Operational Efficiency of Bank Loans and Deposits: A Case Study of Vietnamese Banking System

Abstract

:1. Introduction

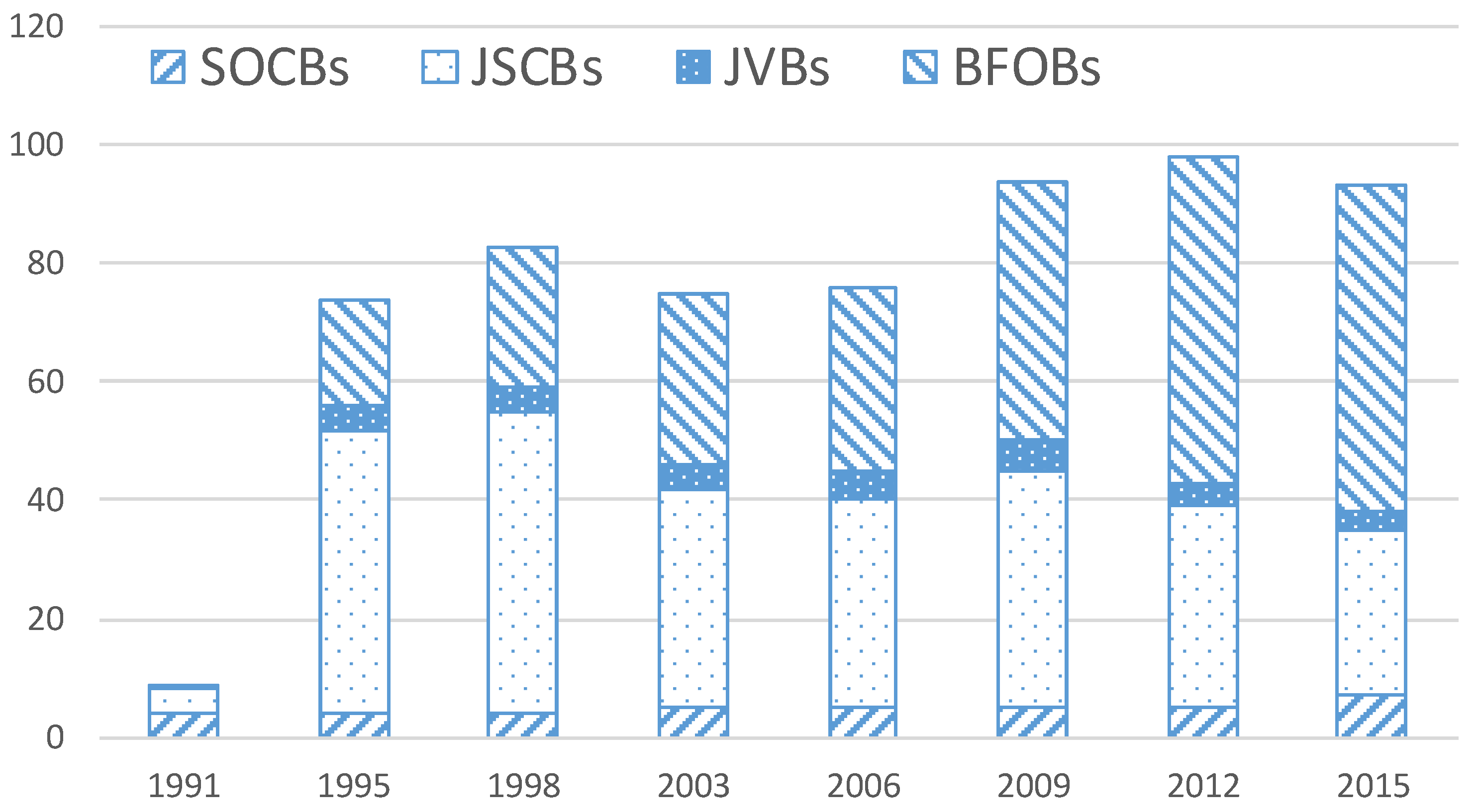

2. The Vietnamese Banking System and Its Efficiency

3. Technical Aspects of the Study

3.1. Methodology

- the logarithmic value of the loans utilised by the bank;

- the logarithmic value of the deposits mobilised by the bank;

- a set of exogenous instrumental variables in Equation (1);

- a set of exogenous instrumental variables in Equation (2);

- and : the residuals, which then will be used to estimate the inefficiency of the two activities in the next step.

