Dynamic Relationships between Price and Net Asset Value for Asian Real Estate Stocks

Abstract

:1. Introduction

2. Brief Literature

3. Literature Gap and Research Contribution

4. Sample and Data

5. Research Methodology

5.1. Panel Co-Integration Approach

- (a)

- Panel unit root tests of Levin et al. (2002) (LLC) and Im et al. (1997) (IPS) to test the null hypothesis of a panel (1).

- (b)

- (c)

- Dynamic OLS panel regression for long-term coefficients and dynamic ECM panel data models for short-term dynamics.

- (d)

- Panel causality tests to examine the causal effects between P and NAV.

5.2. Factor Analysis

5.3. Generalized Spillover Index Approach

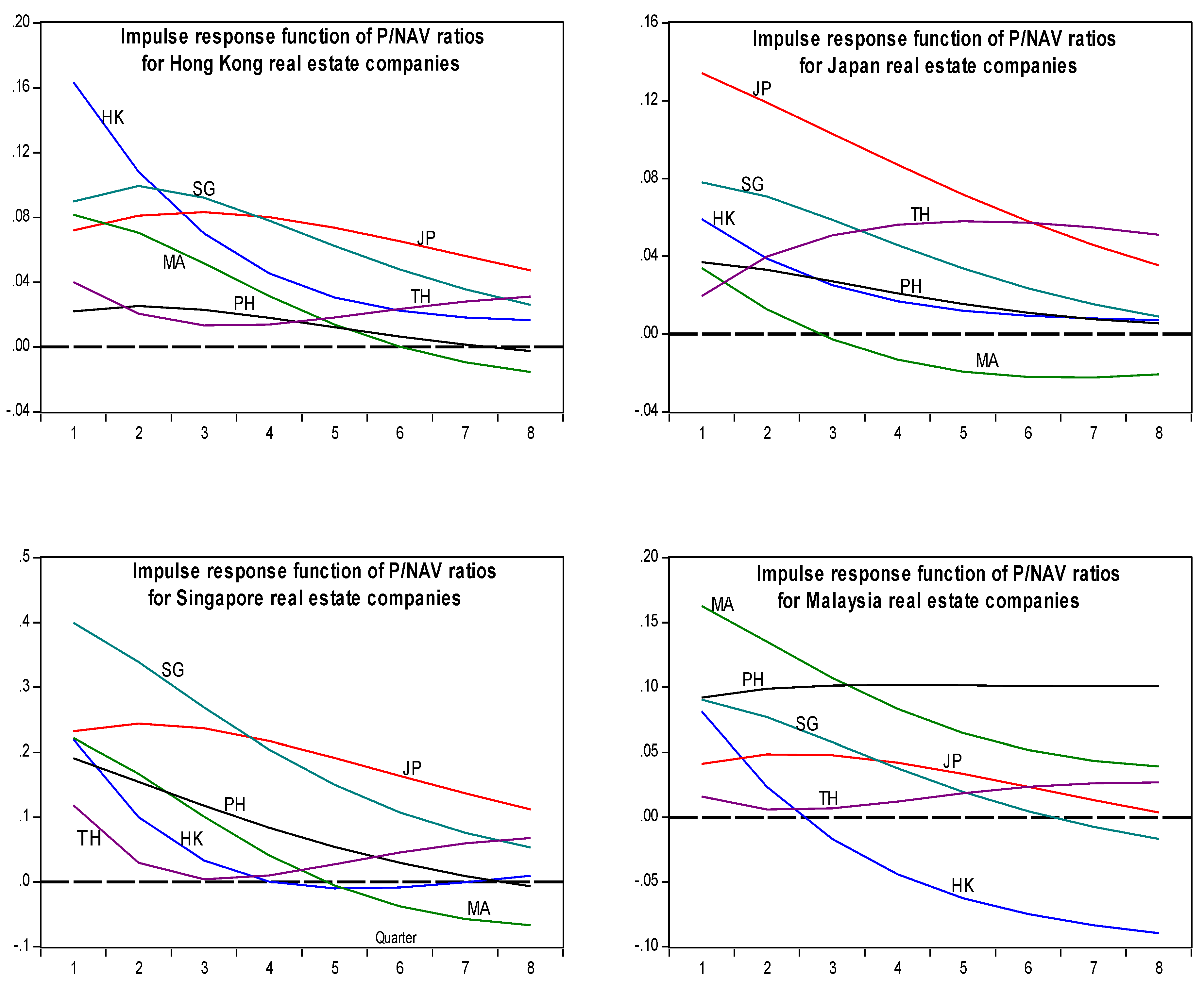

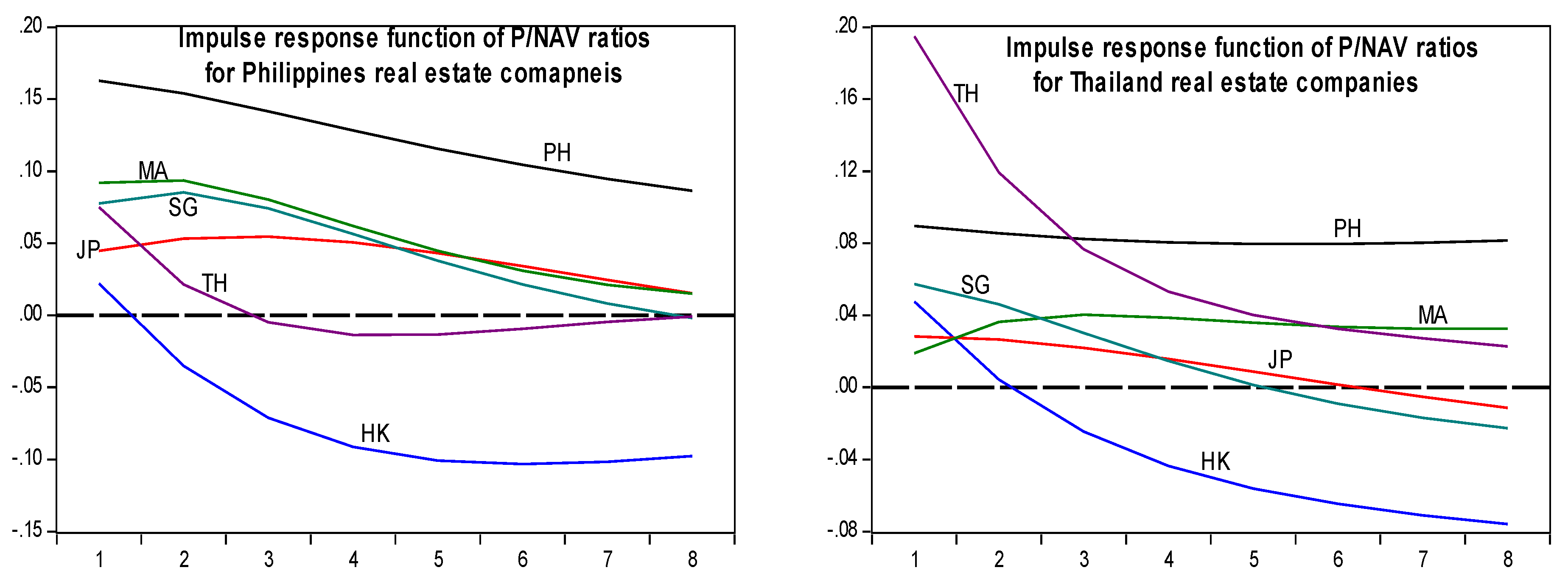

5.4. Generalized Impulse Response Functions

