Financial Market Integration: Evidence from Cross-Listed French Firms

Abstract

:1. Introduction

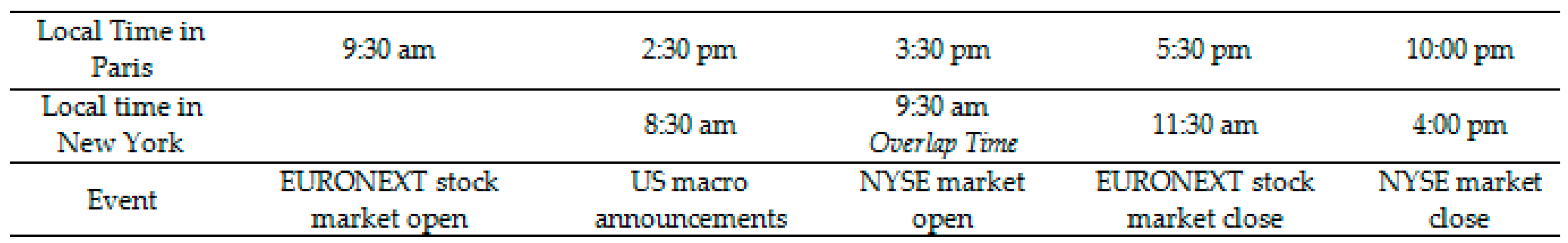

2. Data

3. Methodology