3.2. Data

4. Results and Discussions

4.1. SEM Analysis

4.2. Efficiency Analysis Using COLS

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| No. | Bank’s Name | No. | Bank’s Name |

|---|---|---|---|

| 1 | An Binh Commercial Joint Stock Bank | 23 | Orient Commercial Joint Stock Bank |

| 2 | Asia Commercial Joint Stock Bank | 24 | Petrolimex Group Commercial Joint Stock Bank |

| 3 | Bao Viet Joint Stock Commercial Bank | 25 | Saigon—Hanoi Commercial Joint Stock Bank |

| 4 | Construction Bank (former name: Trustbank) | 26 | Saigon Bank for Industry & Trade |

| 5 | DongA Joint Stock Commercial Bank | 27 | Saigon Commercial Bank |

| 6 | First Joint Stock Commercial Bank | 28 | Saigon Thuong Tin Commercial Joint Stock Bank |

| 7 | Global Petro Commercial Joint Stock Bank | 29 | South East Asia Joint Stock Commercial Bank |

| 8 | Great Asia Commercial Joint Stock Bank | 30 | Southern Commercial Joint Stock Bank |

| 9 | Hanoi Building Commercial Joint Stock Bank | 31 | TienPhong Commercial Joint Stock Bank |

| 10 | Ho Chi Minh City Development Joint Stock Commercial Bank | 32 | Viet A Joint Stock Commercial Bank |

| 11 | HSBC Bank (Vietnam) Limited | 33 | Viet Capital Commercial Joint Stock Bank |

| 12 | Indovina Bank Ltd. | 34 | Viet Nam Technological and Commercial Joint Stock Bank |

| 13 | Joint Stock Commercial Bank for Foreign Trade of Vietnam | 35 | Vietnam Bank for Agriculture and Rural Development |

| 14 | Joint Stock Commercial Bank for Investment and Development of Vietnam | 36 | Vietnam Bank for Social Policies |

| 15 | Kienlong Commercial Joint Stock Bank | 37 | Vietnam Commercial Joint Stock Bank for Private Enterprise |

| 16 | Lien Viet Post Joint Stock Commercial Bank | 38 | Vietnam Export Import Commercial Joint Stock Bank |

| 17 | Mekong Development Joint Stock Commercial Bank | 39 | Vietnam International Commercial Joint Stock Bank |

| 18 | Mekong Housing Bank | 40 | Vietnam Joint Stock Commercial Bank of Industry and Trade |

| 19 | Military Commercial Joint Stock Bank | 41 | Vietnam Maritime Commercial Joint Stock Bank |

| 20 | Nam A Commercial Joint Stock Bank | 42 | VietNam Tin Nghia Commercial Joint Stock Bank |

| 21 | National Citizen Bank | 43 | Western Commercial Joint Stock Bank |

| 22 | Ocean Commercial One Member Limited Liability Bank | 44 | Vietnam Public Joint Stock Commercial Bank |

References

- Amsler, C., A. Prokhorov, and P. Schmidt. 2016. Endogeneity in schotastic frontier models. Journal of Econometrics 190: 280–88. [Google Scholar] [CrossRef]

- Ariff, Mohamed, and Can Luc. 2008. Cost and profit efficiency of Chinese banks: A non-parametric analysis. China Economic Review 19: 260–73. [Google Scholar] [CrossRef]

- Assaf, A. George, Carlos P. Barros, and Roman Matousek. 2011. Productivity and efficiency analysis of Shinkin banks: Evidence from bootstrap and Bayesian approaches. Journal of Banking & Finance 35: 331–42. [Google Scholar]

- Belsley, David A. 1988. Two-or three-stage least squares? Computer Science in Economics and Management 1: 21–30. [Google Scholar] [CrossRef]

- Berger, Allen N., and Christa H. S. Bouwman. 2009. Bank Liquidity Creation. The Review of Financial Studies 22: 3779–837. [Google Scholar] [CrossRef]

