The Energy Saving and Emission Reduction Effect of Carbon Trading Pilot Policy in China: Evidence from a Quasi-Natural Experiment

Abstract

:1. Introduction

2. Literature Review

2.1. Technological Innovation Effect of Environmental Policy

2.2. Carbon Emission Reduction Effect of Carbon Trading Policy

2.3. Impact of Carbon Trading Policy on Energy Efficiency

2.4. Current Literature Gap and Contribution of This Study

3. Methodology and Data

3.1. Baseline Regression Model

3.2. Dynamic Regression Model

3.3. Synthetic Control Method (SCM)

3.4. Variables Selection

- (1)

- Explained variable

- (2)

- Core explanatory variables

- (3)

- Control variables

3.5. Data Source and Feature

4. Empirical Research

4.1. Baseline Regression

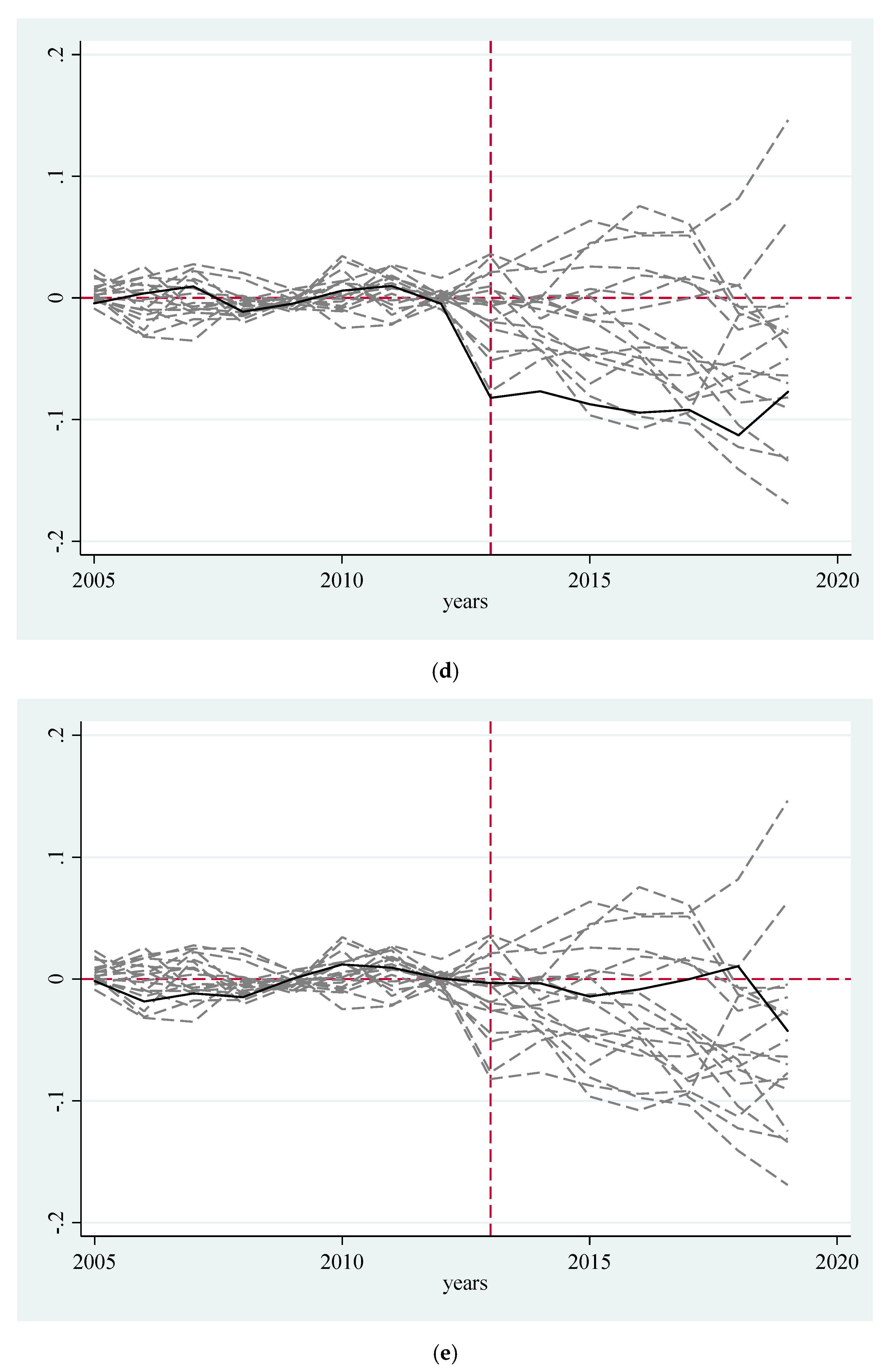

4.2. Parallel Trend Test

4.3. Synthetic Control Method (SCM)

4.4. Propensity Scoring Matching (PSM)

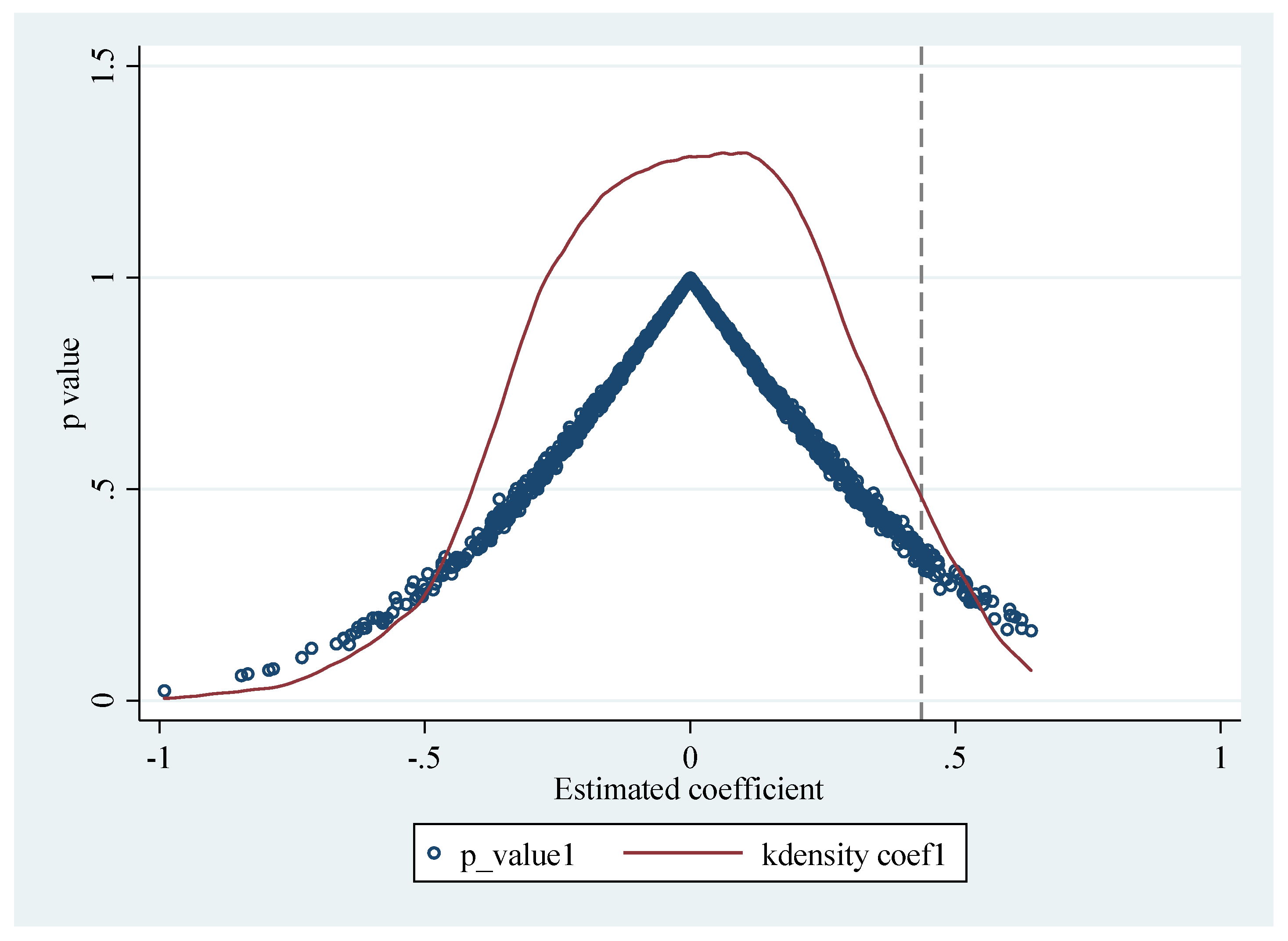

4.5. Placebo Test

5. Conclusions

6. Policy Implications

- (1)

- Strengthen government guidance and make full use of the promotion effect of carbon trading market on technological innovation. The government should provide a platform for enterprises to stimulate the efficiency of R&D and emission reduction, impel enterprises to elevate the efficiency of technology transfer, and construct a rewarding environment for R&D and technological innovation [69]. Support innovative leading enterprises in the carbon trading market, strengthen publicity, and create a sound atmosphere for technological innovation in energy conservation and emission reduction. For innovative enterprises and institutions with insufficient funds, it is important to augment the support of green finance, comprising tax, subsidy, transfer payment, credit and other support. Besides this, considering the dynamic evolution of the impact of carbon trading on energy conservation and emission reduction, the government should establish a monitoring and feedback mechanism to continuously track and follow up the emission control efforts and energy efficiency in various regions. In the process of building a national carbon emissions trading market, attention should be paid to regional differences, and careful progress should be made on the basis of systematically summarizing the pilot experience of carbon emissions trading. The government should successfully complete the role transition, fully coordinate the relationship between environmental policy tools and give play to their regional synergy.

