Financial Innovation, Stock Market Development, and Economic Growth: An Application of ARDL Model

Abstract

:1. Introduction

2. Literature Review

2.1. Studies on Financial Innovation and Economic Growth

2.2. Studies on Stock Market Development and Economic Growth

2.3. Financial Innovation and Stock Market Development

3. Conceptual Development and Proposed Hypothesis

4. The Methodology of the Study

4.1. Variable Definition and Sources

4.2. The Autoregressive Distributed Lag (ARDL) Model

- If Fs > upper bound of critical value, confirm the existence of cointegration.

- If Fs < lower bound of critical value, conform variables are not cointegrated.

- If Fs ≤ upper bound and ≥lower bound of critical value then the conclusive decision may not reach about variables cointegration.

5. Data Analysis and Interpretation

5.1. Unit Root Test

5.2. ARDL Bounds Testing for Cointegration

5.3. Long Run Coefficient Estimation

5.4. ECM Short Run Dynamic ARDL Estimation

5.5. Granger Causality Test Under Error Correction Term (ECM)

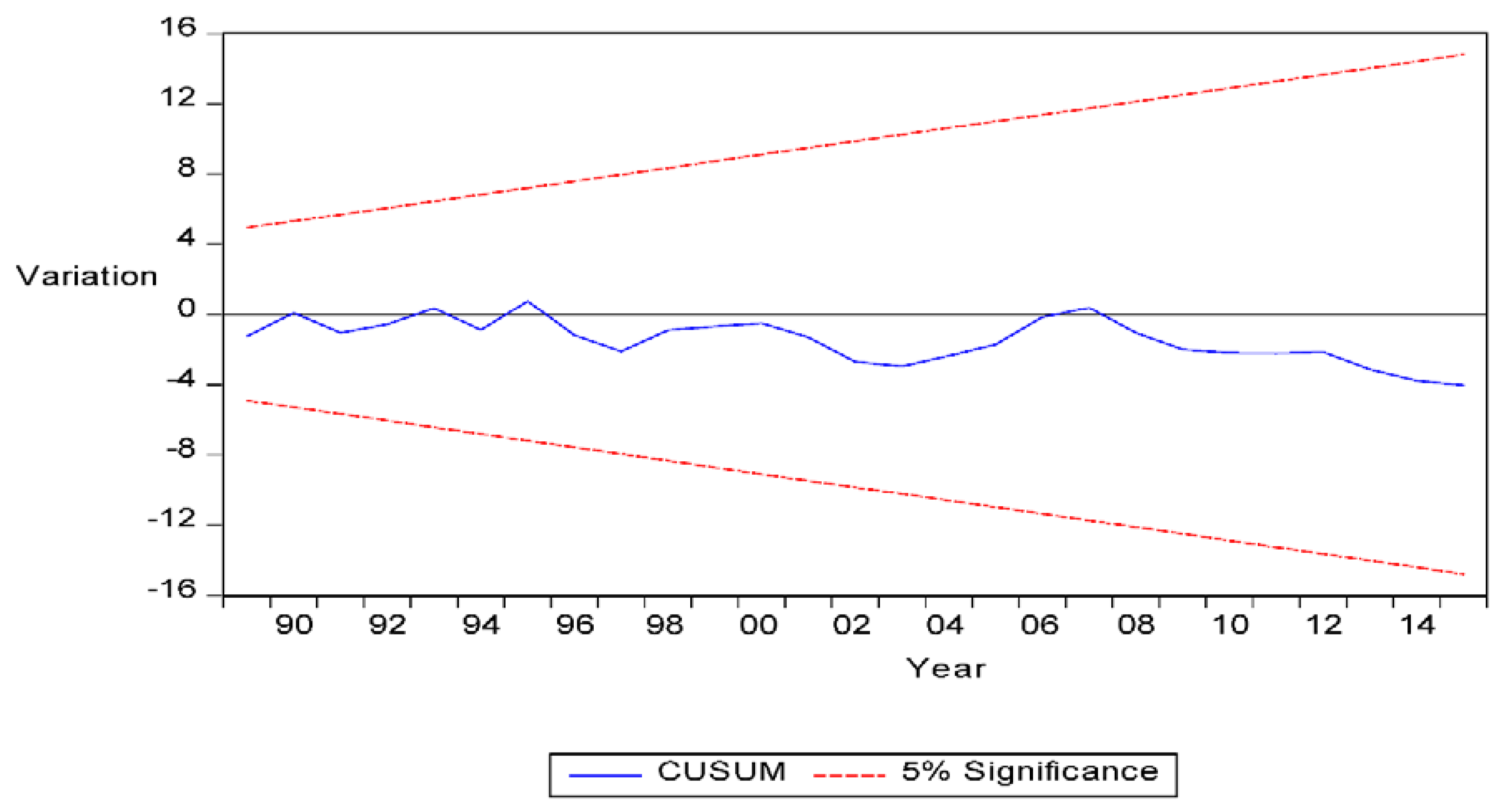

