In this section, we want to derive optimal portfolios, which include protection from losses due to changing inflation if inflation is rising or high, but decouple their performance from inflation if inflation is low. In the first step, we do this regime by regime and rather think of a one-month horizon. In the second step, we consider longer time horizons and do not assume that the regime is known in advance.

4.1. Regime-Dependent Optimal Portfolios

As correlation alone is not a reliable indicator for inflation protection, we follow [

5,

7] to also include the expected returns of the asset classes, as well as their standard deviations in our decision process. This is done within an optimization problem. According to our goal of protecting a portfolio from losses due to (rising) inflation, we do not only consider the classical mean-variance approach by [

37], but also adjust this framework to account for the risk of underperforming inflation within the optimization problem. This leads to the following two investment problems:

Optimization problem “Mean Variance (MV)”: Optimization problem “Inflation Protection (IP)”: In both optimization problems, x represents the portfolio weights, the portfolio return, I the inflation rate, the expected portfolio return and the expected inflation rate. Obviously, (MV)is the classical mean-variance approach. The Optimization problem (IP)is the modified optimization problem and mainly driven by the aspect that an investor might be interested in a portfolio that behaves similar to the inflation rate whenever inflation is high, but will be rather unhappy with a match with inflation when inflation is low. Therefore, the return component of the optimization problem considers the out-performance of the inflation rate, whereas the risk component is driven by events where inflation has been higher than the portfolio return.

Both optimization problems include the

risk aversion parameter

λ. In order to find realistic values for

λ, we apply the following approach: we consider two “benchmark” portfolios, Portfolio 1 consisting of 20% stocks and 80% bonds and a more diversified Portfolio 2 consisting of 10% stocks, 40% bonds, 10% gold, 20% real estate and 20% commodities. Here, Portfolio 1 is a standard portfolio, and Portfolio 2 is a mix of the two suggested portfolios from [

7] for moderate and high inflation, in which we included commodities as additional risky investment and added the suggested cash part to bonds. For these two portfolios, we derive implicit

λ values by setting the goal function of the optimization problems to zero. To do this, we applied the following simulation scheme to determine 100,000 asset returns and the

λ values

3:

We applied this simulation scheme for one- and 12-month time horizons and achieved the following range of λ values regarding optimization problems (MV)and (IP):

For Portfolio 1, the λ values have been 3.0087 for (MV) and 8.6436 for (IP). Portfolio 2 leads to 5.5669 for (MV) and 14.6254 for (IP). We then decided to choose the closest λ in 0.25 steps around the average of the values for Portfolio 1 and Portfolio 2 to set up our optimization problems. Thus, we apply for optimization problem (MV) and for optimization problem (IP).

Recall that the empirical time series is split into the nine regimes. As the first step, the optimization problems (MV) and (IP) are solved for every regime individually. Accordingly, the optimal portfolios in the sequel are an answer to the question: whenever the time series has been in regime

, which portfolio would have been optimal in exactly this regime

? Motivated by the transition matrix shown in

Table 3, in most of the cases, the regime stays in the current regime and does not change. Obviously not included at this point are considerations that when we assume that, e.g., the market is calm and the regime switches from high inflation (Regime 3) into a inflation transition (Regime 2), an investor may want to set up a different investment strategy than in the case when the inflation is low (Regime 1) and switches into the transition state (Regime 2). This effect is included later in the simulations to develop optimal portfolios for longer time horizons.

4.2. Monthly Time Horizon

Table 7 shows the portfolio weights and the portfolio characteristics in each regime for optimization problem (MV).

Table 8 displays the portfolio weights and the portfolio characteristics in each regime for optimization problem (IP).

