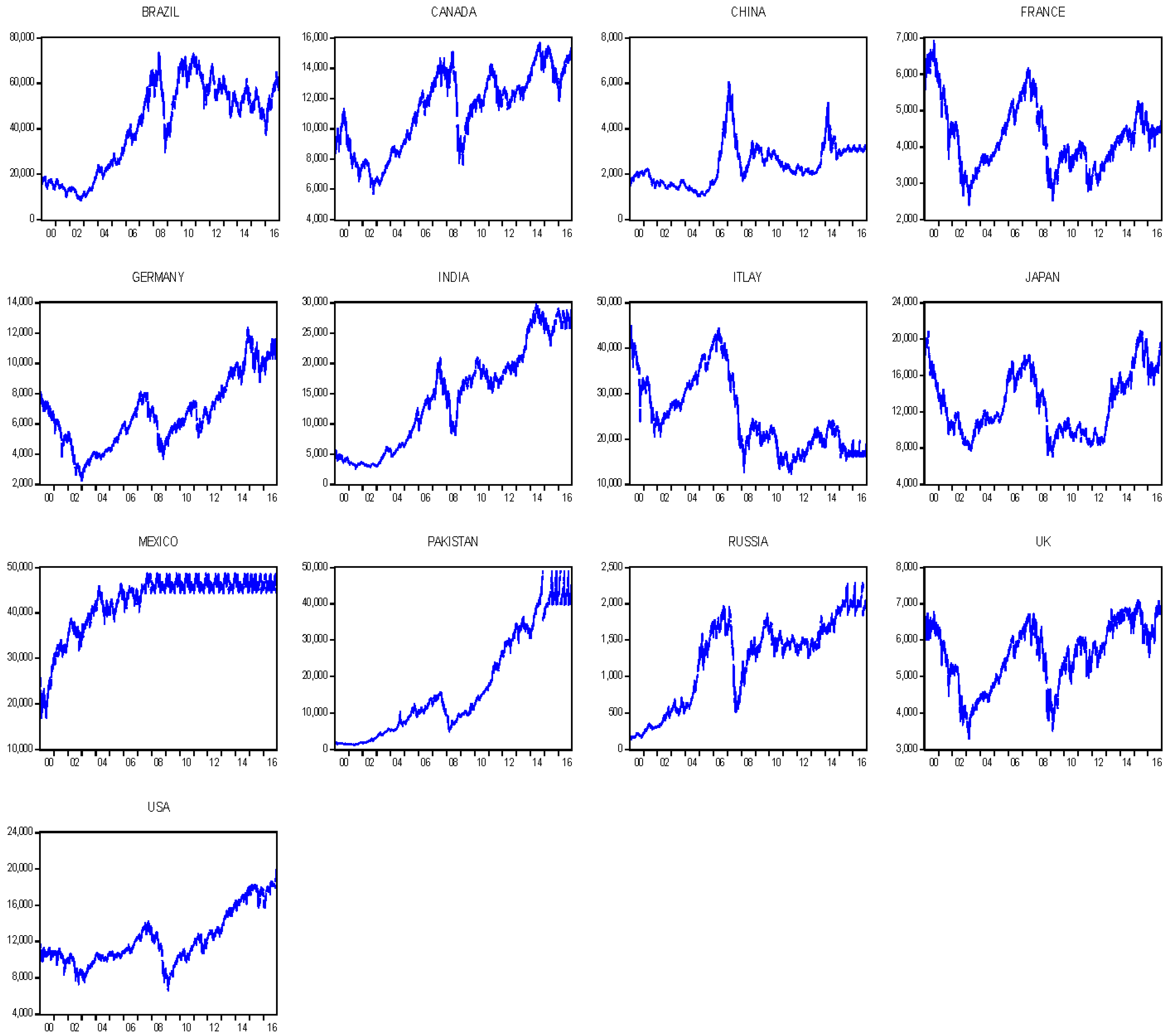

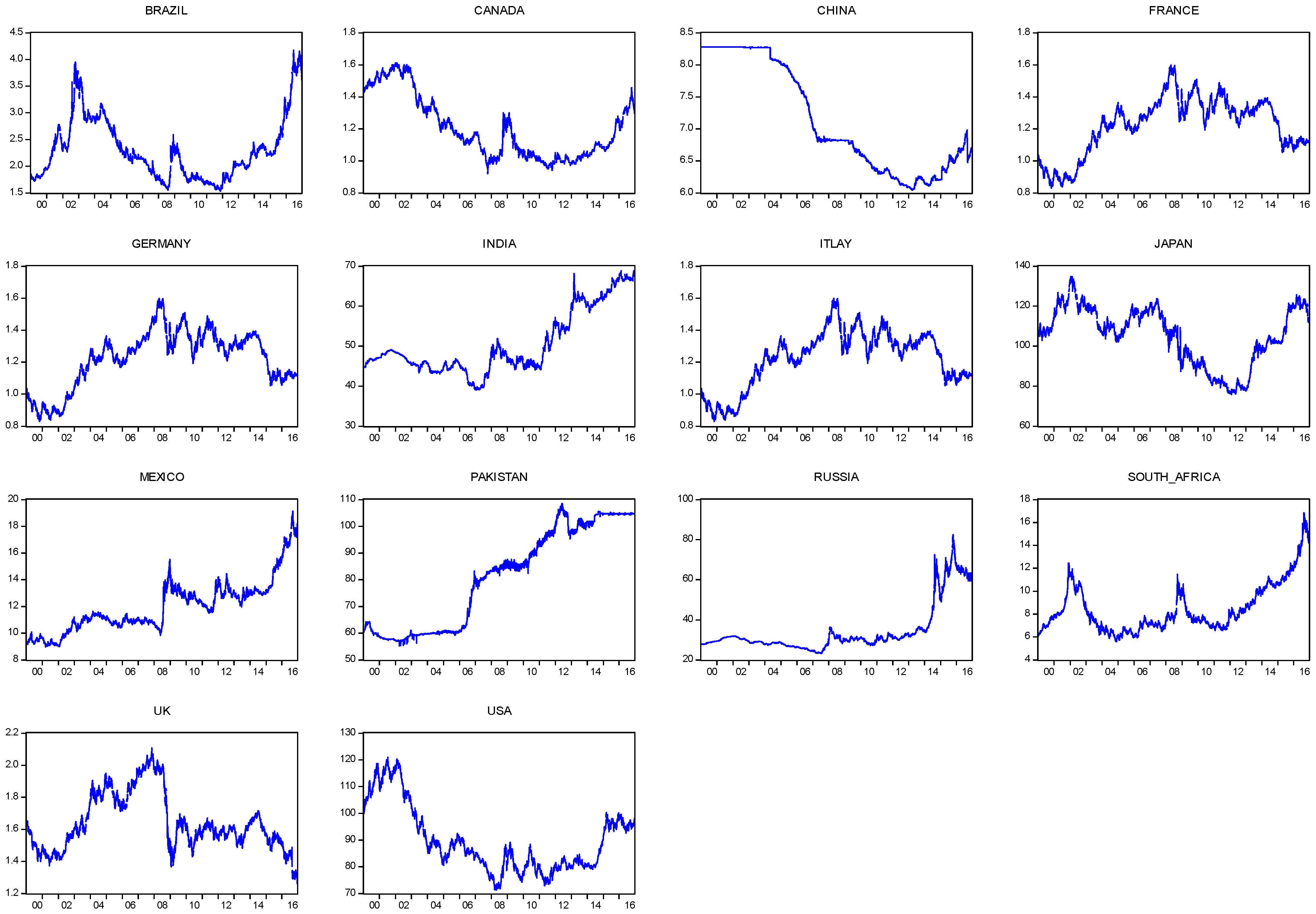

4. Empirical Results

The results for this study are comprised from the daily data of stock indices and real exchange rate for 14 countries includes Canada, France, Germany, Italy, Japan, UK, USA, Russia, Brazil, China, India, Mexico and South Africa and Pakistan. There is no study conducted for daily data using these countries for the 2000–2016-time period. Stationary tests are conducted based on the

Dickey and Fuller (

1979) and

Phillips and Perron (

1988) tests. The results have shown that all the stock indices for sample countries are non-stationary at level but stationary at 1st difference. Exchange rates for all the countries are also stationary at 1st difference but non-stationary at level.