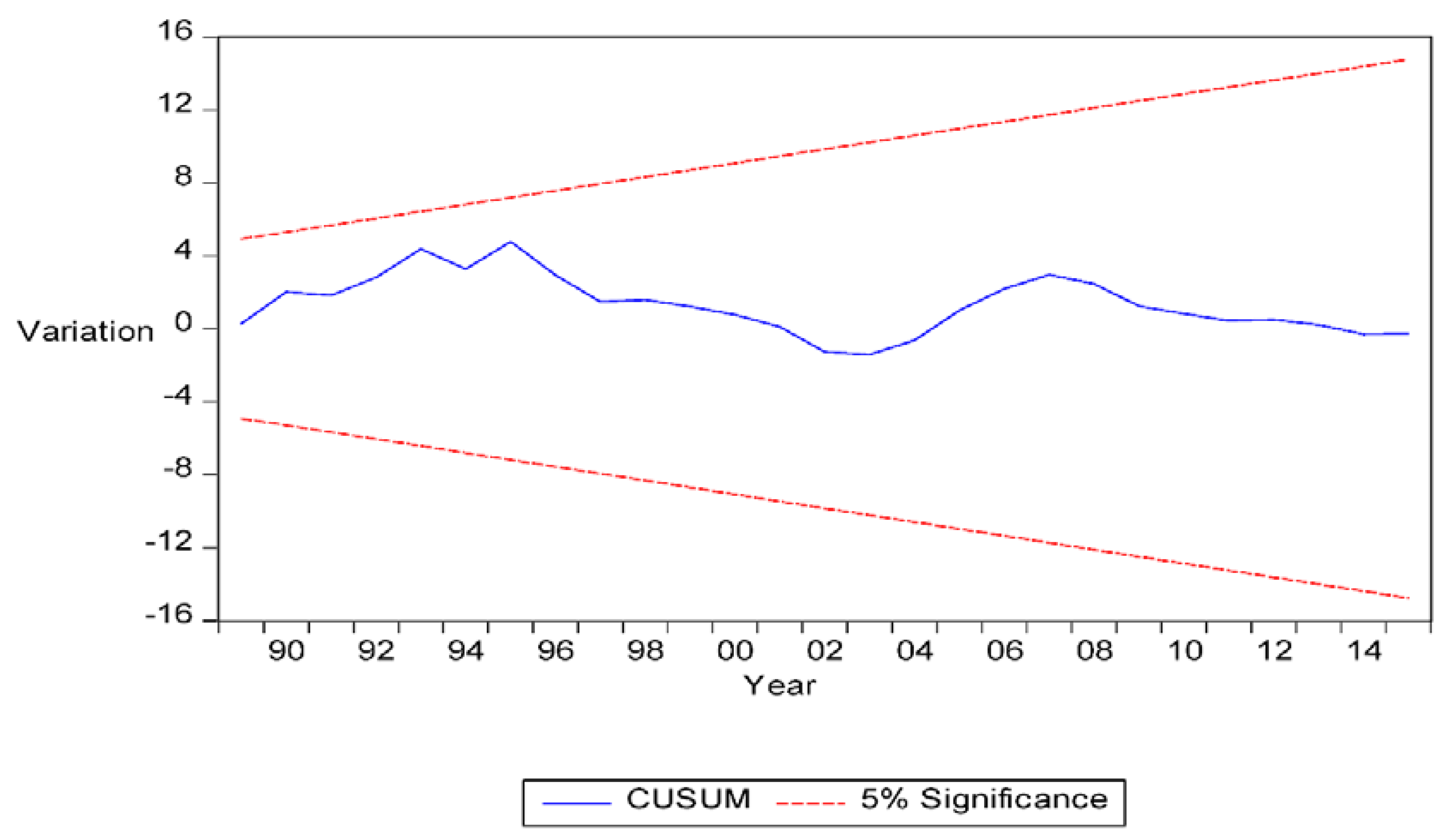

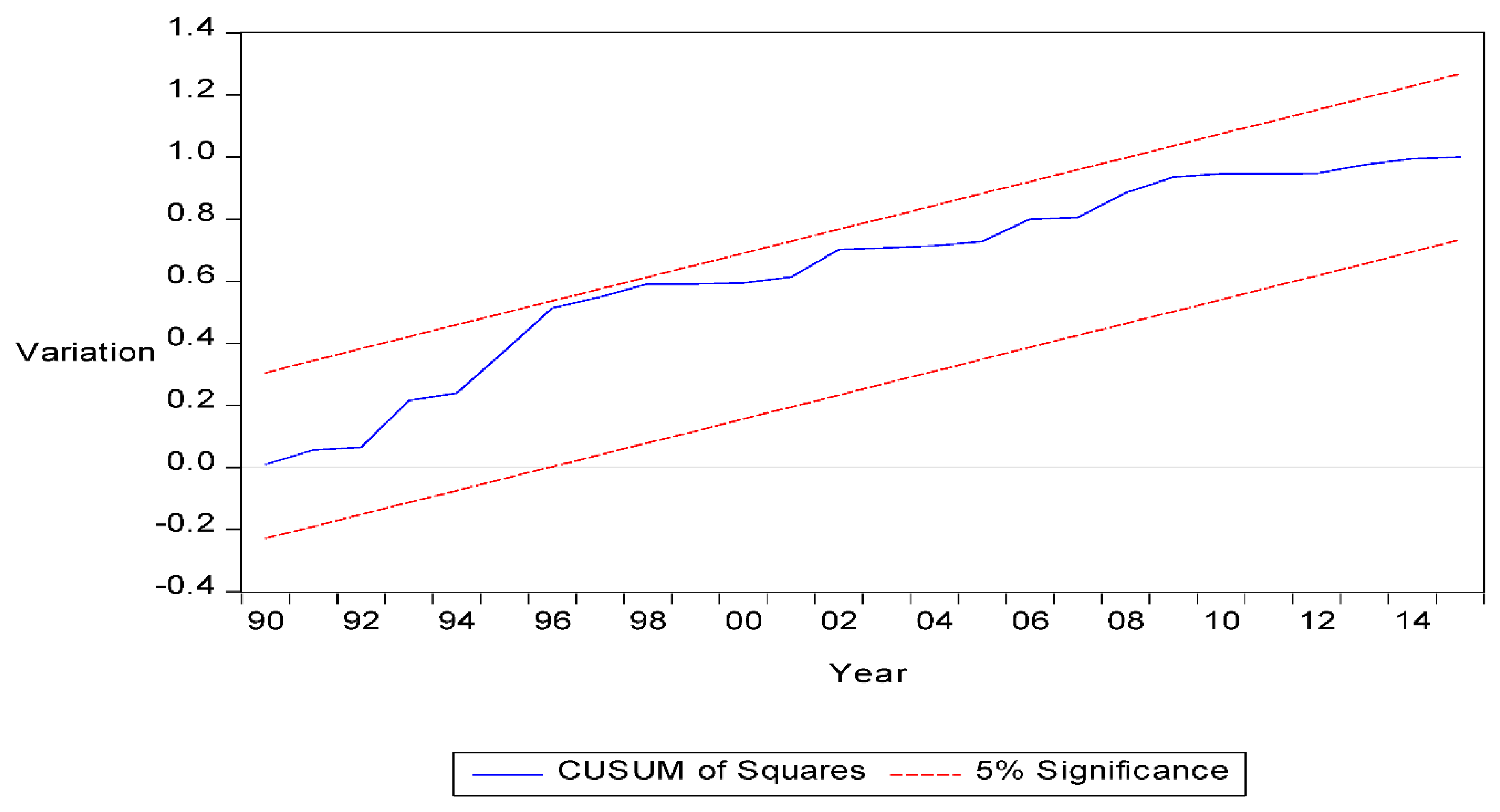

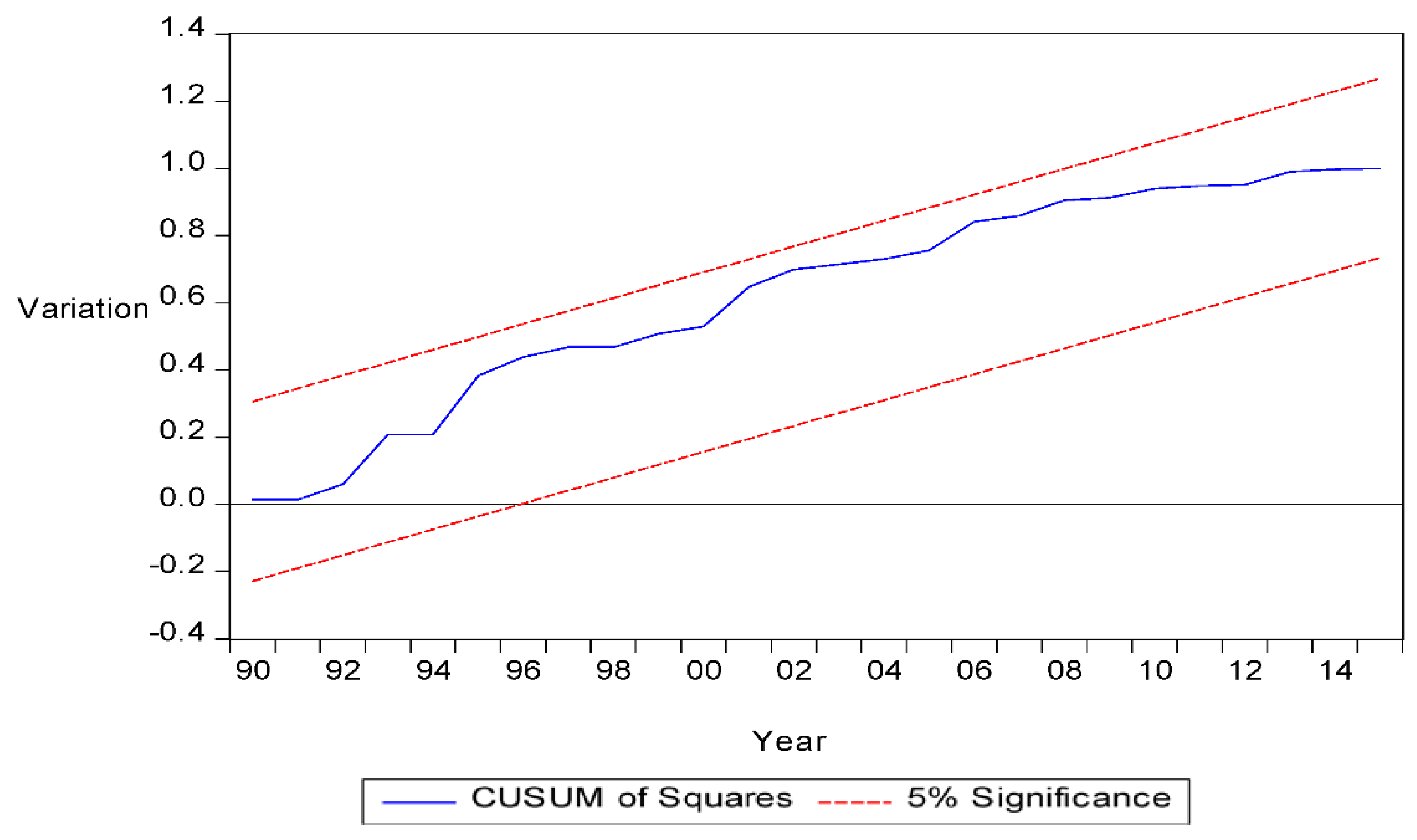

5.6. Model Robust Test

6. Findings and Conclusions

- In regards to the financial innovation and economic growth nexus: financial innovation plays a fundamental role in financial sector development. It is because financial innovation expands financial activities in the economy with the emergence of new forms and structures of financial institutions, better financial services through technological advancement, improved financial products, and capital accumulation by encouraging saving in the society, which in turn lead to economic development. Furthermore, an efficient financial sector requires financial innovation, which allows efficient allocation of economic resources in the economy in productive ways. Therefore, the government should make the financial sector more financial innovation-oriented to provide financial services to a large number of households, who can then contribute towards the development process.

