Complexity-Regularized Regression for Serially-Correlated Residuals with Applications to Stock Market Data

Abstract

:1. Introduction

2. Methodology

2.1. Regression for Time Series

2.2. Model-Free Regression

2.3. Computational Mechanics

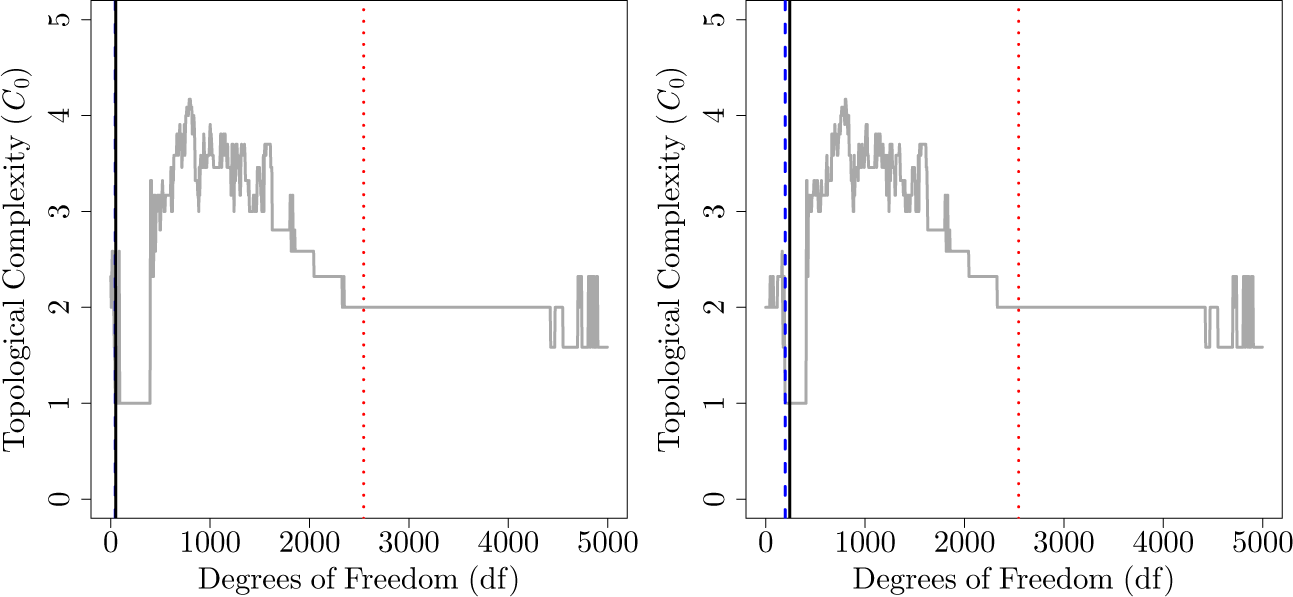

2.4. Complexity Regularized Regression

2.4.1. Details for Operationalization

3. Simulation Experiments

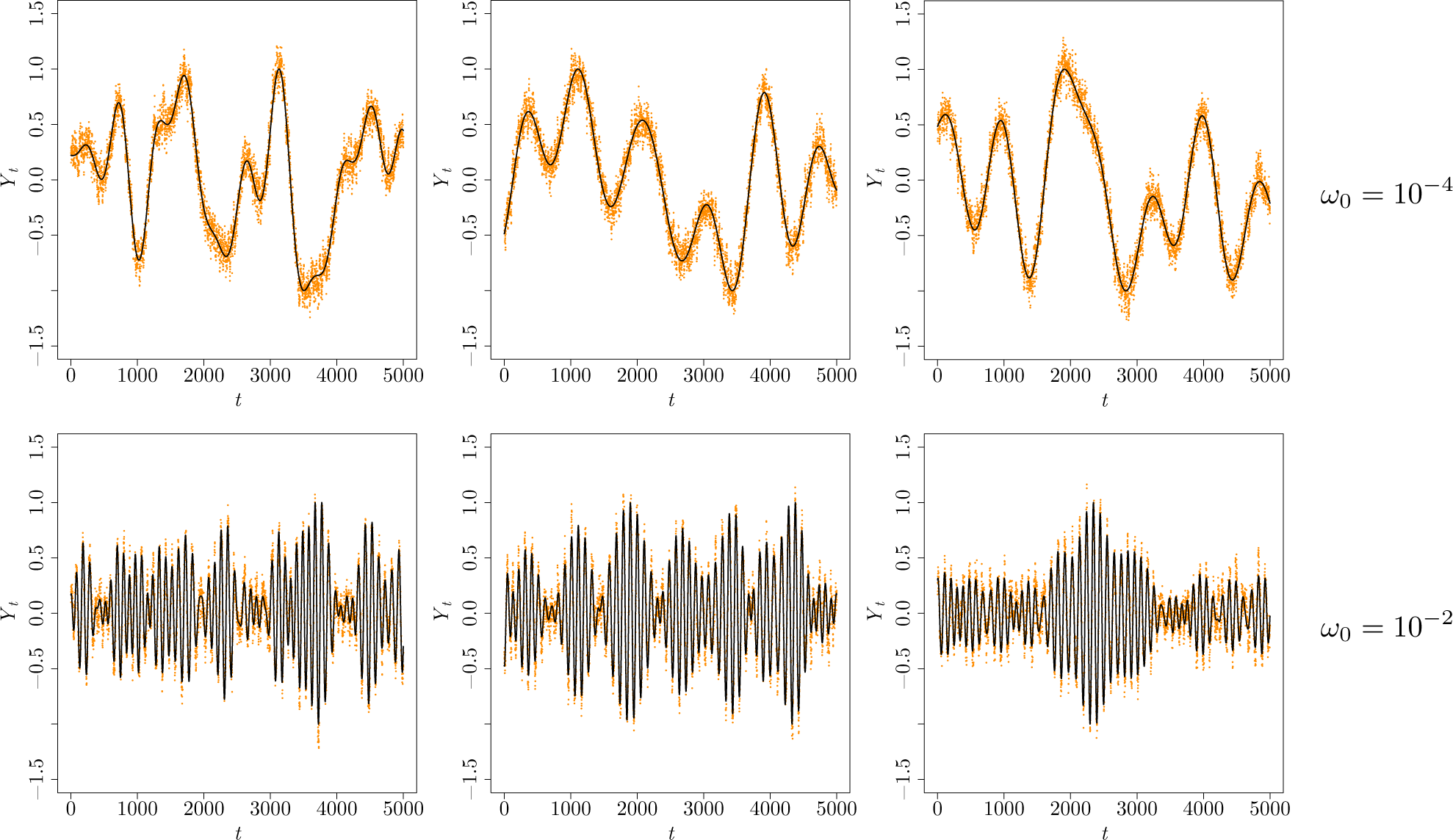

3.1. The Generative Model

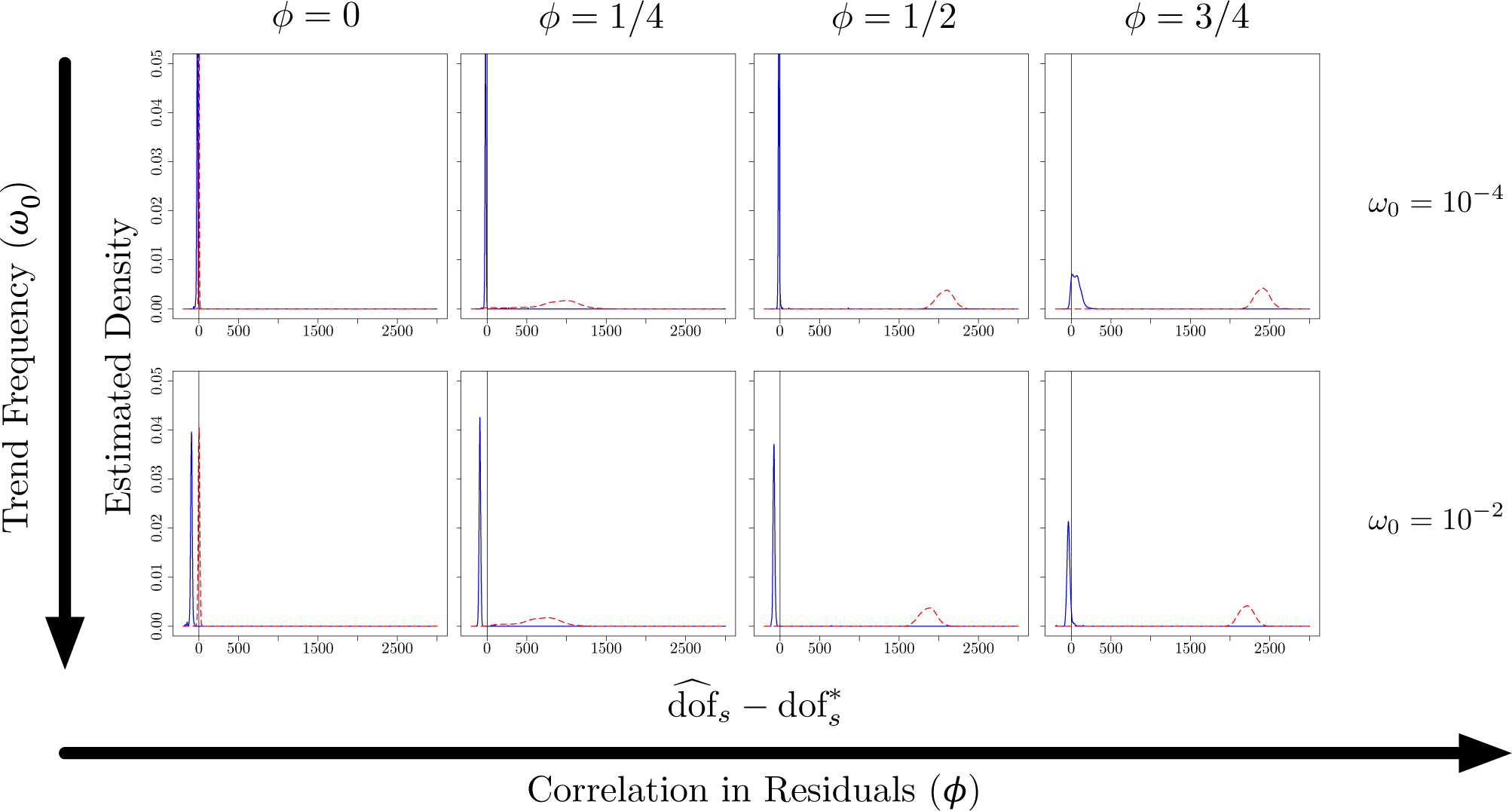

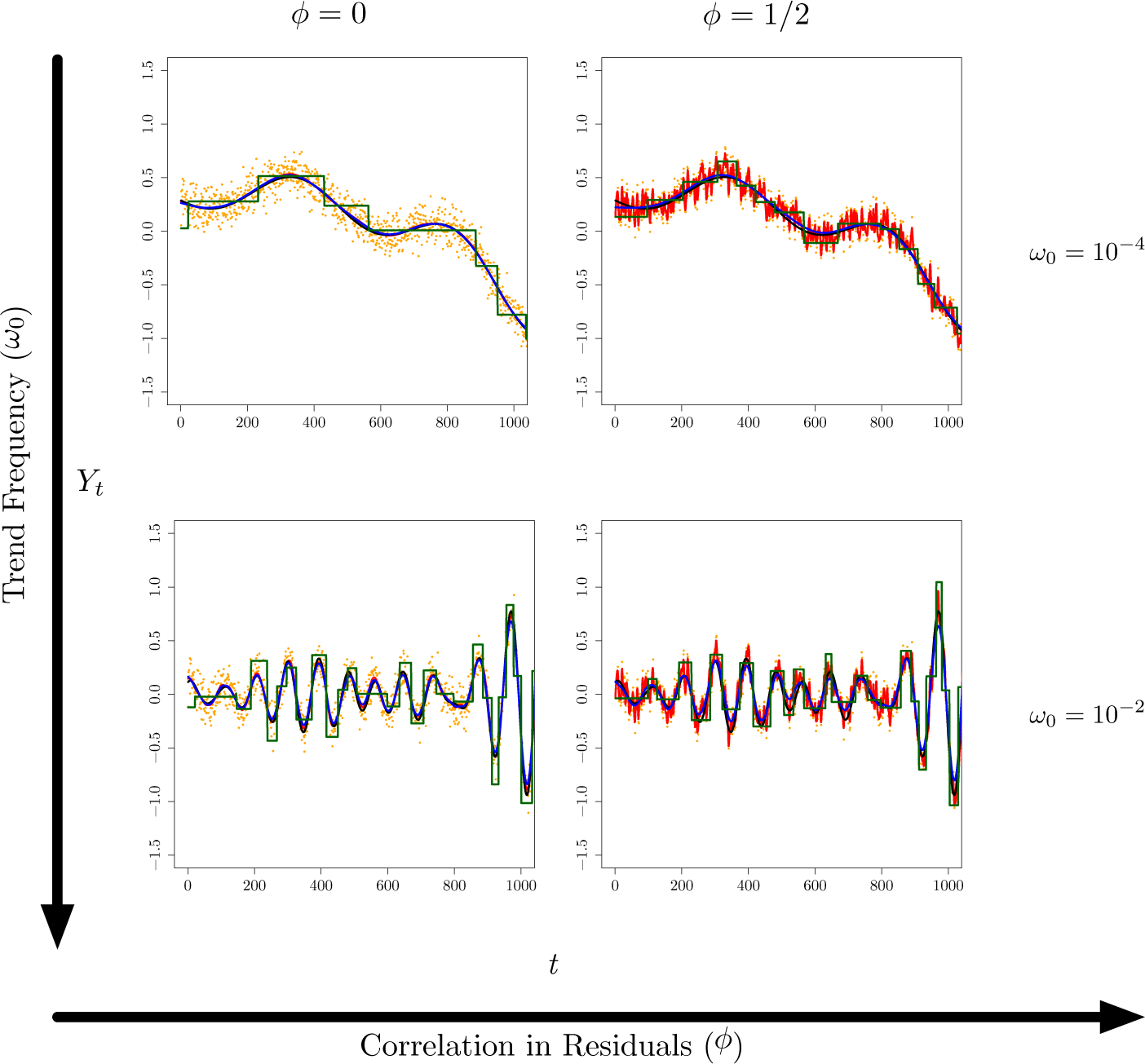

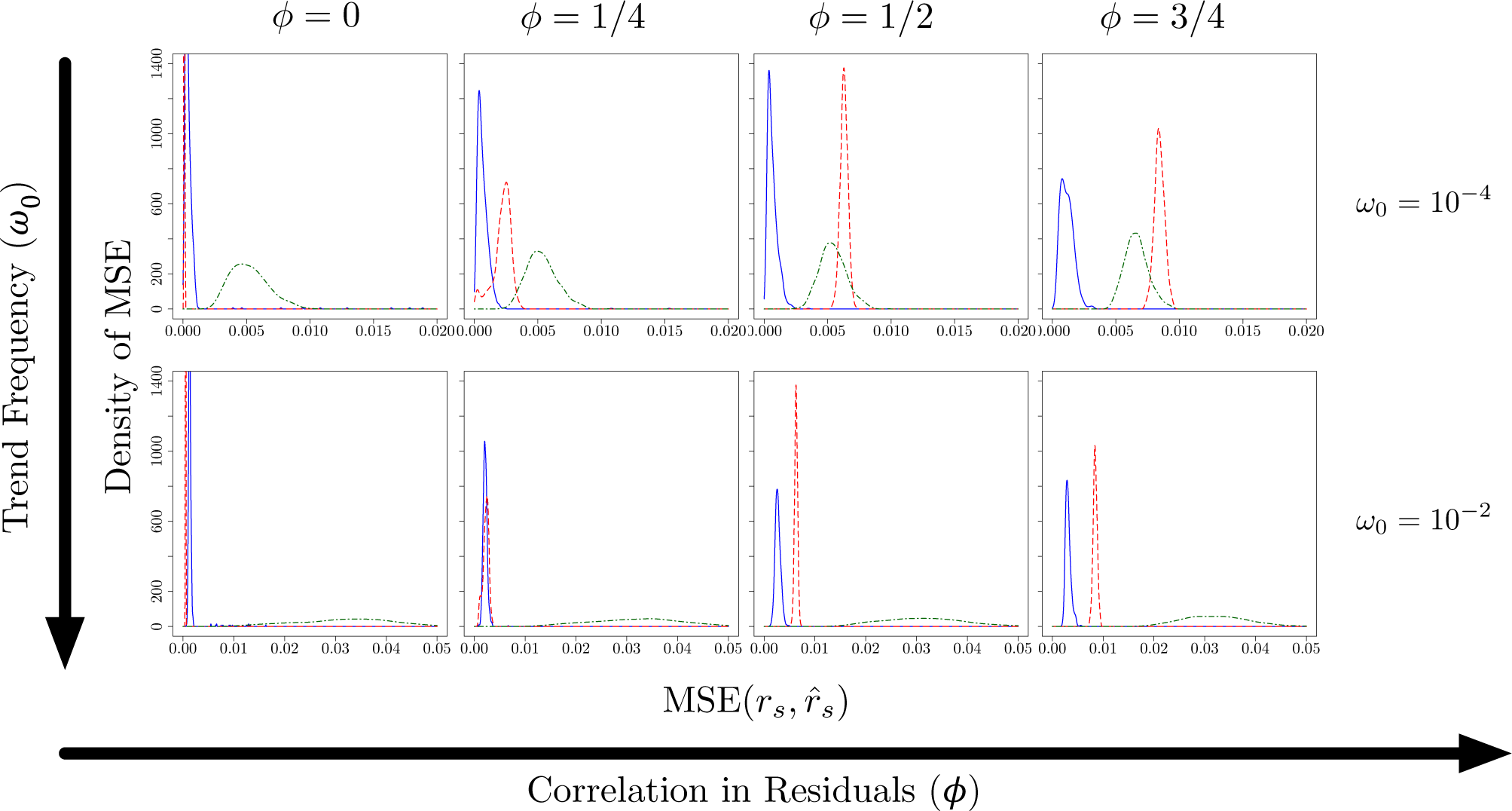

3.2. Simulation Results

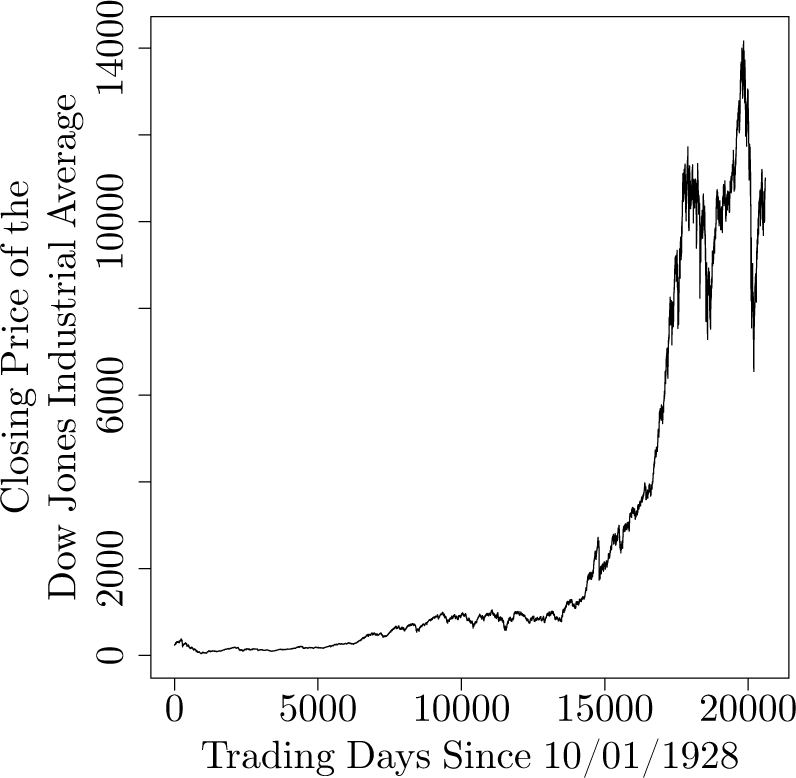

4. Financial Time Series

