1. Introduction

Risk measurement and management are crucially important issues in the modern finance and insurance industries. Some recent major financial crises, such as the Asian financial crisis and the Global Financial Crisis (GFC) may be partly attributed to inappropriate risk management practices. Since the GFC, the credit risk, in particular the default risk, has regained increasing attention around the globe. Some “too big to fails”, such as Lehman Brothers, encountered financial difficulties which may be attributed to default events. The debt crises of Dubai and European countries may present real-world evidence that not only corporations may default. It may not be unreasonable to say that the traditional perception that some financial instruments traded in markets are perfectly risk-free may be an illusion. Even U.S. treasury debts may be downgraded regardless of its triple-A status for more than 70 years by major rating agencies

1. In that sense, every investor should be cautious about default risk when making investment decisions. Indeed, due to the highly leveraged nature of derivative securities and structured products with default risk, trading these products could be a highly risky business. Appropriate practices in risk measurement and management of these defaultable products may protect both institutional and individual investors against massive exposure to these risky products. As many traded derivative securities have sophisticated structures, advanced quantitative tools may be needed to understand and evaluate the risk inherent from trading these securities.

Some quantitative risk measures have been proposed in the literature. Value at Risk (VaR) is popular among market practitioners. Regulators recommend the use of VaR for regulatory capital determination while risk managers adopt VaR for allocating capital and imposing risk limits to different trading desks. For more details about VaR, see, for example,

Jorion (

2001), J.P. Morgan’s Risk Metrics—Technical Document,

Duffie and Pan (

1997) and

El-Jahel et al. (

1999), among others. It is known in the literature that VaR is not sub-additive and penalizes diversification of risk. This does not appear to be consistent with financial intuition. Partly motivated by this observation,

Artzner et al. (

1999) proposed an axiomatic approach to risk measures and the notion of coherent risk measures. The introduction of coherent risk measures provides a remedy to overcome some defects of VaR. However, it was argued in

Frittelli and Rosazza Gianin (

2002) and

Föllmer and Schied (

2002) that, in practice, the risk of a trading position might increase nonlinearly with the size of the position. This is attributed to the lack of liquidity for a large trading position. To incorporate the nonlinear dependence of the risk of a trading position on the additional liquidity risk,

Frittelli and Rosazza Gianin (

2002) and

Föllmer and Schied (

2002) extended the class of coherent risk measures to that of convex risk measures. They replaced the sub-additive and positive homogeneous properties of coherent risk measures by a convexity property. In

Frittelli and Rosazza Gianin (

2002) and

Föllmer and Schied (

2002), convex risk measures quantify today’s risk of financial positions whose value will be realized at a future date

T. In this sense, these convex risk measures are considered in a static setting.

Based on backward stochastic differential equations (BSDE) and the

g-expectation,

Frittelli and Rosazza Gianin (

2004) and

Rosazza Gianin (

2006) extended a static convex risk measure to a dynamic one which evaluates the risk of a financial position at various intermediate times between today and the final date.

Delbaen et al. (

2008,

2010) represented, through BSDEs driven by Brownian motions, the penalty term of a time-consistent dynamic convex risk measure in an integral form. An integral representation of the penalty term for a time-consistent dynamic convex risk measure was extended to the case with jumps by

Tang and Wei (

2012).

Elliott and Siu (

2011a) applied a BSDE approach to study a risk-based, optimal investment problem of an insurer, where the risk faced by the insurer was described by a convex risk measure and the problem was formulated as a zero-sum stochastic differential game. Some other papers which concern risk-based asset allocation and possibly related problems include, for example,

Øksendal and Sulem (

2009),

Elliott and Siu (

2010a,

2010b,

2011b),

Siu (

2012),

Zhang et al. (

2012,

2013),

Meng and Siu (

2014) and

Siu and Shen (

2017), among others. Some of the literature used a BSDE approach to study the optimal control problems arising from risk-based asset allocation while some of them adopted the dynamic programming approach based on Hamilton-Jacobi-Bellman (HJB) equations.

Although the monotonicity and the convexity axioms may have been generally accepted, the cash additivity axiom (the translation invariance axiom) on convex risk measures may look controversial. In particular,

El Karoui and Ravanelli (

2009) pointed out that the cash additivity axiom fails to hold when the interest rate is stochastic or when the risky position is defaultable. In fact, convex risk measures (cash additive risk measures) are unable to account for the ambiguous discount factor. By replacing the cash additivity axiom with a cash sub-additivity axiom,

El Karoui and Ravanelli (

2009) proposed cash sub-additive risk measures, which can be used to quantify risks when a stochastic interest rate and defaultable contingent claims are present.

Default risk, or credit risk, has been widely studied in the literature.

