1. Introduction

The state of an enterprise at each stage of its life cycle is constantly changing due to the influence of external and internal factors. This is reflected in certain quantitative parameters that determine the level of use of its potential. This system transformation from one state to another fits into the framework of its development only if external and internal disturbances do not go beyond the safe range for the system. If the range boundaries are violated, the system loses stability, disintegrates, or accumulated quantitative changes lead to a completely different system (

Kostyukhin 2021).

When transiting to a new system, certain risk factors may affect an enterprise. Therefore, it is advisable to consider the basic principles of risk management that need to be developed, systematised and used to maintain the smooth operation of the enterprise.

The views and approaches to the existing problems in the field of risk management have changed and led to the formation of a new model of integrated risk management, which comprehensively takes into account the risks for all departments and areas in a company (

Kostyukhin 2021). The use of the proposed model has made it possible to assess all types of risks due to the optimal ratio between methods and models for determining specific types of risks (

Sychev 2017).

The use of risk management principles is the main part of an enterprise management process. The risk management system is formed at the initial stage in the form of a concept and then risk management procedures are developed with their subsequent implementation. At each stage of the formation and implementation of a risk management system, it is necessary to keep records of key risk indicators. It is necessary to take into account the fact that risk management should contribute to achieving financial efficiency, improving product quality and increasing the value of a company. At the same time, risk management should distinguish between ways of dealing with situations and determine the adoption of informed decisions, as well as use the results to take measures to prevent adverse consequences.

It is also necessary to study in detail the uncertainty of the results of management decisions, taking into account the main factors of uncertainty of financial results, their nature and the definition of ways to control the uncertainties that have arisen (

Hanggraeni et al. 2019;

Sidorova 2019;

Tolstykh et al. 2020).

Quantitative (including probabilistic) and qualitative assessment of risk management information can be based on the use of the latest and most accurate information from various sources, including the results of research and forecasts, expert assessments, and statistical studies, resulting in a continuous process of interaction with key stakeholders to finance the project (

Kostyukhin 2021).

Taking into account internal and external characteristics, the human factors, namely the abilities, motivations and intentions of people who can influence the implementation of the tasks and goals of the project (

Sobocka-Szczapa 2021;

Kruzhkova et al. 2018;

Sidorova 2020), are also defined as key risk indicators. The timely involvement of project team members or decision makers at all levels of a company should ensure the relevance of risk management measures. Risk management requires constant management support in the process of forming a risk management policy, ensuring compliance of risk management goals with the goals and strategy of a project, as well as in ensuring the risk management process, which are the resources necessary to fulfil the tasks and goals (

Tertychnaya et al. 2016).

Use of the most relevant information is an important condition for risk identification. Description of the risk will form the basis for the formation of a “risk Profile” of the enterprise, which summarizes data on the description of the risk, existing control mechanisms, planned measures to reduce the level of risk, and who is responsible for the measures (

Bugrov 2003). The formation of a “risk map” will make it possible to clearly formulate priority areas in terms of risk management, determine the most effective control methods (

Gracheva 2009) and conduct a risk assessment.

To date, there are many methods of risk assessment based on the theory of financial instruments (

Aswath 2011) and statistical analysis (

Sadovsky 1974;

Blank 2004). However, these methods unfairly ignore expert and matrix methods, which allow reliable results to be obtained in the absence of formalized problems and in the presence of a lot of information noise.

Most of the known methods used in the analysis of the functioning of complex organizational systems require significant amounts of diverse source information and often do not provide comprehensive assessments of the effectiveness of the main performance indicators of the systems under consideration. The mentioned methods include methods of operations research, methods of network planning (

Philips 1984), multidimensional statistical procedures (

Trukhaev and Gorshkov 1985), data mining (

Duke 2001), the method of functional cost analysis (

Malz 2011), strategic analysis (

Pocheptsov 2004), etc. The decrease in the volume of initial information, characteristic of such methodological approaches as game theory (

Dyubin 1981) and utility theory (

Kini 1981), does not compensate only for their schematic description of the real management process of the enterprise. Among the approaches that ensure the generation of initial data, the method of expert assessments and the Foresight methodology close to it (

