A Scoping Review of Barriers to Investment in Climate Change Solutions

Abstract

1. Introduction

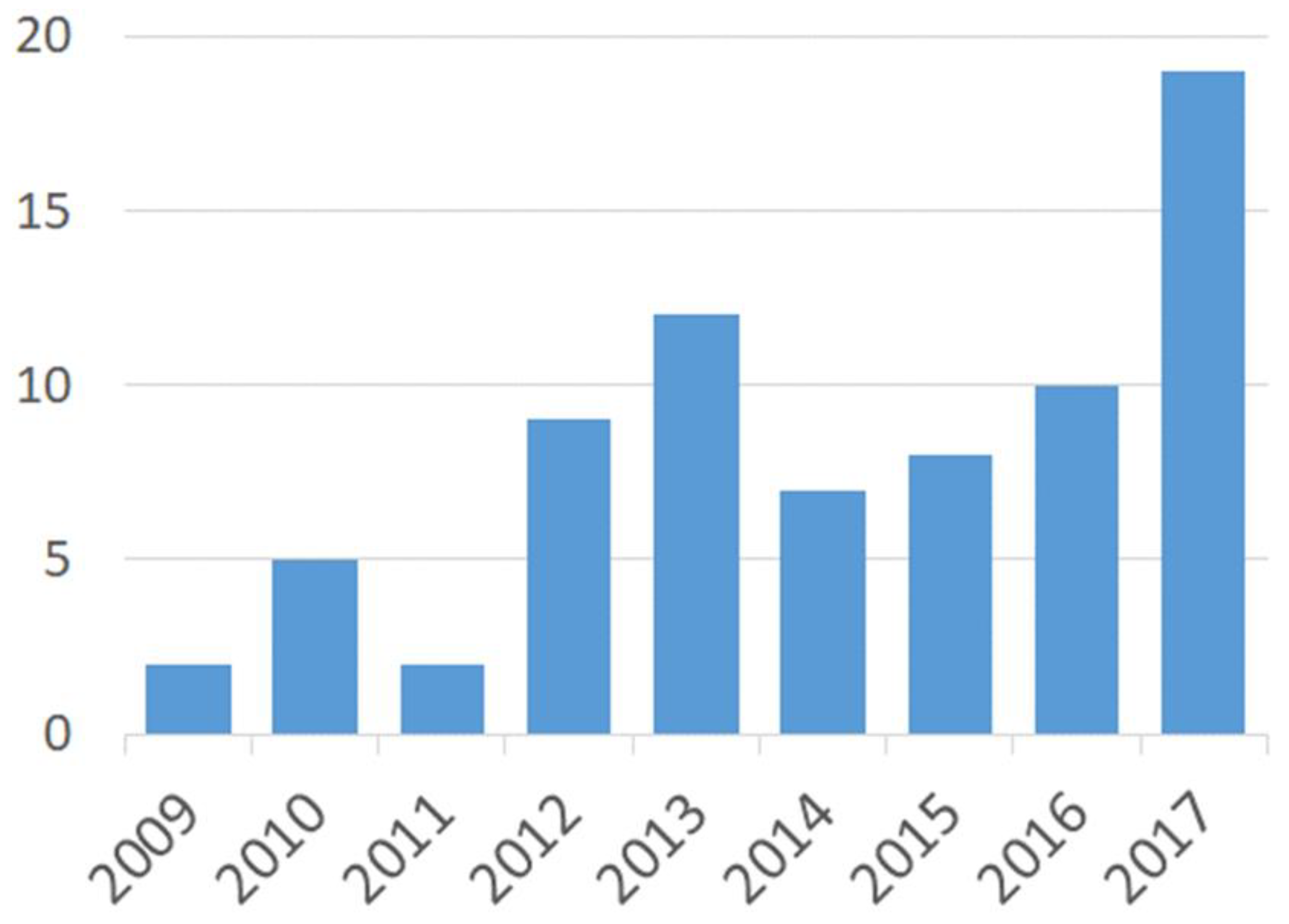

2. Materials and Methods

- Identification of practice-based policy reports;

- Identification of key themes and keywords/codes;

- Scoping review (ex-post) of policy reports using barrier code words found in the first round of coding;

- Use of barrier code words in a content analysis of academic literature.

2.1. Criteria for Selection of Practice-Based Policy Reports

- Published since 2009;

- Published by organisations in developed countries;

- Include specific reference to barriers or solutions in large-scale clean energy infrastructure investment;

- Published by multi-stakeholder groups, or an organisation, either public or private, that regularly consults multiple parties across the investment community.