As we can see, the optimal portfolios weights in the individual regimes are quite different. First, we discuss the optimal portfolios when the market is in a normal state. Regarding Regime 1, the mean-variance optimization problem (MV) leads to a stock-bond portfolio in a 2:1 ratio, whereas the inflation-adjusted optimization problem (IP) is a stock-dominated portfolio with a small portion of bonds. In Regime 2, the mean-variance approach leads to an almost constant stock position of 62.94%; the bond portion is reduced; and gold, commodities and real estate are added. Compared to the corresponding inflation-optimization problem, the stock portion is reduced to 70.22%; the bonds investment is increased; and 9.96% commodities are included. Here, commodities replace parts of the stocks due to the fact that commodities have a much higher correlation with inflation in this regime. By looking at Regime 3, there is a bigger difference between the two portfolios. The inflation-adjusted setting has commodities as the main portfolio component with 47.55%, and the rest is split into bonds and a smaller portion of gold. The mean-variance approach is dominated with 71.60% by commodities, has a comparable gold portion as the (MV) portfolio and only a small portion of bonds, 7.17%. The high expected returns of these two asset classes and the positive correlation of commodities and inflation in Regime 3 are the reason for this portfolio composition.

Now, we look at the optimal portfolios in the case of a turbulent-bearish market. In Regime 4, the (IP) portfolio consists completely of gold, and the (MV) is a split between bonds and gold; in Regime 5, 50.08% of the (IP) portfolio are gold and 43.05% bonds, and a small stock portion is added, as well. The (MV) portfolio is more diversified, with portfolio weights of 20%–30%, and only commodities are excluded. Commodities are excluded due to there negative return in this regime. The other asset classes, gold, bonds and real estate, have a return that is higher than the inflation rate and have been appropriate candidates for the optimal portfolios. The small stock portion in the (IP) portfolio can be explained by diversification effects. In Regime 6, gold leaves both portfolios. The (IP) portfolio is dominated by bonds, has a small real estate portion and a larger commodities portion. The (MV) portfolio is dominated by real estate and has in addition 22.01% bonds.

Lastly, we switch to the case when the market is turbulent-bullish. In Regime 7, both portfolios are dominated by stocks. In the (IP) case, only commodities are added; the (MV) portfolio adds commodities and bonds. In Regime 8, we observe an equal split between stocks and commodities and small portions of real estate and gold for the (IP) setting, whereas the (MV) portfolio is still dominated by 69.88% of stocks and is completed with 18.79% real estate, 9.80% commodities and 1.53% gold. In this regime, stocks have a negative correlation with inflation and commodities a strong positive correlation with inflation. This explains why commodities are more strongly included in the (IP) portfolios due to the optimization problem. In Regime 9, stocks, as well as commodities are positive correlated with inflation; for the optimal portfolios, both are strongly stock dominated, and a small gold portion is added to the portfolios. Here, commodities have not been selected as a portfolio component.

It is interesting to note that the asset classes bonds, commodities, gold and real estate are used to protect the portfolio from losses in inflation if inflation is high. If inflation is low or moderate, stocks, bonds and commodities dominate the optimal portfolios.

A clear advantage of our approach is the distinction of inflation, as well as market regimes. Especially, an investigation of the optimal inflation-protected portfolios from

Table 8 allows us to take a deeper look at the short-term (monthly) hedging properties of our investigated asset classes. Regarding stocks, e.g., [

2,

20] state that stocks do not have hedging potential in the short run, and by looking at the regimes with a high inflation state (Regimes 3 and 6), we observe that stocks are indeed not included in the optimal portfolio, except for the case that the market is turbulent-bullish (Regime 9). Thus, in times of high inflation and a normal or turbulent-bearish market, stocks are not a good choice for an optimal inflation-protected portfolio. However, else if stocks are not in a turbulent-bearish state and/or the inflation is not in a high state, we observe that stocks play an important role in the inflation-protected portfolio. Regarding real estate, we observe that it is hardly included in the case of a calm market (Regimes 1, 2 and 3). In turbulent-bearish markets (Regimes 4, 5 and 6) real estate has for the (IP) portfolios a minor role in the case of a high inflation state (Regime 6), whereas in the (MV) case, real estate has an important role in the case of inflation in transition (Regime 5) and is the dominant portfolio weight in the case of high inflation (Regime 6). Especially in the case of real estate, it becomes clear that the consideration of the market environment is crucial, and that mixed statements in the literature in favor of real estate ([

2,

28] or [

25]), as well as against real estate as an inflation hedge ([

34]) can be explained.

