Optimal Consumption and Investment with Labor Income and European/American Capital Guarantee

Abstract

:1. Introduction

2. Setup

3. The Unrestricted Control Problem

4. The European Capital Guarantee Control Problem

- (1)

- The strategy is affordable, i.e., there exist a unique , such that the budget constraint (22) is fulfilled.

- (2)

- The strategy is optimal for the European capital guarantee control problem given by (20).

- (1)

- Take a loan of size and reserve the labor income to pay back the loan over the time interval .

- (2)

- Reserve the initial amount of money, , to follow the consumption and investment strategy given by:Doing this, the investor replicates the portfolio, , i.e., the investor replicates the terminal value (see Remark 2).

- (3)

- Use the remaining initial amount of money, , to buy a European put option with strike price K and time to maturity T written on the portfolio, .

5. The American Capital Guarantee Control Problem

5.1. An Admissible American Put Option-Based Portfolio

5.2. The Optimal Strategy

- The strategy is optimal for the American capital guarantee control problem given by (26).

- (1)

- Take a loan of size and reserve the labor income to pay back the loan over the time interval .

- (2)

- Reserve the initial amount of money to follow the consumption and investment strategy given by:Doing this, the investor replicates the portfolio (see Remark 2).

- (3)

- Use the remaining initial amount of money to buy an American put option with strike price , and time to maturity T written on the portfolio .

- (4)

- The first time (say τ) drops below the optimal exercise boundary, b, sell the American put option. Not taking the loan we made in (1) into account, the portfolio will then be worth .9 Reserve now the amount of money to follow the consumption and investment strategy given by:Doing this, the investor replicates the portfolio, . Use the remaining initial amount of money to buy an American put option with strike price and maturity T written on the portfolio, .

- (5)

- In case the new portfolio, , drops below the optimal exercise boundary, b, at some point in time, , repeat Step 4.

