Noise Reduction in a Reputation Index

Abstract

:1. Introduction

2. Reputation and Its Measurement

2.1. Definitions for Sentiment and Reputation

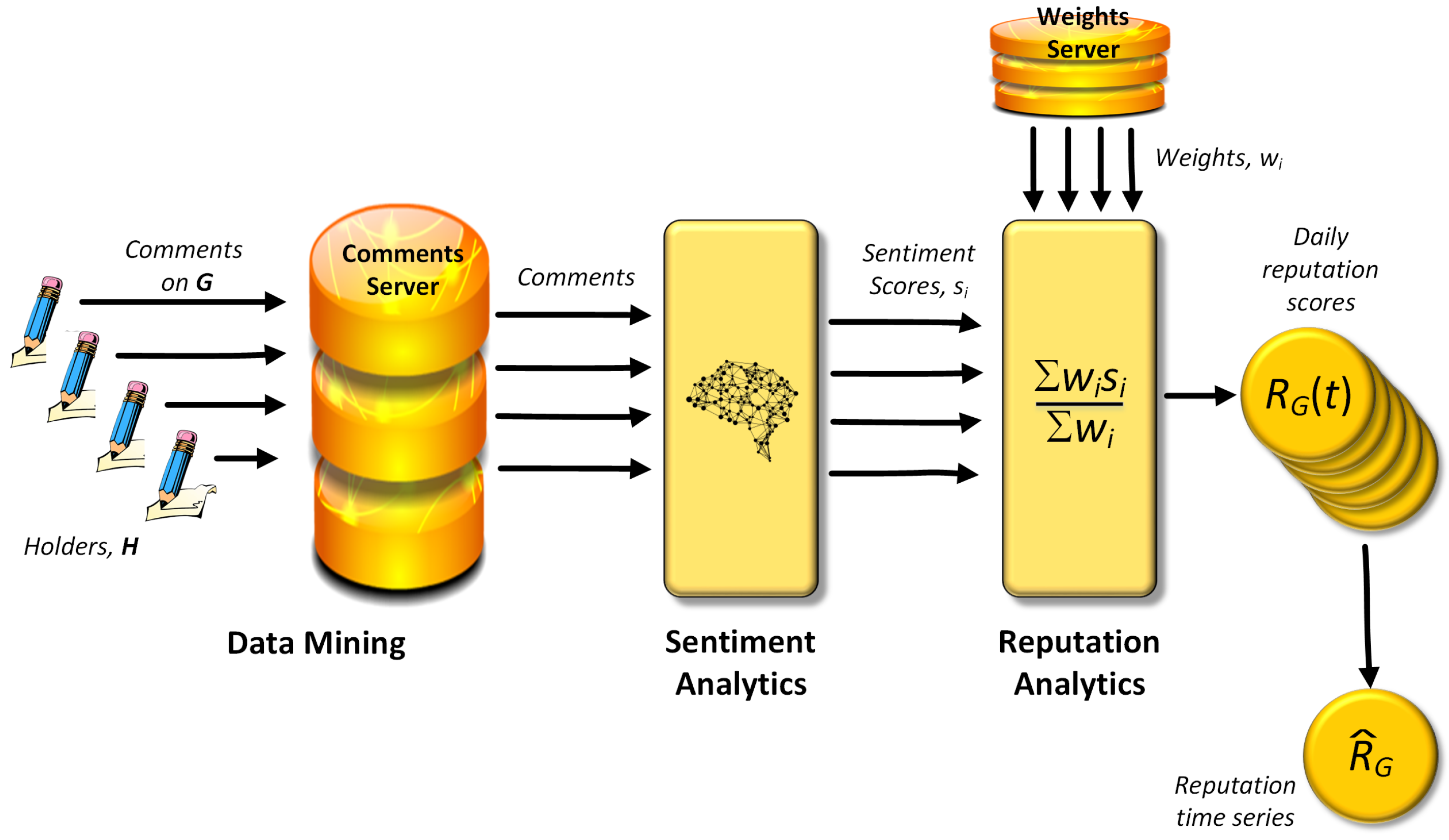

2.2. Sentiment Procurement

- Receive “comments” electronically from opinion holders, H, that convey sentiment with respect to a target G from public sources (news channels, social media, etc.).

- Sentiment analysis for each comment, to give a sentiment “score”, nominally in the range [−1, 1].

- For each comment, define a weight (e.g., to reflect the influence of the opinion holder of the comment).