Loveridge 2009) should be noted. Expert assessments are relatively easy to use and can be used to predict almost any situation, including in conditions of incomplete information. However, the results obtained by using them are poorly formalized, which makes it difficult to use them in a generalized form by mathematical mapping. At the same time, the simulation modelling method free from these limitations (

Shannon 1978) and the CASE technologies that have been intensively developing in recent years (

Kalyanov 1992) involve large expenditures of time and money for the development of models, and the results obtained are quite complex for the operational assessment of the consequences of various control actions. Involvement of the predictive modelling procedure in the enterprise risk management system will increase its competitiveness due to the active use of information about the future state of the main activities of the enterprise (

Brinza et al. 2017).

2. Results

At the initial stage of concept formation, financial, economic and legal aspects are determined. They have a direct impact on the further formation of the risk management policy.

Additionally, it is necessary to identify the main driving forces and prerequisites that affect the goals of the project, the views and values of the parties involved in the project and the possibilities of the enterprise’s projects in terms of resources and competence of the project parties. The focus is on information flows and the decision-making process, as they have a strong influence on goals and ways to achieve them.

One of the elements that should be defined at the initial stage of the formation of the risk management concept is the risk management policy, as it details and explains the requirements and objectives of the project’s risk management. The components of the risk management policy include: economic justification for the use of the risk management system; determination of the links between the strategic objectives of the project and the objectives of the risk management system; definition of the powers and responsibilities used in the risk management system; basic methodological requirements for the risk management process; and measurement of its effectiveness.

To ensure the integration of risk management processes with the current concept of project finance efficiency management, a plan for the implementation of the concept is determined. It must be followed throughout the implementation procedure and all changes and additions must be justified and comply with the risk management policy (

Sidorova et al. 2021).

The next step is to develop a risk management concept, the process of which can be divided into three stages: determining the environmental risk impact, risk assessment and risk management.

The process of performance management and risk management begins with synchronisation with the object, which is to determine the environment for project financing and risk management.

The process of determining the environment consists of identifying the main parameters, boundaries and criteria for risk management. Many of these parameters are similar to those that were adopted when forming the risk management concept, but in terms of their impact on the boundaries of the risk management process at the implementation stage, they should be considered in more detail.

Environmental factors carry risks for projects from the outside. These include macroeconomics and the financial system; legal and political features; and main patterns and trends affecting the goals of a project enterprise and the goals of external stakeholders (

Kostyukhin 2021).

The internal environment is understood as all factors that carry risks from within a project. Accounting for internal environmental factors is necessary to align the objectives of the risk management system with objectives of a project and to assist in the implementation of the strategic objectives of a project, which determine the financial outcome of a project.

The internal environment includes the following elements: the capabilities of available resources and expertise; information flows and the decision-making process; and business processes, procedures, and structural elements of a project enterprise.

The most effective form of operating system is the economic efficiency of systems. The main factor that depends on the effectiveness of the risk management system can be defined as the specifics of the degree to which it is applied. Taking into account the individuality of a project, the following stages are carried out in the process of determining the operating environment of the system:

- -

The working group of the project is determined and powers are distributed;

- -

The scope of the risk management processes is planned;

- -

The separation of processes, procedures, functions, goals and objectives is carried out;

- -

The relationships between all projects of an enterprise are distributed;

- -

Methodologies for assessing possible risks are determined;

- -

The criteria for assessing the effectiveness of the risk management system are established;

- -

The scope and limitations of the planned research and the required resources are determined.

The development of risk criteria is a continuation of the procedure for forming a risk management policy. It is important to define the risk criteria at the initial stage of the implementation of the risk management system and update it subsequently. During the implementation of the project’s risk management processes, criteria are being developed according to which the significance of each individual risk can be assessed (

Sidorova et al. 2021).

The factors that should be taken into account are: risk assessment; types of distribution of goods in agreement with the distribution of shares; risk exposure and prevention; risk of a risk taker, which is at the level at which the risk arises from the loss of resources and services that, in particular, are intended to be used at the end to determine the risk of unintended risks.