2.2. Coding of Policy Report

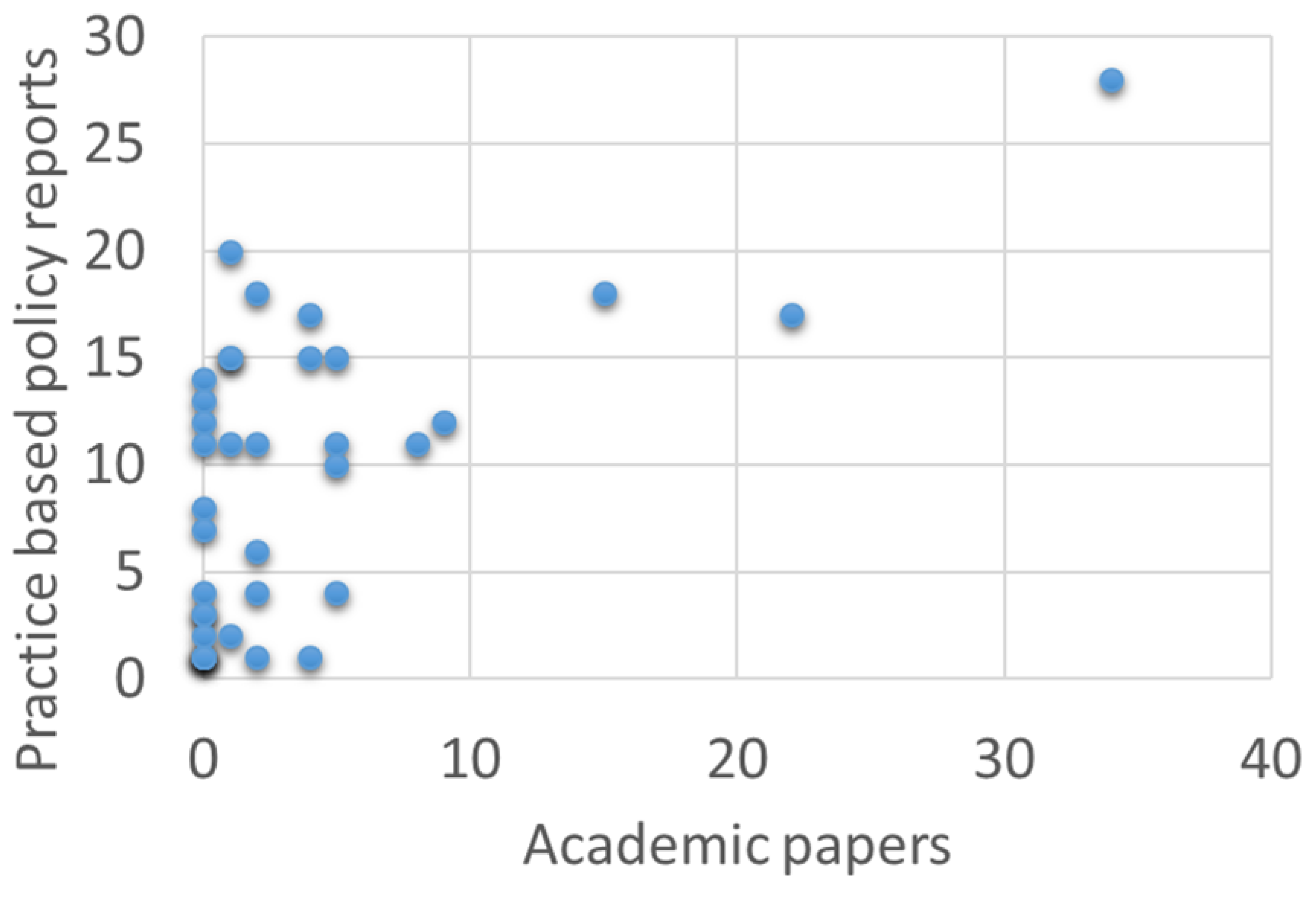

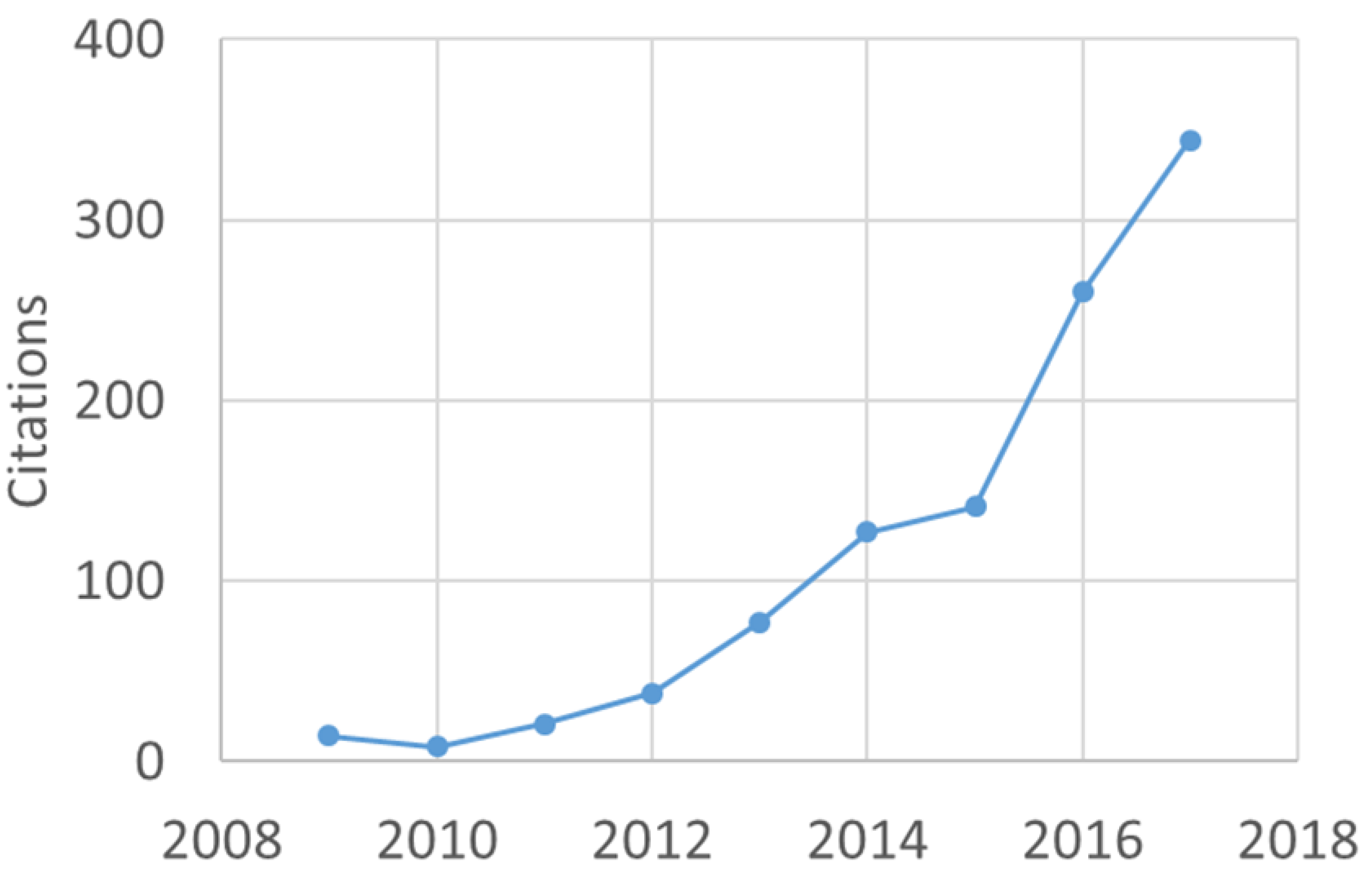

2.3. Scoping Review of Academic Literature

3. Results

4. Discussion

4.1. Identification of Investment Barriers

4.2. Theme Analysis

4.3. Testing Barriers Through Implemented Solutions

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- International Energy Agency. Climate Policy Uncertainty and Investment Risk. Available online: https://www.iea.org/publications/freepublications/publication/Climate_Policy_Uncertainty.pdf (accessed on 6 June 2018).