- (2)

- Establish comprehensive public policy and industrial policy system that encourage the transformation of energy structure and industrial structure. On the one hand, in terms of increasing the R&D and innovation of basic originality and common technologies in the new energy industry, the government should play a greater role in the investment of basic R&D funds and the construction of common platforms for the formation of R&D achievements [70,71]. Since TFEE is the key to realize energy conservation and efficiency increase, it is necessary to promote the rational cross regional allocation of renewable energy and technology spillover effect. Encourage and lead the energy consumption structure change from fossil energy to clean energy such as renewable energy, on the premise that the technology of renewable energy is stable and the cost is reduced. On the other hand, the government needs to actively develop strategic emerging industries, spur the integration of the achievements of the new generation of information technology (Internet of Things, big data and artificial intelligence) with traditional industries, and realize the low carbonization of the industrial system.

- (3)

- Accelerate the development of service industry and expand the proportion of clean energy consumption. The 14th Five-year Plan is a critical and window period for reaching the carbon peak. At present, China vigorously advocates supply side structural reform and eliminates backward production capacity, which highlighting the importance of industrial structure adjustment to emission abatement and energy conservation [72,73]. While achieving the emission reduction target, it is also necessary to stimulate the initiative of market players, enhance the optimal allocation of low-carbon elements, and optimize the energy structure. At the same time, with the control of carbon emissions as a constraint means, enterprises are encouraged to carry out technological transformation and upgrading to resolve high-carbon backward production capacity. For the current stage, China’s carbon market practice has proved that carbon trading can derive green consumption demand, and then force the optimization of industrial structures, strengthen the proportion of clean industry, and build a clean, low-carbon, safe and efficient energy system. In the meantime, enterprises should gradually transition from relying on energy consumption to relying on human capital and R&D investment to raise output, thereby realize the upgrading of factor structure and advance the efficiency of factor resource allocation.

- (4)

- Ameliorate the market incentive mechanism for the transformation of scientific and technological achievements, and accelerate the green transition and upgrading of enterprises. Relying on the carbon emission trading policy and the national online carbon trading market, proactively guide universities and scientific research institutions to explore green total factor productivity, and continue to implement the long-term mechanism of in-depth integration and development of IUR (industry, university and research institute). In addition, the government should encourage, support and guide enterprises to engage in green innovation, achievement transformation and green transformation and development, explore the best scheme conducive to the growth of green total factor productivity by supporting R&D, subsidies, tax rebates, exemptions, providing loan guarantees and patent authorization, and give full play to the synergistic governance role of market leadership and government guidance [74]. Eventually, the goal should be to form a market environment beneficial to the development of enterprise technological innovation and industrial structure transformation in the direction of greening. It is needed to improve the design of carbon trading mechanisms, strengthen supervision, help improve the carbon trading market, and boost the innovation ability of low-carbon technology. Strengthening the management of policy signals and elevating the openness, sustainability and consistency of the central and local carbon emission trading policies will stabilize the expectations of enterprises and the public and guide the implementation of low-carbon technology innovation activities.

- (5)

- Enterprises should strengthen the R&D of energy saving and emission reduction technologies, accumulate relevant R&D talents. In detail, they should cooperate with professional research institutions in R&D and patent purchase, actively participate in the carbon trading market and obtain income through the sale of shares, thus form a long-term benign interaction with energy saving and emission reduction technology innovation [75]. They should also enhance the innovative awareness of energy conservation and emission reduction, accurately measure the costs and benefits of innovation, and make reasonable long-term decisions. Simultaneously, it is necessary to strengthen the management level of enterprises and the use efficiency of funds, take advantage of the support of national policies and funds, and facilitate their own technological innovation ability. China’s low-carbon pilot areas show different emission reduction characteristics due to varied conditions. Therefore, the low-carbon transformation should encourage local enterprises to form a distinctive geographical layout, industrial system, production and life mode according to the regional economic development stage and resource situation.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Tang, K.; Liu, Y.; Zhou, D.; Qiu, Y. Urban carbon emission intensity under emission trading system in a developing economy: Evidence from 273 Chinese cities. Environ. Sci. Pollut. Res. 2021, 28, 5168–5179. [Google Scholar] [CrossRef] [PubMed]

- Dong, F.; Dai, Y.; Zhang, S.; Zhang, X.; Long, R. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef] [PubMed]

- Yang, X.; Jiang, P.; Pan, Y. Does China’s carbon emission trading policy have an employment double dividend and a Porter effect? Energy Policy 2020, 142, 111492. [Google Scholar] [CrossRef]

- Wu, Q.; Wang, Y. How does carbon emission price stimulate enterprises’ total factor productivity? Insights from China’s emission trading scheme pilots. Energy Econ. 2022, 109, 105990. [Google Scholar] [CrossRef]

- Qi, S.-Z.; Zhou, C.-B.; Li, K.; Tang, S.-Y. The impact of a carbon trading pilot policy on the low-carbon international competitiveness of industry in China: An empirical analysis based on a DDD model. J. Clean. Prod. 2021, 281, 125361. [Google Scholar] [CrossRef]

- Cao, J.; Ho, M.S.; Ma, R.; Teng, F. When carbon emission trading meets a regulated industry: Evidence from the electricity sector of China. J. Public Econ. 2021, 200, 104470. [Google Scholar] [CrossRef]