6. Results and Discussion

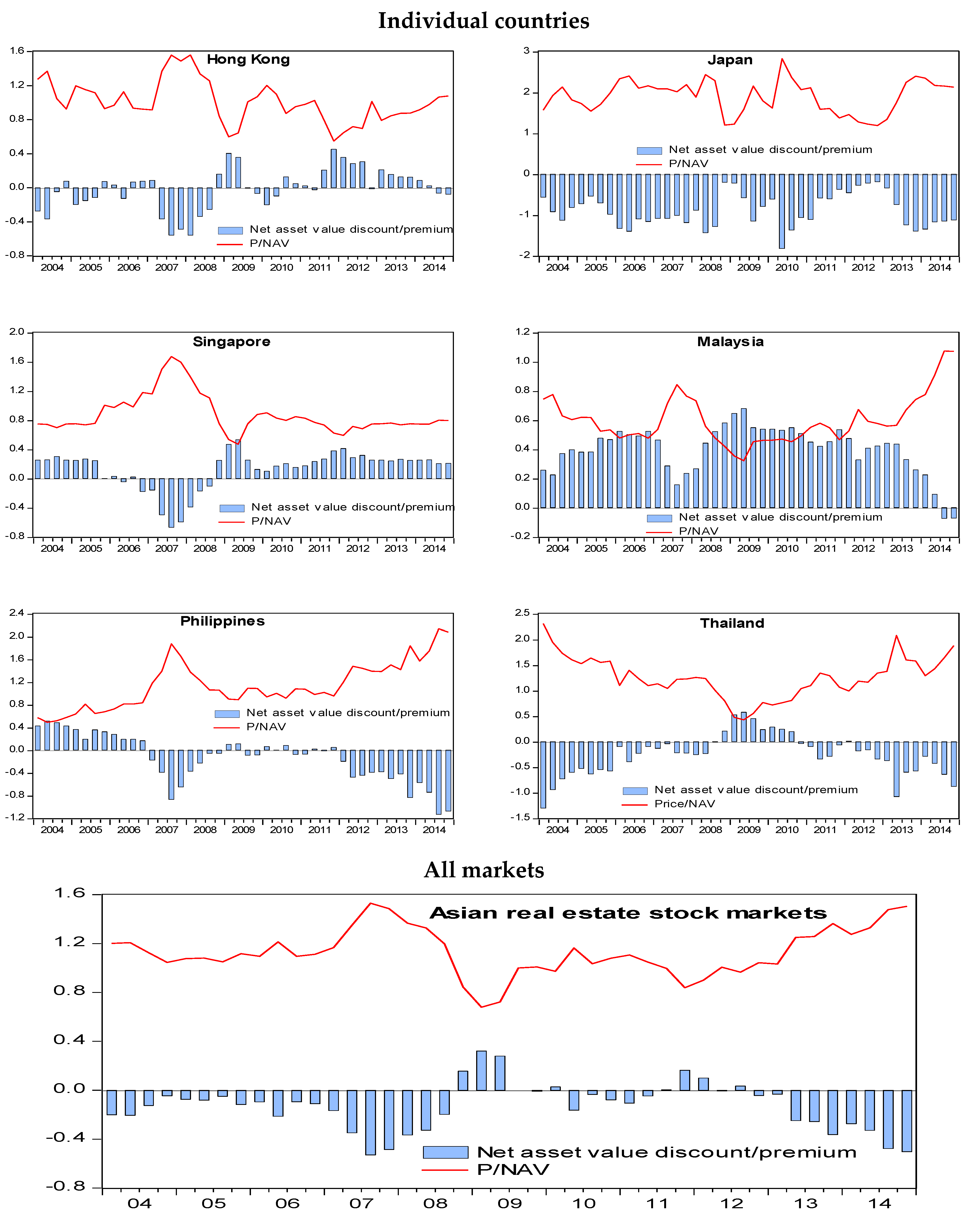

6.1. Panel Co-Integration for Individual Real Estate Stock Markets (Six “Panels”)

6.2. Regional Panel Co-Integration (Asian Panel)

6.3. Correlation Structure of P/NAV Ratios

6.4. Generalized P/NAV Factor Spillovers among Markets

6.5. Generalized Impulse Response Functions (GIRFs)

6.6. Economic Significance of Findings

7. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Adams, Andrew, and Piers Venmore-Rowland. 1989. Property share valuation. Journal of Property Valuation 8: 127–42. [Google Scholar] [CrossRef]

- Ambrose, Brent W., Dong Wook Lee, and Joe Peek. 2007. Co-movement after joining an index: Spillovers of non-fundamental effects. Real Estate Economics 35: 57–90. [Google Scholar] [CrossRef]

- Barkham, Richard J., and Charles W. R. Ward. 1999. Investor sentiment and noise traders: Discount to net asset value in listed property companies in the U.K. Journal of Real Estate Research 18: 291–312. [Google Scholar]

- Brounen, Dirk, David C. Ling, and Melissa Porras Prado. 2013. Short sales and fundamental value: Explaining the REIT premium to NAV. Real Estate Economics 41: 481–516. [Google Scholar] [CrossRef]

- Campbell, John Y., and Robert J. Shiller. 1988. Stock prices, earnings and expected dividends. Journal of Finance 43: 661–76. [Google Scholar] [CrossRef]

- Conner, Philip, and Robert Falzon. 2004. Volatility differences detween the public and private real estate markets. Briefings in Real Estate Finance 4: 107–17. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28: 57–66. [Google Scholar] [CrossRef]