4.1. Modern Practices in Econometrics for Trend Stationary Time Series

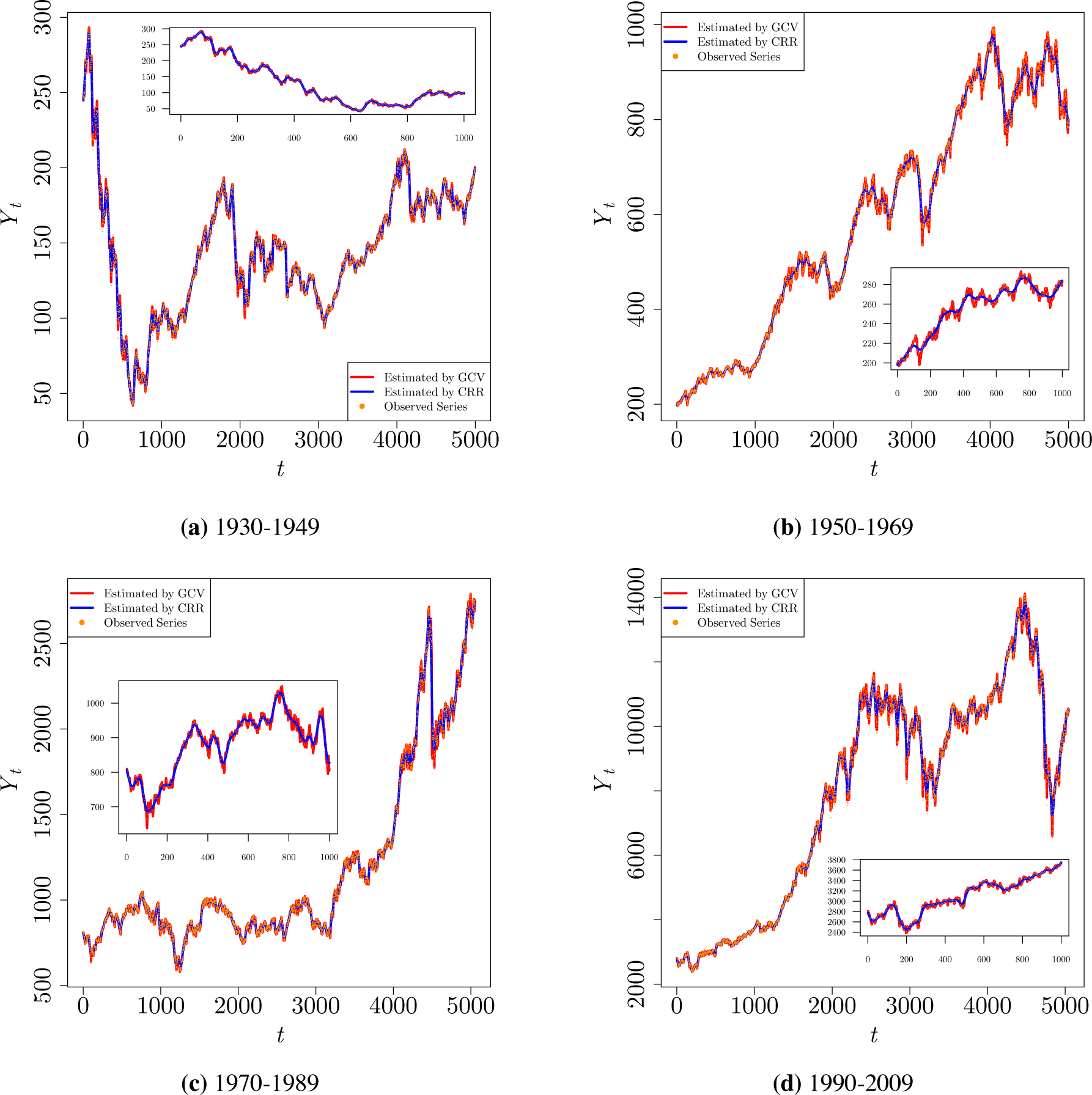

4.2. Macroscale Dynamics of the Market

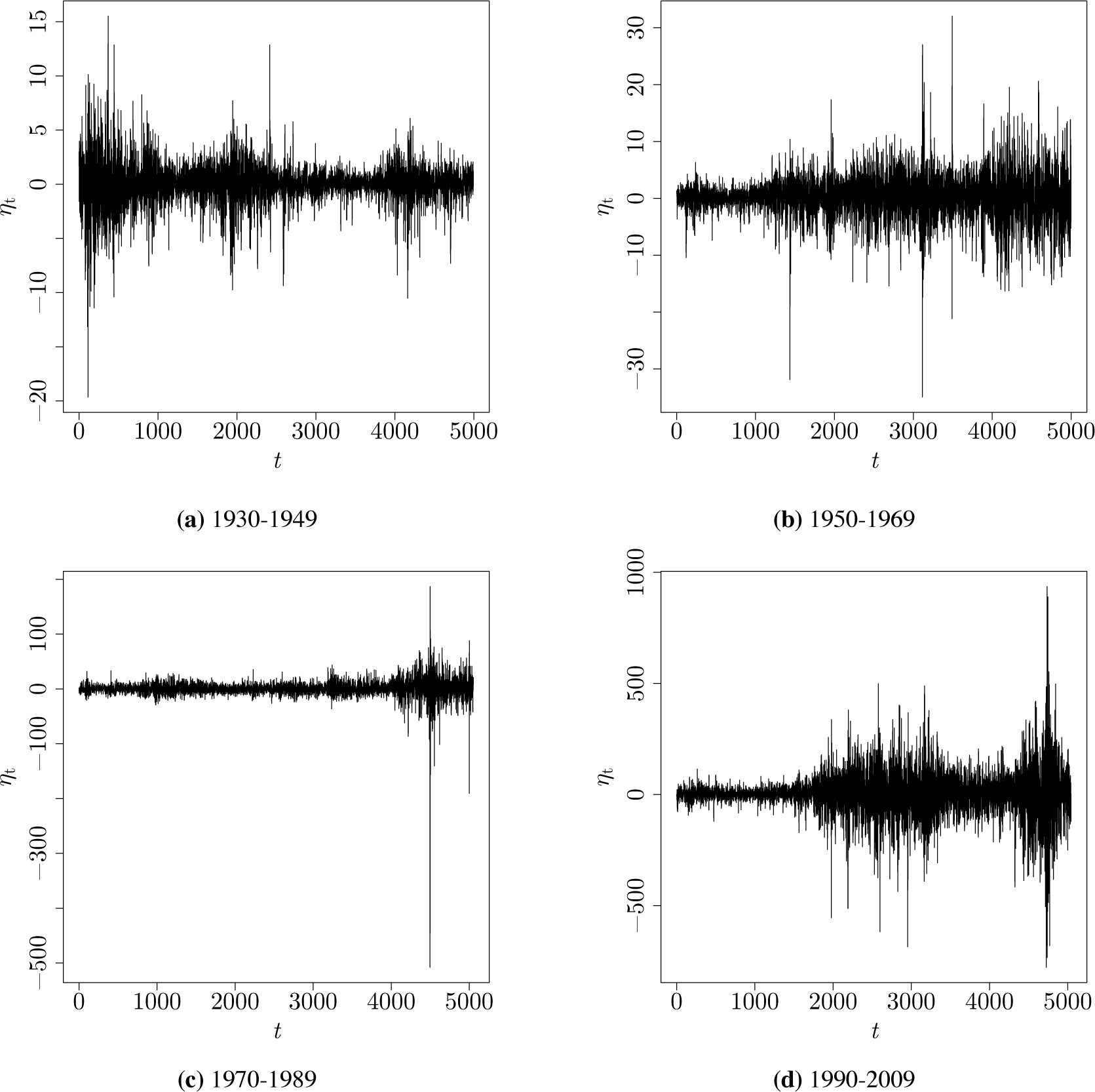

4.3. Microscale Dynamics of the Market and the Associated Causal State Models

5. Discussion and Future Work

6. Conclusion

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Fan, J.; Yao, Q. Nonlinear Time Series: Nonparametric and Parametric Methods; Springer: Berlin, Germany, 2003. [Google Scholar]

- Hastie, T.; Tibshirani, R.; Friedman, J.; Hastie, T.; Friedman, J.; Tibshirani, R. The Elements of Statistical Learning; Springer: Berlin, Germany, 2009. [Google Scholar]