- IIGCC, INCR, IGCC & UNEP-FI. Investment-Grade Climate Change Policy: Financing the Transition to the Low-Carbon Economy. Available online: http://www.iigcc.org/publications/publication/proin-scelerisque-suscipit-rhoncus (accessed on 10 May 2018).

- Climate Policy Initiative. The Challenge of Institutional Investment in Renewable Energy. Available online: https://climatepolicyinitiative.org/publication/the-challenge-of-institutional-investment-in-renewable-energy/ (accessed on 15 June 2018).

- Aldersgate Group. Towards the New Normal: How to Increase Investments in the UK’s Green Infrastructure? Available online: http://www.aldersgategroup.org.uk/events/towards-the-new-normal-how-to-increase-investment-in-the-uk-s-green-infrastructure (accessed on 10 May 2018).

- Institutional Investors Group on Climate Change. Achieving the Investment Plan for Europe’s £315 Billion Ambition: 12 Fixes. Available online: http://www.iigcc.org/files/publication-files/Achieving_EUs_%E2%82%AC315bn_ambition.PDF (accessed on 20 June 2018).

- EY Climate change. The Investment Perspective. Available online: http://www.ey.com/gl/en/industries/financial-services/fso-insights-climate-change-the-investment-perspective (accessed on 10 May 2018).

- World Bank. Green Infrastructure Finance. Available online: http://documents.worldbank.org/curated/en/247041468340183358/pdf/678630PUB0EPI0067902B09780821394885.pdf (accessed on 14 May 2018).

- Vivid Economics. Financing Green Growth. Available online: http://www.vivideconomics.com/publications/financing-green-growth (accessed on 14 May 2018).

- UNEP. Global Trends in Renewable Energy Investment 2018. United Nations Environment, Frankfurt School-UNEP Collaborating Centre & Bloomberg New Energy Finance. Available online: http://www.greengrowthknowledge.org/resource/global-trends-renewable-energy-investment-report-2018 (accessed on 14 September 2018).

- GREEN-WIN. Financing the Low-Carbon Transition: Current Landscape and Future Direction. Available online: https://www.green-win-project.eu/resource/financing-low-carbon-transition-current-landscape-and-future-direction-0 (accessed on 20 June 2018).

- Wuestenhagen, R.; Menichetti, E. Strategic choices for renewable energy investment: Conceptual framework and opportunities for further research. Energy Policy 2012, 40, 1–10. [Google Scholar] [CrossRef]

- Green Investment Bank Commission. Unlocking Investment to Deliver Britain’s Low Carbon Future. Available online: https://www.e3g.org/docs/Unlocking_investment_to_deliver_Britains_low_carbon_future_-_Green_Investment_Bank_Commission_Report_June_2010.pdf (accessed on 15 May 2018).

- G20 Green Finance Study Group. G20 Green Finance Synthesis Report. Available online: http://unepinquiry.org/g20greenfinancerepositoryeng/ (accessed on 5 June 2018).

- Jones, A. Perceived barriers and policy solutions in clean energy infrastructure investment. J. Clean. Prod. 2015, 104, 297. [Google Scholar] [CrossRef]

- Linnenluecke, M.K.; Smith, T.; McKnight, B. Environmental finance: A research agenda for interdisciplinary finance research. Econ. Model. 2016, 59, 124–130. [Google Scholar] [CrossRef]

- Taskforce on Climate related Financial Disclosures. Final Report: Recommendations of the Task Force on Climate Related Financial Disclosures; Financial Stability Board: Basel, Switzerland, 2017. [Google Scholar]

- Diaz-Rainey, I.; Robertson, B.; Wilson, C. Stranded research? Leading finance journals are silent on climate change. Clim. Chang. 2017, 143, 243–260. [Google Scholar]

- Peterson, J.; Pearce, P.; Ferguson, L.; Langford, L. Understanding scoping reviews: Definition, purpose and process. J. Am. Assoc. Nurse Pract. 2017, 29, 12–16. [Google Scholar] [CrossRef] [PubMed]

- British Banking Association. Financing the UK’s Infrastructure Needs. Available online: https://www.bba.org.uk/news/reports/financing-the-uks-infrastructure-needs/#.WxEPpmaWwdU (accessed on 1 June 2018).

- E3G (2016) A Sustainable Finance Plan for the European Union. Available online: https://www.e3g.org/docs/A_Sustainable_Finance_Plan_for_the_EU.pdf (accessed on 19 June 2018).

- EU High Level Expert Group On Sustainable Finance. Financing a Sustainable European Economy. Available online: https://ec.europa.eu/info/sites/info/files/180131-sustainable-finance-final-report_en.pdf (accessed on 30 May 2018).

- European Commission. Financing Sustainability. Triggering Investments for the Clean Economy. Available online: https://ec.europa.eu/epsc/publications/strategic-notes/financing-sustainability_en (accessed on 10 May 2018).

- Green Finance Initiative The Renewable Energy Infrastructure Investment Opportunity for UK Pension Funds. Available online: http://greenfinanceinitiative.org/wp-content/uploads/2017/11/Final-Report-14.11.2017.pdf (accessed on 14 May 2018).

- Green Finance Initiative. Fifteen Steps to Green Finance. Available online: http://greenfinanceinitiative.org/fifteen-steps-to-green-finance/ (accessed on 10 May 2018).

- Green Finance Taskforce. Accelerating Green Finance. Available online: https://www.gov.uk/government/publications/accelerating-green-finance-green-finance-taskforce-report (accessed on 14 May 2018).

- IFC. Mobilizing Public and Private Funds for Inclusive Green Growth Investment in Developing Countries. Available online: https://openknowledge.worldbank.org/handle/10986/26450 (accessed on 14 May 2018).

- International Centre for Trade and Sustainable Development. Breaking down The Barriers to Clean Energy Trade and Investment. Available online: https://www.ictsd.org/bridges-news/biores/news/breaking-down-the-barriers-to-clean-energy-trade-and-investment (accessed on 14 May 2018).