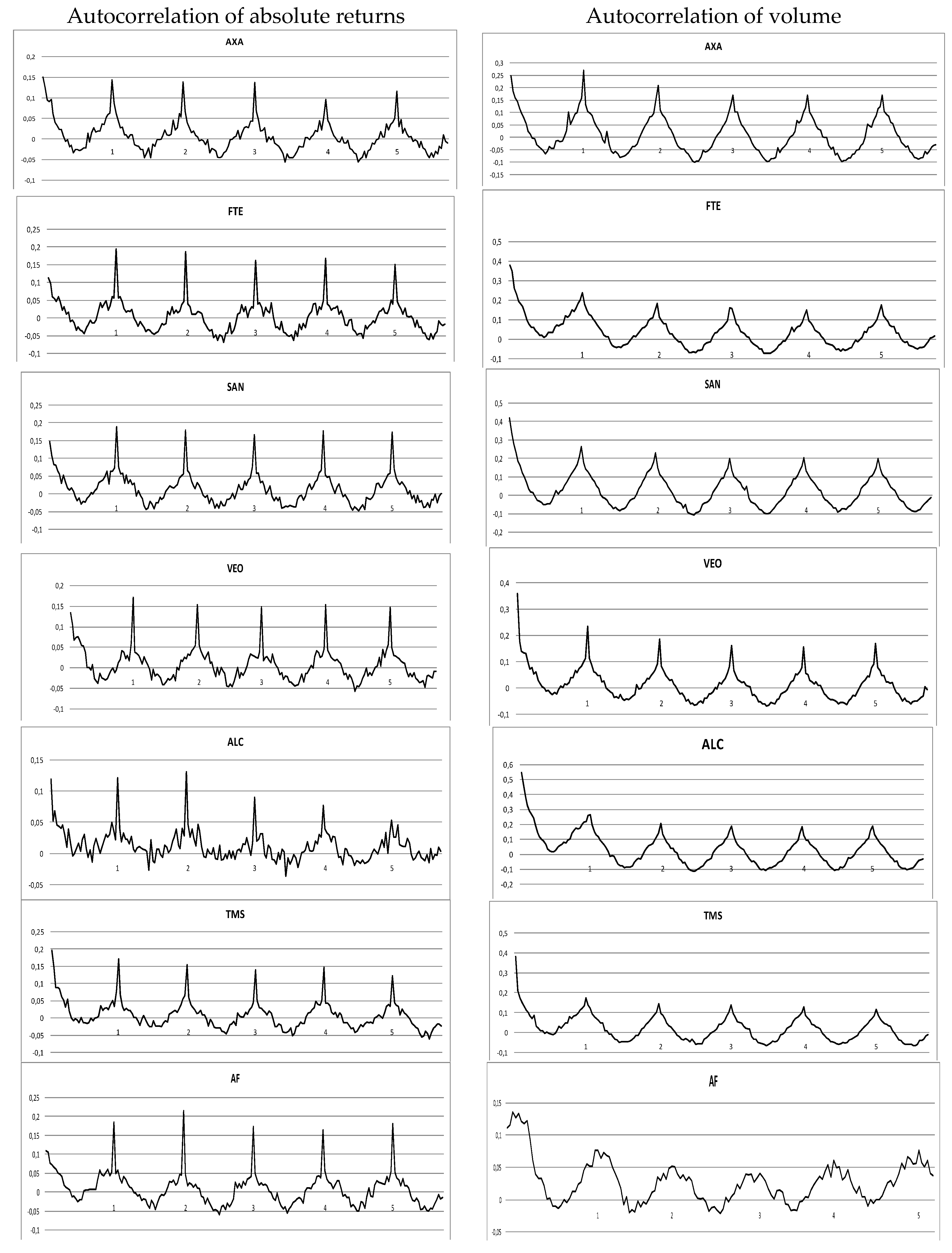

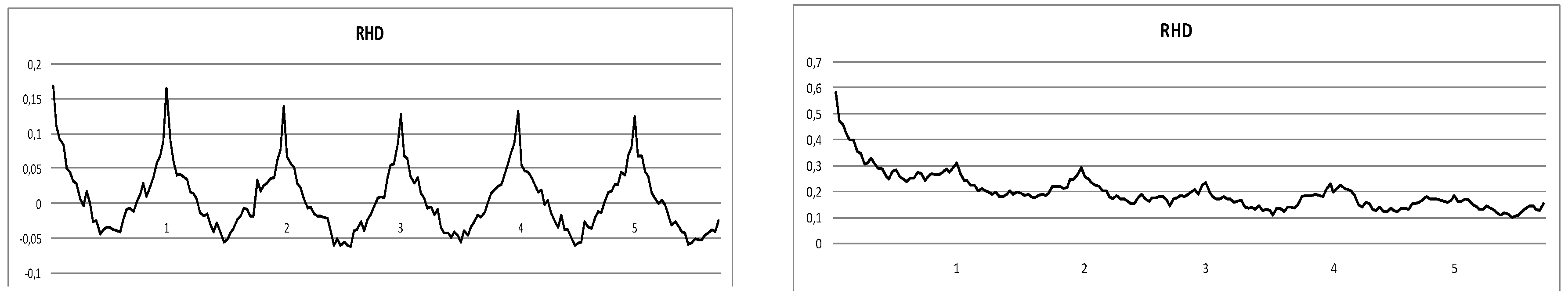

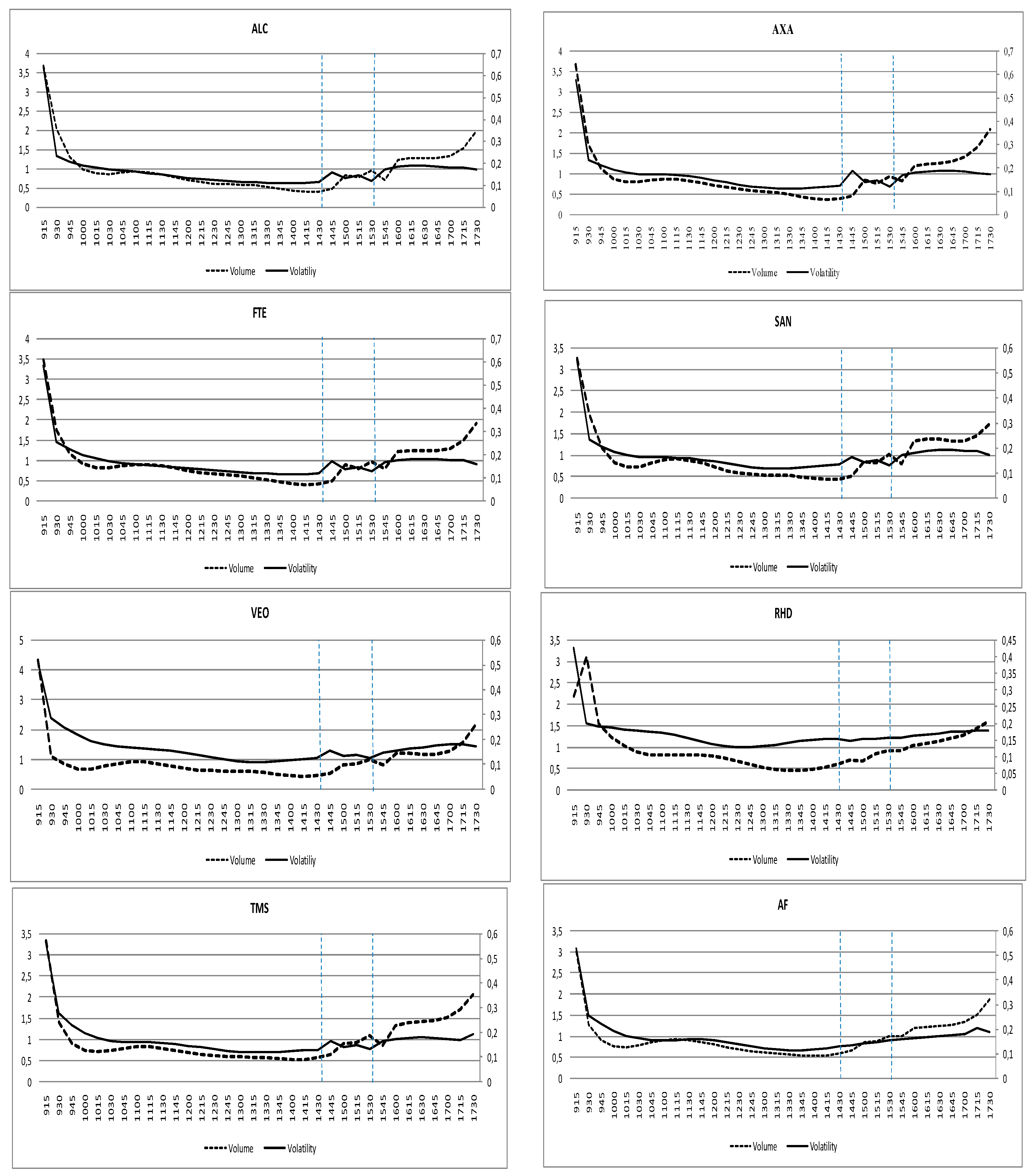

4. Flexible Fourier Form

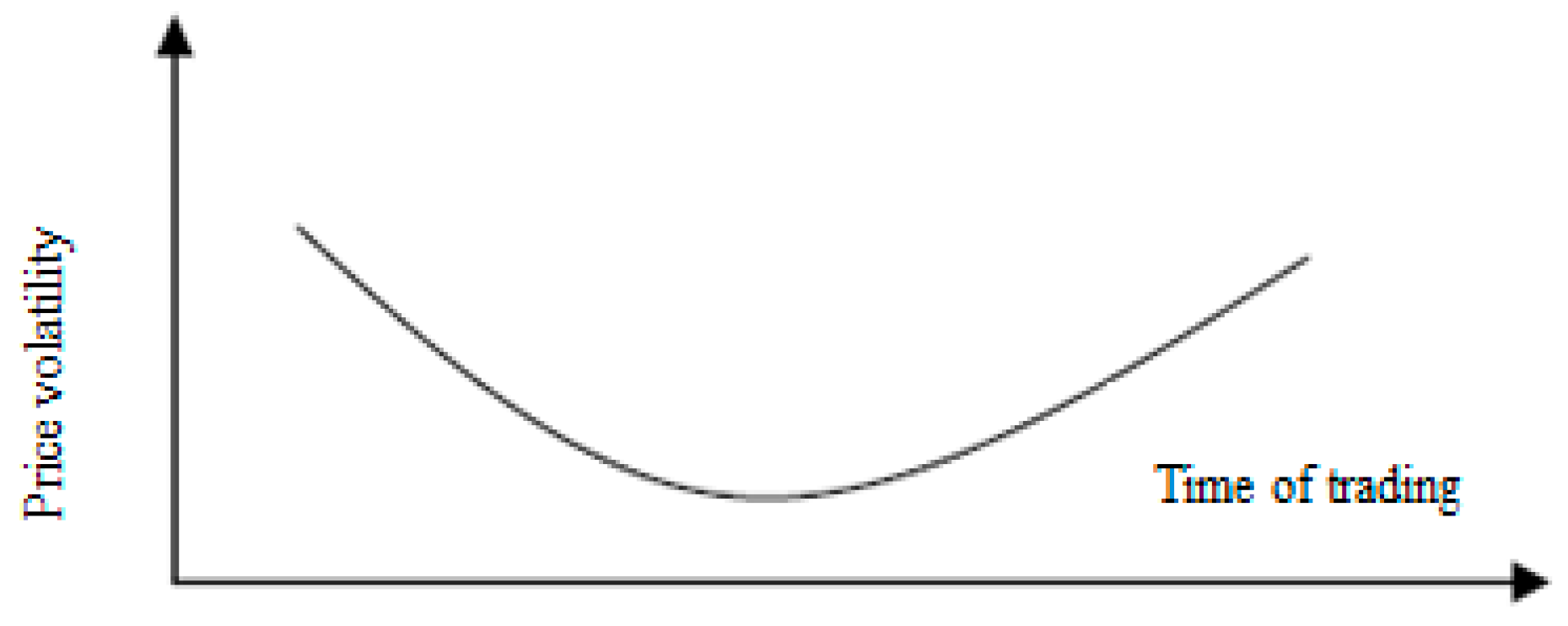