Merton (

1974) pioneered the structural approach to model default risk, where the firm value is assumed to be observable and default occurs when a firm’s asset is not sufficient to cover its liability. Although a considerable effort has been made on extending Merton’s structural model (1974) in different directions, the observable firm value assumption is questioned from the practical perspective. Another approach to price default risk is a reduced-form intensity-based approach, which assumes that the default is triggered exogenously. Under this approach together with the assumption of the recovery in market values, the classical term structure machinery can be applied to model default risk. Previous works on the intensity-based approach, to name a few, include

Madan and Unal (

1998),

Duffie and Singleton (

1999),

Collin-Dufresne et al. (

2004),

Jarrow et al. (

2005), and etc. For a survey of both approaches, interested readers may refer to

Bielecki and Rutkowski (

2002)’s monograph on credit risk. Recently, there has been a growing interest in optimal investment problems with default risk.

Hou (

2003) and

Jin and Hou (

2003) considered an optimal investment problem of a portfolio with diversifiable default risk under the Vasicek-type models for both the short rate and the credit spread.

Korn and Kraft (

2003) discussed a continuous-time portfolio optimization problem with a defaultable bond and several stocks where the Merton structural firm value model was used to model default risk. For more general results, one may refer to the thesis by

Kraft (

2004).

Bielecki and Jang (

2006) studied a portfolio optimization problem with undiversifiable default risk in a deterministic short rate and credit spread modelling framework.

Kraft and Steffensen (

2008) investigated an optimal portfolio decision making problem in the presence of corporate bonds, where default risk was modeled by a reduced-form intensity-based model.

Bo et al. (

2010,

2013) considered optimal investment-consumption problems with defaultable bonds in an infinite-horizon modelling set up.

Lim and Quenez (

2011) studied the indifference pricing of a defaultable contingent claim via an exponential utility maximization problem.

Capponi and Figueroa-Lopez (

2014) investigated a portfolio optimization problem with defaultable securities in a Markovian regime-switching modelling environment. Some recent works along this direction include

Jiao et al. (

2013),

Bo and Capponi (

2016), and

Zhao et al. (

2016), among others.

In this paper, an optimal asset allocation problem of an investor in the presence of a defaultable security is discussed in a general non-Markovian economy. Specifically, a continuous-time financial market with three primitive assets, namely a money market account, an ordinary share and a defaultable security, is considered. The price process of the ordinary share is modelled by a non-Markovian geometric Brownian motion with random parameters. The intensity-based, reduced-form approach is adopted to model the default risk of the defaultable security. A general situation where model parameters such as interest rate, default intensity, appreciation rate and volatility are non-Markovian random processes is considered. A risk-based asset allocation problem for an investor, whose goal is to select an optimal portfolio with a view to minimizing the risk described by a sub-additive risk measure of his/her terminal wealth is described. The sub-additive risk measure is adopted here to take into account the effect of interest rate risk or stochastic discount factor. The investment problem is formulated as a two-person, zero-sum, stochastic differential game. In this game problem, the investor and the market act antagonistically to each other so as to achieve an equilibrium state in the sense of the Nash equilibrium in the game theory. We employ the BSDE approach as in, for example,

Elliott and Siu (

2011a) and

Øksendal and Sulem (

2011,

2014) to discuss the game problem. The advantage of using the BSDE approach is that it provides a solid theoretical basis to study the investment problem in a non-Markovian modelling framework. Closed-form solutions to the asset allocation problem are obtained when the penalty function is a quadratic function and when the risk measure is a sub-additive coherent risk measure. An important case of the non-Markovian general model, namely the self-exciting threshold diffusion model with time delay, is considered. This model can be thought of as a continuous-time version of one of the oldest and important classes of parametric nonlinear time series models, namely the self-exciting threshold autoregressive models, pioneered by