- Dumitrescu, Elena-Ivona, and Christophe Hurlin. 2012. Testing for Granger mon-causality in heterogeneous panels. Economic Modeling 29: 1450–60. [Google Scholar] [CrossRef]

- Engle, Robert F., and C. W. Granger. 1987. Co-integration and error correction: Representation, estimation, and testing. Econometrica: Journal of the Econometric Society 55: 251–76. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1988. Dividend yields and expected stock returns. Journal of Financial Economics 22: 3–25. [Google Scholar] [CrossRef]

- Hendershott, Patric, Bryan Macgregor, and Michael White. 2003. Explaining real commercial rent using an error-correction model with panel data. Journal of Real Estate Finance and Economics 24: 59–87. [Google Scholar] [CrossRef]

- Hoesli, Martin, and Elias Oikarinen. 2012. Are REITs real estate? Evidence from international sector level data. Journal of International Money and Finance 31: 1823–50. [Google Scholar] [CrossRef]

- Hudson-Wilson, Susan, Frank J. Fabozzi, and Jacques N. Gordon. 2003. Why real estate? Journal of Portfolio Management 29: 12–25. [Google Scholar] [CrossRef]

- Im, Kyung So, M. Hashem Pesaran, and Yongcheol Shin. 2003. Testing for unit roots in heterogeneous panels. Journal of Econometrics 115: 53–74. [Google Scholar] [CrossRef]

- Johansen, Søren. 1991. Estimation and hypothesis testing of co-integration vectors in Gaussian vector autoregressive models. Econometrica: Journal of the Econometric Society 59: 1551–80. [Google Scholar] [CrossRef]

- Kaiser, Henry F. 1960. The application of electronic computers to factor analysis. Educational and Psychological Measurement 20: 141–51. [Google Scholar] [CrossRef]

- Lee, Charles M., Andrei Shleifer, and Richard H. Thaler. 1991. Investor sentiment and the closed-end fund puzzle. The Journal of Finance 46: 75–109. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, Wei-Ling Huang, and Chun-Hao Yin. 2013. The dynamic interactions among the stock, bond and insurance markets. North American Journal of Economics and Finance 26: 28–52. [Google Scholar] [CrossRef]

- Levin, Andrew, Chien-Fu Lin, and Chia-Shang James Chu. 2002. Unit root tests in panel data: Asymptotic and finite sample properties. Journal of Econometrics 108: 1–24. [Google Scholar] [CrossRef]

- Lin, Pin-Te. 2013. Examining volatility spillover in Asian REIT markets. Applied Financial Economics 23: 1701–05. [Google Scholar] [CrossRef]

- Lin, Pin-Te, and Franz Fuerst. 2014. The integration of direct real estate and stock markets in Asia. Applied Economics 46: 1323–34. [Google Scholar] [CrossRef]

- Ling, David C., and Andy Naranjo. 1999. The integration of commercial real estate markets and stock markets. Real Estate Economics 27: 483–515. [Google Scholar] [CrossRef]

- Liow, Kim Hiang, and Ying Li. 2006. Net asset value discounts for Asian-Pacific real estate companies: Long-run relationships and short-term dynamics. Journal of Real Estate Finance and Economics 33: 363–88. [Google Scholar] [CrossRef]

- Liow, Kim Hiang, and Mong Chuan Sim. 2006. The risk and return profile of Asian listed real estate stocks. Pacific Rim Property Research Journal 12: 283–310. [Google Scholar] [CrossRef]

- Liow, Kim Hiang, and Haishan Yang. 2005. Long-term co-memories and short-run adjustment: Securitized real estate and stock markets. The Journal of Real Estate Finance and Economics 31: 283–300. [Google Scholar] [CrossRef]

- Lizieri, Colin. 2013. After the fall: Real estate in the mixed-asset portfolio in the aftermath of the global financial crisis. Journal of Portfolio Management 39: 43–59. [Google Scholar]

- Lizieri, Colin, and Stephen Satchell. 1997. Interactions between property and equity markets: An investigation of linkages in the United Kingdom 1972–1992. Journal of Real Estate Finance and Economics 15: 11–26. [Google Scholar] [CrossRef]

- MacDonald, Ronald, and David Power. 1995. Stock prices, dividends ansd retention: Long-run relationships and short-run dynamics. Journal of Empirical Finance 2: 135–51. [Google Scholar] [CrossRef]