- It is inevitable that a well-functioning stock market promotes economic growth, especially in developing countries, like Bangladesh. The efficient stock market allows investors to raise long-term capital easily, which attracts not an only domestic investment but also attracts foreign investors as well. Stock market development, therefore, enhances financial development with productivity in the economy

Author Contributions

Funding

Conflicts of Interest

References

- Abdul-Khaliq, Shatha. 2013. The Impact of Stock Market Liquidity on Economic Growth in Jordan. European Journal of Business and Management 5: 154–59. [Google Scholar]

- Adjasi, Charles K. D., and Nicholas B. Biekpe. 2006. Stock Market Development and Economic Growth: The Case of Selected African Countries. Journal Compilation 18: 144–61. [Google Scholar] [CrossRef]

- Adu-Asare Idun, Anthony, and Anthony Q. Q. Aboagye. 2014. Bank competition, financial innovations and economic growth in Ghana. African Journal of Economic and Management Studies 5: 30–51. [Google Scholar] [CrossRef]

- Ahmad, Rubi, Oyebola Fatima Etudaiye-Muhtar, Bolaji Tunde Matemilola, and Amin Noordin Bany-Ariffin. 2016. Financial market development, global financial crisis and economic growth: Evidence from developing nations. Portuguese Economic Journal 15: 199–214. [Google Scholar] [CrossRef]

- Ahmed, Abdullahi D., and Kelesego K. Mmolainyane. 2014. Financial integration, capital market development and economic performance: Empirical evidence from Botswana. Economic Modelling 42: 1–14. [Google Scholar] [CrossRef]

- Aigbokhan, Ben E. 1995. Financial Development and Economic Growth: A Test of Hypothesis on Supply-Leading and Demand Following Finance. With Evidence on Nigeria, The Nigerian Economic and Financial Review 1: 1–10. [Google Scholar]

- Ajide, Folorunsho. 2015. Financial Innovation and Sustainable Development in Selected Countries in West Africa. Innovation in Finance 15: 85–112. [Google Scholar] [CrossRef]

- Ake, Boubakari, and Rachelle Ognaligui. 2010. Financial Stock Market and Economic Growth in Developing Countries: The Case of Douala Stock Exchange in Cameroon. International Journal of Business and Management 5: 82–88. [Google Scholar] [CrossRef]

- Akhavein, Jalal D., W. Scott Frame, and Lawrence J. White. 2001. The diffusion of financial innovations: An examination of the adoption of small business credit scoring by large banking organizations. The Journal of Business 78: 577–96. [Google Scholar] [CrossRef]

- Albentosa, Prats, María Asuncíon, and Beatriz Sandoval. 2016. Stock Market and Economic Growth in Eastern Europe. Kiel: Kiel Institute for the World Economy, pp. 1–35. [Google Scholar]

- Allen, Franklin. 2011. Trends in Financial Innovation and Their Welfare Impact An Overview. Welfare Effects of Financial Innovation 18: 493–514. [Google Scholar] [CrossRef]

- Ansong, Abraham, Edward Marfo-Yiadom, and Emmanuel Ekow-Asmah. 2011. The Effects of Financial Innovation on Financial Savings: Evidence from an Economy in Transition. Journal of African Business 12: 93–113. [Google Scholar] [CrossRef]

- Antonios, Adamopoulos. 2010. Stock Market and Economic Growth: An Empirical Analysis for Germany. Business and Economics Journal 1: 1–12. [Google Scholar]

- Arrau, Patricio. 1991. The Demand for Money in Developing Countries: Assessing the Role of Financial Innovation: World Bank Publications. Washington: World Bank Group. [Google Scholar]

- Asghar, Nabila, and Zakir Hussain. 2014. Financial Development, Trade Openness and Economic Growth in Developing Countries Recent Evidence from Panel Data. Pakistan Economic and Social Review 52: 99–126. [Google Scholar]

- Azam, Muhammad, Muhammad Haseeb, Aznita binti Samsi, and Jimoh Olajide Raji. 2016. Stock Market Development and Economic Growth: Evidences from Asia-4 Countries. International Journal of Economics and Financial Issues 6: 1200–8. [Google Scholar]

- Banerjee, Anindya, Juan J. Dolado, John W. Galbraith, and David Hendry. 1993. Co-Integration, Error Correction, and the Econometric Analysis of Non-Stationary Data. Oxford: Oxford University Press, OUP Catalogue. [Google Scholar]

- Bangladesh Bank. 2017. Annual Report. Dhaka: Bangladesh Bank. [Google Scholar]

- Bangladesh Bureau of Statistics. 2017. National Accounts Statistics—Bangladesh Bureau of Statistics. In Yearly. Bangladesh: Bangladesh Bureau of Statistics, p. 250. [Google Scholar]

- Bara, Alex, and Calvin Mudzingiri. 2016. Financial innovation and economic growth: Evidence from Zimbabwe. Investment Management and Financial Innovations 13: 65–75. [Google Scholar] [CrossRef]

- Bara, Alex, Gift Mugano, and Pierre Le Roux. 2016. Financial Innovation and Economic Growth in the SADC. Economic Research Southern Africa 1: 1–23. [Google Scholar] [CrossRef]

- Bayar, Yilmaz. 2016. Institutional Determinants of Stock Market Development in European Union Transition Economies. The Romanian Economic Journal 19: 211–16. [Google Scholar]

- Beck, Thorsten, Tao Chen, Chen Lin, and Frank M. Song. 2016. Financial innovation: The bright and the dark sides. Journal of Banking & Finance 72: 28–51. [Google Scholar] [Green Version]

- Beck, Thorsten, Lemma Senbet, and Witness Simbanegavi. 2014. Financial inclusion and innovation in Africa: An overview. Journal of African Economies 24: i3–i11. [Google Scholar] [CrossRef]

- Bekeart, Geert, and Campbell R. Harvey. 1997. Capital Market as Engine of Economic Grwoth. The Brown Journal of World Affairs 5: 33–53. [Google Scholar]

- Bekhet, Hussain Ali, Ali Matar, and Tahira Yasmin. 2017. CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renewable and Sustainable Energy Reviews 70: 117–32. [Google Scholar] [CrossRef]

- Bencivenga, Valerie R., and Bruce D. Smith. 1991. Financial Intermediation and Endogenous Growth. The Review of Economic Studies 58: 195–209. [Google Scholar] [CrossRef]

- Bilyk, Valentyna. 2006. Financial Innovations and the Demand for Money in Ukraine. Master’s thesis, Economics Education and Research Consortium, National University of Kyiv-Mohyla Academy, Kiev, Ukraine. [Google Scholar]

- Błach, Joanna. 2011. Financial Innovations and Their Role in the Modern Financial System—Identification and Systematization of the Problem. Financial Internet Quarterly “e-Finanse” 7: 13–26. [Google Scholar]

- Blair, Margaret M. 2011. Financial Innovation, Leverage, Bubbles and the Distribution of Income. Review of Banking & Financial Law 30: 225–311. [Google Scholar]

- Boot, Arnoud, and Matej Marinc. 2010. Financial innovation: Economic growth versus instability in bank-based versus financial market driven economies. International Journal of Business and Commerce 2: 1–32. [Google Scholar]

- Borensztein, Eduardo, Jose De Gregorio, and Jong-Wha Lee. 1998. How does foreign direct investment affect economic growth? Journal of International Economics 45: 115–35. [Google Scholar] [CrossRef]

- Boubakari, Ake, and Dehuan Jin. 2010. The Role of Stock Market Development in Economic Growth: Evidence from Some Euronext Countries. International Journal of Financial Research 1. [Google Scholar] [CrossRef]

- Bundoo, Sunil K. 2017. Stock market development and integration in SADC (Southern African Development Community). Review of Development Finance 7: 64–72. [Google Scholar] [CrossRef]

- Bwire, Thomas, and Andrew Musiime. 2015. Financial Development—Economic Growth Nexus: Empirical Evidence from Uganda. Journal of Social Science 4: 1–18. [Google Scholar]

- Caporale, Guglielmo Maria, Peter G. A. Howells, and Alaa M. Soliman. 2004. Stock Market Development and Economic Growth: The Causal Linkage. Journal of Economic Development 29: 33–50. [Google Scholar]

- Caporale, Guglielmo Maria, Peter Howells, and Alaa M. Soliman. 2003. Endogenous Growth Models and Stock Market Development: Evidence from Four Countries. Review of Development Economics 9: 166–76. [Google Scholar] [CrossRef]

- Carp, Lenuţa. 2012. Can Stock Market Development Boost Economic Growth? Empirical Evidence from Emerging Markets in Central and Eastern Europe. Procedia Economics and Finance 3: 438–44. [Google Scholar] [CrossRef]