When the market is not turbulent-bearish, the gold portion of the portfolio increases comparing low inflation, inflation in transition and high inflation (Regime 1->2->3 and Regime 7->8->9). Thus, as a portfolio component, gold works in these cases as an inflation hedge. However, when the market is in distress, i.e., turbulent-bearish, the (IP) portfolio is gold, and the (MV) portfolio is a split between gold and bonds when the inflation is low (Regime 4). However, the gold portion is halved by taking a look at the inflation in transition optimal portfolios (Regime 5), and finally, in case of high inflation (Regime 6), gold is removed completely from the portfolios. Therefore, gold can be interpreted as a hedge against a turbulent-bearish market, but not as hedge against high inflation when the market is turbulent-bearish.

Commodities, on the other hand, are chosen as a hedge against inflation when the market is calm (Regimes 2 and 3) or when the market is in turbulent-bullish and inflation is in transition (Regime 8). For the (IP) portfolio, they are additionally included in the case of high inflation and a turbulent-bearish market (Regime 6). Though, our results are in line with, e.g., [

29,

30].

With respect to bonds, the general opinion in the literature is that they do not work as an inflation hedge for short time horizons (e.g., [

2,

17]). Our results show that bonds play hardly any role in turbulent-bullish markets (Regimes 7, 8 and 9). However, due to the negative correlation between bonds and stocks, bonds are an important portfolio component when the market is in distress (Regime 4, 5 and 6). When the market is calm (Regimes 1, 2 and 3), bonds are included in the portfolios, but compared to other portfolios components, they are in these cases not the return drivers of the portfolio.