- Compose a reputation index applicable at a particular time using all the sentiment scores received in a given time period (such as one day). This is Equation (1).

- Accumulate successive time-based reputation indexes to form the reputation time series, of Equation (2).

2.2.1. Reputation and Financial Risk

2.2.2. Reputation Measurement Error

3. Methodology

3.1. Nomenclature

3.2. The State-Space and the Kalman Filter

- Kalman filtering incorporates a specific smoothing parameter which can be used to assess measurement noise. Other smoothing methodologies (e.g., Loess filter and moving average) do not have such a specific relationship with measurement.

- Construction of the reputation index (specifically resetting to an initial value every period) produces a signal for which a static model with noise is appropriate: there is necessarily no trend and no seasonality. A particularly simple version of the Kalman model is available for precisely this situation.

- Very little lag is introduced by the smoothing process.

- The Kalman filter (state-space) method makes direct use of the distribution of reputation scores, which can be modelled successfully by a Normal distribution.

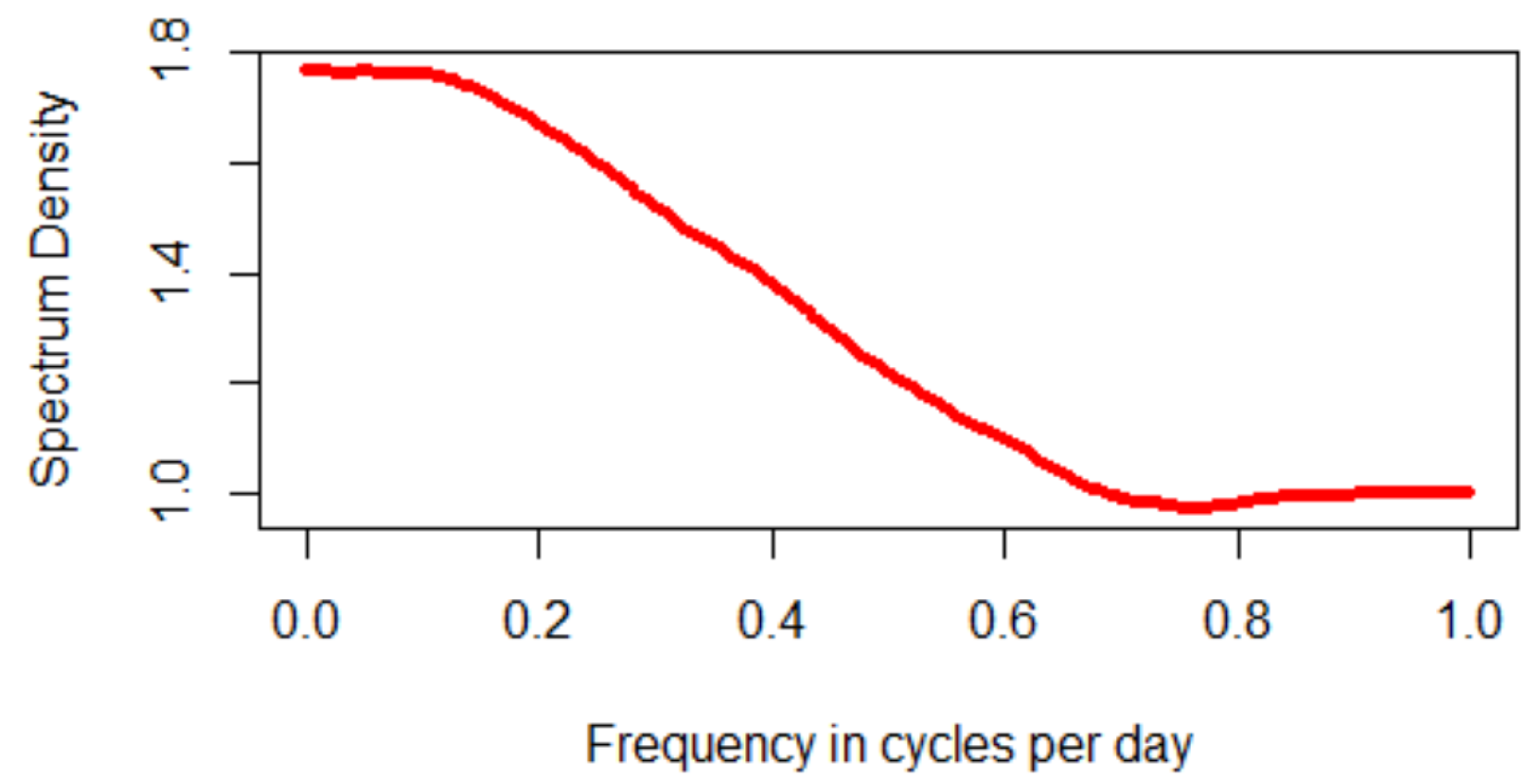

- The Kalman filter methodology assumes that the time series being analysed is stationary. All of the reputational time series in this study are stationary, as demonstrated by examining their frequency spectra. It is expected that others will also be stationary unless they are driven by seasonal events.