The final stage of the risk management policy formation procedure is to conduct an assessment, which consists of identifying, describing and evaluating the identified risks.

The results of the risk analysis and assessment are entered into the proposed risk map and a selection procedure is carried out, which consists of choosing a solution option or several complementary solutions, and then implementing measures in accordance with the selected option or solution options. The result of countering risks is positive when the risk level has an acceptable value. Among the measures to counteract risks, we can distinguish:

- -

Termination of actions related to one or more risks;

- -

Finding an opportunity to avoid negative consequences;

- -

Implementation of measures to reduce the impact of negative consequences of risk;

- -

Measures to reduce damage from possible consequences;

- -

When choosing measures to counteract risks, the main indicator of applicability is the ratio of costs to the expected effect. It is also required to assess the limitations and obligations that the parties bear towards each other. Particular attention should be paid to taking into account the values and goals of all parties associated with risks, and the interests of other parties should be taken into account so as not to affect their interests.

In conditions of limited resources and in the case of several alternatives having the same effectiveness, the option that is acceptable to all parties and in the order of certain priorities is chosen.

Procedures for countering risks, a detailed description and a schedule for the implementation of measures to counteract risks are determined with a risk management plan.

The plan is a document that contains expected effects; the methodology for measuring effectiveness; performers of the plan; expected actions; requirements for monitoring and control; required resources and deadlines. The risk management plan is integrated into the company’s performance management system and coordinated with all interested parties.

In order to control the effectiveness of the measures taken to counteract risks and to take into account changes in external and internal factors, the risk management process should include an ongoing monitoring procedure. Information about the current state of execution of the plan for the implementation of measures to counteract risks can be used in the analysis of the effectiveness of a project (

Ochaykin 2015).

Generalisations of data on risks, existing control mechanisms, and planned measures to reduce the level of risk are formed in the “Risk Profile” of an enterprise. Based on the results of the risk assessment procedure, measures to counteract risks are implemented. In some cases, the assessment may lead to the decision to carry out an additional risk analysis.

There are a large number of risk assessment methods based on the theory of financial instruments and statistical analysis (

Kostyukhin 2021). At the same time, expert and matrix methods are not used enough to obtain reliable results in conditions of a large flow of information noise.

However, the above approaches in relation to the risk management process show that the risk management system within the framework of a company’s activities should be presented in the form of an algorithm that includes a cyclically closed set of organisational, economic and managerial measures consisting of the stages of preparation, decision making and their implementation (

Table 1).

At the preparation stage, the problem and risks are identified and then their classification in various areas of increased risk of an enterprise takes place.

The decision-making stage characterizes the main parameters of risks: probability of occurrence, synergy, degree of influence, strength and danger. This stage should include the stage of multi-scenario forecasting of the consequences of management decisions and all permissible changes in the factors of the internal and external environment of an enterprise.

The goal of the decision-making stage is determining the assessments of the consequences of the risks and ensuring the possibility of displaying the main links between the elements of the organisational and technical system under consideration “in statics”.

Most of the known methods used to analyse the features of the functioning of complex organisational systems often do not provide comprehensive assessments of the effectiveness of the main performance indicators of the systems in question, since a significant amount of diverse source information is needed. The mentioned methods include methods of operations research, network planning methods, multidimensional statistical procedures, data mining, functional cost analysis, strategic analysis, etc. The decrease in the volume of initial information, characteristic of such methodological approaches as game theory and utility theory, does not compensate only for their schematic description of the real management process of an enterprise. Among the approaches that ensure the generation of initial data, the method of expert assessments and the Foresight methodology should be noted (

Iliukhin and Kostiukhin 2009).

Expert assessments are relatively easy to use and can be used to predict almost any situation, including in conditions of limited information. At the same time, the results obtained are poorly formalised, which makes it difficult to use them by mathematical mapping. At the same time, the method of simulation modelling and CASE technologies, which have been intensively developing in recent years, involve large expenditures of time and money for the development of models, and the results obtained are quite complex for an operational assessment of the consequences of various control actions (

Brinza et al. 2014).