- Cavenaile, Laurent, Christian Gengenbach, and Franz Palm. 2014. Stock Markets, Banks and Long Run Economic Growth: A Panel Cointegration-Based Analysis. De Economist 162: 19–40. [Google Scholar] [CrossRef]

- Chang, Tsangyao, and Steven B. Caudill. 2005. Financial development and economic growth: The case of Taiwan. Applied Economics 37: 1329–35. [Google Scholar] [CrossRef]

- Cheng, Xiaoqiang, and Hans Degryse. 2014. The Impact of Bank and Non-Bank Financial Institutions on Local Economic Growth in China. Journal of Financial Services Research 37: 179–99. [Google Scholar] [CrossRef]

- Chizea, John. 2012. Stock Market Development and Economic Growth in Nigeria: A Time Series Study for the period 1980–2007. Ph.D. thesis, Newcastle Business School, Northumbria University, Newcastle upon Tyne, UK; p. 296. [Google Scholar]

- Chou, Yuan K. 2007. Modelling Financial Innovation and Economic Growth. Jounral of Business and Management 2: 1–36. [Google Scholar]

- Chou, Yuan K., and Martin S. Chin. 2011. Financial Innovations and Endogenous Growth. Journal of Economics and Management 25: 25–40. [Google Scholar]

- Comin, Diego, and Ramana Nanda. 2014. Financial Development and Technology Diffusion. Cambridge: Harvard University, p. 33. [Google Scholar]

- Cooray, Arusha. 2010. Do stock markets lead to economic growth? Journal of Policy Modeling 32: 448–60. [Google Scholar] [CrossRef]

- Coşkun, Yener, Ünal Seven, H. Murat Ertuğrul, and Talat Ulussever. 2017. Capital market and economic growth nexus: Evidence from Turkey. Central Bank Review 17: 19–29. [Google Scholar] [CrossRef]

- Craig, R. Sean, Ina Dettmann-Busch, Eduardo Gomes, Garth Greubel, Klaus Liebig, Keith Lui, Roberto Marino, Daniel Mminele, Ram Prasad Bandi, Srichander Ramaswamy, and et al. 2008. Financial Innovation and Emerging Markets: Opportunities for Growth vs. Risks for Financial Stability. Berlin: InWEnt. [Google Scholar]

- De Gregorio, Jose, and Pablo E. Guidotti. 1995. Financial development and economic growth. World Development 23: 433–48. [Google Scholar] [CrossRef]

- Demetriades, Panicos O., and Khaled A. Hussein. 1996. Does financial development cause economic growth? Time-series evidence from 16 countries. Journal of Development Economics 51: 387–411. [Google Scholar] [CrossRef]

- Demetriades, Panicos O., and Kul B. Luintel. 1996. Financial Development, Economic Growth and Banking Sector Controls: Evidence from India. The Economic Journal 106: 359–74. [Google Scholar] [CrossRef]

- Djoumessi, Emilie Chanceline Kinfack. 2009. Financial Development and Economic Growth: A Comparative Study between Cameroon and South Africa. Master’s thesis, University of South Africa, Pretoria, South Africa; pp. 1–165. [Google Scholar]

- Duasa, Jarita. 2014. Financial Development and Economic Growth: The Experiences of Selected OIC Countries. International Journal of Economics and Management 8: 215–28. [Google Scholar]

- Engle, Robert F., and Clive W. J. Granger. 1987. Cointegration and error correction representation: Estimation and testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Enisan, Akinlo A., and Akinlo O. Olufisayo. 2009. Stock market development and economic growth: Evidence from seven sub-Sahara African countries. Journal of Economics and Business 61: 162–71. [Google Scholar] [CrossRef]

- Epstein, Stephan R. 1992. Regional fairs, institutional innovation, and economic growth in late medieval Europe 1. The Economic History Review 47: 459–82. [Google Scholar] [CrossRef]

- Gamolya, Andriy. 2006. Stock Market and Economic Growth in Ukraine. Master’s thesis, Economics Education and Research Consortium, National University of Kyiv-Mohyla Academy, Kiev, Ukraine; pp. 1–48. [Google Scholar]

- Geiger, Theodor. 1960. The Stages of Economic Growth: A Non-Communist Manifesto. Edited by Walt Whitman Rostow. New York: Cambridge University Press. [Google Scholar]

- Ghatak, Subrata, and Jalal U. Siddiki. 2001. The use of the ARDL approach in estimating virtual exchange rates in India. Journal of Applied Statistics 28: 573–83. [Google Scholar] [CrossRef]

- Glaeser, Edward L., Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei Shleifer. 2004. Do Institutions Cause Growth? Cambridge: National Bureau of Economic Research. [Google Scholar]

- Gurley, John G., and Edward S. Shaw. 1955. Financial Aspects of Economic Development. American Economic Review 45: 516–37. [Google Scholar]

- Handa, Jagdish, and Shubha Rahman Khan. 2008. Financial development and economic growth: A symbiotic relationship. Applied Financial Economics 18: 1033–49. [Google Scholar] [CrossRef]

- Hellwig, Martin. 1991. Banking, financial intermediation and corporate finance. European Financial Integration, 35–63. [Google Scholar] [CrossRef]

- Ishioro, Bernard O. 2013. Stock Market Development and Economic Growth: Evidence from Zimbabwe. Stock Market 22: 343–60. [Google Scholar]

- Jahfer, Athambawa, and Tohru Inoue. 2014. Stock market development and economic growth in Sri Lanka. International Journal of Business and Emerging Markets 6: 271. [Google Scholar] [CrossRef]

- Jedidia, Khoutem Ben, Thouraya Boujelbène, and Kamel Helali. 2014. Financial development and economic growth: New evidence from Tunisia. Journal of Policy Modeling 36: 883–98. [Google Scholar] [CrossRef]

- Johansen, Søren, and Katarina Juselius. 1990. Maximum Likelihood Estimation and Inference on Cointegration—With Applications to the Demand for Money. Oxford Bulletin of Economics and Statistics 51: 169–210. [Google Scholar] [CrossRef]

- Johansen, Søren. 1991. Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models. Econometrica 59: 1551–80. [Google Scholar] [CrossRef]

- Johansen, Søren. 1995. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models. Oxford: Oxford University Press. [Google Scholar]

- Johnson, Simon, and James Kwak. 2012. Is Financial Innovation Good for the Economy? In Innovation Policy and the Economy. Edited by James Lerner and Scott Stern. Chicago: University of Chicago Press, pp. 1–15. [Google Scholar]

- Juhkam, Andres. 2003. Financial Innovation in Estonia. Tallinn: Poliitikauuringute Keskus Praxis. [Google Scholar]

- Kabir, Sarkar Humayun, and Hafiz Al Asad Bin Hoque. 2007. Financial Liberalization, Financial Development and Economic Growth: Evidence from Bangladesh. Savings and Development 4: 431–48. [Google Scholar]

- Kajurová, Veronika, and Petr Rozmahel. 2016. Stock Market Development and Economic Growth: Evidence from the European Union. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis 64: 1927–36. [Google Scholar]

- Karim, Saba, and Ghulam Mujtaba Chaudhary. 2017. Effect of Stock Market Development on Economic Growth of Major South Asian and East Asian Economies: A Comparative Analysis. Journal of Business Studies Quarterly 8: 81–88. [Google Scholar]

- Kassimatis, Konstantinos. 2000. Stock Market Development and Economic Growth in Emerging Economies. Ph.D. thesis, Middlesex University, London, UK; p. 277. [Google Scholar]

- Jedidia, Khoutem Ben, Thouraya Boujelbène, and Kamel Helali. 2014. Financial development and economic growth: New evidence from Tunisia. Journal of Policy Modeling 36: 883–98. [Google Scholar] [CrossRef]

- King, Robert G., and Ross Levine. 1993. Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics 108: 717–37. [Google Scholar] [CrossRef]

- Kothari, Vinod. 2006. Securitization: The Financial Instrument of the Future. Hoboken: John Wiley & Sons. [Google Scholar]

- Kyophilavong, Phouphet, Gazi Salah Uddin, and Muhammad Shahbaz. 2016. The Nexus between Financial Development and Economic Growth in Lao PDR. Global Business Review 17: 303–17. [Google Scholar] [CrossRef]

- Laeven, Luc, Ross Levine, and Stelios Michalopoulos. 2014. Financial Innovation and Endogenous Growth. Stanford: Stanford University. [Google Scholar]

- Levine, Ross. 1997. Financial Development and Economic Growth: Views and Agenda. Journal of Economic Literature 35: 688–726. [Google Scholar]

- Lumpkin, Stephen. 2010. Regulatory issues related to financial innovation. OECD Journal: Financial Market Trends 2: 1–31. [Google Scholar] [CrossRef]