3.3. Kalman Filter Fundmentals

3.3.1. Kalman Smoothing: The Static Model Specialisation

3.3.2. Normality Assumption of State-Space Analysis

3.3.3. Kalman Filter Noise Estimation

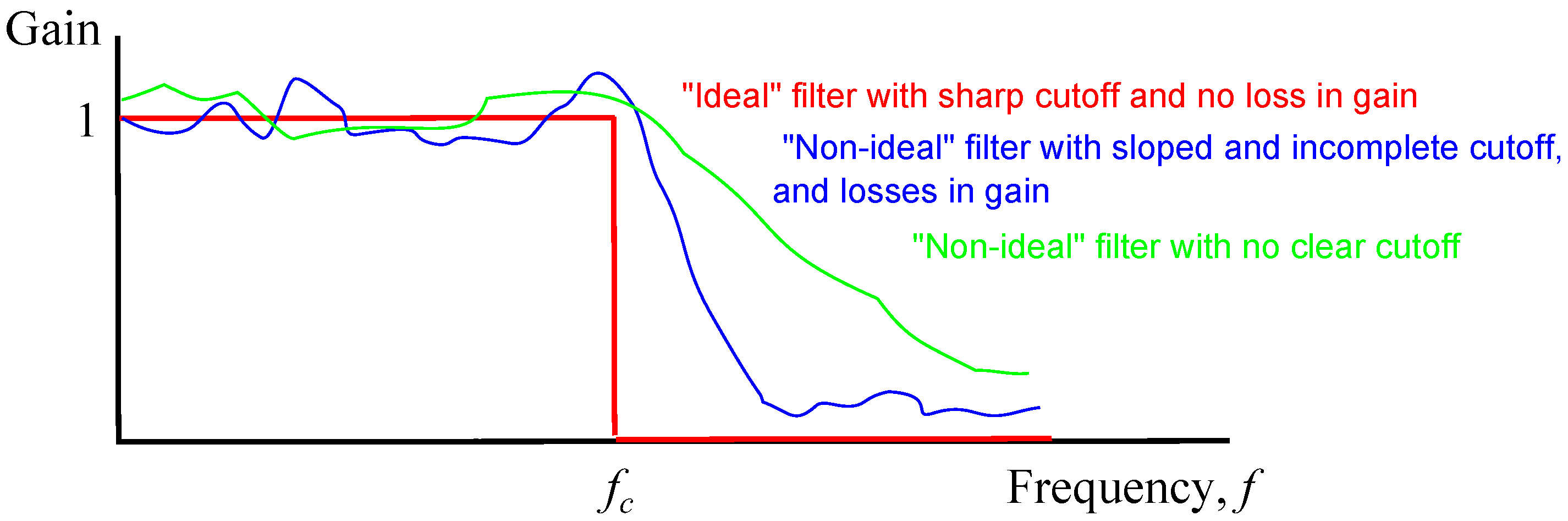

3.4. Low Pass Filter Noise Estimation

3.4.1. The Power Spectral Density (PSD)

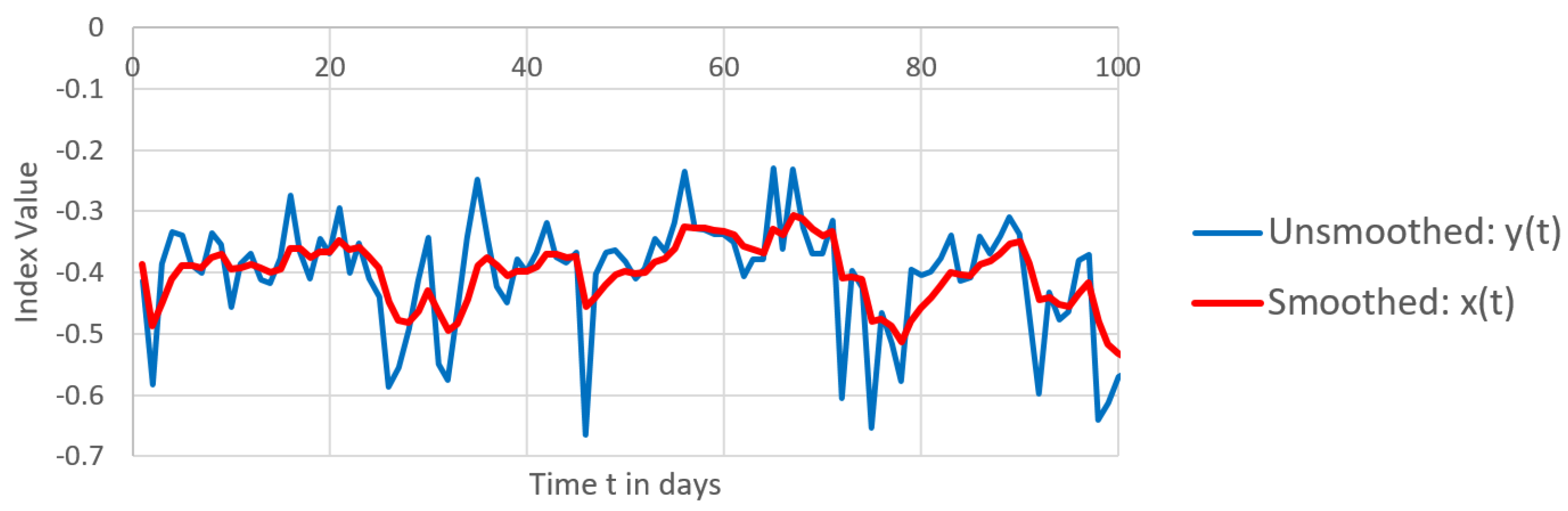

3.4.2. Low Pass Filter Procedures

- Obtain the PSD for the input signal under consideration

- Determine a cutoff frequency, , by finding the point at which the power spectrum stabilises. All power spectra considered have the property that the power density stabilises at some fraction of the total number of ordinates in the spectrum. Most reputation power spectra exhibit shape frequency profiles similar to the profile illustrated in SubSection 4.2.2. The plot shows a limiting value at frequency 0.7. There is one exception where the spectrum indicated periodicity with period of 100 days (organisation NW in Table 4). This periodicity was likely due to chance, as no reason for it was apparent and it was not observed for other organisation. There is a discussion of special treatment of two other organisations in SubSection 4.3.

- Apply a filter to the input signal using the cutoff frequency to obtain the output signal

- Obtain the PSD for the output signal, . If there are n PSD components , denote the normalised cumulative sums of the square of those components by (squaring emphasises any distinction between low and high frequencies).