- IRENA. Unlocking Renewable Energy Investment: The Role of Risk Mitigation and Structured Finance. Available online: http://www.irena.org/publications/2016/Jun/Unlocking-Renewable-Energy-Investment-The-role-of-risk-mitigation-and-structured-finance (accessed on 14 May 2018).

- Mercer. Investing in a Time of Climate Change. Available online: https://www.mercer.com/content/dam/mercer/attachments/global/investments/mercer-climate-change-report-2015.pdf (accessed on 14 May 2018).

- Organisation for Economic Co-operation and Development (OECD). The Role of Pension Funds in Financing Green Growth Initiatives. Available online: http://www.oecd.org/finance/private-pensions/49016671.pdf (accessed on 12 June 2018).

- Organisation for Economic Co-operation and Development (OECD). Towards a Green Investment Policy Framework: The Case of Low-Carbon, Climate-Resilient Infrastructure. Available online: https://www.oecd-ilibrary.org/content/paper/5k8zth7s6s6d-en (accessed on 19 June 2018).

- Organisation for Economic Co-operation and Development (OECD). Long-Term Investors and Green Infrastructure. Available online: http://www.oecd.org/env/cc/Investors%20in%20Green%20Infrastructure%20brochure%20(f)%20%5Blr%5D.pdf (accessed on 14 June 2018).

- Organisation for Economic Co-operation and Development (OECD). Institutional Investors and Green Infrastructure Investments. Available online: https://www.oecd-ilibrary.org/docserver/5k3xr8k6jb0n-en.pdf?expires=1529066539&id=id&accname=guest&checksum=37EA0A186EA86CFEF8496874A8E14AFD (accessed on 13 June 2018).

- Organisation for Economic Co-operation and Development (OECD). Public Financial Institutions and the Low-Carbon Transitions: Five Case Studies on Low-Carbon Infrastructure and Project Investment, OECD Environment. Available online: http://dx.doi.org/10.1787/5jxt3rhpgn9t-en (accessed on 14 May 2018).

- Organisation for Economic Co-operation and Development (OECD). Mobilising Private Investment in Clean-Energy Infrastructure. Available online: https://www.oecd.org/investment/investment-policy/Private-investment-in-clean-energy-infrastructure.pdf (accessed on 14 June 2018).

- Organisation for Economic Co-operation and Development (OECD). Overcoming Barriers to International Investment in Clean Energy. Available online: http://www.oecd.org/fr/publications/overcoming-barriers-to-international-investment-in-clean-energy-9789264227064-en.htm (accessed on 12 June 2018).

- Organisation for Economic Co-operation and Development (OECD). Progress Report on Approaches to Mobilising Institutional Investment for Green Infrastructure. Available online: http://unepinquiry.org/wp-content/uploads/2016/09/11_Progress_Report_on_Approaches_to_Mobilising_Institutional_Investment_for_Green_Infrastructure.pdf (accessed on 6 June 2018).

- UNEP. The Financial System We Need: Aligning Financial System with Sustainable Development. Available online: http://unepinquiry.org/publication/inquiry-global-report-the-financial-system-we-need/ (accessed on 14 May 2018).

- Corbin, J.; Strauss, A. Grounded theory research: Procedures, canons, and evaluative criteria. Qual. Sociol. 1990, 13, 3–21. [Google Scholar] [CrossRef]

- Arksey, H.; O’Malley, L. Scoping studies: Towards a methodological framework. Int. J. Soc. Res. Methodol. 2005, 8, 19–32. [Google Scholar] [CrossRef]

- Gale, R. Environment and Development: Attitudinal Impediments to Policy Integration. Environ. Conserv. 1992, 18, 228–236. [Google Scholar] [CrossRef]

- Gale, R. Environment and Economy: The Policy Models of Development. Environ. Behav. 1992, 24, 723–737. [Google Scholar] [CrossRef]

- Wells, V.; Greenwell, F.; Covey, J.; Rosenthal, H.E.S.; Adcock, M.; Gregory-Smith, D. An exploratory investigation of barriers and enablers affecting investment in renewable companies and technologies in the UK. Interface Focus 2013, 3, 20120039. [Google Scholar] [CrossRef]

- Sandberg, J. Socially Responsible Investment and Fiduciary Duty: Putting the Freshfields Report into Perspective. J. Bus. Ethics 2011, 101, 143–162. [Google Scholar] [CrossRef]

- Richardson, B.J. Do the Fiduciary Duties of Pension Funds Hinder Socially Responsible Investment? Bank. Financ. Law Rev. 2007, 22, 145–201. [Google Scholar]

- Klessmann, C.; Held, A.; Rathmann, M.; Ragwitz, M. Status and perspectives of renewable energy policy and deployment in the European Union-What is needed to reach the 2020 targets? Energy Policy 2011, 39, 7637–7657. [Google Scholar] [CrossRef]

- Fuss, S.; Szolgayova, J.; Khabarov, N.; Obersteiner, M. Renewables and climate change mitigation: Irreversible energy investment under uncertainty and portfolio effects. Energy Policy 2012, 40, 59–68. [Google Scholar] [CrossRef]

- Soderholm, P.; Ek, K.; Pettersson, M. Wind power development in Sweden: Global policies and local obstacles. Renew. Sustain. Energy Rev. 2007, 11, 365–400. [Google Scholar] [CrossRef]

- Sarasa-Maestro, C.J.; Dufo-Lopez, R.; Bernal-Agustin, J.L. Photovoltaic remuneration policies in the European Union. Energy Policy 2013, 55, 317–328. [Google Scholar] [CrossRef]

- Soshinskaya, M.; Crijns-Graus, W.H.J.; Guerrero, J.M.; Vasquez, J.C. Microgrids: Experiences, barriers and success factors. Renew. Sustain. Energy Rev. 2014, 40, 659–672. [Google Scholar] [CrossRef]

- Barradale, M.J. Impact of public policy uncertainty on renewable energy investment: Wind power and the production tax credit. Energy Policy 2010, 38, 7698–7709. [Google Scholar] [CrossRef]