- Magweva, Rabson, and Tafirei Mashamba. 2016. Stock Market Development and Economic Growth: An Empirical Analysis of Zimbabwe (1989–2014). Financial Assets and Investing 7: 20–36. [Google Scholar] [CrossRef]

- Mannah-Blankson, Theresa, and Franklin Belnye. 2004. Financial Innovation and the Demand for Money in Ghana. Accra: Bank of Ghana, pp. 1–23. [Google Scholar]

- Marques, Luís Miguel, José Alberto Fuinhas, and António Cardoso Marques. 2013. Does the stock market cause economic growth? Portuguese evidence of economic regime change. Economic Modelling 32: 316–24. [Google Scholar] [CrossRef]

- Masoud, Najeb M. H. 2013. The Impact of Stock Market Performance upon Economic Growth. International Journal of Economics and Financial Issues 3: 788–98. [Google Scholar]

- Masuduzzaman, Mahedi. 2014. Workers’ Remittance Inflow, Financial Development and Economic Growth: A Study on Bangladesh. International Journal of Economics and Finance 6. [Google Scholar] [CrossRef]

- McGuire, Paul B., and John David Conroy. 2013. Fostering financial innovation for the poor the policy and regulatory environment. In Private Finance for Human Development. Sydney: Foundation for Development Cooperation. [Google Scholar]

- Mia, A. Hannan, Md. Qamruzzaman, and Laila Arjuman Ara. 2014. Stock Market Development and Economic Growth of Bangladesh-A Causal Analysis. Bangladesh Journal of MIS 6: 62–73. [Google Scholar]

- Michalopoulos, Stelios, Luc Laeven, and Ross Levine. 2009. Financial Innovation and Endogenous Growth. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Michalopoulos, Stelios, Luc Laeven, and Ross Levine. 2011. Financial Innovation and Endogenous Growth. Cambridge: National Bureau of Economic Research, pp. 1–33. [Google Scholar]

- Moldovan, Ioana Andrada. 2015. Financial Market’s Contribution to Economic Growth in Romania. Management Dynamics in the Knowledge Economy Journal 3: 447–62. [Google Scholar]

- Morck, Randall, and Masao Nakamura. 1999. Banks and corporate control in Japan. The Journal of Finance 54: 319–39. [Google Scholar] [CrossRef]

- Mwinzi, Dickson Mwangangi. 2014. The Effect of Finanical Innovation on Economic Growth in Kenya. Nairobi: University of Nairobi, p. 54. [Google Scholar]

- Nagayasu, Jun. 2012. Financial innovation and regional money. Applied Economics 44: 4617–29. [Google Scholar] [CrossRef] [Green Version]

- Narayan, Paresh. 2004. Reformulating Critical Values for the Bounds F-Statistics Approach to Cointegration: An Application to the Tourism Demand Model for Fiji. Melbourne: Monash University, pp. 1–40. [Google Scholar]

- Nazir, Mian Sajid, Muhammad Musarat Nawaz, and Usman Javed Gilani. 2010. Relationship between economic growth and stock market development. African Journal of Business Management 4: 3473–79. [Google Scholar]

- Ndako, Umar Bida. 2010. Financial Development, Economic Growth and Stock Market Volatility: Evidence from Nigeria and South Africa. Leicester: University of Leicester. [Google Scholar]

- Ngare, Everlyne, Esman Morekwa Nyamongo, and Roseline N. Misati. 2014. Stock market development and economic growth in Africa. Journal of Economics and Business 74: 24–39. [Google Scholar] [CrossRef]

- Nowbutsing, Baboo M., and M. P. Odit. 2009. Stock Market Development and Economic Growth: The Case of Mauritius. International Business & Economics Research Journal 8: 77–88. [Google Scholar]

- Nsofor, Ebele Sabina. 2016. Impact of Investment on Stock Market Development in Nigeria. International Journal of Financial Economics 5: 1–11. [Google Scholar]

- Nyasha, Sheilla, and Nicholas M. Odhiambo. 2015. Banks, stock market development and economic growth in South Africa: A multivariate causal linkage. Applied Economics Letters 22: 1480–85. [Google Scholar] [CrossRef]

- Nyasha, Sheilla, and Nicholas M. Odhiambo. 2016. Banks, Stock Market Development and Economic Growth in Kenya: An Empirical Investigation. Journal of African Business 18: 1–23. [Google Scholar] [CrossRef] [Green Version]

- Odhiambo, Nicholas M. 2010. Finance-investment-growth nexus in South Africa: An ARDL-bounds testing procedure. Economic Change and Restructuring 43: 205–19. [Google Scholar] [CrossRef]

- Odularu, Gbadebo Olusegun, and Oladapo Adewale Okunrinboye. 2008. Modeling the impact of financial innovation on the demand for money in Nigeria. African Journal of Business Management 3: 39–51. [Google Scholar]

- Ogunmuyiwa, Michael S. 2010. Investor’s Sentiments, Stock Market Liquidity and Economic Growth in Nigeria. Journal of Social Sciences 23: 63–67. [Google Scholar] [CrossRef]

- Orji, Anthony, Jonathan E. Ogbuabor, and Onyinye I. Anthony-Orji. 2015. Financial Liberalization and Economic Growth in Nigeria: An Empirical Evidence. International Journal of Economics and Financial Issues 5: 663–72. [Google Scholar]

- Osinubi, Tokunbo Simbowale. 2010. Does Stock Market Promote Economic Growth In Nigeria? Ibadan: University of Ibadan, pp. 1–29. [Google Scholar]

- Owusu, Erasmus L., and Nicholas M. Odhiambo. 2014. Financial liberalization and economic growth in Nigeria: An ARDL-bounds testing approach. Journal of Economic Policy Reform 17: 164–77. [Google Scholar] [CrossRef]

- Ozcan, Yasar A. 2008. Health Care Benchmarking and Performance Evaluation: An Assessment Using Data Envelopment Analysis (DEA). New York: Springer. [Google Scholar]

- Ozturk, Ilhan, and Ali Acaravci. 2010. CO2 emissions, energy consumption and economic growth in Turkey. Renewable and Sustainable Energy Reviews 14: 3220–25. [Google Scholar] [CrossRef]

- Pagan, Adrian Rodney, and Anthony David Hall. 1983. Diagnostic tests as residual analysis. Econometric Reviews 2: 159–218. [Google Scholar] [CrossRef]

- Pahlavani, Mosayeb, Ed Wilson, and Andrew Charles Worthington. 2005. Trade-GDP nexus in Iran: An application of the autoregressive distributed lag (ARDL) model. Wollongong, New South Wales, Australia: Faculty of Commerce Papers, University of Wollongong. [Google Scholar]

- Perron, Pierre. 1997. Further evidence on breaking trend functions in macroeconomic variables. Journal of Econometrics 80: 355–85. [Google Scholar] [CrossRef]

- Pesaran, H. Hashem, and Yongcheol Shin. 1998. Generalized impulse response analysis in linear multivariate models. Economics Letters 58: 17–29. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef] [Green Version]

- Petros, Jecheche. 2012. The effect of the stock exchange on economic growth: A case of the Zimbabwe stock exchange. Research in Business and Economics Journal 6: 1. [Google Scholar]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a unit root in time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Pohoaţă, Ion, Delia Elena Diaconaşu, and Oana Ramona Socoliuc. 2016. Economic Dynamics—Stock Market Evolution: A Relation Committed To Dysfunctionality in Romania and Croatia. Ecoforum 5: 332–37. [Google Scholar]

- Pradhan, Rudra P., Mak B. Arvin, and S. Bahmani. 2015. Causal nexus between economic growth, inflation, and stock market development: The case of OECD countries. Global Finance Journal 27: 98–111. [Google Scholar] [CrossRef]

- Pradhan, Rudra P., Mak B. Arvin, John H. Hall, and Sahar Bahmani. 2014a. Causal nexus between economic growth, banking sector development, stock market development, and other macroeconomic variables: The case of ASEAN countries. Review of Financial Economics 23: 155–73. [Google Scholar] [CrossRef]

- Pradhan, Rudra P., Sasikanta Tripathy, Shashikant Pandey, and Samadhan K. Bele. 2014b. Banking sector development and economic growth in ARF countries: The role of stock markets. Macroeconomics and Finance in Emerging Market Economies 7: 208–29. [Google Scholar] [CrossRef]

- Prats, María Asuncíon, and Beatriz Sandoval. 2016. Stock market and economic growth in Eastern Europe. Economics Discussion Papers, Kiel, Germany: Kiel Institute for the World Economy (IfW). [Google Scholar]