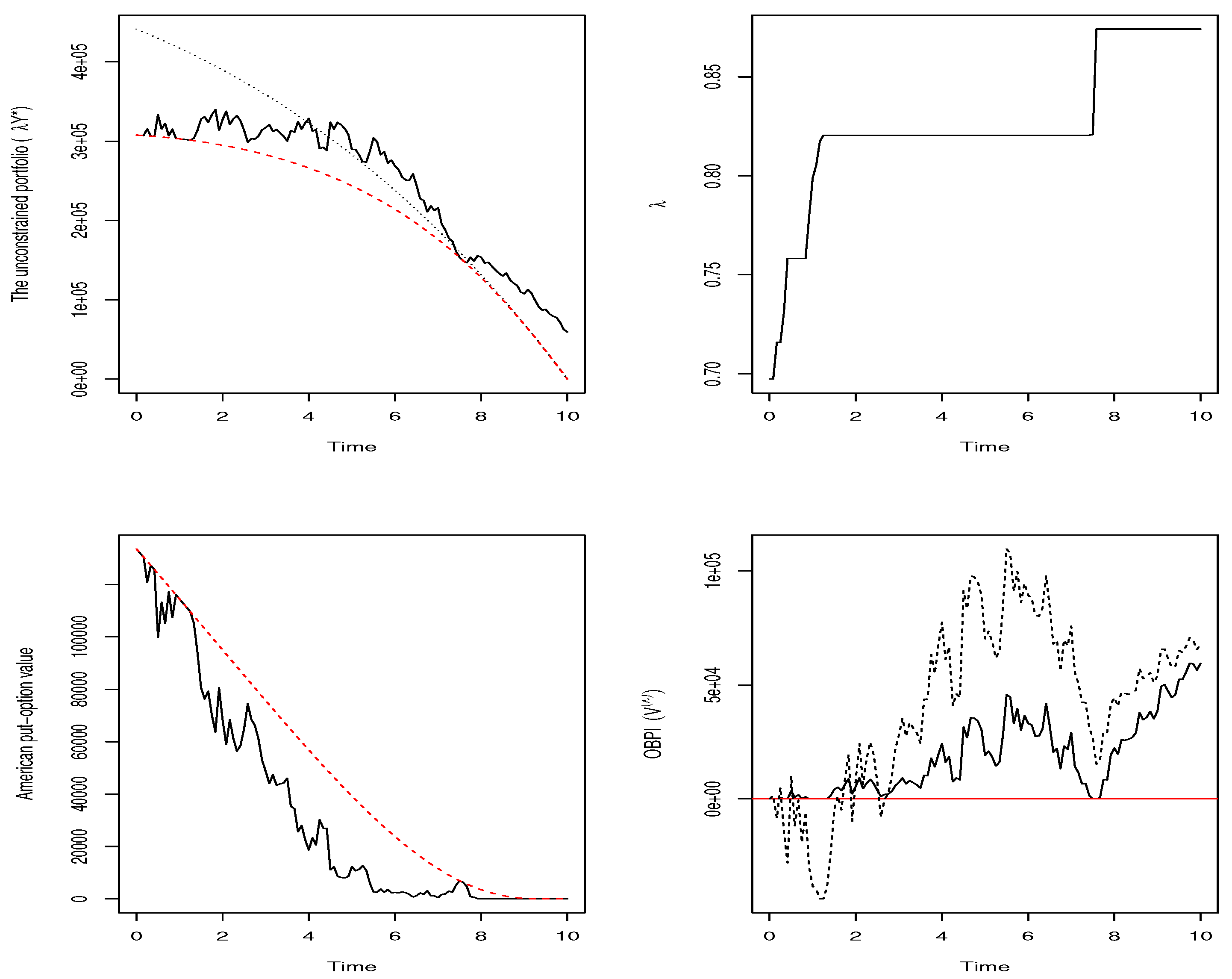

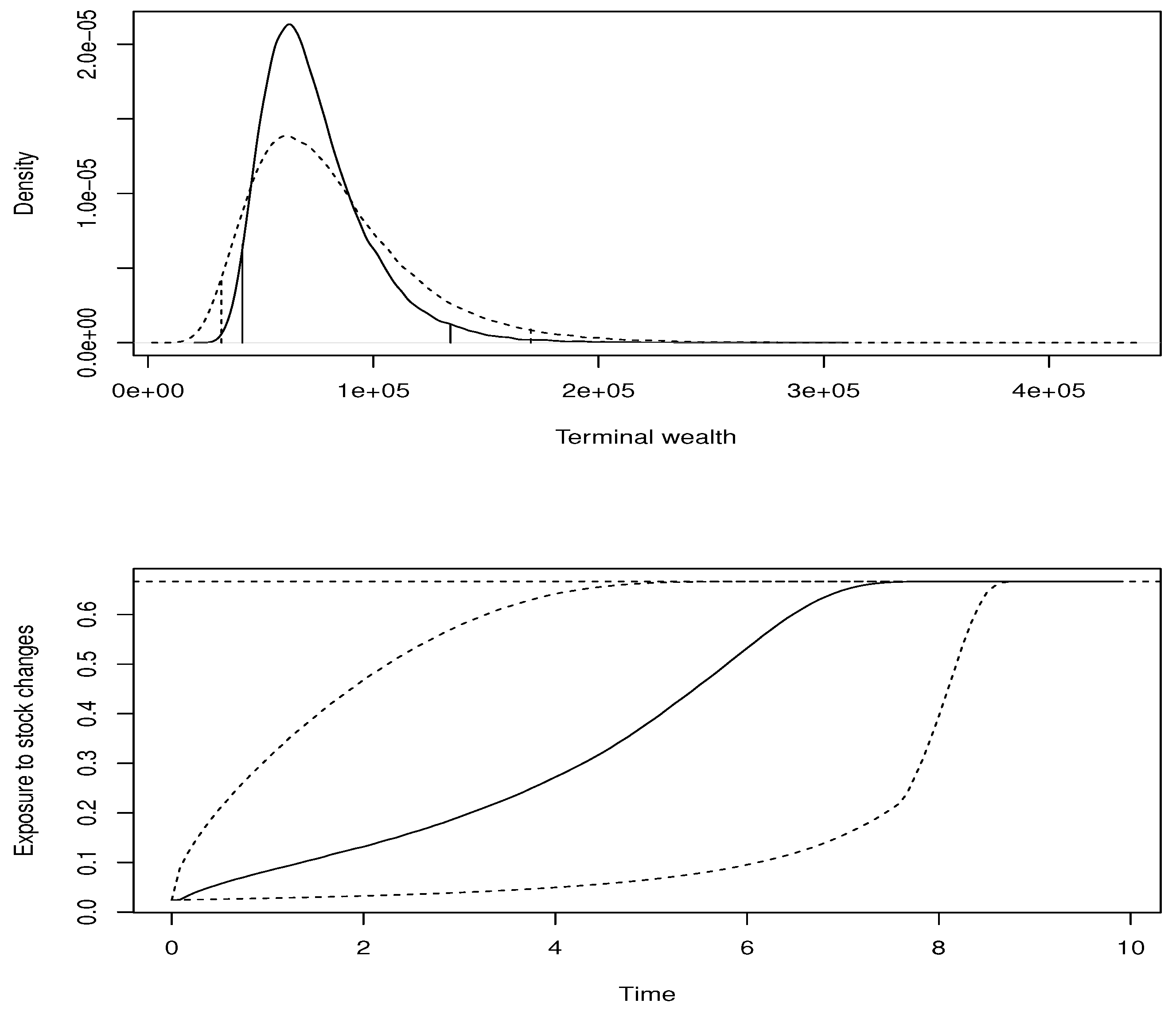

5.3. Numerical Illustrations

6. Conclusions

Acknowledgments

Conflicts of Interest

References

- R. Merton. “Lifetime portfolio selection under uncertainty: The continuous-time case.” Rev. Econ. Stat. 51 (1969): 247–257. [Google Scholar] [CrossRef]