- Ong, Seow-Eng, and Clark L. Maxim. 1997. A heterogeneous panel co-integration-error correction approach to modelling commercial mortgage backed securities prices. Journal of Property Finance 8: 317–35. [Google Scholar] [CrossRef]

- Pedroni, Peter. 1995. Panel Co-Integration: Asymptotic and Finite Sample Properties of Pooled Time Series Tests with an Application to the PPP Hypothesis. Working paper. Bloomington: Indiana University. [Google Scholar]

- Pedroni, Peter. 1999. Critical values for co-integration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economic and Statistics 61: 653–78. [Google Scholar] [CrossRef]

- Pesaran, M. H., and Y. Shin. 1998. Generalized impulse response analysis in linear multivariate models. Economic Letters 58: 17–29. [Google Scholar] [CrossRef]

- Quan, Daniel C., and Sheridan Titman. 1999. Do real estate prices and stock prices move together? An international analysis. Real Estate Economics 27: 183–207. [Google Scholar] [CrossRef]

| 1 | Liow and Sim (2006) find that the ranges of return volatility, measured by the standard deviation of returns, are between 3.48% (USA), 5.93% (UK), 9.52% (Japan), and 26.93% (Indonesia) for the 12 listed real estate indexes. On the other hand, the corresponding range is between 4.40% (USA) and 16.82% (China) for the 12 stock market indexes. In all markets except for China and the USA, real estate indexes have a higher return volatility than the respective stock market indexes. |

| 2 | NAV in the real estate company context represents the underlying value of the real estate ownership along with other assets and adjusted for liabilities and other claims on the company. The price of a listed real estate company is the valuation of the company from the stock market perspective. Similar to an investment trust and other closed-end funds, NAV is the principal basis for valuation of real estate investment companies (Adams and Venmore-Rowland 1989). |

| 3 | P/NAV ratio in the listed real estate context is equivalent to Tobin’s q in the general corporate finance context. |

| 4 | Another related issue in the literature discussed in these studies is why securitized real estate equities traded at NAV discount or premiums. Similar to closed-end funds, there are two types of explanations: rational and behavioral (Lee et al. 1991). Please also consult Barkham and Ward (1999) and Brounen et al. (2013) for explanations as to why real estate stocks/REIT share prices deviate from NAV. Finally, this issue will not be the focus of this study. |

| 5 | To the best of our knowledge and after careful screening, real estate companies in these countries invest, develop, and manage commercial properties. Therefore, the sample is not a clean “real estate investment” sample since Datastream also includes real estate developers and related companies that would normally be valued on an earnings basis but not in relation to their NAVs. This is likely to give rise to one possible source of error in the data and analysis and subsequent interpretation of the results should be viewed with this problem in mind. |

| 6 | The starting point (2004Q1) was the earliest period that all real estate stocks had the P and NAV data. |

| 7 | Empirical tests for co-integration evolve typically around the Engle and Granger (1987) and Johansen (1991) approaches provided that the length of the time series is sufficiently long. |

| 8 | The panel co-integration methodology has been successfully applied by Pedroni (1995) (purchasing power parity); Ong and Maxim (1997) (commercial mortgage-backed security prices); Hendershott et al. (2002) (commercial rent modelling); as well as Liow and Li (2006) (NAVDISC for real estate companies). Please refer to the above references that provides brief mathematical details for the procedures. Finally, we use E-view8 and Rats 8 to implement this empirical work. |

| 9 | The grouped panel dynamic ECM estimates are less economically meaningful, with a statistically insignificant error term for JP and TH and an insignificant short-term NAV coefficient for three country panels (HK, PH, and TH). |

| 10 | The lag lengths of the unrestricted VAR for panel causality test using the SC criterion are: 1 (HK), 5 (JP), 3(MA), 2 (PH), 1 (SG), and 2 (TH). The causality results are not presented for brevity. |

| 11 | Since there are more than one factor for each market, a weighted local variance factor for each of the public real estate markets is estimated. For example, for TH, which has four local factors, the weighted variance factor is estimated as: weighted local variance P/NAV factor for TH market = (V1 × F1 + V2 × F2 + V3 × F3 + V4 × F4)/(V1 + V2 + V3+V4); where V1,…,V4 are the percent of variance for the four factors (F1,…,F4) derived. |

| Country | Average NAV Discounts/Premiums (%) | No. of Quarters with NAV Premium | No. of Quarters with NAV Discount | Price-NAV Ratio | No of Firms (%) with NAV Premium | No. of Firms (%) with NAV Discount | |