The involvement of predictive modelling procedures in the enterprise risk management system will increase its competitiveness due to the active use of information about the state of the main activities of an enterprise in the future and will increase the reliability and objectivity of decisions made and carry out their preparation with the necessary degree of anticipation (

Kostyukhin 2021).

The final stage is the implementation stage, aimed at determining the assessments of the consequences of the risks and ensuring the possibility of displaying the main links between the elements of the organisational and technical system under consideration in dynamics. The final stage of implementation completes the process by monitoring the results.

The proposed algorithm of the risk management system can provide managers with the necessary degree of methodological support and can be used to simulate extreme events and risks in the process of enterprise development in conditions of constant transformation of the economy.

3. Discussion

The vector of development of the modern economy has introduced uncertainty on the medium-term global trends in prices for metallurgical products, which has predetermined the need for multi-scenario analysis and forecasting of the prospects of an enterprise using the results of mathematical modelling. The object of modelling the proposed risk management system was identified as a metallurgical enterprise (

Brinza et al. 2014).

To create the model of the organisational system, the necessary composition of the initial data was selected and a concretizing scheme of the model was developed. The structure of the system includes the allocation of a list of its elements and the determination of the relationships between the elements of the system and the influence of the components of the external environment on them.

Taking into account the above, a list of the main elements of the model was compiled, the main activities and characteristics of the enterprise were determined, and two groups were identified among the environmental influences. The first group includes direct influences and the second group includes global influences that have indirect effects.

The most significant macro-characteristics of the scale for the enterprise, namely, the dynamics of socio-economic development, as well as the level of state support for the enterprise, were identified as direct influences of the external environment. Additionally, elements of the space of the forces of industry competition were involved: the interaction of the enterprise with suppliers, attracted external investments, the sale of manufactured products to consumers and the activities of competing enterprises (

Brinza et al. 2014).

According to the recommendations reflected in the literature on the problems of strategic analysis and management, geopolitics and macroeconomics, seven main characteristics were attributed to the indirect effects of the external environment on the development of the enterprise.

The list of elements of the structure of the simulated organisational system and its components of the external environment is presented in

Table 2.

According to the results of the collective examination, the interrelations between the elements of the system and the degree of influence of the components of the external environment on them were determined. When developing expert questionnaires, a matrix structure was preferably used. In the developed questionnaires, particular combinations of Xi and Yj (i, j = 1,2 … 30) are displayed in the corresponding cells, in which experts were asked to enter the following information:

The presence or absence of the influence of factors Xi on the indicators of Yj and if there are any, the evaluation of the signs of influence. The sign (+) records the fact of an increase in the level of the indicator Yj with an increase in the factor Xi influencing it. The sign (–) records a decrease in Yj with an increase in Xi.

The duration of the periods of inertia of the identified factor influences.

The intensity of the influence of the identified factors on the indicators.

The initial values of the Xi factors characterizing the activity of the enterprise and environmental influences, as well as their initial impulses. Among the large number of potential relationships between factors Xi and indicators Yj of the simulated system, it is possible to determine the level of significant influences. A detailed analysis of the matrix can show which blocks are the most saturated with significant impacts to an even greater extent (

Brinza et al. 2017).

Indirect environmental impacts on the company’s activities are less saturated (69.4% of such impacts were recorded as significant). However, the reverse reactions of the internal factors of the simulated system are few and measured by 17.4%, which is explained with the different scales of the groups X1–X16 and Y22–Y30.

Consideration of the signs of the revealed factor relationships among various sub-matrices showed that the largest share of negative influences is recorded for the groups (X17–X21) × (Y22–Y30), (X17–X21) × (Y17–Y21) and (X1–X16) × (Y17–Y21): 45.5; 41.0 and 38.0%.

Thus, the analysis of the number of relationships between the elements of the enterprise’s activity, as well as the multiplicity of influences on them from the external environment, can determine the level of saturation of the corresponding matrix. There is also a diversity of direct and feedback relationships identified by experts in its structure between Xi and Yj, which indicates the high complexity of the process of managing the organisational system.