- Berger, Allen N., and David B. Humphrey. 1997. Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research 98: 175–212. [Google Scholar] [CrossRef]

- Berger, Allen N., and Loretta J. Mester. 1997. Inside the black box: What explains differences in the efficiencies of financial institutions? Journal of Banking & Finance 21: 895–947. [Google Scholar]

- Berger, Allen N., Diana Hancock, and David B. Humphrey. 1993. Bank efficiency derived from the profit function. Journal of Banking and Finance 17: 317–47. [Google Scholar] [CrossRef]

- Bonin, John P., Iftekhar Hasan, and Paul Wachtel. 2005a. Bank performance, efficiency and ownership in transition countries. Journal of Banking & Finance 29: 31–53. [Google Scholar]

- Bonin, John P., Iftekhar Hasan, and Paul Wachtel. 2005b. Privatisation matters: Bank efficiency in transition countries. Journal of Banking & Finance 29: 2155–78. [Google Scholar]

- Corradi, Valentina, Marzio Galeotti, and Riccardo Rovelli. 1990. A cointegration analysis of the relationship between bank reserves, deposits and loans: The case of Italy, 1965–1987. Journal of Banking & Finance 14: 199–214. [Google Scholar]

- Dermine, Jean. 1986. Deposit rates, credit rates and bank capital. Journal of Banking & Finance 10: 99–114. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1980. Banking in the theory of finance. Journal of Monetary Economics 6: 39–57. [Google Scholar] [CrossRef]

- Favero, Carlo A., and Luca Papi. 1995. Technical efficiency and scale efficiency in the Italian banking sector: A non-parametric approach. Applied Economics 27: 385–95. [Google Scholar] [CrossRef]

- Forsund, Finn R., and Lennart Hjalmarsson. 1987. Analyses of Industrial Structure: A Putty Clay Approach. Stockholm: Almqvist & Wiksell. [Google Scholar]

- Fujii, Hidemichi, Shunsuke Managi, and Roman Matousek. 2014. Indian bank efficiency and productivity changes with undesirable outputs: A disaggregated approach. Journal of Banking & Finance 38: 41–50. [Google Scholar]

- Gefen, David, Detmar Straub, and Marie-Claude Boudreau. 2000. Structural equation modeling and regression: Guidelines for research practice. Communications of the Association for Information Systems 4: 1–78. [Google Scholar]

- Global Credit Research. 2012. Rating Action: Moody’s Downgrades Eight Vietnamese Banks. Available online: https://www.moodys.com/research/Moodys-downgrades-eight-Vietnamese-banks--PR_255975 (accessed on 10 November 2017).

- Greene, William H. 2008. The econometric approach to efficiency measurement. In The Measurement of Productive Efficiency and Productivity Growth. Edited by Harold O. Fried, C. A. Knox Lovell and Shelton S. Schmidt. New York: Oxford University Press, pp. 92–250. [Google Scholar]

- IMF. 2009. The Implications of the Global Financial Crisis for Low-Income Countries. Washington: International Monetary Fund. [Google Scholar]

- Kashyap, Anil K., Raghuram Rajan, and Jeremy C. Stein. 2002. Banks as Liquidity Providers: An Explanation for the Coexistence of Lending and Deposit-taking. The Journal of Finance 57: 33–73. [Google Scholar] [CrossRef]

- Klein, Michael A. 1971. A Theory of the Banking Firm. Journal of Money, Credit and Banking 3: 205–18. [Google Scholar] [CrossRef]

- Kumbhakar, Subal C., Hongren Wang, and Alan P. Horncastle. 2015. A Practioner’s Guide to Stochastic Frontier Analysis Using Stata. New York: Cambridge University Press. [Google Scholar]

- Liu, John S., Louis Y. Y. Lu, Wen-Min Lu, and Bruce J. Y. Lin. 2013. A survey of DEA applications. OMEGA 41: 893–902. [Google Scholar] [CrossRef]

- Monti, Mario. 1972. Deposit, credit and interest rate determination under alternative bank objective functions. In Mathematical Methods in Investment and Finance. Edited by Karl Shell and G. P. Szegö. Amsterdam: North-Holland, pp. 431–54. [Google Scholar]