Tong (

1977,

1978,

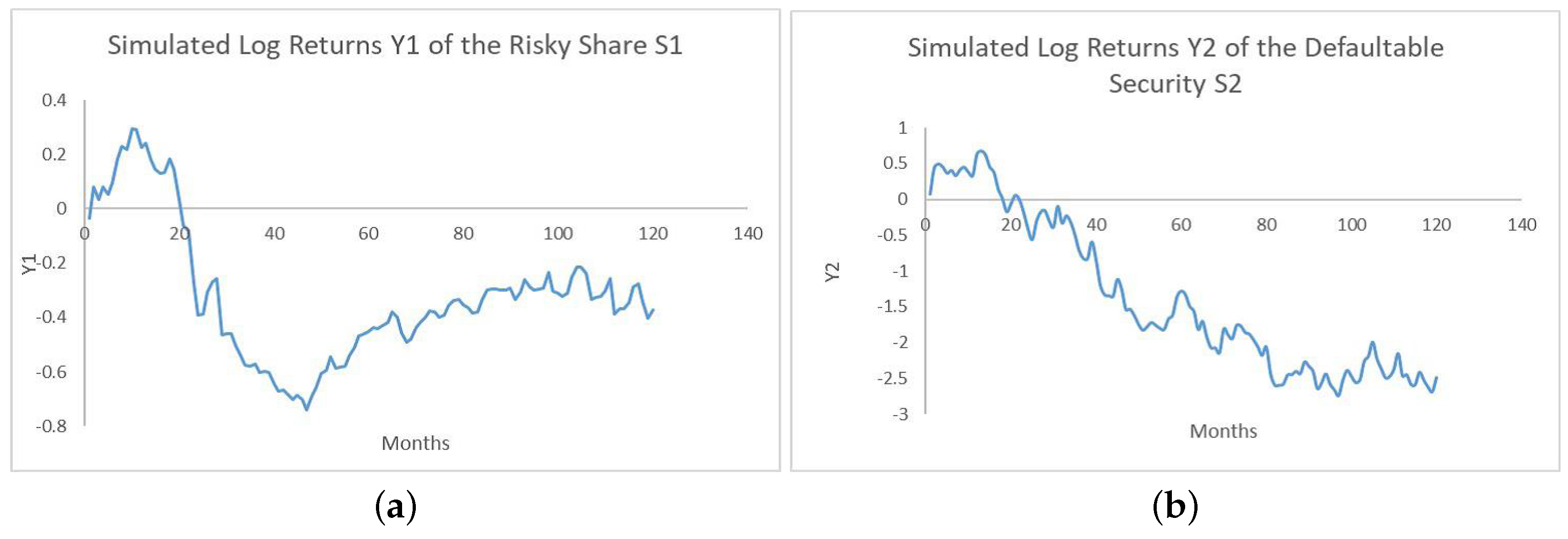

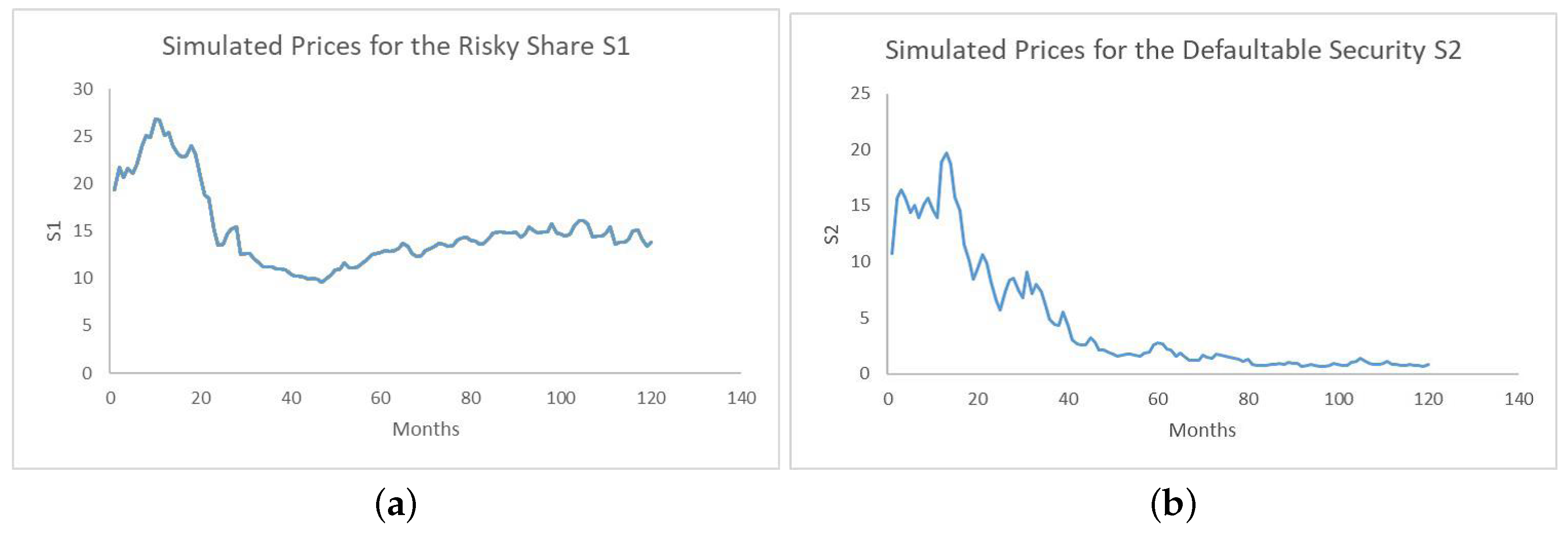

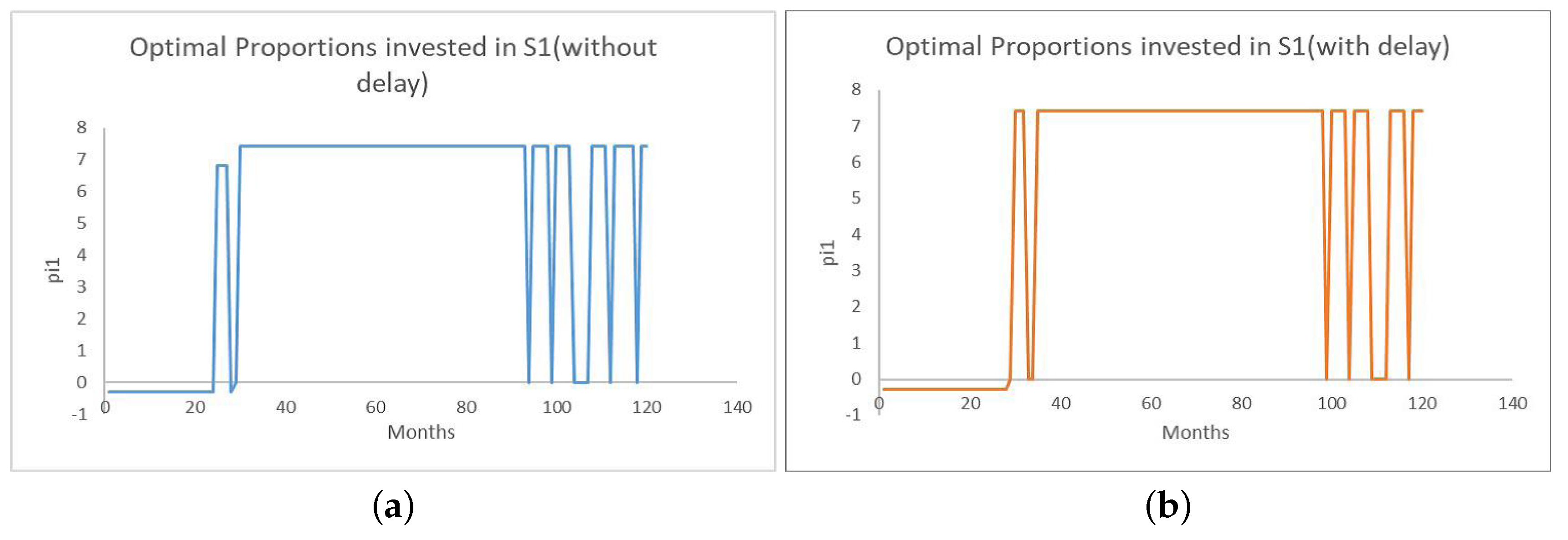

1983). Numerical examples based on simulations for the self-exciting threshold diffusion model with and without time delay are provided to illustrate how the model may be applied. The proposed model can be implemented quite easily using Excel spreadsheets.

The rest of the paper is structured as follows. In

Section 2, the model dynamics of the money market account, the ordinary share and the defaultable security are presented. A brief review on some key concepts of dynamic sub-additive convex risk measures is provided and the asset allocation problem is formulated as the two-person, zero-sum, stochastic differential game problem in

Section 3. In

Section 4, some results of backward stochastic differential equations are first discussed and then applied to solve the game problem. Closed-form solutions to the game problem are derived in some particular cases in

Section 5. In

Section 6, the self-exciting threshold diffusion model with time delay is first described. Then the simulation procedures and numerical results are presented and discussed. The final section gives concluding remarks.

2. The Model Dynamics

We consider a simplified continuous-time financial market with three primitive assets, namely, a money market account B, an ordinary share and a defaultable security . The market is assumed to be arbitrage-free, frictionless and continuously open in a finite time horizon , where . To describe uncertainty, we consider a complete probability space , which is assumed to be rich enough to carry all stochastic processes. Here is the reference probability measure, from which a family of equivalent probability measures can be generated.

Let

and

be two

-standard Brownian motions, where

is a right-continuous,

-complete natural filtration generated by

and

. For each

, write

. Suppose that

and

are correlated with the variance-covariance matrix given by

where the correlation process

satisfies

,

.

Let

be a random variable on the probability space

such that

Here

represents the default time of the defaultable security. As it is well known in the intensity-based credit risk model, (see, for example,

Lando (

2009), chp. 5), we define a default indicator process

by setting

, for each

. Let

be a right-continuous,

-complete natural filtration generated by the indicator process

N, where

, for each

. Let

be the minimal

-field containing both

and

, for each

. Denote

. Note that

is an

-stopping time but not necessarily a

-stopping time. In fact,

is the minimal enlargement of

such that

is an

-stopping time, (see, for example,

Elliott et al. (

2000) for some discussions on certain filtrations in intensity-based models).

As in

Kusuoka (

1999), we make the following assumptions:

- (A1)

There exists a

-adapted (intensity) process

such that

is an

-martingale.

- (A2)

Every -local martingale is an -local martingale.

It is worth mentioning that Condition (A2) is usually called the H-hypothesis, and under this condition and are also two -Brownian motions.