- Wasserman, L. All of Nonparametric Statistics; Springer: Berlin, Germany, 2006. [Google Scholar]

- Huber, P.J.; Ronchetti, E.M. Robust Statistics; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- Kariya, T. Locally robust tests for serial correlation in least squares regression. Ann. Stat. 1980, 8, 1065–1070. [Google Scholar]

- Kariya, T. A robustness property of the tests for serial correlation. Ann. Stat. 1977, 5, 1212–1220. [Google Scholar]

- Bunzel, H.; Vogelsang, T.J. Powerful trend function tests that are robust to strong serial correlation, with an application to the Prebisch-Singer hypothesis. J. Bus. Econ. Stat. 2005, 23, 381–394. [Google Scholar]

- Alexander, S.S. Price movements in speculative markets: Trends or random walks. Ind. Manag. Rev. 1961, 2, 7–26. [Google Scholar]

- Hart, J.D. Kernel regression estimation with time series errors. J. R. Stat. Soc. Ser. B. 1991, 53, 173–187. [Google Scholar]

- Burman, P.; Chow, E.; Nolan, D. A cross-validatory method for dependent data. Biometrika 1994, 81, 351–358. [Google Scholar]

- Hart, J.D.; Yi, S. One-sided cross-validation. J. Am. Stat. Assoc. 1998, 93, 620–631. [Google Scholar]

- Racine, J. Consistent cross-validatory model-selection for dependent data: hv-block cross-validation. J. Econ. 2000, 99, 39–61. [Google Scholar]