- Ngo, Thanh. 2012. Measuring performance of the banking system: Case of Vietnam (1990–2010). Journal of Applied Finance & Banking 2: 289–312. [Google Scholar]

- Ngo, Thanh. 2015. Efficiency of the Banking System in Vietnam under Financial Liberalisation. Ph.D. thesis, Massey University, Palmerston North, New Zealand. [Google Scholar]

- Ngo, Thanh, and Tu Le. 2017. Resource for Research: A Vietnamese Banking Database. SSRN eLibrary 14: 1–14. [Google Scholar]

- Ngo, Thanh, and David Tripe. 2017. Measuring efficiency of Vietnamese banks: Accounting for nonperforming loans in a single-step stochastic cost frontier analysis. Pacific Accounting Review 29: 171–82. [Google Scholar] [CrossRef]

- Nguyen, Phuong Anh, and Michel Simioni. 2015. Productivity and efficiency of Vietnamese banking system: New evidence using Färe-Primont index analysis. Applied Economics 47: 4395–407. [Google Scholar] [CrossRef]

- Nguyen, Thanh Pham Thien, Son Hong Nghiem, Eduardo Roca, and Parmendra Sharma. 2016. Bank reforms and efficiency in Vietnamese banks: Evidence based on SFA and DEA. Applied Economics 48: 2822–35. [Google Scholar] [CrossRef]

- OECD. 2013. Economic Outlook for Southeast Asia, China and India 2014. Paris: OECD Publishing. [Google Scholar]

- SBV. 2017. The State Bank of Vietnam—System of Credit Institutions. Available online: https://www.sbv.gov.vn/webcenter/portal/en/home/fm/socins?_afrLoop=403098344475000#%40%3F_afrLoop%3D403098344475000%26centerWidth%3D80%2525%26leftWidth%3D20%2525%26rightWidth%3D0%2525%26showFooter%3Dfalse%26showHeader%3Dfalse%26_adf.ctrl-state%3D19iilj0m1q_244 (accessed on 10 November 2017).

- Sealey, Calvin W., and James T. Lindley. 1977. Inputs, outputs, and a theory of production and cost at depository financial institutions. The Journal of Finance 32: 1251–66. [Google Scholar] [CrossRef]

- Stewart, Chris, Roman Matousek, and Thao Ngoc Nguyen. 2016. Efficiency in the Vietnamese banking system: A DEA double bootstrap approach. Research in International Business and Finance 36: 96–111. [Google Scholar] [CrossRef]

- Tran, Bao Tran, Bernice Ong, and Scott Weldon. 2015. Vietnam Banking Industry Report. Singapore: Duxton Asset Management. [Google Scholar]

- Vietnamese Government. 2012. Decision No. 254/QD-TTg on Approving the Scheme on “Restructuring the Credit Institutions System in the 2011–2015 Period”. Available online: http://www.lawfirm.vn/?a=doc&id=2530 (accessed on 10 November 2017).

- Vu, Ha, and Daehoon Nahm. 2013. The determinants of profit efficiency of banks in Vietnam. Journal of the Asia Pacific Economy 18: 615–31. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2016. Introductory Econometrics: A Modern Approach, 6th ed. Boston: Cengage Learning. [Google Scholar]

| 1 | It is arguable that deposits can also be seen as an output of the bank (Berger and Humphrey 1997); however, the more common view is to see them as inputs, as opposed to loans, which are outputs. |

| 2 | There is also a ‘production approach’ where banks are seen as a production unit which primarily producing services for account holders (Berger and Humphrey 1997), but it is less common than the ‘intermediation approach’ used in this paper, since banks are commonly seen as the intermediaries in the process by which the economy chooses its activities and the way those activities are financed (Fama 1980). Readers interested in alternative approaches are encouraged to check the study of Favero and Papi (1995), among others. |

| 3 | After the Vietnam War, Vietnam re-joined IMF, WB and ADB in October 1993. In February 1994, the US removed its sanctions on Vietnam. |