|---|---|---|---|---|---|---|---|

| Mean | Standard Deviation | ||||||

| HK | −1.26 | 123.7 | 21 | 23 | 1.013 | 14 (37.8) | 23 (62.7) |

| JP | −89.80 | 254.1 | 44 | 0 | 1.898 | 18 (66.6) | 9 (33.3) |

| MA | 40.02 | 44.1 | 2 | 42 | 0.600 | 3 (7.9) | 35 (92.1) |

| PH | −13.63 | 180.9 | 25 | 19 | 1.136 | 6 (26.1) | 17 (73.9) |

| SG | 12.61 | 45.9 | 9 | 35 | 0.874 | 3 (25) | 9 (75) |

| TH | −32.99 | 130.4 | 36 | 8 | 1.330 | 9 (42.8) | 12 (57.2) |

| (a) Country level | |||||||||

| Country | N | Levin, Lin and Chu (LLC) t Stat | Im, Pesaran, and Shin (IPS) W-Stat | ||||||

| P | NAV | ΔP | ΔNAV | P | NAV | ΔP | ΔNAV | ||

| HK | 38 | 0.51 | −1.28 | −16.48 * | −36.72 * | −0.99 | 0.87 | −18.86 * | −35.08 * |

| JP | 27 | 0.52 | −0.94 | −23.11 * | −16.80 * | 0.94 | 0.65 | −22.35 * | −18.54 * |

| MA | 38 | 1.63 | 0.43 | −15.04 * | −20.06 * | −0.31 | 2.27 | −18.86 * | −21.74 * |

| PHI | 23 | 1.29 | −0.41 | −13.35 * | −14.69 * | 0.32 | 0.65 | −16.51 * | −16.65 * |

| SG | 11 | −1.09 | −1.35 | −16.25 * | −11.97 * | 1.51 | 1.21 | −13.41 * | −13.27 * |

| TH | 21 | 0.94 | −0.99 | −7.08 * | −13.44 * | −0.44 | 1.46 | −14.16 * | −16.76 * |

| (b) Regional level | |||||||||

| All | N | Levin, Lin and Chu (LLC) t Stat | Im, Pesaran, and Shin (IPS) W-Stat | ||||||

| P | NAV | ΔP | ΔNAV | P | NAV | ΔP | ΔNAV | ||

| Total | 158 | −0.34 | −1.15 | −32.73 * | −39.63 * | −3.73 * | 3.40 | −41.37 * | −45.17 * |

| (a) Country level | ||||||||

| Country | N | Panel Statistics (within Dimension) | Group Statistics (between Dimension) | |||||

| V | PP rho | PP t | ADF t | PP rho | PP t | ADF t | ||

| HK | 38 | 2.18 ** | −2.35 * | −3.81 * | −3.42 * | 1.09 | −1.46 *** | −0.98 |

| JP | 27 | 2.77 * | −5.53 * | −6.51 * | −4.96 * | −2.69 * | −6.11 * | −4.28 * |

| MA | 38 | 3.27 * | −4.19 * | −5.52 * | −5.35 * | 1.26 | −0.95 | −0.29 |

| PHI | 23 | 2.32 ** | −4.15 * | −5.35 * | −5.23 * | 0.74 | −0.89 | −0.96 |

| SG | 12 | 1.89 ** | −1.19 | −2.11 ** | −2.21 ** | −0.88 | −2.41 * | −2.61 * |

| TH | 21 | 3.19 * | −2.71 * | −3.15 * | −2.51 * | −1.53 *** | −3.17 * | −2.69 * |

| (b) Regional level | ||||||||

| All | N | Panel Statistics | Group Statistics | |||||

| V | PP rho | PP t | ADF t | PP rho | PP t | ADF t | ||

| Total | 158 | 5.67 ** | −8.35 * | −11.20 * | −10.15 * | −0.47 | −5.84 * | −5.01 * |

| (a) Country level | |||||||

| Estimators | Parameters | HK | JP | MA | PHI | SG | TH |

| Panel DOLS (Pooled) | Long-Term Coefficient | ||||||

| Coefficient | 0.961 * | 0.826 * | 0.948 * | 0.479 * | 0.797 * | 0.921 * | |

| Standard Error | 0.045 | 0.036 | 0.095 | 0.076 | 0.078 | 0.090 | |

| t-Statistics | 21.410 | 23.260 | 9.810 | 6.270 | 10.250 | 10.240 | |

| Panel Dynamics ECM (Pooled) | Short-Term Dynamics | ||||||

| Short-term Coefficient | 0.066 *** | 0.147 * | 0.197 * | 0.052 | 0.295 ** | 0.142 ** | |