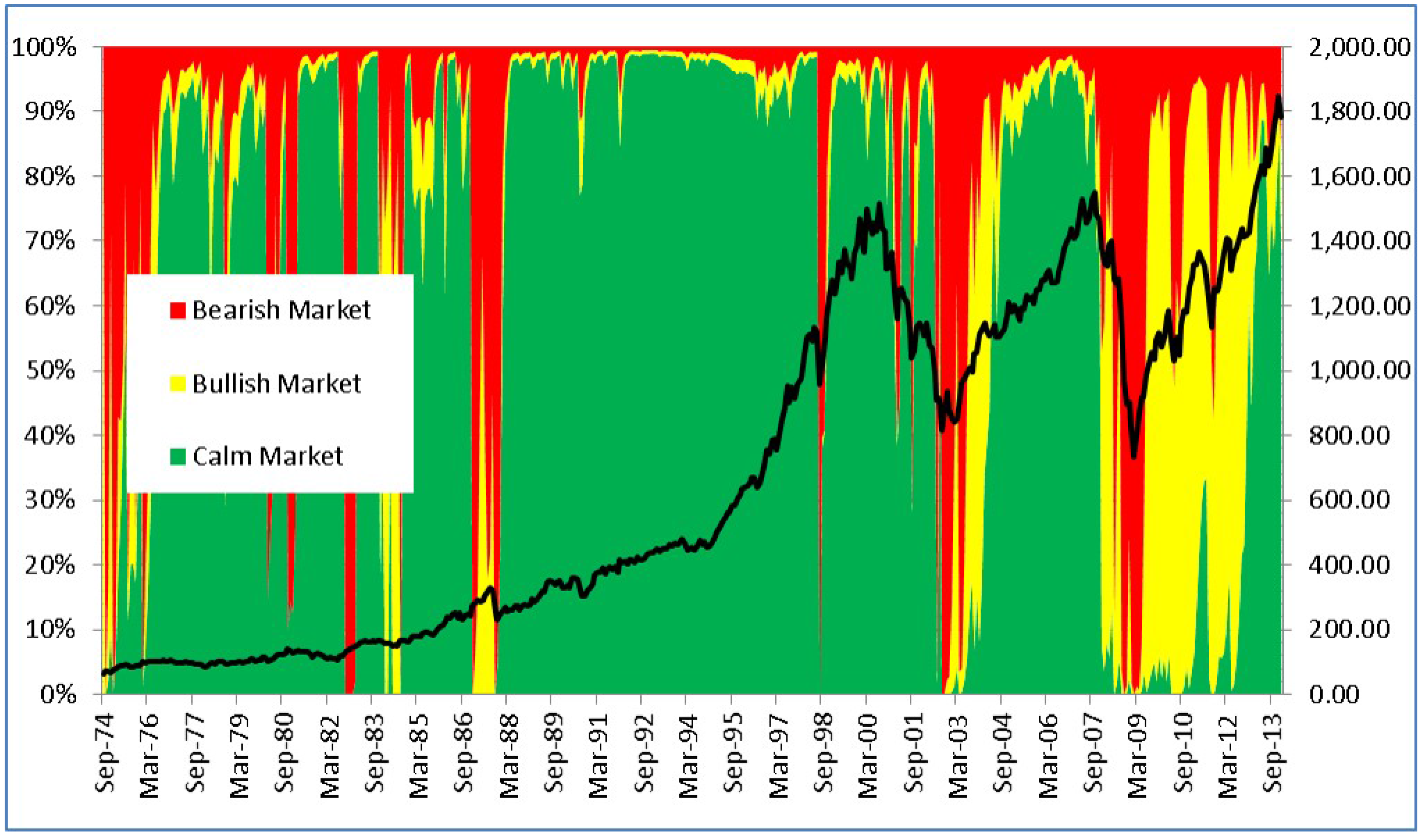

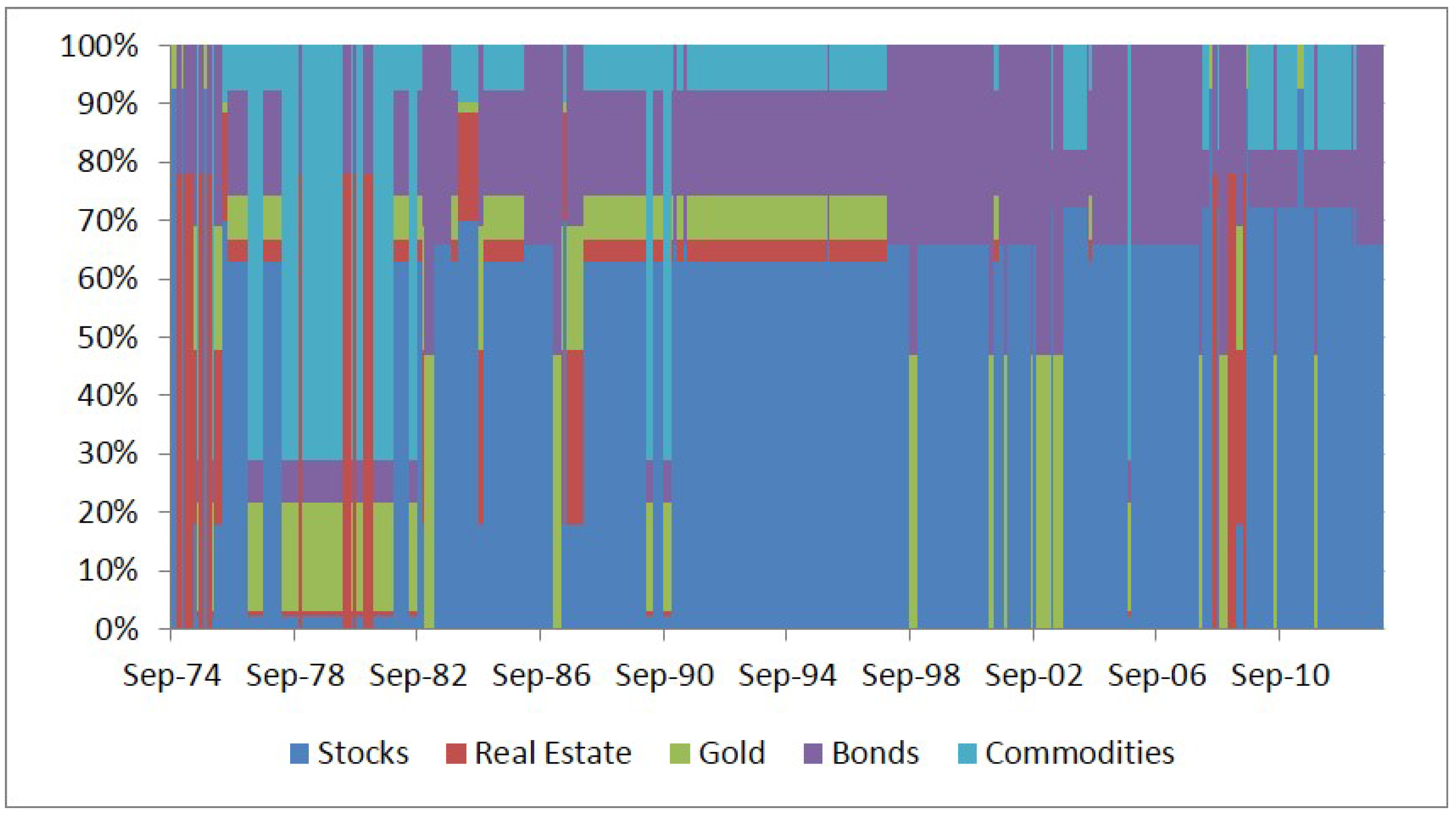

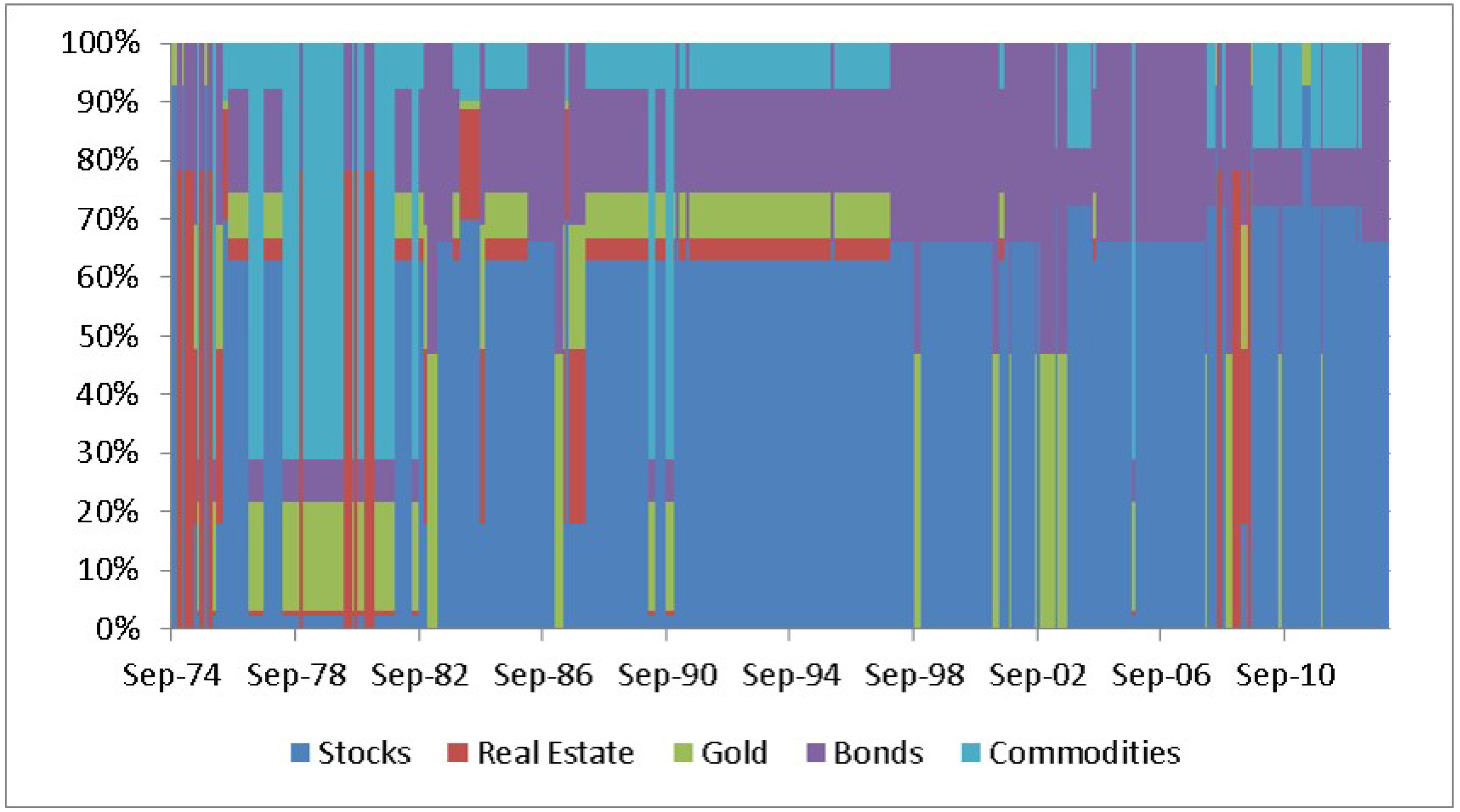

Summing up, for general statements about short-term inflation-hedging properties of stocks, real estate, gold, commodities and bonds, it is crucial to incorporate the inflation regime, as well as the market regime. As the last step in this subsection, we take a look at the selection of the optimal portfolios over time. Therefore, the classification of S&P 500 and the inflation rate is done on a monthly basis. Here, we included for the classification of month

i only the data history until month

i. Then, we followed the investment idea, that if month

i is in regime

s, also the following month

will be in regime

s. As optimal portfolios, we have selected the according (IP) portfolios from

Table 8, and

Figure 4 illustrates the optimal portfolios over time. Analogously, we have taken the according (MV) portfolios from

Table 7, and the portfolio decomposition is shown in

Figure 5.

This procedure allows us to take a look at the performance of our (IP) portfolio during several crises and to compare it to other portfolios. As benchmarks, we used the mean variance (MV) portfolio, applying the similar strategy to the optimal portfolios from

Table 7, and a 50% stock/50% bond portfolio, as well as an equally-weighted so-called

-portfolio.

Table 9 and

Table 10 as well as