- Bernard, A.; Haurie, A.; Vielle, M.; Viguier, L. A two-level dynamic game of carbon emission trading between Russia, China, and Annex B countries. J. Econ. Dyn. Control 2008, 32, 1830–1856. [Google Scholar] [CrossRef]

- Rogge, K.S.; Schneider, M.; Hoffmann, V.H. The innovation impact of the EU Emission Trading System—Findings of company case studies in the German power sector. Ecol. Econ. 2011, 70, 513–523. [Google Scholar] [CrossRef]

- Orugba, H.O.; Ogbeide, S.E.; Osagie, C. Emission trading scheme and the effect of carbon fee on petroleum refineries. Asian J. Appl. Sci. 2019, 7, 537–545. [Google Scholar] [CrossRef] [Green Version]

- Dutta, A. Impact of carbon emission trading on the European Union biodiesel feedstock market. Biomass Bioenergy 2019, 128, 105328. [Google Scholar] [CrossRef]

- Anke, C.-P.; Hobbie, H.; Schreiber, S.; Möst, D. Coal phase-outs and carbon prices: Interactions between EU emission trading and national carbon mitigation policies. Energy Policy 2020, 144, 111647. [Google Scholar] [CrossRef]

- Naranjo Tuesta, Y.; Crespo Soler, C.; Ripoll Feliu, V. Carbon management accounting and financial performance: Evidence from the European Union emission trading system. Bus. Strategy Environ. 2021, 30, 1270–1282. [Google Scholar] [CrossRef]

- Hossain, M.; Farooque, O. The emission trading system, risk management committee and voluntary corporate response to climate change–a CDP study. Int. J. Account. Inf. Manag. 2019, 27, 262–283. [Google Scholar] [CrossRef]

- Zhao, L.; Wen, F.; Wang, X. Interaction among China carbon emission trading markets: Nonlinear Granger causality and time-varying effect. Energy Econ. 2020, 91, 104901. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Chang. 2021, 168, 120744. [Google Scholar] [CrossRef]

- Brouwers, R.; Schoubben, F.; Van Hulle, C. The influence of carbon cost pass through on the link between carbon emission and corporate financial performance in the context of the European Union Emission Trading Scheme. Bus. Strategy Environ. 2018, 27, 1422–1436. [Google Scholar] [CrossRef]

- Cai, W.; Ye, P. Does carbon emission trading improve low-carbon technical efficiency? Evidence from China. Sustain. Prod. Consum. 2022, 29, 46–56. [Google Scholar] [CrossRef]

- Gullberg, A.T.; Ohlhorst, D.; Schreurs, M. Towards a low carbon energy future–Renewable energy cooperation between Germany and Norway. Renew. Energy 2014, 68, 216–222. [Google Scholar] [CrossRef]

- Johnstone, P.; Rogge, K.S.; Kivimaa, P.; Fratini, C.F.; Primmer, E. Exploring the re-emergence of industrial policy: Perceptions regarding low-carbon energy transitions in Germany, the United Kingdom and Denmark. Energy Res. Soc. Sci. 2021, 74, 101889. [Google Scholar] [CrossRef]

- Krokida, S.-I.; Lambertides, N.; Savva, C.S.; Tsouknidis, D.A. The effects of oil price shocks on the prices of EU emission trading system and European stock returns. Eur. J. Financ. 2020, 26, 1–13. [Google Scholar] [CrossRef]

- Lee, Y.-J.; Kim, N.-W.; Choi, K.-H.; Yoon, S.-M. Analysis of the informational efficiency of the EU carbon emission trading market: Asymmetric MF-DFA approach. Energies 2020, 13, 2171. [Google Scholar] [CrossRef]

- Lovcha, Y.; Perez-Laborda, A.; Sikora, I. The determinants of CO2 prices in the EU emission trading system. Appl. Energy 2022, 305, 117903. [Google Scholar] [CrossRef]

- Kumar, S.; Managi, S.; Jain, R.K. CO2 mitigation policy for Indian thermal power sector: Potential gains from emission trading. Energy Econ. 2020, 86, 104653. [Google Scholar] [CrossRef] [Green Version]

- Giner, B. Accounting for emission trading schemes: A still open debate. Soc. Environ. Account. J. 2014, 34, 45–51. [Google Scholar] [CrossRef]

- Sadayuki, T.; Arimura, T.H. Do regional emission trading schemes lead to carbon leakage within firms? Evidence from Japan. Energy Econ. 2021, 104, 105664. [Google Scholar] [CrossRef]

- Jiang, J.; Xie, D.; Ye, B.; Shen, B.; Chen, Z. Research on China’s cap-and-trade carbon emission trading scheme: Overview and outlook. Appl. Energy 2016, 178, 902–917. [Google Scholar] [CrossRef]

- Chen, S.; Shi, A.; Wang, X. Carbon emission curbing effects and influencing mechanisms of China’s Emission Trading Scheme: The mediating roles of technique effect, composition effect and allocation effect. J. Clean. Prod. 2020, 264, 121700. [Google Scholar] [CrossRef]