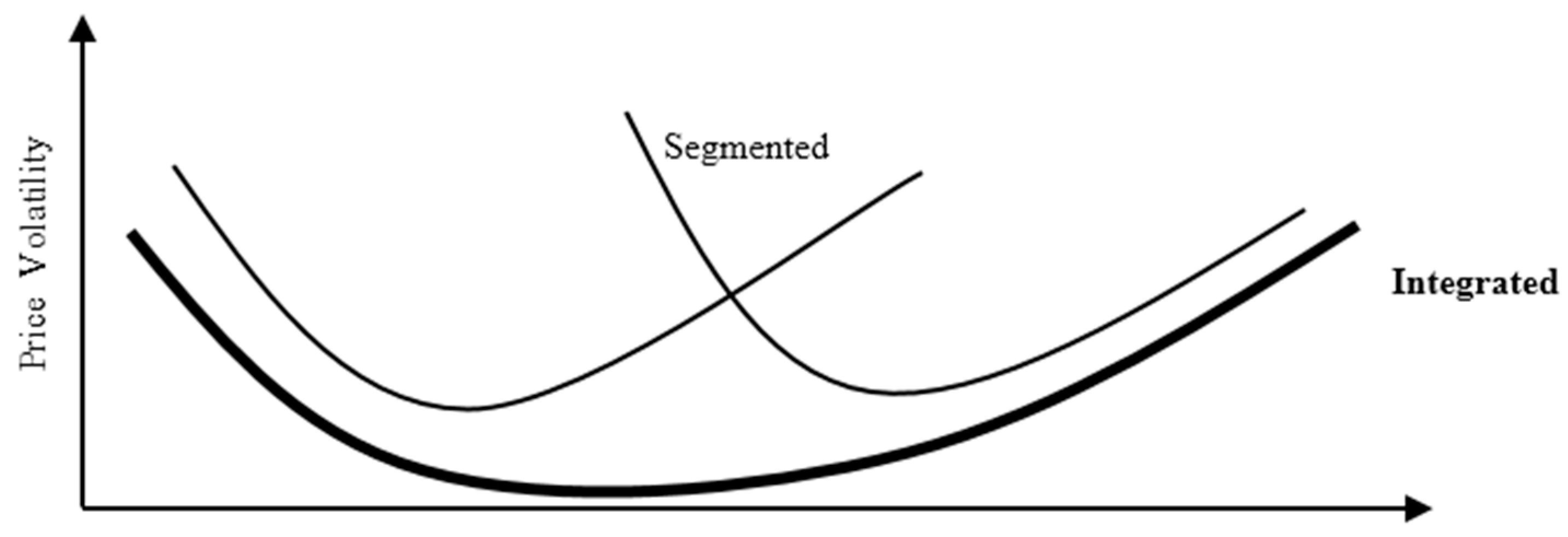

5. Estimation of U-Shape Curve

6. Convergence of Prices during the 2-HR Overlap Period

7. Implications for Future Research

8. Conclusions

Conflicts of Interest

References

- Anat, R. Admati, and Paul Pfleiderer. 1988. A Theory of Intraday Trading Patterns. The Review of Financial Studies 1: 3–40. [Google Scholar]