- Stokes, L.C. The politics of renewable energy policies: The case of feed-in tariffs in Ontario, Canada. Energy Policy 2013, 56, 490–500. [Google Scholar] [CrossRef]

- Vogt-Schilb, A.; Hallegatte, S. Climate policies and nationally determined contributions: Reconciling the needed ambition with the political economy. Wires Energy Environ. 2017, 6, e256. [Google Scholar] [CrossRef]

- Masi, D.; Kumar, V.; Garza-Reyes, J.A.; Godsell, J. Towards a more circular economy: Exploring the awareness, practices, and barriers from a focal firm perspective. Prod. Plan. Control 2018, 29, 539–550. [Google Scholar] [CrossRef]

- Hu, J.; Harmsen, R.; Crijns-Graus, W.; Worrell, E. Barriers to investment in utility-scale variable renewable electricity (VRE) generation projects. Renew. Energy 2018, 121, 730–744. [Google Scholar] [CrossRef]

- Mazzucato, M.; Semieniuk, G. Financing renewable energy: Who is financing what and why it matters. Technol. Forecast. Soc. Chang. 2018, 127, 8–22. [Google Scholar] [CrossRef]

- Schmidt, T.S.; Battke, B.; Grosspietsch, D.; Hoffmann, V.H. Do deployment policies pick technologies by (not) picking applications?—A simulation of investment decisions in technologies with multiple applications. Res. Policy 2016, 45, 1965–1983. [Google Scholar] [CrossRef]

- Gatzert, N.; Kosub, T. Risks and risk management of renewable energy projects: The case of onshore and offshore wind parks. Renew. Sustain. Energy Rev. 2016, 60, 982–998. [Google Scholar] [CrossRef]

- Gatzert, N.; Kosub, T. The Impact of European Initiatives on the Treatment of Insurers’ Infrastructure Investments Under Solvency II. Geneva Pap. Risk Insur. Issues Pract. 2017, 42, 708–731. [Google Scholar] [CrossRef]

- Polzin, F. Mobilizing private finance for low-carbon innovation-A systematic review of barriers and solutions. Renew. Sustain. Energy Rev. 2017, 77, 525–535. [Google Scholar] [CrossRef]

- Hu, J.; Harmsen, R.; Crijns-Graus, W.; Worrell, E.; van den Broek, M. Identifying barriers to large-scale integration of variable renewable electricity into the electricity market: A literature review of market design. Renew. Sustain. Energy Rev. 2018, 81, 2181–2915. [Google Scholar] [CrossRef]

- Hall, S.; Foxon, T.J.; Bolton, R. Investing in low-carbon transitions: Energy finance as an adaptive market. Clim. Policy 2017, 17, 280–298. [Google Scholar] [CrossRef]

- Richards, G.; Noble, B.; Belcher, K. Barriers to renewable energy development: A case study of large-scale wind energy in Saskatchewan, Canada. Energy Policy 2012, 42, 691–698. [Google Scholar] [CrossRef]

- Bellantuono, G. The misguided quest for regulatory stability in the renewable energy sector. J. World Energy Law Bus. 2017, 10, 274–292. [Google Scholar] [CrossRef]

- Byrnes, L.; Brown, C.; Foster, J.; Wagner, L.D. Australian renewable energy policy: Barriers and challenges. Renew. Energy 2013, 60, 711–721. [Google Scholar] [CrossRef]

- del Rio, P.; Tarancon, M.; Penasco, C. The determinants of support levels for wind energy in the European Union. An econometric study. Mitig. Adapt. Strateg. Glob. Chang. 2014, 19, 391–410. [Google Scholar] [CrossRef]

- Del Rio, P.; Tarancon, M. Analysing the determinants of on-shore wind capacity additions in the EU: An econometric study. Appl. Energy 2012, 95, 12–21. [Google Scholar] [CrossRef]

- Gatzert, N.; Vogl, N. Evaluating investments in renewable energy under policy risks. Energy Policy 2016, 95, 238–252. [Google Scholar] [CrossRef]

- Gonzalez, J.S.; Lacal-Arantegui, R. A review of regulatory framework for wind energy in European Union countries: Current state and expected developments. Renew. Sustain. Energy Rev. 2016, 56, 588–602. [Google Scholar] [CrossRef]

- Karneyeva, Y.; Wuestenhagen, R. Solar feed-in tariffs in a post-grid parity world: The role of risk, investor diversity and business models. Energy Policy 2017, 106, 445–456. [Google Scholar] [CrossRef]

- Boomsma, T.K.; Linnerud, K. Market and policy risk under different renewable electricity support schemes. Energy 2015, 89, 435–448. [Google Scholar] [CrossRef]

- Chronopoulos, M.; Hagspiel, V.; Fleten, S. Stepwise Green Investment under Policy Uncertainty. Energy J. 2016, 37, 87–108. [Google Scholar] [CrossRef]

- Criscuolo, C.; Menon, C. Environmental policies and risk finance in the green sector: Cross-country evidence. Energy Policy 2015, 83, 38–56. [Google Scholar] [CrossRef]

- Chen, L.; Kettunen, J. Is certainty in carbon policy better than uncertainty? Eur. J. Oper. Res. 2017, 258, 230–243. [Google Scholar] [CrossRef]

- Holburn, G.; Lui, K.; Morand, C. Policy Risk and Private Investment in Ontario’s Wind Power Sector. Can. Public Policy 2010, 6, 465–486. [Google Scholar]

- Boute, A. The Quest for Regulatory Stability in the EU Energy Market: An Analysis through the Prism of Legal Certainty. Eur. Law Rev. 2012, 37, 675–692. [Google Scholar] [CrossRef]

- Nelson, T.; Nelson, J.; Ariyaratnam, J.; Camroux, S. An analysis of Australia’s large scale renewable energy target: Restoring market confidence. Energy Policy 2013, 62, 386–400. [Google Scholar] [CrossRef]

- Kann, S. Overcoming barriers to wind project finance in Australia. Energy Policy 2009, 37, 3139–3148. [Google Scholar] [CrossRef]

- Bode, S.; Michaelowa, A. Avoiding perverse effects of baseline and investment additionality determination in the case of renewable energy projects. Energy Policy 2003, 31, 505–517. [Google Scholar] [CrossRef][Green Version]