3.4.3. Moving Average Filter

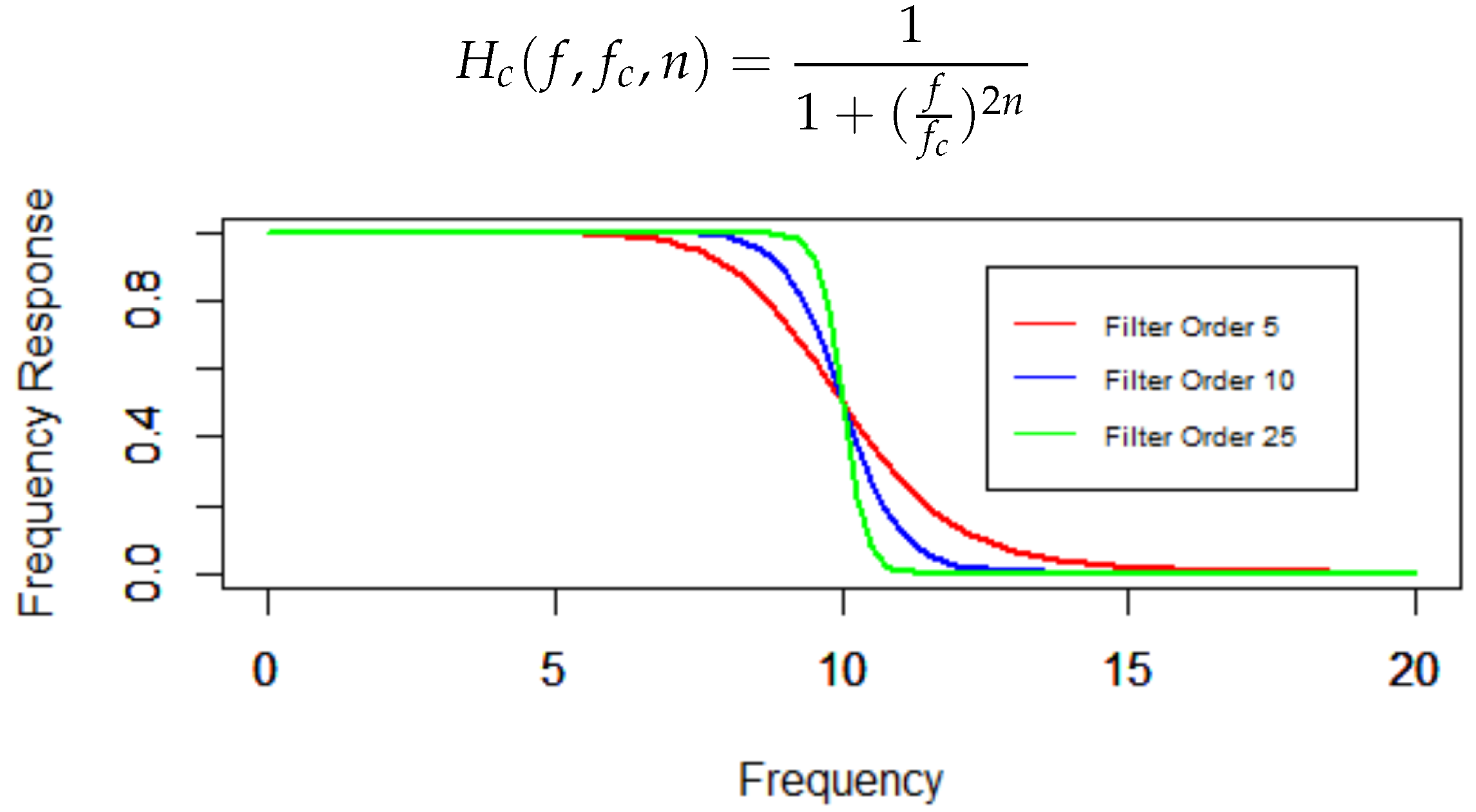

3.4.4. Butterworth Filter

3.5. Signal to Noise Calculation

4. Results

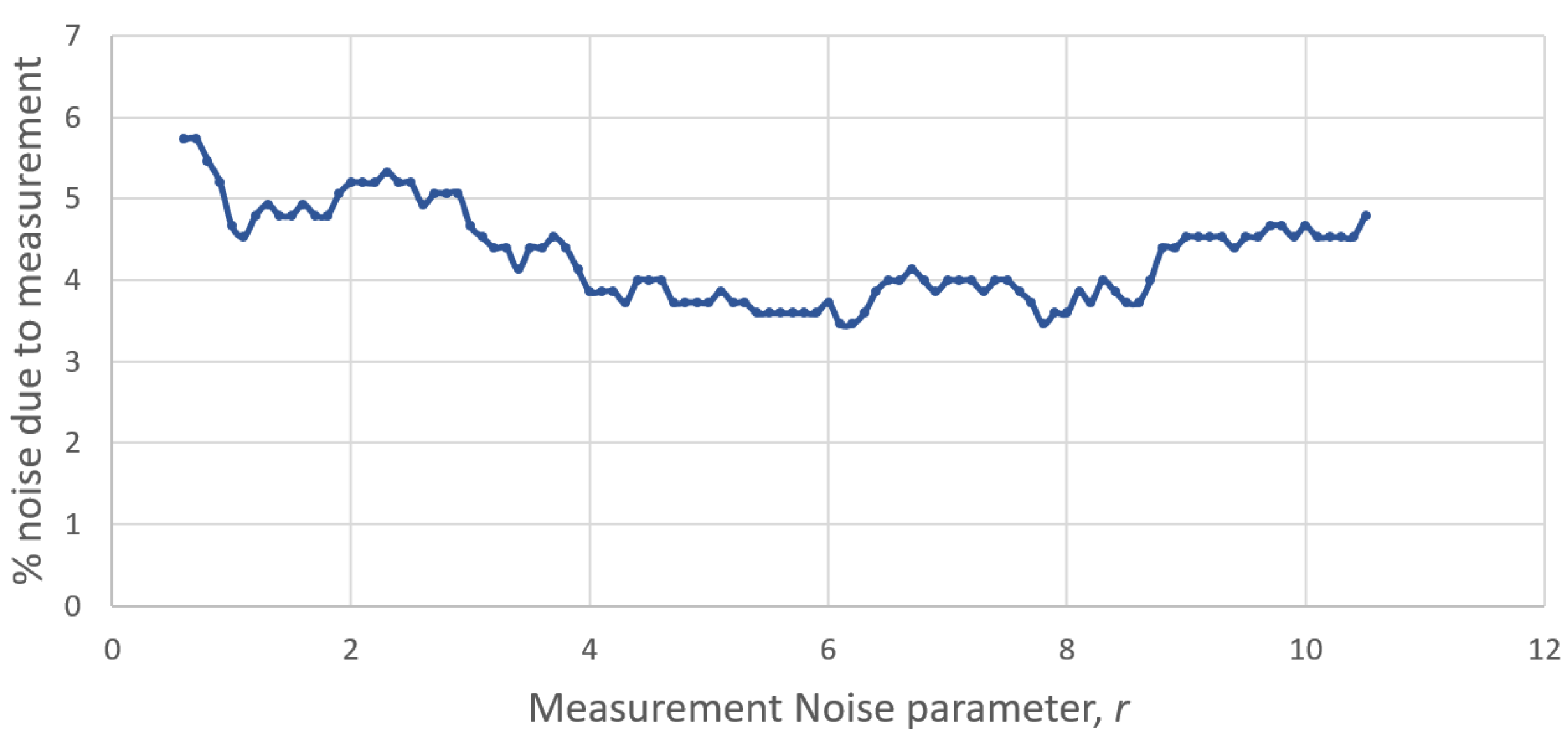

4.1. Kalman Filter Results

4.2. Low Pass Filter Results

4.2.1. Low Pass Filter Results: Moving Average Method

4.2.2. Low Pass Filter Results: Butterworth Method

4.3. Special Treatment of Power Spectra Arising from Reputational Shocks

4.4. Monetary Impact

- (from Section 4.1)

- (from Section 4.1)

- (from Section 4.2.2)

- (from Section 4.2.2)

- (from Section 4.2.1)

- (from Section 4.2.1)

5. Discussion

Acknowledgments

Conflicts of Interest

Appendix A. Calculation of System Noise Parameter q

| Organisation | Mean Time-Sliced SD | Overall SD |

|---|---|---|

| BW | 0.049 | 0.048 |

| FT | 0.078 | 0.076 |

| FD | 0.058 | 0.058 |

| HUD | 0.075 | 0.072 |

| NSS | 0.066 | 0.067 |

| MB | 0.049 | 0.047 |

| VOL | 0.097 | 0.094 |

| BSG | 0.115 | 0.112 |

| RYB | 0.112 | 0.108 |

| NW | 0.108 | 0.099 |

| HX | 0.098 | 0.091 |

| HS | 0.117 | 0.099 |

| LL | 0.143 | 0.135 |

| NT | 0.124 | 0.114 |

| TB | 0.150 | 0.147 |