- Andersen, Torben G., and Tim Bollerslev. 1997. Intraday periodicity and volatility persistence in financial markets. Journal of Empirical Finance 4: 115–58. [Google Scholar] [CrossRef]

- Andersen, Torben G., Tim Bollerslev, and Jun Cai. 2000. Intraday and Interday Volatility in Japanese stock market. Journal of International Financial Market Institution and Money 10: 107–30. [Google Scholar] [CrossRef]

- Arouri, M. H. 2005. Intégration Financière et, Diversification internationale des Portefeuilles. Économie et Prévision 168: 115–32. [Google Scholar] [CrossRef]

- Baele, Lieven, and Koen Inghelbrecht. 2010. Time-varying integration, interdependence and contagion. Journal of International Money and Finance 29: 791–818. [Google Scholar] [CrossRef]

- Bollerslev, Tim, Jun Cai, and Frank M. Song. 2000. Intraday periodicity, long memory volatility and macroeconomic annoucement effects in the US Treasury bond market. Journal of Empirical Finance 7: 37–55. [Google Scholar] [CrossRef]

- Doidge, Craig, G. Andrew Karolyi, and René M. Stulz. 2004. Why are foreign firms listed in the US worth more? Journal of Financial Economics 71: 205–38. [Google Scholar] [CrossRef]

- Foerster, Stephen R., and G. Andrew Karolyi. 1998. Multimarket Trading and Liquidity: A Transaction Data Analysis of Canada-US Interlistings. Journal of International Financial Markets Institutions and Money 8: 393–412. [Google Scholar] [CrossRef]

- Froot, Kenneth A., and Emil M. Dabora. 1999. How are stock prices affected by the location of trade? Journal of Financial Economics 53: 189–216. [Google Scholar] [CrossRef]

- Gallant, A. Ronald. 1981. On the Bias in Flexible Functional Forms and an Essentially Unbiased Form. Journal of Econometrics 15: 211–45. [Google Scholar] [CrossRef]

- Goodhart, Charles A. E., and Maureen O’Hara. 1997. High Frequency Data in Financial Markets: Issues and Applications. Journal of Empirical Finance 4: 73–114. [Google Scholar] [CrossRef]

- Hasbrouck, Joel. 1995. One Security, Many Markets: Determining the Contributions to Price Discovery. Journal of Finance 4: 1175–99. [Google Scholar] [CrossRef]

- Hupperets, Erik C. J., and Albert J. Menkveld. 2002. Intraday Analysis of market integration: Dutch Blue Chips traded in Amsterdam and New York. Journal of Financial Markets 5: 57–82. [Google Scholar] [CrossRef]

- Madhavan, Ananth. 2000. Market Microstructure: A Survey. Journal of Financial Markets 3: 205–58. [Google Scholar] [CrossRef]

- Lowengrub, Paul, and Michael Melvin. 2002. Before and after international cross listing: An intraday examination of volume and volatility. International Financial Market Institutions and Money 12: 139–55. [Google Scholar] [CrossRef]

- Taylor, Stephen J., and Xinzhong Xu. 1997. The Incremental Volatility Information in one Million Foreign Exchange Quotations. Journal of Empirical Finance 4: 317–40. [Google Scholar] [CrossRef]

- Teiletche, Jérôme. 1998. La dynamique à très haute fréquence de l’indice CAC40. Finance 19: 197–220. [Google Scholar]

