4.1. Reformulation as a Controller vs. Stopper Game

Let

be the wealth process in a crash-free market controlled by the pre-crash strategy

: then,

follows the stochastic differential equation (SDE):

where

solves Equation (

1). At the crash time

τ the investor’s wealth equals

, and the interest rate is denoted by

. Considering the post-crash value function, we can replace

by these values, and therefore, we can reformulate the worst-case optimization problem in (

2) as the pre-crash problem:

Since

, given in Equation (

8), is strictly monotone increasing with respect to

x, this problem can be rewritten as a controller

vs. stopper game of the form:

and

.

Remark 2. Compared to the previous literature, where a non-negative strategy was required, we have now included the positive part of pre-crash strategies k in the controller vs. stopper game. First, as already mentioned, the optimal post-crash strategy can become negative. It would therefore be conceptually bad to exclude negative pre-crash strategies. This is in particular due to the fact that there is nothing preventing us from following the optimal post-crash strategy before the crash, given that it is negative. In such a setting, the investor will benefit two-fold. On the one hand, he behaves optimally with regard to the terminal wealth utility criterion. Even more, having a negative position, he would benefit from a positive crash height at such a time instant. It is thus clear that in this situation, the worst case for the investor is a jump of size zero. Further, for all pre-crash strategies, the worst case is a crash of size zero when they attain negative values. As it makes no sense from the point of optimal final utility to hold a position smaller than , we can thus also restrict the class of admissible strategies for our worst-case problem to those that are bounded from below by and, thus, are bounded in total. Therefore, if , then the worst case crash size is . Otherwise, if , the investor holds risky assets at the crash time, and the worst-case is the maximal crash size .

Now, the aim is to solve the controller

vs. stopper game (

10). As already mentioned above, [

6] and [

5] used the notion of indifference to determine the optimal pre-crash strategy for a model with a constant interest rate. Therein, a pre-crash strategy

is called an indifference strategy if the investor, who applies this strategy, reaches the same performance for two different stopping times, which means (see, for example, [

6], Chapter 4.2):

for all stopping times

. In the next section, we will also use this definition to identify the optimal pre-crash strategy.

4.2. Identification of Optimal Pre-Crash Strategy by the Martingale Method

The main result of this paper is the following theorem, which gives the optimal pre-crash strategy for the worst-case optimization problem in (

2).

Theorem 2. Let be the optimal post-crash strategy given by Equation (9), and let be the uniquely determined solution of the following ordinary differential equation (ODE):where:and is given by Equation (

7).

Then, is the optimal pre-crash strategy for the worst-case optimization problem in (

2).

Remark 3. Note that for general parameters and (i.e., the model indeed contains a stochastic interest rate), ODE Equation (

11)

is a non-autonomous equation, because is not constant over time. In order to prove this result, we give a sequence of auxiliary results. The first Lemma ensures that is an admissible pre-crash strategy in the sense of Definition 1.

Lemma 3. Let and be given by Equation (

9)

and (

12),

respectively. Then, the ordinary differential equation:has a uniquely determined solution with for all . Remark 4. Since is a deterministic, continuous and bounded function on , it is easy to check that it is admissible in the sense of Definition 1. Especially, the lemma above provides the inequality for all . Thus, following this strategy before the market crash, the investor’s wealth stays positive at the crash time.

In the next lemma, we will show that an investor who applies the pre-crash strategy

is indifferent with respect to the market crash, which means

is an indifference strategy for the controller

vs. stopper game (

10).

Lemma 4. Let be the uniquely determined solution of the ODE Equation (

11)

, and let be given by Equation (

10)

for and . Then, is a martingale on and is an indifference strategy for the controller vs. stopper game. Proof of Lemma 4. As in [

5], we use a martingale argument to prove the assertion. The proof will be divided into two steps. First, we show that

is a martingale on

, and then, we obtain the assertion by applying Doob’s optional sampling theorem.