| VG | 0.141 | 0.137 |

| BB | 0.087 | 0.085 |

| DB | 0.093 | 0.084 |

Appendix B. Kalman Calculation Parameters

| Organisation | Relative % Error | Parameter q Estimate | Parameter r Estimate |

|---|---|---|---|

| BM | 1.11 | 0.05 | 7.3 |

| FT | 0.11 | 0.08 | 4.31 |

| FD | 0.82 | 0.06 | 6.53 |

| HUD | 1.26 | 0.07 | 16.04 |

| NSS | 0.56 | 0.07 | 6.18 |

| MB | 0.65 | 0.05 | 8.58 |

| VOL | 0.29 | 0.1 | 4.36 |

| BSG | 0.39 | 0.11 | 10.5 |

| RYB | 0.17 | 0.11 | 5.79 |

| NW | 0.26 | 0.11 | 5.19 |

| HX | 0.29 | 0.1 | 9.83 |

| HS | 0.16 | 0.12 | 6.65 |

| LL | 0.35 | 0.14 | 9.9 |

| NT | 0.2 | 0.12 | 8.08 |

| TB | 0.26 | 0.15 | 7.69 |

| VG | 0.25 | 0.14 | 6.22 |

| BB | 0.28 | 0.09 | 9.19 |

| DB | 0.48 | 0.09 | 4.66 |

References

- Butterworth, Stephen. 1930. On the Theory of Filter Amplifiers. Wireless Engineer 7: 536–41. [Google Scholar]

- Cerna, Michael, and Audrey F. Harvey. 2009. The Fundamentals of FFT-Based Signal Analysis and Measurement, National Instruments Application Note 041. Available online: http://www.ni.com/white-paper/4278/en/ (accessed on 8 November 2017).