| 4 | |

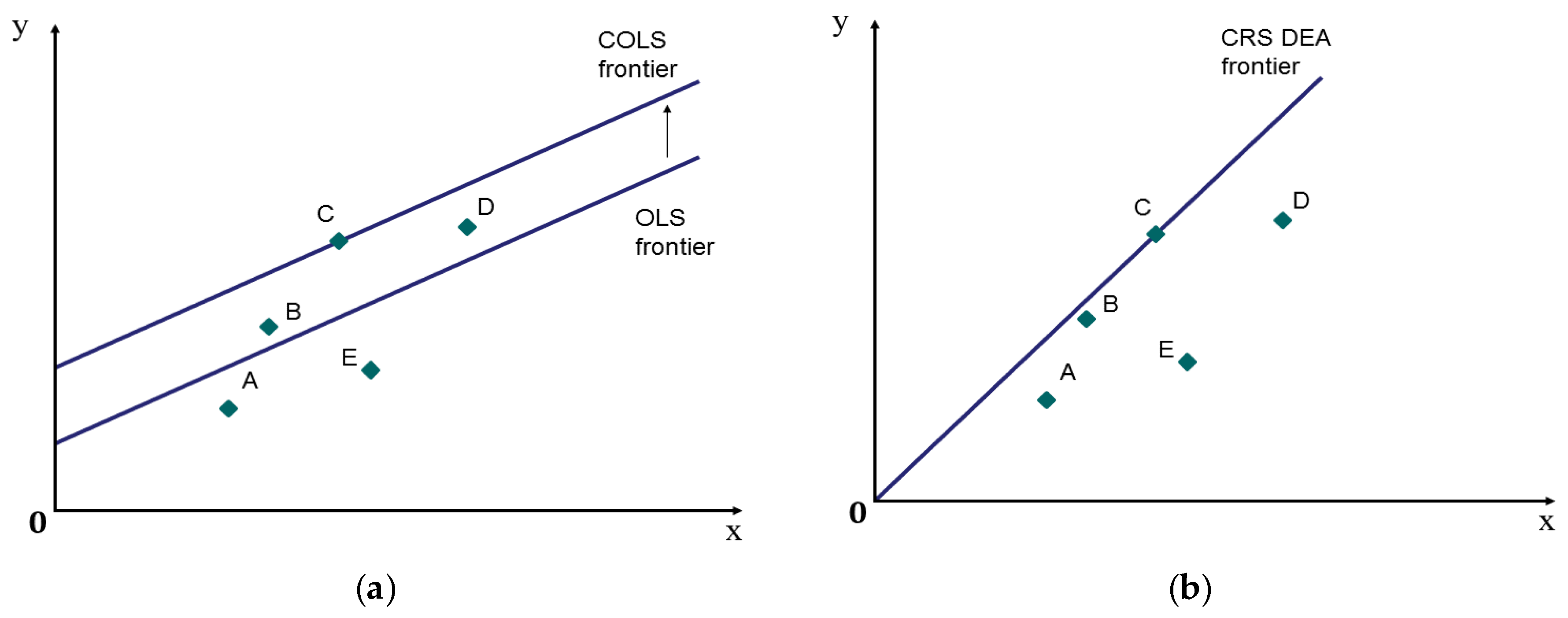

| 5 | The idea of shifting the OLS frontier upward or inward is to match it with the production possibility frontier. |

| 6 | For simplicity, we omit the subscript “i” for bank and “t” for year. |

| 7 | In this sense, we argue that the aim of Vietnamese banks is to maximize the amount of funds mobilized from savers as well as the amount of funds utilized for borrowers. |

| 8 | The total assets of the seven state-owned commercial banks, as of September 2016, were VND 3,690,463 billion, and accounted for 45% of the total assets of the Vietnamese banking sector (SBV 2017). Although our panel is not perfectly balanced, the gaps in our observations are relatively few, hence we consider it valid to compare performance between years (even though the composition of the cross sections are not exactly identical). |