- Lozano, R.; Reid, A. Socially responsible or reprehensible? Investors, electricity utility companies, and transformative change in Europe. Energy Res. Soc. Sci. 2018, 37, 37–43. [Google Scholar] [CrossRef]

- De Cian, E.; Massimo, T. Mitigation Portfolio and Policy Instruments When Hedging Against Climate Policy and Technology Uncertainty. Environ. Model. Assess. 2012, 17, 123–136. [Google Scholar] [CrossRef]

- Li, M. Analysis of the Financing of Hydropower Projects. In Proceedings of the CRIOCM2009 International Symposium on Advancement of Construction Management and Real Estate, Nanjing, China, 29 October 2009. [Google Scholar]

- Linnerud, K.; Holden, E. Investment barriers under a renewable-electricity support scheme: Differences across investor types. Energy 2015, 87, 699–709. [Google Scholar] [CrossRef]

- Linnerud, K.; Simonsen, M. Swedish-Norwegian tradable green certificates: Scheme design flaws and perceived investment barriers. Energy Policy 2017, 106, 560–578. [Google Scholar] [CrossRef]

- Salm, S.; Hille, S.L.; Wustenhagen, R. What are retail investors’ risk-return preferences towards renewable energy projects? A choice experiment in Germany. Energy Policy 2016, 97, 310–320. [Google Scholar] [CrossRef]

- Espinoza, O.; Mallo, M.F.L.; Weitzenkamp, M. Overcoming barriers to biomass cogeneration in US wood products industry. Wood Fiber Sci. 2015, 47, 295–312. [Google Scholar]

- Junginger, M.; Schouwenberg, P.P.; Nikolaisen, L.; Andrade, O. Drivers and Barriers for Bioenergy Trade. In International Bioenergy Trade Lecture Notes in Energy; Junginger, M., Goh, C., Faaij, A., Eds.; Springer: Dordrecht, The Netherlands, 2014; p. 17. [Google Scholar]

- Martinot, E. Renewable energy in Russia: Markets, development and technology transfer. Renew. Sustain. Energy Rev. 1999, 3, 49–75. [Google Scholar] [CrossRef]

- Pfeifer, S.; Sullivan, R. Public policy, institutional investors and climate change: A UK case-study. Clim. Chang. 2008, 89, 245–262. [Google Scholar] [CrossRef]

- Ruggiero, S.; Varho, V.; Rikkonen, P. Transition to distributed energy generation in Finland: Prospects and barriers. Energy Policy 2015, 86, 433–443. [Google Scholar] [CrossRef]

- Gatzert, N.; Kosub, T. Determinants of policy risks of renewable energy investments International. J. Energy Sect. Manag. 2017, 11, 28–45. [Google Scholar] [CrossRef]

- Kuik, O.; Fuss, S. Renewables in the Energy Market: A Financial-Technological Analysis Considering Risk and Policy Options. In Financial Aspects in Energy; Dorsman, A., Westerman, W., Karan, M., Arslan, Ö., Eds.; Springer: Berlin, Germany, 2011; pp. 33–50. [Google Scholar]

- Michaelowa, A.; Allen, M.; Sha, F. Policy instruments for limiting global temperature rise to 1.5 degrees C - can humanity rise to the challenge? Clim. Policy 2018, 18, 275–286. [Google Scholar] [CrossRef]

- Koch, H.J. Policies for Financing Renewables. In READy: Renewable Energy Action on Deployment-Policies for Accelerated Deployment of Renewable Energy; de Vos, R., Ed.; Elsevier: Utrecht, The Netherlands, 2013. [Google Scholar]

- Breitschopf, B.; Pudlik, M. Basel Iii and Solvency Ii: Are the Risk Margins for Investments in Pv and Wind Adequate? Energy Environ. 2013, 24, 171–194. [Google Scholar] [CrossRef]

- Masini, A.; Menichetti, E. Investment decisions in the renewable energy field: An analysis of main determinants. In Proceedings of the PICMET 2010 Technology Management for Global Economic Growth, Phuket, Thailand, 18–22 July 2010. [Google Scholar]

- Fung, C.C.; Tang, S.C.; Xu, Z.; Wong, K.P. Comparing Renewable Energy policies in four countries & overcoming consumers’ adoption barriers with REIS. In Proceedings of the IEEE Power and Energy Society General Meeting, PES, Vancouver, BC, Canada, 21–25 July 2013. [Google Scholar]

- Geddes, A.; Schmidt, T.S.; Steffen, B. The multiple roles of state investment banks in low-carbon energy finance: An analysis of Australia, the UK and Germany. Energy Policy 2018, 115, 158–170. [Google Scholar] [CrossRef]

- Arnold, U.; Yildiz, O. Economic risk analysis of decentralized renewable energy infrastructures-A Monte Carlo Simulation approach. Renew. Energy 2015, 77, 227–239. [Google Scholar] [CrossRef]

- Aguilar, F.X.; Cai, Z. Exploratory analysis of prospects for renewable energy private investment in the U.S. Energy Econ. 2010, 32, 1245–1252. [Google Scholar] [CrossRef]

- Chen, W.; Yin, H. Optimal subsidy in promoting distributed renewable energy generation based on policy benefit. Clean Technol. Environ. Policy 2017, 19, 225–233. [Google Scholar] [CrossRef]

- Leete, S.; Xu, J.; Wheeler, D. Investment barriers and incentives for marine renewable energy in the UK: An analysis of investor preferences. Energy Policy 2013, 60, 866–875. [Google Scholar] [CrossRef]

- Esmaieli, M.; Ahmadian, M. The effect of research and development incentive on wind power investment, a system dynamics approach. Renew. Energy 2018, 126, 765–773. [Google Scholar] [CrossRef]

- Matthes, F.C. Energy transition in Germany: A case study on a policy-driven structural change of the energy system. Evol. Inst. Econ. Rev. 2017, 14, 141–169. [Google Scholar] [CrossRef]

- Yanosek, K. Policies for Financing the Energy Transition. Daedalus 2012, 141, 94–104. [Google Scholar] [CrossRef]

- Granoff, I.; Hogarth, J.R.; Miller, A. Nested barriers to low-carbon infrastructure investment. Nat. Clim. Chang. 2016, 6, 1065–1071. [Google Scholar] [CrossRef]