- Cosma, Ioana A., and Ludger Evers. 2010. Markov Chains and Monte Carlo Methods: Lecture Notes, Chapter 7; African Institute for Mathematical Sciences (AIMS). Available online: http://www.isn.ucsd.edu/classes/beng260/complab/week2/CosmaEvers2010.pdf (accessed on 6 February 2018).

- Deloitte RiskAdvisory. 2016. Reputation Matters: Developing Reputational Resilience Ahead of Your Crisis. Available online: https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/risk/deloitte-uk-reputation-matters-june-2016.pdf (accessed on 8 November 2017).

- Hamilton, James. 1986. State-space models. In Handbook of Econometrics, Chapter 50. Amsterdam: Elsevier, vol. 4, pp. 3039–80. [Google Scholar]

- Hamming, Richard Wesley. 1989. Digital Filters. Englewood Cliffs: Prentice-Hall, Available online: https://www.dsprelated.com/freebooks/filters/ (accessed on 6 February 2018).

- Jackson, Leland B. 1996. Digital Filters and Signal Processing: With MATLAB Exercises. Boston: Kluwer Academic Publishers. [Google Scholar]

- Jung, Jae C., and Su Bin Park. 2016. Case Study: Volkswagen’s Diesel Emissions Scandal. Thunderbird International Business Review 59: 127–37. Available online: http://onlinelibrary.wiley.com/doi/10.1002/tie.21876/full (accessed on 6 February 2018). [CrossRef]

- Kalman, Rudolph Emil. 1960. A New Approach to Linear Filtering and Prediction Problems. Transactions of the ASME–Journal of Basic Engineering 82: 35–45. [Google Scholar] [CrossRef]

- Liu, Bing. 2015. Sentiment Analysis: Mining Opinions, Sentiments and Emotions. Cambridge: Cambridge University Press. [Google Scholar]

- Mitic, Peter. 2017a. Standardised Reputation Measurement. In Proceedings of the IDEAL 2017, Guilin, China. Edited by Hujun Yin, Yang Gao, Songcan Chen, Yimin Wen, Guoyong Cai, Tianlong Gu, Junping Du, Antonio J. Tallón-Ballesteros and Minling Zhang. Lecture Notes in Computer Science (LNCS). Cham: Springer, vol. 10585, pp. 534–542. [Google Scholar] [CrossRef]

- Mitic, Peter. 2017b. Reputation Risk: Measured. In Proceedings of the Paper present at the Complex Systems May 2017, The New Forest, UK, 23–25 May 2017; Edited by George Rzevski and Carlos Brebbia. Southampton: Wessex Institute of Technology Press. [Google Scholar]

- Oppenheim, Alan V., and Ronald W. Schafer. 1989. Discrete-Time Signal Processing. Upper Saddle River: Prentice Hall. [Google Scholar]

- Shumway, Robert H., and David S. Stoffer. 2017. Time Series Analysis and Its Applications: With R Examples, 4th ed. New York: Springer International, chp. 6. [Google Scholar]

- Smith, Julius Orion. 2007. Introduction to Digital Filters: With Audio Applications. Berlin: W3K Publishing. [Google Scholar]

- Smith, Steven W. 1999. The Scientist and Engineer’s Guide to Digital Signal Processing, 2nd ed. Poway: California Technical Publishing, Available online: http://www.analog.com/en/education/education-library/scientist_engineers_guide.html (accessed on 6 February 2018).

- Stoica, Petre, and Randolph L. Moses. 2005. Spectral Analysis of Signals. Upper Saddle River: Prentice Hall. [Google Scholar]