- Carmack, P.S.; Schucany, W.R.; Spence, J.S.; Gunst, R.F.; Lin, Q.; Haley, R.W. Far casting cross-validation. J. Comput. Graph. Stat. 2009, 18, 879–893. [Google Scholar]

- Opsomer, J.; Wang, Y.; Yang, Y. Nonparametric Regression with Correlated Errors. Stat. Sci. 2001, 16, 134–153. [Google Scholar]

- Davies, P.L.; Kovac, A. Local extremes, runs, strings and multiresolution. Ann. Stat. 2001, 29, 1–48. [Google Scholar]

- Shalizi, C.; Crutchfield, J. Computational mechanics: Pattern and prediction, structure and simplicity. J. Stat. Phys. 2001, 104, 817–879. [Google Scholar]

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. J. Polit. Econ. 1973, 81, 637–654. [Google Scholar]

- Hart, J.D.; Wehrly, T.E. Kernel regression estimation using repeated measurements data. J. Am. Stat. Assoc. 1986, 81, 1080–1088. [Google Scholar]

- Silverman, B.W. Smoothed functional principal components analysis by choice of norm. Ann. Stat. 1996, 24, 1–24. [Google Scholar]

- Hall, P.; Hart, J.D. Nonparametric regression with long-range dependence. Stoch. Process. Appl. 1990, 36, 339–351. [Google Scholar]

- Robinson, P.M. Large-sample inference for nonparametric regression with dependent errors. Ann. Stat. 1997, 25, 2054–2083. [Google Scholar]

- Johnstone, I.M.; Silverman, B.W. Wavelet threshold estimators for data with correlated noise. J. R. Stat. Soc. Ser. B. 1997, 59, 319–351. [Google Scholar]