Figure 6 show the results. By looking at the performance over the whole time period, the (IP) portfolio and the (MV) portfolio show strong results. This indicates that due to the Markov-switching approach, we do not only achieve protection against negative movements, but also enable the portfolio to use upside potential. When we look at the S&P 500 rally from December 1987 until March 2000, we see that our portfolios have an acceptable performance, although in these cases, the benchmark strategies are slightly better. During the second oil crisis (January 1979–June 1980), the early 1980s recession (July 1981–November 1982), the First Gulf War (August 1990–March 1991), Hurricane Katrina and the aftermaths (August–December 2005) and the financial crisis (July 2007–June 2009), we observe that in each crisis, the (IP) portfolio outperforms the inflation rate, as illustrated in

Table 10. We clearly see that the (MV) portfolio does not beat the inflation rate in the early 1980s recession. This follows directly from the optimization approach. The (MV) problem does not link the performance to the inflation rate, whereas the (IP) portfolio directly considers the inflation rate. The performance of the 50% stock/50% bond portfolio is not linked to the inflation rate at all, and thus, the performance depends mostly on the market regime. Lastly, we take a look at the

-portfolio. Here, we see that often, diversification seems to be a key element for the portfolio decomposition. In all crises, the performance of the portfolio exceeds the inflation rate, but at least during the First Gulf War, it exceeds the inflation rate only slightly. Thus, diversification itself may not guarantee an inflation-protected portfolio. Additionally, we see that during every crisis, except for the early 1980s recession, the performance of the (IP) portfolio is higher than the 50% stock/50% bond portfolio and the

