Market Sentiments Distribution Law

Abstract

:1. Introduction

2. Literature Review

3. Methodology

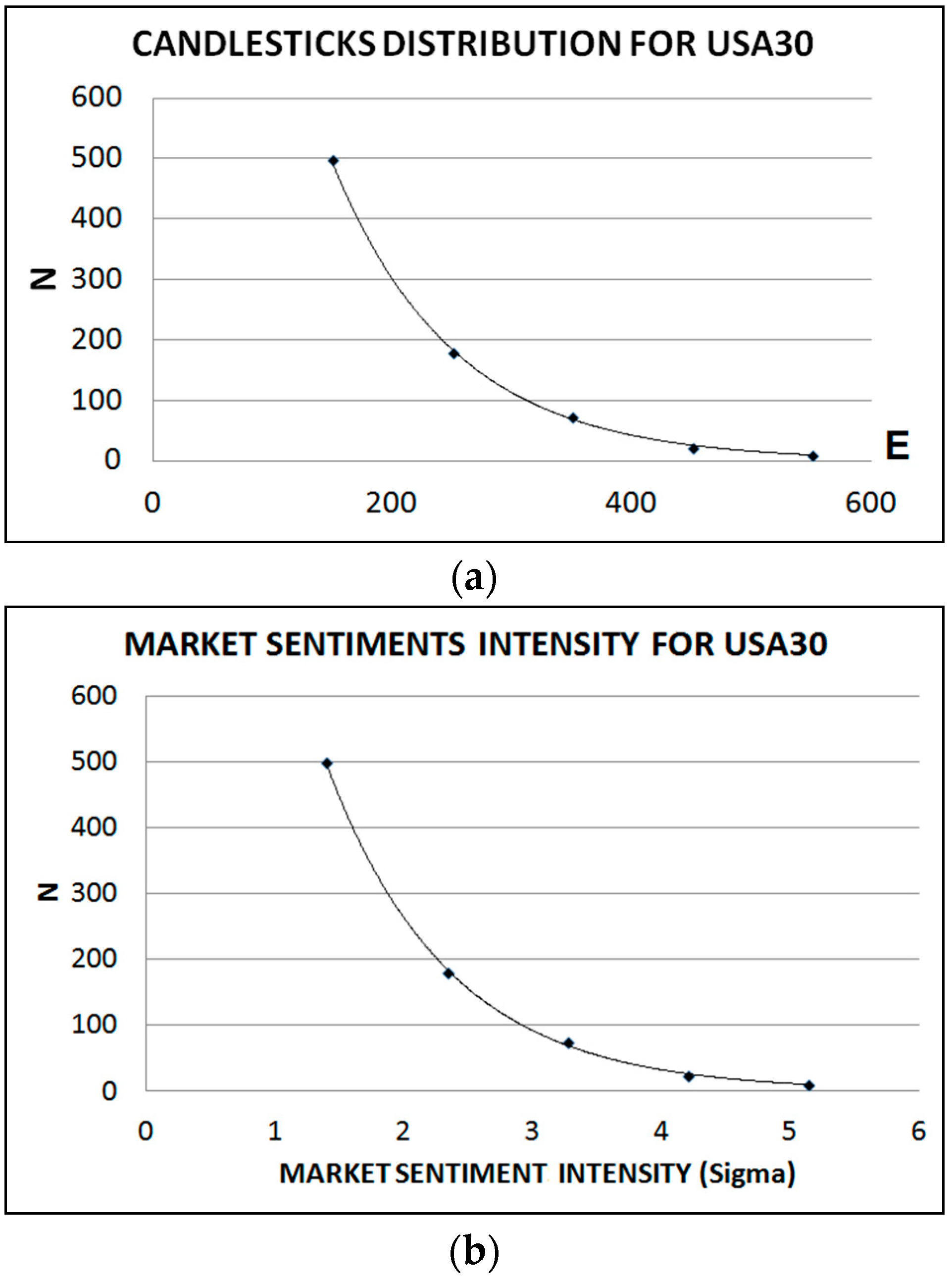

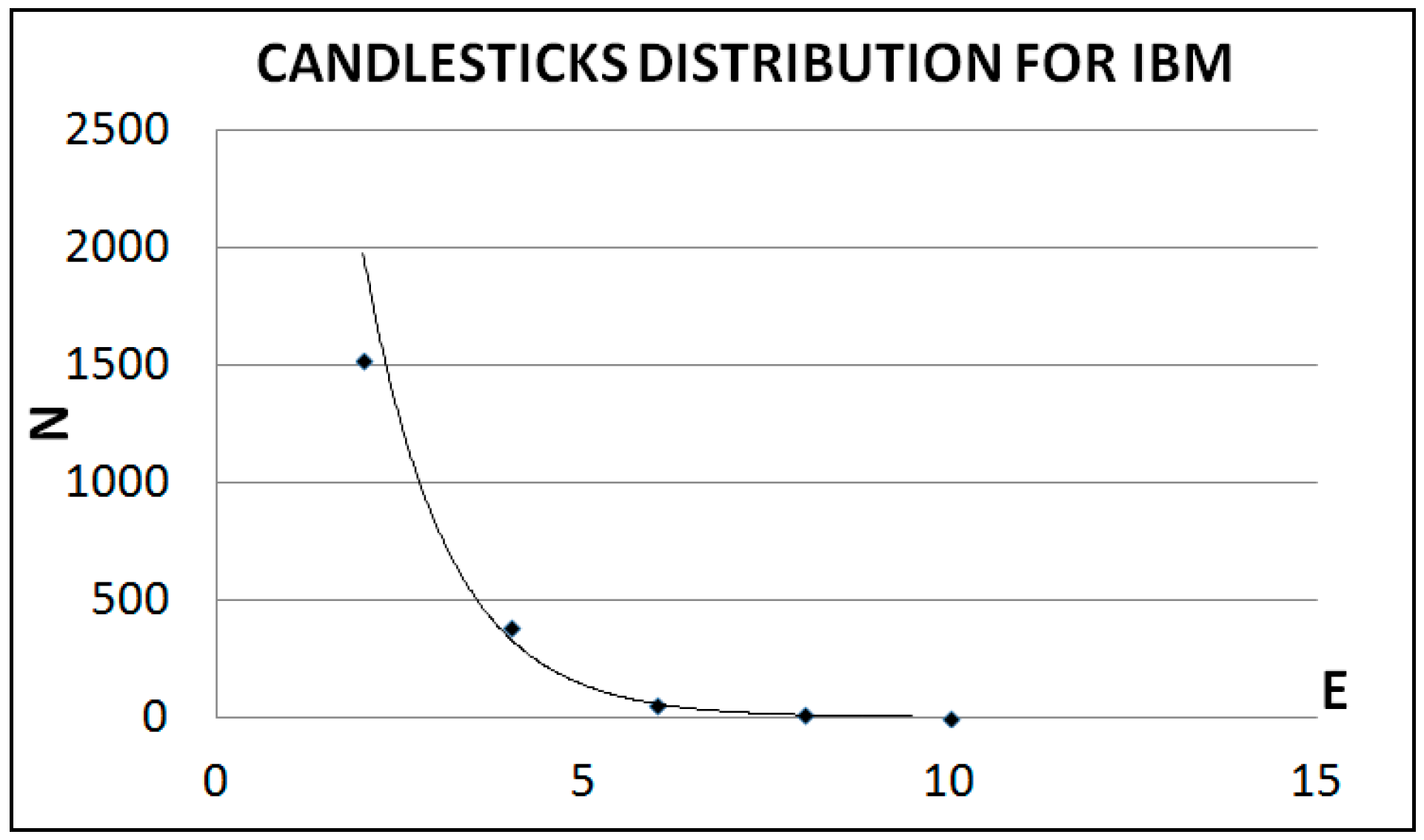

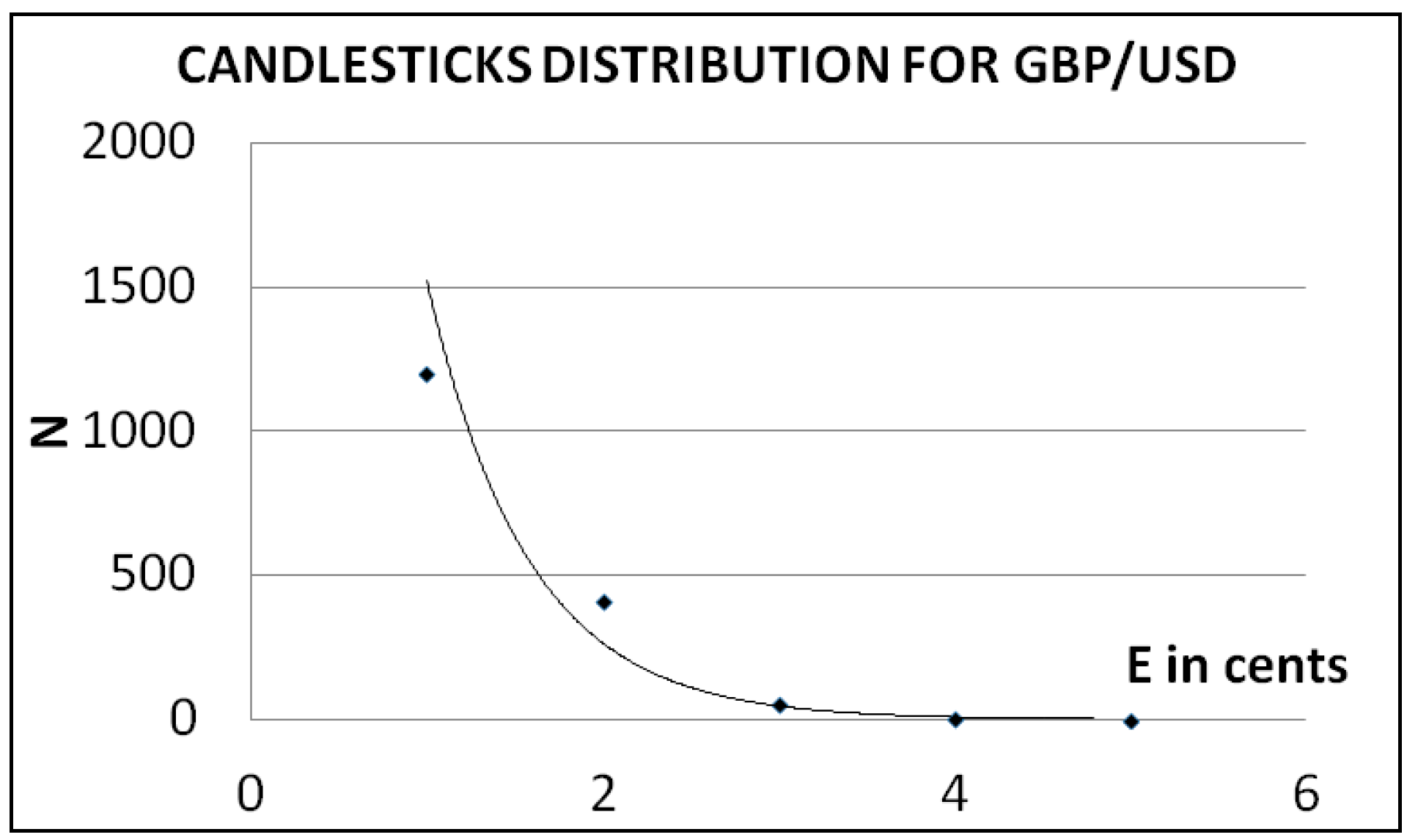

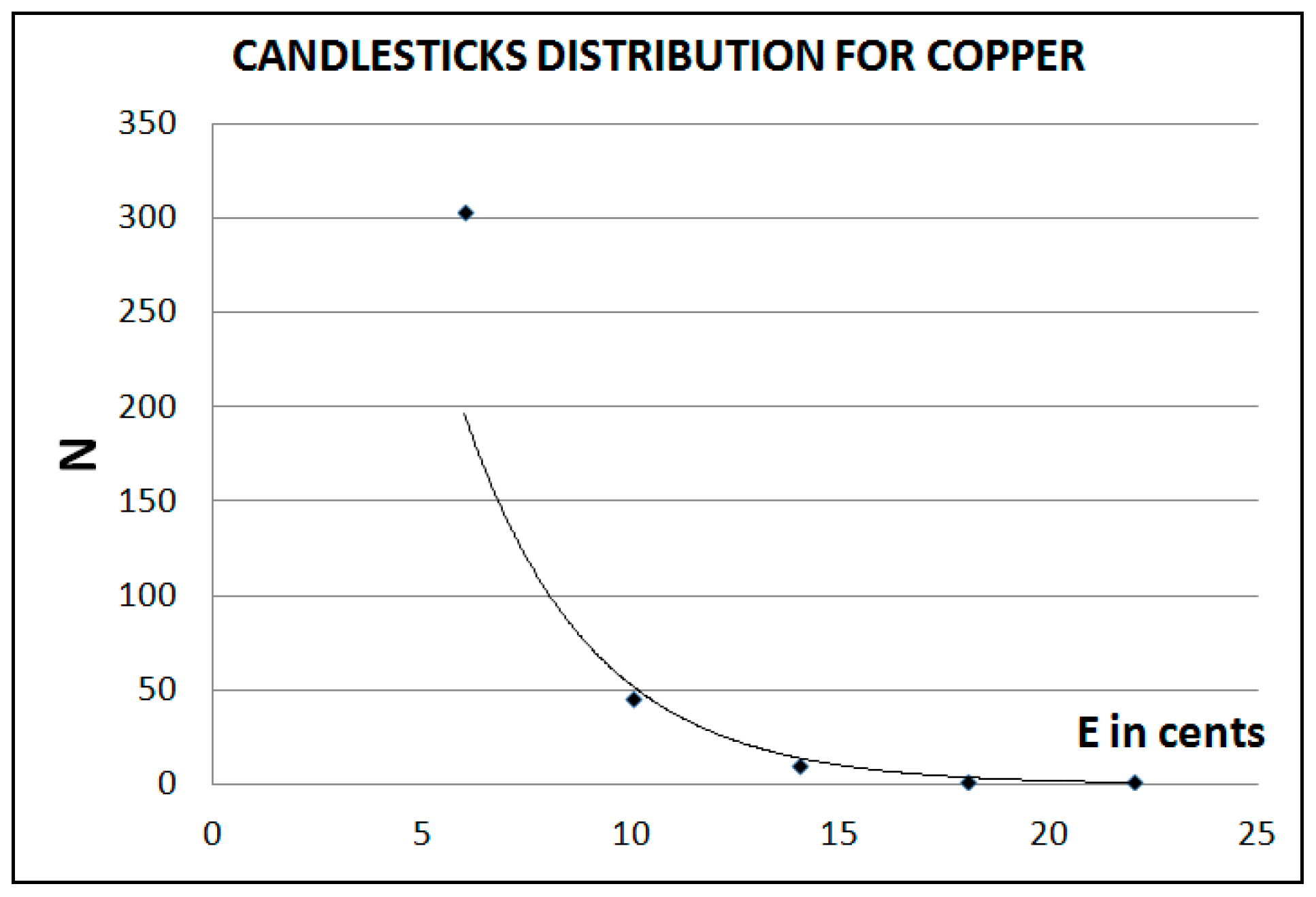

- Let x be the size of a candlestick

- Let I be an interval of width equal to x centered x, which is calculated as follows:I = [x − Δx/2, x + Δx/2]

- Let N be the number of candlesticks found in the interval I

- Then, we affirm that: N = No·exp(−λx)

4. Data Preprocessing

“When the maximum Lyapunov exponent exceeds zero, the system exhibits chaos. If it is greater than one, the predictable limit is less than the sampling frequency. Thus, the chaotic time series predictions are only of practical use when the chaotic system with the maximum Lyapunov exponent is between zero and one. If the positive exponent approaches zero, long-term predictions are possible.”

5. Results

6. Discussion

- (i)

- Black candlestick is equal to bearish sentiments.

- (ii)

- White candlestick is equal to bullish sentiments.

- (iii)

- The intensity of the sentiment is measured by the length of the candlestick. That is, the greater the length of the candlestick, the greater the intensity of the sentiment because each candlestick is observed in the same time unit (“day”, in our case).