- Cook, R.D.; Weisberg, S. Residuals and Influence in Regression; Chapman and Hall: New York, NY, USA, 1982. [Google Scholar]

- Fox, J. Regression Diagnostics: An Introduction; SAGE Publications: Los Angeles, CA, USA, 1991; Volume 79. [Google Scholar]

- Claeskens, G.; Hjort, N.L. Model Selection and Model Averaging; Cambridge University Press: Cambridge, UK, 2008; Volume 330. [Google Scholar]

- Davies, P.L.; Kovac, A.; Meise, M. Nonparametric regression, confidence regions and regularization. Ann. Stat. 2009, 37, 2597–2625. [Google Scholar]

- Wasserman, L. Low Assumptions, High Dimensions. Ration. Mark. Morals. 2011, 2, 201–209. [Google Scholar]

- Bradley, J.V. Distribution-free Statistical Tests; Prentice-Hall: Upper Saddle River, NJ, USA, 1968. [Google Scholar]

- Crutchfield, J. Between order and chaos. Nat. Phys. 2011, 8, 17–24. [Google Scholar]

- Ellison, C.J.; Mahoney, J.R.; Crutchfield, J.P. Prediction, retrodiction, and the amount of information stored in the present. J. Stat. Phys. 2009, 136, 1005–1034. [Google Scholar]

- Shalizi, C.R.; Klinkner, K.L. Blind Construction of Optimal Nonlinear Recursive Predictors for Discrete Sequences, Proceedings of the Twentieth Conference on Uncertainty in Artificial Intelligence, Banff, Canada, 7–11 July 2004; Chickering, M., Halpern, J.Y., Eds.; AUAI Press: Arlington, VA, USA, 2004; pp. 504–511.

- Boschetti, F. Mapping the complexity of ecological models. Ecol. Complex. 2008, 5, 37–47. [Google Scholar]

- Varn, D.P.; Crutchfield, J.P. From finite to infinite range order via annealing: The causal architecture of deformation faulting in annealed close-packed crystals. Phys. Lett. A. 2004, 324, 299–307. [Google Scholar]

- Haslinger, R.; Klinkner, K.; Shalizi, C. The computational structure of spike trains. Neural Comput 2010, 22, 121–157. [Google Scholar]

- Ray, A. Symbolic dynamic analysis of complex systems for anomaly detection. Signal Process 2004, 84, 1115–1130. [Google Scholar]

- Darmon, D.; Sylvester, J.; Girvan, M.; Rand, W. Predictability of user behavior in social media: Bottom-up v. top-down modeling, Proceedings of IEEE 2013 International Conference on Social Computing (SocialCom 2013), Washington, DC, USA, 8–14 September 2013; pp. 102–107.

- Shalizi, C.R.; Shalizi, K.L.; Crutchfield, J.P. An Algorithm for Pattern Discovery in Time Series; Technical Report 02-10-060; Santa Fe Institute: Santa Fe, NM, USA, 2002. [Google Scholar]

- Crutchfield, J.P. The calculi of emergence: Computation, dynamics and induction. Physica D 1994, 75, 11–54. [Google Scholar]

- Marton, K.; Shields, P.C. Entropy and the consistent estimation of joint distributions. Ann. Probab. 1994, 22, 960–977. [Google Scholar]

- Dejong, D.; Dave, C. Structural Macroeconomics; Princeton University Press: Princeton, NJ, USA, 2007. [Google Scholar]

- Hodrick, R.J.; Prescott, E.C. Postwar US business cycles: An empirical investigation. J. Money Credit Bank 1997, 29, 1–16. [Google Scholar]

- Paige, R.L.; Trindade, A.A. The Hodrick-Prescott Filter: A special case of penalized spline smoothing. Electron. J. Stat. 2010, 4, 856–874. [Google Scholar]

- Cogley, T.; Nason, J.M. Effects of the Hodrick-Prescott filter on trend and difference stationary time series Implications for business cycle research. J. Econ. Dyn. Control. 1995, 19, 253–278. [Google Scholar]

- Ravn, M.O.; Uhlig, H. On adjusting the Hodrick–Prescott filter for the frequency of observations. Rev. Econ. Stat. 2002, 84, 371–376. [Google Scholar]

- Pedersen, T.M. The Hodrick–Prescott filter, the Slutzky effect, and the distortionary effect of filters. J. Econ. Dyn. Control. 2001, 25, 1081–1101. [Google Scholar]

- Hamilton, J.D. Time Series Analysis; Princeton University Press: Princeton, NJ, USA, 1994; Volume 2. [Google Scholar]

- White, H.; Granger, C.W. Consideration of trends in time series. J. Time Ser. Econom. 2011, 3, 1–40. [Google Scholar]

- Park, J.-B.; Lee, J.-W.; Yang, J.-S.; Jo, H.-H.; Moon, H.-T. Complexity analysis of the stock market. Physica A 2007, 379, 179–187. [Google Scholar] [Green Version]

- Yang, J.-S.; Kwak, W.; Kaizoji, T.; Kim, I. Increasing market efficiency in the stock markets. Eur. Phys. J. B. 2008, 61, 241–246. [Google Scholar]

- Cochrane, D.; Orcutt, G.H. Application of least squares regression to relationships containing auto-correlated error terms. J. Am. Stat. Assoc. 1949, 44, 32–61. [Google Scholar]

- Goerg, G.M.; Shalizi, C.R. LICORS: Light Cone Reconstruction of States for Non-parametric Forecasting of Spatio-Temporal Systems 2012, arXiv, 1206.2398.