-portfolio. For a risk-adjusted perspective, we include in

Table 9 the standard deviation, the Sharpe ratio, the Omega and the maximum drawdown for the strategies over the whole period, as in

Figure 6 and in

Table 11 and

Table 12, for different crises periods. As a benchmark for the Sharpe ratio and the Omega, we used the inflation rate. Thus, the Sharpe ratio and Omega are derived considering the monthly excess returns of the investment strategies over the inflation rate. Focusing on the whole period, we observe that the (MV) portfolio has the highest Sharpe ratio and highest Omega, closely followed by the (IP) portfolio. Nevertheless, the higher volatility of the (IP) portfolio leads to the highest maximum drawdown, which can be traced back to the time period from March 2002–October 2006, in which the minimum was obtained in September 2004. For individual crisis periods, we observe a mixed picture. Due to strong diversification effects of the

-portfolio and the high percentage of bonds in the 50% stock/50% bond portfolio, the standard deviation of these portfolios is usually lower than in the (IP) and (MV) portfolios. This results in a generally higher maximum drawdown in the (IP) and (MV) portfolios. The (IP) portfolio has, except for the early 1980s recession and Katrina, a Sharpe ratio and an Omega in a comparable region to the highest according values, and during the First Gulf War, the (IP) portfolio has the highest Sharpe ratio.