- Li, Y.; Liu, T.; Song, Y.; Li, Z.; Guo, X. Could carbon emission control firms achieve an effective financing in the carbon market? A case study of China’s emission trading scheme. J. Clean. Prod. 2021, 314, 128004. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. What are the main factors affecting carbon price in Emission Trading Scheme? A case study in China. Sci. Total Environ. 2019, 654, 525–534. [Google Scholar] [CrossRef]

- Vincent, F.Y.; Maglasang, R.; Tsao, Y.-C. Shelf space allocation problem under carbon tax and emission trading policies. J. Clean. Prod. 2018, 196, 438–451. [Google Scholar]

- Wen, F.; Zhao, L.; He, S.; Yang, G. Asymmetric relationship between carbon emission trading market and stock market: Evidences from China. Energy Econ. 2020, 91, 104850. [Google Scholar] [CrossRef]

- Xuan, D.; Ma, X.; Shang, Y. Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 2020, 270, 122383. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, S.; Luo, T.; Gao, J. The effect of emission trading policy on carbon emission reduction: Evidence from an integrated study of pilot regions in China. J. Clean. Prod. 2020, 265, 121843. [Google Scholar] [CrossRef]

- Wu, M.; Li, K.X.; Xiao, Y.; Yuen, K.F. Carbon Emission Trading Scheme in the shipping sector: Drivers, challenges, and impacts. Mar. Policy 2022, 138, 104989. [Google Scholar] [CrossRef]

- Li, L.; Dong, J.; Song, Y. Impact and acting path of carbon emission trading on carbon emission intensity of construction land: Evidence from pilot areas in China. Sustainability 2020, 12, 7843. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. What will China’s carbon emission trading market affect with only electricity sector involvement? A CGE based study. Energy Econ. 2019, 78, 301–311. [Google Scholar] [CrossRef]

- Ionescu, L. Towards a sustainable and inclusive low-carbon economy: Why carbon taxes, and not schemes of emission trading, are a cost-effective economic instrument to curb greenhouse gas emissions. J. Self-Gov. Manag. Econ. 2019, 7, 35–41. [Google Scholar]

- Kim, K.-T.; Lee, D.-J.; An, D. Real option valuation of the R&D investment in renewable energy considering the effects of the carbon emission trading market: A Korean case. Energies 2020, 13, 622. [Google Scholar]

- Chaabane, A.; Ramudhin, A.; Paquet, M. Design of sustainable supply chains under the emission trading scheme. Int. J. Prod. Econ. 2012, 135, 37–49. [Google Scholar] [CrossRef]

- Muzumdar, A.; Modi, C.; Vyjayanthi, C. A permissioned blockchain enabled trustworthy and incentivized emission trading system. J. Clean. Prod. 2022, 349, 131274. [Google Scholar] [CrossRef]

- Hanley, E.S.; Deane, J.; Gallachóir, B.Ó. The role of hydrogen in low carbon energy futures–A review of existing perspectives. Renew. Sustain. Energy Rev. 2018, 82, 3027–3045. [Google Scholar] [CrossRef]

- Melgar-Dominguez, O.D.; Pourakbari-Kasmaei, M.; Lehtonen, M.; Mantovani, J.R.S. An economic-environmental asset planning in electric distribution networks considering carbon emission trading and demand response. Electr. Power Syst. Res. 2020, 181, 106202. [Google Scholar] [CrossRef]

- Long, X.; Naminse, E.Y.; Du, J.; Zhuang, J. Nonrenewable energy, renewable energy, carbon dioxide emissions and economic growth in China from 1952 to 2012. Renew. Sustain. Energy Rev. 2015, 52, 680–688. [Google Scholar] [CrossRef]

- Bellocchi, S.; Klöckner, K.; Manno, M.; Noussan, M.; Vellini, M. On the role of electric vehicles towards low-carbon energy systems: Italy and Germany in comparison. Appl. Energy 2019, 255, 113848. [Google Scholar] [CrossRef]

- Ma, Y.; Wang, L.; Zhang, T. Research on the dynamic linkage among the carbon emission trading, energy and capital markets. J. Clean. Prod. 2020, 272, 122717. [Google Scholar] [CrossRef]

- De Brauwer, C.P.-S.; Cohen, J.J. Analysing the potential of citizen-financed community renewable energy to drive Europe’s low-carbon energy transition. Renew. Sustain. Energy Rev. 2020, 133, 110300. [Google Scholar] [CrossRef]

- Nakata, T.; Silva, D.; Rodionov, M. Application of energy system models for designing a low-carbon society. Prog. Energy Combust. Sci. 2011, 37, 462–502. [Google Scholar] [CrossRef]

- Zhou, B.; Zhang, C.; Song, H.; Wang, Q. How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci. Total Environ. 2019, 676, 514–523. [Google Scholar] [CrossRef]

- Abadie, A.; Diamond, A.; Hainmueller, J. Synthetic control methods for comparative case studies: Estimating the effect of California’s tobacco control program. J. Am. Stat. Assoc. 2010, 105, 493–505. [Google Scholar] [CrossRef] [Green Version]