By applying Ito’s formula on

and using that

for all

, we obtain that:

Here, we used that

solves Equation (

6) for all

. Because of the fact that

fulfills Equation (

11), it remains to show that:

is a martingale. The solution of this linear SDE is given by:

By Novikov’s condition (see, for example, [

12], Corollary 5.13), the second factor is a martingale, and therefore,

is a martingale on

. It remains to show, that

By definition of

and with

, we have:

Finally,

is a martingale on

. By Doob’s optional sampling theorem, we obtain:

for all stopping times

. By definition,

is thus an indifference strategy for the controller

vs. stopper game (

10). ☐

Due to the martingale property of the process

, we also obtain an indifference frontier, which prevents the investor from too optimistic of an investment (see, e.g., [

6], p. 343): let

be an arbitrary admissible pre-crash strategy, and let

be the solution of ODE (

11); then,

is a martingale on

. Define

and:

Then, as in ([

6], Lemma 4.3), we obtain by the martingale property that:

Consequently, it is sufficient to consider pre-crash strategies

with

for all

. The optimal strategy cannot cross the indifference frontier

, because one can then improve its performance by cutting it off at

, and therefore, it would not be optimal. Thus, the optimal pre-crash strategy is an element of the set:

The next lemma will show that is optimal in the no-crash scenario in the class . This result is an important part of the proof of Theorem 2.

Lemma 5. Let be given by Equation (

9)

, and let be the uniquely determined indifference strategy as a solution of Equation (

11)

. Then, the solution of the constrained stochastic optimal control problem:is given by . Proof of Lemma 5. Let

denote the value function of the constrained stochastic optimal control problem Equation (

15). To obtain it, we consider the corresponding HJB equation given by:

By the standard separation method

with

for all

, we can reduce the HJB equation to an equation for

. By the first order condition, we obtain a candidate for the optimal control:

Inserting

in the equation and applying

with

and

, we obtain (with Equation (

7)) that:

and:

Therefore, we conclude that:

solves the HJB Equation (

16). Using the same arguments for the verification result as in ([

8], Corollary 3.2), we obtain that:

is the optimal control for the constrained optimization problem, because

for all

. ☐

Remark 5. Lemma 5 shows that is the optimal strategy in the no-crash scenario in the class . Note that the value function only differs from the post-crash value function by the factor instead of .

Now, using Lemma 3–5, we prove Theorem 2.

Proof of Theorem 2. We have to show that

is the optimal strategy for the controller

vs. stopper game (

10). Then, by the arguments of

Section 4.1, we obtain that

is the optimal pre-crash strategy for the worst-case optimization problem Equation (

2).