- Kayser, D. Solar photovoltaic projects in China: High investment risks and the need for institutional response. Appl. Energy 2016, 174, 144–152. [Google Scholar] [CrossRef]

- Finon, D. The transition of the electricity system towards decarbonization: The need for change in the market regime. Clim. Policy 2013, 13, 130–145. [Google Scholar] [CrossRef]

- Curtin, J.; McInerney, C.; Johannsdottir, L. How can financial incentives promote local ownership of onshore wind and solar projects? Case study evidence from Germany, Denmark, the UK and Ontario. Local Econ. 2018, 33, 40–62. [Google Scholar] [CrossRef]

- Aflaki, S.; Netessine, S. Strategic Investment in Renewable Energy Sources: The Effect of Supply Intermittency. Manuf. Serv. Oper. Manag. 2017, 19, 489–507. [Google Scholar] [CrossRef]

- Alishahi, E.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K. A system dynamics approach for investigating impacts of incentive mechanisms on wind power investment. Renew. Energy 2012, 37, 310–317. [Google Scholar] [CrossRef]

- Spiess, T.; De Sousa, C. Barriers to Renewable Energy Development on Brownfields. J. Environ. Policy Plan. 2016, 18, 507–534. [Google Scholar] [CrossRef]

- Abolhosseini, S.; Heshmati, A. The main support mechanisms to finance renewable energy development. Renew. Sustain. Energy Rev. 2014, 40, 876–885. [Google Scholar] [CrossRef]

- Deng, Y.; Guo, W. A Review of Investment, Financing and Policies Support Mechanisms for Renewable Energy Development. In Proceedings of the Tenth International Conference on Management Science and Engineering Management, Singapore, 24 August 2016; p. 502. [Google Scholar]

- Garcia, A.; Alzate, J.M.; Barrera, J. Regulatory design and incentives for renewable energy. J. Regul. Econ. 2012, 41, 315–336. [Google Scholar] [CrossRef]

- Kitzing, L. Risk implications of renewable support instruments: Comparative analysis of feed-in tariffs and premiums using a mean-variance approach. Energy 2014, 64, 495–505. [Google Scholar] [CrossRef]

- Linnerud, K.; Andersson, A.M.; Fleten, S. Investment timing under uncertain renewable energy policy: An empirical study of small hydropower projects. Energy 2014, 78, 154–164. [Google Scholar] [CrossRef]

- Tsoutsos, T.; Tournaki, S.; Farmaki, E.; Sonvilla, P.; Lensing, P.; Bartnicki, J.; Cobos, A.; Biscan, M. Benchmarking Framework to Encourage Energy Efficiency Investments in South Europe. The Trust EPC South Approach. Procedia Environ. Sci. 2017, 38, 413–419. [Google Scholar] [CrossRef]

- Polzin, F.; Migendt, M.; Taeube, F.A.; von Flotow, P. Public policy influence on renewable energy investments-A panel data study across OECD countries. Energy Policy 2015, 80, 98–111. [Google Scholar] [CrossRef]

- Rasouli, M.; Teneketzis, D. A methodology for Generation Expansion Planning for renewable energy economies. In Proceedings of the 2016 IEEE 55th Conference on Decision and Control (CDC), Las Vegas, NV, USA, 12–14 December 2016; pp. 1556–1563. [Google Scholar]

- Bodnar, P.; Ott, C.; Edwards, R.; Hoch, S.; McGlynn, E.F.; Wagner, G. Underwriting 1.5 °C: Competitive approaches to financing accelerated climate change mitigation. Clim. Policy 2017, 18, 368–382. [Google Scholar] [CrossRef]

- Gillenwater, M. Probabilistic decision model of wind power investment and influence of green power market. Energy Policy 2013, 63, 1111–1125. [Google Scholar] [CrossRef]

- Jami, A.A.N.; Walsh, P.R. The role of public participation in identifying stakeholder synergies in wind power project development: The case study of Ontario, Canada. Renew. Energy 2014, 68, 194–202. [Google Scholar] [CrossRef]

- Gisler, T.; Capezzali, M.; Guittet, M.; Burkhard, R.; Favrat, D. Evaluation and recommendation of a subsidy instrument for new large hydropower plants, use case of Switzerland. Sustain. Energy Technol. Assess. 2018, 26, 6–16. [Google Scholar] [CrossRef]

- Montes, G.; Prados Martin, E.; Ordonez Garcia, J. The current situation of wind energy in Spain. Renew. Sustain. Energy Rev. 2007, 11, 467–481. [Google Scholar] [CrossRef]

- Rezec, M.; Scholtens, B. Financing energy transformation: The role of renewable energy equity indices. Int. J. Green Energy 2017, 14, 368–378. [Google Scholar] [CrossRef]

- Lee, C.W.; Zhong, J. Financing and risk management of renewable energy projects with a hybrid bond. Renew. Energy 2015, 75, 779–787. [Google Scholar] [CrossRef]

- Eichhammer, W.; Ragwitz, M.; Schlomann, B. Financing Instruments to Promote Energy Efficiency and Renewables in Times of Tight Public Budgets. Energy Environ. 2013, 24, 1–26. [Google Scholar] [CrossRef]

- Owen, R.; Brennan, G.; Lyon, F. Enabling investment for the transition to a low carbon economy: Government policy to finance early stage green innovation. Curr. Opin. Environ. Sustain. 2018, 31, 137–145. [Google Scholar] [CrossRef]

- Kempa, K.; Moslener, U. Climate policy with the chequebook-An economic analysis of climate investment support. Econ. Energy Environ. Policy 2017, 6, 219. [Google Scholar] [CrossRef]

- Aiello, S. Addressing Financial Objections to Sustainable Design and Construction. J. Green Build. Fall 2010 2010, 5, 67–77. [Google Scholar] [CrossRef]

- Bjorneboe, M.G.; Svendsen, S.; Heller, A. Initiatives for the energy renovation of single-family houses in Denmark evaluated on the basis of barriers and motivators. Energy Build. 2018, 167, 347–358. [Google Scholar] [CrossRef]