The practical application of the qualitative modelling method as a decision support tool in strategic management tasks to determine the consequences of risks in relation to the assessment of the company’s activities in order to substantiate scenarios for its effective development is justified.

One of the “bottlenecks” of the expert system is the difficulties in acquiring the knowledge necessary for the development of meaningful systems and structuring this knowledge into a convenient form for use. The analysis of the features of the development of hierarchical organisational structures using this method is achieved by developing models of procedures for analysing hierarchies.

Annual sets of publications were involved in the work and, based on them, the texts of publications determined the existence of relationships between factors (X1, X4–X9, X11–X21) and enterprise indicators, as well as components of the direct influence of the external environment on them (Y1, Y4–Y9, Y11–Y21) that do not carry the risk of disclosure of confidential information. The signs of the adequacy of reproducing information about the structure of the simulated organisational system simultaneously by the two approaches used in the work were carried out by comparing materials with the results of content analysis, fixing the presence (+) or absence (0) of the influence of factors Xi on the indicators Yj in the weekly publications. Then, we considered the correspondence between them on two grounds:

- (1)

The absence of a particular factor influences the indicators in the materials of the collective examination in the absence of references to them in publications (this was assessed by the coincidence of the “white background” and the “0” sign in the matrix cells);

- (2)

The presence of a particular factor influences the indicators identified by the materials of the collective examination, when they were mentioned in publications (this was determined by the coincidence of the “gray background” and the “+” sign in the matrix cells).

The identification of information inconsistencies between the compared variants of the matrix structures according to the listed features is equivalent to the definition of errors of the first and second kind. The results of comparing the information provided by two independent information sources showed the effectiveness of involving the resources of the corporate press in the tasks of modelling organisational systems with a matrix structure. The comparison of independent information sources obtained by content analysis of data provides verification of the realism of the restored structure of the matrix-type organisational system, but is insufficient for use as the main tool for identifying all significant structural relationships. In this connection, the technology of in-depth text mining is used to obtain the required knowledge about the structure of systems.