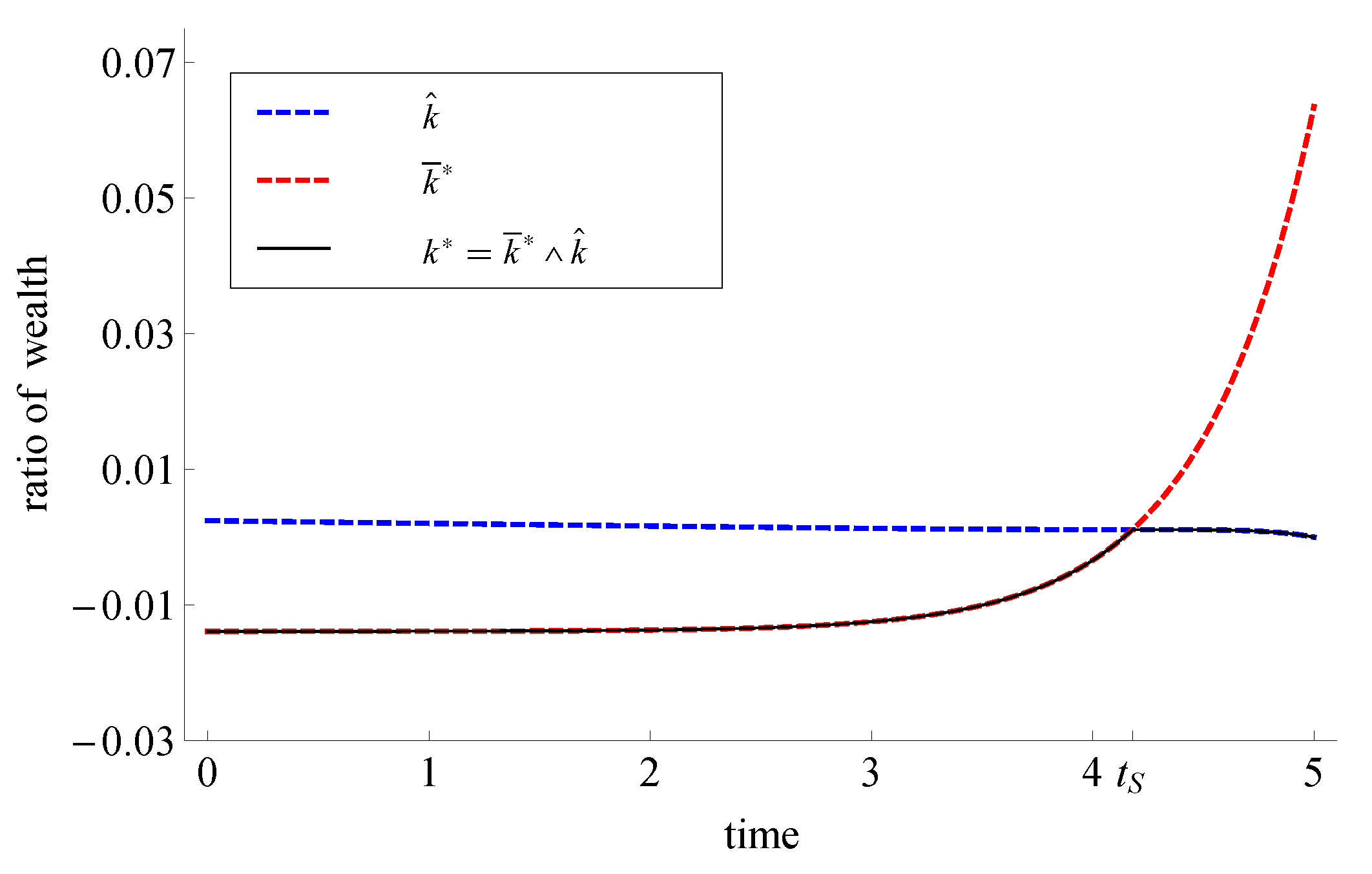

Let . Since and , the infimum is attained at , which is the point of intersection of and (if it exists).

Now, let us consider the stochastic process on the interval . For , we have . In Theorem 4, we already proved that is a martingale on , and therefore, is a martingale on . Note that if , that means for all , then is a martingale on . In particular, this is the case if (see Lemma 6 below).

Now, let , and assume that , which means there exists a (uniquely determined) intersection point of and , denoted by . Moreover, let us define . If , then denotes the uniquely determined root of , because it is strictly monotone increasing for .

Let us consider the stochastic process with on the interval .

For

, we have:

With:

we have:

Now, by Novikov’s condition, the second factor is a martingale on

. As further,

is

-measurable for

, we have for

:

The inequality above holds because of two arguments: First, we observe that

for

, and therefore, the integrand of the deterministic integral is positive. Secondly, we only have to consider the cases

and

(because of

) for the estimate of the deterministic integral. For both of these cases, we easily obtain that:

for

because

for

and

for

. By the arguments above, we obtain that

for

. Therefore,

is a supermartingale on

. If

, we obtain, together with the martingale property on

, that

is a supermartingale on

.

Otherwise, if

, then we have to consider

on the interval

. By assumption, we have that

, and therefore,

for

. For

, we obtain:

Again, by Novikov’s condition, we obtain that is a martingale on .

Finally,

is a supermartingale on

(for

,

is even a martingale on

). By Doob’s optional sampling theorem (see, for example, ([

13], Theorem 16)), we have:

The inequality implies that is a worst-case scenario for the strategy .

Analogously, to the indifference optimality principle in [

6] and [

5], we have:

The second inequality holds, because

is optimal in the no-crash scenario (see Lemma 5). By inequality (

18),

is the optimal strategy for the controller

vs. stopper game in the class

. Due to the indifference frontier, that means, due to the fact that the optimal strategy is in the class

, we obtain that

is the optimal pre-crash strategy for the worst-case optimization problem in (

2). Obviously,

is admissible in the sense of Definition 1, because it is a deterministic, continuous and bounded function on

. Due to the fact that

for all

(see Lemma 3), we easily obtain that

for all

. ☐

Lemma 6. Let . Then, for all , where is a solution of Equation (

13)

and is the optimal post-crash strategy given by Equation (

9).