- Werner, Ingrid M., and Allan W. Kleidon. 1996. UK and US trading of British cross-listed stocks: An intraday analysis of market integration. The Review of Financial Studies 9: 619–64. [Google Scholar] [CrossRef]

| 1 | See (Arouri 2005) or (Baele and Inghelbrecht 2010) for a survey of the literature. |

| 2 | This intraday behavior aroused the interest in the development of theoretical models to understand the origin of these stylized facts. See (Anat and Pfleiderer 1988; Goodhart and O’Hara 1997; Foerster and Karolyi 1998; Bollerslev et al. 2000). |

| 3 | ADR (American Depositary Receipts) are negotiable instruments issued by a US bank and representing the shares that it has acquired in a foreign company listed on a non-US market. There are three levels of ADR, depending on information disclosure requirements of the American regulator (Securities and Exchange Commission), with level 3 corresponding to full listing. |

| 4 | The Paris Bourse became part of EURONEXT on 22 September 2000. |

| 5 | The data were obtained from Tick data, New York Stock Exchange (NYSE). |

| 6 | For various reasons, not all of the cross-listed French firms are included in our study (for example, where the ADR of a given firm is not widely-traded). |

| 7 | These are companies that have a solid record of stable earnings and a reputation for high quality management. The large caps suggest that the perceived management style of the firm has probably an impact on the US market (see Froot and Dabora 1999; Doidge and Stulz 2004). |

| 8 | Standard deviation looks higher for ADR in all cases. Clearly, we can observe that ADRs of a given country gives an information advantage on the ADRs’ underlying stocks that can be bought or sold quicker than otherwise. |

| 9 | We retain the absolute return as the measure of volatility. The autocorrelation of the absolute return is higher than squared return; therefore, there is more structure and information to study (see (Taylor and Xu 1986)). |

| 10 | Following the major part of the studies on data of high frequency, we shall assume that intraday return have mean zero and are uncorrelated. It is assumed that the variance and covariance of squared returns exist and are finite. However, we choose the absolute return as a proxy of volatility. For deep highlight see (Taylor and Xu 1986; Teiletche 1998; Madhavan 2000). |

| 11 | With the choice P = 3, the combination of trigonometric functions and polynomial terms are likely to result in better approximation properties when estimating regularly recurring cycles. |

| 12 | In order to facilitate comparison of prices, prices in euro are converted into dollars using the daily EUR/USD rate for the whole of 2005. Indeed the volatility of the exchange rate is more less pronounced than returns. |

| 13 | It’s about The French Financial Transaction Tax (FTT) on the purchase of certain French equities. It’s issued by a French headquartered company with a market capitalization in excess of 1 billion euros as at 1 January of the tax year. ADRs tax started on 1 January 2013. |

| Mean | Std. Dev | Minimum | Maximum | AC abs a Return | Nb of Obs. | Nb of Shares | ||

|---|---|---|---|---|---|---|---|---|

| PARIS | AF | 0.0028 | 0.22 | −2.58 | 4.55 | 0.151 | 8986 | 38,924 |

| NY | AF ADR | 0.0055 | 0.47 | −3.82 | 4.90 | 0.059 | 6540 | 11,200 |

| PARIS | FTE | −0.0016 | 0.21 | −3.95 | 3.93 | 0.106 | 8963 | 288,608 |

| NY | FTE ADR | −0.0045 | 0.29 | −4.33 | 1.99 | 0.028 | 6540 | 5689 |

| PARIS | VEO | 0.0041 | 0.20 | −1.88 | 1.83 | 0.174 | 8987 | 43,916 |

| NY | VEO ADR | 0.005 | 0.33 | −3.56 | 2.39 | 0.112 | 6540 | 827 |

| PARIS | RHD | 0.0005 | 0.63 | −1.79 | 11.78 | 0.077 | 8948 | 27,497 |

| NY | RHD ADR | −0.0049 | 1.03 | −1.75 | 7.67 | 0.117 | 6540 | 2060 |

| PARIS | AXA | 0.0044 | 0.20 | −2.81 | 2.77 | 0.098 | 8986 | 203,737 |

| NY | AXA ADR | 0.004 | 0.26 | −2.71 | 1.98 | 0:015 | 6540 | 11,912 |

| PARIS | TMS | −0.001 | 0.24 | −3.32 | 5.45 | 0.104 | 8986 | 59,102 |

| NY | TMS ADR | −0.0045 | 0.35 | −2.90 | 3.89 | 0.050 | 6540 | 2696 |

| PARIS | SAN | 0.0025 | 0.21 | −2.46 | 4.13 | 0.104 | 8986 | 115,074 |

| NY | SAN ADR | 0.0014 | 0.24 | −3.05 | 3.54 | 0.071 | 6540 | 36,555 |

| PARIS | ALC | −0.0037 | 0.29 | −7.97 | 5.09 | 0.106 | 8987 | 315,642 |

| NY | ALC ADR | −0.0011 | 0.38 | −9.77 | 9.05 | 0.065 | 6540 | 38,980 |

| C | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Paris | AXA | 0.331 * | −0.368 ** | 0.108 * | −0.011 | −0.012 | 0.001 | −0.034 * | −0.022 * | −0.008 * |