- Ghisetti, C.; Mancinelli, S.; Mazzanti, M.; Zoli, M. Financial barriers and environmental innovations: Evidence from EU manufacturing firms. Clim. Policy 2017, 17, 131–147. [Google Scholar] [CrossRef]

- Haeckel, B.; Pfosser, S.; Traenkler, T. Explaining the energy efficiency gap-Expected Utility Theory versus Cumulative Prospect Theory. Energy Policy 2017, 111, 414–426. [Google Scholar] [CrossRef]

- Campiglio, E.; Dafermos, Y.; Monnin, P.; Ryan-Collins, J.; Schotten, G.; Tanaka, M. Climate change challenges for central banks and financial regulators. Nat. Clim. Chang. 2018, 8, 462–468. [Google Scholar] [CrossRef]

- Egli, F.; Steffen, B.; Schmidt, T.S. A dynamic analysis of financing conditions for renewable energy technologies. Nat. Energy 2018, 3, 1084–1092. [Google Scholar] [CrossRef]

| Author/Organisation | Year of Publication | Title |

|---|---|---|

| Aldersgate Group | 2018 [4] | Towards the new normal: How to increase investments in the UK’s green infrastructure? |

| British Banking Association | 2015 [19] | Financing the UK’s infrastructure needs |

| Climate Policy Initiative | 2013 [3] | The challenge of Institutional Investment in Renewable Energy |

| E3G | 2016 [20] | A Sustainable Finance Plan for the European Union |

| EU High Level Expert Group on Sustainable Finance | 2018 [21] | Financing a Sustainable European Economy |

| European Commission | 2017 [22] | Financing Sustainability. Triggering Investments for the Clean Economy |

| EY | 2016 [6] | Climate change. The investment perspective |

| G20 | 2016 [13] | G20 Green Finance Synthesis Report |

| Green Finance Initiative | 2017 [23] | The Renewable Energy Infrastructure Investment Opportunity for UK Pension Funds |

| 2017 [24] | Fifteen Steps to Green Finance | |

| Green Finance Taskforce | 2018 [25] | Accelerating Green Finance |

| Green Investment Bank Commission | 2010 [12] | Unlocking investment to deliver Britain’s low carbon future |

| GREEN-WIN | 2017 [10] | Financing the Low-Carbon Transition: Current Landscape and Future Direction |

| IFC | 2013 [26] | Mobilizing Public and Private Funds for Inclusive Green Growth Investment in Developing Countries |

| IIGCC, INCR, IGCC and UNEP-FI | 2011 [2] | Investment-grade climate change policy: Financing the transition to the low-carbon economy |

| Institutional Investors Group on Climate Change | 2015 [5] | Achieving the Investment Plan for Europe’s £315 billion ambition: 12 fixes |

| International Centre for Trade and Sustainable Development | 2015 [27] | Breaking down the barriers to clean energy trade and investment |

| International Energy Agency | 2007 [1] | Climate Policy Uncertainty and Investment Risk |

| IRENA | 2016 [28] | Unlocking Renewable Energy Investment: The Role of Risk Mitigation and Structured Finance |

| Mercer | 2015 [29] | Investing in a time of climate change |

| Organisation for Economic Co-operation and Development (OECD) | 2011 [30] | The Role of Pension Funds in Financing Green Growth Initiatives |

| 2012 [31] | Towards a Green Investment Policy Framework: The Case of Low-Carbon, Climate-Resilient Infrastructure | |

| 2013 [32] | Long-term investors and green infrastructure | |

| 2013 [33] | Institutional Investors and Green Infrastructure Investments | |

| 2014 [34] | Public Financial Institutions and the Low-carbon Transitions: Five Case Studies on Low-carbon infrastructure and project investment | |

| 2015 [35] | Mobilising private investment in clean-energy infrastructure | |

| 2015 [36] | Overcoming Barriers to International Investment in Clean Energy | |

| 2016 [37] | Progress Report on Approaches to Mobilising Institutional Investment for Green Infrastructure | |

| UNEP | 2015 [38] | The financial System We Need: Aligning Financial System with Sustainable development |

| Vivid Economics | 2014 [8] | Financing Green Growth |

| World Bank | 2012 [7] | Green Infrastructure Finance |

| Theme | Code Words |

|---|---|

| Immaturity of climate change policy frameworks and lack of stable policies | Policy framework; Policy direction; Long term; Policy uncertainty; Stable regulatory framework; Policy stability; Certainty |

| Policies are in favour of ‘brown’ energy-infrastructure (e.g., fossil fuel subsidies) | Fossil fuel subsidies; Carbon price; Perverse incentives; Distorted |

| Constraints on decision making within investor companies | Fiduciary duty; Trust; Investor perceptions; Awareness; Short term; Accounting; Solvency |

| Perceptions that returns of renewable infrastructure investments are too low and require high initial capital investment | Risk return |

| Requirement that projects need a certain credit rating so that it is possible to invest | Credit rating; Risk rating; Credit worthy |

| Technology-risk associated with uncertain and unproved technologies | Technology risk |

| Transparency on climate related disclosure and data | Climate disclosure; Standards; ESG; Benchmark |

| Limited projects with acceptable risk-return profiles | Liquidity; Liquid market; Scale |

| Lack of suitable financial vehicles/financial instruments | Financial vehicle; Financial instruments |

| High transaction costs or fees | Transaction costs; High fees |

| Lack of knowledge/technical advice on green infrastructure investment | Technical advice; Technical knowledge |

| Other barriers | Barrier |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hafner, S.; James, O.; Jones, A. A Scoping Review of Barriers to Investment in Climate Change Solutions. Sustainability 2019, 11, 3201. https://doi.org/10.3390/su11113201

Hafner S, James O, Jones A. A Scoping Review of Barriers to Investment in Climate Change Solutions. Sustainability. 2019; 11(11):3201. https://doi.org/10.3390/su11113201

Chicago/Turabian StyleHafner, Sarah, Olivia James, and Aled Jones. 2019. "A Scoping Review of Barriers to Investment in Climate Change Solutions" Sustainability 11, no. 11: 3201. https://doi.org/10.3390/su11113201

APA StyleHafner, S., James, O., & Jones, A. (2019). A Scoping Review of Barriers to Investment in Climate Change Solutions. Sustainability, 11(11), 3201. https://doi.org/10.3390/su11113201