| Year | Number of Banks | SOCBs | SPBs | JSCBs | JVBs | BFOBs |

|---|---|---|---|---|---|---|

| 2008 | 40 | 6 | 1 | 32 | 1 | 0 |

| 2009 | 43 | 7 | 1 | 33 | 1 | 1 |

| 2010 | 43 | 7 | 1 | 33 | 1 | 1 |

| 2011 | 38 | 6 | 0 | 30 | 1 | 1 |

| 2012 | 35 | 5 | 0 | 28 | 1 | 1 |

| 2013 | 33 | 5 | 0 | 27 | 1 | 0 |

| 2014 | 30 | 4 | 0 | 25 | 1 | 0 |

| 2015 | 27 | 3 | 0 | 23 | 1 | 0 |

| Variable | Obs | Mean | Median | Maximum | Minimum | Std. Dev. |

|---|---|---|---|---|---|---|

| LOAN | 289 | 12.3388 | 12.1801 | 15.7777 | 8.0742 | 1.3631 |

| DEPOSIT | 289 | 12.3889 | 12.4489 | 15.5139 | 8.6800 | 1.4466 |

| TA | 289 | 13.0661 | 13.1061 | 16.2169 | 9.7549 | 1.2915 |

| LR | 289 | 12.1845 | 13.1353 | 16.9538 | 7.1175 | 3.1409 |

| DOL | 289 | 0.6410 | 0.6701 | 0.9829 | 0.0138 | 0.1835 |

| UNEMP | 289 | 2.2739 | 2.3000 | 2.6000 | 1.8000 | 0.2704 |

| ILL | 289 | 0.2193 | 0.2113 | 0.7608 | 0.0000 | 0.1409 |

| BRANCH | 289 | 1639 | 88 | 199689 | 0 | 16258 |

| LOA | 289 | 0.5172 | 0.5110 | 0.9773 | 0.0116 | 0.1605 |

| TYPE | 289 | 0.1246 | 0 | 1 | 0 | 0.3308 |

| Panel A. Results of Equation (9)—Dependent Variable: LOAN | ||||

| Variable | Coefficient | Standard Error | t-Statistic | |

| DEPOSIT | 0.208 | 0.022 | 9.294 | *** |

| LOA | 2.440 | 0.073 | 33.480 | *** |

| TA | 0.765 | 0.025 | 30.462 | ** |

| LR | 0.008 | 0.005 | 1.797 | *** |

| BRANCH | 0.000 | 0.000 | 2.543 | *** |

| TYPE | −0.022 | 0.041 | −0.535 | |

| UNEMP | 0.063 | 0.199 | 0.315 | |

| Constant | −1.466 | 0.191 | −7.678 | *** |

| Panel B. Results of Equation (10)—Dependent Variable: DEPOSIT | ||||

| Variable | Coefficient | Standard Error | t-Statistic | |

| LOAN | −0.029 | 0.048 | −0.614 | |

| DOL | 2.686 | 0.108 | 24.893 | *** |

| TA | 1.072 | 0.046 | 23.362 | *** |

| LR | 0.037 | 0.007 | 5.042 | *** |

| BRANCH | 0.000 | 0.000 | −9.220 | *** |

| TYPE | −0.136 | 0.064 | −2.121 | ** |

| UNEMP | −1.071 | 0.319 | −3.357 | *** |

| Constant | −3.532 | 0.286 | −12.328 | *** |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, T.; Tripe, D.; Ngo, T. Operational Efficiency of Bank Loans and Deposits: A Case Study of Vietnamese Banking System. Int. J. Financial Stud. 2018, 6, 14. https://doi.org/10.3390/ijfs6010014

Nguyen T, Tripe D, Ngo T. Operational Efficiency of Bank Loans and Deposits: A Case Study of Vietnamese Banking System. International Journal of Financial Studies. 2018; 6(1):14. https://doi.org/10.3390/ijfs6010014

Chicago/Turabian StyleNguyen, Tram, David Tripe, and Thanh Ngo. 2018. "Operational Efficiency of Bank Loans and Deposits: A Case Study of Vietnamese Banking System" International Journal of Financial Studies 6, no. 1: 14. https://doi.org/10.3390/ijfs6010014

APA StyleNguyen, T., Tripe, D., & Ngo, T. (2018). Operational Efficiency of Bank Loans and Deposits: A Case Study of Vietnamese Banking System. International Journal of Financial Studies, 6(1), 14. https://doi.org/10.3390/ijfs6010014