- R. Merton. “Optimum consumption and portfolio rules in a continuous-time model case.” J. Econ. Theory 3 (1971): 373–413. [Google Scholar] [CrossRef]

- I. Karatzas, J.P. Lehoczky, and S.E. Shreve. “Optimal portfolio and consumption decisions for a `small investor’ on a finite horizon.” SIAM J. Control Optim. 27 (1987): 1157–1186. [Google Scholar] [CrossRef]

- J.C. Cox, and C.F. Huang. “Optimal consumption and portfolio policies when asset prices follow a diffusion process.” J. Econ. Theory 49 (1989): 33–83. [Google Scholar] [CrossRef]

- J.C. Cox, and C.F. Huang. “A variational problem arising in financial economics.” J. Math. Econ. 20 (1991): 465–487. [Google Scholar] [CrossRef]

- N. El-Karoui, M. Jeanblanc, and V. Lacoste. “Optimal portfolio management with American capital guarantee.” J. Econ. Dyn. Control 29 (2005): 449–468. [Google Scholar] [CrossRef]

- P. Lakner, and L.M. Nygren. “Portfolio optimization with downside constraints.” Math. Financ. 2 (2006): 283–299. [Google Scholar] [CrossRef]

- H. He, and H.F. Pagès. “Labor income, borrowing constraints, and equilibrium asset prices.” Econ. Theory 3 (1993): 663–696. [Google Scholar] [CrossRef]

- N. El-Karoui, and M. Jeanblanc. “Optimization of consumption with labor income.” Financ. Stoch. 2 (1998): 409–440. [Google Scholar] [CrossRef]

- D. Duffie, and T. Zariphopoulou. “Optimal investment with undiversifiable income risk.” Math. Financ. 3 (1993): 135–148. [Google Scholar] [CrossRef]

- D. Duffie, W. Fleming, H. Soner, and T. Zariphopoulou. “Hedging in incomplete markets with HARA utility.” J. Econ. Dyn. Control 21 (1997): 753–782. [Google Scholar] [CrossRef]

- H. Koo. “Consumption and portfolio selection with labor income: A continuous time approach.” Math. Financ. 8 (1998): 49–65. [Google Scholar] [CrossRef]

- C. Munk. “Optimal consumption/investment policies with undiversifiable income risk and liquidity constraints.” J. Econ. Dyn. Control 24 (2000): 1315–1343. [Google Scholar] [CrossRef]

- I. Karatzas, and S.E. Shreve. Methods of Mathematical Finance. New York, NY, USA: Springer-Verlag, 1998. [Google Scholar]

- W.H. Fleming, and R.W. Richel. Deterministic and Stochastic Optimal Control. New York, NY, USA: Springer-Verlag, 1975. [Google Scholar]

- I. Karatzas, and S.E. Shreve. Brownian Motion and Stochastic Calculus. New York, NY, USA: Springer-Verlag, 1991. [Google Scholar]

- B.A. Jensen, and C. Sørensen. “Paying for minimum interest rate guarantees: Who should compensate who? ” Eur. Financ. Manag. 25 (2001): 183–211. [Google Scholar] [CrossRef]

- L. Teplá. “Optimal investment with minimum performance constraints.” J. Econ. Dyn. Control 25 (2001): 1629–1645. [Google Scholar] [CrossRef]

- 1.Initial wealth plus the financial value of future labor income.

- 2.In addition, most banks require the investor himself to provide (say) five percent funding.

- 3.In some countries, this is actually possible, but since expenses are incredible high, we assume that the investor does not consider this as an opportunity.

- 4.In particular, , is a geometric Brownian motion if β is constant.

- 5.In the case of equality in (21), the investor has no choice, but to invest all his wealth, including labor income, in the risk-free short rate to be sure to fulfil the capital guarantee.

- 6.In the case of equality in (27), the investor has no choice, but to invest all his wealth, including labor income, in the risk-free short rate to be sure to fulfil the capital guarantee.

- 7. now means differentiating w.r.t. the second variable.

- 8.It is implicit, given that now refers to an American put option written on the portfolio, .

- 9.Taking the loan we made in (1) into account, the portfolio is worth , i.e., we stand at the capital guarantee boundary.

- 10.This ensures that the stochastic integral in (43) is well-defined.

- 11.We have used (16). Note that , is a geometric Brownian motion, since we have chosen β to be constant.

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Kronborg, M.T. Optimal Consumption and Investment with Labor Income and European/American Capital Guarantee. Risks 2014, 2, 171-194. https://doi.org/10.3390/risks2020171

Kronborg MT. Optimal Consumption and Investment with Labor Income and European/American Capital Guarantee. Risks. 2014; 2(2):171-194. https://doi.org/10.3390/risks2020171

Chicago/Turabian StyleKronborg, Morten Tolver. 2014. "Optimal Consumption and Investment with Labor Income and European/American Capital Guarantee" Risks 2, no. 2: 171-194. https://doi.org/10.3390/risks2020171