Let . We next define the following, (path), spaces:

- (1)

is the set of -progressively measurable, -valued processes on the product space ;

- (2)

is the set of -measurable, -valued, essentially bounded random variables;

- (3)

is the set of

-measurable,

-valued random variables

such that

- (4)

is the set of -adapted, -valued, essentially bounded, càdlàg processes;

- (5)

is the set of

-adapted,

-valued, càdlàg processes

such that

- (6)

is the set of

-predictable,

-valued processes

such that

- (7)

is the set of

-predictable,

-valued processes

such that

Let

be the instantaneous, continuously-compounded, risk-free rate of interest at time

t, where

for each

. Then the price process of the money market account

evolves over time as

Let

and

denote the appreciation rate and the volatility of the ordinary share

at time

t, respectively. The price process

of the ordinary share is governed by the following geometric Brownian motion (GBM) with random parameters:

Let

and

denote the appreciation rate and the volatility of the defaultable security

at time

t, respectively, and

the proportion of downward jumps in the price of the defaultable security

at time

t when a default of the firm issuing the security

occurs. Adopting the intensity-based approach, we assume that the dynamics of the defaultable security is governed by the following stochastic differential equation:

We assume that

,

,

,

,

and

, for each

, are

-predictable, uniformly bounded processes on

, and further require that

, for each

. This assumption allows that the model dynamics (

1)–(

3) have random coefficients. Furthermore, the dynamics of the ordinary share and the defaultable security are not necessarily Markovian. That is, for each

, the appreciation rates

and

, the volatilities

and

, the proportion of downward jumps

could be functionals of the price processes

and

. One of the key motivations of applying the BSDE approach is to deal with non-Markovian controlled state processes with random coefficients.

Let

be a portfolio process, where

and

represent the proportions of the wealth invested in the ordinary share and the defaultable security at time

t, respectively. Then, the proportion that the investor allocates to the money market account is

at time

t. Let

be the wealth process of the investor with the portfolio process

. Then the evolution of the wealth process

over time under the reference measure

is governed by:

where

We say a portfolio process is admissible if it satisfies the following standard conditions:

- (1)

is -predictable;

- (2)

, for a.a. , where is a compact subset of ;

- (c)

, for a.a. .

Write

for the space of all admissible portfolio processes

. Clearly, for any

, the wealth Equation (

4) satisfies the Lipschitz and linear growth conditions. Therefore, by the standard theory of SDEs, the wealth Equation (

4) admits a unique strong solution

, for any

.

3. Risk-Based Asset Allocation Problem

In this section, we introduce sequentially the concepts of convex risk measures (cash additive measures) and cash sub-additive convex risk measures. Furthermore, we present an integral representation for the penalty term when the risk measure is time-consistent. Then we specify a family of real-world probability measures equivalent to the reference probability measure by a version of Girsanov’s theorem. Finally, we state the risk-minimization problem.

The concept of convex risk measures was introduced independently by

Frittelli and Rosazza Gianin (

2002) and

Föllmer and Schied (

2002). It generalizes the notion of coherent risk measures proposed by

Artzner et al. (

1999). Before we discuss the concept of cash sub-additive convex risk measures, we review the definition of a convex risk measure (a cash additive risk measure).

Let be the space of -measurable random variables. The space consists of random variables describing risky financial positions whose values will be realized at the terminal time T. Then a convex risk measure is defined as follows:

Definition 1. A convex risk measure is a functional such that it satisfies the following three axiomatic properties:

- (1)

Cash additivity (or cash invariance) : if and , then .

- (2)

Monotonicity : for any , if , for all , then .

- (3)

Convexity : for any and , then .

The convexity axiom reflects the situation that the risk of a trading portfolio might increase in a nonlinear fashion with the size of the portfolio that is attributed to the liquidity risk of a large portfolio, (see

Frittelli and Rosazza Gianin (

2002) and

Föllmer and Schied (

2002) for original discussions on the motivation of developing convex risk measures). With the cash additivity and the normalization assumption that

,

can be interpreted as the minimum amount of capital which is required to make the financial position described by

X acceptable.

Although it seems that the monotonicity and the convexity axioms may have been quite well-accepted, the cash additivity axiom is rather controversial.

El Karoui and Ravanelli (

2009) pointed out that while regulators and financial institutions determine reserves or capitals today to cover losses due to future risky positions, the cash additivity axiom requires that the risky positions and the reserved capital are expressed in terms of the same numéraire. Implicitly, the risky positions should be discounted before calculating the convex risk measure, with the assumption that the discounting procedure does not involve any additional risks. However, if the interest rate is stochastic or the future risky position is defaultable, the cash additivity axiom may be questioned. That is, a convex risk measure (a cash additive risk measure) is unable to account for an ambiguous discount factor. By replacing the cash additivity axiom with the cash sub-additivity axiom,

El Karoui and Ravanelli (

2009) introduced a cash sub-additive convex risk measure, which can be used to model stochastic interest rate and defaultable contingent claims.

Definition 2. A sub-additive convex risk measure is a functional such that it satisfies the following three axiomatic properties:

- (1)

Cash sub-additivity : if and , then .

- (2)

Monotonicity : for any , if , for all , then .