| RESID (−1) | −0.116 * | −0.093 * | −0.130 * | −0.135 * | −0.213 * | −0.117 * | |

| Panel DOLS (Grouped) | Long-Term Coefficient | ||||||

| Coefficient | 0.519 * | 1.224 * | 2.188 * | 1.023 * | 0.599 * | 1.229 * | |

| Standard Error | 0.070 | 0.119 | 0.2755 | 0.338 | 0.208 | 0.148 | |

| t-Statistics | 7.366 | 10.248 | 7.943 | 3.030 | 2.875 | 8.324 | |

| Panel Dynamics ECM (Grouped) | Short-Term Dynamics | ||||||

| Short-term Coefficient | 0.026 | 0.137 * | 0.203 * | 0.044 | 0.258 ** | 0.107 | |

| RESID (−1) | −0.047 * | −6.2 × 10−5 | −0.009 * | −0.016 * | −0.024 ** | 0.416 | |

| (b) Regional level | |||||||

| Estimators | Parameters | Overall | |||||

| Panel DOLS (Pooled) | Long-Term Coefficient | ||||||

| Coefficient | 0.849 * | ||||||

| Standard Error | 0.023 | ||||||

| t-Statistics | 37.133 | ||||||

| Panel Dynamics ECM (Pooled) | Short- Term Dynamics | ||||||

| Short-Term Coefficient | 0.107 * | ||||||

| RESID (−1) | −0.119 * | ||||||

| Panel DOLS (Grouped) | Long- Term Coefficient | ||||||

| Coefficient | 1.214 * | ||||||

| Standard Error | 0.090 | ||||||

| t-Statistics | 13.489 | ||||||

| Panel Dynamics ECM (Grouped) | Short- Term Dynamics | ||||||

| Short-Term Coefficient | 0.090 * | ||||||

| RESID (−1) | −0.001 *** | ||||||

| (a) Country level | |||

| Panel Pairwise Granger Causality Tests (Common Coefficients) | |||

| Country/Lag Length | Null Hypothesis: | F-Statistics | |

| HK (lag 1) | P does not Granger Cause NAV | 8.34 * | |

| NAV does not Granger Cause P | 28.88 * | ||

| JP (lag 5) | P does not Granger Cause NAV | 11.05 * | |

| NAV does not Granger Cause P | 16.50 * | ||

| MA (lag 3) | P does not Granger Cause NAV | 0.27 | |

| NAV does not Granger Cause P | 36.55 * | ||

| PHI (lag 2) | P does not Granger Cause NAV | 18.45 * | |

| NAV does not Granger Cause P | 3.39 * | ||

| SG (lag1) | P does not Granger Cause NAV | 4.80 * | |

| NAV does not Granger Cause P | 15.05 * | ||

| TH (lag 2) | P does not Granger Cause NAV | 8.10 * | |

| NAV does not Granger Cause P | 18.83 * | ||

| Pairwise Dumitrescu–Hurlin (2012) Panel Causality Tests (Individual Coefficients) | |||