Remark 6. For the case , we obtain that for all , and therefore, . By Lemma 4, we obtain that is a martingale on . In this case, we have an equality instead of the first inequality in Equation (

18)

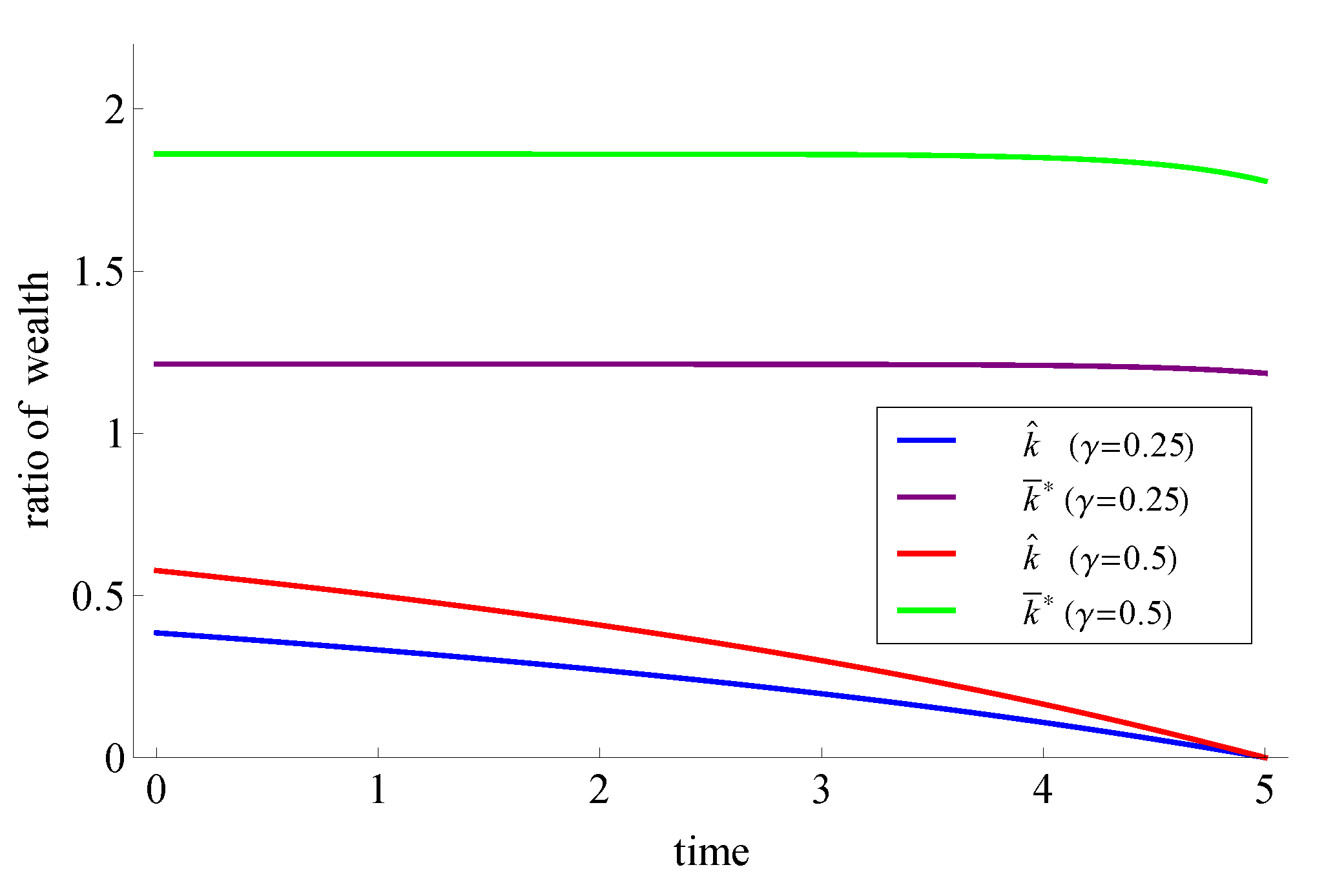

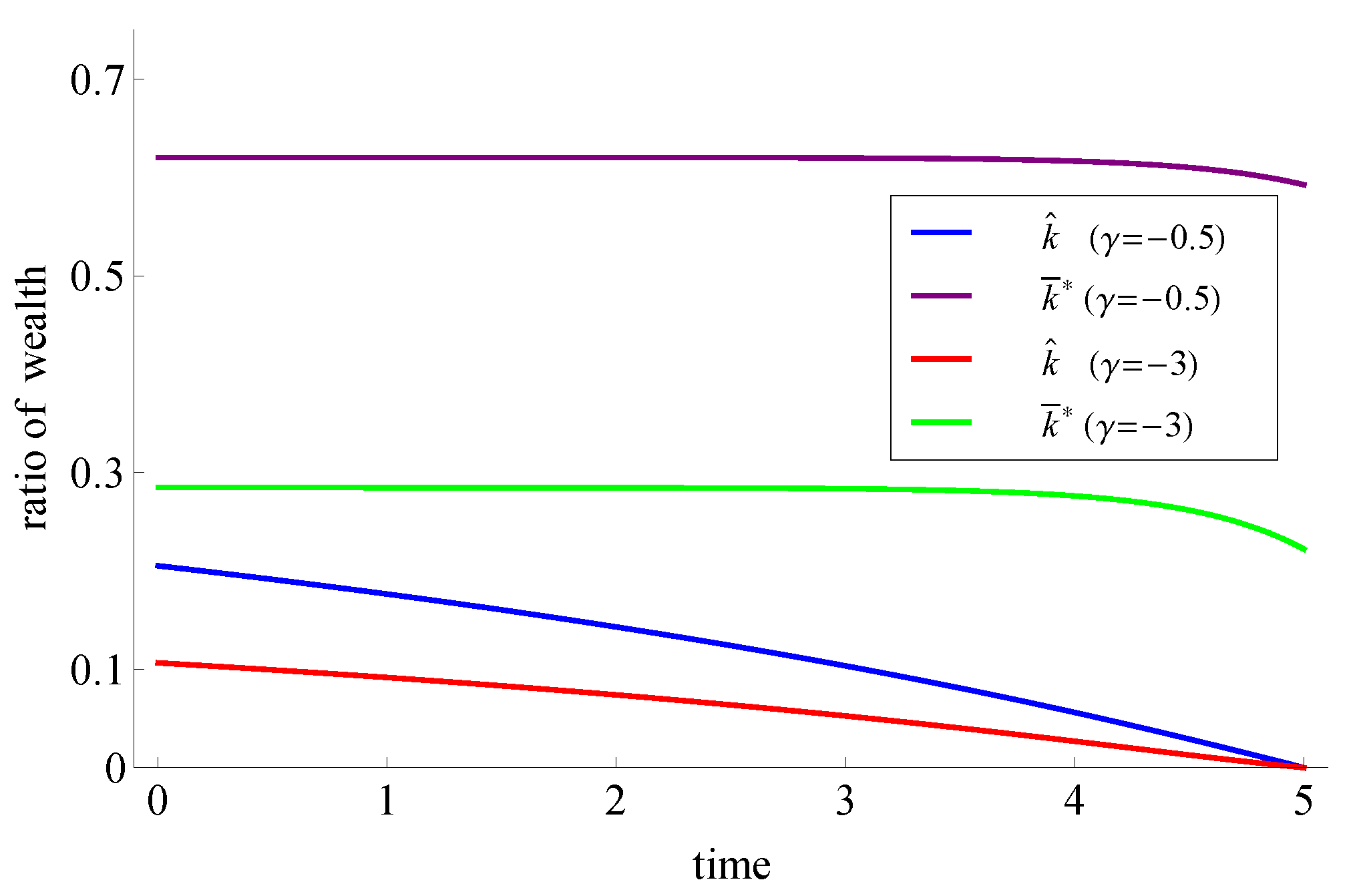

, because of Doob’s optional sampling theorem for a martingale. Therefore, if , then it is optimal to follow the indifference strategy before the market crash. For the special case of , which occurs when either the price and the interest rate are uncorrelated or (log-utility case), we obtain the optimal post-crash strategy given by: Moreover, the optimal pre-crash strategy has to fulfill ODE (

11)

, which reduces to the same ODE given in ([6], Equation 4.3) for this special case. In the next section, we can illustrate the strategies that are optimal before and after the market crash, respectively.