- (3)

Convexity : for any and , then .

In fact,

El Karoui and Ravanelli (

2009) introduced a sub-additive risk measure by setting

, where

is a (stochastic) discount factor. The cash sub-additivity axiom allows that the functional

is expressed in terms of the current numéraire but directly defined on the future risky position expressed in terms of the future numéraire. In other words, using a sub-additive convex risk measure, reserves or capitals may be determined in advance to make the financial position acceptable without recourse to the discounting procedure.

Theorem 1. Let be a family of sub-probability measures on . Define a function such that , . Then if a sub-additive risk measure satisfies the assumption of continuity from below, there exists a family and a function η such that In the sequel, a family of sub-probability measures associated with the reference measure will be defined by using a version of Girsanov’s transformation. Firstly, we introduce processes , , and the discount rate process , which parameterize the family of sub-probability measures. Suppose that the process satisfies the following conditions:

- (1)

is -predictable;

- (2)

, for a.a. , where is a compact subset of ;

- (3)

for some constant C, for a.a. ;

- (4)

, for a.a. ;

We denote the space of all these processes by . A process is said to be an admissible strategy.

First, we define a real-valued,

-adapted, process

on

by putting

Applying Itô’s differentiation rule to

,

For each

, we define a probability measure

equivalent to

as:

Then, a sub-probability measure

is defined by

The sub-probability measures may be related to state price densities in the asset pricing literature.

Therefore, the family of sub-probability measures, i.e.,

, can be generated as:

Denote by

,

and

. Then, for each

, a controlled state process

satisfies

Recall that associated with any

, the wealth equation admits a unique solution

, i.e., the SDE (

10) has a unique solution

, for any

. Similarly, associated with any

, the SDE (

9) has a unique solution

, for any

. To simplify our notation, we suppress the subscripts

and

and write, for each

,

,

,

and

for

,

,

and

, respectively.

We now specify a penalty function

, which admits an integral representation. Note that for each

,

and

, where

and

are compact metric spaces in

and

, respectively. Let

be a bounded, measurable convex function. To simplify the notation, we denote

unless otherwise stated. We consider a penalty function of the following form:

Here

is an expectation under

. As shown in

El Karoui and Ravanelli (

2009), if

F is finite and independent of

, then

is the penalty function representing a sub-additive risk measure

. In fact, a sub-additive risk measure has an integral representation which is similar to that of a convex risk measure (see, for example,

Delbaen et al. (

2010) and

Tang and Wei (

2012)).

We now specify a cash sub-additive risk measure for the terminal wealth of the investor as:

The objective of the investor is to minimize the risk measure by selecting an optimal portfolio process

. Consequently, the optimization problem of the investor can be described as the following min-max problem:

Denote the initial value of the controlled processes as

. Recalling the form of the penalty function and using a version of Bayes’ rule,

Write, for each

,

Then

Therefore, the problem can be considered as a two-person, zero-sum, stochastic differential game between the investor and the market, (see, for example, (

Øksendal and Sulem) (

2011,

2014)). Here the investor selects an admissible strategy

so as to minimize the risk measure of the wealth process at the terminal time

T. On the other hand, the market responds antagonistically to the investor’s action by selecting a combination of the stochastic discount factor and the real-world probability measure, respectively, indexed by

and

, corresponding to the worst-case scenario where the risk is maximized. To solve the game problem, one must determine the optimal strategies

and

of the investor and the market, respectively. In reality, the global financial market does not normally respond to a single investor unless he/she is a large institutional trader, or a representative trader from a theoretical perspective. However, the interpretation for a market in the game problem here is a “fictitious” player who would tend to select the worst-case market scenario to induce a conversative outcome for the robust optimal asset allocation problem of the investor. The stochastic differential game approach is similar to the idea of worst-case portfolio optimization in

Korn and Steffensen (

2007). However, in

Korn and Steffensen (

2007), the market selects large financial shocks, or crashes, instead of worst-case probability scenarios.

It is anticipated that financial institutions pursuing a prudent investment approach may find the risk-based allocation approach relevant. Pension and endowment funds may perhaps serve as two examples of such institutions. The risk-based asset allocation approach may be different from some traditional investment methodologies such as those based on utility maximization and mean-variance optimization since the former does not treat maximizing investment returns as one of the main objectives while the latter does. In a sense, the risk-based asset allocation approach would tend to produce a conservative result. Having said that, there are some empirical evidence, (see, for example,

Lee (

2011) and the relevant references therein), that risk-based portfolios, which are seemingly return-insensitive, quite surprisingly outperform market capitalization-weighted portfolios and mean-variance efficient portfolios.

4. The BSDE Approach to the Game Problem

In this section, we first discuss the solvability of Backward Stochastic Differential Equations (BSDEs) driven by the Brownian motion and the martingale M, which will be used to solve the game problem described in the previous section. We then present a result which gives the solution of the game problem as a solution of a BSDE. Finally, we solve the game problem.