Overall, we conclude that our presented (IP) portfolio provides a strategy to protect the portfolio returns against inflation and to incorporate upside potential. By additionally taking into account the market regime by constructing portfolios with the focus on inflation protection, the resulting portfolios also offer some incorporated protection against market turbulences when the inflation stays low, as seen in the financial crisis. Finally, a comparison to benchmark strategies supports the relevance of the combination of Markov-switching models for the inflation rate, as well as the market indicator to develop inflation-protected strategies.

4.3. Longer Time Horizons

Due to the fact that the empirical time series is limited for investigating longer time horizons, simulations are used to create return series for longer time periods. To do this, we apply the following Markov-switching model to the return time series of the different asset classes: the monthly returns are simulated based on the parameters and the transition matrix of the Markov-switching model in order to allow regime switches for the monthly returns as described above in Steps 1–4 on page 13. By focusing on longer time horizons, the transition matrix in

Table 3 is considered. Thus, by simulating a 12-month return, the transition probabilities are included, and more importantly, for the asset parameters, it does not only depend in which regime we are in month

i, it is also considered in which regime we have been in the previous month

. Recalling the example given in the previous subsection for monthly optimal portfolios, in our simulation, it is a difference if we get into a normal market state with inflation in transition (Regime 2) when the previous month has been in a normal market and high inflation state (Regime 3) or in a normal market and low inflation state (Regime 1); e.g., bond returns could behave differently when we switch from a high inflation into an inflation in transition state than when we switch from a low inflation state into an inflation in transition state. Therefore, in Step 3 of the simulation described on page 13, the average returns of the underlying factors in Regime

i depend on the empirical returns whenever Regime

i occurs in the time series combined with an expert view reflecting especially the switch from the previous regime into Regime

i. At this step in our simulation, the Black–Litterman approach allows us to incorporate expert views. In this paper, we restricted ourselves to use the empirical observations as expert views. We illustrate this by an example: Assume in our simulation, in month

i, we are in Regime 3. At this point, we use for the simulation of the underlying returns not only the parameters estimated on a dataset consisting of all observations when Regime 3 occurred. The transition matrix in

Table 3 shows that in 41 cases, the previous month

has also been in Regime 3, but in five cases, the previous month has been in Regime 2; this means the inflation went from a transition into a high inflation state. Additionally, in four cases, the previous month has been in Regime 6,

i.e., a high inflation and turbulent-bearish market, and the market went from being turbulent-bearish to being normal. In one case, the market has previously been positive-turbulent (Regime 9), and in one case, the inflation has been in a low inflation state (Regime 1). Summarizing, several paths could have led to being in Regime 3 at month

i. We could have come from a previous month with a turbulent-bullish or turbulent-bearish market, as well as from a previous month with an already calm market, but inflation in a transition or calm state. Therefore, due to the fact that in our simulation, at each month

i, the regime of the previous month

is known, the estimation of the parameters for the underlying returns in month

i is supplemented by an expert view based on the according regime change from the regime

of the previous month to Regime 3.

As the next step, the monthly returns are combined to create returns for investment horizons of 12, 60, 120 and 240 months. For every time horizon, 100,000 returns are calculated. Based on this set of return series, the optimization problems (MV) and (IP) are solved to determine the optimal portfolios.

Table 13 contains the optimal portfolios for optimization problem (MV) and

Table 14 for optimization problem (IP).

By increasing the time horizon, we see that the mean-variance approach results in diversified portfolios consisting of roughly 43% stocks, 20% real estate, 23% bonds, 7% gold and 7% commodities. This portfolio remains relatively stable over time. On the other hand, the inflation-adjusted portfolio leads for a relatively short time horizons to a diversified portfolio consisting of stocks, bonds, gold and commodities with stocks playing the dominant part of the portfolio, while for longer time horizons, the portfolio only consists of stocks and bonds with an increasing bond part. Thus, by focusing on an inflation-protected investment strategy, the time horizon is crucial. While gold and commodities are only considered on a short-term horizon, stocks and bonds are used as inflation-protecting assets for longer time horizons. Here, we go hand in hand with the results of [

2,

16] (stocks) and [

2,

17,

24] (bonds).