- Qamruzzaman, Md., and Jianguo Wei. 2017. Financial innovation and economic growth in Bangladesh. Financial Innovation 3: 19. [Google Scholar] [CrossRef]

- Ram, Rati. 1999. Financial development and economic growth: Additional evidence. Journal of Development Studies 35: 164–74. [Google Scholar] [CrossRef]

- Hasan, Rezwanul, and Suborna Barua. 2015. Financial Development and Economic Growth: Evidence from a Panel Study on South Asian Countries. Asian Economic and Financial Review 5: 1159–73. [Google Scholar]

- Saad, Wadad. 2014. Financial Development and Economic Growth: Evidence from Lebanon. International Journal of Economics and Finance 6. [Google Scholar] [CrossRef]

- Sabandi, Muhammad, and Leny Noviani. 2015. The Effects of Trade Liberalization, Financial Development and Economic Crisis on Economic Growth in Indonesia. Journal of Economics and Sustainable Development 6: 120–28. [Google Scholar]

- Huntington, Samuel. P. 1993. The Third Wave: Democratization in the Late Twentieth Century. Norman: University of Oklahoma Press. [Google Scholar]

- Saqib, Najia. 2013. Impact of Development and Efficiency of Financial Sector on Economic Growth: Empirical Evidence from Developing Countries. Journal of Knowledge Management, Economics and Information Technology 3: 1–15. [Google Scholar]

- Saqib, Najia. 2015. Review of Literature on Finance-Growth Nexus. Journal of Applied Finance & Banking 5: 175–95. [Google Scholar]

- Schrieder, Gertrud, and Franz Heidhues. 1995. Reaching the Poor through Financial Innovations. Quarterly Journal of International Agriculture 2: 132–48. [Google Scholar]

- Schumpeter, Joseph. 1911. The Theory of Economic Development. Cambridge: Harvard University Press. [Google Scholar]

- Sekhar, Satya, and V. Gudimetla. 2013. Theorems and Theories of Financial Innovation: Models and Mechanism Perspective. Financial and Quantitative Analysis 1: 26–29. [Google Scholar] [CrossRef]

- Seven, Ünal, and Hakan Yetkiner. 2016. Financial intermediation and economic growth: Does income matter? Economic Systems 40: 39–58. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, Ijaz Ur Rehman, and Ahmed Taneem Muzaffar. 2015. Re-Visiting Financial Development and Economic Growth Nexus: The Role of Capitalization in Bangladesh. South African Journal of Economics 83: 452–71. [Google Scholar] [CrossRef]

- Shaughnessy, Haydn. 2015. Innovation in Financial Services: The Elastic Innovation Index Report. La Hulpe: Innotribe, 21p. [Google Scholar]

- Shittu, Ayodele Ibrahim. 2012. Financial Intermediation and Economic Growth in Nigeria. British Journal of Arts and Social Sciences 4: 164–79. [Google Scholar]

- Silva, N. K. L., P. R. M. R. Perera, and N. L. C. Silva. 2018. Relationship between Stock Market Performance & Economic Growth: Empirical Evidence from Sri Lanka. Journal for Accounting Researchers and Educators 1: 1. [Google Scholar]

- Silve, Florent, and Alexander Plekhanov. 2014. Institutions, Innovation and Growth: Cross-Country Evidence. London: European Bank for Reconstruction and Development, p. 28. [Google Scholar]

- Simiyu, Robert Silikhe, Paul Nyatha Ndiang’ui, and Celestine Chege Ngugi. 2014. Effect of Financial Innovations and Operationalization on Market Size in Commercial Banks: A Case Study of Equity Bank, Eldoret Branch. International Journal of Business and Social Science 85: 227–50. [Google Scholar]

- Smaoui, Houcem, and Salem Nechi. 2017. Does sukuk market development spur economic growth? Research in International Business and Finance 41: 136–47. [Google Scholar] [CrossRef]

- Soyode, Afolabi. 1990. The role of capital market in economic development. Security Market Journal in Nigeria 6: 223–254. [Google Scholar]

- Tachiwou, Aboudou Maman. 2010. Stock Market Development and Economic Growth: The Case of West African Monetary Union. Nternational Journal of Economics and Finance 2: 97–103. [Google Scholar] [CrossRef]

- Van Nieuwerburgh, Stijn, Frans Buelens, and Ludo Cuyvers. 2006. Stock market development and economic growth in Belgium. Explorations in Economic History 43: 13–38. [Google Scholar] [CrossRef] [Green Version]

- Wachter, Jessica A. 2006. Comment on: “Can financial innovation help to explain the reduced volatility of economic activity?”. Journal of Monetary Economics 53: 151–54. [Google Scholar] [CrossRef]

- Wadud, Md. Abdul. 2009. Financial development and economic growth: A cointegration and errorcorrection modeling approach for south Asian countries. Economics Bulletin 29: 1670–77. [Google Scholar]

- Weinstein, David E., and Yishay Yafeh. 1998. On the costs of a bank-centered financial system: Evidence from the changing main bank relations in Japan. The Journal of Finance 53: 635–72. [Google Scholar] [CrossRef]

- Wong, Anson, and Xianbo Zhou. 2011. Development of Financial Market and Economic Growth: Review of Hong Kong, China, Japan, The United States and The United Kingdom. International Journal of Economics and Finance 3: 111–15. [Google Scholar] [CrossRef]

- World Bank. 2017. World Development Indicators. Available online: http://data.worldbank.org/data-catalog/world-development-indicators (accessed on 1 June 2017).

- World Economic Outlook. 2017. World Economic Outlook (WEO) Data. IMF. Available online: https://www.imf.org/external/pubs/ft/weo/2017/02/weodata/index.aspx (accessed on 1 June 2017).

- Zivot, Eric, and Donald W. K. Andrews. 2002. Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business & Economic Statistics 20: 25–44. [Google Scholar]

| Variable | Variable Definition | Expected Sign |

|---|---|---|

| Dependent variable | ||

| Y | The percentage change in gross domestic par capital used as an indicator of economic growth. Following, Pradhan et al. (2014b); Nyasha and Odhiambo (2016); Hasan and Barua (2015); Ishioro (2013) | |

| Independent variable | ||

| FI | The ratio between Broad to Narrow money (M2/M1) measures the demand for real cash balance and income and interest elasticities. By following, Bara and Mudxingiri (2016); Ansong et al. (2011); Qamruzzaman and Wei (2017) | Negtive/Positive |

| SMD | Market capitalization (MC) of listed domestic companies (% of GDP); Total Value Traded (TAR) in the stock market (% of GDP); Turnover ratio (TUR) between Market capitalization and Total value traded. By following Pradhan et al. (2014b); Nyasha and Odhiambo (2016); Nyasha and Odhiambo (2015) | Positive |

| Macroeconomic variable | ||

| GEXP | Government final consumption expenditure measures as a percentage of Gross Domestic Product, to capture the degree of government evolvement in the economy | Positive |

| GCF | Gross capital formation measures an increase of net physical assets in the economy as a percentage of Gross Domestic Product. | Positive |

| INF | Inflation rate: measured in percentage change by using Consumer Price Index | Negative |

| TO | Trade openness measures total trade flow (Export + imports) as a percentage of gross domestic product, apply to investigate openness of the economy regarding internationalization. | Positive |

| Y | MC | TAR | TUR | FI | GEXP | GCF | INF | TO | |

|---|---|---|---|---|---|---|---|---|---|

| Panel A: Descriptive statistics (original value) | |||||||||

| Mean | 2.826 | 7.43 | 23.18 | 0.45 | 3.45 | 4.82 | 21.53 | 7.83 | 28.75 |

| Median | 2.98 | 3.39 | 20.68 | 0.12 | 3.34 | 4.96 | 21.96 | 7.60 | 27.25 |

| Maximum | 5.778 | 34.32 | 43.92 | 1.73 | 4.16 | 6.14 | 28.88 | 19.48 | 48.11 |

| Minimum | 1.93 | 0.26 | 5.77 | 0.03 | 2.64 | 4.03 | 14.43 | 0.73 | 16.68 |

| Std. Dev. | 1.89 | 9.51 | 11.58 | 0.55 | 0.47 | 0.49 | 4.76 | 4.01 | 9.99 |

| Panel B: Descriptive statistics with natural log value | |||||||||

| Mean | 0.973 | 3.457 | 1.088 | 3.008 | 1.23 | 1.568 | 3.045 | 1.874 | 3.301 |

| Median | 1.114 | 3.344 | 1.221 | 3.029 | 1.20 | 1.602 | 3.089 | 2.028 | 3.305 |

| Maximum | 1.754 | 4.166 | 3.535 | 3.782 | 1.42 | 1.814 | 3.363 | 2.969 | 3.873 |