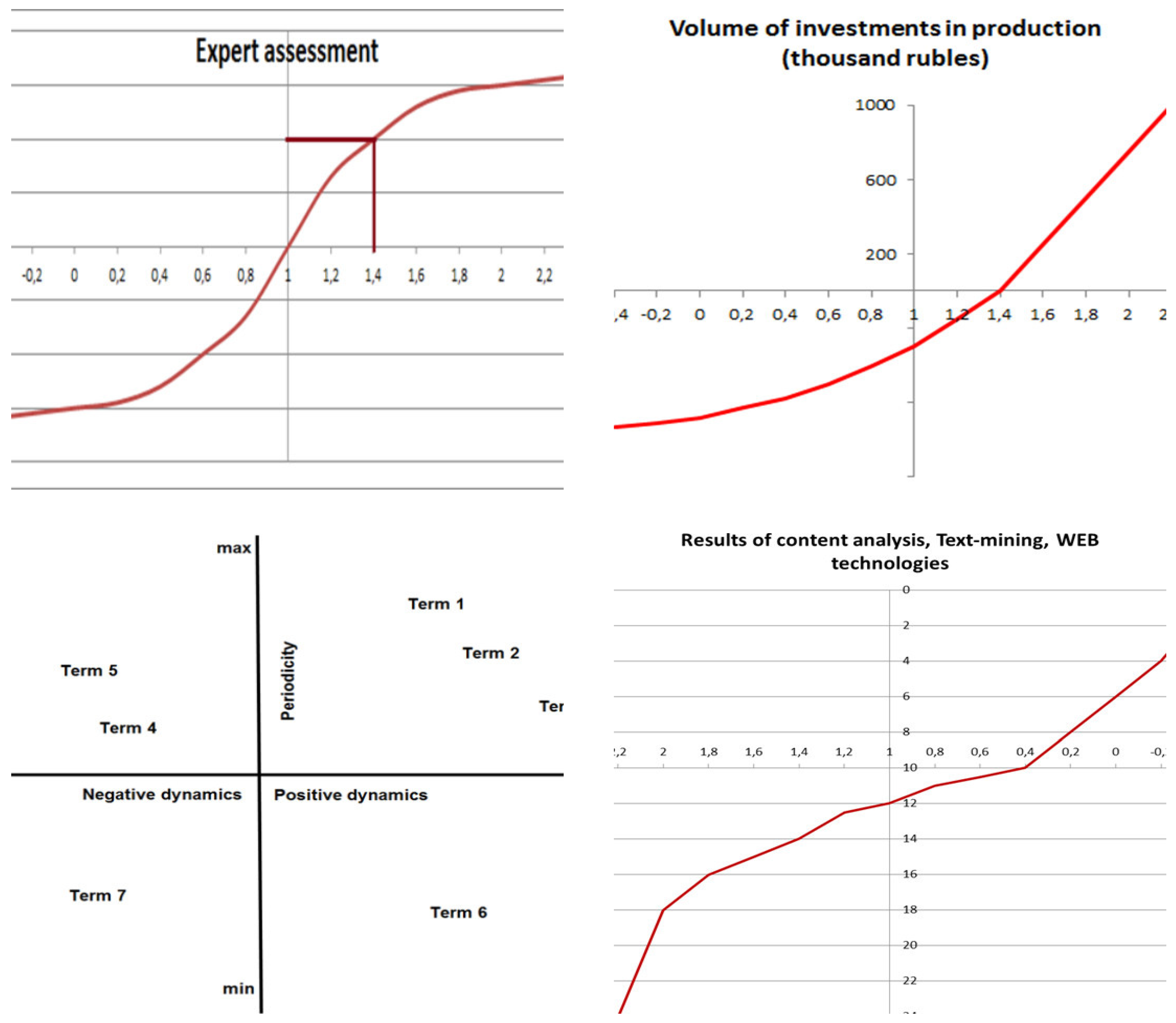

The accuracy of the forecast is ensured by attracting both internal and external documentation sources and conducting content analysis (

Figure 1).

The performed studies allowed us to determine the factors characterizing the main activities of the enterprise for the formation of a mathematical model (

Table 3).

The number of factors characterizing the main activities of the metallurgical enterprise and used in the mathematical model may not be limited.

In this case, the hierarchical scheme of the mathematical model being developed, generalizing the production potential of the enterprise, is presented in the form of two levels. The contribution of each of these second-level particular factors to the value of the production base of the enterprise is characterized with one of the weight parameters Wk, where k = 1, …, 4, with the sum of all parameters equal to 1.0. Then, we determine the numerical values of each of the parameters presented in

Table 4.

The influence of certain types of risks on the main directions of the enterprise’s functioning is possible and threatens its progressive development. This is why when modelling future variants of the enterprise’s activities, it is necessary to take into account multiple risks that characterize the organisational and technical system under consideration. A variety of options for the transformation of elements and factors determines one of the alternative scenarios for the development of this system.

Timely receipt of information about future possible crisis scenarios for the enterprise, alternative to inertia, enables their managers to make timely decisions aimed at preventing a slowdown in the development of the structures they lead. Using the developed predictive model, the most dangerous risks for the development of the enterprise were identified:

Project management. This includes an increase in the project implementation time, exceeding the project budget and poor quality.

Business development. The main risk markers are defined as difficulties in participating in transactions that increase the value of the enterprise, overpayment for a transaction or inaccurate analysis, leading to insufficient return on capital investments.

Violation of legal and regulatory requirements. This risk includes non-compliance with laws and regulations regarding the prevention of bribery, corruption, money laundering, sanctions, listing rules, and antitrust requirements.

Management capabilities. The inability of management to attract, retain and develop the professionalism of key managers is considered.

Organisational development. This arises from inefficient delegation of authority, in which management structures and systems can adversely affect the achievement of strategic goals.

Liquidity. The risk arises when payment obligations are not fulfilled and the company’s ability to attract financing is reduced, or there is a lack of financial resources to complete projects, as well as business development activities.

Political risk. This risk arises from strategic and financial losses, as well as personnel losses as a result of macroeconomic and social policies, or events related to political instability on the world stage.