| Time Period | T | ||

|---|---|---|---|

| 1930–1949 | 4996 | 341 | 0.002727 |

| 1950–1969 | 5000 | 101 | 0.000361 |

| 1970–1989 | 5054 | 221 | 0.033354 |

| 1990–2009 | 5043 | 191 | 0.897089 |

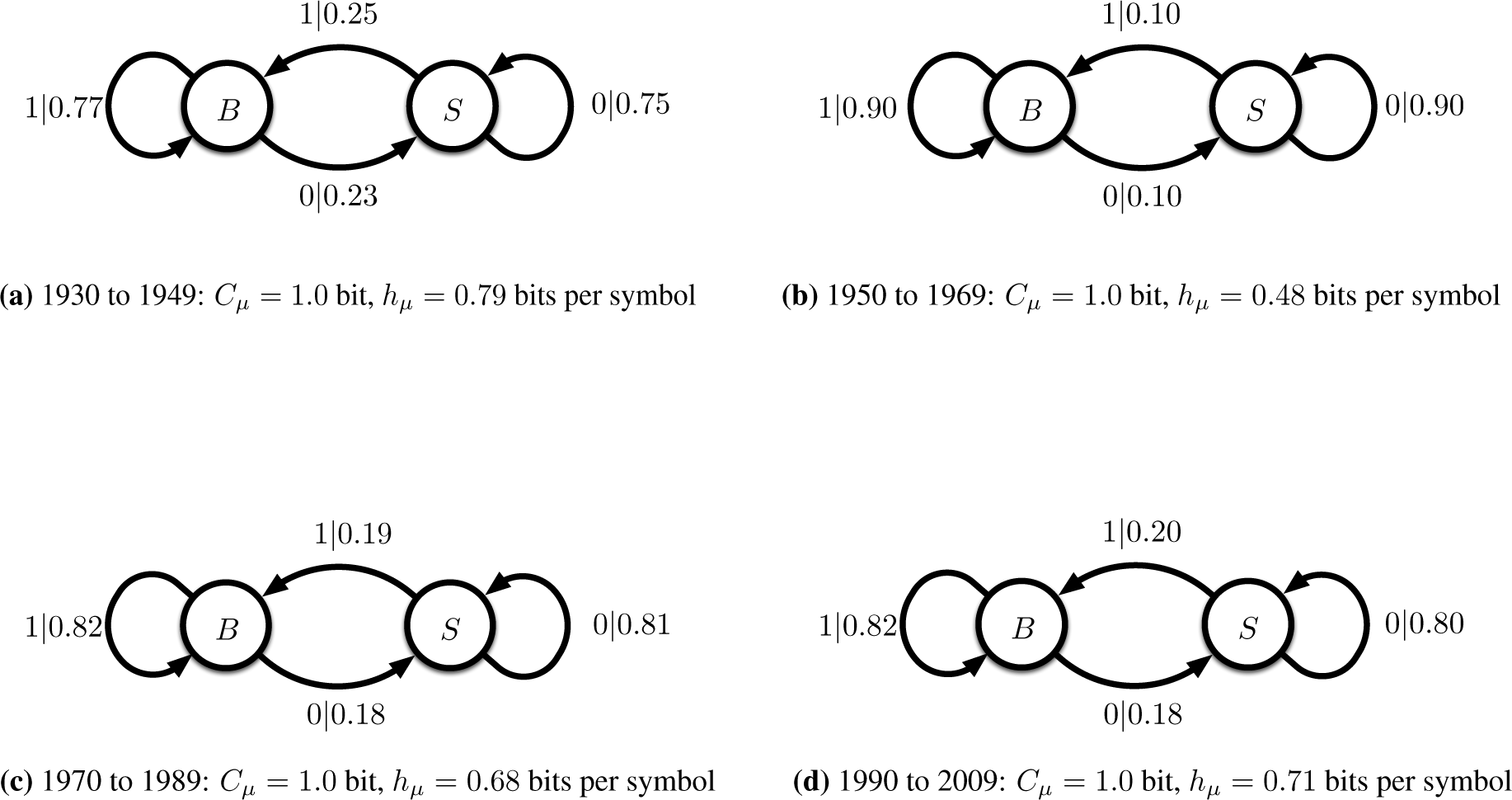

| Time Period | Cμ (bits) | hμ (bits per symbol) |

|---|---|---|

| 1930–1949 | 1.0 | 0.79 |

| 1950–1969 | 1.0 | 0.48 |

| 1970–1989 | 1.0 | 0.68 |

| 1990–2009 | 1.0 | 0.71 |

© 2015 by the authors; licensee MDPI, Basel, Switzerland This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Darmon, D.; Girvan, M. Complexity-Regularized Regression for Serially-Correlated Residuals with Applications to Stock Market Data. Entropy 2015, 17, 1-27. https://doi.org/10.3390/e17010001

Darmon D, Girvan M. Complexity-Regularized Regression for Serially-Correlated Residuals with Applications to Stock Market Data. Entropy. 2015; 17(1):1-27. https://doi.org/10.3390/e17010001

Chicago/Turabian StyleDarmon, David, and Michelle Girvan. 2015. "Complexity-Regularized Regression for Serially-Correlated Residuals with Applications to Stock Market Data" Entropy 17, no. 1: 1-27. https://doi.org/10.3390/e17010001