First of all, we introduce a BSDE with random default time.

Definition 3. Let ξ be a real-valued, -measurable terminal condition and be a -measurable driver function, where , and are the -predictable σ-field on , the Borel σ-fields of ℜ and , respectively. Then a solution of the BSDE associated with the terminal value ξ and the driver g is a triplet of processes satisfying Alternatively, in a differential form, The following existence and uniqueness theorem is due to

Peng and Xu (

2010) (see also some possibly related results presented in

Shen and Elliott (

2011) for BSDEs driven by single jump processes). So we state the result here without giving the proof.

Theorem 2. Suppose that and the following two conditions hold:

- (i)

;

- (ii)

the Lipschitz condition: for each , there exists a constant such that

Then the BSDE (11) has a unique solution. The following theorem is similar to Proposition 2.2 in

El Karoui et al. (

1997). It provides a link between the solution of a BSDE and the solution of the game problem. Since

El Karoui et al. (

1997) only considered the BSDE driven by Brownian motions, we extend the theorem to the BSDE with random default time by giving a sketch of the proof. Although similar results for different versions of BSDEs with jumps have been considered in literature (see, e.g.,

Delong (

2013)), we relegate the proof to the

appendix to make the paper self-contained. Note that the driver of the linear BSDE (

13) does not satisfy the Lipschitz condition in the sense of Theorem 2 due to the fact that the coefficient of

in the driver is linear in

rather than

. Therefore, instead of relying on Theorem 2, we discuss the solvability of (

13) by using the martingale representation theorem directly.

Theorem 3. Let , , and be -predictable, uniformly bounded processes taking values in ℜ, ℜ, and ℜ, respectively. Suppose that . Then, the following linear BSDE:has a unique solution . Furthermore, Y has the following expectation representation:where the double-indexed process is the adjoint process satisfying the following forward linear SDE:and satisfies the following semi-group property: The following theorem is a comparison theorem for BSDEs, which is slightly different from Theorem 3.3 in

Peng and Xu (

2010). Theorem 3 is an essential ingredient for the proof of the following theorem, which is very similar to that of Theorem 3.3 in

Peng and Xu (

2010). So we omit the proof here.

Theorem 4. Suppose that , and and are two drivers satisfying Conditions (i)-(ii) in Theorem 2. Let and be the unique solutions of BSDEs corresponding to and , respectively. If

- (a)

, a.e., a.s.,

- (b)

, a.e., a.s., and

- (c)

for each and , where , the following inequality holds:

Recalling the processes

,

and

defined in Equations (

6), (

9) and (

10), we apply Itô’s differentiation rule to calculate

Using the isometry formula for jump processes, we have

For each

,

Write, for each

,

Write, for each

,

Thus, the stochastic differential game discussed in

Section 4 is equivalent to the following stochastic differential game:

We now define the Hamiltonian

of the game problem as follows:

The Hamiltonian

H is said to satisfy Isaacs’ condition if

It is well known that

H satisfies Isaacs’ condition if and only if there exist two measurable functions

and

such that

To make Isaac’s condition hold, we require that the Hamiltonian

H is convex in

and concave in

. In other words, it is required that the function

is concave in

and convex in

. Interested readers may refer to

Friedman (

1975) and

Elliott (

1976) for the detail of the relation between Isaacs’ condition and stochastic differential games. From now on, we assume that Issacs’ condition holds for the Hamiltonian

H.

The following lemma verifies the solvability of the BSDE with the Hamiltonian given by the driver.

Lemma 1. For any , the following BSDEhas a unique solution . Proof. Note that the admissible strategy

and the function

F are bounded. Moreover, we know that

, for any

. Observing

we can conclude that the Hamiltonian is square integrable, i.e.,

. By Theorem 2 or Theorem 3, we obtain that for any

, the BSDE has a unique solution

. ☐

The following theorem relates the solution of the game problem to the solution of a BSDE with random default time. Interested readers may find the proof in

De Scheemaekere (

2008) and

Elliott and Siu (

2011a). Although the BSDE considered in this paper is different from those in

De Scheemaekere (

2008) and

Elliott and Siu (

2011a) due to the presence of random default time, the proof is almost the same via using Theorems 2–4 and Lemma 1.

Theorem 5. Suppose that Isaacs’ condition and the two conditions in Theorem 2 hold. Then there is a unique solution of the BSDE associated with the driver , : Furthermore, the pair of strategies is a saddle point of the zero-sum stochastic differential game, and The BSDE approach was also adopted in

Elliott and Siu (

2011a) to discuss the optimal investment problem. Our paper differentiates with

Elliott and Siu (

2011a) in three aspects. Firstly, we consider the asset allocation problem for a general investor while

Elliott and Siu (

2011a) discussed an optimal investment problem for an insurer. Secondly, the BSDE in our paper is driven by both a Brownian motion and a single jump process while that in

Elliott and Siu (

2011a) is only driven by a Brownian motion. Thirdly, due to presence of the stochastic discount factor, we use the sub-additive convex risk measure as a proxy of risk while

Elliott and Siu (

2011a) applied the convex risk measure. Due to the first and third differences between the current paper and

Elliott and Siu (

2011a) as mentioned, it does not seem that our results simply reduce to those in

Elliott and Siu (

2011a) even if the single jump process is absent.