In

Table 1, long-run estimates for stock indices and exchange rates are given and show that the stock indices of Canada, France, Germany, Italy, Japan, UK, USA, Russia, Brazil, China, India, Mexico, South Africa and Pakistan have a long-term statistically significant relationship with the real exchange rate of all these countries. The stock indices of Brazil, China, Canada, France, Italy, UK and USA have negative significant relationship and all other counties have the positive statistically significant relationship.

In

Table 2, a vector error correction model (VECM) is applied to check the short-run relationship between the stock indices and real exchange rate. ECM shows the speed of adjustment and it is negative and statistically significant in all the countries, showing that these two variables have a short-run relationship and there is cointegration between these two variables. To check the symmetrical and short-run relationship, ARDL is applied.

In

Table 3, stock indices are taken as dependent variable and results show that stock indices depend on its lagged terms and also have a short-run relationship with exchange rates in all the sample countries.

In

Table 4, exchange rates are taken as dependent variable and show that exchange rate can also be predicted by its lagged term. If exchange rate changes that will also lead towards the change in stock price in short run. CUMSUM graphs are given in the

Appendix A that shows the stability of variables.

In

Table 5, results are shown from the non-linear ARDL estimation, first taking the stock price as the dependent variable, and asymmetrical changes in exchange rate are observed by taking negative and positive series for all sample countries. The Wald test is applied to check the asymmetrical impact of the exchange rate on stock prices. The results show that there is asymmetrical impact on stock prices by positive and negative changes in the stock prices. The short-run asymmetrical impact of exchange rate changes on stock prices are significant among all the countries, Canada, France, Germany, Italy, Japan, UK, USA, Russia, Brazil, China, India, Mexico and South Africa and Pakistan at different lag orders. Wald test results show that positive and negative coefficients have a different impact on stock prices in all sample countries.

In

Table 6, results are shown from the non-linear ARDL estimation, taking the exchange rate as dependent variable, and asymmetrical changes in stock prices are observed by taking negative and positive series for all sample countries. The Wald test is applied to check the asymmetrical impact of stock prices on exchange rates. Results show that there is an asymmetrical impact on exchange rates by positive and negative changes in stock prices. The short-run asymmetrical impact of stock price changes on exchange rates are significant among all the countries Canada, France, Germany, Italy, Japan, UK, USA, Russia, Brazil, China, India, Mexico and South Africa and Pakistan at different lag orders. Wald test results show that positive and negative coefficients have a different impact on exchange rates in all the sample countries.

5. Conclusions

Currency appreciation or depreciation will affect all companies at the domestic level or at the multinational level. If one country’s currency depreciates, it will lead towards the increased cost of imported goods, hence exports will be high at that time because other countries can purchase at low cost, but imports will be low as costs are high.

If firms are export-oriented, then they will have higher sales and enjoy high profits. But if firms are not export-oriented, they may suffer a decline in their profits. If a company benefits from the increase in sales due to currency depreciation, then it will lead to high stock prices and vice versa. Currency appreciation will also lead to changes in stock prices. Results from the sample countries also support the flow-oriented model that exchange rate changes lead to changes in stock price. On the other side, if stock prices change that will also lead towards changes in exchange rates. This is also supported by the results and supports the portfolio approach that emphasizes that changes in stock price also lead towards the changes in exchange rate.

There are many studies on the relationship between currency and equity market and conclusions drawn about short-run and long-run integration. In this study, the main objective is to check the linear short-run relationship measured through linear ARDL and to check the asymmetrical linkages between the currency and equity markets through non-Linear ARDL that either positive and negative changes have different impacts on another variable. Variables are not stationary at level, so non-linearity can be checked. In our study, all variables are stationary at order 1.

Cointegration between these variables are confirmed and they also have a long-run relationship. Short-run effects are checked by VECM and show that there is a short-run relationship between these two variables. To check the asymmetries, either positive or negative changes in stock price had the same impact on exchange rates or were different. Results have shown that there is an asymmetrical relationship between stock price and exchange rate. Results are drawn in each way, from exchange rate to stock price and stock price to exchange rate. This study concentrates on the G8 plus 5 countries sample with Pakistan and draws the inferences from the daily data of 2000–2016.

Results clearly show that there is asymmetrical relationship between the stock price and exchange rate. Further studies can be conducted by adding more countries, more variables and at different periods. This study contributes to policy making such that a country can depreciate their currency to improve their trade balance and must be aware of asymmetrical effects on stock price and exchange rates of their future policies.