| Country | Null Hypothesis: | W-Stat | Zbar-Stat |

| HK (lag1) | P does not homogeneously cause NAV | 5.28 * | 4.58 * |

| NAV does not homogeneously cause P | 5.67 * | 5.45 * | |

| JP (lag 5) | P does not homogeneously cause NAV | 15.22 * | 13.2 * |

| NAV does not homogeneously cause P | 12.02 * | 8.9 * | |

| MA (lag 3) | P does not homogeneously cause NAV | 1.76 | −0.98 |

| NAV does not homogeneously cause P | 6.69 * | 12.59 * | |

| PH (lag 2) | P does not homogeneously cause NAV | 2.45 * | 4.33 * |

| NAV does not homogeneously cause P | 1.14 | 0.26 | |

| SG (lag 1) | P does not homogeneously cause NAV | 2.23 | 0.168 |

| NAV does not homogeneously cause P | 4.91 * | 4.14 * | |

| TH (lag 2) | P does not homogeneously cause NAV | 1.67 * | 1.81 * |

| NAV does not homogeneously cause P | 5.19 * | 12.23 * | |

| (b) Regional level | |||

| Panel Pairwise Granger Causality Tests | |||

| Null Hypothesis: | F-Statistics | ||

| Overall/lag 3 | P does not Granger Cause NAV | 32.09 * | |

| NAV does not Granger Cause P | 89.20 * | ||

| Pairwise Dumiterscu–Hurlin Panel Causality Tests | |||

| Null Hypothesis: | W-Stat | Zbar-Stat | |

| Overall /lag 3 | P does not homogeneously cause NAV | 4.9 * | 7.65 * |

| NAV does not homogeneously cause P | 6.57 * | 15.13 * | |

| Factor | Hong Kong | Japan | Singapore | Malaysia | Philippines | Thailand |

|---|---|---|---|---|---|---|

| 1 | 27.19 | 32.83 | 68.76 | 26.45 | 36.38 | 23.38 |

| 2 | 11.91 | 20 | 10.31 | 20.94 | 13.68 | 19.96 |

| 3 | 11.16 | 13.53 | 12.79 | 13 | 18.29 | |

| 4 | 10.2 | 8.23 | 12.52 | 9.96 | 14.38 | |

| 5 | 9.16 | 6.07 | 7.49 | 3.91 | ||

| 6 | 6.69 | 5.53 | 2.93 | |||

| 7 | 4.48 | |||||

| 8 | 2.95 | |||||

| Total | 83.75 | 86.19 | 79.07 | 83.12 | 76.94 | 76 |

| Country | HK | JP | SG | MA | PH | TH |

|---|---|---|---|---|---|---|

| HK | 1 | 0.694 *** | 0.589 *** | −0.153 | −0.401 *** | −0.238 |

| JP | 0.572 *** | 1 | 0.117 | 0.035 | −0.343 ** | −0.090 |

| SG | 0.638 *** | 0.179 | 1 | −0.074 | −0.063 | −0.243 |

| MA | 0.138 | 0.400 *** | 0.116 | 1 | 0.670 *** | 0.515 *** |

| PH | −0.350 ** | −0.416 *** | 0.098 | 0.019 | 1 | 0.825 *** |

| TH | −0.121 | 0.093 | −0.331 ** | 0.098 | 0.510 *** | 1 |

| SG | PH | TH | JP | HK | MA | “FROM” Others | |

|---|---|---|---|---|---|---|---|

| SG | 42.4 | 9.1 | 2.5 | 30.5 | 5.9 | 9.7 | 58 |

| PH | 9.3 | 47.9 | 2.9 | 6.2 | 22 | 11.7 | 52 |

| TH | 4.6 | 34.5 | 40.2 | 1.5 | 13.7 | 5.5 | 60 |

| JP | 16.4 | 4.9 | 16.5 | 53.9 | 5.4 | 2.9 | 46 |

| HK | 26.9 | 1.8 | 3.1 | 26.2 | 31.2 | 10.7 | 69 |

| MA | 8.9 | 35.8 | 1.6 | 4.8 | 15.5 | 33.3 | 67 |

| ‘’TO” others | 66 | 86 | 27 | 69 | 62 | 41 | 351 |

| TOTAL | 108 | 134 | 67 | 123 | 94 | 74 | 58.50% |

| ‘’FROM” others | 58 | 52 | 60 | 46 | 69 | 67 | |

| Net spillovers | 8 | 34 | −33 | 23 | −7 | −26 | |

| Share in spillover transmission | 18.80% | 24.50% | 7.69% | 19.66% | 17.66% | 11.68% | |

| Share in spillover absorption | 16.52% | 14.81% | 17.09% | 13.11% | 19.66% | 19.09% | |

| Share in spillover average | 17.66% | 19.66% | 12.39% | 16.38% | 18.66% | 15.38% |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

LIOW, K.H.; YEO, S. Dynamic Relationships between Price and Net Asset Value for Asian Real Estate Stocks. Int. J. Financial Stud. 2018, 6, 28. https://doi.org/10.3390/ijfs6010028

LIOW KH, YEO S. Dynamic Relationships between Price and Net Asset Value for Asian Real Estate Stocks. International Journal of Financial Studies. 2018; 6(1):28. https://doi.org/10.3390/ijfs6010028

Chicago/Turabian StyleLIOW, Kim Hiang, and Sherry YEO. 2018. "Dynamic Relationships between Price and Net Asset Value for Asian Real Estate Stocks" International Journal of Financial Studies 6, no. 1: 28. https://doi.org/10.3390/ijfs6010028