| NY | AXA ADR | 5.362 * | −13.77 ** | 5.09 ** | −2.30 * | −0.588 * | −0.192 * | 0.066 | −0.12 * | 0.015 |

| Paris | ALC | 0.380 * | −0.525 * | 0.166 * | −0.04 | −0.016 | −0.007 | −0.037 * | −0.021 | −0.006 |

| NY | ALC ADR | 6.28 * | −16.01 ** | 5.816 ** | −2.682 * | −0.676 * | −0.239 * | −0.079 | −0.148 * | 0.003 |

| Paris | RDIA | 0.228 * | −0.150 * | 0.047 | 0 | −0.004 | 0 | −0.01 | 0.003 | −0.007 |

| NY | RDIA ADR | 3.671 * | −7.530 ** | 2.622 ** | −0.966 * | −0.237 * | 0.012 | −0.242 * | −0.140 * | −0.025 |

| Paris | TMS | 0.501 * | −0.765 * | 0.234 * | −0.078 | −0.016 | 0 | −0.067 * | −0.031 * | −0.010 * |

| NY | TMS ADR | 4.118 * | −10.41 ** | 3.945 ** | −1.752 | −0.490 * | −0.163 * | 0.057 * | −0.080 * | 0.012 |

| Paris | VEO | 0.387 * | −0.471 * | 0.136 * | −0.018 | −0.003 | 0.008 | −0.041 | −0.018 * | −0.005 |

| NY | VEO ADR | 5.974 * | −16.255 ** | 6.112 ** | −2.969 * | −0.772 * | −0.260 * | 0.243 * | −0.012 * | 0.057 * |

| Paris | FTE | 0.416 * | −0.588 * | 0.183 * | −0.051 | −0.013 | −0.004 | −0.043 * | −0.023 * | −0.004 |

| NY | FTE ADR | 5.528 * | −13.962 ** | 5.112 ** | −2.357 * | −0.617 * | −0.199 * | −0.007 | −0.135 * | 0.023 |

| Paris | AF | 0.400 * | −0.557 * | 0.174 * | −0.049 | −0.010 | 0.005 | −0.038 * | −0.021 * | −0.002 |

| NY | AF ADR | 3.94 * | −9.69 ** | 3.639 ** | −1.652 * | −0.480 * | −0.131 * | 0.088 * | −0.069 * | −0.003 |

| Paris | SAN | 0.315 * | −0.328 * | 0.096 * | −0.008 | −0.007 | 0.002 | −0.038 * | −0.021 * | −0.008 * |