- Bridge, G.; Bouzarovski, S.; Bradshaw, M.; Eyre, N. Geographies of energy transition: Space, place and the low-carbon economy. Energy Policy 2013, 53, 331–340. [Google Scholar] [CrossRef]

- Mo, J.-L.; Agnolucci, P.; Jiang, M.-R.; Fan, Y. The impact of Chinese carbon emission trading scheme (ETS) on low carbon energy (LCE) investment. Energy Policy 2016, 89, 271–283. [Google Scholar] [CrossRef]

- Stoerk, T.; Dudek, D.J.; Yang, J. China’s national carbon emissions trading scheme: Lessons from the pilot emission trading schemes, academic literature, and known policy details. Clim. Policy 2019, 19, 472–486. [Google Scholar] [CrossRef]

- Ying, Z.; Xin-gang, Z. The impact of Renewable Portfolio Standards on carbon emission trading under the background of China’s electricity marketization reform. Energy 2021, 226, 120322. [Google Scholar] [CrossRef]

- Oke, A.E.; Aigbavboa, C.O.; Dlamini, S.A. Carbon Emission Trading in South African Construction Industry. Energy Procedia 2017, 142, 2371–2376. [Google Scholar] [CrossRef]

- Mathur, S.P.; Arya, A. Impact of emission trading on optimal bidding of price takers in a competitive energy market. In Harmony Search and Nature Inspired Optimization Algorithms; Springer: Berlin/Heidelberg, Germany, 2019; pp. 171–180. [Google Scholar]

- Al Sadawi, A.; Madani, B.; Saboor, S.; Ndiaye, M.; Abu-Lebdeh, G. A comprehensive hierarchical blockchain system for carbon emission trading utilizing blockchain of things and smart contract. Technol. Forecast. Soc. Chang. 2021, 173, 121124. [Google Scholar] [CrossRef]

- Ermolieva, T.; Ermoliev, Y.; Fischer, G.; Jonas, M.; Makowski, M.; Wagner, F. Carbon Emission Trading and Carbon Taxes under Uncertainties, Greenhouse Gas Inventories; Springer: Berlin/Heidelberg, Germany, 2010; pp. 277–289. [Google Scholar]

- Thisted, E.V.; Thisted, R.V. The diffusion of carbon taxes and emission trading schemes: The emerging norm of carbon pricing. Environ. Politics 2020, 29, 804–824. [Google Scholar] [CrossRef]

- Wu, L.; Zhu, Q. Impacts of the carbon emission trading system on china’s carbon emission peak: A new data-driven approach. Nat. Hazards 2021, 107, 2487–2515. [Google Scholar] [CrossRef]

- Wang, P.; Dai, H.-C.; Ren, S.-Y.; Zhao, D.-Q.; Masui, T. Achieving Copenhagen target through carbon emission trading: Economic impacts assessment in Guangdong Province of China. Energy 2015, 79, 212–227. [Google Scholar] [CrossRef]

- Nguyen, D.H.; Chapman, A.; Farabi-Asl, H. Nation-wide emission trading model for economically feasible carbon reduction in Japan. Appl. Energy 2019, 255, 113869. [Google Scholar] [CrossRef]

- Villoria-Sáez, P.; Tam, V.W.; del Río Merino, M.; Arrebola, C.V.; Wang, X. Effectiveness of greenhouse-gas Emission Trading Schemes implementation: A review on legislations. J. Clean. Prod. 2016, 127, 49–58. [Google Scholar] [CrossRef]

- Bocklet, J.; Hintermayer, M.; Schmidt, L.; Wildgrube, T. The reformed EU ETS-intertemporal emission trading with restricted banking. Energy Econ. 2019, 84, 104486. [Google Scholar] [CrossRef]

- Marin, G.; Marino, M.; Pellegrin, C. The impact of the European Emission Trading Scheme on multiple measures of economic performance. Environ. Resour. Econ. 2018, 71, 551–582. [Google Scholar] [CrossRef]

- Mukherjee, I.; Giest, S. Designing policies in uncertain contexts: Entrepreneurial capacity and the case of the European Emission Trading Scheme. Public Policy Adm. 2019, 34, 262–286. [Google Scholar] [CrossRef] [Green Version]

- Boersen, A.; Scholtens, B. The relationship between European electricity markets and emission allowance futures prices in phase II of the EU (European Union) emission trading scheme. Energy 2014, 74, 585–594. [Google Scholar] [CrossRef]

- Shen, J.; Tang, P.; Zeng, H. Does China’s carbon emission trading reduce carbon emissions? Evidence from listed firms. Energy Sustain. Dev. 2020, 59, 120–129. [Google Scholar] [CrossRef]

- Zhao, X.-G.; Wu, L.; Li, A. Research on the efficiency of carbon trading market in China. Renew. Sustain. Energy Rev. 2017, 79, 1–8. [Google Scholar] [CrossRef]

- Khaqqi, K.N.; Sikorski, J.J.; Hadinoto, K.; Kraft, M. Incorporating seller/buyer reputation-based system in blockchain-enabled emission trading application. Appl. Energy 2018, 209, 8–19. [Google Scholar] [CrossRef]