- (i)

- Section 4 shows that the extension or peak to peak amplitude has more information than the price of the studied financial instrument

- (ii)

- It proved to be lawful to measure the market sentiments intensity in standard deviation units of E length.

- (iii)

- Section 5 shows that the working hypothesis is supported by the coefficient of correlation whose values fluctuate between 0.9357 and 0.9980.

7. Conclusions

Acknowledgments

Conflicts of Interest

References

- Cheung, Y.W. An empirical model of daily highs and lows. Int. J. Finance Econ. 2007, 12, 1–20. [Google Scholar] [CrossRef]

- Balasubramani, S.; Suganthi, M.; Suresh, P. Study and Analysis of Causal Relationship of Various Macroeconomic Variables on Stock Market Index in India for the Year 2001 to 2003 by Candlestick Chart—A Review. Available online: http://www.icmrr.org/October_2013/IJFRR/10132001.pdf (accessed on 1 September 2016).

- Lu, T.H.; Shiu, Y.M. Pinpoint and Synergistic Trading Strategies of Candlesticks. Int. J. Econ. Finance 2011, 3. [Google Scholar] [CrossRef]

- Nison, S. Japanese Candlestick Charting Techniques: A Contemporary Guide to the Ancient Investment Techniques of the Far East; Simon & Schuster: New York, NY, USA, 2001. [Google Scholar]

- Cofnas, A. The Forex Trading Course: A Self-Study Guide to Becoming a Successful Currency Trader, 2nd ed.; Wiley: Hoboken, NJ, USA, 2015. [Google Scholar]

- Du Plessis, J. The Definitive Guide to Point and Figure: A Comprehensive Guide to the Theory and Practical Use of the Point and Figure Charting Method; Harriman House: Petersfield, UK, 2012. [Google Scholar]

- Lee, K.H.; Jo, G.S. Expert system for predicting stock market timing using a candlestick chart. Expert Syst. Appl. 1999, 16, 357–364. [Google Scholar] [CrossRef]

- Chmielewski, L.; Janowicz, M.; Orlowski, A. Prediction of Trend Reversals in Stock Market by Classification of Japanese Candlesticks. In Proceedings of the 9th International Conference on Computer Recognition Systems CORES, Wroclow, Poland, 25–27 May 2015; pp. 641–647.

- Xie, H.; Fan, K.; Wang, S. The role of Japanese Candlestick in DVAR model. J. Syst. Sci. Complex. 2015, 28, 1177–1193. [Google Scholar] [CrossRef]

- Roy, P. A novel fuzzy document-based information retrieval scheme (FDIRS). Appl. Inf. 2016, 3. [Google Scholar] [CrossRef]

- Hyongdo, L. The God of Trading, Honma: The Creator of Japanese Candle Charts, Honma’s Secret Methods of Investment. Available online: https://www.amazon.com/God-Trading-Honma-Japanese-Investment-ebook/dp/B00J24NXJK (accessed on 1 September 2016).

- Marshall, B.R.; Young, M.R.; Rose, L.C. Candlestick technical trading strategies: Can they create value for investors? J. Bank. Finance 2006, 30, 2303–2323. [Google Scholar] [CrossRef]

- Dorsey, D. The Mass Index. Tech. Anal. Stock. Commod. 1992, 10, 265–267. [Google Scholar]

- Bollinger, J.A. Bollinger on Bollinger Bands; McGraw Hill: New York, NY, USA, 2002. [Google Scholar]

- Botes, E.; Siepman, D. The Vortex Indicator. Tech. Anal. Stock. Commod. 2010, 28, 20–30. [Google Scholar]

- Eric, D.; Andjelic, G.B.; Redzepagic, S. Application of MACD and RVI Indicators as Functions of Investment Strategy Optimization on the Financial Market. J. Econ. Bus. 2009, 27, 171–196. [Google Scholar]

- Wolf, A.; Swift, J.B.; Swinney, H.L.; Vastano, J.A. Determining Lyapunov exponents from a time series. Physica D 1985, 16, 285–317. [Google Scholar] [CrossRef]