Productivity. This affected the metallurgical enterprises in many countries following the previous commodity boom in the period of market stagnation.

Growth of socio-environmental requirements. This risk includes projects whose implementation has been postponed or stopped at the request of the local community and environmental defenders, while enterprises are forced to take into account measures aimed at obtaining and retaining a social license in their strategic development plans.

Prices. The volatility of metal prices and exchange rates causes uncertainty in the estimates of the market value of the company’s assets, which affect the possibility of transactions.

Effective management of the listed multiple risks requires an assessment of their impact on the company’s activities in the foreseeable future, which can make it possible to rationally implement forecasts based on the methodology of qualitative modelling (

Bugrov 2003).

In order to specify the listed 11 risk groups, it was proposed to also introduce additional impulses (

Figure 2).

As can be seen from

Figure 2, additional impulses visualized in the form of a graph give individual elements of the external environment’s simulated organizational and technical system, and determine the causal relationships between the factors of the system.

The obtained results of the conducted examinations make it possible to rank the level of influence of each of the considered particular risks in relation to the main activities of the metallurgical enterprise and the elements of direct environmental influence associated with them. To do this, we calculated the weighted average sum of the company’s performance indicators and the associated effective values of the elements of the direct influence of the external environment for the inertial scenario (WSI), as well as for options displaying the results of each of the internal and external particular risks (WSR). The “weights” of particular indicators were obtained taking into account the recommendations (

Kostyukhin 2021).

Obviously, the higher the WS value takes, the more the structure of the organisational and technical system is subject to the negative consequences of the manifestation of risk. The revealed regularity determines the possibility of ranking the totality of particular risks in their implementation by the degree of decline in the performance of the enterprise in the medium term.

The determination of the initial data reflecting the degree of action of the most relevant multiple risks for the enterprise created the necessary prerequisites for predicting the consequences of each of the selected options for the transformation of elements of the external environment.

Fragmentation of the results at the lower hierarchical level of mathematical modelling of the dynamics of the metallurgical enterprise’s main activities in the implementation of the multiple risks as “Project management” and “Business Development” is presented in

Table 5 and

Table 6.

Analysis of the obtained results shows that during the implementation of each of the scenarios considered, the levels of the absolute majority of the company’s activities are significantly inferior to their counterparts in the inertial scenario and, in the medium term, it reaches a stable low level, while competing manufacturers receive the opportunity to sharply strengthen market positions. According to the degree of negative impact on the company’s performance, the consequences of the implementation of each of the considered multiple risks significantly exceed the considered expected consequences of the implementation of particular risks (

Brinza et al. 2017).

An important feature of the consequences of the manifestation of the action of multiple and particular risks is their poor recognisability in the current time and during the short-term forecast period, which is explained by receiving only “weak signals” when receiving feedback from managed objects. In this regard, the involvement of the principles of enterprise management by “weak signals” can be an important management resource (

Kostyukhin 2021). At the same time, the prediction of significant trends in changes in the activities of the managed organisational and technical system during longer periods of anticipation by “weak signals” is quite easily carried out using the method of qualitative modelling.

The significant danger of the above-mentioned multiple risks for the company’s activities, identified by means of predictive modelling, and the high probability of their implementation, as evidenced by the study (

Brinza et al. 2014), necessitates the generation of preventive measures to reduce the negative consequences of their manifestation, to eliminate these consequences.

Thus, the results obtained during the analysis allow errors associated with insufficient detail to be identified and eliminated and, as a result, violation of the logic of business processes, inaccuracy and duplication of information flows (

Prodanova et al. 2020;

Barcho et al. 2020).

The improvement of business processes is a key aspect of the company’s activity, since the activity should go beyond the project, that is, it should be permanent (

Kostygova et al. 2020). As can be seen, the process approach at the enterprise was carried out in an incomplete volume, since the indicators of efficiency and effectiveness of business processes were not developed, and incomplete identification was also carried out (

Filatov et al. 2019). This situation may eventually affect the shortcomings of the integrated risk management model (

Filatov et al. 2018;

Ivanova et al. 2018).