| Context | Positive Reputation | Negative Reputation |

|---|---|---|

| BAU | 0.6% | −1.1% |

| Stressed | 2.3% | −2.7% |

| Super-Stressed | 5% | −15% |

| Organisation | Mean % Noise | Max. % Noise | SN in db |

|---|---|---|---|

| BM | 7.2 | 9.5 | 6.7 |

| FT | 4.4 | 6.3 | 10.5 |

| FD | 6.5 | 8.7 | 7.5 |

| HUD | 16.1 | 18.1 | 9.8 |

| NSS | 6.2 | 7.7 | 8.5 |

| MB | 8.5 | 10.7 | 6.2 |

| VOL | 4.4 | 5.2 | 9.6 |

| BSG | 11.1 | 12.3 | 9.3 |

| RYB | 5.8 | 8.1 | 11.7 |

| NW | 5.2 | 7.2 | 12.1 |

| HX | 9.8 | 13.1 | 10.7 |

| HS | 6.7 | 7.7 | 12.5 |

| LL | 9.8 | 11.1 | 9.2 |

| NT | 8.1 | 12.9 | 10.6 |

| TB | 7.8 | 10.8 | 11.3 |

| VG | 6.3 | 9.7 | 13.3 |

| BB | 9.2 | 10.8 | 10 |

| DB | 4.7 | 8.3 | 8.9 |

| Mean | 7.6 | 9.9 | 9.9 |

| Organisation | Mean % Noise | Max % Noise | SN in db |

|---|---|---|---|

| BW | 9.5 | 25.9 | 24.1 |

| FT | 10.4 | 24.4 | 15.3 |

| FD | 13.7 | 41.1 | 22 |

| HUD | 13 | 29.6 | 18.5 |

| NSS | 18.2 | 54.3 | 26.5 |

| MB | 13.3 | 42.6 | 19.8 |

| VOL | 10.1 | 28.9 | 7.8 |

| BSG | 11.9 | 29.7 | 15.8 |

| RYB | 6.3 | 15.4 | 9.6 |

| NW | 3.1 | 10.2 | 7.8 |

| HX | 10.3 | 29.7 | 9.8 |

| HS | 8.2 | 27.1 | 5.6 |

| LL | 11.5 | 34.1 | 9.4 |

| NT | 19 | 56 | 9.7 |

| TB | 5.5 | 14.8 | 13.5 |

| VG | 9.9 | 28 | 14.6 |

| BB | 8.3 | 24.2 | 13.3 |

| DB | 14.4 | 36 | 21.9 |

| Mean | 10.9 | 30.7 | 14.7 |

| Organisation | Mean % Noise | Max % Noise | SN in db |

|---|---|---|---|

| BW | 30.7 | 30.8 | 13.9 |

| FT | 32 | 32.3 | 21.9 |

| FD | 12.4 | 12.6 | 35.4 |

| HUD | 24.8 | 25.5 | 17.9 |

| NSS | 6.2 | 22.7 | 66.8 |

| MB | 12.1 | 12.6 | 31.8 |

| VOL | 9.9 | 13.3 | 6.9 |

| BSG | 25.2 | 25.8 | 13.9 |

| RYB | 21.5 | 21.6 | 11.1 |

| NW | 25 | 25.2 | 5.7 |

| HX | 16.1 | 17.3 | 18.1 |

| HS | 16.4 | 22 | 6.3 |

| LL | 29.8 | 29.9 | 27.3 |

| NT | 7.4 | 13.7 | 49.6 |

| TB | 23.7 | 23.8 | 8.9 |

| VG | 19.1 | 19.2 | 16.2 |

| BB | 30.3 | 30.4 | 16.9 |

| DB | 28.9 | 28.9 | 28.9 |

| Mean | 20.6 | 22.6 | 22.1 |

| Filter | Reputation | Max % Noise Estimate | Mean % Noise Estimate |

|---|---|---|---|

| Kalman | Positive | 2.1 | 2.1 |

| Kalman | Negative | 2.5 | 2.4 |

| Butterworth | Positive | 1.8 | 1.8 |

| Butterworth | Negative | 2.1 | 2.1 |

| Moving Average | Positive | 2 | 1.6 |

| Moving Average | Negative | 2.4 | 1.9 |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mitic, P. Noise Reduction in a Reputation Index. Int. J. Financial Stud. 2018, 6, 19. https://doi.org/10.3390/ijfs6010019

Mitic P. Noise Reduction in a Reputation Index. International Journal of Financial Studies. 2018; 6(1):19. https://doi.org/10.3390/ijfs6010019

Chicago/Turabian StyleMitic, Peter. 2018. "Noise Reduction in a Reputation Index" International Journal of Financial Studies 6, no. 1: 19. https://doi.org/10.3390/ijfs6010019

APA StyleMitic, P. (2018). Noise Reduction in a Reputation Index. International Journal of Financial Studies, 6(1), 19. https://doi.org/10.3390/ijfs6010019