| NY | SAN ADR | 6.260 * | −15.65 *** | 5.628 ** | −2.629 * | −0.707 * | −0.244 * | −0.233 * | −0.231 * | −0.054 * |

| Estimation of Dummy Variables | ||||||||||

| υ0 | υ1 | υ2 | ||||||||

| Paris | AXA | 0.306 ** | 0.004 | −0.036 ** | ||||||

| NY | AXA ADR | 0.145 ** | 1.114 ** | 0.26 ** | ||||||

| Paris | ALC | 0.370 ** | 0.024 ** | −0.039 * | ||||||

| NY | ALC ADR | 0.200 ** | 1.045 ** | 0.430 ** | ||||||

| Paris | RDIA | 0.213 * | 0.01 | 0.003 | ||||||

| NY | RDIA ADR | 1.14 * | 0.408 * | −0.049 | ||||||

| Paris | TMS | 0.229 * | 0.026 * | −0.023 * | ||||||

| NY | TMS ADR | 0.190 * | 0.855 ** | 0.136 ** | ||||||

| Paris | VEO | 0.186 * | −0.007 | −0.018 | ||||||

| NY | VEO ADR | 0.149 * | 1.463 ** | 0.143 * | ||||||

| Paris | FTE | 0.287 ** | −0.02 | −0.028 | ||||||

| NY | FTE ADR | 0.110 * | 0.938 ** | 0.253 ** | ||||||

| Paris | AF | 0.229 ** | 0.028 | 0.000 | ||||||

| NY | AF ADR | 0.115 * | 0.091 * | 0.043 | ||||||

| Paris | SAN | 0.288 ** | 0.07 | −0.029 | ||||||

| NY | SAN ADR | 0.165 * | 0.377 ** | 0.062 * | ||||||

| Cross Correlations | AXA | ALC | RDIA | TMS | VEO | FTE | AF | SAN |

|---|---|---|---|---|---|---|---|---|

| 0 Lags | 0.874 ** | 0.948 ** | 0.611 ** | 0.879 ** | 0.835 ** | 0.891 ** | 0.698 * | 0.872 * |

| EURONEXT Lagged | ||||||||

| 15 min | 0.022 * | 0.023 * | 0.056 * | 0.018 * | 0.066 * | 0.017 | 0.011 | 0.018 |

| 30 min | −0.023 | −0.021 | 0.013 | −0.014 | −0.007 | −0.028 | 0.021 | −0.009 |

| NYSE Lagged | ||||||||

| 15 min | 0.017 | 0.001 | 0.015 * | −0.005 | 0.026 | 0.002 | 0.021 | 0.057 |

| 30 min | −0.029 | −0.022 | −0.017 | −0.014 | 0.015 | −0.021 | −0.018 | 0.024 |

| ECT | γ1 | γ2 | β1 | β2 | R2 | ||

|---|---|---|---|---|---|---|---|

| Paris | AXA | −0.114 ** | 0.036 | −0.019 | −0.025 | −0.022 | 0.013 |

| NY | AXA ADR | 0.006 | 0.109 ** | −0.017 | −0.098 * | −0.012 | 0.004 |

| Paris | ALC | −0.203 ** | 0.038 | 0.082 | −0.042 | −0.109 | 0.008 |

| NY | ALC ADR | 0.003 | 0.145 ** | 0.051 | −0.130 ** | −0.073 | 0.003 |

| Paris | RHD | −0.019 * | −0.081 * | −0.055 | 0.058 * | 0.017 | 0.011 |

| NY | RDIA ADR | 0.002 | 0.220 ** | 0.117 * | −0.207 ** | −0.109 * | 0.019 |

| Paris | TMS | −0.019 * | −0.081 * | −0.055 | 0.058 * | 0.017 | 0.011 |

| NY | TMS ADR | 0.117 ** | 0.120 ** | −0.047 | −0.127 ** | 0.039 | 0.014 |

| Paris | VEO | −0.132 ** | −0.015 | −0.006 | 0.028 | 0.011 | 0.014 |

| NY | VEO ADR | 0.053 * | 0.148 ** | −0.051 | −0.107 * | 0.062 | 0.013 |

| Paris | FTE | −0.194 ** | 0.032 | 0.046 | −0.044 | −0.078 | 0.022 |

| NY | FTE ADR | 0.035 | 0.117 ** | −0.019 | −0.114 ** | −0.005 | 0.003 |

| Paris | AF | −0.022 | −0.048 | 0.038 | 0.065 | −0.026 | 0.006 |

| NY | AF ADR | 0.049 * | −0.080 | 0.002 | 0.038 | −0.054 | 0.008 |

| Paris | SAN | −0.108 ** | −0.015 | 0.048 | 0.024 | −0.025 | 0.007 |

| NY | SAN ADR | 0.059 * | 0.019 | 0.013 | −0.004 | 0.007 | 0.003 |

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mehanaoui, M. Financial Market Integration: Evidence from Cross-Listed French Firms. J. Risk Financial Manag. 2017, 10, 18. https://doi.org/10.3390/jrfm10040018

Mehanaoui M. Financial Market Integration: Evidence from Cross-Listed French Firms. Journal of Risk and Financial Management. 2017; 10(4):18. https://doi.org/10.3390/jrfm10040018

Chicago/Turabian StyleMehanaoui, Mohamed. 2017. "Financial Market Integration: Evidence from Cross-Listed French Firms" Journal of Risk and Financial Management 10, no. 4: 18. https://doi.org/10.3390/jrfm10040018