| Minimum | −1.47 | 2.643 | −1.339 | 1.752 | 0.97 | 1.393 | 2.669 | −0.310 | 2.814 |

| Std. Dev. | 0.71 | 0.471 | 1.497 | 0.549 | 0.15 | 0.102 | 0.225 | 0.709 | 0.341 |

| Panel C: Correlation Matrix | |||||||||

| Y | 1 | ||||||||

| MC | 0.19 * | 1 | |||||||

| TAR | 0.15 ** | 0.20 ** | 1 | ||||||

| TUR | 0.22 * | 0.43 ** | 0.17 ** | 1 | |||||

| FI | 0.41 * | 0.55 ** | 0.59 * | 0.66 * | 1 | ||||

| GEXP | 0.30 | −0.23 | −0.06 | −0.30 | −0.23 | 1 | |||

| GCF | 0.29 ** | 0.18 ** | 0.30 * | 0.44 * | 0.59 * | −0.26 | 1 | ||

| INF | 0.59 ** | 0.25 * | 0.17 | 0.25 ** | 0.46 ** | −0.13 | 0.81 * | 1 | |

| TO | 0.78 ** | 0.43 * | 0.09 * | 0.13 ** | 0.68 ** | −0.15 | 0.53 * | 0.20 ** | 1 |

| At Level | First Difference | Decision | ||||||

|---|---|---|---|---|---|---|---|---|

| ADF | PP | ADF | PP | |||||

| lnFI | 0.69(0.99) | 0.61(0.98) | −4.1(0.001) ** | −4.4(0.001) ** | I(1) | |||

| −1.87(0.64) | −1.74(0.70) | −4.47(0.006) ** | −4.2(0.006) ** | I(1) | ||||

| 4.00(0.99) | 3.71(0.99) | −3.02(0.001) ** | −3.37(0.001) ** | I(1) | ||||

| lnTAR | 0.33(0.97) | 0.66(0.98) | −5.61(0.001) ** | −5.63(0.02) * | I(1) | |||

| −1.53(0.79) | −1.50(0.80) | −5.61(0.00) ** | −6.26(0.001) ** | I(1) | ||||

| 4.06(0.99) | 4.75(1.00) | −3.88(0.00) ** | −2.88(0.03) * | I(1) | ||||

| lnTUR | 2.29(0.99) | −0.33(0.90) | −2.57(0.011) * | −9.55(0.001) ** | I(1) | |||

| −2.78(0.21) | −2.54(0.30) | −4.58(0.005) ** | −28.68(0.00) ** | I(1) | ||||

| 1.82(0.98) | 1.025(0.91) | −7.73(0.02) * | −7.80(0.00) ** | I(1) | ||||

| lnY | −3.80(0.00) ** | −3.64(0.00) ** | I(0) | |||||

| −7.71(0.00) ** | −7.45(0.00) ** | I(0) | ||||||

| −15.6(0.00) ** | −15.64(0.00) ** | I(0) | ||||||

| lnGEXP | −1.02(0.73) | −7.35(0.80) | −4.35(0.001) ** | −28.84(0.01) * | I(1) | |||

| −2.38(0.37) | −3.38(0.01) | −4.28(0.004) ** | −25.92(0.01) * | I(1) | ||||

| 0.77(0.87) | −0.63(0.43) | −4.29(0.00) ** | −12.38(0.00) ** | I(1) | ||||

| lnGCF | −0.28(0.91) | −0.33(0.90) | −5.97(0.01) * | −5.76(0.002) ** | I(1) | |||

| −3.52(0.05) | −1.72(0.71) | −3.87(0.02) * | −5.90(0.001) ** | I(1) | ||||

| 2.68(0.99) | 3.31(0.99) | −1.54(0.01) * | −4.97(0.02) * | I(1) | ||||

| lnINF | −4.06(0.003) | −4.02(0.006) | I(0) | |||||

| −4.81(0.009) | −4.28(0.001) | I(0) | ||||||

| −1.09(0.024) | −1.74(0.03) | I(0) | ||||||

| lnMC | −0.75(0.81) | −0.34(0.90) | −6.59(0.00) ** | −8.25(0.00) ** | I(1) | |||

| −2.57(0.29) | −2.38(0.38) | −6.70(0.00) ** | −15.19(0.00) ** | I(1) | ||||

| 0.028(0.68) | 0.704(0.86) | −6.48(0.00) ** | −6.62(0.00) ** | I(1) | ||||

| lnTO | 1.68(0.99) | −0.33(0.90) | −2.33(0.01) * | −6.24(0.02) * | I(1) | |||

| −3.16(0.11) | −3.30(0.08) | −4.77(0.00) ** | −6.41(0.01) * | I(1) | ||||

| 3.29(0.99) | 1.17(0.93) | −0.46(0.04) * | −5.80(0.002) ** | I(1) | ||||

| Perron (1997) | Zivot and Andrews (2002) | |||||||

|---|---|---|---|---|---|---|---|---|

| Level | 1st Diff | Level | 1st Diff | |||||

| T-Stat | TB | T-Stat | TB | T-Stat | TB | T-Stat | TB | |

| lnY | −8.41 ** | 1984 | −16.61 ** | 1990 | −9.50 ** | 2004 | −15.34 ** | 1990 |

| lnMC | −3.58 ** | 2001 | −7.41 ** | 2012 | −7.26 ** | 1996 | −10.73 ** | 1996 |

| lnTAR | −5.33 * | 1983 | −7.44 ** | 1984 | −5.60 ** | 1987 | −5.65 ** | 1985 |

| lnTUR | −4.82 | 1996 | −7.49 ** | 1985 | −3.70 | 1984 | −5.21 ** | 2001 |

| lnFI | −3.98 | 2003 | −6.76 | 1999 | −3.54 | 1994 | −5.69 ** | 2007 |

| lnGCF | −5.38 ** | 1995 | −9.54 ** | 1987 | −1.84 | 2000 | −6.89 ** | 1997 |

| lnTO | −6.04 ** | 1990 | −7.04 ** | 1984 | −5.83 ** | 1991 | −4.57 * | 2007 |

| lnINF | −5.98 ** | 2000 | −8.18 ** | 1990 | −6.16 ** | 2003 | −6.98 ** | 2000 |

| Model Specification | Cointegration | ||||||

|---|---|---|---|---|---|---|---|

| 9.87 | Accepted | ||||||

| 13.87 | Accepted | ||||||

| 8.89 | Accepted | ||||||

| 8.72 | Accepted | ||||||

| Critical value | K | 1% | 5% | 10% | |||

| I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | ||

| Pesaran et al. (2001) | 5 | 3.41 | 4.68 | 2.62 | 3.79 | 2.26 | 3.35 |

| Narayan (2004) | 5 | 3.27 | 5.99 | 3.58 | 3.58 | 2.67 | 2.67 |

| Stock Market Development | Financial Innovation | |||

|---|---|---|---|---|

| Market Capitalization ARDL (1, 0, 1, 0, 0, 0) Lag: SIC | Market Turnover ARDL (1, 0, 0, 1, 0, 0) Lag: SIC | Stock Traded Value ARDL (1, 0, 1, 0, 0, 0) Lag: SIC | Broad/Narrow Money ARDL (1, 0, 1, 0, 0, 0) Lag: SIC | |

| lnMC | 0.17(0.0001) ** | |||

| lnTUR | 0.69(0.009) ** | |||

| lnTAR | 0.17(0.005) ** | |||

| lnFI | 0.21(0.0002) ** | |||

| lnGCF | 0.25(0.005) ** | 0.07(0.035) * | 0.25(0.04) * | 0.41(0.01) ** |

| lnGEXP | 0.87(0.023) * | 1.32(0.075) | 0.78(0.029) * | 0.19(0.8054) |

| lnINF | −0.16(0.11) | −0.05(0.35) | −0.16(0.0002) ** | −0.057(0.22) |

| lnTO | 0.05(0.025) * | 0.09(0.026) * | 0.05(0.031) | 0.15(0.02) ** |

| Market Capitalization Lag: SIC | Market Turnover Lag: SIC | Stock Traded Value Lag: SIC | Broad/Narrow Money Lag: SIC | |