- Sadegheih, A. Optimal design methodologies under the carbon emission trading program using MIP, GA, SA, and TS. Renew. Sustain. Energy Rev. 2011, 15, 504–513. [Google Scholar] [CrossRef]

- Bariss, U.; Avenitis, E.; Junghans, G.; Blumberga, D. CO2 emission trading effect on Baltic electricity market. Energy Procedia 2016, 95, 58–65. [Google Scholar] [CrossRef] [Green Version]

- Zhang, C.; Wang, Q.; Shi, D.; Li, P.; Cai, W. Scenario-based potential effects of carbon trading in China: An integrated approach. Appl. Energy 2016, 182, 177–190. [Google Scholar] [CrossRef]

- Li, X.-Y.; Tang, B.-J. Incorporating the transport sector into carbon emission trading scheme: An overview and outlook. Nat. Hazards 2017, 88, 683–698. [Google Scholar] [CrossRef]

- Shrestha, A.; Eshpeter, S.; Li, N.; Li, J.; Nile, J.O.; Wang, G. Inclusion of forestry offsets in emission trading schemes: Insights from global experts. J. For. Res. 2021, 33, 279–287. [Google Scholar] [CrossRef]

- Creti, A.; Joëts, M. Multiple bubbles in the European Union emission trading scheme. Energy Policy 2017, 107, 119–130. [Google Scholar] [CrossRef]

| Variable | Variable Name | CE | TFEE | ES | IND | EC | URB | OWN | REGU | RD | Numbers |

|---|---|---|---|---|---|---|---|---|---|---|---|

| All samples | Mean | 4.462 | 1.434 | 42.887 | 1.073 | 4.033 | 54.532 | 27.586 | 0.149 | 1.475 | 450 |

| Std. Dev. | 0.332 | 0.8251 | 15.529 | 0.606 | 0.305 | 14.017 | 13.192 | 0.131 | 1.081 | ||

| Minimum | 3.197 | 0.306 | 1.213 | 0.381 | 2.913 | 26.87 | 5.821 | 0.002 | 0.18 | ||

| Maximum | 5.173 | 4.756 | 76.005 | 5.169 | 4.616 | 89.6 | 134.671 | 0.991 | 6.31 | ||

| Experimentalgroup | Mean | 4.367 | 1.954 | 31.135 | 1.552 | 4.026 | 71.897 | 18.617 | 0.096 | 2.792 | 90 |

| Std. Dev. | 0.235 | 0.879 | 14.936 | 1.024 | 0.233 | 14.898 | 8.633 | 0.082 | 1.526 | ||

| Minimum | 4.029 | 0.852 | 1.21 | 0.727 | 3.614 | 43.2 | 5.938 | 0.002 | 1.04 | ||

| Maximum | 4.837 | 4.631 | 62.61 | 5.169 | 4.533 | 89.6 | 42.138 | 0.503 | 6.31 | ||

| Control group | Mean | 4.486 | 1.304 | 45.825 | 0.954 | 4.035 | 50.191 | 29.829 | 0.162 | 1.146 | 360 |

| Std. Dev. | 0.348 | 0.758 | 14.249 | 0.357 | 0.321 | 9.809 | 13.191 | 0.138 | 0.582 | ||

| Minimum | 3.197 | 0.306 | 8.37 | 0.381 | 2.913 | 26.87 | 5.821 | 0.011 | 0.18 | ||

| Maximum | 5.173 | 4.756 | 76.01 | 2.847 | 4.616 | 72.47 | 134.671 | 0.991 | 2.79 |

| Variable | Average Treatment Effect | Long-Run Dynamic Effect | ||||||

|---|---|---|---|---|---|---|---|---|

| (1) CE | (2) CE | (3) TFEE | (4) TFEE | (5) CE | (6) CE | (7) TFEE | (8) TFEE | |

| treat × post | −0.092 * (1.21) | −0.008 * (0.38) | 0.567 *** (3.24) | 0.464 *** (3.03) | ||||

| pilot × time2013 | −0.126 *** (−3.49) | −0.081 *** (−3.80) | 0.544 *** (2.11) | 0.436 * (1.47) | ||||

| pilot × time2014 | −0.133 *** (−3.74) | −0.086 *** (−4.20) | 0.547 *** (2.11) | 0.453 * (1.50) | ||||

| pilot × time2015 | −0.131 *** (−3.65) | −0.087 *** (−3.85) | 0.529 *** (2.02) | 0.433 * (1.37) | ||||

| pilot × time2016 | −0.142 *** (−3.83) | −0.102 (−4.42) | 0.554 *** (2.10) | 0.489 ** (1.57) | ||||

| pilot × time2017 | −0.148 *** (−3.85) | −0.103 *** (−4.12) | 1.181 *** (3.62) | 1.124 *** (3.10) | ||||

| pilot × time2018 | −0.162 *** (−4.07) | −0.101 *** (−4.07) | 1.399 *** (4.47) | 1.312 *** (3.47) | ||||