5. Particular Cases

In this section, we discuss the problem for two parametric forms of the penalty function

F. In both cases, we obtain the optimal strategies for the investor and the market. In the first case, we consider the quadratic penalty function, motivated by the entropic penalty function considered in, for example, Delbaean et al. (2008). More specifically, we assume that

F is a quadratic function of

. In the second case, we consider a zero penalty function, which was proposed by

Jarrow (

2002) for put option premiums. This case may also be related to coherent measures of risk.

5.1. Quadratic Penalty Function

Suppose that the penalty function has the following quadratic form:

Note that, for each , , -a.s.. Thus, F is convex in and .

Observing Equation (

15), we see that the Hamiltonian is given by:

The first-order condition for maximizing the Hamiltonian

with respect to

gives the following equation:

By the definition of the admissible strategy set , we know that is bounded. If we further assume that , then . So the optimal discount rate is attained at .

The first-order condition for maximizing the Hamiltonian

with respect to

gives the following three equations:

The first-order condition for minimizing the Hamiltonian

with respect to

gives the following two equations:

Then the optimal strategy of the market is given by:

The optimal strategy of the investor is given by:

For simplicity, we assume that the compact sets and are sufficiently large and the coefficients satisfy proper conditions (e.g., boundedness and strict positivity) so that the obtained optimal strategies satisfy the boundedness conditions in the definitions of the admissible spaces, i.e., and .

Prior to default, the default risk has impacts on the optimal proportions invested in both the ordinary share and the defaultable security, if we assume that there is non-zero correlation, i.e.,

, for each

, between the dynamics of the ordinary and defaultable shares. After default, the price of the defaultable security jumps to zero

2, and hence the investor is unwilling to invest into the defaultable security. In this case, the investor allocates his/her wealth between the ordinary share and the money market account according to the Sharpe ratios. Simple calculations lead to the following closed-form expression for the difference of the optimal proportions invested in the ordinary share before and after default:

Consequently, under the assumption that , we have the following observations:

The investor should decrease (resp. increase) his investment in the ordinary share after default, i.e.,

(resp.

), if the Sharpe ratios of the ordinary share and the defaultable security satisfy the following condition:

The investor should maintain his investment in the ordinary share after default, i.e.,

, if the Sharpe ratios of the ordinary share and the defaultable security satisfy the following condition:

If the ordinary share and the defaultable security are issued by two affiliated entities, it may not be unreasonable to assume that their dynamics are correlated. If this is the case, for the sake of diversification, the investor allocates his/her money in the ordinary share and the defaultable security issued by two independent corporations, then it is not unreasonable to assume that , i.e., , for each . Thus, it is clear that the default risk can only affect the optimal proportion of the defaultable security and the optimal proportion of wealth invested in the ordinary share remains unchanged before and after default.

Jarrow et al. (

2005) showed that if there are a countably infinite number of identical corporations whose default times are independent of each other, the martingale part

M can be diversified away. Now we assume that the default risk is diversifiable. In this case, the optimal strategy

of the investor is simplified as:

if

,

. That is, the investor allocates his/her money in the ordinary share and the defaultable security according to their respective Sharpe ratios. The optimal market prices of risk

are:

Thus, the associated probability measure is a risk-neutral measure in this case.

5.2. Sub-Additive Coherent Risk Measure

Suppose that the penalty function is

Then the sub-additive risk measure becomes a sub-additive coherent risk measure.

Jarrow (

2002) discussed a similar risk measure, namely, the put premium risk measure. The put premium is the insurance cost that makes a firm’s net value remains solvent.

Jarrow (

2002) argued that adding alpha dollars to the firm will reduce the put premium by less than alpha dollars. This is exactly the idea of the put premium risk measure discussed in

Jarrow (

2002). Compared with coherent risk measure in

Artzner et al. (

1999), the put premium risk measure weakens the translation invariance axiom to a translation monotonicity axiom.

If we further assume that

, the Hamiltonian becomes:

The first-order condition for maximizing/minimizing

with respect to

and

gives:

and

So the Hamiltonian can be simplified as:

If we assume that

, the optimal discount rate is

. Therefore, the maximum value of the Hamiltonian becomes:

It follows from Theorem 5 that , for each . In other words, the sub-additive risk measure vanishes in the zero-sum game. This result is accordance with intuition thanks to the following facts:

- (1)

The default risk is assumed to be zero (the martingale part M has been diversified away);

- (2)

The diffusion risk is offset by holding opposite positions in and ;

- (3)

The discount risk is hedged by investing the outstanding proportion of wealth into the money market account.