|---|---|---|---|---|

| ECT(-1) | −0.825(0.002) ** | −0.623(0.001) ** | −0.8756(0.002) ** | −0.734(0.015) ** |

| ∆lnGFC | 0.318(0.038) * | 0.318(0.031) * | 0.32(0.012) * | 0.318(0.047) * |

| ∆lnTUR | 0.14(0.021) * | |||

| ∆lnGEXP | 1.05(0.035) * | 0.029(0.979) | 0.49(0.015) * | 1.053(0.036) * |

| ∆lnINF | −0.21(0.001) ** | −0.063(0.26) | −0.05(0.25) | −0.206(0.11) |

| ∆lnTO | 0.063(0.028) * | −0.19(0.14) | 0.11(0.049) * | 0.062 (0.003) ** |

| ∆lnMC | 0.22(0.001) ** | |||

| ∆lnM2/M1 | 0.27 (0.03) * | |||

| ∆lnTAR | 0.14 (0.001) ** | |||

| Diagnostic Test | ||||

| 0.85 | 0.83 | 0.82 | ||

| 0.78 | 0.79 | 0.76 | ||

| 14.94 (0.001) | 13.57(0.025) | 14.46(0.005) | ||

| 1.67(0.19) | 2.44(0.11) | 4.94(0.1852) | 3.23(0.71) | |

| 5.41(0.71) | 8.11(0.52) | 8.83(0.2624) | 4.05(0.85) | |

| 0.85(0.72) | 0.39(0.81) | 0.95(0.62) | 0.88(0.65) | |

| 1.18(0.28) | 0.07(0.95) | 0.76(0.44) | 0.25(0.62) | |

| Stability test | ||||

| CUSUM @5% | Figure 2 | Figure 3 | Figure 4 | Figure 5 |

| CUSUMSQ @5% | Figure 6 | Figure 7 | Figure 8 | Figure 9 |

| Type of Granger Causality | |||||||

|---|---|---|---|---|---|---|---|

| Short Run | Long Run | ||||||

| Model 1: Market capitalization proxy of stock market development | |||||||

| Dependent Variables | ∆lnY | ∆lnGEXP | ∆lnGCF | ∆lnINF | ∆lnMC | ∆lnTO | |

| ∆lnY | 0.44 * | 0.02 * | 2.35 ** | 0.27 ** | 0.85 * | −0.16 ** | |

| ∆lnGEXP | 1.84 * | 3.28 | 0.78 | 3.25 * | 0.11 | −0.08 ** | |

| ∆lnGCF | 2.08 * | 8.76 | 4.33 | 1.95 * | 1.25 ** | −0.12 ** | |

| ∆lnINF | 6.73 | 6.04 | 4.88 | 2.13 | 2.12 | −1.03 ** | |

| ∆lnMC | 4.16 ** | 0.46 * | 1.44 * | 4.24 * | 1.74 * | −2.36 ** | |

| ∆lnTO | 3.29 * | 1.55 * | 0.78 | 1.78 * | 0.02 | −1.55 ** | |

| Model 2: Broad to Narrow money proxy of financial innovation | |||||||

| ∆lnY | ∆lnGEXP | ∆lnGCF | ∆lnINF | ∆lnFI | ∆lnTO | ||

| ∆lnY | 0.45 * | 0.32 ** | 1.99 * | 0.44 * | 6.62 * | −0.23 ** | |

| ∆lnGEXP | 5.05 * | 0.45 | 8.10 | 1.63 ** | 3.20 | 0.13 | |

| ∆lnGCF | 0.67 ** | 5.88 ** | 0.35 * | 1.36 ** | 3.50 | −0.01 * | |

| ∆lnINF | 7.26 * | 8.91 ** | 6.28 | 9.09 ** | 2.20 * | 0.64 * | |

| ∆lnFI | 2.57 ** | 0.66 * | 0.39 | 6.29 * | 0.72 | −0.18 ** | |

| ∆lnTO | 0.39 | 1.08 | 0.85 | 1.75 | 0.45 | −1.22 ** | |

| Model 3: Stock traded value proxy of stock market development | |||||||

| ∆lnY | ∆lnGEXP | ∆lnGCF | ∆lnINF | ∆lnTO | ∆lnTAR | ||

| ∆lnY | 4.02 ** | 0.28 | 3.40 | 1.21 ** | 0.03 | −0.53 * | |

| ∆lnGEXP | 8.12 ** | 12.31 ** | 7.08 | 6.30 ** | 0.75 ** | 0.12 | |

| ∆lnGCF | 6.02 | 6.62 * | 6.07 | 2.22 | 0.82 | 0.05 * | |

| ∆lnINF | 10.13 * | 3.51 | 5.33 ** | 4.76 | 2.55 | −0.36 ** | |

| ∆lnTO | 0.69 ** | 0.68 ** | 4.61 ** | 1.88 * | 0.39 | −1.12 ** | |

| ∆lnTAR | 7.21 | 2.24 | 2.16 | 3.61 | 5.47 | −0.44 ** | |

| Model 4: Turnover ratio proxy of stock market development | |||||||

| ∆lnY | ∆lnGEXP | ∆lnGCF | ∆lnTUR | ∆lnINF | ∆lnTO | ||

| ∆lnY | 4.02 * | 0.28 ** | 5.22 ** | 3.40 ** | 1.21 * | −0.53 ** | |

| ∆lnGEXP | 1.46 | 1.48 | 2.89 ** | 0.72 | 2.36 ** | −0.09 ** | |

| ∆lnGCF | 6.02 * | 6.62 ** | 1.28 | 6.07 ** | 2.22 | 0.05 | |

| ∆lnTUR | 2.59 ** | 3.20 | 2.17 * | 0.14 | 3.40 | −0.12 ** | |

| ∆lnINF | 0.52 * | 1.10 * | 0.16 | 3.76 | 1.86 | −0.04 * | |

| ∆lnTO | 0.69 | 0.68 ** | 4.61 | 4.24 ** | 1.88 | −1.12 * | |

| Model Specification | ||||

|---|---|---|---|---|

| Tested Causality | Model 1 | Model 2 | Model 3 | Model 4 |

| Directional Relationship | Directional Relationship | Directional Relationship | Directional Relationship | |

| Y vs. GEXP | Y ←→ GEXP | Y ←→ GEXP | Y ←→ GEXP | Y ←→ GEXP |

| Y vs. GCF | Y ←→ GCF | Y ←→ GCF | NA | Y ←→ GCF |

| Y vs. INF | Y < = INF | Y ←→ INF | Y = > INF | Y < = INF |

| Y vs. TO | Y ←→ TO | Y < = TO | Y ←→ TO | Y < = TO |

| Y vs. MC | Y ←→ MC | |||

| Y vs. M2/M1 | Y ←→ M2/M1 | |||

| Y vs. TAR | Y ←→ TAR | |||

| Y vs. TUR | Y ←→ TUR | |||

| GEXP vs. GCF | NA | GEXP ← GCF | GEXP ←→ GCF | GEXP → GCF |

| GEXP vs. INF | NA | GEXP ← INF | GEXP ← INF | GEXP → INF |

| GEXP vs. TO | GEXP ←→ TO | NA | GEXP ←→ TO | GEXP ← TO |

| GEXP vs. MC | GEXP ←→ MC | |||

| GEXP vs. FI | GEXP ←→ FI | |||

| GEXP vs. TUR | GEXP ←→ TAR | |||

| GEXP vs. TAR | GEXP ← TUR | |||

| GCF vs. INF | GCF → INF | GCF ← INF | GCF → INF | GCF ← INF |

| GCF vs. TO | GCF ← TO | NA | GCF → TO | GCF ←→ TO |

| GCF vs. MC | GCF ←→ MC | |||

| GCF vs. FI | GCF ← FI | |||

| GCF vs. TRU | NA | |||

| GCF vs. TAR | NA | |||

| INF vs. TO | INF → TO | INF ← TO | INF → TO | NA |

| INF vs. MC | INF → MC | |||

| INF vs. FI | INF ←→ FI | |||

| INF vs. TAR | NA | |||

| INF vs. TUR | NA | |||

| TO vs. MC | TO → MC | |||

| TO vs. M2/M1 | TO ← M2/M1 | |||

| TO vs. TAR | NA | |||

| TO vs. TUR | TO → TUR | |||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qamruzzaman, M.; Wei, J. Financial Innovation, Stock Market Development, and Economic Growth: An Application of ARDL Model. Int. J. Financial Stud. 2018, 6, 69. https://doi.org/10.3390/ijfs6030069

Qamruzzaman M, Wei J. Financial Innovation, Stock Market Development, and Economic Growth: An Application of ARDL Model. International Journal of Financial Studies. 2018; 6(3):69. https://doi.org/10.3390/ijfs6030069

Chicago/Turabian StyleQamruzzaman, Md., and Jianguo Wei. 2018. "Financial Innovation, Stock Market Development, and Economic Growth: An Application of ARDL Model" International Journal of Financial Studies 6, no. 3: 69. https://doi.org/10.3390/ijfs6030069