| pilot × time2019 | −0.172 *** (−4.22) | −0.112 *** (−3.93) | 1.905 *** (5.11) | 1.829 *** (4.20) | ||||

| ES | 0.002 *** (5.263) | −0.015 *** (−4.918) | 0.001 ** (1.85) | −0.007 *** (−3.52) | ||||

| IND | 0.037 *** (3.478) | 0.038 (0.481) | −0.027 *** (−2.02) | 0.209 *** (2.15) | ||||

| EC | 1.036 *** (58.75) | 1.079 *** (8.382) | 1.002 *** (13.38) | −0.626 *** (−2.07) | ||||

| URB | 0.005 *** (8.818) | −0.011 *** (−2.341) | −0.002 *** (−2.28) | 0.022 *** (2.29) | ||||

| OWN | 0.001 ** (1.693) | −0.003 (−0.815) | −0.001 *** (−2.51) | 0.008 *** (3.55) | ||||

| REGU | 0.245 *** (6.847) | 0.153 (0.585) | 0.032 (1.41) | −0.075 (−0.53) | ||||

| RD | −0.043 *** (−5.715) | 0.219 *** (4.032) | −0.006 (−0.65) | 0.157 (1.15) | ||||

| Constant | 4.469 *** (265.60) | −0.121 (−1.01) | 1.330 *** (36.53) | −2.134 *** (−3.50) | 4.429 *** (184.56) | −0.114 (−0.98) | 1.084 *** (22.91) | −1.999 *** (−3.42) |

| Time effect | YES | YES | YES | YES | YES | YES | YES | YES |

| Province effect | YES | YES | YES | YES | YES | YES | YES | YES |

| R−squared | 0.06 | 0.93 | 0.20 | 0.42 | 0.97 | 0.99 | 0.91 | 0.92 |

| Variables | Unmatched/Matched | Mean Value | Bias(%) | Test | ||

|---|---|---|---|---|---|---|

| Experiment | Control | t-Value | p-Value | |||

| ES | U | 31.136 | 45.825 | −100.6 | −8.66 | 0.000 |

| M | 39.638 | 38.826 | 5.6 | 0.29 | 0.770 | |

| IND | U | 1.5521 | 0.9541 | 78.0 | 9.10 | 0.000 |

| M | 0.9918 | 1.0126 | −2.7 | −0.39 | 0.699 | |

| EC | U | 4.0269 | 4.0354 | −3.0 | −0.24 | 0.813 |

| M | 4.1463 | 4.1505 | −1.5 | −0.08 | 0.940 | |

| URB | U | 71.898 | 50.191 | 172.1 | 16.73 | 0.000 |

| M | 59.026 | 59.318 | −2.3 | −0.16 | 0.875 | |

| OWN | U | 18.618 | 29.829 | −100.6 | −7.66 | 0.000 |

| M | 19.624 | 20.386 | −6.8 | −0.31 | 0.756 | |

| REGU | U | 0.0961 | 0.1626 | −58.7 | −4.39 | 0.000 |

| M | 0.0972 | 0.0998 | −2.3 | −0.17 | 0.866 | |

| RD | U | 2.7927 | 1.1461 | 142.5 | 16.30 | 0.000 |

| M | 1.7165 | 1.728 | −1.0 | −0.09 | 0.925 | |

| Variable | CE | TFEE | ||||

|---|---|---|---|---|---|---|

| (1) Kernel Matching | (2) Radius Matching | (3) K-Neighbor Matching | (4) Kernel Matching | (5) Radius Matching | (6) K-Neighbor Matching | |

| treat × post | −0.098 *** (−1.62) | −0.077 *** (−1.13) | −0.090 *** (−1.36) | 0.495 *** (3.06) | 0.493 *** (2.51) | 0.519 *** (2.99) |

| Constant | −1.861 (−0.41) | −1.861 (−0.41) | −1.861 (−0.41) | −1.861 (−0.41) | −1.861 (−0.41) | −1.861 (−0.41) |

| Control variables | YES | YES | YES | YES | YES | YES |

| Time fixed | YES | YES | YES | YES | YES | YES |

| Province fixed | YES | YES | YES | YES | YES | YES |

| R-squared | 0.588 | 0.588 | 0.588 | 0.588 | 0.588 | 0.588 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, H.; Wu, J. The Energy Saving and Emission Reduction Effect of Carbon Trading Pilot Policy in China: Evidence from a Quasi-Natural Experiment. Int. J. Environ. Res. Public Health 2022, 19, 9272. https://doi.org/10.3390/ijerph19159272

Zhang H, Wu J. The Energy Saving and Emission Reduction Effect of Carbon Trading Pilot Policy in China: Evidence from a Quasi-Natural Experiment. International Journal of Environmental Research and Public Health. 2022; 19(15):9272. https://doi.org/10.3390/ijerph19159272

Chicago/Turabian StyleZhang, Huan, and Jingyu Wu. 2022. "The Energy Saving and Emission Reduction Effect of Carbon Trading Pilot Policy in China: Evidence from a Quasi-Natural Experiment" International Journal of Environmental Research and Public Health 19, no. 15: 9272. https://doi.org/10.3390/ijerph19159272