- Zhou, T.; Gao, S.; Wang, J.; Chu, C.; Todo, Y.; Tang, Z. Financial time series prediction using a dendritic neuron model. Knowl. Based Syst. 2016, 105, 214–224. [Google Scholar] [CrossRef]

- Grassberger, P.; Procaccia, I. Estimation of the Kolmogorov entropy from a chaotic signal. Phys. Rev. A 1983, 28. [Google Scholar] [CrossRef]

- Shannon, C.E. A Mathematical Theory of Communication. Bell Syst. Tech. J. 1948, 27, 623–656. [Google Scholar] [CrossRef]

- He, S.; Sun, K.; Wang, H. Multivariate permutation entropy and its application for complexity analysis of chaotic systems. Physica A 2016, 461, 812–823. [Google Scholar] [CrossRef]

- Sprott, J.C. Chaos Data Analizer. Available online: http://sprott.physics.wisc.edu/cda.htm (accessed on 1 September 2016).

- Bitvai, Z.; Cohn, T. Day trading profit maximization with multi-task learning and technical analysis. Mach. Learn. 2015, 101, 187–209. [Google Scholar] [CrossRef]

- Di Lorenzo, R. Basic Technical Analysis of Financial Markets; Springer: Milan, Italy, 2013; pp. 135–142. [Google Scholar]

- Hussein, A.S.; Hamed, I.M.; Tolba, M.F. An Efficient System for Stock Market Prediction. In Proceedings of the 7th IEEE International Conference Intelligent Systems, Warsaw, Poland, 24–26 September 2014; pp. 871–882.

- Lu, T.H.; Shiu, Y.M.; Liu, T.C. Profitable candlestick trading strategies—The evidence from a new perspective. Rev. Financ. Econ. 2012, 21, 63–68. [Google Scholar] [CrossRef]

| Financial Instrument | LLE for Extension (E) | LLE for Median Price |

|---|---|---|

| USA30 | 0.599 | 0.318 |

| GBPUSD | 0.719 | 0.396 |

| IBM | 0.714 | 0.235 |

| Copper | 0.585 | 0.321 |

| Financial Instrument | Entropy for Extension (E) | Entropy for Median Price |

|---|---|---|

| USA30 | 0.589 | 0.363 |

| GBPUSD | 0.586 | 0.398 |

| IBM | 0.472 | 0.196 |

| Copper | 0.585 | 0.218 |

| Interval | E (Class Mark) | N |

|---|---|---|

| [100, 200[ | 150 | 498 |

| [200, 300[ | 250 | 180 |

| [200, 300[ | 350 | 74 |

| [400, 500[ | 450 | 23 |

| ≥500 | 550 | 10 |

| Interval | E (Class Mark) | N |

|---|---|---|

| [1, 3[ | 2 | 1519 |

| [3, 5[ | 4 | 388 |

| [5, 7[ | 6 | 57 |

| [7, 9[ | 8 | 18 |

| ≥9 | 10 | 1 |

| Interval | E (Class Mark) | N |

|---|---|---|

| [0.5, 1.5[ | 1 | 1200 |

| [1.5, 2.5[ | 2 | 415 |

| [2.5, 3.5[ | 3 | 55 |

| [3.5, 4.5[ | 4 | 4 |

| ≥4.5 | 5 | 2 |

| Interval | E (Class Mark) | N |

|---|---|---|

| [4, 8[ | 6 | 303 |

| [8, 12[ | 10 | 46 |

| [12, 16[ | 14 | 10 |

| [16, 20[ | 18 | 2 |

| ≥20 | 22 | 3 |

© 2016 by the author; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Reyes-Molina, J. Market Sentiments Distribution Law. Entropy 2016, 18, 324. https://doi.org/10.3390/e18090324

Reyes-Molina J. Market Sentiments Distribution Law. Entropy. 2016; 18(9):324. https://doi.org/10.3390/e18090324

Chicago/Turabian StyleReyes-Molina, Jorge. 2016. "Market Sentiments Distribution Law" Entropy 18, no. 9: 324. https://doi.org/10.3390/e18090324

APA StyleReyes-Molina, J. (2016). Market Sentiments Distribution Law. Entropy, 18(9), 324. https://doi.org/10.3390/e18090324